| Brookfield Property Partners L.P. 73 Front Street, 5th Floor Hamilton HM 12 Bermuda | Tel +411 294 3309 www.brookfieldpropertypartners.com | |

December 19, 2016

Via EDGAR and e-mail

Jennifer Monick

Office of Real Estate and Commodities

Securities and Exchange Commission

Mail Stop 3233

Washington, DC 20549

| Re: | Brookfield Property Partners L.P. |

Form 20-F for the fiscal year ended December 31, 2015

Filed March 17, 2016

File No. 001-35505

Dear Ms. Monick:

Thank you for your letter dated December 5, 2016 and your comment contained therein (the “Comment Letter”). In my capacity as Chief Financial Officer of the service provider to Brookfield Property Partners L.P. (the “company”), I am replying to the comment raised by the Staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) in the Comment Letter on behalf of the company.

The company responds to your comment (which we have repeated below initalics) as follows:

Form 20-F for the year ended December 31, 2015

Financial statements analysis, page 60

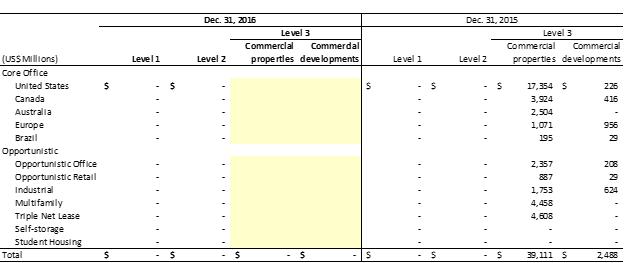

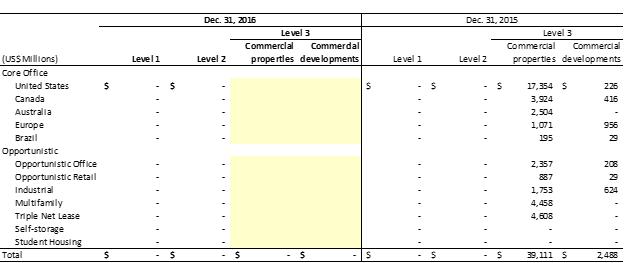

| 1. | We note your response to our prior comment 1. Based on the table at the bottom of page F-27, it appears that your consolidated properties are made up of 10 asset classes (i.e. Office – United States, Office – Canada, etc.) to meet the disclosure requirements of IFRS 13. In future filings, please revise the fair value hierarchy table on page F-28 to disclose the fair value at the asset class level. Further, please revise future filings to include a sensitivity analysis at the asset class level; your sensitivity analysis should be based on reasonably likely changes for each asset class. Within your response, please tell us what basis point change you expect to provide for each asset class. Please refer to paragraphs 93 and 94 of IFRS 13. |

In response to your comment above, the company proposes to amend its disclosures in the Investment Properties footnote in future filings as follows:

| · | the company will add the fair value at the asset class level to the fair value hierarchy table, based on the company’s current asset class groupings; and |

| · | the company will add a separate table with a sensitivity analysis for each of the company’s current asset classes. |

The sensitivity analysis for each asset class will be based on the primary valuation methodology used for the asset class and will involve adjusting the significant unobservable inputs for reasonably possible alternative assumptions in those inputs. The significant unobservable inputs are discount and terminal capitalization rates for assets valued using the discounted cash flow method and capitalization rates for assets valued using the direct capitalization method. The company will estimate reasonably possible alternative assumptions for each asset class based on the changes in the significant unobservable inputs observed by the company between September 30, 2014 and September 30, 2016 for investments held throughout this period. For new asset classes without historical data, the company will initially use a 5 basis point change in valuation metrics. The company will review the sensitivity analysis periodically to reflect any changes for each asset class following the acquisition period.

Consequently, below please find a draft of the tables the company proposes to include in its revised disclosures, with additional disclosures of fair value at the asset class level and a separate table for sensitivity analysis, which includes the proposed sensitivity / basis point change the company expects to provide for each asset class:

***

If you have any questions or comments regarding this letter, please call the undersigned at (212) 417-7166.

Very truly yours,

/s/ “Bryan Davis”

Bryan K. Davis

Chief Financial Officer

Brookfield Property Group LLC