UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22692

American Funds College Target Date Series

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2024

Gregory F. Niland

American Funds College Target Date Series

5300 Robin Hood Road

Norfolk, Virginia 23513

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

American Funds College

Target Date Series®

Semi-annual report

for the six months ended

April 30, 2024 |  |

A balanced approach

that seeks to build

and preserve wealth

for higher education

The Securities and Exchange Commission has adopted new regulations that will change the content and design of annual and semi-annual shareholder reports beginning in July 2024. Certain types of information, including investment portfolio and financial statements, will not be included in the shareholder reports but will be available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR.

If you would like to receive shareholder reports and other communications from the fund electronically, you may update your mailing preferences with your financial intermediary or enroll in e-delivery at capitalgroup.com (for accounts held directly with the fund).

American Funds® College 2042 Fund, American Funds® College 2039 Fund, American Funds® College 2036 Fund, American Funds College 2033 Fund®, American Funds College 2030 Fund®, American Funds College 2027 Fund®: Each fund will seek to achieve the following objectives to varying degrees: growth, income and preservation of capital, depending on the proximity to its target date. The target date is meant to roughly correspond to the year in which the fund beneficiary will start to withdraw funds to meet higher education expenses. Each fund will increasingly emphasize income and preservation of capital by investing a greater portion of its assets in fixed income, equity-income and balanced funds as it approaches and passes its target date. In this way, each fund seeks to achieve an appropriate balance of total return and stability during different time periods.

American Funds College Enrollment Fund®: The fund’s investment objective is to provide current income, consistent with preservation of capital.

American Funds, by Capital Group, is one of the nation’s largest mutual fund families. For over 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class 529-A shares at net asset value. If a sales charge had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

Here are the average annual total returns on a $1,000 investment for periods ended March 31, 2024 (the most recent calendar quarter-end). Also shown are the expense ratios as of the series prospectus dated January 1, 2024.

| | | Cumulative

total returns | | Average annual

total returns | | |

| Class 529-A shares | | 1 year | | 5 years | | 10 years | | Lifetime1 | | Expense ratios |

| | | | | | | | | | | | | | | | | | | | | |

| Reflecting 3.50% maximum initial sales charge: | | | | | | | | | | | | | | | | | | | | |

| American Funds College 2042 Fund | | | — | | | | — | | | | — | | | | –1.25 | % | | | 0.87 | %2 |

| American Funds College 2039 Fund | | | 18.67 | % | | | — | | | | — | | | | 3.60 | | | | 0.87 | |

| American Funds College 2036 Fund | | | 15.80 | | | | 7.78 | % | | | — | | | | 6.82 | | | | 0.79 | |

| American Funds College 2033 Fund | | | 10.02 | | | | 6.35 | | | | — | | | | 6.23 | | | | 0.73 | |

| American Funds College 2030 Fund | | | 5.19 | | | | 4.70 | | | | 5.09 | % | | | 6.57 | | | | 0.71 | |

| American Funds College 2027 Fund | | | 1.72 | | | | 2.94 | | | | 3.85 | | | | 5.20 | | | | 0.70 | |

| | | | | | | | | | | | | | | | | | | | | |

| Reflecting 2.50% maximum initial sales charge: | | | | | | | | | | | | | | | | | | | | |

| American Funds College Enrollment Fund3 | | | 0.76 | | | | 0.65 | | | | 0.97 | | | | 0.80 | | | | 0.69 | |

| 1 | Since September 14, 2012, for all funds except College 2042 Fund, which commenced operations on March 15, 2024, College 2039 Fund, which commenced operations on March 26, 2021, College 2036 Fund, which commenced operations on February 9, 2018, and College 2033 Fund, which commenced operations on March 27, 2015. Lifetime return of –1.25% for College 2042 Fund is cumulative as this fund has less than one year of history. |

| 2 | Expense ratios are estimated for College 2042 Fund. |

| 3 | American Funds College 2024 Fund® was closed on March 22, 2024, and assets were merged into the American Funds College Enrollment Fund. |

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Fellow investors:

Results for American Funds College Target Date Series for the periods ended April 30, 2024, are shown in the table on page 2, as well as results of each fund’s benchmark and peer group index.

For additional information about the series, its investment results, holdings and the Target Date Solutions Committee, visit capitalgroup.com/individual/products/target-date-college-series.html. You can also access information about Capital Group’s American Funds and read our insights about the markets, retirement, saving for college, investing fundamentals and more at capitalgroup.com.

Contents

The college target date funds invest in Class R-6 shares of the underlying funds. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. Refer to the fund’s most recent prospectus for details. For more information on fee waivers and expense reimbursements, refer to capitalgroup.com.

The funds’ allocation strategy does not guarantee that investors’ education savings goals will be met. Investors and their advisors should periodically evaluate their investment to determine whether it continues to meet their needs. Investment allocations may not achieve fund objectives. There are expenses associated with the underlying funds in addition to fund of funds expenses. The funds’ risks are directly related to the risks of the underlying funds. Refer to the series prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the series.

| American Funds College Target Date Series | 1 |

Results at a glance

For periods ended April 30, 2024, with all distributions reinvested for Class 529-A shares

| | | Cumulative total returns | | Average annual total returns |

| | | 6 months | | 1 year | | 5 years | | 10 years | | Lifetime1 |

| | | | | | | | | | | |

| American Funds College 2042 Fund2 | | | — | | | | — | | | | — | | | | — | | | | –1.60 | % |

| S&P 500 Composite Index3,4 | | | — | | | | — | | | | — | | | | — | | | | –1.48 | |

| Bloomberg U.S. Aggregate Index4,5 | | | — | | | | — | | | | — | | | | — | | | | –1.59 | |

| | | | | | | | | | | | | | | | | | | | | |

| American Funds College 2039 Fund2 | | | 19.43 | % | | | 17.09 | % | | | — | | | | — | | | | 3.45 | |

| S&P 500 Index3,4 | | | 20.98 | | | | 22.66 | | | | — | | | | — | | | | 9.62 | |

| Bloomberg U.S. Aggregate Index4,5 | | | 4.97 | | | | –1.47 | | | | — | | | | — | | | | –3.22 | |

| | | | | | | | | | | | | | | | | | | | | |

| American Funds College 2036 Fund2 | | | 17.11 | | | | 14.70 | | | | 7.28 | % | | | — | | | | 6.77 | |

| S&P 500 Index3,4 | | | 20.98 | | | | 22.66 | | | | 13.19 | | | | — | | | | 13.02 | |

| Bloomberg U.S. Aggregate Index4,5 | | | 4.97 | | | | –1.47 | | | | –0.16 | | | | — | | | | 0.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| American Funds College 2033 Fund2 | | | 13.14 | | | | 9.56 | | | | 6.02 | | | | — | | | | 6.24 | |

| S&P 500 Index3,4 | | | 20.98 | | | | 22.66 | | | | 13.19 | | | | — | | | | 12.37 | |

| Bloomberg U.S. Aggregate Index4,5 | | | 4.97 | | | | –1.47 | | | | –0.16 | | | | — | | | | 0.81 | |

| | | | | | | | | | | | | | | | | | | | | |

| American Funds College 2030 Fund | | | 10.17 | | | | 5.17 | | | | 4.54 | | | | 5.12 | % | | | 6.61 | |

| American Funds College 2027 Fund | | | 7.36 | | | | 2.39 | | | | 2.98 | | | | 3.93 | | | | 5.28 | |

| S&P 500 Index3,4 | | | 20.98 | | | | 22.66 | | | | 13.19 | | | | 12.41 | | | | 13.33 | |

| Bloomberg U.S. Aggregate Index4,5 | | | 4.97 | | | | –1.47 | | | | –0.16 | | | | 1.20 | | | | 1.17 | |

| | | | | | | | | | | | | | | | | | | | | |

| American Funds College Enrollment Fund | | | 4.41 | | | | 1.48 | | | | 0.83 | | | | 1.04 | | | | 0.89 | |

| Bloomberg U.S. Aggregate 1–5 Years Index4,6 | | | 2.86 | | | | 1.90 | | | | 0.92 | | | | 1.27 | | | | 1.20 | |

Past results are not predictive of results in future periods.

| 1 | Since September 14, 2012, for all funds except College 2042 Fund, which commenced operations on March 15, 2024, College 2039 Fund, which commenced operations on March 26, 2021, College 2036 Fund, which commenced operations on February 9, 2018, and College 2033 Fund, which commenced operations on March 27, 2015. Lifetime and index returns for College 2042 Fund are cumulative as this fund has less than one year of history. |

| 2 | Six-month and one-, five- and 10-year returns for College 2042 Fund are unavailable since the fund commenced operations on March 15, 2024. Five- and 10-year returns for College 2039 Fund are unavailable since the fund commenced operations on March 26, 2021. 10-year returns for College 2036 Fund are unavailable since the fund commenced operations on February 9, 2018. 10-year returns for College 2033 Fund are unavailable since the fund commenced operations on March 27, 2015. |

| 3 | The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. Source: S&P Dow Jones Indices LLC. |

| 4 | The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. |

| 5 | The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade (bonds rated BBB/Baa and above) fixed-rate bond market. Source: Bloomberg Index Services Ltd. |

| 6 | The Bloomberg U.S. Aggregate 1–5 Years Index represents securities in the one- to five-year maturity range of the U.S. investment-grade (bonds rated BBB/Baa and above) fixed-rate bond market. Source: Bloomberg Index Services Ltd. |

| 2 | American Funds College Target Date Series |

Investment approach for American Funds College Target Date Series

About the series

Launched in September 2012, American Funds College Target Date Series was designed to provide a low-maintenance investment option for parents who want to use a 529 savings plan to save for college.

An investor simply needs to select the College Target Date Series fund that most closely corresponds to the projected enrollment year of the student. American Funds takes care of the fund selection and the asset allocation and adjusts these over time as the enrollment date approaches. The only thing investors should need to worry about is making contributions.

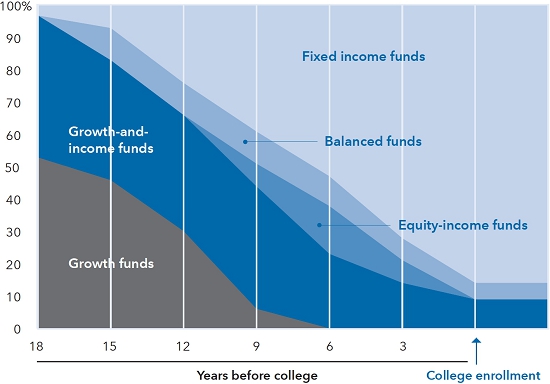

For dates far from enrollment, the respective funds of funds have an emphasis on long-term growth of capital. For dates close to enrollment, the funds of funds have an emphasis on near-term preservation of capital.

The funds in the series have a conservative tilt. The automatic rebalancing is disciplined and frequent to align the funds with their stated investment objective.

The investment professionals of the Target Date Solutions Committee don’t attempt to be tactical asset allocators — that is, buy or sell based on market changes. They work out the rebalancing schedule, or “glide path,” that they believe would make sense through the cycle, and they stick to it.

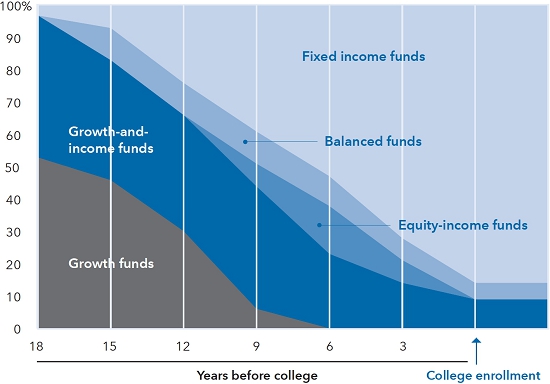

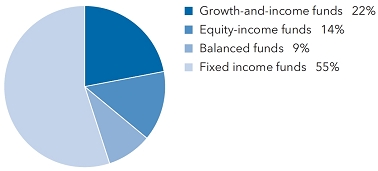

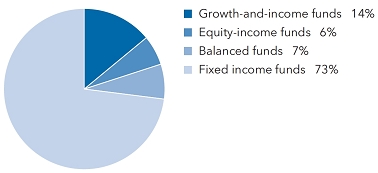

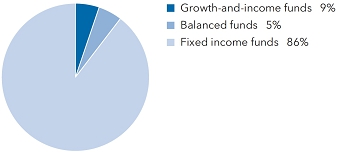

American Funds College Target Date Series glide path

The target allocations shown are as of April 30, 2024, and are subject to the Target Date Solutions Committee’s discretion. The investment adviser anticipates that the funds will invest their assets within a range that deviates no more than 10% above or below the allocations shown in the prospectus. Underlying funds may be added or removed during the year. Refer to capitalgroup.com for current allocations.

| American Funds College Target Date Series | 3 |

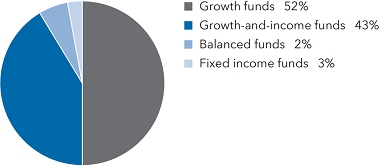

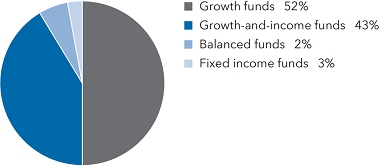

| American Funds College 2042 Fund | unaudited |

| Investment portfolio April 30, 2024 | |

| Growth funds 52% | | Shares | | | Value

(000) | |

| AMCAP Fund, Class R-6 | | | 43,438 | | | $ | 1,783 | |

| SMALLCAP World Fund, Inc., Class R-6 | | | 22,727 | | | | 1,530 | |

| New Perspective Fund, Class R-6 | | | 24,750 | | | | 1,450 | |

| The Growth Fund of America, Class R-6 | | | 19,836 | | | | 1,351 | |

| EuroPacific Growth Fund, Class R-6 | | | 17,353 | | | | 992 | |

| The New Economy Fund, Class R-6 | | | 12,867 | | | | 740 | |

| American Funds Global Insight Fund, Class R-6 | | | 3,673 | | | | 81 | |

| | | | | | | | 7,927 | |

| | | | | | | | | |

| Growth-and-income funds 43% | | | | | | | | |

| Fundamental Investors, Class R-6 | | | 29,546 | | | | 2,262 | |

| Capital World Growth and Income Fund, Class R-6 | | | 27,955 | | | | 1,757 | |

| The Investment Company of America, Class R-6 | | | 23,854 | | | | 1,279 | |

| Washington Mutual Investors Fund, Class R-6 | | | 11,128 | | | | 666 | |

| International Growth and Income Fund, Class R-6 | | | 15,892 | | | | 586 | |

| | | | | | | | 6,550 | |

| | | | | | | | | |

| Balanced funds 2% | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 4,113 | | | | 135 | |

| American Funds Global Balanced Fund, Class R-6 | | | 3,698 | | | | 135 | |

| | | | | | | | 270 | |

| | | | | | | | | |

| Fixed income funds 3% | | | | | | | | |

| U.S. Government Securities Fund, Class R-6 | | | 37,526 | | | | 433 | |

| American High-Income Trust, Class R-6 | | | 14,262 | | | | 135 | |

| | | | | | | | 568 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $15,568,000) | | | | | | | 15,315 | |

| Other assets less liabilities 0% | | | | | | | (2 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 15,313 | |

| 4 | American Funds College Target Date Series |

American Funds College 2042 Fund (continued)

Investments in affiliates1

| | | Value at

3/15/20242

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

4/30/2024

(000) | | | Dividend

income

(000) | | | Capital gain

distributions

received

(000) | |

| Growth funds 52% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AMCAP Fund, Class R-6 | | $ | — | | | $ | 1,823 | | | $ | — | | | $ | — | | | $ | (40 | ) | | $ | 1,783 | | | $ | — | | | $ | — | |

| SMALLCAP World Fund, Inc., Class R-6 | | | — | | | | 1,562 | | | | — | | | | — | | | | (32 | ) | | | 1,530 | | | | — | | | | — | |

| New Perspective Fund, Class R-6 | | | — | | | | 1,472 | | | | — | | | | — | | | | (22 | ) | | | 1,450 | | | | — | | | | — | |

| The Growth Fund of America, Class R-6 | | | — | | | | 1,379 | | | | — | | | | — | | | | (28 | ) | | | 1,351 | | | | — | | | | — | |

| EuroPacific Growth Fund, Class R-6 | | | — | | | | 1,003 | | | | — | | | | — | | | | (11 | ) | | | 992 | | | | — | | | | — | |

| The New Economy Fund, Class R-6 | | | — | | | | 757 | | | | — | | | | — | | | | (17 | ) | | | 740 | | | | — | | | | — | |

| American Funds Global Insight Fund, Class R-6 | | | — | | | | 82 | | | | — | | | | — | | | | (1 | ) | | | 81 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 7,927 | | | | | | | | | |

| Growth-and-income funds 43% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fundamental Investors, Class R-6 | | | — | | | | 2,300 | | | | — | | | | — | | | | (38 | ) | | | 2,262 | | | | — | | | | — | |

| Capital World Growth and Income Fund, Class R-6 | | | — | | | | 1,779 | | | | — | | | | — | | | | (22 | ) | | | 1,757 | | | | — | | | | — | |

| The Investment Company of America, Class R-6 | | | — | | | | 1,297 | | | | — | | | | — | | | | (18 | ) | | | 1,279 | | | | — | | | | — | |

| Washington Mutual Investors Fund, Class R-6 | | | — | | | | 675 | | | | — | | | | — | | | | (9 | ) | | | 666 | | | | — | | | | — | |

| International Growth and Income Fund, Class R-6 | | | — | | | | 591 | | | | — | | | | — | | | | (5 | ) | | | 586 | | | | — | 3 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 6,550 | | | | | | | | | |

| Balanced funds 2% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Balanced Fund, Class R-6 | | | — | | | | 137 | | | | — | | | | — | | | | (2 | ) | | | 135 | | | | — | | | | — | |

| American Funds Global Balanced Fund, Class R-6 | | | — | | | | 137 | | | | — | | | | — | | | | (2 | ) | | | 135 | | | | — | 3 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 270 | | | | | | | | | |

| Fixed income funds 3% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Government Securities Fund, Class R-6 | | | — | | | | 439 | | | | — | | | | — | | | | (6 | ) | | | 433 | | | | 2 | | | | — | |

| American High-Income Trust, Class R-6 | | | — | | | | 135 | | | | — | | | | — | | | | — | 3 | | | 135 | | | | — | 3 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 568 | | | | | | | | | |

| Total 100% | | | | | | | | | | | | | | $ | — | | | $ | (253 | ) | | $ | 15,315 | | | $ | 2 | | | $ | — | |

| 1 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

| 2 | Commencement of operations. |

| 3 | Amount less than one thousand. |

Refer to the notes to financial statements.

| American Funds College Target Date Series | 5 |

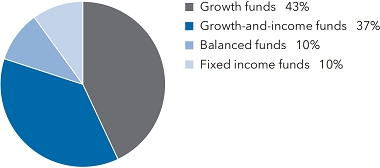

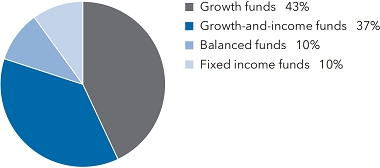

| American Funds College 2039 Fund | unaudited |

| Investment portfolio April 30, 2024 | |

| Growth funds 43% | | Shares | | | Value

(000) | |

| AMCAP Fund, Class R-6 | | | 2,242,326 | | | $ | 92,025 | |

| SMALLCAP World Fund, Inc., Class R-6 | | | 1,349,963 | | | | 90,880 | |

| The Growth Fund of America, Class R-6 | | | 1,127,495 | | | | 76,782 | |

| New Perspective Fund, Class R-6 | | | 1,128,603 | | | | 66,136 | |

| The New Economy Fund, Class R-6 | | | 649,729 | | | | 37,353 | |

| EuroPacific Growth Fund, Class R-6 | | | 622,364 | | | | 35,593 | |

| American Funds Global Insight Fund, Class R-6 | | | 1,380,239 | | | | 30,503 | |

| | | | | | | | 429,272 | |

| | | | | | | | | |

| Growth-and-income funds 37% | | | | | | | | |

| The Investment Company of America, Class R-6 | | | 1,820,035 | | | | 97,572 | |

| Capital World Growth and Income Fund, Class R-6 | | | 1,421,252 | | | | 89,311 | |

| Fundamental Investors, Class R-6 | | | 1,144,456 | | | | 87,620 | |

| Washington Mutual Investors Fund, Class R-6 | | | 1,025,287 | | | | 61,384 | |

| International Growth and Income Fund, Class R-6 | | | 807,065 | | | | 29,789 | |

| | | | | | | | 365,676 | |

| | | | | | | | | |

| Balanced funds 10% | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 1,573,683 | | | | 51,570 | |

| American Funds Global Balanced Fund, Class R-6 | | | 1,318,229 | | | | 48,049 | |

| | | | | | | | 99,619 | |

| | | | | | | | | |

| Fixed income funds 10% | | | | | | | | |

| American High-Income Trust, Class R-6 | | | 5,677,279 | | | | 53,650 | |

| U.S. Government Securities Fund, Class R-6 | | | 1,547,888 | | | | 17,878 | |

| The Bond Fund of America, Class R-6 | | | 1,567,600 | | | | 17,181 | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 1,307,178 | | | | 11,974 | |

| | | | | | | | 100,683 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $926,174,000) | | | | | | | 995,250 | |

| Other assets less liabilities 0% | | | | | | | (238 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 995,012 | |

| 6 | American Funds College Target Date Series |

American Funds College 2039 Fund (continued)

Investments in affiliates1

| | | Value at

11/1/2023

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

4/30/2024

(000) | | | Dividend

income

(000) | | | Capital gain

distributions

received

(000) | |

| Growth funds 43% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AMCAP Fund, Class R-6 | | $ | 62,851 | | | $ | 15,844 | | | $ | — | | | $ | — | | | $ | 13,330 | | | $ | 92,025 | | | $ | 432 | | | $ | 1,978 | |

| SMALLCAP World Fund, Inc., Class R-6 | | | 62,851 | | | | 17,560 | | | | — | | | | — | | | | 10,469 | | | | 90,880 | | | | 761 | | | | — | |

| The Growth Fund of America, Class R-6 | | | 50,271 | | | | 16,557 | | | | — | | | | — | | | | 9,954 | | | | 76,782 | | | | 516 | | | | 3,928 | |

| New Perspective Fund, Class R-6 | | | 43,980 | | | | 15,408 | | | | — | | | | — | | | | 6,748 | | | | 66,136 | | | | 645 | | | | 2,273 | |

| The New Economy Fund, Class R-6 | | | 25,109 | | | | 7,622 | | | | — | | | | — | | | | 4,622 | | | | 37,353 | | | | 167 | | | | 1,093 | |

| EuroPacific Growth Fund, Class R-6 | | | 25,198 | | | | 6,336 | | | | — | | | | — | | | | 4,059 | | | | 35,593 | | | | 494 | | | | 584 | |

| American Funds Global Insight Fund, Class R-6 | | | 18,819 | | | | 8,554 | | | | — | | | | — | | | | 3,130 | | | | 30,503 | | | | 344 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 429,272 | | | | | | | | | |

| Growth-and-income funds 37% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Investment Company of America, Class R-6 | | | 62,625 | | | | 22,600 | | | | — | | | | — | | | | 12,347 | | | | 97,572 | | | | 781 | | | | 2,611 | |

| Capital World Growth and Income Fund, Class R-6 | | | 56,334 | | | | 22,556 | | | | — | | | | — | | | | 10,421 | | | | 89,311 | | | | 805 | | | | 1,067 | |

| Fundamental Investors, Class R-6 | | | 57,451 | | | | 18,371 | | | | — | | | | — | | | | 11,798 | | | | 87,620 | | | | 615 | | | | 2,501 | |

| Washington Mutual Investors Fund, Class R-6 | | | 37,463 | | | | 17,753 | | | | — | | | | — | | | | 6,168 | | | | 61,384 | | | | 547 | | | | 955 | |

| International Growth and Income Fund, Class R-6 | | | 18,593 | | | | 7,972 | | | | — | | | | — | | | | 3,224 | | | | 29,789 | | | | 269 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 365,676 | | | | | | | | | |

| Balanced funds 10% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 31,264 | | | | 15,988 | | | | — | | | | — | | | | 4,318 | | | | 51,570 | | | | 765 | | | | — | |

| American Funds Global Balanced Fund, Class R-6 | | | 31,364 | | | | 12,734 | | | | — | | | | — | | | | 3,951 | | | | 48,049 | | | | 387 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 99,619 | | | | | | | | | |

| Fixed income funds 10% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American High-Income Trust, Class R-6 | | | 32,022 | | | | 19,400 | | | | — | | | | — | | | | 2,228 | | | | 53,650 | | | | 1,506 | | | | — | |

| U.S. Government Securities Fund, Class R-6 | | | 12,835 | | | | 5,020 | | | | — | | | | — | | | | 23 | | | | 17,878 | | | | 372 | | | | — | |

| The Bond Fund of America, Class R-6 | | | — | | | | 17,686 | | | | — | | | | — | | | | (505 | ) | | | 17,181 | | | | 147 | | | | — | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | — | | | | 12,106 | | | | — | | | | — | | | | (132 | ) | | | 11,974 | | | | 140 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 100,683 | | | | | | | | | |

| Total 100% | | | | | | | | | | | | | | $ | — | | | $ | 106,153 | | | $ | 995,250 | | | $ | 9,693 | | | $ | 16,990 | |

| 1 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

Refer to the notes to financial statements.

| American Funds College Target Date Series | 7 |

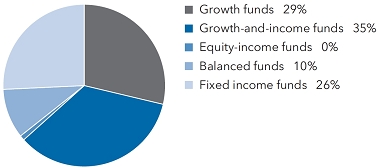

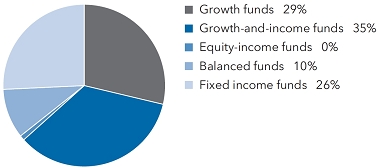

| American Funds College 2036 Fund | unaudited |

| Investment portfolio April 30, 2024 | |

| Growth funds 29% | | Shares | | | Value

(000) | |

| The Growth Fund of America, Class R-6 | | | 2,316,365 | | | $ | 157,744 | |

| AMCAP Fund, Class R-6 | | | 3,332,453 | | | | 136,764 | |

| New Perspective Fund, Class R-6 | | | 1,844,595 | | | | 108,093 | |

| SMALLCAP World Fund, Inc., Class R-6 | | | 1,598,080 | | | | 107,583 | |

| American Funds Global Insight Fund, Class R-6 | | | 3,661,987 | | | | 80,930 | |

| The New Economy Fund, Class R-6 | | | 1,153,470 | | | | 66,313 | |

| EuroPacific Growth Fund, Class R-6 | | | 106,921 | | | | 6,115 | |

| | | | | | | | 663,542 | |

| | | | | | | | | |

| Growth-and-income funds 35% | | | | | | | | |

| The Investment Company of America, Class R-6 | | | 3,742,778 | | | | 200,650 | |

| Capital World Growth and Income Fund, Class R-6 | | | 3,143,093 | | | | 197,512 | |

| Fundamental Investors, Class R-6 | | | 2,340,901 | | | | 179,219 | |

| Washington Mutual Investors Fund, Class R-6 | | | 2,564,581 | | | | 153,542 | |

| International Growth and Income Fund, Class R-6 | | | 1,752,414 | | | | 64,682 | |

| American Mutual Fund, Class R-6 | | | 285,023 | | | | 14,955 | |

| | | | | | | | 810,560 | |

| | | | | | | | | |

| Equity-income funds 0% | | | | | | | | |

| Capital Income Builder, Class R-6 | | | 84,651 | | | | 5,610 | |

| The Income Fund of America, Class R-6 | | | 73,517 | | | | 1,738 | |

| | | | | | | | 7,348 | |

| | | | | | | | | |

| Balanced funds 10% | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 4,045,255 | | | | 132,563 | |

| American Funds Global Balanced Fund, Class R-6 | | | 2,294,420 | | | | 83,632 | |

| | | | | | | | 216,195 | |

| | | | | | | | | |

| Fixed income funds 26% | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 22,244,000 | | | | 243,794 | |

| American High-Income Trust, Class R-6 | | | 16,911,469 | | | | 159,813 | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 17,328,356 | | | | 158,728 | |

| American Funds Mortgage Fund, Class R-6 | | | 1,523,507 | | | | 12,889 | |

| American Funds Strategic Bond Fund, Class R-6 | | | 1,456,561 | | | | 12,847 | |

| U.S. Government Securities Fund, Class R-6 | | | 258,906 | | | | 2,990 | |

| | | | | | | | 591,061 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $2,190,775,000) | | | | | | | 2,288,706 | |

| Other assets less liabilities 0% | | | | | | | (537 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 2,288,169 | |

| 8 | American Funds College Target Date Series |

American Funds College 2036 Fund (continued)

Investments in affiliates1

| | | Value at

11/1/2023

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

4/30/2024

(000) | | | Dividend

income

(000) | | | Capital gain

distributions

received

(000) | |

| Growth funds 29% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Growth Fund of America, Class R-6 | | $ | 124,054 | | | $ | 10,453 | | | $ | — | | | $ | — | | | $ | 23,237 | | | $ | 157,744 | | | $ | 1,213 | | | $ | 9,241 | |

| AMCAP Fund, Class R-6 | | | 110,156 | | | | 4,038 | | | | — | | | | — | | | | 22,570 | | | | 136,764 | | | | 724 | | | | 3,314 | |

| New Perspective Fund, Class R-6 | | | 89,591 | | | | 5,534 | | | | — | | | | — | | | | 12,968 | | | | 108,093 | | | | 1,223 | | | | 4,311 | |

| SMALLCAP World Fund, Inc., Class R-6 | | | 91,428 | | | | 1,052 | | | | — | | | | — | | | | 15,103 | | | | 107,583 | | | | 1,052 | | | | — | |

| American Funds Global Insight Fund, Class R-6 | | | 69,182 | | | | 1,181 | | | | — | | | | — | | | | 10,567 | | | | 80,930 | | | | 1,181 | | | | — | |

| The New Economy Fund, Class R-6 | | | 54,293 | | | | 2,560 | | | | — | | | | — | | | | 9,460 | | | | 66,313 | | | | 340 | | | | 2,220 | |

| EuroPacific Growth Fund, Class R-6 | | | 5,133 | | | | 202 | | | | — | | | | — | | | | 780 | | | | 6,115 | | | | 92 | | | | 109 | |

| | | | | | | | | | | | | | | | | | | | | | | | 663,542 | | | | | | | | | |

| Growth-and-income funds 35% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Investment Company of America, Class R-6 | | | 161,426 | | | | 9,783 | | | | — | | | | — | | | | 29,441 | | | | 200,650 | | | | 1,786 | | | | 6,307 | |

| Capital World Growth and Income Fund, Class R-6 | | | 160,200 | | | | 9,917 | | | | — | | | | — | | | | 27,395 | | | | 197,512 | | | | 2,031 | | | | 2,856 | |

| Fundamental Investors, Class R-6 | | | 142,629 | | | | 9,056 | | | | — | | | | — | | | | 27,534 | | | | 179,219 | | | | 1,391 | | | | 5,921 | |

| Washington Mutual Investors Fund, Class R-6 | | | 124,395 | | | | 10,171 | | | | — | | | | — | | | | 18,976 | | | | 153,542 | | | | 1,581 | | | | 2,945 | |

| International Growth and Income Fund, Class R-6 | | | 52,786 | | | | 3,647 | | | | — | | | | — | | | | 8,249 | | | | 64,682 | | | | 634 | | | | — | |

| American Mutual Fund, Class R-6 | | | — | | | | 14,844 | | | | — | | | | — | | | | 111 | | | | 14,955 | | | | 45 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 810,560 | | | | | | | | | |

| Equity-income funds 0% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Income Builder, Class R-6 | | | — | | | | 5,596 | | | | — | | | | — | | | | 14 | | | | 5,610 | | | | 16 | | | | — | |

| The Income Fund of America, Class R-6 | | | — | | | | 1,744 | | | | — | | | | — | | | | (6 | ) | | | 1,738 | | | | 1 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 7,348 | | | | | | | | | |

| Balanced funds 10% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 105,281 | | | | 13,744 | | | | — | | | | — | | | | 13,538 | | | | 132,563 | | | | 2,306 | | | | — | |

| American Funds Global Balanced Fund, Class R-6 | | | 72,657 | | | | 2,312 | | | | — | | | | — | | | | 8,663 | | | | 83,632 | | | | 737 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 216,195 | | | | | | | | | |

| Fixed income funds 26% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 176,677 | | | | 64,019 | | | | — | | | | — | | | | 3,098 | | | | 243,794 | | | | 4,886 | | | | — | |

| American High-Income Trust, Class R-6 | | | 124,926 | | | | 26,414 | | | | — | | | | — | | | | 8,473 | | | | 159,813 | | | | 4,973 | | | | — | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 122,544 | | | | 28,520 | | | | — | | | | — | | | | 7,664 | | | | 158,728 | | | | 4,764 | | | | — | |

| American Funds Mortgage Fund, Class R-6 | | | — | | | | 13,331 | | | | — | | | | — | | | | (442 | ) | | | 12,889 | | | | 116 | | | | — | |

| American Funds Strategic Bond Fund, Class R-6 | | | — | | | | 13,259 | | | | — | | | | — | | | | (412 | ) | | | 12,847 | | | | 61 | | | | — | |

| U.S. Government Securities Fund, Class R-6 | | | 2,885 | | | | 69 | | | | — | | | | — | | | | 36 | | | | 2,990 | | | | 69 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 591,061 | | | | | | | | | |

| Total 100% | | | | | | | | | | | | | | $ | — | | | $ | 247,017 | | | $ | 2,288,706 | | | $ | 31,222 | | | $ | 37,224 | |

| 1 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

Refer to the notes to financial statements.

| American Funds College Target Date Series | 9 |

| American Funds College 2033 Fund | unaudited |

| Investment portfolio April 30, 2024 | |

| Growth funds 8% | | Shares | | | Value

(000) | |

| AMCAP Fund, Class R-6 | | | 1,679,448 | | | $ | 68,925 | |

| New Perspective Fund, Class R-6 | | | 1,109,967 | | | | 65,044 | |

| American Funds Global Insight Fund, Class R-6 | | | 2,789,694 | | | | 61,652 | |

| The Growth Fund of America, Class R-6 | | | 241,815 | | | | 16,468 | |

| SMALLCAP World Fund, Inc., Class R-6 | | | 155,977 | | | | 10,500 | |

| The New Economy Fund, Class R-6 | | | 124,073 | | | | 7,133 | |

| | | | | | | | 229,722 | |

| | | | | | | | | |

| Growth-and-income funds 38% | | | | | | | | |

| American Mutual Fund, Class R-6 | | | 4,673,809 | | | | 245,235 | |

| Capital World Growth and Income Fund, Class R-6 | | | 3,813,245 | | | | 239,624 | |

| Washington Mutual Investors Fund, Class R-6 | | | 3,916,788 | | | | 234,498 | |

| The Investment Company of America, Class R-6 | | | 4,095,309 | | | | 219,550 | |

| Fundamental Investors, Class R-6 | | | 1,726,939 | | | | 132,214 | |

| International Growth and Income Fund, Class R-6 | | | 1,603,927 | | | | 59,201 | |

| | | | | | | | 1,130,322 | |

| | | | | | | | | |

| Equity-income funds 6% | | | | | | | | |

| Capital Income Builder, Class R-6 | | | 1,626,459 | | | | 107,786 | |

| The Income Fund of America, Class R-6 | | | 3,430,006 | | | | 81,085 | |

| | | | | | | | 188,871 | |

| | | | | | | | | |

| Balanced funds 9% | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 6,030,843 | | | | 197,631 | |

| American Funds Global Balanced Fund, Class R-6 | | | 2,378,067 | | | | 86,680 | |

| | | | | | | | 284,311 | |

| | | | | | | | | |

| Fixed income funds 39% | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 39,854,641 | | | | 436,807 | |

| American High-Income Trust, Class R-6 | | | 21,565,313 | | | | 203,792 | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 22,098,531 | | | | 202,423 | |

| American Funds Mortgage Fund, Class R-6 | | | 19,169,701 | | | | 162,176 | |

| American Funds Strategic Bond Fund, Class R-6 | | | 18,321,219 | | | | 161,593 | |

| Intermediate Bond Fund of America, Class R-6 | | | 907,175 | | | | 11,040 | |

| | | | | | | | 1,177,831 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $2,992,788,000) | | | | | | | 3,011,057 | |

| Other assets less liabilities 0% | | | | | | | (694 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 3,010,363 | |

| 10 | American Funds College Target Date Series |

American Funds College 2033 Fund (continued)

Investments in affiliates1

| | | Value at

11/1/2023

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

4/30/2024

(000) | | | Dividend

income

(000) | | | Capital gain

distributions

received

(000) | |

| Growth funds 8% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AMCAP Fund, Class R-6 | | $ | 55,851 | | | $ | 2,048 | | | $ | 437 | | | $ | 72 | | | $ | 11,391 | | | $ | 68,925 | | | $ | 367 | | | $ | 1,680 | |

| New Perspective Fund, Class R-6 | | | 53,911 | | | | 3,329 | | | | — | | | | — | | | | 7,804 | | | | 65,044 | | | | 736 | | | | 2,594 | |

| American Funds Global Insight Fund, Class R-6 | | | 52,703 | | | | 899 | | | | — | | | | — | | | | 8,050 | | | | 61,652 | | | | 900 | | | | — | |

| The Growth Fund of America, Class R-6 | | | 13,423 | | | | 1,131 | | | | 590 | | | | 41 | | | | 2,463 | | | | 16,468 | | | | 131 | | | | 1,000 | |

| SMALLCAP World Fund, Inc., Class R-6 | | | 8,924 | | | | 102 | | | | — | | | | — | | | | 1,474 | | | | 10,500 | | | | 103 | | | | — | |

| The New Economy Fund, Class R-6 | | | 5,840 | | | | 275 | | | | — | | | | — | | | | 1,018 | | | | 7,133 | | | | 37 | | | | 239 | |

| | | | | | | | | | | | | | | | | | | | | | | | 229,722 | | | | | | | | | |

| Growth-and-income funds 38% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Mutual Fund, Class R-6 | | | 209,797 | | | | 10,962 | | | | — | | | | — | | | | 24,476 | | | | 245,235 | | | | 3,355 | | | | 3,744 | |

| Capital World Growth and Income Fund, Class R-6 | | | 199,897 | | | | 5,984 | | | | — | | | | — | | | | 33,743 | | | | 239,624 | | | | 2,480 | | | | 3,504 | |

| Washington Mutual Investors Fund, Class R-6 | | | 197,898 | | | | 7,020 | | | | — | | | | — | | | | 29,580 | | | | 234,498 | | | | 2,440 | | | | 4,579 | |

| The Investment Company of America, Class R-6 | | | 178,257 | | | | 8,919 | | | | — | | | | — | | | | 32,374 | | | | 219,550 | | | | 1,963 | | | | 6,955 | |

| Fundamental Investors, Class R-6 | | | 106,376 | | | | 5,414 | | | | — | | | | — | | | | 20,424 | | | | 132,214 | | | | 1,029 | | | | 4,385 | |

| International Growth and Income Fund, Class R-6 | | | 50,848 | | | | 583 | | | | — | | | | — | | | | 7,770 | | | | 59,201 | | | | 583 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 1,130,322 | | | | | | | | | |

| Equity-income funds 6% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Income Builder, Class R-6 | | | 93,634 | | | | 4,834 | | | | — | | | | — | | | | 9,318 | | | | 107,786 | | | | 2,357 | | | | 116 | |

| The Income Fund of America, Class R-6 | | | 69,058 | | | | 4,979 | | | | — | | | | — | | | | 7,048 | | | | 81,085 | | | | 1,836 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 188,871 | | | | | | | | | |

| Balanced funds 9% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 172,126 | | | | 3,652 | | | | — | | | | — | | | | 21,853 | | | | 197,631 | | | | 3,652 | | | | — | |

| American Funds Global Balanced Fund, Class R-6 | | | 76,741 | | | | 775 | | | | — | | | | — | | | | 9,164 | | | | 86,680 | | | | 775 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 284,311 | | | | | | | | | |

| Fixed income funds 39% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 374,582 | | | | 53,662 | | | | — | | | | — | | | | 8,563 | | | | 436,807 | | | | 9,478 | | | | — | |

| American High-Income Trust, Class R-6 | | | 178,200 | | | | 13,712 | | | | — | | | | — | | | | 11,880 | | | | 203,792 | | | | 6,634 | | | | — | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 177,397 | | | | 14,068 | | | | — | | | | — | | | | 10,958 | | | | 202,423 | | | | 6,350 | | | | — | |

| American Funds Mortgage Fund, Class R-6 | | | 121,493 | | | | 39,473 | | | | — | | | | — | | | | 1,210 | | | | 162,176 | | | | 3,468 | | | | — | |

| American Funds Strategic Bond Fund, Class R-62 | | | 120,404 | | | | 41,109 | | | | 1,416 | | | | — | | | | 1,496 | | | | 161,593 | | | | 1,157 | | | | — | |

| Intermediate Bond Fund of America, Class R-6 | | | — | | | | 11,236 | | | | — | | | | — | | | | (196 | ) | | | 11,040 | | | | 72 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 1,177,831 | | | | | | | | | |

| Total 100% | | | | | | | | | | | | | | $ | 113 | | | $ | 261,861 | | | $ | 3,011,057 | | | $ | 49,903 | | | $ | 28,796 | |

| 1 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

| 2 | A portion of the fund’s income dividends and/or capital gains distribution was deemed a return of capital for tax purposes. The net realized gain and/or dividend income amounts reflect the return of capital distribution. |

Refer to the notes to financial statements.

| American Funds College Target Date Series | 11 |

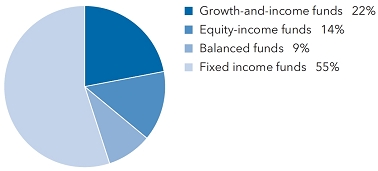

| American Funds College 2030 Fund | unaudited |

| Investment portfolio April 30, 2024 | |

| Growth-and-income funds 22% | | Shares | | | Value

(000) | |

| American Mutual Fund, Class R-6 | | | 7,070,956 | | | $ | 371,013 | |

| Washington Mutual Investors Fund, Class R-6 | | | 4,064,349 | | | | 243,333 | |

| Capital World Growth and Income Fund, Class R-6 | | | 2,269,813 | | | | 142,635 | |

| The Investment Company of America, Class R-6 | | | 1,272,776 | | | | 68,233 | |

| | | | | | | | 825,214 | |

| | | | | | | | | |

| Equity-income funds 14% | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 13,714,148 | | | | 324,203 | |

| Capital Income Builder, Class R-6 | | | 3,161,927 | | | | 209,541 | |

| | | | | | | | 533,744 | |

| | | | | | | | | |

| Balanced funds 9% | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 7,887,241 | | | | 258,465 | |

| American Funds Global Balanced Fund, Class R-6 | | | 1,852,084 | | | | 67,508 | |

| | | | | | | | 325,973 | |

| | | | | | | | | |

| Fixed income funds 55% | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 46,384,935 | | | | 508,379 | |

| American Funds Mortgage Fund, Class R-6 | | | 45,336,452 | | | | 383,546 | |

| American Funds Strategic Bond Fund, Class R-6 | | | 41,930,257 | | | | 369,825 | |

| American High-Income Trust, Class R-6 | | | 27,216,481 | | | | 257,196 | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 27,892,967 | | | | 255,500 | |

| Intermediate Bond Fund of America, Class R-6 | | | 19,347,580 | | | | 235,460 | |

| Short-Term Bond Fund of America, Class R-6 | | | 4,370,348 | | | | 41,081 | |

| | | | | | | | 2,050,987 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $3,898,042,000) | | | | | | | 3,735,918 | |

| Other assets less liabilities 0% | | | | | | | (875 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 3,735,043 | |

| 12 | American Funds College Target Date Series |

American Funds College 2030 Fund (continued)

Investments in affiliates1

| | | Value at

11/1/2023

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

4/30/2024

(000) | | | Dividend

income

(000) | | | Capital gain

distributions

received

(000) | |

| Growth funds 0% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AMCAP Fund, Class R-62 | | $ | 4,918 | | | $ | 180 | | | $ | 6,245 | | | $ | (278 | ) | | $ | 1,425 | | | $ | — | | | $ | 32 | | | $ | 148 | |

| American Funds Global Insight Fund, Class R-62 | | | 4,816 | | | | 82 | | | | 5,679 | | | | 219 | | | | 562 | | | | — | | | | 82 | | | | — | |

| New Perspective Fund, Class R-62 | | | 4,837 | | | | 299 | | | | 5,894 | | | | (763 | ) | | | 1,521 | | | | — | | | | 66 | | | | 233 | |

| | | | | | | | | | | | | | | | | | | | | | | | — | | | | | | | | | |

| Growth-and-income funds 22% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Mutual Fund, Class R-6 | | | 318,566 | | | | 15,701 | | | | — | | | | — | | | | 36,746 | | | | 371,013 | | | | 5,052 | | | | 5,623 | |

| Washington Mutual Investors Fund, Class R-6 | | | 229,854 | | | | 9,324 | | | | 30,388 | | | | 6,911 | | | | 27,632 | | | | 243,333 | | | | 2,714 | | | | 5,319 | |

| Capital World Growth and Income Fund, Class R-6 | | | 137,327 | | | | 4,388 | | | | 22,259 | | | | (367 | ) | | | 23,546 | | | | 142,635 | | | | 1,616 | | | | 2,407 | |

| The Investment Company of America, Class R-6 | | | 77,481 | | | | 4,001 | | | | 27,246 | | | | 1,599 | | | | 12,398 | | | | 68,233 | | | | 752 | | | | 3,006 | |

| Fundamental Investors, Class R-62 | | | 9,966 | | | | 470 | | | | 12,304 | | | | (37 | ) | | | 1,905 | | | | — | | | | 60 | | | | 411 | |

| International Growth and Income Fund, Class R-62 | | | 4,825 | | | | 22 | | | | 5,556 | | | | (608 | ) | | | 1,317 | | | | — | | | | 23 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 825,214 | | | | | | | | | |

| Equity-income funds 14% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 278,460 | | | | 17,426 | | | | — | | | | — | | | | 28,317 | | | | 324,203 | | | | 7,354 | | | | — | |

| Capital Income Builder, Class R-6 | | | 187,707 | | | | 5,071 | | | | 1,715 | | | | 129 | | | | 18,349 | | | | 209,541 | | | | 4,614 | | | | 228 | |

| | | | | | | | | | | | | | | | | | | | | | | | 533,744 | | | | | | | | | |

| Balanced funds 9% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 225,488 | | | | 4,899 | | | | 550 | | | | 79 | | | | 28,549 | | | | 258,465 | | | | 4,782 | | | | — | |

| American Funds Global Balanced Fund, Class R-6 | | | 66,768 | | | | 641 | | | | 7,930 | | | | 527 | | | | 7,502 | | | | 67,508 | | | | 642 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 325,973 | | | | | | | | | |

| Fixed income funds 55% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Bond Fund of America, Class R-6 | | | 457,784 | | | | 39,596 | | | | — | | | | — | | | | 10,999 | | | | 508,379 | | | | 11,141 | | | | — | |

| American Funds Mortgage Fund, Class R-6 | | | 318,061 | | | | 60,722 | | | | — | | | | — | | | | 4,763 | | | | 383,546 | | | | 8,638 | | | | — | |

| American Funds Strategic Bond Fund, Class R-63 | | | 315,610 | | | | 52,047 | | | | 3,908 | | | | — | | | | 6,076 | | | | 369,825 | | | | 2,507 | | | | — | |

| American High-Income Trust, Class R-6 | | | 231,298 | | | | 10,506 | | | | — | | | | — | | | | 15,392 | | | | 257,196 | | | | 8,448 | | | | — | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 228,256 | | | | 13,053 | | | | — | | | | — | | | | 14,191 | | | | 255,500 | | | | 8,062 | | | | — | |

| Intermediate Bond Fund of America, Class R-6 | | | 154,023 | | | | 80,846 | | | | — | | | | — | | | | 591 | | | | 235,460 | | | | 4,115 | | | | — | |

| Short-Term Bond Fund of America, Class R-6 | | | — | | | | 41,336 | | | | — | | | | — | | | | (255 | ) | | | 41,081 | | | | 300 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 2,050,987 | | | | | | | | | |

| Total 100% | | | | | | | | | | | | | | $ | 7,411 | | | $ | 241,526 | | | $ | 3,735,918 | | | $ | 71,000 | | | $ | 17,375 | |

| 1 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

| 2 | Affiliated issuer during the reporting period but no longer held at 4/30/2024. |

| 3 | A portion of the fund’s income dividends and/or capital gains distribution was deemed a return of capital for tax purposes. The net realized gain and/or dividend income amounts reflect the return of capital distribution. |

Refer to the notes to financial statements.

| American Funds College Target Date Series | 13 |

| American Funds College 2027 Fund | unaudited |

| Investment portfolio April 30, 2024 | |

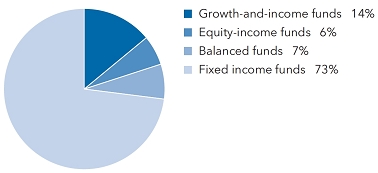

| Growth-and-income funds 14% | | Shares | | | Value

(000) | |

| American Mutual Fund, Class R-6 | | | 6,080,148 | | | $ | 319,025 | |

| Capital World Growth and Income Fund, Class R-6 | | | 947,391 | | | | 59,534 | |

| Washington Mutual Investors Fund, Class R-6 | | | 991,814 | | | | 59,380 | |

| | | | | | | | 437,939 | |

| | | | | | | | | |

| Equity-income funds 6% | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 6,150,440 | | | | 145,397 | |

| Capital Income Builder, Class R-6 | | | 875,771 | | | | 58,037 | |

| | | | | | | | 203,434 | |

| | | | | | | | | |

| Balanced funds 7% | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 6,666,258 | | | | 218,453 | |

| | | | | | | | | |

| Fixed income funds 73% | | | | | | | | |

| Intermediate Bond Fund of America, Class R-6 | | | 44,045,884 | | | | 536,038 | |

| American Funds Mortgage Fund, Class R-6 | | | 53,838,817 | | | | 455,476 | |

| Short-Term Bond Fund of America, Class R-6 | | | 46,653,712 | | | | 438,545 | |

| The Bond Fund of America, Class R-6 | | | 28,748,980 | | | | 315,089 | |

| American Funds Strategic Bond Fund, Class R-6 | | | 33,971,031 | | | | 299,625 | |

| American High-Income Trust, Class R-6 | | | 15,440,096 | | | | 145,909 | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 15,763,118 | | | | 144,390 | |

| | | | | | | | 2,335,072 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $3,429,284,000) | | | | | | | 3,194,898 | |

| Other assets less liabilities 0% | | | | | | | (786 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 3,194,112 | |

| 14 | American Funds College Target Date Series |

American Funds College 2027 Fund (continued)

Investments in affiliates1

| | | Value at

11/1/2023

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

4/30/2024

(000) | | | Dividend

income

(000) | | | Capital gain

distributions

received

(000) | |

| Growth-and-income funds 14% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Mutual Fund, Class R-6 | | $ | 282,182 | | | $ | 12,009 | | | $ | 7,737 | | | $ | 1,522 | | | $ | 31,049 | | | $ | 319,025 | | | $ | 4,431 | | | $ | 4,981 | |

| Capital World Growth and Income Fund, Class R-6 | | | 60,055 | | | | 1,899 | | | | 12,212 | | | | 2,023 | | | | 7,769 | | | | 59,534 | | | | 696 | | | | 1,053 | |

| Washington Mutual Investors Fund, Class R-6 | | | 67,322 | | | | 2,425 | | | | 19,898 | | | | 1,680 | | | | 7,851 | | | | 59,380 | | | | 740 | | | | 1,543 | |

| The Investment Company of America, Class R-62 | | | 4,463 | | | | 204 | | | | 5,287 | | | | 112 | | | | 508 | | | | — | | | | 29 | | | | 174 | |

| | | | | | | | | | | | | | | | | | | | | | | | 437,939 | | | | | | | | | |

| Equity-income funds 6% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Income Fund of America, Class R-6 | | | 148,913 | | | | 4,821 | | | | 23,199 | | | | 472 | | | | 14,390 | | | | 145,397 | | | | 3,687 | | | | — | |

| Capital Income Builder, Class R-6 | | | 63,773 | | | | 1,691 | | | | 13,729 | | | | (399 | ) | | | 6,701 | | | | 58,037 | | | | 1,468 | | | | 77 | |

| | | | | | | | | | | | | | | | | | | | | | | | 203,434 | | | | | | | | | |

| Balanced funds 7% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 197,235 | | | | 4,887 | | | | 8,635 | | | | 1,040 | | | | 23,926 | | | | 218,453 | | | | 4,152 | | | | — | |

| American Funds Global Balanced Fund, Class R-62 | | | 4,219 | | | | 23 | | | | 4,737 | | | | (419 | ) | | | 914 | | | | — | | | | 23 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 218,453 | | | | | | | | | |

| Fixed income funds 73% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Intermediate Bond Fund of America, Class R-6 | | | 444,813 | | | | 87,571 | | | | — | | | | — | | | | 3,654 | | | | 536,038 | | | | 10,631 | | | | — | |

| American Funds Mortgage Fund, Class R-6 | | | 417,080 | | | | 30,907 | | | | — | | | | — | | | | 7,489 | | | | 455,476 | | | | 10,772 | | | | — | |

| Short-Term Bond Fund of America, Class R-6 | | | 273,235 | | | | 165,736 | | | | — | | | | — | | | | (426 | ) | | | 438,545 | | | | 7,510 | | | | — | |

| The Bond Fund of America, Class R-6 | | | 318,585 | | | | 13,663 | | | | 26,132 | | | | (1,017 | ) | | | 9,990 | | | | 315,089 | | | | 7,321 | | | | — | |

| American Funds Strategic Bond Fund, Class R-63 | | | 282,466 | | | | 15,340 | | | | 4,562 | | | | 30 | | | | 6,351 | | | | 299,625 | | | | 1,797 | | | | — | |

| American High-Income Trust, Class R-6 | | | 148,914 | | | | 5,130 | | | | 18,149 | | | | 745 | | | | 9,269 | | | | 145,909 | | | | 5,130 | | | | — | |

| American Funds Multi-Sector Income Fund, Class R-6 | | | 146,375 | | | | 4,876 | | | | 16,239 | | | | 543 | | | | 8,835 | | | | 144,390 | | | | 4,876 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 2,335,072 | | | | | | | | | |

| Total 100% | | | | | | | | | | | | | | $ | 6,332 | | | $ | 138,270 | | | $ | 3,194,898 | | | $ | 63,263 | | | $ | 7,828 | |

| 1 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

| 2 | Affiliated issuer during the reporting period but no longer held at 4/30/2024. |

| 3 | A portion of the fund’s income dividends and/or capital gains distribution was deemed a return of capital for tax purposes. The net realized gain and/or dividend income amounts reflect the return of capital distribution. |

Refer to the notes to financial statements.

| American Funds College Target Date Series | 15 |

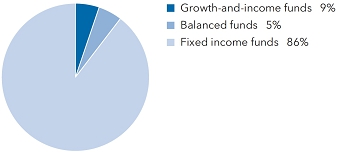

| American Funds College Enrollment Fund | unaudited |

Investment portfolio April 30, 2024

| Growth-and-income funds 9% | | Shares | | | Value

(000) | |

| American Mutual Fund, Class R-6 | | | 7,209,932 | | | $ | 378,305 | |

| | | | | | | | | |

| Balanced funds 5% | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 6,423,928 | | | | 210,512 | |

| | | | | | | | | |

| Fixed income funds 86% | | | | | | | | |

| Short-Term Bond Fund of America, Class R-6 | | | 204,804,974 | | | | 1,925,166 | |

| Intermediate Bond Fund of America, Class R-6 | | | 91,342,904 | | | | 1,111,643 | |

| American Funds Mortgage Fund, Class R-6 | | | 50,008,539 | | | | 423,073 | |

| American Funds Strategic Bond Fund, Class R-6 | | | 23,910,684 | | | | 210,892 | |

| | | | | | | | 3,670,774 | |

| | | | | | | | | |

| Total investment securities 100% (cost: $4,620,954,000) | | | | | | | 4,259,591 | |

| Other assets less liabilities 0% | | | | | | | (1,158 | ) |

| | | | | | | | | |

| Net assets 100% | | | | | | $ | 4,258,433 | |

Investments in affiliates1

| | | Value at

11/1/2023

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

4/30/2024

(000) | | | Dividend

income

(000) | | | Capital gain

distributions

received

(000) | |

| Growth-and-income funds 9% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Mutual Fund, Class R-6 | | $ | 143,812 | | | $ | 234,300 | | | $ | 31,821 | | | $ | 1,775 | | | $ | 30,239 | | | $ | 378,305 | | | $ | 2,040 | | | $ | 2,392 | |

| Balanced funds 5% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| American Balanced Fund, Class R-6 | | | 80,032 | | | | 138,241 | | | | 16,983 | | | | (539 | ) | | | 9,761 | | | | 210,512 | | | | 1,560 | | | | — | |

| Fixed income funds 86% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Short-Term Bond Fund of America, Class R-6 | | | 741,056 | | | | 1,314,242 | | | | 98,839 | | | | 673 | | | | (31,966 | ) | | | 1,925,166 | | | | 20,800 | | | | — | |

| Intermediate Bond Fund of America, Class R-6 | | | 429,790 | | | | 826,975 | | | | 56,297 | | | | (4,451 | ) | | | (84,374 | ) | | | 1,111,643 | | | | 11,998 | | | | — | |

| American Funds Mortgage Fund, Class R-6 | | | 162,204 | | | | 336,640 | | | | 22,113 | | | | (3,064 | ) | | | (50,594 | ) | | | 423,073 | | | | 5,201 | | | | — | |

| American Funds Strategic Bond Fund, Class R-62 | | | 81,345 | | | | 182,528 | | | | 11,224 | | | | (1,979 | ) | | | (39,778 | ) | | | 210,892 | | | | (227 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | 3,670,774 | | | | | | | | | |

| Total 100% | | | | | | | | | | | | | | $ | (7,585 | ) | | $ | (166,712 | ) | | $ | 4,259,591 | | | $ | 41,372 | | | $ | 2,392 | |

| 1 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

| 2 | A portion of the fund’s income dividends and/or capital gains distribution was deemed a return of capital for tax purposes. The net realized gain and/or dividend income amounts reflect the return of capital distribution. |

Refer to the notes to financial statements.

| 16 | American Funds College Target Date Series |

| Financial statements | unaudited |

| | |

Statements of assets and liabilities

at April 30, 2024 | (dollars and shares in thousands, except per-share amounts) |

| | | | | College 2042

Fund | | | College 2039

Fund | | | College 2036

Fund | | | College 2033

Fund | | | College 2030

Fund | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | |

| Investment securities of affiliated issuers, at value | | $ | 15,315 | | | $ | 995,250 | | | $ | 2,288,706 | | | $ | 3,011,057 | | | $ | 3,735,918 | |

| Receivables for: | | | | | | | | | | | | | | | | | | | | |

| Sales of investments | | — | | | | — | | | | — | | | | — | | | | — | |

| Sales of fund’s shares | | | 1,198 | | | | 1,605 | | | | 2,554 | | | | 1,335 | | | | 2,065 | |

| Dividends | | | 2 | | | | 469 | | | | 2,719 | | | | 4,611 | | | | 7,369 | |

| Total assets | | | 16,515 | | | | 997,324 | | | | 2,293,979 | | | | 3,017,003 | | | | 3,745,352 | |

| | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | |

| Payables for: | | | | | | | | | | | | | | | | | | | | |

| Purchases of investments | | | 1,185 | | | | 1,582 | | | | 4,547 | | | | 5,088 | | | | 7,639 | |

| Repurchases of fund’s shares | | | 15 | | | | 492 | | | | 727 | | | | 859 | | | | 1,799 | |

| Services provided by related parties | | | 2 | | | | 191 | | | | 423 | | | | 540 | | | | 677 | |

| Trustees’ deferred compensation | | | — | * | | | 2 | | | | 8 | | | | 15 | | | | 23 | |

| Other | | | | | — | * | | | 45 | | | | 105 | | | | 138 | | | | 171 | |

| Total liabilities | | | 1,202 | | | | 2,312 | | | | 5,810 | | | | 6,640 | | | | 10,309 | |

| Net assets at April 30, 2024 | | $ | 15,313 | | | $ | 995,012 | | | $ | 2,288,169 | | | $ | 3,010,363 | | | $ | 3,735,043 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | | | | | | | | | |

| Capital paid in on shares of beneficial interest | | $ | 15,567 | | | $ | 906,987 | | | $ | 2,153,454 | | | $ | 2,969,345 | | | $ | 3,883,905 | |

| Total distributable earnings (accumulated loss) | | | (254 | ) | | | 88,025 | | | | 134,715 | | | | 41,018 | | | | (148,862 | ) |

| Net assets at April 30, 2024 | | $ | 15,313 | | | $ | 995,012 | | | $ | 2,288,169 | | | $ | 3,010,363 | | | $ | 3,735,043 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment securities of affiliated issuers, at cost | | $ | 15,568 | | | $ | 926,174 | | | $ | 2,190,775 | | | $ | 2,992,788 | | | $ | 3,898,042 | |

| | | | | | | | | | | | | | | | | | | | | |

| Shares of beneficial interest issued and outstanding (no stated par value) — unlimited shares authorized | | | | | | | | | | | | | | | | | | | | |

| Class 529-A: | | Net assets | | $ | 10,143 | | | $ | 692,439 | | | $ | 1,762,514 | | | $ | 2,455,467 | | | $ | 3,060,159 | |

| | | Shares outstanding | | | 1,031 | | | | 65,254 | | | | 146,117 | | | | 207,184 | | | | 242,949 | |

| | | Net asset value per share | | $ | 9.84 | | | $ | 10.61 | | | $ | 12.06 | | | $ | 11.85 | | | $ | 12.60 | |

| Class 529-C: | | Net assets | | $ | 1,016 | | | $ | 81,577 | | | $ | 105,900 | | | $ | 80,442 | | | $ | 113,538 | |

| | | Shares outstanding | | | 103 | | | | 7,768 | | | | 8,902 | | | | 6,856 | | | | 9,126 | |

| | | Net asset value per share | | $ | 9.83 | | | $ | 10.50 | | | $ | 11.90 | | | $ | 11.73 | | | $ | 12.44 | |

| Class 529-E: | | Net assets | | $ | 132 | | | $ | 13,676 | | | $ | 50,582 | | | $ | 72,693 | | | $ | 94,924 | |

| | | Shares outstanding | | | 13 | | | | 1,291 | | | | 4,206 | | | | 6,172 | | | | 7,602 | |

| | | Net asset value per share | | $ | 9.84 | | | $ | 10.59 | | | $ | 12.03 | | | $ | 11.78 | | | $ | 12.49 | |

| Class 529-T: | | Net assets | | $ | 10 | | | $ | 11 | | | $ | 15 | | | $ | 16 | | | $ | 15 | |

| | | Shares outstanding | | | 1 | | | | 1 | | | | 1 | | | | 1 | | | | 1 | |

| | | Net asset value per share | | $ | 9.84 | | | $ | 10.67 | | | $ | 12.17 | | | $ | 11.90 | | | $ | 12.63 | |

| Class 529-F-1: | | Net assets | | $ | 10 | | | $ | 11 | | | $ | 15 | | | $ | 12 | | | $ | 11 | |

| | | Shares outstanding | | | 1 | | | | 1 | | | | 1 | | | | 1 | | | | 1 | |

| | | Net asset value per share | | $ | 9.84 | | | $ | 10.67 | | | $ | 12.15 | | | $ | 11.91 | | | $ | 12.66 | |

| Class 529-F-2: | | Net assets | | $ | 3,992 | | | $ | 207,007 | | | $ | 369,132 | | | $ | 401,150 | | | $ | 465,562 | |

| | | Shares outstanding | | | 406 | | | | 19,424 | | | | 30,624 | | | | 33,875 | | | | 36,995 | |

| | | Net asset value per share | | $ | 9.84 | | | $ | 10.66 | | | $ | 12.05 | | | $ | 11.84 | | | $ | 12.58 | |

| Class 529-F-3: | | Net assets | | $ | 10 | | | $ | 291 | | | $ | 11 | | | $ | 583 | | | $ | 834 | |

| | | Shares outstanding | | | 1 | | | | 27 | | | | 1 | | | | 49 | | | | 66 | |

| | | Net asset value per share | | $ | 9.84 | | | $ | 10.68 | | | $ | 12.22 | | | $ | 11.84 | | | $ | 12.58 | |

Refer to the end of the statements of assets and liabilities for footnote.

Refer to the notes to financial statements.

| American Funds College Target Date Series | 17 |

| Financial statements (continued) | unaudited |

| | |

Statements of assets and liabilities

at April 30, 2024 (continued) | (dollars and shares in thousands, except per-share amounts) |

| | | | | College 2027

Fund | | | College

Enrollment

Fund | |

| Assets: | | | | | | | | | | |

| Investment securities of affiliated issuers, at value | | $ | 3,194,898 | | | $ | 4,259,591 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | | 1,390 | | | | 1,431 | |

| Sales of fund’s shares | | | 1,741 | | | | 2,359 | |

| Dividends | | | 8,301 | | | | 13,091 | |

| Total assets | | | 3,206,330 | | | | 4,276,472 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 8,301 | | | | 13,091 | |

| Repurchases of fund’s shares | | | 3,131 | | | | 3,789 | |

| Services provided by related parties | | | 620 | | | | 926 | |

| Trustees’ deferred compensation | | | 20 | | | | 47 | |

| Other | | | | | 146 | | | | 186 | |

| Total liabilities | | | 12,218 | | | | 18,039 | |

| Net assets at April 30, 2024 | | $ | 3,194,112 | | | $ | 4,258,433 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | $ | 3,404,077 | | | $ | 4,688,084 | |

| Total distributable earnings (accumulated loss) | | | (209,965 | ) | | | (429,651 | ) |

| Net assets at April 30, 2024 | | $ | 3,194,112 | | | $ | 4,258,433 | |

| | | | | | | | | |

| Investment securities of affiliated issuers, at cost | | $ | 3,429,284 | | | $ | 4,620,954 | |

| | | | | | | | | | | |

Shares of beneficial interest issued and outstanding

(no stated par value) — unlimited shares authorized | | | | | | |

| Class 529-A: | | Net assets | | $ | 2,521,379 | | | $ | 3,306,652 | |

| | | Shares outstanding | | | 218,003 | | | | 364,586 | |

| | | Net asset value per share | | $ | 11.57 | | | $ | 9.07 | |

| Class 529-C: | | Net assets | | $ | 152,152 | | | $ | 240,179 | |

| | | Shares outstanding | | | 13,303 | | | | 26,198 | |

| | | Net asset value per share | | $ | 11.44 | | | $ | 9.17 | |

| Class 529-E: | | Net assets | | $ | 82,296 | | | $ | 125,815 | |

| | | Shares outstanding | | | 7,182 | | | | 13,888 | |

| | | Net asset value per share | | $ | 11.46 | | | $ | 9.06 | |

| Class 529-T: | | Net assets | | $ | 13 | | | $ | 11 | |

| | | Shares outstanding | | | 1 | | | | 1 | |

| | | Net asset value per share | | $ | 11.60 | | | $ | 9.07 | |

| Class 529-F-1: | | Net assets | | $ | 11 | | | $ | 10 | |

| | | Shares outstanding | | | 1 | | | | 1 | |

| | | Net asset value per share | | $ | 11.63 | | | $ | 9.08 | |

| Class 529-F-2: | | Net assets | | $ | 438,250 | | | $ | 585,368 | |

| | | Shares outstanding | | | 37,932 | | | | 64,633 | |

| | | Net asset value per share | | $ | 11.55 | | | $ | 9.06 | |

| Class 529-F-3: | | Net assets | | $ | 11 | | | $ | 398 | |

| | | Shares outstanding | | | 1 | | | | 44 | |

| | | Net asset value per share | | $ | 11.55 | | | $ | 9.05 | |

| * | Amount less than one thousand. |

Refer to the notes to financial statements.

| 18 | American Funds College Target Date Series |

| Financial statements (continued) | unaudited |

| | |

Statements of operations

for the six months ended April 30, 2024 | (dollars in thousands) |

| | | College 2042

Fund1 | | | College 2039

Fund | | | College 2036

Fund | | | College 2033

Fund | | | College 2030

Fund | |

| Investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Income: | | | | | | | | | | | | | | | | | | | | |

| Dividends from affiliated issuers | | $ | 2 | | | $ | 9,693 | | | $ | 31,222 | | | $ | 49,903 | | | $ | 71,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| Fees and expenses2: | | | | | | | | | | | | | | | | | | | | |

| Distribution services | | | 2 | | | | 1,272 | | | | 2,656 | | | | 3,422 | | | | 4,369 | |

| Transfer agent services | | | 1 | | | | 459 | | | | 1,167 | | | | 1,587 | | | | 2,005 | |

| 529 plan services | | | — | 3 | | | 245 | | | | 611 | | | | 823 | | | | 1,037 | |

| Reports to shareholders | | | — | | | | 12 | | | | 30 | | | | 42 | | | | 53 | |

| Registration statement and prospectus | | | — | | | | 60 | | | | 81 | | | | 93 | | | | 102 | |

| Trustees’ compensation | | | — | 3 | | | 2 | | | | 5 | | | | 7 | | | | 9 | |

| Auditing and legal | | | — | | | | 1 | | | | 3 | | | | 4 | | | | 5 | |

| Custodian | | | — | | | | 1 | | | | 3 | | | | 3 | | | | 5 | |

| Other | | | — | | | | 1 | | | | 3 | | | | 4 | | | | 5 | |

| Total fees and expenses before waivers | | | 3 | | | | 2,053 | | | | 4,559 | | | | 5,985 | | | | 7,590 | |

| Less waivers of fees and expenses: | | | | | | | | | | | | | | | | | | | | |

| Transfer agent services waivers | | | — | | | | — | 3 | | | — | 3 | | | — | 3 | | | — | 3 |

| Total fees and expenses after waivers | | | 3 | | | | 2,053 | | | | 4,559 | | | | 5,985 | | | | 7,590 | |

| Net investment income (loss) | | | (1 | ) | | | 7,640 | | | | 26,663 | | | | 43,918 | | | | 63,410 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net realized gain (loss) and unrealized appreciation (depreciation): | | | | | | | | | | | | | | | | | | | | |

| Net realized gain (loss) on sale of investments in affiliated issuers | | | — | | | | — | | | | — | | | | 113 | | | | 7,411 | |

| Capital gain distributions received from affiliated issuers | | | — | | | | 16,990 | | | | 37,224 | | | | 28,796 | | | | 17,375 | |

| | | | — | | | | 16,990 | | | | 37,224 | | | | 28,909 | | | | 24,786 | |

| Net unrealized appreciation (depreciation) on investments in affiliated issuers | | | (253 | ) | | | 106,153 | | | | 247,017 | | | | 261,861 | | | | 241,526 | |

| Net realized gain (loss) and unrealized appreciation (depreciation) | | | (253 | ) | | | 123,143 | | | | 284,241 | | | | 290,770 | | | | 266,312 | |

| Net increase (decrease) in net assets resulting from operations | | $ | (254 | ) | | $ | 130,783 | | | $ | 310,904 | | | $ | 334,688 | | | $ | 329,722 | |

Refer to the end of the statements of operations for footnotes.

Refer to the notes to financial statements.

| American Funds College Target Date Series | 19 |

| Financial statements (continued) | unaudited |

| | |

Statements of operations

for the six months ended April 30, 2024 (continued) | (dollars in thousands) |

| | | College 2027

Fund | | | College

Enrollment

Fund | |

| Investment income (loss): | | | | | | | | |

| Income: | | | | | | | | |

| Dividends from affiliated issuers | | $ | 63,263 | | | $ | 41,372 | |

| | | | | | | | | |

| Fees and expenses2: | | | | | | | | |

| Distribution services | | | 3,882 | | | | 2,734 | |

| Transfer agent services | | | 1,719 | | | | 1,131 | |

| 529 plan services | | | 893 | | | | 617 | |

| Reports to shareholders | | | 46 | | | | 24 | |

| Registration statement and prospectus | | | 86 | | | | 21 | |

| Trustees’ compensation | | | 7 | | | | 5 | |

| Auditing and legal | | | 5 | | | | 2 | |

| Custodian | | | 4 | | | | 2 | |

| Other | | | 4 | | | | 2 | |

| Total fees and expenses before waivers | | | 6,646 | | | | 4,538 | |

| Less waivers of fees and expenses: | | | | | | | | |

| Transfer agent services waivers | | | — | 3 | | | — | 3 |

| Total fees and expenses after waivers | | | 6,646 | | | | 4,538 | |

| Net investment income (loss) | | | 56,617 | | | | 36,834 | |

| | | | | | | | | |

| Net realized gain (loss) and unrealized appreciation (depreciation): | | | | | | | | |

| Net realized gain (loss) on sale of investments in affiliated issuers | | | 6,332 | | | | (7,585 | ) |

| Capital gain distributions received from affiliated issuers | | | 7,828 | | | | 2,392 | |

| | | | 14,160 | | | | (5,193 | ) |

| Net unrealized appreciation (depreciation) on investments in affiliated issuers | | | 138,270 | | | | (166,712 | ) |

| Net realized gain (loss) and unrealized appreciation (depreciation) | | | 152,430 | | | | (171,905 | ) |

| Net increase (decrease) in net assets resulting from operations | | $ | 209,047 | | | $ | (135,071 | ) |

| 1 | For the period March 15, 2024, commencement of operations, through April 30, 2024. |

| 2 | Additional information related to class-specific fees and expenses is included in the notes to financial statements. |

| 3 | Amount less than one thousand. |

Refer to the notes to financial statements.

| 20 | American Funds College Target Date Series |

| Financial statements (continued) | |

| | |

| Statements of changes in net assets | (dollars in thousands) |

| | | College 2042 Fund | | | College 2039 Fund | | | College 2036 Fund | |

| | | Period ended

April 30,

20241,2 | | | Six months

ended

April 30,

20242 | | | Year ended

October 31,

2023 | | | Six months

ended

April 30,

20242 | | | Year ended

October 31,

2023 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | (1 | ) | | $ | 7,640 | | | $ | 5,075 | | | $ | 26,663 | | | $ | 28,373 | |

| Net realized gain (loss) | | | — | | | | 16,990 | | | | 3,791 | | | | 37,224 | | | | (11,421 | ) |

| Net unrealized appreciation (depreciation) | | | (253 | ) | | | 106,153 | | | | 14,421 | | | | 247,017 | | | | 95,169 | |

| Net increase (decrease) in net assets resulting from operations | | | (254 | ) | | | 130,783 | | | | 23,287 | | | | 310,904 | | | | 112,121 | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions paid to shareholders | | | — | | | | (12,777 | ) | | | (8,161 | ) | | | (35,906 | ) | | | (65,538 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net capital share transactions | | | 15,567 | | | | 248,136 | | | | 334,390 | | | | 223,415 | | | | 364,389 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total increase (decrease) in net assets | | | 15,313 | | | | 366,142 | | | | 349,516 | | | | 498,413 | | | | 410,972 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets: | | | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | — | | | | 628,870 | | | | 279,354 | | | | 1,789,756 | | | | 1,378,784 | |

| End of period | | $ | 15,313 | | | $ | 995,012 | | | $ | 628,870 | | | $ | 2,288,169 | | | $ | 1,789,756 | |

| | | College 2033 Fund | | | College 2030 Fund | | | College 2027 Fund | |

| | | Six months

ended

April 30,

20242 | | | Year ended

October 31,

2023 | | | Six months

ended

April 30,

20242 | | | Year ended

October 31,

2023 | | | Six months

ended

April 30,

20242 | | | Year ended

October 31,

2023 | |

| Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 43,918 | | | $ | 59,928 | | | $ | 63,410 | | | $ | 98,867 | | | $ | 56,617 | | | $ | 93,222 | |

| Net realized gain (loss) | | | 28,909 | | | | (27,032 | ) | | | 24,786 | | | | (42,749 | ) | | | 14,160 | | | | (21,043 | ) |

| Net unrealized appreciation (depreciation) | | | 261,861 | | | | 77,750 | | | | 241,526 | | | | 15,480 | | | | 138,270 | | | | (41,053 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 334,688 | | | | 110,646 | | | | 329,722 | | | | 71,598 | | | | 209,047 | | | | 31,126 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions paid to shareholders | | | (67,762 | ) | | | (97,514 | ) | | | (104,891 | ) | | | (119,272 | ) | | | (95,850 | ) | | | (89,087 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net capital share transactions | | | 226,734 | | | | 379,677 | | | | 254,993 | | | | 375,848 | | | | 221,928 | | | | 311,526 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total increase (decrease) in net assets | | | 493,660 | | | | 392,809 | | | | 479,824 | | | | 328,174 | | | | 335,125 | | | | 253,565 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | 2,516,703 | | | | 2,123,894 | | | | 3,255,219 | | | | 2,927,045 | | | | 2,858,987 | | | | 2,605,422 | |

| End of period | | $ | 3,010,363 | | | $ | 2,516,703 | | | $ | 3,735,043 | | | $ | 3,255,219 | | | $ | 3,194,112 | | | $ | 2,858,987 | |

Refer to the end of the statements of changes in net assets for footnotes.

Refer to the notes to financial statements.

| American Funds College Target Date Series | 21 |

| Financial statements (continued) | |

| | |

| Statements of changes in net assets (continued) | (dollars in thousands) |

| | | College Enrollment Fund | |

| | | Six months

ended

April 30,

20242 | | | Year ended

October 31,

2023 | |

| Operations: | | | | | | | | |

| Net investment income (loss) | | $ | 36,834 | | | $ | 60,063 | |

| Net realized gain (loss) | | | (5,193 | ) | | | (69,802 | ) |

| Net unrealized appreciation (depreciation) | | | (166,712 | ) | | | 49,932 | |

| Net increase (decrease) in net assets resulting from operations | | | (135,071 | ) | | | 40,193 | |

| | | | | | | | | |

| Distributions paid to shareholders | | | (56,609 | ) | | | (45,828 | ) |

| | | | | | | | | |

| Net capital share transactions | | | 2,812,401 | | | | (476,616 | ) |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 2,620,721 | | | | (482,251 | ) |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 1,637,712 | | | | 2,119,963 | |

| End of period | | $ | 4,258,433 | | | $ | 1,637,712 | |

| 1 | For the period March 14, 2024, commencement of operations, through April 30, 2024. |

| 2 | Unaudited. |

Refer to the notes to financial statements.

| 22 | American Funds College Target Date Series |

| Notes to financial statements | unaudited |

1. Organization