UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22954

HIMCO VARIABLE INSURANCE TRUST

(Exact name of registrant as specified in charter)

One Hartford Plaza, Hartford, Connecticut 06155

(Address of principal executive offices) (Zip code)

Brenda J. Page

Hartford Investment Management Company

One Hartford Plaza

Hartford, Connecticut 06155

(Name and address of agent for service)

Registrant’s telephone number, including area code: (860) 297-6444

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HIMCO VIT Index Fund

Table of Contents

This report is prepared for the general information of contract owners and qualified retirement plan participants. It is not an offer to buy or sell an annuity contract or qualified retirement plan, fund or any security. It should not be used in connection with any offer, except in conjunction with the appropriate product prospectus (which contains all pertinent product information including the applicable sales, administrative and other charges) and the current prospectus and/or summary prospectus of the Fund available for investment thereunder.

Schedule of Investments

June 30, 2017 (Unaudited)

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% | |

| | | | Automobiles & Components - 0.7% | |

| | 10,467 | | | BorgWarner, Inc. | | $ | 443,382 | |

| | 14,056 | | | Delphi Automotive plc | | | 1,232,008 | |

| | 205,214 | | | Ford Motor Co. | | | 2,296,345 | |

| | 72,053 | | | General Motors Co. | | | 2,516,811 | |

| | 13,211 | | | Goodyear Tire & Rubber Co. (The) | | | 461,857 | |

| | 9,184 | | | Harley-Davidson, Inc. | | | 496,120 | |

| | | | | | | | |

| | | | | | | 7,446,523 | |

| | | | | | | | |

| | | | Banks - 6.4% | | | |

| | 522,168 | | | Bank of America Corp. | | | 12,667,796 | |

| | 42,572 | | | BB&T Corp. | | | 1,933,195 | |

| | 144,461 | | | Citigroup, Inc. | | | 9,661,552 | |

| | 26,578 | | | Citizens Financial Group, Inc. | | | 948,303 | |

| | 9,284 | | | Comerica, Inc. | | | 679,960 | |

| | 39,366 | | | Fifth Third Bancorp | | | 1,021,941 | |

| | 57,040 | | | Huntington Bancshares, Inc. | | | 771,181 | |

| | 186,413 | | | JPMorgan Chase & Co. | | | 17,038,148 | |

| | 57,512 | | | KeyCorp | | | 1,077,775 | |

| | 8,073 | | | M&T Bank Corp. | | | 1,307,422 | |

| | 18,068 | | | People’s United Financial, Inc. | | | 319,081 | |

| | 25,390 | | | PNC Financial Services Group, Inc. (The) | | | 3,170,449 | |

| | 63,071 | | | Regions Financial Corp. | | | 923,360 | |

| | 25,368 | | | SunTrust Banks, Inc. | | | 1,438,873 | |

| | 83,120 | | | US Bancorp | | | 4,315,590 | |

| | 235,985 | | | Wells Fargo & Co. | | | 13,075,929 | |

| | 10,632 | | | Zions Bancorp | | | 466,851 | |

| | | | | | | | |

| | | | | | | 70,817,406 | |

| | | | | | | | |

| | | | Capital Goods - 7.3% | | | |

| | 31,355 | | | 3M Co. | | | 6,527,797 | |

| | 2,314 | | | Acuity Brands, Inc. | | | 470,390 | |

| | 4,999 | | | Allegion plc | | | 405,519 | |

| | 12,074 | | | AMETEK, Inc. | | | 731,322 | |

| | 23,127 | | | Arconic, Inc. | | | 523,827 | |

| | 29,453 | | | Boeing Co. (The) | | | 5,824,331 | |

| | 30,913 | | | Caterpillar, Inc. | | | 3,321,911 | |

| | 8,108 | | | Cummins, Inc. | | | 1,315,280 | |

| | 15,440 | | | Deere & Co. | | | 1,908,230 | |

| | 8,168 | | | Dover Corp. | | | 655,237 | |

| | 23,469 | | | Eaton Corp. plc | | | 1,826,592 | |

| | 33,815 | | | Emerson Electric Co. | | | 2,016,050 | |

| | 15,177 | | | Fastenal Co. | | | 660,655 | |

| | 6,853 | | | Flowserve Corp. | | | 318,185 | |

| | 7,334 | | | Fluor Corp. | | | 335,751 | |

| | 15,821 | | | Fortive Corp. | | | 1,002,260 | |

| | 8,072 | | | Fortune Brands Home & Security, Inc. | | | 526,617 | |

| | 14,879 | | | General Dynamics Corp. | | | 2,947,530 | |

| | 456,939 | | | General Electric Co. | | | 12,341,922 | |

| | 39,999 | | | Honeywell International, Inc. | | | 5,331,467 | |

| | 16,313 | | | Illinois Tool Works, Inc. | | | 2,336,837 | |

| | 13,433 | | | Ingersoll-Rand plc | | | 1,227,642 | |

| | 6,319 | | | Jacobs Engineering Group, Inc. | | | 343,690 | |

| | 49,222 | | | Johnson Controls International plc | | | 2,134,266 | |

| | 4,086 | | | L3 Technologies, Inc. | | | 682,689 | |

| | 13,061 | | | Lockheed Martin Corp. | | | 3,625,864 | |

| | 16,787 | | | Masco Corp. | | | 641,431 | |

| | 9,160 | | | Northrop Grumman Corp. | | | 2,351,464 | |

| | 18,431 | | | PACCAR, Inc. | | | 1,217,183 | |

| | 6,988 | | | Parker-Hannifin Corp. | | | 1,116,822 | |

| | 8,797 | | | Pentair plc | | | 585,352 | |

| | 7,771 | | | Quanta Services, Inc.(2) | | | 255,821 | |

| | 15,272 | | | Raytheon Co. | | | 2,466,123 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Capital Goods - 7.3% - (continued) | | | |

| | 6,760 | | | Rockwell Automation, Inc. | | $ | 1,094,850 | |

| | 8,520 | | | Rockwell Collins, Inc. | | | 895,282 | |

| | 5,354 | | | Roper Technologies, Inc. | | | 1,239,612 | |

| | 3,041 | | | Snap-on, Inc. | | | 480,478 | |

| | 8,026 | | | Stanley Black & Decker, Inc. | | | 1,129,499 | |

| | 14,045 | | | Textron, Inc. | | | 661,519 | |

| | 2,566 | | | TransDigm Group, Inc. | | | 689,920 | |

| | 4,434 | | | United Rentals, Inc.(2) | | | 499,756 | |

| | 39,097 | | | United Technologies Corp. | | | 4,774,135 | |

| | 2,819 | | | WW Grainger, Inc. | | | 508,914 | |

| | 9,430 | | | Xylem, Inc. | | | 522,705 | |

| | | | | | | | |

| | | | | | | 80,472,727 | |

| | | | | | | | |

| | | | Commercial & Professional Services - 0.6% | |

| | 4,531 | | | Cintas Corp. | | | 571,087 | |

| | 6,307 | | | Equifax, Inc. | | | 866,708 | |

| | 16,652 | | | IHS Markit Ltd.(2) | | | 733,354 | |

| | 17,623 | | | Nielsen Holdings plc | | | 681,305 | |

| | 12,062 | | | Republic Services, Inc. | | | 768,712 | |

| | 6,673 | | | Robert Half International, Inc. | | | 319,837 | |

| | 4,474 | | | Stericycle, Inc.(2) | | | 341,456 | |

| | 8,068 | | | Verisk Analytics, Inc.(2) | | | 680,697 | |

| | 21,326 | | | Waste Management, Inc. | | | 1,564,262 | |

| | | | | | | | |

| | | | | | | 6,527,418 | |

| | | | | | | | |

| | | | Consumer Durables & Apparel - 1.3% | |

| | 14,751 | | | Coach, Inc. | | | 698,312 | |

| | 17,933 | | | DR Horton, Inc. | | | 619,944 | |

| | 6,020 | | | Garmin Ltd. | | | 307,201 | |

| | 19,107 | | | Hanesbrands, Inc. | | | 442,518 | |

| | 5,903 | | | Hasbro, Inc. | | | 658,244 | |

| | 6,942 | | | Leggett & Platt, Inc. | | | 364,663 | |

| | 10,661 | | | Lennar Corp., Class A | | | 568,445 | |

| | 17,974 | | | Mattel, Inc. | | | 386,980 | |

| | 8,177 | | | Michael Kors Holdings Ltd.(2) | | | 296,416 | |

| | 3,315 | | | Mohawk Industries, Inc.(2) | | | 801,202 | |

| | 25,348 | | | Newell Brands, Inc. | | | 1,359,160 | |

| | 69,533 | | | NIKE, Inc., Class B | | | 4,102,447 | |

| | 14,899 | | | PulteGroup, Inc. | | | 365,472 | |

| | 4,093 | | | PVH Corp. | | | 468,649 | |

| | 2,892 | | | Ralph Lauren Corp. | | | 213,430 | |

| | 9,690 | | | Under Armour, Inc., Class A(2) | | | 210,854 | |

| | 9,672 | | | Under Armour, Inc., Class C(2) | | | 194,988 | |

| | 16,809 | | | VF Corp. | | | 968,198 | |

| | 3,881 | | | Whirlpool Corp. | | | 743,677 | |

| | | | | | | | |

| | | | | | | 13,770,800 | |

| | | | | | | | |

| | | | Consumer Services - 1.8% | |

| | 21,961 | | | Carnival Corp. | | | 1,439,983 | |

| | 1,504 | | | Chipotle Mexican Grill, Inc.(2) | | | 625,814 | |

| | 6,524 | | | Darden Restaurants, Inc. | | | 590,031 | |

| | 10,870 | | | H&R Block, Inc. | | | 335,992 | |

| | 10,751 | | | Hilton Worldwide Holdings, Inc. | | | 664,949 | |

| | 16,302 | | | Marriott International, Inc., Class A | | | 1,635,254 | |

| | 42,766 | | | McDonald’s Corp. | | | 6,550,040 | |

| | 8,802 | | | Royal Caribbean Cruises Ltd. | | | 961,442 | |

| | 75,981 | | | Starbucks Corp. | | | 4,430,452 | |

| | 5,475 | | | Wyndham Worldwide Corp. | | | 549,745 | |

| | 4,189 | | | Wynn Resorts Ltd. | | | 561,829 | |

| | 17,358 | | | Yum! Brands, Inc. | | | 1,280,326 | |

| | | | | | | | |

| | | | | | | 19,625,857 | |

| | | | | | | | |

The accompanying Notes are an integral part of these financial statements.

Schedule of Investments – (continued)

June 30, 2017 (Unaudited)

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Diversified Financials - 5.2% | |

| | 2,970 | | | Affiliated Managers Group, Inc. | | $ | 492,604 | |

| | 39,393 | | | American Express Co. | | | 3,318,466 | |

| | 7,999 | | | Ameriprise Financial, Inc. | | | 1,018,193 | |

| | 54,562 | | | Bank of New York Mellon Corp. (The) | | | 2,783,753 | |

| | 99,665 | | | Berkshire Hathaway, Inc., Class B(2) | | | 16,880,261 | |

| | 6,361 | | | BlackRock, Inc. | | | 2,686,950 | |

| | 25,341 | | | Capital One Financial Corp. | | | 2,093,673 | |

| | 4,821 | | | CBOE Holdings, Inc. | | | 440,639 | |

| | 63,844 | | | Charles Schwab Corp. (The) | | | 2,742,738 | |

| | 17,828 | | | CME Group, Inc. | | | 2,232,779 | |

| | 19,948 | | | Discover Financial Services | | | 1,240,566 | |

| | 14,412 | | | E*TRADE Financial Corp.(2) | | | 548,088 | |

| | 17,966 | | | Franklin Resources, Inc. | | | 804,697 | |

| | 19,208 | | | Goldman Sachs Group, Inc. (The) | | | 4,262,255 | |

| | 31,065 | | | Intercontinental Exchange, Inc. | | | 2,047,805 | |

| | 21,347 | | | Invesco Ltd. | | | 751,201 | |

| | 16,991 | | | Leucadia National Corp. | | | 444,485 | |

| | 8,733 | | | Moody’s Corp. | | | 1,062,632 | |

| | 74,734 | | | Morgan Stanley | | | 3,330,147 | |

| | 5,980 | | | NASDAQ, Inc. | | | 427,510 | |

| | 14,951 | | | Navient Corp. | | | 248,934 | |

| | 11,323 | | | Northern Trust Corp. | | | 1,100,709 | |

| | 6,725 | | | Raymond James Financial, Inc. | | | 539,480 | |

| | 13,527 | | | S&P Global, Inc. | | | 1,974,807 | |

| | 18,556 | | | State Street Corp. | | | 1,665,030 | |

| | 40,414 | | | Synchrony Financial | | | 1,205,146 | |

| | 12,659 | | | T Rowe Price Group, Inc. | | | 939,424 | |

| | | | | | | | |

| | | | | | | 57,282,972 | |

| | | | | | | | |

| | | | Energy - 6.0% | |

| | 29,401 | | | Anadarko Petroleum Corp. | | | 1,333,041 | |

| | 19,958 | | | Apache Corp. | | | 956,587 | |

| | 22,325 | | | Baker Hughes, Inc. | | | 1,216,936 | |

| | 24,426 | | | Cabot Oil & Gas Corp. | | | 612,604 | |

| | 40,022 | | | Chesapeake Energy Corp.(2) | | | 198,909 | |

| | 99,406 | | | Chevron Corp. | | | 10,371,028 | |

| | 4,990 | | | Cimarex Energy Co. | | | 469,110 | |

| | 7,774 | | | Concho Resources, Inc.(2) | | | 944,774 | |

| | 64,910 | | | ConocoPhillips | | | 2,853,444 | |

| | 27,583 | | | Devon Energy Corp. | | | 881,829 | |

| | 30,289 | | | EOG Resources, Inc. | | | 2,741,760 | |

| | 9,094 | | | EQT Corp. | | | 532,817 | |

| | 222,326 | | | Exxon Mobil Corp. | | | 17,948,378 | |

| | 45,536 | | | Halliburton Co. | | | 1,944,843 | |

| | 5,696 | | | Helmerich & Payne, Inc. | | | 309,521 | |

| | 14,179 | | | Hess Corp. | | | 622,033 | |

| | 100,736 | | | Kinder Morgan, Inc. | | | 1,930,102 | |

| | 44,598 | | | Marathon Oil Corp. | | | 528,486 | |

| | 27,218 | | | Marathon Petroleum Corp. | | | 1,424,318 | |

| | 8,510 | | | Murphy Oil Corp. | | | 218,111 | |

| | 19,940 | | | National Oilwell Varco, Inc. | | | 656,824 | |

| | 10,452 | | | Newfield Exploration Co.(2) | | | 297,464 | |

| | 23,883 | | | Noble Energy, Inc. | | | 675,889 | |

| | 40,117 | | | Occidental Petroleum Corp. | | | 2,401,805 | |

| | 19,925 | | | ONEOK, Inc. | | | 1,039,288 | |

| | 23,017 | | | Phillips 66 | | | 1,903,276 | |

| | 8,925 | | | Pioneer Natural Resources Co. | | | 1,424,252 | |

| | 9,873 | | | Range Resources Corp. | | | 228,757 | |

| | 72,905 | | | Schlumberger Ltd. | | | 4,800,065 | |

| | 24,482 | | | TechnipFMC plc(2) | | | 665,910 | |

| | 7,930 | | | Tesoro Corp. | | | 742,248 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Energy - 6.0% - (continued) | |

| | 20,518 | | | Transocean Ltd.(2) | | $ | 168,863 | |

| | 23,466 | | | Valero Energy Corp. | | | 1,583,016 | |

| | 43,354 | | | Williams Cos., Inc. (The) | | | 1,312,759 | |

| | | | | | | | |

| | | | | | | 65,939,047 | |

| | | | | | | | |

| | | | Food & Staples Retailing - 1.9% | |

| | 23,013 | | | Costco Wholesale Corp. | | | 3,680,469 | |

| | 53,455 | | | CVS Health Corp. | | | 4,300,989 | |

| | 47,884 | | | Kroger Co. (The) | | | 1,116,655 | |

| | 25,835 | | | Sysco Corp. | | | 1,300,276 | |

| | 77,502 | | | Wal-Mart Stores, Inc. | | | 5,865,351 | |

| | 44,806 | | | Walgreens Boots Allliance, Inc. | | | 3,508,758 | |

| | 16,767 | | | Whole Foods Market, Inc. | | | 706,058 | |

| | | | | | | | |

| | | | | | | 20,478,556 | |

| | | | | | | | |

| | | | Food, Beverage & Tobacco - 5.2% | |

| | 101,352 | | | Altria Group, Inc. | | | 7,547,683 | |

| | 29,942 | | | Archer-Daniels-Midland Co. | | | 1,239,000 | |

| | 9,281 | | | Brown-Forman Corp., Class B | | | 451,057 | |

| | 10,061 | | | Campbell Soup Co. | | | 524,681 | |

| | 201,760 | | | Coca-Cola Co. (The) | | | 9,048,936 | |

| | 21,209 | | | Conagra Brands, Inc. | | | 758,434 | |

| | 8,996 | | | Constellation Brands, Inc., Class A | | | 1,742,795 | |

| | 9,645 | | | Dr Pepper Snapple Group, Inc. | | | 878,756 | |

| | 30,229 | | | General Mills, Inc. | | | 1,674,687 | |

| | 7,345 | | | Hershey Co. (The) | | | 788,633 | |

| | 14,153 | | | Hormel Foods Corp. | | | 482,759 | |

| | 6,109 | | | JM Smucker Co. (The) | | | 722,878 | |

| | 13,233 | | | Kellogg Co. | | | 919,164 | |

| | 31,305 | | | Kraft Heinz Co. (The) | | | 2,680,960 | |

| | 5,941 | | | McCormick & Co., Inc. | | | 579,307 | |

| | 9,689 | | | Molson Coors Brewing Co., Class B | | | 836,548 | |

| | 79,610 | | | Mondelez International, Inc., Class A | | | 3,438,356 | |

| | 21,153 | | | Monster Beverage Corp.(2) | | | 1,050,881 | |

| | 74,952 | | | PepsiCo, Inc. | | | 8,656,206 | |

| | 81,492 | | | Philip Morris International, Inc. | | | 9,571,235 | |

| | 43,418 | | | Reynolds American, Inc. | | | 2,823,907 | |

| | 15,121 | | | Tyson Foods, Inc., Class A | | | 947,028 | |

| | | | | | | | |

| | | | | | | 57,363,891 | |

| | | | | | | | |

| | | | Health Care Equipment & Services - 5.7% | |

| | 91,048 | | | Abbott Laboratories | | | 4,425,843 | |

| | 17,404 | | | Aetna, Inc. | | | 2,642,449 | |

| | 3,962 | | | Align Technology, Inc.(2) | | | 594,775 | |

| | 8,707 | | | AmerisourceBergen Corp. | | | 823,073 | |

| | 13,904 | | | Anthem, Inc. | | | 2,615,760 | |

| | 25,592 | | | Baxter International, Inc. | | | 1,549,340 | |

| | 11,929 | | | Becton Dickinson and Co. | | | 2,327,467 | |

| | 71,851 | | | Boston Scientific Corp.(2) | | | 1,991,710 | |

| | 16,574 | | | Cardinal Health, Inc. | | | 1,291,446 | |

| | 9,039 | | | Centene Corp.(2) | | | 722,035 | |

| | 15,426 | | | Cerner Corp.(2) | | | 1,025,366 | |

| | 13,433 | | | Cigna Corp. | | | 2,248,550 | |

| | 2,563 | | | Cooper Cos., Inc. (The) | | | 613,633 | |

| | 3,800 | | | CR Bard, Inc. | | | 1,201,218 | |

| | 32,050 | | | Danaher Corp. | | | 2,704,700 | |

| | 8,168 | | | DaVita, Inc.(2) | | | 528,960 | |

| | 12,028 | | | DENTSPLY SIRONA, Inc. | | | 779,896 | |

| | 11,008 | | | Edwards Lifesciences Corp.(2) | | | 1,301,586 | |

| | 6,163 | | | Envision Healthcare Corp.(2) | | | 386,235 | |

| | 31,142 | | | Express Scripts Holding Co.(2) | | | 1,988,105 | |

| | 15,016 | | | HCA Healthcare, Inc.(2) | | | 1,309,395 | |

The accompanying Notes are an integral part of these financial statements.

Schedule of Investments – (continued)

June 30, 2017 (Unaudited)

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Health Care Equipment & Services - 5.7% - (continued) | |

| | 4,162 | | | Henry Schein, Inc.(2) | | $ | 761,729 | |

| | 14,692 | | | Hologic, Inc.(2) | | | 666,723 | |

| | 7,572 | | | Humana, Inc. | | | 1,821,975 | |

| | 4,624 | | | IDEXX Laboratories, Inc.(2) | | | 746,406 | |

| | 1,933 | | | Intuitive Surgical, Inc.(2) | | | 1,808,070 | |

| | 5,368 | | | Laboratory Corp. of America Holdings(2) | | | 827,424 | |

| | 11,066 | | | McKesson Corp. | | | 1,820,800 | |

| | 71,824 | | | Medtronic plc | | | 6,374,380 | |

| | 4,281 | | | Patterson Cos., Inc. | | | 200,993 | |

| | 7,179 | | | Quest Diagnostics, Inc. | | | 798,018 | |

| | 16,277 | | | Stryker Corp. | | | 2,258,922 | |

| | 50,563 | | | UnitedHealth Group, Inc. | | | 9,375,391 | |

| | 4,691 | | | Universal Health Services, Inc., Class B | | | 572,677 | |

| | 4,823 | | | Varian Medical Systems, Inc.(2) | | | 497,685 | |

| | 10,558 | | | Zimmer Biomet Holdings, Inc. | | | 1,355,647 | |

| | | | | | | | |

| | | | | | | 62,958,382 | |

| | | | | | | | |

| | | | Household & Personal Products - 1.9% | |

| | 13,078 | | | Church & Dwight Co., Inc. | | | 678,487 | |

| | 6,758 | | | Clorox Co. (The) | | | 900,436 | |

| | 46,346 | | | Colgate-Palmolive Co. | | | 3,435,629 | |

| | 24,714 | | | Coty, Inc., Class A | | | 463,635 | |

| | 11,746 | | | Estee Lauder Cos., Inc. (The), Class A | | | 1,127,381 | |

| | 18,623 | | | Kimberly-Clark Corp. | | | 2,404,415 | |

| | 134,196 | | | Procter & Gamble Co. (The) | | | 11,695,181 | |

| | | | | | | | |

| | | | | | | 20,705,164 | |

| | | | | | | | |

| | | | Insurance - 2.8% | |

| | 20,822 | | | Aflac, Inc. | | | 1,617,453 | |

| | 19,126 | | | Allstate Corp. (The) | | | 1,691,503 | |

| | 46,146 | | | American International Group, Inc. | | | 2,885,048 | |

| | 13,751 | | | Aon plc | | | 1,828,196 | |

| | 9,417 | | | Arthur J Gallagher & Co. | | | 539,123 | |

| | 2,875 | | | Assurant, Inc. | | | 298,109 | |

| | 24,499 | | | Chubb Ltd. | | | 3,561,665 | |

| | 7,863 | | | Cincinnati Financial Corp. | | | 569,674 | |

| | 2,155 | | | Everest Re Group Ltd. | | | 548,641 | |

| | 19,275 | | | Hartford Financial Services Group, Inc. (The)(3) | | | 1,013,287 | |

| | 11,768 | | | Lincoln National Corp. | | | 795,281 | |

| | 14,487 | | | Loews Corp. | | | 678,137 | |

| | 27,039 | | | Marsh & McLennan Cos., Inc. | | | 2,107,960 | |

| | 56,690 | | | MetLife, Inc. | | | 3,114,549 | |

| | 14,064 | | | Principal Financial Group, Inc. | | | 901,081 | |

| | 30,479 | | | Progressive Corp. (The) | | | 1,343,819 | |

| | 22,509 | | | Prudential Financial, Inc. | | | 2,434,123 | |

| | 5,708 | | | Torchmark Corp. | | | 436,662 | |

| | 14,661 | | | Travelers Cos., Inc. (The) | | | 1,855,056 | |

| | 11,974 | | | Unum Group | | | 558,348 | |

| | 6,668 | | | Willis Towers Watson PLC | | | 969,927 | |

| | 13,718 | | | XL Group Ltd. | | | 600,848 | |

| | | | | | | | |

| | | | | | | 30,348,490 | |

| | | | | | | | |

| | | | Materials - 2.8% | |

| | 11,424 | | | Air Products & Chemicals, Inc. | | | 1,634,317 | |

| | 5,811 | | | Albemarle Corp. | | | 613,293 | |

| | 4,647 | | | Avery Dennison Corp. | | | 410,655 | |

| | 18,370 | | | Ball Corp. | | | 775,398 | |

| | 12,232 | | | CF Industries Holdings, Inc. | | | 342,007 | |

| | 58,974 | | | Dow Chemical Co. (The) | | | 3,719,490 | |

| | 7,651 | | | Eastman Chemical Co. | | | 642,608 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Materials - 2.8% - (continued) | |

| | 13,697 | | | Ecolab, Inc. | | $ | 1,818,277 | |

| | 45,492 | | | EI du Pont de Nemours & Co. | | | 3,671,659 | |

| | 7,031 | | | FMC Corp. | | | 513,615 | |

| | 69,840 | | | Freeport-McMoRan, Inc.(2) | | | 838,778 | |

| | 4,144 | | | International Flavors & Fragrances, Inc. | | | 559,440 | |

| | 21,664 | | | International Paper Co. | | | 1,226,399 | |

| | 17,331 | | | LyondellBasell Industries N.V., Class A | | | 1,462,563 | |

| | 3,286 | | | Martin Marietta Materials, Inc. | | | 731,398 | |

| | 23,024 | | | Monsanto Co. | | | 2,725,121 | |

| | 18,418 | | | Mosaic Co. (The) | | | 420,483 | |

| | 27,978 | | | Newmont Mining Corp. | | | 906,207 | |

| | 16,740 | | | Nucor Corp. | | | 968,744 | |

| | 13,442 | | | PPG Industries, Inc. | | | 1,478,082 | |

| | 14,999 | | | Praxair, Inc. | | | 1,988,117 | |

| | 10,274 | | | Sealed Air Corp. | | | 459,864 | |

| | 4,251 | | | Sherwin-Williams Co. (The) | | | 1,491,931 | |

| | 6,934 | | | Vulcan Materials Co. | | | 878,399 | |

| | 13,175 | | | WestRock Co. | | | 746,496 | |

| | | | | | | | |

| | | | | | | 31,023,341 | |

| | | | | | | | |

| | | | Media - 3.0% | |

| | 19,327 | | | CBS Corp., Class B | | | 1,232,676 | |

| | 11,317 | | | Charter Communications, Inc., Class A(2) | | | 3,812,131 | |

| | 248,322 | | | Comcast Corp., Class A | | | 9,664,692 | |

| | 8,068 | | | Discovery Communications, Inc., Class A(2) | | | 208,396 | |

| | 11,062 | | | Discovery Communications, Inc., Class C(2) | | | 278,873 | |

| | 11,935 | | | DISH Network Corp., Class A(2) | | | 749,041 | |

| | 20,731 | | | Interpublic Group of Cos., Inc. (The) | | | 509,983 | |

| | 20,053 | | | News Corp., Class A | | | 274,726 | |

| | 6,285 | | | News Corp., Class B | | | 88,933 | |

| | 12,212 | | | Omnicom Group, Inc. | | | 1,012,375 | |

| | 5,032 | | | Scripps Networks Interactive, Inc., Class A | | | 343,736 | |

| | 40,692 | | | Time Warner, Inc. | | | 4,085,884 | |

| | 55,215 | | | Twenty-First Century Fox, Inc., Class A | | | 1,564,793 | |

| | 25,558 | | | Twenty-First Century Fox, Inc., Class B | | | 712,302 | |

| | 18,485 | | | Viacom, Inc., Class B | | | 620,541 | |

| | 76,329 | | | Walt Disney Co. (The) | | | 8,109,956 | |

| | | | | | | | |

| | | | | | | 33,269,038 | |

| | | | | | | | |

| | | | Pharmaceuticals, Biotechnology & Life Sciences - 8.6% | |

| | 83,507 | | | AbbVie, Inc. | | | 6,055,093 | |

| | 16,911 | | | Agilent Technologies, Inc. | | | 1,002,991 | |

| | 11,782 | | | Alexion Pharmaceuticals, Inc.(2) | | | 1,433,516 | |

| | 17,623 | | | Allergan plc | | | 4,283,975 | |

| | 38,612 | | | Amgen, Inc. | | | 6,650,145 | |

| | 11,208 | | | Biogen, Inc.(2) | | | 3,041,403 | |

| | 86,440 | | | Bristol-Myers Squibb Co. | | | 4,816,437 | |

| | 40,969 | | | Celgene Corp.(2) | | | 5,320,644 | |

| | 50,947 | | | Eli Lilly & Co. | | | 4,192,938 | |

| | 68,563 | | | Gilead Sciences, Inc. | | | 4,852,889 | |

| | 7,661 | | | Illumina, Inc.(2) | | | 1,329,337 | |

| | 8,918 | | | Incyte Corp.(2) | | | 1,122,865 | |

| | 141,343 | | | Johnson & Johnson | | | 18,698,265 | |

| | 5,213 | | | Mallinckrodt plc(2) | | | 233,595 | |

| | 143,512 | | | Merck & Co., Inc. | | | 9,197,684 | |

| | 1,355 | | | Mettler-Toledo International, Inc.(2) | | | 797,472 | |

| | 24,185 | | | Mylan N.V.(2) | | | 938,862 | |

| | 5,774 | | | PerkinElmer, Inc. | | | 393,440 | |

The accompanying Notes are an integral part of these financial statements.

Schedule of Investments – (continued)

June 30, 2017 (Unaudited)

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Pharmaceuticals, Biotechnology & Life Sciences - 8.6% -

(continued) | |

| | 7,523 | | | Perrigo Co. plc | | $ | 568,137 | |

| | 313,128 | | | Pfizer, Inc. | | | 10,517,969 | |

| | 3,998 | | | Regeneron Pharmaceuticals, Inc.(2) | | | 1,963,578 | |

| | 20,527 | | | Thermo Fisher Scientific, Inc. | | | 3,581,346 | |

| | 13,068 | | | Vertex Pharmaceuticals, Inc.(2) | | | 1,684,073 | |

| | 4,200 | | | Waters Corp.(2) | | | 772,128 | |

| | 25,752 | | | Zoetis, Inc. | | | 1,606,410 | |

| | | | | | | | |

| | | | | | | 95,055,192 | |

| | | | | | | | |

| | | | Real Estate - 2.9% | |

| | 4,779 | | | Alexandria Real Estate Equities, Inc., REIT | | | 575,726 | |

| | 22,300 | | | American Tower Corp., REIT | | | 2,950,736 | |

| | 8,239 | | | Apartment Investment & Management Co., Class A, REIT | | | 354,030 | |

| | 7,230 | | | AvalonBay Communities, Inc., REIT | | | 1,389,389 | |

| | 8,073 | | | Boston Properties, Inc., REIT | | | 993,140 | |

| | 15,778 | | | CBRE Group, Inc., Class A, REIT(2) | | | 574,319 | |

| | 19,209 | | | Crown Castle International Corp., REIT | | | 1,924,358 | |

| | 8,383 | | | Digital Realty Trust, Inc., REIT | | | 946,860 | |

| | 4,088 | | | Equinix, Inc., REIT | | | 1,754,406 | |

| | 19,264 | | | Equity Residential, REIT | | | 1,268,149 | |

| | 3,442 | | | Essex Property Trust, Inc., REIT | | | 885,523 | |

| | 6,607 | | | Extra Space Storage, Inc., REIT | | | 515,346 | |

| | 3,790 | | | Federal Realty Investment Trust, REIT | | | 479,018 | |

| | 30,564 | | | GGP, Inc., REIT | | | 720,088 | |

| | 24,586 | | | HCP, Inc., REIT | | | 785,769 | |

| | 38,814 | | | Host Hotels & Resorts, Inc., REIT | | | 709,132 | |

| | 12,888 | | | Iron Mountain, Inc., REIT | | | 442,832 | |

| | 22,334 | | | Kimco Realty Corp., REIT | | | 409,829 | |

| | 6,249 | | | Macerich Co. (The), REIT | | | 362,817 | |

| | 5,959 | | | Mid-America Apartment Communities, Inc., REIT | | | 627,959 | |

| | 27,825 | | | Prologis, Inc., REIT | | | 1,631,658 | |

| | 7,845 | | | Public Storage, REIT | | | 1,635,918 | |

| | 14,327 | | | Realty Income Corp., REIT | | | 790,564 | |

| | 7,675 | | | Regency Centers Corp., REIT | | | 480,762 | |

| | 16,381 | | | Simon Property Group, Inc., REIT | | | 2,649,791 | |

| | 5,343 | | | SL Green Realty Corp., REIT | | | 565,289 | |

| | 14,030 | | | UDR, Inc., REIT | | | 546,749 | |

| | 18,620 | | | Ventas, Inc., REIT | | | 1,293,718 | |

| | 9,038 | | | Vornado Realty Trust, REIT | | | 848,668 | |

| | 19,212 | | | Welltower, Inc., REIT | | | 1,438,018 | |

| | 39,420 | | | Weyerhaeuser Co., REIT | | | 1,320,570 | |

| | | | | | | | |

| | | | | | | 31,871,131 | |

| | | | | | | | |

| | | | Retailing - 5.4% | |

| | 3,875 | | | Advance Auto Parts, Inc. | | | 451,786 | |

| | 20,816 | | | Amazon.com, Inc.(2) | | | 20,149,888 | |

| | 3,454 | | | AutoNation, Inc.(2) | | | 145,621 | |

| | 1,477 | | | AutoZone, Inc.(2) | | | 842,569 | |

| | 7,616 | | | Bed Bath & Beyond, Inc. | | | 231,526 | |

| | 13,921 | | | Best Buy Co., Inc. | | | 798,091 | |

| | 9,718 | | | CarMax, Inc.(2) | | | 612,817 | |

| | 13,237 | | | Dollar General Corp. | | | 954,255 | |

| | 12,419 | | | Dollar Tree, Inc.(2) | | | 868,336 | |

| | 6,379 | | | Expedia, Inc. | | | 950,152 | |

| | 6,886 | | | Foot Locker, Inc. | | | 339,342 | |

| | 11,550 | | | Gap, Inc. (The) | | | 253,985 | |

| | 7,734 | | | Genuine Parts Co. | | | 717,406 | |

| | 62,730 | | | Home Depot, Inc. (The) | | | 9,622,782 | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Retailing - 5.4% - (continued) | |

| | 8,945 | | | Kohl’s Corp. | | $ | 345,903 | |

| | 12,642 | | | L Brands, Inc. | | | 681,277 | |

| | 16,175 | | | LKQ Corp.(2) | | | 532,966 | |

| | 45,022 | | | Lowe’s Cos., Inc. | | | 3,490,556 | |

| | 15,977 | | | Macy’s, Inc. | | | 371,305 | |

| | 22,614 | | | Netflix, Inc.(2) | | | 3,378,758 | |

| | 5,837 | | | Nordstrom, Inc. | | | 279,184 | |

| | 4,775 | | | O’Reilly Automotive, Inc.(2) | | | 1,044,484 | |

| | 2,580 | | | Priceline Group, Inc. (The)(2) | | | 4,825,942 | |

| | 20,568 | | | Ross Stores, Inc. | | | 1,187,391 | |

| | 3,589 | | | Signet Jewelers Ltd. | | | 226,968 | |

| | 34,271 | | | Staples, Inc. | | | 345,109 | |

| | 28,948 | | | Target Corp. | | | 1,513,691 | |

| | 5,625 | | | Tiffany & Co. | | | 528,019 | |

| | 33,752 | | | TJX Cos., Inc. (The) | | | 2,435,882 | |

| | 6,746 | | | Tractor Supply Co. | | | 365,701 | |

| | 5,794 | | | TripAdvisor, Inc.(2) | | | 221,331 | |

| | 3,060 | | | Ulta Salon Cosmetics & Fragrance, Inc.(2) | | | 879,260 | |

| | | | | | | | |

| | | | | | | 59,592,283 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment - 3.4% | |

| | 40,659 | | | Advanced Micro Devices, Inc.(2) | | | 507,424 | |

| | 19,257 | | | Analog Devices, Inc. | | | 1,498,195 | |

| | 56,385 | | | Applied Materials, Inc. | | | 2,329,264 | |

| | 21,059 | | | Broadcom Ltd. | | | 4,907,800 | |

| | 247,077 | | | Intel Corp. | | | 8,336,378 | |

| | 8,225 | | | KLA-Tencor Corp. | | | 752,670 | |

| | 8,464 | | | Lam Research Corp. | | | 1,197,064 | |

| | 12,036 | | | Microchip Technology, Inc. | | | 928,938 | |

| | 54,564 | | | Micron Technology, Inc.(2) | | | 1,629,281 | |

| | 31,219 | | | NVIDIA Corp. | | | 4,513,019 | |

| | 6,669 | | | Qorvo, Inc.(2) | | | 422,281 | |

| | 77,520 | | | QUALCOMM, Inc. | | | 4,280,654 | |

| | 9,682 | | | Skyworks Solutions, Inc. | | | 928,988 | |

| | 52,276 | | | Texas Instruments, Inc. | | | 4,021,593 | |

| | 13,015 | | | Xilinx, Inc. | | | 837,125 | |

| | | | | | | | |

| | | | | | | 37,090,674 | |

| | | | | | | | |

| | | | Software & Services - 13.2% | |

| | 32,535 | | | Accenture plc, Class A | | | 4,023,929 | |

| | 36,381 | | | Activision Blizzard, Inc. | | | 2,094,454 | |

| | 25,956 | | | Adobe Systems, Inc.(2) | | | 3,671,217 | |

| | 9,071 | | | Akamai Technologies, Inc.(2) | | | 451,827 | |

| | 2,921 | | | Alliance Data Systems Corp. | | | 749,791 | |

| | 15,616 | | | Alphabet, Inc., Class A(2) | | | 14,517,883 | |

| | 15,656 | | | Alphabet, Inc., Class C(2) | | | 14,227,077 | |

| | 4,486 | | | ANSYS, Inc.(2) | | | 545,856 | |

| | 10,176 | | | Autodesk, Inc.(2) | | | 1,025,944 | |

| | 23,475 | | | Automatic Data Processing, Inc. | | | 2,405,248 | |

| | 16,442 | | | CA, Inc. | | | 566,756 | |

| | 7,931 | | | Citrix Systems, Inc.(2) | | | 631,149 | |

| | 30,904 | | | Cognizant Technology Solutions Corp., Class A | | | 2,052,026 | |

| | 7,623 | | | CSRA, Inc. | | | 242,030 | |

| | 14,857 | | | DXC Technology Co. | | | 1,139,829 | |

| | 52,814 | | | eBay, Inc.(2) | | | 1,844,265 | |

| | 16,267 | | | Electronic Arts, Inc.(2) | | | 1,719,747 | |

| | 124,023 | | | Facebook, Inc., Class A(2) | | | 18,724,993 | |

| | 17,345 | | | Fidelity National Information Services, Inc. | | | 1,481,263 | |

| | 11,143 | | | Fiserv, Inc.(2) | | | 1,363,235 | |

| | 4,745 | | | Gartner, Inc.(2) | | | 586,055 | |

The accompanying Notes are an integral part of these financial statements.

Schedule of Investments – (continued)

June 30, 2017 (Unaudited)

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Software & Services - 13.2% - (continued) | |

| | 8,001 | | | Global Payments, Inc. | | $ | 722,650 | |

| | 44,858 | | | International Business Machines Corp. | | | 6,900,506 | |

| | 12,771 | | | Intuit, Inc. | | | 1,696,117 | |

| | 49,216 | | | MasterCard, Inc., Class A | | | 5,977,283 | |

| | 405,089 | | | Microsoft Corp. | | | 27,922,785 | |

| | 157,603 | | | Oracle Corp. | | | 7,902,214 | |

| | 16,776 | | | Paychex, Inc. | | | 955,225 | |

| | 58,617 | | | PayPal Holdings, Inc.(2) | | | 3,145,974 | |

| | 9,328 | | | Red Hat, Inc.(2) | | | 893,156 | |

| | 35,084 | | | salesforce.com, Inc.(2) | | | 3,038,274 | |

| | 31,914 | | | Symantec Corp. | | | 901,571 | |

| | 7,887 | | | Synopsys, Inc.(2) | | | 575,199 | |

| | 8,690 | | | Total System Services, Inc. | | | 506,193 | |

| | 4,632 | | | VeriSign, Inc.(2) | | | 430,591 | |

| | 96,871 | | | Visa, Inc., Class A | | | 9,084,562 | |

| | 24,726 | | | Western Union Co. (The) | | | 471,030 | |

| | | | | | | | |

| | | | | | | 145,187,904 | |

| | | | | | | | |

| | | | Technology Hardware & Equipment - 5.5% | |

| | 16,035 | | | Amphenol Corp., Class A | | | 1,183,704 | |

| | 273,566 | | | Apple, Inc. | | | 39,398,975 | |

| | 262,349 | | | Cisco Systems, Inc. | | | 8,211,524 | |

| | 48,284 | | | Corning, Inc. | | | 1,450,934 | |

| | 3,395 | | | F5 Networks, Inc.(2) | | | 431,369 | |

| | 7,160 | | | FLIR Systems, Inc. | | | 248,165 | |

| | 6,397 | | | Harris Corp. | | | 697,785 | |

| | 87,352 | | | Hewlett Packard Enterprise Co. | | | 1,449,170 | |

| | 88,323 | | | HP, Inc. | | | 1,543,886 | |

| | 20,048 | | | Juniper Networks, Inc. | | | 558,938 | |

| | 8,577 | | | Motorola Solutions, Inc. | | | 743,969 | |

| | 14,217 | | | NetApp, Inc. | | | 569,391 | |

| | 15,583 | | | Seagate Technology plc | | | 603,841 | |

| | 18,628 | | | TE Connectivity Ltd. | | | 1,465,651 | |

| | 15,281 | | | Western Digital Corp. | | | 1,353,896 | |

| | 11,201 | | | Xerox Corp. | | | 321,805 | |

| | | | | | | | |

| | | | | | | 60,233,003 | |

| | | | | | | | |

| | | | Telecommunication Services - 2.1% | |

| | 322,581 | | | AT&T, Inc. | | | 12,170,981 | |

| | 28,796 | | | CenturyLink, Inc. | | | 687,648 | |

| | 15,359 | | | Level 3 Communications, Inc.(2) | | | 910,789 | |

| | 214,041 | | | Verizon Communications, Inc. | | | 9,559,071 | |

| | | | | | | | |

| | | | | | | 23,328,489 | |

| | | | | | | | |

| | | | Transportation - 2.3% | |

| | 6,485 | | | Alaska Air Group, Inc. | | | 582,094 | |

| | 25,846 | | | American Airlines Group, Inc. | | | 1,300,571 | |

| | 7,392 | | | CH Robinson Worldwide, Inc. | | | 507,683 | |

| | 48,413 | | | CSX Corp. | | | 2,641,413 | |

| | 38,620 | | | Delta Air Lines, Inc. | | | 2,075,439 | |

| | 9,453 | | | Expeditors International of Washington, Inc. | | | 533,905 | |

| | 12,907 | | | FedEx Corp. | | | 2,805,078 | |

| | 4,501 | | | JB Hunt Transport Services, Inc. | | | 411,301 | |

| | 5,566 | | | Kansas City Southern | | | 582,482 | |

| | 15,205 | | | Norfolk Southern Corp. | | | 1,850,448 | |

| | 31,726 | | | Southwest Airlines Co. | | | 1,971,454 | |

| | 42,366 | | | Union Pacific Corp. | | | 4,614,081 | |

| | 14,785 | | | United Continental Holdings, Inc.(2) | | | 1,112,571 | |

| | 36,139 | | | United Parcel Service, Inc., Class B | | | 3,996,612 | |

| | | | | | | | |

| | | | | | | 24,985,132 | |

| | | | | | | | |

| | | | | | | | |

Shares or Principal Amount | | Market Value(1) | |

| COMMON STOCKS - 99.1% - (continued) | |

| | | | Utilities - 3.1% | |

| | 34,637 | | | AES Corp. | | $ | 384,817 | |

| | 11,954 | | | Alliant Energy Corp. | | | 480,192 | |

| | 12,731 | | | Ameren Corp. | | | 696,004 | |

| | 25,800 | | | American Electric Power Co., Inc. | | | 1,792,326 | |

| | 9,350 | | | American Water Works Co., Inc. | | | 728,833 | |

| | 22,612 | | | CenterPoint Energy, Inc. | | | 619,117 | |

| | 14,715 | | | CMS Energy Corp. | | | 680,569 | |

| | 16,023 | | | Consolidated Edison, Inc. | | | 1,294,979 | |

| | 33,002 | | | Dominion Energy, Inc. | | | 2,528,943 | |

| | 9,412 | | | DTE Energy Co. | | | 995,696 | |

| | 36,722 | | | Duke Energy Corp. | | | 3,069,592 | |

| | 17,095 | | | Edison International | | | 1,336,658 | |

| | 9,416 | | | Entergy Corp. | | | 722,866 | |

| | 16,627 | | | Eversource Energy | | | 1,009,425 | |

| | 48,592 | | | Exelon Corp. | | | 1,752,713 | |

| | 23,283 | | | FirstEnergy Corp. | | | 678,932 | |

| | 24,564 | | | NextEra Energy, Inc. | | | 3,442,153 | |

| | 16,971 | | | NiSource, Inc. | | | 430,385 | |

| | 16,585 | | | NRG Energy, Inc. | | | 285,594 | |

| | 26,791 | | | PG&E Corp. | | | 1,778,119 | |

| | 5,853 | | | Pinnacle West Capital Corp. | | | 498,441 | |

| | 35,846 | | | PPL Corp. | | | 1,385,806 | |

| | 26,543 | | | Public Service Enterprise Group, Inc. | | | 1,141,614 | |

| | 7,499 | | | SCANA Corp. | | | 502,508 | |

| | 13,161 | | | Sempra Energy | | | 1,483,903 | |

| | 52,186 | | | Southern Co. (The) | | | 2,498,666 | |

| | 16,558 | | | WEC Energy Group, Inc. | | | 1,016,330 | |

| | 26,642 | | | Xcel Energy, Inc. | | | 1,222,335 | |

| | | | | | | | |

| | | | | | | 34,457,516 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(cost $554,544,219) | | | 1,089,830,936 | |

| | | | | | | | |

| | |

| | | | Total Long-Term Investments

(cost $554,544,219) | | | 1,089,830,936 | |

| | | | | | | | |

|

| SHORT-TERM INVESTMENTS - 0.9% | |

| | | | Repurchase Agreements - 0.9% | |

| | | | RBC Capital Markets LLC TriParty Repurchase Agreement (dated 06/30/2017, repurchase price $9,951,879, collateralized by GNMA 3.50% - 4.00%, 2043 - 2047, U.S. Treasury Notes 1.50% - 2.38%, 2017 - 2024, U.S. Treasury Inflation Index Note 0.38% , 2025, value of $10,123,187) | | | | |

| $ | 9,951,000 | | | 1.06%, 07/03/2017 | | | 9,951,000 | |

| | | | | | | | |

| | |

| | | | Total Short-Term Investments

(cost $9,951,000) | | | 9,951,000 | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | Total Investments

(cost $564,495,219)(4) | | | 100.0 | % | | $ | 1,099,781,936 | |

| | | | Other Assets and Liabilities | | | — | % | | | (333,023 | ) |

| | | | | | | | | | | | |

| | | | Net Assets | | | 100.0 | % | | $ | 1,099,448,913 | |

| | | | | | | | | | | | |

The accompanying Notes are an integral part of these financial statements.

Schedule of Investments – (continued)

June 30, 2017 (Unaudited)

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| | The Fund may refer to any one or more of the industry classifications used by one or more widely recognized market indices, ratings group indices and/or as defined by Fund management. Industry classifications may not be identical across all security types. |

| | Equity industry classifications used in this report are the Global Industry Classification Standard (GICS®), which was developed by and is the exclusive property and service mark of MSCI, Inc. and S&P. |

| | For Fund compliance purposes, the Fund may not use the same classification system shown in this report as these classifications are used for reporting ease. |

| (1) | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

| (2) | Non-income producing. |

| (3) | Affiliated company as defined under Sections 2(a)(2) and 2(a)(3) of the Investment Company Act of 1940. Hartford Investment Management Company, the Fund’s adviser, is a wholly-owned subsidiary of The Hartford Financial Services Group, Inc. A summary of transactions for the six-month period ended June 30, 2017 is as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Company | | Beginning

Value At

January 1, 2017 | | | Purchase

Cost | | | Sales

Proceeds | | | Realized

Gain (Loss) | | | Unrealized

Gain (Loss) | | | Ending

Value At

June 30, 2017 | | | Dividend

Income | |

Hartford Financial Services Group, Inc. (The) | | $ | 984,497 | | | $ | — | | | $ | (68,886) | | | $ | 12,372 | | | $ | 85,304 | | | $ | 1,013,287 | | | $ | 9,268 | |

| (4) | At June 30, 2017, the cost of securities for federal income tax purposes was $595,633,196, and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| | | | |

Unrealized Appreciation | | $ | 518,510,625 | |

Unrealized Depreciation | | | (14,361,885 | ) |

| | | | |

Net Unrealized Appreciation | | $ | 504,148,740 | |

| | | | |

Futures Contracts Outstanding at June 30, 2017

| | | | | | | | | | | | | | | | | | | | |

Description | | Number of

Contracts | | | Expiration

Date | | | Aggregate Cost | | | Notional Value | | | Unrealized

Appreciation/

(Depreciation) | |

Long position contracts: | | | | | | | | | | | | | | | | | | | | |

S&P 500 (E-Mini) | | | 88 | | | | 09/15/2017 | | | $ | 10,700,546 | | | $ | 10,651,976 | | | $ | (48,570) | |

| | Cash of $560,000 was pledged as initial margin deposit and collateral for the daily variation margin on open futures contracts at June 30, 2017. |

| | |

| GLOSSARY: (abbreviations used in preceding Schedule of Investments) |

|

| Index Abbreviations: |

MSCI | | Morgan Stanley Capital International |

S&P | | Standard & Poor’s |

|

| Other Abbreviations: |

ETF | | Exchange Traded Fund |

GNMA | | Government National Mortgage Association |

REIT | | Real Estate Investment Trust |

|

| Counterparty Abbreviations: |

RBC | | RBC Dominion Securities |

The accompanying Notes are an integral part of these financial statements.

Schedule of Investments – (concluded)

June 30, 2017 (Unaudited)

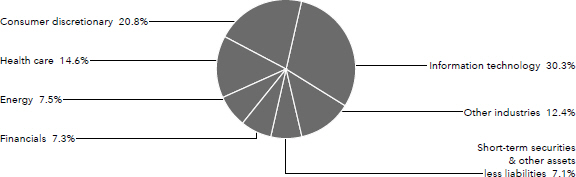

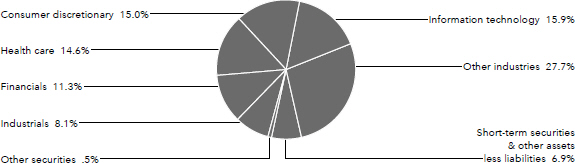

Diversification by Sector

as of June 30, 2017

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 12.2 | % |

Consumer Staples | | | 9.0 | |

Energy | | | 6.0 | |

Financials | | | 14.4 | |

Health Care | | | 14.3 | |

Industrials | | | 10.2 | |

Information Technology | | | 22.1 | |

Materials | | | 2.8 | |

Real Estate | | | 2.9 | |

Telecommunication Services | | | 2.1 | |

Utilities | | | 3.1 | |

| | | | |

Total | | | 99.1 | % |

| | | | |

Short-Term Investments | | | 0.9 | |

Other assets and liabilities | | | — | |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for reporting ease.

Investment Valuation Hierarchy Level Summary at June 30, 2017

| | | | | | | | | | | | | | | | |

Description | | Total | | | Level 1(1) | | | Level 2(1) | | | Level 3(1) | |

Assets: | | | | | | | | | | | | | | | | |

Common Stocks(2) | | $ | 1,089,830,936 | | | $ | 1,089,830,936 | | | $ | — | | | $ | — | |

Short-Term Investments | | | 9,951,000 | | | | — | | | | 9,951,000 | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 1,099,781,936 | | | $ | 1,089,830,936 | | | $ | 9,951,000 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Futures(3) | | $ | (48,570 | ) | | $ | (48,570 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | (48,570 | ) | | $ | (48,570 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| (1) | For the six-month period ended June 30, 2017, there were no transfers between any levels. |

| (2) | Refer to the Schedule of Investments for further industry breakout. |

| (3) | Derivative instruments (excluding purchased and written options, if applicable) are valued at the unrealized appreciation/depreciation on the investments. |

| Note: | For purposes of reporting transfers between different hierarchy levels, both transfers in and out of each level, as applicable, are shown as if they occurred at the beginning of the period. |

The accompanying Notes are an integral part of these financial statements.

Statement of Assets and Liabilities

June 30, 2017 (Unaudited)

| | | | |

Assets: | | | | |

Investments in unaffiliated securities, at market value (cost $563,709,281) | | $ | 1,098,768,649 | |

Investments in affiliated securities, at market value (cost $785,938) | | | 1,013,287 | |

Cash(1) | | | 567,095 | |

Receivables: | | | | |

Fund shares sold | | | 532,832 | |

Dividends and interest | | | 1,091,374 | |

Variation margin on futures contracts | | | 4,077 | |

Other assets | | | 8,771 | |

| | | | |

Total assets | | | 1,101,986,085 | |

| | | | |

Liabilities: | | | | |

Payables: | | | | |

Investment securities purchased | | | 461,833 | |

Fund shares redeemed | | | 1,603,783 | |

Investment management fees | | | 224,970 | |

Distribution fees | | | 81,374 | |

Accrued expenses | | | 165,212 | |

| | | | |

Total liabilities | | | 2,537,172 | |

| | | | |

Net assets | | $ | 1,099,448,913 | |

| | | | |

Summary of Net Assets: | | | | |

Capital stock and paid-in-capital | | $ | 471,716,230 | |

Undistributed net investment income | | | 27,525,653 | |

Accumulated net realized gain | | | 64,968,883 | |

Unrealized appreciation of investments | | | 535,238,147 | |

| | | | |

Net assets | | $ | 1,099,448,913 | |

| | | | |

Class IA: Net asset value per share | | $ | 45.39 | |

| | | | |

Shares Outstanding | | | 15,629,003 | |

| | | | |

Net Assets | | $ | 709,478,437 | |

| | | | |

Class IB: Net asset value per share | | $ | 44.80 | |

| | | | |

Shares Outstanding | | | 8,705,072 | |

| | | | |

Net Assets | | $ | 389,970,476 | |

| | | | |

| (1) | Cash of $560,000 was pledged as initial margin deposit and collateral for the daily variation margin on open futures contracts at June 30, 2017. |

The accompanying Notes are an integral part of these financial statements.

Statement of Operations

For the Six-Month Period Ended June 30, 2017 (Unaudited)

| | | | |

Investment Income: | | | | |

Dividends from unaffiliated securities | | $ | 11,153,169 | |

Dividends from affiliated securities | | | 9,268 | |

Interest | | | 23,238 | |

| | | | |

Total investment income, net | | | 11,185,675 | |

| | | | |

Expenses: | | | | |

Investment management fees | | | 1,631,550 | |

Transfer agent fees | | | 7,522 | |

Distribution fees - Class IB | | | 488,667 | |

Custodian fees | | | 10,608 | |

Accounting service fees | | | 153,447 | |

Trustees fees | | | 63,141 | |

Audit fees | | | 33,310 | |

Printing fees | | | 42,257 | |

Legal fees | | | 73,598 | |

Insurance fees | | | 32,395 | |

Other expenses | | | 31,358 | |

| | | | |

Total expenses (before waivers) | | | 2,567,853 | |

| | | | |

Total waivers | | | (284,110 | ) |

| | | | |

Total expenses | | | 2,283,743 | |

| | | | |

Net Investment Income | | | 8,901,932 | |

| | | | |

Net Realized Gain on Investments and Other Financial Instruments: | | | | |

Net realized gain on investments in unaffiliated securities | | | 31,617,168 | |

Net realized gain on investments in affiliated securities | | | 12,372 | |

Net realized gain on futures | | | 616,109 | |

| | | | |

Net Realized Gain on Investments and Other Financial Instruments | | | 32,245,649 | |

| | | | |

Net Changes in Unrealized Appreciation (Depreciation) of Investments and Other Financial Instruments: | | | | |

Net unrealized appreciation of investments | | | 53,995,391 | |

Net unrealized depreciation of futures contracts | | | (31,106 | ) |

| | | | |

Net Changes in Unrealized Appreciation of Investments and Other Financial Instruments | | | 53,964,285 | |

| | | | |

Net Realized and Unrealized Gain on Investments and Other Financial Instruments | | | 86,209,934 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 95,111,866 | |

| | | | |

The accompanying Notes are an integral part of these financial statements.

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Six-Month

Period Ended

June 30, 2017

(Unaudited) | | | For the

Year Ended

December 31,

2016 | |

Operations: | | | | | | | | |

Net investment income | | $ | 8,901,932 | | | $ | 19,187,983 | |

Net realized gain on investments and other financial instruments | | | 32,245,649 | | | | 67,798,334 | |

Net unrealized appreciation (depreciation) of investments and other financial instruments | | | 53,964,285 | | | | 24,458,604 | |

| | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | | 95,111,866 | | | | 111,444,921 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

From net investment income | | | | | | | | |

Class IA | | | — | | | | (13,966,007 | ) |

Class IB | | | — | | | | (8,249,355 | ) |

| | | | | | | | |

Total distributions from net investment income | | | — | | | | (22,215,362 | ) |

| | | | | | | | |

From net realized gain on investments | | | | | | | | |

Class IA | | | — | | | | (46,415,619 | ) |

Class IB | | | — | | | | (27,416,493 | ) |

| | | | | | | | |

Total distributions from net realized gain on investments | | | — | | | | (73,832,112 | ) |

| | | | | | | | |

Total distributions | | | — | | | | (96,047,474 | ) |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Class IA | | | | | | | | |

Sold | | | 12,520,978 | | | | 21,673,449 | |

Issued on reinvestment of distributions | | | — | | | | 60,381,626 | |

Redeemed | | | (41,410,754 | ) | | | (96,689,732 | ) |

| | | | | | | | |

Total capital share transactions | | | (28,889,776 | ) | | | (14,634,657 | ) |

| | | | | | | | |

Class IB | | | | | | | | |

Sold | | | 17,331,559 | | | | 20,176,793 | |

Issued on reinvestment of distributions | | | — | | | | 35,665,848 | |

Redeemed | | | (42,730,824 | ) | | | (93,903,225 | ) |

| | | | | | | | |

Total capital share transactions | | | (25,399,265 | ) | | | (38,060,584 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (54,289,041 | ) | | | (52,695,241 | ) |

| | | | | | | | |

Net Increase (Decrease) in Net Assets | | | 40,822,825 | | | | (37,297,794 | ) |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of period | | | 1,058,626,088 | | | | 1,095,923,882 | |

| | | | | | | | |

End of period | | $ | 1,099,448,913 | | | $ | 1,058,626,088 | |

| | | | | | | | |

Undistributed net investment income | | $ | 27,525,653 | | | $ | 18,623,721 | |

| | | | | | | | |

Shares: | | | | | | | | |

Class IA | | | | | | | | |

Sold | | | 283,920 | | | | 529,762 | |

Issued on reinvestment of distributions | | | — | | | | 1,499,047 | |

Redeemed | | | (939,863 | ) | | | (2,384,897 | ) |

| | | | | | | | |

Total share activity | | | (655,943 | ) | | | (356,088 | ) |

| | | | | | | | |

Class IB | | | | | | | | |

Sold | | | 401,900 | | | | 504,675 | |

Issued on reinvestment of distributions | | | — | | | | 895,227 | |

Redeemed | | | (979,575 | ) | | | (2,344,051 | ) |

| | | | | | | | |

Total share activity | | | (577,675 | ) | | | (944,149 | ) |

| | | | | | | | |

The accompanying Notes are an integral part of these financial statements.

Notes to Financial Statements

June 30, 2017 (Unaudited)

HIMCO Variable Insurance Trust (the “Trust”) is an open-end registered management investment company. The Trust is organized under the laws of the State of Delaware and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (“1940 Act”).

HIMCO VIT Index Fund (the “Fund”) serves as an underlying investment option for certain variable annuity and variable life insurance separate accounts of Hartford Life Insurance Company (“Hartford Life”) and its affiliates and certain qualified retirement plans. The Fund may also serve as an underlying investment option for certain variable annuity and variable life separate accounts of other insurance companies. Owners of variable annuity contracts and policyholders of variable life insurance contracts may choose the funds permitted in the variable insurance contract prospectus. In addition, participants in certain qualified retirement plans may choose the Fund if permitted by their plans.

The Fund is a series of the Trust. The Fund is the successor of a series of Hartford Series Fund, Inc. (the “Hartford Index HLS Fund”). The reorganization of the Hartford Index HLS Fund with and into the Fund occurred on October 20, 2014. All information regarding and references to periods prior to October 20, 2014 relate to the Hartford Index HLS Fund. The Fund is a diversified open-end management investment company and applies specialized accounting and reporting under Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The Fund is authorized to issue an unlimited number of shares for each class.

The Fund is divided into Class IA and Class IB shares. Each class is offered at the per share net asset value (“NAV”) without a sales charge and is subject to the same expenses, except that the Class IB shares are subject to distribution and service fees charged pursuant to a distribution plan (the “Distribution Plan”) approved by the Board of Trustees in accordance with Rule 12b-1 under the 1940 Act and the requirements of the applicable market conduct rules of the Financial Industry Regulatory Authority concerning asset-based sales charges.

| 2. | Significant Accounting Policies: |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements, which are in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). The preparation of financial statements in accordance with U.S. GAAP may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets resulting from operations during the reporting period. Actual results could differ from those estimates.

| | a) | Determination of Net Asset Value – The NAV of each class of the Fund’s shares is determined as of the close of regular trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m. Eastern Time) (the “NYSE Close”) on each day that the Exchange is open (“Valuation Date”). If the Exchange is closed due to weather or other extraordinary circumstances on a day it would typically be open for business, the Fund will treat such day as a typical business day and accept purchase and redemption orders and calculate the Fund’s NAV as of 4:00 p.m. Eastern Time. The NAV for each class of shares is determined by dividing the value of the Fund’s net assets attributable to a class of shares by the number of shares outstanding for that class. For any day where, due to technical or other issues, trading is halted before the scheduled close of the Exchange, and not as part of a trading halt that is effected on a market-wide basis, the Fund may elect to continue to treat the Valuation Date as occurring at the time of the schedule close of the Exchange. Information that becomes known to the Fund after the NAV has been calculated on a particular day will not generally be used to retroactively adjust the NAV determined earlier that day. |

| | b) | Investment Valuation and Fair Value Measurements – For purposes of calculating the NAV, portfolio securities and other assets held in the Fund’s portfolio for which market prices are readily available are valued at market value. Market value is generally determined on the basis of last reported sales prices or official close price. If no sales were reported, market value is based on prices obtained from independent pricing services, a quotation reporting system or established market makers. If market prices are not readily available or are deemed unreliable, the Fund will use the fair value of the security or other instrument as determined in good faith under policies and procedures established by and under the supervision of the Board of Trustees. Market prices are considered not readily available where there is an absence of |

Notes to Financial Statements – (continued)

June 30, 2017 (Unaudited)

| | current or reliable market-based data (e.g., trade information or broker quotes), including where events occur after the close of the relevant market, but prior to the NYSE Close that materially affect the values of the Fund’s portfolio holdings or assets. In addition, market prices are considered not readily available when, due to extraordinary circumstances, the exchanges or markets on which the securities or other instruments trade do not open for trading for the entire day and no other market prices are available. Securities and other instruments that are primarily traded on foreign markets may trade on days that are not business days of the Fund. The value of the foreign securities or other instruments in which the Fund invests may change on days when a shareholder will not be able to purchase or redeem shares of the Fund. Fair value pricing is subjective in nature and the use of fair value pricing by the Fund may cause the NAV of its shares to differ significantly from the NAV that would have been calculated using market prices at the close of the exchange on which a portfolio holding is primarily traded. There can be no assurance that the Fund could obtain the fair value assigned to an investment if the Fund were to sell the investment at approximately the time at which the Fund determines its NAV. |

Fixed income securities, including those with a remaining maturity of less than sixty (60 days), and non-exchange traded derivatives held by the Fund are valued in accordance with procedures established by the Board of Trustees. Such investments are normally valued on the basis of quotes obtained from independent pricing services or brokers and dealers. Prices obtained from independent pricing services use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Senior floating rate interests generally trade in over-the-counter (“OTC”) markets and are priced through an independent pricing service utilizing independent market quotations from loan dealers or financial institutions. Generally, the Fund may use fair valuation in regard to fixed income positions when the Fund holds defaulted or distressed investments or investments in a company in which a reorganization is pending. If pricing services do not provide a price for short term investments maturing in 60 days or less, such investments are generally valued at amortized cost if their original term to maturity was 60 days or less, or by amortizing their value on the 61st day prior to maturity, if the original term exceeded 60 days.

Exchange traded futures, options and options on futures are valued in accordance with procedures established by the Board of Trustees. Such instruments are normally valued on the basis of quotes obtained from independent pricing services. Prices obtained from independent pricing services use most recent settlement prices and/or bid and ask prices for futures; and last sale prices and bid and ask prices for options and options on futures. If pricing services are not able to provide prices for futures, such instruments will generally be valued at the most recent trade price as of the NYSE Close. If pricing services are not able to provide prices for options and options on futures, such instruments will generally be valued on the basis of quotes obtained from brokers, dealers or market makers. If the option is out of the money, within 30 days of expiration and no bid price is available, the option may be valued at zero. If such instruments do not trade on an exchange, values may be supplied by an independent pricing service using a formula or other objective method that may take into consideration the style, direction, expiration, strike price, notional value and volatility or other adjustments.

U.S. GAAP defines fair value as the price that the fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The U.S. GAAP fair value measurement standards require disclosure of a fair value hierarchy for each major category of assets and liabilities. Various inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized into three broad hierarchy levels. This hierarchy is based on whether the valuation inputs are observable or unobservable. The determination of which category within the fair value hierarchy is appropriate for any given instrument is based on the lowest level of input that is significant to the fair value measurement. These levels are:

| | • | | Level 1 – Inputs using (unadjusted) quoted prices in active markets or exchanges for identical assets and liabilities. Level 1 may include exchange traded instruments, such as domestic equities, some foreign equities, options, futures, investment companies, exchange traded funds, rights and warrants. |

| | • | | Level 2 – Observable inputs other than Level 1 prices, which may include, but are not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities or other market corroborated inputs. Level 2 may include debt investments that are traded less frequently than exchange traded instruments and are valued using independent pricing services; foreign equities, which are principally traded |

Notes to Financial Statements – (continued)

June 30, 2017 (Unaudited)

| | on certain foreign markets and are adjusted daily pursuant to a fair value pricing service in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE Close; senior floating rate interests, which are valued using an aggregate of dealer bids; short-term investments, which are valued at amortized cost; and swaps, which are valued based upon the terms of each swap contract. |

| | • | | Level 3 – Significant unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available. Level 3 may include financial instruments whose values are determined using indicative market quotes or require significant management judgment or estimation. These unobservable valuation inputs may include estimates for current yields, maturity/duration, prepayment speed, and indicative market quotes for comparable investments along with other assumptions relating to credit quality, collateral value, complexity of the investment structure, general market conditions and liquidity. This category may include investments where trading has been halted or there are certain restrictions on trading. While these investments are priced using unobservable inputs, the valuation of these investments reflects the best available data and management believes the prices are a reasonable representation of exit price. |

The procedures adopted by the Board of Trustees define how investments are to be valued, including the formation and activities of a Valuation Committee. The Valuation Committee has the overall responsibility for implementing the procedures adopted by the Board of Trustees, including the responsibility for determining the fair value of the Fund’s investments. The Valuation Committee is also responsible for determining in good faith the fair value of an investment when the value cannot be obtained from primary pricing services or alternative sources or if the valuation of an investment, as provided by the primary pricing service or alternative source, is believed not to reflect the investment’s fair value as of the Valuation Date.

The Valuation Committee is comprised of the Trust’s Chief Executive Officer, Treasurer, Chief Operating Officer, and Chief Legal Officer, or their designees, and other personnel of the investment manager subject to prior approval by the Board of Trustees. In addition, the Trust’s Chief Compliance Officer (“CCO”) shall designate a member of the compliance group to attend Valuation Committee meetings as a non-voting resource, to monitor for and provide guidance with respect to compliance with these procedures and to keep the Trust’s CCO regularly informed of pricing and Valuation Committee proceedings. Two members of the Valuation Committee or their designees, representing different departments, shall constitute a quorum for purposes of permitting the Committee to take action. The Valuation Committee will consider all relevant factors in determining an investment’s fair value, and may seek the advice of the Fund’s adviser, knowledgeable brokers, and legal counsel in making such determination.

At each quarterly meeting of the Board of Trustees, the Valuation Committee provides a written report that includes details of all fair-valued investments to the extent any are fair-valued, including the reason for the fair valuation, and an indication, when possible, of the accuracy of the valuation by disclosing the next available reliable public price quotation or the disposition price of such investments (the “look-back” review). The Board of Trustees then must consider for ratification all of the fair value determinations made during the previous quarter.

Valuation levels are not necessarily indicative of the risk associated with investing in such investments. Individual investments within any of the above mentioned asset classes may be assigned a different hierarchical level than those presented above, as individual circumstances dictate.

For additional information, refer to the Investment Valuation Hierarchy Level Summary included in the Schedule of Investments.

| | c) | Investment Transactions and Investment Income – Investment transactions are recorded as of the trade date (the date the order to buy or sell is executed) for financial reporting purposes. Investments purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Realized gains and losses are determined on the basis of identified cost. |

Dividend income from domestic securities is recorded on the ex-dividend date. Interest income, including amortization of premium, accretion of discounts and additional principal received in-kind in lieu of cash, is accrued on a daily basis.

| | d) | Joint Trading Account – The Fund may invest cash balances into a joint trading account that may be invested in one or more repurchase agreements. |

Notes to Financial Statements – (continued)

June 30, 2017 (Unaudited)

| | e) | Fund Share Valuation and Dividend Distributions to Shareholders – Orders for the Fund’s shares are executed in accordance with the investment instructions of the contract holders and plan participants. Each class of shares offered by the Fund has equal rights as to assets and voting privileges (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Income and non-class specific expenses are allocated daily to each class on the basis of the relative net assets of the class. Realized and unrealized gains and losses are allocated daily based on the relative net assets of each class of shares of the Fund. |

Orders for the purchase of the Fund’s shares received prior to the close of the Exchange on any day the Exchange is open for business are priced at the NAV determined as of the close of the Exchange. Orders received after the close of the Exchange, or on a day on which the Exchange and/or the Fund is not open for business, are priced at the next determined NAV.

Dividends are declared pursuant to a policy adopted by the Board of Trustees based upon the investment performance of the Fund. The policy of the Fund is to pay dividends from net investment income and to make distributions of realized gains, if any, at least once per year.

Distributions from net investment income, realized capital gains and capital are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP with respect to character and timing. These differences may include, but are not limited to, losses deferred due to wash sale adjustments, foreign currency gains and losses, adjustments related to Passive Foreign Investment Companies (“PFICs”), Real Estate Investment Trusts (“REITs”), Regulated Investment Companies (“RICs”), certain derivatives and partnerships. Permanent book and federal income tax basis differences relating to shareholder distributions will result in reclassifications to certain of the Fund’s capital accounts (see Federal Income Taxes: Reclassification of Capital Accounts note).

| 3. | Securities and Other Investments: |

| | a) | Repurchase Agreements and Reverse Repurchase Agreements – A repurchase agreement is an agreement by which a counterparty agrees to sell an investment and agrees to repurchase the investment sold from the buyer, the Fund, at a mutually agreed upon time and price. A reverse repurchase agreement is an agreement by which the Fund agrees to sell an investment and agrees to repurchase the investment sold from the buyer, the counterparty, at a mutually agreed upon time and price. During the period of the repurchase agreement, the counterparty will deposit cash and or securities in a third party custodial account to serve as collateral. At the time the Fund enters into a repurchase agreement, the value of the underlying collateral, including accrued interest, will be equal to or exceed the value of the repurchase agreement. Repurchase agreements expose the Fund to counterparty risk – that is, the risk that the counterparty will not fulfill its obligations. To minimize counterparty risk, the investments that serve to collateralize the repurchase agreement are held by the Fund’s custodian in book entry or physical form in the custodial account of the Fund or in a third party custodial account. Repurchase agreements are valued at cost plus accrued interest, which approximates fair value. Repurchase agreements have master netting arrangements which allow the Fund to offset amounts owed to a counterparty with amounts owed by the counterparty, including any collateral. Upon an event of default under a master repurchase agreement, the non-defaulting party may close out all transactions traded under such agreement and net amounts owed under each transaction to one net amount payable by one party to the other. Absent an event of default, the master repurchase agreement does not result in an offset of reported amounts of assets and liabilities in the Statement of Assets and Liabilities across transactions between the Fund and the applicable counterparty. The Fund, as shown on the Schedule of Investments, had outstanding repurchase agreements and related collateral as of June 30, 2017. |

| | b) | Investments Purchased on a When-Issued or Delayed-Delivery Basis – Delivery and payment for investments that have been purchased by the Fund on a forward commitment, or when-issued or delayed-delivery basis, take place beyond the customary settlement period. The Fund may dispose of or renegotiate a delayed-delivery transaction after it is entered into, and may sell delayed-delivery investments before they are delivered, which may result in a realized gain or loss. During this period, such investments are subject to market fluctuations, and the Fund identifies investments segregated in its records with a value at least equal to the amount of the commitment. When-issued and delayed delivery investments and forward commitments involve the risk that the investment the Fund buys will lose value prior to its delivery. There are also risks that the investment will never be issued or that the other party to the transaction will not |

Notes to Financial Statements – (continued)

June 30, 2017 (Unaudited)

| | meet its obligation. If this occurs, the Fund loses both the investment opportunity for the assets it set aside to pay for the investment and any gain in the investment’s price. The Fund did not hold when-issued or delayed-delivery investments as of June 30, 2017. |

| 4. | Financial Derivative Instruments: |

The following disclosures contain information on how and why the Fund uses derivative instruments, the credit-risk-related contingent features in certain derivative instruments, and how derivative instruments affect the Fund’s financial position and results of operations. The location and fair value amounts of these instruments in the Statement of Assets and Liabilities and the realized gains and losses and changes in unrealized gains and losses in the Statement of Operations, each categorized by type of derivative contract, are included in the following Additional Derivative Instrument Information footnote. The derivative instruments outstanding as of year-end are disclosed in the notes to the Schedule of Investments, if applicable. The amounts of realized gains and losses and changes in unrealized appreciation and depreciation on derivative instruments during the year are disclosed in the Statement of Operations.

| | a) | Futures Contracts – The Fund may enter into futures contracts. A futures contract is an agreement between two parties to buy or sell an asset at a set price on a future date. The Fund uses futures contracts to manage or obtain exposure to the investment markets, commodities, or movements in interest rates and currency values. The primary risks associated with the use of futures contracts are the imperfect correlation between the change in market value of the investments held by the Fund and the prices of futures contracts and the possibility of an illiquid market. Upon entering into a futures contract, the Fund is required to deposit with a futures commission merchant (“FCM”) an amount of cash or U.S. Government or Agency Obligations in accordance with the initial margin requirements of the broker or exchange. Futures contracts are marked to market daily at the most recent settlement price reported by an exchange on which, over time, they are traded most extensively, and an appropriate payable or receivable for the change in value (“variation margin”) is recorded by the Fund. Gains or losses are recognized but not considered realized until the contracts expire or are closed. Futures contracts involve, to varying degrees, risk of loss in excess of the variation margin disclosed in the Statement of Assets and Liabilities; however, the Fund seeks to reduce this risk through the use of an FCM. The Fund, as shown on the Schedule of Investments, had outstanding futures contracts as of June 30, 2017. |

Additional Derivative Instrument Information:

Fair Value of Derivative Instruments in the Statement of Assets and Liabilities as of June 30, 2017:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Risk Exposure Category | |

| | | Interest Rate

Contracts | | | Foreign

Exchange

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Commodity

Contracts | | | Other

Contracts | | | Total | |