|

| | | |

| REPORT TO SHAREHOLDERS | | |

| Year ended December 31, 2019 | |

| | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

| | | | |

| | | | |

| Table of Contents | | | |

| | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | |

| | | | |

| | | | |

Basis of Presentation

The following Management's Discussion and Analysis ("MD&A") of the financial and operating results of Pembina Pipeline Corporation ("Pembina" or the "Company") is dated February 27, 2020, and is supplementary to, and should be read in conjunction with, Pembina's audited consolidated financial statements as at and for the year ended December 31, 2019 ("Consolidated Financial Statements"). The Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards ("IFRS"), using the accounting policies described in Note 4 of the Consolidated Financial Statements. All dollar amounts contained in this MD&A are expressed in Canadian dollars unless otherwise noted. Additional information about Pembina filed with Canadian and U.S. securities commissions, including quarterly and annual reports, annual information forms (filed with the U.S. Securities and Exchange Commission (the "SEC") under Form 40-F) and management information circulars, can be found online at www.sedar.com, www.sec.gov and through Pembina's website at www.pembina.com.

Abbreviations

For a list of abbreviations that may be used in this MD&A, refer to the Abbreviations section of this MD&A.

Non-GAAP Financial Measures

Pembina has identified certain operating and financial performance measures that management believes provide meaningful information in assessing Pembina's underlying performance. Readers are cautioned that these measures do not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other entities. Refer to the "Non-GAAP Measures" section of this MD&A for a list and description, including reconciliations to the most directly comparable GAAP measure, of such non-GAAP measures.

Risk Factors and Forward-Looking Information

The Company’s financial and operational performance is potentially affected by a number of factors, including, but not limited to, the factors described within the "Risk Factors" and "Forward-Looking Statements & Information" sections of this MD&A. This MD&A contains forward-looking statements based on Pembina’s current expectations, estimates, projections and assumptions. This information is provided to assist readers in understanding the Company’s future plans and expectations and may not be appropriate for other purposes.

1 Pembina Pipeline Corporation 2019 Annual Report

1. ABOUT PEMBINA

Pembina is a leading transportation and midstream service provider that has been serving North America's energy industry for 65 years. Pembina owns an integrated system of pipelines that transport various hydrocarbon liquids and natural gas products produced primarily in western Canada. The Company also owns gas gathering and processing facilities; an oil and natural gas liquids infrastructure and logistics business; is growing an export terminals business; and is currently constructing a petrochemical facility to convert propane into polypropylene. Pembina's integrated assets and commercial operations along the majority of the hydrocarbon value chain allow it to offer a full spectrum of midstream and marketing services to the energy sector. Pembina is committed to identifying additional opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure that would extend Pembina's service offering even further along the hydrocarbon value chain. These new developments will contribute to ensuring that hydrocarbons produced in the WCSB and the other basins where Pembina operates can reach the highest value markets throughout the world.

Purpose of Pembina:

To be the leader in delivering integrated infrastructure solutions connecting global markets;

| |

| • | Customers choose us first for reliable and value-added services; |

| |

| • | Investors receive sustainable industry-leading total returns; |

| |

| • | Employees say we are the 'employer of choice' and value our safe, respectful, collaborative and fair work culture; and |

| |

| • | Communities welcome us and recognize the net positive impact of our social and environmental commitment. |

Kinder Acquisition

On December 16, 2019, Pembina completed its acquisition of Kinder Morgan Canada Limited ("Kinder Morgan Canada") by way of a plan of arrangement pursuant to Section 193 of the Business Corporations Act (Alberta) and the U.S. portion of the Cochin Pipeline system from Kinder Morgan, Inc. (collectively the "Kinder Acquisition"). The total consideration paid in respect of the Kinder Acquisition was $4.25 billion including $2.0 billion in cash, net of cash received, $1.71 billion of common shares and $536 million of class A preferred shares.

Upon closing of the Kinder Acquisition, Pembina announced it would increase its monthly dividend by $0.01 per common share, commencing with the dividend paid on February 14, 2020.

Pembina Pipeline Corporation 2019 Annual Report 2

2. FINANCIAL & OPERATING OVERVIEW

Consolidated Financial Overview Three Months Ended December 31

Results of Operations |

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

| Revenue | 1,754 |

| 1,726 |

| 28 |

| 2 |

|

Net revenue(1) | 837 |

| 706 |

| 131 |

| 19 |

|

| Gross profit | 603 |

| 663 |

| (60 | ) | (9 | ) |

| Earnings | 145 |

| 368 |

| (223 | ) | (61 | ) |

Earnings per common share – basic (dollars) | 0.21 |

| 0.66 |

| (0.45 | ) | (68 | ) |

Earnings per common share – diluted (dollars) | 0.21 |

| 0.66 |

| (0.45 | ) | (68 | ) |

| Cash flow from operating activities | 728 |

| 674 |

| 54 |

| 8 |

|

Cash flow from operating activities per common share – basic (dollars)(1) | 1.41 |

| 1.33 |

| 0.08 |

| 6 |

|

Adjusted cash flow from operating activities(1) | 576 |

| 543 |

| 33 |

| 6 |

|

Adjusted cash flow from operating activities per common share – basic (dollars)(1) | 1.11 |

| 1.07 |

| 0.04 |

| 4 |

|

| Capital expenditures | 429 |

| 356 |

| 73 |

| 21 |

|

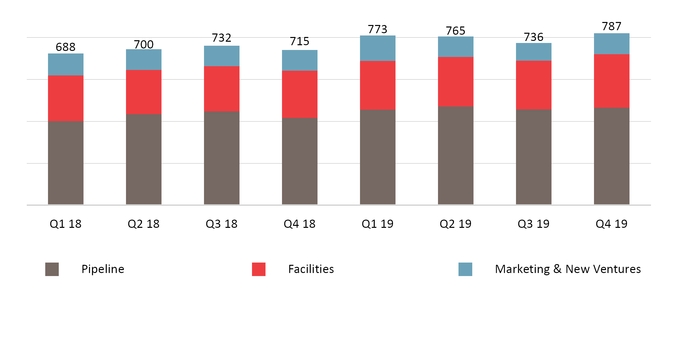

Adjusted EBITDA(1) | 787 |

| 715 |

| 72 |

| 10 |

|

Total volume (mboe/d)(2) | 3,577 |

| 3,453 |

| 124 |

| 4 |

|

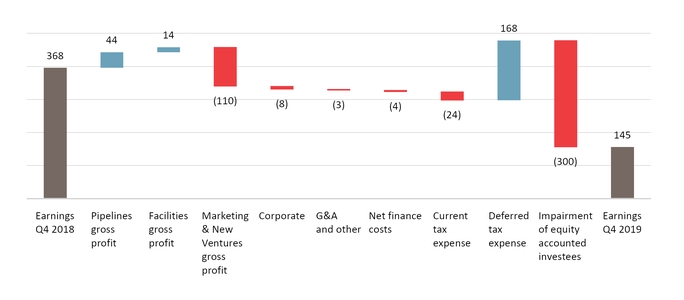

Bridge Analysis of Earnings ($ millions)

Results Overview

Earnings in the fourth quarter of 2019 were positively impacted by higher gross profit in both Pipelines and Facilities from new assets placed into service and additional assets from the Kinder Acquisition. Marketing & New Ventures benefited from higher margins on crude and the impact of IFRS 16, more than offset by unrealized losses on commodity-related derivatives due to contracts maturing in the period, and increasing forward prices for crude and NGL compared to contract positions. In addition, Pembina recorded an impairment charge of $300 million ($220 million net of tax) on its convertible preferred interest in Ruby. The impairment charge was the result of an assessment triggered by pending contract expirations in a business environment in the Rockies Basin that remains challenged. Deferred tax expense decreased due to the deferred tax recovery on the Ruby impairment and the prior year partnership earnings that are included in current tax expense in the current period.

3 Pembina Pipeline Corporation 2019 Annual Report

|

| | |

| Changes in Results for the Three Months Ended December 31 |

| Revenue | ▲ | $28 million increase, primarily driven by new assets placed into service (see the "Projects and New Developments" sections), higher deferred revenue recognized during the fourth quarter of 2019 and the contribution from new assets following the Kinder Acquisition, partially offset by lower marketing revenues due to lower NGL volumes and lower prices for propane and crude. |

| Operating expenses | ▼ | $12 million increase due to higher labour and power costs driven by growth in the business, costs associated with the reclamation of previous site contamination and the contribution from new assets following the Kinder Acquisition, partially offset by savings following Redwater Co-generation going into service in March 2019. |

| Share of profit from equity accounted investees | ▼ | $41 million decrease, largely due to lower propane margins at Aux Sable resulting from a decrease in sales prices, combined with a narrower Chicago-AECO natural gas differential resulting in lower interruptible volumes and tolls on Alliance. |

| Realized gain on commodity-related derivatives | ● | Consistent realized gains relating to the settlement of NGL based derivatives. |

| Unrealized loss (gain) on commodity-related derivatives | ▼ | $112 million negative variance primarily due to crude and NGL contracts maturing in the period, and an increase in the forward price of crude and NGL which drove the associated derivative contracts into a loss position. |

| General & administrative and other expense | ● | Consistent with prior period as higher corporate general & administrative and other expenses in 2019, due to growth in the business and acquisition costs, were largely offset by project write-downs taken during the fourth quarter of 2018. |

| Impairment of investment in equity accounted investee | ▼ | Pembina recognized an impairment charge of $300 million (pre-tax) on its convertible preferred interest in Ruby. The impairment charge was the result of an assessment triggered by pending contract expirations in a business environment in the Rockies Basin that remains challenged. |

| Net finance costs | ● | Consistent with prior period as additional interest expense associated with higher average debt levels, combined with higher interest expense recognized on the adoption of IFRS 16, was largely offset by higher foreign exchanges gains. |

| Current tax expense | ▼ | $24 million increase primarily due to the growth in prior year partnership earnings as a result of expansions that are recognized in taxable income in the current year. |

| Deferred tax expense | ▲ | $168 million decrease in deferred expense primarily due to the recovery on the impairment discussed above and growth in partnership earnings in the prior year that are recognized in taxable income in the current year. |

| Earnings | ▼ | $223 million decrease from the fourth quarter of 2018 driven by the items noted above. |

| Cash flow from operating activities | ▲ | $54 million increase, primarily driven by an increase in operating results after adjusting for non-cash items, $34 million change in non-cash working capital and the $13 million impact from the adoption of IFRS 16, partially offset by the $35 million decrease in distributions from equity accounted investees and $36 million increase in taxes paid. |

Adjusted cash flow from operating activities(1) | ▲ | $33 million increase largely due to the same items impacting cash flow from operating activities, discussed above, net of the $34 million change in non-cash working capital and $24 million increase in current tax expense, partially offset by the $36 million increase in taxes paid. |

Adjusted EBITDA(1) | ▲ | $72 million increase due to new assets placed into service in Pipelines and Facilities, the $18 million contribution from new assets following the Kinder Acquisition, higher margins on crude in Marketing & New Ventures and the $16 million impact from the adoption of IFRS 16, partially offset by lower propane margins decreasing the contribution from Aux Sable and the narrower Chicago-AECO natural gas differential impacting Alliance. Included in adjusted EBITDA is $196 million (2018: $233 million) related to equity accounted investees. |

Total volume (mboe/d)(2) | ▲ | 124 mboe/d increase due to the larger asset base and temporary interruptible volumes on the Ruby Pipeline, partially offset by lower supply volumes at the Redwater Complex, combined with decreased volumes at Veresen Midstream. Revenue volumes include 368 mboe/d (2018: 332 mboe/d) related to equity accounted investees. |

|

| | | | | | |

| ▲ | Increase; | ▼ | Decrease; or | ● | No impact; | to earnings, adjusted EBITDA, cash flow from operations, adjusted cash flow from operating activities or total volumes. |

| |

(1) | Refer to the "Non-GAAP Measures" section. |

| |

(2) | Total revenue volumes. See "Abbreviations" for definition. Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section for further information. |

Pembina Pipeline Corporation 2019 Annual Report 4

Consolidated Financial Overview 12 Months Ended December 31

Results of Operations |

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

| Revenue | 7,230 |

| 7,351 |

| (121 | ) | (2 | ) |

Net revenue(1) | 3,120 |

| 2,836 |

| 284 |

| 10 |

|

| Gross profit | 2,433 |

| 2,327 |

| 106 |

| 5 |

|

| Earnings | 1,492 |

| 1,278 |

| 214 |

| 17 |

|

Earnings per common share – basic (dollars) | 2.66 |

| 2.28 |

| 0.38 |

| 17 |

|

Earnings per common share – diluted (dollars) | 2.65 |

| 2.28 |

| 0.37 |

| 16 |

|

| Cash flow from operating activities | 2,532 |

| 2,256 |

| 276 |

| 12 |

|

Cash flow from operating activities per common share – basic (dollars)(1) | 4.94 |

| 4.47 |

| 0.47 |

| 11 |

|

Adjusted cash flow from operating activities(1) | 2,234 |

| 2,154 |

| 80 |

| 4 |

|

Adjusted cash flow from operating activities per common share – basic (dollars)(1) | 4.36 |

| 4.27 |

| 0.09 |

| 2 |

|

| Capital expenditures | 1,645 |

| 1,226 |

| 419 |

| 34 |

|

Adjusted EBITDA(1) | 3,061 |

| 2,835 |

| 226 |

| 8 |

|

Total volume (mboe/d)(2) | 3,451 |

| 3,398 |

| 53 |

| 2 |

|

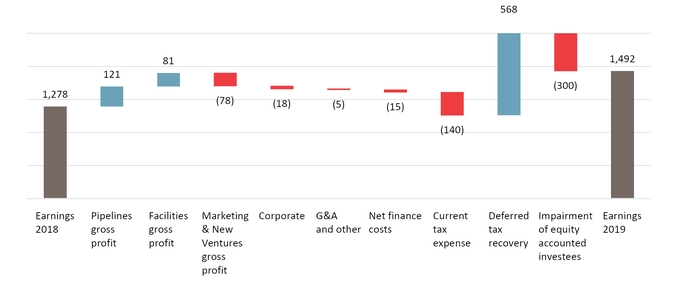

Bridge Analysis of Earnings ($ millions)

Results Overview

Earnings for the 12 months ended December 31, 2019 were positively impacted by higher gross profit in both Pipelines and Facilities from new assets placed into service. Facilities also benefited from higher propane and butane terminalling revenue. Marketing & New Ventures gross profit decreased largely due to lower share of profit in Aux Sable following a decrease in propane pricing and higher depreciation expense following the adoptions of IFRS 16. Higher current tax expense was offset by the deferred tax recovery, primarily due to the reduction in Alberta income tax rate from 12 percent to eight percent over a four-year period. Earnings were further impacted by the $300 million ($220 million net of tax) impairment charge on Pembina's convertible preferred interest in Ruby.

5 Pembina Pipeline Corporation 2019 Annual Report

|

| | |

| Changes in Results for the 12 Months Ended December 31 |

| Revenue | ▼ | $121 million decrease, primarily due to lower NGL and crude prices, partially offset by revenue associated with new assets placed into service (see the "Projects and New Developments" sections) and the contribution from new assets following the Kinder Acquisition, increased terminalling revenue, a $33 million arbitration award payment and increased recovery of operating expenses. |

| Operating expenses | ▼ | $51 million increase largely due to increases in power costs as a result of both increased power pool prices and higher consumption from new assets placed into service, combined with higher labour costs and repairs and maintenance due to the larger asset base. |

| Share of profit from equity accounted investees | ▼ | $41 million decrease largely due to lower propane margins at Aux Sable resulting from lower sales prices during 2019 and narrower Chicago-AECO natural gas differential impacting Alliance, partially offset by the impact of a $24 million finance gain reversal recorded in the first half of 2018. |

| Realized (gain) loss on commodity-related derivatives | ▲ | $84 million increase due to decreasing market prices creating a gain for NGL and crude-based derivatives settled during the period. |

| Unrealized loss (gain) on commodity-related derivatives | ▼ | $86 million increase in unrealized loss primarily due to crude and NGL contracts maturing in the period. |

| General & administrative and other expense | ● | Consistent with prior period as higher corporate general & administrative and other expenses in 2019, due to growth in the business and acquisition costs, were largely offset by project write-downs taken during 2018. |

| Impairment of investment in equity accounted investee | ▼ | Impairment charge of $300 million on Pembina's convertible preferred interest in Ruby, discussed above. |

| Net finance costs | ▼ | $15 million increase due to additional interest expense associated with higher average debt levels, combined with higher interest expense recognized on the adoption of IFRS 16, partially offset by higher foreign exchanges gains. |

| Current tax expense | ▼ | $140 million increase is primarily due to the growth in prior year partnership earnings, as a result of expansions that are recognized in taxable income in the current year, as well as higher earnings in the current year. |

| Deferred tax recovery | ▲ | $568 million decrease in deferred tax primarily due to the reduction in the Alberta tax rate from 12 percent to eight percent over a four-year period, the recovery on the impairment discussed above, and growth in the partnership earnings in the prior year that are recognized in taxable income in the current year. |

| Earnings | ▲ | $214 million increase compared to 2018, driven by the items noted above. |

| Cash flow from operating activities | ▲ | $276 million increase, primarily driven by an increase in operating results after adjusting for non-cash items, $189 million change in non-cash working capital, combined with the $56 million impact from the adoption of IFRS 16, partially offset by the $115 million increase in taxes paid and $47 million decrease in distributions from equity accounted investees. |

Adjusted cash flow from operating activities(1) | ▲ | $80 million increase largely due to the increase in cash flow from operating activities, combined with the $118 million increase in taxes paid, partially offset by the $140 million increase in current tax expense and the $189 million change in non-cash working capital. |

Adjusted EBITDA(1) | ▲ | $226 million increase primarily due to the contribution from new assets placed into service and the contribution from new assets following the Kinder Acquisition, combined with the impact from the realized gain on commodity-related derivatives, the recognition of variable revenues related to capital recoveries, increased terminalling and storage revenues and $61 million impact from the adoption of IFRS 16, partially offset by decreased NGL and crude market prices in Marketing & New Ventures. Included in adjusted EBITDA is $802 million (2018: $850 million) related to equity accounted investees. |

Total volume (mboe/d)(2) | ▲ | 53 mboe/d increase due to new assets placed into service, higher temporary interruptible volumes on the Ruby Pipeline, partially offset by lower supply volumes at the Redwater Complex. Revenue volumes include 332 mboe/d (2018: 313 mboe/d) related to equity accounted investees. |

|

| | | | | | |

| ▲ | Increase; | ▼ | Decrease; or | ● | No impact; | to earnings, adjusted EBITDA, cash flow from operations, adjusted cash flow from operating activities or total volumes. |

| |

(1) | Refer to the "Non-GAAP Measures" section. |

| |

(2) | Total revenue volumes. See "Abbreviations" for definition. Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section for further information. |

Pembina Pipeline Corporation 2019 Annual Report 6

3. SEGMENT RESULTS

Business Overview

The Pipelines Division provides customers with pipeline transportation, terminalling, storage and rail services in key market hubs in Canada and the United States for crude oil, condensate, natural gas liquids and natural gas. The division manages pipeline transportation capacity of 3.1 mmboe/d(1), above ground storage of 11 mmbbls(1) and rail terminalling capacity of approximately 145 mboe/d(1) within its conventional, oil sands and heavy oil, and transmission assets. The conventional assets include strategically located pipelines and terminalling hubs that gather and transport light and medium crudes, condensate and natural gas liquids from western Alberta and northeast British Columbia to the Edmonton, Alberta area for further processing or transportation on downstream pipelines. The oil sands and heavy oil assets transport heavy and synthetic oil produced within Alberta to the Edmonton area and offer associated storage, terminalling and rail services. The transmission assets transport natural gas, ethane and condensate throughout Canada and the United States on long haul pipelines linking various key market hubs. In addition, the Pipelines Division assets provide linkages between Pembina's upstream and downstream assets across North America, enabling integrated customer service offerings. Together, these assets supply product from hydrocarbon producing regions to refineries, fractionators and market hubs in Alberta, British Columbia, Illinois and California, as well as other regions throughout North America.

The Facilities Division includes infrastructure that provides Pembina's customers with natural gas, condensate and NGL services. Pembina's operated natural gas gathering and processing assets are strategically positioned in active, liquids-rich areas of the WCSB and Williston Basin and are integrated with the Company's other businesses. Pembina provides sweet and sour gas gathering, compression, condensate stabilization, and both shallow cut and deep cut gas processing services with a total capacity of approximately six(2) bcf/d for its customers. Virtually all of the condensate and NGL extracted through Canadian-based facilities are transported by Pembina's Pipelines Division. In addition all NGL transported along the Alliance Pipeline are extracted through Pembina operated Channahon Facility at the terminus. The Facilities Division includes approximately 326 mbpd(2) of NGL fractionation, 21 mmbbls(1) of cavern storage and associated pipeline and rail terminalling facilities and the Company is currently constructing a liquefied propane export facility on Canada's West Coast. These facilities are fully integrated with the Company's other divisions, providing customers with the ability to access a comprehensive suite of services to enhance the value of their hydrocarbons. In addition, Pembina owns a bulk marine export terminal in Vancouver, British Columbia.

The Marketing & New Ventures Division strives to maximize the value of hydrocarbon liquids and natural gas originating in the basins where the Company operates. Pembina seeks to create new markets, and further enhance existing markets, to support both the Company's and its customers' overall business interests. In particular, Pembina seeks to identify opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure. Pembina strives to increase producer netbacks and product demand to improve the overall competitiveness of the basins where the Company operates. Within the Marketing & New Ventures Division, Pembina undertakes value-added commodity marketing activities including buying and selling products (natural gas, ethane, propane, butane, condensate and crude oil), commodity arbitrage, and optimizing storage opportunities. The marketing business enters into contracts for capacity on both Pembina's and third-party infrastructure, handles proprietary and customer volumes and aggregates production for onward sale. The Marketing & New Ventures Division includes an integrated PDH/PP Facility being constructed by Pembina's joint venture, CKPC and the proposed Jordan Cove LNG project.

| |

(1) | Net capacity; excludes projects under development. |

| |

(2) | Net capacity. Includes Aux Sable capacity. The financial and operational results for Aux Sable are included in the Marketing & New Ventures Division; excludes projects under development. |

7 Pembina Pipeline Corporation 2019 Annual Report

Financial and Operational Overview by Division

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 | 12 Months Ended December 31 |

| 2019 | 2018 | 2019 | 2018 |

| ($ millions, except where noted) | Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted

EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted

EBITDA(2) |

|

| Pipelines | 2,667 |

| 345 |

| 467 |

| 2,529 |

| 301 |

| 417 |

| 2,566 |

| 1,376 |

| 1,854 |

| 2,521 |

| 1,255 |

| 1,703 |

|

| Facilities | 910 |

| 169 |

| 254 |

| 924 |

| 155 |

| 233 |

| 885 |

| 655 |

| 955 |

| 877 |

| 574 |

| 880 |

|

Marketing & New Ventures(3) | — |

| 93 |

| 120 |

| — |

| 203 |

| 109 |

| — |

| 406 |

| 423 |

| — |

| 484 |

| 409 |

|

| Corporate | — |

| (4 | ) | (54 | ) | — |

| 4 |

| (44 | ) | — |

| (4 | ) | (171 | ) | — |

| 14 |

| (157 | ) |

| Total | 3,577 |

| 603 |

| 787 |

| 3,453 |

| 663 |

| 715 |

| 3,451 |

| 2,433 |

| 3,061 |

| 3,398 |

| 2,327 |

| 2,835 |

|

| |

(1) | Pipelines and Facilities are revenue volumes which are physical volumes plus volumes recognized from take-or-pay commitments. Volumes are stated in mboe/d, with natural gas volumes converted to mboe/d from MMcf/d at a 6:1 ratio. |

| |

(2) | Refer to the "Non-GAAP Measures" section. |

| |

(3) | Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section for further information. |

Pembina Pipeline Corporation 2019 Annual Report 8

Pipelines

Financial Overview Three Months Ended December 31

Results of Operations |

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

Conventional revenue(1) | 354 |

| 303 |

| 51 |

| 17 |

|

Transmission revenue(1) | 60 |

| 34 |

| 26 |

| 76 |

|

Oil Sands revenue(1) | 73 |

| 66 |

| 7 |

| 11 |

|

Pipelines revenue(1) | 487 |

| 403 |

| 84 |

| 21 |

|

Operating expenses(1) | 137 |

| 120 |

| 17 |

| 14 |

|

| Share of profit from equity accounted investees | 61 |

| 74 |

| (13 | ) | (18 | ) |

| Depreciation and amortization included in operations | 66 |

| 56 |

| 10 |

| 18 |

|

| Gross profit | 345 |

| 301 |

| 44 |

| 15 |

|

Adjusted EBITDA(2) | 467 |

| 417 |

| 50 |

| 12 |

|

Volumes (mboe/d)(3) | 2,667 |

| 2,529 |

| 138 |

| 5 |

|

| Distributions from equity accounted investees | 80 |

| 88 |

| (8 | ) | (9 | ) |

|

| | |

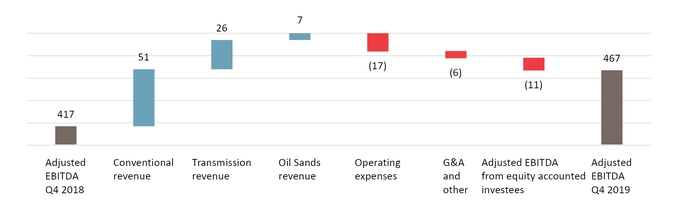

| Change in Results | | |

Conventional revenue(1) | ▲ | Increase due to revenues associated with Phase IV and V assets placed into service in December 2018, a timing difference in the recognition of deferred revenue, which was primarily recognized in the fourth quarter of 2019 compared to the third quarter of 2018, and increased recovery of operating expenses. |

Transmission revenue(1) | ▲ | Increase largely due to the contribution from the Cochin Pipeline following the Kinder Acquisition, combined with higher average tolls following the recontracting of Alberta Ethane Gathering System and return to normal operations on the Vantage Pipeline following a year-long third-party force majeure. |

Oil Sands revenue(1) | ▲ | Increase primarily due to contribution from the Edmonton Terminals following the Kinder Acquisition. |

Operating expenses(1) | ▼ | Increase primarily due to higher labour driven by growth in the business, costs associated with the reclamation of previous site contamination and the contribution from new assets following the Kinder Acquisition. |

| Share of profit from equity accounted investees | ▼ | Decrease largely due to lower interruptible volumes and tolls on the Alliance Pipeline, driven by a narrower AECO-Chicago natural gas differential. |

| Depreciation and amortization included in operations | ▼ | Increase in depreciation due to larger asset base as Pembina continued to expand its conventional pipeline system, placing Phase IV and V assets into service in December 2018 and the newly acquired assets from the Kinder Acquisition. |

| Distributions from equity accounted investees | ▼ | $80 million consists of $50 million (2018: $56 million) from Alliance and $30 million (2018: $31 million) from Ruby. |

Volumes (mboe/d)(3) | ▲ | Increase in revenue volumes primarily due to increased volumes on the Peace Pipeline system, explained in revenue above and temporary interruptible volumes on the Ruby Pipeline, partially offset by lower volumes on the Alliance Pipeline due to a narrower AECO-Chicago natural gas differential. Revenue volumes include 134 mboe/d (2018: 146 mboe/d) related to Alliance and 146 mboe/d (2018: 89 mboe/d) related to Ruby. |

Adjusted EBITDA(2) | ▲ | $50 million increase primarily due to increase in revenues, partially offset by increased operating expenses and lower contribution from Alliance, explained above, combined with higher general & administrative and other expenses due to the larger asset base. Included in adjusted EBITDA is $76 million (2018: $88 million) related to Alliance and $52 million (2018: $52 million) related to Ruby. |

Bridge Analysis of Adjusted EBITDA(2) ($ millions)

| |

(1) | Includes inter-division transactions. See note 20 of the Consolidated Financial Statements. |

| |

(2) | Refer to the "Non-GAAP Measures" section. |

| |

(3) | Revenue volumes. See "Abbreviations" for definition. |

9 Pembina Pipeline Corporation 2019 Annual Report

Financial Overview 12 Months Ended December 31

Results of Operations |

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

Conventional revenue(1) | 1,314 |

| 1,186 |

| 128 |

| 11 |

|

Transmission revenue(1) | 189 |

| 155 |

| 34 |

| 22 |

|

Oil Sands revenue(1) | 284 |

| 247 |

| 37 |

| 15 |

|

Total revenue(1) | 1,787 |

| 1,588 |

| 199 |

| 13 |

|

Operating expenses(1) | 436 |

| 396 |

| 40 |

| 10 |

|

| Share of profit from equity accounted investees | 270 |

| 279 |

| (9 | ) | (3 | ) |

| Depreciation and amortization included in operations | 245 |

| 216 |

| 29 |

| 13 |

|

| Gross profit | 1,376 |

| 1,255 |

| 121 |

| 10 |

|

Adjusted EBITDA(2) | 1,854 |

| 1,703 |

| 151 |

| 9 |

|

Volumes (mboe/d)(3) | 2,566 |

| 2,521 |

| 45 |

| 2 |

|

| Distributions from equity accounted investees | 390 |

| 380 |

| 10 |

| 3 |

|

|

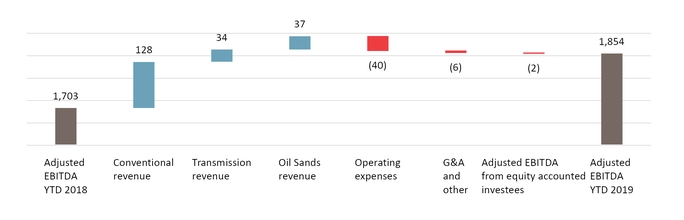

| | |

| Change in Results | | |

Conventional revenue(1) | ▲ | Increase due to additional revenues associated with Phase IV and V assets and higher recovery of applicable operating expenses, driven by increases in repairs and maintenance, higher power pool prices and power consumption. |

Transmission revenue(1) | ▲ | Increase largely due to the contribution from the Cochin Pipeline following the Kinder Acquisition, higher average tolls on the Alberta Ethane Gathering System and the end of the year-long third-party force majeure combined with favourable foreign exchange rate impacts on the Vantage Pipeline. |

Oil Sands revenue(1) | ▲

| Increase primarily due to the recognition of $23 million of variable revenue related to year-to-date and prior year capital recoveries, the contribution from the Edmonton Terminals following the Kinder Acquisition and higher recovery of operating expenses due to increased power pool prices. |

Operating expenses(1) | ▼ | Increase primarily due to increased labour and power costs as a result of the larger asset base and higher power pool prices, combined with increased repairs and maintenance. |

| Share of profit from equity accounted investees | ▼ | Decrease largely due to lower interruptible volumes on the Alliance Pipeline during the fourth quarter, driven by narrower AECO-Chicago natural gas differential, partially offset by general & administrative expense savings associated with transitioning Alliance to an owner-operator model. |

| Depreciation and amortization included in operations | ▼ | Increase in depreciation due to larger asset base as Pembina placed Phase IV and V assets into service in December 2018 and the newly acquired assets from the Kinder Acquisition. |

| Distributions from equity accounted investees | ▲ | $390 million consists of $268 million (2018: $259 million) from Alliance and $121 million (2018: $120 million) from Ruby. |

Volumes (mboe/d)(3) | ▲ | Increase primarily due to conventional Phase IV and V assets placed into service in December 2018 combined with higher interruptible volumes on the Ruby Pipeline. Revenue volumes include 141 mboe/d (2018: 143 mboe/d) related to Alliance and 103 mboe/d (2018: 89 mboe/d) related to Ruby. |

Adjusted EBITDA(2) | ▲

| $151 million increase primarily due to the increase in revenues, partially offset by the increase in operating expenses, discussed above, combined with higher general & administrative and other expenses due to the larger asset base. Included in adjusted EBITDA is $328 million (2018: $342 million) related to Alliance and $202 million (2018: $191 million) related to Ruby. |

Bridge Analysis of Adjusted EBITDA(2) ($ millions)

| |

(1) | Includes inter-division transactions. See Note 20 of the Consolidated Financial Statements. |

| |

(2) | Refer to the "Non-GAAP Measures" section. |

| |

(3) | Revenue volumes. See "Abbreviations" for definition. |

Pembina Pipeline Corporation 2019 Annual Report 10

Operational Overview

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 3 Months Ended December 31 | 12 Months Ended December 31 |

| | 2019 | 2018 | 2019 | 2018 |

| ($ millions, except where noted) | Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) | Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

|

| Pipelines | | | | | | | | | | | | |

| Conventional | 958 |

| 216 |

| 253 |

| 897 |

| 182 |

| 215 |

| 910 |

| 849 |

| 993 |

| 878 |

| 776 |

| 907 |

|

| Transmission | 646 |

| 96 |

| 173 |

| 566 |

| 86 |

| 162 |

| 591 |

| 384 |

| 684 |

| 570 |

| 352 |

| 643 |

|

| Oil Sands | 1,063 |

| 33 |

| 41 |

| 1,066 |

| 33 |

| 40 |

| 1,065 |

| 143 |

| 177 |

| 1,073 |

| 127 |

| 153 |

|

| Total | 2,667 |

| 345 |

| 467 |

| 2,529 |

| 301 |

| 417 |

| 2,566 |

| 1,376 |

| 1,854 |

| 2,521 |

| 1,255 |

| 1,703 |

|

| |

(1) | Revenue volumes. See "Abbreviations" for definition. |

| |

(2) | Refer to the "Non-GAAP Measures" section. |

Projects & New Developments(1)

Pipelines continues to focus on the execution of various system expansions. The projects in the following table were recently placed into service and impact Pipelines results. |

| |

| Significant Projects | In-service Date |

| Phase V Peace Pipeline Expansion | December 2018 |

| Phase IV Peace Pipeline Expansion | December 2018 |

As previously announced, during the quarter, Pembina approved the first stage of an additional expansion of the Peace Pipeline System ("Phase IX"), which will add additional capacity in the northwest Alberta to Gordondale corridor to accommodate increased activity in the Montney. This expansion has an estimated cost of approximately $100 million and is supported by 10-year contracts with predominantly investment grade counterparties under significant take-or-pay provisions. This portion of the Phase IX expansion allows Pembina to fully utilize approximately 100 mbpd of latent capacity that will be created on Peace Pipeline east of La Glace as a result of the Phase VII and VIII expansions. Once this expansion is completed, Pembina will have achieved segregated liquids transportation service for ethane-plus, propane-plus, crude and condensate across multiple pipeline systems between Gordondale and the Edmonton, Alberta area. Phase IX is anticipated to be placed into service in the fourth quarter of 2021, subject to regulatory and environmental approvals.

Pembina continues to evaluate the need for additional pump stations in the Fox Creek to Namao corridor to achieve Pembina's fully powered-up market delivery capacity of 1.3 mmbpd across the Peace and Northern systems. Engineering is currently underway and based on further commercial support, the scope of Phase IX may be revised in the future to include these projects. In addition, the elimination of batching and other hydraulic optimization initiatives, which Pembina refers to as Phase X, could create up to an incremental 100 mbpd of capacity with minimal capital spending.

Collectively, the projects in Pipelines are trending on budget. The following outlines the significant projects currently underway and new developments within Pipelines:

|

| | |

| Phase VI Peace Pipeline Expansion | | |

Capital Budget: $280 million | In-service Date: In stages starting first quarter of 2020 through mid-2020 | Status: Initial stage is delayed, trending over budget |

| This expansion includes upgrades at Gordondale; a 16-inch pipeline in the La Glace to Wapiti corridor and associated pump station and terminal upgrades; and a 20-inch pipeline in the Kakwa to Lator corridor. Commissioning of the first stage of the expansion is underway and construction of the second stage is ongoing. |

|

| | |

| Phase VII Peace Pipeline Expansion | | |

Capital Budget: $950 million | In-service Date: First half of 2021 | Status: On time, trending under budget |

| This expansion is expected to add approximately 240 mbpd of incremental capacity upstream of Fox Creek, accessing capacity available on the pipelines downstream of Fox Creek. Included in the expansion is a 20-inch, approximately 220-kilometer pipeline in the La Glace-Valleyview-Fox Creek corridor, as well as six new pump stations or terminal upgrades, between La Glace and Edmonton, Alberta. Pipeline construction commenced in January 2020. |

11 Pembina Pipeline Corporation 2019 Annual Report

|

| | |

| Phase VIII Peace Pipeline Expansion | | |

Capital Budget: $500 million | In-service Date(2): In stages starting in 2020 through the first half of 2022 | Status: On time, trending on budget |

| This expansion will include 10-inch and 16-inch pipelines in the Gordondale to La Glace corridor as well as six new pump stations or terminal upgrades located between Gordondale and Fox Creek. Engineering work is progressing as planned to support a construction start date in the second half of 2020. |

|

| | |

| Phase IX Peace Pipeline Expansion | | |

Capital Budget: $100 million | In-service Date(2): Fourth quarter of 2021 | Status: On time, trending on budget |

| This expansion currently will include 6-inch and 16-inch pipelines debottlenecking the corridor north of Gordondale as well as upgrades at one pump station. In addition, this expansion will see existing pipelines, which are currently batching, converted to single product lines. Engineering work is progressing as planned. |

|

| | |

| NEBC Montney Infrastructure | | |

Capital Budget: Not disclosed separately(3) | In-service Date: Complete and awaiting a third-party downstream connection | Status: On time, on budget |

| This infrastructure includes producer tie-in connections to Pembina's Birch Terminal as well as upgrades to the terminal including additional storage and pumps, along with minor site modifications. Construction on the new facilities and associated lateral is complete. |

|

| | |

| Wapiti Condensate Lateral | | |

Capital Budget: Not disclosed separately(3) | In-service Date: First quarter of 2020 | Status: Delayed, trending on budget |

| This is a 12-inch lateral, which will connect growing condensate volumes from a third-party owned facility in the Pipestone Montney region into Pembina's Peace Pipeline. Construction is complete and commissioning is underway. |

| |

(1) | For further details on Pembina's significant assets, including definitions, refer to Pembina's Annual Information Form for the year ended December 31, 2019 (the "AIF") filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com. |

| |

(2) | Subject to environmental and regulatory approvals. See the "Forward-Looking Statements & Information" section. |

| |

(3) | Combined capital budget is $120 million. |

Pembina Pipeline Corporation 2019 Annual Report 12

Facilities

Financial Overview Three Months Ended December 31

Results of Operations

|

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

Gas Services net revenue(1)(2)(3) | 152 |

| 138 |

| 14 |

| 10 |

|

NGL Services net revenue(1)(2)(3) | 133 |

| 127 |

| 6 |

| 5 |

|

Facilities net revenue(1)(2)(3) | 285 |

| 265 |

| 20 |

| 8 |

|

Operating expenses(1) | 80 |

| 87 |

| (7 | ) | (8 | ) |

| Share of profit from equity accounted investees | 14 |

| 16 |

| (2 | ) | (13 | ) |

| Depreciation and amortization included in operations | 50 |

| 39 |

| 11 |

| 28 |

|

| Gross profit | 169 |

| 155 |

| 14 |

| 9 |

|

Adjusted EBITDA(3) | 254 |

| 233 |

| 21 |

| 9 |

|

Volumes (mboe/d)(4) | 910 |

| 924 |

| (14 | ) | (2 | ) |

| Distributions from equity accounted investees | 21 |

| 39 |

| (18 | ) | (46 | ) |

|

| | |

| Changes in Results | | |

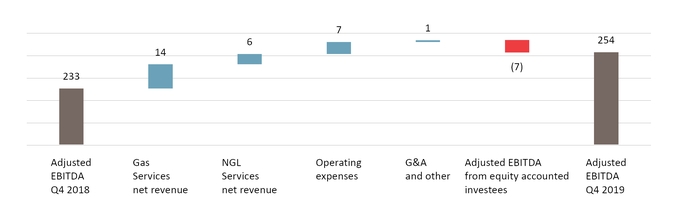

Gas Services net revenue(1)(2)(3) | ▲ | Increase is largely attributable to revenues associated with Duvernay II being placed into service in November 2019, combined with increased take-or-pay revenues at Kakwa River. |

NGL Services net revenue(1)(2)(3) | ▲ | Increase primarily due to Redwater Co-generation and Burstall Ethane Storage going into service in March 2019 and January 2019, respectively, combined with additional revenues from the Vancouver Wharves following the Kinder Acquisition, partially offset by lower supply volumes at the Redwater Complex. |

Operating expenses(1) | ▲ | Decrease largely due to a refund adjustment from a third-party, combined with a reduction in power costs following Redwater Co-generation going into service in March 2019, partially offset by higher labour costs as a result of Burstall Ethane Storage and Redwater Co-generation going into service. |

| Share of profit from equity accounted investees | ● | Consistent with prior period. |

| Depreciation and amortization included in operations | ▼ | Increase primarily due to Redwater Co-generation and Burstall Ethane Storage going into service in March 2019 and January 2019, respectively. |

| Distributions from equity accounted investees | ▼ | $21 million consists of $20 million (2018: $38 million) from Veresen Midstream and $1 million (2018: $1 million) from Fort Corp. The decrease in the Veresen Midstream distribution is primarily due to the conversion of Veresen Midstream Class B Units to Class A Units by Pembina's joint venture partner, reducing Pembina's distribution to its ownership percentage. |

Volumes (mboe/d)(4) | ▼ | Decrease in revenue volumes primarily due to lower supply volumes at the Redwater Complex, combined with decreased volumes from Veresen Midstream's Dawson facilities due to lower volumes, partially offset by additional volumes associated with Duvernay II being placed into service. Revenue volumes include 88 mboe/d (2018: 97 mboe/d) related to Veresen Midstream. |

Adjusted EBITDA(3) | ▲ | $21 million increase primarily due to higher net revenues and lower operating expenses, discussed above, partially offset by lower revenues from Veresen Midstream, due to lower volumes. Included in adjusted EBITDA is $48 million (2018: $54 million) related to Veresen Midstream. |

Bridge Analysis of Adjusted EBITDA(3) ($ millions)

| |

(1) | Includes inter-division transactions. See Note 20 of the Consolidated Financial Statements. |

| |

(2) | Revenue and cost of goods sold reported for all 2018 periods have been restated to reflect updated presentation for 2019, where the majority of cost of goods sold and corresponding revenues are reported in Marketing & New Ventures. |

| |

(3) | Refer to the "Non-GAAP Measures" section. |

| |

(4) | Revenue volumes. See "Abbreviations" for definition. |

13 Pembina Pipeline Corporation 2019 Annual Report

Financial Overview 12 Months Ended December 31

Results of Operations

|

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

Gas Services net revenue(1)(2)(3) | 588 |

| 546 |

| 42 |

| 8 |

|

NGL Services net revenue(1)(2)(3) | 529 |

| 460 |

| 69 |

| 15 |

|

Facilities net revenue(1)(2)(3) | 1,117 |

| 1,006 |

| 111 |

| 11 |

|

Operating expenses(1) | 344 |

| 313 |

| 31 |

| 10 |

|

| Share of profit from equity accounted investees | 50 |

| 30 |

| 20 |

| 67 |

|

| Depreciation and amortization included in operations | 168 |

| 149 |

| 19 |

| 13 |

|

| Gross profit | 655 |

| 574 |

| 81 |

| 14 |

|

Adjusted EBITDA(3) | 955 |

| 880 |

| 75 |

| 9 |

|

Volumes (mboe/d)(4) | 885 |

| 877 |

| 8 |

| 1 |

|

| Distributions from equity accounted investees | 101 |

| 133 |

| (32 | ) | (24 | ) |

|

| | |

| Changes in Results | | |

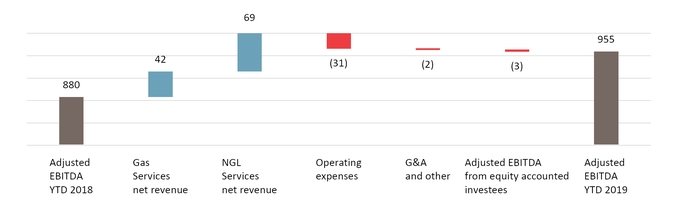

Gas Services net revenue(1)(2)(3) | ▲

| Increase is largely attributable to higher operating expense recoveries as a result of higher power and repairs and maintenance costs, increased demand at the Saturn Complex and Cutbank Complex and Duvernay II being placed into service in November 2019. |

NGL Services net revenue(1)(2)(3) | ▲

| Increase primarily due to increased terminalling revenues for propane and butane, the contribution from Redwater Co-generation and Burstall Ethane Storage going into service March 2019 and January 2019, respectively. |

Operating expenses(1) | ▼

| Increase due to higher power consumption from Burstall Ethane Storage being placed into service, increased repairs and maintenance, higher power pool prices and increased labour costs as a result of a larger headcount associated with new assets placed into service, partially offset by a reduction in the Redwater Complex power costs following Redwater Co-generation going into service in March 2019. |

| Share of profit from equity accounted investees | ▲ | Increase mainly due to a $24 million finance gain reversal recorded in 2018, partially offset by a one-time revenue adjustment of $5 million related to Veresen Midstream's Dawson facilities. |

| Depreciation and amortization included in operations | ▼ | Increase primarily due to Redwater Co-generation and Burstall Ethane Storage going into service March 2019 and January 2019, respectively. |

| Distributions from equity accounted investees | ▼ | $101 million consists of $96 million (2018: $124 million) from Veresen Midstream and $5 million (2018: $9 million) from Fort Corp. The decrease in distributions from Veresen Midstream is due to the same reasons mentioned above. |

Volumes (mboe/d)(4) | ▲

| Increase primarily due to additional volumes from Veresen Midstream due to the North Central Liquids Hub being placed into service in June 2018 and higher volumes at the Saturn Complex and Cutbank Complex, partially offset by lower volumes at the Younger facility due to third-party outages and lower volumes at the Redwater Complex. Revenue volumes include 88 mboe/d (2018: 81 mboe/d) related to Veresen Midstream. |

Adjusted EBITDA(3) | ▲

| $75 million increase primarily due to strong NGL Services and Gas Services revenues, partially offset by higher operating expenses, discussed above. Included in adjusted EBITDA is $182 million (2018: $183 million) related to Veresen Midstream. |

Bridge Analysis of Adjusted EBITDA(3) ($ millions)

| |

(1) | Includes inter-division transactions. See Note 20 of the Consolidated Financial Statements. |

| |

(2) | Revenue and cost of goods sold reported for all 2018 periods have been restated to reflect updated presentation for 2019, where the majority of cost of goods sold and corresponding revenues are reported in Marketing & New Ventures. |

| |

(3) | Refer to the "Non-GAAP Measures" section. |

| |

(4) | Revenue volumes. See "Abbreviations" for definition. |

Pembina Pipeline Corporation 2019 Annual Report 14

Operational Overview

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 3 Months Ended December 31 | 12 Months Ended December 31 |

| | 2019 | 2018 | 2019 | 2018 |

| ($ millions, except where noted) | Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

|

| Facilities | | | | | | | | | | | | |

| Gas Services | 690 |

| 90 |

| 146 |

| 683 |

| 83 |

| 142 |

| 678 |

| 337 |

| 551 |

| 664 |

| 301 |

| 537 |

|

| NGL Services | 220 |

| 79 |

| 108 |

| 241 |

| 72 |

| 91 |

| 207 |

| 318 |

| 404 |

| 213 |

| 273 |

| 343 |

|

| Total | 910 |

| 169 |

| 254 |

| 924 |

| 155 |

| 233 |

| 885 |

| 655 |

| 955 |

| 877 |

| 574 |

| 880 |

|

| |

(1) | Revenue volumes. See "Abbreviations" for definition. |

| |

(2) | Refer to the "Non-GAAP Measures" section. |

Projects & New Developments

Facilities continues to build-out its natural gas and NGL processing and fractionation assets to service customer demand. The projects in the following table were recently placed into service and impact Facilities results. |

| |

Significant Projects(1) | In-service Date |

| Duvernay II | November 2019 |

| Redwater Co-generation | March 2019 |

| Burstall Ethane Storage | January 2019 |

| Rail Yard Expansion | December 2018 |

| Cavern Storage | Throughout 2018 |

Veresen Midstream(2) | |

| North Central Liquids Hub | June 2018 |

| Saturn Phase II Gas Plant | January 2018 |

As previously announced, Pembina approved the development of a $120 million co-generation facility at the Empress NGL Extraction facility (the "Empress Co-generation Facility"). The Empress Co-generation Facility will reduce overall operating costs and greenhouse gas emissions by providing power and heat to the extraction and fractionation facilities and has an expected in-service date in mid-2022, subject to regulatory and environmental approval.

As previously announced, the anticipated startup of the Prince Rupert LPG Export Terminal has generated significant interest from our customers and offtakers and Pembina has decided to move forward with an expansion of the terminal (the "Prince Rupert Terminal Expansion"), which will increase propane export capacity to approximately 40 mbpd. The Prince Rupert Terminal Expansion is expected to cost approximately $175 million and has an anticipated in-service date in the first half of 2023, subject to regulatory and environmental approvals.

As previously announced, in conjunction with the Hythe Developments project, Veresen Midstream entered into a contract with NuVista Energy ("NuVista") whereby NuVista retained an option to have Veresen Midstream own and fund the Pipestone North compressor station in exchange for an annual capital fee. NuVista has elected to exercise their option. As planned, NuVista will build and operate the compressor station. Upon completion the compressor station will be transfered at cost to Pembina. As a result of NuVista’s election, the capital budget for the Hythe Developments project has increased from $185 million to $240 million, net to Pembina.

Collectively, the projects in Facilities are trending on budget.

15 Pembina Pipeline Corporation 2019 Annual Report

The following outlines the projects currently underway and new developments within Facilities:

|

| | |

| Duvernay III | | |

Capital Budget: $200 million | In-service Date: Mid to late 2020 | Status: On time, trending on budget |

| Duvernay III is the second tranche of infrastructure development under the 20-year infrastructure development and service agreement with Chevron Canada Limited and Kuwait Foreign Petroleum Exploration Company. This development includes a 100 MMcf/d sweet gas, shallow cut processing train, 20 mbpd of inlet condensate stabilization and other associated infrastructure. Detailed design is complete, long-lead equipment fabrication is nearing completion and piling has been completed on site. Based on the customers' request for additional infrastructure the capital cost of this project was increased from the original cost of $175 million. |

|

| | |

| Duvernay Sour Treatment Facilities | | |

Capital Budget: $65 million | In-service Date: First quarter of 2020 | Status: On time, trending on budget |

| Sour gas treating facilities at the Duvernay Complex including 150 MMcf/d sour gas sweetening system with 300 MMcf/d of amine regeneration capability and up to one tonne of sulphur per day of acid gas incineration. Construction was completed in mid-February and commissioning is currently progressing. |

|

| | |

| Prince Rupert Terminal | | |

Capital Budget: $250 million | In-service Date(3): Second half of 2020 | Status: On time, trending over budget |

| The Prince Rupert Terminal is located on Watson Island, British Columbia and is expected to have a permitted capacity of approximately 25 mbpd of propane. The propane supply will be sourced primarily from the Company's Redwater Complex. Facility mechanical construction continues with modules setting, equipment install and piping work well underway. On site sphere assembly is nearly complete and marine retrofit work on the wharf is progressing. |

|

| | |

| Prince Rupert Terminal Expansion | | |

Capital Budget: $175 million | In-service Date(3): First half of 2023 | Status: On time, trending on budget |

The Prince Rupert Terminal Expansion will increase propane export capacity to approximately 40 mbpd. Front End Engineering Design ("FEED") work has started. |

|

| | |

| Hythe Developments | | |

Capital Budget(4): $240 million | In-service Date: Late 2020 | Status: On time, trending on budget |

| Pembina and its 45 percent owned joint venture, Veresen Midstream, will construct natural gas gathering and processing infrastructure in the Pipestone Montney region. The infrastructure consists of an expansion of up to 125 MMcf/d (56 MMcf/d net to Pembina) of sour gas processing at Veresen Midstream's existing Hythe facility and a new, approximately 60 km, 12-inch sour gas pipeline, to be owned by Veresen Midstream and constructed by Pembina. In addition, Veresen Midstream will fund and own a compressor station, built and operated by NuVista and various laterals will be owned and constructed by Pembina. All long-lead equipment has been ordered and construction has commenced. |

|

| | |

| Empress Infrastructure | | |

Capital Budget: $120 million | In-service Date: Late 2020 | Status: On time, trending on budget |

| This expansion will add new fractionation and terminalling facilities, which are expected to add approximately 30 mbpd of propane-plus fractionation capacity to Pembina's Empress NGL Extraction Facility. Mechanical construction is progressing on the fractionation and rail sites. Electrical construction has commenced on both sites. Pipeline construction began in February and rail track construction is expected to commence in May 2020. |

|

| | |

| Empress Co-generation | | |

Capital Budget: $120 million | In-service Date(3): Mid-2022 | Status: On time, trending on budget |

| This project enables Pembina to be more efficient with its production, utilize heat recovery and provide a second source of power through the installation of a co-generation unit at the Empress NGL Extraction Facility. FEED work was completed in the fourth quarter of 2019 and detailed engineering started in January 2020. |

| |

(1) | For further details on Pembina's significant assets, including definitions, refer to Pembina's AIF filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com. |

| |

(2) | Investment in equity accounted investee, which Pembina has a 45 percent interest in as of December 31, 2019. Results from Veresen Midstream impact share of profit from equity accounted investees and proportionally consolidated metrics. See Note 10 to the Consolidated Financial Statements. |

| |

(3) | Subject to environmental and regulatory approvals. See the "Forward-Looking Statements & Information" section. |

Pembina Pipeline Corporation 2019 Annual Report 16

Marketing & New Ventures

Financial Overview Three Months Ended December 31

Results of Operations

|

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

Marketing revenue(1)(2) | 1,092 |

| 1,163 |

| (71 | ) | (6 | ) |

Cost of goods sold(1)(2) | 989 |

| 1,087 |

| (98 | ) | (9 | ) |

Net revenue(1)(3) | 103 |

| 76 |

| 27 |

| 36 |

|

| Share of profit from equity accounted investees | 13 |

| 39 |

| (26 | ) | (67 | ) |

| Realized gain on commodity-related derivative financial instruments | (8 | ) | (5 | ) | 3 |

| (60 | ) |

| Unrealized loss (gain) on commodity-related derivative financial instruments | 23 |

| (89 | ) | (112 | ) | 126 |

|

| Depreciation and amortization included in operations | 8 |

| 6 |

| 2 |

| 33 |

|

| Gross profit | 93 |

| 203 |

| (110 | ) | (54 | ) |

Adjusted EBITDA(3) | 120 |

| 109 |

| 11 |

| 10 |

|

Volumes (mboe/d)(4) | 190 |

| 201 |

| (11 | ) | (5 | ) |

| Distributions from equity accounted investees | 22 |

| 31 |

| (9 | ) | (29 | ) |

|

| | |

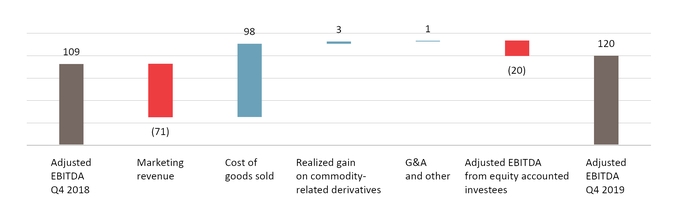

| Change in Results | | |

Marketing revenue(1)(2) | ▼ | Decrease due to lower marketed NGL volumes, combined with lower crude and NGL prices during the fourth quarter of 2019. |

Cost of goods sold(1)(2) | ▲ | Decrease due to lower crude and NGL prices, lower NGL sales and the $11 million impact of adopting IFRS 16 that reduced cost of goods sold and increased depreciation and finance costs. |

| Share of profit from equity accounted investees | ▼ | Decrease largely due to lower propane margins at Aux Sable resulting from a decrease in sales prices, combined with a narrower Chicago-AECO natural gas differential. |

| Realized gain on commodity-related derivatives | ● | Consistent realized gains relating to the settlement of NGL-based derivatives. |

| Unrealized loss (gain) on commodity-related derivatives | ▼ | Unrealized loss primarily due to an increase in the forward price of crude and NGL which drove the associated derivative contracts into a loss position. |

| Depreciation and amortization included in operations | ● | $9 million of additional depreciation was recognized on leased rail cars following the adoption of IFRS 16, offset by a decrease in amortization due to certain fully amortized intangibles. |

| Distributions from equity accounted investees | ▼ | Decrease of $9 million due to the lower margins at Aux Sable, discussed in share of profit from equity accounted investees above. |

Volumes (mboe/d)(4) | ▼ | NGL sales volumes decreased due to lower supply volumes from the Redwater Complex, combined with higher butane sales made in the fourth quarter of 2018, partially offset by increased volumes at Aux Sable. Revenue volumes includes 32 mboe/d (2018: 28 mboe/d) related to Aux Sable. |

Adjusted EBITDA(3) | ▲ | Increase due to higher margins on crude and the $11 million impact of the adoption of IFRS 16, partially offset by lower a contribution from Aux Sable and higher general & administrative and other expenses in New Ventures. Included in adjusted EBITDA is $18 million (2018: $34 million) related to Aux Sable. |

Bridge Analysis of Adjusted EBITDA(3) ($ millions)

| |

(1) | Includes inter-division transactions. See Note 20 of the Consolidated Financial Statements. |

| |

(2) | Revenue and cost of goods sold reported for all 2018 periods have been restated to reflect updated presentation for 2019, where the majority of cost of goods sold and corresponding revenues are reported in Marketing & New Ventures. |

| |

(3) | Refer to the "Non-GAAP Measures" section. |

| |

(4) | Marketed NGL volumes. See "Abbreviations" for definition. |

17 Pembina Pipeline Corporation 2019 Annual Report

Financial Overview 12 Months Ended December 31

Results of Operations

|

| | | | | | | | |

| ($ millions, except where noted) | 2019 |

| 2018 |

| Change |

| % Change |

|

Marketing revenue(1)(2) | 4,804 |

| 5,175 |

| (371 | ) | (7 | ) |

Cost of goods sold(1)(2) | 4,417 |

| 4,789 |

| (372 | ) | (8 | ) |

Net revenue(1)(3) | 387 |

| 386 |

| 1 |

| — |

|

| Share of profit from equity accounted investees | 50 |

| 102 |

| (52 | ) | (51 | ) |

| Realized (gain) loss on commodity-related derivative financial instruments | (33 | ) | 51 |

| 84 |

| 165 |

|

| Unrealized loss (gain) on commodity-related derivative financial instruments | 13 |

| (73 | ) | (86 | ) | 118 |

|

| Depreciation and amortization included in operations | 51 |

| 26 |

| 25 |

| 96 |

|

| Gross profit | 406 |

| 484 |

| (78 | ) | (16 | ) |

Adjusted EBITDA(3) | 423 |

| 409 |

| 14 |

| 3 |

|

Volumes (mboe/d)(4) | 189 |

| 175 |

| 14 |

| 8 |

|

| Distributions from equity accounted investees | 84 |

| 109 |

| (25 | ) | (23 | ) |

|

| | |

| Change in Results | | |

Marketing revenue(1)(2) | ▼ | Decrease primarily due to lower NGL and crude prices, partially offset by higher NGL sales volumes and a $33 million arbitration award payment that was resolved during the first quarter of 2019. |

Cost of goods sold(1)(2) | ▲

| Decrease largely due to lower crude and NGL market prices, discussed above, combined with a $41 million adjustment on the adoption of IFRS 16 that reduced cost of goods sold and increased depreciation and finance costs. |

| Share of profit from equity accounted investees | ▼ | Decrease due to lower propane margins at Aux Sable resulting from lower sales prices during 2019 and narrower Chicago-AECO natural gas differential, combined with an outage during June 2019 to complete regular maintenance at Aux Sable. |

| Realized (gain) loss on commodity-related derivatives | ▲ | Increase due to decreasing market prices creating a gain for NGL and crude-based derivatives settled during the period. |

| Unrealized loss (gain) on commodity-related derivatives | ▼ | Unrealized loss primarily due to crude and NGL contracts maturing in the period. |

| Depreciation and amortization included in operations | ▼ | Increase largely due to $36 million of depreciation on leased rail cars, which are recognized as a right-of-use asset and depreciated following the adoption of IFRS 16, partially offset by a decrease in amortization due to fully amortized intangibles. |

| Distributions from equity accounted investees | ▼ | Decrease of $25 million largely due to the lower margins at Aux Sable, discussed in share of profit from equity accounted investees above. |

Volumes (mboe/d)(4) | ▲ | Increased NGL sales volumes primarily driven by higher butane volumes, partially offset by lower ethane volumes at Aux Sable. Revenue volumes includes 33 mboe/d (2018: 35 mboe/d) related to Aux Sable. |

Adjusted EBITDA(3) | ▲ | Increase primarily due to higher realized gains on commodity-related derivatives, combined with the $41 million impact of the adoption of IFRS 16 and lower general & administrative and other expenses in New Ventures, offset by lower margins after adjusting for the $33 million arbitration award payment discussed above. Included in adjusted EBITDA is $74 million (2018: $114 million) related to Aux Sable. |

Bridge Analysis of Adjusted EBITDA(3)(5)($ millions)

| |

(1) | Includes inter-division transactions. See Note 20 of the Consolidated Financial Statements. |

| |

(2) | Revenue and cost of goods sold reported for all 2018 periods have been restated to reflect updated presentation for 2019, where all cost of goods sold and corresponding revenues are reported in Marketing & New Ventures. |

| |

(3) | Refer to the "Non-GAAP Measures" section. |

| |

(4) | Marketed NGL volumes. See "Abbreviations" for definition. |

| |

(5) | Marketing revenue excludes the positive arbitration award payment of $33 million. |

Pembina Pipeline Corporation 2019 Annual Report 18

Operational Overview

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 3 Months Ended December 31 | 12 Months Ended December 31 |

| | 2019 | 2018 | 2019 | 2018 |

| ($ millions, except where noted)(unaudited) | Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

| Volumes(1) |

| Gross Profit |

| Adjusted EBITDA(2) |

|

| Marketing & New Ventures | | | | | | | | | | | | |

| Marketing | 190 |

| 96 |

| 127 |

| 201 |

| 203 |

| 111 |

| 189 |

| 407 |

| 440 |

| 175 |

| 484 |

| 432 |

|

New Ventures(3) | — |

| (3 | ) | (7 | ) | — |

| — |

| (2 | ) | — |

| (1 | ) | (17 | ) | — |

| — |

| (23 | ) |

| Total | 190 |

| 93 |

| 120 |

| 201 |

| 203 |

| 109 |

| 189 |

| 406 |

| 423 |

| 175 |

| 484 |

| 409 |

|

| |

(1) | Marketed NGL volumes. Volumes are stated in mboe/d. |

| |

(2) | Refer to the "Non-GAAP Measures" section. |

| |

(3) | All New Ventures projects have not yet commenced operations and therefore have no volumes. |

Projects & New Developments

As previously announced, subsequent to the quarter, CKPC executed a lump sum engineering, procurement and construction ("EPC") contract related to the construction of the PDH plant within its integrated PDH/PP Facility. With this contract, CKPC has fixed approximately 60 percent of the cost of the PDH/PP Facility thus far. In conjunction with the execution of the lump sum contract, Pembina also revised its proportionate share of the capital cost of the PDH/PP Facility from $2.5 billion to $2.7 billion. Pembina now expects the PDH/PP Facility to be placed into commercial service in the second half of 2023.

Subsequent to the quarter, CKPC entered into a reimbursable engineering and procurement services contract with TR Canada E&C Inc. ("TR") for the PP plant. TR and its parent company, Técnicas Reunidas S.A., are well experienced in the design and engineering of PP and other petrochemical facilities. All major engineering and procurement contracts have now been awarded for the PDH/PP Facility.

Regulatory processes for the proposed Jordan Cove LNG Project are ongoing. Subsequent to the quarter, the U.S. Federal Energy Regulatory Commission delayed a decision originally expected on February 13, 2020. Pembina looks forward to obtaining a final decision. Pembina is focused on getting all the remaining permits required to proceed with this project. These permits are a critical component of the regulatory process and are necessary to enable the commercial viability of the project and allow this investment to move forward. The timing and ultimate approval of this project is uncertain and dependent upon receipt of these remaining approvals.

The following outlines the projects currently underway and new developments within Marketing & New Ventures: |

| | |

| PDH/PP Facility | |

Capital Budget(1): $2.7 billion | In-service Date: Second half of 2023 |

| The PDH/PP Facility will be located adjacent to Pembina's Redwater fractionation complex and will convert approximately 23,000 bpd of locally supplied propane into polypropylene, a high value recyclable polymer used in a wide range of finished products including but not limited to automobiles, medical devices, food packaging and home electronic appliances, among others. All long-lead equipment orders have been placed and early works site preparation continues to progress, with completion of that work targeted for the first half of 2020. All major engineering and procurement contracts have now been awarded for the PDH/PP Facility. |

|

| | |

| Jordan Cove LNG Project (proposed) | |

| The proposed Jordan Cove LNG project ("Jordan Cove") is a world-scale LNG export facility, which would transport North American natural gas to world markets. The project is made up of two parts: the LNG terminal, with a planned design capacity of 7.8 million tonnes per annum, and the Pacific Connector Gas pipeline which would transport natural gas from Malin, Oregon to an LNG terminal in Coos County, Oregon. |

| The carrying value of the project at December 31, 2019 is $352 million, including capitalized borrowing costs of $12 million. |

| In conjunction with a final investment decision, the Company intends to seek partners for both the Pacific Connector Gas Pipeline and LNG Terminal thereby reducing its 100 percent ownership interest to a net ownership interest of between 40 and 60 percent with the intention to reduce the capital, operating, and other project risks. |

19 Pembina Pipeline Corporation 2019 Annual Report

4. LIQUIDITY & CAPITAL RESOURCES

Available Sources of Liquidity

|

| | | | |

| As at December 31 | | |

| ($ millions) | 2019 |

| 2018 |

|

Working capital(1) | (470 | ) | (477 | ) |

Variable rate debt(2)(3) |

|

|

|

|

| Bank debt | 2,100 |

| 1,305 |

|

| Total variable rate debt outstanding (weighted average of 3.3% (2018: 3.2%)) | 2,100 |

| 1,305 |

|

Fixed rate debt(2) |

|

|

|

|

| Senior unsecured notes | 273 |

| 540 |

|

| Senior unsecured medium-term notes | 7,800 |

| 5,700 |

|

| Total fixed rate debt outstanding (weighted average of 4.0% (2018: 4.2%)) | 8,073 |

| 6,240 |

|

Finance lease liability(4) | — |

| 19 |

|

| Total debt outstanding | 10,173 |

| 7,564 |

|

| Cash and unutilized debt facilities | 1,040 |

| 2,372 |

|

| |

(1) | As at December 31, 2019, working capital includes $74 million (December 31, 2018: $480 million) associated with the current portion of loans and borrowings. |

| |

(3) | At December 31, 2019, US$454 million was drawn on the unsecured $2.5 billion revolving credit facility (December 31, 2018: nil). |

| |

(4) | Finance lease liabilities reported separately following the adoption of IFRS 16, see "Changes in Accounting Policies". |

Pembina anticipates its cash flow from operating activities, the majority of which is derived from fee-based contracts, will be more than sufficient to meet its short-term and long-term operating obligations, capital investment requirements and to fund its dividends. Pembina expects to source funds required for capital projects and contributions to investments in equity accounted investees from cash, its credit facilities and by accessing the capital markets, as required. Based on its successful access to financing in the capital markets over the past several years, Pembina expects to continue to have access to additional funds as required. Refer to "Risk Factors – Additional Financing and Capital Resources" below and Note 24 to the Consolidated Financial Statements for more information. Management remains satisfied that the leverage employed in Pembina's capital structure is sufficient and appropriate given the characteristics and operations of the underlying asset base.

Management may make adjustments to Pembina's capital structure as a result of changes in economic conditions or the risk characteristics of the underlying assets. To maintain or modify Pembina's capital structure in the future, Pembina may renegotiate new debt terms, repay existing debt, seek new borrowing, issue additional equity and/or repurchase shares.

As at December 31, 2019, Pembina's credit facilities consisted of an unsecured $2.5 billion (December 31, 2018: $2.5 billion) revolving credit facility, which includes a $750 million (December 31, 2018: $750 million) accordion feature and matures in May 2024, an unsecured $500 million (December 31, 2018: $1.0 billion) non-revolving term loan which matures in August 2022, and an operating facility of $20 million (December 31, 2018: $20 million) which is due in May 2020 and is typically renewed on an annual basis. There are no repayments due over the term of these facilities. On December 16, 2019, Pembina entered into an unsecured $500 million non-revolving term loan. On September 19, 2019, Pembina fully repaid an unsecured $1.0 billion (December 31, 2018: $1.0 billion) non-revolving term loan. As at December 31, 2019, Pembina had $1.0 billion (December 31, 2018: $2.4 billion) of cash and unutilized debt facilities. At December 31, 2019, Pembina had loans and borrowings (excluding deferred financing costs) of $10.2 billion (December 31, 2018: $7.5 billion). Pembina is required to meet certain specific and customary affirmative and negative financial covenants under its senior unsecured notes, medium-term notes, revolving credit facility, non-revolving term loan and operating facility, including a requirement to maintain certain financial ratios. Pembina is also subject to customary restrictions on its operations and activities under its notes and credit facilities, including restrictions on the granting of security, incurring indebtedness and the sale of its assets.

On January 10, 2020, Pembina closed an offering of $1.0 billion of senior unsecured medium-term notes. The fixed rate notes were used to partially repay the variable rate bank debt outstanding at December 31, 2019. See the "Financing Activity" section for further details of the notes issued.

Pembina Pipeline Corporation 2019 Annual Report 20

Covenants

Pembina's financial covenants include the following:

|

| | | | |

| Debt Instrument | Financial Covenant(1) | Ratio | Ratio at December 31, 2019 |

|