Ultimus Managers Trust

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

August 10, 2016

FILED VIA EDGAR

Division of Investment Management

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

| Re: | Response to Staff’s Comments on Form N-1A for Ultimus Managers Trust (the “Trust”), on behalf of its series, Ladder Select Bond Fund (the “Fund”) (File Nos. 811-22680; 333-180308) |

Dear Lauren Sprague and Marianne Dobelbower:

Set forth below is a summary of the additional comments provided by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), which you provided orally on July 29, 2016. These additional comments relate to the Trust’s Post-Effective Amendment Nos. 70 and 73, filed on May 16, 2016 (Accession No. 0001398344-16-013443). Following each additional comment is the Trust’s response.

RESPONSE LETTER

Executive Summary Response

The Fund believes that the CMBS market represents a large and liquid securities market, comprising $934 billion in total securities according to Trepp, LLC (“Trepp”). Approximately 78% of CMBS bonds are publicly registered securities with individual CUSIPs, and CMBS securities are included in the Barclays US and Global Aggregate Bond indices, the Barclays US and Multiverse Securitized Bond indices, and two CMBS-specific indices, Barclays US CMBS and Barclays US CMBS2. CMBS securities benefit from highly standardized terms set at issuance such as tranche ratings, size, maturities, coupons, and payment dates. CMBS market makers include most of the largest and best capitalized banks active in the United States. As shown below in Responses 2-F and 2-G, given the size and scope of trading activity and diversity of market participants in the CMBS market, the Fund, at any reasonable size expectations, will be a small part of the overall market and average daily trading volume (“ADTV”). CMBS spread volatility, particularly at the more senior level and intermediate-term duration, where the Fund expects to focus, is muted compared to less liquid and more exotic securities which are not part of the principal investment strategy of the Fund.

In order to alleviate concerns the Staff may have regarding the liquidity of other structured credit securities in which the Fund previously stated it intended to invest, the Fund intends on revising the disclosure in its prospectus to state that investments in mortgage-backed securities (other than CMBS) and investments in CLOs, asset-backed securities, structured notes and credit-linked notes in the aggregate will not exceed 5% of its net assets (plus the amount of borrowings for investment purposes). Accordingly, the description of the Fund’s principal investment strategies will be revised to remove references to the foregoing structured credit securities and instead reflect that the securities in which the Fund will principally invest (other than the currently disclosed derivative instruments that may be used for hedging purposes) will be limited to CMBS, debt securities issued by companies primarily engaged in the real estate business, including REITs, and debt securities issued by governmental entities.

Comments and Responses

| 1. | Either please provide a model portfolio or a percentage breakdown of net assets of the fund that the adviser expects to invest in each security type in the principal investment strategy. |

Response:

In light of the aforementioned determination to limit the Fund’s investments in non-CMBS structured credit securities to no more than 5% of the Fund’s net assets, the Fund respectfully declines to provide a model portfolio at this time, as the CMBS market is a large and liquid market and the Fund’s portfolio will be responsive to market conditions to best satisfy its objectives of income and capital preservation. Any model portfolio the Fund may provide would necessarily be a snapshot based on then-current market conditions and may not be representative of a portfolio over time and based on future market conditions.

The Fund respectfully advises the Staff that Ladder Capital Asset Management LLC (“Adviser”) is not proposing that the Fund be a “high-yield” product but rather a safety-oriented senior secured product, consistent with the Fund’s capital preservation objective. As stated in the Fund’s prospectus, “under normal market conditions, the Fund will principally invest in CMBS that are rated investment-grade at the time of purchase by at least one nationally recognized statistical rating organization (“NRSRO”) or, if unrated, are determined by the Adviser to be of comparable credit quality.”

The Fund also notes that the Adviser has indicated that approximately 98% of its Adviser’s affiliates’ prior CMBS investments have been investment-grade rated.

| 2. | Please provide market data on the following items for each security in the principal investment strategy: |

| A. | number of market makers, |

| B. | trading volume for each security type or the frequency and availability of broker-dealer quotes, |

| C. | volatility of trading prices for the security type, |

| D. | bid-ask spreads on each security type, |

| E. | restrictions on trading or transfer of assets, |

| F. | the ratio of the fund's position in the security type relative to the market size, |

| G. | the size of the fund's position in the security type relative to the ADTV, |

| H. | the availability of and the adviser’s access to information on each debt security type and the underlying borrowers, and |

| I. | how the fund will be able to appropriately value these instruments on a daily basis. |

Response: In light of the limits that the Fund will impose on investments in non-CMBS structured credit securities, we have limited our responses below to the CMBS markets.

| A. | number of market makers, |

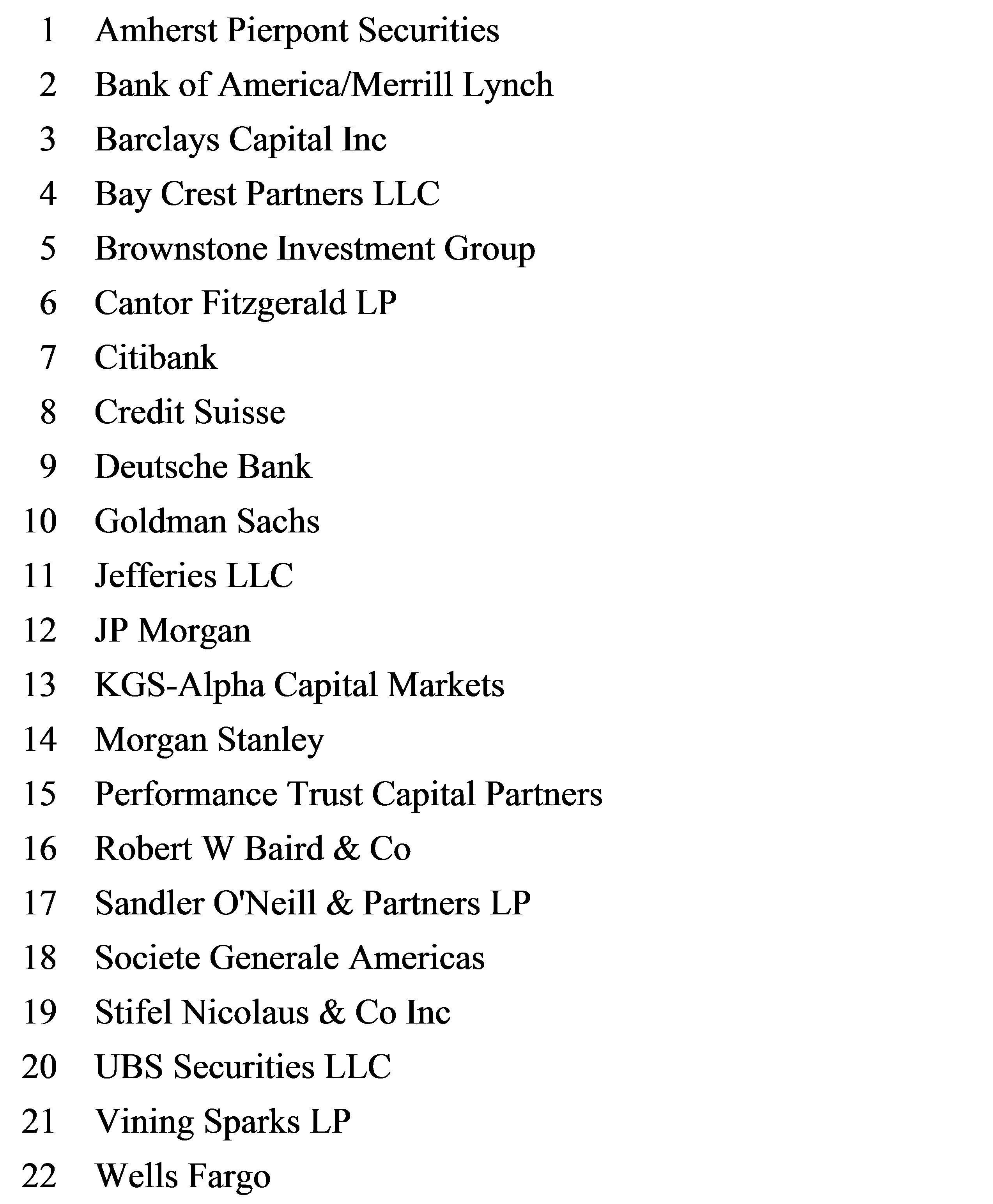

Subsidiaries of the Adviser’s parent, Ladder Capital Corp (collectively, “Ladder”), and affiliates of the Adviser maintain an active dialogue with the following 22 broker-dealers that trade CMBS:

The Fund will seek to be authorized to trade with all of the above counterparties.

| B. | trading volume for each security type or the frequency and availability of broker-dealer quotes, |

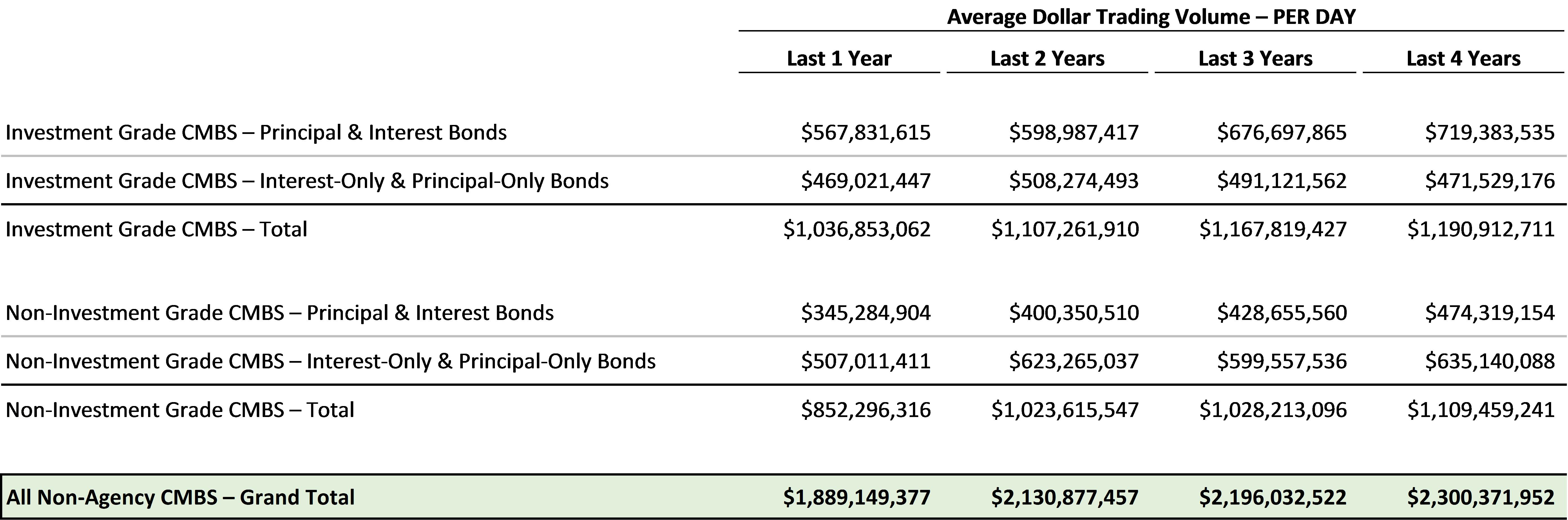

Based on TRACE trading data provided by FINRA, and as previously submitted by the Fund to the Staff, the aggregate registered and Rule 144A CMBS market, excluding Agency CMBS, had average dollar trading volume of $1.9 billion per day in the last year, and $2.3 billion per day on average for the last four years.

On a per annum basis, the aggregate registered and Rule 144A CMBS market, excluding Agency CMBS, had average dollar trading volume of $391 billion per year in the last year, and $473 billion per year on average for the last four years, based on TRACE trading data provided by FINRA.

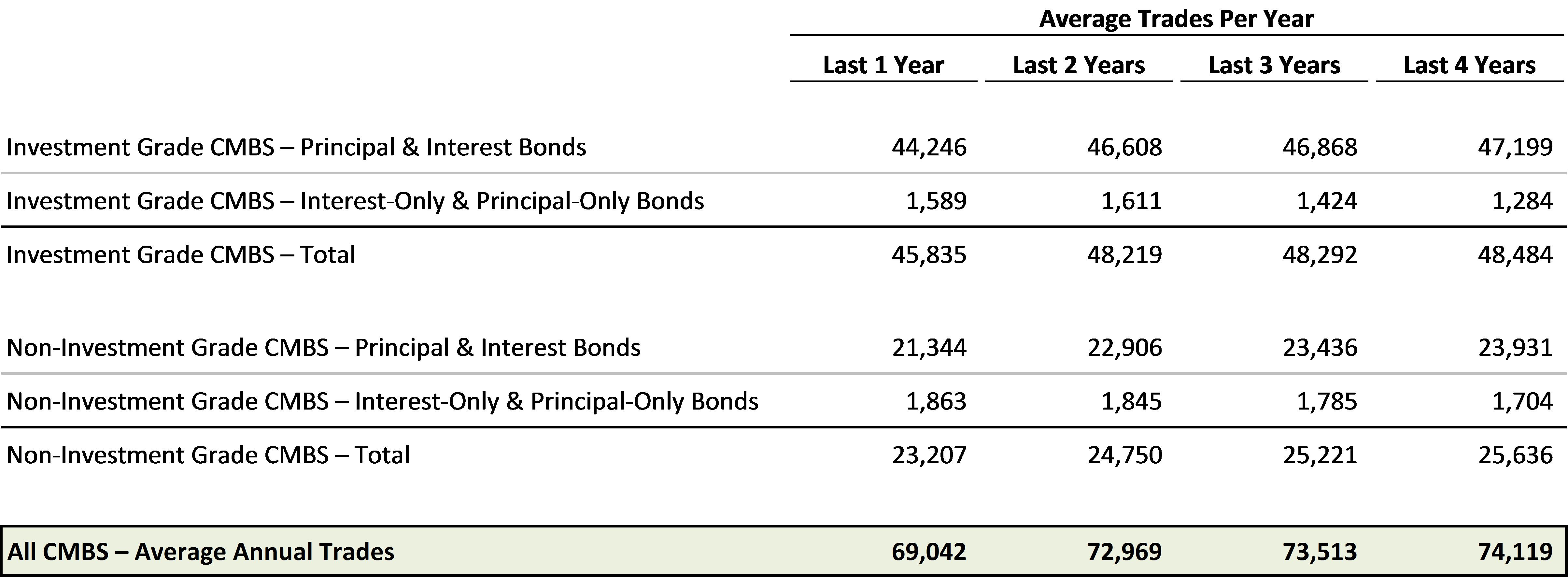

The CMBS market had 69,042 reported trades in the last year (representing an average of 275 trades per trading day), and 74,199 average reported trades per year for the last four years (representing an average of 296 trades per trading day), based on TRACE trading data provided by FINRA.

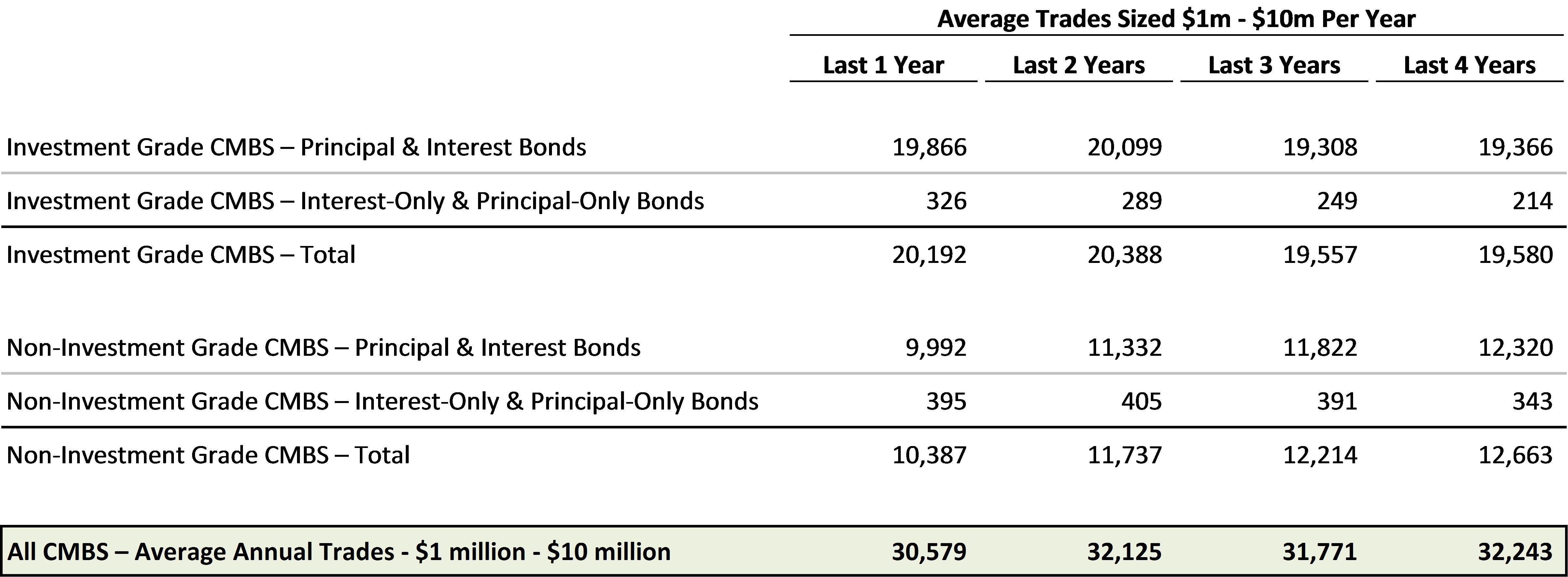

Of the above trading activity, about 44% of trades were in the $1 million - $10 million trade size, indicating a significant institutional market for these securities, based on TRACE trading data provided by FINRA.

| C. | volatility of trading prices for the security type, |

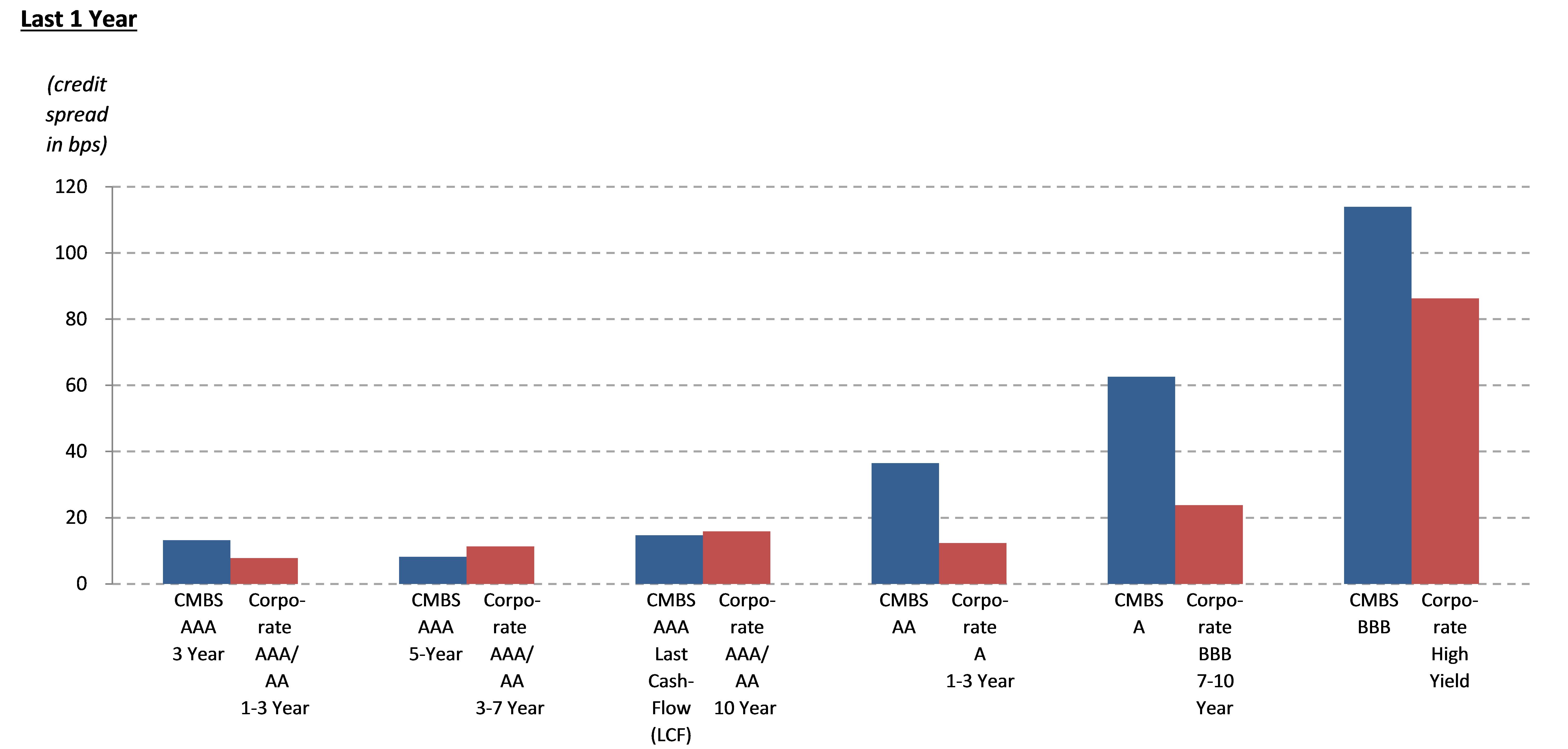

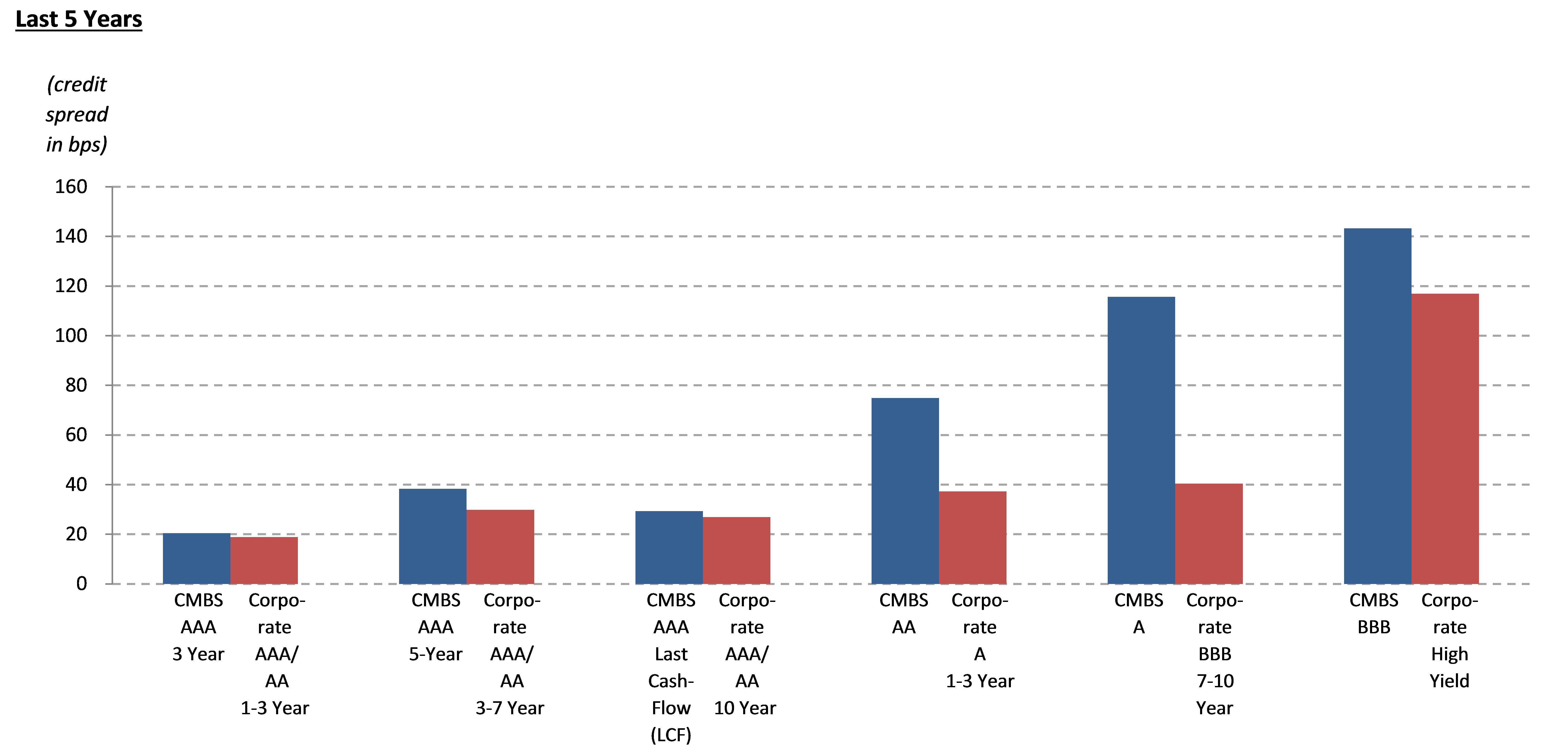

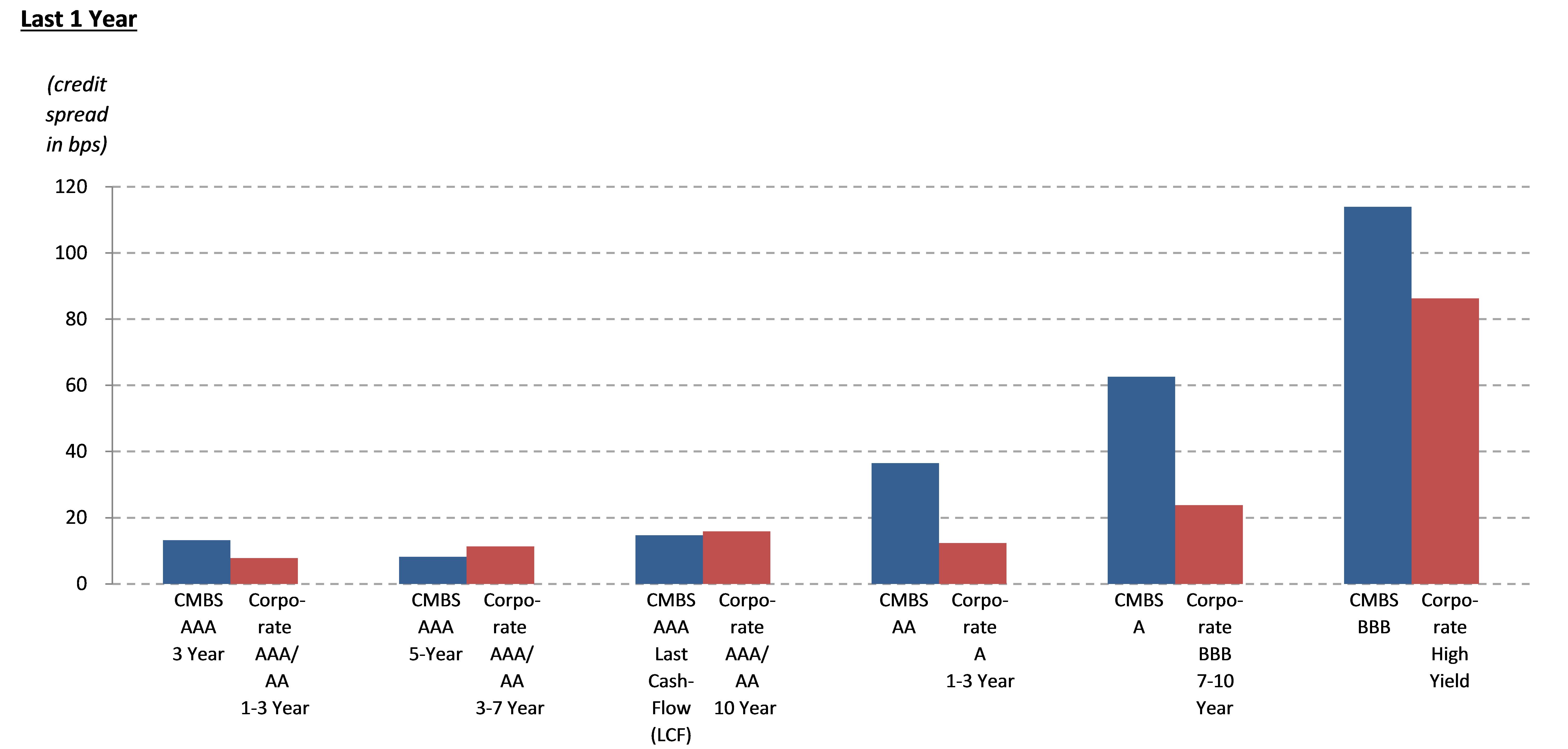

Based on the Wells Fargo Fixed Income Research historical data set attached hereto (data as of 07/29/2016), CMBS credit spread volatility as determined by historical standard deviation is roughly in-line with corporate unsecured bonds at the senior-most levels and wider at lower-rated levels. Corporate unsecured bonds are generally considered to be a large, liquid component of the overall bond market, with yields comparable to yields on CMBS securities. The following three graphs summarize the standard deviations calculated from the Wells Fargo data over the last 1, 3 and 5 years, and the table that precedes the three graphs illustrates comparative spreads between CMBS and corporate bonds. The next chart is an example of the structured products data set provided by FINRA on each trading day, and shows that the CMBS credit spread standard deviation as materially lower than other structured products including ABS, CBO’s, CDO’s, and CLO’s at both the investment grade and non-investment grade-rated levels.

Credit Spread Standard Deviations (includes registered and Rule 144A CMBS)

Source: Wells Fargo Fixed Income Research.

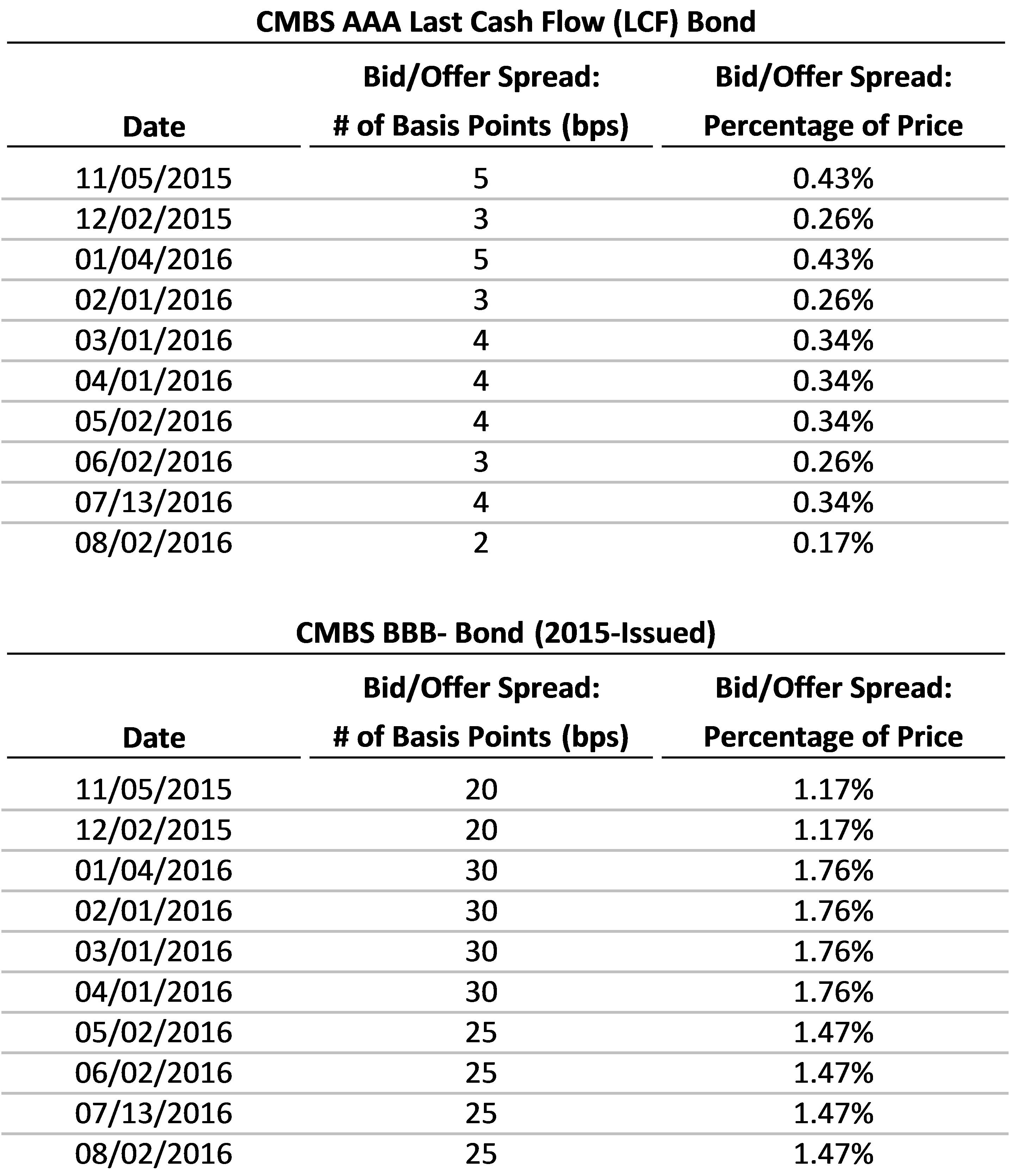

| D. | bid-ask spreads on each security type, |

To the Adviser’s knowledge, bid-ask spread historical data is not generally captured in CMBS or corporate unsecured markets by any regulatory entities and/or broker-dealers. However, in CMBS, there is a highly competitive and active secondary market driven by both CUSIPs owned by broker-dealers/market makers and daily Bids Wanted in Competition (“BWIC”.) This actual trading volume information is captured on a daily basis via FINRA’s TRACE reporting system.

The tables below are the Adviser’s best estimate of gross quoted bid/offer spreads based on market making activities and bid lists over an example timeframe from the 22 broker-dealers that Ladder faces for CMBS trading shown earlier herein.

| E. | restrictions on trading or transfer of assets, |

There are no restrictions on trading or transfer of publicly-registered CMBS securities, which comprise approximately 78% of the CMBS market, according to Trepp. CMBS sold pursuant to Rule 144A are generally subject to limitations which restrict trading to Qualified Institutional Buyers (“QIBs”).

| F. | the ratio of the fund's position in the security type relative to the market size, |

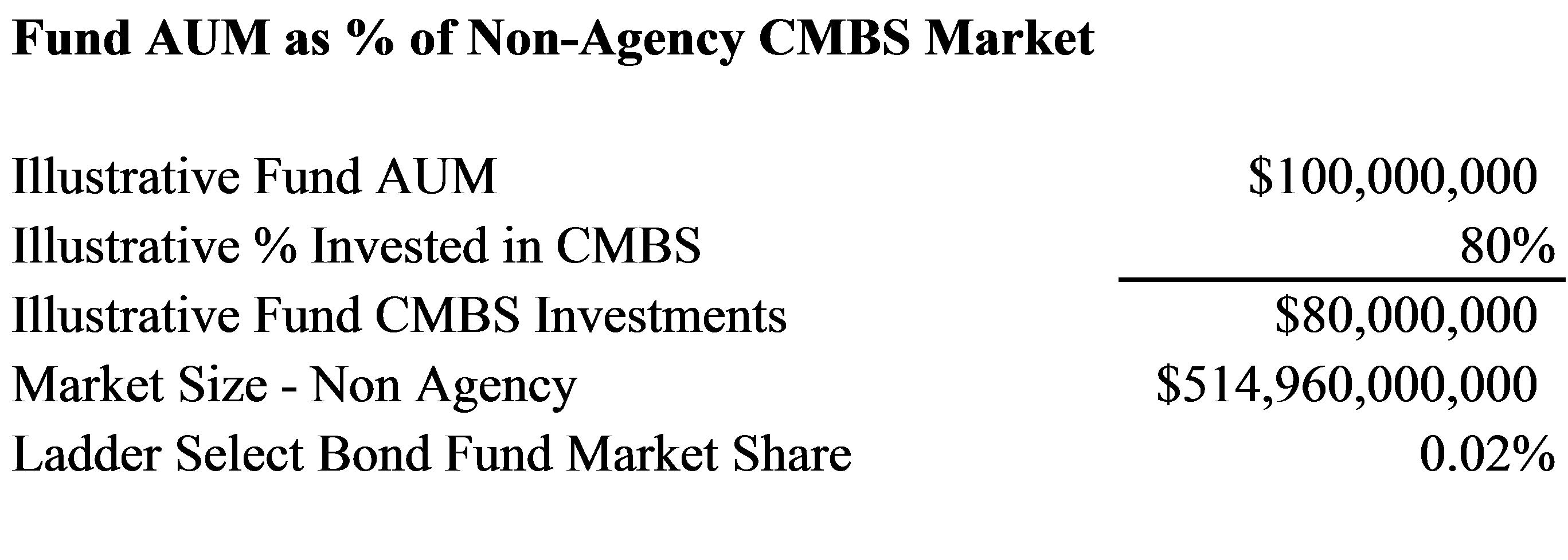

The Fund’s CMBS portfolio is likely to represent significantly less than 1% of the CMBS market for the foreseeable future, per the data and analysis more fully described below.

The Non-Agency CMBS market is estimated to be $515 billion, and the total CMBS market including agency securities is estimated to be $934 billion, per Trepp and Securities Industry and Financial Markets Association (“SIFMA”), as previously reported by the Fund to the Staff and as further detailed in the table below.

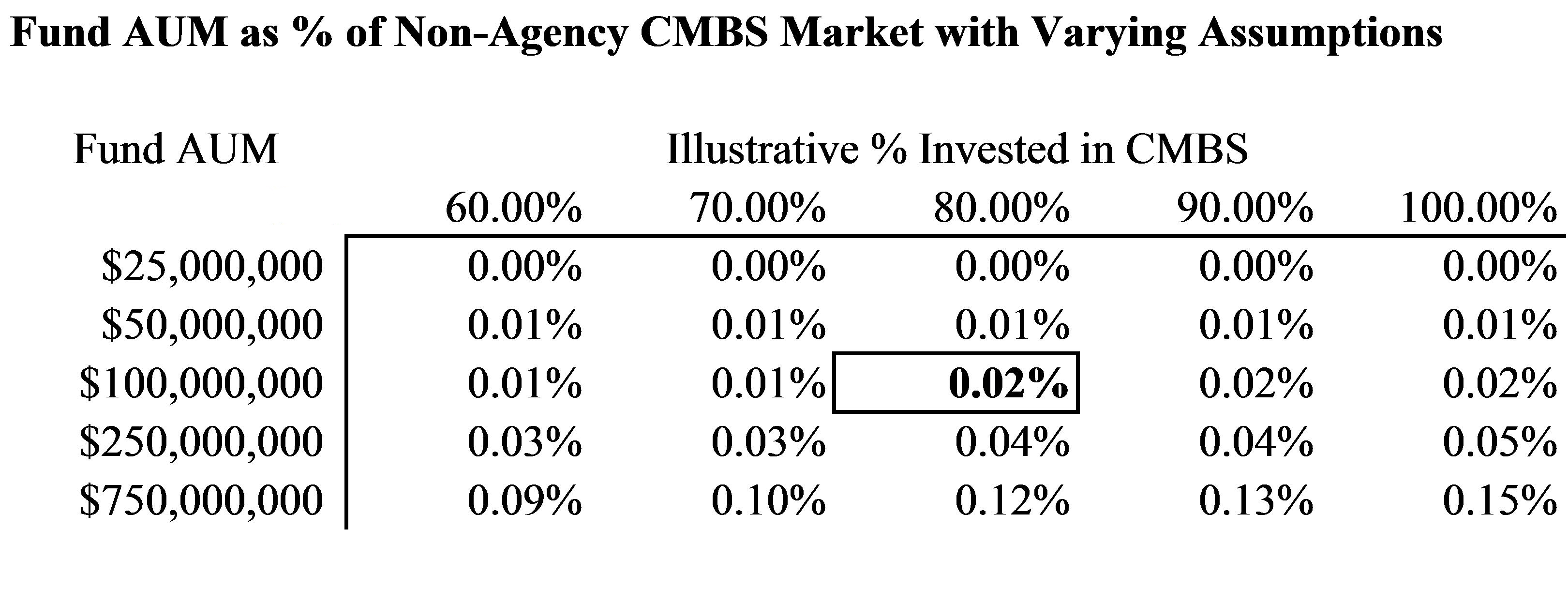

Using an illustrative $100 million Fund AUM, of which 80% is invested in non-Agency CMBS, the Fund’s CMBS portfolio would represent 0.02% of the non-Agency CMBS market, as detailed below:

Varying the assumptions in the above calculation to include Fund AUM’s between $25 million and $750 million, with CMBS investments ranging from 60% to 100% of Fund AUM, the Fund’s CMBS portfolio could represent up to of 0.15% of the non-agency CMBS market, as detailed below.

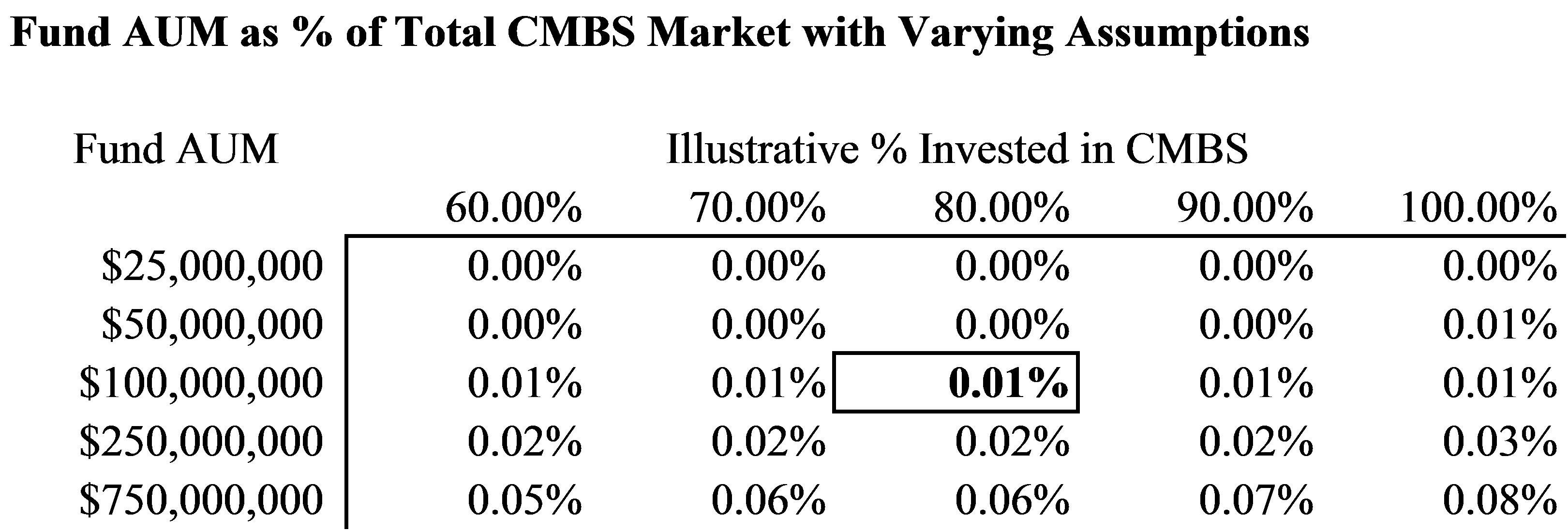

As a percentage of the total CMBS market, including Agency securities, the Fund’s CMBS portfolio would represent an even smaller portion of the total market.

| G. | the size of the fund's position in the security type relative to the ADTV, |

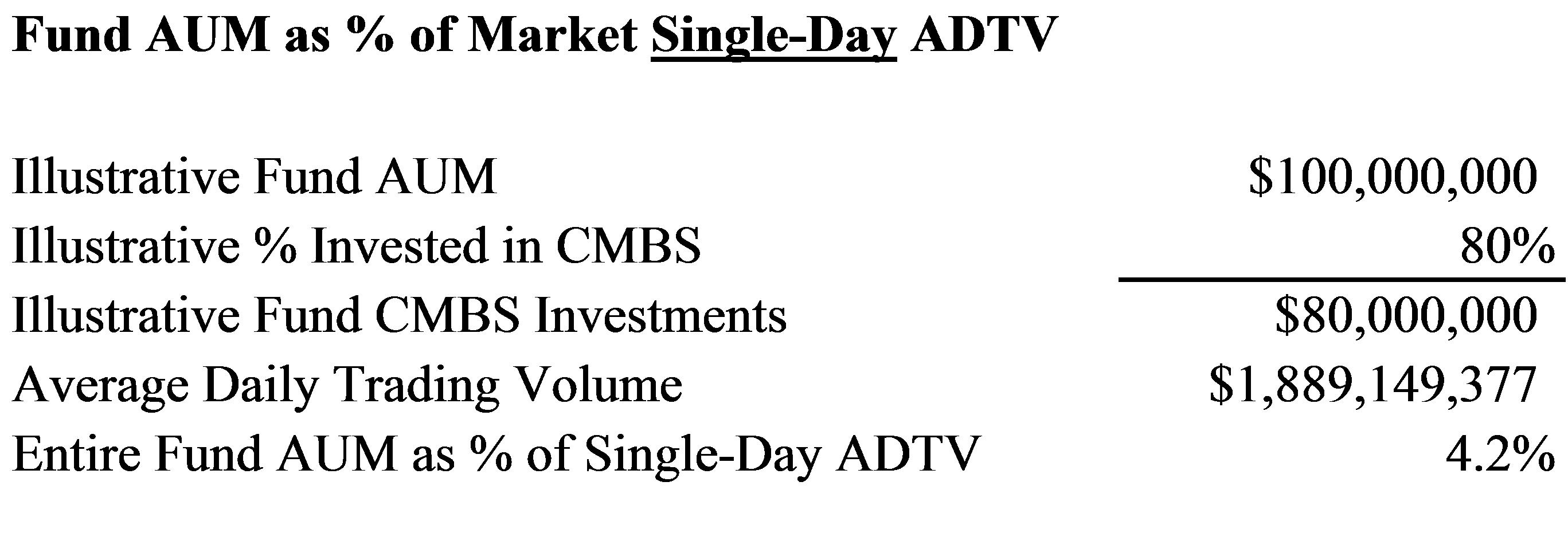

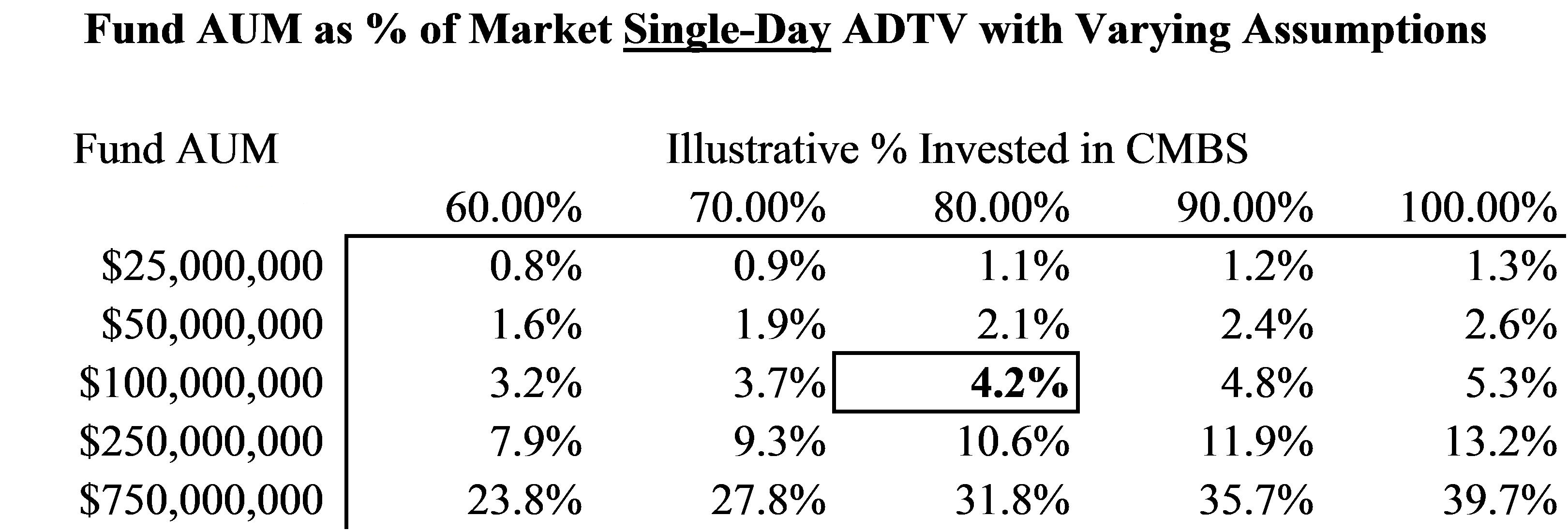

The single-day ADTV of the CMBS market is estimated to be $1.9 billion per day (in whole dollars, $1,889,149,377), per TRACE data provided by FINRA. Given a range of illustrative Fund AUM’s and percentages invested in CMBS, the Fund’s total CMBS portfolio is expected to represent significantly less than a single day’s trading volume of the market.

Using an illustrative $100 million Fund AUM, of which 80% is invested in non-Agency CMBS, the Fund’s CMBS portfolio would represent 4.2% of the non-Agency CMBS market ADTV, as detailed below.

Varying the assumptions in the above calculation to include Fund AUM’s between $25 million and $750 million, with CMBS investments ranging from 60% to 100% of Fund AUM, the Fund’s CMBS portfolio could represent up to of 40% of ADTV of the non-agency CMBS market, as detailed below.

| H. | the availability of and the Adviser’s access to information on each debt security type and the underlying borrowers, and |

CMBS data is provided by CMBS trust servicers in accordance with Commercial Real Estate Finance Council industry standards. We have attached these standards to this response letter for your review. Servicer data is aggregated by market data providers including Bloomberg and Trepp and is also available directly to investors. It is expected that the Fund and Adviser will have full immediate access to current information in this comprehensive format for all CMBS bonds that the Adviser expects the Fund to purchase as it becomes available.

| I. | how the fund will be able to appropriately value these instruments on a daily basis. |

The Fund will value CMBS instruments on a daily basis pursuant to the Trust’s pricing policies and procedures, which are generally summarized below.

| · | The Trust will value the investment at its most recent market value, if readily available, as reported by one of the Trust’s approved pricing services (e.g. Interactive Data Corporation, Bloomberg and Thomson Reuters). |

| · | When market values are not readily available, the Trust’s fair value policies, as determined in good faith by the Board of Trustees (the “Board”), will apply. In such situations, the Trust will first look to one of its approved independent pricing agents to provide an evaluated price. As previously discussed, investment grade-rated CMBS are usually priced by one of the Trust’s approved pricing agents: Interactive Data Corporation, Bloomberg, and Thomson Reuters. These pricing agents generally consider the institutional bid and last sale price for the investment, along with other factors such as account security prices, yield, maturity, call features, ratings, institutional-sized trading in similar types of investments, and developments related to the specific investment. |

| · | In the event the Trust is unable to obtain an evaluated price from an approved independent pricing agent, the Trust will contact the Adviser to determine a fair value using data from other sources, such as market makers or other pricing services, including Trepp and Markit Ltd. (“Markit”). If the Adviser relies upon such a source, the Adviser will supply the Trust’s administrator (“Administrator”) with appropriate contact information and supporting documentation (in writing). |

| · | If the Adviser is unable to determine a fair value using data from other sources, then the Fund will use the Trust’s and Adviser’s pricing and valuation procedures to determine a fair value. Under such procedures, the Trust and Adviser will generally consider the following factors, among others: fundamental analytical data relating to the investment; the nature and duration of any restriction on the disposition of the investment; evaluation of market forces that may influence the investment’s price; the type of investment; financial statements of the investment’s issuer; cost at date of purchase; the size of the holding in the Fund’s portfolio and the relative position size to the market for that investment; discounts from the market value of unrestricted securities of the same class at time of purchase; special reports prepared by analysts; information as to any transactions or offers for the investment; existence of merger proposals or other corporate transactions; price and volume of trading in similar investments; changes in interest rates; observations from financial institutions; government actions or pronouncements; other news events; the existence of a shelf registration for restricted securities or of any undertaking to register the security; and other acceptable valuation methods. |

| · | Subsequent to any fair-value determination, the Adviser will review the appropriateness of the fair valuation based on any new information or changes in assumptions regarding the investment, market quotations, actual trade prices, or other information. If changes are warranted, the Adviser will revise the original fair valuation and consider if the Trust needs to revise the fair value determination or methodology. |

| · | The Adviser and Administrator will also document in writing all determinations, including the factors considered and the valuation methodology employed. |

| · | In all instances of fair-valuated investments, the Administrator and the Adviser will provide regular reports to the Board discussing any fair value pricing activity for the Fund. The Adviser will promptly notify the Board if it believes the Trust should make any material changes to the price, methodology, or pricing procedures. |

We acknowledge that:

| · | the Trust is responsible for the adequacy and accuracy of the disclosure in Trust filings; |

| · | the Commission or Staff comments or changes to disclosure in response to Staff comments in the filing reviewed by the staff do not foreclose the Commission from taking any action with respect to the filing; and |

| · | the Trust may not assert this action as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Thank you for your comments. Please contact me at (513) 587-3454 if you have any questions.

Sincerely,

| /s/ Bo J. Howell | |

| |

| Bo J. Howell | |

| Secretary | |