|

Exhibit 99.1

|

CU Bancorp

Investor Presentation

as of December 31, 2013

… a better banking experience

Forward-Looking Statements

This presentation contains forward-looking statements about CU Bancorp (the “Company”) for which the Company claims the protection of the safe harbor provisions contained in the Private Securities Litigation Reform Act of 1995, including forward-looking statements relating to the Company’s current business plan and expectations regarding future operating results. Forward-looking statements are based on management’s knowledge and belief as of today and include information concerning the Company’s possible or assumed future financial condition, and its results of operations, business and earnings outlook. These forward-looking statements are subject to risks and uncertainties. A number of factors, some of which are beyond the Company’s ability to control or predict, could cause future results to differ materially from those contemplated by such forward-looking statements. These factors include (1) difficult and adverse conditions in the global and domestic capital and credit markets and the state of California, (2) significant costs or changes in business practices required by new banking laws or regulations such as those related to Basel III, (3) weakness in general business and economic conditions, which may affect, among other things, the level of growth, income, non-performing assets, charge-offs and provision expense, (4) changes in market rates and prices which may adversely impact the value of financial products, (5) changes in the interest rate environment and market liquidity which may reduce interest margins and impact funding sources, (6) competition in the Company’s markets, (7) changes in the financial performance and/or condition of the Company’s borrowers, (8) increases in Federal Deposit Insurance Corporation premiums due to market developments and regulatory changes, (9) earthquake, fire, pandemic or other natural disasters, (10) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or regulatory agencies, (11) international instability, downgrading or defaults on sovereign debt, including that of the United States of America or increased oil prices, (12) additional downgrades of securities issued by U.S. government sponsored or supported entities such as Fannie Mae and Freddie Mac, (13) the impact of the Dodd-Frank Act, (14) the effect of U.S. federal government debt, budget and tax matters, (15) changes in the level of early payoffs on acquired loans and the amount of fair value discount on these loans recognized each quarter, and (16) the success of the Company at managing the risks involved in the foregoing. Forward-looking statements speak only as of the date they are made, and the Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the statements are made, or to update earnings guidance, including the factors that influence earnings. For a more complete discussion of these risks and uncertainties, see CU Bancorp’s reports on Form 10-K and 10-Q as filed with the Securities and Exchange Commission and the Company’s press releases.

2

Investment Highlights………………………….……… 4

Earnings Review……………………………………….13

Appendix… 22

Investment Highlights

Premier community-based business banking franchise serving large and diverse market Strong organic loan growth Attractive low-cost core deposit base Exceptional credit quality Growing visibility in the investment community

Premier Business Banking Franchise

$1.4 billion in assets, achieved by experienced management team* in eight years, through organic growth and two successful acquisitions

14th largest publicly-owned bank by assets in combined Los Angeles, Orange and Ventura counties 268th largest publicly-owned bank by assets in U.S.

Asset CAGR of 39% since inception in 2005 through 12/31/13

Footprint includes eight branches covering L.A., Orange and Ventura counties

*See appendix for management experience

Sophisticated Relationship Management Team offers Solutions for Small- and Medium-Sized Businesses

Sophisticated relationship management team offers personalized and responsive service focused on small- and medium-sized businesses in Los Angeles, Orange and Ventura counties

Los Angeles County is the largest manufacturing center in the U.S. and would be 9th largest state in U.S.

L.A. County expected to add more than 150,000 jobs over the next two years; current unemployment rate of 9.2% projected to fall to 7.2% by end of 2015*

Orange County would be 31st largest state in U.S.

Orange County unemployment rate is 5.2% as of December 31, 2013**

Three-county area is home to more than 532,000 small- and middle-market business** (defined as employing 1 to 499 workers)

*Source: Forecast by Beacon Economics, February 2014

**Source: Los Angeles Economic Development Corporation and California EDD, as of 2012

Franchise Growth Strategies

Organic Growth

Offer expertise in C&I and commercial real estate lending to small and middle-market businesses

Provide customers with sophisticated products and solutions

Leverage relationship-based banking approach and superior service

Grow SBA lending platform expertise acquired in recent acquisition

Continue recruiting “in market” talent from competitors

Growth by Acquisition

Strong management team experienced with successful, accretive acquisitions

California Oaks State Bank (12/31/10) Premier Commercial Bank (7/31/12)

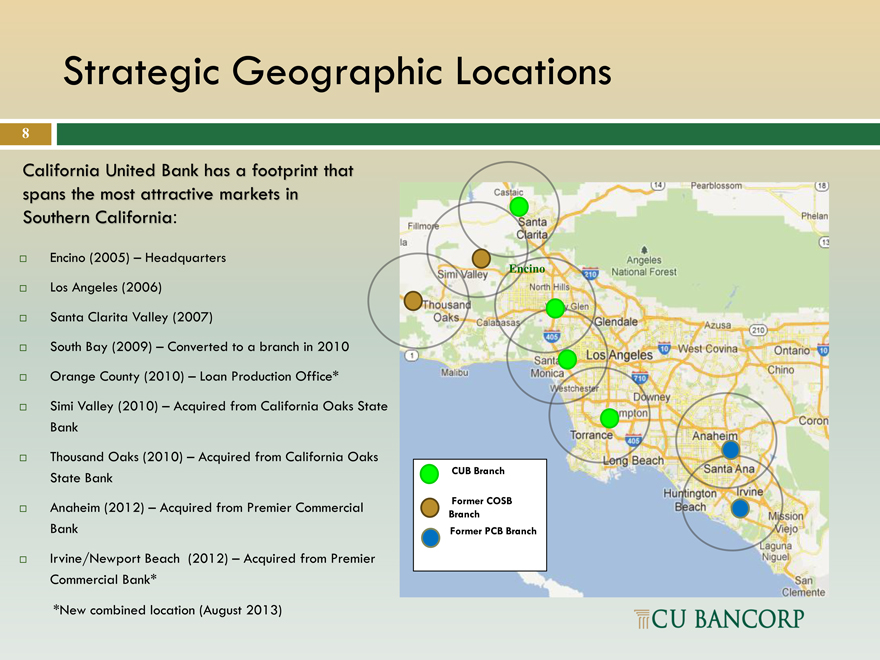

Strategic Geographic Locations

CUB Branch

Former COSB Branch Former PCB Branch

California United Bank has a footprint that spans the most attractive markets in Southern California:

Encino (2005) – Headquarters Los Angeles (2006)

Santa Clarita Valley (2007)

South Bay (2009) – Converted to a branch in 2010

Orange County (2010) – Loan Production Office*

Simi Valley (2010) – Acquired from California Oaks State Bank

Thousand Oaks (2010) – Acquired from California Oaks State Bank

Anaheim (2012) – Acquired from Premier Commercial Bank

Irvine/Newport Beach (2012) – Acquired from Premier Commercial Bank*

*New combined location (August 2013)

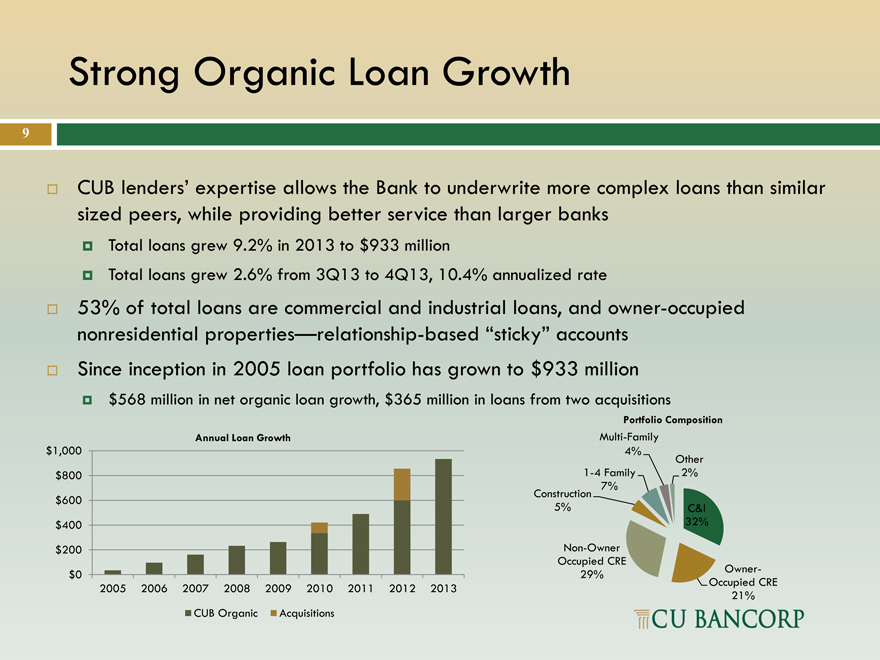

Strong Organic Loan Growth

CUB lenders’ expertise allows the Bank to underwrite more complex loans than similar sized peers, while providing better service than larger banks

Total loans grew 9.2% in 2013 to $933 million

Total loans grew 2.6% from 3Q13 to 4Q13, 10.4% annualized rate

53% of total loans are commercial and industrial loans, and owner-occupied nonresidential properties—relationship-based “sticky” accounts Since inception in 2005 loan portfolio has grown to $933 million

$568 million in net organic loan growth, $365 million in loans from two acquisitions

Annual Loan Growth

$1,000

$800

$600

$400

$200

$0

2005 2006 2007 2008 2009 2010 2011 2012 2013

CUB Organic Acquisitions

Multi-FamilyPortfolio Composition

4%

Other

1-4 Family 2%

Construction 7%

5%

Non-Owner

Occupied CRE

29% Owner-

Occupied CRE

21%

9

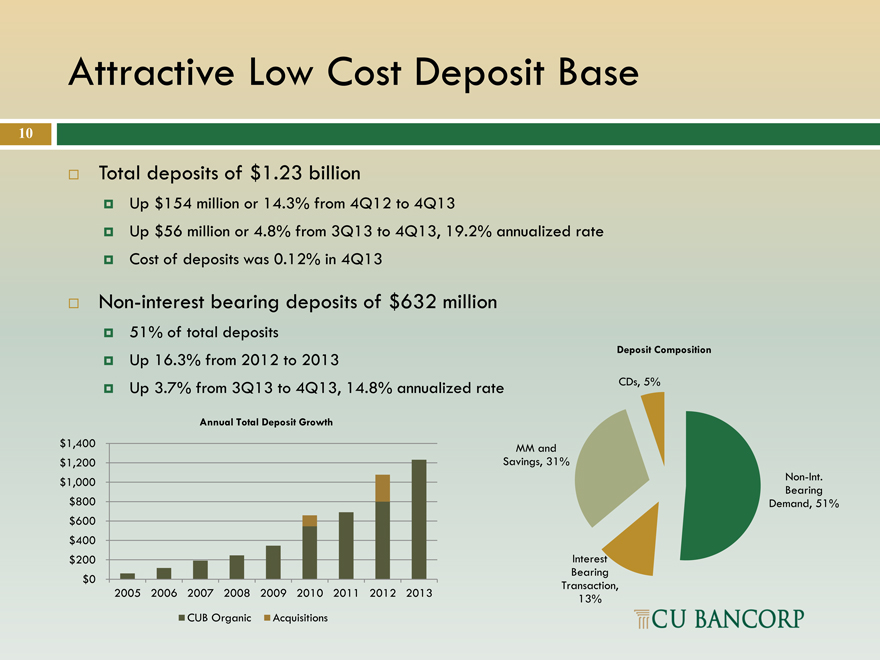

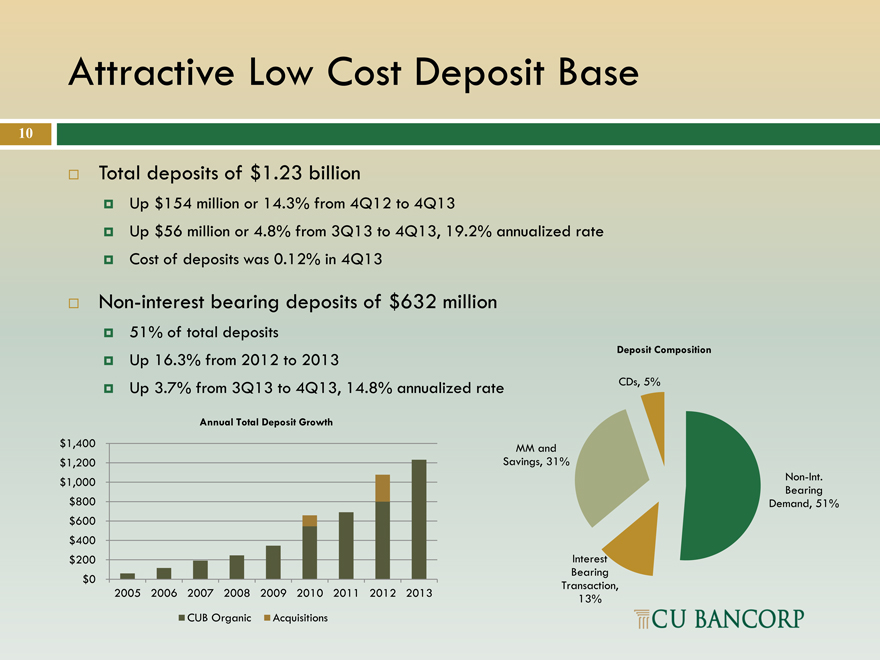

Attractive Low Cost Deposit Base

Total deposits of $1.23 billion

Up $154 million or 14.3% from 4Q12 to 4Q13

Up $56 million or 4.8% from 3Q13 to 4Q13, 19.2% annualized rate Cost of deposits was 0.12% in 4Q13

Non-interest bearing deposits of $632 million

51% of total deposits

Up 16.3% from 2012 to 2013

Up 3.7% from 3Q13 to 4Q13, 14.8% annualized rate

Annual Total Deposit Growth

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

2005 2006 2007 2008 2009 2010 2011 2012 2013

CUB Organic Acquisitions

Deposit Composition

CDs, 5%

MM and

Savings, 31%

Non-Int.

Bearing

Demand, 51%

Interest

Bearing

Transaction,

13%

10

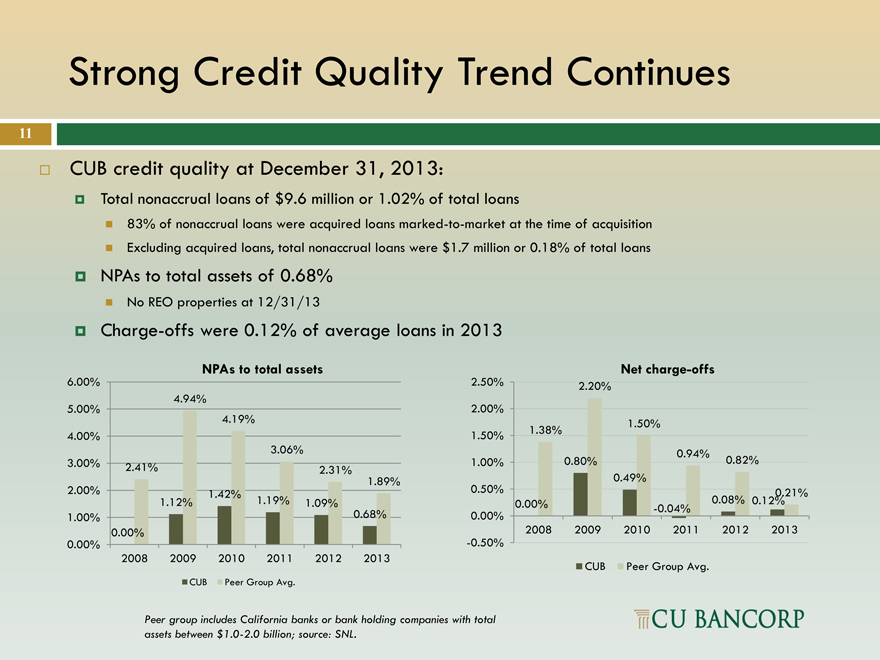

Strong Credit Quality Trend Continues

CUB credit quality at December 31, 2013:

Total nonaccrual loans of $9.6 million or 1.02% of total loans

83% of nonaccrual loans were acquired loans marked-to-market at the time of acquisition Excluding acquired loans, total nonaccrual loans were $1.7 million or 0.18% of total loans

NPAs to total assets of 0.68%

No REO properties at 12/31/13

Charge-offs were 0.12% of average loans in 2013

NPAs to total assets

6.00%

4.94%

5.00%

4.19%

4.00%

3.06%

3.00% 2.41% 2.31%

1.89%

2.00% 1.42%

1.12% 1.19% 1.09%

1.00% 0.68%

0.00%

0.00%

2008 2009 2010 2011 2012 2013

CUB Peer Group Avg.

Net charge-offs

2.50% 2.20%

2.00%

1.50%

1.50% 1.38%

0.94%

1.00% 0.80% 0.82%

0.49%

0.50% 0.21%

0.00% 0.08% 0.12%

0.00% -0.04%

2008 2009 2010 2011 2012 2013

-0.50%

CUB Peer Group Avg.

Peer group includes California banks or bank holding companies with total assets between $1.0-2.0 billion; source: SNL.

11

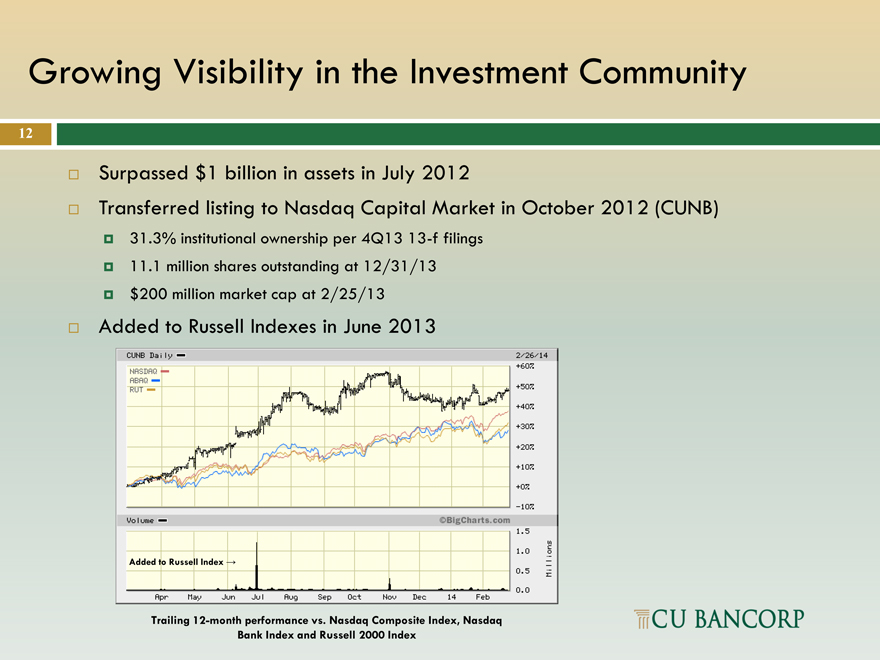

Growing Visibility in the Investment Community

Surpassed $1 billion in assets in July 2012

Transferred listing to Nasdaq Capital Market in October 2012 (CUNB)

31.3% institutional ownership per 4Q13 13-f filings 11.1 million shares outstanding at 12/31/13 $200 million market cap at 2/25/13

Added to Russell Indexes in June 2013

Added to Russell Index

Trailing 12-month performance vs. Nasdaq Composite Index, Nasdaq

Bank Index and Russell 2000 Index

12

Earnings Review

FY 2013 and 4Q13 Results

13

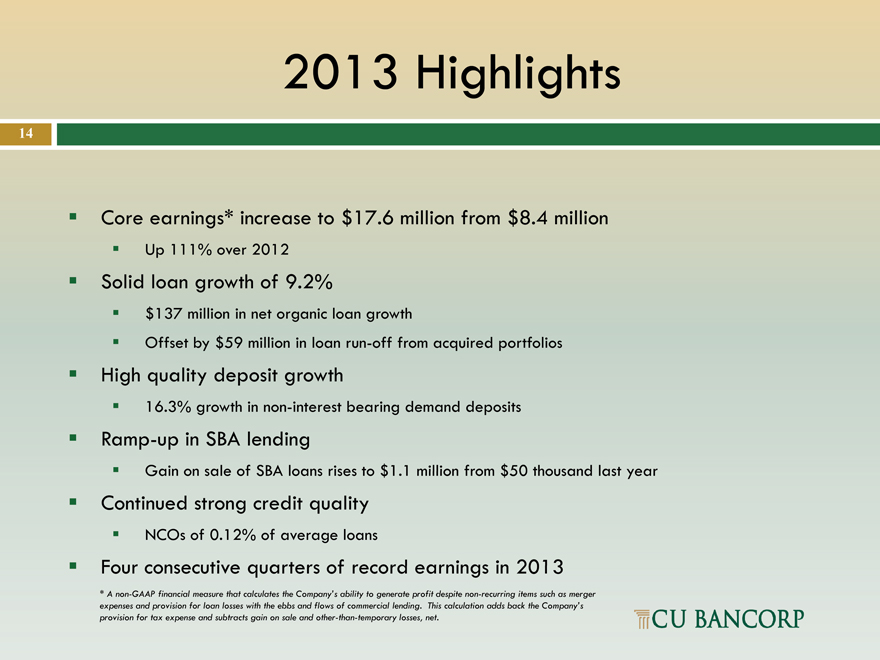

2013 Highlights

Core earnings* increase to $17.6 million from $8.4 million

Up 111% over 2012

Solid loan growth of 9.2%

$137 million in net organic loan growth

Offset by $59 million in loan run-off from acquired portfolios

High quality deposit growth

16.3% growth in non-interest bearing demand deposits

Ramp-up in SBA lending

Gain on sale of SBA loans rises to $1.1 million from $50 thousand last year

Continued strong credit quality

NCOs of 0.12% of average loans

Four consecutive quarters of record earnings in 2013

* A non-GAAP financial measure that calculates the Company’s ability to generate profit despite non-recurring items such as merger expenses and provision for loan losses with the ebbs and flows of commercial lending. This calculation adds back the Company’s provision for tax expense and subtracts gain on sale and other-than-temporary losses, net.

14

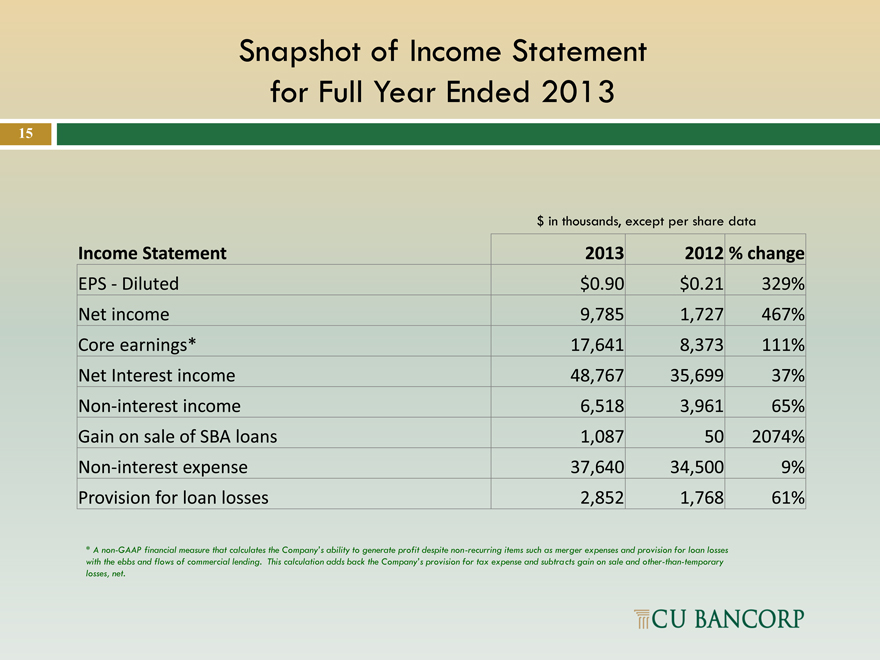

Snapshot of Income Statement

for Full Year Ended 2013

$ in thousands, except per share data

Income Statement 2013 2012 % change

EPS Diluted $0.90 $0.21 329%

Net income 9,785 1,727 467%

Core earnings* 17,641 8,373 111%

Net Interest income 48,767 35,699 37%

Non-interest income 6,518 3,961 65%

Gain on sale of SBA loans 1,087 50 2074%

Non-interest expense 37,640 34,500 9%

Provision for loan losses 2,852 1,768 61%

* A non-GAAP financial measure that calculates the Company’s ability to generate profit despite non-recurring items such as merger expenses and provision for loan losses

with the ebbs and flows of commercial lending. This calculation adds back the Company’s provision for tax expense and subtracts gain on sale and other-than-temporary

losses, net.

15

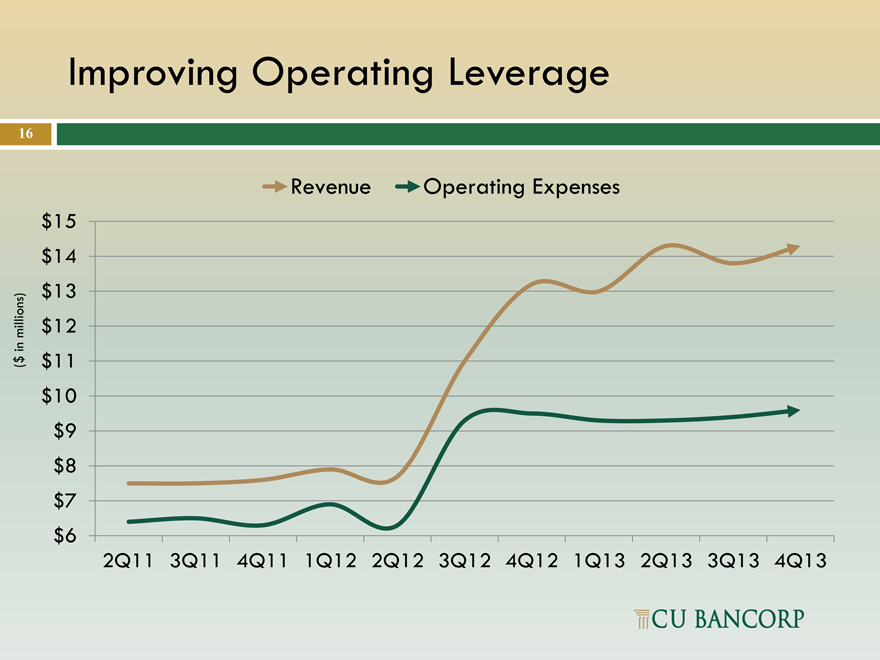

Improving Operating Leverage

Revenue Operating Expenses

$15

$14

$13

(millions) $12

in

$ $11

$10

$9

$8

$7

$6

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13

16

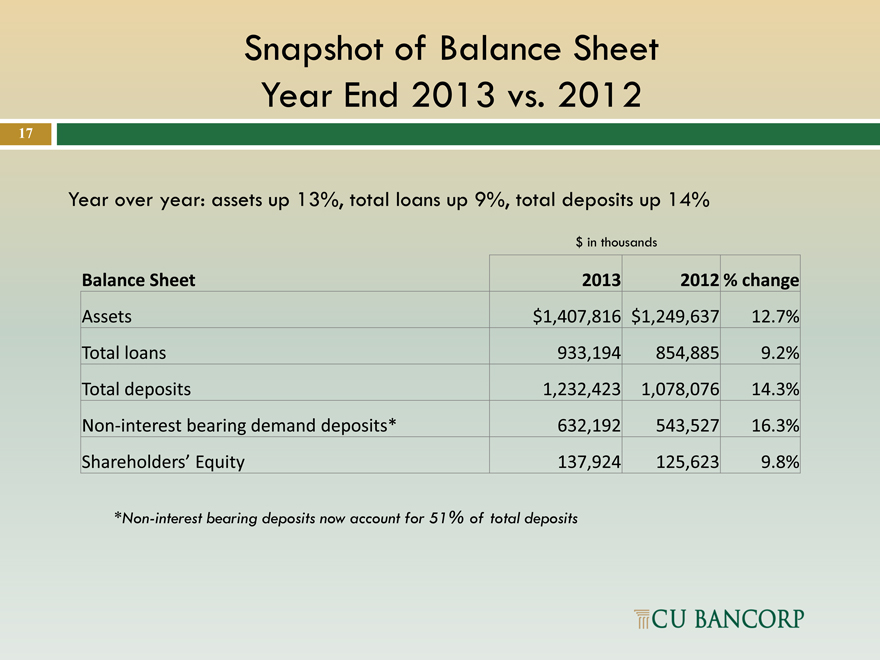

Snapshot of Balance Sheet

Year End 2013 vs. 2012

Year over year: assets up 13%, total loans up 9%, total deposits up 14%

$ in thousands

Balance Sheet 2013 2012 % change

Assets $1,407,816 $1,249,637 12.7%

Total loans 933,194 854,885 9.2%

Total deposits 1,232,423 1,078,076 14.3%

Non-interest bearing demand deposits* 632,192 543,527 16.3%

Shareholders’ Equity 137,924 125,623 9.8%

*Non-interest bearing deposits now account for 51% of total deposits

17

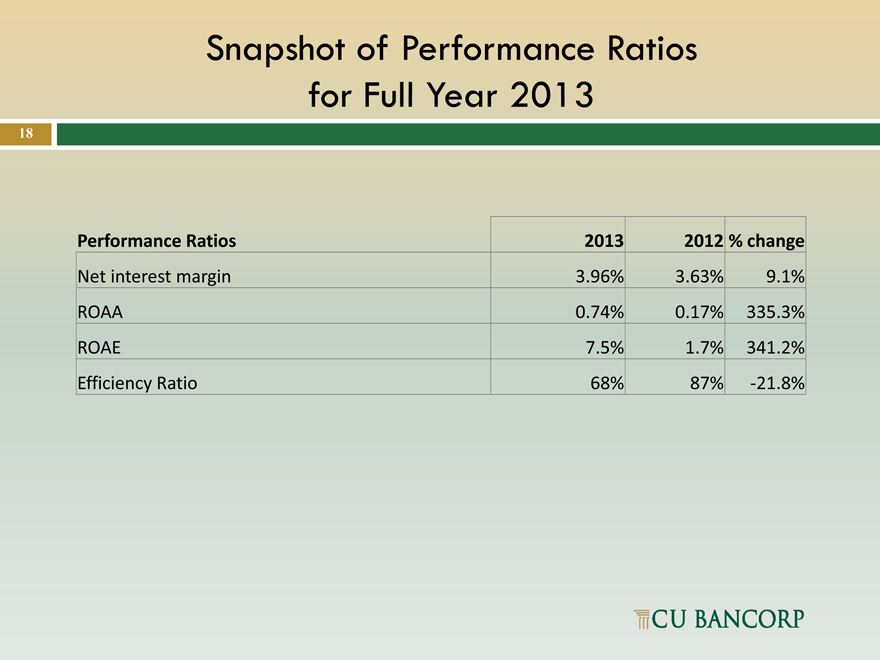

Snapshot of Performance Ratios

for Full Year 2013

Performance Ratios 2013 2012 % change

Net interest margin 3.96% 3.63% 9.1%

ROAA 0.74% 0.17% 335.3%

ROAE 7.5% 1.7% 341.2%

Efficiency Ratio 68% 87% -21.8%

18

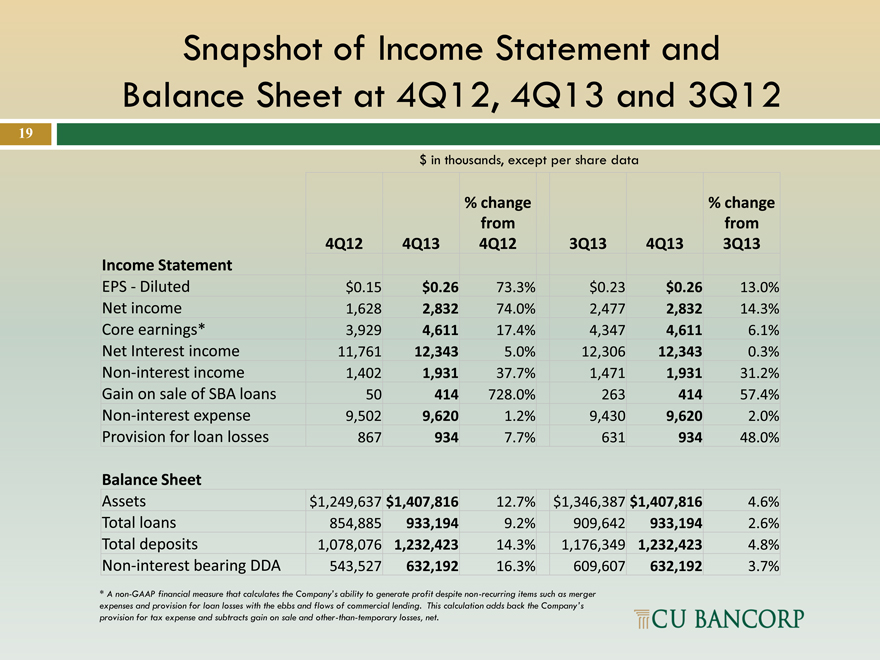

Snapshot of Income Statement and

Balance Sheet at 4Q12, 4Q13 and 3Q12

$ in thousands, except per share data

% change % change

from from

4Q12 4Q13 4Q12 3Q13 4Q13 3Q13

Income Statement

EPS—Diluted $0.15 $0.26 73.3% $0.23 $0.26 13.0%

Net income 1,628 2,832 74.0% 2,477 2,832 14.3%

Core earnings* 3,929 4,611 17.4% 4,347 4,611 6.1%

Net Interest income 11,761 12,343 5.0% 12,306 12,343 0.3%

Non-interest income 1,402 1,931 37.7% 1,471 1,931 31.2%

Gain on sale of SBA loans 50 414 728.0% 263 414 57.4%

Non-interest expense 9,502 9,620 1.2% 9,430 9,620 2.0%

Provision for loan losses 867 934 7.7% 631 934 48.0%

Balance Sheet

Assets $1,249,637 $1,407,816 12.7% $1,346,387 $1,407,816 4.6%

Total loans 854,885 933,194 9.2% 909,642 933,194 2.6%

Total deposits 1,078,076 1,232,423 14.3% 1,176,349 1,232,423 4.8%

Non-interest bearing DDA 543,527 632,192 16.3% 609,607 632,192 3.7%

* A non-GAAP financial measure that calculates the Company’s ability to generate profit despite non-recurring items such as merger

expenses and provision for loan losses with the ebbs and flows of commercial lending. This calculation adds back the Company’s

provision for tax expense and subtracts gain on sale and other-than-temporary losses, net.

19

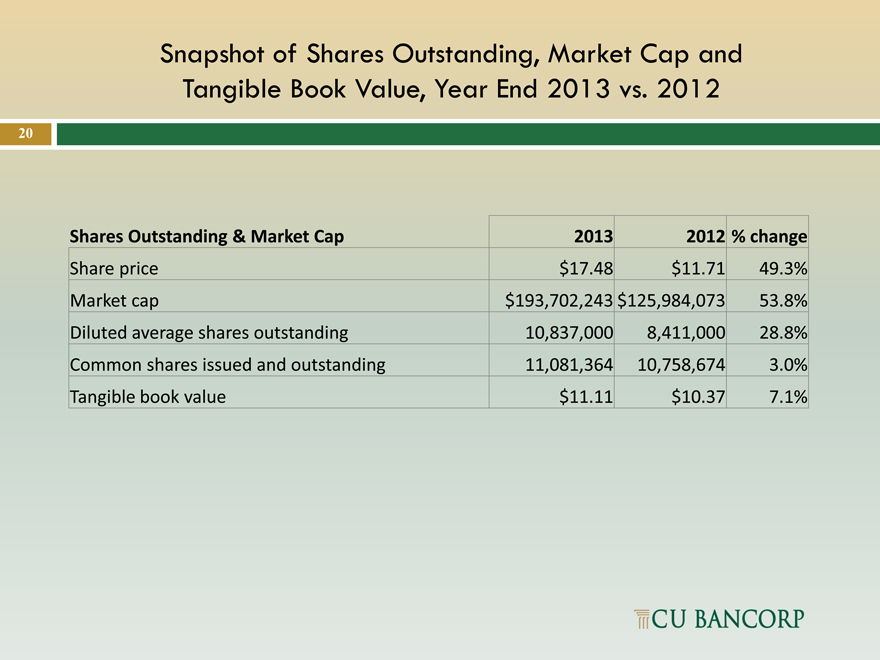

Snapshot of Shares Outstanding, Market Cap and

Tangible Book Value, Year End 2013 vs. 2012

Shares Outstanding & Market Cap 2013 2012 % change

Share price $17.48 $11.71 49.3%

Market cap $193,702,243 $125,984,073 53.8%

Diluted average shares outstanding 10,837,000 8,411,000 28.8%

Common shares issued and outstanding 11,081,364 10,758,674 3.0%

Tangible book value $11.11 $10.37 7.1%

20

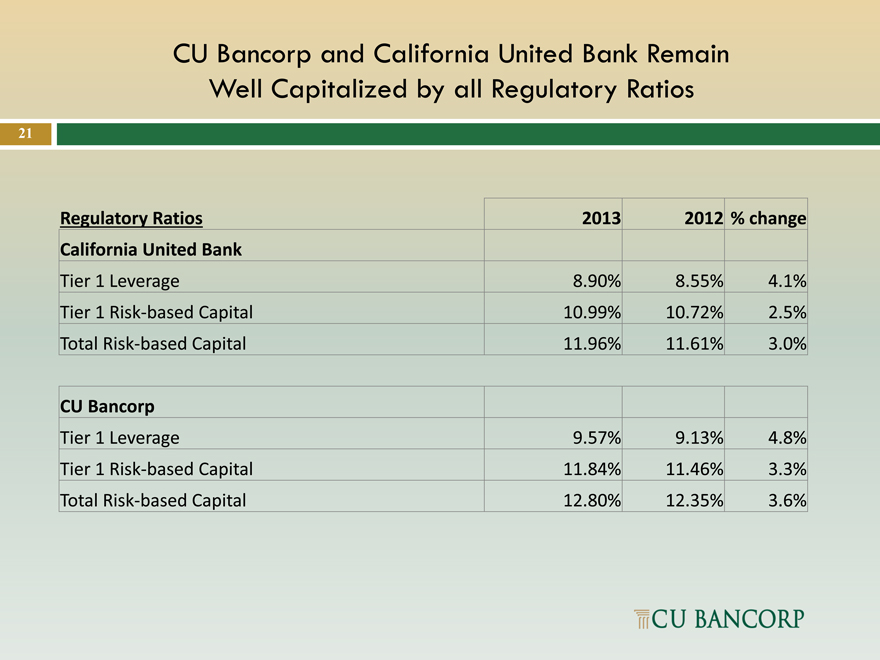

CU Bancorp and California United Bank Remain

Well Capitalized by all Regulatory Ratios

Regulatory Ratios 2013 2012 % change

California United Bank

Tier 1 Leverage 8.90% 8.55% 4.1%

Tier 1 Risk-based Capital 10.99% 10.72% 2.5%

Total Risk-based Capital 11.96% 11.61% 3.0%

CU Bancorp

Tier 1 Leverage 9.57% 9.13% 4.8%

Tier 1 Risk-based Capital 11.84% 11.46% 3.3%

Total Risk-based Capital 12.80% 12.35% 3.6%

21

Appendix

22

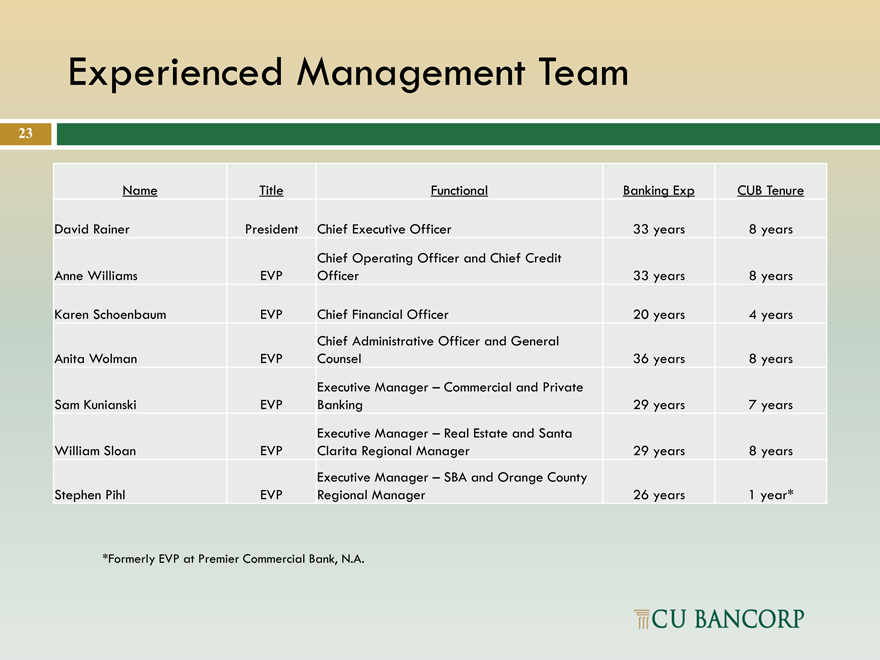

Experienced Management Team

Name Title Functional Banking Exp CUB Tenure

David Rainer President Chief Executive Officer 33 years 8 years

Chief Operating Officer and Chief Credit

Anne Williams EVP Officer 33 years 8 years

Karen Schoenbaum EVP Chief Financial Officer 20 years 4 years

Chief Administrative Officer and General

Anita Wolman EVP Counsel 36 years 8 years

Executive Manager – Commercial and Private

Sam Kunianski EVP Banking 29 years 7 years

Executive Manager – Real Estate and Santa

William Sloan EVP Clarita Regional Manager 29 years 8 years

Executive Manager – SBA and Orange County

Stephen Pihl EVP Regional Manager 26 years 1 year*

*Formerly EVP at Premier Commercial Bank, N.A.

23

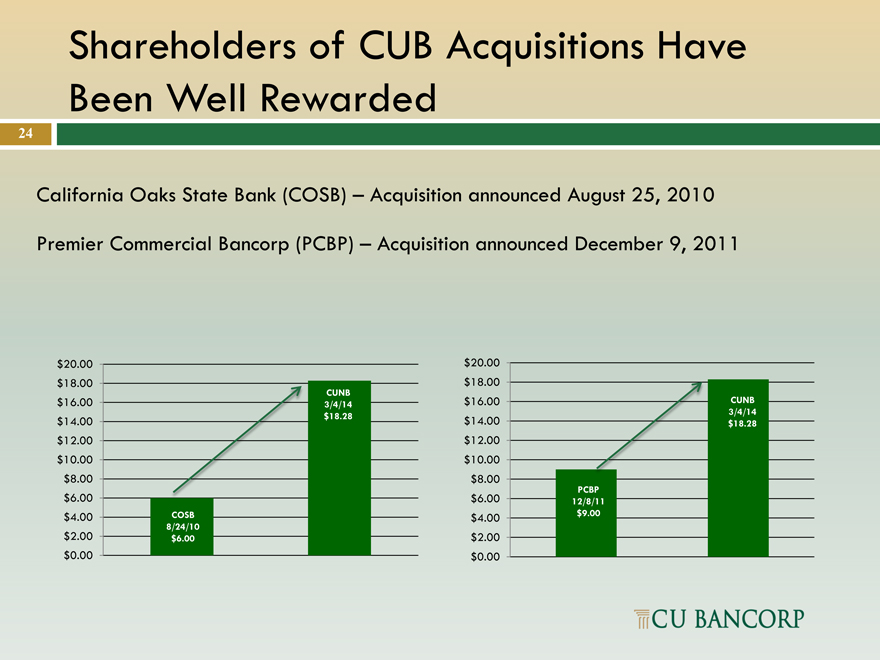

Shareholders of CUB Acquisitions Have

Been Well Rewarded

California Oaks State Bank (COSB) – Acquisition announced August 25, 2010

Premier Commercial Bancorp (PCBP) – Acquisition announced December 9, 2011

$20.00 $20.00

$18.00 $18.00

CUNB

$16.00 3/4/14 $16.00 CUNB

$18.28 3/4/14

$14.00 $14.00 $18.28

$12.00 $12.00

$10.00 $10.00

$8.00 $8.00

PCBP

$6.00 $6.00 12/8/11

$4.00 COSB $4.00 $9.00

8/24/10

$2.00 $6.00 $2.00

$0.00 $0.00

24

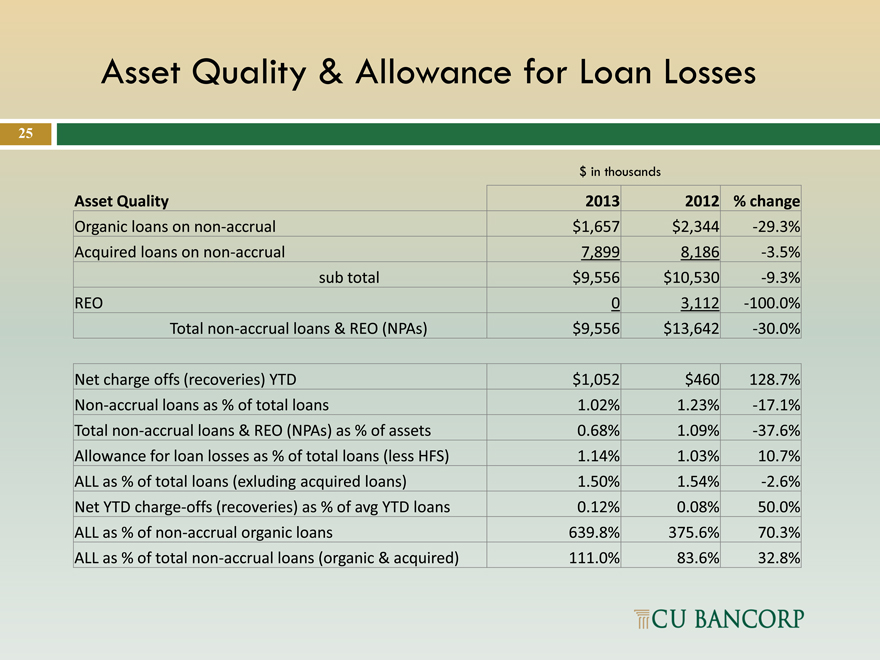

Asset Quality & Allowance for Loan Losses

$ in thousands

Asset Quality 2013 2012 % change

Organic loans on non-accrual $1,657 $2,344 -29.3%

Acquired loans on non-accrual 7,899 8,186 -3.5%

sub total $9,556 $10,530 -9.3%

REO 0 3,112 -100.0%

Total non-accrual loans & REO (NPAs) $9,556 $13,642 -30.0%

Net charge offs (recoveries) YTD $1,052 $460 128.7%

Non-accrual loans as % of total loans 1.02% 1.23% -17.1%

Total non-accrual loans & REO (NPAs) as % of assets 0.68% 1.09% -37.6%

Allowance for loan losses as % of total loans (less HFS) 1.14% 1.03% 10.7%

ALL as % of total loans (exluding acquired loans) 1.50% 1.54% -2.6%

Net YTD charge-offs (recoveries) as % of avg YTD loans 0.12% 0.08% 50.0%

ALL as % of non-accrual organic loans 639.8% 375.6% 70.3%

ALL as % of total non-accrual loans (organic & acquired) 111.0% 83.6% 32.8%

25

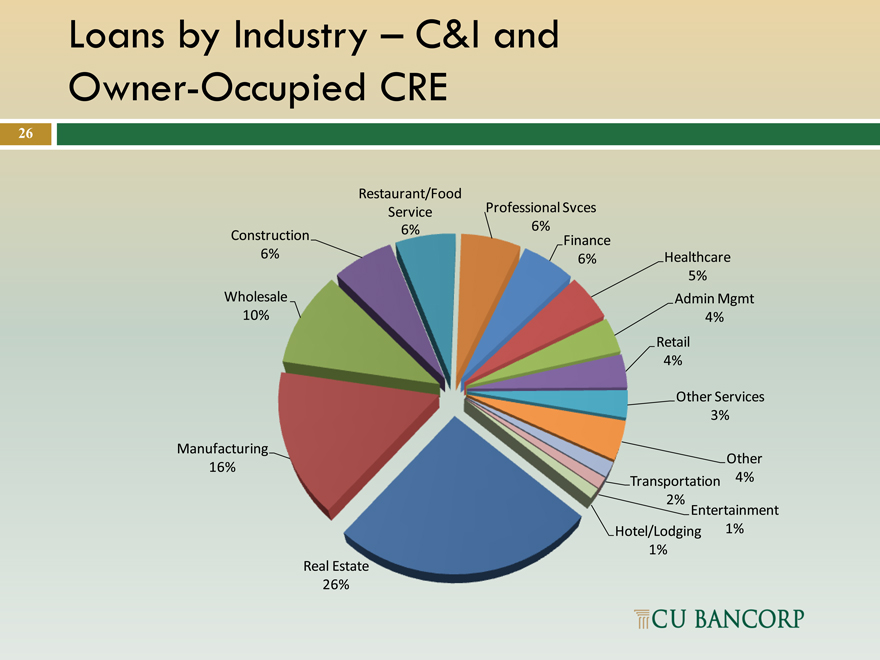

Loans by Industry – C&I and

Owner-Occupied CRE

Restaurant/Food

Service Professional Svces

6% 6%

Construction Finance

6% 6% Healthcare

5%

Wholesale Admin Mgmt

10% 4%

Retail

4%

Other Services

3%

Manufacturing

16% Other

Transportation 4%

2% Entertainment

Hotel/Lodging 1%

1%

Real Estate

26%

26

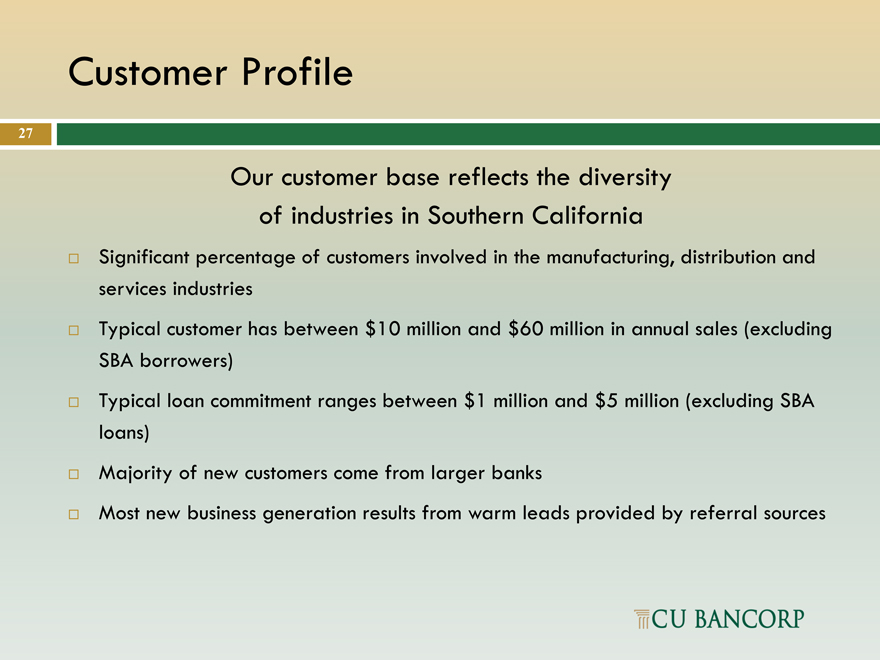

Customer Profile

Our customer base reflects the diversity of industries in Southern California

Significant percentage of customers involved in the manufacturing, distribution and services industries Typical customer has between $10 million and $60 million in annual sales (excluding SBA borrowers) Typical loan commitment ranges between $1 million and $5 million (excluding SBA loans) Majority of new customers come from larger banks Most new business generation results from warm leads provided by referral sources

27