UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

______________________

Date of Report (Date of earliest event reported):December 2, 2013

Gray Fox Petroleum Corp.

(Exact Name of Registrant as Specified in its Charter)

______________________________________________________________________________

| Nevada | 333-181683 | 99-0373721 |

| (State of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

3333 Lee Parkway, Suite 600, Dallas, Texas 75219

(Address of principal executive offices)

Registrant’s telephone number, including area code: (214) 665-9564

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

In this Amendment No. 1 to the Current Report on Form 8-K, references to “the Company,” “Gray Fox,” “we,” “us,” and “our” refer to GRAY FOX PETROLEUM CORP.

EXPLANATORY NOTE

This Amendment No. 1 to the Current Report on Form 8-K filed with the Securities Exchange Commission (the “SEC”) on December 6, 2013 is being filed to provide additional information regarding the Company’s current business operations. The text of the original Current Report on Form 8-K, as so supplemented, is set forth in its entirety herein. All of the amendments (other than insignificant typographical corrections) are in Item 2.01 under the caption “FORM 10 DISCLOSURE — Item1. Business — Current Operations.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains “forward-looking” statements including statements regarding our expectations of our future operations. For this purpose, any statements contained in this Form 8-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as "may," "will," "expect," "believe," "anticipate," "estimate," or "continue" or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include, but are not limited to, economic conditions generally and in the industries in which we may participate and competition within our chosen industry. In light of these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to publicly announce revisions we make to these forward-looking statements to reflect the effect of events or circumstances that may arise after the date of this report. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On December 2, 2013, Gray Fox Petroleum Corp. completed the acquisition of 22 separate oil and gas leases (the “Leases”) issued by the Bureau of Land Management for the U.S. (“BLM”) pursuant to a Lease Purchase Agreement with FFMJ, LLC. The leased land comprises 32,723 acres in the Butte Valley Oil Play Region in north central Nevada. The expiration dates of the Leases range from March 31, 2016 to July 31, 2017. Gray Fox has a 100% Working Interest and an 82% Net Revenue Interest in the Leases.

The aggregate purchase price of the Leases was $250,000. Gray Fox made the final payment of $75,000 into escrow on October 23, 2013 and requested approval from the BLM to the assignment of the Leases from FFMJ, LLC to Gray Fox. On December 2, 2013, Gray Fox received confirmation of the BLM’s approval of the assignment of the Leases. At that time, the money was released from escrow and the lease purchase was consummated.

The entry into the Lease Purchase Agreement was previously reported in Item 1.01 of the Current Report on Form 8-K filed with the SEC on July 10, 2013.

FORM 10 DISCLOSURE

Item 2.01(f) of Form 8-K states that if the registrant was a shell company, like our company, the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10.

ITEM 1. BUSINESS

See Item 1.01 of this Current Report on Form 8-K and Item 1 of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013, which are incorporated herein by this reference.

Background

Gray Fox Petroleum Corp. (formerly Viatech Corp.) was incorporated in the State of Nevada on September 22, 2011. The Company was formed originally to provide interior design and architectural visualization, 3D rendering and architectural animation services. On May 31, 2013, the then majority stockholder, Viatcheslav Gelshetyen, entered into a stock purchase agreement with Lawrence Pemble pursuant to which Mr. Gelshetyen sold 7,000,000 shares of common stock, $0.001 par value per share (“Common Stock”), of the Company to Mr. Pemble and forgave $8,363 in stockholder loans he had made to the Company in consideration of $50,000 in cash from Mr. Pemble. This transaction is referred to as the “Change in Control.” As a result of the Change in Control, Mr. Gelshetyen no longer owns any shares of Common Stock. In addition, Mr. Gelshetyen resigned his positions as the sole director and officer of the Company and Mr. Pemble was appointed as the Company’s sole director and as its Chief Executive Officer, President, Treasurer and Secretary. On June 5, 2013, the board of directors approved the dismissal of Ronald R. Chadwick, P.C. as its independent auditor and appointed M&K CPAS, LLC as its new independent auditor.

On June 10, 2013, the Company entered into an Agreement for Redemption of Shares of Common Stock, pursuant to which the Company redeemed 4,700,000 shares of Common Stock held by Mr. Pemble. As a result of this redemption, on June 10, 2013, Mr. Pemble’s shareholdings decreased from 7,000,000 shares to 2,300,000 shares, which represented approximately 53% of the total shares issued and outstanding.

On June 18, 2013, the Company received approval from Financial Industry Regulatory Authority to change its name from “Viatech Corp.” to “Gray Fox Petroleum Corp.” and to conduct a forward stock split of the issued and outstanding shares of Common Stock whereby each outstanding share of Common Stock would be exchanged for eight new shares of Common Stock. On June 20, 2013, the Company effected the stock split, which increased the issued and outstanding shares of Common Stock from 4,320,000 shares to 34,560,000 shares. In connection with the Change in Control and name change, on July 19, 2013, the Company’s ticker symbol on the OTCBB was changed from VTCH to GFOX.

As of December 2, 2013, the Company had 35,660,000 shares of Common Stock issued and outstanding.

The Company’s fiscal year end is March 31. Since the Company’s inception on September 22, 2011, it has not generated any revenues and, through the second quarter of fiscal year 2014, has incurred a cumulative net loss of $348,416. The Company’s administrative offices are located at 3333 Lee Parkway, Suite 600, Dallas, Texas 75219. The Company has one full time employee, Lawrence Pemble, who serves as its sole officer and director.

Current Operations

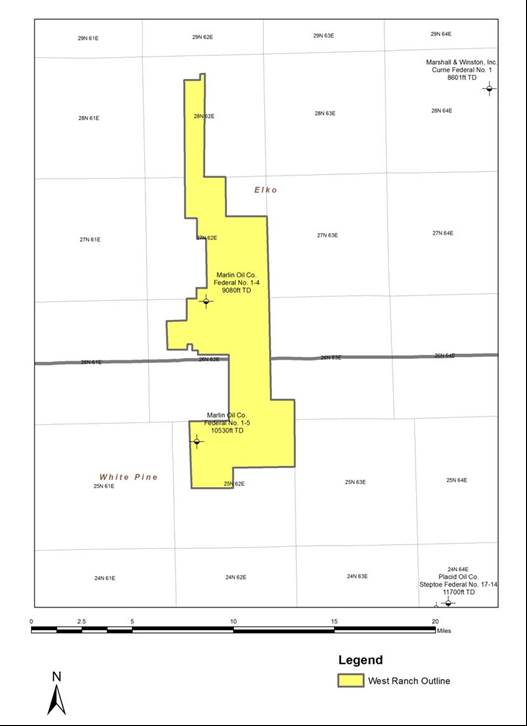

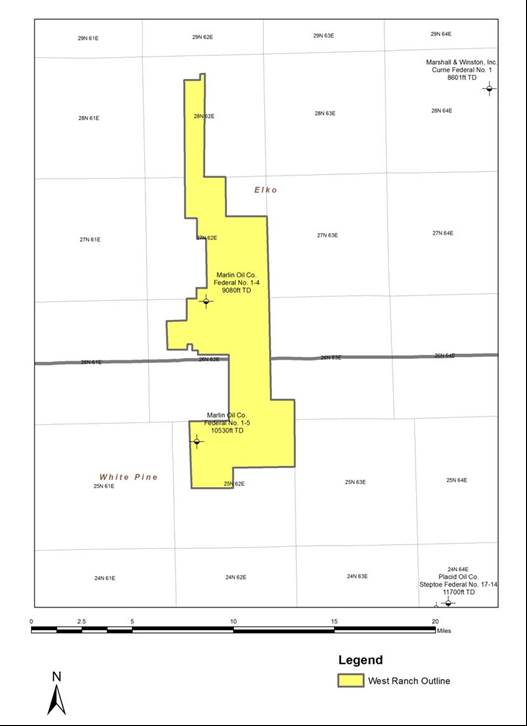

The Company is currently an exploration stage company exploring oil and gas production opportunities. On December 2, 2013, Gray Fox completed the acquisition of 22 separate oil and gas leases issued by the BLM from FFMJ, LLC for an aggregate purchase price of $250,000. As further described in “Item 3. Properties” below, the leased land, known as the “West Ranch Prospect,” comprises 32,723 acres in the Butte Valley Oil Play Region in north central Nevada. We have a 100% Working Interest and an 82% Net Revenue Interest in the Leases. If the property is viable and can be developed, we will receive 82% of the net revenues generated from the property. As the leaseholder, we are responsible for evaluating, exploring, paying for and maintaining the Leases.

Our plan of operations for the next 12 months is to conduct geological mapping, gravity surveying and 2D seismic coverage on the West Ranch Prospect. To that end, we have developed an initial exploration plan to identify drilling targets. This initial exploration plan is designed to identify new drilling locations targeting certain geological formations that the Company believes may be capable of producing oil or natural gas in commercial quantities. A summary of the initial exploration plan is as follows:

Phase 1 – Acquire Gravity and Magnetic Data

Two test wells were previously drilled on the West Ranch Prospect but the Company believes those wells were not drilled to sufficient depths. Gray Fox intends to conduct tests to gather available gravity and magnetic data. The gravity and magnetic data, along with the data from the earlier test wells, will be used to analyze further the geology and production potential of the West Ranch Prospect and may reveal production potential that the original wells did not. The gravity and magnetic data that is available spans 2,000 gravity stations and over 600 line miles of magnetic data. Gray Fox intends to analyze approximately 100 new gravity stations.

Phase 2 – Interpret Gravity and Magnetic Data and Surface Mapping

Gray Fox intends to use the gravity and magnetic data, combined with analysis and interpretation of surface geology and airphotos, to further analyze the geological formation of the West Ranch Prospect. Gray Fox intends to analyze the gravity data in an effort to identify faults, structural highs and Tertiary basin geometry, and intends to use the magnetic data to delineate faults and determine the magnetic basement structure. This analysis, along with the information from the existing test wells, will aid the Company in determining where in the geological formation of the West Ranch Prospect commercial quantities of oil and gas may be located.

Phase 3 – Obtain Seismic Permitting

Gray Fox intends to engage a third party consulting company to work with the BLM and other state and private permitting agencies to obtain permits to conduct tests for seismic activity.

Phase 4 – Acquire Seismic Data

Gray Fox intends to conduct tests to gather seismic data on the West Ranch Prospect in order to map any geological structures identified in the gravity and magnetic data as accurately as possible. This mapping should help the Company to determine more accurately the site of future drilling efforts. Gray Fox estimates that approximately 10 miles of existing seismic data currently exists and anticipates it will locate and acquire approximately 30 miles of new seismic data.

Phase 5 – Interpret Existing Data Sets

Gray Fox intends to interpret fully all of the geological and geophysical data collected to date in order to aid it in determining the best locations in which to drill test wells.

Phase 6 – Define Drilling Locations

Although the two previously drilled wells did not produce commercial quantities of oil and gas, the Company believes it is possible that those wells may have missed a commercial accumulation of oil by only a few hundred feet. The Company believes the additional geological and geophysical data it acquires may help it pinpoint more closely the location of commercial quantities of oil and gas. The Company intends to use the additional data collected and its interpretation to identify the location of one or more test wells. Gray Fox intends to engage a third party petroleum engineer to assess the potential reserves.

Phase 7 – Determine Drilling Strategy

Depending on the outcome of the various tests and analysis conducted, the Company will determine whether or not to begin drilling. If it decides to move forward with drilling, it will determine whether to conduct its own drilling operations or whether to hire a third party drilling contractor or other drilling partner to drill the wells. If it decides to move forward with drilling, Gray Fox will obtain any necessary permitting and then will, or will have the third party drilling partner, spud and drill a test well. If the test well proves successful, Gray Fox intends to develop a full field development plan and commence production. If the test well proves unsuccessful, the Company will evaluate alternative well locations and determine whether to drill additional test wells in those alternative locations.

We anticipate the cost of the first six phases in our initial exploration plan (which consist of gathering and interpreting data and determining potential drilling locations) will be approximately $550,000. We currently do not have sufficient funds to implement our initial exploration plan and we will require additional capital to carry out our business plan. There is no assurance that we will be able to obtain the necessary financing. Historically, Gray Fox has been able to raise a limited amount of capital through private placements of its Common Stock, but there is no certainty that will it will be able to continue to raise funds privately. If Gray Fox is unable to secure additional financing, it will not be able to continue operations and its existing shareholders may lose some or all of their investments.

Competitive Conditions

The oil and natural gas industry is highly competitive. We compete with private and public companies in all facets of the oil and natural gas business. Numerous independent oil and gas companies, oil and gas syndicators, and major oil and gas companies actively seek out and bid for oil and gas prospects and properties as well as for the services of third-party providers, such as drilling companies, upon which we rely. Many of these companies not only explore for, produce and market oil and natural gas, but also carry out refining operations and market the resulting products worldwide. Most of our competitors have longer operating histories and substantially greater financial and other resources than we do.

Competitive conditions may be affected by various forms of energy legislation and/or regulation considered from time to time by the governments of the United States and the State of Nevada, as well as factors that we cannot control, including international political conditions, overall levels of supply and demand for oil and gas, and the markets for synthetic fuels and alternative energy sources.

Government Regulation

Our current and future operations and exploration activities are or will be subject to various laws and regulations in the United States and in the State of Nevada. These laws and regulations govern the protection of the environment, conservation, prospecting, development, energy production, taxes, labor standards, occupational health and safety, toxic substances, chemical products and materials, waste management and other matters relating to the oil and gas industry. Permits, registrations or other authorizations may also be required to maintain our operations and to carry out our future oil and gas exploration and production activities, and these permits, registrations or authorizations will be subject to revocation, modification and renewal.

Governmental authorities have the power to enforce compliance with lease conditions, regulatory requirements and the provisions of required permits, registrations or other authorizations, and violators may be subject to civil and criminal penalties including fines, injunctions, or both. The failure to obtain or maintain a required permit may also result in the imposition of civil and criminal penalties, and third parties may have the right to sue to enforce compliance.

We expect to be able to comply with all applicable laws and regulations and do not believe that such compliance will have a material adverse effect on our competitive position. We have obtained and intend to obtain all environmental permits, licenses and approvals required by all applicable regulatory agencies to maintain our current oil and gas operations and to carry out our future exploration activities. We are not aware of any material violations of environmental permits, licenses or approvals issued with respect to our operations, and we believe that the operators of the properties in which we have an interest comply with all applicable laws and regulations. We intend to continue complying with all environmental laws and regulations, and at this time we do not anticipate incurring any material capital expenditures to do so.

Compliance with environmental requirements, including financial assurance requirements and the costs associated with the cleanup of any spill, could have a material adverse effect on our capital expenditures, earnings or competitive position. Our failure to comply with any laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of injunctive relief, or both. Legislation affecting the oil and gas industry is subject to constant review, and the regulatory burden frequently increases. Changes in any of the laws and regulations could have a material adverse effect on our business, and in view of the many uncertainties surrounding current and future laws and regulations, including their applicability to our operations, we cannot predict their overall effect on our business.

ITEM 1A. RISK FACTORS

Smaller reporting companies are not required to provide the information required by this Item.

ITEM 2. FINANCIAL INFORMATION

See Items 6, 7 and 7A of Part II of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013 and Items 2 and 3 of Part I of the Company’s Quarterly Report on Form 10-Q for the six month period ended September 30, 2013, which are incorporated herein by this reference.

ITEM 3. PROPERTIES

Headquarters

The Company’s administrative offices are located at 3333 Lee Parkway, Suite 600, Dallas, Texas 75219.

West Ranch Prospect

On December 2, 2013, Gray Fox completed the acquisition of 22 separate oil and gas leases issued by the BLM from FFMJ, LLC. The expiration dates of the Leases range from March 31, 2016 to July 31, 2017. The Leases exclude well or lease bonds in place with the Nevada Division of Minerals and/or the BLM. The leased land, known as the “West Ranch Prospect,” comprises 32,723 acres in the Butte Valley located in north central Nevada in Elko and White Pine Counties, 50 miles north of Ely, NV. The West Ranch Prospect is also located approximately 100 miles north of Railroad Valley's oilfields and approximately 60 miles east of Pine Valley's oilfields. Gray Fox has a 100% Working Interest and an 82% Net Revenue Interest in West Ranch Prospect.

The prospect is located approximately 100 miles north of Railroad Valley's oilfields and approximately 60 miles east of Pine Valley's oilfields, which have produced a combined 50+ million barrels of oil from structures and reservoir horizons similar to those under the West Ranch Prospect. The Company believes the West Ranch Prospect is located in a prolific oil generating basin and offers attractive oil discovery potential within multiple prospective horizons over two large anticlinal structures: the Mississippian Diamond Peak sandstones and the Devonian Guilmette dolomitic carbonates.

Summary of Oil and Gas Reserves

Due to our recent acquisition of the Leases, we do not have any audited or independently verified figures for production or reserve reporting. Because no wells have yet been drilled on the Leases, we do not have production data from our oil and gas operations.

ITEM 4. SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of Common Stock owned beneficially as of December 2, 2013 by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities; (ii) each of our directors; (iii) each of our named executive officers; and (iv) the officers and directors as a group. The address of each listed stockholder is c/o Gray Fox Petroleum Corp., 3333 Lee Parkway, Suite 600, Dallas, Texas 75219. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock owned by such person.

| Name of Beneficial Owner | Shares Beneficially Owned (1) | | Percentage Ownership (2) |

| Executive Officers and Directors | | | |

| | Lawrence Pemble | 18,400,000 | | 51.6% |

| | Executive officers and directors as a group (1 person) | 18,400,000 | | 51.6% |

| | | | | |

| 5% or greater beneficial owners (excluding Mr. Pemble) | | | |

| | None | -- | | -- |

| | | | | |

(1) As adjusted for an 8:1 stock split completed on June 20, 2013.

(2) Based on 35,660,000 shares of Common Stock issued and outstanding as of December 2, 2013.

The Company is not aware of any arrangement that may result in “change in control” of the Company.

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS

The sole director and officer of the Company is set forth below.

| Name | | Positions | | Age |

| Lawrence Pemble | | Director, Chief Executive Officer, President, Treasurer and Secretary | | 25 |

Lawrence Pemble: Lawrence Pemble, age 25, was appointed Director, Chief Executive Officer, President, Treasurer and Secretary of the Company on May 31, 2013. From 2012 to April 2013, Mr. Pemble served as a project manager for Crest African Mining, Ltd., a mining and resource company. As a project manager, Mr. Pemble oversaw the company's African operations, conducted feasibility studies on mineral and energy exploration projects across Africa and established various working projects that he managed from their initial grass roots phases. From 2010 to 2012, Mr. Pemble was employed by Centrica, Europe’s largest energy company, as a front line Manager and Project Strategist. Mr. Pemble served as a Royal Marine from 2004 until 2010, and was commissioned as an Officer in 2006. Mr. Pemble was chosen to be a director because of his background in the mining and exploration industries.

Except as disclosed above, Mr. Pemble is not an officer or director of any company with a class of securities registered pursuant to Section 12 of the Exchange Act of 1934, as amended (the “Exchange Act”) or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Pemble has not been involved in any legal proceeding for which disclosure is required pursuant to Item 401 of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”). There are no family relationships among any of our officers and directors.

ITEM 6. EXECUTIVE COMPENSATION

The following table sets forth certain information relating to all compensation of our named executive officers for services rendered in all capacities to the Company during the year ended March 31, 2013 and the period from September 22, 2011 (inception) to March 31, 2012:

Summary Compensation Table

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Award ($) | | Option Award ($) | | Non-Equity Incentive Plan Compensation ($) | | Non-Qualified Deferred Compensation ($) | | All Other Compensation ($) | | Total Compensation ($) |

| Viatcheslav Gelshetyen * | | 2013 | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - |

| Former President, Chief Executive Officer, Secretary and Treasurer | | 2012** | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - |

| | | | | | | | | | | | | | | | | | | |

| * | Mr. Gelshetyen resigned from his positions as President, Chief Executive Officer, Secretary and Treasurer, which he had held since the Company’s inception on September 22, 2011 in connection with the Change in Control on May 31, 2013. |

| ** | Consists of the shortened period from September 22, 2011 (inception) to March 31, 2012. |

Employment Contracts, Termination of Employment, Change-in-Control Arrangements

On July 8, 2013, the Company entered into an Employment Agreement with Lawrence Pemble regarding his position as President and Chief Executive Officer of the Company. The Employment Agreement was effective as of May 31, 2013, the date on which Mr. Pemble acquired a controlling interest in the Company. The Employment Agreement has an initial term of three years and will automatically renew for successive one-year periods until terminated by either party in accordance with its terms. Mr. Pemble will be paid a base salary of $120,000 per year. Mr. Pemble will also be entitled to receive 3,000,000 shares of Common Stock, which will be issued in increments of 1,000,000 shares on May 31 in 2014, 2015 and 2016. The Employment Agreement may be terminated (i) at any time by the Company for “cause”, (ii) upon 60 days’ written notice by either party for any reason, (iii) at any time by Mr. Pemble for “good reason”, or (iv) by either party at the end of the initial term or any subsequent terms. The Employment Agreement also terminates immediately upon Mr. Pemble’s death or disability. If Mr. Pemble’s employment is terminated for “cause” by the Company, or if he voluntarily resigns without “good reason”, then he will forfeit any shares of Common Stock that have not vested as of the date of such termination or resignation. If Mr. Pemble’s employment is terminated for any other reason, he will be entitled to receive three months of his then-current base salary and the full 3,000,000 shares of Common Stock.

There are no compensation plans or arrangements, including payments to be made by the Company, with respect to the officers, directors, employees or consultants of the Company that would result from the resignation, retirement or any other termination of such directors, officers, employees or consultants. There are no arrangements for directors, officers or employees that would result from a change in control.

Outstanding Equity Awards at Fiscal Year-End

There were no equity awards outstanding as of March 31, 2013.

Compensation of Directors

The individuals serving as directors are not compensated by the Company for their services as directors. Directors are reimbursed for reasonable out-of-pocket expenses incurred. There are currently no arrangements pursuant to which directors are or will be compensated in the future for any services provided as directors. The table below summarizes the compensation that we paid to our director for the year ended March 31, 2013.

| Name | | Fees Earned or Paid in Cash ($) | | Stock Award ($) | | Option Award ($) | | Non-Equity Incentive Plan Compensation ($) | | Non-Qualified Deferred Compensation ($) | | All Other Compensation ($) | | Total Compensation ($) |

| Viatcheslav Gelshetyen * | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - | | - 0 - |

| | | | | | | | | | | | | | | |

| * | Mr. Gelshetyen resigned from his positions as Director, which he had held since the Company’s inception on September 22, 2011 in connection with the Change in Control on May 31, 2013. |

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

See Item 13 of Part III of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013, which is incorporated herein by this reference.

ITEM 8. LEGAL PROCEEDINGS

See Item 3 of Part I of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013, which is incorporated herein by this reference.

ITEM 9. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

The Company’s Common Stock is quoted on the OTCBB under the symbol “GFOX.” No shares traded on the OTCBB prior to July 28, 2013 and there is no established trading market for our shares. The following table sets forth the high and low sales prices per share of Common Stock for the periods indicated.

| | High | | Low |

| Second quarter of 2013 | $0.50 | | $0.50 |

| Third quarter of 2013 | $1.09 | | $0.50 |

| Fourth quarter of 2013 (through November 26) | $1.17 | | $0.80 |

Holders

As of December 2, 2013, there were approximately nine record holders of our Common Stock, according to the books of our transfer agent. This does not include persons who hold our common stock in nominee or “street name” accounts through brokers or banks.

Dividends

The Company has not declared or paid cash dividends since its inception on September 22, 2011 and has no current plans to pay any cash dividends on our common stock for the foreseeable future. To the extent we have earnings; we intend to retain such earnings for future operations and to finance the growth of the business. There are no provisions in our amended and restated articles of incorporation or bylaws that restrict us from declaring or paying dividends. The Nevada Revised Statutes (“NRS”), however, do prohibit us from declaring dividends when, after giving effect to the distribution of the dividend, we would not be able to pay our debts as they become due in the usual course of business or our total assets would be less than the sum of our total liabilities, plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution.

Any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our ability to comply with the Nevada statutes, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our board of directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

As of the date of this report, the Company does not have any equity compensation plans.

ITEM 10. RECENT SALES OF UNREGISTERED SECURITIES

See Item 5 of Part II of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013 and Item 2 of Part II of the Company’s Quarterly Reports on Form 10-Q for the quarters ended June 30, 2013 and September 30, 2013, which are incorporated herein by this reference.

From October 1, 2013 through December 2, 2013, we have issued 200,000 shares of Common Stock for $200,000. We believed that these sales are exempt from registration under the Securities Act in reliance on Regulation S of such act. We determined an exemption under Regulation S was available because none of these issuances involved underwriters, underwriting discounts or commissions; we placed Regulation S required restrictive legends on all certificates issued; no offers or sales of stock under the Regulation S offering were made to persons in the United States; and no direct selling efforts of the Regulation S offering were made in the United States.

ITEM 11. DESCRIPTION OF REGISTRANT’S SECURITIES

Certain provisions of Gray Fox’s amended and restated articles of incorporation and bylaws are summarized or referenced below. The summaries do not purport to be complete, do not relate to or give effect to the provisions of statutory or common law, and are qualified in their entirety by express reference to Gray Fox’s amended and restated articles of incorporation and bylaws.

Authorized Capital Stock

Gray Fox’s authorized capital stock as stated in its amended and restated articles of incorporation consists of 75,000,000 shares of common stock, $0.001 par value per share. As of December 2, 2013, there were 35,660,000 shares of Common Stock issued and outstanding. The holders of shares of Common Stock have no subscription, redemption, sinking fund or conversion rights. In addition, the holders of shares of Common Stock have no preemptive rights to maintain their percentage of ownership in future offerings or sales of stock. The holders of shares of Common Stock have no cumulative voting rights and have one vote per share in all elections of directors and on all other matters submitted to a vote of the Company’s stockholders. Holders of Common Stock are entitled to receive dividends, as and when declared by the Company’s board of directors, out of funds legally available to pay dividends. Upon liquidation, dissolution or winding up of the Company’s affairs, the remaining assets of the Company available for distribution will be distributed among the holders of Common Stock ratably in proportion to the numbers of shares of Common Stock held by them. The shares of Common Stock currently outstanding are fully paid and nonassessable.

Dividend Policy

The Company has not declared or paid cash dividends since its inception on September 22, 2011 and has no current plans to pay any cash dividends on our common stock for the foreseeable future. To the extent we have earnings; we intend to retain such earnings for future operations and to finance the growth of the business. There are no provisions in our amended and restated articles of incorporation or bylaws that restrict us from declaring or paying dividends. The NRS, however, do prohibit us from declaring dividends when, after giving effect to the distribution of the dividend, we would not be able to pay our debts as they become due in the usual course of business or our total assets would be less than the sum of our total liabilities, plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution.

Any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our ability to comply with the Nevada statutes, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our board of directors may deem relevant.

Anti-Takeover Effects of Nevada Law

NRS sections 78.378 to 78.379 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the amended and restated articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our amended and restated articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our company.

We are subject to NRS section 78.438, an anti-takeover law. In general, NRS section 78.438 prohibits a Nevada corporation from engaging in any business combination with any interested stockholder for a period of two years following the date on which the stockholder became an interested stockholder, unless prior to that date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder or the combination is approved by the corporation’s directors and the other stockholders. NRS section 78.439 provides that business combinations after the two year period following the date that the stockholder becomes an interested stockholder may also be prohibited unless approved by the corporation's directors or other stockholders or unless the price and terms of the transaction meet the criteria set forth in the statute.

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock is Island Stock Transfer Company. The transfer agent’s address is 15500 Roosevelt Boulevard, Suite 301, Clearwater, Florida 33760 and its telephone number is (727) 289-0010.

Listing

Our Common Stock is listed on the OTCBB under the symbol “GFOX.”

ITEM 12. INDEMNIFICATION OF DIRECTORS AND OFFICERS

NRS section 78.138 provides that a director or officer will not be individually liable unless it is proven that (i) the director’s or officer's acts or omissions constituted a breach of his or her fiduciary duties, and (ii) such breach involved intentional misconduct, fraud or a knowing violation of the law.

NRS section 78.7502 permits a company to indemnify its directors and officers against expenses, judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with a threatened, pending or completed action, suit or proceeding if the officer or director (i) is not liable pursuant to NRS section 78.138 or (ii) acted in good faith and in a manner the officer or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe the conduct of the officer or director was unlawful.

NRS section 78.751 permits a Nevada company to indemnify its officers and directors against expenses incurred by them in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of final disposition thereof, upon receipt of an undertaking by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court of competent jurisdiction that such officer or director is not entitled to be indemnified by the company. NRS section 78.751 further permits the company to grant its directors and officers additional rights of indemnification under its articles of incorporation or bylaws or otherwise.

NRS section 78.752 provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee or agent of the company, or is or was serving at the request of the company as a director, officer, employee or agent of another company, partnership, joint venture, trust or other enterprise, for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee or agent, or arising out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.

Our amended and restated articles of incorporation provide that Gray Fox may indemnify each person who is or was a director or officer to the fullest extent permissible under applicable Nevada law. The board of directors, in its sole discretion, has the power to indemnify any other persons for whom indemnification is permitted by NRS to the fullest extent permissible thereunder. Further, amended and restated articles of incorporation permit the board of directors to may purchase liability indemnification and/or other similar insurance as the board of directors determines is necessary or appropriate.

In addition, our bylaws provide that officers or directors are not personally liable for any obligations of the Company or for any duties or obligations arising out of acts performed by the officer or director on behalf of the Company. Further, Gray Fox will indemnify and hold harmless each person who serves as a director or officer from any claims or liabilities to which such persons become subject as a result of their serving as an officer or director. Gray Fox will reimburse each officer and director for all expenses reasonably incurred by him or her in connection with any such claim or liability. However, the Company will not indemnify or reimburse an officer or director for expenses incurred in connection with any claim or liability arising out of his or her own negligence or willful misconduct.

ITEM 13. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See Item 8 of Part II of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013 and Item 1 of Part I of the Company’s Quarterly Report on Form 10-Q for the quarter September 30, 2013, which are incorporated herein by this reference.

ITEM 14. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

See Item 9 of Part II of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2013, which is incorporated herein by this reference.

Item 5.06 Change in Shell Company Status

As a result of the acquisition of the Leases as described in Item 2.01 of this Current Report on Form 8-K, the Company is no longer a “shell company,” as defined in Rule 12b-2 of the Exchange Act. The information set forth in Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | |

| Exhibit | Exhibit Description |

| 3.1 | Amended and Restated Articles of Incorporation (incorporated by reference to the Current Report on Form 8-K filed with the SEC on June 11, 2013) |

| 3.2 | Bylaws (incorporated by reference to the S-1 Registration Statement filed with the SEC on May 25, 2012) |

| 10.1 | Agreement for Redemption of Shares of Common Stock (incorporated by reference to the Current Report on Form 8-K filed with the SEC on June 11, 2013) |

| 10.2 | Lease Purchase Agreement dated July 5, 2013 by and between Gray Fox Petroleum Corp. and FFMJ, LLC (incorporated by reference to the Current Report on Form 8-K filed with the SEC on July 10, 2013) |

| 10.3 | Employment Agreement dated May 31, 2013 by and between Gray Fox Petroleum Corp. and Lawrence Pemble (incorporated by reference to the Current Report on Form 8-K filed with the SEC on July 10, 2013) |

| 10.4 | Securities Purchase Agreement dated July 17, 2013 by and between Gray Fox Petroleum Corp. and Rooftop Investments, Ltd. (incorporated by reference to the Current Report on Form 8-K filed with the SEC on July 23, 2013) |

| 10.5 | Securities Purchase Agreement dated September 9, 2013 by and between Gray Fox Petroleum Corp. and Rooftop Investments, Ltd. (incorporated by reference to the Current Report on Form 8-K filed with the SEC on September 13, 2013) |

| 10.6 | Securities Purchase Agreement dated October 15, 2013 by and between Gray Fox Petroleum Corp. and Rooftop Investments, Ltd. (incorporated by reference to the Current Report on Form 8-K filed with the SEC on October 15, 2013) |

| 10.7 | Securities Purchase Agreement dated November 11, 2013 by and between Gray Fox Petroleum Corp. and Rooftop Investments, Ltd. (incorporated by reference to the Current Report on Form 8-K filed with the SEC on November 15, 2013) |

| 16.1 | Letter from Ronald R. Chadwick, P.C. (incorporated by reference to the Current Report on Form 8-K filed with the SEC on June 10, 2013) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | GRAY FOX PETROLEUM CORP. |

| | |

| Date: December 13, 2013 | By: | /s/ Lawrence Pemble |

| | | Lawrence Pemble, President

|