UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22954

HIMCO VARIABLE INSURANCE TRUST

(Exact name of registrant as specified in charter)

One Hartford Plaza, Hartford, Connecticut 06155

(Address of principal executive offices) (Zip code)

Brenda J. Page

Hartford Investment Management Company

One Hartford Plaza

Hartford, Connecticut 06155

(Name and address of agent for service)

Registrant’s telephone number, including area code: (860) 297-6444

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in the HIMCO Variable Insurance Trust (HVIT) funds.

Market Review

U.S. equity and bond markets continued to perform well in 2014. U.S. equities (as represented by the S&P 500 Index1) rose 13.69% for the year, while U.S. bonds (as

represented by the Barclays U.S. Aggregate Bond Index2) rose 5.97%. International markets did not fare as well.

The S&P 500 Index ended the year slightly below its all-time high reached on December 29, 2014. Solid corporate earnings and encouraging U.S. macroeconomic data overcame geopolitical tensions and reduced prospects for growth outside the U.S. The U.S. unemployment rate fell during the year to 5.6%, the lowest level since June 2008. On average nearly 250,000 new jobs were created every month in 2014, 50,000 more per month than in 2013. In the third quarter of 2014, gross domestic product, the most recognized measure of economic growth, rose 5%. The price of a barrel of oil fell nearly 50% during the second half of the year, driving down gasoline prices and providing a lift to consumer spending.

U.S. bond prices benefited from continued low interest rates (bond prices move in the opposite direction of interest rates). Many market participants expected rates to increase as the economy improved and the U.S. Federal Reserve ended quantitative easing. However, sub-par growth in the eurozone and Japan, combined with diminished growth in China, have helped dampen interest rates. Central bankers outside the U.S. are engaging in quantitative easing programs to help stimulate growth, but these moves may also further lower local interest rates and thus increase demand for higher yielding U.S. Treasuries. Weaker growth in the rest of the world may also slow U.S. growth. These outcomes could help keep U.S. interest rates lower for longer.

Looking ahead to 2015, we expect the pace of U.S. growth relative to other economies, along with the actions of central bankers around the world, to be themes of keen interest to investors.

Preparation for whatever markets may deliver is no easy task, and that is why you should consider regular reviews with your financial advisor.

Thank you again for investing with the HIMCO Variable Insurance Trust funds.

Matthew J. Poznar,

President, HVIT

| 1 | The S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. |

| 2 | The Barclays U.S. Aggregate Bond Index is an unmanaged index and is composed of securities from the Barclays Government/Credit Bond Index, Mortgage-Backed Securities Index, Asset-Backed Securities Index and Commercial Mortgage-Backed Securities Index. |

HIMCO VIT Index Fund

Table of Contents

This report is prepared for the general information of variable annuity and variable life contract owners and qualified retirement plan participants. It is not an offer of contracts or of qualified retirement plans. It should not be used in connection with any offer, except in conjunction with the appropriate product prospectus which contains all pertinent information including the applicable sales, administrative and other charges.

The views expressed in the Fund’s Manager Discussion under “Why did the Fund perform this way?” and “What is the outlook?” are views of the Fund’s adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. The Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

HIMCO VIT Index Fund inception 05/01/1987

| | |

(Effective October 20, 2014, Hartford Index HLS Fund (the “Predecessor Fund”) was reorganized into HIMCO VIT Index Fund (the “Fund”).) (The Fund is advised by Hartford Investment Management Company (“Hartford Investment Management”)) | | Investment objective – The Fund seeks to provide investment results which approximate the price and yield performance of publicly traded common stocks in the aggregate. |

Performance information for periods prior to October 20, 2014 is that of the Predecessor Fund. Hartford Funds Management Company, LLC served as the investment manager to the Predecessor Fund and Hartford Investment Management, the Fund’s adviser, served as sub-adviser to the Predecessor Fund. The Predecessor Fund had the same investment objective and strategies as the Fund.

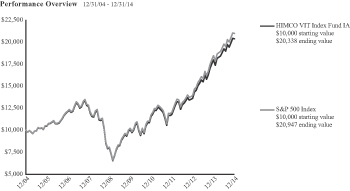

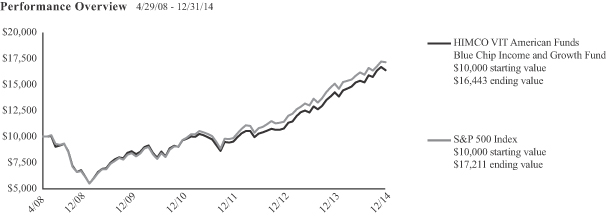

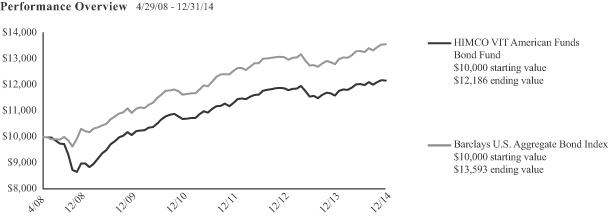

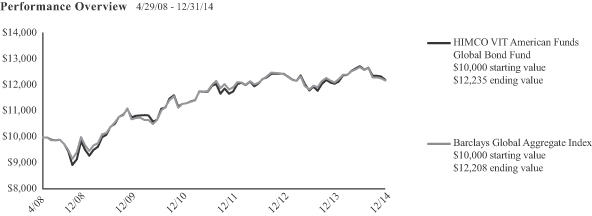

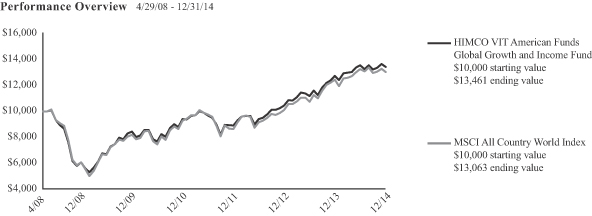

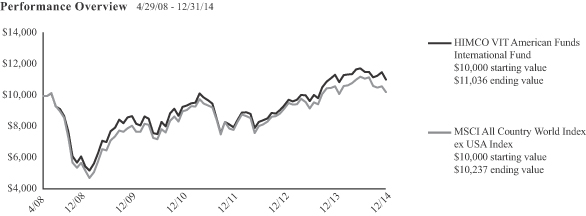

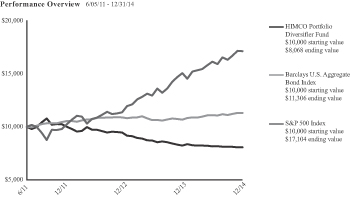

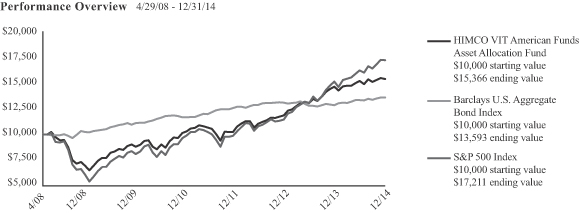

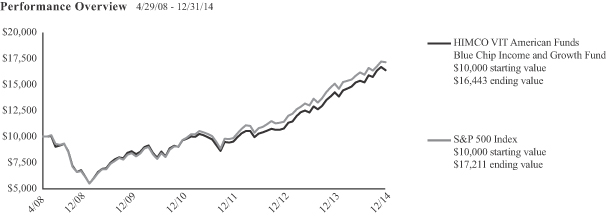

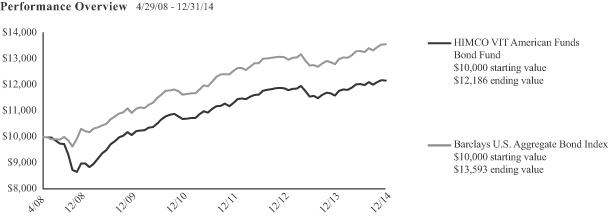

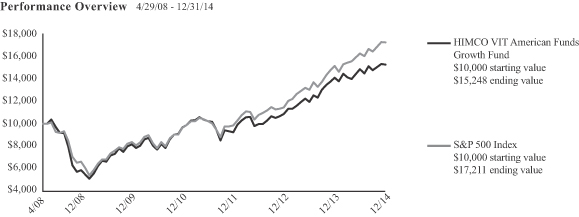

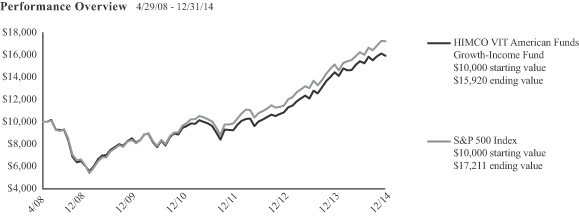

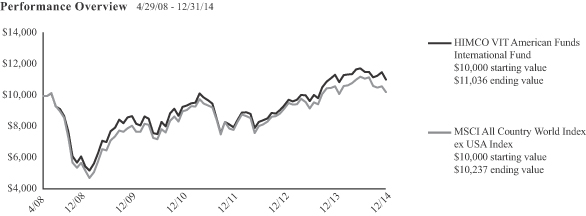

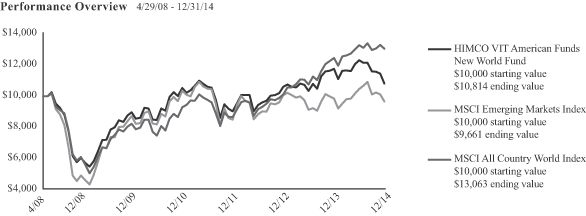

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns (as of 12/31/14)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

HIMCO VIT Index Class IA | | | 13.33% | | | | 15.10% | | | | 7.36% | |

HIMCO VIT Index Class IB | | | 13.01% | | | | 14.81% | | | | 7.10% | |

S&P 500 Index | | | 13.69% | | | | 15.45% | | | | 7.67% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

| | | | | | | | |

| Operating Expenses* | | Net | | | Gross | |

HIMCO VIT Index Class IA | | | 0.33% | | | | 0.35% | |

HIMCO VIT Index Class IB | | | 0.58% | | | | 0.60% | |

| * | As shown in the Fund’s current prospectus dated October 20, 2014. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2014. |

Gross expenses are the Fund’s total annual operating expenses shown in the Fund’s most recent prospectus. Net expenses are the Fund’s total annual operating expenses shown in the Fund’s most recent prospectus and reflect contractual expense reimbursements in instances when these

reductions reduce the Fund’s gross expenses. Contractual reimbursements remain in effect until April 30, 2016, and shall renew automatically for one-year terms unless the adviser provides written notice of termination prior to the start of the next term or upon approval of the Board of Trustees of the Fund.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by HIMCO Variable Insurance Trust. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by HIMCO Variable Insurance Trust. The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

All investments are subject to risk including the possible loss of principal. The primary risks of investing in the Fund are described below. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

Market, Selection and Strategy Risk: The Fund’s share price may fluctuate due to market risk and/or security selections that may underperform the market or relevant benchmarks. If the investment strategy does not perform as expected, the Fund could underperform its peers or lose money. There is no guarantee the Fund will achieve its stated objective.

Passive Management Risk: The Fund is not actively managed, and will generally remain fully invested even when stock prices are falling.

Index Tracking Risk: The Fund’s performance may not match or correlate to that of its index, which may cause the Fund’s performance to be lower than expected.

Manager Discussion

December 31, 2014 (Unaudited)

Portfolio Manager

Paul Bukowski, CFA

Executive Vice President and Head of Quantitative Equities

Edward Caputo, CFA

Senior Vice President

How did the Fund perform?

The Class IA shares of the HIMCO VIT Index Fund (the “Fund”) returned 13.33% for the 12-month period ending December 31, 2014. The Fund performed very closely to its benchmark, the S&P 500 Index, which returned 13.69%.1

Why did the Fund perform this way?

By design, the Fund is managed to mimic the performance of the S&P 500 Index and is expected to perform in line with the index. However, we do not purchase the stock of our parent, The Hartford Financial Services Group, Inc. (HIG). This exposure to HIG is reallocated across the life/health, property/casualty and multi-line insurance industries. The performance of the Fund tends to marginally differ from the benchmark, primarily due to trading in futures contracts, index events, minimal cash exposure, and lack of exposure to HIG.

Nine of the 10 sectors (as defined by GICS) within the index had positive returns for the year 2014. Utilities and health care led the way, gaining 28.9% and 25.3%, respectively, as investors looked for yield and turned defensive. The only sector that produced negative return was energy, which lost 7.8%.

On a stock level, the leading constituents in the S&P 500 Index for 2014 were Southwest Airlines Co., which rallied 126.3%, followed by Electronic Arts Inc., which gained 104.9%. Edwards Lifesciences Corp. rounded out the top three, finishing up 93.7%. Laggards for the period included the energy sector’s Transocean Ltd., which fell 59.9%, and Denbury Resources Inc., which dropped 49.6%.

What is the outlook?

The Fund will continue to invest in the S&P 500 Index with a focus on risk control and efficient trading. Performance of the Fund is expected to be similar to that of the index.

Turning the calendar to 2015, we believe that fundamentals are still positive as balance sheets hold ample cash positions and earnings growth is driven by moderate sales. Valuations appear to be neutral, with levels above long-term averages but consistent with the current rate environment and business/growth cycle. We expect volatility to trend higher in 2015 as

pending rate hikes, the conclusion of Quantitative Easing III at the end of October 2014, and softness in European economies increase market uncertainty. Our 2015 year-end price target for the S&P 500 Index is 2080, which represents a low single-digit price return for the year, largely driven by earnings/revenue growth.

Possible risks to our outlook include commodity volatility, heightened geopolitical tensions, the potential for surprises in rate guidance, global monetary policy and unexpected weakness in economic indicators.

Diversification by Sector

as of December 31, 2014

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 12.1 | % |

Consumer Staples | | | 9.8 | |

Energy | | | 8.4 | |

Financials | | | 16.6 | |

Health Care | | | 14.1 | |

Industrials | | | 10.4 | |

Information Technology | | | 19.5 | |

Materials | | | 3.2 | |

Telecommunication Services | | | 2.3 | |

Utilities | | | 3.2 | |

| | | | |

Total | | | 99.6 | % |

| | | | |

Short-Term Investments | | | 0.5 | |

Other assets and liabilities | | | (0.1 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for reporting ease.

Schedule of Investments

December 31, 2014

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% | |

| | | | Automobiles & Components - 1.1% | |

| | 15,176 | | | BorgWarner, Inc. | | $ | 833,921 | |

| | 19,850 | | | Delphi Automotive plc | | | 1,443,492 | |

| | 258,395 | | | Ford Motor Co. | | | 4,005,122 | |

| | 90,650 | | | General Motors Co. | | | 3,164,592 | |

| | 18,449 | | | Goodyear Tire & Rubber Co. (The) | | | 527,088 | |

| | 14,389 | | | Harley-Davidson, Inc. | | | 948,379 | |

| | 44,762 | | | Johnson Controls, Inc. | | | 2,163,795 | |

| | | | | | | | |

| | | | | | | 13,086,389 | |

| | | | | | | | |

| | | | Banks - 6.1% | |

| | 705,808 | | | Bank of America Corp. | | | 12,626,905 | |

| | 48,167 | | | BB&T Corp. | | | 1,873,215 | |

| | 203,397 | | | Citigroup, Inc. | | | 11,005,812 | |

| | 12,014 | | | Comerica, Inc. | | | 562,736 | |

| | 54,972 | | | Fifth Third Bancorp | | | 1,120,054 | |

| | 31,586 | | | Hudson City Bancorp, Inc. | | | 319,650 | |

| | 54,040 | | | Huntington Bancshares, Inc. | | | 568,501 | |

| | 250,859 | | | JPMorgan Chase & Co. | | | 15,698,756 | |

| | 57,925 | | | KeyCorp | | | 805,158 | |

| | 8,786 | | | M&T Bank Corp. | | | 1,103,697 | |

| | 19,754 | | | People’s United Financial, Inc. | | | 299,866 | |

| | 35,329 | | | PNC Financial Services Group, Inc. (The) | | | 3,223,065 | |

| | 92,263 | | | Regions Financial Corp. | | | 974,297 | |

| | 34,885 | | | SunTrust Banks, Inc. | | | 1,461,681 | |

| | 120,014 | | | US Bancorp | | | 5,394,629 | |

| | 316,635 | | | Wells Fargo & Co. | | | 17,357,931 | |

| | 13,498 | | | Zions BanCorp. | | | 384,828 | |

| | | | | | | | |

| | | | | | | 74,780,781 | |

| | | | | | | | |

| | | | Capital Goods - 7.5% | |

| | 43,003 | | | 3M Co. | | | 7,066,253 | |

| | 6,450 | | | Allegion plc | | | 357,717 | |

| | 16,400 | | | AMETEK, Inc. | | | 863,132 | |

| | 44,455 | | | Boeing Co. (The) | | | 5,778,261 | |

| | 40,687 | | | Caterpillar, Inc. | | | 3,724,081 | |

| | 11,451 | | | Cummins, Inc. | | | 1,650,891 | |

| | 41,038 | | | Danaher Corp. | | | 3,517,367 | |

| | 23,998 | | | Deere & Co. | | | 2,123,103 | |

| | 11,030 | | | Dover Corp. | | | 791,072 | |

| | 31,862 | | | Eaton Corp. plc | | | 2,165,342 | |

| | 46,549 | | | Emerson Electric Co. | | | 2,873,470 | |

| | 18,282 | | | Fastenal Co. | | | 869,492 | |

| | 9,119 | | | Flowserve Corp. | | | 545,590 | |

| | 10,546 | | | Fluor Corp. | | | 639,404 | |

| | 21,147 | | | General Dynamics Corp. | | | 2,910,250 | |

| | 673,776 | | | General Electric Co. | | | 17,026,319 | |

| | 52,580 | | | Honeywell International, Inc. | | | 5,253,794 | |

| | 24,090 | | | Illinois Tool Works, Inc. | | | 2,281,323 | |

| | 17,802 | | | Ingersoll-Rand plc | | | 1,128,469 | |

| | 8,665 | | | Jacobs Engineering Group, Inc.(2) | | | 387,239 | |

| | 6,660 | | | Joy Global, Inc. | | | 309,823 | |

| | 5,668 | | | L-3 Communications Holdings, Inc. | | | 715,358 | |

| | 18,043 | | | Lockheed Martin Corp. | | | 3,474,540 | |

| | 23,940 | | | Masco Corp. | | | 603,288 | |

| | 13,607 | | | Northrop Grumman Corp. | | | 2,005,536 | |

| | 23,725 | | | PACCAR, Inc. | | | 1,613,537 | |

| | 7,066 | | | Pall Corp. | | | 715,150 | |

| | 10,034 | | | Parker-Hannifin Corp. | | | 1,293,884 | |

| | 12,466 | | | Pentair plc | | | 827,992 | |

| | 9,599 | | | Precision Castparts Corp. | | | 2,312,207 | |

| | 14,606 | | | Quanta Services, Inc.(2) | | | 414,664 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Capital Goods - 7.5% - (continued) | |

| | 20,662 | | | Raytheon Co. | | $ | 2,235,009 | |

| | 9,120 | | | Rockwell Automation, Inc. | | | 1,014,144 | |

| | 8,834 | | | Rockwell Collins, Inc. | | | 746,296 | |

| | 6,632 | | | Roper Industries, Inc. | | | 1,036,913 | |

| | 3,860 | | | Snap-on, Inc. | | | 527,816 | |

| | 10,525 | | | Stanley Black & Decker, Inc. | | | 1,011,242 | |

| | 18,527 | | | Textron, Inc. | | | 780,172 | |

| | 6,700 | | | United Rentals, Inc.(2) | | | 683,467 | |

| | 56,866 | | | United Technologies Corp. | | | 6,539,590 | |

| | 4,065 | | | WW Grainger, Inc. | | | 1,036,128 | |

| | 12,159 | | | Xylem, Inc. | | | 462,893 | |

| | | | | | | | |

| | | | | | | 92,312,218 | |

| | | | | | | | |

| | | | Commercial & Professional Services - 0.7% | |

| | 11,714 | | | ADT Corp. (The) | | | 424,398 | |

| | 6,424 | | | Cintas Corp. | | | 503,899 | |

| | 2,402 | | | Dun & Bradstreet Corp. (The) | | | 290,546 | |

| | 8,030 | | | Equifax, Inc. | | | 649,386 | |

| | 12,624 | | | Iron Mountain, Inc., REIT | | | 488,044 | |

| | 21,600 | | | Nielsen N.V. | | | 966,168 | |

| | 13,585 | | | Pitney Bowes, Inc. | | | 331,066 | |

| | 16,766 | | | Republic Services, Inc. | | | 674,831 | |

| | 9,092 | | | Robert Half International, Inc. | | | 530,791 | |

| | 5,591 | | | Stericycle, Inc.(2) | | | 732,868 | |

| | 28,028 | | | Tyco International plc | | | 1,229,308 | |

| | 28,436 | | | Waste Management, Inc. | | | 1,459,336 | |

| | | | | | | | |

| | | | | | | 8,280,641 | |

| | | | | | | | |

| | | | Consumer Durables & Apparel - 1.4% | |

| | 18,447 | | | Coach, Inc. | | | 692,869 | |

| | 22,377 | | | DR Horton, Inc. | | | 565,914 | |

| | 3,000 | | | Fossil Group, Inc.(2) | | | 332,220 | |

| | 8,050 | | | Garmin Ltd. | | | 425,282 | |

| | 4,609 | | | Harman International Industries, Inc. | | | 491,826 | |

| | 7,537 | | | Hasbro, Inc. | | | 414,460 | |

| | 9,156 | | | Leggett & Platt, Inc. | | | 390,137 | |

| | 11,983 | | | Lennar Corp., Class A | | | 536,958 | |

| | 22,742 | | | Mattel, Inc. | | | 703,751 | |

| | 13,800 | | | Michael Kors Holdings Ltd.(2) | | | 1,036,380 | |

| | 4,200 | | | Mohawk Industries, Inc.(2) | | | 652,512 | |

| | 18,069 | | | Newell Rubbermaid, Inc. | | | 688,248 | |

| | 46,848 | | | NIKE, Inc., Class B | | | 4,504,435 | |

| | 22,499 | | | PulteGroup, Inc. | | | 482,829 | |

| | 5,500 | | | PVH Corp. | | | 704,935 | |

| | 4,086 | | | Ralph Lauren Corp. | | | 756,564 | |

| | 11,200 | | | Under Armour, Inc., Class A(2) | | | 760,480 | |

| | 23,176 | | | VF Corp. | | | 1,735,882 | |

| | 5,213 | | | Whirlpool Corp. | | | 1,009,967 | |

| | | | | | | | |

| | | | | | | 16,885,649 | |

| | | | | | | | |

| | | | Consumer Services - 1.7% | |

| | 30,280 | | | Carnival Corp. | | | 1,372,592 | |

| | 2,111 | | | Chipotle Mexican Grill, Inc.(2) | | | 1,445,001 | |

| | 8,900 | | | Darden Restaurants, Inc. | | | 521,807 | |

| | 18,468 | | | H&R Block, Inc. | | | 622,002 | |

| | 14,292 | | | Marriott International, Inc., Class A | | | 1,115,205 | |

| | 65,275 | | | McDonald’s Corp. | | | 6,116,267 | |

| | 11,200 | | | Royal Caribbean Cruises Ltd. | | | 923,216 | |

| | 50,183 | | | Starbucks Corp. | | | 4,117,515 | |

| | 11,965 | | | Starwood Hotels & Resorts Worldwide, Inc. | | | 970,003 | |

| | 8,291 | | | Wyndham Worldwide Corp. | | | 711,036 | |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments – (continued)

December 31, 2014

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Consumer Services - 1.7% - (continued) | |

| | 5,427 | | | Wynn Resorts Ltd. | | $ | 807,321 | |

| | 29,371 | | | Yum! Brands, Inc. | | | 2,139,677 | |

| | | | | | | | |

| | | | 20,861,642 | |

| | | | | | | | |

| | | | Diversified Financials - 5.3% | |

| | 3,700 | | | Affiliated Managers Group, Inc.(2) | | | 785,288 | |

| | 59,726 | | | American Express Co. | | | 5,556,907 | |

| | 12,390 | | | Ameriprise Financial, Inc. | | | 1,638,577 | |

| | 75,590 | | | Bank of New York Mellon Corp. (The) | | | 3,066,686 | |

| | 122,249 | | | Berkshire Hathaway, Inc., Class B(2) | | | 18,355,687 | |

| | 8,568 | | | BlackRock, Inc. | | | 3,063,574 | |

| | 37,290 | | | Capital One Financial Corp. | | | 3,078,289 | |

| | 77,183 | | | Charles Schwab Corp. (The) | | | 2,330,155 | |

| | 21,140 | | | CME Group, Inc. | | | 1,874,061 | |

| | 30,469 | | | Discover Financial Services | | | 1,995,415 | |

| | 19,252 | | | E*TRADE Financial Corp.(2) | | | 466,957 | |

| | 26,318 | | | Franklin Resources, Inc. | | | 1,457,228 | |

| | 27,204 | | | Goldman Sachs Group, Inc. (The) | | | 5,272,951 | |

| | 7,565 | | | Intercontinental Exchange, Inc. | | | 1,658,929 | |

| | 28,823 | | | Invesco Ltd. | | | 1,139,085 | |

| | 6,729 | | | Legg Mason, Inc. | | | 359,127 | |

| | 21,178 | | | Leucadia National Corp. | | | 474,811 | |

| | 18,241 | | | McGraw Hill Financial, Inc. | | | 1,623,084 | |

| | 12,364 | | | Moody’s Corp. | | | 1,184,595 | |

| | 102,496 | | | Morgan Stanley | | | 3,976,845 | |

| | 7,829 | | | NASDAQ OMX Group, Inc. (The) | | | 375,479 | |

| | 27,400 | | | Navient Corp. | | | 592,114 | |

| | 14,767 | | | Northern Trust Corp. | | | 995,296 | |

| | 28,068 | | | State Street Corp. | | | 2,203,338 | |

| | 17,358 | | | T Rowe Price Group, Inc. | | | 1,490,358 | |

| | | | | | | | |

| | | | 65,014,836 | |

| | | | | | | | |

| | | | Energy - 8.4% | |

| | 33,967 | | | Anadarko Petroleum Corp. | | | 2,802,277 | |

| | 25,308 | | | Apache Corp. | | | 1,586,052 | |

| | 29,031 | | | Baker Hughes, Inc. | | | 1,627,768 | |

| | 27,518 | | | Cabot Oil & Gas Corp. | | | 814,808 | |

| | 13,238 | | | Cameron International Corp.(2) | | | 661,238 | |

| | 34,936 | | | Chesapeake Energy Corp. | | | 683,698 | |

| | 126,813 | | | Chevron Corp. | | | 14,225,882 | |

| | 5,900 | | | Cimarex Energy Co. | | | 625,400 | |

| | 82,620 | | | ConocoPhillips | | | 5,705,737 | |

| | 15,425 | | | CONSOL Energy, Inc. | | | 521,519 | |

| | 23,993 | | | Denbury Resources, Inc. | | | 195,063 | |

| | 25,813 | | | Devon Energy Corp. | | | 1,580,014 | |

| | 4,528 | | | Diamond Offshore Drilling, Inc. | | | 166,223 | |

| | 15,750 | | | Ensco plc, Class A | | | 471,713 | |

| | 36,756 | | | EOG Resources, Inc. | | | 3,384,125 | |

| | 10,141 | | | EQT Corp. | | | 767,674 | |

| | 283,930 | | | Exxon Mobil Corp. | | | 26,249,328 | |

| | 15,603 | | | FMC Technologies, Inc.(2) | | | 730,845 | |

| | 56,957 | | | Halliburton Co. | | | 2,240,119 | |

| | 7,288 | | | Helmerich & Payne, Inc. | | | 491,357 | |

| | 17,096 | | | Hess Corp. | | | 1,262,027 | |

| | 113,971 | | | Kinder Morgan, Inc. | | | 4,822,113 | |

| | 45,367 | | | Marathon Oil Corp. | | | 1,283,432 | |

| | 18,783 | | | Marathon Petroleum Corp. | | | 1,695,354 | |

| | 11,172 | | | Murphy Oil Corp. | | | 564,409 | |

| | 19,526 | | | Nabors Industries Ltd. | | | 253,447 | |

| | 28,833 | | | National Oilwell Varco, Inc. | | | 1,889,426 | |

| | 9,329 | | | Newfield Exploration Co.(2) | | | 253,002 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Energy - 8.4% - (continued) | |

| | 17,058 | | | Noble Corp. plc | | $ | 282,651 | |

| | 24,120 | | | Noble Energy, Inc. | | | 1,144,012 | |

| | 52,026 | | | Occidental Petroleum Corp. | | | 4,193,816 | |

| | 13,984 | | | ONEOK, Inc. | | | 696,263 | |

| | 37,110 | | | Phillips 66 | | | 2,660,787 | |

| | 9,987 | | | Pioneer Natural Resources Co. | | | 1,486,565 | |

| | 11,217 | | | QEP Resources, Inc. | | | 226,808 | |

| | 11,162 | | | Range Resources Corp. | | | 596,609 | |

| | 86,312 | | | Schlumberger Ltd. | | | 7,371,908 | |

| | 23,569 | | | Southwestern Energy Co.(2) | | | 643,198 | |

| | 44,872 | | | Spectra Energy Corp. | | | 1,628,854 | |

| | 8,420 | | | Tesoro Corp. | | | 626,027 | |

| | 23,044 | | | Transocean Ltd. | | | 422,397 | |

| | 35,004 | | | Valero Energy Corp. | | | 1,732,698 | |

| | 45,157 | | | Williams Cos., Inc. (The) | | | 2,029,356 | |

| | | | | | | | |

| | | | 103,295,999 | |

| | | | | | | | |

| | | | Food & Staples Retailing - 2.5% | |

| | 29,282 | | | Costco Wholesale Corp. | | | 4,150,723 | |

| | 76,902 | | | CVS Health Corp. | | | 7,406,432 | |

| | 32,964 | | | Kroger Co. (The) | | | 2,116,618 | |

| | 15,313 | | | Safeway, Inc. | | | 537,793 | |

| | 39,143 | | | Sysco Corp. | | | 1,553,586 | |

| | 105,861 | | | Wal-Mart Stores, Inc. | | | 9,091,343 | |

| | 58,296 | | | Walgreens Boot Allliance, Inc. | | | 4,442,155 | |

| | 24,072 | | | Whole Foods Market, Inc. | | | 1,213,710 | |

| | | | | | | | |

| | | | 30,512,360 | |

| | | | | | | | |

| | | | Food, Beverage & Tobacco - 5.2% | |

| | 132,648 | | | Altria Group, Inc. | | | 6,535,567 | |

| | 43,213 | | | Archer-Daniels-Midland Co. | | | 2,247,076 | |

| | 10,433 | | | Brown-Forman Corp., Class B | | | 916,435 | |

| | 11,895 | | | Campbell Soup Co. | | | 523,380 | |

| | 264,344 | | | Coca-Cola Co. (The) | | | 11,160,604 | |

| | 14,852 | | | Coca-Cola Enterprises, Inc. | | | 656,755 | |

| | 28,434 | | | ConAgra Foods, Inc. | | | 1,031,586 | |

| | 11,253 | | | Constellation Brands, Inc., Class A(2) | | | 1,104,707 | |

| | 13,062 | | | Dr Pepper Snapple Group, Inc. | | | 936,284 | |

| | 40,387 | | | General Mills, Inc. | | | 2,153,839 | |

| | 9,876 | | | Hershey Co. (The) | | | 1,026,413 | |

| | 8,999 | | | Hormel Foods Corp. | | | 468,848 | |

| | 6,759 | | | JM Smucker Co. (The) | | | 682,524 | |

| | 16,752 | | | Kellogg Co. | | | 1,096,251 | |

| | 8,200 | | | Keurig Green Mountain, Inc. | | | 1,085,639 | |

| | 39,443 | | | Kraft Foods Group, Inc. | | | 2,471,498 | |

| | 24,050 | | | Lorillard, Inc. | | | 1,513,707 | |

| | 8,521 | | | McCormick & Co., Inc. | | | 633,110 | |

| | 13,506 | | | Mead Johnson Nutrition Co. | | | 1,357,893 | |

| | 10,683 | | | Molson Coors Brewing Co., Class B | | | 796,097 | |

| | 112,730 | | | Mondelez International, Inc., Class A | | | 4,094,917 | |

| | 9,700 | | | Monster Beverage Corp.(2) | | | 1,050,995 | |

| | 100,409 | | | PepsiCo, Inc. | | | 9,494,675 | |

| | 104,226 | | | Philip Morris International, Inc. | | | 8,489,208 | |

| | 20,620 | | | Reynolds American, Inc. | | | 1,325,247 | |

| | 19,583 | | | Tyson Foods, Inc., Class A | | | 785,082 | |

| | | | | | | | |

| | | | 63,638,337 | |

| | | | | | | | |

| | | | Health Care Equipment & Services - 4.6% | |

| | 100,995 | | | Abbott Laboratories | | | 4,546,795 | |

| | 23,638 | | | Aetna, Inc. | | | 2,099,764 | |

| | 13,858 | | | AmerisourceBergen Corp. | | | 1,249,437 | |

| | 18,155 | | | Anthem, Inc. | | | 2,281,539 | |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments – (continued)

December 31, 2014

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Health Care Equipment & Services - 4.6% - (continued) | |

| | 36,325 | | | Baxter International, Inc. | | $ | 2,662,259 | |

| | 12,898 | | | Becton Dickinson and Co. | | | 1,794,886 | |

| | 89,018 | | | Boston Scientific Corp.(2) | | | 1,179,489 | |

| | 22,177 | | | Cardinal Health, Inc. | | | 1,790,349 | |

| | 13,647 | | | CareFusion Corp.(2) | | | 809,813 | |

| | 20,362 | | | Cerner Corp.(2) | | | 1,316,607 | |

| | 17,498 | | | Cigna Corp. | | | 1,800,719 | |

| | 30,369 | | | Covidien plc | | | 3,106,141 | |

| | 5,012 | | | CR Bard, Inc. | | | 835,099 | |

| | 11,436 | | | DaVita HealthCare Partners, Inc.(2) | | | 866,163 | |

| | 9,385 | | | DENTSPLY International, Inc. | | | 499,939 | |

| | 7,209 | | | Edwards Lifesciences Corp.(2) | | | 918,282 | |

| | 49,225 | | | Express Scripts Holding Co.(2) | | | 4,167,881 | |

| | 10,297 | | | Humana, Inc. | | | 1,478,958 | |

| | 2,453 | | | Intuitive Surgical, Inc.(2) | | | 1,297,490 | |

| | 5,596 | | | Laboratory Corp. of America Holdings(2) | | | 603,808 | |

| | 15,573 | | | McKesson Corp. | | | 3,232,643 | |

| | 66,107 | | | Medtronic, Inc. | | | 4,772,925 | |

| | 5,605 | | | Patterson Cos., Inc. | | | 269,601 | |

| | 9,669 | | | Quest Diagnostics, Inc. | | | 648,403 | |

| | 19,187 | | | St Jude Medical, Inc. | | | 1,247,731 | |

| | 20,086 | | | Stryker Corp. | | | 1,894,712 | |

| | 6,613 | | | Tenet Healthcare Corp.(2) | | | 335,081 | |

| | 64,413 | | | UnitedHealth Group, Inc. | | | 6,511,510 | |

| | 6,100 | | | Universal Health Services, Inc., Class B | | | 678,686 | |

| | 6,552 | | | Varian Medical Systems, Inc.(2) | | | 566,814 | |

| | 11,345 | | | Zimmer Holdings, Inc. | | | 1,286,750 | |

| | | | | | | | |

| | | | | | | 56,750,274 | |

| | | | | | | | |

| | | | Household & Personal Products - 2.1% | |

| | 29,168 | | | Avon Products, Inc. | | | 273,888 | |

| | 8,586 | | | Clorox Co. (The) | | | 894,747 | |

| | 57,374 | | | Colgate-Palmolive Co. | | | 3,969,707 | |

| | 14,926 | | | Estee Lauder Cos., Inc. (The), Class A | | | 1,137,361 | |

| | 24,943 | | | Kimberly-Clark Corp. | | | 2,881,914 | |

| | 181,187 | | | Procter & Gamble Co. (The) | | | 16,504,324 | |

| | | | | | | | |

| | | | | | | 25,661,941 | |

| | | | | | | | |

| | | | Insurance - 2.8% | |

| | 22,906 | | | ACE Ltd. | | | 2,631,441 | |

| | 31,290 | | | Aflac, Inc. | | | 1,911,506 | |

| | 29,109 | | | Allstate Corp. (The) | | | 2,044,907 | |

| | 95,366 | | | American International Group, Inc. | | | 5,341,450 | |

| | 19,694 | | | Aon plc | | | 1,867,582 | |

| | 5,468 | | | Assurant, Inc. | | | 374,175 | |

| | 16,398 | | | Chubb Corp. (The) | | | 1,696,701 | |

| | 11,068 | | | Cincinnati Financial Corp. | | | 573,654 | |

| | 34,567 | | | Genworth Financial, Inc., Class A(2) | | | 293,820 | |

| | 18,280 | | | Lincoln National Corp. | | | 1,054,208 | |

| | 21,624 | | | Loews Corp. | | | 908,641 | |

| | 37,356 | | | Marsh & McLennan Cos., Inc. | | | 2,138,257 | |

| | 77,545 | | | MetLife, Inc. | | | 4,194,409 | |

| | 19,580 | | | Principal Financial Group, Inc. | | | 1,016,985 | |

| | 38,296 | | | Progressive Corp. (The) | | | 1,033,609 | |

| | 31,382 | | | Prudential Financial, Inc. | | | 2,838,816 | |

| | 9,596 | | | Torchmark Corp. | | | 519,815 | |

| | 22,855 | | | Travelers Cos., Inc. (The) | | | 2,419,202 | |

| | 18,396 | | | Unum Group | | | 641,653 | |

| | 19,151 | | | XL Group plc | | | 658,220 | |

| | | | | | | | |

| | | | | | | 34,159,051 | |

| | | | | | | | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Materials - 3.2% | |

| | 12,941 | | | Air Products & Chemicals, Inc. | | $ | 1,866,480 | |

| | 4,371 | | | Airgas, Inc. | | | 503,452 | |

| | 79,220 | | | Alcoa, Inc. | | | 1,250,884 | |

| | 7,349 | | | Allegheny Technologies, Inc. | | | 255,525 | |

| | 6,096 | | | Avery Dennison Corp. | | | 316,260 | |

| | 9,075 | | | Ball Corp. | | | 618,643 | |

| | 3,307 | | | CF Industries Holdings, Inc. | | | 901,290 | |

| | 74,379 | | | Dow Chemical Co. (The) | | | 3,392,426 | |

| | 9,914 | | | Eastman Chemical Co. | | | 752,076 | |

| | 18,039 | | | Ecolab, Inc. | | | 1,885,436 | |

| | 60,793 | | | EI du Pont de Nemours & Co. | | | 4,495,034 | |

| | 8,848 | | | FMC Corp. | | | 504,601 | |

| | 69,833 | | | Freeport-McMoRan, Inc. | | | 1,631,299 | |

| | 5,370 | | | International Flavors & Fragrances, Inc. | | | 544,303 | |

| | 28,467 | | | International Paper Co. | | | 1,525,262 | |

| | 27,900 | | | LyondellBasell Industries N.V., Class A | | | 2,214,981 | |

| | 4,100 | | | Martin Marietta Materials, Inc. | | | 452,312 | |

| | 11,117 | | | MeadWestvaco Corp. | | | 493,484 | |

| | 32,442 | | | Monsanto Co. | | | 3,875,846 | |

| | 21,161 | | | Mosaic Co. (The) | | | 966,000 | |

| | 33,668 | | | Newmont Mining Corp. | | | 636,325 | |

| | 21,359 | | | Nucor Corp. | | | 1,047,659 | |

| | 11,168 | | | Owens-Illinois, Inc.(2) | | | 301,424 | |

| | 9,183 | | | PPG Industries, Inc. | | | 2,122,650 | |

| | 19,439 | | | Praxair, Inc. | | | 2,518,517 | |

| | 14,229 | | | Sealed Air Corp. | | | 603,736 | |

| | 5,412 | | | Sherwin-Williams Co. (The) | | | 1,423,573 | |

| | 7,958 | | | Sigma-Aldrich Corp. | | | 1,092,395 | |

| | 8,772 | | | Vulcan Materials Co. | | | 576,584 | |

| | | | | | | | |

| | | | | | | 38,768,457 | |

| | | | | | | | |

| | | | Media - 3.5% | |

| | 14,812 | | | Cablevision Systems Corp., Class A | | | 305,720 | |

| | 32,000 | | | CBS Corp., Class B | | | 1,770,880 | |

| | 172,833 | | | Comcast Corp., Class A | | | 10,026,042 | |

| | 33,695 | | | DIRECTV(2) | | | 2,921,356 | |

| | 9,971 | | | Discovery Communications, Inc., Class A(2) | | | 343,501 | |

| | 18,271 | | | Discovery Communications, Inc., Class C(2) | | | 616,098 | |

| | 15,252 | | | Gannett Co., Inc. | | | 486,996 | |

| | 27,957 | | | Interpublic Group of Cos., Inc. (The) | | | 580,667 | |

| | 33,285 | | | News Corp., Class A(2) | | | 522,242 | |

| | 16,649 | | | Omnicom Group, Inc. | | | 1,289,798 | |

| | 6,704 | | | Scripps Networks Interactive, Inc., Class A | | | 504,610 | |

| | 18,787 | | | Time Warner Cable, Inc. | | | 2,856,751 | |

| | 56,241 | | | Time Warner, Inc. | | | 4,804,106 | |

| | 124,441 | | | Twenty-First Century Fox, Inc., Class A | | | 4,779,157 | |

| | 24,783 | | | Viacom, Inc., Class B | | | 1,864,921 | |

| | 104,719 | | | Walt Disney Co. (The) | | | 9,863,483 | |

| | | | | | | | |

| | | | | | | 43,536,328 | |

| | | | | | | | |

| | | | Pharmaceuticals, Biotechnology & Life Sciences - 9.5% | |

| | 106,945 | | | AbbVie, Inc. | | | 6,998,481 | |

| | 17,825 | | | Actavis plc(2) | | | 4,588,333 | |

| | 22,334 | | | Agilent Technologies, Inc. | | | 914,354 | |

| | 13,300 | | | Alexion Pharmaceuticals, Inc.(2) | | | 2,460,899 | |

| | 19,981 | | | Allergan, Inc. | | | 4,247,761 | |

| | 51,014 | | | Amgen, Inc. | | | 8,126,020 | |

| | 15,859 | | | Biogen Idec, Inc.(2) | | | 5,383,338 | |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments – (continued)

December 31, 2014

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Pharmaceuticals, Biotechnology & Life Sciences - 9.5% -

(continued) | |

| | 111,238 | | | Bristol-Myers Squibb Co. | | $ | 6,566,379 | |

| | 53,604 | | | Celgene Corp.(2) | | | 5,996,143 | |

| | 65,718 | | | Eli Lilly & Co. | | | 4,533,885 | |

| | 101,172 | | | Gilead Sciences, Inc.(2) | | | 9,536,473 | |

| | 11,354 | | | Hospira, Inc.(2) | | | 695,433 | |

| | 187,747 | | | Johnson & Johnson | | | 19,632,704 | |

| | 7,800 | | | Mallinckrodt plc(2) | | | 772,434 | |

| | 191,227 | | | Merck & Co., Inc. | | | 10,859,781 | |

| | 25,147 | | | Mylan, Inc.(2) | | | 1,417,536 | |

| | 7,511 | | | PerkinElmer, Inc. | | | 328,456 | |

| | 9,383 | | | Perrigo Co. plc | | | 1,568,462 | |

| | 422,538 | | | Pfizer, Inc. | | | 13,162,059 | |

| | 4,950 | | | Regeneron Pharmaceuticals, Inc.(2) | | | 2,030,737 | |

| | 26,795 | | | Thermo Fisher Scientific, Inc. | | | 3,357,146 | |

| | 16,100 | | | Vertex Pharmaceuticals, Inc.(2) | | | 1,912,680 | |

| | 5,547 | | | Waters Corp.(2) | | | 625,258 | |

| | 33,650 | | | Zoetis, Inc. | | | 1,447,959 | |

| | | | | | | | |

| | | | | | | 117,162,711 | |

| | | | | | | | |

| | | | Real Estate - 2.4% | |

| | 26,572 | | | American Tower Corp., REIT | | | 2,626,642 | |

| | 9,794 | | | Apartment Investment & Management Co., Class A, REIT | | | 363,847 | |

| | 8,875 | | | AvalonBay Communities, Inc., REIT | | | 1,450,086 | |

| | 10,198 | | | Boston Properties, Inc., REIT | | | 1,312,381 | |

| | 18,815 | | | CBRE Group, Inc., Class A(2) | | | 644,414 | |

| | 22,350 | | | Crown Castle International Corp., REIT | | | 1,758,945 | |

| | 24,289 | | | Equity Residential, REIT | | | 1,744,922 | |

| | 4,300 | | | Essex Property Trust, Inc., REIT | | | 888,380 | |

| | 42,000 | | | General Growth Properties, Inc., REIT | | | 1,181,460 | |

| | 30,799 | | | HCP, Inc., REIT | | | 1,356,080 | |

| | 21,977 | | | Health Care REIT, Inc., REIT | | | 1,663,000 | |

| | 50,981 | | | Host Hotels & Resorts, Inc., REIT | | | 1,211,818 | |

| | 27,527 | | | Kimco Realty Corp., REIT | | | 692,029 | |

| | 9,450 | | | Macerich Co. (The), REIT | | | 788,224 | |

| | 11,768 | | | Plum Creek Timber Co., Inc., REIT | | | 503,553 | |

| | 33,443 | | | Prologis, Inc., REIT | | | 1,439,052 | |

| | 9,720 | | | Public Storage, REIT | | | 1,796,742 | |

| | 20,890 | | | Simon Property Group, Inc., REIT | | | 3,804,278 | |

| | 19,726 | | | Ventas, Inc., REIT | | | 1,414,354 | |

| | 11,759 | | | Vornado Realty Trust, REIT | | | 1,384,152 | |

| | 35,219 | | | Weyerhaeuser Co., REIT | | | 1,264,010 | |

| | | | | | | | |

| | | | | | | 29,288,369 | |

| | | | | | | | |

| | | | Retailing - 4.4% | | | |

| | 25,503 | | | Amazon.com, Inc.(2) | | | 7,914,856 | |

| | 5,019 | | | AutoNation, Inc.(2) | | | 303,198 | |

| | 2,161 | | | AutoZone, Inc.(2) | | | 1,337,897 | |

| | 12,395 | | | Bed Bath & Beyond, Inc.(2) | | | 944,127 | |

| | 19,540 | | | Best Buy Co., Inc. | | | 761,669 | |

| | 14,440 | | | CarMax, Inc.(2) | | | 961,415 | |

| | 20,350 | | | Dollar General Corp.(2) | | | 1,438,745 | |

| | 13,702 | | | Dollar Tree, Inc.(2) | | | 964,347 | |

| | 6,625 | | | Expedia, Inc. | | | 565,510 | |

| | 6,359 | | | Family Dollar Stores, Inc. | | | 503,696 | |

| | 7,335 | | | GameStop Corp., Class A | | | 247,923 | |

| | 17,884 | | | Gap, Inc. (The) | | | 753,095 | |

| | 10,190 | | | Genuine Parts Co. | | | 1,085,948 | |

| | 88,411 | | | Home Depot, Inc. (The) | | | 9,280,503 | |

| | 13,530 | | | Kohl’s Corp. | | | 825,871 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Retailing - 4.4% - (continued) | | | |

| | 16,459 | | | L Brands, Inc. | | $ | 1,424,526 | |

| | 65,264 | | | Lowe’s Cos., Inc. | | | 4,490,163 | |

| | 23,112 | | | Macy’s, Inc. | | | 1,519,614 | |

| | 4,037 | | | Netflix, Inc.(2) | | | 1,379,080 | |

| | 9,390 | | | Nordstrom, Inc. | | | 745,472 | |

| | 6,750 | | | O’Reilly Automotive, Inc.(2) | | | 1,300,185 | |

| | 6,600 | | | PetSmart, Inc. | | | 536,547 | |

| | 3,509 | | | Priceline Group, Inc. (The)(2) | | | 4,000,997 | |

| | 14,046 | | | Ross Stores, Inc. | | | 1,323,976 | |

| | 42,946 | | | Staples, Inc. | | | 778,182 | |

| | 42,699 | | | Target Corp. | | | 3,241,281 | |

| | 7,543 | | | Tiffany & Co. | | | 806,045 | |

| | 46,161 | | | TJX Cos., Inc. (The) | | | 3,165,721 | |

| | 9,100 | | | Tractor Supply Co. | | | 717,262 | |

| | 7,525 | | | TripAdvisor, Inc.(2) | | | 561,817 | |

| | 6,659 | | | Urban Outfitters, Inc.(2) | | | 233,931 | |

| | | | | | | | |

| | | | | | | 54,113,599 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment - 2.4% | |

| | 20,330 | | | Altera Corp. | | | 750,990 | |

| | 20,796 | | | Analog Devices, Inc. | | | 1,154,594 | |

| | 81,823 | | | Applied Materials, Inc. | | | 2,039,029 | |

| | 17,000 | | | Avago Technologies Ltd. | | | 1,710,030 | |

| | 36,183 | | | Broadcom Corp., Class A | | | 1,567,809 | |

| | 5,078 | | | First Solar, Inc.(2) | | | 226,453 | |

| | 324,362 | | | Intel Corp. | | | 11,771,097 | |

| | 11,046 | | | KLA-Tencor Corp. | | | 776,755 | |

| | 10,675 | | | Lam Research Corp. | | | 846,955 | |

| | 15,897 | | | Linear Technology Corp. | | | 724,903 | |

| | 13,408 | | | Microchip Technology, Inc. | | | 604,835 | |

| | 72,107 | | | Micron Technology, Inc.(2) | | | 2,524,466 | |

| | 34,634 | | | NVIDIA Corp. | | | 694,412 | |

| | 70,912 | | | Texas Instruments, Inc. | | | 3,791,310 | |

| | 17,679 | | | Xilinx, Inc. | | | 765,324 | |

| | | | | | | | |

| | | | | | | 29,948,962 | |

| | | | | | | | |

| | | | Software & Services - 10.3% | |

| | 42,109 | | | Accenture plc, Class A | | | 3,760,755 | |

| | 31,797 | | | Adobe Systems, Inc.(2) | | | 2,311,642 | |

| | 11,931 | | | Akamai Technologies, Inc.(2) | | | 751,176 | |

| | 4,300 | | | Alliance Data Systems Corp.(2) | | | 1,230,015 | |

| | 15,275 | | | Autodesk, Inc.(2) | | | 917,416 | |

| | 32,318 | | | Automatic Data Processing, Inc. | | | 2,694,352 | |

| | 21,515 | | | CA, Inc. | | | 655,132 | |

| | 10,701 | | | Citrix Systems, Inc.(2) | | | 682,724 | |

| | 40,834 | | | Cognizant Technology Solutions Corp., Class A(2) | | | 2,150,318 | |

| | 9,355 | | | Computer Sciences Corp. | | | 589,833 | |

| | 75,811 | | | eBay, Inc.(2) | | | 4,254,513 | |

| | 20,821 | | | Electronic Arts, Inc.(2) | | | 978,899 | |

| | 140,200 | | | Facebook, Inc., Class A(2) | | | 10,938,404 | |

| | 18,974 | | | Fidelity National Information Services, Inc. | | | 1,180,183 | |

| | 16,326 | | | Fiserv, Inc.(2) | | | 1,158,656 | |

| | 19,058 | | | Google, Inc., Class A(2) | | | 10,113,318 | |

| | 19,158 | | | Google, Inc., Class C(2) | | | 10,084,771 | |

| | 61,679 | | | International Business Machines Corp. | | | 9,895,779 | |

| | 19,125 | | | Intuit, Inc. | | | 1,763,134 | |

| | 65,730 | | | MasterCard, Inc., Class A | | | 5,663,297 | |

| | 552,731 | | | Microsoft Corp. | | | 25,674,355 | |

| | 217,059 | | | Oracle Corp. | | | 9,761,143 | |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments – (continued)

December 31, 2014

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Software & Services - 10.3% - (continued) | |

| | 21,772 | | | Paychex, Inc. | | $ | 1,005,213 | |

| | 12,551 | | | Red Hat, Inc.(2) | | | 867,776 | |

| | 39,328 | | | salesforce.com, Inc.(2) | | | 2,332,544 | |

| | 46,256 | | | Symantec Corp. | | | 1,186,698 | |

| | 10,268 | | | Teradata Corp.(2) | | | 448,506 | |

| | 10,940 | | | Total System Services, Inc. | | | 371,522 | |

| | 7,326 | | | VeriSign, Inc.(2) | | | 417,582 | |

| | 32,738 | | | Visa, Inc., Class A | | | 8,583,904 | |

| | 34,911 | | | Western Union Co. (The) | | | 625,256 | |

| | 72,128 | | | Xerox Corp. | | | 999,694 | |

| | 59,215 | | | Yahoo!, Inc.(2) | | | 2,990,950 | |

| | | | | | | | |

| | | | | | | 127,039,460 | |

| | | | | | | | |

| | | | Technology Hardware & Equipment - 6.8% | |

| | 20,650 | | | Amphenol Corp., Class A | | | 1,111,177 | |

| | 393,247 | | | Apple, Inc. | | | 43,406,604 | |

| | 343,067 | | | Cisco Systems, Inc. | | | 9,542,409 | |

| | 86,037 | | | Corning, Inc. | | | 1,972,828 | |

| | 136,464 | | | EMC Corp. | | | 4,058,439 | |

| | 4,963 | | | F5 Networks, Inc.(2) | | | 647,498 | |

| | 9,326 | | | FLIR Systems, Inc. | | | 301,323 | |

| | 7,002 | | | Harris Corp. | | | 502,884 | |

| | 125,206 | | | Hewlett-Packard Co. | | | 5,024,517 | |

| | 25,829 | | | Juniper Networks, Inc. | | | 576,503 | |

| | 14,069 | | | Motorola Solutions, Inc. | | | 943,749 | |

| | 20,811 | | | NetApp, Inc. | | | 862,616 | |

| | 111,518 | | | QUALCOMM, Inc. | | | 8,289,133 | |

| | 14,845 | | | SanDisk Corp. | | | 1,454,513 | |

| | 21,950 | | | Seagate Technology plc | | | 1,459,675 | |

| | 27,218 | | | TE Connectivity Ltd. | | | 1,721,538 | |

| | 14,696 | | | Western Digital Corp. | | | 1,626,847 | |

| | | | | | | | |

| | | | | | | 83,502,253 | |

| | | | | | | | |

| | | | Telecommunication Services - 2.3% | |

| | 347,886 | | | AT&T, Inc. | | | 11,685,491 | |

| | 38,319 | | | CenturyLink, Inc. | | | 1,516,666 | |

| | 67,413 | | | Frontier Communications Corp. | | | 449,645 | |

| | 18,700 | | | Level 3 Communications, Inc.(2) | | | 923,406 | |

| | 278,286 | | | Verizon Communications, Inc. | | | 13,018,219 | |

| | 40,673 | | | Windstream Holdings, Inc. | | | 335,145 | |

| | | | | | | | |

| | | | | | | 27,928,572 | |

| | | | | | | | |

| | | | Transportation - 2.2% | |

| | 9,718 | | | CH Robinson Worldwide, Inc. | | | 727,781 | |

| | 66,779 | | | CSX Corp. | | | 2,419,403 | |

| | 56,250 | | | Delta Air Lines, Inc. | | | 2,766,937 | |

| | 12,884 | | | Expeditors International of Washington, Inc. | | | 574,755 | |

| | 17,644 | | | FedEx Corp. | | | 3,064,057 | |

| | 7,350 | | | Kansas City Southern | | | 896,921 | |

| | 20,778 | | | Norfolk Southern Corp. | | | 2,277,477 | |

| | 3,603 | | | Ryder System, Inc. | | | 334,539 | |

| | 45,623 | | | Southwest Airlines Co. | | | 1,930,765 | |

| | 59,680 | | | Union Pacific Corp. | | | 7,109,678 | |

| | 46,788 | | | United Parcel Service, Inc., Class B | | | 5,201,422 | |

| | | | | | | | |

| | | | | | | 27,303,735 | |

| | | | | | | | |

| | | | Utilities - 3.2% | |

| | 44,294 | | | AES Corp. | | | 609,928 | |

| | 7,923 | | | AGL Resources, Inc. | | | 431,883 | |

| | 16,188 | | | Ameren Corp. | | | 746,752 | |

| | 32,805 | | | American Electric Power Co., Inc. | | | 1,991,920 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.6% - (continued) | |

| | | | Utilities - 3.2% - (continued) | |

| | 28,625 | | | CenterPoint Energy, Inc. | | $ | 670,684 | |

| | 18,273 | | | CMS Energy Corp. | | | 634,987 | |

| | 19,518 | | | Consolidated Edison, Inc. | | | 1,288,383 | |

| | 39,138 | | | Dominion Resources, Inc. | | | 3,009,712 | |

| | 11,810 | | | DTE Energy Co. | | | 1,020,030 | |

| | 47,482 | | | Duke Energy Corp. | | | 3,966,646 | |

| | 21,872 | | | Edison International | | | 1,432,179 | |

| | 12,145 | | | Entergy Corp. | | | 1,062,445 | |

| | 57,664 | | | Exelon Corp. | | | 2,138,181 | |

| | 28,269 | | | FirstEnergy Corp. | | | 1,102,208 | |

| | 5,320 | | | Integrys Energy Group, Inc. | | | 414,162 | |

| | 29,326 | | | NextEra Energy, Inc. | | | 3,117,061 | |

| | 21,141 | | | NiSource, Inc. | | | 896,801 | |

| | 21,117 | | | Northeast Utilities | | | 1,130,182 | |

| | 22,775 | | | NRG Energy, Inc. | | | 613,786 | |

| | 16,761 | | | Pepco Holdings, Inc. | | | 451,374 | |

| | 31,806 | | | PG&E Corp. | | | 1,693,351 | |

| | 7,331 | | | Pinnacle West Capital Corp. | | | 500,781 | |

| | 44,566 | | | PPL Corp. | | | 1,619,083 | |

| | 33,974 | | | Public Service Enterprise Group, Inc. | | | 1,406,863 | |

| | 9,416 | | | SCANA Corp. | | | 568,726 | |

| | 15,460 | | | Sempra Energy | | | 1,721,626 | |

| | 60,321 | | | Southern Co. (The) | | | 2,962,364 | |

| | 15,469 | | | TECO Energy, Inc. | | | 316,960 | |

| | 15,032 | | | Wisconsin Energy Corp. | | | 792,788 | |

| | 33,783 | | | Xcel Energy, Inc. | | | 1,213,485 | |

| | | | | | | | |

| | | | | | | 39,525,331 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(cost $682,643,668) | | $ | 1,223,357,895 | |

| | | | | | | | |

| | |

| | | | Total Long-Term Investments

(cost $682,643,668) | | $ | 1,223,357,895 | |

| | | | | | | | |

|

| SHORT-TERM INVESTMENTS - 0.5% | |

| | | | Repurchase Agreements - 0.4% | | | |

| | | | RBC Capital Markets LLC TriParty Repurchase Agreement (maturing on 01/02/2015 in the amount of $5,151,011, collateralized by U.S. Treasury Note 0.63%, 2021, value of $5,239,209) | | | | |

| $ | 5,151,000 | | | 0.04%, 12/31/2014 | | $ | 5,151,000 | |

| | | | | | | | |

| | |

| | | | U.S. Treasury Bills - 0.1% | | | |

| | 650,000 | | | 0.06%, 05/07/2015(3)(4) | | $ | 649,898 | |

| | | | | | | | |

| | |

| | | | Total Short-Term Investments

(cost $5,800,875) | | $ | 5,800,898 | |

| | | | | | | | |

| | | | | | | | | | |

| | | |

| | Total Investments

(cost $688,444,543)(5) | | | 100.1 | % | | $ | 1,229,158,793 | |

| | Other Assets and Liabilities | | | (0.1 | )% | | | (923,572 | ) |

| | | | | | | | | | |

| | Net Assets | | | 100.0 | % | | $ | 1,228,235,221 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments – (continued)

December 31, 2014

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| | Equity industry classifications used in this report are the Global Industry Classification Standard, which was developed by and is the exclusive property and service mark of MSCI, Inc. and Standard & Poor’s. |

| | For Fund compliance purposes, the Fund may not use the same classification system shown in this report as these classifications are used for reporting ease. |

| (1) | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

| (3) | The interest rate disclosed for these securities represents the effective yield on the date of the acquisition. |

| (4) | This security, or a portion of this security, is pledged as initial margin deposit and collateral for daily variation margin loss on open futures contracts held at December 31, 2014. |

| (5) | At December 31, 2014, the cost of securities for federal income tax purposes was $725,412,493, and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| | | | |

Unrealized Appreciation | | $ | 526,763,734 | |

Unrealized Depreciation | | | (23,017,434 | ) |

| | | | |

Net Unrealized Appreciation | | $ | 503,746,300 | |

| | | | |

Futures Contracts Outstanding at December 31, 2014

| | | | | | | | | | | | | | | | | | | | |

Description | | Number of

Contracts | | | Expiration

Date | | | Notional Amount | | | Market Value | | | Unrealized

Appreciation/

(Depreciation) | |

Long position contracts: | | | | | | | | | | | | | | | | | | | | |

S&P 500 Futures | | | 65 | | | | 03/20/2015 | | | $ | 6,621,628 | | | $ | 6,670,300 | | | $ | 48,672 | |

| | |

| GLOSSARY: (abbreviations used in preceding Schedule of Investments) |

|

| Index Abbreviations: |

S&P | | Standard & Poors |

|

| Other Abbreviations: |

REIT | | Real Estate Investment Trust |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments – (concluded)

December 31, 2014

Investment Valuation Hierarchy Level Summary at December 31, 2014

| | | | | | | | | | | | | | | | |

Description | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Assets:1 | | | | | | | | | | | | | | | | |

Common Stocks2 | | $ | 1,223,357,895 | | | $ | 1,223,357,895 | | | $ | — | | | $ | — | |

Short-Term Investments | | | 5,800,898 | | | | — | | | | 5,800,898 | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 1,229,158,793 | | | $ | 1,223,357,895 | | | $ | 5,800,898 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Futures3 | | $ | 48,672 | | | $ | 48,672 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 48,672 | | | $ | 48,672 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| 1 | For the year ended December 31, 2014, there were no transfers between any levels. |

| 2 | Refer to the Schedule of Investments for further industry breakout. |

| 3 | Derivative instruments are valued at the unrealized appreciation/depreciation on the investments. |

| Note: | For purposes of reporting transfers between different hierarchy levels, both transfers in and out of each level, as applicable, are shown as if they occurred at the beginning of the period. |

The accompanying notes are an integral part of these financial statements.

Statement of Assets and Liabilities

December 31, 2014

| | | | |

Assets: | | | | |

Investments in securities, at market value (cost $688,444,543) | | $ | 1,229,158,793 | |

Cash | | | 812 | |

Receivables: | | | | |

Fund shares sold | | | 66,885 | |

Dividends and interest | | | 1,634,699 | |

Other assets | | | 5,723 | |

| | | | |

Total assets | | | 1,230,866,912 | |

| | | | |

Liabilities: | | | | |

Payables: | | | | |

Fund shares redeemed | | | 2,016,465 | |

Investment management fees | | | 314,612 | |

Variation margin on financial derivative instruments | | | 79,244 | |

Distribution fees | | | 99,984 | |

Accrued expenses | | | 121,386 | |

| | | | |

Total liabilities | | | 2,631,691 | |

| | | | |

Net assets | | $ | 1,228,235,221 | |

| | | | |

Summary of Net Assets: | | | | |

Capital stock and paid-in-capital | | $ | 706,519,456 | |

Undistributed net investment income | | | 4,598,751 | |

Accumulated net realized loss | | | (23,645,908 | ) |

Unrealized appreciation of investments | | | 540,762,922 | |

| | | | |

Net assets | | $ | 1,228,235,221 | |

| | | | |

Class IA: Net asset value per share | | $ | 41.11 | |

| | | | |

Shares Outstanding | | | 18,507,704 | |

| | | | |

Net Assets | | $ | 760,767,812 | |

| | | | |

Class IB: Net asset value per share | | $ | 40.86 | |

| | | | |

Shares Outstanding | | | 11,439,729 | |

| | | | |

Net Assets | | $ | 467,467,409 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

Statement of Operations

For the Year Ended December 31, 2014

| | | | |

Investment Income: | | | | |

Dividends | | $ | 24,533,056 | |

Interest | | | 3,422 | |

Less: Foreign tax withheld | | | (2,819 | ) |

Other Income | | | 118,992 | |

| | | �� | |

Total investment income, net | | | 24,652,651 | |

| | | | |

Expenses: | | | | |

Investment management fees | | | 3,581,933 | |

Transfer agent fees | | | 5,430 | |

Distribution fees - Class IB | | | 1,098,350 | |

Custodian fees | | | 3,969 | |

Accounting service fees | | | 112,949 | |

Trustee fees | | | 40,394 | |

Audit fees | | | 41,380 | |

Printing fees | | | 81,184 | |

Legal fees | | | 37,871 | |

Insurance fees | | | 16,710 | |

Other expenses | | | 29,371 | |

| | | | |

Total expenses (before waivers) | | | 5,049,541 | |

| | | | |

Total waivers | | | (38,555 | ) |

| | | | |

Total expenses | | | 5,010,986 | |

| | | | |

Net Investment Income | | | 19,641,665 | |

| | | | |

Net Realized Gain on Investments and Other Financial Instruments: | | | | |

Net realized gain on investments | | | 44,399,883 | |

Net realized gain on futures | | | 1,444,101 | |

| | | | |

Net Realized Gain on Investments and Other Financial Instruments | | | 45,843,984 | |

| | | | |

Net Changes in Unrealized Appreciation of Investments and Other Financial Instruments: | | | | |

Net unrealized appreciation of investments | | | 83,807,361 | |

Net unrealized depreciation of futures | | | (243,976 | ) |

| | | | |

Net Changes in Unrealized Appreciation of Investments and Other Financial Instruments | | | 83,563,385 | |

| | | | |

Net Realized and Unrealized Gain on Investments and Other Financial Instruments | | | 129,407,369 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 149,049,034 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

Statement of Changes in Net Assets

| | | | | | | | |

| | | For the

Year Ended

December 31,

2014 | | | For the

Year Ended

December 31,

2013(1) | |

Operations: | | | | | | | | |

Net investment income | | $ | 19,641,665 | | | $ | 18,832,003 | |

Net realized gain on investments and other financial instruments | | | 45,843,984 | | | | 28,993,576 | |

Net unrealized appreciation of investments and other financial instruments | | | 83,563,385 | | | | 254,915,353 | |

| | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | | 149,049,034 | | | | 302,740,932 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

From net investment income | | | | | | | | |

Class IA | | | (10,493,733 | ) | | | (12,237,589 | ) |

Class IB | | | (5,612,447 | ) | | | (5,813,586 | ) |

| | | | | | | | |

Total distributions from net investment income | | | (16,106,180 | ) | | | (18,051,175 | ) |

| | | | | | | | |

From net realized gain on investments | | | | | | | | |

Class IA | | | (32,453,081 | ) | | | — | |

Class IB | | | (19,873,215 | ) | | | — | |

| | | | | | | | |

Total distributions from net realized gain on investments | | | (52,326,296 | ) | | | — | |

| | | | | | | | |

Total distributions | | | (68,432,476 | ) | | | (18,051,175 | ) |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Class IA | | | | | | | | |

Sold | | | 28,800,028 | | | | 45,697,338 | |

Issued on reinvestment of distributions | | | 42,946,814 | | | | 12,237,589 | |

Redeemed | | | (126,111,461 | ) | | | (176,784,689 | ) |

| | | | | | | | |

Total capital share transactions | | | (54,364,619 | ) | | | (118,849,762 | ) |

| | | | | | | | |

Class IB | | | | | | | | |

Sold | | | 59,747,881 | | | | 102,183,899 | |

Issued on reinvestment of distributions | | | 25,485,662 | | | | 5,813,586 | |

Redeemed | | | (60,237,522 | ) | | | (95,764,784 | ) |

| | | | | | | | |

Total capital share transactions | | | 24,996,021 | | | | 12,232,701 | |

| | | | | | | | |

Net decrease from capital share transactions | | | (29,368,598 | ) | | | (106,617,061 | ) |

| | | | | | | | |

Net Increase in Net Assets | | | 51,247,960 | | | | 178,072,696 | |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of period | | | 1,176,987,261 | | | | 998,914,565 | |

| | | | | | | | |

End of period | | $ | 1,228,235,221 | | | $ | 1,176,987,261 | |

| | | | | | | | |

Undistributed net investment income | | $ | 4,598,751 | | | $ | 1,323,641 | |

| | | | | | | | |

Shares: | | | | | | | | |

Class IA | | | | | | | | |

Sold | | | 718,762 | | | | 1,353,264 | |

Issued on reinvestment of distributions | | | 1,121,090 | | | | 323,585 | |

Redeemed | | | (3,150,411 | ) | | | (5,158,205 | ) |

| | | | | | | | |

Total share activity | | | (1,310,559 | ) | | | (3,481,356 | ) |

| | | | | | | | |

Class IB | | | | | | | | |

Sold | | | 1,512,641 | | | | 3,032,803 | |

Issued on reinvestment of distributions | | | 668,764 | | | | 154,529 | |

Redeemed | | | (1,514,157 | ) | | | (2,804,770 | ) |

| | | | | | | | |

Total share activity | | | 667,248 | | | | 382,562 | |

| | | | | | | | |

| (1) | See Note 10 in the accompanying Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

December 31, 2014

HIMCO Variable Insurance Trust (“the Trust”) is an open-end registered management investment company. The Trust is organized under the laws of the State of Delaware and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (“1940 Act”).

HIMCO VIT Index Fund (the “Fund”) serves as an underlying investment option for certain variable annuity and variable life insurance separate accounts of Hartford Life Insurance Company (“HLIC”) and its affiliates and certain qualified retirement plans. The Fund may also serve as an underlying investment option for certain variable annuity and variable life separate accounts of other insurance companies. Owners of variable annuity contracts and policyholders of variable life insurance contracts may choose the funds permitted in the variable insurance contract prospectus. In addition, participants in certain qualified retirement plans may choose the Fund if permitted by their plans.

The Fund is a series of the Trust. The Fund is a diversified open-end management investment company and applies specialized accounting and reporting under Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The Fund is authorized to issue an unlimited number of shares with a par value of 0.001 each.

The Fund is divided into Class IA and Class IB shares. Each class is offered at the per share net asset value (“NAV”) without a sales charge and is subject to the same expenses, except that the Class IB shares are subject to distribution and service fees charged pursuant to a Distribution Plan adopted in accordance with Rule 12b-1 under the 1940 Act.

Effective October 20, 2014, Hartford Index HLS Fund (the “Predecessor Fund”) was reorganized into the HIMCO VIT Index Fund. The Fund is advised by Hartford Investment Management Company (“Hartford Investment Management”). See Note 9.

| 2. | Significant Accounting Policies: |

The following is a summary of significant accounting policies of the Fund in the preparation of its financial statements, which are in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). The preparation of financial statements in accordance with U.S. GAAP may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

| | a) | Determination of Net Asset Value – The NAV of each class of the Fund’s shares is determined as of the close of regular trading (normally 4:00 p.m. Eastern Time) (the “NYSE Close”) on each day that the New York Stock Exchange (the “Exchange”) is open (“Valuation Date”). Information that becomes known to the Fund after the NAV has been calculated on a particular day will not generally be used to retroactively adjust the NAV determined earlier that day. |

| | b) | Investment Valuation and Fair Value Measurements – For purposes of calculating the NAV, portfolio investments and other assets held by the Fund’s portfolio for which market prices are readily available are valued at market value. Market value is generally determined on the basis of last reported sales prices or official close price. If no sales are reported, market value is based on bid ask/prices, and dealer, broker or market maker-quotations. Last sale prices, official closing prices and bid and ask prices are supplied by one or more independent pricing services. If market prices are not readily available or are deemed unreliable, the Fund will use the fair value of the investment as determined in good faith under policies and procedures established by and under the supervision of the Trust’s Board of Trustees (“Board of Trustees”). |

Short-term investments maturing in 60 days or less are generally valued at amortized cost, if their original term to maturity was 60 days or less, or by amortizing their value on the 61st day prior to maturity, if the original term to maturity exceeded 60 days, which approximates fair value.

Exchange traded equity securities are normally valued at the last reported sale price on the exchange or market on which the security is primarily traded and generally has the highest volume of trading activity (the “Primary Market”) at the Valuation Date. If the security did not trade on the Primary Market, it may be valued at the last reported sales price on another exchange or market where it trades at the Valuation Date. The value of an equity security not traded on any exchange but traded on an over-the-counter (“OTC”) market shall be valued at the last reported sales price or official closing price on the exchange or market on which the security is traded as of the Valuation Date.

Notes to Financial Statements – (continued)

December 31, 2014

Exchange traded options, futures and options on futures are valued at the settlement price on last trade price determined by the relevant exchange as of the NYSE Close. If a last trade price is not available, the value will be the mean of the bid and ask prices as of the NYSE Close. If a mean of the bid and ask prices cannot be calculated for the day, the value will be the bid price as of the NYSE Close. In the case of OTC options and such instruments that do not trade on an exchange, values may be supplied by a pricing service using a formula or other objective method that may take into consideration the style, direction, expiration, strike price, notional value and volatility or other special adjustments.

Financial instruments for which prices are not available from an independent pricing service may be valued using market quotations obtained from one or more dealers that make markets in the respective financial instrument in accordance with procedures established by the Board of Trustees.

U.S. GAAP defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants. The U.S. GAAP fair value measurement standards require disclosure of a fair value hierarchy for each major category of assets and liabilities. Various inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized into three broad hierarchy levels. This hierarchy is based on whether the valuation inputs are observable or unobservable. These levels are:

| | • | | Level 1 – Quoted prices in active markets for identical investments. Level 1 may include exchange traded instruments, such as domestic equities, some foreign equities, options, futures, mutual funds, exchange traded funds, rights and warrants. |

| | • | | Level 2 – Observable inputs other than Level 1 prices, such as quoted prices for similar investments; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data. Level 2 may include debt investments that are traded less frequently than exchange traded instruments and which are valued using independent pricing services; foreign equities, which are principally traded on certain foreign markets and are adjusted daily pursuant to a fair value pricing service in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE Close; senior floating rate interests, which are valued using an aggregate of dealer bids; short-term investments, which are valued at amortized cost; and swaps, which are valued based upon the terms of each swap contract. |

| | • | | Level 3 – Significant unobservable inputs that are supported by limited or no market activity. Level 3 may include financial instruments whose values are determined using indicative market quotes or require significant management judgment or estimation. These unobservable valuation inputs may include estimates for current yields, maturity/duration, prepayment speed, and indicative market quotes for comparable investments along with other assumptions relating to credit quality, collateral value, complexity of the investment structure, general market conditions and liquidity. This category may include investments where trading has been halted or there are certain restrictions on trading. While these investments are priced using unobservable inputs, the valuation of these investments reflects the best available data and management believes the prices are a reasonable representation of exit price. |

The Board of Trustees has adopted procedures for determining the value of portfolio securities. These procedures define how investments are to be valued, including the formation and activities of a Valuation Committee. The Valuation Committee has the overall responsibility for implementing the procedures adopted by the Board of Trustees, including, the responsibility for determining the fair value of the Fund’s investments. The Valuation Committee is also responsible for determining in good faith the fair value of investments when the value cannot be obtained from primary pricing services or alternative sources or if the valuation of an investment as provided by the primary pricing service or alternative source is believed not to reflect the investment’s fair value as of the Valuation Date.

The Valuation Committee is comprised of the Trust’s Chief Executive Officer, Chief Financial Officer, Chief Administrative Officer, and Chief Legal officer, or their designees. In addition, the Trust’s Chief Compliance Officer (“CCO”) shall designate a member of the compliance group to attend Valuation Committee meetings as a non-voting resource, to monitor for and provide guidance with respect to compliance with these procedures and to keep the Trust’s CCO regularly informed of pricing and Valuation Committee proceedings. Two members of the Valuation Committee or their designees, representing different departments, shall constitute a quorum for purposes of permitting the Committee

Notes to Financial Statements – (continued)

December 31, 2014

to take action. The Valuation Committee will consider all relevant factors in determining an investment’s fair value, and may seek the advice of the Fund’s adviser, knowledgeable brokers, and legal counsel in making such determination.

At each quarterly meeting of the Board of Trustees, the Valuation Committee provides a written report which include details of all fair-valued investments, including the reason for the fair valuation, and an indication, when possible, of the accuracy of the valuation by disclosing the next available reliable public price quotation or the disposition price of such investments (the “look-back” review). The Board of Trustees then must consider for ratification all of the fair value determinations made during the previous quarter.

Valuation levels are not necessarily indicative of the risk associated with investing in such investments. Individual investments within any of the above mentioned asset classes may be assigned a different hierarchical level than those presented above, as individual circumstances dictate.

For additional information, refer to the Investment Valuation Hierarchy Level Summary which follows the Schedule of Investments.

| | c) | Investment Transactions and Investment Income – Investment transactions are recorded as of the trade date (the date the order to buy or sell is executed) for financial reporting purposes. Investments purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Realized gains and losses are determined on the basis of identified cost. |

Dividend income from domestic securities is accrued on the ex-dividend date. Interest income, including amortization of premium, accretion of discounts and additional principal received in-kind in lieu of cash, is accrued on a daily basis.

| | d) | Fund Share Valuation and Dividend Distributions to Shareholders – Orders for the Fund’s shares are executed in accordance with the investment instructions of the contract holders and plan participants. The NAV of the Fund’s shares is determined as of the close of business on each business day of the Exchange. The NAV is determined separately for each class of shares of the Fund by dividing the Fund’s net assets attributable to that class by the number of shares of the class outstanding. Each class of shares offered by the Fund has equal rights as to assets and voting privileges (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Income and non-class specific expenses are allocated daily to each class on the basis of the relative net assets of the class. Realized and unrealized gains and losses are allocated daily based on the relative net assets of each class of shares of the Fund. |

Orders for the purchase of the Fund’s shares received prior to the close of the Exchange on any day the Exchange is open for business are priced at the NAV determined as of the close of the Exchange. Orders received after the close of the Exchange, or on a day on which the Exchange and/or the Fund is not open for business, are priced at the next determined NAV.

Dividends are declared pursuant to a policy adopted by the Trust’s Board of Trustees based upon the investment performance of the Fund. The policy of the Fund is to pay dividends from net investment income and realized gains, if any, at least once a year.

Distributions from net investment income, realized capital gains and capital are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP with respect to character and timing. These differences may include, but are not limited to, losses deferred due to wash sale adjustments, foreign currency gains and losses, adjustments related to Passive Foreign Investment Companies (“PFICs”), Real Estate Investment Trusts (“REITs”), Regulated Investment Companies (“RICs”), certain derivatives and partnerships. Permanent book and federal income tax basis differences relating to shareholder distributions will result in reclassifications to certain of the Fund’s capital accounts (see Federal Income Taxes: Reclassification of Capital Accounts note).

| 3. | Securities and Other Investments: |