| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-227446-05 | ||

|  |

MSC 2019-H7

Free Writing Prospectus

Structural and Collateral Term Sheet

$746,987,515

(Approximate Total Mortgage Pool Balance)

$653,614,000

(Approximate Offered Certificates)

Morgan Stanley Capital I Inc.

as Depositor

Argentic Real Estate Finance LLC

Morgan Stanley Mortgage Capital Holdings LLC

Starwood Mortgage Capital LLC

Cantor Commercial Real Estate Lending, L.P.

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2019-H7

July 9, 2019

| MORGAN STANLEY Co-Lead Bookrunning Manager | Cantor Fitzgerald & Co. Co-Lead Bookrunning Manager | |

The Williams Capital Group, L.P. Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the SEC (File No. 333-227446) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC web site atwww.sec.gov. Alternatively, the depositor or any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free 1-866-718-1649 or by email toprospectus@ms.com.

This is not a research report and was not prepared by any Underwriter’s research department. It was prepared by the Underwriters’ sales, trading, banking or other non-research personnel. Please see additional important information and qualifications at the end of this Term Sheet.

| MSC 2019-H7 |

Neither this Term Sheet nor anything contained herein shall form the basis for any contract or commitment whatsoever.The information contained herein is preliminary as of the date hereof.This Term Sheet is subject to change, completion or amendment from time to time.The information contained herein will be superseded by similar information delivered to you as part of the Preliminary Prospectus.The information contained herein supersedes any such information previously delivered.The information contained herein should be reviewed only in conjunction with the entire Preliminary Prospectus.All of the information contained herein is subject to the same limitations and qualifications contained in the Preliminary Prospectus.The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties.Such information is described in the Preliminary Prospectus.The information contained herein will be more fully described in the Preliminary Prospectus.The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value.Prior to making any investment decision, prospective investors are strongly urged to read the Preliminary Prospectus in its entirety.Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Term Sheet is truthful or complete.Any representation to the contrary is a criminal offense.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, the email communication to which this Term Sheet may have been attached are not applicable to this Term Sheet and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this Term Sheet having been sent via Bloomberg or another email system.

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

THE ASSET-BACKED SECURITIES REFERRED TO IN THIS TERM SHEET ARE BEING OFFERED WHEN, AS AND IF ISSUED. IN PARTICULAR, YOU ARE ADVISED THAT THE ASSET-BACKED SECURITIES, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING, AMONG OTHER THINGS, THE POSSIBILITY THAT ONE OR MORE CLASSES OF SECURITIES MAY BE SPLIT, COMBINED OR ELIMINATED), AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS. AS A RESULT, YOU MAY COMMIT TO PURCHASE SECURITIES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND YOU ARE ADVISED THAT ALL OR A PORTION OF THE SECURITIES MAY NOT BE ISSUED THAT HAVE THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. OUR OBLIGATION TO SELL SECURITIES TO YOU IS CONDITIONED ON THE SECURITIES AND THE UNDERLYING TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. IF WE DETERMINE THAT THE FOREGOING CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, WE WILL NOTIFY YOU, AND NEITHER THE ISSUING ENTITY NOR ANY UNDERWRITER WILL HAVE ANY OBLIGATION TO YOU TO DELIVER ALL OR ANY PORTION OF THE SECURITIES WHICH YOU HAVE COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY BETWEEN US AS A CONSEQUENCE OF THE NON-DELIVERY.

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-2

| MSC 2019-H7 |

Offered Certificates

| Class | Expected Ratings (Fitch/KBRA/S&P)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(4) | Expected Principal Window (Months)(4) | Certificate Principal UW NOI Debt Yield(5) | Certificate Principal to Value Ratio(6) | |||||||||

| Class A-1 | AAAsf/AAA(sf)/AAA(sf) | $19,200,000 | 30.000% | (7) | 2.83 | 1 – 59 | 15.1% | 41.7% | |||||||||

| Class A-2 | AAAsf/AAA(sf)/AAA(sf) | $29,900,000 | 30.000% | (7) | 4.92 | 59 – 60 | 15.1% | 41.7% | |||||||||

| Class A-SB | AAAsf/AAA(sf)/AAA(sf) | $26,600,000 | 30.000% | (7) | 7.37 | 60 – 115 | 15.1% | 41.7% | |||||||||

| Class A-3 | AAAsf/AAA(sf)/AAA(sf) | (8) | 30.000% | (7) | (8) | (8) | 15.1% | 41.7% | |||||||||

| Class A-4 | AAAsf/AAA(sf)/AAA(sf) | (8) | 30.000% | (7) | (8) | (8) | 15.1% | 41.7% | |||||||||

| Class X-A | AAAsf/AAA(sf)/AAA(sf) | $522,891,000 | (9) | N/A | Variable(10) | N/A | N/A | N/A | N/A | ||||||||

| Class X-B | A-sf/AAA(sf)/NR | $130,723,000 | (9) | N/A | Variable(10) | N/A | N/A | N/A | N/A | ||||||||

| Class A-S | AAAsf/AAA(sf)/AA-(sf) | $62,560,000 | 21.625% | (7) | 9.97 | 120 – 120 | 13.5% | 46.7% | |||||||||

| Class B | AA-sf/AA(sf)/NR | $33,614,000 | 17.125% | (7) | 9.97 | 120 – 120 | 12.8% | 49.4% | |||||||||

| Class C | A-sf/A(sf)/NR | $34,549,000 | 12.500% | (7) | 9.97 | 120 – 120 | 12.1% | 52.1% | |||||||||

Privately Offered Certificates(11)

| Class | Expected Ratings (Fitch/KBRA/S&P)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(4) | Expected Principal Window (Months)(4) | Certificate Principal UW NOI Debt Yield(5) | Certificate Principal to Value Ratio(6) | |||||||||

| Class X-D(12) | BBBsf/BBB+(sf)/NR | $15,873,000 | (9) | N/A | Variable(10) | N/A | N/A | N/A | N/A | ||||||||

| Class D(12) | BBBsf/BBB+(sf)/NR | $15,873,000 | 10.375% | (7) | 9.97 | 120 – 120 | 11.8% | 53.4% | |||||||||

| Class E-RR(12) | BBB-sf/BBB-(sf)/NR | $22,410,000 | 7.375% | (7) | 9.97 | 120 – 120 | 11.4% | 55.2% | |||||||||

| Class F-RR | BB-sf/BB(sf)/NR | $17,741,000 | 5.000% | (7) | 9.97 | 120 – 120 | 11.2% | 56.6% | |||||||||

| Class G-RR | B-sf/B+(sf)/NR | $8,403,000 | 3.875% | (7) | 9.97 | 120 – 120 | 11.0% | 57.3% | |||||||||

| Class H-RR | NR/NR/NR | $28,946,514 | 0.000% | (7) | 9.97 | 120 – 120 | 10.6% | 59.6% | |||||||||

| (1) | Ratings shown are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”) and S&P Global Ratings, a Standard & Poor’s Financial Services LLC business (“S&P”). Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated on or about July 9, 2019 (the “Preliminary Prospectus”). Capitalized terms used but not defined herein have the meanings assigned to such terms in the Preliminary Prospectus. |

| (2) | Approximate, subject to a permitted variance of plus or minus 5% or, in the case of the Class A-3, Class A-4, Class X-D, Class D and Class E-RR certificates, such greater percentages as are contemplated by footnotes (8) and (12) below. In addition, the notional amounts of the Class X-A, Class X-B and Class X-D certificates may vary depending upon the final pricing of the classes of principal balance certificates whose certificate balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any class of the Class X-A, Class X-B or Class X-D certificates, as applicable, would be equal to zero at all times, such class of certificates will not be issued on the closing date of this securitization. |

| (3) | The approximate initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates, are represented in the aggregate. |

| (4) | The Expected Weighted Average Life and Expected Principal Window during which distributions of principal would be received as set forth in the foregoing table with respect to each class of certificates having a certificate balance are based on the assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans. |

| (5) | Certificate Principal UW NOI Debt Yield for any class of principal balance certificates is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial certificate balance of all the principal balance certificates, and the denominator of which is the total initial certificate balance of the subject class of principal balance certificates and all other classes of principal balance certificates, if any, that are senior to such class. The Certificate Principal UW NOI Debt Yields of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | Certificate Principal to Value Ratio for any class of principal balance certificates is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial certificate balance of the subject class of principal balance certificates and all other classes of principal balance certificates, if any, that are senior to such class, and the denominator of which is the total initial certificate balance of all the principal balance certificates. The Certificate Principal to Value Ratios of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates are calculated in the aggregate for those classes as if they were a single class. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-3

| MSC 2019-H7 |

| (7) | The pass-through rate for each class of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates (collectively referred to as the “principal balance certificates”) will be one of the following: (i) a fixed rateper annum, (ii) a variable rateper annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rateper annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rateper annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the net mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The exact initial certificate balances of the Class A-3 and Class A-4 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the initial certificate balances, weighted average lives and principal windows of the Class A-3 and Class A-4 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-3 and Class A-4 certificates is expected to be approximately $447,191,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of Initial | Expected Range | Expected Range of |

| Class A-3 | $100,000,000 – $205,000,000 | 9.75 – 9.80 | 115 – 118 / 115 – 119 |

| Class A-4 | $242,191,000 – $347,191,000 | 9.91 – 9.93 | 118 – 120 / 119 – 120 |

| (9) | The Class X-A, Class X-B and Class X-D certificates (collectively referred to as the “Class X certificates”) are notional amount certificates and will not be entitled to distributions of principal. The notional amount of the Class X-A certificates will be equal to the aggregate certificate balance of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates. The notional amount of the Class X-B certificates will be equal to the aggregate certificate balance of the Class A-S, Class B and Class C certificates. The notional amount of the Class X-D certificates will be equal to the certificate balance of the Class D certificates. If the certificate balance of a class of principal balance certificates constitutes all or part of the notional amount of a class of Class X certificates, then such class of principal balance certificates constitutes “an underlying class of principal balance certificates” for such class of Class X certificates. |

| (10) | The pass-through rate for the Class X-A certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates for the related distribution date, weighted on the basis of their respective certificate balances outstanding immediately prior to that distribution date. The pass-through rate for the Class X-B certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, Class B and Class C certificates for the related distribution date, weighted on the basis of their respective certificate balances outstanding immediately prior to that distribution date. The pass-through rate for the Class X-D certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class D certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the net mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (11) | Not offered pursuant to the Preliminary Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates is provided only to enhance your understanding of the offered certificates. The privately offered certificates also include the Class V and Class R certificates, which do not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date, and which are not shown in the chart. The Class V certificates represent a beneficial ownership interest held through the grantor trust in certain excess interest in respect of mortgage loans having anticipated repayment dates, if any. The Class R certificates represent the beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, as further described in the Preliminary Prospectus. |

| (12) | The initial certificate balance of each class of the Class D and Class E-RR certificates and the initial notional amount of the Class X-D certificates are subject to change based on final pricing of all certificates (other than the Class R Certificates) and the final determination of the fair market value of the Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates (collectively, the “RR Certificates”), which will be retained by Argentic Real Estate Finance LLC, as “retaining sponsor”, or its “majority owned affiliate” (in each case as defined under Regulation RR) or other permitted transferee in satisfaction of the risk retention requirements. The initial certificate balance of the Class D certificates (and correspondingly, the initial notional amount of the Class X-D certificates) is expected to fall within a range of $13,632,000 to $18,114,000. The initial certificate balance of the Class E-RR certificates is expected to fall within a range of $20,169,000 to $24,651,000. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the RR Certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-4

| MSC 2019-H7 |

Issue Characteristics

| Offered Certificates: | $653,614,000 (approximate) monthly pay, multi-class, commercial mortgage pass-through certificates, consisting of eight principal balance classes (Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B and Class C) and two interest-only classes (Class X-A and Class X-B) |

| Co-Lead Bookrunning Managers: | Morgan Stanley & Co. LLC and Cantor Fitzgerald & Co. |

| Co-Manager: | The Williams Capital Group, L.P. |

| Mortgage Loan Sellers: | Argentic Real Estate Finance LLC, Morgan Stanley Mortgage Capital Holdings LLC, Starwood Mortgage Capital LLC and Cantor Commercial Real Estate Lending, L.P. |

| Rating Agencies: | Fitch, KBRA and S&P |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Special Servicer: | LNR Partners, LLC |

| Trustee/Certificate Administrator/ Certificate Registrar/Custodian: | Wells Fargo Bank, National Association |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| Initial Directing Certificateholder: | Argentic Securities Income USA LLC or an affiliate thereof |

| Credit Risk Retention: | Eligible horizontal residual interest |

| Cut-off Date: | The mortgage loans will be considered part of the trust fund as of their respective cut-off dates. The cut-off date with respect to each mortgage loan is the respective due date for the monthly debt service payment that is due in July 2019 (or, in the case of any mortgage loan that has its first due date after July 2019, the date that would have been its due date in July 2019 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Pricing Date: | Week of July 15, 2019 |

| Expected Closing Date: | On or about July 25, 2019 |

| Determination Dates: | The 11th day of each month or, if the 11th day is not a business day, then the business day immediately following such 11th day. |

| Distribution Dates: | The 4th business day following each determination date. The first distribution date will be in August 2019. |

| Rated Final Distribution Date: | The distribution date in July 2052 |

| Interest Accrual Period: | Preceding calendar month |

| Payment Structure: | Sequential pay |

| Tax Treatment: | REMIC |

| Optional Termination: | 1.00% clean-up call |

| Minimum Denominations: | $10,000 for each class of Offered Certificates (other than Class X-A and Class X-B certificates); $1,000,000 for the Class X-A and Class X-B certificates |

| Settlement Terms: | DTC, Euroclear and Clearstream |

| Legal/Regulatory Status: | Each class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No class of Offered Certificates is SMMEA eligible. |

| Analytics: | The certificate administrator is expected to make available all distribution date statements, CREFC® reports and supplemental notices received by it to certain modeling financial services as described in the Preliminary Prospectus. |

| Bloomberg Ticker: | MSC 2019-H7<MTGE><GO> |

| Risk Factors: | THE OFFERED CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-5

| MSC 2019-H7 |

Structural Overview

| Accrual: | Each class of Offered Certificates will accrue interest on a 30/360 basis. |

| Amount and Order of Distributions: | On each distribution date, funds available for distribution from the mortgage loans (which are net of specified expenses of the issuing entity, including fees payable to, and advances, costs and expenses reimbursable to, the master servicer, any primary servicer, the special servicer, the certificate administrator, the trustee, the operating advisor, the asset representations reviewer and CREFC®) other than (i) any yield maintenance charges and prepayment premiums and (ii) any excess interest distributable to the Class V certificates, will be distributed in the following amounts and order of priority:

First, to the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class X-A, Class X-B and Class X-D certificates, in respect of interest, up to an amount equal to, andpro rata in accordance with, the interest entitlements for those classes;

Second, to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates as follows, to the extent of funds allocated to principal and available for distribution: either (i)(a)first, to principal on the Class A-SB certificates, until the certificate balance of the Class A-SB certificates is reduced to the planned principal balance for the related distribution date set forth in Annex E to the Preliminary Prospectus, and (b)second, to principal on each class of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates, in that order, in each case until the certificate balance of such class of certificates has been reduced to zero, or (ii) if the certificate balance of each class of principal balance certificates other than the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates has been reduced to zero as a result of the allocation of losses on the mortgage loans to those certificates, to principal on the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates,pro rata, without regard to the distribution priorities described above or the planned principal balance of the Class A-SB certificates;

Third, to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates: (a)first, up to an amount equal to, andpro rata based on, any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by each such class, and (b)second, up to an amount equal to, andpro rata based on, interest on such unreimbursed losses previously allocated to each such class at the pass-through rate for such class from the date the related loss was allocated to such class;

Fourth, to each class of the Class A-S, Class B and Class C certificates, in that order, as follows: (a) to interest on such class of certificates in the amount of its interest entitlement; (b) to the extent of funds allocable to principal and available for distribution that remain after distributions in respect of principal to each class with a higher priority (as set forth in this clause or prior enumerated clauses set forth above), to principal on such class of certificates until its certificate balance has been reduced to zero; and (c) to reimburse such class of certificates,first, for any previously unreimbursed losses on the mortgage loans that were previously allocated to those certificates, andsecond, for interest on such unreimbursed losses at the pass-through rate for such class from the date the related loss was allocated to such class;

Fifth, to the Class D, Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates in the amounts and order of priority described in “Description of the Certificates—Distributions” in the Preliminary Prospectus; and

Sixth, to the Class R certificates, any remaining amounts.

|

| Interest and Principal Entitlements: | The interest entitlement of each class of Offered Certificates on each distribution date generally will be the interest accrued during the related interest accrual period on the related certificate balance or notional amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that class for such distribution date as described below. If prepayment interest shortfalls arise from voluntary prepayments on serviced mortgage loans during any collection period, the master servicer is required to make a limited compensating interest payment to offset those shortfalls. See “Description of the Certificates—Prepayment Interest Shortfalls” in the Preliminary Prospectus. The remaining amount of prepayment interest shortfalls will be allocated to reduce the interest entitlement on all classes of certificates (other than the Class V and Class R certificates),pro rata, based on their respective amounts of accrued interest for the related distribution date. If a class receives less than the entirety of its interest entitlement on any distribution date, then the shortfall (excluding any shortfall due to prepayment interest shortfalls), together with interest thereon, will be added to its interest entitlement for the next succeeding distribution date.

The principal distribution amount for each distribution date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any non-recoverable advances and interest thereon and any workout-delayed reimbursement amounts that are reimbursed to the master servicer or the trustee during the related collection period. Non-recoverable advances and interest thereon are reimbursable from principal collections before reimbursement from other amounts. Workout-delayed reimbursement amounts will be reimbursable from principal collections.

|

| Special Servicer Compensation: | The principal compensation to be paid to the special servicer in respect of its special servicing activities will be the special servicing fee, the workout fee and the liquidation fee.

The special servicing fee for each distribution date is calculated at the special servicing fee rate based on the outstanding principal balance of each mortgage loan (and any related companion loan) that is serviced under the pooling and servicing agreement for this securitization (a “serviced mortgage loan” and “serviced companion loan”, respectively) and that is being specially serviced or as to which the related mortgaged property has |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-6

| MSC 2019-H7 |

| become an REO property. The special servicing fee rate will be a rate equal to the greater of 0.25%per annum and theper annum rate that would result in a special servicing fee of $3,500 for the related month. The special servicing fee will be payable monthly,first, from liquidation proceeds, insurance and condemnation proceeds, and other collections in respect of the related specially serviced mortgage loan or REO property and,then, from general collections on all the mortgage loans and any REO properties.

The special servicer will also be entitled to (i) liquidation fees generally equal to 1.0% of liquidation proceeds and certain other collections in respect of a specially serviced mortgage loan (and any related serviced companion loan) or related REO property and of amounts received in respect of mortgage loan repurchases by the related mortgage loan sellers and (ii) workout fees generally equal to 1.0% of interest (other than post-ARD excess interest on mortgage loans with anticipated repayment dates and other than default interest) and principal payments made in respect of a rehabilitated mortgage loan (and any related serviced companion loan), in the case of each of clause (i) and (ii), subject to a cap of $1,000,000 and a floor of $25,000 with respect to any mortgage loan, whole loan or related REO property and subject to certain adjustments and exceptions as described in the Preliminary Prospectus under “Pooling and Servicing Agreement—Servicing and Other Compensation and Payment of Expenses—Special Servicing Compensation”.

With respect to any non-serviced mortgage loan, the related special servicer under the related other pooling and servicing agreement pursuant to which such mortgage loan is being serviced will be entitled to similar compensation as that described above with respect to such non-serviced mortgage loan under such other pooling and servicing agreement as further described in the Preliminary Prospectus, although any related fees may accrue at a different rate and there may be a higher (or no) cap on liquidation and workout fees. |

| Prepayment Premiums/Yield Maintenance Charges: | If any yield maintenance charge or prepayment premium is collected during any collection period with respect to any mortgage loan, then on the immediately succeeding distribution date, the certificate administrator will pay to the holders of each class of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C and Class D certificates the product of (a) the amount of such yield maintenance charge or prepayment premium (net of any liquidation fees payable therefrom), (b) the related Base Interest Fraction for such class and the applicable principal prepayment, and (c) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the total amount of principal distributed to all principal balance certificates (other than the Control Eligible Certificates) for that distribution date. Any portion of the yield maintenance charge or prepayment premium that is collected during any collection period with respect to any mortgage loan and remaining after the distributions in the preceding sentence (as to the applicable distribution date, the “Class X YM Distribution Amount”) will be distributed to the holders of the Class X certificates as follows: (1) first, to the Class X-A and Class X-B certificates, in the case of each such class in an amount equal to the product of (i) a fraction, the numerator of which is equal to the amount of principal distributed on the applicable distribution date with respect to the underlying class(es) of principal balance certificates whose certificate balance(s) comprise the notional amount of such class of Class X certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to the principal balance certificates, multiplied by (ii) the Class X YM Distribution Amount for the applicable distribution date, and (2) second, to the Class X-D certificates, in an amount equal to the portion of the Class X YM Distribution Amount remaining after the distributions to the holders of the Class X-A and Class X-B certificates. Notwithstanding any of the foregoing to the contrary, if at any time the certificate balances of the principal balance certificates (other than the Control Eligible Certificates) have been reduced to zero as a result of the allocation of principal payments on the mortgage loans, the certificate administrator will pay to the holders of each remaining class of principal balance certificates then entitled to distributions of principal on the subject distribution date the product of (a) any yield maintenance charge or prepayment premium distributable on the subject distribution date (net of any liquidation fees payable therefrom) and (b) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the total amount of principal distributed to all principal balance certificates for that distribution date. “Base Interest Fraction” means, with respect to any principal prepayment of any mortgage loan that provides for the payment of a yield maintenance charge or prepayment premium, and with respect to any class of principal balance certificates, a fraction (A) the numerator of which is the greater of (x) zero and (y) the difference between (i) the pass-through rate on that class, and (ii) the applicable discount rate and (B) the denominator of which is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate; provided, that: under no circumstances will the Base Interest Fraction be greater than one; if the discount rate referred to above is greater than or equal to both the mortgage interest rate on the related mortgage loan and the pass-through rate on that class, then the Base Interest Fraction will equal zero; and if the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan and is less than the pass-through rate on that class, then the Base Interest Fraction will be equal to 1.0. Consistent with the foregoing, the Base Interest Fraction is equal to: |

| (Pass-Through Rate – Discount Rate) | |||

| (Mortgage Rate – Discount Rate) |

| Realized Losses: | On each distribution date, immediately following the distributions to be made to the certificateholders on that date, the certificate administrator is required to calculate the amount, if any, by which (i) the aggregate stated principal balance of the mortgage loans, including any successor REO loans expected to be outstanding |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-7

| MSC 2019-H7 |

| immediately following that distribution date is less than (ii) the then aggregate certificate balance of the principal balance certificates after giving effect to distributions of principal on that distribution date (any such deficit, a “Realized Loss”), which amount will be applied to reduce the certificate balances of the Class H-RR, Class G-RR, Class F-RR, Class E-RR, Class D, Class C, Class B and Class A-S certificates, in that order, in each case until the related certificate balance has been reduced to zero, and then to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 certificates,pro rata, based upon their respective certificate balances, until their respective certificate balances have been reduced to zero. | |

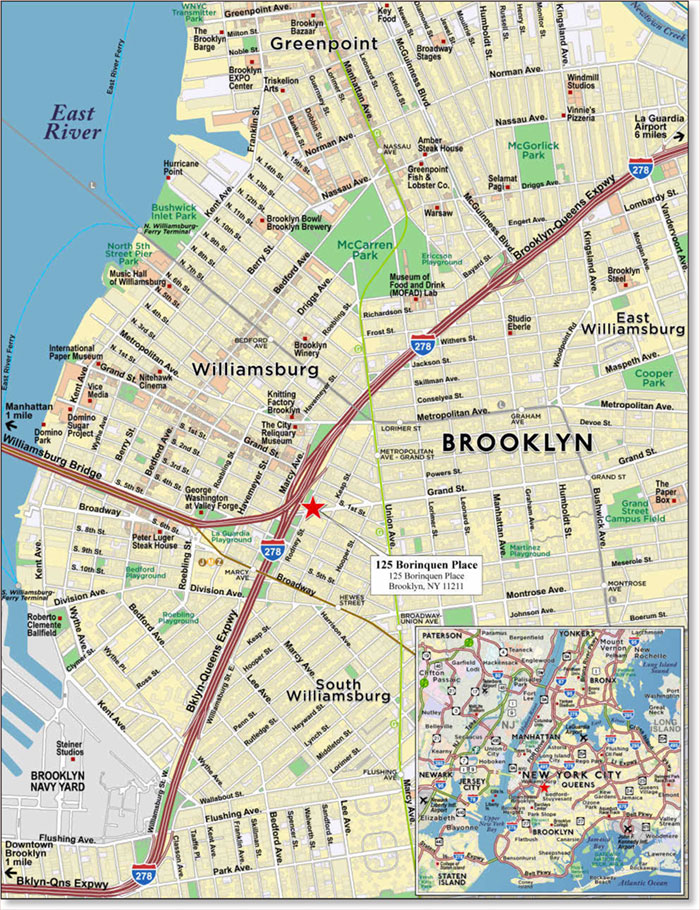

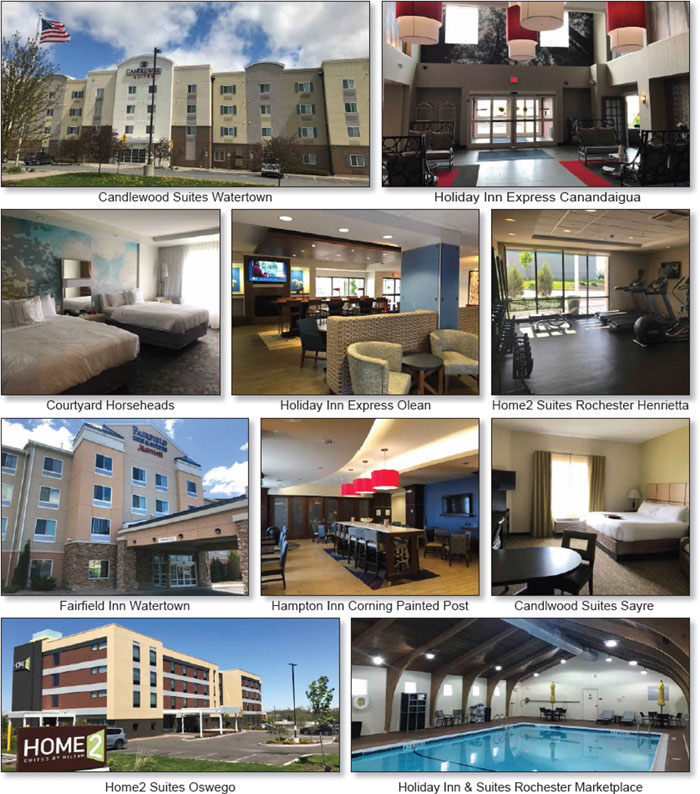

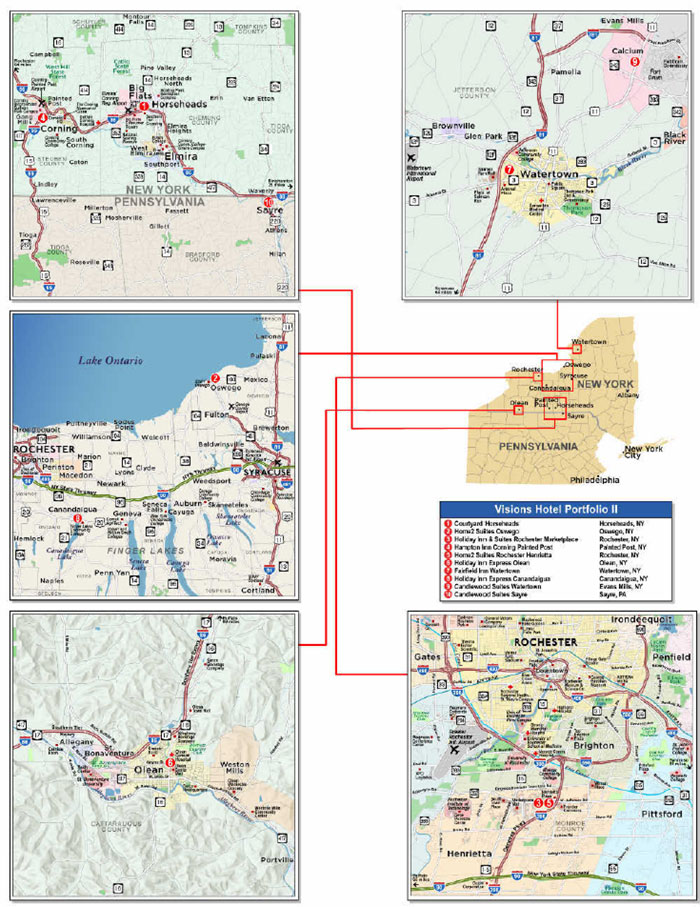

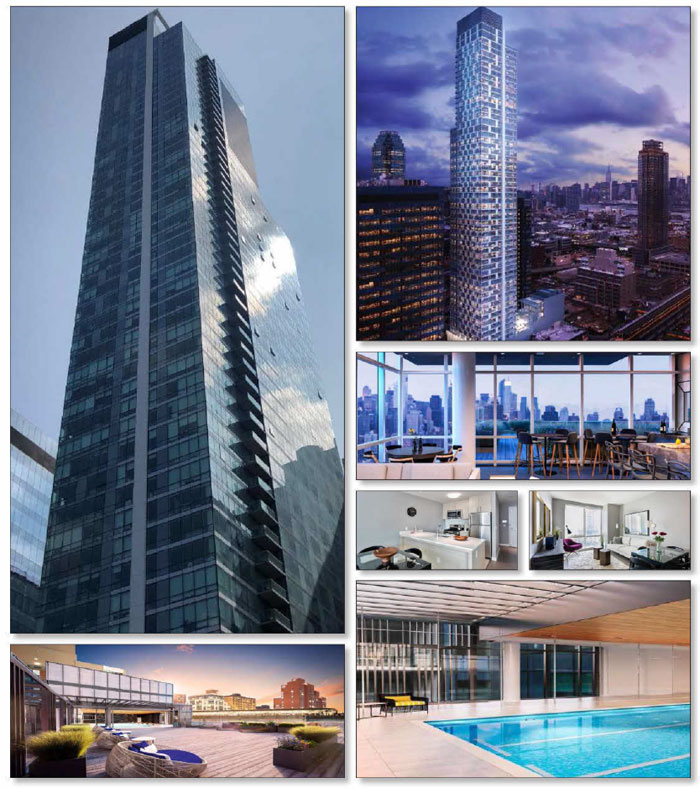

| Serviced Whole Loans: | Each of the following mortgaged properties or portfolio of mortgaged properties secures a mortgage loan and one or morepari passu promissory notes and, in some cases, one or more generally subordinate promissory notes (each suchpari passu or generally subordinate promissory note, a “serviced companion loan”) that will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement for this transaction: Grand Canal Shoppes, SoCal Retail Portfolio, Embassy Suites at Centennial Olympic Park, 125 Borinquen Place, Visions Hotel Portfolio II, Legacy Tower and Eleven Seventeen Perimeter (prior to the securitization of the related control note). With respect to each such mortgaged property or portfolio of mortgaged properties, the related mortgage loan, together with the related serviced companion loan(s), is referred to herein (for so long as it is serviced under the pooling and servicing agreement for this transaction) as a “serviced whole loan.” Each serviced companion loan is not part of the mortgage pool and may be contributed to one or more future securitization transactions (if not already securitized) or may be otherwise transferred at any time, subject to compliance with the related intercreditor agreement. See the tables below entitled “Mortgage Loans with Pari Passu Companion Loans” and“Mortgage Loans with Subordinate Debt” and “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus, for additional information regarding each such whole loan.

With respect to the Eleven Seventeen Perimeter whole loan (a “servicing shift whole loan”), the pooling and servicing agreement for this transaction will govern servicing of such whole loan until the securitization of the related control note; however, servicing of such whole loan will generally be directed by the holder of the related control note (which is not included in this securitization), and such holder will have the right to replace the special servicer with respect to the related whole loan with or without cause. After the securitization of the related control note, a servicing shift whole loan will cease to be a serviced whole loan and will be serviced pursuant to the pooling and servicing agreement for another securitization transaction (see “Non-Serviced Whole Loans” below). |

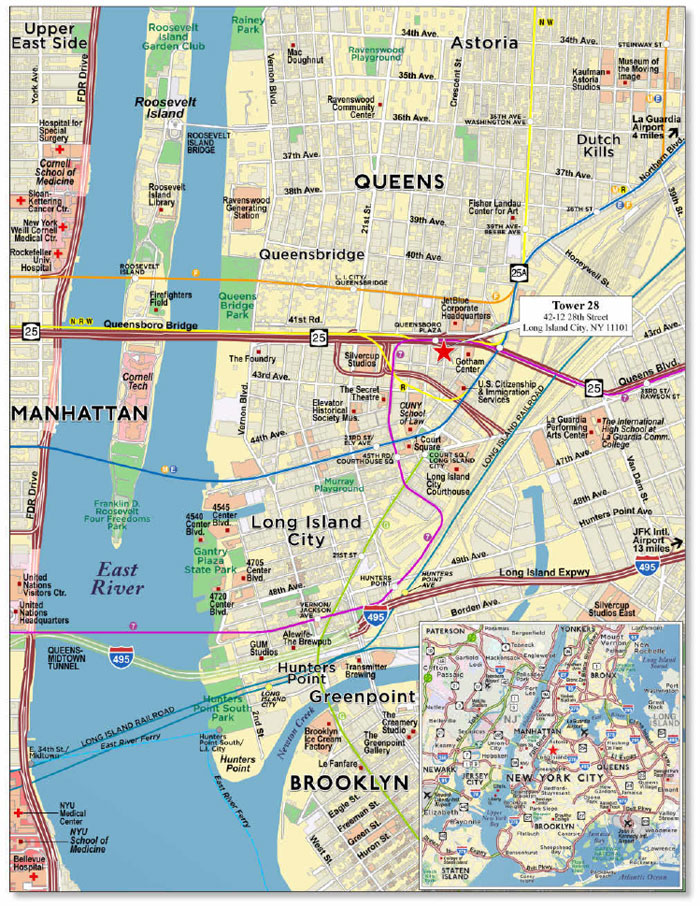

| Non-Serviced Whole Loans: | Each of the following mortgaged properties or portfolios of mortgaged properties secures a mortgage loan (each, a “non-serviced mortgage loan”), one or morepari passu promissory notes and, in some cases, one or more generally subordinate promissory notes (each suchpari passu or generally subordinate promissory note, a “non-serviced companion loan”) that will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement or trust and servicing agreement (referred to herein as a related “pooling and servicing agreement”) for another securitization transaction: Tower 28, FedEx Niles, 3 Columbus Circle, Eleven Seventeen Perimeter (on and after the securitization of the related control note) and AC by Marriott San Jose. With respect to each such mortgaged property, the related mortgage loan, together with the related non-serviced companion loan(s), is referred to herein (for so long as it is serviced under the pooling and servicing agreement for another securitization transaction) as a “non-serviced whole loan.” Each non-serviced companion loan is not part of the mortgage pool and may be contributed to one or more future securitization transactions (if not already securitized) or may be otherwise transferred at any time, subject to compliance with the related intercreditor agreement. Servicing of each non-serviced whole loan will generally be directed by the holder of the related control note (or, if such control note is included in a securitization, the directing certificateholder thereunder (or other party designated to exercise the rights of such control note)), and such holder will have the right to replace the special servicer with respect to the related whole loan with or without cause. See the table below entitled “Mortgage Loans with Pari Passu Companion Loans” and“Mortgage Loans with Subordinate Debt” and “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus for additional information regarding each such whole loan. |

| Directing Certificateholder/ Controlling Class: | The initial Directing Certificateholder is expected to be Argentic Securities Income USA LLC or an affiliate thereof.

The “Directing Certificateholder” will be the Controlling Class Certificateholder (or its representative) selected by more than 50% (by certificate balance) of the Controlling Class Certificateholders;provided, that (1) absent that selection, (2) until a Directing Certificateholder is so selected or (3) upon receipt of a notice from a majority of the Controlling Class Certificateholders (by certificate balance) that a Directing Certificateholder is no longer designated, the Controlling Class Certificateholder that owns the largest aggregate certificate balance of the Controlling Class (or its representative) will be the Directing Certificateholder;provided, that (i) if such holder elects or has elected to not be the Directing Certificateholder, the holder of the next largest aggregate certificate balance of the Controlling Class will be the Directing Certificateholder, (ii) in the event no one holder owns the largest aggregate certificate balance of the Controlling Class, then there will be no Directing Certificateholder until appointed in accordance with the terms of the pooling and servicing agreement, and (iii) the certificate administrator and the other parties to the pooling and servicing agreement will be entitled to assume that the identity of the Directing Certificateholder has not changed until such parties receive written notice of a replacement of the Directing Certificateholder from a party holding the requisite interest in the Controlling Class (as confirmed by the certificate registrar) or the resignation of the then current Directing Certificateholder. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-8

| MSC 2019-H7 |

The “Controlling Class” will be, as of any time of determination, the most subordinate class of Control Eligible Certificates then outstanding that has an aggregate certificate balance (as notionally reduced by any Cumulative Appraisal Reduction Amounts (as defined below)) at least equal to 25% of the initial certificate balance thereof; provided, that if at any time the certificate balances of the principal balance certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans, then the Controlling Class will be the most subordinate class of Control Eligible Certificates that has a certificate balance greater than zero without regard to the application of any Cumulative Appraisal Reduction Amounts. The Controlling Class as of the closing date will be the Class H-RR certificates.

The “Control Eligible Certificates” will be any of the Class E-RR, Class F-RR, Class G-RR and Class H-RR certificates. |

| Control Rights: | Prior to a Control Termination Event, the Directing Certificateholder will have certain consent and consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Control Termination Event” will occur when the most senior class of Control Eligible Certificates has a certificate balance (taking into account the application of any Cumulative Appraisal Reduction Amounts to notionally reduce the certificate balance thereof) of less than 25% of the initial certificate balance thereof; provided, that a Control Termination Event will be deemed not continuing in the event that the certificate balances of the principal balance certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans.

After the occurrence of a Control Termination Event but prior to the occurrence of a Consultation Termination Event, the Directing Certificateholder will not have any consent rights, but the Directing Certificateholder will have certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Consultation Termination Event” will occur when there is no class of Control Eligible Certificates that has a then outstanding certificate balance at least equal to 25% of the initial certificate balance of that class, in each case, without regard to the application of any Cumulative Appraisal Reduction Amounts; provided, that a Consultation Termination Event will be deemed not continuing in the event that the certificate balances of the principal balance certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans.

After the occurrence of a Consultation Termination Event, the Directing Certificateholder will not have any consent or consultation rights, except with respect to any rights expressly set forth in the pooling and servicing agreement, and the operating advisor will be entitled to exercise certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters.

Notwithstanding any proviso to, or other contrary provision in, the definitions of “Control Termination Event,” “Consultation Termination Event” and “Operating Advisor Consultation Event,” a Control Termination Event, a Consultation Termination Event and an Operating Advisor Consultation Event will be deemed to have occurred with respect to any Excluded DCH Loan, and neither the Directing Certificateholder nor any Controlling Class Certificateholder will have any consent or consultation rights with respect to the servicing of such Excluded DCH Loan.

An “Excluded DCH Loan” is a mortgage loan or whole loan with respect to which the Directing Certificateholder or the holder of the majority of the Controlling Class is a Borrower Party. It is expected that there will be no Excluded DCH Loans as of the closing date with respect to this securitization.

“Borrower Party” means a borrower, a manager of a mortgaged property, an Accelerated Mezzanine Loan Lender or any Borrower Party Affiliate.

“Borrower Party Affiliate” means, with respect to a borrower, a manager of a mortgaged property or an Accelerated Mezzanine Loan Lender, (a) any other person or entity controlling or controlled by or under common control with such borrower, manager or Accelerated Mezzanine Loan Lender, as applicable, or (b) any other person or entity owning, directly or indirectly, 25% or more of the beneficial interests in such borrower, manager or Accelerated Mezzanine Loan Lender, as applicable. For the purposes of this definition, “control” when used with respect to any specified person or entity means the power to direct the management and policies of such person or entity, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Accelerated Mezzanine Loan Lender” means a mezzanine lender under a mezzanine loan that has been accelerated or as to which foreclosure or enforcement proceedings have been commenced against the equity collateral pledged to secure such mezzanine loan.

Notwithstanding any of the foregoing to the contrary, if any mortgage loan is part of a whole loan, the Directing Certificateholder’s consent and/or consultation rights with respect thereto may be limited as described in the Preliminary Prospectus. In particular, with respect to each non-serviced whole loan and any servicing shift whole loan, the Directing Certificateholder will only have certain consultation rights with respect to certain major decisions and other matters related to such whole loan, in each case only prior to a Control Termination Event (and, in the case of any such whole loan with a subordinate companion loan, only if the holder of such subordinate companion loan is no longer the controlling noteholder), and the holder of the related control note (or, if such control note has been securitized, the directing certificateholder with respect to such securitization or other designated party under the related pooling and servicing agreement) will be entitled to similar consent and/or consultation rights with respect to such whole loan. With respect to any serviced A/B whole loan, for so long as the holder of the related subordinate companion loan is the controlling note holder, the holder of such subordinate companion loan (in lieu of the Directing Certificateholder) will be entitled to exercise such consent and consultation rights with respect to such whole loan. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-9

| MSC 2019-H7 |

| Appraisal Reduction Amounts and Collateral Deficiency Amounts: |

An “Appraisal Reduction Amount” generally will be created in the amount, if any, by which the principal balance of a required appraisal loan (which is a mortgage loan with respect to which certain defaults, modifications or insolvency events have occurred as further described in the Preliminary Prospectus) plus other amounts overdue or advanced in connection with such mortgage loan exceeds 90% of the appraised value of the related mortgaged property plus certain escrows and reserves (including letters of credit) held with respect to the mortgage loan.

A mortgage loan will cease to be subject to an Appraisal Reduction Amount when it has been brought current for at least three consecutive months, no additional event of default is foreseeable in the reasonable judgment of the special servicer and no other circumstances exist that would cause such mortgage loan or any related companion loan to be a specially serviced mortgage loan; however, a “Collateral Deficiency Amount” may exist with respect to any mortgage loan that is modified into an AB loan structure (an “AB Modified Loan”) and remains a rehabilitated mortgage loan and, if so, will generally equal the excess of (i) the stated principal balance of such AB Modified Loan (taking into account the related junior note(s) and anypari passu notes included therein, as well as any equity interests or other obligations senior to such junior notes), over (ii) the sum of (in the case of a whole loan, solely to the extent allocable to the subject mortgage loan) (x) the most recent appraised value for the related mortgaged property or mortgaged properties plus (y) solely to the extent not reflected or taken into account in such appraised value and to the extent on deposit with, or otherwise under the control of, the lender (or otherwise on deposit with a party acceptable to the lender or expended for the benefit of the mortgaged property or the mortgage loan at the time the mortgage loan became subject of a workout and became (and as part of the modification related to) such AB Modified Loan) as of the date of such determination, any capital or additional collateral contributed by the related borrower at the time the mortgage loan became the subject of a workout and became (and as part of the modification related to) such AB Modified Loan for the benefit of the related mortgaged property or mortgaged properties (provided, that in the case of a non-serviced mortgage loan, the amounts set forth in this clause (y) will be taken into account solely to the extent relevant information is received by the special servicer), plus (z) any other escrows or reserves (in addition to any amounts set forth in the immediately preceding clause (y)) held by the lender in respect of such AB Modified Loan as of the date of such determination.

As used herein, a “Cumulative Appraisal Reduction Amount” will be, as of any date of determination, the sum of (i) with respect to any Mortgage Loan, any Appraisal Reduction Amount then in effect, and (ii) with respect to any AB Modified Loan, any Collateral Deficiency Amount then in effect.

Any Appraisal Reduction Amount in respect of any non-serviced mortgage loan generally will be calculated in accordance with the other servicing agreement pursuant to which such mortgage loan is being serviced, which calculations are expected to be generally similar to those provided for in the pooling and servicing agreement for this transaction.

If any mortgage loan is part of a whole loan, any Appraisal Reduction Amount or Collateral Deficiency Amount will (or effectively will) be calculated in respect of such whole loan taken as a whole and allocated, to the extent provided in the related intercreditor agreement and the related pooling and servicing agreement,first, to any related subordinate companion loan(s) until the principal balance(s) thereof has been notionally reduced to zero, andsecond, to the related mortgage loan and anypari passu companion loan(s) on apro rata basis by unpaid principal balance.

Appraisal Reduction Amounts in respect of, or allocable to, any mortgage loan will proportionately reduce the interest portion of debt service advances required to be made in respect of such mortgage loan. Appraisal Reduction Amounts and Collateral Deficiency Amounts will be taken into account in determining the identity of the controlling class entitled to appoint the Directing Certificateholder, the existence of a Control Termination Event or an Operating Advisor Consultation Event and the allocation and/or exercise of voting rights for certain purposes (see“—Directing Certificateholder/Controlling Class” above).

|

| Appraised-Out Class: | An “Appraised-Out Class” is any class of Control Eligible Certificates, the certificate balance of which (taking into account the application of any Appraisal Reduction Amounts or Collateral Deficiency Amounts to notionally reduce the certificate balance of such class) has been reduced to less than 25% of its initial certificate balance. Any Appraised-Out Class may not exercise any direction, control, consent and/or similar rights of the Controlling Class until such time, if any, as such class is reinstated as the Controlling Class, and the rights of the Controlling Class will be exercised by the most subordinate class of Control Eligible Certificates that is not an Appraised-Out Class, if any, during such period. |

| Appraisal Remedy: | The holders of the majority (by certificate balance) of an Appraised-Out Class (such holders, the “Requesting Holders”) will have the right, at their sole expense, to require the special servicer to order (or, with respect to a non-serviced mortgage loan, require the master servicer to request from the applicable outside special servicer) a second appraisal of any mortgage loan (or serviced whole loan) for which an appraisal reduction event has occurred or as to which there exists a Collateral Deficiency Amount. With respect to any serviced mortgage loan, the special servicer will be required to use its reasonable best efforts to ensure that such appraisal is delivered within 30 days from receipt of the Requesting Holders’ written request and will be required to ensure that such appraisal is prepared on an “as-is” basis by an MAI appraiser. With respect to any non-serviced mortgage loan, the master servicer will be required to use commercially reasonable efforts to obtain such second appraisal from the applicable outside special servicer and to forward such second appraisal to the special servicer. Upon receipt of such supplemental appraisal, the outside special servicer (for Appraisal Reduction Amounts on non-serviced mortgage loans, but only to the extent provided for in the applicable outside |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-10

| MSC 2019-H7 |

| pooling and servicing agreement and applicable intercreditor agreement) and the special servicer (for Collateral Deficiency Amounts on serviced mortgage loans and non-serviced mortgage loans and for Appraisal Reduction Amounts on serviced mortgage loans) will be required to determine, in accordance with the applicable servicing standard, whether, based on its assessment of such supplemental appraisal, any recalculation of the applicable Appraisal Reduction Amount or Collateral Deficiency Amount is warranted and, if so warranted, will be required to recalculate such Appraisal Reduction Amount or Collateral Deficiency Amount, as applicable, based upon such supplemental appraisal and receipt of information requested by the special servicer from the master servicer. If required by any such recalculation, the applicable Appraised-Out Class will be reinstated as the Controlling Class and each Appraised-Out Class will, if applicable, have its related certificate balance notionally restored to the extent required by such recalculation of the Appraisal Reduction Amount or Collateral Deficiency Amount, if applicable. | |

| Sale of Defaulted Loans: | Under certain circumstances, the special servicer may be required to use reasonable efforts to solicit offers for a defaulted serviced mortgage loan (and any relatedpari passucompanion loan (to the extent provided under the related intercreditor agreement) and/or related REO properties). If the special servicer does not receive an offer at least equal to the outstanding principal balance plus all accrued and unpaid interest and outstanding costs and expenses and certain other specified amounts (the “Par Purchase Price”), the special servicer may purchase the defaulted loan or REO property at the Par Purchase Price or may accept the highest offer received from any person that is determined to be a fair price for such defaulted loan or REO property. If multiple offers are received during the period designated by the special servicer for receipt of offers, the special servicer is generally required to select the highest offer. If the highest offer is made by an Interested Person (i.e., certain specified parties under the pooling and servicing agreement for this transaction, including the parties to such agreement, the Directing Certificateholder, any sponsor, any Borrower Party and known affiliates of the foregoing), the trustee, rather than the special servicer, will generally be required to determine whether the offer constitutes a fair price. Absent an offer at least equal to the Par Purchase Price, no offer from an Interested Person will constitute a fair price unless (x) it is the highest offer received and (y) at least one other offer is received from an independent third party. Neither the trustee nor any of its affiliates may make an offer for or purchase any specially serviced loan or REO property. See “Pooling and Servicing Agreement—Sale of Defaulted Loans and REO Properties” in the Prospectus.

Notwithstanding any of the foregoing to the contrary, the special servicer will not be required to accept the highest cash offer for a defaulted loan or REO property if it determines (in consultation with the Directing Certificateholder (unless a Consultation Termination Event exists or the mortgage loan is an Excluded DCH Loan) and any related companion loan holders), in accordance with the Servicing Standard (and subject to the requirements of any related intercreditor agreement), that rejection of such offer would be in the best interests of the certificateholders and any related companion loan holders (as a collective whole as if they constituted a single lender, and, if applicable, taking into account the subordinate nature of any subordinate companion loan). In addition, the special servicer may accept a lower offer (from any person other than itself or an affiliate) if it determines, in its reasonable and good faith judgment (but in all cases in accordance with the Servicing Standard), that acceptance of such offer would be in the best interests of the certificateholders and any related companion loan holders (as a collective whole as if they constituted a single lender, and, if applicable, taking into account the subordinate nature of any subordinate companion loan).

In addition, with respect to the Grand Canal Shoppes mortgage loan, Venetian Casino Resort, LLC has the right to purchase such mortgage loan following an acceleration thereof, subject to certain conditions. See “Description of the Mortgage Pool—Mortgage Pool Characteristics—Condominium and Other Split Interests” in the Prospectus.

If title to any mortgaged property is acquired by the trust fund, the special servicer will be required to sell such mortgaged property prior to the close of the third calendar year beginning after the year of acquisition, unless (a) the IRS grants or has not denied an extension of time to sell such mortgaged property or (b) the special servicer, trustee and the certificate administrator receive an opinion of independent counsel to the effect that the holding of the property by the trust longer than the above-referenced three-year period will not result in the imposition of a tax on any REMIC of the trust fund or cause any REMIC of the trust fund to fail to qualify as a REMIC.

The Directing Certificateholder will not have a right of first refusal to purchase a defaulted loan.

The foregoing applies to mortgage loans serviced under the pooling and servicing agreement for this transaction. With respect to any non-serviced whole loan, if the special servicer under the applicable pooling and servicing agreement determines to sell the related controlling companion loan if it becomes a defaulted mortgage loan, then the applicable special servicer will be required to sell the related whole loan, including the related mortgage loan included in the MSC 2019-H7 securitization trust and the relatedpari passu companion loan(s) and, under certain circumstances, any subordinate companion loan(s), as a single loan. In connection with any such sale, the special servicer under the applicable pooling and servicing agreement will be required to follow procedures substantially similar to those set forth above.

|

| Appointment and Replacement of Special Servicer: | The Directing Certificateholder will appoint the initial special servicer as of the closing date. Prior to the occurrence and continuance of a Control Termination Event, the special servicer may generally be replaced by the Directing Certificateholder with or without cause.

After the occurrence and during the continuance of a Control Termination Event and upon (a) the written direction of holders of principal balance certificates evidencing not less than 25% of the voting rights allocable to all the principal balance certificates (taking into account the application of Cumulative Appraisal Reduction Amounts to notionally reduce the certificate balances of the respective classes thereof) requesting a vote to replace the special servicer with a replacement special servicer, (b) payment by such requesting holders to the |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-11

| MSC 2019-H7 |

| certificate administrator of all reasonable fees and expenses to be incurred by the certificate administrator in connection with administering such vote and (c) delivery by such holders to each applicable rating agency of a rating agency communication, the certificate administrator will be required to post such notice on its internet website and by mail and conduct the solicitation of votes of all certificates in such regard, which such vote must occur within 180 days of the posting of such notice. Upon the written direction of holders of principal balance certificates evidencing at least 75% of the voting rights that constitute a minimum Certificateholder Quorum, the trustee will be required to immediately replace the special servicer with a qualified replacement special servicer designated by such holders of certificates.

If the operating advisor determines, in its sole discretion exercised in good faith, that (i) the special servicer is not performing its duties as required under the pooling and servicing agreement or is otherwise not acting in accordance with the servicing standard, and (ii) the replacement of the special servicer would be in the best interest of the certificateholders as a collective whole, then the operating advisor may recommend the replacement of the special servicer. The operating advisor’s recommendation to replace the special servicer must be confirmed within 180 days of the posting of such notice by an affirmative vote of holders of certificates representing a majority of the outstanding principal balance of all certificates whose holders voted on the matter, provided that the certificateholders and/or certificate owners that so voted on the matter (i) hold certificates representing at least 20% of the outstanding principal balance of all certificates on an aggregate basis and (ii) include at least three certificateholders and/or certificate owners that are not affiliated with each other.

A “Certificateholder Quorum” means, in connection with any solicitation of votes in connection with the replacement of the special servicer or the asset representations reviewer, the holders of principal balance certificates evidencing at least 75% of the aggregate voting rights allocable to all principal balance certificates (taking into account, other than with respect to the termination of the asset representations reviewer, the application of any Cumulative Appraisal Reduction Amounts to notionally reduce the certificate balances of the respective classes thereof).

With respect to each serviced whole loan, any holder of a relatedpari passu companion loan, following a servicer termination event with respect to the special servicer that affects such holder, will be entitled to direct the trustee (and the trustee will be required) to terminate the special servicer solely with respect to such serviced whole loan. A replacement special servicer will be selected by the trustee or, prior to a Control Termination Event, by the Directing Certificateholder;provided, that any successor special servicer appointed to replace the special servicer with respect to such whole loan can generally not be the entity (or its affiliate) that was terminated at the direction of the holder of the relatedpari passu companion loan.

Notwithstanding any of the foregoing to the contrary, with respect to any servicing shift whole loan and any serviced A/B whole loans as to which the subordinate companion loan holder is the related controlling note holder, the holder of the related control note will be entitled to replace the special servicer with respect to such whole loan at any time, with or without cause, and while it is a serviced whole loan, no other party may replace the special servicer for such whole loan unless there is a servicer termination event with respect thereto.

With respect to any non-serviced whole loan, the MSC 2019-H7 trust, as holder of the related mortgage loan, has the right to terminate the special servicer under the related pooling and servicing agreement if a servicer termination event occurs with respect to such special servicer that affects the trust in its capacity as such holder. Such rights may be exercised by the Directing Certificateholder prior to a Control Termination Event (or the special servicer, following the occurrence and during the continuance of a Control Termination Event). The successor special servicer will be selected pursuant to the applicable pooling and servicing agreement by the related directing holder prior to a control termination event under such pooling and servicing agreement. |

| Servicing Standard: | Each of the master servicer and the special servicer is obligated to service and administer the mortgage loans (and, if applicable, the serviced companion loans) in accordance with the definition of the “Servicing Standard” described in the Preliminary Prospectus and the terms of the pooling and servicing agreement, provided that each non-serviced mortgage loan, if any, will be serviced by another master servicer or special servicer under the pooling and servicing agreement with respect to the securitization of the related companion loan, which entities will be obligated to service and administer such non-serviced mortgage loan pursuant to a similar standard set forth in the related pooling and servicing agreement. |

| Voting Rights: | Voting rights for the certificates will be allocated as follows: (1) 2% in the case of the Class X Certificates, allocated pro rata among the respective classes thereof based upon their respective notional amounts as of the date of determination; and (2) in the case of any class of principal balance certificates, a percentage equal to the product of 98% and a fraction, the numerator of which is equal to the related certificate balance of such class of principal balance certificates, determined as of the prior determination date, and the denominator of which is equal to the aggregate of the certificate balances of all classes of the principal balance certificates, determined as of the prior determination date (and solely in connection with certain votes relating to the replacement of the special servicer and the operating advisor as described in the Preliminary Prospectus, such numerator and denominator will take into account any notional reduction in the certificate balance of any class of principal balance certificates for Cumulative Appraisal Reduction Amounts allocated to such class). The voting rights of any class of certificates will be allocated among certificateholders of such class in proportion to their respective percentage interests. The Class V and the Class R certificates will not be entitled to any voting rights. |

| Excluded Special Servicer: | If the special servicer obtains knowledge that it has become a Borrower Party with respect to any mortgage loan (an “Excluded Special Servicer Loan”), the special servicer will be required to resign as special servicer of that Excluded Special Servicer Loan. Prior to the occurrence and continuance of a Control Termination Event, the Directing Certificateholder will be entitled to appoint (and may remove and replace with or without cause) a |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-12

| MSC 2019-H7 |

| separate special servicer that is not a Borrower Party (an “Excluded Special Servicer”) with respect to any Excluded Special Servicer Loan, unless such Excluded Special Servicer Loan is also an Excluded DCH Loan. After the occurrence and during the continuance of a Control Termination Event, if at any time the applicable Excluded Special Servicer Loan is also an Excluded DCH Loan or if the Directing Certificateholder is entitled to appoint the Excluded Special Servicer but does not so appoint within 30 days of notice of such resignation, the resigning special servicer will be required to select the related Excluded Special Servicer. Any Excluded Special Servicer will be required to perform all of the obligations of the special servicer and will be entitled to all special servicing compensation with respect to such Excluded Special Servicer Loan earned while the related mortgage loan is an Excluded Special Servicer Loan. | |

| Liquidated Loan Waterfall: | On liquidation of any mortgage loan, all net liquidation proceeds related to the mortgage loan (but not any related companion loan) will be applied so that amounts allocated as a recovery of accrued and unpaid interest will not, in the first instance, include any delinquent interest that was not advanced as a result of Appraisal Reduction Amounts or accrued on the portion of the stated principal balance thereof equal to any related Collateral Deficiency Amount in effect from time to time and as to which no advance was made. After the adjusted interest amount is so allocated, any remaining liquidation proceeds will be allocated to offset certain advances and to pay principal on the mortgage loan until the unpaid principal amount of the mortgage loan has been reduced to zero. Any remaining liquidation proceeds will then be allocated to pay delinquent interest that was not advanced as a result of Appraisal Reduction Amounts or that accrued on the portion of the stated principal balance thereof equal to any related Collateral Deficiency Amount in effect from time to time and as to which no advance was made. |

| Operating Advisor: | The operating advisor will have access to any final asset status report and information available with respect to the transaction on the certificate administrator’s website and will have certain monitoring responsibilities on behalf of the entire issuing entity. After the occurrence and during the continuance of an Operating Advisor Consultation Event, the operating advisor will be entitled to consult with the master servicer and the special servicer with respect to certain major decisions on behalf of the issuing entity and in the best interest of, and for the benefit of, the certificateholders, as a collective whole, as if those certificateholders constituted a single lender.

After the occurrence and during the continuance of a Consultation Termination Event, the operating advisor will be subject to termination without cause if the holders of certificates representing at least 15% of the voting rights allocable to the Non-Reduced Classes vote to terminate and replace the operating advisor and such vote is approved by the holders of certificates representing more than 50% of the voting rights allocable to the Non-Reduced Classes that exercise their right to vote, provided that the holders of certificates representing at least 50% of the voting rights allocable to the Non-Reduced Classes have exercised their right to vote. The holders initiating such vote will be responsible for the fees and expenses in connection with the vote and replacement.

An “Operating Advisor Consultation Event” will occur when either (i) the aggregate certificate balance of the RR Certificates (taking into account the application of any Cumulative Appraisal Reduction Amounts to notionally reduce the certificate balances of such classes) is 25% or less of the initial aggregate certificate balance of such classes or (ii) a Control Termination Event has occurred and is continuing.

“Non-Reduced Class” means any class of principal balance certificates then outstanding for which (a)(1) the initial certificate balance of such class of certificates minus (2) the sum (without duplication) of (x) any payments of principal (whether as principal prepayments or otherwise) distributed to the certificateholders of such class of certificates, (y) any Cumulative Appraisal Reduction Amounts allocated to such class of certificates and (z) any realized losses previously allocated to such class of certificates is equal to or greater than (b) 25% of the difference between (1) the initial certificate balance of such class of certificates and (2) any payments of principal (whether as principal prepayments or otherwise) distributed to the certificateholders of such class of certificates. |

| Operating Advisor Expenses: | In addition to the Operating Advisor Fee and the Operating Advisor Consulting Fee, the operating advisor will be entitled to reimbursement of Operating Advisor Expenses in accordance with the terms of the pooling and servicing agreement for this transaction. “Operating Advisor Expenses” for each distribution date will equal any unreimbursed indemnification amounts or additional trust fund expenses payable to the operating advisor pursuant to the pooling and servicing agreement for this transaction (other than the Operating Advisor Fee and the Operating Advisor Consulting Fee). |

| Asset Representations Reviewer: | The asset representations reviewer will be required to review certain delinquent mortgage loans after a specified delinquency threshold has been met and the required percentage of certificateholders vote to direct a review as described below. The asset representations reviewer will be entitled to the Asset Representations Reviewer Fee with respect to such review. See “Pooling and Servicing Agreement—The Asset Representations Reviewer” in the Preliminary Prospectus.

The certificate administrator will be required to notify certificateholders if the specified delinquency threshold has been met as described in the Preliminary Prospectus under “—The Asset Representations Reviewer”.

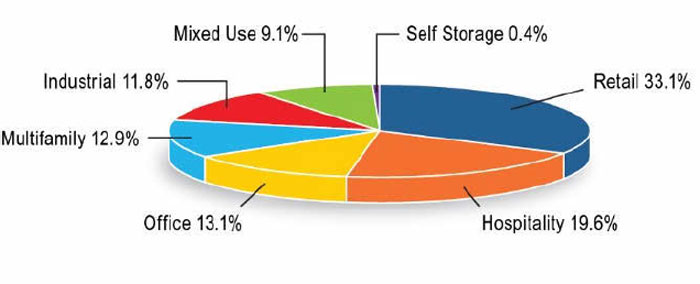

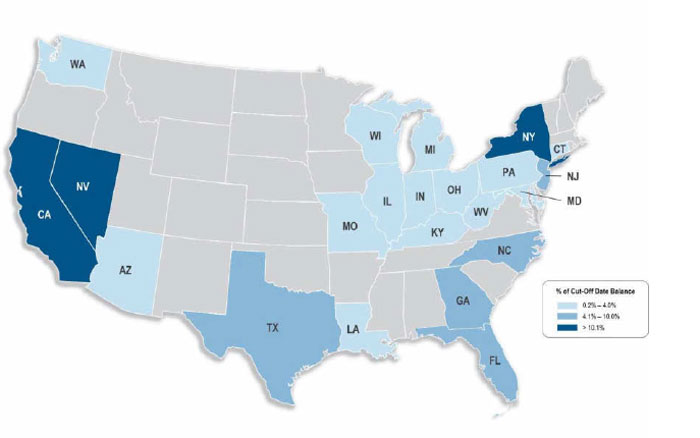

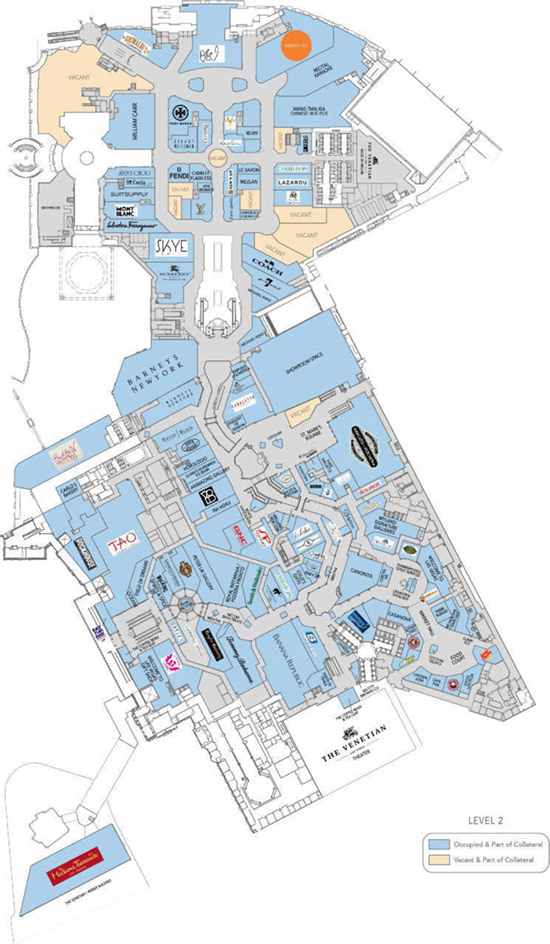

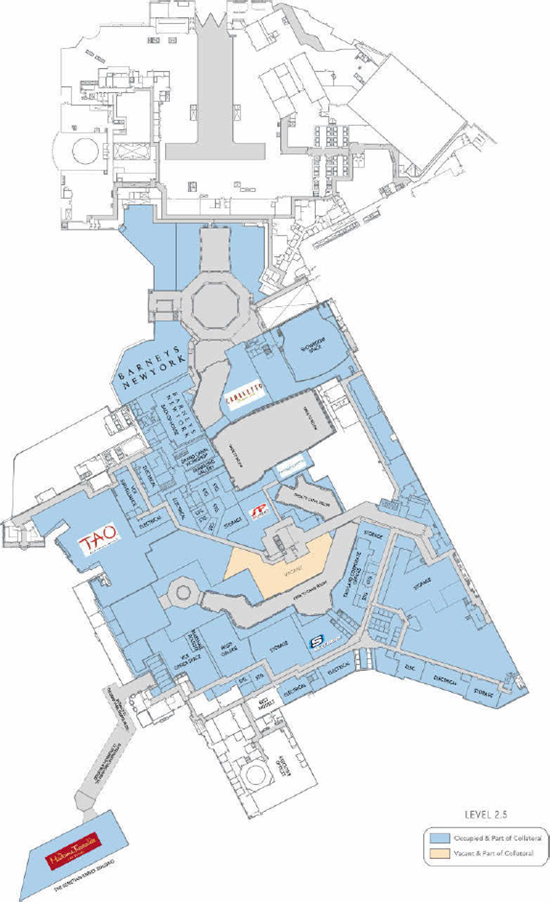

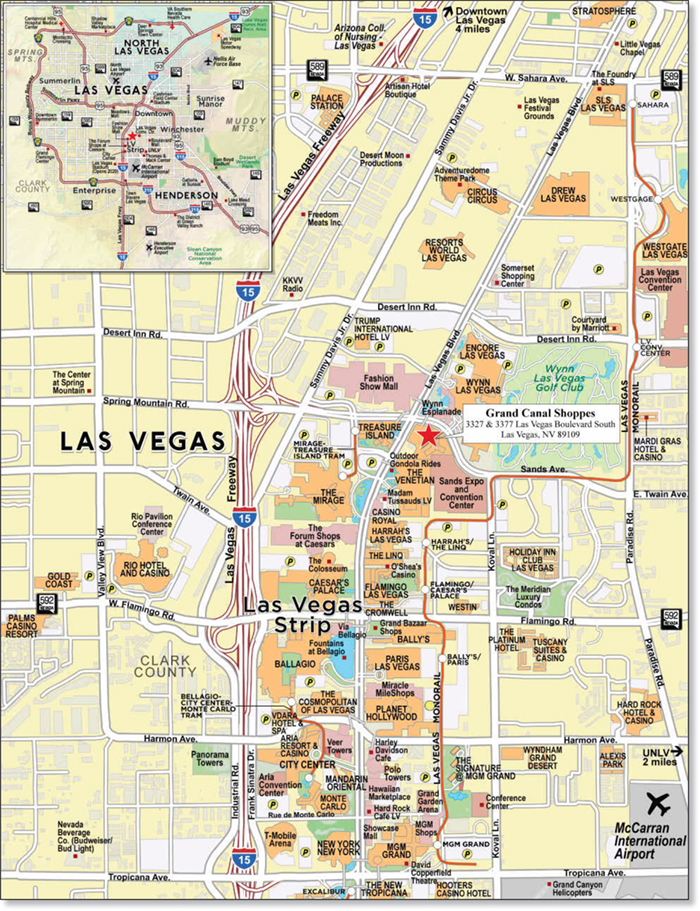

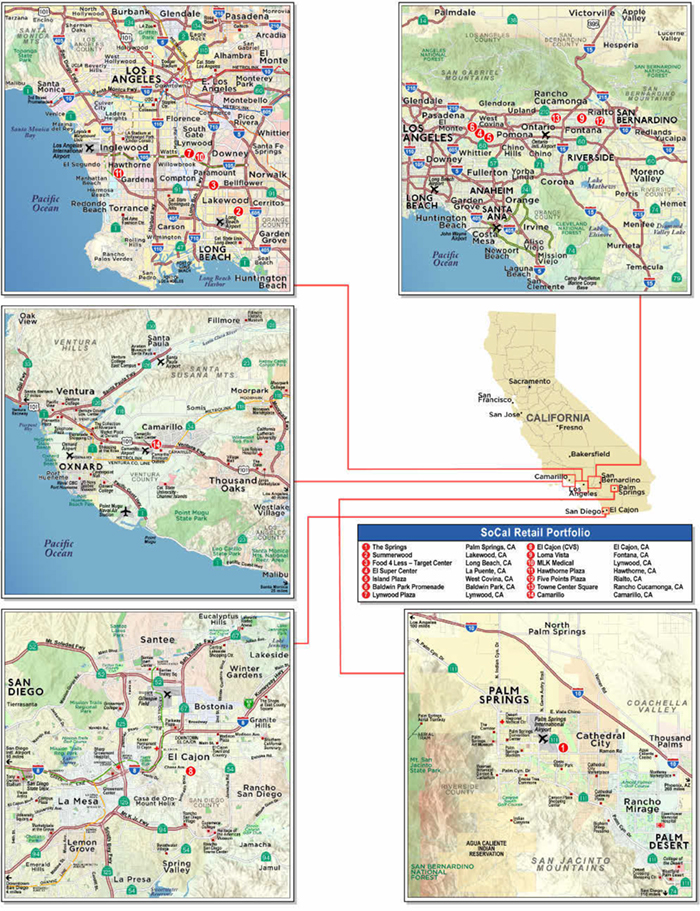

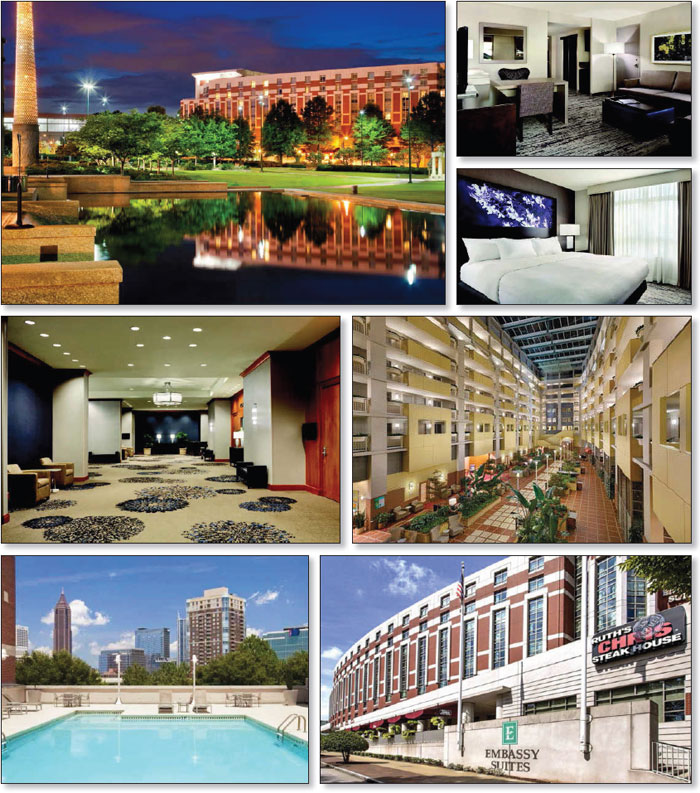

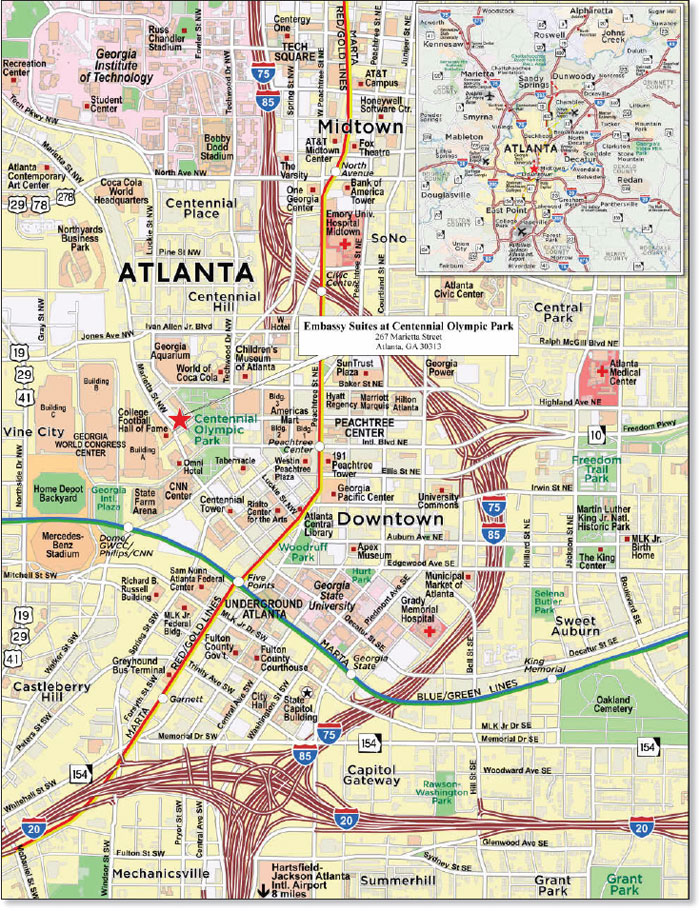

If certificateholders entitled to not less than 5.0% of the voting rights request a vote to commence an asset review, and if subsequently (i) a majority of the voting rights allocable to those certificateholders who cast votes and (ii) a majority of the voting rights that constitute a minimum Asset Review Quorum authorizes an asset review within 150 days of the request for a vote, the asset representations reviewer will be required to conduct an asset review of delinquent loans. |