Analyst & Investor Day December 16, 2014

Forward-looking statements Certain statements in this presentation, including those relating to future business outlook and economic performance, long-term growth goals, finances, dividend and share repurchase plans and other expectations and objectives of management are not based on historical fact and are “forward-looking statements” within the meaning of applicable securities laws.” Generally, these statements can be identified by the use of words such as “believes,” “estimates,” “anticipates,” “expects,” “on track,” “feels,” “forecasts,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the Company’s forward- looking statements. These risks and uncertainties include, but are not limited to: local, regional, national and international economic conditions; consumer confidence and spending patterns; price and availability of commodities, such as beef, chicken, shrimp, pork, seafood, dairy, potatoes, onions and energy supplies, which are subject to fluctuation and could increase or decrease more than the Company expects; weather, acts of God and other disasters; the seasonality of the Company’s business; inflation or deflation; increases in unemployment rates and taxes; increases in labor and health insurance costs; competition and changes in consumer tastes and the level of acceptance of the Company’s restaurant concepts (including consumer acceptance of prices); consumer reaction to public health issues; consumer perception of food safety; demographic trends; the cost of advertising and media; government actions and policies; interest rate changes, compliance with debt covenants and the Company’s ability to make debt payments; the availability of credit presently arranged from the Company’s revolving credit facilities; and the future cost and availability of credit. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in its Form 10-K filed with the Securities and Exchange Commission on March 3, 2014 and its subsequent filings with the Securities and Exchange Commission. The Company assumes no obligation to update any forward-looking statement, except as may be required by law. These forward-looking statements speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement. This presentation contains certain non-GAAP measures which are provided to assist in an understanding of the Company’s business and performance. These measures may differ from non-GAAP measures used by other companies and should always be considered in conjunction with the appropriate GAAP measure. Reconciliations of non-GAAP measures to the most comparable GAAP measures are provided at the end of this presentation. Note: A copy of this presentation and the related appendix can be viewed at www.bloominbrands.com in the Investors section

Liz Smith CEO

Portfolio of founder-inspired leading brands Significant opportunities for sales growth Culture of continuous innovation and productivity Disciplined stewards of capital Seasoned global management team Strong Platform for Sustainable Growth

50% 17% 14% 6% 13% $4.3 bn Sales LTM Sales by Concept (3) Diversified Brand Portfolio Brand Market Position (2) Locations (1) 753 #1 244 #2 201 #2 66 #4 Brazil / Korea 227 #1/#2 (1) Includes company-owned and franchise restaurants as of September 28, 2014. (2) Based on Euromonitor for 2013. (3) Last twelve periods ending September 28, 2014. Excludes Roy’s Total: 1,491 Differentiated Brands with Leading Market Positions

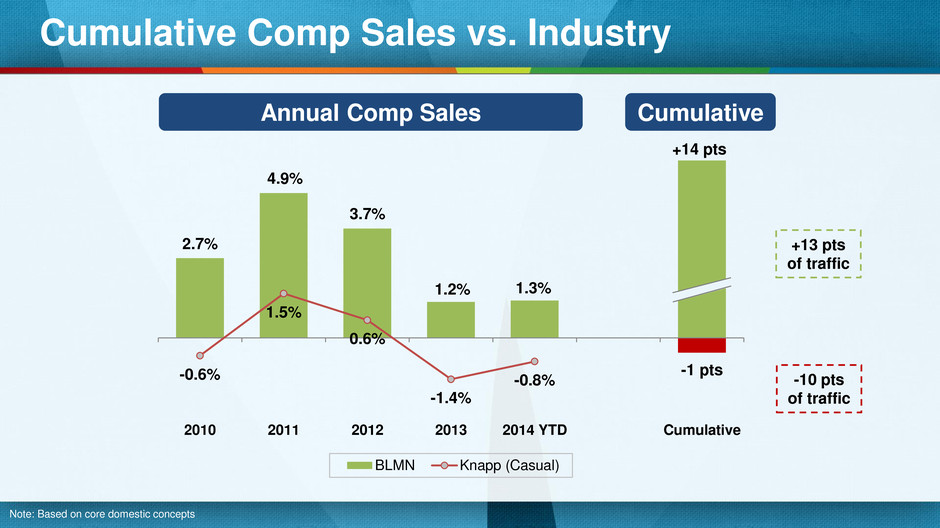

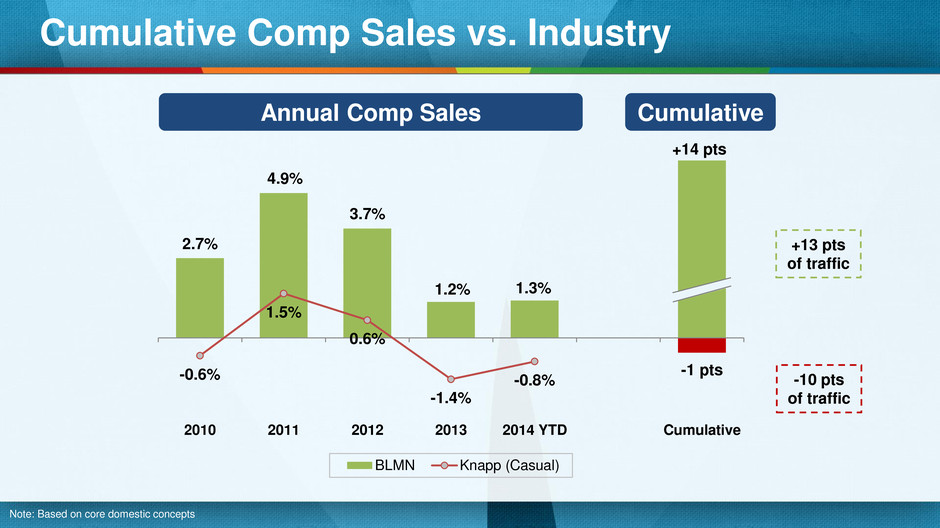

Cumulative Comp Sales vs. Industry Annual Comp Sales Cumulative Note: Based on core domestic concepts 2.7% 4.9% 3.7% 1.2% 1.3% +14 pts -1 pts -0.6% 1.5% 0.6% -1.4% -0.8% 2010 2011 2012 2013 2014 YTD Cumulative BLMN Knapp (Casual) +13 pts of traffic -10 pts of traffic

Recognized for Our Culture / Performance

Market Overview Since IPO

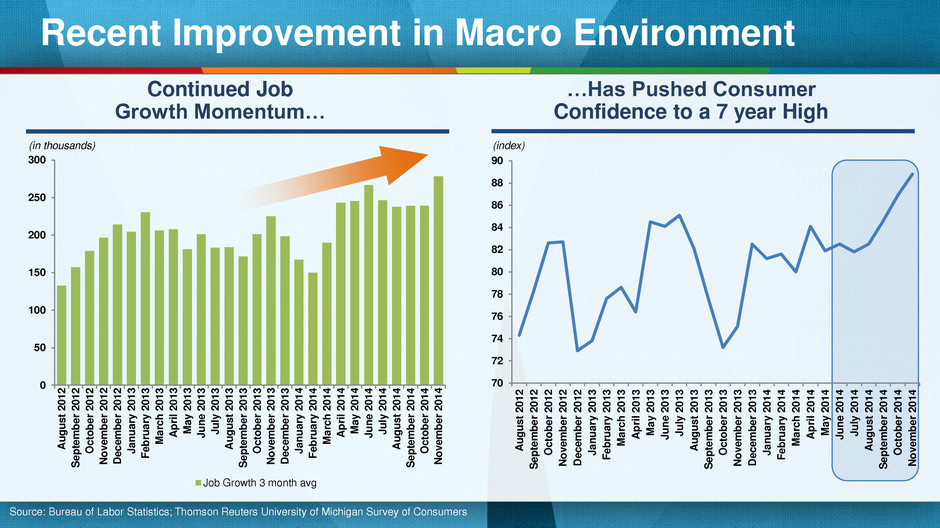

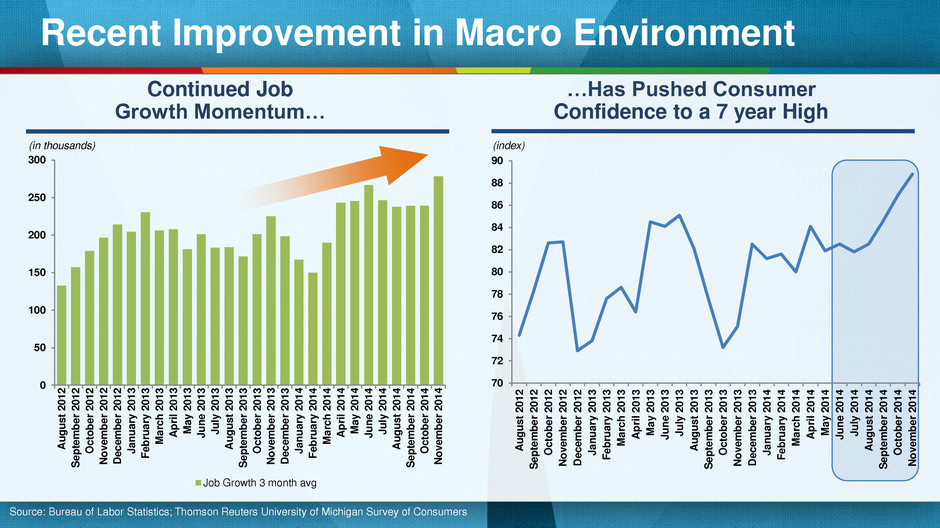

0 50 100 150 200 250 300 A ug u s t 2 0 1 2 S e p te m be r 2 0 1 2 O c tober 2 0 1 2 N ov e m be r 2 0 1 2 D e c e m b e r 2 0 1 2 J a nuar y 2 0 1 3 Feb rua ry 2 0 1 3 Mar c h 2 0 1 3 A pr il 2 0 1 3 Ma y 2 0 1 3 J une 2 0 1 3 J u ly 2 0 1 3 A ug u s t 2 0 1 3 S e p te m be r 2 0 1 3 O c tober 2 0 1 3 N ov e m be r 2 0 1 3 D e c e m b e r 2 0 1 3 J a nuar y 2 0 1 4 Feb rua ry 2 0 1 4 Mar c h 2 0 1 4 A pr il 2 0 1 4 Ma y 2 0 1 4 J une 2 0 1 4 J u ly 2 0 1 4 A ug u s t 2 0 1 4 S e p te m be r 2 0 1 4 O c tober 2 0 1 4 N ov e m be r 2 0 1 4 Job Growth 3 month avg …Has Pushed Consumer Confidence to a 7 year High Continued Job Growth Momentum… Recent Improvement in Macro Environment (in thousands) Source: Bureau of Labor Statistics; Thomson Reuters University of Michigan Survey of Consumers 70 72 74 76 78 80 82 84 86 88 90 A ug u s t 2 0 1 2 S e p te m be r 2 0 1 2 O c tober 2 0 1 2 N ov e m be r 2 0 1 2 D e c e m b e r 2 0 1 2 J a nuar y 2 0 1 3 Feb rua ry 2 0 1 3 Mar c h 2 0 1 3 A pr il 2 0 1 3 Ma y 2 0 1 3 J une 2 0 1 3 J u ly 2 0 1 3 A ug u s t 2 0 1 3 S e p te m be r 2 0 1 3 O c tober 2 0 1 3 N ov e m be r 2 0 1 3 D e c e m b e r 2 0 1 3 J a nuar y 2 0 1 4 Feb rua ry 2 0 1 4 Mar c h 2 0 1 4 A pr il 2 0 1 4 Ma y 2 0 1 4 J une 2 0 1 4 J u ly 2 0 1 4 A ug u s t 2 0 1 4 S e p te m be r 2 0 1 4 O c tober 2 0 1 4 N ov e m be r 2 0 1 4 (index)

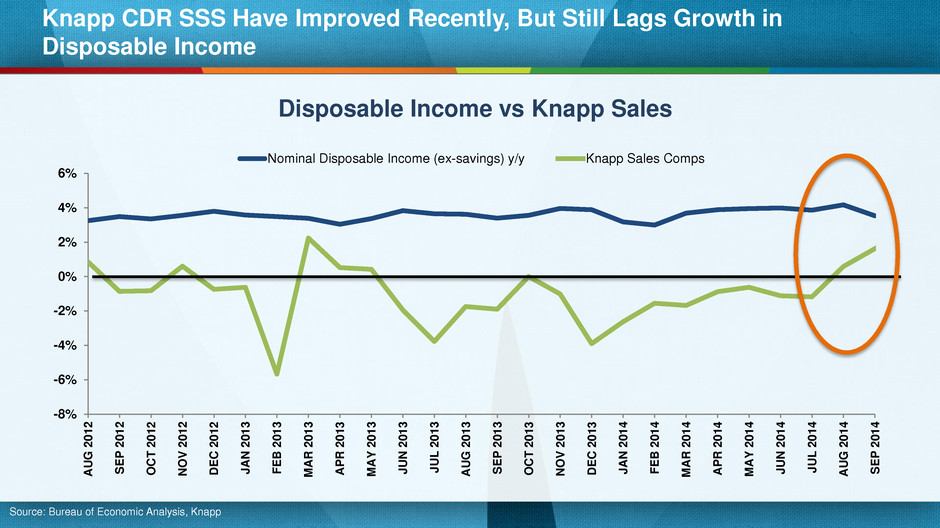

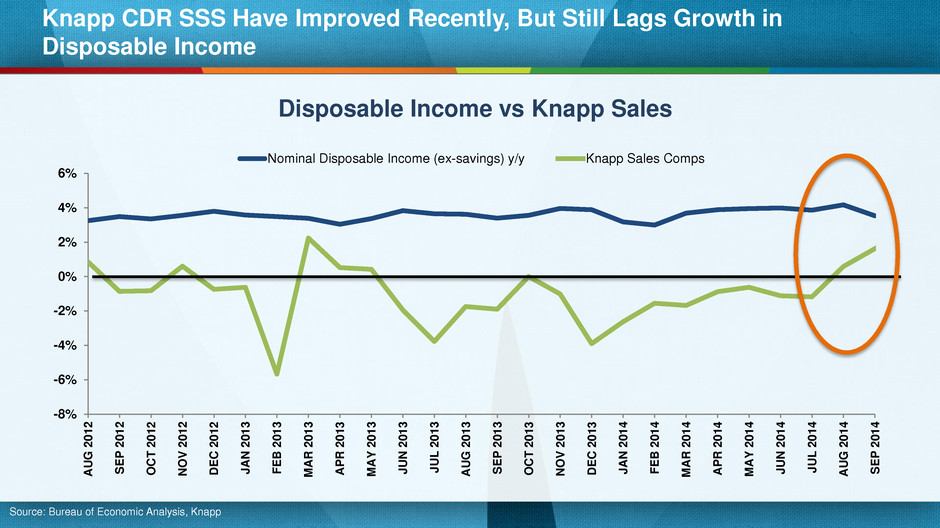

-8% -6% -4% -2% 0% 2% 4% 6% A U G 2 0 1 2 SEP 2 0 1 2 O C T 2 0 1 2 N O V 2 0 1 2 DE C 2 0 1 2 J A N 2 0 1 3 FEB 2 0 1 3 M A R 2 0 1 3 AP R 2 0 1 3 M A Y 2 0 1 3 J U N 2 0 1 3 J UL 2 0 1 3 A U G 2 0 1 3 SEP 2 0 1 3 O C T 2 0 1 3 N O V 2 0 1 3 DE C 2 0 1 3 J A N 2 0 1 4 FEB 2 0 1 4 M A R 2 0 1 4 AP R 2 0 1 4 M A Y 2 0 1 4 J U N 2 0 1 4 J UL 2 0 1 4 A U G 2 0 1 4 SEP 2 0 1 4 Nominal Disposable Income (ex-savings) y/y Knapp Sales Comps Source: Bureau of Economic Analysis, Knapp Knapp CDR SSS Have Improved Recently, But Still Lags Growth in Disposable Income Disposable Income vs Knapp Sales

Source: Knapp Data ending 11/2/14 -2.8% -3.3% -5.4% -5.6% -2.5% -0.4% -1.5% -2.8% -2.9% -7% -6% -5% -4% -3% -2% -1% 0% C'06 C'07 C'08 C'09 C'10 C'11 C'12 C'13 YTD'14 Knapp CDR Traffic Trend BLM IPO Expectation 0% -1% CDR Traffic has Declined Since 2006

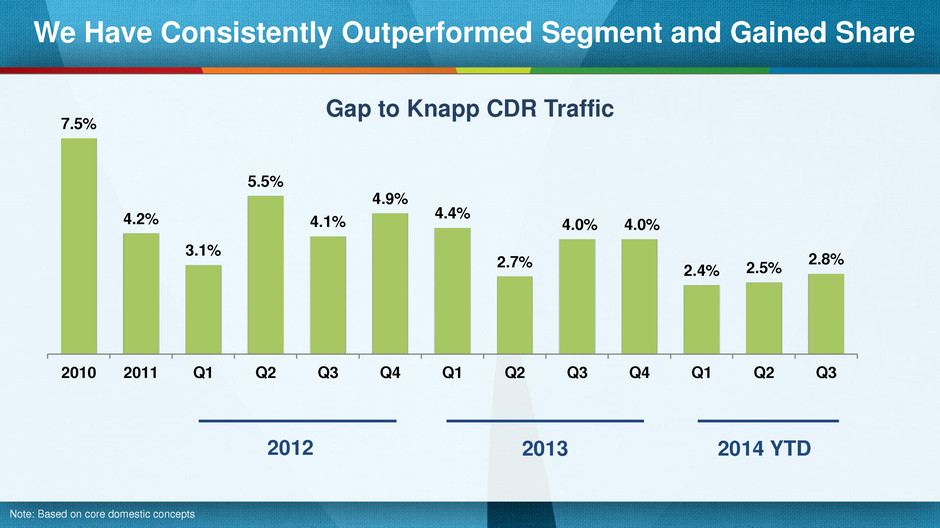

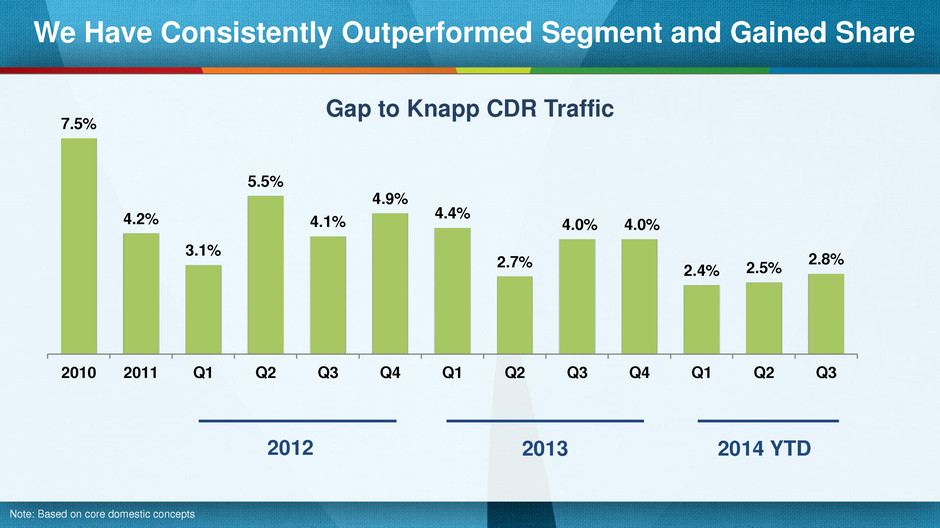

7.5% 4.2% 3.1% 5.5% 4.1% 4.9% 4.4% 2.7% 4.0% 4.0% 2.4% 2.5% 2.8% 2010 2011 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2012 2013 2014 YTD Gap to Knapp CDR Traffic We Have Consistently Outperformed Segment and Gained Share Note: Based on core domestic concepts

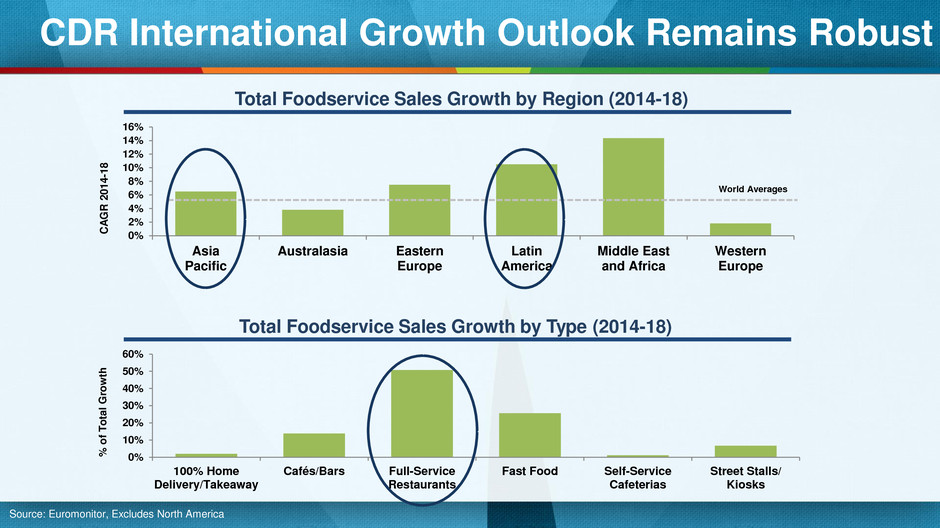

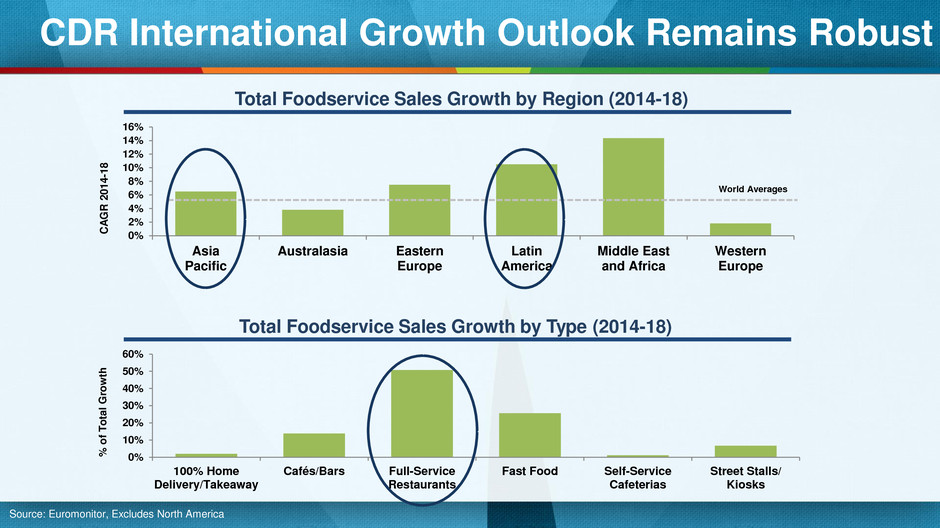

0% 2% 4% 6% 8% 10% 12% 14% 16% Asia Pacific Australasia Eastern Europe Latin America Middle East and Africa Western Europe C A G R 2 0 1 4 -1 8 0% 10% 20% 30% 40% 50% 60% 100% Home Delivery/Takeaway Cafés/Bars Full-Service Restaurants Fast Food Self-Service Cafeterias Street Stalls/ Kiosks % o f T o ta l Gro w th Total Foodservice Sales Growth by Region (2014-18) CDR International Growth Outlook Remains Robust Total Foodservice Sales Growth by Type (2014-18) World Averages 67% of all growth coming from LatAm (21%) and Asia (45%) 76% of all FSR growth coming from LatAm (16%) and Asia (59%) with China representing 36% Source: Euromonitor, Excludes North America

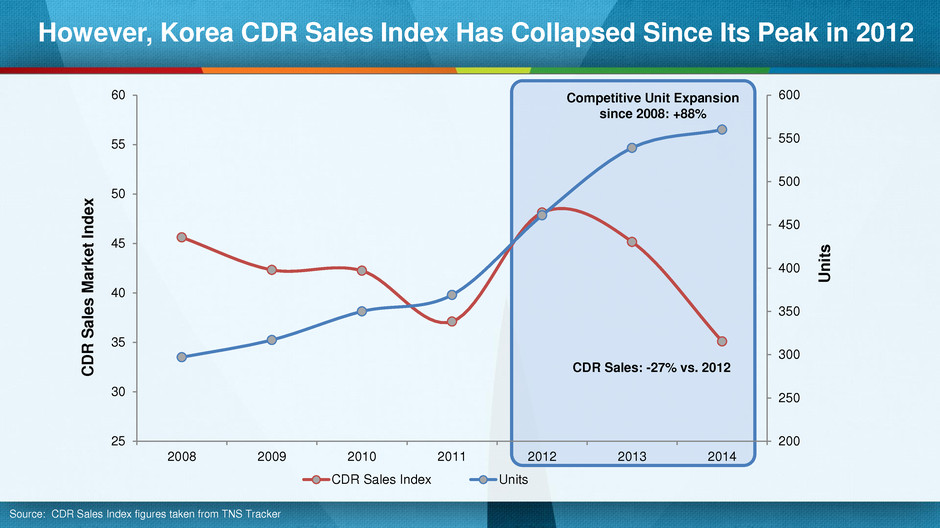

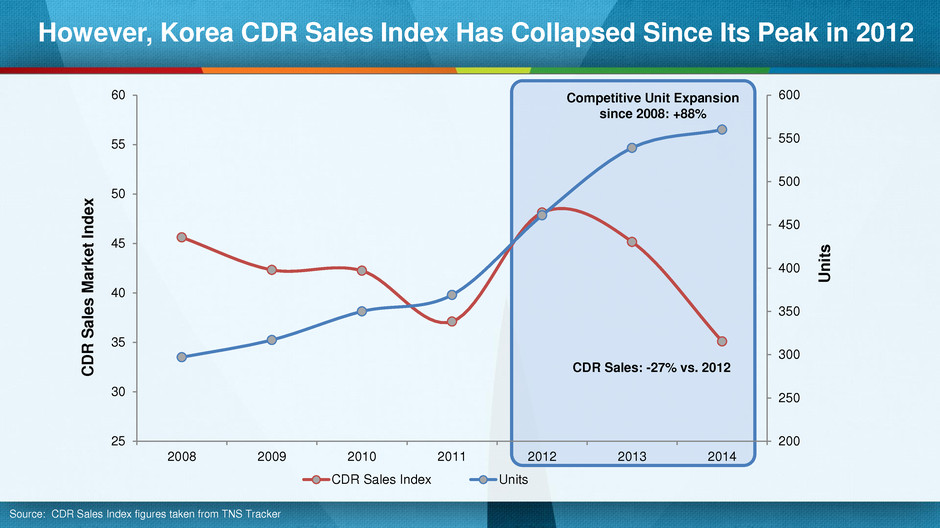

Competitive Unit Expansion since 2008: +88% CDR Sales: -27% vs. 2012 However, Korea CDR Sales Index Has Collapsed Since Its Peak in 2012 Source: CDR Sales Index figures taken from TNS Tracker 200 250 300 350 400 450 500 550 600 25 30 35 40 45 50 55 60 2008 2009 2010 2011 2012 2013 2014 Uni ts C D R S a le s M a rk e t Ind e x CDR Sales Index Units

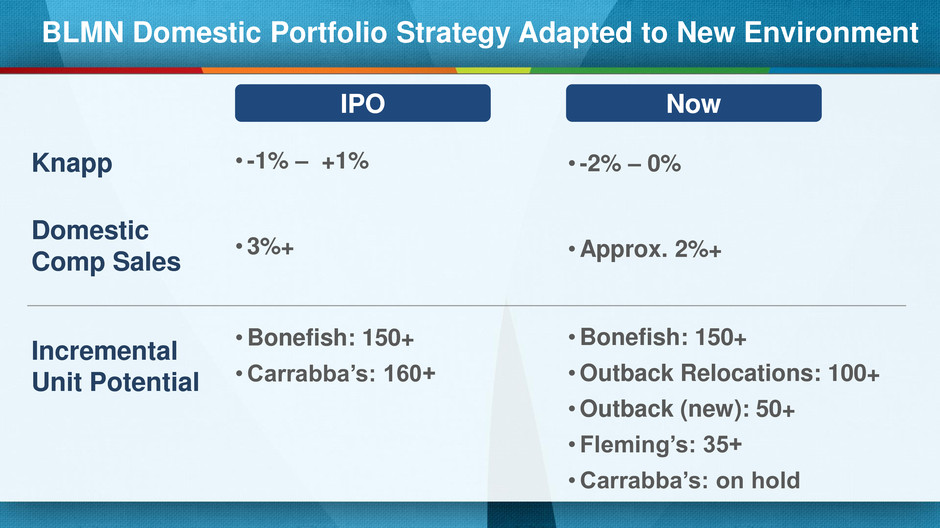

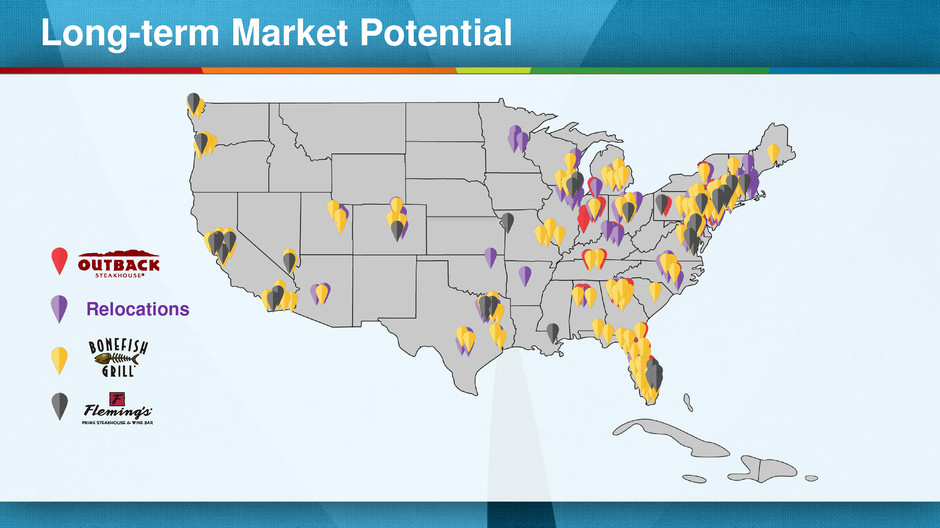

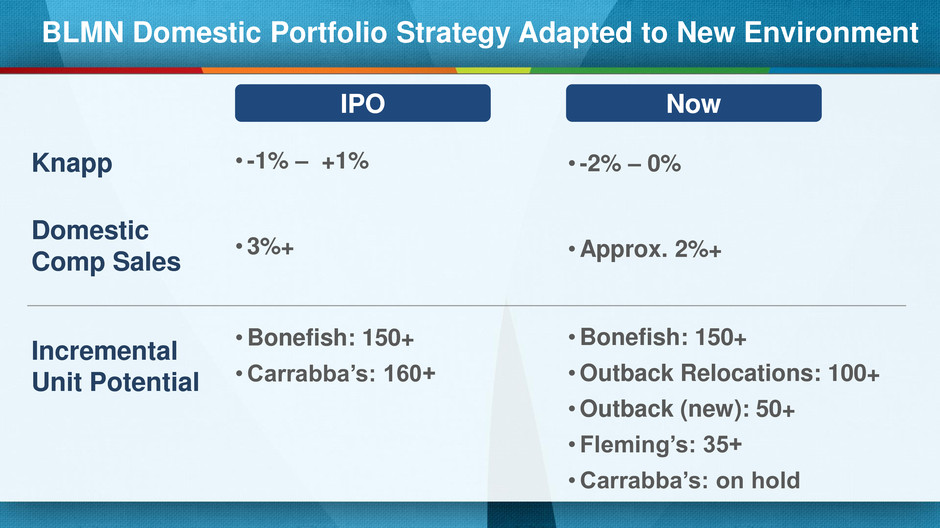

Incremental Unit Potential •3%+ •Approx. 2%+ • Bonefish: 150+ •Carrabba’s: 160+ • Bonefish: 150+ •Outback Relocations: 100+ •Outback (new): 50+ • Fleming’s: 35+ •Carrabba’s: on hold BLMN Domestic Portfolio Strategy Adapted to New Environment Domestic Comp Sales IPO Now • -1% – +1% • -2% – 0% Knapp

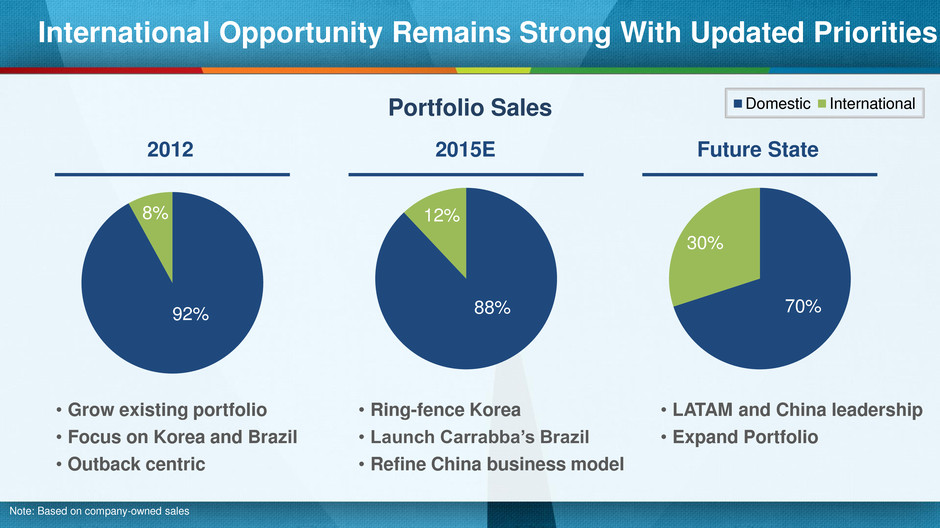

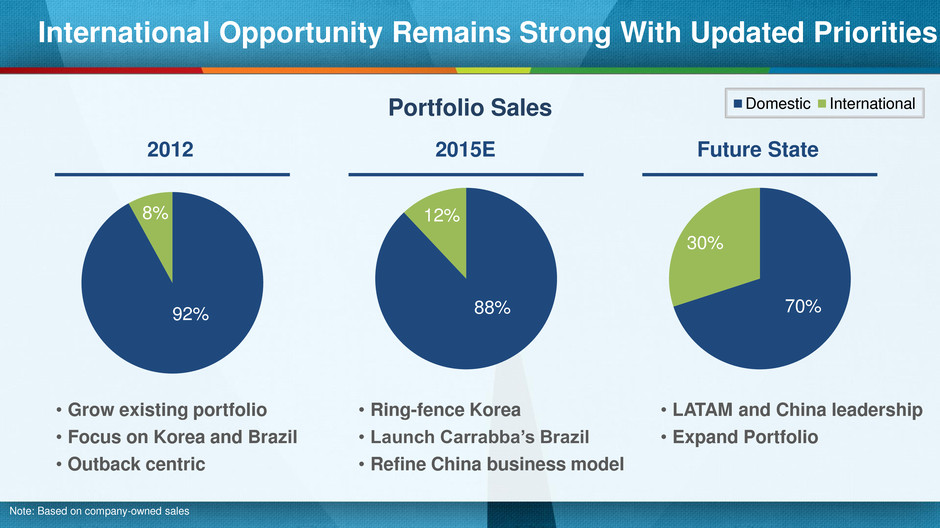

70% 30% 92% 8% 2015E 2012 Future State • Ring-fence Korea • Launch Carrabba’s Brazil • Refine China business model • Grow existing portfolio • Focus on Korea and Brazil • Outback centric • LATAM and China leadership • Expand Portfolio International Opportunity Remains Strong With Updated Priorities 88% 12% Portfolio Sales Note: Based on company-owned sales Domestic International

Sustainable Growth Strategy Update

Continuous Productivity Mindset to Fund Investment World Class Team and Infrastructure to Build Scale Three Platforms for Sustainable Growth Unchanged 3 Accelerate International Growth 2 Domestic New Unit Expansion 1 Grow Comp Sales & Profitability

Grow Comp Store Sales: Core AUVs Continue to Grow Across The Portfolio 1 $2,500 $2,600 $2,700 $2,800 $2,900 $3,000 $3,100 $3,200 $3,300 $3,400 2009 2010 2011 2012 2013 Est. 2014 Core Domestic Annual AUVs Core Domestic $2,500 $2,600 $2,700 $2,800 $2,900 $3,000 $3,100 $3,200 $3,300 $3,400 2009 Est. 2014 AUV Contribution by Concept 3.2% CAGR Driven Primarily by Traffic ($ in thousands) ($ in thousands)

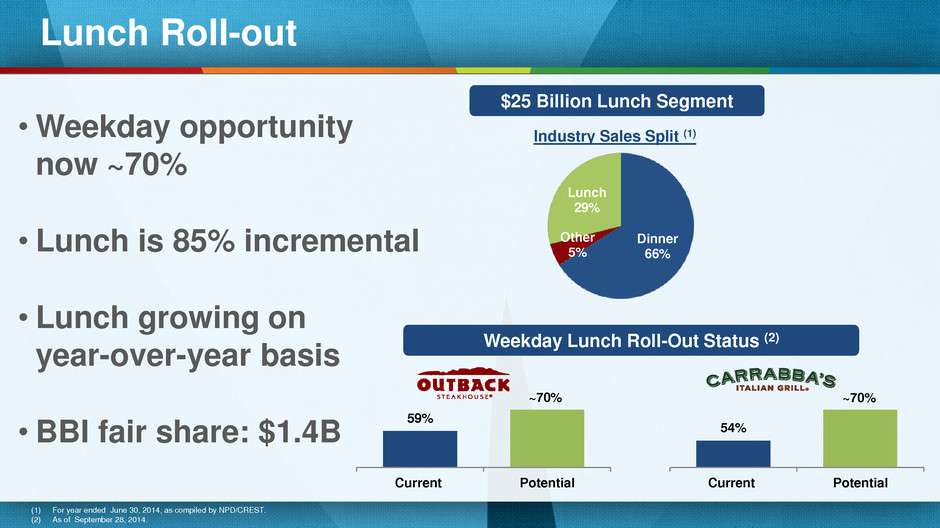

•Deliver Superior brand experience – Ongoing menu and marketing innovation – Significant investment in digital and technology • Expand occasions and frequency – Focus on $25 billion domestic lunch segment – BBI fair share would be $1.4 billion • Strong remodel and relocation program Grow Comp Sales and Profitability 1

• Celebrate Best at Steak • Expand Beyond Special Occasion • Return to Polished Casual • The Contemporary Steakhouse Deliver Superior Brand Experience Across Portfolio

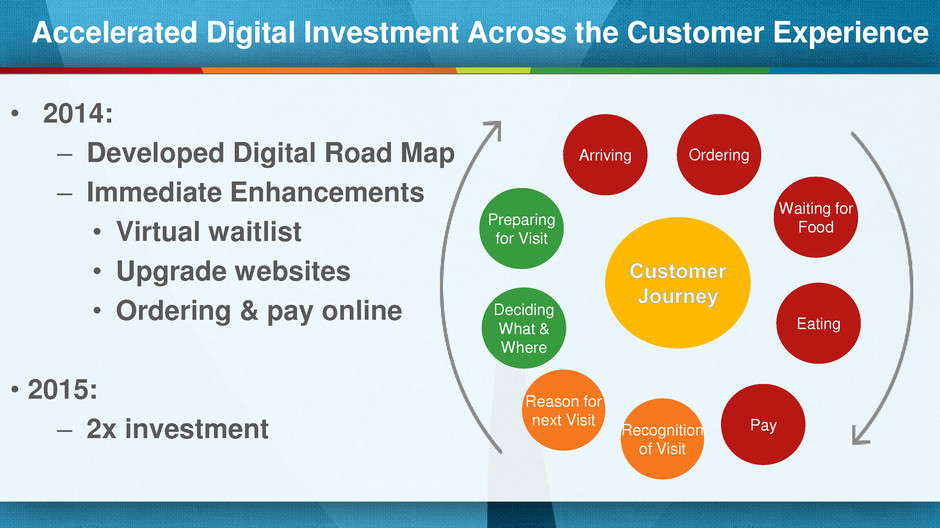

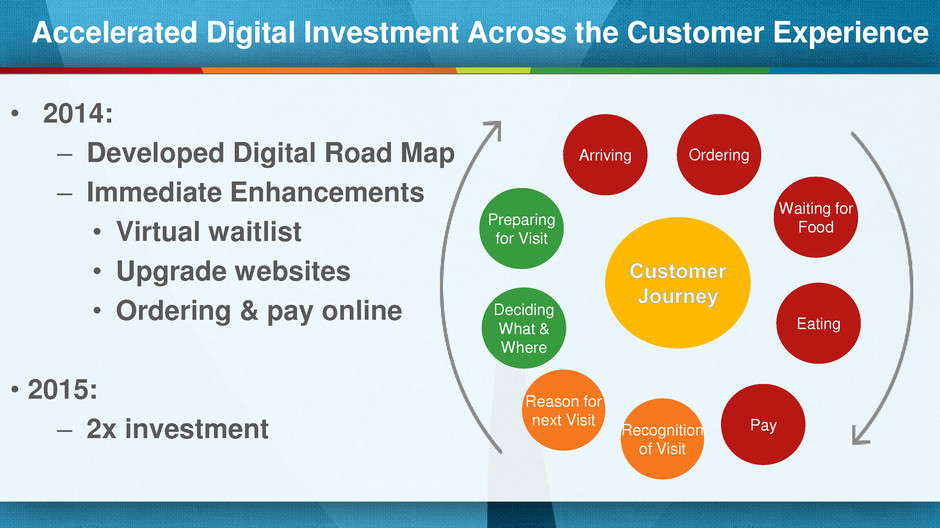

Pay Recognition of Visit Deciding What & Where Preparing for Visit Arriving Ordering Waiting for Food Eating Reason for next Visit • 2014: – Developed Digital Road Map – Immediate Enhancements • Virtual waitlist • Upgrade websites • Ordering & pay online • 2015: – 2x investment Accelerated Digital Investment Across the Customer Experience

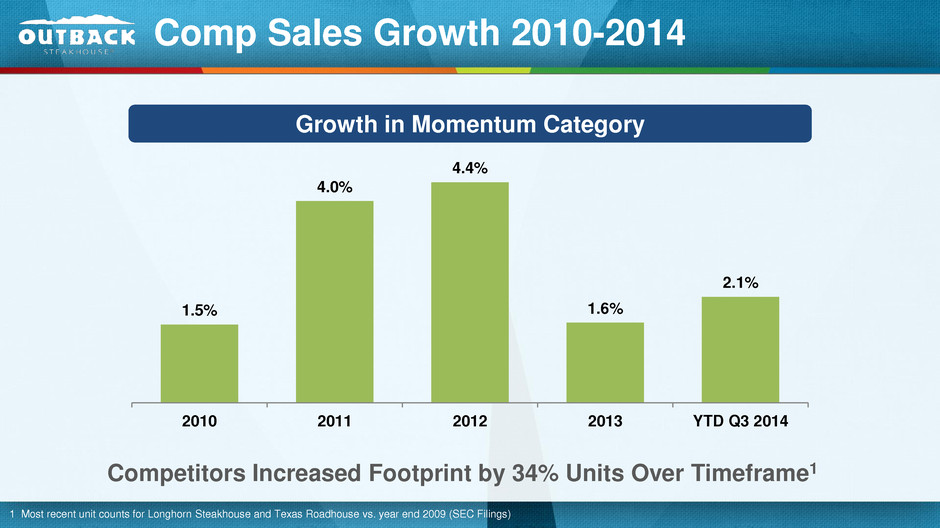

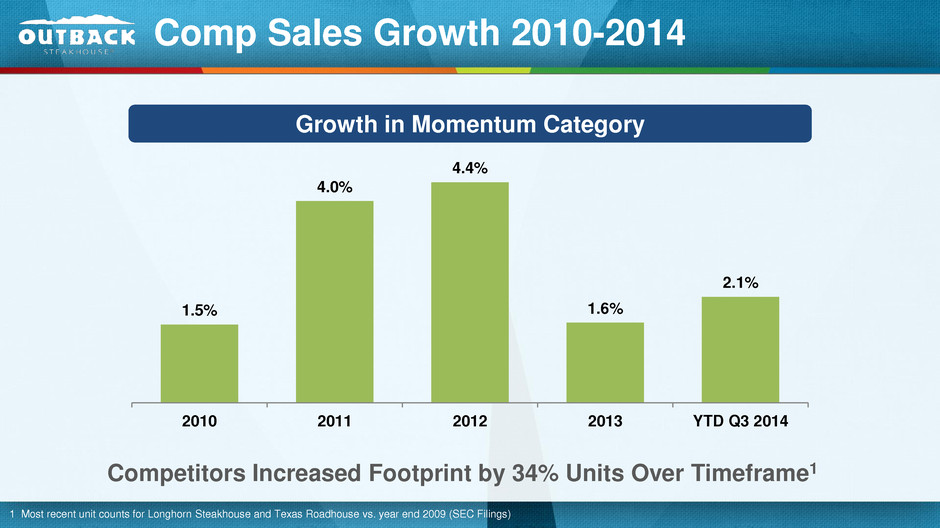

Comp Sales Growth 2010-2014 1.5% 4.0% 4.4% 1.6% 2.1% 2010 2011 2012 2013 YTD Q3 2014 Growth in Momentum Category 1 Most recent unit counts for Longhorn Steakhouse and Texas Roadhouse vs. year end 2009 (SEC Filings) Competitors Increased Footprint by 34% Units Over Timeframe1

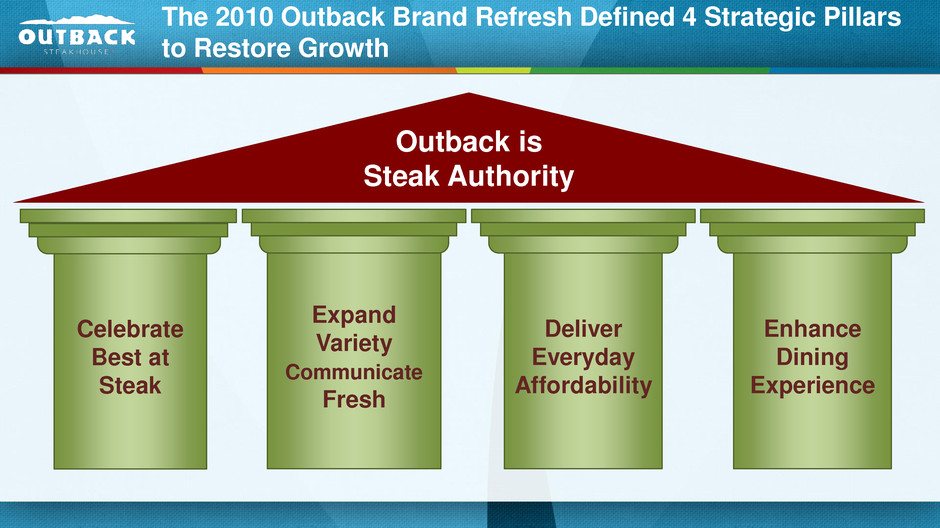

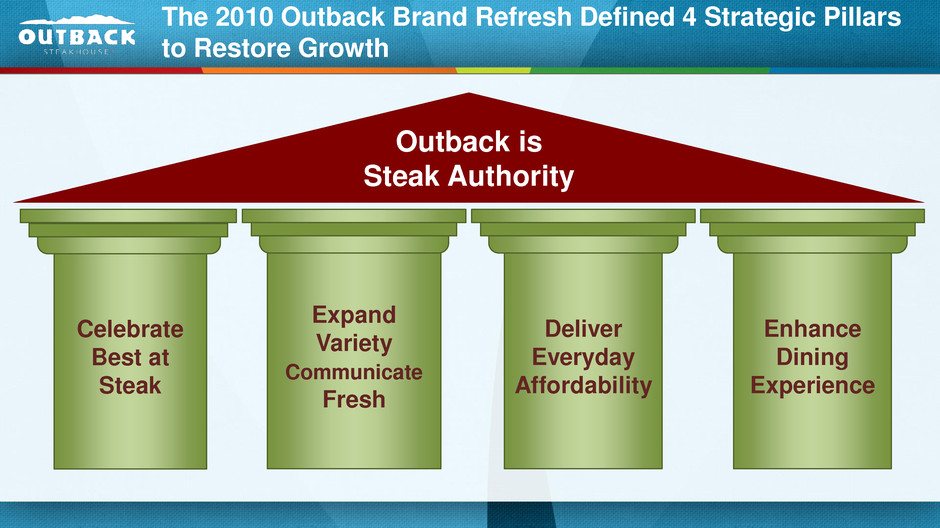

The 2010 Outback Brand Refresh Defined 4 Strategic Pillars to Restore Growth Outback is Steak Authority Expand Variety Communicate Fresh Deliver Everyday Affordability Enhance Dining Experience Celebrate Best at Steak

In Q3 2014, We Reaffirmed Our Steak Authority New Menu Design, Plate ware, In-Restaurant Messaging Product Spec Operations & Training Advertising/Marketing 360° “Best at Steak”

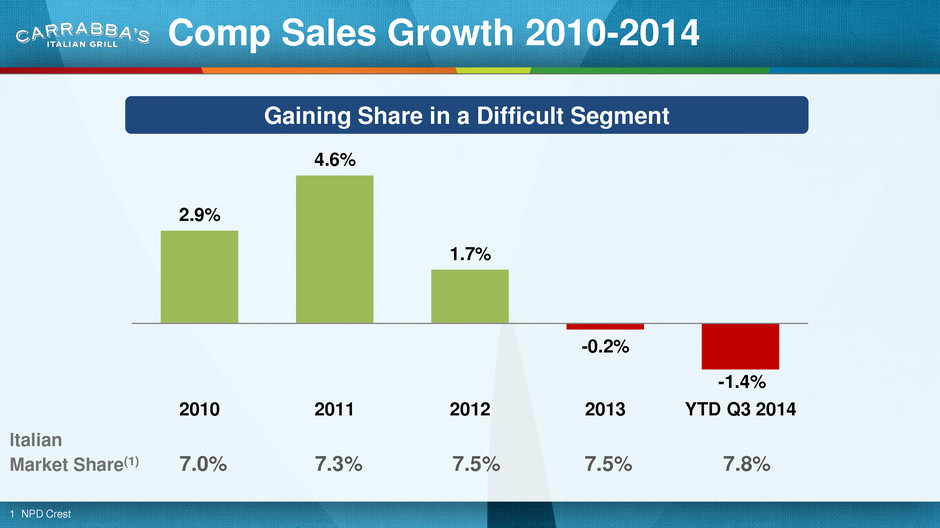

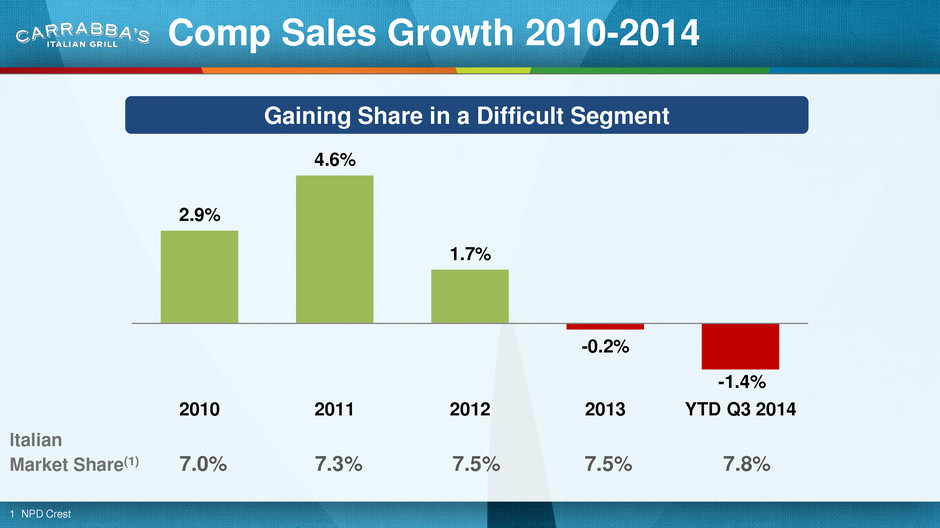

Comp Sales Growth 2010-2014 Gaining Share in a Difficult Segment Italian Market Share(1) 7.0% 7.3% 7.5% 7.5% 7.8% 2.9% 4.6% 1.7% -0.2% -1.4% 2010 2011 2012 2013 YTD Q3 2014 1 NPD Crest

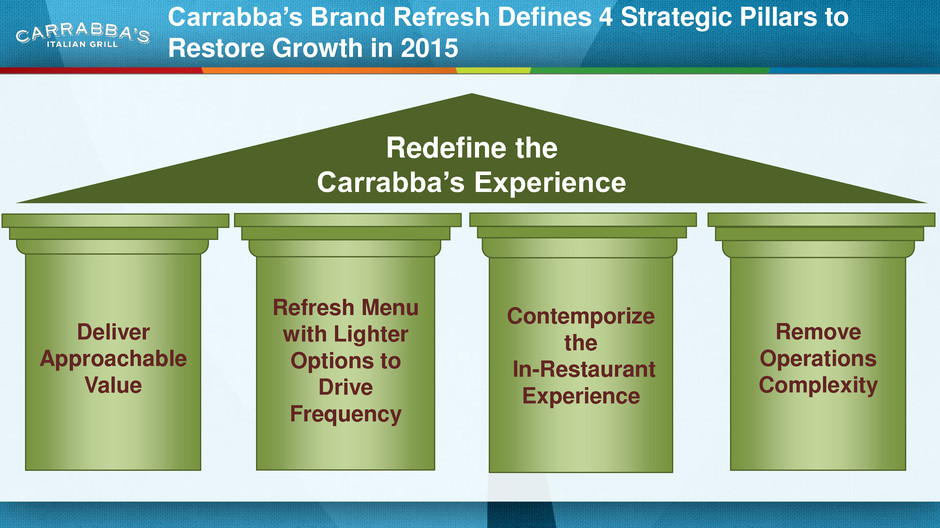

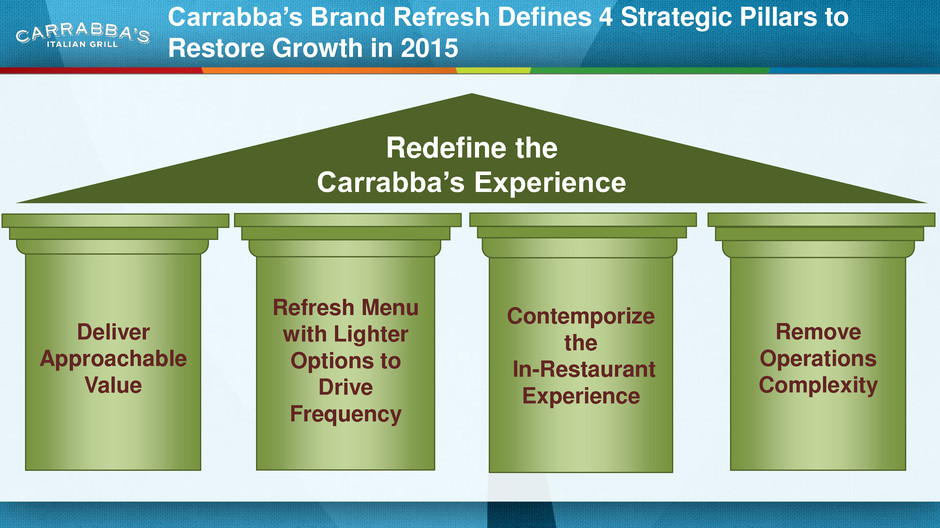

Redefine the Carrabba’s Experience Carrabba’s Brand Refresh Defines 4 Strategic Pillars to Restore Growth in 2015 Deliver Approachable Value Refresh Menu with Lighter Options to Drive Frequency Contemporize the In-Restaurant Experience Remove Operations Complexity

More Entry Level Options Broader Variety Across Price Points Communicate Value through Marketing Balance Indulgence with More Everyday Options Small Plates for Sharing Lighter Items <600 Calories Continue to Evolve Decor More Contemporary Uniforms Update Music and Lighting Reduce Menu Items Reduce Ingredients Redesign Kitchen Flow Leverage Technology Launch A Less Complex, More Affordable Menu in 2015 Deliver Approachable Value Refresh the Menu / Lighter Options Contemporize In- Restaurant Experience Remove Operations Complexity

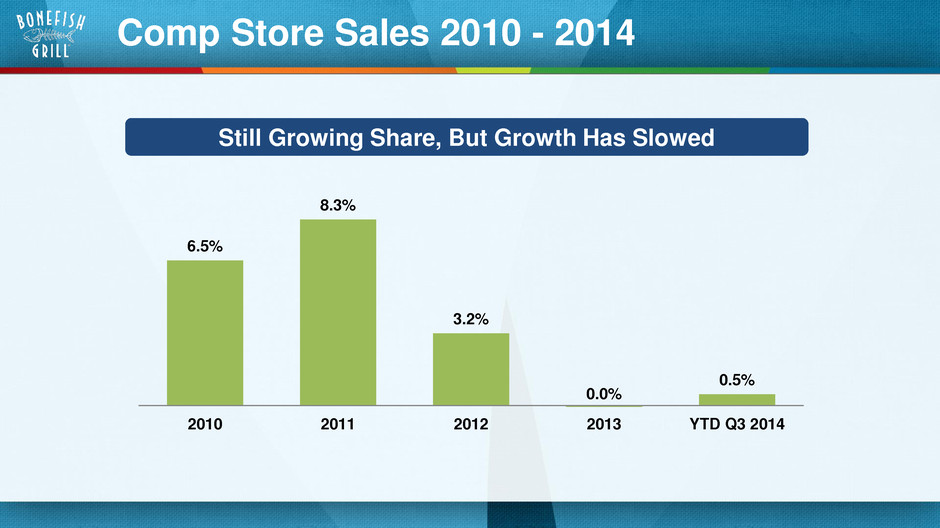

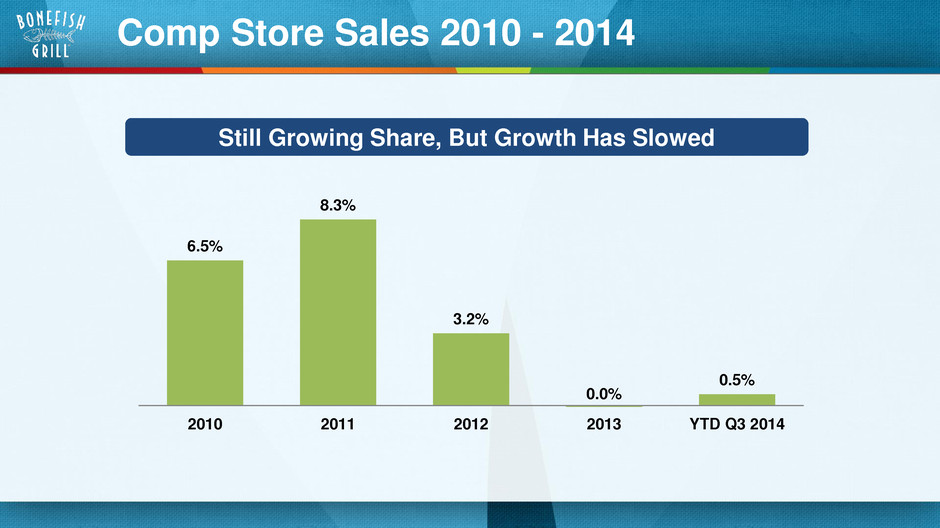

Comp Store Sales 2010 - 2014 6.5% 8.3% 3.2% 0.0% 0.5% 2010 2011 2012 2013 YTD Q3 2014 Still Growing Share, But Growth Has Slowed

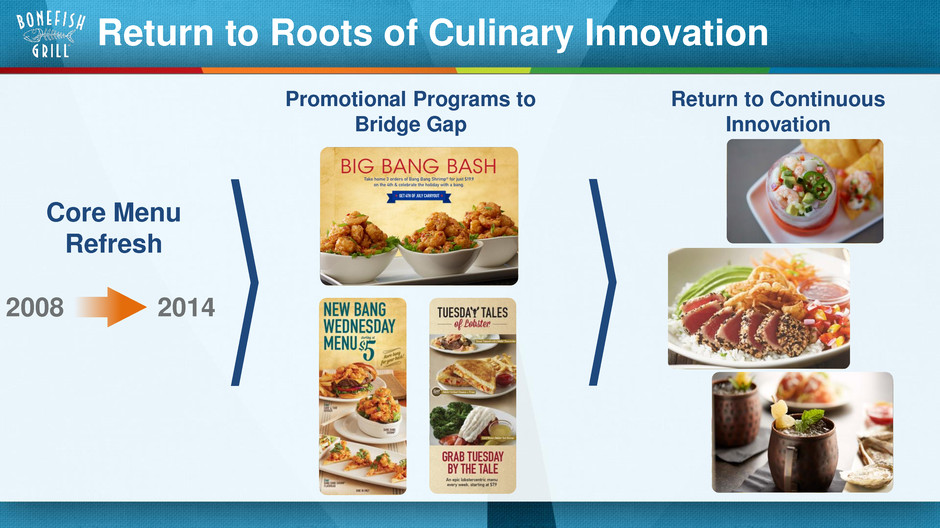

Return to Roots of Culinary Innovation Core Menu Refresh 2008 2014 Promotional Programs to Bridge Gap Return to Continuous Innovation

New Core Menu: • Launched New Menu July 2014 – 36 New items and 3 new food platforms – Increase in customer satisfaction • Seasonal menus corresponding to fishing seasons Innovative, Independent, Polished, Unique Private Dining Program: New Bar Menu: • Launched August 2014 • Launches January 2015 Online Reservations: • Launched November 2014 •Accounts for 46% of reservations

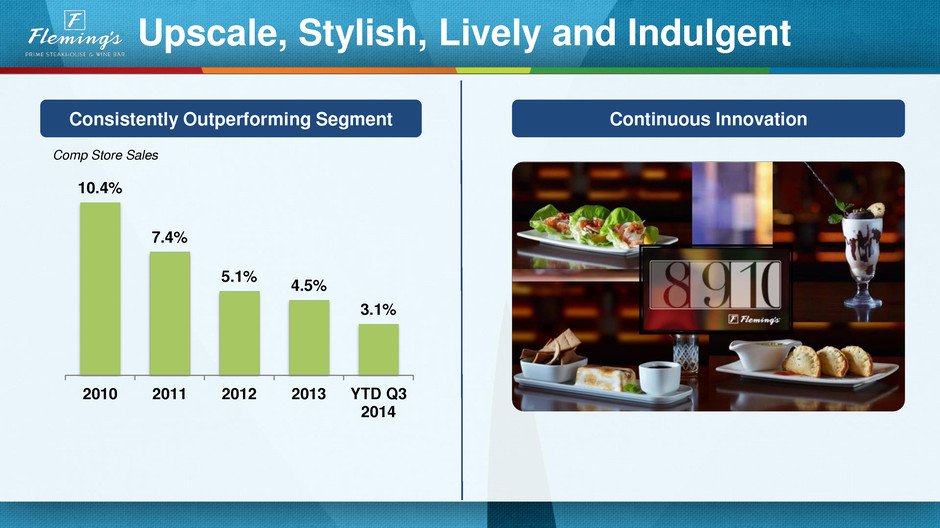

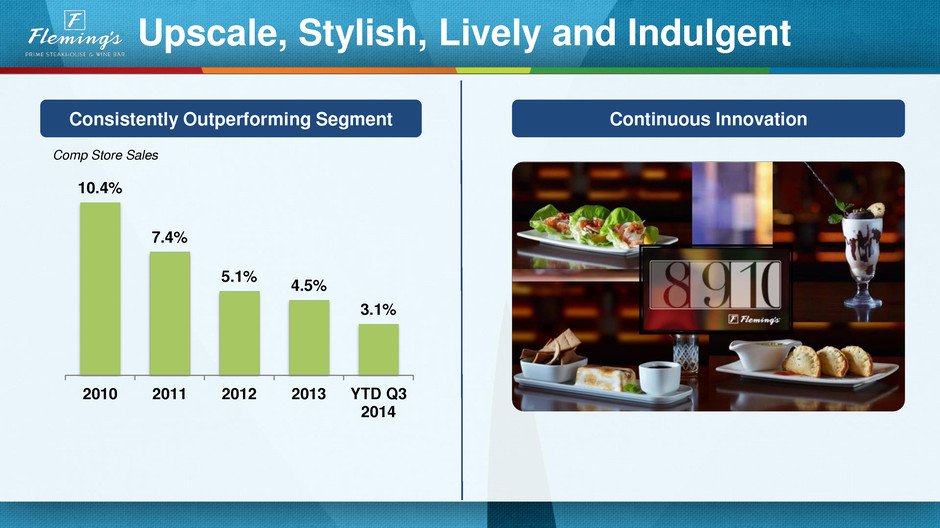

10.4% 7.4% 5.1% 4.5% 3.1% 2010 2011 2012 2013 YTD Q3 2014 Upscale, Stylish, Lively and Indulgent Consistently Outperforming Segment Continuous Innovation Comp Store Sales

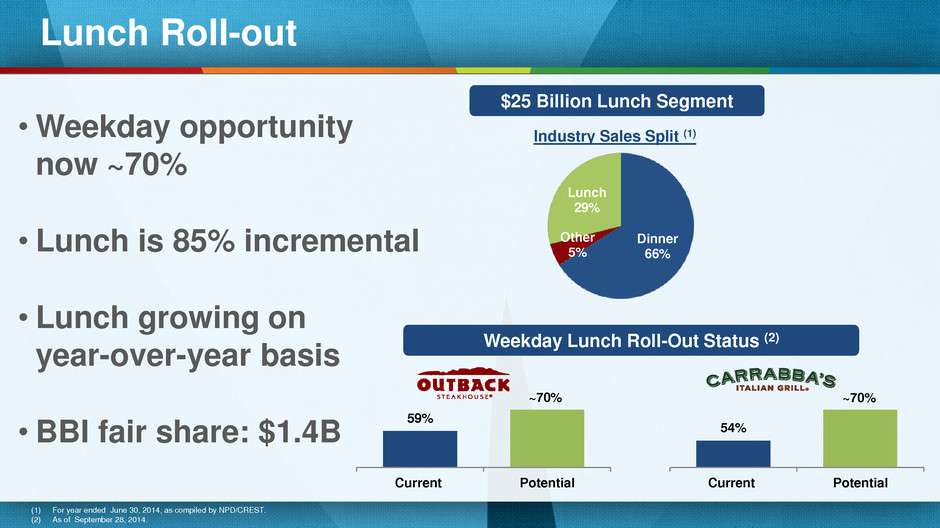

54% Current Potential 59% Current Potential Dinner 66% Other 5% Lunch 29% (1) For year ended June 30, 2014, as compiled by NPD/CREST. (2) As of September 28, 2014. •Weekday opportunity now ~70% • Lunch is 85% incremental • Lunch growing on year-over-year basis •BBI fair share: $1.4B Industry Sales Split (1) Lunch Roll-out $25 Billion Lunch Segment Weekday Lunch Roll-Out Status (2) ~70% ~70%

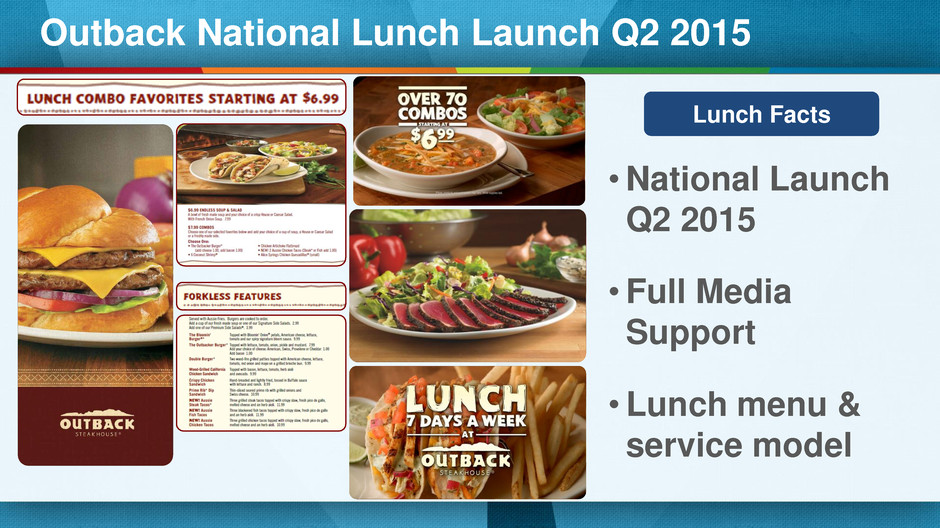

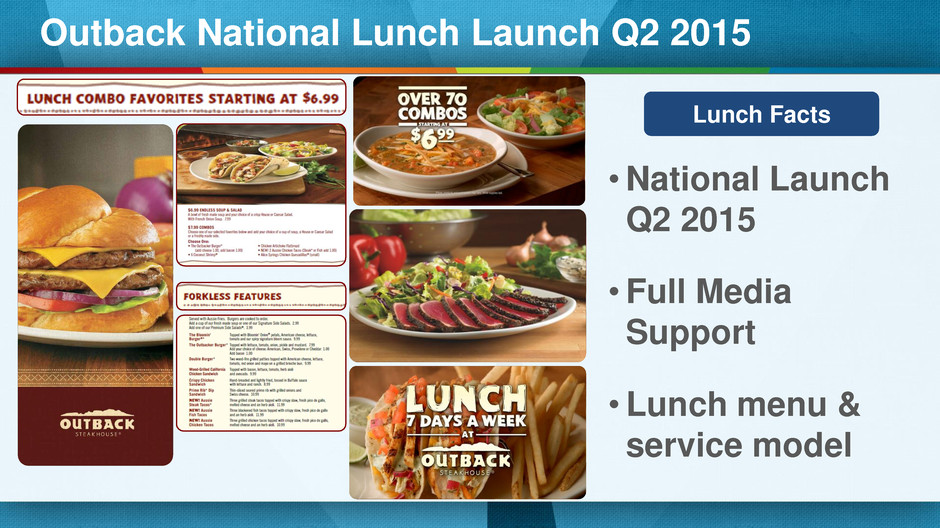

Outback National Lunch Launch Q2 2015 •National Launch Q2 2015 • Full Media Support •Lunch menu & service model Lunch Facts

• Interior remodel completed in 2013 • 30+ Exteriors in test • 40% fleet remodel complete • +3% lift holding • Updated look for all new units • Multi-year refresh underway • Updated look for all new units • Multi-year refresh underway Multi-year Remodel Program Elevates Portfolio Brand Image and Enhances Consistency

Outback Exterior

Carrabba’s Remodel

Bonefish Remodel Consistent with Contemporary Polished Position

Continuous Productivity Mindset to Fund Investment World Class Team and Infrastructure to Build Scale Three Platforms for Sustainable Growth Unchanged 3 Accelerate International Growth 1 Grow Comp Sales & Profitability 2 Domestic New Unit Expansion

Domestic New Unit Expansion: Portfolio Re-Prioritization 2 Growth: Ramp to 3.5% (75% Domestic) • 2% annual growth (50% Domestic) • Intense Competition for “A” Sites Brand Bonefish Re-Prioritization: Carrabba’s • Bonefish • Outback – New + Relocations • Fleming’s • Carrabba’s: on-hold IPO Now

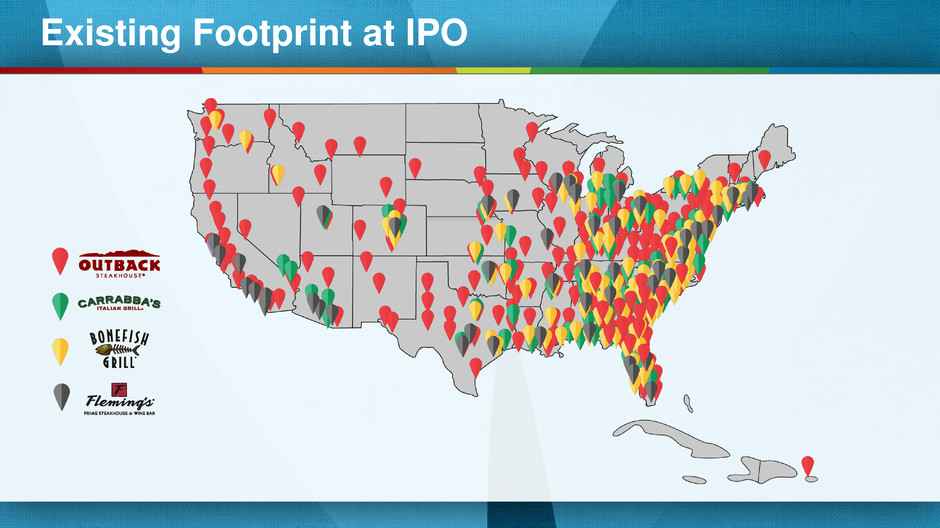

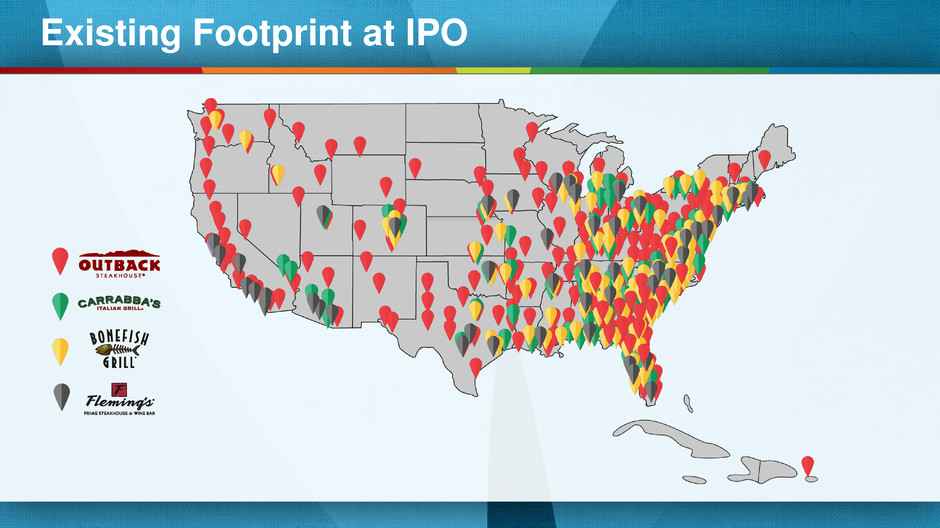

Existing Footprint at IPO

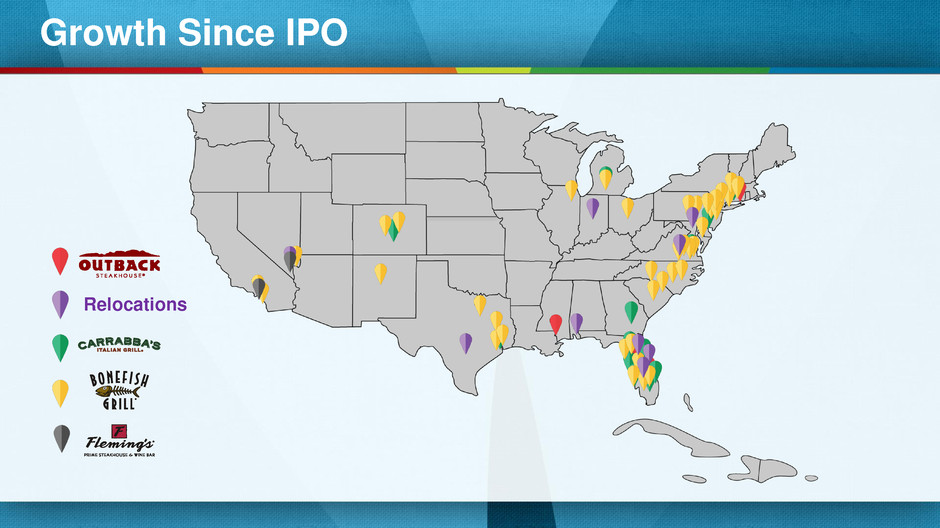

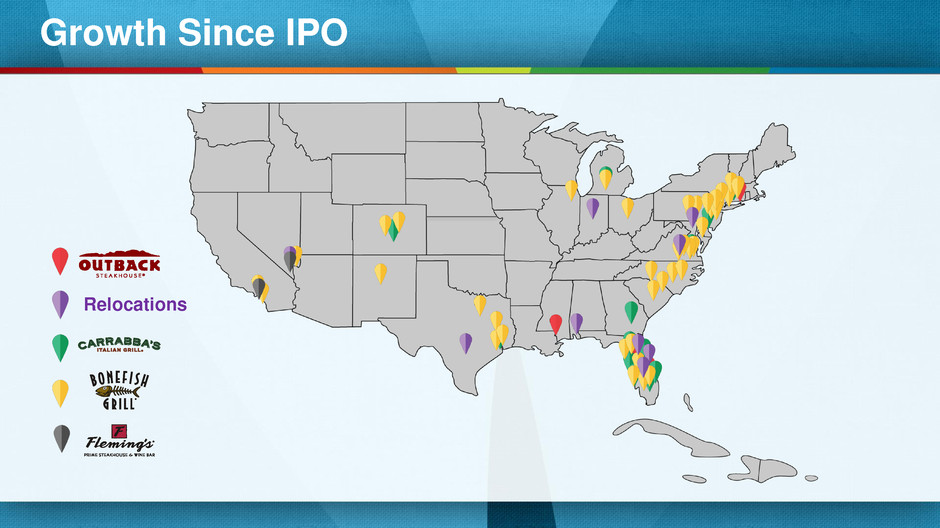

Growth Since IPO Relocations

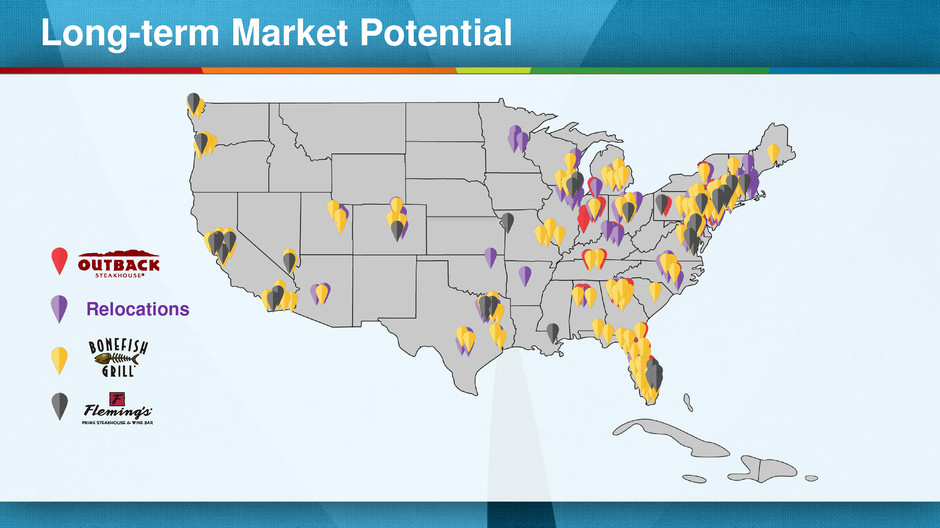

Long-term Market Potential Unit Potential [xx] [xx] [xx] [xx] Relocations

Acceleration of Relocation Opportunity • Identified opportunity for 100+ across Outback – Initial tests have proven successful • Revitalization of these assets enables us to: – Increase site visibility and access – Contemporize image – Capitalize on lunch daypart

Continuous Productivity Mindset to Fund Investment World Class Team and Infrastructure to Build Scale Three Platforms for Sustainable Growth Unchanged 1 Grow Comp Sales & Profitability 2 Domestic New Unit Expansion 3 Accelerate International Growth

3 South Korea Brazil Hong Kong China - 3 units North America Middle East Latin America Asia Pacific Locations by Ownership Type (1) (3) Company-owned (176) Franchise (51) 106 59 7 33 9 6 3 Mexico - 1 unit Platform for International Growth (1) As of September 28, 2014 (2) Includes $546 million in sales from Company-owned restaurants and $146 million from franchised and joint venture locations for the twelve periods ending September 28, 2014. (3) Includes 34 restaurants in South Korea that are planned to close primarily during Q4 2014 and Q1 2015. • Focused on Outback since 1996 – Current base of 227 units in 21 countries(1) – $692M system-wide sales(2) • Strong infrastructure and leadership to leverage in high CDR growth LATAM and Asia markets

Grow Company and Joint-Venture Markets Ring-fence Korea Selectively Franchise • Brazil •China • Andean Cluster International Growth Priorities • Reduce footprint from 106 to 72 • Financial exposure contained • Southeast Asia • Middle East 2 3 1 46 new openings since IPO, including 40+% of 2014 openings

Launch 2nd Concept Globally • Bringing Carrabba’s to Brazil • Locally adapting the brand • First two stores to open in São Paulo in March 2015 • Italian is the #2 segment • Leveraging strong in-market capability

Mindset to Fund Investment World Class Team and Infrastructure to Build Scale Three Platforms for Sustainable Growth Unchanged 1 Grow Comp Sales & Profitability 2 Domestic New Unit Expansion 3 Accelerate International Growth Productivity Continuous

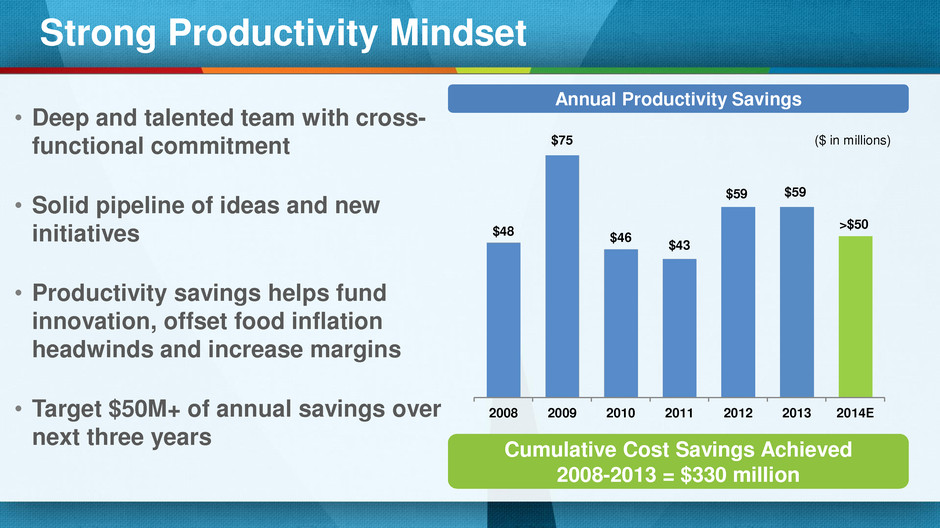

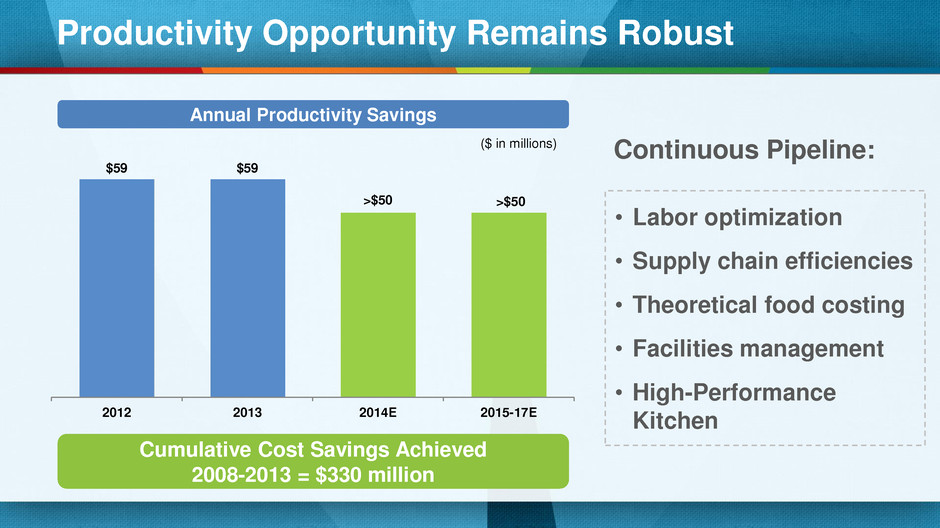

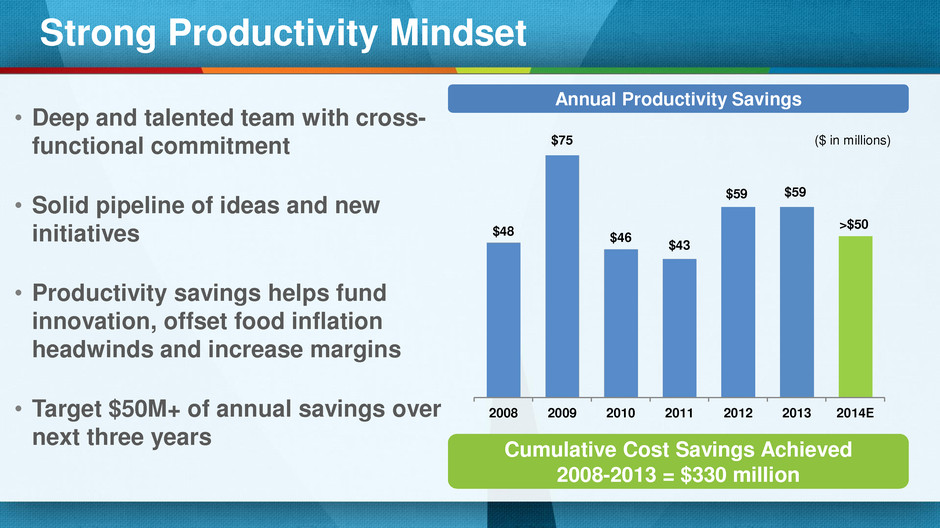

Strong Productivity Mindset $48 $75 $46 $43 $59 $59 >$50 2008 2009 2010 2011 2012 2013 2014E • Deep and talented team with cross- functional commitment • Solid pipeline of ideas and new initiatives • Productivity savings helps fund innovation, offset food inflation headwinds and increase margins • Target $50M+ of annual savings over next three years Annual Productivity Savings ($ in millions) Cumulative Cost Savings Achieved 2008-2013 = $330 million

Concepts Strong Operational Leadership Combined With Functional Expertise Liz Smith Chief Executive Officer Mike Kappitt SVP, Global Chief Marketing Officer Joe Kadow EVP, Chief Legal Officer Donagh Herlihy EVP, Digital & Chief Information Officer David Deno EVP, CFAO John Li SVP, Chief R&D Officer Pat Murtha EVP, President BBI International Jeff Smith EVP, President Outback Steakhouse Stephen Judge EVP, President Bonefish Grill Dave Pace EVP, President Carrabba’s Mandy Shaw SVP, CAO and International Finance Juan Guerrero SVP, Chief Global Supply Chain Officer Suk Singh SVP, Chief Development Officer Recent Hires Skip Fox SVP, President Fleming’s Gregg Scarlett SVP, CDR Operations

2015 and Beyond

Bloomin’ Brands Go Forward Business Model Approx. 2% Comp Sales Growth Sales Levers Flat to Down Domestic Segment International Expansion Disciplined Pricing Margin Levers Ongoing Productivity Efforts Investing Ahead of Growth +10% increasing to +15% Long-term EPS Growth Target1 1 Adjusted Diluted EPS

Domestic Debt pay-down • New Development - Bonefish • Renovations - Fleet • Relocations - Outback • Maintenance • Digital & IT Initiatives BLMN Free Cash Flow Has Been Used Primarily For Debt Repayment Capex & Maintenance Excess Cash Flow • Brazil • China International Note: Cash uses above exclude interest, taxes, and compensation plans as well as changes in new working capital $215 million to $235 million $100 million to $150 million

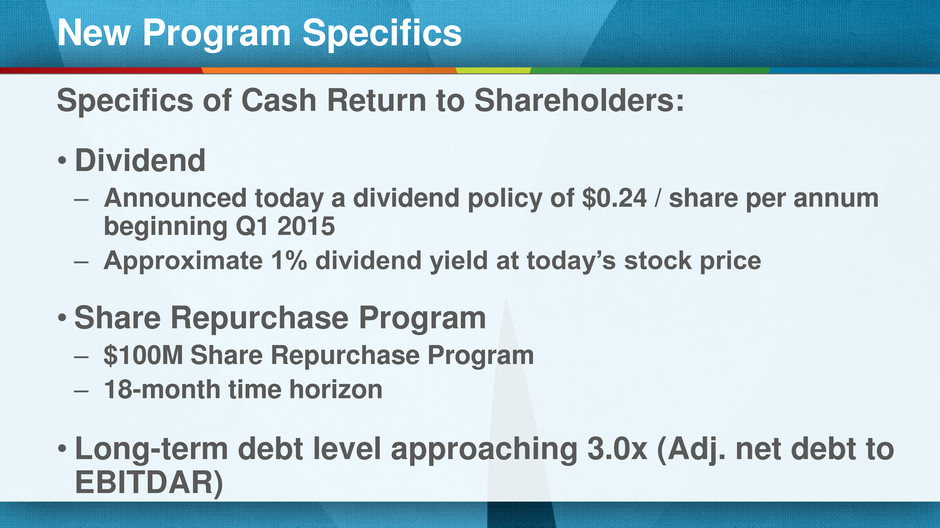

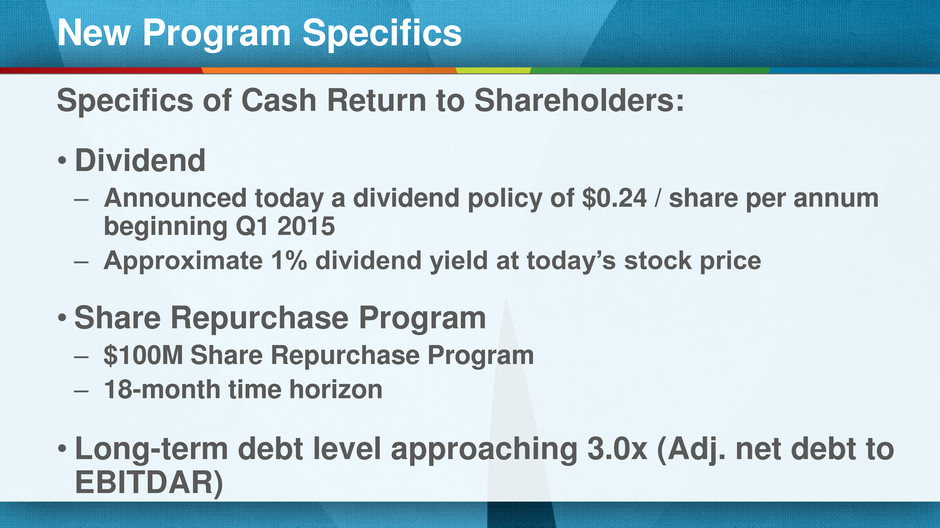

In 2015 We Return Cash to Shareholders •Implementing a $100M program over 18 months •$0.24 per annum beginning Q1 •Approximate 1% dividend yield at today’s price Dividend Share Buyback Discretionary Cash

Dividend Domestic Debt Pay-down • New Development - Bonefish • Renovations - Fleet • Relocations - Outback • Maintenance • Digital & IT Initiatives Disciplined Cash Flow Investment Funds Growth and Strengthens Balance Sheet in 2015 Capex & Maintenance Excess Cash Flow • Brazil • China • Balanced strategy to utilize excess cash International Stock Purchase Note: Cash uses above exclude interest, taxes, and compensation plans as well as changes in new working capital $235 million to $255 million $110 million to $160 million

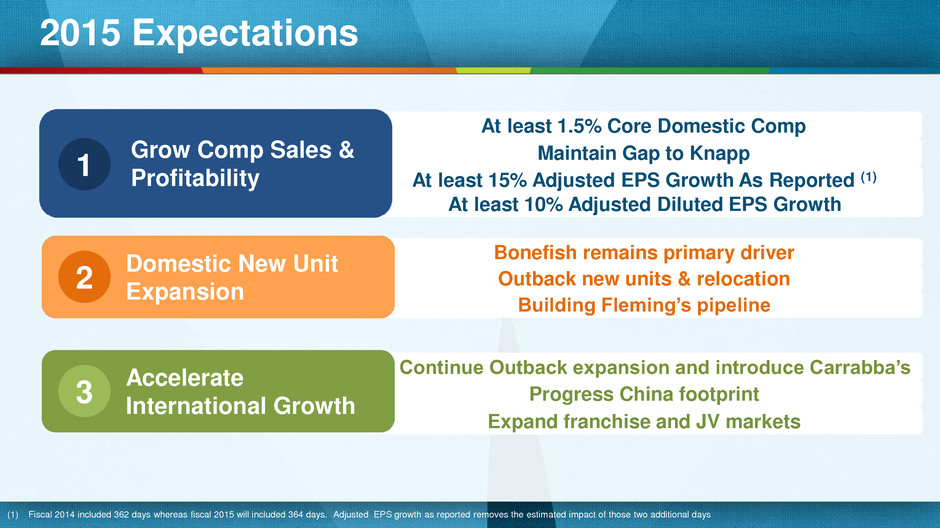

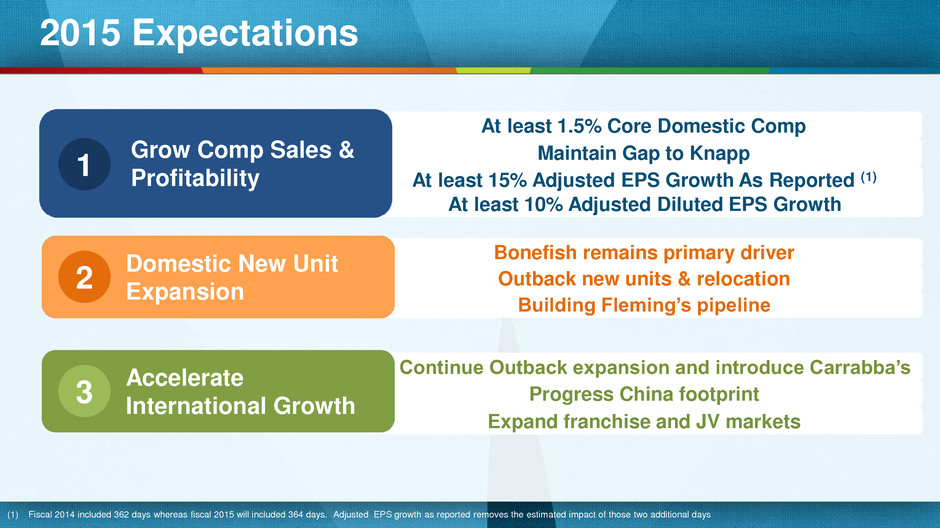

At least 10% Adjusted Diluted EPS Growth At least 15% Adjusted EPS Growth As Reported (1) Maintain Gap to Knapp At least 1.5% Core Domestic Comp Expand franchise and JV markets 2015 Expectations Building Fleming’s pipeline Outback new units & relocation Bonefish remains primary driver Domestic New Unit Expansion 2 Progress China footprint Continue Outback expansion and introduce Carrabba’s Accelerate International Growth 3 Grow Comp Sales & Profitability 1 (1) Fiscal 2014 included 362 days whereas fiscal 2015 will included 364 days. Adjusted EPS growth as reported removes the estimated impact of those two additional days

Adding It All Up… We Remain Very Bullish About Our Long-term Growth Opportunities •Well-positioned brands in their respective categories • Established global platform with growth opportunities • Significant margin improvement opportunities • Improving capital structure that provides more flexibility DISCIPLINED STEWARDS OF CAPITAL

David Deno Chief Financial and Administrative Officer

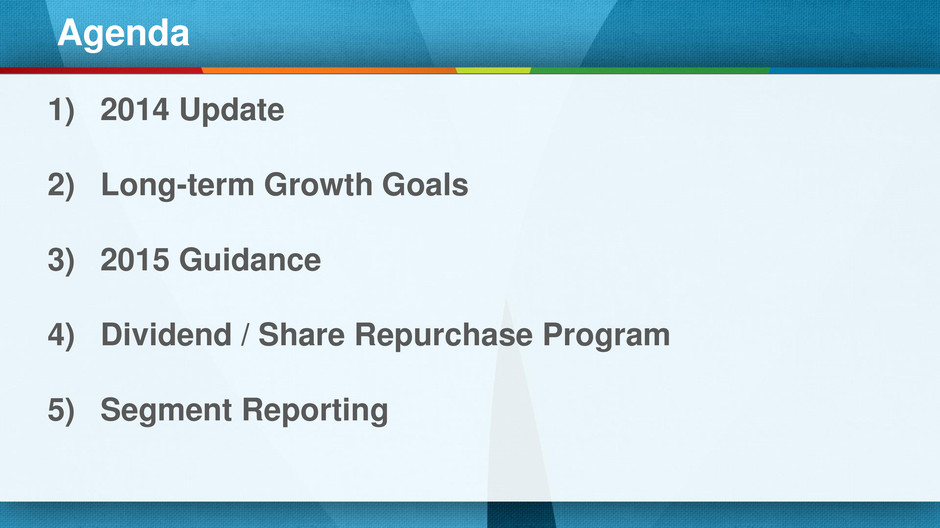

Agenda 1) 2014 Update 2) Long-term Growth Goals 3) 2015 Guidance 4) Dividend / Share Repurchase Program 5) Segment Reporting

2014 Update

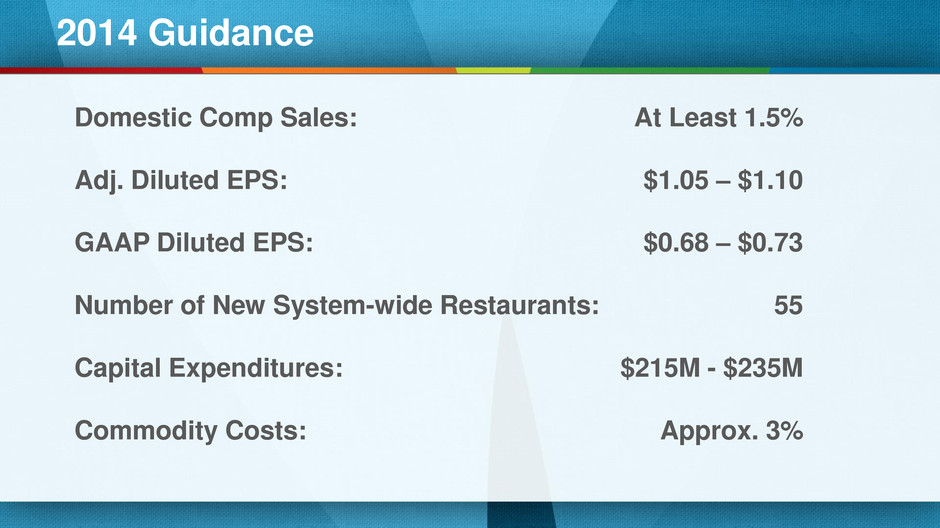

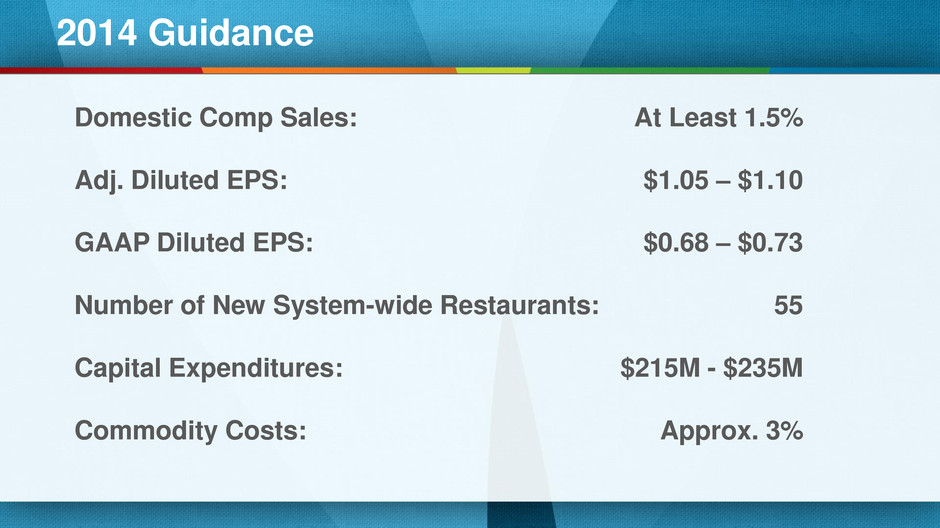

2014 Guidance Domestic Comp Sales: At Least 1.5% Adj. Diluted EPS: $1.05 – $1.10 GAAP Diluted EPS: $0.68 – $0.73 Number of New System-wide Restaurants: 55 Capital Expenditures: $215M - $235M Commodity Costs: Approx. 3%

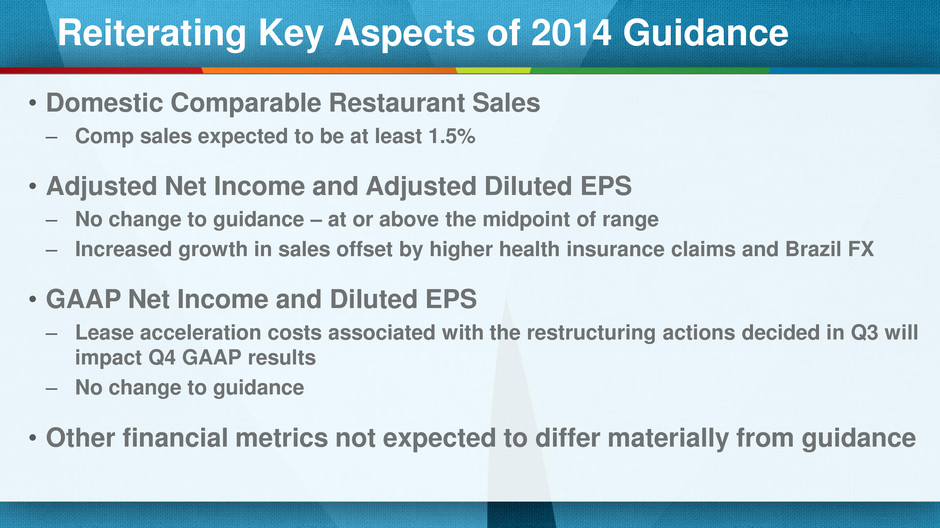

Reiterating Key Aspects of 2014 Guidance • Domestic Comparable Restaurant Sales – Comp sales expected to be at least 1.5% • Adjusted Net Income and Adjusted Diluted EPS – No change to guidance – at or above the midpoint of range – Increased growth in sales offset by higher health insurance claims and Brazil FX • GAAP Net Income and Diluted EPS – Lease acceleration costs associated with the restructuring actions decided in Q3 will impact Q4 GAAP results – No change to guidance • Other financial metrics not expected to differ materially from guidance

Long-term Growth Goals

3-Year Plan Goals (Annual) Domestic Comp Sales: Approx. 2% • 2015 expectations at least 1.5% Adj. Diluted EPS Growth: 10% increasing to 15% Capital Expenditures: $235M - $290M Commodity Costs: +3% Number of New System-wide Restaurants: 60 – 90 • 2015 expectations 40 to 50

Financial Goals Adapted to Reflect Current Environment What’s Changed? What Hasn’t Changed? • Domestic Comp Sales reflect CDR market trends • Reprioritized new unit development • International opportunity bigger than expected • Productivity pipeline and initiatives strong • Significant margin improvement opportunities • Improving capital structure that provides more flexibility

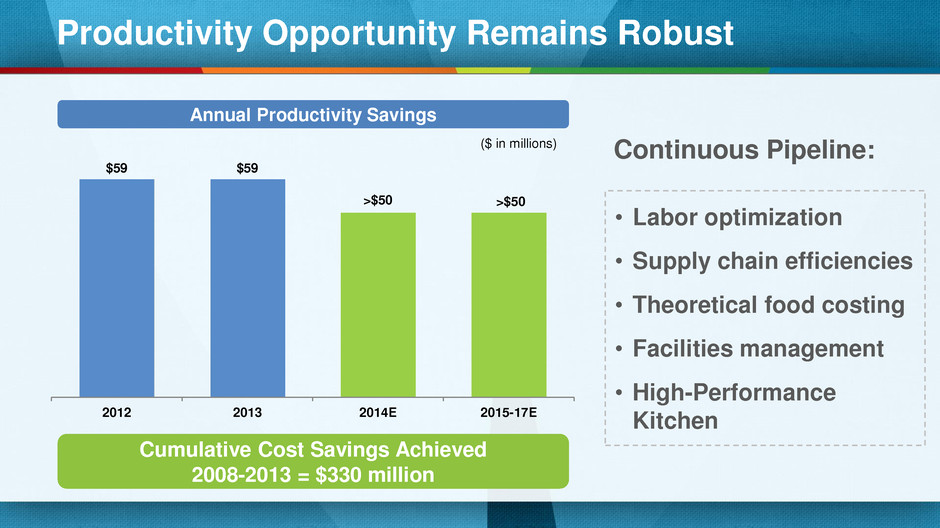

Productivity Opportunity Remains Robust $59 $59 >$50 >$50 2012 2013 2014E 2015-17E Annual Productivity Savings ($ in millions) Cumulative Cost Savings Achieved 2008-2013 = $330 million • Labor optimization • Supply chain efficiencies • Theoretical food costing • Facilities management • High-Performance Kitchen Continuous Pipeline:

Winning Formula: Pricing + Productivity Offsets Inflation • Inflationary pressures expected to continue – Commodity pressures – Wage inflation – Rent • Productivity is the lever that allows for prudent levels of pricing • Pricing below inflation protects traffic

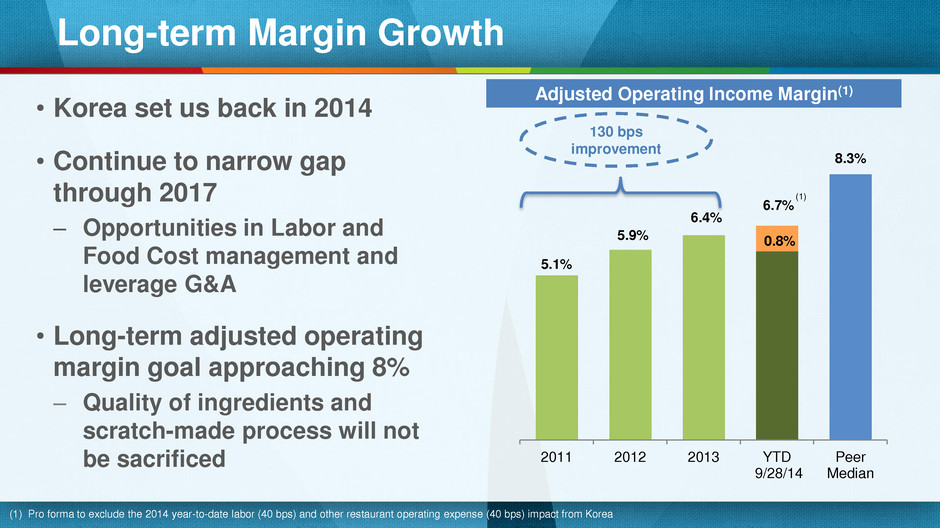

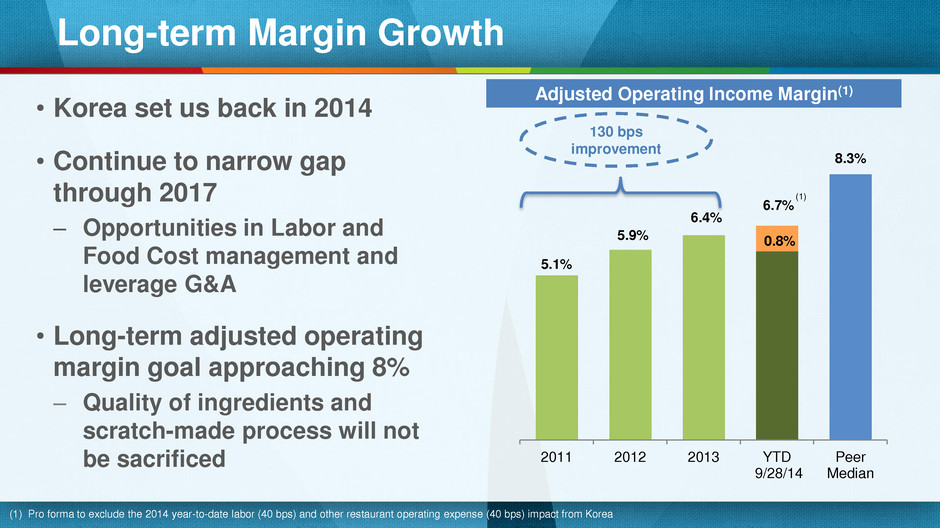

Long-term Margin Growth • Korea set us back in 2014 • Continue to narrow gap through 2017 – Opportunities in Labor and Food Cost management and leverage G&A • Long-term adjusted operating margin goal approaching 8% – Quality of ingredients and scratch-made process will not be sacrificed Adjusted Operating Income Margin(1) 5.1% 5.9% 6.4% 6.7% 0.8% 8.3% 2011 2012 2013 YTD 9/28/14 Peer Median 130 bps improvement (1) (1) Pro forma to exclude the 2014 year-to-date labor (40 bps) and other restaurant operating expense (40 bps) impact from Korea

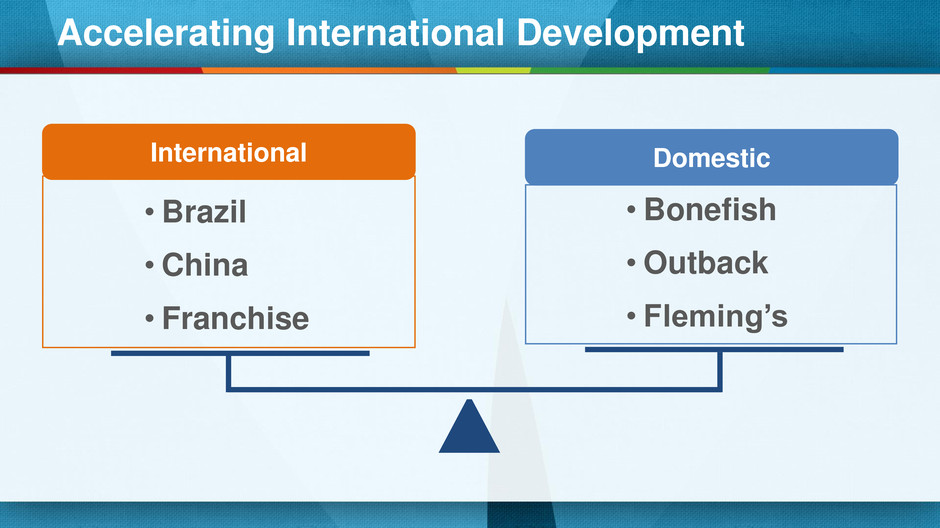

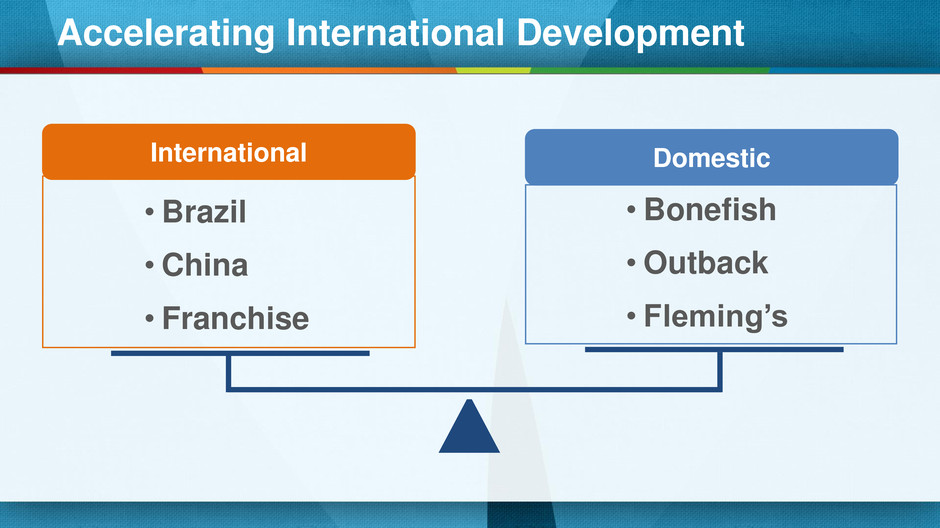

Accelerating International Development International Domestic • Brazil • China • Franchise • Bonefish • Outback • Fleming’s [_] to [_] stores [_] to [_] stores

Relocation Tests Have Proven Successful and Program Will Accelerate • Identified opportunity for 100+ across Outback – Ramp up to 10+ each year • 20 - 40% lifts observed in test • Going forward, will add back asset impairment costs related to Outback relocation program Before After

Capital Expectations – Disciplined Stewards of Capital •Capital expenditures guided by: – Highest levels of return – Investment ahead of growth • 2016 and beyond: – Increased spend in the range of $270M to $290M per year – Build out new restaurant pipeline with emphasis on International growth All Initiatives Are Funded In 3-year Plan

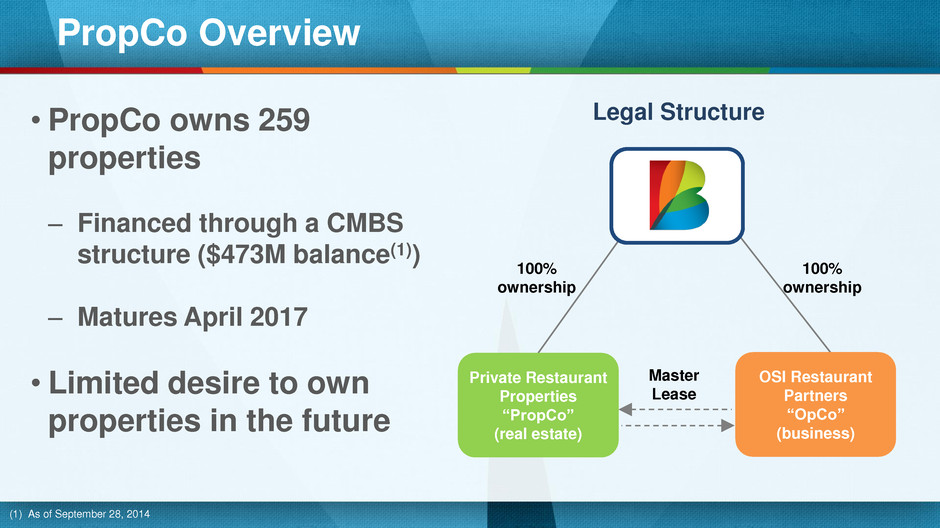

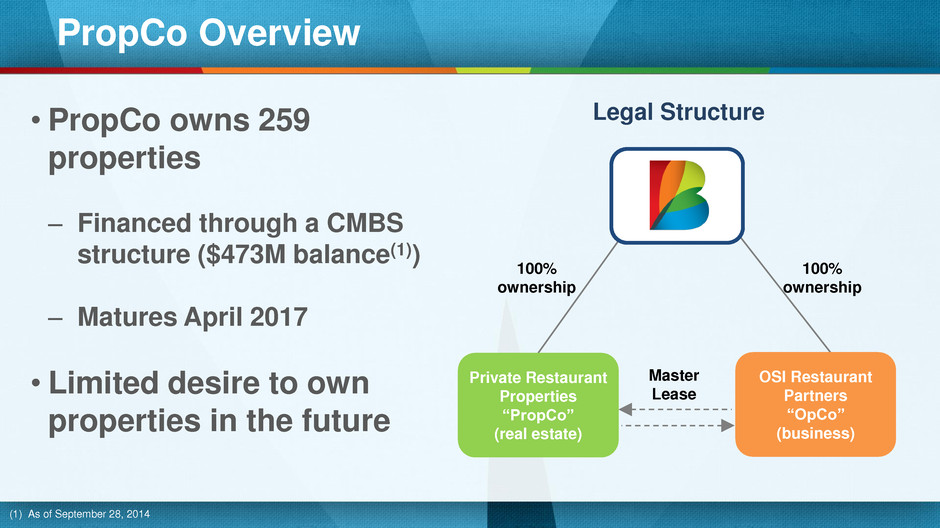

PropCo Overview • PropCo owns 259 properties – Financed through a CMBS structure ($473M balance(1)) – Matures April 2017 • Limited desire to own properties in the future 100% ownership Master Lease 100% ownership OSI Restaurant Partners “OpCo” (business) Private Restaurant Properties “PropCo” (real estate) Legal Structure (1) As of September 28, 2014

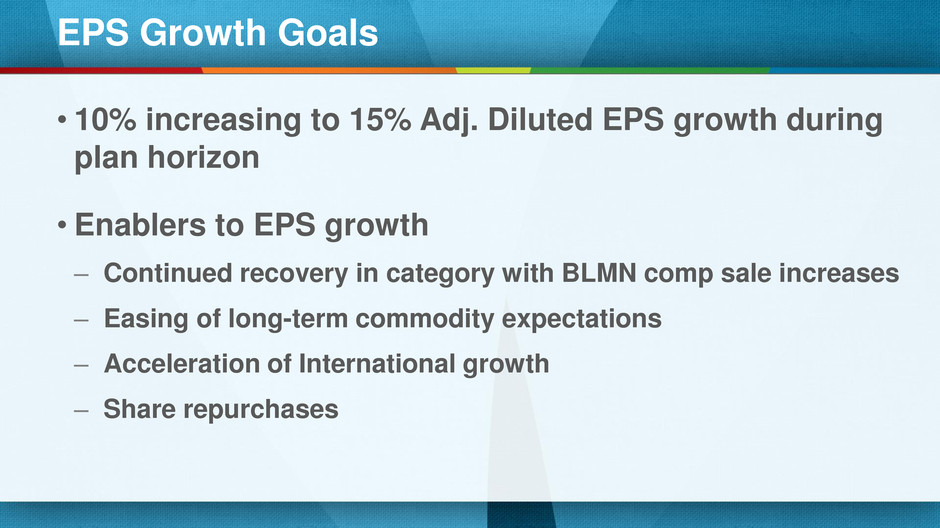

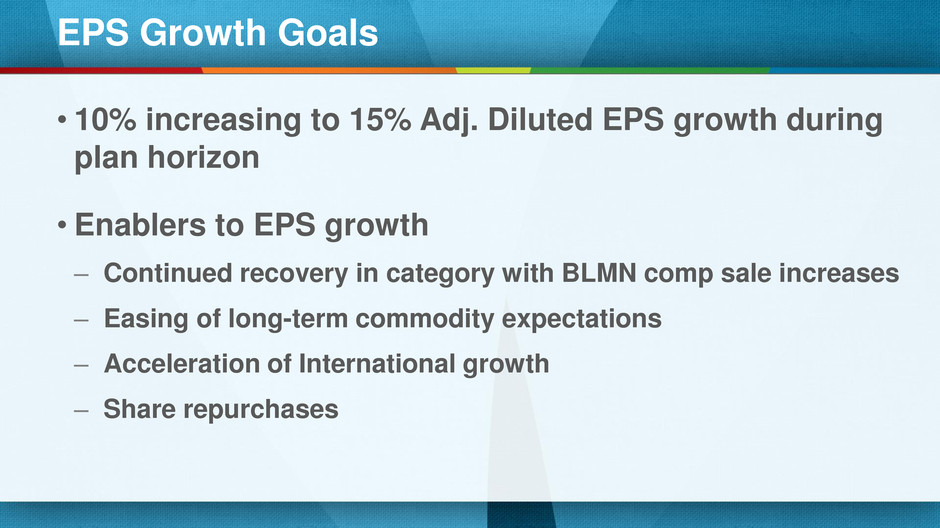

EPS Growth Goals • 10% increasing to 15% Adj. Diluted EPS growth during plan horizon • Enablers to EPS growth – Continued recovery in category with BLMN comp sale increases – Easing of long-term commodity expectations – Acceleration of International growth – Share repurchases

2015 Guidance

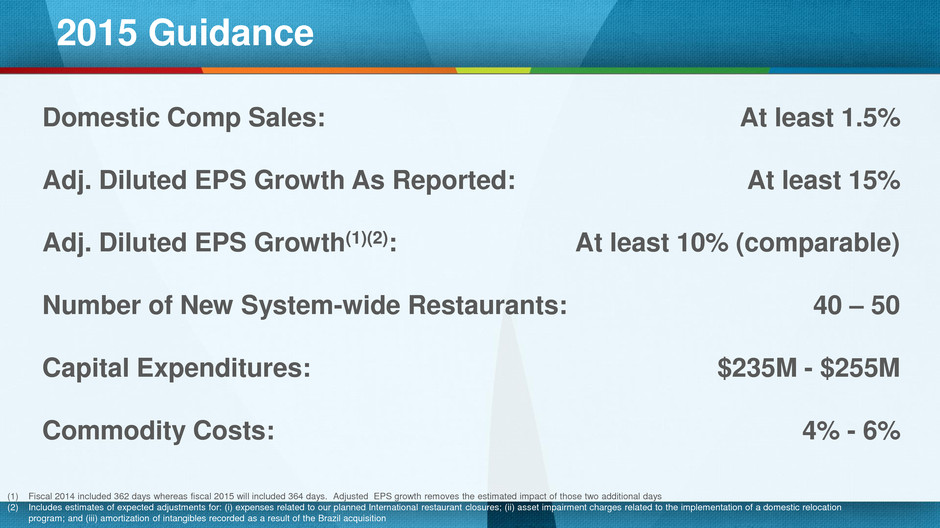

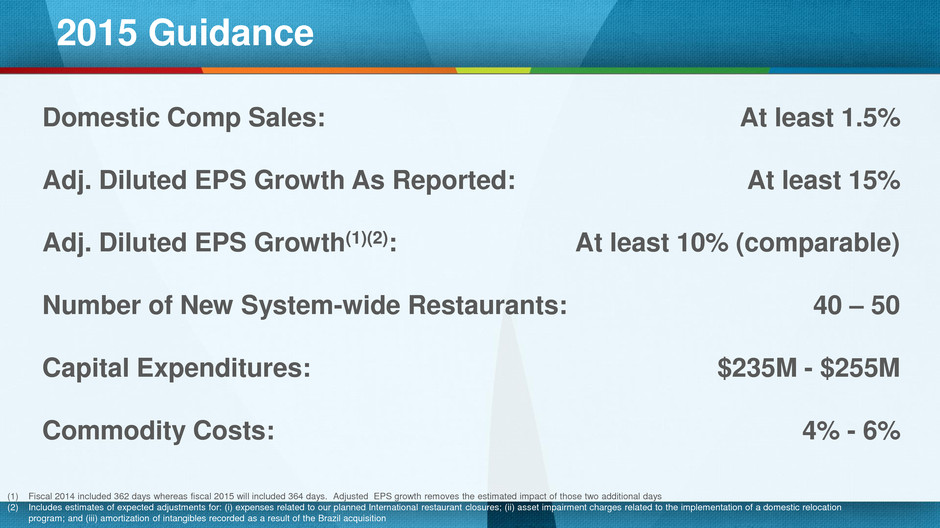

Domestic Comp Sales: At least 1.5% Adj. Diluted EPS Growth As Reported: At least 15% Adj. Diluted EPS Growth(1)(2): At least 10% (comparable) Number of New System-wide Restaurants: 40 – 50 Capital Expenditures: $235M - $255M Commodity Costs: 4% - 6% 2015 Guidance (1) Fiscal 2014 included 362 days whereas fiscal 2015 will included 364 days. Adjusted EPS growth removes the estimated impact of those two additional days (2) Includes estimates of expected adjustments for: (i) expenses related to our planned International restaurant closures; (ii) asset impairment charges related to the implementation of a domestic relocation program; and (iii) amortization of intangibles recorded as a result of the Brazil acquisition

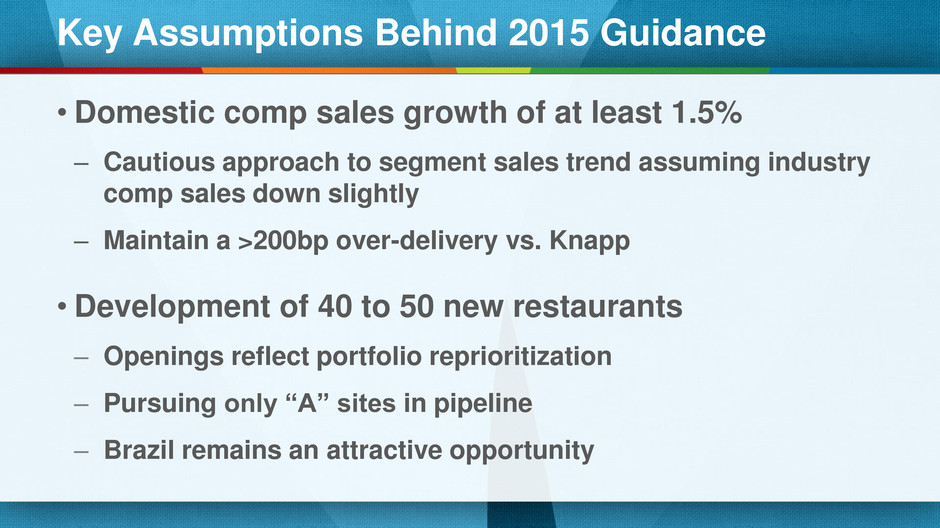

Key Assumptions Behind 2015 Guidance • Domestic comp sales growth of at least 1.5% – Cautious approach to segment sales trend assuming industry comp sales down slightly – Maintain a >200bp over-delivery vs. Knapp •Development of 40 to 50 new restaurants – Openings reflect portfolio reprioritization – Pursuing only “A” sites in pipeline – Brazil remains an attractive opportunity

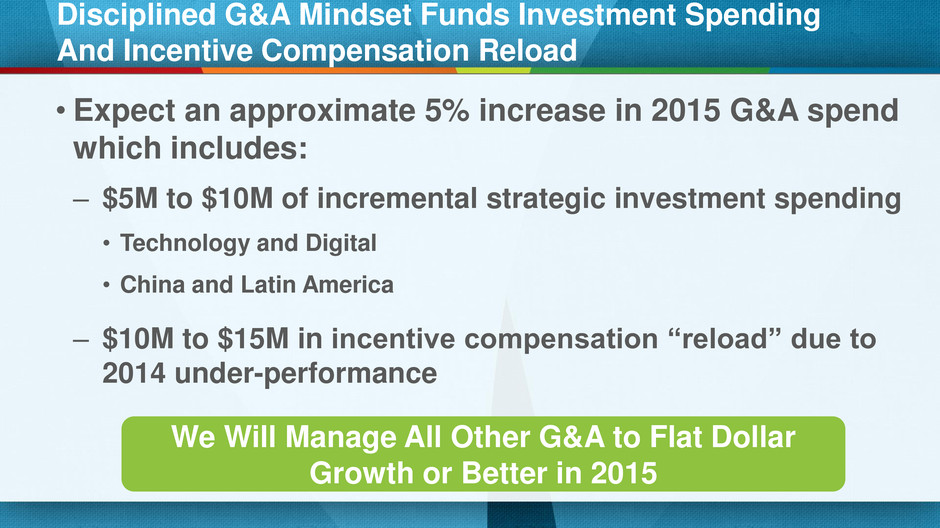

• Expect an approximate 5% increase in 2015 G&A spend which includes: – $5M to $10M of incremental strategic investment spending • Technology and Digital • China and Latin America – $10M to $15M in incentive compensation “reload” due to 2014 under-performance Disciplined G&A Mindset Funds Investment Spending And Incentive Compensation Reload We Will Manage All Other G&A to Flat Dollar Growth or Better in 2015

Key Assumptions Behind 2015 Guidance •Other factors: – FOREX curve for the Brazilian Real suggests a $9M headwind in 2015 – Higher expected commodity costs (4 - 6%) due to higher beef costs

Dividend / Share Repurchase Program

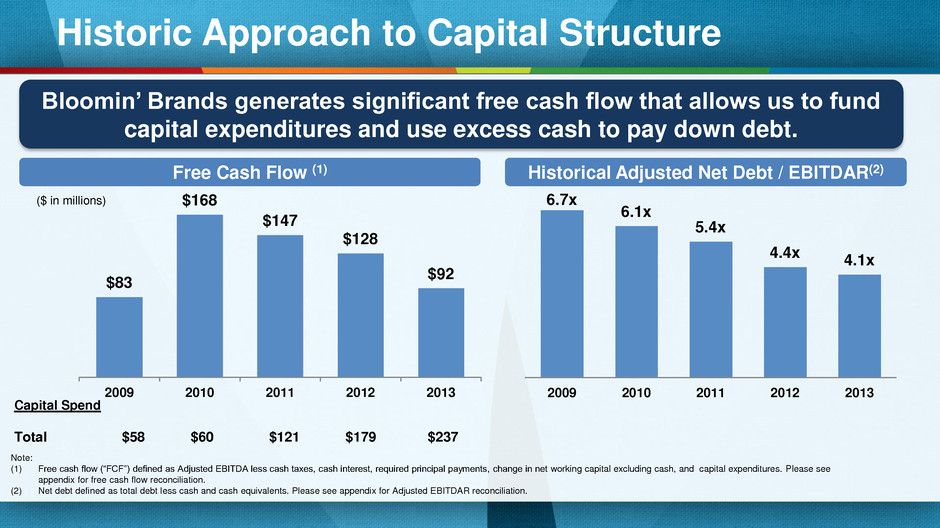

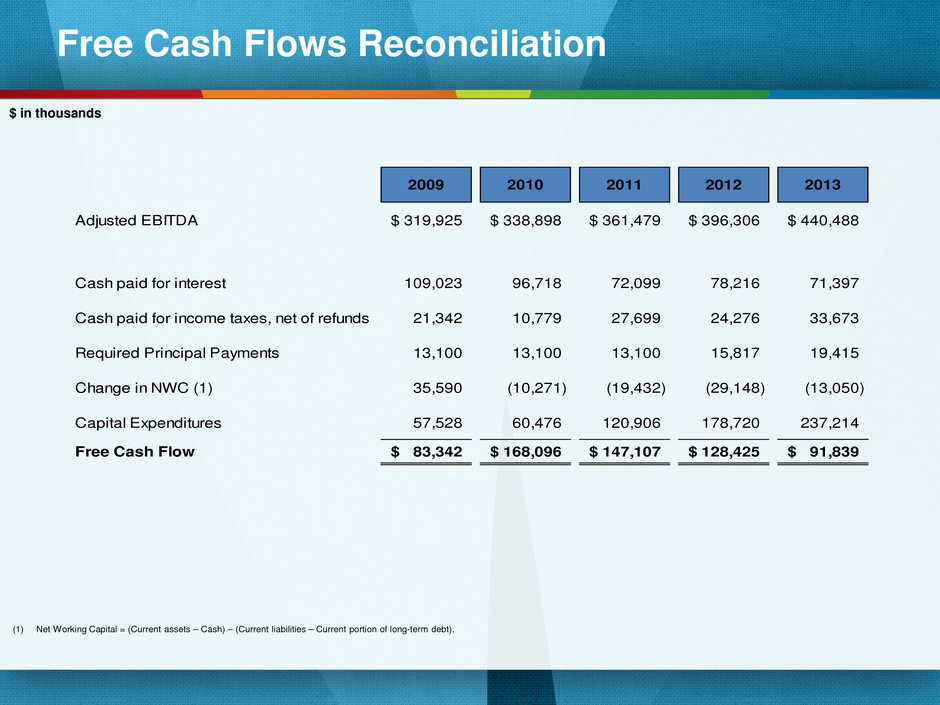

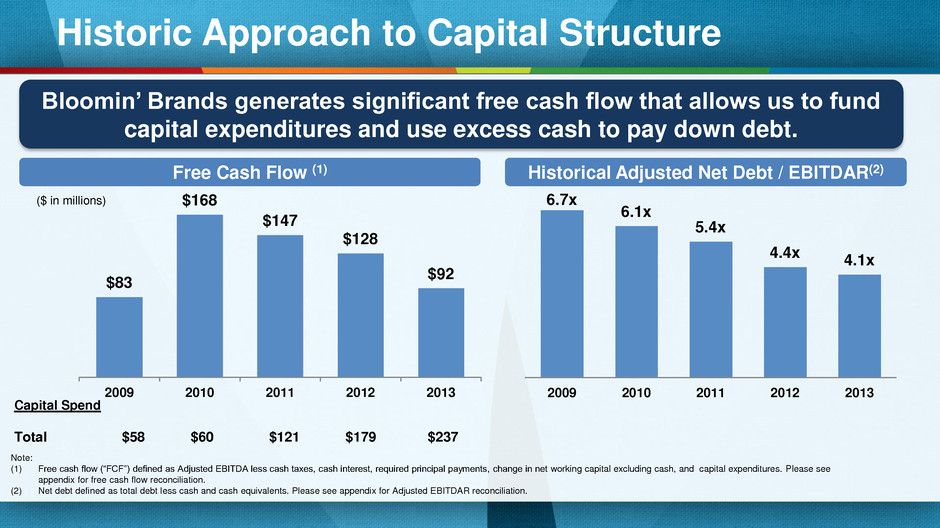

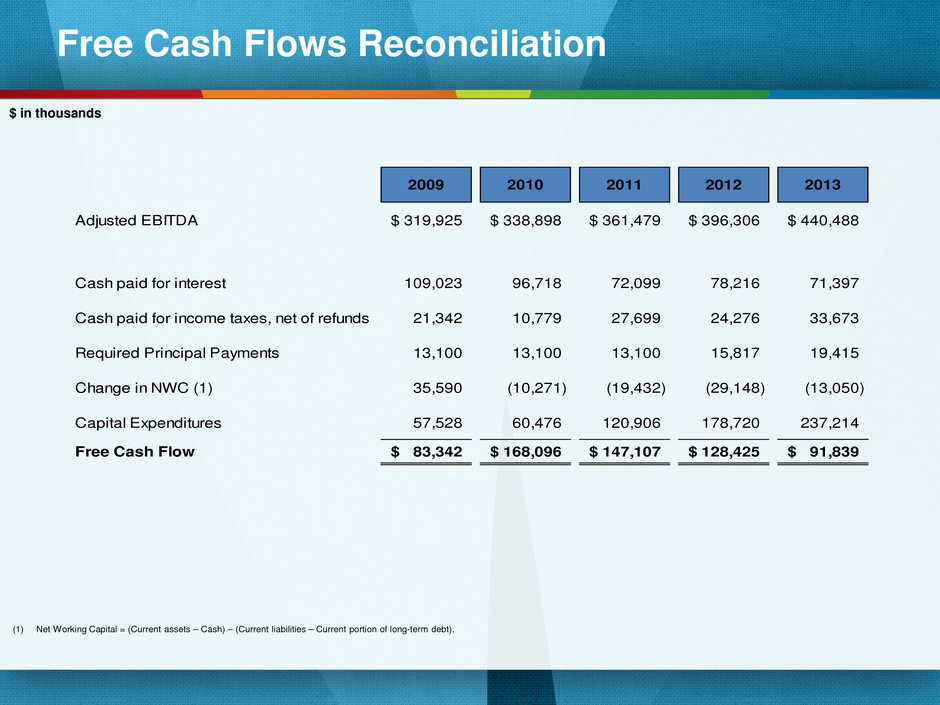

Historic Approach to Capital Structure Historical Adjusted Net Debt / EBITDAR(2) $83 $168 $147 $128 $92 2009 2010 2011 2012 2013 ($ in millions) Free Cash Flow (1) Capital Spend Total $58 $60 $121 $179 $237 Note: (1) Free cash flow (“FCF”) defined as Adjusted EBITDA less cash taxes, cash interest, required principal payments, change in net working capital excluding cash, and capital expenditures. Please see appendix for free cash flow reconciliation. (2) Net debt defined as total debt less cash and cash equivalents. Please see appendix for Adjusted EBITDAR reconciliation. Bloomin’ Brands generates significant free cash flow that allows us to fund capital expenditures and use excess cash to pay down debt. 6.7x 6.1x 5.4x 4.4x 4.1x 4.2x 2009 2010 2011 2012 2013 2014 LTM 6.7x 6.1x 5.4x 4.4x 4.1x 2009 2010 2011 2012 2013

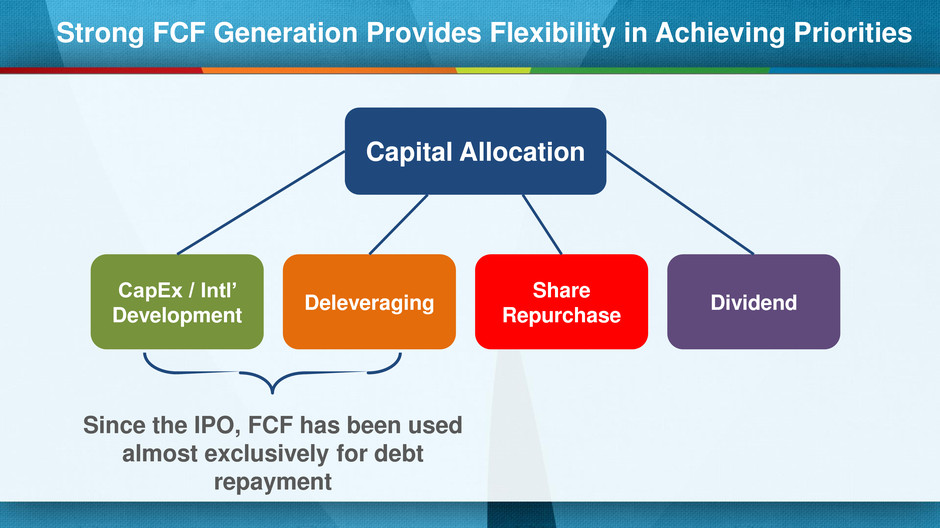

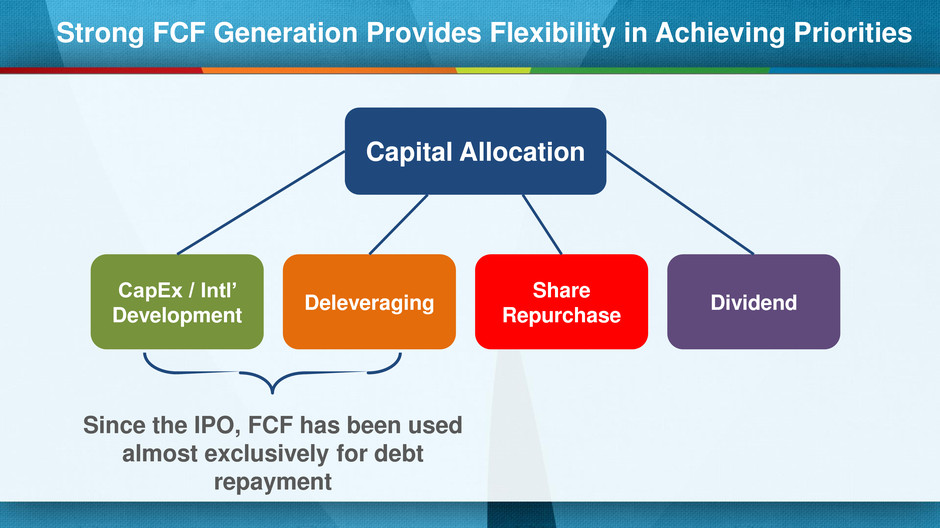

Strong FCF Generation Provides Flexibility in Achieving Priorities Since the IPO, FCF has been used almost exclusively for debt repayment Capital Allocation CapEx / Intl’ Development Deleveraging Share Repurchase Dividend

New Program Specifics Specifics of Cash Return to Shareholders: • Dividend – Announced today a dividend policy of $0.24 / share per annum beginning Q1 2015 – Approximate 1% dividend yield at today’s stock price • Share Repurchase Program – $100M Share Repurchase Program – 18-month time horizon • Long-term debt level approaching 3.0x (Adj. net debt to EBITDAR)

Segment Reporting

Segment Reporting Increases Visibility • Evolution: – Growth in International requires more visibility – Due in part to the acquisition of Brazil, we are realigning our operating segments • Solution: – Beginning with Q1 2015, we will report two segments: • U.S. segment • International segment – In addition, we will provide comp sales and AUVs for Brazil and Korea

What Are Our Goals Moving Forward? Disciplined Stewards Of Capital Long-term Goals Drivers • Continued traffic gains • Responsible price increases • Acceleration of new store expansion driven by Bonefish and International • Ongoing productivity gains • Fixed cost leverage Approx. 2% comp sales growth Improved operating margins 10% Adjusted EPS Growth increasing to 15% (comparable) Returning cash to shareholders

Appendix

Adjusted Operating Income Margin Reconciliation $ in thousands (1) Transaction-related expenses primarily relate to the following: (i) costs incurred in connection with the IPO completed in 2012, which include certain executive and stock-based compensation costs; (ii) secondary offerings of our common stock completed in 2013 and March 2014; (iii) costs incurred in 2013 to acquire a controlling ownership interest in our Brazilian operations, and (iv) the refinancings of the CMBS Loan in 2012 and the Senior Secured Credit Facility in 2012 and May 2014. (2) Relates to severance incurred as a result of our organizational realignment. (3) Represents asset impairment charges and related costs associated with our decision to sell the Roy’s concept and corporate aircraft. (4) Relates to asset impairment charges associated with the decision to close 22 domestic locations in the fourth quarter of 2013. Represents impairments incurred in the thirty- nine weeks ended September 28, 2014 related to the decision to close 36 international restaurants, and expenses incurred during the thirty-nine weeks ended September 28, 2014 in connection with the decision to close 22 domestic locations. (5) Represents management fees and certain other reimbursable expenses paid to a management company owned by our sponsors and founders, which includes a termination fee of $8.0 million in 2012. (6) Related to a gain associated with the collection of the promissory note and other amounts due to us in connection with the 2009 sale of the Cheeseburger in Paradise concept. (7) Related to the recovery of a note receivable in connection with a settlement agreement. (8) Related to an IRS payroll tax audit for the employer’s share of FICA taxes for cash tips allegedly received and unreported by the Company’s tipped employees during calendar years 2010 through 2012. (9) Represents non-cash intangible amortization recorded as a result of the acquisition of our Brazilian operations. Thirty-nine weeks ended September 28, 2011 2012 2013 2014 Income from operations 213,452$ 181,137$ 225,357$ 151,296$ Operating income margin 5.6% 4.5% 5.5% 4.5% Adjustments: Transaction-related expenses (1) 7,583$ 45,495$ 3,888$ 1,118$ Severance (2) - - - 5,362 Asset impairments and related costs (3) - - - 16,952 Restaurant impairments and closing costs (4) - - 18,695 16,502 Management fees and expenses (5) 9,370 13,776 - - Gain on a disposal of business (6) - (3,500) - - Recovery of note receivable from affiliated entity (7) (33,150) - - - Payroll tax audit contingency (8) - - 17,000 - Purchased intangibles amortization (9) - - 560 4,535 Adjusted income from operations 197,255$ 236,908$ 265,500$ 195,765$ Adjusted income from operations margin 5.1% 5.9% 6.4% 5.9% Years Ended December 31,

Adjusted EBITDAR Reconciliation $ in thousands 2009 2010 2011 2012 2013 Net (loss) income attributable to Bloomin' Brands (64,463)$ 52,968$ 100,005$ 49,971$ 208,367$ (Benefit) provision for income taxes (2,462) 21,300 21,716 12,106 (42,208) Interest expense, net 115,880 91,428 83,387 86,642 74,773 Depreciation and amortization 186,074 156,267 153,689 155,482 164,094 EBITDA 235,029$ 321,963$ 358,797$ 304,201$ 405,026$ Impairments and disposals (1) 192,572 4,915 15,062 7,945 3,716 Transaction-related expenses (2) - 1,157 7,583 29,495 3,888 Stock-based compensation expense (2) 15,215 3,146 3,907 21,526 13,857 Others losses (gains) (3) 884 (1,833) (90) 1,906 328 Payroll tax audit contingency (4) - - - - 17,000 Management fees and expenses (5) 9,786 9,550 9,370 13,776 - (158,061) - - 20,957 14,586 - - - - (36,608) Loss on guarantee (8) 24,500 - - - - Gain on disposal of business (9) - - - (3,500) - Recovery of note receivable from affiliated entity (10) - - (33,150) - - Restaurant closing costs (11) - - - - 18,695 Adjusted EBITDA 319,925$ 338,898$ 361,479$ 396,306$ 440,488$ Rent (12) 125,838 126,578 128,532 144,278 156,300 Adjusted EBITDAR 445,763$ 465,476$ 490,011$ 540,584$ 596,788$ Total debt, net of discounts 2,302,233$ 2,171,524$ 2,109,290$ 1,494,440$ 1,419,143$ Less: Cash 330,957 365,536 482,084 261,690 209,871 Net Debt 1,971,276$ 1,805,988$ 1,627,206$ 1,232,750$ 1,209,272$ Capitalized Rent (13) 1,006,700 1,012,621 1,028,252 1,154,224 1,250,404 Adjusted Net Debt 2,977,976$ 2,818,609$ 2,655,458$ 2,386,974$ 2,459,676$ Adjusted Net Debt / Adjusted EBITDAR 6.7 6.1 5.4 4.4 4.1 (Gain) loss on the extinguishment and modification of debt (6) Gain on remeasurement of equity method investment (7) Years Ended December 31,

Adjusted EBITDAR Reconciliation - Continued (1) Represents non-cash impairment charges for fixed assets and intangible assets, cash and non-cash expense from restaurant closings and net gains or losses on the disposal of fixed assets. (2) Transaction-related expenses primarily relate to the following: (i) cost associated with the sale of our restaurants in Japan in 2011; (ii) costs associated with the sale of properties in the sale- leaseback transaction completed in March 2012; (iii) costs incurred in connection with the IPO completed in 2012, which includes certain executive and stock compensation costs; (iv) secondary offerings of our common stock completed in 2013 and March 2014; (v) costs incurred in 2013 to acquire a controlling ownership interest in our Brazilian operations, and (vi) the refinancings of the CMBS loan in 2012 and the Senior Secured Credit Facility in 2012 and May 2014. (3) Represents (income) expense incurred as a result of (losses) gains on the Company’s partner deferred compensation participant investment accounts, foreign currency loss (gain) and the loss (gain) on the cash surrender value of executive life insurance. (4) Related to an IRS payroll tax audit for the employer’s share of FICA taxes for cash tips allegedly received and unreported by the Company’s tipped employees during calendar years 2010 through 2012. (5) Represents management fees and certain other reimbursable expenses paid to a management company owned by our sponsors and founders, which includes a termination fee of $8.0 million in 2012. (6) Related to the (i) retirement of a portion of the OSI Senior Notes in 2009; (ii) refinancing in 2012, repricing in 2013, and refinancing in May 2014 of OSI’s Senior Secured Credit Facility; (iii) the retirement of OSI’s Senior Notes in 2012, and (iv) the extinguishment of the previous CMBS loan in 2012. (7) As a result of the acquisition of a controlling interest in our Brazilian Joint Venture in 2013, we recorded a gain on remeasurement of the previously held equity investment. (8) In 2009, we recorded a loss related to our guarantee of an uncollateralized line of credit for our then joint venture partner in Roy’s. (9) Related to a gain associated with the collection of the promissory note and other amounts due to us in connection with the 2009 sale of the Cheeseburger in Paradise concept. (10) Related to a recovery of a note receivable in connection with a settlement agreement. (11) Asset impairment charges associated with the decision to close 22 domestic locations. (12) Represents rent and maintenance expense. (13) Represents 8x Rent.

Free Cash Flows Reconciliation $ in thousands 2009 2010 2011 2012 2013 Adjusted EBITDA 319,925$ 338,898$ 361,479$ 396,306$ 440,488$ Cash paid for interest 109,023 96,718 72,099 78,216 71,397 Cash paid for income taxes, net of refunds 21,342 10,779 27,699 24,276 33,673 Required Principal Payments 13,100 13,100 13,100 15,817 19,415 Change in NWC (1) 35,590 (10,271) (19,432) (29,148) (13,050) Capital Expenditures 57,528 60,476 120,906 178,720 237,214 Free Cash Flow 83,342$ 168,096$ 147,107$ 128,425$ 91,839$ (1) Net Working Capital = (Current assets – Cash) – (Current liabilities – Current portion of long-term debt).