Filed by CU Bancorp

Pursuant to Rule 425 under the Securities Act of 1933

And deemed filed pursuant to Rule 14a-12

Of the Securities Exchange Act of 1934

Subject Companies:

California United Bank

Premier Commercial Bancorp

Premier Commercial Bank, N.A.

Commission File No. 333-133061

March 6, 2012

The following Current Report on Form 8-K was filed by California United Bank with the Federal Deposit Insurance Corporation on March 6, 2012. The Form 8-K contains a copy of a slide presentation that California United Bank’s Chief Financial Officer will utilize in private meetings at the Sandler O’Neill & Partners, L.P. West Coast Financial Services Conference in San Francisco, California on Tuesday, March 6, 2012.

Additional Information for Shareholders

In connection with the proposed merger with Premier Commercial Bancorp, CU Bancorp will file with the Securities and Exchange Commission (the “SEC”) and the California Department of Corporations, a registration statement that will include (i) a joint proxy statement of California United Bank, CU Bancorp and Premier Commercial Bancorp, which also constitutes a prospectus of CU Bancorp, and (ii) a proxy statement/prospectus of CU Bancorp and California United Bank in connection with the bank holding company reorganization. CU Bancorp, California United Bank and Premier Commercial Bancorp will each deliver the proxy statement/prospectus to their respective shareholders. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed transactions when it becomes available, as well as any amendments or supplements to those documents, because it will contain important information. A free copy of the proxy statement/prospectus (when available) and other related documents filed by California United Bank may be obtained by writing to California United Bank, 15821 Ventura Boulevard, Suite 100, Encino, CA 91436, Attention: Corporate Secretary, or from the SEC in Washington D.C. The proxy statement/prospectus (when it is available) and the other documents may also be obtained for free by accessing California United Bank’s website at www.cunb.com under the tab “Investor Relations” and then under the heading “Filings” and at the SEC’s website atwww.sec.gov.

Participants in the Merger Transactions

CU Bancorp, California United Bank, Premier Commercial Bancorp and their directors, and executive officers may be deemed to be participants in the solicitation of proxies from their shareholders in connection with the proposed merger. Information about the directors and executive officers of CU Bancorp, California United Bank and Premier Commercial Bancorp will be set forth in the proxy statement /prospectus relating to the merger when it becomes available. Information about California United Bank’s directors

Page1 of 24

and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2011 and Form 10-K/A for the year ended December 31, 2010, which were filed with the FDIC on March 6, 2012 and April 29, 2011, respectively and its notice of annual meeting and proxy circular for its most recent annual meeting, which was filed with the FDIC on September 9, 2011. These documents will be available without charge at www.cunb.com as described in the previous paragraph or by writing to California United Bank, 15821 Ventura Boulevard, Suite 100, Encino, CA 91436, Attention: Corporate Secretary. Information about the directors and executive officer of Premier Commercial Bancorp is available in its notice of annual meeting and proxy circular for its most recent annual meeting, which was mailed to shareholders on or about April 8, 2011.

This communication does not constitute an offer of any securities for sale.

Page2 of24

FEDERAL DEPOSIT INSURANCE CORPORATION

Washington, D.C. 20429

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2012

CALIFORNIA UNITED BANK

(Exact name of registrant as specified in its charter)

| | | | |

| California | | 57904 | | 20-1461510 |

(State or other jurisdiction of incorporation) | | FDIC Certificate Number | | (IRS Employer Identification No.) |

15821 Ventura Boulevard, Suite 100

Encino, CA 91436

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (818) 257-7700

(Former name or former address, if change since last report)

Check the appropriate box below if the Form 8-K filing is to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

California United Bank’s Chief Financial Officer, Karen Schoenbaum, will discuss the slides furnished as Exhibit 99.1 in informal meetings at the Sandler O’Neill West Coast Financial Services Conference on March 6, 2012 in San Francisco, California. A copy of that slide presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K (including Exhibit 99.1) is being furnished pursuant to Item 8.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

As discussed therein, the slide presentation furnished as Exhibit 99.1 to this Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and, as such, may involve known and unknown risks, uncertainties and assumptions. These forward-looking statements relate to the Company’s current expectations and are subject to the limitations and qualifications set forth in the presentation as well as in the Company’s other documents filed with the Federal Deposit Insurance Corporation, including, without limitation, that actual events and/or results may differ materially from those projected in such forward-looking statements.

| Item 9.01 | Financial Statements and Exhibits |

Exhibit 99.1

Slide presentation by the Company’s Chief Financial Officer to be discussed in informal meetings at the Sandler O’Neill West Coast Financial Services Conference on March 6, 2012 in San Francisco, California.

Page4 of24

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | |

| | | | | CALIFORNIA UNITED BANK |

| | | |

| Dated: March 6, 2012 | | | | By: | | /s/ Anita Y. Wolman |

| | | | | | Anita Y. Wolman |

| | | | | | Executive Vice President and General Counsel |

Page5 of24

EXHIBIT INDEX

| | |

Exhibit No. | | Description |

| |

| 99.1 | | Slide presentation by the Company’s Chief Financial Officer to be discussed in informal meetings at the Sandler O’Neill West Coast Financial Services Conference on March 6, 2012 in San Francisco, California. |

Page6 of24

Exhibit 99.1

Page7 of24

California United Bank March 5, 2011

Investor Presentation

Trading Symbol: CUNB www.californiaunitedbank.com

United in Our Dedication to Relationships

Forward-Looking Statements

This presentation contains certain forward-looking information about California United Bank that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Bank. There are a number of important factors that could cause actual results to differ materially from those expressed in, implied or projected by, such forward-looking statements. Risks and uncertainties include but are not limited to lower than expected revenues; credit quality deterioration which could cause an increase in the allowance for loan losses and a reduction in net earnings; increased competitive pressure among depository institutions; a change in the interest rate environment which reduces interest margins; asset/liability repricing risks and liquidity risks; general economic conditions, either nationally or in the market areas in which the Bank does or anticipates doing business are less favorable than expected; environmental conditions, including natural disasters, may disrupt our business, impede our operations, negatively impact the values of collateral security for the Bank’s loans or impair the ability of our borrowers to support their debt obligations; the economic and regulatory effects of the continuing war on terrorism and other events of war; legislative or regulatory requirements or changes adversely affecting the Bank’s business; and changes in the securities markets. If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, California United Bank’s results could differ materially from those expressed in, implied or projected by such forward-looking statements. California United Bank assumes no obligation to update such forward-looking statements. For a more complete discussion of risks and uncertainties, read the Bank’s annual report on Form 10-K, quarterly reports on Form 10-Q and other reports filed by the Bank with the FDIC. The documents filed with the FDIC may be obtained at California United Bank’s website at www.californiaunitedbank.com. These documents may also be obtained free of charge from California United Bank by directing a request to California United Bank, 15821 Ventura Boulevard, Suite 100, Encino, California 91436, Attention: Investors Relations. Telephone 818 257-7700.

United in Our Dedication to Relationships

Page8 of24

3

Who We Are

California United Bank is a premier community-based commercial bank servicing the Metropolitan Los Angeles, Orange, and Ventura County Markets

• Locations in Los Angeles, Orange County, the San Fernando Valley, the Glendale/San Gabriel Valley, the Conejo Valley, the Santa Clarita Valley, the Simi Valley, and the South Bay

• Servicing small to medium sized businesses, non-profit organizations, entrepreneurs, professionals, and high-net worth individuals

• Eight locations opened in 6 years

• Total assets continue to grow with $800 million after 6 years

• Experienced management team with an established track record of delivering results

• The Bank has grown total assets at a 41.0% CAGR and total deposits at a 50.5% CAGR since inception in 2005 through December 31, 2011

United in Our Dedication to Relationships

4

Why We Are Different

California United Bank sets itself apart from other banks for the following reasons:

• CUNB has been engaged in the successful practice of business banking since its inception

• Executive team has extensive experience building high performing banks

• Follows a very basic and proven model to build shareholder value

• CUNB operates in one of the biggest markets for small to medium sized businesses

• There is a compelling need and opportunity for an independent business bank in Southern California which is currently dominated by behemoth banks

• Proven ability to attract top bankers

• Local advisory boards guide the Bank in its respective business communities

• History of disciplined underwriting and stellar credit quality

• Executive team has proven track record of identifying, acquiring, and successfully integrating banks—California Oaks State Bank at December 31, 2010 and Premier Commercial Bancorp expected Q2/Q3 2012, subject to regulatory and shareholder approval.

United in Our Dedication to Relationships

Page9 of24

5

Experienced Management

Name Title Functional Banking Exp CUB Tenure

David Rainer President Chief Executive Officer 31 years 6 years Anne Williams EVP Chief Operating Officer & Chief Credit Officer 31 years 6 years Karen Schoenbaum EVP Chief Financial Officer 18 years 2 years

Anita Wolman EVP General Counsel 34 years 6 years

Executive Manager —Commercial and Private

Sam Kunianski SVP 27 years 5 years Banking Executive Manager – Real Estate and Santa William Sloan SVP 27 years 6 years Clarita Regional Manager

United in Our Dedication to Relationships

6

California United Bank – The Story

2005 2006 2007 2008 2009 2010 2011

May 6, 2005 June 19, 2006 Jan. 12, 2007 May 19, 2008 Jan. 12, 2009 Feb. 1, 2010 April 7, 2011

Completes IPO of Opens new Completes second Opens new Conejo Chooses to not Hires 13 former Completes a $35 million at $10 regional branch offering of $22 Valley Loan participate in First Regional private offering of per share office in West Los million at $16.50 Production Office TARP, turning bankers $10.3 million in Angeles per share down $8.3 million March 11, 2010 common stock at

May 23, 2005 Dec. 31, 2008 $12.75 per share Opens new (1.25 x book value) Commences June 30, 2006 May 23, 2007 Reports net March 31, 2009 Glendale/San operations as a Sets record first Opens new income of $1.9 Exceeds $400 Gabriel Valley Loan commercial bank year asset growth regional branch million, concludes million in total Production Office June 30, 2011 of 178.1% for office in Santa third full year of assets Reaches $797 Southern California Clarita operation with no June 30, 2010 million in total

Dec. 31, 2005 commercial banks non-performing Passes $500MM in assets Surpasses $100 Sep. 21, 2009 assets, and total assets with million in total Dec. 31, 2007 Opens South Bay achieves 45.9% $532MM in fifth November 7, 2011 assets after Reports a profit of commercial center asset growth over year of operations Integrated Bank second full quarter $29 thousand in in Gardena, CA prior year and California of operations second full year of July 19, 2010 Oaks State Bank operation and Dec. 31, 2009 Opens new Orange on single robust reaches $260 Announces 2009 County Loan system platform million in total net income of $745 Production Office assets thousand with total assets of $457 Nov. 15, 2010 December 9, 2011 million Opens new South Announces merger Bay branch agreement with Premier

Dec. 31, 2010 Commercial Completes the Bancorp with $450 acquisition of million in assets California Oaks State Bank

United in Our Dedication to Relationships

Page10 of24

7

A History of Success

The Management Team at California United Bank has three decades of banking experience in the Southern California Market. The same Executive Team that created success at the banks below are now in charge at California United Bank.

• Wells Fargo/Security Pacific – 1980s

• California United Bank (1992 – 1997)

– Grew to $1 billion in assets

– Sold to Bank of Hawaii in 1997

• Santa Monica Bank

– Sold to U.S. Bancorp in 2000

• California United Bank (Current)

– Opened in 2005

– Acquired Cal Oaks State Bank December 31, 2010

– Announced merger agreement with Premier Commercial Bancorp December 9, 2011 – $800 million in assets as of December 31, 2011

United in Our Dedication to Relationships

8

Combining Technology & Banking

California United Bank offers customers the community banking experience with the technology and sophistication of a big bank

• CUNB Treasury Management’s innovative products include Online Banking and E-statements. These products help to reduce carbon footprints, as well as lag time of delivery

• Remote Deposit capabilities equip business customers with state of the art scanners that enable deposits without ever needing to go into a branch

• Launched an innovative website on August 2010 to support the Bank’s initiatives including periodic blog updates from the President

• The Bank rolled out an automated wire system in May 2011

United in Our Dedication to Relationships

Page11 of24

9

Dedicated to the Community

• CUNB Employees are involved in their local communities

• Strong cultural value demonstrates that supporting the community is also good business

• CUNB supports over 75 charities throughout Southern California financially and with volunteer hours

• Reliance on local advisory boards which help guide the Bank in its respective markets

• “Outstanding” CRA Rating

United in Our Dedication to Relationships

10

Formula for Success

Inputs Key Elements Results

Experienced

People Dynamic Diversified Market

Products Customer Satisfaction

Financial Community Performance & Involvement Shareholder Value Technology New Business

Strong Capital Base Core Values

United in Our Dedication to Relationships

Page12 of24

11

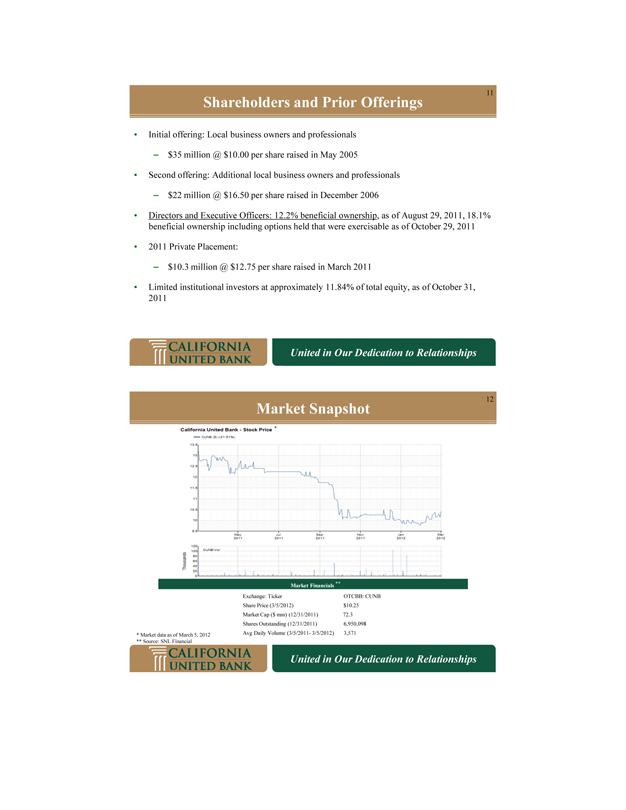

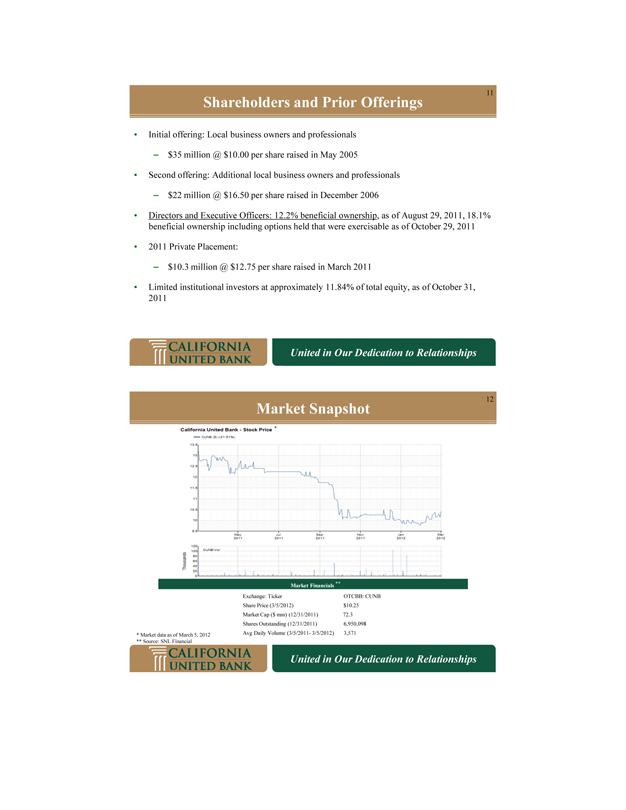

Shareholders and Prior Offerings

• Initial offering: Local business owners and professionals – $35 million @ $10.00 per share raised in May 2005

• Second offering: Additional local business owners and professionals – $22 million @ $16.50 per share raised in December 2006

• Directors and Executive Officers: 12.2% beneficial ownership, as of August 29, 2011, 18.1% beneficial ownership including options held that were exercisable as of October 29, 2011

• 2011 Private Placement:

– $10.3 million @ $12.75 per share raised in March 2011

• Limited institutional investors at approximately 11.84% of total equity, as of October 31, 2011

United in Our Dedication to Relationships

12

Market Snapshot

*

Market Financials **

Exchange: Ticker OTCBB: CUNB Share Price (3/5/2012) $10.25 Market Cap ($ mm) (12/31/2011) 72.3 Shares Outstanding (12/31/2011) 6,950,098

* Market data as of March 5, 2012 Avg Daily Volume (3/5/2011- 3/5/2012) 3,571

** Source: SNL Financial

United in Our Dedication to Relationships

Page13 of24

13

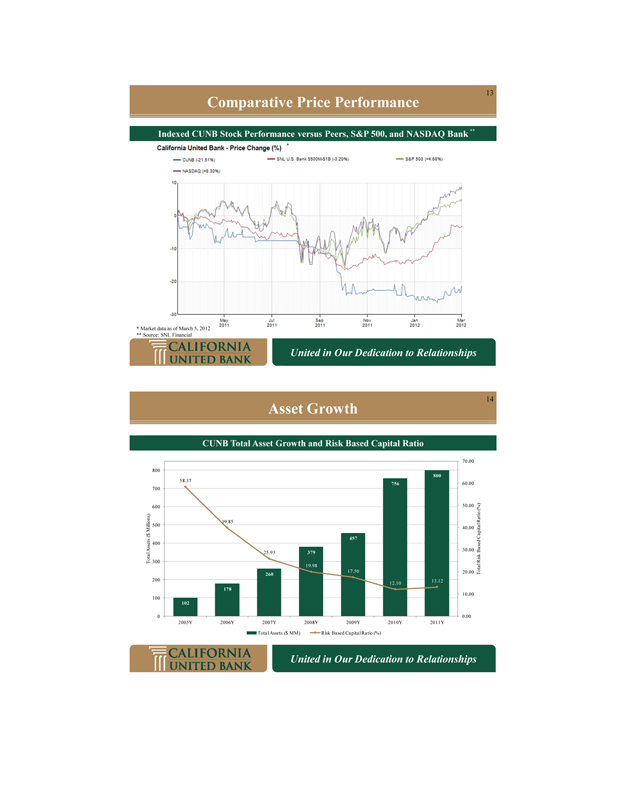

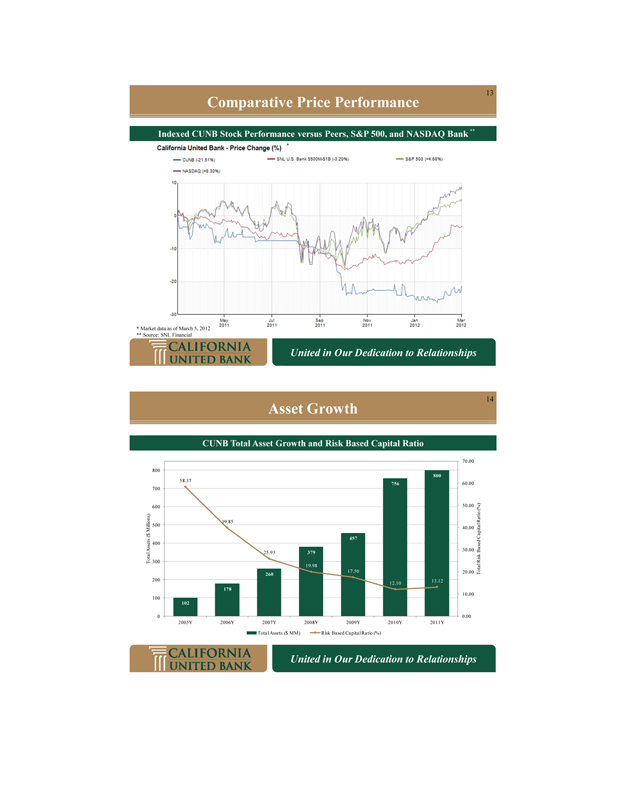

Comparative Price Performance

Indexed CUNB Stock Performance versus Peers, S&P 500, and NASDAQ Bank **

*

* Market data as of March 5, 2012

** Source: SNL Financial

United in Our Dedication to Relationships

14

Asset Growth

CUNB Total Asset Growth and Risk Based Capital Ratio

70.00 800

800

58.37

756 60.00 700

600 50.00 (%) Ratio 39.85 500 Millions) 40.00 $

( Capital

457 400 Assets 30.00 Based 25.93 379 Risk Total 300 19.98 17.50 20.00 Total

260

200 13.12 12.10

178

10.00 100

102

0 0.00 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y

Total Assets ($ MM) Risk Based Capital Ratio (%)

United in Our Dedication to Relationships

Page14 of24

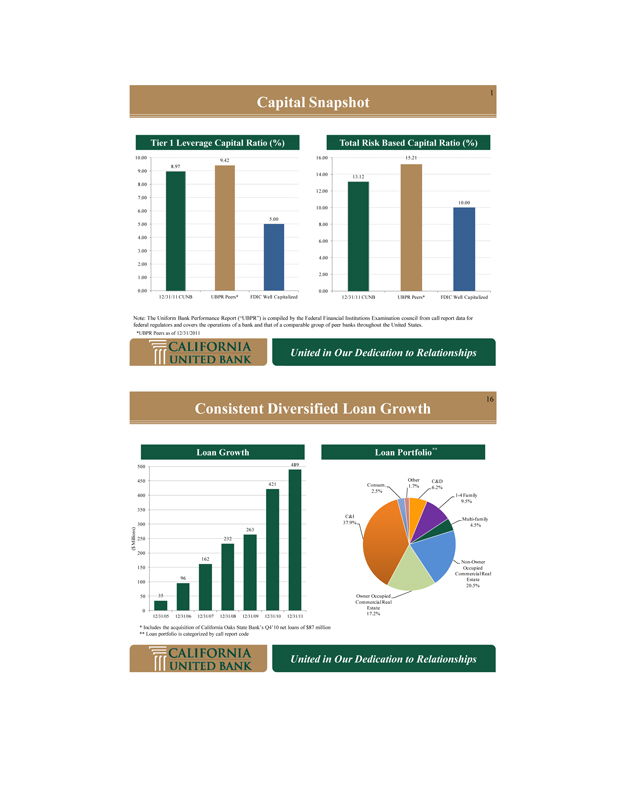

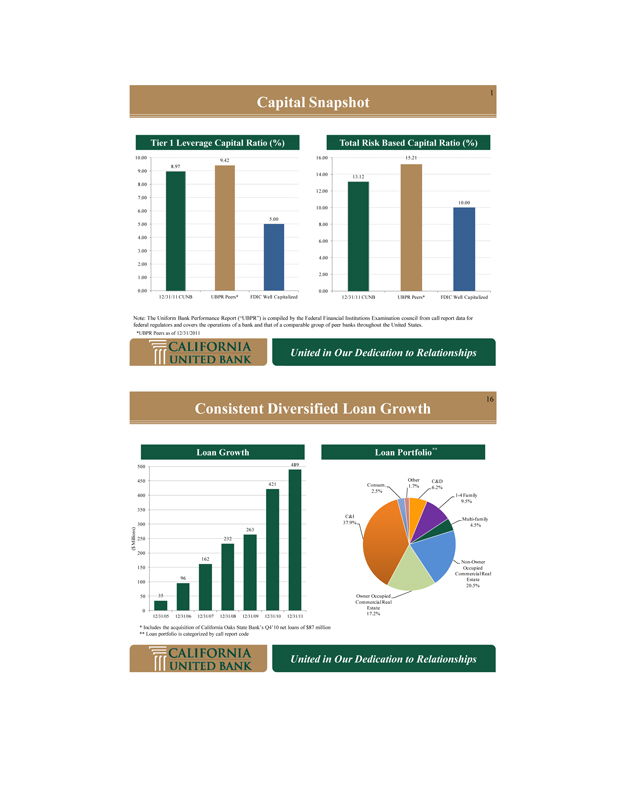

1

Capital Snapshot

Tier 1 Leverage Capital Ratio (%) Total Risk Based Capital Ratio (%)

10.00 16.00 15.21

9.42 9.00 8.97 14.00 13.12 8.00 12.00 7.00 10.00 10.00 6.00 5.00 5.00 8.00 4.00 6.00 3.00 4.00 2.00 2.00 1.00

0.00 0.00

12/31/11 CUNB UBPR Peers* FDIC Well Capitalized 12/31/11 CUNB UBPR Peers* FDIC Well Capitalized

Note: The Uniform Bank Performance Report (“UBPR”) is compiled by the Federal Financial Institutions Examination council from call report data for federal regulators and covers the operations of a bank and that of a comparable group of peer banks throughout the United States.

*UBPR Peers as of 12/31/2011

United in Our Dedication to Relationships

16

Consistent Diversified Loan Growth

Loan Growth Loan Portfolio**

500 489

450 421 Other C&D Consum. 1.7%

6.2%

400 2.5% 1-4 Family

9.5% 350 C&I

Multi-family 300 37.9% 263 4.5% Millions) 250 232 $

( 200

162

Non-Owner

150 Occupied

96 Commercial Real Estate 100 20.5%

50 35 Owner Occupied Commercial Real

* Estate 0 17.2% 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11

* Includes the acquisition of California Oaks State Bank’s Q4’10 net loans of $87 million

** Loan portfolio is categorized by call report code

United in Our Dedication to Relationships

Page15 of24

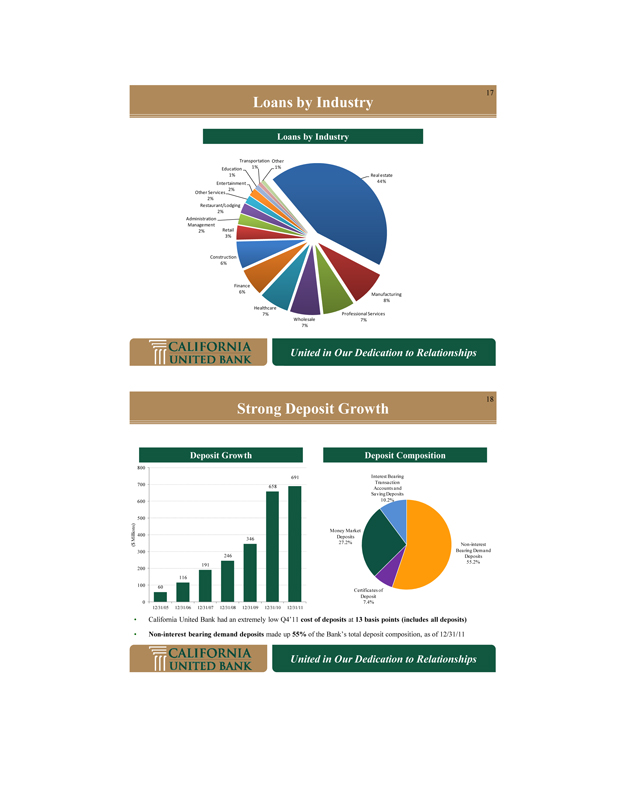

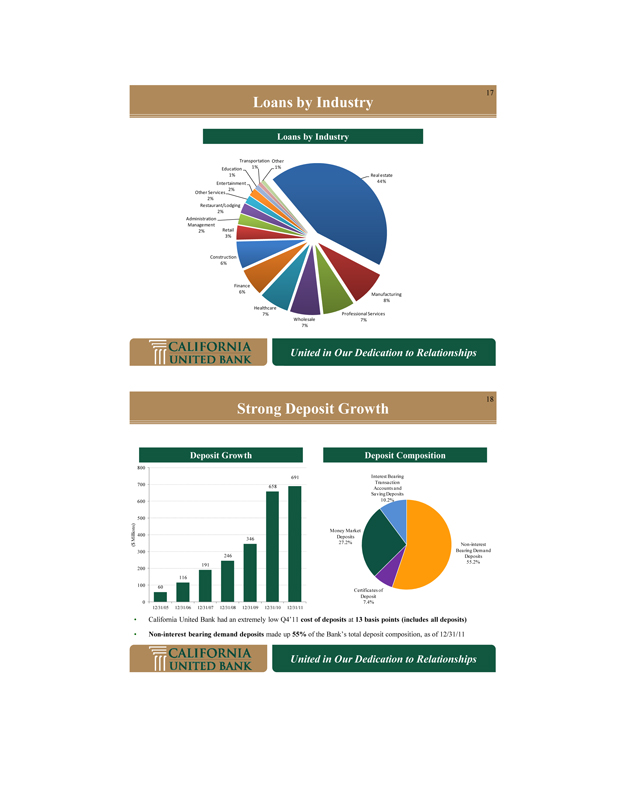

17

Loans by Industry

Loans by Industry

Transportation Other Education 1% 1%

1% Real estate Entertainment 44% 2% Other Services 2% Restaurant/Lodging 2% Administration Management

2% Retail 3%

Construction 6%

Finance 6%

Manufacturing 8% Healthcare

7% Professional Services Wholesale 7% 7%

United in Our Dedication to Relationships

18

Strong Deposit Growth

Deposit Growth Deposit Composition

800

691 Interest Bearing 700 658 Transaction Accounts and Saving Deposits 600 10.2%

500

400 Money Market Millions) 346 Deposits $ 27.2% Non-interest ( 300 Bearing Demand 246 Deposits 55.2% 191 200 116 100 60 Certificates of Deposit

0 7.4% 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11

• California United Bank had an extremely low Q4’11 cost of deposits at 13 basis points (includes all deposits)

• Non-interest bearing demand deposits made up 55% of the Bank’s total deposit composition, as of 12/31/11

United in Our Dedication to Relationships

Page16 of24

19

Non-Interest Bearing Deposits- Peer Comparison

Historical Non-Interest Bearing Deposits and Cost of Interest Bearing Deposits

60.0 55.2 4.5 4.0 (%) 50.0 3.5 42.2 (%) Deposits 40.0 3.0 Total 33.9 deposits / 30.1 29.6 2.5 30.0 26.5 bearing deposits 24.5 2.0 Interest bearing 20.0 1.5 of Cost interest 1.0

- 14.8 14.7 Non 10.0 13.5 11.0

7.8 0.5 2.4 1.5 3.3 3.0 3.8 3.6 3.1 7.41.8 1.8 7.20.8 1.1 0.6 0.7 0.4 0.0 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 0.0 Peer Median (Cost of Int Bear. Dep)* CUNB (Cost of Int Bear. Dep)* Peer Median (Non-Int Dep) CUNB (Non-Int Dep) *As of MRQ

Peer Group includes: Heritage Oaks Bancorp, Community West Bancshares, Montecito Bancorp, First Security Business Bank, Fullerton Community Bank, FSB, Sunwest Bank, Centennial Bank, Pacific Premier Bancorp, Inc., Pacific Trust Bank, FSB, Kaiser Federal Bank, Opus Bank, Malaga Bank F.S.B., Grandpoint Capital, Inc.,1st Enterprise Bank, State Bank of India (California), Pacific City Financial Corporation, and Saehan Bancorp (Southern CA banks with $500 million to $1 billion in total assets)

United in Our Dedication to Relationships

20

Core Deposits & Time Deposits- Peer Comparison

Historical Core Deposits as a % of Total Deposits

100.0 96.3 94.4 94.3 91.9 90.0 90.8 92.4 81.7 80.0 89.7 83.0 70.0 76.2 74.7 74.1 72.1 60.0 65.0 50.0 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y

Peer Median CUNB

Historical Time Deposits as a % of Total Deposits

60.00 53.1 52.1 50.6 47.2

50.00 42.5 35.8 39.9 40.00

30.00

20.00 18.5

8.6 12.6 10.7

6.1 7.4 10.00 4.3 0.00 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y As of MRQ Peer Median CUNB

Peer Group includes: Heritage Oaks Bancorp, Community West Bancshares, Montecito Bancorp, First Security Business Bank, Fullerton Community Bank, FSB, Sunwest Bank, Centennial Bank, Pacific Premier Bancorp, Inc., Pacific Trust Bank, FSB, Kaiser Federal Bank, Opus Bank, Malaga Bank F.S.B., Grandpoint Capital, Inc.,1st Enterprise Bank, State Bank of India (California), Pacific City Financial Corporation, and Saehan Bancorp (Southern CA banks with $500 million to $1 billion in total assets)

United in Our Dedication to Relationships

Page17 of24

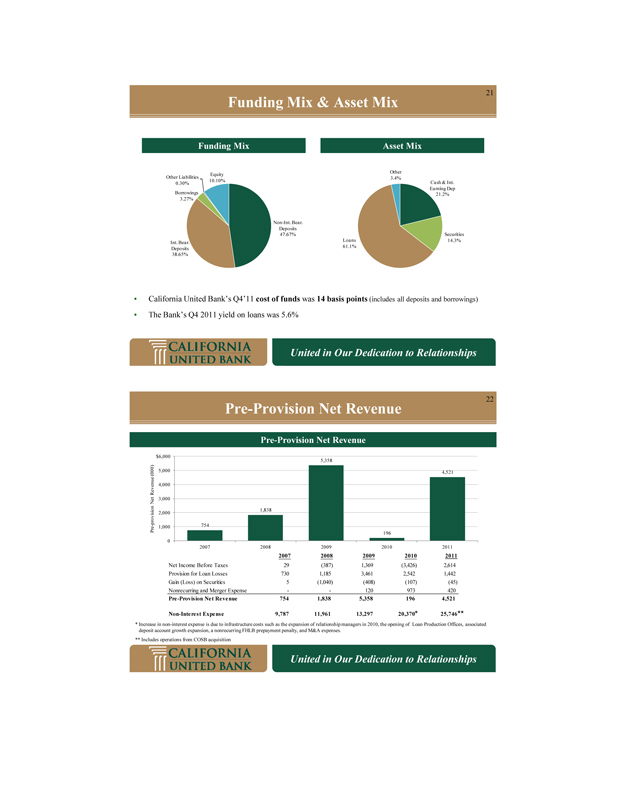

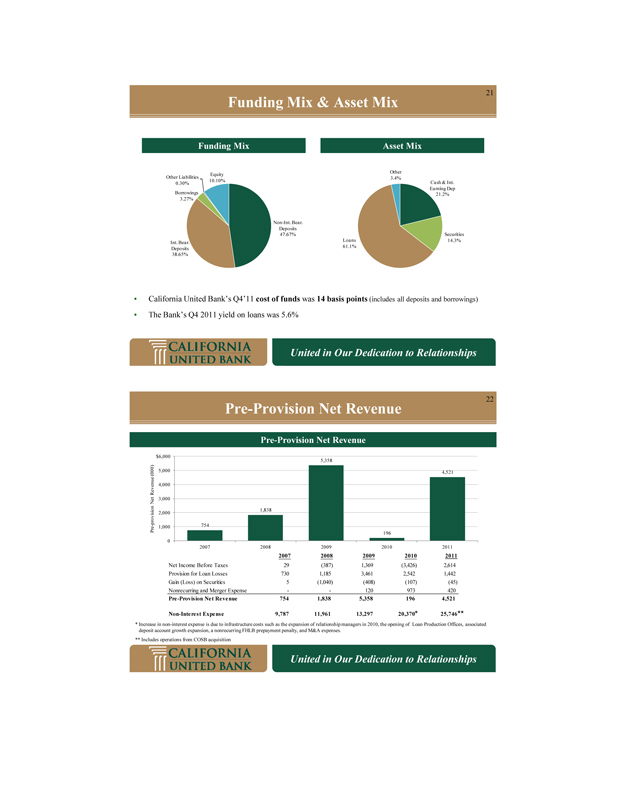

21

Funding Mix & Asset Mix

Funding Mix Asset Mix

Other Equity Other Liabilities 3.4%

10.10% Cash & Int.

0.30%

Borrowings Earning Dep

3.27% 21.2%

Non-Int. Bear. Deposits

47.67% Securities Loans 14.3% Int. Bear.

61.1% Deposits 38.65%

• California United Bank’s Q4’11 cost of funds was 14 basis points (includes all deposits and borrowings)

• The Bank’s Q4 2011 yield on loans was 5.6%

United in Our Dedication to Relationships

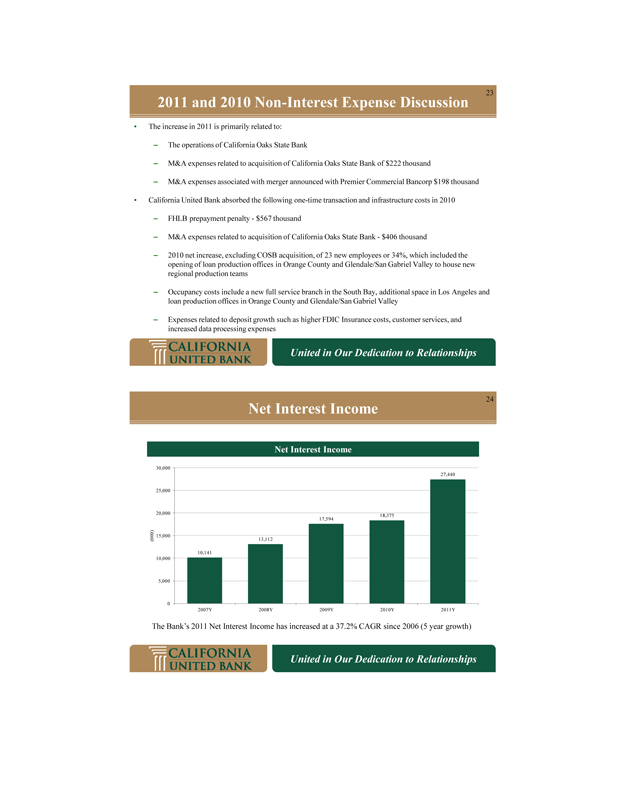

22

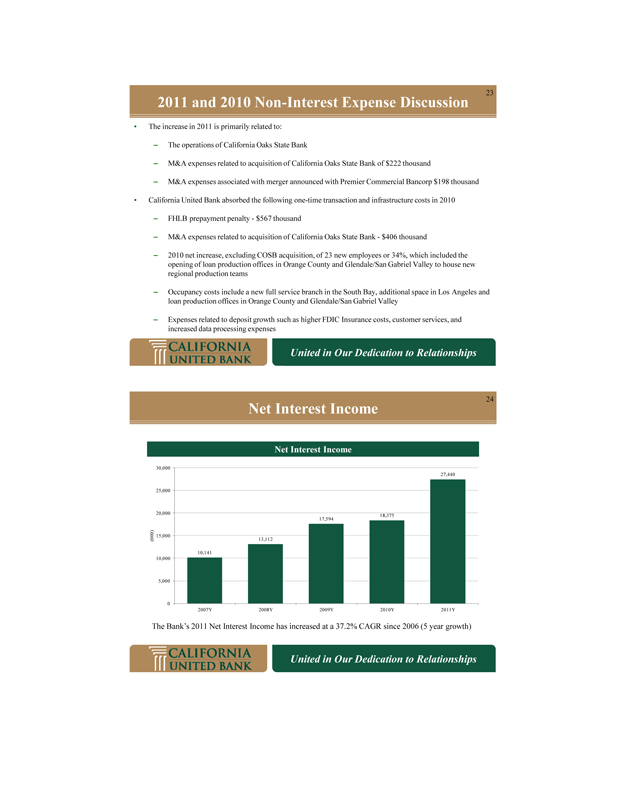

Pre-Provision Net Revenue

Pre-Provision Net Revenue

$6,000 5,358

(000) 5,000 4,521 Revenue 4,000 Net 3,000 1,838 provision 2,000 Pre—1,000 754 196 0 2007 2008 2009 2010 2011

2007 2008 2009 2010 2011

Net Income Before Taxes 29 (387) 1,369 (3,426) 2,614 Provision for Loan Losses 730 1,185 3,461 2,542 1,442 Gain (Loss) on Securities 5 (1,040) (408) (107) (45) Nonrecurring and Merger Expense — — 120 973 420

Pre-Provision Net Revenue 754 1,838 5,358 196 4,521

Non-Interest Expense 9,787 11,961 13,297 20,370* 25,746**

* Increase in non-interest expense is due to infrastructure costs such as the expansion of relationship managers in 2010, the opening of Loan Production Offices, associated deposit account growth expansion, a nonrecurring FHLB prepayment penalty, and M&A expenses.

** Includes operations from COSB acquisition

United in Our Dedication to Relationships

Page18 of24

23

2011 and 2010 Non-Interest Expense Discussion

• The increase in 2011 is primarily related to:

– The operations of California Oaks State Bank

– M&A expenses related to acquisition of California Oaks State Bank of $222 thousand

– M&A expenses associated with merger announced with Premier Commercial Bancorp $198 thousand

• California United Bank absorbed the following one-time transaction and infrastructure costs in 2010

– FHLB prepayment penalty—$567 thousand

– M&A expenses related to acquisition of California Oaks State Bank—$406 thousand

– 2010 net increase, excluding COSB acquisition, of 23 new employees or 34%, which included the opening of loan production offices in Orange County and Glendale/San Gabriel Valley to house new regional production teams

– Occupancy costs include a new full service branch in the South Bay, additional space in Los Angeles and loan production offices in Orange County and Glendale/San Gabriel Valley

– Expenses related to deposit growth such as higher FDIC Insurance costs, customer services, and increased data processing expenses

United in Our Dedication to Relationships

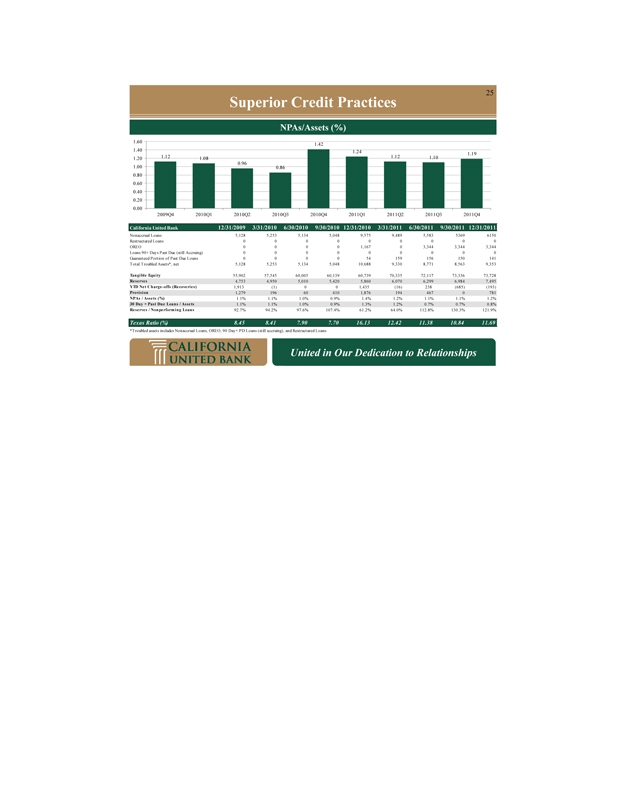

24

Net Interest Income

Net Interest Income

30,000

27,440

25,000

20,000

18,375 17,594

15,000

(000) 13,112 10,141 10,000

5,000

0

2007Y 2008Y 2009Y 2010Y 2011Y

The Bank’s 2011 Net Interest Income has increased at a 37.2% CAGR since 2006 (5 year growth)

United in Our Dedication to Relationships

Page19 of24

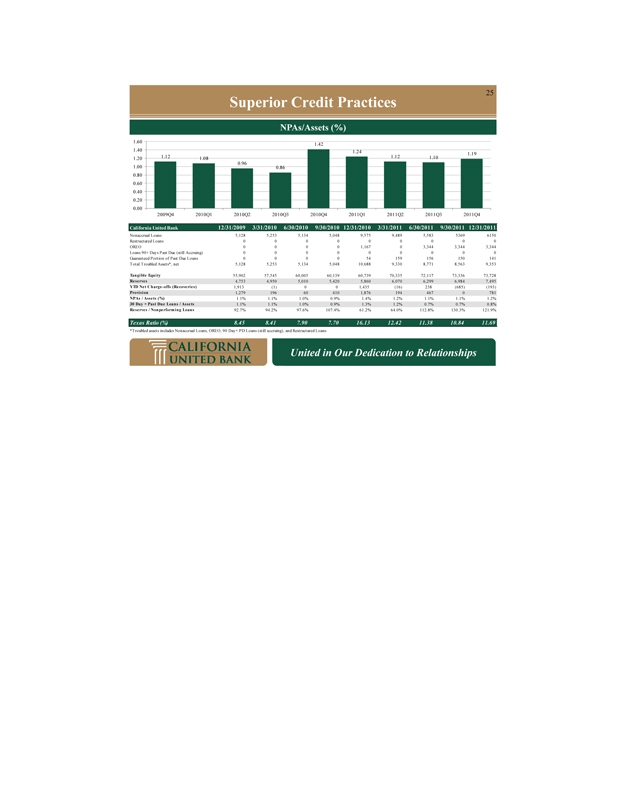

Superior | | Credit Practices |

2009Q4 | | 2010Q1 2010Q2 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 |

California | | United Bank 12/31/2009 3/31/2010 6/30/2010 9/30/2010 12/31/2010 3/31/2011 6/30/2011 9/30/2011 12/31/2011 |

Nonaccrual | | Loans 5,128 5,253 5,134 5,048 9,575 9,489 5,583 5369 6150 Restructured Loans 0 0 0 0 0 0 0 0 0 OREO 0 0 0 0 1,167 0 3,344 3,344 3,344 Loans 90+ Days Past Due (still Accruing) 0 0 0 0 0 0 0 0 0 Guaranteed Portion of Past Due Loans 0 0 0 0 54 159 156 150 141 Total Troubled Assets*, net 5,128 5,253 5,134 5,048 10,688 9,330 8,771 8,563 9,353 |

Tangible | | Equity 55,902 57,545 60,005 60,139 60,739 70,335 72,117 73,336 73,728 Reserves 4,753 4,950 5,010 5,420 5,860 6,070 6,299 6,984 7,495 |

YTD | | Net Charge-offs (Recoveries) 1,913 (1) 0 0 1,435 (16) 238 (685) (193) |

Provision | | 1,279 196 60 410 1,876 194 467 0 781 NPAs / Assets (%) 1.1% 1.1% 1.0% 0.9% 1.4% 1.2% 1.1% 1.1% 1.2% |

30 | | Day + Past Due Loans / Assets 1.1% 1.1% 1.0% 0.9% 1.3% 1.2% 0.7% 0.7% 0.8% Reserves / Nonperforming Loans 92.7% 94.2% 97.6% 107.4% 61.2% 64.0% 112.8% 130.3% 121.9% |

Texas | | Ratio (%) 8.45 8.41 7.90 7.70 16.13 12.42 11.38 10.84 11.69 |

*Troubled | | assets includes Nonaccrual Loans, OREO, 90 Day+ PD Loans (still accruing), and Restructured Loans |

United | | in Our Dedication to Relationships |

Page20 of24

26

12/31/2011 Peer Group Credit Quality Comparisons

Non Performing Assets/ Assets (%) Reserves/ Non Performing Assets (%)

3.0 2.8 90.0

80.0 78.9 2.5 70.0 2.0 60.0 50.0 1.5 39.6 1.2 40.0 1.0 30.0 20.0 0.5 10.0 0.0 0.0 Median of 17 Peer Banks* * CUNB Median of 17 Peer Banks* * CUNB

Texas Ratio (%) NCOs/Average Loans (%)

25.0 22.9 0.3 0.3 0.3 20.0 0.2 15.0 0.2 11.7

10.0 0.2 0.2 0.2 5.0 0.2 0.0 0.2 * Median of 17 Peer Banks* CUNB Median of 17 Peer Banks* CUNB

* As of MRQ

Peer Group includes: Heritage Oaks Bancorp, Community West Bancshares, Montecito Bancorp, First Security Business Bank, Fullerton Community Bank, FSB, Sunwest Bank, Centennial Bank, Pacific Premier Bancorp, Inc., Pacific Trust Bank, FSB, Kaiser Federal Bank, Opus Bank, Malaga Bank F.S.B., Grandpoint Capital, Inc.,1st Enterprise Bank, State Bank of India (California), Pacific City Financial Corporation, and Saehan Bancorp (Southern CA banks with $500 million to $1 billion in total assets)

United in Our Dedication to Relationships

27

2011 Highlights

• Successfully integrated California Oaks State Bank, bringing the total of California United Bank full service branches to six

• Announcement of merger agreement with Premier Commercial Bancorp, pro forma balance sheet over $1.2 billion in assets

• Total assets of $800 million, an increase of 5.8% from 12/31/10

• Net interest income of $27.4 million, an increase of 49.3% from 12/31/10

• Loans of $489 million, an increase of 16.1% from 12/31/10

• Total deposits of $691 million, an increase of 5.0% from 12/31/10

• Non-interest-bearing deposits of $381.5 million, an increase of 37.3% from 12/31/10

• Non-interest bearing deposits are 55% of total deposits

United in Our Dedication to Relationships

Page21 of24

28

12/31/2011 Peer Group Balance Sheet Comparisons

Quarterly Asset Growth Rate (%) Total Real Estate Loans as % of

5 | | 4.3 Total Equity Capital 5 600 558.9 4 4 500 3 382.5 3 400 1.8 300 2 2 200 1 100 1 0 0 |

Median of 17 Peer Banks CUNB Median of 17 Peer Banks* CUNB

Core Deposits as % Total Deposits CD’s as % Total Deposits 95 94.3 45 41.5 94 40 93 35 30 92 25 91 20 89.7 90 15 89 10 7.4 88 5 87 0

Median of 17 Peer Banks* CUNB Median of 17 Peer Banks* CUNB *As of MRQ

Peer Group includes: Heritage Oaks Bancorp, Community West Bancshares, Montecito Bancorp, First Security Business Bank, Fullerton Community Bank, FSB, Sunwest Bank, Centennial Bank, Pacific Premier Bancorp, Inc., Pacific Trust Bank, FSB, Kaiser Federal Bank, Opus Bank, Malaga Bank F.S.B., Grandpoint Capital, Inc.,1st Enterprise Bank, State Bank of India (California), Pacific City Financial Corporation, and Saehan Bancorp (Southern CA banks with $500 million to $1 billion in total assets)

United in Our Dedication to Relationships

29 2011 Peer Group Margin Comparisons Cost of Funds (%)* Net Interest Margin (%) Yield on Loans (%) 1.20 7.0 4.00 3.78 3.7 1.0 6.0 5.8 3.50 1.00 5.6 5.0 3.00 0.80 2.50 4.0 0.60 2.00 3.0 1.50 0.40 2.0 1.00 0.20 0.1 1.0 0.50 0.00 0.0 0.00

Median of 17 Peer ** CUNB Median of 17 Peer** CUNB Median of 17 Peer ** CUNB Banks Banks Banks

*Includes Noninterest bearing deposits

** As of MRQ

Peer Group includes: Heritage Oaks Bancorp, Community West Bancshares, Montecito Bancorp, First Security Business Bank, Fullerton Community Bank, FSB, Sunwest Bank, Centennial Bank, Pacific Premier Bancorp, Inc., Pacific Trust Bank, FSB, Kaiser Federal Bank, Opus Bank, Malaga Bank F.S.B., Grandpoint Capital, Inc.,1st Enterprise Bank, State Bank of India (California), Pacific City Financial Corporation, and Saehan Bancorp (Southern CA banks with $500 million to $1 billion in total assets)

United in Our Dedication to Relationships

Page22 of24

30

• | | California United Bank’s balance sheet is positioned to take advantage of a rising rate environment |

– | | Significant revenue synergies and cost savings possible with Premier Commercial Bancorp transaction. |

– | | Earnings will be positively impacted by greater utilization of current commercial lines of credit as the economy continues to stabilize and moves toward recovery |

– | | CUNB will be able to enhance its margin by deploying its extremely low cost deposits into new attractive loans |

– | | The balance sheet has over $109 million of funds at the Federal Reserve Bank as of December 31, 2011which can be deployed into higher earning assets |

– | | There is currently an embedded loan portfolio discount of $3.2 million from the Cal Oaks acquisition which could be accretive to income if loans perform over time |

United | | in Our Dedication to Relationships |

Acquisition | | of Premier Commercial Bancorp |

Structure: | | ??Merger of Premier Commercial Bancorp into CU Bancorp1 Consideration: ??100% Common Stock |

Transaction | | Value: ??Based on 3,721,442 shares of CU Bancorp1 stock issued or approx. $38.1 million Transaction Terms: ??Fixed number of shares within a 10% up/down collar. Floating number of shares between +/- 10% and 25%. Walk-away rights at +/- 25%. |

Approvals: | | ??Requires regulatory and shareholder approvals Cost Savings: ??Significant synergies and cost savings |

Deal | | Related Expenses: ??Approx. $4.1 million Anticipated Closing: ??Q2 2012 |

Due | | Diligence: ??Completed extensive third party loan due diligence |

141r | | Loan Mark: ??Est. at 5.4% IRR: ??20%+ |

Payback | | Period: ??Approx. tangible equity dilution payback within 2 years from total earnings and 4 years to exceed our future standalone estimates EPS Accretion: ??Accretive to Core2 EPS in 2012 |

1) | | Holding company to be created in connection with the transaction; subject to regulatory and shareholder approval 2) excluding nonrecurring deal expenses |

United | | in Our Dedication to Relationships |

Page23 of24

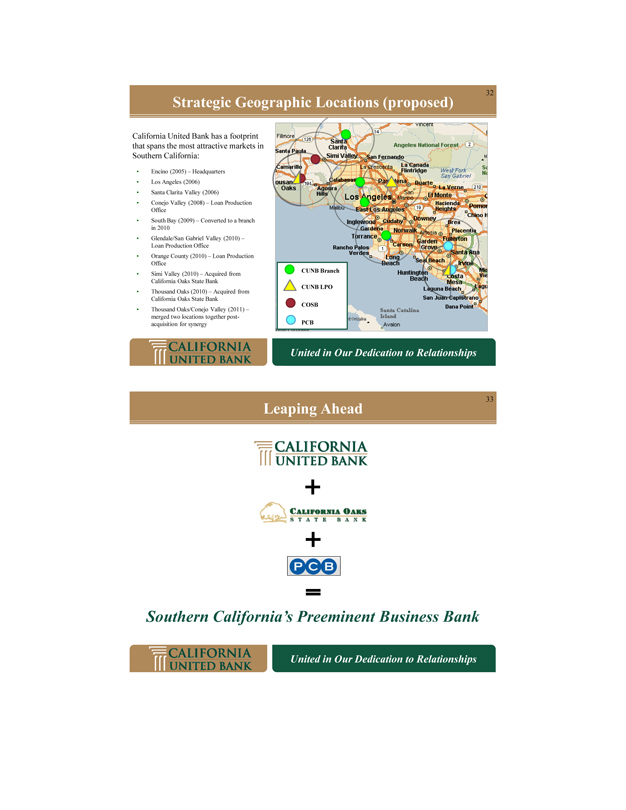

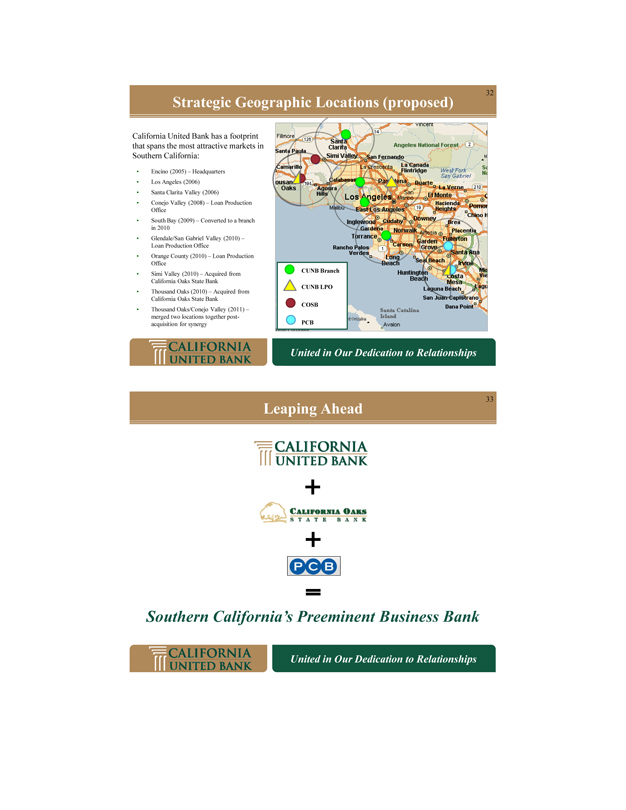

32

Strategic Geographic Locations (proposed)

California United Bank has a footprint that spans the most attractive markets in Southern California:

• Encino (2005) – Headquarters

• Los Angeles (2006)

• Santa Clarita Valley (2006)

• Conejo Valley (2008) – Loan Production Office

• South Bay (2009) – Converted to a branch in 2010

• Glendale/San Gabriel Valley (2010) –Loan Production Office

• Orange County (2010) – Loan Production Office

CUNB Branch

• Simi Valley (2010) – Acquired from

California Oaks State Bank CUNB LPO

• Thousand Oaks (2010) – Acquired from

California Oaks State Bank COSB

• Thousand Oaks/Conejo Valley (2011) –merged two locations together post- PCB acquisition for synergy

United in Our Dedication to Relationships

33

Leaping Ahead

Southern California’s Preeminent Business Bank

United in Our Dedication to Relationships

Page24 of24

34

Growth Strategies in The Current Market

• Organic growth within geographic footprint

– Eight strategic locations across three adjacent counties in Southern California

– Business rich markets that are dominated by small to medium sized businesses

• Opportunistic yet selective approach to acquisition targets

– Banks that replicate California Oaks State Bank and Premier Commercial Bancorp characteristics in footprint

– Banks in current markets or attractive adjacent markets

• Other Opportunities

– Expand customer utilization of credit lines as economy improves

– Balance sheet positioned for rising rate environment

– Deploy liquidity into higher earning assets

United in Our Dedication to Relationships

35

Contact/Join Us Today

• For more information, please contact:

– Karen Schoenbaum, CFO (818) 257-7700 kschoenbaum@californiaunitedbank.com

United in Our Dedication to Relationships