UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under §240.14a-12 |

CU BANCORP

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

August 11, 2016

Dear Shareholder:

It is my pleasure to invite you to CU Bancorp’s 2016 Annual Meeting of Shareholders. We will hold the meeting on Thursday, September 15, 2016, at 8:30 a.m., at the Jonathan Club, 545 South Figueroa Street, Los Angeles, California, 90071.

This booklet includes the Notice of Annual Meeting and the Proxy Statement. The Proxy Statement describes the business that we will conduct at the meeting and provides information about CU Bancorp. This year the shareholders are being asked to elect the Company’s Board of Directors and ratify the selection of independent registered public accountants.

Your vote is important. Whether or not you plan to attend the meeting, please complete, date, sign and return the enclosed proxy card promptly in the envelope provided. You may also vote electronically over the Internet or by telephone, by following the instructions on the reverse of the proxy card. If you attend the meeting and prefer to vote in person, you may do so. IT IS VERY IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING.

We thank you for your continued support of CU Bancorp and look forward to seeing you at the meeting.

| | |

| | Sincerely, |

| |

| |  |

| |

| | David I. Rainer |

| Chairman and Chief Executive Officer |

818 W. 7th Street, Suite 220. Los Angeles, California 90017. Telephone: (213) 430-7000

IMPORTANT NOTICE REGARDINGTHE INTERNET AVAILABILITYOF PROXY MATERIALSFOR

THE ANNUAL MEETINGOF SHAREHOLDERSTOBEHELDON SEPTEMBER 15, 2016

The Proxy Statement to Shareholders is available at:

http://www.viewproxy.com/cubancorp2016

2

CU BANCORP

818 W. 7th Street, Suite 220

Los Angeles, California 90017

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD THURSDAY, SEPTEMBER 15, 2016 - 8:30 a.m.

NOTICE IS HEREBY GIVEN that, pursuant to the Bylaws of CU Bancorp and the call of its Board of Directors, the Annual Meeting of Shareholders of CU Bancorp (the “Company”) will be held at the Jonathan Club, 545 South Figueroa Street, Los Angeles, California, 90071, on Thursday, September 15, 2016 at 8:30 a.m., for the purpose of considering and voting upon the following matters:

| | 1. | Electing the following twelve (12) persons to the Board of Directors to serve until the 2017 Annual Meeting of Shareholders and until their successors are elected and have qualified: |

| | |

| Roberto E. Barragan | | Jeffrey J. Leitzinger |

| Charles R. Beauregard | | David I. Rainer |

| Kenneth J. Cosgrove | | Roy A. Salter |

| David C. Holman | | Daniel F. Selleck |

| K. Brian Horton | | Charles H. Sweetman |

| Eric S. Kentor | | Kaveh Varjavand |

| | 2. | Ratification of the selection of RSM US LLP, to serve as the independent registered public accounting firm for the Company for the year ending 2016. |

| | 3. | Such other business as may properly come before the Meeting and any adjournment or adjournments thereof. |

If you were a shareholder of record at the close of business on July 18, 2016, you may vote at the Annual Meeting.

Article II, Section 13 of our Bylaws provides for the nomination of directors in the following manner:

Section 13.NOMINATION OF DIRECTORS.Nominations for election of members of the board of directors may be made by the board of directors or by any shareholder of any outstanding class of capital stock of the corporation entitled to vote for the election of directors. Notice of intention to make any nominations (other than for persons named in the notice of the meeting at which such nomination is to be made) shall be made in writing and shall be delivered or mailed to the President or to the Chief Executive Officer of the corporation no more than sixty (60) days prior to any meeting of shareholders called for the election of directors and no more than ten (10) days after the date the notice of such meeting is sent to shareholders pursuant to Section 4 of Article II of these Bylaws; provided, however, that if ten (10) days’ notice of such meeting is sent to shareholders, such notice of intention to nominate must be received by the President or by the Chief Executive Officer of the corporation not later than time fixed in the notice of the meeting for the opening of the meeting. Such notification shall contain the following information to the extent known to the notifying shareholder: (a) the name and address of each proposed nominee; (b) the principal occupation of each proposed nominee; (c) the number of shares of capital stock of the corporation owned by each proposed nominee; (d) the name and residence address of the notifying shareholder; (e) the number of shares of capital stock of the corporation owned by the notifying shareholder; (f) with the written consent of the proposed nominee, a copy of which shall be furnished with the notification, whether the proposed nominee has ever been convicted of or pleadednolo contendere to any criminal offense involving dishonesty or

3

breach of trust, filed a petition in bankruptcy, or been adjudged a bankrupt. The notice shall be signed by the nominating shareholder and by the nominee. Nominations not made in accordance herewith shall be disregarded by the Chairman of the meeting and, upon his instructions, the inspectors of election shall disregard all votes cast for each such nominee. The restrictions set forth in this paragraph shall not apply to nomination of a person to replace a proposed nominee who has died or otherwise become incapacitated to serve as a director between the last day for giving notice hereunder and the date of election of directors if the procedure called for in this paragraph was followed with respect to the nomination of the proposed nominee.

We urge you to sign and return the enclosed proxy as promptly as possible whether or not you plan to attend the meeting in person. If you do attend the meeting, you may then withdraw your proxy. The proxy may be revoked at any time prior to its exercise.

| | | | |

| Dated: August 11, 2016 | | By Order of the Board of Directors |

| | |

| | | |  |

| | |

| | | | Anita Y. Wolman, Executive Vice President, General Counsel and Corporate Secretary |

ANNUAL REPORT ON FORM 10-K

THE COMPANY’S 2015 ANNUAL REPORT TO SHAREHOLDERS ON FORM 10-K (THE “ANNUAL REPORT”) WAS PREVIOUSLY MAILED TO ALL SHAREHOLDERS. IN ADDITION, THE ANNUAL REPORT IS AVAILABLE ATwww.cunb.com UNDER THE “INVESTOR RELATIONS” TAB. IF YOU WISH TO RECEIVE ADDITIONAL COPIES OF THE ANNUAL REPORT ON FORM 10-K, AS FILED WITH SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE EXHIBITS THERETO, PLEASE CONTACT MARY BECKNER, AT CU BANCORP, 15821 VENTURA BOULEVARD, SUITE 100, ENCINO, CALIFORNIA 91436, TELEPHONE (818) 257-7791. YOU MAY ALSO SEND YOUR REQUEST BY FACSIMILE TO (818) 257-7703 OR BY E-MAIL TO MBECKNER@CUNB.COM.

4

818 W. 7th Street, Suite 220

Los Angeles, California 90017

Phone: (213) 430-7000

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD THURSDAY, SEPTEMBER 15, 2016

8:30 a.m.

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of Proxies for use at the Annual Meeting of Shareholders (the “Meeting”) of CU Bancorp (the “Company”), to be held at the Jonathan Club, 545 South Figueroa Street, Los Angeles, California, 90071, on Thursday, September 15, 2016, at 8:30 a.m., and at any and all postponements or adjournments thereof. It is anticipated that this Proxy Statement will be mailed to shareholders on or about August 11, 2016.

The matters to be considered and voted upon at the Meeting will be:

| | 1. | Election of Directors. Electing twelve (12) directors who will serve until the 2017 Annual Meeting of Shareholders and until their successors are elected and have qualified. The names of the persons to be placed in nomination for a seat on the Board of Directors are: |

| | |

| Roberto E. Barragan | | Jeffrey J. Leitzinger |

| Charles R. Beauregard | | David I. Rainer |

| Kenneth J. Cosgrove | | Roy A. Salter |

| David C. Holman | | Daniel F. Selleck |

| K. Brian Horton | | Charles H. Sweetman |

| Eric S. Kentor | | Kaveh Varjavand |

| | 2. | Ratification of Selection of Accountants. Ratifying the selection of RSM US LLP, to serve as the independent registered public accounting firm for the Company for the year ending 2016. |

| | 3. | Other Business. Transacting such other business as may properly come before the Meeting and any adjournment or adjournments thereof. |

If you were a shareholder of record at the close of business on July 18, 2016, you may vote at the Annual Meeting.

5

Contents

6

7

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why Did You Send Me this Proxy Statement?

We sent you this Proxy Statement and the enclosed proxy card because our Board of Directors is soliciting your proxy to vote at the 2016 Annual Meeting of Shareholders. This Proxy Statement summarizes the information you need to know to cast an informed vote at the Annual Meeting. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card. You may also vote electronically by telephone or the Internet by following the instructions on the proxy card.

We have previously sent you the CU Bancorp 2015 Annual Report to Shareholders, which includes our Annual Report on Form 10-K. The 2015 Annual Report to Shareholders is also available on our website atwww.cubancorp.com. CU Bancorp is also referred to in this Proxy Statement as “the Company”. The Company, together with its subsidiary, California United Bank is referred to herein as “CUB”.

Who is Entitled to Vote?

We will begin sending this Proxy Statement, the attached Notice of Annual Meeting and the enclosed proxy card on or about August 11, 2016 to all shareholders entitled to vote. Shareholders who were the record owners of CU Bancorp Common Stock at the close of business on July 18, 2016 are entitled to vote. On this record date, there were 17,669,381 shares issued and outstanding of CU Bancorp Common Stock (the “Common Stock”). Our Common Stock is our only class of outstanding stock entitled to vote at the Annual Meeting.

What is the difference between a Shareholder of Record and a “Street Name” holder?

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a company, trust or other nominee, then the broker, company, trust or other nominee is considered to be the shareholder of record with respect to those shares. However you are still considered the beneficial owner of those shares and your shares are said to be held in “street name”. Street name holders generally cannot vote their shares directly and must instead instruct the broker, company, trust or other nominee how to vote their shares using the voting instruction form provided by it. If you hold your shares in street name and do not provide voting instructions, your broker, company, trust or other nominee has discretionary authority to vote your shares on the ratification of the selection of RSM US LLP as our independent auditor, even in the absence of your specific voting instruction. Those shares will also be counted as present at the meeting for purpose of determining a quorum. However, in the absence of your specific instructions as to how to vote, your broker, company, trust or other nominee does not have discretionary authority to vote on the election of directors or any other proposals.

What Constitutes a Quorum?

A quorum of shareholders is necessary to hold a valid meeting. The presence at the annual meeting in person or by proxy of the holders of a majority of the outstanding shares of common stock entitled to vote shall constitute a quorum for the transaction of business. Proxies marked as abstaining (including proxies containing broker non-votes) on any matter to be acted upon by shareholders will be treated as present at the meeting for purposes of determining a quorum but will not be counted as votes cast on such matters. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

8

How Many Votes Do I Have?

Holders of common stock are entitled to one vote, in person or by proxy, for each share of common stock held in his or her name on the books of the Company as of the Record Date for the Meeting on any matter submitted to the vote of the shareholders, except that in connection with the election of directors, the shares are entitled to be voted cumulatively. Cumulative voting entitles a shareholder to give one nominee as many votes as is equal to the number of directors to be elected multiplied by the number of shares owned by such shareholder, or to distribute his or her votes on the same principle between two or more nominees as he or she deems appropriate. The twelve (12) candidates receiving the highest number of votes will be elected.

Pursuant to California law, no shareholder may cumulate votes for a candidate unless such candidate(s) name has been placed in nomination prior to the voting and the shareholder has given notice at the Meeting prior to the voting of the shareholder’s intention to cumulate. If any shareholder gives notice, all shareholders may cumulate their votes.

The proxy holder does not, at this time, intend to cumulate votes pursuant to the proxies solicited in this Proxy Statement unless another shareholder gives notice to cumulate, in which case the proxy holder may cumulate votes in accordance with the recommendations of the Board of Directors. Therefore, discretionary authority to cumulate votes in such event is solicited in this Proxy Statement.

How Do I Vote By Proxy?

Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Annual Meeting and vote. You may also vote over the Internet or by telephone. Instructions for all voting can be found on the back of the Proxy Card included with this Proxy Statement.

If you properly fill in your proxy card and send it to us in time to vote, or vote by Internet or telephone, your “proxy” (the individual named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board of Directors as follows:

| | • | | “FOR” the election of all twelve (12) nominees for director; and |

| | • | | “FOR” the ratification of the selection of RSM US LLP as the Company’s independent registered public accounting firm for 2016. |

For the election of directors (Proposal 1), a shareholder may withhold authority for the proxy holders to vote for any one or more of the nominees by marking the enclosed proxy card in the manner instructed on the proxy card. Unless authority to vote for the nominees is so withheld, the proxy holders will vote the proxies received by them for the election of the nominees listed on the proxy card as directors of the Company. Your proxy does not have an obligation to vote for nominees not identified on the preprinted proxy card (that is, write-in candidates). Should any shareholder attempt to “write in” a vote for a nominee not identified on the preprinted card (and described in these proxy materials), your proxy will NOT vote the shares represented by your proxy card for any such write-in candidate, but will instead vote the shares for any and all other indicated candidates. If any of the nominees should be unable or decline to serve, which is not now anticipated, your proxy will have discretionary authority to vote for a substitute who shall be designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, your

9

proxy intends to vote all of the proxies in such a manner, in accordance with the cumulative voting, as will assure the election of as many of the nominees identified on the proxy card as possible. In such event, the specific nominees to be voted for will be determined by the proxy holders, in their sole discretion.

If any other matter is presented (including but not limited to a motion for adjournment or postponement of the meeting), your proxy will vote in accordance with the recommendation of the Board of Directors, or, if no recommendation is given, in accordance with his or her best judgment. At the time this Proxy Statement went to press, we knew of no matters which needed to be acted on at the Annual Meeting, other than those discussed in this Proxy Statement.

What is the Effect of Withholding Authority to Vote, Broker Non-Votes and Abstentions?

The twelve (12) nominees for director who receive the most votes will be elected. So, if you do not vote for a particular nominee, or you indicate “WITHHOLD AUTHORITY TO VOTE” for a particular nominee on your proxy card, your vote will not count either “FOR” or “AGAINST” the nominee. Ratification of the appointment of our auditors requires the approval of a majority of the votes represented and voting at the meeting.

If you hold your shares of Common Stock in “street name” (that is, through a broker or other nominee) you must vote your shares through your broker. You should receive a form from your broker asking how you want to vote your shares. Follow the instructions on that form to give voting instructions to your broker. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine, but not on non-routine matters. If you fail to instruct your broker or nominee as to how to vote your shares of Common Stock, your broker or nominee may, in its discretion, vote your shares “FOR” ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the year ending December 31, 2016, which is considered a routine matter. HOWEVER, YOUR BROKER MAY NOT VOTE YOUR SHARES “FOR” the election of the nominees for director, without your specific direction. A “broker non-vote” occurs when your broker does not vote on a particular proposal because the broker does not receive instructions from the beneficial owner and does not have discretionary authority. It is VERY IMPORTANT that you return the instructions to your broker or nominee. Therefore if you wish to be represented you must vote by completing the information which is sent to you by your broker or nominee.

California law requires the following two votes to adopt any proposal (other than the election of directors): (1) the affirmative vote of a majority of the shares represented and voting at the Annual Meeting, unless the vote of a greater number is required by law or by our Articles of Incorporation and (2) the affirmative vote of at least a majority of the shares required to constitute a quorum. In determining whether the first vote under (1) has been obtained, abstentions and broker non-votes are not treated as shares voting and therefore will not affect the vote on any proposal. In determining whether the second vote under (2) has been obtained, abstentions and broker non-votes will have the effect of votes cast AGAINST the proposal to ratify our independent registered public accounting firm. That is, abstentions and broker non-votes will reduce the number of affirmative votes and therefore reduce the total percentage of votes the proposal might otherwise have received.

May I Vote Telephonically or Electronically over the Internet?

Shareholders whose shares are registered in their own names may vote either by mail, telephone or over the Internet. Special instructions to be followed by any registered shareholder interested in voting via the Internet or telephone are set forth on the reverse of your proxy card. The Internet and telephone voting procedures are designed to authenticate the shareholder’s identity and to allow shareholders to vote their shares and confirm that their voting instructions have been properly recorded.

10

If your shares are registered in street name, you may also be eligible to vote your shares electronically over the Internet or by telephone. A large number of companies and brokerage firms are participating in the Broadridge Financial Solutions, Inc. online program. This program provides eligible shareholders who receive a paper copy of this Proxy Statement the opportunity to vote via the Internet or by telephone. If your company or brokerage firm is participating in Broadridge’s program, your proxy card will provide the instructions. If your proxy card does not reference Internet or telephone information, please complete and return the proxy card in the self-addressed, postage paid envelope provided.

May I Change my Vote After I Return My Proxy?

A form of Proxy for use at the Meeting is enclosed. If it is executed and returned it may nevertheless be revoked at any time before it is exercised by: (i) filing with the Corporate Secretary of the Company, Anita Y. Wolman, an instrument revoking it or a duly executed Proxy bearing a later date; (ii) appearing and voting in person at the Meeting; or (iii) if you have voted your shares by Internet or telephone, recording a different vote, or by signing and returning a Proxy card dated as of a date that is later than your last Internet or telephone vote. Subject to such revocation, shares represented by a properly executed Proxy received in time for the Meeting will be voted by the Proxy Holder thereof in accordance with the instructions on the Proxy. IF NO INSTRUCTION IS SPECIFIED WITH RESPECT TO A MATTER TO BE ACTED UPON, THE SHARES REPRESENTED BY THE PROXY WILL BE VOTED IN FAVOR OF THE PROPOSAL LISTED ON THE PROXY. IF ANY OTHER BUSINESS IS PROPERLY PRESENTED AT THE MEETING, THE PROXY WILL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATIONS OF THE COMPANY’S BOARD OF DIRECTORS.

How Do I Vote in Person?

If you plan to attend the Annual Meeting and vote in person, we will give you a ballot form when you arrive. However, we strongly recommend that you return the proxy card rather than vote in person as this will expedite the vote counting process at the meeting.PLEASE NOTE THAT IF YOUR SHARES ARE HELD IN THE NAME OF YOUR BROKER, COMPANY OR OTHER NOMINEE, YOU MUST BRING A POWER OF ATTORNEY FROM YOUR NOMINEE IN ORDER TO VOTE AT THE ANNUAL MEETING. IF YOUR SHARES ARE HELD IN STREET NAME YOU WILLNOT BE ABLE TO VOTE AT THE MEETING WITHOUT THE POWER OF ATTORNEY FORM.

How may I obtain a separate set of proxy materials or request a single set for my household?

If you share an address with another shareholder, you may receive only one set of proxy materials unless you have provided contrary instructions. If you wish to receive a separate set of proxy materials now or in the future, please request the additional copies by e-mail toawolman@cunb.com, by facsimile to (818) 257-7703 or by calling (818) 257-7779. The Proxy Statement is also available on the internet athttp://www.viewproxy.com/cubancorp2016.

What should I do if I receive more than one set of voting materials?

Similarly, if you share an address with another shareholder and have received multiple copies of our proxy materials, you may contact us in the same manner or write us at the address set forth below in the last question to request delivery of a single copy of these materials.

Why may I receive multiple voting instruction forms and/or proxy cards?

If you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one proxy card. In each case, please complete, sign, date and return each proxy card and voting instruction form that you receive.

11

Who is Making the Solicitation?

This solicitation of Proxies is being made by the Board of Directors of the Company. The expense of preparing, assembling, printing and mailing this Proxy Statement and the materials used in the solicitation of Proxies for the Meeting will be borne by the Company. It is contemplated that Proxies will be solicited principally through the use of the mail, but officers, directors and employees of the Company may solicit Proxies personally or by telephone, without receiving special compensation for such activities. Although there is no formal agreement to do so, the Company may reimburse companies, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding these Proxy Materials to shareholders whose stock in the Company is held of record by such entities. We have hired Alliance Advisors, LLC to seek the proxies of custodians, such as brokers, who hold shares which belong to other people as well as our individual shareholders. This service will cost the Company approximately $6,500. It is possible that Alliance Advisors, at the direction of the Company, may solicit proxies by telephone and will receive additional compensation for such activities.

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting

of Shareholders to be held on September 15, 2016

The Proxy Statement is available on the internet at

http://www.viewproxy.com/cubancorp2016

12

VOTING SECURITIES

There were 17,669,381 shares issued and outstanding of the Company’s common stock (the “Common Stock”) on July 18, 2016, which has been fixed as the record date for the purpose of determining the shareholders entitled to notice of and to vote at the Meeting. Each holder of Common Stock will be entitled to one vote, in person or by Proxy, for each share of Common Stock held of record on the books of the Company as of the record date for the Meeting on any matter submitted to the vote of the shareholders, except that in connection with the election of directors, the shares may be voted cumulatively if a shareholder present at the Meeting has given notice at the Meeting, prior to the voting, of his or her intention to vote cumulatively. If any shareholder has given such notice, then all shareholders entitled to vote for the election of directors may cumulate their votes. Cumulative voting means that a shareholder has the right to vote the number of shares he or she owns as of the record date, multiplied by the number of directors to be elected. This total number of votes may be cast for one nominee or it may be distributed on the same principle among as many nominees as the shareholder sees fit. If cumulative voting is declared at the Meeting, votes represented by Proxies delivered pursuant to this Proxy Statement may be cumulated in the discretion of the Proxy Holders, in accordance with the recommendations of the Company’s Board of Directors.

A majority of the outstanding shares, represented in person or by Proxy, is required for a quorum. Nominees receiving the most votes, up to the number of directors to be elected, are elected as directors for the ensuing year. A majority of the shares represented and voting at the Meeting is required to ratify the selection of RSM US LLP (“RSM”) as the Company’s independent registered public accounting firm for 2016.

If you hold Common Stock in “street name” and you fail to instruct your broker or nominee as to how to vote such Common Stock, your broker or nominee may, in its discretion, vote such Common Stock “FOR” ratification of the selection of RSM as the independent registered public accounting firm and auditors of the Company for 2016, but CANNOT vote FOR election of directors, unless you instruct them as to your vote. IT IS EXTREMELY IMPORTANT THAT YOU VOTE BY RETURNING YOUR PROXY CARD OR BY INTERNET OR TELEPHONE.

13

PROPOSAL 1 – ELECTION OF DIRECTORS

Nominees

The Bylaws of the Company provide that the number of directors shall not be less than nine nor more than seventeen until changed by an amendment to the Articles of Incorporation or the Bylaws, leaving the Board of Directors with the authority to fix the exact number of directors within that range. As of the date of this Proxy Statement the exact number of CUB directors determined by the Board of Directors is 12 (and there are no vacancies), and with regard to the business to be conducted at the Annual Meeting, the Board of Directors has fixed the exact number of Company directors at twelve.

Directors are elected annually for a term ending on the next annual shareholders’ meeting date and when their successors are duly elected and qualified.

The persons named below are currently members of the Board of Directors. All of the listed persons will be nominated for election to serve until the 2017 Annual Meeting of Shareholders and until their successors are elected and have qualified, pursuant to the recommendation of the Compensation, Nominating and Corporate Governance Committee of the Board of Directors and concurrence of the Board of Directors.

| | |

Roberto E. Barragan | | Jeffrey J. Leitzinger |

Charles R. Beauregard | | David I. Rainer |

Kenneth J. Cosgrove | | Roy A. Salter |

David C. Holman | | Daniel F. Selleck |

K. Brian Horton | | Charles H. Sweetman |

Eric S. Kentor | | Kaveh Varjavand |

Votes will be cast in such a way as to effect the election of all twelve nominees, or as many thereof as possible under the rules of cumulative voting. In the event that any of the nominees should be unable to serve as a director, it is intended that the Proxy will be voted for the election of such substitute nominees, if any, as shall be designated by the Board of Directors. Management has no reason to believe that any of the nominees will be unavailable to serve. Additional nominations can only be made by complying with the notice provision set forth in the Bylaws of the Company, an extract of which is included in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement. This Bylaw provision is designed to give the Board of Directors advance notice of competing nominations, if any, and the qualifications of nominees, and may have the effect of precluding third-party nominations if the notice provisions are not followed.

14

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

The Board of Directors has determined that all of the current directors on the Board, except for Mr. Rainer and Mr. Horton, are “independent,” as that term is defined by the rules and regulations of The NASDAQ Stock Market. These ten independent directors comprise a majority of the Board of Directors.

The following table lists the names and certain information as of July 18, 2016 regarding the Company’s directors. All the named individuals serve as directors of CU Bancorp and its subsidiary California United Bank (the “Bank”).

| | | | | | |

Name | | Age | | Position with CUB | | Year First

Appointed or

Elected |

| | | |

Roberto E. Barragan | | 56 | | Director, Nominee | | 2004 |

| | | |

Charles R. Beauregard* | | 68 | | Director, Nominee | | 2014 |

| | | |

Kenneth J. Cosgrove | | 69 | | Vice Chairman California United Bank, Nominee | | 2012 |

| | | |

David C. Holman* | | 67 | | Director (Lead), Nominee | | 2014 |

| | | |

K. Brian Horton* | | 56 | | Director and President, Nominee | | 2014 |

| | | |

Eric S. Kentor | | 57 | | Director, Nominee | | 2014 |

| | | |

Jeffrey Leitzinger, Ph.D.* | | 62 | | Director, Nominee | | 2014 |

| | | |

David I. Rainer | | 59 | | Chairman and Chief Executive Officer, Nominee | | 2004 |

| | | |

Roy A. Salter | | 59 | | Director, Nominee | | 2004 |

| | | |

Daniel F. Selleck | | 60 | | Director, Nominee | | 2004 |

| | | |

Charles H. Sweetman | | 74 | | Director, Nominee | | 2004 |

| | | |

Kaveh Varjavand** | | 53 | | Director, Nominee | | 2015 |

| * | Appointed November 30, 2014 following acquisition of 1st Enterprise Bank |

| ** | Appointed September 1, 2015 |

The Company’s directors serve one-year terms. None of the directors or executive officers was selected pursuant to any arrangement or understanding, other than with the directors and executive officers of the Company acting within their capacities as such. There are no family relationships between the directors and executive officers of CU Bancorp. None of the directors or executive officers of CU Bancorp serve as directors of any other company which has a class of securities registered under, or which are subject to the periodic reporting requirements of, the Securities Exchange Act of 1934, as amended, or any investment company registered under the Investment Company Act of 1940. None of the directors or executive officers of CUB have been involved in any legal proceedings during the past ten years that are material to an evaluation of the ability or integrity of any director or executive officer of CU Bancorp.

CU Bancorp believes that all of its directors’ and nominees’ respective educational background and business experience give them the qualifications and skills necessary to serve as directors of CUNB. The following is a description of the business experience during at least the past five years of each director nominee as well as their specific experience, qualifications, attributes or skills which led to the conclusion that each of the director nominees listed above should serve as a member of CU Bancorp’s Board of Directors:

Roberto E. Barragan. Mr. Barragan currently is President of the Valley Economic Development Center, Inc. (“VEDC”). He has served in various capacities with the VEDC since 1995. The VEDC is a 501(c)3 community based private non-profit corporation which offers training, consulting, technical assistance and financing to small- and medium-sized businesses. He was a founder of the Pacoima Development Federal Credit Union. Mr. Barragan is an expert on the needs of small businesses within CUB’s communities and assists significantly in the Community Reinvestment Act efforts of CUB. Mr. Barragan serves as the Community Reinvestment Act “CRA” Board Liaison, between CUB’s CRA Committee and the Board of Directors.

15

CU Bancorp has nominated Mr. Barragan because he is an expert on the needs of small businesses within California United Bank’s communities, as well as lending, community development and government programs designed to assist in small business lending. He is also extremely experienced and knowledgeable about the Southern California small business lending climate and opportunities. His experience and community contacts provide him with the knowledge to assist significantly in the Community Reinvestment Act and small business lending efforts of California United Bank.

Charles R. Beauregard. Mr. Beauregard has served as a director of the Company since November 30, 2014, following the merger of 1st Enterprise Bank with and into California United Bank. He was a director of 1st Enterprise Bank since its incorporation in 2006 and served as Chairman of the Director’s Loan Committee at 1st Enterprise as well as a member of the Compensation Committee, the Strategic and Capital Planning Committee, and the Governance Committee. Mr. Beauregard is a retired bank executive with over 30 years of commercial banking experience. Mr. Beauregard was formerly chief credit officer for Wells Fargo Bank’s Trust and Private Bank Group.

CU Bancorp has nominated Mr. Beauregard because of his experience as a bank executive with a specialty in commercial banking as well as his experience as a community bank director, which provides additional expertise to the CU Bancorp Board of Directors, and in particular to the California United Bank Loan Committee.

Kenneth J. Cosgrove. Mr. Cosgrove was previously the Chairman and Chief Executive Officer of Premier Commercial Bancorp and Premier Commercial Bank, N.A. and had served in that position since its formation. He has over 40 years of banking experience. He is currently also a member of the Board of Directors of the holding company for Pacific Coast Bankers Bank as well as Pacific Coast Bankers Bank, a bankers’ bank in San Francisco, CA and serves as the Chairman of the Board.

CU Bancorp has nominated Mr. Cosgrove based on his extensive knowledge of banking, the banking industry, the Southern California (particularly Orange County) banking market and SBA lending. Mr. Cosgrove is a member of the California United Bank Directors’ Loan Committee and provides expertise to that Committee.

David C. Holman. Mr. Holman is the Lead Director for CU Bancorp. He was previously the Chairman of the board of directors of 1st Enterprise Bank, serving since incorporation of 1st Enterprise in February 2006 and was also a private investor throughout that period. He was Chairman of both the Strategic and Capital Planning Committee and the Nominating and Governance Committee, and a member of the Compliance and Compensation Committees of 1st Enterprise. Mr. Holman was formerly a senior executive at First Interstate Bank in Los Angeles and has been actively involved in the commercial banking industry for 40 years in California as a banker or investor.

CU Bancorp has nominated Mr. Holman because of his experience as a senior executive of a southern California based bank and knowledge of that market, as well as his experience as the Chairman of the board of directors of an independent bank, particularly with regard to the compensation and corporate governance areas.

K. Brian Horton. Mr. Horton is President and a director of CU Bancorp and California United Bank. He previously served as the President and a director of 1st Enterprise since February 2006. Previously, he served as Division President of Mellon 1st Business Bank, from September 2004 to June 2005, and in various management positions at Mellon 1st Business Bank (and its predecessor, 1st Business Bank) from 1988 through June 2005, including Executive Vice President from 2003 to 2004, and Regional Vice President for the Orange County Regional Office from 1997 to 2003.

16

CU Bancorp has nominated Mr. Horton because of his executive management position and his experience as a commercial banker in the market served by California United Bank and his experience as a director of an independent bank. He currently serves on the California United Bank Loan Committee.

Eric S. Kentor. Mr. Kentor is an attorney, independent business consultant and private investor working primarily with companies in the medical technology and clean tech, or “green” sectors. From 1995, until its purchase by Medtronic in 2001, Mr. Kentor served as Senior Vice President, General Counsel, and Corporate Secretary and as a permanent member of the Executive Management Committee at MiniMed Inc. The company was a world leader in the design, development, manufacture and marketing of advanced systems for the treatment of diabetes. Prior to MiniMed, Mr. Kentor served as Vice President of Legal Services for Health Net and as Executive Counsel for its parent corporation. Previously, Mr. Kentor was a partner at the law firm of McDermott, Will & Emery. Mr. Kentor has also served as a director of both private and public companies, including Endocare, Inc., a publicly traded medical device company where he served as a director until the company was acquired in 2009. As an attorney experienced in corporate governance, Mr. Kentor provides legal and corporate governance expertise as well as experience as an executive officer and director of public companies.

CU Bancorp has nominated Mr. Kentor because of his significant experience in corporate and securities law as well as corporate governance. His experience as an executive officer and director of public companies has provided him with substantial experience in the sophisticated areas of public company corporate governance, securities law and management. He currently serves as Chairman of the Compensation, Nominating and Corporate Governance Committee and as a Committee Member of the Audit and Risk Committee of the CU Bancorp Board of Directors.

Jeffrey J. Leitzinger, Ph.D. Dr. Leitzinger previously served as a director of 1st Enterprise since its incorporation in 2006. He was a member of the ALCO Committee, the Nominating and Governance Committee, and the Strategic and Capital Planning Committee. Dr. Leitzinger has been President and Chief Executive Officer of EconOne Research, Inc. in Los Angeles since 1997, and has been an economic consultant for over 30 years.

CU Bancorp has nominated Mr. Leitzinger because his talents and experience as an economist assist the Company in its strategic planning and its analysis of the impact of economic factors on its business. Additionally, as a small business owner Dr. Leitzinger provides insight into this part of California United Bank’s target market. Dr. Leitzinger serves as the board liaison to the California United Bank Asset and Liability Committee (ALCO).

David I. Rainer. Mr. Rainer is Chairman of the Board of Directors and the Chief Executive Officer of CU Bancorp and California United Bank. He was previously California State President for US Bank and Executive Vice President of Commercial Banking for US Bank, in which capacity he led the commercial banking operations for US Bank in the Western United States, from Colorado to California. In February 1999, Mr. Rainer became President and Chief Executive Officer of Santa Monica Bank which was acquired by US Bank in November 1999. From 1992 to 1999, Mr. Rainer was an executive officer of California United Bank (not related to the current California United Bank), and its successor Pacific Century Bank, N.A., and served as Executive Vice President and then director, President and Chief Executive Officer. Mr. Rainer is a member of the Board of Directors of the Federal Reserve Bank of San Francisco, Los Angeles Branch.

CU Bancorp has nominated Mr. Rainer because the Company believes that including the chief executive officer on the Board of Directors is essential to providing appropriate information to the Board about the Company and management, on improvements in California United Bank’s value and on corporate initiatives. As a banker with over 25 years of experience in super-regional banks as well as community banks, strong leadership and executive experience, Mr. Rainer can provide valuable knowledge and insight as to all aspects of the Company’s operations.

17

Roy A. Salter. Mr. Salter is a senior advisor of FTI Consulting, and global leader of the firm’s Valuation and Financial Advisory Services (VFAS) group and Media and Entertainment group based in Los Angeles. FTI Consulting is a global business advisory firm that employs top-tier professionals from every major financial center and every corner of the globe dedicated to helping organizations protect and enhance enterprise value in an increasingly complex legal, regulatory and economic environment. As global leader of the firm’s VFAS practice, Mr. Salter and his colleagues oversee FTI’s provision of business and intangible asset valuations, financial opinions (fairness and solvency opinions; purchase price allocation, goodwill impairment, portfolio valuation and other accounting opinions); forecasting, financial and strategic analysis; and transaction support covering a broad spectrum of industries and situations to both middle market and Fortune 500 companies and capital market constituents.

CU Bancorp has nominated Mr. Salter primarily based upon his financial analysis and valuation expertise as well as background in bank marketing. His analytical experience can be of assistance in financial analysis and strategic initiatives, in particular. In addition, as the founder and an executive officer of a successful small business, he can provide expertise and insight into a large portion of CU Bancorp’s target market.

Daniel F. Selleck. Mr. Selleck is President of the Westlake Village-based Selleck Development Group, Inc. which specializes in the development and acquisition of commercial properties. That company has completed the development of more than 3.5 million square feet of property, with a value approximating $1 billion, including the development of the former General Motors Assembly Plant in Van Nuys, California and the Shoppes at Westlake Village shopping center. As a real estate expert, Mr. Selleck provides his expertise to CUB’s Directors’ Loan Committee and provides expertise in real estate lending and structure.

CU Bancorp has nominated Mr. Selleck because of his expertise as a leading developer in California United Bank’s target markets. He has experience in real estate lending, borrowing, and construction which can be of assistance to California United Bank’s real estate and construction lending efforts. Additionally, as an established resident and business figure of California United Bank’s target market area, he is in a position to provide business and community knowledge and insight.

Charles H. Sweetman. Mr. Sweetman is a managing partner of Sweetman Properties, LLC, a commercial income property company located in Palm Desert, California and also is the President and Chief Executive Officer of Sweetman Group, Inc. a property management and consulting firm. Mr. Sweetman provides strong entrepreneurial experience to the Board as well as significant business development skills. He is a member of the Compensation, Nominating and Corporate Governance Committee.

CU Bancorp has nominated Mr. Sweetman because of his leadership experience and community involvement as well as his entrepreneurial experience in founding and managing a small- to medium-size business, managing and successfully selling that business as well as executive experience with a large national company. His experience provides him with insight into California United Bank’s target market and particularly his management experience provides him with knowledge of compensation and employment matters. He has also been a successful real estate investor with the ability to provide market information as well as real estate expertise.

Kaveh Varjavand. Mr. Varjavand is an accounting and financial professional with 29 years of experience in the financial services industry, including 18 years in public accounting, during 14 of which he was a managing partner. Mr. Varjavand is the founder and president of AARCS (Accounting, Audit, and Reporting Consulting Services), established in 2013, which provides consulting services to community banks in the areas of financial reporting, risk assessment, regulatory compliance, governance and credit risk management, among others. From

18

2006 to 2013, he was the Partner-in-Charge of the Southern California Financial Services Group at Moss Adams LLP, where he was responsible for all aspects of practice development related to financial services clients in Southern California. In 1990 Mr. Varjavand joined the audit staff at KPMG LLP, and served there as an audit partner from 1999 to 2006. He left KPMG for four years from 1994 to 1998 to work in the banking industry: from 1994 to 1997 he served as Vice President, Corporate Planning & Internal Asset Review, at Coast Federal Bank, an $8 billion savings bank; from 1997 to 1998, he served as First Vice President, Planning & Analysis at California Federal Bank, a $60 billion savings bank. He is a member of the American Institute of Certified Public Accountants and the California Society of Certified Public Accountants. Mr. Varjavand earned a bachelor’s degree in accounting with a minor in economics from the University of Kentucky. He has been a licensed certified public accountant since 1992.

CU Bancorp has nominated Mr. Varjavand because his education, knowledge and experience allow him to provide the board of directors with insight regarding financial and accounting matters and to serve on the CU Bancorp’s Audit and Risk Committee and as an audit committee financial expert. In particular, Mr. Varjavand’s financial institutions accounting expertise and corporate governance experience contributes a valuable source of expertise to CU Bancorp in these areas. Mr. Varjavand is an Audit and Risk Committee designated financial expert and serves as Chairman of the Audit and Risk Committee of the CU Bancorp Board of Directors.

Executive Officers

The following sets forth the names and certain information as of July 18, 2016 with respect to the Company’s executive officers (except for Mr. Rainer and Mr. Horton whose information is included above):

| | | | | | | | |

Name | | Age | | Position with Company | | Year First

Appointed | |

| | | |

Anne A. Williams | | 58 | | Executive Vice President, Chief Operating Officer / Chief Credit Officer CU Bancorp and California United Bank and Director – California United Bank | | | 2005 | |

| | | |

Karen A. Schoenbaum | | 54 | | Executive Vice President and Chief Financial Officer CU Bancorp and California United Bank | | | 2009 | |

| | | |

Robert E. Sjogren | | 50 | | Executive Vice President and Chief Risk Officer1CU Bancorp and California United Bank | | | 2016 | |

| | | |

Anita Y. Wolman | | 64 | | Executive Vice President, Chief Administrative Officer, General Counsel & Corporate Secretary2CU Bancorp and California United Bank | | | 2009 | |

| 1. | Mr. Sjogren joined the Company in July 2016 |

Anne A. Williams, Executive Vice President, Chief Operating Officer and Chief Credit Officer. Ms. Williams is a Director of California United Bank and Executive Vice President and Chief Operating Officer / Chief Credit Officer of CUB. Prior to joining us, Ms. Williams served as Senior Vice President and Credit Risk Manager for US Bank’s Commercial Banking Market for the State of California. Ms. Williams was previously the Executive Vice President and Chief Credit Officer of Santa Monica Bank, which was acquired by US Bank in November 1999. Prior to joining Santa Monica Bank, Ms. Williams was the Executive Vice President and Chief Credit Officer at California United Bank (and its successor, Pacific Century Bank, N.A.) from 1992 to 1999.

Karen A. Schoenbaum, Executive Vice President and Chief Financial Officer.Ms. Schoenbaum has served as CU Bancorp and California United’s Executive Vice President and Chief Financial Officer since October 2009. Prior to joining CUB, Ms. Schoenbaum was Executive Vice President and Interim Chief Financial

19

Officer of Premier Business Bank in Los Angeles. She previously served as Executive Vice President and Chief Financial Officer of California National Bank from 2001 to 2008, where she was responsible for the financial and regulatory reporting, accounting, treasury, asset and liability management, general services and corporate real estate departments. From 1997 to 2001, Ms. Schoenbaum was Executive Vice President, Chief Financial Officer and Chief Information Officer of Pacific Century Bank, N.A. a subsidiary of Bank of Hawaii Corporation.

Robert E. Sjogren, Executive Vice President and Chief Risk Officer.Mr. Sjogren was appointed Executive Vice President and Chief Risk Officer of CU Bancorp and California United Bank in July 2016. He previously was Chief Operating Officer of Pacific Mercantile Bancorp beginning in 2013, and was its General Counsel prior to that. Mr. Sjogren began his banking career in 1988 as a regulatory examiner for the Federal Deposit Insurance Corporation, where he worked for ten years and became a Senior Examiner and Team Leader while attending Loyola Law School. Upon graduating law school and passing the Bar Exam, Mr. Sjogren worked for Nixon Peabody LLP in their financial institutions practice from 1998 to 2004.

Anita Y. Wolman, Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary. Ms. Wolman was appointed Chief Administrative Officer in 2013 and Executive Vice President & General Counsel in January 2009. She previously was Senior Vice President Legal/Compliance beginning in 2005. Prior to joining CUB, Ms. Wolman was Senior Vice President, General Counsel & Corporate Secretary of California Commerce Bank (Citibank/Banamex USA). Earlier Ms. Wolman was Executive Vice President, General Counsel & Corporate Secretary of Pacific Century Bank, N.A. a subsidiary of Bank of Hawaii Corporation and its predecessor California United Bank. Ms. Wolman was previously Senior Vice President Legal/Compliance and had served in that capacity since 2005.

There are no family relationships between any Director and an Executive Officer or among any Directors.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership of, and transactions in, the Company’s equity securities with the SEC. Such directors, executive officers and 10% stockholders are also required to furnish the Company with copies of all Section 16(a) reports that they file. Based solely on a review of the copies of such reports received by the Company, and on written representations from certain reporting persons, the Company believes that all Section 16(a) filing requirements applicable to its directors, executive officers and 10% stockholders were complied with during 2015 with the exception of a total of three (3) filings for Mr. Rainer and Mses. Williams and Wolman, respectively, which, due to administrative error, were 4 days delinquent and related to the number of shares of restricted stock not delivered to the recipient upon vesting, in order for the recipient to satisfy his or her tax withholding obligations in connection with the vesting.

20

CORPORATE GOVERNANCE PRINCIPLES AND CODE OF ETHICS

The Board of Directors is committed to good business practices, transparency in financial reporting and the highest level of corporate governance. In response to this, the Board has adopted formally the following Corporate Governance Guidelines:

Corporate Governance Guidelines

Our corporate governance guidelines provide for, among other things:

| | • | | A Board consisting of a majority of independent directors; |

| | • | | A lead independent director; |

| | • | | Periodic executive sessions of non-management directors; |

| | • | | An Audit and Risk Committee and a Compensation, Nominating and Corporate Governance Committee consisting entirely of independent directors; |

| | • | | Annual Performance Evaluation of the Board; |

| | • | | Director education and orientation; and |

| | • | | Ethical conduct of directors and adherence to a duty of loyalty to the Bank. |

In connection with our ongoing review of corporate governance and best practices, in March 2015, the Board appointed David Holman to the newly created position of Lead Independent Director. Mr. Holman was previously the Chairman of the Board of 1st Enterprise Bank and additionally brings many years of banking experience to this position. As Lead Director he calls and chairs meetings of the independent and non-management directors, acts as a liaison between the independent directors, other members of the Board and management, and assists as necessary on Board agendas to assure that all stakeholders’ interests are represented appropriately. In the absence of the Chairman, the Lead Director will chair meetings of the Board of Directors.

The Board has adopted a Code of Ethics that applies to the Company’s principal executive officer, principal financial officer, controller and principal accounting officer, or persons performing similar functions, as well as Principles of Business Conduct & Ethics that apply to its directors, officers and employees as well as those of its subsidiary. A copy is available on the Company’s website atwww.cubancorp.com or by contacting Anita Wolman, Corporate Secretary, at 15821 Ventura Boulevard, Suite 100, Encino, CA 91436. A copy will be provided without charge.

We also have an Insider Trading Policy which prohibits Directors and Senior Officers from the purchase or sale of puts, calls, options or other derivative securities based on the Company’s securities. Corporate Governance Guidelines also prohibit Directors and Named Executive Officers from pledging their Company securities in connection with margin accounts or other borrowing arrangements.

Board Leadership Structure

The Board and the CNCG Committee has determined that given the quality of leadership, shareholder relationships and other mitigating matters peculiar to Mr. Rainer and the Company at this stage of its growth, it is appropriate for Mr. Rainer to serve as both Chief Executive Officer and Chairman of the Board. In 2014, Mr. Horton was named to serve as President of the Company, thereby separating the jobs of CEO and President. In further recognition of the combined Chairman/CEO structure, in 2015 the Board of Directors named Mr. Holman to a newly created position of Lead Independent Director to call and chair meetings of the independent and non-management directors, act as a liaison between the independent directors, other members of the Board and management and assist on Board agendas and in other matters to assure that all stakeholder’s interests are represented appropriately. Through the Lead Independent Director, the Company aims to foster an appropriate

21

level of separation between the levels of leadership in the Company. Leadership is also provided through the respective chairs of the Board’s various committees. The Board believes it is critical for both the CEO and the President to serve of the Board of Directors.

Director Resignation Policy

As part of its Corporate Governance Guidelines, the CU Bancorp Board of Directors has adopted a “Director Resignation Policy.” This policy provides that at any shareholder meeting at which directors are subject to an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election will then be required to tender a letter of resignation to the Chairman of the Board for consideration by the Board’s Compensation, Nominating and Corporate Governance Committee which will thereafter recommend to the CU Bancorp Board of Directors the action to be taken with respect to such offer of resignation. The CU Bancorp Board of Directors will act no later than 90 days following the date of the shareholder meeting with respect to each such letter of resignation and will notify the director concerned of its decision and promptly publicly disclose such decision. Any director who tenders his or her resignation pursuant to this provision will not participate in any Board or committee action regarding whether to accept his or her resignation offer.

Stock Ownership Policy

The Board has always taken the position that all Directors and Named Executive Officers should own a meaningful amount of Company common stock to foster alignment with the interests of the shareholders. In August 2015, the Compensation, Nominating and Corporate Governance Committee recommended and the Board of Directors approved, a Stock Ownership Policy setting forth requirements for stock ownership by directors and Named Executive Officers (“Participants”). The policy requires that these individuals own common shares of CU Bancorp as follows:

| | |

Participant | | Value of Shares Owned |

Chief Executive Officer | | 3x Base Salary |

President | | 2x Base Salary |

Other Named Executive Officers | | 1x Base Salary |

Non-Employee Directors | | 3x Annual Cash Retainer |

Participants may satisfy the ownership guidelines with: i) shares owned directly; ii) shares owned indirectly; iii) vested restricted stock of iv) unvested restricted stock/units subject only to time based requirements. Unexercised options and unvested performance-contingent shares/units are not counted toward meeting the ownership guidelines. These requirements are reviewed annually as of December 31. If a Participant is not in compliance with the Stock Ownership Policy at any such determination date, the participant must retain 100% of all shares of CU Bancorp common stock held as of such date and no less than 50% of the net shares received as a result of the exercise, vesting or payment of any Company equity awards granted to the Participant. Participants not in compliance with the minimum ownership guidelines will receive written notification that the Retention Ratio described above will apply until the Participant provides written notification and documentation indicating that he or she has come into compliance with the Stock Ownership Policy. Because a Participant must retain a percentage of net shares acquired from CU Bancorp equity awards until the Participant satisfies the specified guideline level of ownership, there is no minimum time period required to achieve the guideline level of ownership, and the Board recognizes that a newly-elected or appointted Director or Executive Officer may require a period of time to accumulate a sufficient number of shares to attain the designated minimum ownership level.

22

At December 31, 2015 all directors and executive officers were in compliance with this policy with the exception of Kaveh Varjavand, who joined the Board effective September 1, 2015. As a recently-appointed Board member, Mr. Varjavand is working toward ownership of the requisite number of shares in accordance with the Company’s ownership policy.

THE BOARD OF DIRECTORS AND COMMITTEES OF THE COMPANY

The Board of Directors of the Company oversees its business and monitors the performance of management. In accordance with corporate governance principles, our Board of Directors does not involve itself in day-to-day operations. The directors keep themselves informed through, among other things, discussions with the Chief Executive Officer, other key executives and our principal outside advisors (legal counsel, outside auditors, and other consultants), by reading reports and other materials that the Company sends them and by participating in Board and committee meetings.

During 2015, the Board of Directors of CU Bancorp held twelve meetings. During 2015, no director of the Company attended less than 75% of all Board meetings and the meetings of any committee of the Boards on which he or she served.

In 2015, the Board of Directors had the following committees: Audit and Risk Committee; Compensation, Nominating and Corporate Governance Committee; and Executive Committee. In addition, the Bank maintained a Board of Directors Loan Committee. The Audit and Risk Committee and the Compensation, Nominating and Corporate Governance Committee both consisted solely of independent directors.

Executive Sessions

Executive sessions of non-management directors are held by the Board on an “as needed” basis and at least four times annually. Prior to March 2015, the executive sessions of non-management directors were chaired by the Vice Chairman of the Board, when there was one, or in his or her absence, a director chosen by the non-management directors. In March 2015 the Board appointed David Holman as the Lead Independent Director. In that role he or in his absence, a director chosen by the independent directors chairs meetings of the independent directors. In 2015, the non-management directors met four times.

Attendance at Annual Meetings

It is the policy of the Board that directors are expected to attend each Annual Meeting of Shareholders. Such attendance allows for direct interaction with shareholders. All of the Company’s directors attended the Company’s 2015 Meeting of Shareholders.

Reporting of Complaints/Concerns Regarding Accounting or Auditing Matters

The Company’s Board of Directors has adopted procedures for receiving and responding to complaints or concerns regarding accounting and auditing matters. These procedures were designed to provide a channel of communication for employees and others who have complaints or concerns regarding accounting or auditing matters involving the Company. Employee concerns may be communicated in a confidential or anonymous manner to the Audit and Risk Committee of the Board. The Audit and Risk Committee Chairman will make a determination on the appropriate level of inquiry, investigation or disposal of the complaint. All complaints are discussed with the Company’s senior management, as appropriate, and are monitored by the Audit and Risk Committee for handling, investigation and final disposition. The Chairman of the Audit and Risk Committee will report the status and disposition of all complaints to the Board of Directors. No complaints were received during 2015.

23

Shareholder Communications with the Board

Shareholders wishing to communicate with the Board of Directors as a whole, or with an individual director, may do so by writing to the following address:

CU Bancorp

15821 Ventura Boulevard, Suite 110

Encino, California 91436

Attention: Corporate Secretary

Any communications directed to the Corporate Secretary will be forwarded to the entire Board of Directors, unless the Chairman of the Board reasonably believes communication with the entire Board of Directors is not appropriate or necessary or unless the communication is addressed solely to a specific committee or to an individual director.

Audit and Risk Committee and Board of Directors Risk Management

Board Authority for Risk Oversight

The Board has active involvement and responsibility for overseeing risk management of the Company arising out of its operations and business strategy and understanding of what level of risk is appropriate for the Company. The Board monitors, reviews and reacts to material enterprise risks identified by management. The Board receives specific oral and written reports from officers with oversight responsibility for particular risks within the Company. Executive management reports include reporting on financial, credit, liquidity, interest rate, capital, operational, legal and regulatory compliance and reputation risks and the Company’s degree of exposure to those risks. The Board helps ensure that management is properly focused on risk by, among other things, reviewing and discussing the performance of senior management and business line leaders. While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. The Company has adopted, and the Board has approved, a comprehensive set of policies designed to address areas of risk in the Company which management has implemented and disseminated throughout the Company and which are reviewed regularly.

Audit and Risk Management Committee Oversight

The Company has a separately designated standing Audit and Risk Committee established in accordance with applicable regulatory and NASDAQ requirements. The Audit and Risk Committee also serves as the Audit and Risk Committee of California United Bank. The Audit and Risk Committee Charter adopted by the Board sets out the responsibilities, authority and specific duties of the Audit and Risk Committee. The Audit and Risk Committee must consist of at least three members, each of whom are non-management (independent) directors and each of whom must meet the independence and expertise requirements of the NASDAQ, the Sarbanes-Oxley Act of 2002 and rules promulgated thereunder, and other applicable rules and regulations. At least one member must have accounting or related financial management expertise and qualify as a “financial expert”, as defined under the regulations of the SEC. Pursuant to the Audit and Risk Committee Charter, the Audit and Risk Committee has the following primary duties and responsibilities:

| | • | | oversight of the quality and integrity of regulatory and financial accounting, financial statements, financial reporting processes and systems of internal accounting and financial controls; |

24

| | • | | oversight of the quality of compliance risk management and enterprise risk management; |

| | • | | oversight of the Company’s compliance with legal and regulatory requirements; |

| | • | | oversight of the annual independent audit of the Company’s financial statements and internal controls over financial, accounting, regulatory and legal compliance and conformity with the Company’s Principles of Business Conduct and Ethics; |

| | • | | engagement of the independent registered public accounting firm and evaluation of the qualifications, independence and performance of the independent registered public accounting firm; |

| | • | | approval of all audit and non-audit services permitted to be provided by the independent registered public accountants (other than those services that meet the requirements of any de minimus exception established by law or regulation); |

| | • | | oversight and retention of internal audit and/or outsourced internal audit services, as well as review of the internal auditors and review of all internal audit reports and follow up on citations, comments and recommendations; and |

| | • | | preparation of an annual report substantially in compliance with the rules of the SEC with regard to companies subject to the Sarbanes-Oxley Act, to be included in the Company’s annual proxy statement, if applicable. |

The Audit & Risk Committee Charter is available on the Company’s website atwww.cubancorp.com.

The Audit and Risk Committee is primarily responsible for overseeing the risk management function at the Company, on behalf of the Board. The Company’s Chief Risk Officer reports directly to the Audit and Risk Committee. The Bank’s Chief Risk Manager and Bank Secrecy Act and Compliance Officers also have direct reporting lines to the Audit and Risk Committee. The Audit and Risk Committee directs and employs third parties to conduct periodic reviews and monitoring of compliance efforts with a special focus on those areas that expose the Company to compliance risk. Among the purposes of the periodic monitoring is to ensure adherence to established policy and procedures. All reviews are reported to the Audit and Risk Committee, which regularly reports to the Board of Directors. The Audit and Risk Committee regularly meets with various members of management and receives reports on risk management and the processes in place to monitor and control such risk.

The Audit and Risk Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities and has direct access to the independent auditors, as well as to anyone in our organization. The Audit and Risk Committee has the ability to retain special legal or accounting experts, or such other consultants, advisors or experts it deems necessary in the performance of its duties and shall receive appropriate funding from the Company for payment of compensation to any such persons. The Audit and Risk Committee works closely with management and the Company’s independent registered public accounting firm. At December 31, 2015, the Audit and Risk Committee consisted of Messrs. Varjavand (Chairman), Beauregard, Kentor, Leitzinger and Salter, each of whom was “independent” as defined by the rules and regulations of the NASDAQ Stock Market. For additional information regarding the background and relevant experience of Messrs. Varjavand, Beauregard, Kentor, Leitzinger and Salter, please see the biographies of directors under the section entitled “Directors”, above.

For 2015 and through the date of this Proxy Statement, the Board of Directors has also determined that Mr. Varjavand, who serves as the Chairman of the Audit and Risk Committee, has: (i) an understanding of generally accepted accounting principles and financial statements; (ii) an ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) an experience

25

preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by our financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal control over financial reporting; and (v) an understanding of audit committee functions and is therefore qualifies as an “audit committee financial expert”, is “financially sophisticated” and is “independent” as those terms are defined by the applicable rules and regulations of the Securities and Exchange Commission and the NASDAQ Stock Market. The designation of a person as an audit committee financial expert does not result in the person being deemed an expert for any purpose, including under Section 11 of the Securities Act of 1933. The designation does not impose on the person any duties, obligations or liability greater than those imposed on any other audit committee member or any other director and does not affect the duties, obligations or liability of any other member of the Audit and Risk Committee or Board of Directors.

The Audit and Risk Committee held eight (8) regular and two (2) special meetings during 2015. The Audit and Risk Committee regularly meets without members of management present.

Compensation, Nominating and Corporate Governance Committee and Bank Loan Committee Oversight

In addition to the Audit and Risk Committee, other committees of the Board of Directors of the Company and California United Bank consider the risks within their area of responsibility. For example, the Compensation, Nominating and Corporate Governance Committee reviews the risks that may be implicated by the Company’s executive and other compensation programs. For a discussion of that Committee’s review of executive officer compensation plans and employee incentive plans and the risks associated with these plans, see “Executive Compensation – Risk of Compensation Programs,” herein. The Bank’s Loan Committee reviews credit risk, portfolio quality and trends, as well as the results of external credit reviews. The Compensation, Nominating and Corporate Governance Committee recommends director candidates with appropriate experience and skills who will set the proper tone for the Company’s risk profile and provide competent oversight over our material risks.

Audit and Risk Committee Report

The following report of the Audit and Risk Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of CU Bancorp’s other filings under the Securities Act or under the Exchange Act, except to the extent CU Bancorp specifically incorporates this report by reference.

The Audit and Risk Committee oversees CU Bancorp’s financial reporting process on behalf of the board of directors. The Audit and Risk Committee consists of five (5) members of the Board of Directors, each of whom is independent under the NASDAQ listing standards, SEC Rules and other regulations applicable to audit committees. In fulfilling its oversight responsibilities, the Audit and Risk Committee approved the engagement and retention of RSM US LLP as CU Bancorp’s independent registered public accountants, reviewed and discussed with management and the external auditors the audited financial statements included in CU Bancorp’s Annual Report on Form 10-K filed with the Securities and Exchange Commission and the unaudited financial statements included in CU Bancorp’s Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. RSM US LLP has served as the Company’s (or prior to that California United Bank’s) independent registered accounting firm since 2005 and reports directly to the Audit and Risk Committee. In selecting RSM US LLP as the Company’s independent registered accounting firm for 2015, the Audit and Risk Committee considered a number of factors including:

| | • | | The professional qualifications of RSM US LLP’s lead audit partner and other members of the audit team participating in the engagement; |

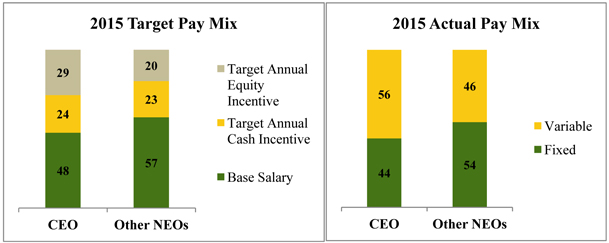

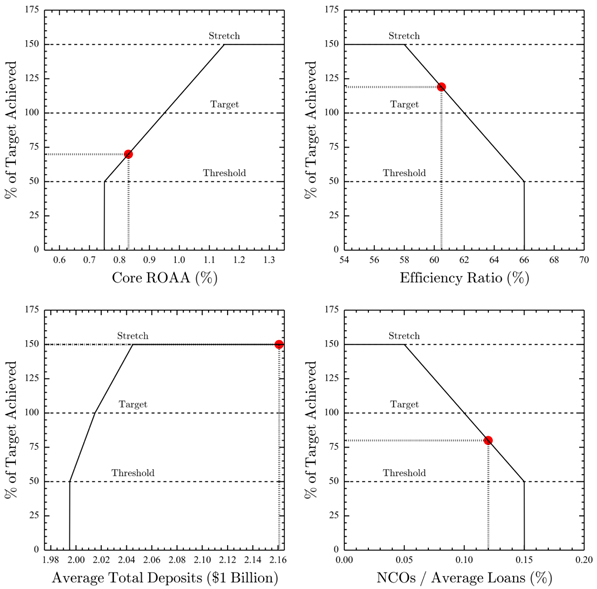

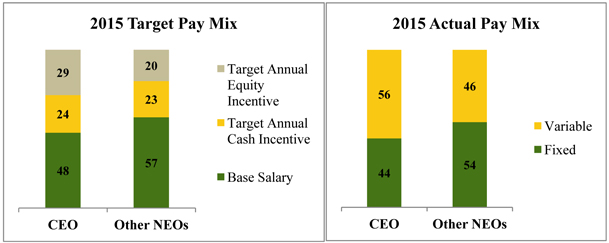

26