Exhibit 99.1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

TABLE OF CONTENTS

| 1 | INTRODUCTION | 3 |

| 2 | CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 4 |

| 3 | THIRD QUARTER INTERIM MD&A – QUARTERLY HIGHLIGHTS AND SIGNIFICANT EVENTS | 6 |

| 4 | PROPERTY SUMMARY | 8 |

| 5 | SUMMARY OF QUARTERLY RESULTS | 27 |

| 6 | DISCUSSION OF OPERATIONS | 28 |

| 7 | PROPOSED TRANSACTIONS | 30 |

| 8 | LIQUIDITY AND CAPITAL RESOURCES | 30 |

| 9 | CONTINGENCIES | 32 |

| 10 | RELATED PARTY DISCLOSURES | 32 |

| 11 | CRITICAL ACCOUNTING POLICIES AND ESTIMATES | 33 |

| 12 | ACCOUNTING CHANGES AND RECENT ACCOUNTING PRONOUNCEMENTS | 34 |

| 13 | FINANCIAL INSTRUMENTS AND RELATED RISKS | 35 |

| 14 | RISKS AND UNCERTAINTIES | 37 |

| 15 | DISCLOSURE CONTROLS AND PROCEDURES | 37 |

| 16 | CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING | 38 |

| 17 | DISCLOSURE OF OUTSTANDING SHARE DATA | 38 |

| 18 | OFF-BALANCE SHEET ARRANGEMENTS | 38 |

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

This Management’s Discussion and Analysis (“MD&A”) of Prophecy Development Corp. and its subsidiaries (“Prophecy”, or the “Company”) was prepared by management as at November 14, 2018 and was reviewed, approved, and authorized for issue by the Company’s Audit Committee. The following discussion of performance, financial condition and future prospects should be read in conjunction with the unaudited condensed interim consolidated financial statements of the Company and notes thereto for the three and nine months ended September 30, 2018 prepared in accordance with International Financial Reporting Standards (“IFRS”) applicable to the preparation of interim financial statements, including International Accounting Standard (“IAS”) 34 Interim Financial Reporting, as issued by the International Accounting Standards Board. This MD&A should also be read in conjunction with both the audited annual consolidated financial statements for the year ended December 31, 2017 (prepared in accordance with IFRS) (“Annual Financial Statements”) and the related annual MD&A (“Annual MD&A”) dated March 29, 2018, and the 2017 Annual Information Form (“AIF”), all of which are available under the Company’s SEDAR profile at www.sedar.com.

The information provided herein supplements but does not form part of the financial statements. Financial information is expressed in Canadian Dollars, unless stated otherwise. Readers are cautioned that this MD&A contains “forward-looking statements” and that actual events may vary from management’s expectations. Readers are encouraged to read the cautionary note contained herein regarding such forward-looking statements. Information on risks associated with investing in the Company’s securities as well as information about mineral resources and reserves under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) are contained in the Company’s most recently filed AIF which is available on the Company’s website at www.prophecydev.com or on SEDAR at www.sedar.com.

Description of Business

Prophecy is a company amalgamated under the laws of the Province of British Columbia, Canada. The Company’s Common shares (the “Shares”, and each, a “Share”) are listed for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “PCY”, the OTCQX® Best Market under the symbol “PRPCF” and the Frankfurt stock exchange under the symbol “1P2N”.

On August 8, 2018, the Company completed a split of the issued and outstanding Shares on the basis of 10 new Shares for every one old Share outstanding (the “Split”). As required by IAS 33, Earnings Per Share, all information with respect to the number of Shares and issuance prices for the time periods prior to the Split was restated to reflect the Split.

The principal business of the Company is the acquisition, exploration and development of mineral and energy projects. The Company owns a 100% interest in the following projects: two vanadium projects located in North America including the Gibellini vanadium project which is comprised of the Gibellini and Louie Hill vanadium deposits and associated claims located in the State of Nevada, USA (the “Gibellini Project”) and the Titan vanadium-titanium-iron project comprised of the Titan vanadium-titanium-iron deposit and related claims located in the Province of Ontario, Canada (the “Titan Project”); the Pulacayo Paca silver-lead-zinc property which is comprised of the Pulacayo and Paca silver-lead-zinc deposits and related concessions located in Bolivia (the “Pulacayo Project”); two coal projects located in Mongolia including the Ulaan Ovoo project which is comprised of the Ulaan Ovoo coal deposit, coal leases and Ulaan Ovoo mine and the Khujirt exploration license (the “Ulaan Ovoo Coal Property”) and the Khavtgai Uul and Chandgana Tal coal deposits, coal leases and Chandgana Tal mine (the “Chandgana Project”); and the Chandgana Power Plant project comprised of a land right located in Mongolia.

Prophecy is focused on making the Gibellini Project the first operating primary vanadium mine in North America, offering the best quality vanadium pentoxide product that exceeds customer requirements in a variety of high-tech applications such as vanadium redox flow batteries and in the aerospace industry. All of the Gibellini deposit measured and indicated resources are in the oxide and transition zones of the Woodruff Formation black shale where the mineralization has a low content of deleterious elements (less than 1% Fe, Ti, and MgO). The deposit is amenable to open pit mining and the mineralization appears amenable to metal recovery by heap leach followed by solvent extraction methods without an initial roasting step to produce V2O5 as a bagged product on site that meets the specifications for high-tech applications. The Company is considering development of its Titan Project and acquisition of other vanadium resources to augment the Gibellini Project and position Prophecy as a major producer of vanadium.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

The vanadium resources are part of a portfolio of projects the Company is building that, through their diversity of locations, commodities and products, reduces exposure to adverse regulation and political climates and changes in specific commodity prices. A diverse portfolio of projects from which a variety of minerals are mined and sold provides multiple opportunities to maintain revenue and is one facet of Prophecy’s efforts to attain its ultimate objective of stable positive cash flow.

General Corporate Information:

At September 30, 2018 and November 14, 2018 Prophecy had: (i) 78,814,457 and 80,852,527 Shares issued and outstanding, respectively; (ii) 9,057,870 and 9,591,000 stock options for Shares outstanding, respectively; and (iii) 30,763,447 and 29,781,627 Share purchase warrants for Shares outstanding, respectively. | Transfer Agent and Registrar Computershare Investor Services Inc. 3rd Floor, 510 Burrard Street Vancouver, BC, Canada V6C 3B9 Tel: +1 (604) 661-9400 |

| | |

Investor and Contact Information All financial reports, news releases and corporate information can be accessed by visiting our website at: www.prophecydev.com Investor & Media requests and queries: Bekzod Kasimov Tel: +1 (888) 513-6286 Email: ir@prophecydev.com | Head Office and Registered Office Suite 1610 - 409 Granville Street Vancouver, BC, Canada V6C 1T2 Tel: +1 (604) 569-3661 |

Directors and Officers

As at the date of this MD&A, Prophecy’s directors and officers were as follows:

| Directors | Officers |

| John Lee, Chairman | Gerald Panneton, President and Chief Executive Officer |

| Gerald Panneton | Irina Plavutska, Chief Financial Officer |

| Greg Hall | Tony Wong, Corporate Secretary |

| Masa Igata | Bekzod Kasimov, Vice-President, Business Development |

| Louis Dionne | Michael Drozd, Vice-President, Operations |

| | Danniel Oosterman, Vice-President, Exploration Ron Espell, Vice-President, Environment and Sustainability John Lee, Head of International Affairs |

| | |

| Audit Committee | Corporate Governance and Compensation Committee |

| Greg Hall (Chair) | Greg Hall (Chair) |

| Louis Dionne | Louis Dionne |

| Masa Igata | Masa Igata |

Qualified Persons

Danniel Oosterman, B.Sc.(Hons), PGeo, is a “qualified person” as defined under NI 43-101. Mr. Oosterman serves as the Company’s Vice-President, Exploration and qualified person. He is not considered independent of Prophecy given the large extent that his professional time is dedicated solely to Prophecy. Mr. Oosterman has reviewed and approved the technical and scientific disclosure regarding the mineral properties of Prophecy contained in this MD&A.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

2.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains ”forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities legislation concerning anticipated developments in the Company’s continuing and future operations in the United States, Canada, Bolivia and Mongolia, and the adequacy of the Company’s financial resources and financial projections. Such forward-looking statements include but are not limited to statements regarding the permitting, feasibility, plans for development of the Gibellini Project; development of the Titan Project; development of the Pulacayo Project; development and production of electricity from Prophecy’s Chandgana Power Plant, including finalizing of any power purchase agreement; the likelihood of securing project financing; estimated future coal production at the Chandgana Project; and coal production at the Ulaan Ovoo Coal Property and the Chandgana Project, and other information concerning possible or assumed future results of operations of Prophecy. See in particular, Section 4 – Property Summary.

Forward-looking statements in this document are frequently identified by words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, “potentially” or similar expressions, or statements that events, conditions or results “will”, “may”, “would”, “could”, “should” occur or are “to be” achieved, and statements related to matters which are not historical facts. Information concerning management’s expectations regarding Prophecy’s future growth, results of operations, performance, business prospects and opportunities may also be deemed to be forward-looking statements, as such information constitutes predictions based on certain factors, estimates and assumptions subject to significant business, economic, competitive and other uncertainties and contingencies, and involve known and unknown risks which may cause the actual results, performance, or achievements to be different from future results, performance, or achievements contained in such forward-looking statements made by Prophecy.

In making the forward-looking statements in this MD&A, Prophecy has made several assumptions that it believes are appropriate, including, but not limited to assumptions that: all required third party contractual, regulatory and governmental approvals will be obtained for the development, construction and production of Prophecy’s properties and the Chandgana Power Plant; there being no significant disruptions affecting operations, whether due to labour disruptions or other causes; currency exchange rates being approximately consistent with current levels; certain price assumptions for vanadium, silver, other metals and coal, prices for and availability of fuel, parts and equipment and other key supplies remain consistent with current levels; production forecasts meeting expectations; the accuracy of Prophecy’s current mineral resource estimates; labour and materials costs increasing on a basis consistent with Prophecy’s current expectations; and any additional required financing will be available on reasonable terms; market developments and trends in global supply and demand for vanadium, silver, other metals, coal and energy meeting expectations. Prophecy cannot assure you that any of these assumptions will prove to be correct.

Numerous factors could cause Prophecy’s actual results to differ materially from those expressed or implied in the forward-looking statements, including the following risks and uncertainties, which are discussed in greater detail under the heading “Risks and Uncertainties” in this MD&A and “Risk Factors” in Prophecy’s most recent AIF as filed under the Company’s SEDAR profile at www.SEDAR.com and posted on Prophecy’s website: Prophecy’s history of net losses and lack of foreseeable positive cash flow; exploration, development and production risks, including risks related to the development of Prophecy’s mineral properties; Prophecy not having a history of profitable mineral production; commencing mine development without a feasibility study; the uncertainty of mineral resource and mineral reserve estimates; the capital and operating costs required to bring Prophecy’s projects into production and the resulting economic returns from its projects; foreign operations and political conditions, including the legal and political risks of operating in Bolivia and Mongolia, which are developing countries and being subject to their local laws; the availability and timeliness of various government approvals, permits and licenses; the feasibility, funding and development of Prophecy’s projects; protecting title to Prophecy’s mineral properties; environmental risks; the competitive nature of the mining business; lack of infrastructure; Prophecy’s reliance on key personnel; uninsured risks; commodity price fluctuations; reliance on contractors; Prophecy’s need for substantial additional funding and the risk of not securing such funding on reasonable terms or at all; foreign exchange risk; anti-corruption legislation; recent global financial conditions; the payment of dividends; the inability of insurance to cover all potential risks associated with mining operations; conflicts of interest; and reliance on information systems with exposure to cyber-security risks.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

In light of the risks and uncertainties inherent in all forward-looking statements, the inclusion or incorporation by reference of forward-looking statements in this MD&A should not be considered as a representation by Prophecy or any other person that Prophecy’s objectives or plans will be achieved.

These factors should be considered carefully, and readers should not place undue reliance on Prophecy’s forward-looking statements. The Company believes that the expectations reflected in the forward-looking statements contained in this MD&A and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Prophecy undertakes no obligation to publicly update any future revisions to forward-looking statements to reflect events or circumstances after the date of this MD&A or to reflect the occurrence of unanticipated events, except as expressly required by law.

3.

THIRD QUARTER INTERIM MD&A – QUARTERLY HIGHLIGHTS AND SIGNIFICANT EVENTS

●

On July 6, 2018, the Company closed the first tranche of a non-brokered private placement previously announced on May 30, 2018 and amended on June 26, 2018 (the “Placement”) and raised gross cash proceeds of $1,081,690 through the issuance of the equivalent of 3,863,180 Units (the “Units” and each, a “Unit”) of Prophecy. Each Unit is comprised of one Share and one Share purchase warrant (the “Warrants” and each, a “Warrant”). Each Warrant entitles the holder to purchase one additional Share at an exercise price the equivalent of $0.40 for a period of three years from the date of issuance. No finder’s fees were paid in connection with the issuance of any securities under the first tranche of the Placement.

●

On August 8, 2018, the Company completed the Split.

●

On August 14, 2018, the Company closed the second and final tranche of the Placement and raised gross cash proceeds of $55,506 through the issuance of 198,237 Units at a price of $0.28 per Unit, with each Unit consisting of one Share and one Warrant. No finder’s fees were paid in connection with the issuance of any securities under the second and final tranche of the Placement.

●

On August 14, 2018, the Company appointed Daniel Fidock as a member of its Board of Directors.

●

On August 14, 2018, the Company announced the results from the metallurgical tests conducted by Northwest Nonferrous Metals Mining Group Co., Ltd. (the “NWME”) on samples collected from the Gibellini Project. Samples were collected by NWME’s technical team during their visit to the project’s site in February 2018, with tests performed at NWME’s facility in Xi’an, China. Further details of the metallurgical test results conducted by NWME and announced via press release can be found at the Company’s SEDAR profile at www.SEDAR.com.

●

On August 15, 2018, the Company issued a request for proposal from qualified bidders for engineering, procurement, construction and management services (the “EPCM”) for operations at the Gibellini Project. The project’s EPCM work, based on technical data from an historic independent feasibility report submitted by AMEC E&C Services, Inc. on September 12, 2011, commenced in September 2011 with about 30% completion, before the remaining work was halted in November 2014, due to low vanadium prices. The Company is now re-initiating the EPCM work in light of the Preliminary Economic Assessment (“PEA”) authored by Amec Foster Wheeler E&C Services Inc. and dated effective May 29, 2018. The Company expects Phase 1 of the EPCM, updating basic engineering design, to start in October 2018 and to be completed by early 2020; Phase 2, equipment procurement and detailed engineering design, to be completed in early 2021; Phase 3, facilities construction, to start in mid 2021 and be completed in early 2022 with the Gibellini Project wet commissioning to be in the middle of 2022.

●

On August 20, 2018, the Company secured water supply for the Gibellini Project’s construction and operation. The Company signed a 10-year water least agreement (the “Agreement”) with the owner of a private ranch, located approximately 14.5 km from the Gibellini Project. The Agreement can be extended for any number of additional 7-year terms, not to exceed (with the primary term) a total of 99 years. Per the terms of the Agreement, the lessor has granted to Prophecy the rights to 805 acre-feet (approximately 262.4 million gallons) of water per year for the Gibellini Project, at a minimum flow rate of 500 gallons per minute from its year-round springs surface water stream.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

●

On August 24, 2018, the Company engaged NewFields Companies, LLC (“NewFields”), an environmental, engineering, and construction management consulting firm to advance permitting and environmental impact statement (the “EIS”) preparation for the Gibellini Project. The Company and NewFields’ teams will work closely with the Bureau of Land Management (the “BLM”), the Nevada Division of Environmental Protection and other federal and state permitting agencies to target the filing of all major permitting applications by the end of 2019.

Subsequent to period end

●

On October 2, 2018, the Company signed a Memorandum of Agreement for voluntary cost recovery with the BLM to expedite Gibellini Project permitting efforts. Prophecy and the BLM agreed in principal to a fixed cost structure that will have Prophecy reimburse the BLM for the cost of all anticipated work for the BLM to complete its review of the Company’s submission of mine plan of operations and any updates to existing baseline studies.

●

On October 4, 2018, the Company’s Form 20-F registration statement, voluntary filed with the United States Securities and Exchange Commission (the "SEC"), was declared effective. The Form 20-F is available for download, either from the Investor section of the Company’s website at www.prophecydev.com or from the SEC’s website at www.sec.gov.

●

On October 10, 2018, the Company appointed Gerald Panneton as the Company’s President and new Chief Executive Officer, replacing John Lee, who remains Chairman of the Board of Directors of the Company. The Company granted to Mr. Panneton 1,000,000 bonus shares and 500,000 incentive stock options exercisable at a price of $0.26 per Share for a term of five years expiring on October 10, 2023.

The Company also appointed Gerald Panneton and Louis Dionne to the Company’s Board of Directors, effective October 10, 2018 to replace Harald Batista and Daniel Fidock, both of whom will remain key advisors to the Company. The Company granted to Mr. Dionne 50,000 incentive stock options exercisable at a price of $0.26 per Share for a term of five years expiring on October 10, 2023.

●

On October 16, 2018, the Company announced that it executed a lease agreement (the “Lease”) with an arms-length private Mongolian company (the “Lessee”) whereby the Lessee plans to perform mining operations at Prophecy’s Ulaan Ovoo coal mine, and will pay Prophecy USD$2.00 (the “Production Royalty”) for every tonne of coal shipped from the Ulaan Ovoo site premises. The Lessee paid Prophecy USD$100,000 in cash, as a non-refundable advance royalty payment and is preparing, at its own and sole expense, to restart and operate the Ulaan Ovoo mine with its own equipment, supplies, housing and crew. The Lessee will pay all government taxes and royalties related to its proposed mining operation.

The Lease is valid for 3 years with an annual advance royalty payment (“ARP”) for the first year of $100,000 which was due and paid upon signing, and USD$150,000 and USD$200,000 due on the 1st and 2nd anniversary of the Lease, respectively. The ARP can be credited towards the USD$2.00 per tonne Production Royalty payments to be made to Prophecy as the Lessee starts to sell Ulaan Ovoo coal. The 3-year Lease can be extended upon mutual agreement.

●

On October 17, 2018, the Company granted in aggregate, 940,000 incentive stock options to various directors, officers, employees and consultants of the Company. The options are exercisable at a price of $0.33 per Share for a term of five years expiring on October 17, 2023.

●

On October 29, 2018, the Company announced the appointment of Ron Espell as the Company’s Vice- President, Environment and Sustainability, effective November 14, 2018. The Company will grant to Mr. Espell 200,000 incentive stock options exercisable at the 5-day volume-weighted average trading price of the Company’s shares calculated at the end of trading on November 14, 2018 and rounded up to the nearest whole $0.01 per Share for a term of five years expiring on November 14, 2023.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

●

On November 1, 2018, the Company entered into an agreement with BMO Nesbitt Burns Inc. (“BMO”), under which BMO agreed to buy on a bought deal basis 12,000,000 Shares, at a price of $0.46 per share for gross proceeds of approximately $5.5 million (the “Offering”). The shares will be offered by way of a short form prospectus in each of the provinces and territories of Canada, except Québec and may also be offered by way of private placement in the United States. The Offering is expected to close on or about November 22, 2018.

For further information please view the Company’s 2018 news releases under the Company’s SEDAR profile at www.sedar.com.

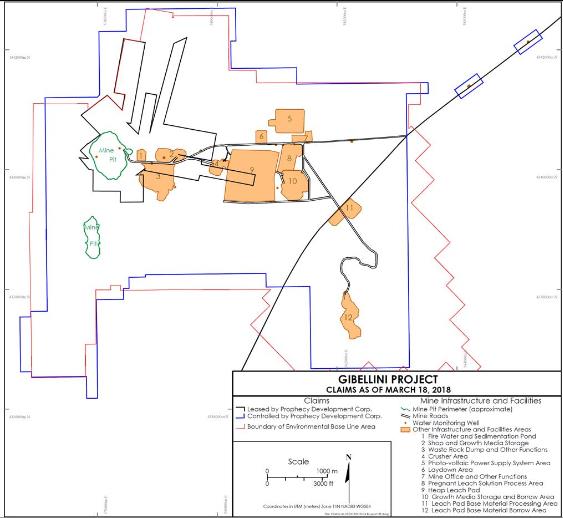

Gibellini Project

The Gibellini Project consists of a total of 354 unpatented lode mining claims that include: the Gibellini group of 40 claims, the VC Exploration group of 105 claims, and the Prophecy group of 209 claims. The Gibellini group of claims is referred to by the Company as a “project”. All the claims are located in Eureka County, Nevada, approximately 25 miles south of the town of Eureka and are easily accessed from US Highway 50 to a paved road that becomes a graded, gravel road.

The Gibellini group of claims was acquired on June 22, 2017, through lease from the claimant and current holder of the Gibellini mineral claims (the “Gibellini Lessor”) and includes an area of approximately 771 acres. Under the Gibellini mineral lease agreement dated June 22, 2017 (the “Gibellini MLA”), Prophecy leased the Gibellini group of claims which originally constituted the Gibellini Project by among other things, agreeing to pay to the Gibellini Lessor, annual advance royalty payments which will be tied, based on an agreed formula (not to exceed USD$120,000 per year), to the average vanadium pentoxide price of the prior year. Upon commencement of production, Prophecy will maintain its acquisition through lease of the Gibellini group of claims by paying to the Gibellini Lessor, a 2.5% NSR until a total of USD$3 million is paid. Thereafter, the NSR will be reduced to 2% over the remaining life of the mine (and referred to thereafter, as “Production Royalty Payments”). All advance royalty payments made, will be deducted as credits against future Production Royalty Payments. The lease is for a term of 10 years, which can be extended for an additional 10 years at Prophecy’s option.

On April 19, 2018, the Gibellini MLA was amended to grant Prophecy the option, at any time during the term of the agreement, to require the Gibellini Lessor to transfer their title over all of the leased mining claims (excluding four claims which will be retained by the Gibellini Lessor and which contain minimal resource) to Prophecy in exchange for USD1,000,000, to be paid as an advance royalty payment.

On July 10, 2017, the Company acquired (through lease) from the holders (the “Former Louie Hill Lessors”) 10 unpatented lode claims totaling approximately 207 gross acres that comprised the Louie Hill group of claims located approximately 500 metres south of the Gibellini group of claims. These claims were subsequently abandoned by the Former Louie Hill Lessors, and on March 11 and 12, 2018, the Company staked the area within and under 17 new claims totaling approximately 340 gross acres which now collectively comprise the expanded Louie Hill group of claims.

On October 22, 2018, the Company entered into a royalty agreement (the “Royalty Agreement”) with the Former Louie Hill Lessors to replace on substantially similar terms, the former Louie Hill Mineral Lease Agreement dated July 10, 2017, wherein Prophecy will pay an advance royalty and a net smelter royalty on vanadium pentoxide produced from the area of the 10 unpatented lode claims originally acquired through lease from the Former Louie Hill Lessors that is now contained within 17 lode claims since staked by the Company’s subsidiaries. The annual advance royalty payments will be tied, based on an agreed formula (the total amount not to exceed USD$28,000 per year), to the average vanadium pentoxide price for the prior year.

Upon commencement of production, Prophecy will pay to the Former Louie Hill Lessors, a 2.5% NSR of which, 1.5% of the NSR may be purchased at any time by Prophecy for USD$1 million, leaving the total NSR to be reduced to 1% over the remaining life of the mine (and referred to thereafter, as “Production Royalty Payments”). All advance royalty payments made, will be deducted as credits against future Production Royalty Payments. The Royalty Agreement shall be for an indefinite period and shall be valid and in full force and effect for as long as the Company, its subsidiaries, or any of their permitted successors or assigns holds a valid and enforceable mining concession over the area.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

On December 5, 2017, the Company announced that it had significantly expanded the land position at the Gibellini Project, by staking a total of 198 new claims immediately adjacent to the Gibellini Project covering 4091 acres that are sufficient to enable future vanadium mining, processing and extraction. These claims are in the adjudication process as of the date of this MD&A.

On February 15, 2018, the Company indirectly acquired an additional 105 unpatented lode mining claims located adjacent to its existing Gibellini Project in Nevada, USA through the indirect acquisition of VC Exploration (US) Inc, by paying a total of $335,661 in cash and issuing the equivalent of 500,000 Share purchase warrants to arm’s-length, private parties.

The Company entered into a technical advisory and cooperation agreement with the NWME to advance the Gibellini Project. The scope of work for NWME includes technical design and engineering of vanadium ore processing facilities to recover vanadium pentoxide at Gibellini with the goal of producing a commercial high grade vanadium pentoxide product on site.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

As part of the agreement, NWME reviewed the historic Gibellini feasibility study commissioned by the project’s previous operator, including metallurgical studies, prepared by SGS and McClelland Laboratories.

The NWME technical team recently concluded a visit to the Gibellini site and collected representative oxide and transition zone samples. The samples will be used in metallurgical work to enhance heap leaching of the black-shale vanadium ore and process recovery of vanadium from the pregnant leach solution.

On March 28, 2018, the Company announced that following a meeting between the staff of the Battle Mountain District-Mt. Lewis field office of the BLM and the Company on March 23, 2018, the Gibellini Project will be one of the first projects to undergo NEPA review under Secretary of the Interior Order No. 3355 with the following subject: Streamlining National Environmental Policy Reviews and Implementation of Executive Order 13807 (the “Order”).

The Order states as one of its intentions to “immediately implement certain improvements to [NEPA] reviews conducted by the Department of the Interior Department. Among these improvements which would be of potential benefit to the Company, is the requirement to a complete review of environmental impact statements in less time, and shorter documentation requirements than before.

At the end of the meeting, the BLM and Prophecy tentatively agreed to the following:

1.

Prophecy is to revise and submit the baseline studies and plan of operation for the Gibellini Project in May 2018 based largely on submissions from the project’s previous operator;

2.

the BLM and Prophecy will then identify data and studies requiring updates, which Prophecy will engage contractors to perform;

3.

in parallel, Prophecy will begin preparing an environmental report relating to the Gibellini Project; and

4.

upon acceptance of the baseline studies, plan of operation, and environmental report by the BLM, Prophecy expects to trigger a Notice of Intent by the BLM to prepare an EIS for the Gibellini Project, currently expected to be completed in 2019.

Gibellini Deposit

On May 29, 2018, the Company received an independent technical report providing an updated the resource on the Gibellini project. The report is titled “Gibellini Vanadium Project Eureka County, Nevada, NI 43-101 Technical Report on Preliminary Economic Assessment” prepared by Mr. Kirk Hanson, P.E., Technical Director, Open Pit Mining; Mr. Edward J.C. Orbock III, RM SME, Principal Geologist and US Manager of Consulting; Mr. Edwin Peralta, P.E., Senior Mining Engineer; and Mr. Lynton Gormely, P.Eng., Consultant Metallurgist of Amec Foster Wheeler E&C Services Inc. The report has an effective date of May 29, 2018.

The PEA replaces the technical report entitled “Gibellini Vanadium Project, Nevada, USA, NI 43-101 Technical Report”, effective November 10, 2017 and filed November 20, 2017. The PEA is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The PEA disclosed an estimated 7.94 million tons at a weighted average grade of 0.314% vanadium pentoxide (“V2O5”) in the Measured category and 15.02 million tons at a weighted average grade of 0.271% V2O5 in the Indicated category leading to a total combined Measured and Indicated Mineral Resource of 22.95 million tons at a weighted average grade of 0.286% V2O5. Total contained metal content of the Measured and Indicated Mineral Resources is 131.34 million pounds V2O5. The Inferred Mineral Resource estimate is 14.97 million tons at a weighted average grade of 0.175% V2O5. The total contained metal content of the Inferred Mineral Resource estimate is 52.30 million pounds V2O5. The table below contains a summary of the Gibellini deposit resource estimate:

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 1: Mineral Resource Statement, Gibellini

| Confidence Category | Domain | Cut-offV2O5 (%) | Tons(Mt) | GradeV2O5(%) | ContainedV2O5 (Mlb) |

| Measured | Oxide | 0.101 | 3.96 | 0.251 | 19.87 |

| Transition | 0.086 | 3.98 | 0.377 | 29.98 |

| Indicated | Oxide | 0.101 | 7.83 | 0.222 | 34.76 |

| Transition | 0.086 | 7.19 | 0.325 | 46.73 |

| Total Measured and Indicated | | | 22.95 | 0.286 | 131.34 |

| Inferred | Oxide | 0.101 | 0.16 | 0.170 | 0.55 |

| Transition | 0.086 | 0.01 | 0.180 | 0.03 |

| Reduced | 0.116 | 14.80 | 0.175 | 51.72 |

| Total Inferred | | | 14.97 | 0.175 | 52.30 |

Notes to accompany Mineral Resource table for Gibellini:

1.

The Qualified Person for the estimate is Mr. E.J.C. Orbock III, RM SME, a Wood Group of companies employee. The Mineral Resources have an effective date of May 29, 2018.

2.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3.

Mineral Resources are reported at various cut-off grades for oxide, transition, and reduced material.

4.

Mineral Resources are reported within a conceptual pit shell that uses the following assumptions: Mineral Resource V2O5 price: $14.64/lb; mining cost: $2.21/ton mined; process cost: $13.62/ton; general and administrative (“G&A”) cost: $0.99/ton processed; metallurgical recovery assumptions of 60% for oxide material, 70% for transition material and 52% for reduced material; tonnage factors of 16.86 ft3/ton for oxide material, 16.35 ft3/ton for transition material and 14.18 ft3/ton for reduced material; royalty: 2.5% net smelter return (NSR); shipping and conversion costs: $0.37/lb. An overall 40º pit slope angle assumption was used.

5.

Rounding as required by reporting guidelines may result in apparent summation differences between tons, grade and contained metal content. Tonnage and grade measurements are in US units. Grades are reported in percentages.

Louie Hill Deposit

The Louie Hill deposit lies approximately 1,600 ft south of the Gibellini deposit.

The Gibellini Technical Report provides an Inferred Mineral Resource of 7.52 million tons at a weighted average grade of 0.276% vanadium pentoxide (V2O5). The oxidation domains were not modeled. The total contained metal content of the estimate is 41.49 million pounds V2O5. The table below summarizes the Louie Hill deposit resource estimate:

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 2: Mineral Resources Statement, Louie Hill

| Confidence Category | | | | |

| Inferred | 0.101 | 7.52 | 0.276 | 41.49 |

Notes to accompany Mineral Resource table for Louie Hill:

1.

The Qualified Person for the estimate is Mr. E.J.C. Orbock III, RM SME, a Wood Group of companies employee. The Mineral Resources have an effective date of May 29, 2018. The resource model was prepared by Mr. Mark Hertel, RM SME.

2.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3.

Oxidation state was not modeled.

4.

Mineral Resources are reported within a conceptual pit shell that uses the following assumptions: Mineral Resource V2O5 price: $14.64/lb; mining cost: $2.21/ton mined; process cost: $13.62/ton; general and administrative (G&A) cost: $0.99/ton processed; metallurgical recovery assumptions of 60% for mineralized material; tonnage factors of 16.86 ft3/ton for mineralized material, royalty: 2.5% net smelter return (NSR); shipping and conversion costs: $0.37/lb. For the purposes of the resource estimate, an overall 40º slope angle assumption was used.

5.

Rounding as required by reporting guidelines may result in apparent summation differences between tons, grade and contained metal content. Tonnage and grade measurements are in US units. Grades are reported in percentages.

A total of 280 drill holes (about 51,265 ft) have been completed on the Gibellini Project since 1946, comprising 16 core holes (4,046 ft), 169 rotary drill holes (25,077 ft; note not all drill holes have footages recorded) and 95 reverse circulation holes (22,142 ft).

The vanadium-host black shale unit ranges from 175 to over 300 ft thick and overlies gray mudstone. The shale has been oxidized to various hues of yellow and orange to a depth of 100 ft. Alteration (oxidation) of the rocks is classified as one of three oxide codes: oxidized, transitional, and reduced.

No work has been conducted on the Gibellini Project since 2011. We have completed no exploration or drilling activities since the Gibellini Project acquisition.

The power supply for the Gibellini Project site is assumed to be at 24.9 kV and supplied from a planned substation to be located near Fish Creek Ranch. This substation would tap and step-down the 69kV supply carried by the line to the Pan Mine to 24.9kV and place it on a line to the Gibellini Project. Negotiations with the power utility, Mt. Wheeler Power, would need to be undertaken to secure any future power supply contract and transmission line to the site.

On April 18, 2018, the Company announced that it signed an agreement with Monitor Ventures Inc. (“Monitor”) for the right to access and use information related to the Gibellini Project which was commissioned, compiled and held by Monitor. In consideration, Prophecy paid $7,000 in cash, issued to Monitor the equivalent of 500,000 warrants entitling Monitor to purchase one Share at an exercise price the equivalent of $0.30 for a period of three years, and will, upon approval of the EIS by BLM, pay Monitor, $50,000 in cash.

On April 30, 2018, the Company announced that it is initiating preparations for its exploration and verification drilling program on the Gibellini vanadium project in Q2 2018. A total of 4,880m of reverse circulation drilling in 64 holes are planned in the following target areas:

Gibellini: 33 holes total 2,740 meters

Thirty-three (33) infill drill holes have been planned to increase the confidence level of a potential near-surface higher-grade starter pit (“HSP”) with the following historic drilling highlights:

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 3: Historic drill results on the Gibellini Resource

| Hole ID | From (m) | To (m) | Meters | % V2O5 |

| T-38 | 3.05 | 45.72 | 42.7 | 0.755 |

| including… | 28.96 | 44.20 | 15.2 | 1.399 |

| NG-47 | 1.52 | 57.91 | 56.4 | 0.533 |

| including… | 28.96 | 39.62 | 10.7 | 1.005 |

| NG-6 | 6.10 | 70.10 | 64.0 | 0.455 |

| T-33 | 1.52 | 57.91 | 56.4 | 0.462 |

| including… | 33.53 | 41.15 | 7.6 | 1.102 |

| T-27 | 1.52 | 60.96 | 59.4 | 0.419 |

| NG-12 | 22.86 | 60.96 | 38.1 | 0.652 |

| including… | 24.38 | 45.72 | 21.3 | 0.857 |

| IG-2 | 4.57 | 53.34 | 48.8 | 0.501 |

| NG-4 | 3.05 | 56.39 | 53.3 | 0.413 |

Because the drill holes are vertical and the oxidation zones are nearly horizontal the meterage reported is considered true thickness.

Louie Hill: 28 holes total 1,765 meters

A total of 28 holes are planned for infill and expansion which are aimed to increase total resource tonnage, upgrade resource confidence level, and to delineate whether higher grade mineralized intercepts comprise continuous zones, based on the following past drill highlights:

Table 4: Historic drill results from the Louie Hill resource

| Hole ID | From (m) | To (m) | Meters | % V2O5 |

| UC58-1 | 1.52 | 24.38 | 22.86 | 0.457 |

| UC58-11 | 16.76 | 30.48 | 13.72 | 0.489 |

| UC58-13 | 13.72 | 25.91 | 12.19 | 0.428 |

| UC58-3 | 0.00 | 27.43 | 27.43 | 0.406 |

| including… | 18.29 | 22.86 | 4.57 | 0.877 |

| UC58-46 | 0.00 | 9.14 | 9.14 | 0.620 |

| UC58-6 | 0.00 | 12.19 | 12.19 | 0.733 |

| including… | 0.00 | 7.62 | 7.62 | 0.936 |

Because the drill holes are vertical and the oxidation zones are nearly horizontal the meterage reported is considered true thickness.

Middle Earth, Big Sky and Northeast Regional prospects: 3 holes total 375 meters.

Regional prospects are all within a three-kilometer trend of the Gibellini resource and occur within Prophecy’s controlled claims. Combined, the three prospects cover 2.5 square kilometers which is over twice the size of Gibellini’s foot print.

These prospects contain exposures of the same host rocks found at Gibellini and Louie Hill, known as the Woodruff Formation, which is comprised predominantly of various mudstones and lesser chert.

Over 390 assay results from trenches in the Big Sky and Northeast Trench prospects and core samples from the historic drilling at Middle Earth prospect all demonstrated appreciable vanadium grades. Below are highlights from past trenching and drilling:

Table 5: Historic results from exploration prospects on Gibellini property

| Prospect | Hole ID/Trench | From (m) | To (m) | Meters | % V2O5 |

| MiddleEarth | UC58-18 | 0 | 4.572 | 4.6 | 0.567 |

| MiddleEarth | UC58-19 | 0 | 18.288 | 18.3 | 0.337 |

| Northeast | TRENCH Nt3 | 3.0 | 60.0 | 57.0 | 0.270 |

Because the drill holes are vertical and the oxidation zones are nearly horizontal the meterage reported is considered true thickness.

A total of three holes making for total drilling of 375 meters are designed to drill test the three regional prospects.

On May 9, 2018, the Company submitted its Management’s plan of operations (the “MPO”) to the BLM and the Reclamation Permit Application to the Nevada Division of Environmental Protection, Bureau of Mining Regulation and Reclamation (the “BMRR”).

The MPO was prepared by SRK Consulting (U.S.) Inc. with over 1,100 pages of detailed development plans for the open pit mining operations and processing facilities to extract and recover vanadium from the Gibellini Project with stated average mine production during the seven-year mine life of 15.7 million tons of ore material containing 120.5 million pounds of vanadium. The primary facilities include the: pit, waste rock disposal facility, mine office, auxiliary facilities such as water and power, crushing facilities and stockpile, heap leach pad, process facility, water ponds, borrow areas, and mine and access roads.

A map of the proposed facilities is available at www.prophecydev.com.

In addition, the MPO includes the following designs along with associated environmental baseline studies:

1. Quality Assurance Plan

2. Storm Water Management Plan

3. Adaptive Waste Rock Management Plan

4. Monitoring Plan

5. Noxious Weed Management Plan

6. Spill Contingency Plan

7. Feasibility Study Level Pit Slope Design

8. Heap Leach and Waste Rock Dump Facility Stability Report

9. Geochemical Characterization Report

10. Water Management Plan

11. Closure and Reclamation Plan

12. Transportation Plan

13. Standardized Reclamation Cost Estimate

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

The baseline studies supplementing the MPO were completed by the previous operator between 2010 and 2012, and included studies of biological resources, cultural resources, surface water resources, ground water resources, and waste rock geochemical characterization.

In August 2018, the Company engaged NewFields, an environmental, engineering, and construction management consulting firm to advance EIS preparation for the Gibellini Project.

Prophecy’s and NewFields’ teams will work closely with the BLM and other federal and state permitting agencies to target the filing of all major permitting applications by the end of 2019. The Company anticipates that the Gibellini EIS will not be more than 150 pages (excluding appendices) and the EIS notice of intent (the “NOI”) will be triggered in 2019. Should that occur, the EIS decision for the project may be rendered in 2020, according to new government direction on such matters.

Under the engagement, NewFields will provide comprehensive environmental permitting and related engineering services that include:

●

developing with Prophecy, overall permitting roadmap and budget;

●

performing necessary updates to already-filed baseline studies and MPO;

●

preparation of Water Pollution Control Permit application (the “WPCP”) including detailed design and engineering analysis;

●

preparation of resource report, which is a precursor to trigger the NOI to prepare the Gibellini EIS; and

●

preparation of various federal and state permit applications such as the application for Air Quality Permit, Surface Disturbance/Class II Operation Permit, Explosives Permit, Class III Waiver Landfill Permit, Multi‐Sector General Stormwater Permit, Hazardous Materials Storage Permit, Hazardous Waste Permit, Septic System Permit, Potable Water System Permit, Dam Safety Permit, and Industrial Artificial Pond Permit.

NewFields completed the Gibellini heap leach pad and waste dump designs (over 40 pages) as part of an overall basic engineering design lead by Scotia International of Nevada, Inc. in 2014. NewFields’ familiarity with the project should help to expedite permitting efforts at Gibellini.

As a result of direction from Secretary of the Interior Order No. 3355 (Streamlining National Environmental Policy Reviews and Implementation of Executive Order 13807) Prophecy anticipates the Gibellini EIS will not be more than 150 pages (excluding appendices) and the BLM to complete the Gibellini final EIS within one year from the issuance of the NOI. Should that occur, it means that permitting for the Gibellini Project may potentially be concluded in 2020.

PEA

On May 29, 2018, the Company received results of a PEA for the Gibellini Project. The PEA reported an after tax cumulative cash flow of $601.5 million, an internal rate of return of 50.8%, a net present value of $338.3 million at a 7% discount rate and a 1.72 years payback on investment from start-up assuming an average vanadium pentoxide price of $12.73 per pound. As of May 29, 2018, the price of vanadium pentoxide is $14.20 per pound according to www.asianmetal.com. The PEA was prepared by Amec Foster Wheeler E&C Services Inc. and is based on the NI 43-101 compliant resource calculations reported above.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 6: Highlights of the PEA (after tax)

All dollar values are expressed in US dollars unless otherwise noted

| Internal rate of return | 50.8% |

Net present value (“NPV”) | $338.3 million at 7% discount rate |

| Payback period | 1.72 years |

| Average annual production | 9.65 million lbs V2O5 |

Average V2O5 selling price | $12.73 per lb |

| Operating cash cost | $4.77 per lb V2O5 |

All-in sustaining costs* | $6.28 per lb V2O5 |

Breakeven price** | $7.76 per lb V2O5 |

| Initial capital cost including 25% contingency | $116.76 million |

| Average grade | 0.26% V2O5 |

| Strip ratio | 0.17 waste to leach material |

| Mining operating rate | 3.4 million tons (leach material and waste) per year |

Average V2O5 recovery through Direct Heap Leaching | 62% |

| Life of mine | 13.5 years |

*includes selling costs, royalties, operating cash cost, reclamation, exploration and sustaining capital costs.

**includes selling costs, royalties, operating cash costs, taxes (local, state, and federal), working capital, and sustaining and capital costs.

The PEA is preliminary in nature, and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Sensitivity Analysis

The tables below show the sensitivity analysis to the vanadium pentoxide price, grade, and to the PEA capital cost and operating costs. This sensitivity analysis indicates strong project economics even in very challenging conditions, and that the project is well positioned to benefit from the current rising vanadium price environment. A 20% increase in the vanadium price relative to the base case translates to a USD$491.3 million after-tax NPV at a 7% discount rate.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 7: Sensitivity Analysis

All dollar values are expressed in US dollars unless otherwise noted

V2O5 price change | V2O5 price USD$/lb | After-taxIRR | After-tax NPVUSD$M @ 7% | After-taxcashflowUSD$M |

| 30% | 16.55 | 69% | 568.0 | 996.0 |

| 20% | 15.28 | 63% | 491.3 | 864.4 |

| 10% | 14.00 | 57% | 415.2 | 733.2 |

| Base price | 12.73 | 51% | 338.3 | 600.4 |

| -10% | 11.46 | 44% | 261.0 | 467.2 |

| -20% | 10.18 | 36% | 183.1 | 333.2 |

| -30% | 8.91 | 26% | 103.9 | 196.9 |

V2O5 gradechange | V2O5grade | After-taxIRR | After-tax NPVUSD$M @ 7% | After-taxcashflowUSD$M |

| 30% | 0.34% | 68% | 554.4 | 972.8 |

| 20% | 0.31% | 63% | 482.4 | 849.0 |

| 10% | 0.28% | 57% | 410.7 | 725.4 |

| Base grade | 0.26% | 51% | 338.3 | 600.4 |

| -10% | 0.23% | 44% | 265.6 | 475.0 |

| -20% | 0.21% | 37% | 192.2 | 348.9 |

| -30% | 0.18% | 28% | 118.3 | 221.6 |

| Capexchange | CapexUSD$M | After-taxIRR | After-tax NPVUSD$M @ 7% | After-taxcashflowUSD$M |

| 30% | 151.8 | 40% | 307.2 | 564.3 |

| 20% | 140.1 | 43% | 317.6 | 576.3 |

| 10% | 128.4 | 47% | 328.0 | 588.4 |

| Base Capex | 116.8 | 51% | 338.3 | 600.4 |

| -10% | 105.1 | 55% | 348.6 | 612.5 |

| -20% | 93.4 | 61% | 358.9 | 624.6 |

| -30% | 81.7 | 67% | 369.3 | 636.8 |

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

| Opexchange | OpexUSD$M | After-taxIRR | After-tax NPVUSD$M @ 7% | After-taxcashflowUSD$M |

| 30% | 6.20 | 45% | 257.9 | 450.2 |

| 20% | 5.72 | 47% | 284.8 | 500.3 |

| 10% | 5.25 | 49% | 311.6 | 550.4 |

| Base Capex | 4.77 | 51% | 338.3 | 600.4 |

| -10% | 4.29 | 53% | 364.8 | 650.0 |

| -20% | 3.82 | 55% | 390.7 | 698.4 |

| -30% | 3.34 | 56% | 416.0 | 745.4 |

Mining & Processing

Mining at the Gibellini and Louie Hill projects is planned to be a conventional open pit mine utilizing a truck and shovel fleet comprised of 100-ton trucks and front end loaders. Average mine production during the 13.5 year mine life is 3.4 million tons of leach material (3 million tons) and waste (0.4 million tonnes) per year at a strip ratio of 0.17. Mining is to be completed through contract, with Prophecy’s mining staff overseeing the contracted mining operation and performing the mine engineering and survey work.

Table 8

| | | | | | Metal containedV2O5 (Mlb) | |

| YR 1 | 2,600 | 400 | — | 0.291 | 17.440 | 10.633 |

| YR 2 | 2,400 | 600 | — | 0.278 | 16.690 | 10.480 |

| YR 3 | 1,760 | 1,240 | — | 0.310 | 18.580 | 12.067 |

| YR 4 | 650 | 2,350 | — | 0.372 | 22.320 | 15.217 |

| YR 5 | 310 | 2,680 | 10 | 0.366 | 21.950 | 15.185 |

| YR 6 | 2,240 | 750 | 10 | 0.315 | 18.920 | 11.928 |

| YR 7 | 3,000 | — | — | 0.316 | 18.980 | 11.394 |

| YR 8 | 1,910 | 700 | 380 | 0.189 | 11.310 | 7.085 |

| YR 9 | 690 | 1,220 | 1,090 | 0.216 | 12.940 | 8.023 |

| YR 10 | 110 | 370 | 2,520 | 0.208 | 12.480 | 6.898 |

| YR 11 | 450 | 360 | 2,180 | 0.182 | 10.910 | 6.103 |

| YR 12 | 50 | 140 | 2,820 | 0.166 | 9.980 | 5.349 |

| YR 13 | 390 | 10 | 2,600 | 0.183 | 10.970 | 5.839 |

| YR 14 | 1,710 | — | — | 0.195 | 6.670 | 4.096 |

| Totals: | 18,290 | 10,830 | 11,590 | 0.258 | 210.15 | 130.297 |

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

The processing method envisioned for the Gibellini Project will be to feed leach material from the mine via loader to a hopper that feeds the crushing plant. The leach material will then be fed to the agglomerator where sulfuric acid, flocculent and water will be added to achieve adequate agglomeration. The agglomerated leach material will be transported to a stacker on the leach pad, which will stack the material to a height of 15 feet. Once the material is stacked, solution will be added to the leach heap at a rate of 0.0025 gallons per minute per square foot. The solution will be collected in a pond and this pregnant leach solution will be sent to the process building for metal recovery where it will go through solvent extraction and stripping processes to produce the vanadium pentoxide.

Vanadium Recoveries and Metallurgical Testing

Approximately 130.3 million pounds of V2O5 is expected to be produced from Gibellini and Louie Hill leaching operations at an average recovery of 62% (oxide: 60%, transition: 70% and reduced: 52%). The heap leaching is performed at ambient temperature and atmospheric pressure without pre-roasting or other beneficiation process. The pregnant leach solution is continuously collected with leach material undergoing, on average, a 150-day heap-leaching cycle. Table 9 below summarizes the projected metallurgical recoveries used in the PEA for the three defined oxidation-type domains.

Table 9

| Mill Feed Material Type | Direct Leaching Recovery |

| Oxide | 60% |

| Transition | 70% |

| Reduced | 52% |

The direct heap leach vanadium recovery estimates used in the PEA were based on extensive metallurgical testing work performed by SGS Lakefield Research Laboratories, Dawson Minerals Laboratories, and McClelland Laboratories. Samples were selected from a range of depths within the deposit, representative of the various types and styles of mineralization. Samples were obtained to ensure that tests were performed on sufficient sample mass. The end results demonstrated low acid consumption (less than 100 lb acid consumption per ton leached) and high recovery through direct leaching. Notable test results included the following:

Acid Heap Leach Testing of a Gibellini Bulk Sample, McClelland Laboratories, September 4, 2013

A series of trenches were excavated and approximately 18 tons of material were sent to McClelland Laboratories for pilot testing. The material was air dried and stage crushed to 2” where a column sample was cut for 12” columns and then the leach material was crushed to – ½”. A head sample was taken and material for bench marking columns, and a bottle roll test was also taken. The results of the pilot plant testing are shown in Table 10:

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 10

| Crush Size 100%Passing | Test Type | Time (Days) | Head Grade%V* | % VanadiumRecovery | AcidConsumptionlbs/st |

| 50 mm (2”) | Column, open circuit | 123 | 0.299 | 76.6% | 88 |

| 12.5 mm (1/2”) | Column, open circuit | 123 | 0.313 | 80.2% | 72 |

| 12.5 mm (1/2”) | Column, closed circuit | 199 | 0.284 | 68.3% | 84 |

| 12.5 mm (1/2”) | Column, closed circuit | Column, closed circuit | 0.313 | 74.0% | 96 |

| 12.5 mm (1/2”) | Bottle Roll | 4 | 0.286 | 67.1% | 74 |

| 1.7 mm (-10m) | Bottle Roll | 4 | 0.286 | 66.3% | 66 |

| -75µ | Bottle Roll | 4 | 0.279 | 67.6% | 62 |

| -75µ | Bottle Roll | 30 | 0.298 | 74.2% | 54 |

*to convert V to V2O5, multiply V by 1.7852.

Solvent Extraction (SX) Test Work

The design parameters from this test work are:

● SX Extraction pH Range 1.8 to 2.0

● Di-2-Ethyl Hexyl Phosphoric Acid Concentration 0.45 M (~17.3% by weight) Cytec

● 923 Concentration 0.13 M (~5.4% by weight)

● The Organic Diluent is Orform SX-12 (high purity kerosene)

● SO2 addition of 1.0 to 1.5 g/l

● Strip Solution Sulfuric Acid Concentration 225 to 250 g/l SX

● Extraction Efficiency ~97%

● SX Strip Efficiency ~98%

Pilot Scale Solvent Extraction Testing on Vanadium Bearing Solutions from Two Gibellini Project Column Leach Tests, McClelland Laboratories, September 16, 2013

Solvent extraction (“SX”) processing was conducted to recover vanadium from sulfuric acid pregnant leach solution (“PLS”) generated during pilot column testing on bulk leach samples from the Gibellini project. Laboratory scale testing was conducted on select solutions generated during the pilot SX processing, to optimize the SX processing conditions. Additional laboratory scale testing was conducted on the loaded strip solution generated during the pilot SX testing, to evaluate methods for upgrading and purifying it to levels that may be required for sale of a final vanadium bearing product.

The final pregnant strip solution was 6.1% vanadium, 250 g/l sulfuric acid with approximately 2% Fe and Al. The solution was suitable for oxidation using sodium chlorate to convert the V+4 to V+5 which was then precipitated using ammonia to make ammonium metavanadate (“AMV”). To make a vanadium product for the steel industry, this AMV is calcined (ammonia driven off) and heated to above 700°C (the fusion temperature of V2O5). This fused V2O5 would then be cooled on a casting wheel, pulverized and packaged. Additionally, using ion exchange resins in conjunction with solvent extraction, strip solution was produced which met or exceeded specifications of electrolyte for vanadium flow batteries.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

In August of 2018, Prophecy received metallurgical results from its technology partner, NWME from samples collected during a site visit in March of 2018. Tests were performed at it’s laboratory testing facilities located in Xi’an, China. NWME utilized a SX processing method to recover vanadium from sulfuric acid PLS generated by bottle roll and column test acid leaching on Gibellini samples. The solution was reduced and then precipitated using ammonia to make AMV. The AMV was calcined and heated then cooled and pulverized. A vanadium pentoxide with 98.56 % purity content was produced. The assay for this work is shown below:

| V2O5 % | SI % | Fe % | P % | S % | As % | Na2O % | K2O % | Al % | U % |

| 98.56 | 0.0078 | 0.88 | 0.058 | 0.47 | 0.0026 | 0.43 | 0.052 | 0.22 | 0.0001 |

Uranium content is less than 0.0001% which does not affect the marketability of the product.

The PLS was produced with very low deleterious elements which enabled using an efficient SX process. The PLS V2O5 concentration was 1.15 gram per liter and the Pregnant Strip Solution V2O5 concentration was 39.61 grams per liter.

Capital and Operating Costs

The projected capital costs for the Gibellini vanadium project over a 1 ½ year construction period and mine life average operating costs are summarized in Tables 11 and 12 below. The capital cost includes 25% contingency or USD23.4 million.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 11: Pre-Production Capital Cost

All dollar values are expressed in US dollars unless otherwise noted

| |

| Open Pit Mine |

| Open pit mine development | 1,412 |

| Gibellini incremental WRSF | 212 |

| Mobile equipment | 111 |

| Infrastructure-On Site |

| Site prep | 2,431 |

| Roads | 1,391 |

| Water supply | 2,007 |

| Sanitary system | 61 |

| Electrical – on site | 2,052 |

| Communications | 165 |

| Contact water ponds | 174 |

| Non-process facilities – buildings | 7,583 |

| Process Facilities |

| Mill feed handling | 15,380 |

| Heap leach system | 20,037 |

| Process plant | 14,441 |

| Off-Site Infrastructure |

| Water system | 4,495 |

| Electrical supply system | 3,227 |

| First fills | 860 |

| Subtotal Total Direct Cost | 76,039 |

| Construction indirect costs | 4,254 |

| Sales tax / OH&P | 4,236 |

| EPCM | 8,879 |

| Total Before Contingency | 93,409 |

| Contingency (25%) | 23,352 |

| Total Project Cost | 116,761 |

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 12: Operating Costs

All dollar values are expressed in US dollars unless otherwise noted

Total Cash Operating Cost | | USD$ per lb of V2O5 Produced |

| G&A | 0.99 | 0.31 |

| Mining Cost | 2.72 | 0.85 |

| Total Processing Cost | 11.54 | 3.61 |

| Total | 15.26 | 4.77 |

The cash operating costs in the first half of the project covering years 1-7 is USD$3.59 per lb of V2O5 produced and for the years 8-14 is USD$7.12 per lb of V2O5 produced, resulting in the weighted average cash cost of USD$4.77 per lb of V2O5 produced. The cash operating cost is lower in the first half of the project due to processing higher grade material.

During the nine months ended September 30, 2018, the Company incurred total costs of $1,801,829 (same period 2017 - $101,475) for the Gibellini Project including for $251,094 (same period 2017 - $9,734) for registrations, annual maintenance fees, and taxes, $135,531 for advance royalty payments (same period 2017 - $Nil), $930,835 (same period 2017 - $91,177) for geological and engineering services, and $484,369 (same period 2017 - $564) for personnel, legal, general and administrative expenses.

Outlook

Permitting

Further to our news release dated May 9, 2018, Prophecy achieved a major permitting milestone by submitting its MPO and associated baseline studies with the BLM. Prophecy expects to receive feedback within 60 days and amend the reports as necessary. Upon acceptance of the baseline studies, MPO, and environmental report by the BLM, Prophecy expects to trigger a NOI in 2019 by the BLM, to prepare an EIS for the Gibellini project.

In December 2017, vanadium was listed by the U.S. Geological Survey as one of 23 metals critical to the US economy despite there being no active primary vanadium mines in North America. As a result of direction from Secretary of the Interior Order No. 3355 (Streamlining National Environmental Policy Reviews and Implementation of Executive Order 13807), Prophecy anticipates the Gibellini EIS will not be more than 150 pages (excluding appendices) and the BLM to complete the Gibellini final EIS within one year from the issuance of the NOI. Should that occur, it means that permitting for the Gibellini project may potentially be concluded in 2020.

Engineering Procurement Construction Management:

Prophecy is preparing to tender EPCM contracts with detailed engineering design and cost estimates in 2018. The Company expects to complete this task in 2019, as Prophecy has already received complete basic engineering design drawings for the Gibellini vanadium project prepared by Scotia International of Nevada Inc. which includes hundreds of drawings related to: process flow, crushing, heap leach pad, pregnant leach solution pond, solvent extraction plant, piping and infrastructure (i.e. power, water, and haul road).

On August 15, 2018, the Company issued a request for proposal (the “RFP”) for EPCM from qualified bidders. The Project’s EPCM work, based on technical data from an historic independent feasibility report submitted by AMEC E&C Services, Inc. on September 12, 2011, commenced in September 2011 with about 30% completion, before the remaining work was halted in November 2014, due to low vanadium prices. The Company is now re-initiating the EPCM work in light of the PEA.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

The EPCM will consist of three phases:

●

Phase 1 includes updating and simplifying previous basic engineering designs from producing delicate vanadium battery electrolyte to producing standard vanadium pentoxide off take product. The other parts of the design such as mine design, waste dump design, road design, borrow pit design, buildings and infrastructure designs will not be substantially changed.

●

Phase 2 will be procurement of the required equipment and services, and developing the detailed engineering design required to build the project facilities.

●

Phase 3 will outline construction management services to build the facilities to accomplish the actual work.

The RFP is available at Prophecy’s website: www.prophecydev.com, and access to the Project’s technical data will be provided to interested parties.

All proposals must be returned to Prophecy by no later than the date indicated below. Proposals submitted after the deadline will not be considered.

The Company expects Phase 1 of the EPCM, updating basic engineering design, to start in October 2018 and to be completed by early 2020; Phase 2, equipment procurement and detailed engineering design, to be completed in early 2021; Phase 3, facilities construction, to start in mid 2021 and be completed in early 2022 with the Gibellini Project wet commissioning to be in the middle of 2022.

To try to minimize technical and implementation risk, the Company is working closely with its chosen technology partner, NWME, to fine tune metallurgy, process design and engineering, and ensure maximum vanadium recovery and high-grade vanadium pentoxide commercial product on site. NWME owns and is currently operating the world’s largest black-shale vanadium mine in China with an environmentally friendly, hydrometallurgical leach processing technology without the need of a pre-roasting step. Refer to news release dated March 12, 2018 for more details.

NWME conducted a Gibellini site visit in March 2018 and analyzed Gibellini samples in its laboratories. The results of this work are discussed in the following section.

Test Results

Samples collected by NWME’s technical team during their visit to the Project’s site in February 2018 were analyzed at NWME’s facility in Xi’an, China. Approximately 250 kg of material was submitted for analysis. The results are described herein.

98.6% V2O5 Produced on the 1st Run with Simple Conventional Flowsheet

NWME used SX processing method to recover vanadium from sulfuric acid PLS generated by bottle roll and column test acid leaching on Gibellini samples. The solution was reduced and then precipitated using ammonia to make AMV. The AMV was calcined and heated then cooled and pulverized. A vanadium pentoxide with 98.56 % purity content was produced. The assay for this work is shown in Table 13 below:

Table 13: Gibellini Vanadium Pentoxide Assay

| V2O % | SI % | Fe % | P % | S % | As % | Na2O % | K2O % | Al % | U % |

| 98.56 | 0.0078 | 0.88 | 0.058 | 0.47 | 0.0026 | 0.43 | 0.052 | 0.22 | 0.0001 |

Uranium content is less than 0.0001% which does not affect the marketability of the product.

The PLS was produced with very low deleterious elements which enabled using an efficient SX process. The PLS V2O5 concentration was 1.15 gram per liter and the Pregnant Strip Solution V2O5 concentration was 39.61 grams per liter.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Overall Vanadium Recovery of Over 60% and Low Acid Consumption

PLS was produced from both bottle roll and column tests. Sulfuric acid was added to the feed material with the bottle rolling for 1 hour, then the open bottle was allowed to cure for 24 hours and water was added to the bottle to attain the desired density (40%). Initial samples were taken at 6 hours, 12 hours, 24 hours, 36 hours, 48 hours and then once a day until the bottle roll was completed.

In column tests, sulfuric acid was added to the feed material and the material was allowed to cure for 24 hours before initiating the leaching. Leaching was conducted by applying 108 grams per liter acid solution over the material. PLS was collected every 24 hours and samples were taken for vanadium analysis. All the tests were performed at room temperature and at atmospheric pressure.

The results of the tests are given in Table 14:

Table 14

| Test | Leach Time | | Sulfuric Acid Consumed kg/t |

| Column Test | 21 days | 70.74 | 100 |

| Bottle Roll Test - investigate the effect of the curing method and increase of sulfuric acid addition on the vanadium recovery | 50 hours | 62.8 | 150 |

| Bottle Roll Test - investigate addition of NWME prepared leaching agent on the vanadium recovery | 144 hours | 66.5 | 100 |

| Bottle Roll Test - investigate the leaching of coarse feed (2mm) on the vanadium recovery | 216 hours | 63.7 | 100 |

The results of the bottle roll and column leach tests performed by NWME largely validate the results of previous tests performed by McClelland Laboratories on Gibellini bulk sample in 2013 (18 tons of material).

The NWME test samples were not agglomerated and were on short leach time of 21 days for column tests and 5 days for bottle roll tests. Prophecy studied both the NWME test and McClleland test in detail and believe the results were consistent, whereby 70% recovery can be achieved with longer leach cycle (over 100 days McClelland Laboratories vs 21 days NWME) and less acid consumption (50 kg of acid per tonne of material McClelland Laboratories vs 100 kg of acid per tonne of material NWME).

A summary of acid heap leach tests of a Gibellini bulk sample, completed at McClelland Laboratories, September 4, 2013 is tabulated in Table 15 below:

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Table 15

| Test Type | | | | Sulfuric Acid Consumed kg/t |

|

| 50 mm (2”) | Column, open circuit | 123 | 76.6 | 0.53 | 39.9 |

| 12.5 mm (1/2”) | Column, open circuit | 123 | 80.2 | 0.56 | 32.7 |

| 12.5 mm (1/2”) | Column, closed circuit | 230 | 68.3 | 0.51 | 38.1 |

| 12.5 mm (1/2”) | Column, closed circuit | 198 | 74.0 | 0.56 | 43.5 |

| 12.5 mm (1/2”) | Bottle Roll | 4 | 67.1 | 0.51 | 33.6 |

| 1.7 mm (-10m) | Bottle Roll | 4 | 66.3 | 0.51 | 29.9 |

| -75µ | Bottle Roll | 4 | 67.6 | 0.50 | 28.1 |

| -75µ | Bottle Roll | 30 | 74.2 | 0.53 | 24.5 |

Representative Feed Grade with Benign Test Conditions that Can be Replicated in Commercial Setting

The leaching bottle roll and column tests were performed at room temperature and at atmospheric pressure based on Gibellini’s representative grade from grab sampling method across the width of the mineralization at various locations of the Project. These samples are characterized in Table 16:

Table 16

| Sample Number | Sample ID | Weight kg | Head Grade V2O5 (%) |

| 1 | 18-L6-28 | 17.0 | 0.665 |

| 2 | 18-L6-29 | 17.0 | 0.885 |

| 3 | 18-L6-30 | 12.5 | 0.370 |

| 4 | 18-L6-31 | 18.0 | 0.210 |

| 5 | 18-L6-32 | 13.5 | 0.420 |

| 6 | 18-L6-33 | 22.5 | 0.280 |

| 7 | 18-L6-34 | 19.0 | 0.315 |

| 8 | 18-L6-35 | 20.0 | 0.185 |

| 9 | 18-L6-36 | 18.0 | 0.165 |

| 10 | 18-L6-37 | 20.0 | 0.195 |

| Total | | 177.5 | |

For the purpose of metallurgical testing, the samples were mixed to produce a composite material with the average grade of 0.30% V2O5 which is representative of Gibellini resource grade. The composite material was ground to -75 lm feed. Prophecy believes the test conditions can easily be replicated in a commercial heap leach setting with low technical and implementation risk.

PROPHECY DEVELOPMENT CORP.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

For the nine months ended September 30, 2018

(Expressed in Canadian Dollars, except where indicated)

Unique Vanadium Mineralogy in Achieving Remarkable Recovery at Room Temperature and Atmospheric Pressure

NWME performed detailed mineralogical analysis which included microscope identification using a Carl Zeiss Axioskop, XRD analysis on Bruker D8-A25 XRD, multi-element analysis, electron probe X-ray microanalysis on JEOL JXA 8230, scanning electron microscopy/energy dispersive X-ray spectroscopy analysis on Mineral Liberation Analizer 650 and V element phase analysis. This mineralogical analysis confirmed that the Gibellini resource has a high percentage of independent vanadium minerals (“IVM”) such as kazakhstanite, shubnelite, sherwoodite, bokite, which can be leached easily at room temperature and atmospheric pressure within a short time frame.

NWME noted the unique nature of the Gibellini samples with over 45% IVM versus numerous other typical black shale deposits which they have encountered containing less than 10% IVM.

All of the testwork carried out on the material from the Gibellini Project indicate that there is a two-stage leaching phenomenon in Gibellini ore - about 50% of the vanadium leaches in the first 96 hours (independent vanadium minerals), and the remaining leaching approximately 15 to 20% occurs over a longer time horizon.