Management’s Discussion and Analysis of Financial Results

INTRODUCTION

This management’s discussion and analysis (“MD&A”) of Brookfield Property Partners L.P. (“BPY”, the “partnership”, or “we”) covers the financial position as of March 31, 2016 and December 31, 2015 and results of operations for the three months ended March 31, 2016 and 2015. This MD&A should be read in conjunction with the unaudited condensed consolidated financial statements (the “Financial Statements”) and related notes as of March 31, 2016, included elsewhere in this report, and our annual report for the year ended December 31, 2015 on Form 20-F.

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND USE OF NON-IFRS MEASURES

This MD&A, particularly “Objectives and Financial Highlights – Overview of the Business” and “Additional Information – Trend Information”, contains “forward-looking information” within the meaning of Canadian provincial securities laws and applicable regulations and “forward-looking statements” within the meaning of “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include statements regarding our operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods, and include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “seeks”, “intends”, “targets”, “projects”, “forecasts”, “likely”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: risks incidental to the ownership and operation of real estate properties including local real estate conditions; the impact or unanticipated impact of general economic, political and market factors in the countries in which we do business; the ability to enter into new leases or renew leases on favorable terms; business competition; dependence on tenants’ financial condition; the use of debt to finance our business; the behavior of financial markets, including fluctuations in interest and foreign exchanges rates; uncertainties of real estate development or redevelopment; global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; risks relating to our insurance coverage; the possible impact of international conflicts and other developments including terrorist acts; potential environmental liabilities; changes in tax laws and other tax related risks; dependence on management personnel; illiquidity of investments; the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits therefrom; operational and reputational risks; catastrophic events, such as earthquakes and hurricanes; and other risks and factors detailed from time to time in our documents filed with the securities regulators in Canada and the United States, as applicable.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements or information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

We disclose a number of financial measures in this MD&A that are calculated and presented using methodologies other than in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). We utilize these measures in managing our business, including performance measurement, capital allocation and valuation purposes and believe that providing these performance measures on a supplemental basis to our IFRS results is helpful to investors in assessing our overall performance. These financial measures should not be considered as a substitute for similar financial measures calculated in accordance with IFRS. We caution readers that these non-IFRS financial measures may differ from the calculations disclosed by other businesses, and as a result, may not be comparable to similar measures presented by others. Reconciliations of these non-IFRS financial measures to the most directly comparable financial measures calculated and presented in accordance with IFRS, where applicable, are included within this MD&A.

OBJECTIVES AND FINANCIAL HIGHLIGHTS

BASIS OF PRESENTATION

Our sole material asset is our 37% interest in Brookfield Property L.P. (the “Operating Partnership”). As we have the ability to direct its activities pursuant to our rights as owners of the general partner units, we consolidate the Operating Partnership. Accordingly, our Financial Statements reflect 100% of its assets, liabilities, revenues, expenses and cash flows, including non-controlling interests therein, which capture the ownership interests of other third parties.

We also discuss the results of operations on a segment basis, consistent with how we manage our business. In the first quarter of 2016, we realigned the organizational and governance structures of our businesses to align them more closely with the nature of the partnership’s investments. Such realignment gave rise to changes in how the partnership presents information for financial reporting and management decision-making purposes and resulted in a change in the partnership’s reporting segments. Consequently, as of March 31, 2016, the partnership’s operating segments are organized into four reportable segments: i) Core Office, ii) Core Retail, iii) Opportunistic and iv) Corporate. All prior period segment disclosures have been recast to reflect the changes in the partnership’s reportable segments. These segments are independently and regularly reviewed and managed by the Chief Executive Officer, who is considered the Chief Operating Decision Maker.

Our partnership’s equity interests include general partnership units (“GP Units”), publicly traded limited partnership units (“LP Units”), redeemable/exchangeable partnership units of the Operating Partnership (“Redeemable/Exchangeable Partnership Units”), special limited partnership units of the Operating Partnership (“Special LP Units”) and limited partnership units of Brookfield Office Properties Exchange LP (“Exchange LP Units”). Holders of the GP Units, LP Units, Redeemable/Exchangeable Partnership Units, Special LP Units, and Exchange LP Units will be collectively referred to throughout this MD&A as “Unitholders”. The GP Units, LP Units, Redeemable/Exchangeable Partnership Units, Special LP Units and Exchange LP Units have the same economic attributes in all respects, except that the Redeemable/Exchangeable Partnership Units have provided Brookfield Asset Management Inc. (“Brookfield Asset Management”) the right to request that its units be redeemed for cash consideration since April 2015. In the event that Brookfield Asset Management exercises this right, our partnership has the right, at its sole discretion, to satisfy the redemption request with its LP Units, rather than cash, on a one-for-one basis. As a result, Brookfield Asset Management, as holder of Redeemable/Exchangeable Partnership Units, participates in earnings and distributions on a per unit basis equivalent to the per unit participation of the LP Units of our partnership. However, given the redemption feature referenced above and the fact that they were issued by our subsidiary, we present the Redeemable/Exchangeable Partnership Units as a component of non-controlling interests. The Exchange LP Units are exchangeable at any time on a one-for-one basis, at the option of the holder, for LP Units. As a result of this redemption feature, we present the Exchange LP Units as a component of non-controlling interests.

This MD&A includes financial data for the three months ended March 31, 2016 and includes material information up to May 11, 2016. Financial data have been prepared using accounting policies in accordance with IFRS as issued by the IASB. Non-IFRS measures used in this MD&A are reconciled to or calculated from such financial information. Unless otherwise specified, all operating and other statistical information is presented as if we own 100% of each property in our portfolio, regardless of whether we own all of the interests in each property, excluding information relating to our interests in China Xintiandi (“CXTD”). We believe this is the most appropriate basis on which to evaluate the performance of properties in the portfolio relative to each other and others in the market. All dollar references, unless otherwise stated, are in millions of U.S. Dollars. Canadian Dollars (“C$”), Australian Dollars (“A$”), British Pounds (“£”), Euros (“€”), Brazilian Reais (“R$”), Indian Rupees (“₨”), and Chinese Yuan (“C¥”) are identified where applicable.

Additional information is available on our website at www.brookfieldpropertypartners.com, or on www.sedar.com or www.sec.gov.

OVERVIEW OF THE BUSINESS

Our partnership is Brookfield Asset Management’s primary public entity to make investments in the real estate industry. We are a globally-diversified owner and operator of high-quality properties that typically generate stable and sustainable cash flows over the long term. Our goal is to be a leading global owner and operator of real estate, providing investors with a diversified exposure to some of the most iconic properties in the world and to acquire high-quality assets at a discount to replacement cost or intrinsic value. With approximately 14,000 employees involved in Brookfield Asset Management’s real estate businesses around the globe, we have built operating platforms in various real estate sectors, including:

| |

| • | Core Office sector through our 100% common equity interest in Brookfield Office Properties Inc. (“BPO”) and our 50% interest in Canary Wharf Group plc (“Canary Wharf”); |

| |

| • | Core Retail sector through our 29% interest in General Growth Properties, Inc. (“GGP”) (34% on a fully diluted basis, assuming all outstanding warrants are exercised); and |

| |

| • | Opportunistic sector through investments in Brookfield Asset Management-sponsored real estate opportunity funds. |

Through these platforms, we have amassed a portfolio of premier properties and development sites around the globe, including:

| |

| • | 153 office properties totaling over 101 million square feet primarily located in the world’s leading commercial markets such as New York, London, Los Angeles, Washington, D.C., Sydney, Toronto, and Berlin; |

| |

| • | Office and urban multifamily development sites that enable the construction of 32 million square feet of new properties; |

| |

| • | 128 regional malls and urban retail properties containing approximately 126 million square feet in the United States; |

| |

| • | 104 opportunistic office properties comprising 23 million square feet of office space in the United States, United Kingdom, Brazil and India; |

| |

| • | Over 27 million square feet of opportunistic retail space across 43 properties across the United States and in select Brazilian markets; |

| |

| • | Approximately 55 million square feet of industrial space across 206 industrial properties, primarily consisting of modern logistics assets in North America and Europe, with an additional four million square feet currently under construction; |

| |

| • | Over 39,500 multifamily units across 140 properties throughout the United States; |

| |

| • | Twenty-seven hospitality assets with over 18,200 rooms across North America, Europe and Australia; |

| |

| • | Over 300 properties that are leased to automotive dealerships across the United States and Canada on a triple net lease basis; and |

| |

| • | Over 100 self-storage facilities comprising over 67,000 storage units throughout the United States. |

Our diversified portfolio of high-quality office and retail assets in some of the world’s most dynamic markets has a stable cash flow profile due to its long-term leases. In addition, as a result of the mark-to-market of rents upon lease expiry, escalation provisions in leases and projected increases in occupancy, these assets should generate strong same-property net operating income (“NOI”) growth without significant capital investment. Furthermore, we expect to earn between 8% and 11% unlevered, pre-tax returns on construction costs for our development and redevelopment projects and 20% on our equity invested in Brookfield-sponsored real estate opportunity funds. With this cash flow profile, our goal is to pay an attractive annual distribution to our Unitholders and to grow our distribution by 5% to 8% per annum.

Overall, we seek to earn leveraged after-tax returns of 12% to 15% on our invested capital. These returns will be comprised of current cash flow and capital appreciation. Capital appreciation will be reflected in the fair value gains that flow through our income statement as a result of our revaluation of investment properties in accordance with IFRS to reflect initiatives that increase property level cash flows, change the risk profile of the asset, or to reflect changes in market conditions. From time to time, we will convert some or all of these unrealized gains to cash through asset sales, joint ventures or refinancings.

We believe our global scale and best-in-class operating platforms provide us with a unique competitive advantage as we are able to efficiently allocate capital around the world toward those sectors and geographies where we see the greatest returns. We actively recycle assets on our balance sheet as they mature and reinvest the proceeds into higher yielding investment strategies, further enhancing returns. In addition, due to the scale of our stabilized portfolio and flexibility of our balance sheet, our business model is self-funding and does not require us to access capital markets to fund our continued growth.

PERFORMANCE MEASURES

We expect to generate returns to Unitholders from a combination of cash flow earned from our operations and capital appreciation. Furthermore, if we are successful in increasing cash flow earned from our operations we will be able to increase distributions to Unitholders to provide them with an attractive current yield on their investment.

To measure our performance against these targets, we focus on NOI, funds from operations (“FFO”), Company FFO, fair value changes, and net income and equity attributable to Unitholders. Some of these performance metrics do not have standardized meanings prescribed by IFRS and therefore may differ from similar metrics used by other companies. We define each of these measures as follows:

| |

| • | NOI: revenues from our commercial and hospitality operations of consolidated properties less direct commercial property and hospitality expenses. |

| |

| • | FFO: net income, prior to fair value gains, net, depreciation and amortization of real estate assets, and income taxes less non-controlling interests of others in operating subsidiaries and properties share of these items. When determining FFO, we include our proportionate share of the FFO of unconsolidated partnerships and joint ventures and associates. |

| |

| • | Company FFO: FFO before the impact of depreciation and amortization of non-real estate assets, transaction costs, gains (losses) associated with non-investment properties and the FFO that would have been attributable to the partnership’s shares of GGP if all outstanding warrants of GGP were exercised on a cashless basis. It also includes dilution adjustments to undiluted FFO as a result of the net settled warrants. |

| |

| • | Fair value changes: includes the increase or decrease in the value of investment properties that is reflected in the consolidated statements of income. |

| |

| • | Net income attributable to Unitholders: net income attributable to holders of GP Units, LP Units, Redeemable/Exchangeable Partnership Units, Special LP Units and Exchange LP Units. |

| |

| • | Equity attributable to Unitholders: equity attributable to holders of GP Units, LP Units, Redeemable/Exchangeable Partnership Units, Special LP Units and Exchange LP Units. |

NOI is a key indicator of our ability to increase cash flow from our operations. We seek to grow NOI through pro-active management and leasing of our properties. In evaluating our performance, we analyze a subset of NOI, defined as “same-property NOI,” which excludes NOI that is earned from assets acquired, disposed of or developed during the periods presented, or not of a recurring nature, and from opportunistic assets. Same-property NOI allows us to segregate the performance of leasing and operating initiatives on the portfolio from the impact to performance of investing activities and “one-time items”, which for the historical periods presented consist primarily of lease termination income.

We also consider FFO an important measure of our operating performance. FFO is a widely recognized measure that is frequently used by securities analysts, investors and other interested parties in the evaluation of real estate entities, particularly those that own and operate income producing properties. Our definition of FFO includes all of the adjustments that are outlined in the National Association of Real Estate Investment Trusts (“NAREIT”) definition of FFO, including the exclusion of gains (or losses) from the sale of investment properties, the add back of any depreciation and amortization related to real estate assets and the adjustment for unconsolidated partnerships and joint ventures. In addition to the adjustments prescribed by NAREIT, we also make adjustments to exclude any unrealized fair value gains (or losses) that arise as a result of reporting under IFRS, and income taxes that arise as certain of our subsidiaries are structured as corporations as opposed to real estate investment trusts (“REITs”). These additional adjustments result in an FFO measure that is similar to that which would result if our

partnership was organized as a REIT that determined net income in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), which is the type of organization on which the NAREIT definition is premised. Our FFO measure will differ from other organizations applying the NAREIT definition to the extent of certain differences between the IFRS and U.S. GAAP reporting frameworks, principally related to the recognition of lease termination income. Because FFO excludes fair value gains (losses), including equity accounted fair value gains (losses), realized gains (losses) on the sale of investment properties, depreciation and amortization of real estate assets and income taxes, it provides a performance measure that, when compared year-over-year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and interest costs, providing perspective not immediately apparent from net income. We reconcile FFO to net income rather than cash flow from operating activities as we believe net income is the most comparable measure.

In addition to monitoring, analyzing and reviewing earnings performance, we also review initiatives and market conditions that contribute to changes in the fair value of our investment properties. These value changes, combined with earnings, represent a total return on the equity attributable to Unitholders and form an important component in measuring how we have performed relative to our targets.

We also consider the following items to be important drivers of our current and anticipated financial performance:

| |

| • | Increases in occupancies by leasing vacant space; |

| |

| • | Increases in rental rates through maintaining or enhancing the quality of our assets and as market conditions permit; and |

| |

| • | Reductions in operating costs through achieving economies of scale and diligently managing contracts. |

We also believe that key external performance drivers include the availability of the following:

| |

| • | Debt capital at a cost and on terms conducive to our goals; |

| |

| • | Equity capital at a reasonable cost; |

| |

| • | New property acquisitions that fit into our strategic plan; and |

| |

| • | Investors for dispositions of peak value or non-core assets. |

FINANCIAL STATEMENTS ANALYSIS

REVIEW OF CONSOLIDATED FINANCIAL RESULTS

In this section, we review our financial position and consolidated performance as of March 31, 2016 and December 31, 2015 and for the three months ended March 31, 2016 and 2015. Further details on our results from operations and our financial positions are contained within the “Segment Performance” section beginning on page 12.

Our investment approach is to acquire high-quality assets at a discount to replacement cost or intrinsic value. We have been actively pursuing this strategy through our flexibility to allocate capital to real estate sectors and geographies with the best risk-adjusted returns and to participate in transactions through our investments in various Brookfield Asset Management-sponsored real estate funds. Some of the more significant transactions are highlighted below:

Significant Developments in the first quarter of 2016

During the first quarter of 2016, we acquired a portfolio of self-storage facilities across the U.S. for approximately $840 million in our Opportunistic sector, including the assumption of debt. In our Core Office segment, we sold World Square Retail in Sydney for A$285 million and Royal Centre in Vancouver for C$428 million.

Significant Developments in the first quarter of 2015

During the first quarter of 2015, we were successful in expanding our core office platform as a result of the acquisition of a further interest in Canary Wharf using proceeds raised at the end of 2014 through the issuance of preferred shares. We, in conjunction with our joint venture partner Qatar Investment Authority (“QIA”), acquired 100% of Canary Wharf (the “Canary Wharf Transaction”), a 9.5 million square feet office portfolio in London with an 11.5 million square feet development pipeline.

Summary Operating Results

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Commercial property revenue | $ | 820 |

| $ | 810 |

|

| Hospitality revenue | 392 |

| 270 |

|

| Investment and other revenue | 35 |

| 69 |

|

| Total revenue | 1,247 |

| 1,149 |

|

| Direct commercial property expense | 311 |

| 327 |

|

| Direct hospitality expense | 265 |

| 206 |

|

| Interest expense | 416 |

| 374 |

|

| Depreciation and amortization | 64 |

| 36 |

|

| General and administrative expense | 131 |

| 110 |

|

| Total expenses | 1,187 |

| 1,053 |

|

| Fair value gains, net | 337 |

| 828 |

|

| Share of earnings from equity accounted investments | 130 |

| 264 |

|

| Income before taxes | 527 |

| 1,188 |

|

| Income tax expense | 87 |

| 179 |

|

| Net income | $ | 440 |

| $ | 1,009 |

|

| Net income attributable to non-controlling interests of others in operating subsidiaries and properties | 189 |

| 176 |

|

| Net income attributable to Unitholders | $ | 251 |

| $ | 833 |

|

| | | |

| NOI | $ | 636 |

| $ | 547 |

|

| FFO | $ | 195 |

| $ | 176 |

|

| Company FFO | $ | 217 |

| $ | 181 |

|

Our basic and diluted net income attributable to Unitholders per unit and weighted average units outstanding are calculated as follows:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions, except per share information) | 2016 |

| 2015 |

|

Net income attributable to Unitholders - basic(1) | $ | 251 |

| $ | 833 |

|

| Dilutive effect of conversion of capital securities - corporate | 10 |

| 9 |

|

| Net income attributable to Unitholders - diluted | $ | 261 |

| $ | 842 |

|

| | | |

Weighted average number of units outstanding - basic(1) | 781.2 |

| 782.8 |

|

| Conversion of capital securities - corporate and options | 38.3 |

| 40.1 |

|

| Weighted average number of units outstanding - diluted | 819.5 |

| 822.9 |

|

Net income per unit attributable to Unitholders - basic(1) | $ | 0.32 |

| $ | 1.06 |

|

| Net income per unit attributable to Unitholders - diluted | $ | 0.32 |

| $ | 1.02 |

|

| |

(1) | Basic net income attributable to Unitholders per unit requires the inclusion of preferred shares of the Operating Partnership that are mandatorily convertible into LP Units without an add back to earnings of the associated carry on the preferred shares. Net income attributable to Unitholders per unit with the add back of the associated carry on the preferred shares would be $0.36 per unit and $1.10 per unit for the three months ended March 31, 2016 and 2015, respectively. |

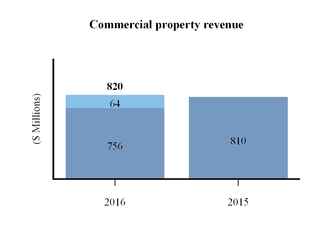

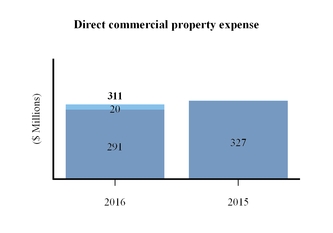

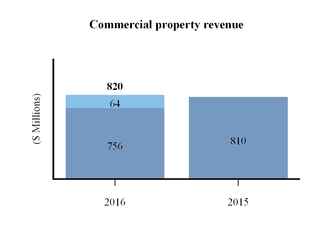

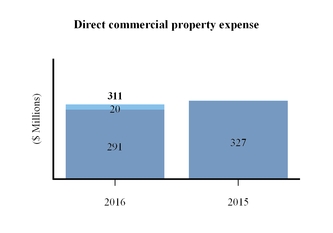

Commercial property revenue and direct commercial property expense

For the three months ended March 31, 2016, commercial property revenue increased by $10 million compared to the same period in the prior year, as a result of incremental capital allocated to higher yielding opportunistic activities, same-property growth in our core office and retail platforms and an increase in our asset base. Acquisitions made in 2015 and 2016, including Associated Estates Realty Corp. (“Associated Estates”), an office portfolio in Brazil and a self-storage portfolio, contributed to a $64 million increase in revenue. These increases were offset by the disposition or partial disposition of mature office assets, some of which resulted in the deconsolidation of certain commercial properties that provided the capital to pursue the aforementioned acquisitions. Material dispositions, full or partial, include Royal Centre in Vancouver, Southern Cross East and West in Melbourne, Manhattan West in New York City, 99 Bishopsgate in London, a portfolio of Washington, D.C. office assets and 75 State Street in Boston.

Direct commercial property expense decreased by $16 million largely due to the disposition of mature assets and the deconsolidation of certain commercial assets. These decreases were offset by additional expenses relating to acquisitions during 2015 and 2016 as mentioned above. Margins in 2016 were 62.1%, an improvement of 2.4% over 2015.

Hospitality revenue and direct hospitality expense

Hospitality revenue increased to $392 million for the three months ended March 31, 2016, compared to $270 million in the same period in the prior year. Direct hospitality expense increased to $265 million for the three months ended March 31, 2016, compared to $206 million in the same period in the prior year. These increases are primarily related to the acquisition of Center Parcs Group (“Center Parcs UK”) in the third quarter of 2015, as well as a strong first quarter at the Paradise Island Holdings Limited (“Atlantis”) due to the timing of Easter in the current year.

Investment and other revenue and investment and other expense

Investment and other revenue includes management fees, leasing fees, development fees, interest income and other non-rental revenue. Investment and other revenue decreased by $34 million for the three months ended March 31, 2016 as compared to the same period in the prior year. This decrease was primarily due to dividend income from Canary Wharf prior to the joint venture transaction in the first quarter of 2015 of $15 million and preferred share dividends from CXTD of $11 million.

Interest expense

Interest expense increased by $42 million for the three months ended March 31, 2016 as compared to the same period in the prior year. This was due to the assumption of debt obligations as a result of acquisition activity and through incremental debt raised from temporary drawdowns on our credit facilities, as well as the issuance of convertible preferred shares to source the capital required for acquisitions.

General and administrative expense

General and administrative expense increased by $21 million for the three months ended March 31, 2016 as compared to the same period in the prior year. The increase was primarily attributable to operating costs of newly acquired entities, including Associated Estates, Center Parcs UK, and portfolios of office assets in Brazil and self-storage assets in the U.S. In addition, we recorded transaction expenses during the first quarter of 2016, primarily related to the acquisition of the self-storage portfolio and a Brazilian office portfolio, of $16 million.

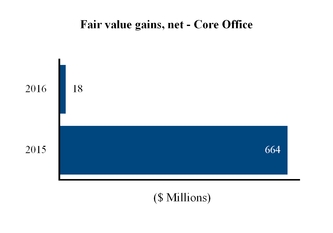

Fair value gains, net

While we measure and record our commercial properties and developments using valuations prepared by management in accordance with our policy, external appraisals and market comparables, when available, are used to support our valuations.

|

| |

| |

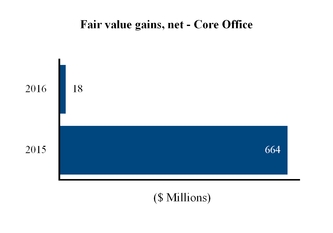

Fair value gains, net for our Core Office sector of $18 million were recognized in the three months ended March 31, 2016. These gains primarily related to properties in New York, Vancouver and Sydney as a result of leasing and transaction activity, including a fair value gain realized on the disposition of Royal Centre during the first quarter of 2016. These gains were offset by fair value losses on energy-dependent markets, including Houston and Calgary.

The prior year included significant fair value gains in New York and Sydney, mainly as a result of cash flow changes, based on leases signed during the quarter and some discount and capitalization rate compression to reflect improvements in the office markets in the impacted regions. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

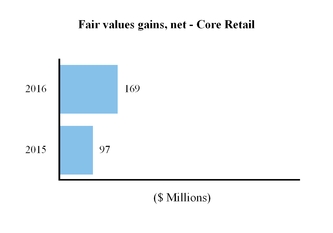

| |

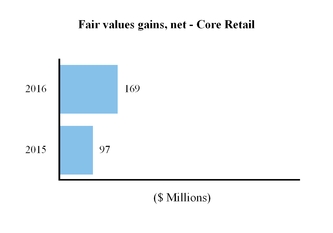

| | Fair value gains, net for the Core Retail segment relate to the appreciation of our warrants in GGP due to an increase in the market price of the underlying shares during the three months ended March 31, 2016 and 2015. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

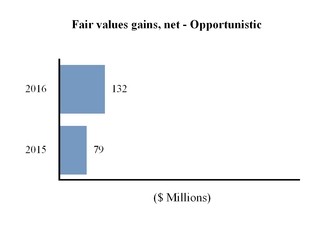

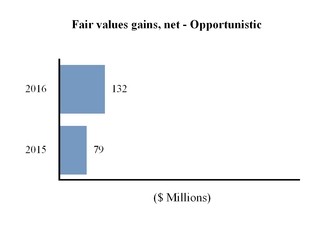

| | Fair value gains, net for the Opportunistic segment of $132 million were recognized in the three months ended March 31, 2016, primarily related to our multifamily portfolio, due to increases in rental rates, resulting from renovation work that has been completed to date. Additionally, in our opportunistic office portfolio, we have seen improved market conditions in certain markets in the United States and London; and in our industrial portfolio, particularly in select markets in the U.S. and Germany as a result of improved leasing. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

In addition, for the three months ended March 31, 2016, we recorded fair value gains, net of $18 million (2015 - fair value loss, net of $12 million), primarily related to mark-to-market adjustments of financial instruments and the settlement of derivative contracts during the quarter.

Share of net earnings from equity accounted investments

Our most material equity accounted investments are Canary Wharf in our Core Office sector, GGP in our Core Retail sector and the Diplomat hotel and our interest in the second value-add multifamily fund in our Opportunistic segment.

|

|

Our share of net earnings from equity accounted investments was $130 million for three months ended March 31, 2016, which represents a decrease of $134 million compared to the prior year. The decrease was driven by our Core Office sector as a result of fair value losses on certain derivative contracts within our equity accounted investments during the quarter, which contributed to an ($88) million fair value loss from equity accounted investments. Also contributing to the decrease in the Core Office are lower fair value gains on our equity accounted Core Office assets than were recognized in the prior period. These decreases were partially offset by an increase of fair value in our Opportunistic sector. The decrease in our Core Retail portfolio compared with the prior year period was primarily related to higher fair value gains in the prior year.

|

Reconciliation of Non-IFRS measures

As described in the “Performance Measures” section on page 3, our partnership uses non-IFRS measures to assess the performance of its operations. An analysis of the measures and reconciliation to IFRS measures is included below.

Commercial property NOI increased by $26 million to $509 million during the three months ended March 31, 2016 compared with $483 million during the same period in the prior year. The increase was primarily driven by new acquisitions across our portfolio offset by the disposition of mature assets, the deconsolidation of certain assets following partial dispositions thereof and the negative impact of foreign exchange.

Hospitality NOI increased by $63 million to $127 million during the three months ended March 31, 2016 compared with $64 million during the same period in the prior year. This increase is primarily due to the acquisition of Center Parcs UK and strong performance at the Atlantis as a result of the timing of the Easter holiday.

The following table reconciles NOI to net income for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Commercial property revenue | $ | 820 |

| $ | 810 |

|

| Direct commercial property expense | (311 | ) | (327 | ) |

| Commercial property NOI | 509 |

| 483 |

|

| Hospitality revenue | 392 |

| 270 |

|

| Direct hospitality expense | (265 | ) | (206 | ) |

| Hospitality NOI | 127 |

| 64 |

|

| Total NOI | 636 |

| 547 |

|

| Investment and other revenue | 35 |

| 69 |

|

| Share of net earnings from equity accounted investments | 130 |

| 264 |

|

| Interest expense | (416 | ) | (374 | ) |

| Depreciation and amortization | (64 | ) | (36 | ) |

| General and administrative expense | (131 | ) | (110 | ) |

| Fair value gains, net | 337 |

| 828 |

|

| Income before taxes | 527 |

| 1,188 |

|

| Income tax expense | (87 | ) | (179 | ) |

| Net income | $ | 440 |

| $ | 1,009 |

|

| Net income attributable to non-controlling interests | 189 |

| 176 |

|

| Net income attributable to Unitholders | $ | 251 |

| $ | 833 |

|

The following table reconciles net income to FFO for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Net income | $ | 440 |

| $ | 1,009 |

|

| Add (deduct): | | |

| Fair value gains, net | (337 | ) | (828 | ) |

| Share of equity accounted fair value gains, net | 88 |

| (93 | ) |

| Depreciation and amortization of real estate assets | 59 |

| 31 |

|

| Income tax expense | 87 |

| 179 |

|

| Non-controlling interests in above items | (142 | ) | (122 | ) |

| FFO | $ | 195 |

| $ | 176 |

|

| Add (deduct): | | |

Depreciation and amortization of real-estate assets, net(1) | 6 |

| 5 |

|

Transaction costs, net(1) | 9 |

| — |

|

Gains/losses associated with non-investment properties, net(1) | (6 | ) | (11 | ) |

Net contribution from GGP warrants(2) | 13 |

| 11 |

|

| Company FFO | $ | 217 |

| $ | 181 |

|

| |

(1) | Presented net of non-controlling interests. |

| |

(2) | Represents incremental FFO that would have been attributable to the partnership’s share of GGP, if all outstanding warrants of GGP had been exercised on a cashless basis. It also includes the dilution adjustments to FFO as a result of the net settled warrants. |

FFO increased to $195 million during the three months ended March 31, 2016 compared with $176 million during the same period in the prior year. These increases were driven by acquisition activity since the prior period, including Associated Estates, an office portfolio in Brazil, a self-storage portfolio in the U.S., and Center Parcs UK, as well as positive same-property growth in our Core Office and Core Retail sectors. These increases are partially offset by the negative impact of foreign exchange rate fluctuations on our earnings from operations outside of the U.S.

Statement of Financial Position Highlights and Key Metrics

|

| | | | | | |

| (US$ Millions) | Mar. 31, 2016 |

| Dec. 31, 2015 |

|

| Investment properties | | |

| Commercial properties | $ | 40,298 |

| $ | 39,111 |

|

| Commercial developments | 2,901 |

| 2,488 |

|

| Equity accounted investments | 17,202 |

| 17,638 |

|

| Hospitality assets | 4,925 |

| 5,016 |

|

| Cash and cash equivalents | 1,237 |

| 1,035 |

|

| Assets held for sale | 1,254 |

| 805 |

|

| Total assets | 73,837 |

| 71,866 |

|

| Debt obligations | 31,128 |

| 30,526 |

|

| Liabilities associated with assets held for sale | 478 |

| 242 |

|

| Total equity | 31,299 |

| 30,933 |

|

| Equity attributable to Unitholders | $ | 21,829 |

| $ | 21,958 |

|

Equity per unit(1) | $ | 29.93 |

| $ | 30.09 |

|

(1) Assumes conversion of mandatorily convertible preferred shares. See page 11 for additional information.

As of March 31, 2016, we had $73,837 million in total assets, compared with $71,866 million at December 31, 2015. This $1,971 million increase reflects acquisition activity since the prior year, including the acquisition of a self-storage portfolio.

Our investment properties are comprised of commercial, operating, rent-producing properties and commercial developments including active sites and those in planning for future development and land. Commercial properties increased from $39,111 million at the end of 2015 to $40,298 million at March 31, 2016. The increase was largely due to the acquisition of our self-storage portfolio, as well as incremental capital spend to maintain or enhance properties and the impact of foreign exchange. This was offset by the full or partial disposition of certain assets during the year, and the reclassification of certain properties to assets held for sale.

Commercial developments consist of commercial property development sites, density rights and related infrastructure. The total fair value of development land and infrastructure was $2,901 million at March 31, 2016, an increase of $413 million from the balance at December 31, 2015. The increase is primarily attributable to additional capital spend on our active developments.

The following table presents the changes in investment properties from December 31, 2015 to March 31, 2016:

|

| | | | | | |

| Mar. 31, 2016 |

| (US$ Millions) | Commercial properties |

| Commercial developments |

|

| Commercial properties, beginning of period | $ | 39,111 |

| $ | 2,488 |

|

| Acquisitions | 1,105 |

| 79 |

|

| Capital expenditures | 106 |

| 198 |

|

| Dispositions | (28 | ) | (3 | ) |

| Fair value gains, net | 133 |

| 7 |

|

| Foreign currency translation | 560 |

| 6 |

|

| Reclassifications to assets held for sale and other changes | (689 | ) | 126 |

|

| Commercial properties, end of period | $ | 40,298 |

| $ | 2,901 |

|

Equity accounted investments, decreased by $436 million since December 31, 2015 primarily due to the reclassification of $363 million from equity accounted investments to assets held for sale, which includes half of our interest in the Potsdamer Platz estate in Berlin in our Core Office sector, a portfolio of hospitality assets in Germany, and fourteen industrial assets in the United States, as we intend to sell interests in these investments to third parties in the next 12 months.

The following table presents a roll-forward of changes in our equity accounted investments:

|

| | | |

| (US$ Millions) | Mar. 31, 2016 |

|

| Equity accounted investments, beginning of period | $ | 17,638 |

|

| Additions, net of disposals | (78 | ) |

| Share of net income | 130 |

|

| Distributions received | (78 | ) |

| Foreign exchange | (60 | ) |

| Reclassification to assets held for sale | (363 | ) |

| Other | 13 |

|

| Equity accounted investments, end of period | $ | 17,202 |

|

Hospitality assets decreased by $91 million since December 31, 2015, primarily as a result of depreciation expense during the first quarter of 2016 and the impact of foreign exchange related to our Center Parcs UK portfolio.

As of March 31, 2016, assets held for sale included three properties in our Core Office segment, half of our interest in the Potsdamer Platz estate, as well as a portfolio of hospitality assets in Germany, 14 industrial assets and 18 multifamily assets in the United States, as we intend to sell controlling interests in these properties to third parties in the next 12 months.

Our debt obligations increased to $31,128 million at March 31, 2016 from $30,526 million at December 31, 2015. Contributing to this increase was the addition of property-specific borrowings related to acquisition activity during the period, as noted above, as well as the impact of foreign exchange. These increases were partially offset by the disposition of encumbered assets during the period and the repayment of corporate borrowings following the refinancing of our credit facility during the quarter.

The following table presents additional information on our partnership’s outstanding debt obligations:

|

| | | | | | |

| (US$ Millions) | Mar. 31, 2016 |

| Dec. 31, 2015 |

|

| Corporate borrowings | $ | 1,142 |

| $ | 1,632 |

|

| Funds subscription facilities | 1,583 |

| 1,594 |

|

| Non-recourse borrowings | | |

| Property-specific borrowings | 27,127 |

| 25,938 |

|

| Subsidiary borrowings | 1,276 |

| 1,362 |

|

| Total debt obligations | $ | 31,128 |

| $ | 30,526 |

|

| Current | 5,652 |

| 8,580 |

|

| Non-current | 25,476 |

| 21,946 |

|

| Total debt obligations | $ | 31,128 |

| $ | 30,526 |

|

The following table presents the components used to calculate equity attributable to Unitholders per unit:

|

| | | | | | |

| (US$ Millions, except unit information) | Mar. 31, 2016 |

| Dec. 31, 2015 |

|

| Total equity | $ | 31,299 |

| $ | 30,933 |

|

| Less: | | |

| Interests of others in operating subsidiaries and properties | 9,470 |

| 8,975 |

|

| Equity attributable to Unitholders | 21,829 |

| 21,958 |

|

| Mandatorily convertible preferred shares | 1,559 |

| 1,554 |

|

| Total equity attributable to unitholders | 23,388 |

| 23,512 |

|

| Partnership units | 711,131,721 |

| 711,412,925 |

|

| Mandatorily convertible preferred shares | 70,038,910 |

| 70,038,910 |

|

| Total partnership units | 781,170,631 |

| 781,451,835 |

|

| Equity attributable to unitholders per unit | $ | 29.93 |

| $ | 30.09 |

|

Equity attributable to Unitholders was $21,829 million at March 31, 2016, a decrease of $129 million from the balance at December 31, 2015. Assuming the conversion of mandatorily convertible preferred shares, equity attributable to unitholders decreased to $29.93 per unit at March 31, 2016 from $30.09 per unit at December 31, 2015. The decrease was a result of distributions from our investments during the period, offset by fair value gains and income from equity accounted investments.

Interests of others in operating subsidiaries and properties was $9,470 million at March 31, 2016, an increase of $495 million from the balance of $8,975 million at December 31, 2015. The increase was primarily a result of the acquisition of new investments through Brookfield

Asset Management-sponsored funds in which the partnership is a limited partner and additional closes on the second opportunity fund reducing our interests therein.

SUMMARY OF QUARTERLY RESULTS

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2016 | 2015 | 2014 |

| (US$ Millions, except per unit information) | Q1 |

| Q4 |

| Q3 |

| Q2 |

| Q1 |

| Q4 |

| Q3 |

| Q2 |

|

| Revenue | $ | 1,247 |

| $ | 1,267 |

| $ | 1,267 |

| $ | 1,170 |

| $ | 1,149 |

| $ | 1,070 |

| $ | 1,098 |

| $ | 1,243 |

|

| Direct operating costs | 576 |

| 573 |

| 573 |

| 504 |

| 533 |

| 524 |

| 505 |

| 533 |

|

| Net income | 440 |

| 1,157 |

| 435 |

| 1,165 |

| 1,009 |

| 1,595 |

| 1,043 |

| 1,289 |

|

| Net income attributable to unitholders | 251 |

| 863 |

| 193 |

| 1,026 |

| 833 |

| 1,492 |

| 978 |

| 892 |

|

| Net income per share attributable to unitholders - basic | $ | 0.32 |

| $ | 1.10 |

| $ | 0.25 |

| $ | 1.31 |

| $ | 1.06 |

| $ | 2.09 |

| $ | 1.37 |

| $ | 1.31 |

|

| Net income per share attributable to unitholders - diluted | $ | 0.32 |

| $ | 1.06 |

| $ | 0.25 |

| $ | 1.26 |

| $ | 1.02 |

| $ | 1.97 |

| $ | 1.33 |

| $ | 1.30 |

|

Revenue varies from quarter to quarter due to acquisitions and dispositions of commercial and other income producing assets, changes in occupancy levels, as well as the impact of leasing activity at market net rents. In addition, revenue also fluctuates as a result of changes in foreign exchange rates and seasonality. Seasonality primarily affects our retail assets, wherein the fourth quarter exhibits stronger performance in conjunction with the holiday season. In addition, our North American hospitality assets generally have stronger performance in the winter and spring months compared to the summer and fall months, while our European hospitality assets exhibit the strongest performance during the summer months. Fluctuations in our net income is also impacted by the fair value of properties in the period to reflect changes in valuation metrics driven by market conditions or property cash flows.

SEGMENT PERFORMANCE

Our operations are organized into four operating segments which include Core Office, Core Retail, Opportunistic and Corporate.

The following table presents FFO by segment for comparison purposes:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Core Office | $ | 144 |

| $ | 140 |

|

| Core Retail | 103 |

| 88 |

|

| Opportunistic | 64 |

| 67 |

|

| Corporate | (116 | ) | (119 | ) |

| FFO | $ | 195 |

| $ | 176 |

|

The following table presents equity attributable to Unitholders by segment as of March 31, 2016 and December 31, 2015:

|

| | | | | | |

| (US$ Millions) | Mar. 31, 2016 |

| Dec. 31, 2015 |

|

| Core Office | $ | 15,884 |

| $ | 15,984 |

|

| Core Retail | 8,750 |

| 8,579 |

|

| Opportunistic | 4,233 |

| 4,251 |

|

| Corporate | (7,038 | ) | (6,856 | ) |

| Total | $ | 21,829 |

| $ | 21,958 |

|

Core Office

Our Core Office segment consists of interests in 153 office properties totaling over 101 million square feet, which are located primarily in the world’s leading commercial markets such as New York, London, Sydney, Toronto and Berlin among others and consists primarily of our 100% common share interest in BPO and our 50% joint venture interest in Canary Wharf.

The following table presents FFO and net income attributable to Unitholders in our Core Office segment for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| FFO | $ | 144 |

| $ | 140 |

|

| Net income attributable to Unitholders | 83 |

| 794 |

|

FFO from our Core Office segment was $144 million for the three months ended March 31, 2016 as compared to $140 million in the same period in the prior year. This increase is primarily related to the FFO contribution from same-property growth in our portfolio, offset by the decrease of FFO contribution following the full or partial disposition of mature assets since March 31, 2015.

Net income attributable to Unitholders decreased by $711 million to $83 million during the three months ended March 31, 2016 as compared to $794 million during the same period in 2015. The decrease was primarily a result of higher fair value gains recorded in the prior period due to the strengthening of market conditions and leasing during the period primarily in New York, London and Sydney and a gain upon contribution of our prior 22% interest in Canary Wharf to our joint venture with QIA.

The following table presents key operating metrics for our Core Office portfolio as at and for the three months ended March 31, 2016 and 2015:

|

| | | | | | | | | | | | |

| | Consolidated | Unconsolidated |

| (US$ Millions, except where noted) | Mar. 31, 2016 |

| Mar. 31, 2015 |

| Mar. 31, 2016 |

| Mar. 31, 2015 |

|

| Total portfolio: | | | | |

NOI(1) | $ | 283 |

| $ | 313 |

| $ | 86 |

| $ | 74 |

|

| Number of properties | 86 |

| 102 |

| 67 |

| 35 |

|

| Leasable square feet (in thousands) | 54,939 |

| 60,367 |

| 26,792 |

| 18,671 |

|

| Occupancy | 91.1 | % | 91.6 | % | 93.8 | % | 95.7 | % |

In-place net rents (per square foot)(2) | $ | 27.74 |

| $ | 27.91 |

| $ | 42.38 |

| $ | 46.50 |

|

| Same-property: | | | | |

NOI(1,2) | $ | 270 |

| $ | 248 |

| $ | 46 |

| $ | 45 |

|

| Number of properties | 73 |

| 73 |

| 9 |

| 9 |

|

| Leasable square feet (in thousands) | 53,522 |

| 53,446 |

| 8,150 |

| 8,141 |

|

| Occupancy | 91.6 | % | 91.0 | % | 94.4 | % | 95.5 | % |

In-place net rents (per square foot)(2) | $ | 27.88 |

| $ | 26.61 |

| $ | 48.05 |

| $ | 43.36 |

|

(1) NOI for unconsolidated properties is presented on a proportionate basis, representing the Unitholders’ interest in the property.

(2) Prior period presented using the March 31, 2016 exchange rate.

NOI from our consolidated properties decreased to $283 million during the three months ended March 31, 2016 from $313 million during the same period in 2015. This decrease was primarily due to the negative impact of foreign exchange and the partial disposition and deconsolidation of the eight assets contributed to the D.C. Fund, as well as dispositions in Boston, Seattle, Vancouver, Melbourne and Toronto, offset by the incremental NOI contribution from new leases, primarily in Downtown New York.

Same-property NOI for our consolidated properties for the three months ended March 31, 2016 compared with the same period in the prior year increased by $22 million to $270 million. This increase was primarily the result of increased occupancy and higher in-place net rents, predominately in our New York, Washington, D.C., Los Angeles and London properties.

NOI from our unconsolidated properties, which is presented on a proportionate basis, increased by $12 million to $86 million during the three months ended March 31, 2016, compared to $74 million during the period in the prior year. This increase primarily reflects the inclusion of Canary Wharf for a full quarter. Occupancy rates decreased to 93.8% from 95.7% primarily as a result of the acquisition of a portfolio in Berlin, where occupancy is lower than in the remainder of the unconsolidated portfolio.

The following table presents certain key operating metrics related to leasing activity in our Core Office segment for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Total portfolio |

| (US$ Millions, except where noted) | Mar. 31, 2016 |

| Mar. 31, 2015 |

|

| Leasing activity (square feet in thousands) | | |

| New leases | 723 |

| 1,264 |

|

| Renewal leases | 781 |

| 622 |

|

| Total leasing activity | 1,504 |

| 1,886 |

|

| Average term (in years) | 8.2 |

| 8.6 |

|

Year one leasing net rents (per square foot)(1) | $ | 30.91 |

| $ | 33.70 |

|

Average leasing net rents (per square foot)(1) | 31.68 |

| 38.19 |

|

Expiring net rents (per square foot)(1) | 30.11 |

| 24.05 |

|

Estimated market net rents for similar space (per square foot)(1) | 39.60 |

| 39.26 |

|

| Tenant improvement and leasing costs (per square foot) | 22.43 |

| 72.63 |

|

(1) Presented using normalized foreign exchange rates, using the March 31, 2016 exchange rate.

For the three months ended March 31, 2016, we leased approximately 1.5 million square feet at average in-place net rents of $31.68 per square foot. Approximately 48% of our leasing activity represented new leases. Our overall Core Office portfolio’s in-place net rents are currently 14% below market net rents, which gives us confidence that we will be able to increase our NOI in the coming years, as we sign new leases. For the three months ended March 31, 2016, tenant improvements and leasing costs related to leasing activity were $22.43 per square foot, compared to $72.63 per square foot in the prior year. The prior year included higher tenant improvements and leasing costs primarily related to Brookfield Place in New York, where leasing costs tend to be higher.

We calculate net rent as the annualized amount of cash rent receivable from leases on a per square foot basis including tenant expense reimbursements, less operating expenses being incurred for that space, excluding the impact of straight-lining rent escalations or amortization of free rent periods. This measure represents the amount of cash, on a per square foot basis, generated from leases in a given period.

The following table presents fair value gains (losses) from consolidated and unconsolidated investments in our Core Office segment for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Consolidated properties | $ | 18 |

| $ | 664 |

|

| Unconsolidated properties | (75 | ) | 110 |

|

| Total fair value (losses) gains, net | $ | (57 | ) | $ | 774 |

|

(1) Fair value gains for unconsolidated properties are presented on a proportionate basis, representing the Unitholders’ interest in the investment.

We recorded fair value (losses) gains, net of $(57) million in the three months ended March 31, 2016 as compared to $774 million in the same period in the prior year. The loss was driven by fair value losses on derivative contracts in Canary Wharf in the current period, partially offset by fair value gains in our New York and Vancouver office portfolios. The prior year included fair value gains in our U.S. and Australian office portfolio, mainly as a result of cash flow changes and discount and terminal capitalization rate compression, as well as a gain upon contributing our prior interest in Canary Wharf to our joint venture with QIA.

The key valuation metrics for commercial properties in our Core Office segment on a weighted-average basis are as follows:

|

| | | | | | | | | | | |

| | Mar. 31, 2016 | Dec. 31, 2015 |

| | Discount rate |

| Terminal capitalization rate |

| Investment horizon | Discount rate |

| Terminal capitalization rate |

| Investment horizon |

|

| Consolidated properties | | | | | | |

| United States | 6.8 | % | 5.6 | % | 12 | 6.9 | % | 5.7 | % | 12 |

|

| Canada | 6.2 | % | 5.7 | % | 10 | 6.1 | % | 5.5 | % | 10 |

|

| Australia | 7.8 | % | 6.2 | % | 10 | 7.6 | % | 6.2 | % | 10 |

|

| United Kingdom | 5.9 | % | 5.1 | % | 12 | 6.0 | % | 5.1 | % | 12 |

|

| Brazil | 9.3 | % | 7.5 | % | 10 | 9.3 | % | 7.5 | % | 10 |

|

| Unconsolidated properties | | | | | | |

| United States | 6.5 | % | 5.4 | % | 11 | 6.3 | % | 5.3 | % | 11 |

|

| Australia | 7.4 | % | 6.1 | % | 10 | 7.4 | % | 6.1 | % | 10 |

|

United Kingdom(1) | 5.1 | % | 5.1 | % | 10 | 4.9 | % | 5.2 | % | 10 |

|

| Germany | 8.1 | % | 4.7 | % | 10 | 8.1 | % | 4.7 | % | 10 |

|

| |

(1) | Certain properties in the United Kingdom accounted for under the equity method are valued using both discounted cash flow and yield models. For comparative purposes, the discount and terminal capitalization rates and investment horizon calculated under the discounted cash flow method are presented in the table above. |

The following table provides an overview of the financial position of our Core Office segment as at March 31, 2016 and December 31, 2015:

|

| | | | | | |

| (US$ Millions) | Mar. 31, 2016 |

| Dec. 31, 2015 |

|

| Investment properties | | |

| Commercial properties | $ | 25,392 |

| $ | 25,048 |

|

| Commercial developments | 1,822 |

| 1,627 |

|

| Equity accounted investments | 7,546 |

| 7,697 |

|

| Participating loan interests | 498 |

| 449 |

|

| Accounts receivable and other | 785 |

| 783 |

|

| Cash and cash equivalents | 596 |

| 430 |

|

| Assets held for sale | 272 |

| 506 |

|

| Total assets | $ | 36,911 |

| $ | 36,540 |

|

| Debt obligations | 14,407 |

| 13,818 |

|

| Capital securities | 1,186 |

| 1,151 |

|

| Accounts payable and other liabilities | 2,761 |

| 2,776 |

|

| Liabilities associated with assets held for sale | 60 |

| 105 |

|

| Non-controlling interests of others in operating subsidiaries and properties | 2,613 |

| 2,706 |

|

| Equity attributable to Unitholders | $ | 15,884 |

| $ | 15,984 |

|

Equity attributable to Unitholders decreased by $100 million to $15,884 million at March 31, 2016 from $15,984 million at December 31, 2015. The decrease was primarily a result of reinvesting the net proceeds from the sale of World Square Retail in Sydney and Royal Centre in Vancouver in our Opportunistic segment, as well as upfinancings within our Core Office portfolio.

Commercial properties totaled $25,392 million at March 31, 2016, compared to $25,048 million at December 31, 2015. The increase was primarily due to the positive impact of foreign exchange as well as incremental capital spent to maintain or enhance properties. These increases were partially offset by the reclassification of three properties to assets held for sale.

Commercial developments increased by $195 million between December 31, 2015 and March 31, 2016. The increase is as a result of incremental capital expenditures on existing commercial developments as well as acquisition activity during the period.

The following table summarizes the scope and progress of active developments in our Core Office segment as of March 31, 2016:

|

| | | | | | | | | | | | | | | | | | | |

| | Total |

| Proportionate |

| | | Cost | Loan |

| (Millions, except square feet in thousands) | square feet under construction (in 000’s) |

| square feet under construction (in 000’s) |

| Expected date of cash stabilization | Percent pre-leased |

| Total(1) |

| To-date |

| Total |

| Drawn |

|

| Office: | | | | | | | | |

| Brookfield Place East Tower, Calgary | 1,400 |

| 1,400 |

| Q3 2018 | 71 | % | C$ | 799 |

| C$ | 442 |

| C$ | 575 |

| C$ | 173 |

|

| L’Oréal Brazil Headquarters, Rio de Janeiro | 197 |

| 92 |

| Q3 2018 | 100 | % | R$ | 137 |

| R$ | 60 |

| R$ | — |

| R$ | — |

|

| Principal Place - Commercial, London | 621 |

| 621 |

| Q1 2020 | 69 | % | £ | 365 |

| £ | 216 |

| £ | 280 |

| £ | 116 |

|

London Wall Place, London(2) | 505 |

| 253 |

| Q2 2020 | 73 | % | £ | 190 |

| £ | 116 |

| £ | 137 |

| £ | 44 |

|

One Manhattan West, Midtown New York(2) | 2,117 |

| 1,186 |

| Q4 2020 | 25 | % | $ | 1,063 |

| $ | 227 |

| $ | 700 |

| $ | 34 |

|

| 100 Bishopsgate, London | 938 |

| 938 |

| Q4 2021 | 38 | % | £ | 802 |

| £ | 323 |

| £ | — |

| £ | — |

|

1 Bank Street, London(2) | 715 |

| 358 |

| Q1 2023 | 40 | % | £ | 247 |

| £ | 58 |

| £ | — |

| £ | — |

|

| Multifamily: | | | | | | | | |

Three Manhattan West, Midtown New York(2) | 587 |

| 329 |

| Q3 2018 | n/a |

| $ | 414 |

| $ | 235 |

| $ | 268 |

| $ | 68 |

|

Newfoundland, London(2) | 546 |

| 273 |

| Q4 2020 | n/a |

| £ | 242 |

| £ | 74 |

| £ | 152 |

| £ | — |

|

Principal Place - Residential, London(2) | 303 |

| 152 |

| n/a | n/a |

| £ | 181 |

| £ | 49 |

| £ | 122 |

| £ | — |

|

Shell Centre - Residential, London(2) | 529 |

| 132 |

| n/a | n/a |

| £ | 164 |

| £ | 57 |

| £ | 111 |

| £ | 8 |

|

| Total | 8,458 |

| 5,734 |

| | | | | | |

| |

(1) | Net of NOI earned during stabilization. |

| |

(2) | Presented on a proportionate basis at our ownership interest in each of these developments. |

The following table presents changes in our partnership’s equity accounted investments in the Core Office segment from December 31, 2015 to March 31, 2016:

|

| | | |

| (US$ Millions) | Mar. 31, 2016 |

|

| Equity accounted investments, beginning of period | $ | 7,697 |

|

| Additions, net of disposals and return of capital distributions | 73 |

|

| Share of net income, including fair value gains | 5 |

|

| Distributions received | (17 | ) |

| Foreign exchange | (49 | ) |

| Reclassification to assets held for sale | (166 | ) |

| Other | 3 |

|

| Equity accounted investments, end of period | $ | 7,546 |

|

Equity accounted investments decreased by $151 million since December 31, 2015 to $7,546 million at March 31, 2016. The decrease was primarily driven by the reclassification of half of our interest in the Potsdamer Platz estate in Berlin to assets held for sale.

At March 31, 2016, we classified three properties to assets held for sale as we intend to sell controlling interests in these properties to third parties in the next 12 months. The decrease in equity accounted investments since December 31, 2015 is driven by the sale of properties in Sydney and Vancouver that had been classified as assets held for sale.

Debt obligations increased from $13,818 million at December 31, 2015 to $14,407 million at March 31, 2016. This increase is the result of refinancing activity of property-level debt related to office properties and draw-downs on existing facilities to fund capital expenditures on existing properties.

The following table provides additional information on our outstanding capital securities – Core Office:

|

| | | | | | | | | |

| (US$ Millions) | Shares outstanding | Cumulative dividend rate |

| Mar. 31, 2016 |

| Dec. 31, 2015 |

|

| BPO Class AAA Preferred Shares: | | | | |

Series G(1) | 3,251,889 | 5.25 | % | $ | 81 |

| $ | 84 |

|

Series H(1) | 6,994,244 | 5.75 | % | 134 |

| 128 |

|

Series J(1) | 6,617,439 | 5.00 | % | 128 |

| 125 |

|

Series K(1) | 4,995,414 | 5.20 | % | 96 |

| 90 |

|

| BPO Class B Preferred Shares: | | | | |

Series 1(2) | 3,600,000 | 70% of bank prime |

| — |

| — |

|

Series 2(2) | 3,000,000 | 70% of bank prime |

| — |

| — |

|

| Capital Securities – Fund Subsidiaries | | | 747 |

| 724 |

|

| Total capital securities | | | $ | 1,186 |

| $ | 1,151 |

|

| |

(1) | BPY and its subsidiaries own 1,003,549, 1,000,000, 1,000,000, and 1,004,586 shares of Series G, Series H, Series J, and Series K Class AAA preferred shares of BPO as of March 31, 2016, respectively, which has been reflected as a reduction in outstanding shares of the BPO Class AAA Preferred Shares. |

(2) Class B, Series 1 and 2 capital securities - corporate are owned by Brookfield Asset Management. BPO has an offsetting loan receivable against these securities earning interest at 95% of bank prime.

We had $747 million of capital securities – fund subsidiaries outstanding at March 31, 2016 as compared to $724 million at December 31, 2015. Capital securities – fund subsidiaries includes $706 million (December 31, 2015 - $683 million) of equity interests in Brookfield DTLA Holdings LLC (“DTLA”) held by co-investors in the fund, which have been classified as a liability, rather than as non-controlling interest, as holders of these interests can cause DTLA to redeem their interests in the fund for cash equivalent to the fair value of the interests on October 15, 2023, and on every fifth anniversary thereafter. In addition, capital securities – fund subsidiaries also includes $41 million at March 31, 2016 (December 31, 2015 - $41 million) which represents the equity interests held by the partnership’s co-investor in the D.C. Fund which have been classified as a liability, rather than as non-controlling interest, due to the fact that on June 18, 2023, and on every second anniversary thereafter, the holders of these interests can redeem their interests in the D.C. Fund for cash equivalent to the fair value of the interests.

Reconciliation of Non-IFRS Measures – Core Office

The key components of NOI in our Core Office segment are presented below:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Commercial property revenue | $ | 514 |

| $ | 569 |

|

| Direct commercial property expense | (231 | ) | (256 | ) |

| Total NOI | $ | 283 |

| $ | 313 |

|

The following table reconciles Core Office NOI to net income for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Same-property net operating income | $ | 270 |

| $ | 248 |

|

| Currency variance | — |

| 10 |

|

| Net operating income related to acquisitions and dispositions | 13 |

| 55 |

|

| Total NOI | 283 |

| 313 |

|

| Investment and other revenue | 20 |

| 40 |

|

| Share of net earnings from equity accounted investments | 5 |

| 149 |

|

| Interest expense | (167 | ) | (175 | ) |

| Depreciation and amortization | (4 | ) | (4 | ) |

| General and administrative expense | (35 | ) | (37 | ) |

| Fair value gains, net | 18 |

| 664 |

|

| Income before taxes | 120 |

| 950 |

|

| Income tax expense | (21 | ) | (115 | ) |

| Net income | 99 |

| 835 |

|

| Net income attributable to non-controlling interests | 16 |

| 41 |

|

| Net income attributable to Unitholders | $ | 83 |

| $ | 794 |

|

The following table reconciles Core Office net income to FFO for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| Net income | $ | 99 |

| $ | 835 |

|

| Add (deduct): | | |

| Fair value gains, net | (18 | ) | (664 | ) |

| Share of equity accounted fair value losses (gains), net | 75 |

| (110 | ) |

| Income tax expense | 21 |

| 115 |

|

| Non-controlling interests in above items | (33 | ) | (36 | ) |

| FFO | $ | 144 |

| $ | 140 |

|

Core Retail

Our Core Retail segment consists of 128 regional malls and urban retail properties containing 126 million square feet in the United States through our 29% interest in GGP (34% on a fully-diluted basis, assuming all outstanding warrants are exercised). Our investment in GGP is accounted for under the equity method.

The following table presents FFO and net income attributable to Unitholders in our Core retail segment for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |

| (US$ Millions) | 2016 |

| 2015 |

|

| FFO | $ | 103 |

| $ | 88 |

|

| Net income attributable to Unitholders | 210 |

| 147 |

|

FFO earned in our Core Retail platform for the three months ended March 31, 2016 was $103 million compared to $88 million for the same period in the prior year. FFO increased due to improved operational performance as a result of rental step-ups, leasing spreads and tenant recharges.

Net income attributable to Unitholders increased by $63 million to $210 million for the three months ended March 31, 2016 as compared to $147 million during the same period in the prior year. The increase in net income attributable to Unitholders is primarily due to greater mark-to-market adjustments on our investment in GGP warrants, as a result of a higher increase in GGP’s share price in the current quarter than in the comparative quarter in the prior year.

The following table presents key operating metrics in our Core Retail portfolio as at and for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Unconsolidated |

| (US$ Millions, except where noted) | Mar. 31, 2016 |

| Mar. 31, 2015 |

|

| NOI: | | |

Total portfolio(1) | $ | 169 |

| $ | 161 |

|

Same-property(1) | 166 |

| 159 |

|

| Number of malls and urban retail properties | 128 |

| 129 |

|

| Leasable square feet (in thousands) | 125,806 |

| 126,973 |

|

Occupancy(2) | 95.2 | % | 94.1 | % |

In-place net rents (per square foot)(2) | 61.25 |

| 60.21 |

|

Tenant Sales (per square foot)(2) | 584 |

| 594 |

|

(1) NOI for unconsolidated properties is presented on a proportionate basis, representing the Unitholders’ interest in the investments.

(2) Presented on a same-property basis.

NOI, which is presented on a proportionate basis, increased to $169 million from $161 million in the prior year, where improved performance was partially offset by dispositions, including partial interests in a marquee mall in Honolulu. On a same-property basis, NOI on unconsolidated properties increased by $7 million to $166 million from $159 million due to increases in rental rates and higher tenant sales in our United States portfolio.

The results of our operations are primarily driven by changes in occupancy and in-place rental rates. The following table presents new and renewal leases with commencement dates in 2016 and 2017 compared to expiring leases for the prior tenant in the same suite, for leases where the downtime between new and previous tenant is less than 24 months, among other metrics.

|

| | | | | | |

| | Total Portfolio |

| (US$ Millions, except where noted) | Mar. 31, 2016 |

| Mar. 31, 2015 |

|

| Number of leases | 922 |

| 969 |

|

| Leasing activity (square feet in thousands) | 2,832 |

| 3,038 |

|

| Average term in years | 6.8 |

| 6.1 |

|

Initial rent per square foot(1) | $ | 67.58 |

| $ | 66.20 |

|

Expiring rent per square foot(2) | 60.09 |

| 59.65 |

|

| Initial rent spread per square foot | 7.49 |

| 6.55 |

|

| % change | 12.5 | % | 11.0 | % |

| Tenant allowances and leasing costs | 33 |

| 40 |

|

(1) Represents initial rent over the term consisting of base minimum rent and common area costs.

(2) Represents expiring rent at end of lease consisting of base minimum rent and common area costs.

Through March 31, 2016, we leased approximately 2.8 million square feet at initial rents approximately 12.5% higher than expiring net rents on a suite-to-suite basis. Additionally, for the three months ended March 31, 2016, tenant allowances and leasing costs related to leasing activity were $33 million compared to $40 million during the same period in the prior year.

Our Core Retail portfolio occupancy rate at March 31, 2016 was 95.2%, up 1.1% from the same period of the prior year. In our Core Retail segment, we use in-place rents as a measure of leasing performance. In-place rents are calculated on a cash basis and consist of base minimum rent, plus reimbursements of common area costs, and real estate taxes. In-place rents increased to $61.25 at March 31, 2016 from $60.21 at March 31, 2015, as a result of strong leasing activity across our portfolio.

We recorded total fair value gains, net of $107 million and $59 million in our retail segment for the three months ended March 31, 2016 and 2015, respectively. The increase is primarily attributable to appreciation of the GGP warrants as a result of an increase in GGP’s stock price.

The key valuation metrics of these properties in our Core Retail segment on a weighted-average basis are presented in the following table. The valuations are most sensitive to changes in the discount rate and timing or variability of cash flows.

|

| | | | | | | | | | | |

| | Mar. 31, 2016 | Dec. 31, 2015 |

| | Discount rate |

| Terminal capitalization rate |

| Investment horizon | Discount rate |

| Terminal capitalization rate |

| Investment horizon |

|

| Unconsolidated properties | | | | | | |

| United States | 7.4 | % | 5.8 | % | 10 | 7.4 | % | 5.8 | % | 10 |

|

Equity attributable to Unitholders in the Core Retail segment increased by $171 million at March 31, 2016 from December 31, 2015 due to the net income attributable to Unitholders and the increase in the value of GGP warrants discussed above.

The following table presents an overview of the financial position of our Core Retail segment as at March 31, 2016 and December 31, 2015:

|

| | | | | | |

| (US$ Millions) | Mar. 31, 2016 |

| Dec. 31, 2015 |

|

| Equity accounted investments | $ | 7,217 |

| $ | 7,215 |

|

| GGP warrants | 1,533 |

| 1,364 |

|

| Total assets | $ | 8,750 |

| $ | 8,579 |

|

| Total liabilities | — |

| — |

|

| Equity attributable to Unitholders | $ | 8,750 |

| $ | 8,579 |

|

Equity accounted investments increased by $2 million driven by positive net income including valuation gains on the GGP warrants mentioned above, partially offset by dividends received from GGP during the current period.

The following table presents a roll-forward of our partnership’s equity accounted investments from December 31, 2015 to March 31, 2016:

|

| | | |

| (US$ Millions) | Mar. 31, 2016 |

|

| Equity accounted investments, beginning of period | $ | 7,215 |

|

| Share of net income, including fair value gains | 41 |

|

| Distributions received | (49 | ) |

| Other | 10 |

|

| Equity accounted investments, end of period | $ | 7,217 |

|

Reconciliation of Non-IFRS Measures – Core Retail

The following table reconciles Core Retail NOI to net income for the three months ended March 31, 2016 and 2015:

|

| | | | | | |

| | Three months ended Mar. 31, | |