UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

Tier i offering

Offering Statement UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

Syntrol Corp.

(Exact name of registrant as specified in its charter)

Date: January 18, 2018

| Florida | 1521 | 27-2942340 |

(State or Other Jurisdiction of Incorporation) | (Primary Standard Classification Code) | (IRS Employer Identification No.)

|

2120 March Rd

Roseville, CA 95747

Phone: 912-226-2802

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Please send copies of all correspondence to:

Registered Agents Inc.

3030 N Rocky Point Dr. Ste. 150

Tampa, FL 33607

Phone: (850) 807-4500

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION A.

PART I - NOTIFICATION

Part I should be read in conjunction with the attached XML Document for Items 1-6

PART I – END

| 1 |

PRELIMINARY OFFERING CIRCULAR DATED January 18, 2018

An offering statement pursuant to Regulation A relating to these securities has been filed with the U.S. Securities and Exchange Commission, which we refer to as the Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

Syntrol Corp.

Up to 20,000,000 SHARES OF COMMON STOCK

NO PAR VALUE PER SHARE

In this public offering we, “Syntrol Corp.” are offering 15,401,820 shares of our common stock and our selling shareholders are offering 4,598,180 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. The primary offering will be conducted on a “best-efforts” basis, which means our officers will use their commercially reasonable best efforts in an attempt to offer and sell the shares. Our officers will not receive any commission or any other remuneration for these sales. In offering the securities on our behalf, the officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

We reserve the right to retain a registered broker dealer (the “Placement Agent”) in the sale of our shares. The Placement Agent and other broker dealers will receive compensation for sales of the securities offered hereby at a commission rate of up to 10% of the gross proceeds of the offering. Our officers and/or Placement Agent will not sell any of the shares in the secondary offering. Resale shares in the secondary offering may be sold to or through underwriters or dealers, directly to purchasers or through agents designated from time to time by the selling shareholders. For additional information regarding the methods of sale, you should refer to the section entitled “Plan of Distribution” in this offering. There is no minimum number of shares required to be purchased by each investor.

All of the shares being registered for sale by the Company will be sold at a set offering price within the range of $0.50 to $1.50 per share for the duration of the offering. In no event will the total offering, including the primary and secondary offering, exceed $20,000,000. Assuming all of the 15,401,820 shares being offered by the Company are sold at $1.00 per share, the Company will receive $15,401,820 in gross proceeds. Assuming 11,551,365 shares (75%) being offered by the Company are sold, the Company will receive $11,551,365 in gross proceeds. Assuming 7,700,910 shares (50%) being offered by the Company are sold, the Company will receive $7,700,910 in gross proceeds. Assuming 3,850,455 shares (25%) being offered by the Company are sold, the Company will receive $3,850,455 in gross proceeds. There is no escrow of funds or minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this offering will successfully raise enough funds to institute our company’s business plan.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

| 2 |

| SHARES OFFERED BY COMPANY | PRICE TO PUBLIC | SELLING AGENT COMMISSIONS | PROCEEDS TO THE COMPANY | |||||

| Per Share | $ | 1.00(1) | 10% ($0.10) | $ | $0.90 | |||

| Minimum Purchase | None | Not applicable | Not Applicable | |||||

| Total (15,401,820 shares) | $ | 15,401,820 | 10% ($1,540,182) | $ | $13,861,638 | |||

| SHARES OFFERED SELLING SHAREHOLDERS | PRICE TO PUBLIC | SELLING AGENT COMMISSIONS | PROCEEDS TO THE SELLING SHAREHOLDERS | |||||

| Per Share | $ | 1.00(1) | Not applicable | $ | 1.00 | |||

| Minimum Purchase | None | Not applicable | Not applicable | |||||

| Total (4,598,180 shares) | $ | 4,598,180 | Not applicable | $ | 4,598,180 | |||

| (1) | The Company is relying on Rule 253(b) with respect to the determination of the purchase price in this preliminary offering. An Issuer may raise an aggregate of up to $20 million in a 12-month period pursuant to Tier I of Regulation A of the Securities Act of 1933, as amended. The above table is reflected at $1.00 per share, which is an arbitrary price per share within the range of $0.50 and $1.50 per share. The offering price will be fixed at a price within the aforementioned range after qualification. |

If all the shares are not sold in the company’s offering, there is the possibility that the amount raised may be minimal and might not even cover the costs of the offering, which the Company estimates at $35,000. The proceeds from the sale of the securities will be placed directly into the Company’s account; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the offering circular. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws. All expenses incurred in this offering are being paid for by the Company.

Our Common Stock trades in the OTCMarket Pink Open Market under the symbol SNLP. There is currently no active trading market for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THEoffering circular. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF A SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

| 3 |

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 12.

THE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

You should rely only on the information contained in this offering circular and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this offering circular. If anyone provides you with different information, you should not rely on it.

The date of this offering circular is January 18, 2018

| 4 |

The following table of contents has been designed to help you find important information contained in this offering circular. We encourage you to read the entire offering circular.

| EXHIBITS TO OFFERING STATEMENT | 42 |

| SIGNATURES | 43 |

You should rely only on the information contained in this offering circular or contained in any free writing offering circular filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this offering circular filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this offering circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

| 5 |

PART - II

In this offering circular, ‘‘Syntrol,’’ the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’ refer to Syntrol Corp., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending December 31st. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This offering circular, and any supplement to this offering circular include “forward-looking statements”. To the extent that the information presented in this offering circular discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this offering circular.

This summary only highlights selected information contained in greater detail elsewhere in this offering circular. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire offering circular, including “Risk Factors” beginning on Page 12, and the financial statements, before making an investment decision.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer towww.investor.gov.

Sale of these shares will commence within two calendar days of the qualification date and it will be a continuous offering pursuant to Rule 251(d)(3)(i)(F).

The Company

We are in the business of delivering Energy Efficiency Products and Services to a cross section of Residential Homeowners, as a licensed Contracting Firm. Within the Residential Homeowner market vertical, the company offers an array of Energy Savings and Efficiency Solutions including: Solar Energy Generation, Heat, Ventilation, Air Conditioning (HVAC), Home Insulation, Windows and Roofs.

We have devised a unique business model. Since inception, the core objective has always been to provide Homeowners with a single source provider solution. Over the past five years, as greater demand for energy savings emerged, SYNTROL set itself on a course to provide each Homeowner with: Quality Product – Energy Efficiency Performance, Unsurpassed Installation and Service in the Field and Measurable Value – Products balanced with Price.

We are located at 2120 March Rd, Roseville, CA 95747 and our phone number is (916) 367-4832.

Risks Affecting Us

Our business will be subject to numerous risks and uncertainties, including those described in “Risk Factors” immediately following this offering circular summary and elsewhere in this offering circular. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. These risks include, but are not limited to, the following:

| 6 |

| • | we are an early-stage company with a limited operating history which makes it difficult to evaluate our current business and future prospects and may increase the risk of your investment; | |

| • | our inability to attract customers and increase sales to new and existing customers; | |

| • | failure of manufacturers and services providers to deliver products or provide services in a cost effective and timely manner; |

| • | our failure to develop, find or market new products and servics; |

| • | our failure to promote and maintain a strong identify in the industry; |

| • | failure to achieve or sustain profitability; |

| • | risks associated with the construction industry; |

| • | our failure to successfully or cost-effectively manage our marketing efforts and channels; |

| • | significant competition; |

| • | changing consumer preferences; | |

| • | adequate protection of confidential information; | |

| • | potential litigation from competitors and construction related claims from customers; | |

| • | a limited market for our common stock; | |

| • | the fact that we are a holding company with no operations and will rely on our operating subsidiary Syntrol Plumbing, Heating and Air, Inc., a privately held corporation incorporated under the laws of California to provide us with funds. |

| 7 |

Emerging Growth Company Status

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of all of these exemptions.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to take advantage of the benefits of this extended transition period.

We could be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although circumstances could cause us to lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act.

The Offering

| Securities being offered by the Company | 15,401,820 shares of common stock, at a fixed price per share within the range of $0.50 and $1.50 per share, set after qualification, offered by us on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold, through us or a Placement Agent. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. | |

| Underwriter | We reserve the right to retain a broker dealer in this offering with a commission up to 10% of the gross proceeds of the offering. | |

| Securities being offered by the Selling Stockholders | 4,598,180 shares of common stock, at a fixed price per share within the range of $0.50 and $1.50 per share, set after qualification, offered by selling stockholders in a resale offering. This fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our Board of Directors for an additional 90 days. | |

| Offering price per share | We and the selling shareholders will sell the shares at a fixed price per share within the range of $0.50 and $1.50 for the duration of this Offering. | |

| 8 |

| Number of shares of common stock outstanding before the offering of common stock | 40,000,001 common shares are currently issued and outstanding. | |

| Number of shares of common stock outstanding after the offering of common stock | 55,401,821 common shares will be issued and outstanding if we sell all of the shares we are offering herein at the price of $1.00 per share. The $1.00 per share price is an arbitrary price per share within the range of $0.50 and $1.50 per share. The offering price will be fixed at a price within the aforementioned range after qualification. | |

| The minimum number of shares to be sold in this offering | None. | |

| Use of Proceeds | We intend to use the gross proceeds to us for working capital, to develop new products and for other corporate purposes. | |

| Termination of the Offering | This offering will terminate upon the earlier to occur of (i) 365 days after this Offering Statement becomes qualified with the Securities and Exchange Commission, or (ii) the date on which all 20,000,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. | |

| Subscriptions: | All subscriptions once accepted by us are irrevocable.

| |

| Registration Costs | We estimate our total offering registration costs to be approximately $35,000.

| |

| Risk Factors: | See “Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

You should rely only upon the information contained in this offering circular. We have not authorized anyone to provide you with information different from that which is contained in this offering circular. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

| 9 |

SUMMARY OF OUR FINANCIAL INFORMATION

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section and the accompanying financial statements and related notes included elsewhere in this offering circular.

The tables and information below are derived from the financial statements of our wholly-owned operating subsidiary, Syntrol Plumbing, Heating and Air, Inc., for the periods indicated. A complete set of our financial statements are contained elsewhere in this Offering Statement.

| Statement of Operations Data: | For the Nine Months Ended September 30, 2017 |

For the Year Ended December 31, 2016 | |||||

| Revenues | $ | 21,243,798 | $ | 29,921,405 | |||

| Operating Expenses: | 4,426,836 | $ | 8,815,319 | ||||

| Net income (loss) | $ | (1,215,200 | ) | $ | (4,047,010) | ||

| Balance Sheet Data: | As of September 30, 2017 | As of December 31, 2016 | |||||

| Cash and cash equivalents | $ | 384,159 | $ | 103,065 | |||

| Working capital (deficit) | $ | (1,427,550 | ) | $ | (3,561,124) | ||

| Total assets | $ | 6,048,385 | $ | 5,355,580 | |||

| Total liabilities | $ | 10,157,279 | $ | 8,249,275 | |||

| Total stockholders’ equity (deficit) | $ | (4,108,894 | ) | $ | (2,893,695) | ||

The Company is electing to not opt out of JOBS Act extended accounting transition period. This may make its financial statements more difficult to compare to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company’s financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

| 10 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Results of Operations for the Nine Months Ended September 30, 2017 and the Years Ended December 31, 2016 and 2015

Revenues

Our total revenue reported for the nine months ended September 30, 2017 was approximately $21,243,798. Our total revenue reported for the year ended December 31, 2016 was approximately $29,921,405, a slight decrease of .04% for the year ended December 31, 2015. This small decrease in revenue resulted an accounting change of recognizing un-earned revenue which was a one-time non-cash transaction, We expect a positive revenue increases in 2017 and 2018.

Cost of Sales

Our cost of sales was $17,619,506 for the nine months ended September 30, 2017. Our cost of revenues was $26,420,709 for the year ended December 31, 2016, over $2,112,010forthe year ended December 31, 2015 because of the revenue changes.

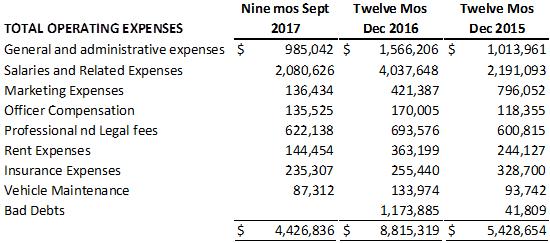

Operating Expenses

Operating expenses was $4,426,836 for the nine months ended September 30, 2017. Our operating expenses increased to $8,815,319 for the year ended December 31, 2016 from approximately $5,428,654 for the year ended December 31, 2015, an increase of approximately 31%. The detail by major category is reflected in the table below.

The main reasons for the increase in operating expenses in 2016 was a result of the high cost of management salaries and personal which have been subsequently right sized in 2017.

Net Loss

We incurred a net loss of $1,215,200 for the nine months ended September 30, 2017. We finished the year ended December 31, 2016 with a loss of approximately $4,047,010, as compared to a profit s of approximately $495,529 during the year ended December 31, 2015. The reasons for specific components are discussed above.

Liquidity and Capital Resources

| 11 |

As of September 30, 2017, we had total current assets of approximately $3,445,711, compared with current liabilities of approximately $4,873,261, resulting in negative working capital of approximately a $1,427,550. This is significant improvement over the working capital balance of approximately $3,561,124 at December 31, 2016. The increase is largely due to new long-term credit facilities that include a longer-term line of credit and new term loan credit accommodation.

Off Balance Sheet Arrangements

As of September 30, 2017, there were no off-balance sheet arrangements.

Critical Accounting Policies

A “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

Our accounting policies are discussed in detail in the footnotes to our financial statements included in this Offering Statement, however, we consider our critical accounting policies to be those related to revenue recognition, calculation of revenue share expense, stock-based compensation, capitalization and related amortization of intangible assets, and impairment of assets.

Recently Issued Accounting Pronouncements

We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operation, financial position or cash flow.

Please consider the following risk factors and other information in this offering circular relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this offering circular before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Related to Our Company and Our Industry

Because we have a limited operating history, you may not be able to accurately evaluate our operations.

We have a limited operating history upon which to evaluate the merits of investing in our company. Because we are in the early stages of operating our business, we are subject to many of the same risks inherent in the operation of a business with a limited operating history, including the potential inability to continue as a going concern.

Because of our early stage of operations, we may not be able to sustain revenues or achieve profits.

| 12 |

There can be no assurance that we will generate sufficient and sustainable revenues to enable us to operate at profitable levels or to generate positive cash flow. As a result of our limited operating history and the nature of the markets in which we compete, we may not be able to accurately predict our revenues. Any failure by us to accurately make such predictions could have a material adverse effect on our business, results of operations and financial condition. Further, our current and future expense levels are based largely on our investment plans and estimates of future revenues. We expect operating results to fluctuate significantly in the future as a result of a variety of factors, many of which are outside of our control. Factors that may adversely affect our operating results include, among others, demand for our products and services, the budgeting cycles of potential customers, lack of enforcement of or changes in governmental regulations or laws, the amount and timing of capital expenditures and other costs relating to the expansion of our operations, the introduction of new or enhanced products and services by us or our competitors, the timing and number of new hires, changes in our pricing policy or those of our competitors, the mix of products, increases in the cost of raw materials, technical difficulties with the products, incurrence of costs relating to future acquisitions, general economic conditions, and market acceptance of our products. As a strategic response to changes in the competitive environment, we may, from time to time, make certain pricing, service or marketing decisions or business combinations that could have a material adverse effect on our business, results of operations and financial condition. Any seasonality is likely to cause quarterly fluctuations in our operating results, and there can be no assurance that such patterns will not have a material adverse effect on our business, results of operations and financial condition. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall.

We may need to raise additional funds in the future that may not be available on acceptable terms or at all.

We may consider issuing additional debt or equity securities in the future to fund our business plan, for potential acquisitions or investments, or for general corporate purposes. If we issue equity or convertible debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization, requiring us to pay additional interest expenses. We may not be able to obtain financing on favorable terms, or at all, in which case, we may not be able to develop or enhance our products, execute our business plan, take advantage of future opportunities or respond to competitive pressures.

Our margins fluctuate which leads to further uncertainty in our profitability model.

While we have the potential to negotiate prices that benefit our clients and affect our profitability as we seek to gain market-share and increase our book of business, margins in the energy and construction business are fluid, and our margins vary based upon the supplier and the customer. This will lead to continued uncertainty in margins from quarter to quarter.

If demand for energy efficiency solutions does not develop as expected, our projected revenues and profits will be affected.

Our future profits are influenced by many factors, including economics, and will be predicated on a stable and/or growing market and consumption of energy efficiency solutions, products and services. We believe, and our growth expectations assume, that the market for energy efficiency will continue to grow, that we will increase our penetration of this market and that our anticipated revenue from selling into this market will continue to increase. If our expectations as to the size of this market and our ability to sell our products and services in this market are not correct, our revenue may not materialize and our business will be harmed.

Projects generally require significant capital, for which financing may not be available.

Our projects are occasionally financed by our customers. The costs of these projects to our customers are costly. If our customers are unable to budget for or raise funds on acceptable terms when needed for any particular project, we may be unable to secure customer contracts, the size of contracts we do obtain may be smaller, or we could be required to delay the development and construction of projects, reduce the scope of those projects or otherwise restrict our operations. Any inability by our customers to raise the funds necessary to finance our projects could materially harm our business, financial condition and operating results.

| 13 |

Operating results may fluctuate and may fall below expectations in any fiscal quarter.

Our operating results are difficult to predict and are expected to fluctuate from quarter to quarter due to a variety of factors, many of which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and investors should not rely on our past results or future predictions prepared by the Company as an indication of our future performance. If our revenue or operating results fall in any period, the value of our common stock would likely decline.

Factors that may cause our operating results to fluctuate include:

| ▪ | our customers’ ability to finance projects; |

| ▪ | our ability to acquire products to resell to our customers; |

| ▪ | the timing of work we do on projects where we recognize revenue on a percentage of completion basis; |

| ▪ | seasonality in demand for our products and services; |

| ▪ | poor weather inhibiting sales; |

| ▪ | a customer’s decision to delay our work on, or other risks involved with, a particular project; |

| ▪ | availability and costs of labor and equipment; |

| ▪ | the addition of new customers or the loss of existing customers; |

| ▪ | the size and scale of new customer projects; |

| ▪ | the availability of bonding for our projects; |

| ▪ | our ability to control costs, including operating expenses; |

| ▪ | changes in the mix of our products and services; |

| ▪ | the length of our sales cycle; |

| ▪ | the productivity and growth of our sales force; |

| ▪ | changes in pricing by us or our competitors, or the need to provide discounts to win business; |

| ▪ | costs related to the acquisition and integration of companies or assets; |

| ▪ | general economic trends, including changes in energy efficiency spending or geopolitical events such as war or incidents of terrorism; and |

| ▪ | future accounting pronouncements and changes in accounting policies. |

Our business is at risk if we lose key personnel or we are unable to attract and integrate additional skills personnel.

The success of our business depends, in large part, on the skill of our personnel. Accordingly, it is critical that we maintain, and continue to build, a highly-experienced management team and specialized workforce, including engineers, experts in project management and business development, and sales professionals. Competition for personnel, particularly those with expertise in the energy services and software industries, is high, and identifying candidates with the appropriate qualifications can be difficult. We may not be able to hire the necessary personnel to implement our business strategy given our anticipated hiring needs, or we may need to provide higher compensation or more training to our personnel than we currently anticipate.

In the event, we are unable to attract, hire and retain the requisite personnel and subcontractors, we may experience delays in completing projects in accordance with project schedules and budgets, which may have an adverse effect on our financial results, harm our reputation and cause us to curtail our pursuit of new projects. Further, any increase in demand for personnel and specialty subcontractors may result in higher costs, causing us to exceed the budget on a project, which in turn may have an adverse effect on our business, financial condition and operating results and harm our relationships with our customers.

Our future success is particularly dependent on the vision, skills, experience and effort of our senior management team, including our president and chief executive officer. If we were to lose the services of our president and chief executive officer or any of our key employees, our ability to effectively manage our operations and implement our strategy could be harmed and our business may suffer.

| 14 |

We operate in a highly competitive industry and competitors may compete more effectively.

The industries in which we operate are highly competitive, with many companies of varying size and business models, many of which have their own proprietary technologies, competing for the same business as we do. Many of our competitors have longer operating histories and greater resources than us, and could focus their substantial financial resources to develop a competing business model, develop products or services that are more attractive to potential customers than what we offer or convince our potential customers that they require financing arrangements that would be impractical for smaller companies to offer. Our competitors may also offer similar products and services at prices below cost and/or devote significant sales forces to competing with us or attempt to recruit our key personnel by increasing compensation, any of which could improve their competitive positions. Any of these competitive factors could make it more difficult for us to attract and retain customers; cause us to lower our prices in order to compete, and reduce our market share and revenue, any of which could have a material adverse effect on our financial condition and operating results. We can provide no assurance that we will continue to effectively compete against our current competitors or additional companies that may enter our markets. We also expect to encounter competition in the form of potential customers electing to develop solutions or perform services internally rather than engaging an outside provider such as us.

We may be unable to manage our growth effectively.

We expect our business and operations to expand rapidly and we anticipate that further expansion of our organization and operations will be required to achieve our expectations for future growth. In order to manage our expanding operations, we will also need to improve our management, operational and financial controls and our reporting systems and procedures. All of these measures will require significant expenditures and will demand the attention of management. If we do not continue to enhance our management personnel and our operational and financial systems and controls in response to growth in our business, we could experience operating inefficiencies that could impair our competitive position and could increase our costs more than we had planned. If we are unable to manage growth effectively, our business, financial condition and operating results could be adversely affected.

We plan to expand our business, in part, through future acquisitions.

We plan to continue to seek-out companies or assets to expand our project skill-sets and capabilities, expand our geographic markets, add experienced management and increase our product and service offerings. However, we may be unable to implement this growth strategy if we cannot identify suitable acquisition candidates, reach agreement with acquisition targets on acceptable terms or arrange required financing for acquisitions on acceptable terms. In addition, the time and effort involved in attempting to identify acquisition candidates and consummate acquisitions may divert members of our management from the operations of our company.

Any future acquisitions could disrupt business.

If we are successful in consummating acquisitions, those acquisitions could subject us to a number of risks, including:

| ▪ | the purchase price we pay could significantly deplete our cash reserves or result in dilution to our existing stockholders; |

| ▪ | we may find that the acquired company or assets do not improve our customer offerings or market position as planned; |

| ▪ | we may have difficulty integrating the operations and personnel of the acquired company; |

| ▪ | key personnel and customers of the acquired company may terminate their relationships with the acquired company as a result of the acquisition; |

| ▪ | we may experience additional financial and accounting challenges and complexities in areas such as tax planning and financial reporting; |

| 15 |

| ▪ | we may assume or be held liable for risks and liabilities as a result of our acquisitions, some of which we may not discover during our due diligence or adequately adjust for in our acquisition arrangements; |

| ▪ | we may incur one-time write-offs or restructuring charges in connection with the acquisition; |

| ▪ | we may acquire goodwill and other intangible assets that are subject to amortization or impairment tests, which could result in future charges to earnings; and |

| ▪ | we may not be able to realize the cost savings or other financial benefits we anticipated. |

These factors could have a material adverse effect on our business, financial condition and operating results.

We may incur a variety of costs to engage in future acquisitions of companies, products or technologies, and the anticipated benefits of those acquisitions may never be realized.

As a part of our business strategy, we may make acquisitions of, or significant investments in, complementary companies, products or technologies, although no acquisitions or investments are currently pending. Any future acquisitions would be accompanied by risks such as:

| ▪ | difficulties in assimilating the operations and personnel of acquired companies; |

| ▪ | diversion of our management’s attention from ongoing business concerns; |

| ▪ | our potential inability to maximize our financial and strategic position through the successful incorporation of acquired technology and rights into our products and services; |

| ▪ | additional expense associated with amortization of acquired assets; |

| ▪ | charges at the time of acquisitions related to the expensing of in process research and development; |

| ▪ | the exposure to additional debt to fund an acquisition; |

| ▪ | dilution to existing shareholders should the Company raise additional equity; |

| ▪ | maintenance of uniform standards, controls, procedures and policies; and |

| ▪ | impairment of existing relationships with employees, suppliers and customers as a result of the integration of new management personnel. |

We cannot guarantee that we will be able to successfully integrate any business, products, technologies or personnel that we might acquire in the future, and our failure to do so could have a material adverse effect on our business, financial condition and operational results.

We may be subject to liability claims for damages and other expenses not covered by insurance that could reduce our earnings and cash flows.

Our business, profitability and growth prospects could suffer if we pay damages or defense costs in connection with a liability claim that is outside the scope of any applicable insurance coverage. We intend to maintain, but do not yet have, general and product liability insurance. There is no assurance that we will be able to obtain insurance in amounts, or for a price, that will permit us to purchase desired amounts of insurance. Additionally, if our costs of insurance and claims increase, then our earnings could decline. Further, market rates for insurance premiums and deductibles have been steadily increasing, which may prevent us from being adequately insured. A product liability or negligence action in excess of insurance coverage could harm our profitability and liquidity.

Insurance and contractual protections may not always cover lost revenue.

We possess insurance, warranties from suppliers, and our subcontractors make contractual obligations to meet certain performance levels, and we also attempt, where feasible, to pass risks we cannot control to our customers, the proceeds of such insurance, warranties, performance guarantees or risk sharing arrangements may not be adequate to cover lost revenue, increased expenses or liquidated damages payments that may be required in the future.

| 16 |

We currently carry customary insurance for business liability. For our work as a general contractor, we carry workers comp insurance for our employees and we have performance bonding insurance. Certain losses of a catastrophic nature such as from floods, tornadoes, thunderstorms and earthquakes are uninsurable or not economically insurable. Such “Acts of God,” work stoppages, regulatory actions or other causes, could interrupt operations and adversely affect our business.

We rely on outside consultants, employees, manufacturers and suppliers.

We will rely on the experience of outside consultants, employees, manufacturers and suppliers. In the event that one or more of these consultants or employees terminates employment with the Company, or becomes unavailable, suitable replacements will need to be retained and there is no assurance that such employees or consultants could be identified under conditions favorable to us.

We rely on strategic relationships to promote our products.

We rely on strategic partnerships with outside companies and individuals to promote and supply certain of our products and services, thus making the future success of our business particularly contingent on the efforts of other parties. An important part of our strategy is to promote acceptance of our products through technology and product alliances with certain distributors who we feel could assist us with our promotion strategies. Our dependence on outside distributors, however, raises potential risks with respect to the future success of our business. Our success is dependent on the successful completion and commercial deployment of our products and services and on the future commitment of our distributors to our products and technology.

We rely on our suppliers.

We will rely on key vendors and suppliers to provide high quality products and services on a consistent basis. Our future success is contingent on the efforts and performance of these suppliers. Although in the past we have obtained adequate quantities of raw materials and finished product on acceptable terms to meet our requirements, we may have difficulty in locating or using alternative resources should supply problems arise with the current suppliers. An interruption or reduction in the source of supply of any of the component materials, or an unanticipated increase in vendor prices, could materially affect our operating results and damage customer relationships as well as our business.

If we fail to protect our intellectual property, our planned business could be adversely affected.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or obtain and use information that we regard proprietary. Unauthorized use of our proprietary technology could harm our business. Litigation to protect our intellectual property rights can be costly and time-consuming to prosecute, and there can be no assurance that we will have the financial or other resources necessary to enforce or defend a patent infringement or proprietary rights violation action.

There has been substantial litigation regarding patent and other intellectual property rights in the fields in which we operate. From time to time, we may be forced to defend ourselves against other claims and legal actions alleging infringement of the intellectual property rights of others. Adverse determinations in any such litigation could subject us to significant liabilities, which could have a material adverse effect on us. Third parties could also obtain patents that may require us to obtain certain licenses. If we are unable to redesign products or are unable to obtain a license, our business and financial condition would be adversely affected.

Although we perform investigations of the intellectual property of third parties, we cannot be certain that we have not infringed the intellectual property rights of such third parties. Any such infringement or misappropriation claim could result in significant costs, substantial damages, and our inability to operate our business. We also could be forced to obtain licenses from third parties or to develop a non-infringing alternative, which could be costly and time-consuming. A court could also order us to pay compensatory damages for such infringement, plus prejudgment interest, and could, in addition, treble the compensatory damages and award attorney fees. These damages could be substantial and could harm our reputation, business, financial condition, and operating results.

| 17 |

Because intellectual property litigation can be costly and time consuming, our intellectual property litigation expenses could be significant, even if we are successful in defending our intellectual property rights. Even invalid claims alone could materially adversely affect our financial condition.

We may be subject to lawsuits related to products we purchase from our suppliers or the services performed by our providers.

In the future, we may be a party to, or may be otherwise responsible for, pending or threatened lawsuits or other claims related to products we purchase from our approved manufacturers and suppliers. We intend to require our approved providers to have product liability insurance, but there can be no assurance that such product liability insurance will be sufficient to protect us against potential liability. Additionally, there is no certainty that we will not be named in an action for product liability. Such cases and claims may raise difficult and complex factual and legal issues and may be subject to many uncertainties and complexities, including, but not limited to, the facts and circumstances of each particular case or claim, the jurisdiction in which each suit is brought, and differences in applicable law. Upon resolution of any pending legal matters or other claims, we may incur charges in excess of established reserves. Product liability lawsuits and claims, safety alerts or product recalls in the future, regardless of their ultimate outcome, could have a material adverse effect on our business and reputation and on our ability to attract and retain customers and joint venture partners. Our business, profitability and growth prospects could suffer if we face such negative publicity.

Product development is an inherently uncertain process, and we may encounter unanticipated development challenges and may not be able to meet our product development and commercialization milestones.

Product development and testing may be subject to unanticipated and significant delays, expenses and technical or other problems. We cannot guarantee that we will successfully achieve our milestones within our planned timeframe or ever. We develop prototypes of planned products prior to the full commercialization of these products. We cannot predict whether prototypes of future products will achieve results consistent with our expectations. A prototype could cost significantly more than expected or the prototype design and construction process could uncover problems that are not consistent with our expectations. Prototypes of emerging products are a material part of our business plan, and if they are not proven to be successful, our business and prospects could be harmed.

More generally, the commercialization of our products may also be adversely affected by many factors not within our control, including:

| ▪ | the willingness of market participants to try a new product and the perceptions of these market participants of the safety, reliability, functionality and cost effectiveness of our products; |

| ▪ | the emergence of newer, possibly more effective technologies; |

| ▪ | the future cost and availability of the raw materials and components needed to manufacture and use our products; and |

| ▪ | the adoption of new regulatory or industry standards that may adversely affect the use or cost of our products. |

Accordingly, we cannot predict that our products will be accepted on a scale sufficient to support development of mass markets for them.

If we are the subject of future product defect or liability suits, our business will likely fail.

In the course of our planned operations, we may become subject to legal actions based on a claim that our products are defective in workmanship or have caused personal or other injuries. We currently maintain limited liability insurance and such coverage may not be adequate to cover all potential claims. Moreover, even if we are able to maintain sufficient insurance coverage in the future, any successful claim could significantly harm our business, financial condition and results of operations.

| 18 |

We may be exposed to lawsuits and other claims if our products malfunction, which could increase our expenses, harm our reputation and prevent us from growing our business.

Any liability for damages resulting from malfunctions of our products could be substantial, increase our expenses and prevent us from growing or continuing our business. Potential customers may rely on our products for critical needs and a malfunction of our products could result in warranty claims or other product liability. In addition, a well-publicized actual or perceived problem could adversely affect the market’s perception of our products. This could result in a decline in demand for our products, which would reduce revenue and harm our business. Further, since our products are used in systems that are made by other manufacturers, we may be subject to product liability claims even if our products do not malfunction.

Our business is substantially dependent on utility rate structures and government incentive programs that encourage the use of alternative energy sources. The reduction or elimination of government subsidies and economic incentives for energy-related technologies would harm our business.

We believe that near-term growth of energy-related technologies, including power conversion technology, relies partly on the availability and size of government and economic incentives and grants (including, but not limited to, the U.S. Investment Tax Credit and various state and local incentive programs). These incentive programs could be challenged by utility companies, or for other reasons found to be unconstitutional, and/or could be reduced or discontinued for other reasons. The reduction, elimination, or expiration of government subsidies and economic incentives could harm our business.

A combination of utility rate structures and government subsidies that encourage the use of alternative energy sources is a primary driver of demand for our products. For example, public utilities are often allowed to collect demand charges on commercial and industrial customers in addition to traditional usage charges. In addition, the federal government and many states encourage the use of alternative energy sources through a combination of direct subsidies and tariff incentives such as net metering for users that use alternative energy sources such as solar power. California also encourages alternative energy technology through its Self-Generation Incentive Program, or SGIP, which offers rebates for businesses and consumers who adopt certain new technologies. Other states have similar incentives and mandates which encourage the adoption of alternative energy sources. Notwithstanding the adoption of other incentive programs, we expect that California will be the most significant market for the sale of our products in the near term. Should California or another state in which we derive a substantial portion of our product revenues in the future change its utility rate structure or eliminate or significantly reduce its incentive programs, demand for our products could be substantially affected, which would adversely affect our business prospects, financial condition and operating results.

As an Emerging Growth Company under the Jobs Act, we are permitted to rely on exemptions from certain disclosures requirements.

We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| ▪ | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| ▪ | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| ▪ | submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and |

| ▪ | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive's compensation to median employee compensation. |

| 19 |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

Our officers and directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies.

Our officers and directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies and with serving as officers and director of publicly-traded companies. Such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. Consequently, our operations, future earnings and ultimate financial success could suffer irreparable harm due to our officers’ and director’s ultimate lack of experience in our industry and with publicly-traded companies and their reporting requirements in general.

Risks Relating to the Company’s Securities and this Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

Our common stock is quoted under the symbol “SNLP” on the OTCPink operated by OTC Markets Group, Inc, an electronic inter-dealer quotation medium for equity securities. We do not currently have an active trading market. There can be no assurance that an active and liquid trading market will develop or, if developed, that it will be sustained.

Our securities are very thinly traded. Accordingly, it may be difficult to sell shares of our common stock without significantly depressing the value of the stock. Unless we are successful in developing continued investor interest in our stock, sales of our stock could continue to result in major fluctuations in the price of the stock.

| 20 |

Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for investors.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including:

| ▪ | technological innovations or new products and services by us or our competitors; |

| ▪ | government regulation of our products and services; |

| ▪ | the establishment of partnerships with other technology companies; |

| ▪ | intellectual property disputes; |

| ▪ | additions or departures of key personnel; |

| ▪ | sales of our common stock; |

| ▪ | our ability to integrate operations, technology, products and services; |

| ▪ | our ability to execute our business plan; |

| ▪ | operating results below expectations; |

| ▪ | loss of any strategic relationship; |

| ▪ | industry developments; |

| ▪ | economic and other external factors; and |

| ▪ | period-to-period fluctuations in our financial results. |

You should consider any one of these factors to be material. Our stock price may fluctuate widely as a result of any of the above.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

We have not paid dividends in the past and have no immediate plans to pay dividends.

We plan to reinvest all of our earnings, to the extent we have earnings, in order to market our products and to cover operating costs and to otherwise become and remain competitive. We do not plan to pay any cash dividends with respect to our securities in the foreseeable future. We cannot assure you that we would, at any time, generate sufficient surplus cash that would be available for distribution to the holders of our common stock as a dividend. Therefore, you should not expect to receive cash dividends on our common stock.

If securities or industry analysts do not publish or do not continue to publish research or reports about our business, or if they issue an adverse or misleading opinion regarding our stock, our stock price and trading volume could decline.

| 21 |

The trading market for our common stock is influenced by the research and reports that industry or securities analysts publish about us or our business. If any of the analysts who cover us now or in the future issue an adverse opinion regarding our stock, our stock price would likely decline. If one or more of these analysts ceases coverage of our company or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

Because we are subject to the “Penny Stock” rules, the level of trading activity in our stock may be reduced.

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any listed, trading equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules which may increase the difficulty Purchasers may experience in attempting to liquidate such securities.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative, low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. The FINRA requirements may make it more difficult for broker-dealers to recommend that their customers buy our Common Stock, which may have the effect of reducing the level of trading activity in our Common Stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our Common Stock.

Investors cannot withdraw funds once invested and will not receive a refund.

Investors do not have the right to withdraw invested funds. Subscription payments will be paid to Syntrol Corp. and held in our corporate bank account if the subscription agreements are in good order and we accept the investor’s investment. Therefore, once an investment is made, investors will not have the use or right to return of such funds.

Substantial future sales of shares of our common stock could cause the market price of our common stock to decline.

The market price of shares of our common stock could decline as a result of substantial sales of our common stock, particularly sales by our directors, executive officers and significant stockholders, a large number of shares of our common stock becoming available for sale or the perception in the market that holders of a large number of shares intend to sell their shares.

This is a fixed price offering and the fixed offering price may not accurately represent the current value of us or our assets at any particular time. Therefore, the purchase price you pay for shares may not be supported by the value of our assets at the time of your purchase.

This is a fixed price offering, which means that the offering price for our shares is fixed and will not vary based on the underlying value of our assets at any time. Our board of directors, in consultation with our Placement Agent, has determined the offering price in its sole discretion. The fixed offering price for our shares has not been based on appraisals of any assets we own or may own, or of our company as a whole, nor do we intend to obtain such appraisals. Therefore, the fixed offering price established for our shares may not be supported by the current value of our company or our assets at any particular time.

| 22 |

The entire amount of your purchase price for your shares will not be available for investment in our company.

A portion of the offering proceeds will be used to pay selling commissions of up to ten percent (10%) of the offering proceeds to our Placement Agent, which it may re-allow and pay to participating broker-dealers, who sell shares. Thus, a portion of the gross amount of the offering proceeds will not be available for investment in our company.

If investors successfully seek rescission, we would face severe financial demands that we may not be able to meet.

Our shares have not been registered under the Securities Act of 1933, or the Securities Act, and are being offered in reliance upon the exemption provided by Section 3(b) of the Securities Act and Regulation A promulgated thereunder. We represent that this Offering Statement does not contain any untrue statements of material fact or omit to state any material fact necessary to make the statements made, in light of all the circumstances under which they are made, not misleading. However, if this representation is inaccurate with respect to a material fact, if this offering fails to qualify for exemption from registration under the federal securities laws pursuant to Regulation A, or if we fail to register the shares or find an exemption under the securities laws of each state in which we offer the shares, each investor may have the right to rescind his, her or its purchase of the shares and to receive back from the Company his, her or its purchase price with interest. Such investors, however, may be unable to collect on any judgment, and the cost of obtaining such judgment may outweigh the benefits. If investors successfully seek rescission, we would face severe financial demands we may not be able to meet and it may adversely affect any non-rescinding investors.

Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment.

The initial public offering price per share will be substantially higher than the pro forma net tangible book value per share of our common stock outstanding prior to this offering. As a result, investors purchasing common stock in this offering will experience immediate dilution. This dilution is due to the fact that our earlier investors paid substantially less than the initial public offering price when they purchased their shares of common stock. In addition, if we issue additional equity securities, you will experience additional dilution.

We may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield a return.

The principal purposes of this offering are to raise additional capital, to create a public market for our common stock and to facilitate our future access to the public equity markets. We currently intend to use the net proceeds we receive from this offering primarily for paying working capital, inventory and general corporate purposes. We may also use a portion of the net proceeds for the acquisition of, or investment in, products, technologies, or businesses that complement our business, although we have no present commitments or agreements to enter into any acquisitions or investments. Our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. Investors in this offering will need to rely upon the judgment of our management with respect to the use of proceeds. If we do not use the net proceeds that we receive in this offering effectively, our business, financial condition, results of operations and prospects could be harmed, and the market price of our common stock could decline.

This offering circular contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this offering circular.

| 23 |

Overview

On September 20, 2017, Syntrol Corp., a Florida corporation (the “Company”), entered into an Agreement and Plan of Reorganization (the “Reorganization Agreement”) with Syntrol Plumbing, Heating and Air, Inc., a privately held corporation incorporated under the laws of California (“Syntrol”), and the members of Syntrol. As a result of the transaction (the “Exchange”), Syntrol became a wholly-owned subsidiary of the Company. In accordance with the terms of the Reorganization Agreement, at the closing an aggregate of 37,798,180 shares of the Company’s common stock were issued to the holders of Syntrol in exchange for their common stock of Syntrol. Further, pursuant to the Reorganization Agreement, Theodore Fotsis will be required to cancel $102,437 of debt with the company and cancel 1,000,000 shares he currently owns in ex-change for 1,600,000 newly issued SNLP shares to Mr. Fotsis. Each of the Company, Syntrol and the shareholders of Syntrol provided customary representations and warranties, pre-closing covenants and closing conditions in the Reorganization Agreement.

Upon the closing of the above transactions, Theodore Fotsis resigned as an officer and director of the Company and Russ Guzior also resigned as an officer and director of the Company. Paul Bianchi was appointed as President, Chief Executive Officer and Director and Todd Fulton was appointed Director.

The Company intends to carry on the business of Syntrol, as its primary line of business. Following the transactions described above, the Company’s corporate offices have been moved and the Company’s phone number has changed. The Company’s new office address and phone is:

Syntrol Plumbing, Heating and Air, Inc.

2120 March Rd, Roseville, CA 95747

(916) 367-4832

Business Plan

Corporate Information

SYNTROL Plumbing, Heating and Air, Inc. (SYNTROL) was incorporated in California in 2010. Business Operations are focused on delivering Energy Efficiency Products and Services to a cross section of Residential Homeowners, as a licensed Contracting Firm. Within the Residential Homeowner market vertical, the company offers an array of Energy Savings and Efficiency Solutions including:

| ▪ | Solar Energy Generation |

| ▪ | Heat, Ventilation, Air Conditioning (HVAC) |

| ▪ | Home Insulation |

| ▪ | Windows |

| ▪ | Roofs |

SYNTROL has devised a unique business model. Since inception, the core objective has always been to provide Homeowners with a single source provider solution. Over the past five years, as greater demand for energy savings emerged, SYNTROL set itself on a course to provide each Homeowner with:

| ▪ | Quality Product – Energy Efficiency Performance |

| ▪ | Unsurpassed Installation and Service in the Field |

| ▪ | Measurable Value – Products balanced with Price |

| 24 |