|

Filed by Engility Holdings, Inc. and New East Holdings, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Engility Holdings, Inc., New East Holdings, Inc. and TASC Parent Corporation Registration No. 333-200384

|

BUILT FOR TODAY

DESIGNED FOR TOMORROW

Lender Presentation

November 2014

Your Mission. Our commitment

Management Presenters

Highly Experienced Management Team

Tony Smeraglinolo

President and CEO Engility Experience: 35 years

Michael Alber

Senior Vice President and CFO Engility Experience: 34 years

Craig Reed

Senior VP, Strategy & Corporate Development Engility Experience: 31 years

John Hynes

President and CEO TASC

Experience: 32 years

Wayne Rehberger

Senior Vice President and CFO TASC

Experience: 36 years

Brad Kopp

Vice President of Finance and Treasurer TASC

Experience: 31 years

2

Agenda

I. Transaction Overview II. Industry Overview III. Engility Overview IV. TASC Overview V. Combination Rationale VI. Transaction Details

3

Transaction Overview

Executive Summary

Engility Holdings Inc. (“Engility” or the “Company”), NYSE: EGL, ~$771 million (1) market capitalization, is a leading government services contractor providing systems engineering, training, and logistics and operational support for a variety of U.S. Government agencies

On October 28, the Company announced a definitive agreement to acquire TASC Inc. (“TASC” or the “Target”), which is currently owned by affiliates of KKR and General Atlantic, in an all-stock transaction valued at ~$1.1 billion

The debt financing for the transaction, which will be used to repay existing debt at Engility and fund a cash dividend to Engility shareholders, will be structured as incremental term loans at TASC, which will be the surviving borrower for the pro forma Company

New debt comprised of $60 million incremental Revolving Credit Facility, $435 million incremental First Lien Term Loan, and $150 million incremental Second Lien Term Loan

- Results in pro forma net first lien and total leverage of 2.9x and 4.4x, respectively, based on 9/30/2014 pro forma combined Adj. EBITDA of $270 million (2)

1. Market capitalization is calculated on a diluted basis assuming a weighted-average share count of approximately 18.2 million shares and a 11/21/2014 share price of $42.39.

2. Calculated in accordance with the TASC Credit Agreement. Numbers may differ from Company’s public filings.

5

Transaction Overview

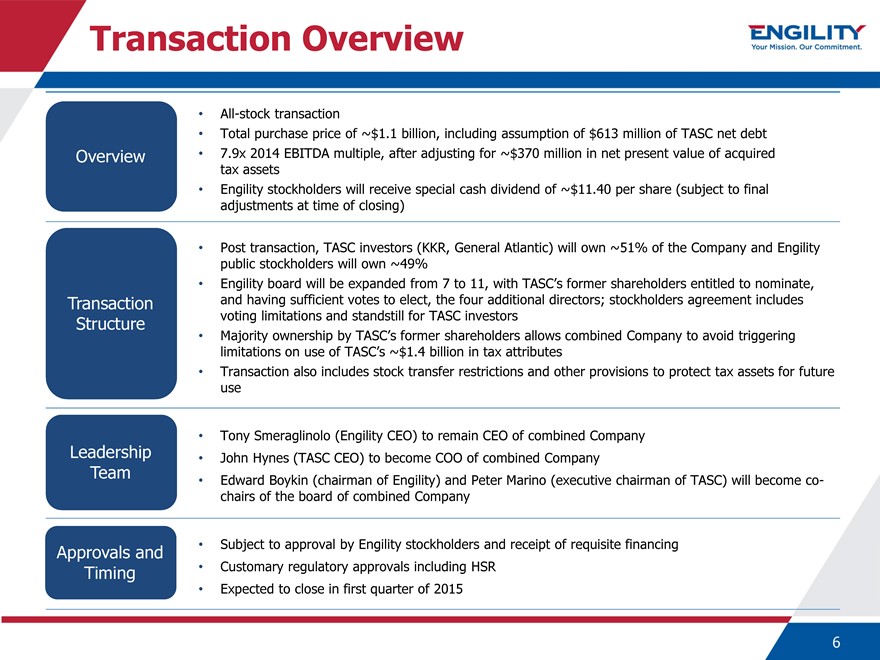

Overview

Transaction Structure

Leadership Team

Approvals and Timing

All-stock transaction

Total purchase price of ~$1.1 billion, including assumption of $613 million of TASC net debt

7.9x 2014 EBITDA multiple, after adjusting for ~$370 million in net present value of acquired tax assets Engility stockholders will receive special cash dividend of ~$11.40 per share (subject to final adjustments at time of closing)

Post transaction, TASC investors (KKR, General Atlantic) will own ~51% of the Company and Engility public stockholders will own ~49% Engility board will be expanded from 7 to 11, with TASC’s former shareholders entitled to nominate, and having sufficient votes to elect, the four additional directors; stockholders agreement includes voting limitations and standstill for TASC investors Majority ownership by TASC’s former shareholders allows combined Company to avoid triggering limitations on use of TASC’s ~$1.4 billion in tax attributes Transaction also includes stock transfer restrictions and other provisions to protect tax assets for future use

Tony Smeraglinolo (Engility CEO) to remain CEO of combined Company John Hynes (TASC CEO) to become COO of combined Company

Edward Boykin (chairman of Engility) and Peter Marino (executive chairman of TASC) will become co-chairs of the board of combined Company

Subject to approval by Engility stockholders and receipt of requisite financing Customary regulatory approvals including HSR

Expected to close in first quarter of 2015

6

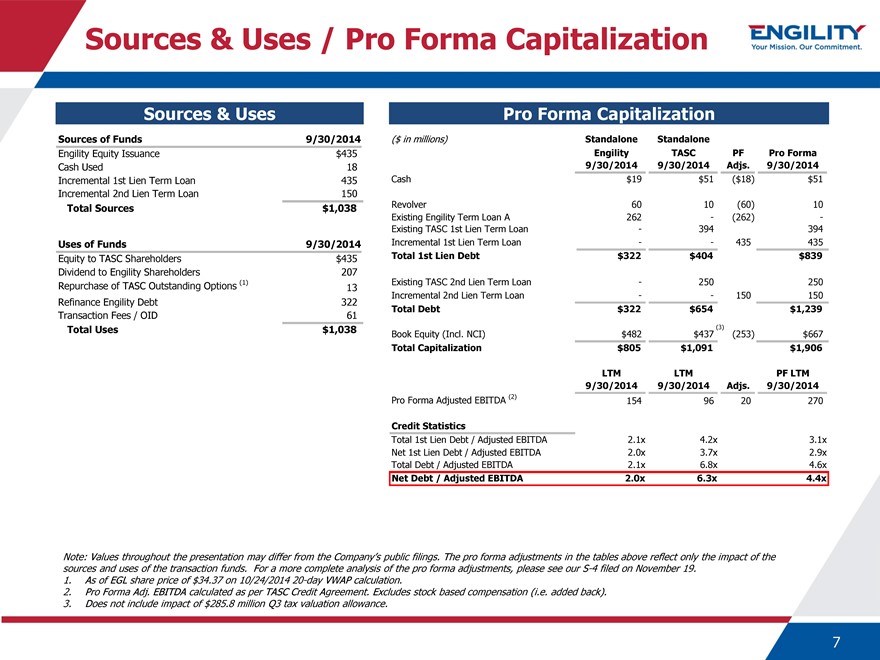

Sources & Uses / Pro Forma Capitalization

Sources & Uses

Sources of Funds 9/30/2014

Engility Equity Issuance $435

Cash Used 18

Incremental 1st Lien Term Loan 435

Incremental 2nd Lien Term Loan 150

Total Sources $1,038

Uses of Funds 9/30/2014

Equity to TASC Shareholders $435

Dividend to Engility Shareholders 207

Repurchase of TASC Outstanding Options (1) 13

Refinance Engility Debt 322

Transaction Fees / OID 61

Total Uses $1,038

Note: Values throughout the presentation may differ from the Company’s public filings. The pro forma adjustments in the tables above reflect only the impact of the sources and uses of the transaction funds. For a more complete analysis of the pro forma adjustments, please see our S-4 filed on November 19.

1. As of EGL share price of $34.37 on 10/24/2014 20-day VWAP calculation.

2. Pro Forma Adj. EBITDA calculated as per TASC Credit Agreement. Excludes stock based compensation (i.e. added back).

3. Does not include impact of $285.8 million Q3 tax valuation allowance.

7

Industry Overview

Industry Executive Summary

After several years of declining spending driven by reductions in Overseas Contingency Operations (“OCO”) funding and sequestration budget cuts, USG services spending appears to be on a path to stabilize over the next 5 years

- Expect some continued run off of OCO spending, mitigated by real requirements and fears driven by continuing international tensions

- Shorter cycle services spending was the first area to face cuts but also has the potential to be the first budget area to recover

Large contractor-addressable USG services market (~$250 billion) significantly greater than USG spending for products and systems

Secular shift in funding ultimately needs to be addressed by cuts to platforms and force structure

- Current system sustainment creates enduring demand for engineering & technical services

- Government workforce demographics creates sustained demand for program management, Systems Engineering & Technical Assistance (“SETA”) and technical consulting support

Agencies that previously were less price sensitive now placing increasing value on cost-efficient delivery of quality services

Competitive intensity is high among industry players trying to maintain market share in industry that is facing contraction after years of expansion

9

Intelligence Community (IC)

IC Services Market

($ in billions)

$30

$25

$20

$15

$10

$5

$0

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19

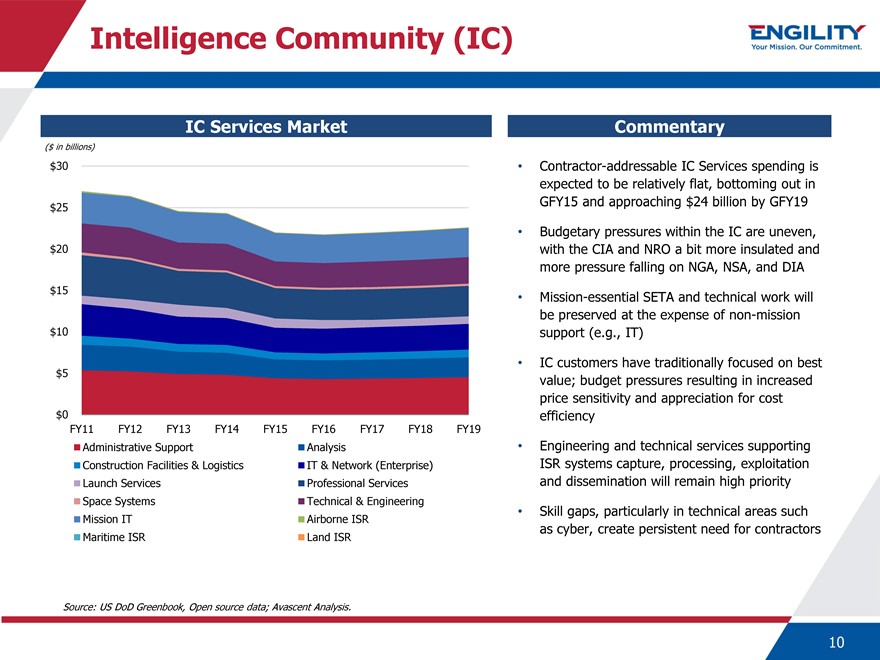

Administrative Support Analysis

Construction Facilities & Logistics IT & Network (Enterprise)

Launch Services Professional Services

Space Systems Technical & Engineering

Mission IT Airborne ISR

Maritime ISR Land ISR

Commentary

Contractor-addressable IC Services spending is expected to be relatively flat, bottoming out in GFY15 and approaching $24 billion by GFY19 Budgetary pressures within the IC are uneven, with the CIA and NRO a bit more insulated and more pressure falling on NGA, NSA, and DIA Mission-essential SETA and technical work will be preserved at the expense of non-mission support (e.g., IT) IC customers have traditionally focused on best value; budget pressures resulting in increased price sensitivity and appreciation for cost efficiency Engineering and technical services supporting ISR systems capture, processing, exploitation and dissemination will remain high priority Skill gaps, particularly in technical areas such as cyber, create persistent need for contractors

Source: US DoD Greenbook, Open source data; Avascent Analysis.

10

Defense

Defense Services Market

($ in billions)

$160

$140

$120

$100

$80

$60

$40

$20

$0

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19

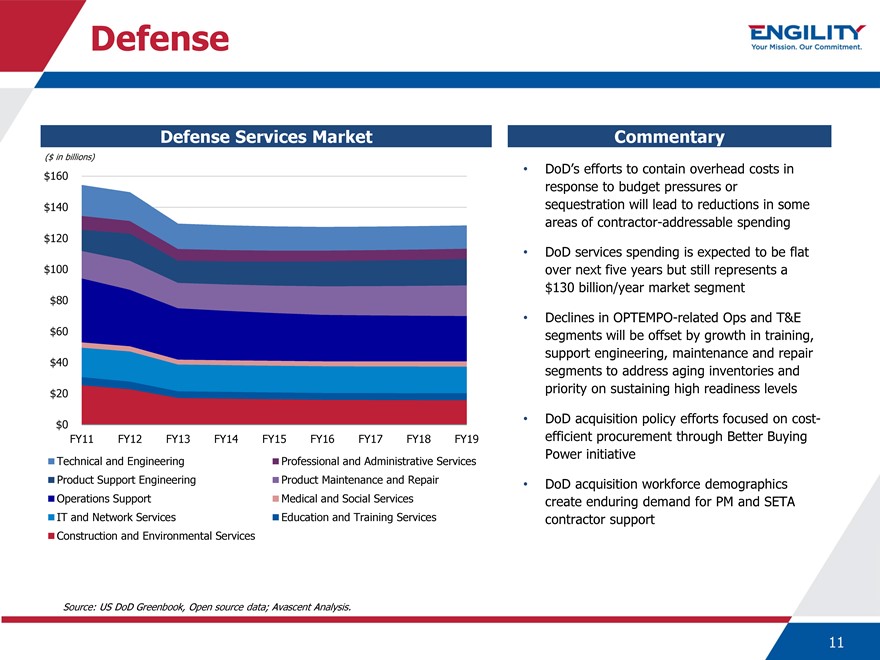

Technical and Engineering Professional and Administrative Services

Product Support Engineering Product Maintenance and Repair

Operations Support Medical and Social Services

IT and Network Services Education and Training Services

Construction and Environmental Services

Source: US DoD Greenbook, Open source data; Avascent Analysis.

Commentary

DoD’s efforts to contain overhead costs in response to budget pressures or sequestration will lead to reductions in some areas of contractor-addressable spending DoD services spending is expected to be flat over next five years but still represents a $130 billion/year market segment Declines in OPTEMPO-related Ops and T&E segments will be offset by growth in training, support engineering, maintenance and repair segments to address aging inventories and priority on sustaining high readiness levels DoD acquisition policy efforts focused on cost-efficient procurement through Better Buying Power initiative DoD acquisition workforce demographics create enduring demand for PM and SETA contractor support

11

Civilian

Civilian Services Market

($ in billions) $120

$100 $80 $60 $40 $20

$0

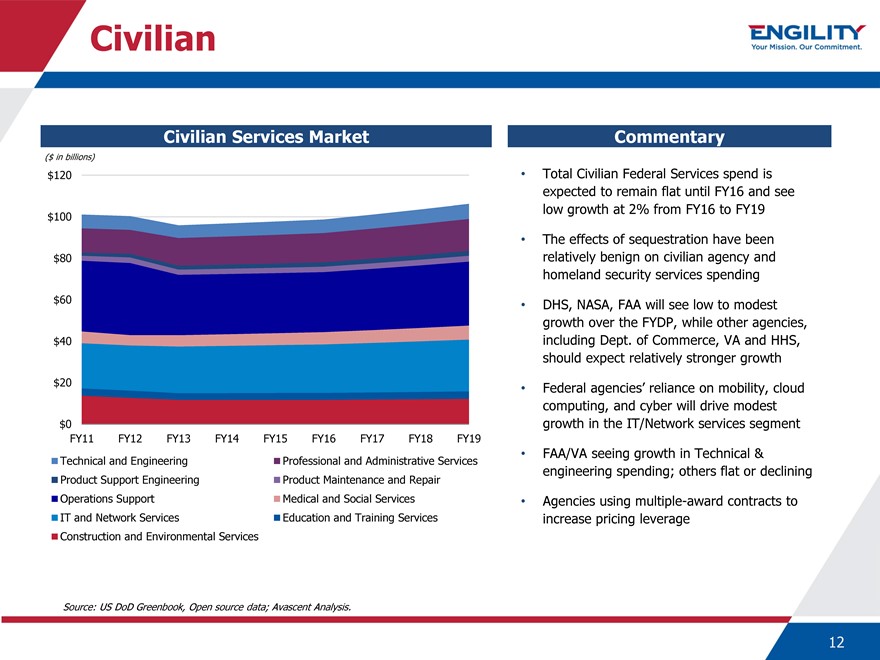

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Technical and Engineering Professional and Administrative Services Product Support Engineering Product Maintenance and Repair Operations Support Medical and Social Services IT and Network Services Education and Training Services Construction and Environmental Services

Source: US DoD Greenbook, Open source data; Avascent Analysis.

Commentary

Total Civilian Federal Services spend is expected to remain flat until FY16 and see low growth at 2% from FY16 to FY19 The effects of sequestration have been relatively benign on civilian agency and homeland security services spending DHS, NASA, FAA will see low to modest growth over the FYDP, while other agencies, including Dept. of Commerce, VA and HHS, should expect relatively stronger growth Federal agencies’ reliance on mobility, cloud computing, and cyber will drive modest growth in the IT/Network services segment FAA/VA seeing growth in Technical & engineering spending; others flat or declining Agencies using multiple-award contracts to increase pricing leverage

12

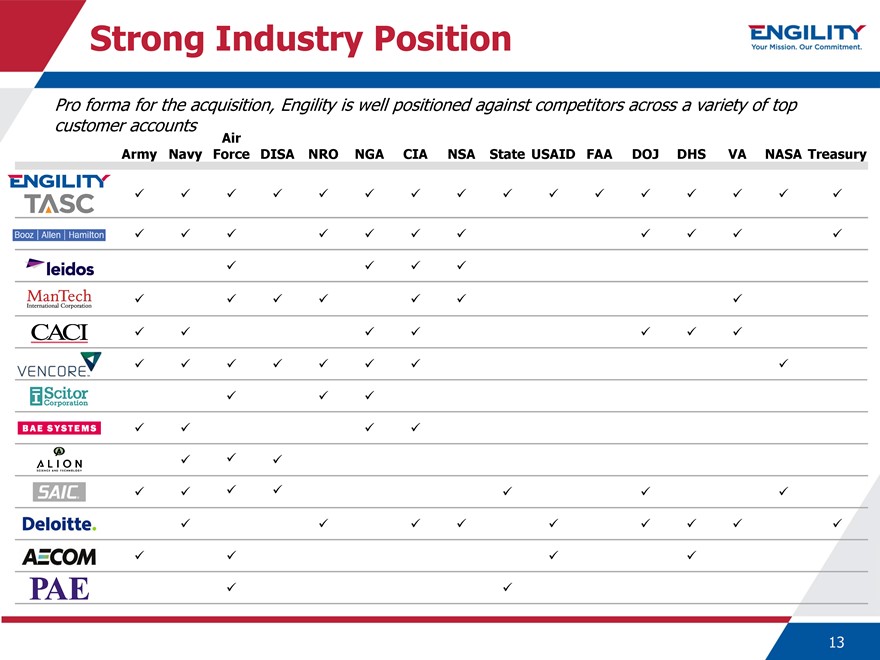

Strong Industry Position

Pro forma for the acquisition, Engility is well positioned against competitors across a variety of top customer accounts

Air

Army Navy Force DISA NRO NGA CIA NSA State USAID FAA DOJ DHS VA NASA Treasury

13

Engility Overview

Company Overview

Engility At A Glance

2014E Revenue: $1.4 billion

Headquarters: Chantilly, VA

Ticker Symbol: NYSE (EGL)

Service Offerings:

– Specialized Technical Consulting – IT Modernization & Sustainment

– Program & Business Support – Supply Chain & Logistics Management

– Engineering & Technology – Training & Education Lifecycle Support

Major Customers: Army, Navy, Marine Corps, Air Force, USAID, DOJ, State Department, FAA, DHS, FDIC, Treasury, VA, HHS, DHA/TRICARE, and state, local and international governments

Employees: Approximately 7,000 employees partnering with our customers in over 50 countries

Key Contracts: Access to over 50 contract vehicles including all major GSA schedules, numerous GWACs, and Agency-specific IDIQs www.engilitycorp.com

Over 50 years of experience….

…with enduring core values

Customer-Focused Differentiated Servant Leadership Earned Trust

15

Engility Transformation

2012 2013 Jan. 2014 H2 2014 Oct. 2014

Spin-off “One” DRC Significant TASC from L-3 Engility Acquisition Award Wins Acquisition

Formed in July 2012 with a “clean sheet of paper” approach; opportunities to duplicate success Strong program performance and reputation for customer success Enhanced competitiveness with streamlined cost structure Price disruptive model gaining traction

– Significant new contract wins and momentum in 2H 2014 Consistent approach to capital deployment and M&A strategy

– Strong track record of developing and executing integration strategies that drive meaningful top-and bottom-line savings (spin-off and DRC acquisition)

– Acquisition positions Engility to accelerate the execution of its strategy

16

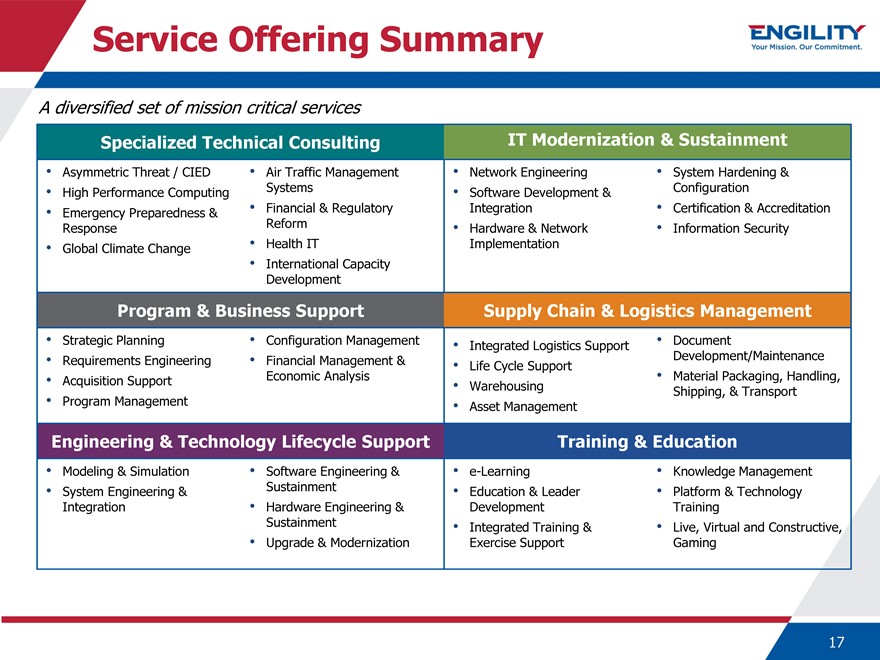

Service Offering Summary

A diversified set of mission critical services

Specialized Technical Consulting

Asymmetric Threat / CIED Air Traffic Management

High Performance Computing Systems

Emergency Preparedness & Financial & Regulatory Response Reform

Global Climate Change Health IT

International Capacity Development

Program & Business Support

Strategic Planning Configuration Management

Requirements Engineering Financial Management &

Acquisition Support Economic Analysis

Program Management

Engineering & Technology Lifecycle Support

Modeling & Simulation Software Engineering &

System Engineering & Sustainment

Integration • Hardware Engineering & Sustainment

Upgrade & Modernization

IT Modernization & Sustainment

Network Engineering • System Hardening & Software Development & Configuration Integration • Certification & Accreditation Hardware & Network • Information Security Implementation

Supply Chain & Logistics Management

Integrated Logistics Support • Document

Development/Maintenance Life Cycle Support

Material Packaging, Handling, Warehousing Shipping, & Transport Asset Management

Training & Education

e-Learning • Knowledge Management Education & Leader • Platform & Technology Development Training Integrated Training & • Live, Virtual and Constructive, Exercise Support Gaming

17

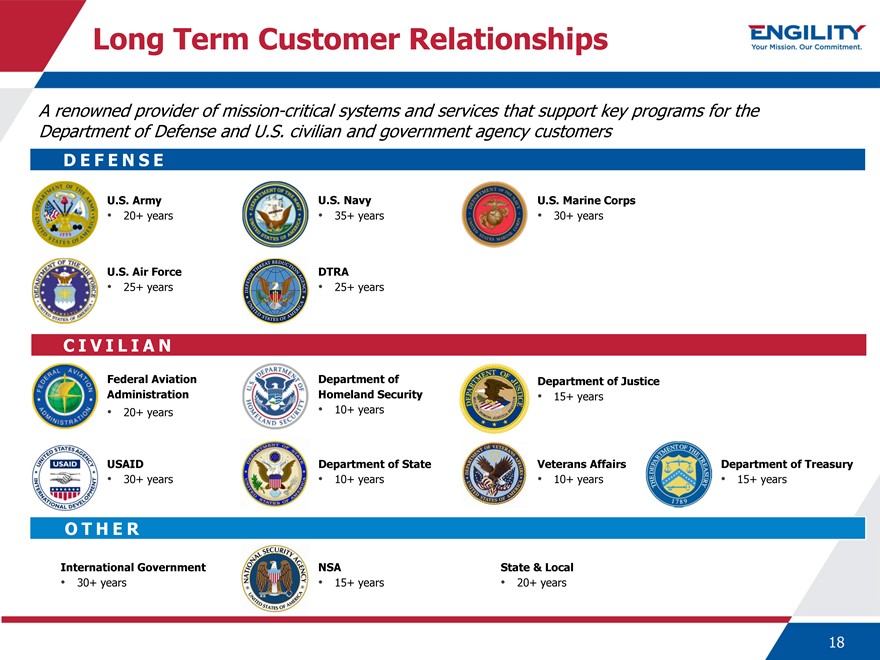

Long Term Customer Relationships

A renowned provider of mission-critical systems and services that support key programs for the Department of Defense and U.S. civilian and government agency customers

DEFENSE

U.S. Army U.S. Navy U.S. Marine Corps

20+ years 35+ years 30+ years

U.S. Air Force DTRA

25+ years 25+ years

Federal Aviation Department of Department of Justice Administration Homeland Security • 15+ years

20+ years 10+ years

USAID Department of State Veterans Affairs Department of Treasury

30+ years 10+ years 10+ years 15+ years

OTHER

International Government NSA State & Local

30+ years 15+ years 20+ years

18

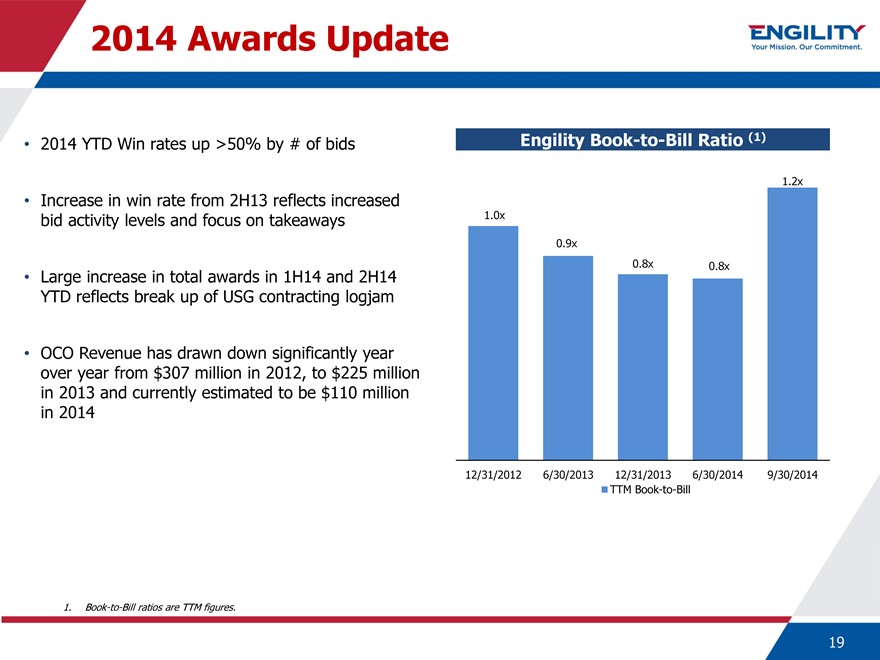

2014 Awards Update

2014 YTD Win rates up >50% by # of bids

Increase Incremental in win Opportunities rate from 2H13 = ~5% reflects increased

bid activity levels and focus on takeaways

Large increase in total awards in 1H14 and 2H14

YTD reflects break up of USG contracting logjam

OCO Revenue has drawn down significantly year

over year from $307 million in 2012, to $225 million

in 2013 and currently estimated to be $110 million

in 2014

Engility Book-to-Bill Ratio (1)

1.2x

1.0x

0.9x

0.8x 0.8x

12/31/2012 6/30/2013 12/31/2013 6/30/2014 9/30/2014 TTM Book-to-Bill

1. Book-to-Bill ratios are TTM figures.

19

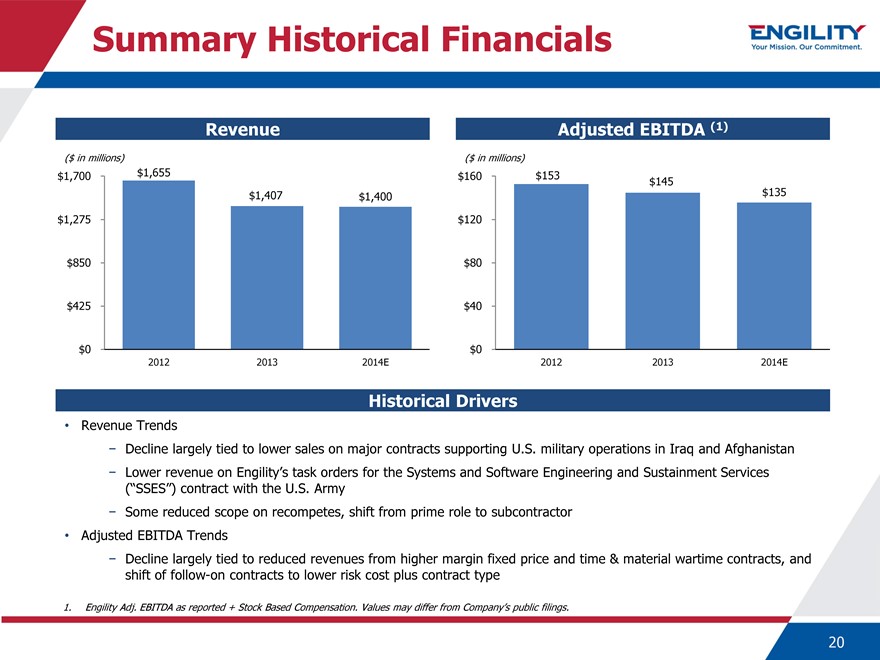

Summary Historical Financials

Revenue

($ in millions) $1,700 $1,655 $1,407 $1,400 $1,275

$850

$425

$0

2012 2013 2014E

Adjusted EBITDA (1)

($ in millions) $160 $153 $145 $135 $120

$80

$40

$0

2012 2013 2014E

Historical Drivers

Revenue Trends

- Decline largely tied to lower sales on major contracts supporting U.S. military operations in Iraq and Afghanistan

- Lower revenue on Engility’s task orders for the Systems and Software Engineering and Sustainment Services (“SSES”) contract with the U.S. Army

- Some reduced scope on recompetes, shift from prime role to subcontractor

Adjusted EBITDA Trends

- Decline largely tied to reduced revenues from higher margin fixed price and time & material wartime contracts, and shift of follow-on contracts to lower risk cost plus contract type

1. Engility Adj. EBITDA as reported + Stock Based Compensation. Values may differ from Company’s public filings.

20

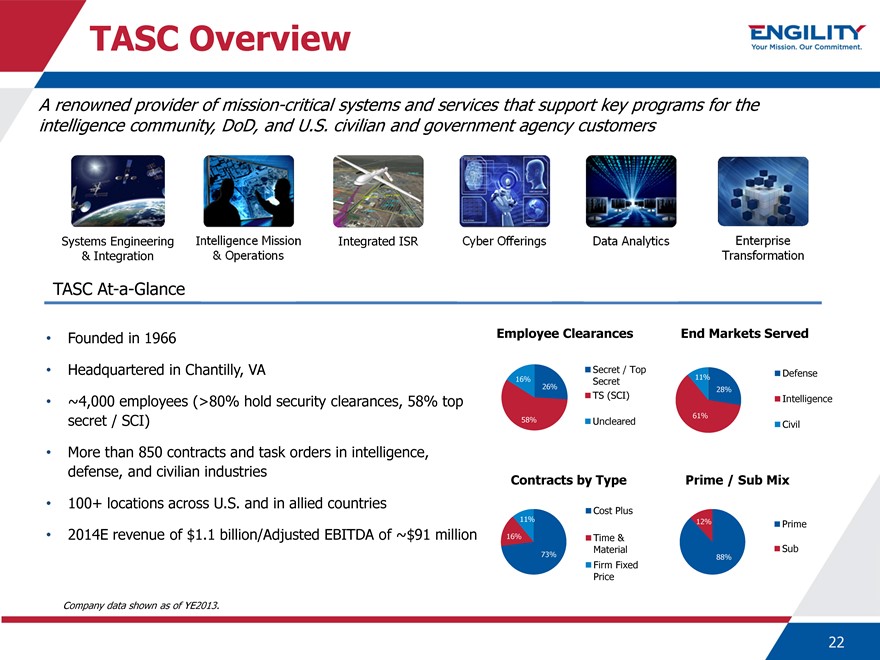

TASC Overview

TASC Overview

A renowned provider of mission-critical systems and services that support key programs for the intelligence community, DoD, and U.S. civilian and government agency customers

Systems Engineering

& Integration

Intelligence Mission & Operations

Integrated ISR

Cyber Offerings

Data Analytics

Enterprise TransformationTASC At-a-Glance

Founded in 1966

Headquartered in Chantilly, VA

~4,000 employees (>80% hold security clearances, 58% top secret / SCI)

More than 850 contracts and task orders in intelligence, defense, and civilian industries

100+ locations across U.S. and in allied countries

2014E revenue of $1.1 billion/Adjusted EBITDA of ~$91 million

Company data shown as of YE2013.

Employee Clearances End Markets Served

Secret / Top 0%

11% Defense

16% 26% Secret

28%

TS (SCI) Intelligence

61%

58% Uncleared Civil

Contracts by Type Prime / Sub Mix

11% Cost Plus

12% Prime 16% Time & Material Sub

73% 88%

Firm Fixed Price

22

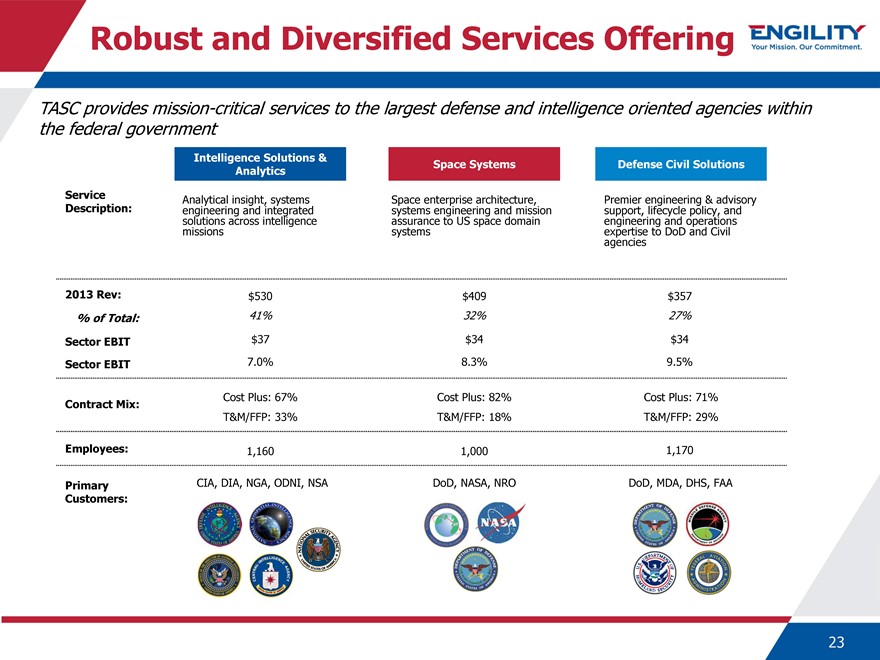

Robust and Diversified Services Offering

TASC provides mission-critical services to the largest defense and intelligence oriented agencies within the federal government

Intelligence Solutions &

Space Systems Defense Civil Solutions Analytics Service Analytical insight, systems Space enterprise architecture, Premier engineering & advisory Description: engineering and integrated systems engineering and mission support, lifecycle policy, and solutions missions across intelligence systems assurance to US space domain engineering expertise to and DoD operations and Civil agencies

2013 Rev: $530 $409 $357

% of Total: 41% 32% 27%

Sector EBIT $37 $34 $34

Sector EBIT 7.0% 8.3% 9.5%

Contract Mix: Cost Plus: 67% Cost Plus: 82% Cost Plus: 71%

T&M/FFP: 33% T&M/FFP: 18% T&M/FFP: 29%

Employees: 1,160 1,000 1,170

Primary CIA, DIA, NGA, ODNI, NSA DoD, NASA, NRO DoD, MDA, DHS, FAA

Customers:

23

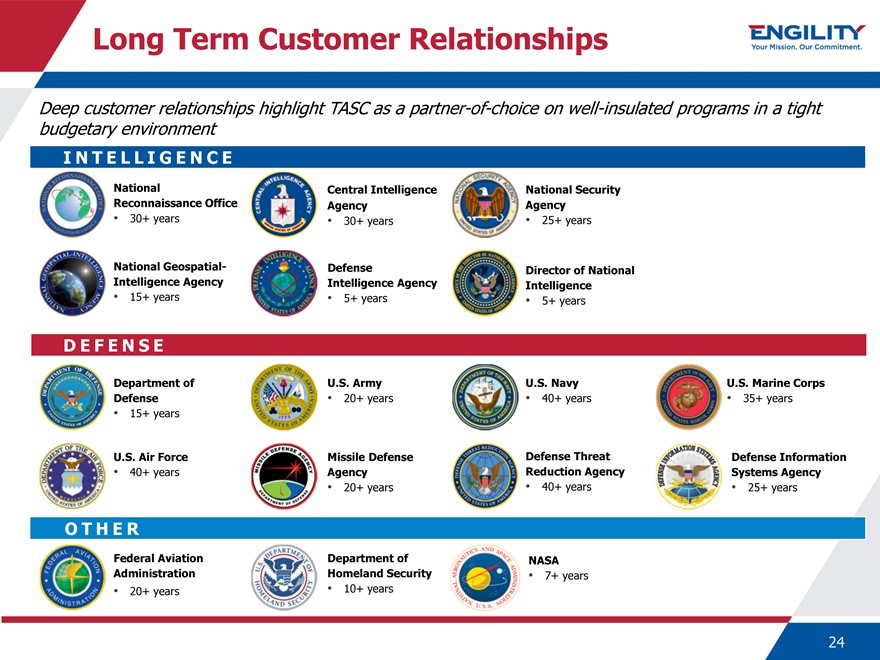

Long Term Customer Relationships

Deep customer relationships highlight TASC as a partner-of-choice on well-insulated programs in a tight budgetary environment

INTELLIGENCE

National Central Intelligence National Security Reconnaissance Office Agency Agency

30+ years 30+ years 25+ years

National Geospatial- Defense Director of National Intelligence Agency Intelligence Agency Intelligence

15+ years 5+ years 5+ years

DEFENSE

Department of U.S. Army U.S. Navy U.S. Marine Corps Defense • 20+ years • 40+ years • 35+ years

15+ years

U.S. Air Force Missile Defense Defense Threat Defense Information

• 40+ years Agency Reduction Agency Systems Agency

20+ years 40+ years 25+ years

OTHER

Federal Aviation Department of NASA Administration Homeland Security • 7+ years

20+ years 10+ years

24

Summary Financial Performance

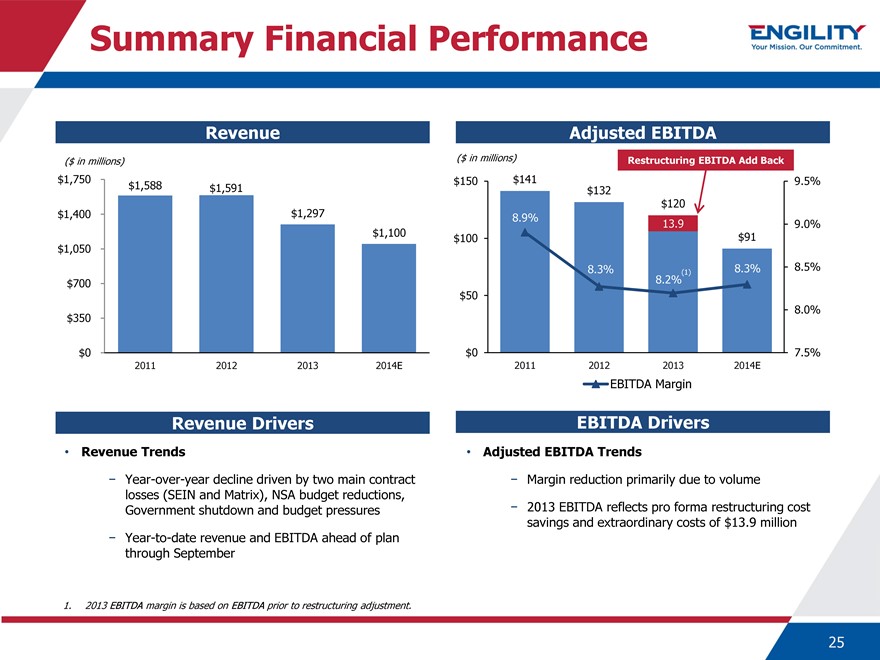

Revenue

($ in millions) $1,750 $1,588 $1,591 $1,400 $1,297 $1,100 $1,050

$700

$350

$0

2011 2012 2013 2014E

Adjusted EBITDA

($ in millions) Restructuring EBITDA Add Back $150 $141 $132 9.5% $120

8.9%

13.9 9.0% $100 $91

8.3% 8.3% 8.5%

(1)

8.2% $50

8.0%

$0 7.5%

2011 2012 2013 2014E

EBITDA Margin

Revenue Drivers

• Revenue Trends

- Year-over-year decline driven by two main contract losses (SEIN and Matrix), NSA budget reductions, Government shutdown and budget pressures

- Year-to-date revenue and EBITDA ahead of plan through September

EBITDA Drivers

• Adjusted EBITDA Trends

- Margin reduction primarily due to volume

- 2013 EBITDA reflects pro forma restructuring cost savings and extraordinary costs of $13.9 million

1. 2013 EBITDA margin is based on EBITDA prior to restructuring adjustment.

25

Summary Financial Performance

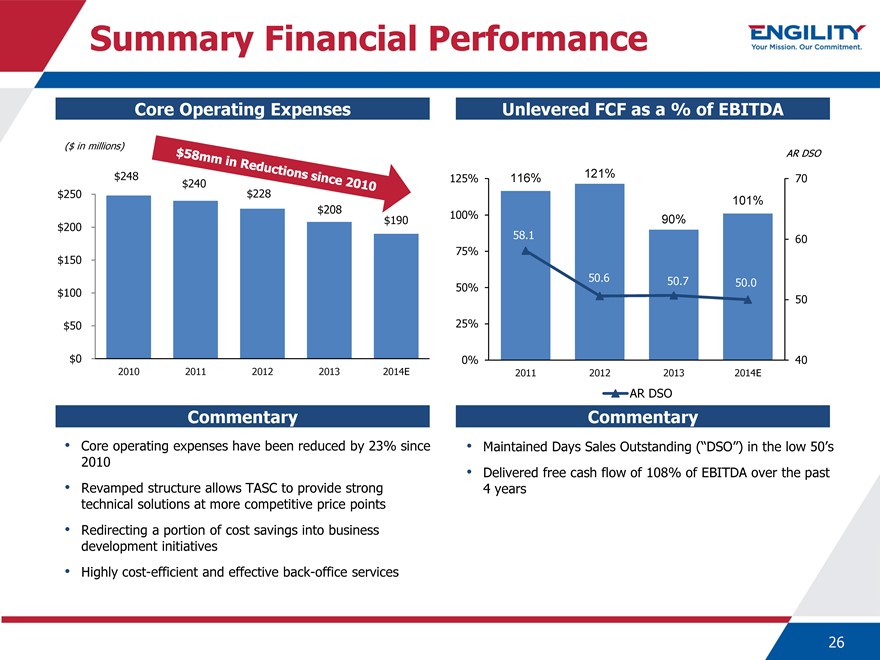

Core Operating Expenses

($ in millions)

$248 $240 $250 $228 $208 $190 $200

$150 $100 $50

$0

2010 2011 2012 2013 2014E

Unlevered FCF as a % of EBITDA

AR DSO

125% 116% 121% 70 101%

100% 90%

58.1 60 75%

50.6 50.7 50.0 50%

50 25%

0% 40

2011 2012 2013 2014E

AR DSO

Commentary

Core operating expenses have been reduced by 23% since 2010

Revamped structure allows TASC to provide strong technical solutions at more competitive price points

Redirecting a portion of cost savings into business development initiatives

Highly cost-efficient and effective back-office services

Commentary

Maintained Days Sales Outstanding (“DSO”) in the low 50’s

Delivered free cash flow of 108% of EBITDA over the past 4 years

26

Engineering a Turnaround for Long-term Growth

To address top-line growth, TASC management has positioned the Company for significant long-term improvement in financial performance

Restructure/Talent Architecture

Winning New Business

Operational Excellence

New management team with a flatter organizational structure improves talent and high level customer interaction Compensation structure aligns performance with expectations Implemented systematic approach at the program level

Few near team recompetes allows for focused resources applied to new business opportunities Allocating resources to accounts in high growth areas, rather than marketing broadly across business units Developing technical approach early in pipeline review and the capture stage

Focusing on further talent acquisition to improve agility and effectiveness Addressing growth weaknesses, improving competitiveness and reducing excess processes Evidence of success

27

Restructure / Talent Architecture

Restructured management team has rationalized TASC’s workforce and improved talent at a lower cost

New President/CEO and most line leaders

Flatter organizational structure brings managers closer to customer accounts with accountability shifted to sector leaders and decision makers

Compensation structure re-aligns performance with long-term goals

Implemented Talent Architecture at the Program Level

A proprietary, systematic approach to staffing that meets customers’ capability and cost needs without compromising mission excellence

Diagnostic: Dialogue to project emerging technical capability requirements and future cost-reduction requirements; SWOT analysis to identify competitive issues

Workforce assessment: Analysis of workforce skill sets and costs; analysis translated into talent map that shows issues and opportunities

Action plan: Plan for architecting workforce based on specific program and budget needs; addresses recruiting world-class subject-matter experts and lower-cost program-support personnel

28

Winning New Business

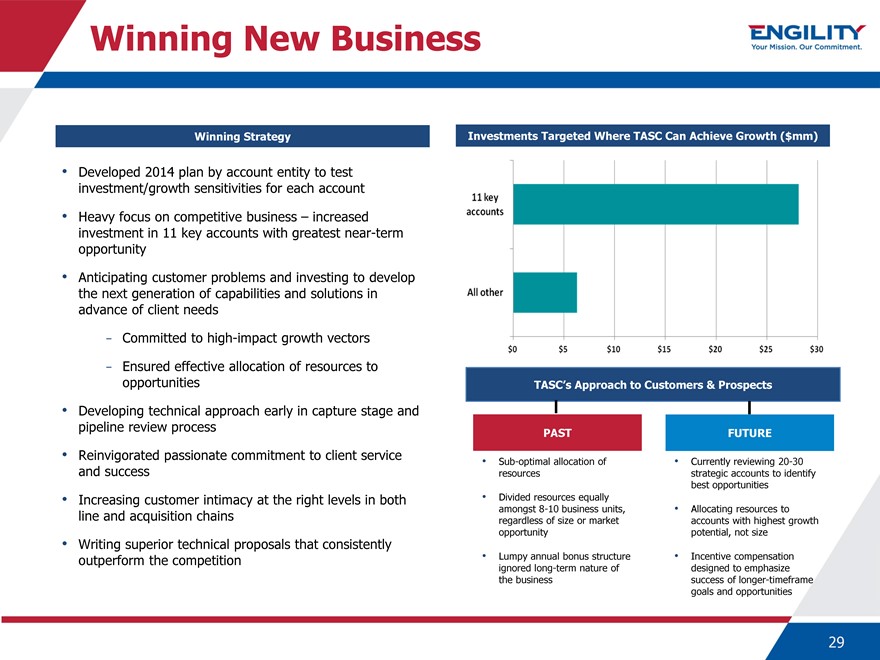

Winning Strategy

Developed 2014 plan by account entity to test investment/growth sensitivities for each account

Heavy focus on competitive business – increased investment in 11 key accounts with greatest near-term opportunity

Anticipating customer problems and investing to develop the next generation of capabilities and solutions in advance of client needs

- Committed to high-impact growth vectors

- Ensured effective allocation of resources to opportunities

Developing technical approach early in capture stage and pipeline review process

Reinvigorated passionate commitment to client service and success

Increasing customer intimacy at the right levels in both line and acquisition chains

Writing superior technical proposals that consistently outperform the competition

Investments Targeted Where TASC Can Achieve Growth ($mm)

11 key accounts

All other

$0 $10 $15 $20 $25 $30

TASC’s Approach to Customers & Prospects

PAST FUTURE

Sub-optimal allocation of Currently reviewing 20-30 resources strategic accounts to identify best opportunities

Divided resources equally amongst 8-10 business units, Allocating resources to regardless of size or market accounts with highest growth opportunity potential, not size

Lumpy annual bonus structure Incentive compensation ignored long-term nature of designed to emphasize the business success of longer-timeframe goals and opportunities

29

Early Evidence of Success

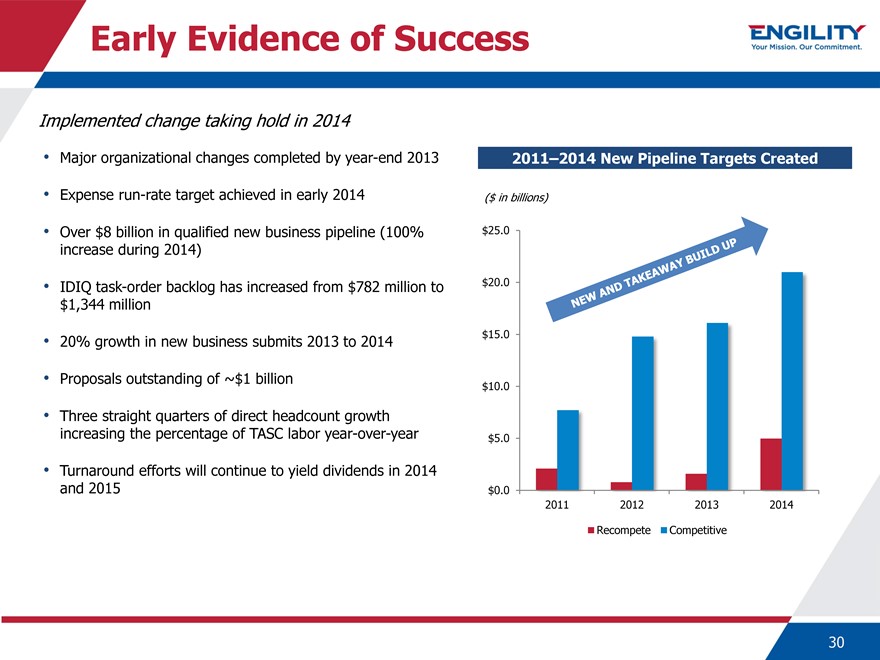

Implemented change taking hold in 2014

Major organizational changes completed by year-end 2013

Expense run-rate target achieved in early 2014

Over $8 billion in qualified new business pipeline (100% increase during 2014)

IDIQ task-order backlog has increased from $782 million to $1,344 million

20% growth in new business submits 2013 to 2014

Proposals outstanding of ~$1 billion

Three straight quarters of direct headcount growth increasing the percentage of TASC labor year-over-year

Turnaround efforts will continue to yield dividends in 2014 and 2015

2011–2014 New Pipeline Targets Created

($ in billions)

$25.0

$20.0

$15.0

$10.0

$5.0

$0.0

2011 2012 2013 2014

Recompete Competitive

30

Combination Rationale

Executive Summary

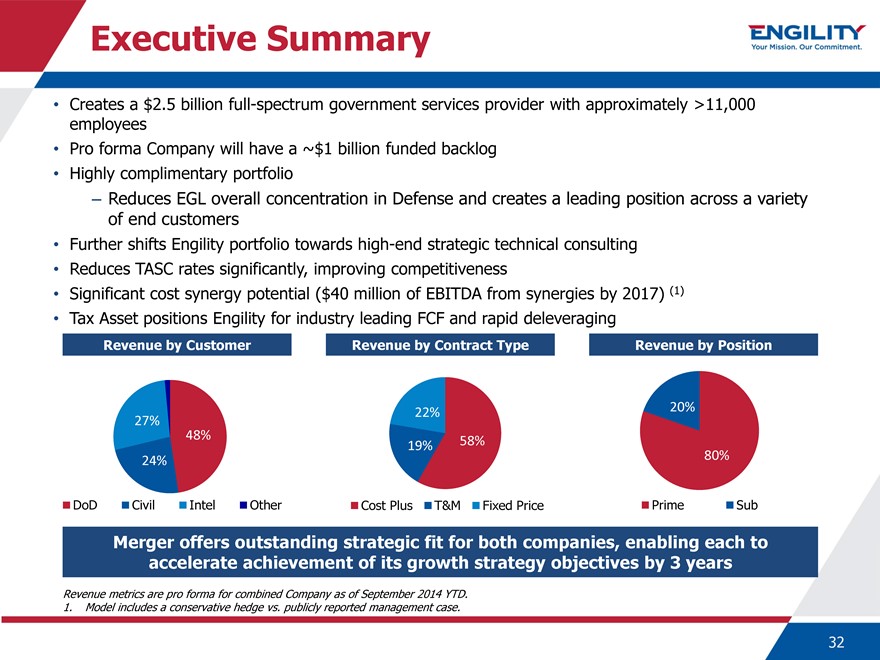

Creates a $2.5 billion full-spectrum government services provider with approximately >11,000 employees

Pro forma Company will have a ~$1 billion funded backlog

Highly complimentary portfolio

– Reduces EGL overall concentration in Defense and creates a leading position across a variety of end customers

Further shifts Engility portfolio towards high-end strategic technical consulting

Reduces TASC rates significantly, improving competitiveness

Significant cost synergy potential ($40 million of EBITDA from synergies by 2017) (1)

Tax Asset positions Engility for industry leading FCF and rapid deleveraging

Revenue by Customer Revenue by Contract Type Revenue by Position

20% 22% 27% 48% 19% 58% 24% 80%

DoD Civil Intel Other Cost Plus T&M Fixed Price Prime Sub

Merger offers outstanding strategic fit for both companies, enabling each to accelerate achievement of its growth strategy objectives by 3 years

Revenue metrics are pro forma for combined Company as of September 2014 YTD.

1. Model includes a conservative hedge vs. publicly reported management case.

32

Pro Forma Credit Highlights Summary

$2.5 billion, Top Tier Government Services Provider Highly Diversified by Customer, Service Offering and Contract Substantial Synergy Potential Significant Tax Attributes Strong Financial Profile Highly Experienced Management Team

33

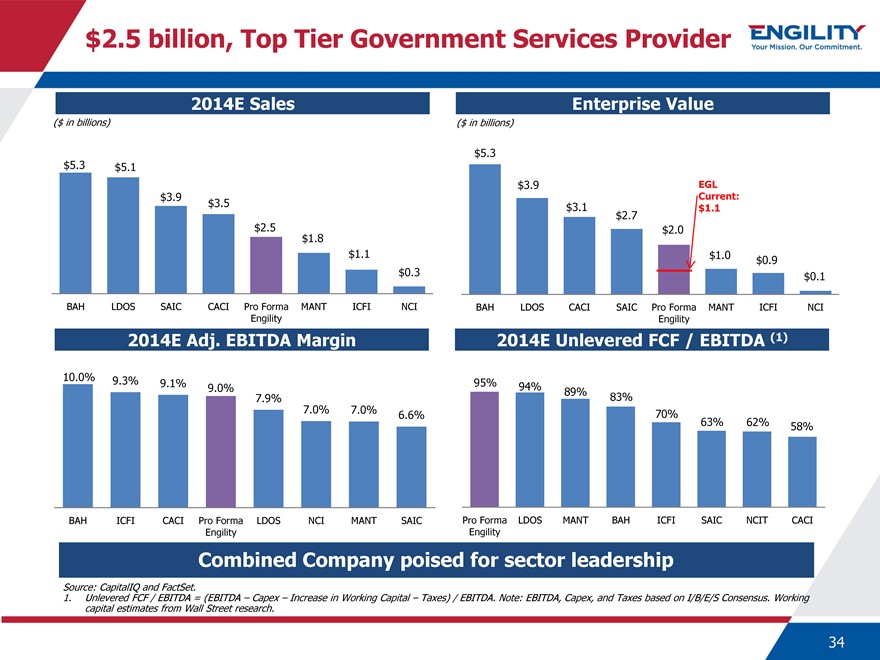

$2.5 billion, Top Tier Government Services Provider

2014E Sales

($ in billions)

$5.3 $5.1

$3.9

$3.5

$2.5 $1.8

$1.1

$0.3

BAH LDOS SAIC CACI Pro Forma MANT ICFI NCI Engility

2014E Adj. EBITDA Margin

10.0% 9.3%

9.1% 9.0%

7.9% 7.0%

7.0% 6.6%

BAH ICFI CACI Pro Forma LDOS NCI MANT SAIC Engility

Enterprise Value

($ in billions)

$5.3

$3.9 EGL

$3.1 Current:

$1.1

$2.7

$2.0

$1.0 $0.9

$0.1

BAH LDOS CACI SAIC Pro Forma MANT ICFI NCI Engility

2014E Unlevered FCF / EBITDA (1)

95% 94%

89% 83%

70%

63% 62% 58%

Pro Forma LDOS MANT BAH ICFI SAIC NCIT CACI Engility

Combined Company poised for sector leadership

Source: CapitalIQ and FactSet.

1. Unlevered FCF / EBITDA = (EBITDA – Capex – Increase in Working Capital – Taxes) / EBITDA. Note: EBITDA, Capex, and Taxes based on I/B/E/S Consensus. Working capital estimates from Wall Street research.

34

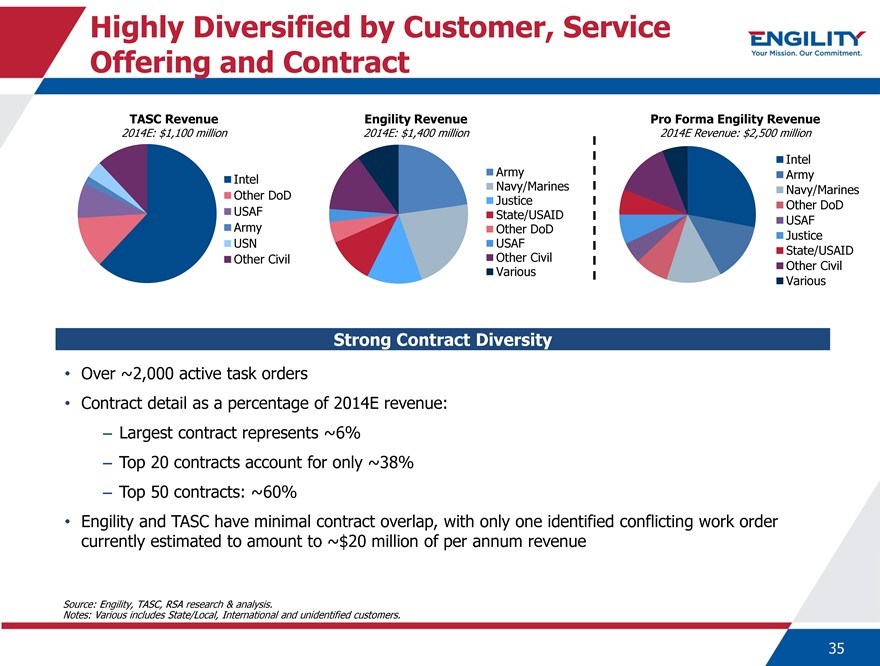

Highly Diversified by Customer, Service Offering and Contract

TASC Revenue Engility Revenue Pro Forma Engility Revenue

2014E: $1,100 million 2014E: $1,400 million 2014E Revenue: $2,500 million

Army Intel Intel Navy/Marines Army Other DoD Navy/Marines Justice Other DoD USAF State/USAID

USAF Army Other DoD

Justice USN USAF

State/USAID Other Civil Other Civil Various Other Civil Various

Strong Contract Diversity

Over ~2,000 active task orders

Contract detail as a percentage of 2014E revenue:

– Largest contract represents ~6%

– Top 20 contracts account for only ~38%

– Top 50 contracts: ~60%

Engility and TASC have minimal contract overlap, with only one identified conflicting work order currently estimated to amount to ~$20 million of per annum revenue

Source: Engility, TASC, RSA research & analysis.

Notes: Various includes State/Local, International and unidentified customers.

35

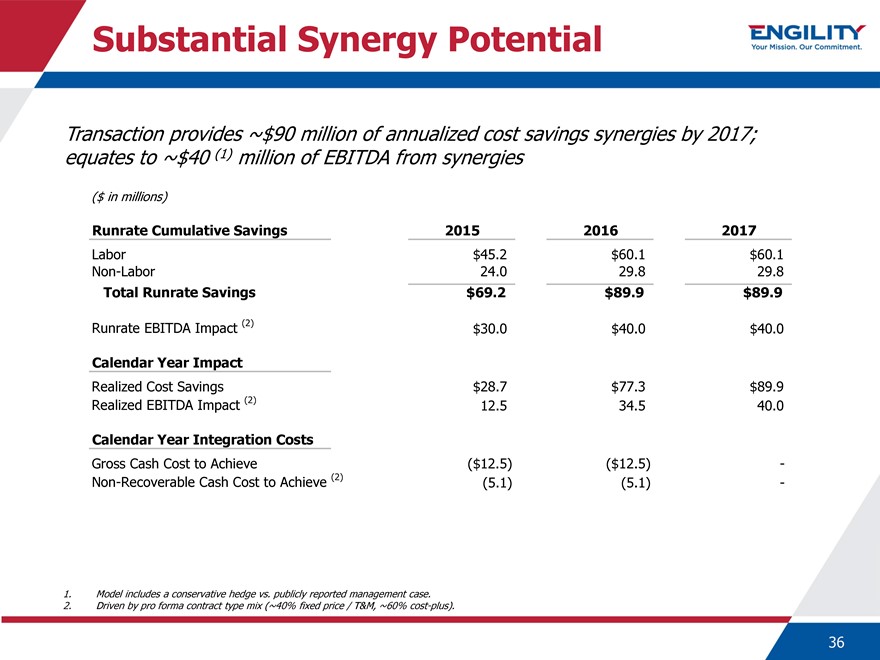

Substantial Synergy Potential

Transaction provides ~$90 million of annualized cost savings synergies by 2017;

equates to ~$40 (1) million of EBITDA from synergies

($ in millions)

Runrate Cumulative Savings 2015 2016 2017

Labor $45.2 $60.1 $60.1

Non-Labor 24.0 29.8 29.8

Total Runrate Savings $69.2 $89.9 $89.9

Runrate EBITDA Impact (2) $30.0 $40.0 $40.0

Calendar Year Impact

Realized Cost Savings $28.7 $77.3 $89.9

Realized EBITDA Impact (2) 12.5 34.5 40.0

Calendar Year Integration Costs

Gross Cash Cost to Achieve($12.5)($12.5) -

Non-Recoverable Cash Cost to Achieve (2)(5.1)(5.1) -

1. Model includes a conservative hedge vs. publicly reported management case.

2. Driven by pro forma contract type mix (~40% fixed price / T&M, ~60% cost-plus).

36

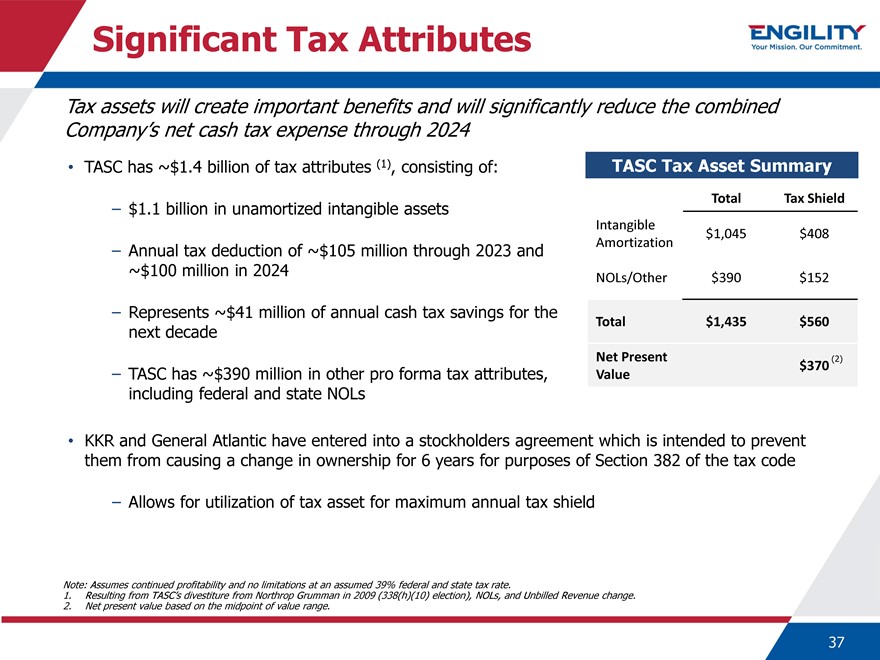

Significant Tax Attributes

Tax assets will create important benefits and will significantly reduce the combined Company’s net cash tax expense through 2024

TASC has ~$1.4 billion of tax attributes (1), consisting of:

– $1.1 billion in unamortized intangible assets

– Annual tax deduction of ~$105 million through 2023 and

~$100 million in 2024

– Represents ~$41 million of annual cash tax savings for the next decade

– TASC has ~$390 million in other pro forma tax attributes, including federal and state NOLs

KKR and General Atlantic have entered into a stockholders agreement which is intended to prevent them from causing a change in ownership for 6 years for purposes of Section 382 of the tax code

– Allows for utilization of tax asset for maximum annual tax shield

TASC Tax Asset Summary

Total Tax Shield

Intangible

$1,045 $ 408

Amortization

NOLs/Other $390 $ 152

Total $1,435 $ 560

Net Present(2)

$ 370

Value

Note: Assumes continued profitability and no limitations at an assumed 39% federal and state tax rate.

1. Resulting from TASC’s divestiture from Northrop Grumman in 2009 (338(h)(10) election), NOLs, and Unbilled Revenue change.

2. Net present value based on the midpoint of value range.

37

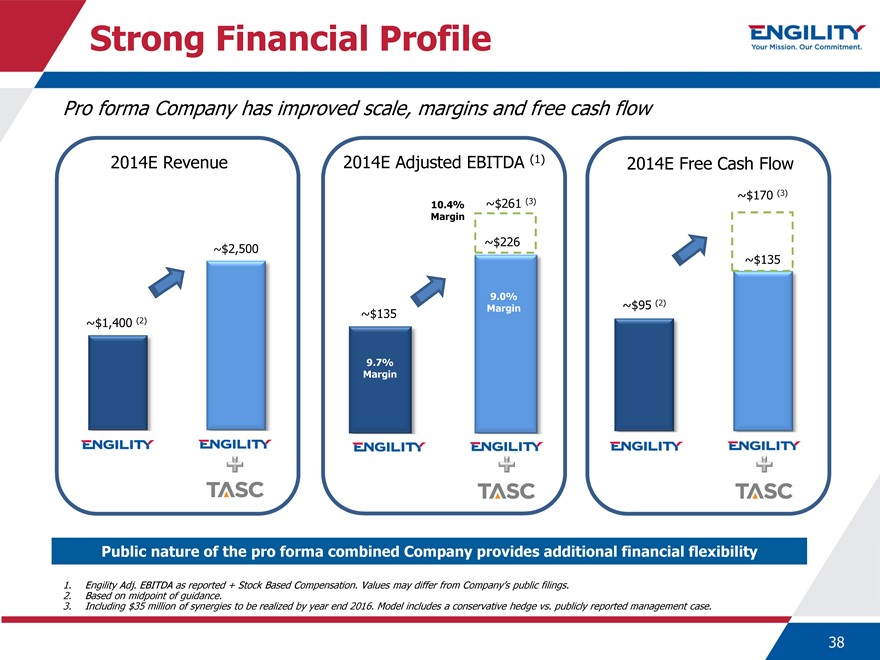

Strong Financial Profile

Pro forma Company has improved scale, margins and free cash flow

2014E Revenue 2014E Adjusted EBITDA (1) 2014E Free Cash Flow

~$261 (3) ~$170 (3)

10.4% Margin

~$226

~$2,500

~$135

9.0%

~$95 (2)

~$135 Margin

~$1,400 (2)

9.7% Margin

Public nature of the pro forma combined Company provides additional financial flexibility

1. Engility Adj. EBITDA as reported + Stock Based Compensation. Values may differ from Company’s public filings.

2. Based on midpoint of guidance.

3. Including $35 million of synergies to be realized by year end 2016. Model includes a conservative hedge vs. publicly reported management case.

38

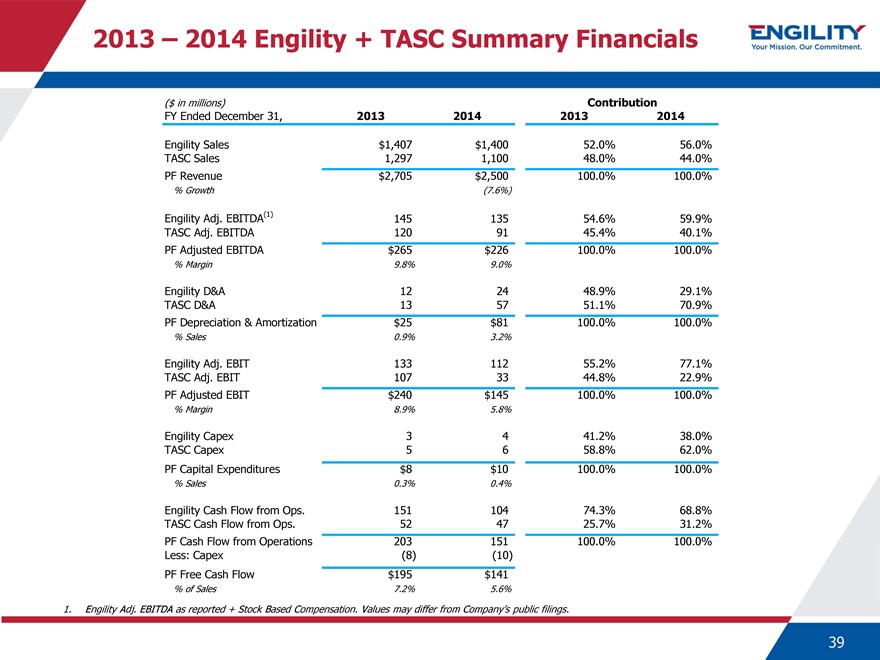

2013 – 2014 Engility + TASC Summary Financials

($ in millions) Contribution

FY Ended December 31, 2013 2014 2013 2014

Engility Sales $1,407 $1,400 52.0% 56.0% TASC Sales 1,297 1,100 48.0% 44.0% PF Revenue $2,705 $2,500 100.0% 100.0%

% Growth (7.6%)

Engility Adj. EBITDA(1) 145 135 54.6% 59.9% TASC Adj. EBITDA 120 91 45.4% 40.1% PF Adjusted EBITDA $265 $226 100.0% 100.0%

% Margin 9.8% 9.0%

Engility D&A 12 24 48.9% 29.1% TASC D&A 13 57 51.1% 70.9% PF Depreciation & Amortization $25 $81 100.0% 100.0%

% Sales 0.9% 3.2%

Engility Adj. EBIT 133 112 55.2% 77.1% TASC Adj. EBIT 107 33 44.8% 22.9% PF Adjusted EBIT $240 $145 100.0% 100.0%

% Margin 8.9% 5.8%

Engility Capex 3 4 41.2% 38.0% TASC Capex 5 6 58.8% 62.0% PF Capital Expenditures $8 $10 100.0% 100.0%

% Sales 0.3% 0.4%

Engility Cash Flow from Ops. 151 104 74.3% 68.8% TASC Cash Flow from Ops. 52 47 25.7% 31.2% PF Cash Flow from Operations 203 151 100.0% 100.0% Less: Capex (8) (10) PF Free Cash Flow $195 $141

% of Sales 7.2% 5.6%

1. Engility Adj. EBITDA as reported + Stock Based Compensation. Values may differ from Company’s public filings.

39

Pro Forma Credit Highlights Summary

$2.5 billion, Top Tier Government Services Provider Highly Diversified by Customer, Service Offering and Contract Substantial Synergy Potential Significant Tax Attributes Strong Financial Profile Highly Experienced Management Team

40

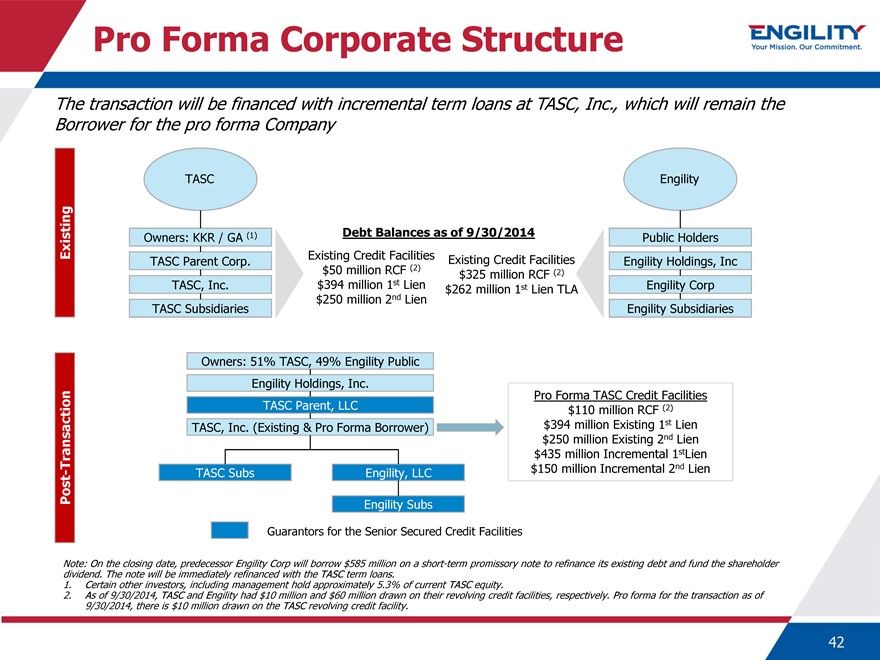

Transaction Details

The transaction will be financed with incremental term loans at TASC, Inc., which will remain the Borrower for the pro forma Company

TASC Engility

Owners: KKR / GA (1) Debt Balances as of 9/30/2014 Public Holders Existing TASC Parent Corp. Existing Credit Facilities Existing Credit Facilities Engility Holdings, Inc $50 million RCF (2) $325 million RCF (2) TASC, Inc. $394 million 1st Lien Engility Corp $262 million 1st Lien TLA $250 million 2nd Lien TASC Subsidiaries Engility Subsidiaries

Owners: 51% TASC, 49% Engility Public

Engility Holdings, Inc. Pro Forma TASC Credit Facilities TASC Parent, LLC $110 million RCF (2) TASC, Inc. (Existing & Pro Forma Borrower) $394 million Existing 1st Lien $250 million Existing 2nd Lien $435 million Incremental 1stLien Transaction—TASC Subs Engility, LLC $150 million Incremental 2nd Lien Post Engility Subs

Guarantors for the Senior Secured Credit Facilities

Note: On the closing date, predecessor Engility Corp will borrow $585 million on a short-term promissory note to refinance its existing debt and fund the shareholder dividend. The note will be immediately refinanced with the TASC term loans.

1. Certain other investors, including management hold approximately 5.3% of current TASC equity.

2. As of 9/30/2014, TASC and Engility had $10 million and $60 million drawn on their revolving credit facilities, respectively. Pro forma for the transaction as of 9/30/2014, there is $10 million drawn on the TASC revolving credit facility.

Pro forma Corporate Structure

42

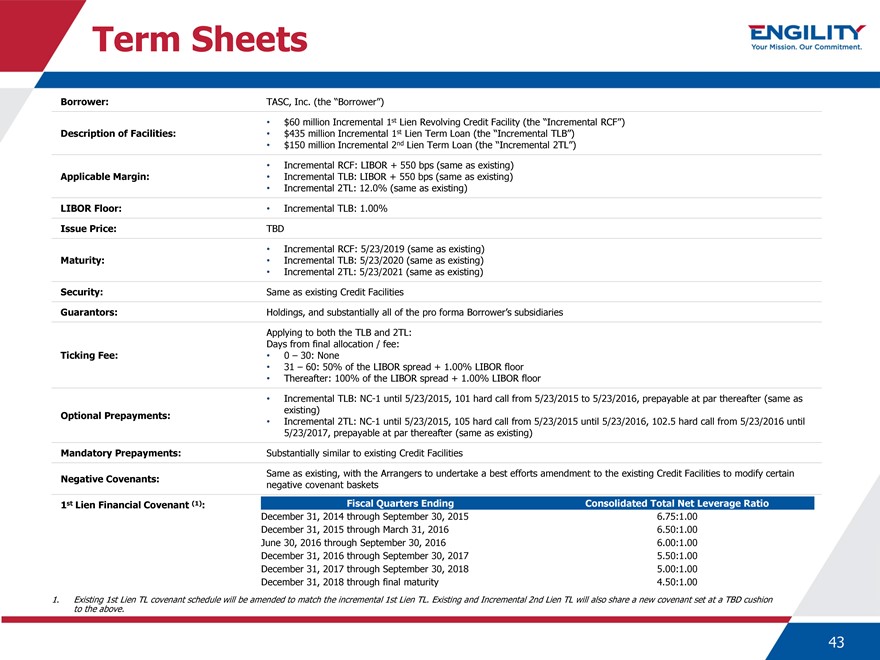

Term Sheets

Borrower: TASC, Inc. (the “Borrower”)

• $60 million Incremental 1st Lien Revolving Credit Facility (the “Incremental RCF”)

Description of Facilities: • $435 million Incremental 1st Lien Term Loan (the “Incremental TLB”)

• $150 million Incremental 2nd Lien Term Loan (the “Incremental 2TL”)

• Incremental RCF: LIBOR + 550 bps (same as existing)

Applicable Margin: • Incremental TLB: LIBOR + 550 bps (same as existing)

• Incremental 2TL: 12.0% (same as existing)

LIBOR Floor: • Incremental TLB: 1.00%

Issue Price: TBD

• Incremental RCF: 5/23/2019 (same as existing)

Maturity: • Incremental TLB: 5/23/2020 (same as existing)

• Incremental 2TL: 5/23/2021 (same as existing)

Security: Same as existing Credit Facilities

Guarantors: Holdings, and substantially all of the pro forma Borrower’s subsidiaries

Applying to both the TLB and 2TL:

Days from final allocation / fee:

Ticking Fee: • 0 – 30: None

• 31 – 60: 50% of the LIBOR spread + 1.00% LIBOR floor

• Thereafter: 100% of the LIBOR spread + 1.00% LIBOR floor

• Incremental TLB: NC-1 until 5/23/2015, 101 hard call from 5/23/2015 to 5/23/2016, prepayable at par thereafter (same as

Optional Prepayments: existing)

• Incremental 2TL: NC-1 until 5/23/2015, 105 hard call from 5/23/2015 until 5/23/2016, 102.5 hard call from 5/23/2016 until

5/23/2017, prepayable at par thereafter (same as existing)

Mandatory Prepayments: Substantially similar to existing Credit Facilities

Negative Covenants: Same as existing, with the Arrangers to undertake a best efforts amendment to the existing Credit Facilities to modify certain

negative covenant baskets

1st Lien Financial Covenant (1): Fiscal Quarters Ending Consolidated Total Net Leverage Ratio

December 31, 2014 through September 30, 2015 6.75:1.00

December 31, 2015 through March 31, 2016 6.50:1.00

June 30, 2016 through September 30, 2016 6.00:1.00

December 31, 2016 through September 30, 2017 5.50:1.00

December 31, 2017 through September 30, 2018 5.00:1.00

December 31, 2018 through final maturity 4.50:1.00

1. Existing 1st Lien TL covenant schedule will be amended to match the incremental 1st Lien TL. Existing and Incremental 2nd Lien TL will also share a new covenant set at a TBD cushion

to the above.

43

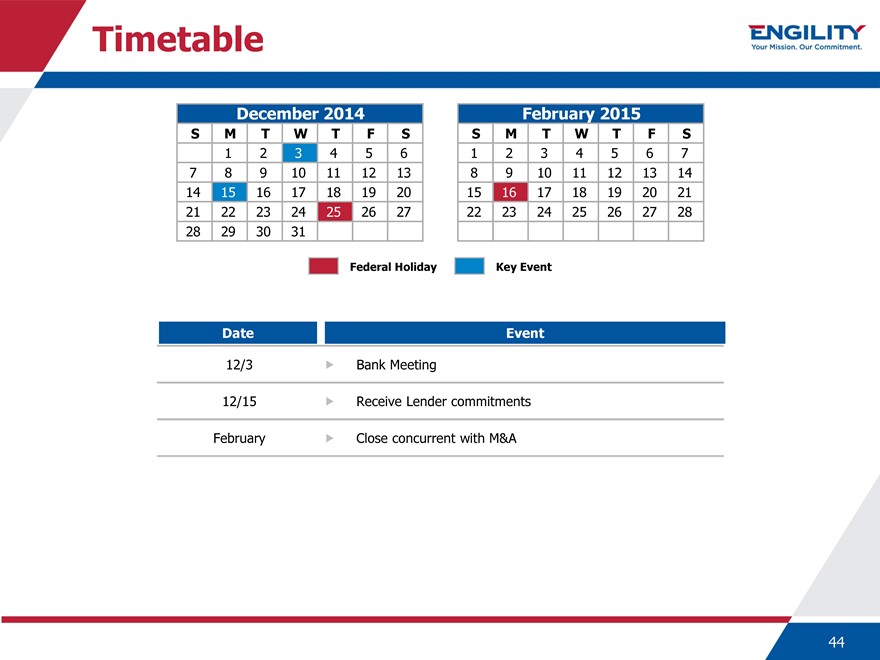

Timetable

December 2014 February 2015

SM T W T F S S M T W T F S

1 2 3 4 5 6 1 2 3 4 5 6 7

7 8 9 10 11 12 13 8 9 10 11 12 13 14

14 15 16 17 18 19 20 15 16 17 18 19 20 21

21 22 23 24 25 26 27 22 23 24 25 26 27 28

28 29 30 31

Federal Holiday Key Event

Date Event

12/3 Bank Meeting

12/15 Receive Lender commitments

February Close concurrent with M&A

44

Appendix

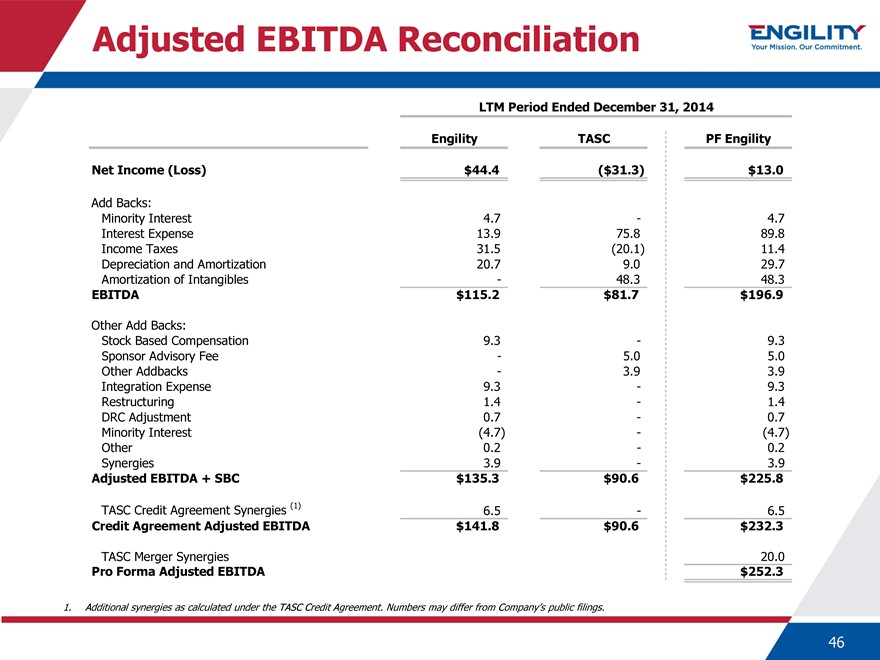

Adjusted EBITDA Reconciliation

LTM Period Ended December 31, 2014

Engility TASC PF Engility

Net Income (Loss) $44.4($31.3) $13.0

Add Backs:

Minority Interest 4.7—4.7

Interest Expense 13.9 75.8 89.8

Income Taxes 31.5(20.1) 11.4

Depreciation and Amortization 20.7 9.0 29.7

Amortization of Intangibles—48.3 48.3

EBITDA $115.2 $81.7 $196.9

Other Add Backs:

Stock Based Compensation 9.3—9.3

Sponsor Advisory Fee—5.0 5.0

Other Addbacks—3.9 3.9

Integration Expense 9.3—9.3

Restructuring 1.4—1.4

DRC Adjustment 0.7—0.7

Minority Interest(4.7) -(4.7)

Other 0.2—0.2

Synergies 3.9—3.9

Adjusted EBITDA + SBC $135.3 $90.6 $225.8

TASC Credit Agreement Synergies (1) 6.5—6.5

Credit Agreement Adjusted EBITDA $141.8 $90.6 $232.3

TASC Merger Synergies 20.0

Pro Forma Adjusted EBITDA $252.3

1. Additional synergies as calculated under the TASC Credit Agreement. Numbers may differ from Company’s public filings.

46

Disclaimer

This confidential information (“Information”) is based on information provided by Engility, Inc. (“EGL” or the “Company”) and TASC, Inc. (“TASC” or the “Target”). Information is being furnished on a confidential basis solely for use by the recipient in making its own evaluation of EGL and TASC and each company’s business, assets, financial condition and prospects.

This Information does not purport to contain all of the information that may be required or desired by a recipient to evaluate EGL and TASC. In all cases, interested parties should conduct their own independent investigation and analysis of EGL and its business, assets, financial condition and prospects. By accepting this Information, the recipient agrees (in addition to any obligations it may have under any confidentiality agreement) that neither it nor its agents, representatives, directors, officers, affiliates or employees will copy, reproduce or distribute to others this Information, in whole or in part, at any time without the prior written consent of EGL or TASC and that it will keep permanently confidential all information contained herein not already in the public domain. The recipient should become familiar with this and other obligations to which the recipient is subject pursuant to any confidentiality agreement. Upon request, the recipient will promptly return all material received from EGL and TASC (including this Information) without retaining any copies thereof.

The financial projections and other estimates contained herein are forward-looking statements with respect to the anticipated performance of EGL and TASC and each company’s respective affiliates. Such financial projections and estimates reflect various assumptions of management of EGL and TASC concerning the future performance of EGL and TASC and are subject to significant business, financial, economic, operating, competitive and other risks and uncertainties and contingencies (many of which are difficult to predict and beyond the control of EGL and TASC) that could cause actual results to differ materially from the statements included herein. In addition, such financial projections and estimates were not prepared with a view to public disclosure or compliance with published guidelines of the U.S. Securities and Exchange Commission, the guidelines established by the American Institute of Certified Public Accountants or U.S. generally accepted accounting principles. Accordingly, although EGL and TASC’s management believes the financial projections and estimates contained herein represent a reasonable estimate of EGL and TASC’s projected financial condition and results of operations, there can be no assurance as to the reliability or correctness of such financial projections and estimates, nor should any assurances be inferred, and actual results may vary materially from those projected.

Neither Engility nor TASC nor any of each company’s respective affiliates, representatives or advisors assumes any responsibility for, and makes no representation or warranty (express or implied) as to, the reasonableness, completeness, accuracy or reliability of the financial projections, estimates and other information contained herein, which speak only as of the date identified on cover page of this presentation. EGL and TASC and each company’s respective affiliates, representatives and advisors expressly disclaim any and all liability based, in whole or in part, on such information, errors therein or omissions therefrom. Neither EGL nor TASC nor any of each company’s respective affiliates, representatives or advisors intends to update or otherwise revise the financial projections, estimates and other information contained herein to reflect circumstances existing after the date identified on the cover page of this presentation to reflect the occurrence of future events even if any or all of the assumptions, judgments and estimates on which the information contained herein is based are shown to be in error.

47

Additional Information for Stockholders

ADDITIONAL INFORMATION FOR STOCKHOLDERS

In connection with the proposed merger, Engility Holdings, Inc. (“Engility”) and New East Holdings, Inc., a wholly owned subsidiary of Engility (“New Engility”), have filed with the SEC a registration statement on Form S-4 which includes a preliminary joint proxy/consent solicitation statement of Engility and TASC Parent Corporation (“TASC”) and a preliminary prospectus of New Engility, as well as other relevant documents concerning the proposed transaction. The registration statement has not yet become effective. Engility will mail the definitive joint proxy/consent solicitation statement/prospectus to the Engility and TASC stockholders. STOCKHOLDERS OF ENGILITY AND TASC ARE URGED TO READ THE REGISTRATION STATEMENT AND THE DEFINITIVE JOINT PROXY/CONSENT SOLICITATION STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the definitive joint proxy/consent solicitation statement/prospectus (when available) and other filings containing information about Engility at the SEC’s website at www.sec.gov. The definitive joint proxy/consent solicitation statement/prospectus (when available) and the other filings may also be obtained free of charge at Engility’s website at www.Engilitycorp.com under the tab “Investor Relations,” and then under the heading “SEC Filings.”

Engility and certain of its directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of Engility stockholders in connection with the proposed merger. Information about the directors and executive officers of Engility and their ownership of Engility common stock is set forth in the proxy statement for Engility’s 2014 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 11, 2014.

Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the definitive joint proxy/consent solicitation statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraphs.

NO OFFERS OR SOLICITATIONS

This communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

48