Exhibit 99.2

www.huntcompaniesfinancetrust.com Hunt Companies Finance Trust Q4 2019 Earnings Supplemental March 2020

Disclaimer This presentation, any related webcast/conference call, and other oral statements made by our representatives from time to time may constitute forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the current views of Hunt Companies Finance Trust, Inc. (NYSE: HCFT) (“HCFT” or the “Company”) with respect to, among other things, the Company’s operations and financial performance. You can identify these forward - looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “projects,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward - looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The Company believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report for fiscal year 2019 on Form 10 - K and other periodic filings with the Securities and Exchange Commission (“SEC”), when evaluating these forward - looking statements. Additional information concerning these and other risk factors are contained in our 2019 Form 10 - K which is available on the SEC’s website at www.sec.gov . These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the filings. The Company assumes no obligation to update or supplement forward - looking statements that become untrue because of subsequent events or circumstances. This presentation includes non - GAAP financial measures within the meaning of Item 10(e) of Regulation S - K, as promulgated by the SEC. While we believe the non - GAAP information included in this presentation provides supplemental information to assist investors in analyzing our financials and to assist investors in comparing our results with other peer issuers, these measures are not in accordance with GAAP, and they should not be considered a substitute for, or superior to, our financial information calculated in accordance with GAAP. Our GAAP financial results and the reconciliations from these results contained herein should be carefully evaluated . 2

Company Overview 3 Strength of Ownership / Sponsorship Access to Extensive Loan Origination Platform Experienced Management Team Real estate investment trust focused on transitional multifamily and other commercial real estate loans or securitizations Externally managed by OREC Investment Management, a subsidiary of ORIX Corporation USA Strong focus on middle - market multifamily sector Emphasis on floating - rate investments Strategy Well Positioned for Current Market Environment KEY INVESTMENT HIGHLIGHTS Strong Credit and Asset Management Capabilities

4 The ORIX Transaction

ORIX Transaction Overview 5 ▪ On January 6, 2020, Hunt Companies Finance Trust, Inc. (NYSE: HCFT) (“ HCFT” or “the Company”) announced that its independent directors unanimously approved the entry into a new management agreement with OREC Investment Management, LLC (the “Manager”), a subsidiary of ORIX Corporation USA (“ORIX USA“) and the concurrent mutual termination of its management agreement with Hunt Investment Management, LLC (“Hunt ”). ▪ A subsidiary of ORIX Corporation, the Japan - based financial services giant, ORIX USA provides a wide range of innovative capital solutions for clients in the corporate, real estate, and municipal finance sectors. ▪ ORIX Corporation assets exceed $110 billion, and it has approximately $400 billion of assets under management. ▪ OREC Investment Management is part of ORIX Real Estate Capital’s finance and investment management platform, which was created through the combination of RED Capital Group, Lancaster Pollard, and Hunt Real Estate Capital . ▪ The combined platform has an annual loan production in excess of $9 billion and a servicing portfolio of more than $40 billion .

ORIX Transaction Overview 6 ▪ The terms of the new management agreement, which are further described in the Company’s Form 8 - K, align with the terms of HCFT’s prior management agreement with HIM in all material respects, including a cap on reimbursable expenses. ▪ Pursuant to the terms of the termination agreement between the Company and Hunt, the termination of the management agreement did not trigger, and Hunt was not paid, a termination fee by the Company. ▪ ORIX USA separately agreed to pay Hunt a negotiated payment in connection with the foregoing. ▪ In connection with the transaction, an affiliate of ORIX USA purchased 1,246,719 shares of the Company’s common stock in a private placement by the Company at a purchase price of $4.61 per share, resulting in an aggregate capital raise of $5,747,375. ▪ The purchase price per share represented a 43% premium over the HCFT common share price on January 2, 2020. ▪ In connection with the transaction, James C. Hunt resigned as the Company’s Chairman of the Board but will continue as a member of the Board. In addition, the Board appointed Interim Chief Financial Officer James A. Briggs as Chief Financial Officer of the Company. James Flynn will continue to serve as CEO and Michael Larsen will continue to serve as President of HCFT.

ORIX Corporation at a Glance 7 Founded in 1964, ORIX Corporation is a publicly traded, Tokyo - based international financial services company with over 32,000 employees worldwide. ORIX USA, a subsidiary of ORIX Corporation, has provided innovative capital solutions that clients need to propel their business to the next level. Global Reach ▪ Operating in 37 countries and regions ▪ More than 2,100 locations ▪ Ranked No. 315 on 2019 Forbes Global 2000: World’s Largest Public Companies Publicly Traded ▪ Listed on the Tokyo (8591) and New York (NYSE: IX) stock exchanges ▪ Approximately $20 billion market capitalization as of March 2019 Capital Ready ▪ Assets exceeding $110 billion ▪ Approximately $400 billion in assets under management Rated ▪ Long - term debt credit rating of A - by S&P’s and A3 by Moody’s (As of March 2019) All information is as of March 2019 .

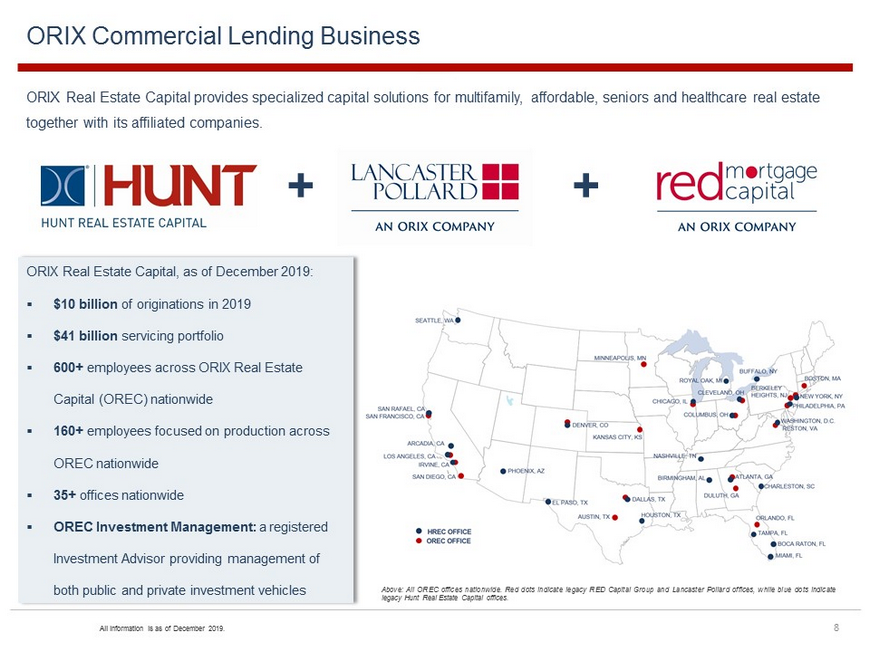

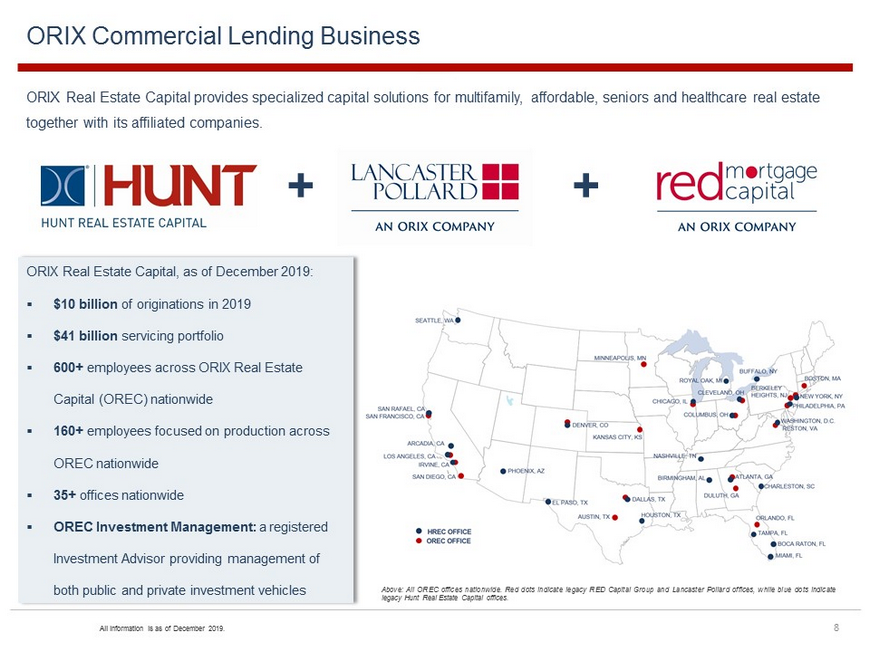

ORIX Real Estate Capital, as of December 2019: ▪ $10 billion of originations in 2019 ▪ $41 billion servicing portfolio ▪ 600+ employees across ORIX Real Estate Capital (OREC) nationwide ▪ 160+ employees focused on production across OREC nationwide ▪ 35+ offices nationwide ▪ OREC Investment Management: a registered Investment Advisor providing management of both public and private investment vehicles ORIX Commercial Lending Business 8 + + ORIX Real Estate Capital provides specialized capital solutions for multifamily, affordable, seniors and healthcare real esta te together with its affiliated companies. Above : All OREC offices nationwide . Red dots indicate legacy RED Capital Group and Lancaster Pollard offices, while blue dots indicate legacy Hunt Real Estate Capital offices . All information is as of December 2019 .

9 Q4 and Full Year 2019 Results

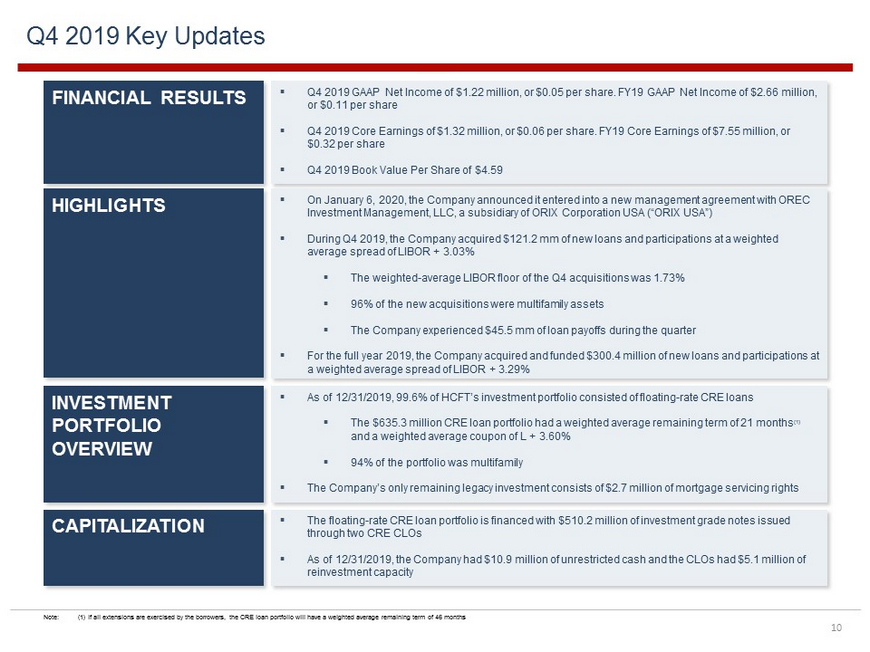

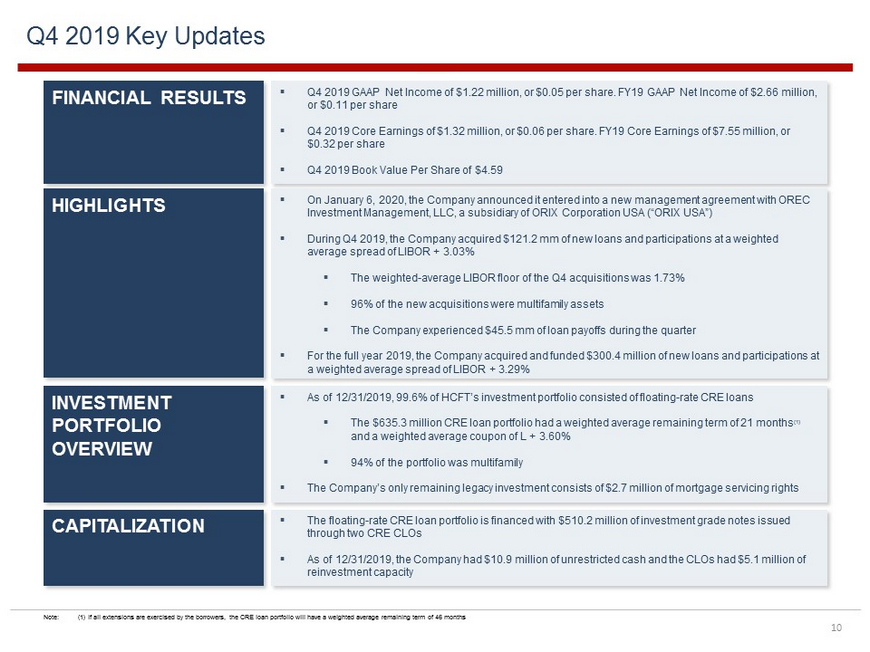

Q4 2019 Key Updates 10 FINANCIAL RESULTS ▪ Q4 2019 GAAP Net Income of $1.22 million, or $0.05 per share. FY19 GAAP Net Income of $2.66 million, or $0.11 per share ▪ Q4 2019 Core Earnings of $1.32 million, or $0.06 per share. FY19 Core Earnings of $7.55 million, or $0.32 per share ▪ Q4 2019 Book V alue P er S hare of $4.59 HIGHLIGHTS ▪ On January 6, 2020, the Company announced it entered into a new management agreement with OREC Investment Management, LLC, a subsidiary of ORIX Corporation USA (“ORIX USA”) ▪ During Q4 2019, the Company acquired $121.2 mm of new loans and participations at a weighted average spread of LIBOR + 3.03% ▪ The weighted - average LIBOR floor of the Q4 acquisitions was 1.73% ▪ 96% of the new acquisitions were multifamily assets ▪ The Company experienced $45.5 mm of loan payoffs during the quarter ▪ For the f ull y ear 2019, the Company acquired and funded $300.4 million of new loans and participations at a weighted average spread of LIBOR + 3.29% INVESTMENT PORTFOLIO OVERVIEW ▪ As of 12/31/2019, 99.6% of HCFT’s investment portfolio consisted of floating - rate CRE loans ▪ The $635.3 million CRE loan portfolio had a weighted average remaining term of 21 months (1 ) and a weighted average coupon of L + 3.60% ▪ 94% of the portfolio was multifamily ▪ The Company’s only remaining legacy investment consists of $2.7 million of mortgage servicing rights CAPITALIZATION ▪ The floating - rate CRE loan portfolio is financed with $510.2 million of investment grade notes issued through two CRE CLOs ▪ As of 12/31/2019, the Company had $10.9 million of unrestricted cash and the CLOs had $5.1 million of reinvestment capacity Note: (1) If all extensions are exercised by the borrowers, the CRE loan portfolio will have a weighted average remaining term of 46 months

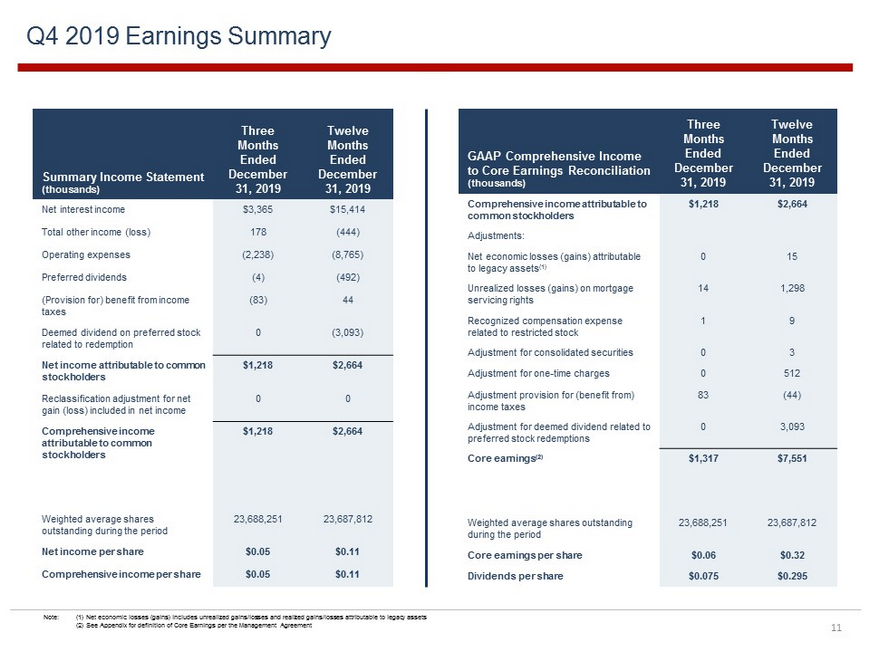

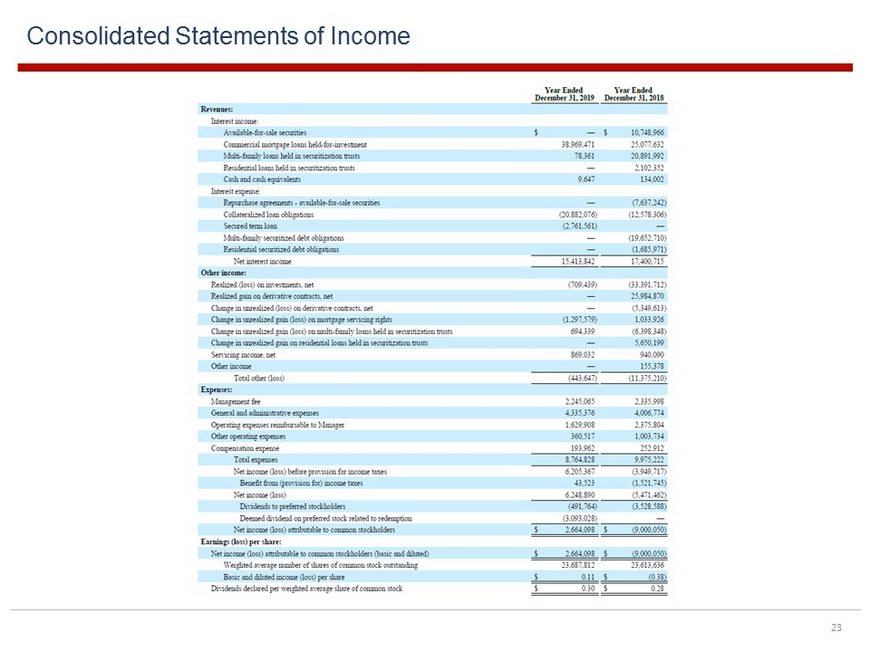

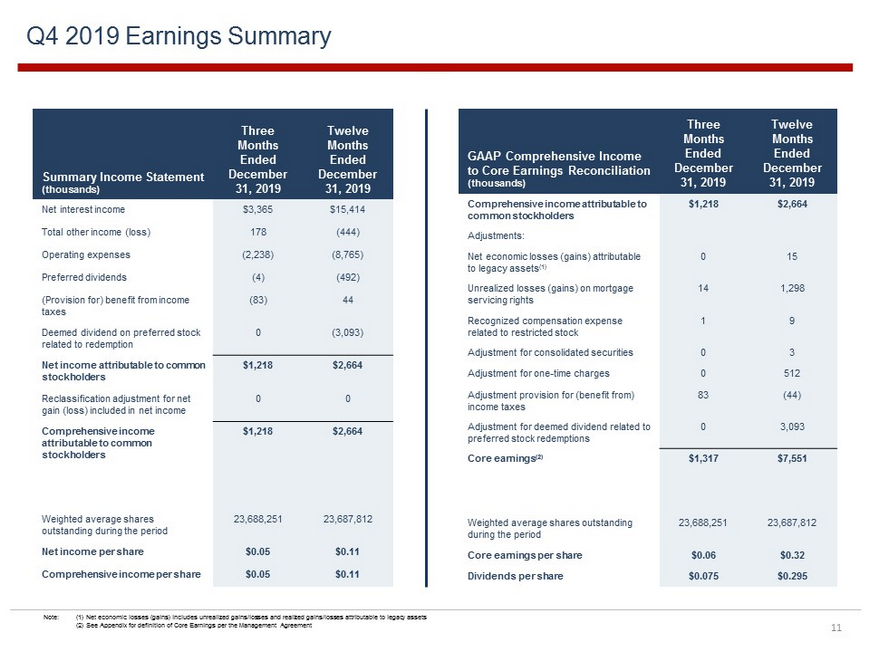

Q4 2019 Earnings Summary 11 Summary Income Statement (thousands) Three Months Ended December 31, 2019 Twelve Months Ended December 31, 2019 Net interest income $3,365 $15,414 Total other income (loss) 178 (444) Operating expenses (2,238) (8,765) Preferred dividends (4) (492) (Provision for) benefit from income taxes (83) 44 Deemed dividend on preferred stock related to redemption 0 (3,093) Net income attributable to common stockholders $1,218 $2,664 Reclassification adjustment for net gain (loss) included in net income 0 0 Comprehensive income attributable to common stockholders $1,218 $2,664 Weighted average shares outstanding during the period 23,688,251 23,687,812 Net income per share $0.05 $0.11 Comprehensive income per share $0.05 $0.11 GAAP Comprehensive Income to Core Earnings Reconciliation (thousands) Three Months Ended December 31, 2019 Twelve Months Ended December 31, 2019 Comprehensive income attributable to common stockholders $1,218 $2,664 Adjustments: Net economic losses (gains) attributable to legacy assets (1) 0 15 Unrealized losses (gains) on mortgage servicing rights 14 1,298 Recognized compensation expense related to restricted stock 1 9 Adjustment for consolidated securities 0 3 Adjustment for one - time charges 0 512 Adjustment provision for (benefit from) income taxes 83 (44) Adjustment for deemed dividend related to preferred stock redemptions 0 3,093 Core earnings (2) $1,317 $7,551 Weighted average shares outstanding during the period 23,688,251 23,687,812 Core earnings per share $0.06 $0.32 Dividends per share $0.075 $0.295 Note: (1) Net economic losses (gains) includes unrealized gains/losses and realized gains/losses attributable to legacy assets (2) See Appendix for definition of Core E arnings per the Management Agreement

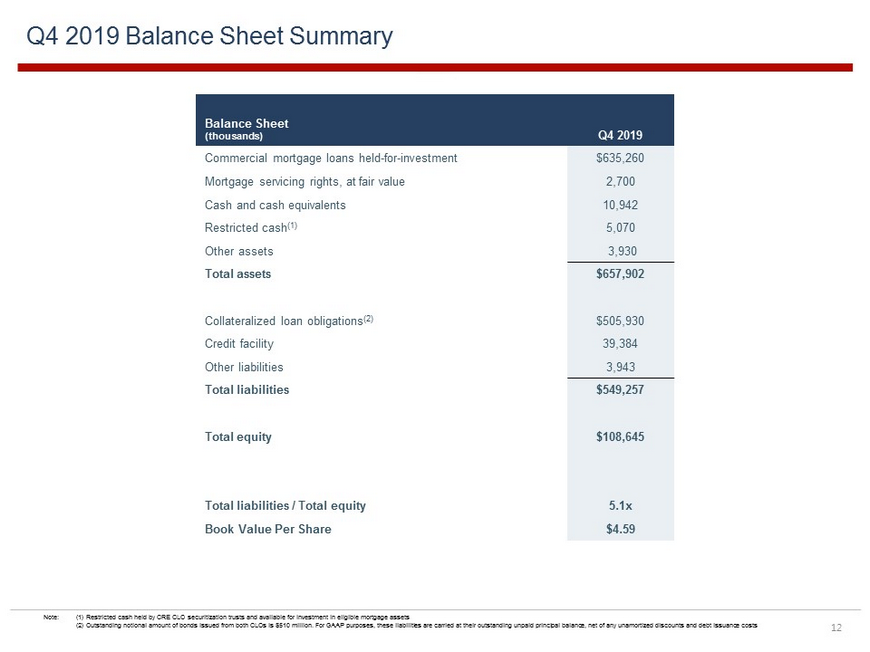

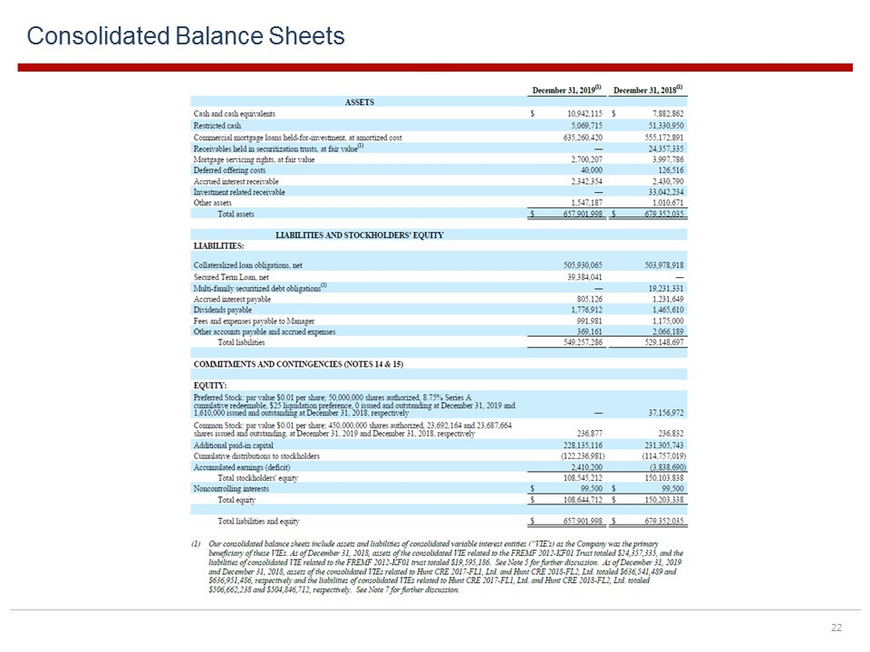

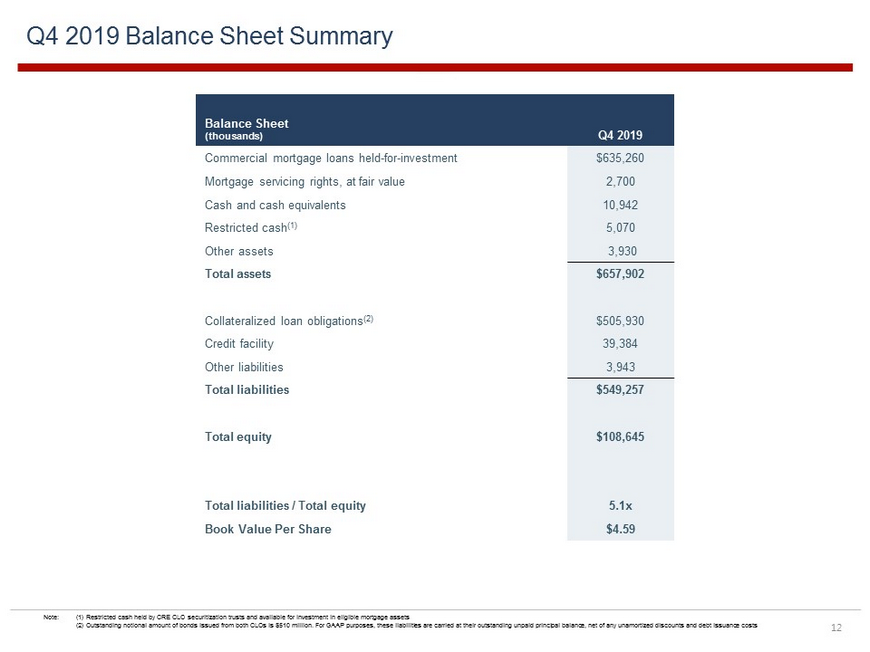

Q4 2019 Balance Sheet Summary 12 Balance Sheet (thousands) Q4 2019 Commercial mortgage loans held - for - investment $635,260 Mortgage servicing rights, at fair value 2,700 Cash and cash equivalents 10,942 Restricted cash (1) 5,070 Other assets 3,930 Total assets $657,902 Collateralized loan obligations (2) $505,930 Credit facility 39,384 Other liabilities 3,943 Total liabilities $549,257 Total equity $108,645 Total liabilities / Total equity 5.1x Book Value Per Share $4.59 Note: (1) Restricted cash held by CRE CLO securitization trusts and available for investment in eligible mortgage assets (2) Outstanding notional amount of bonds issued from both CLOs is $510 million. For GAAP purposes, these liabilities are carr ied at their outstanding unpaid principal balance, net of any unamortized discounts and debt issuance costs

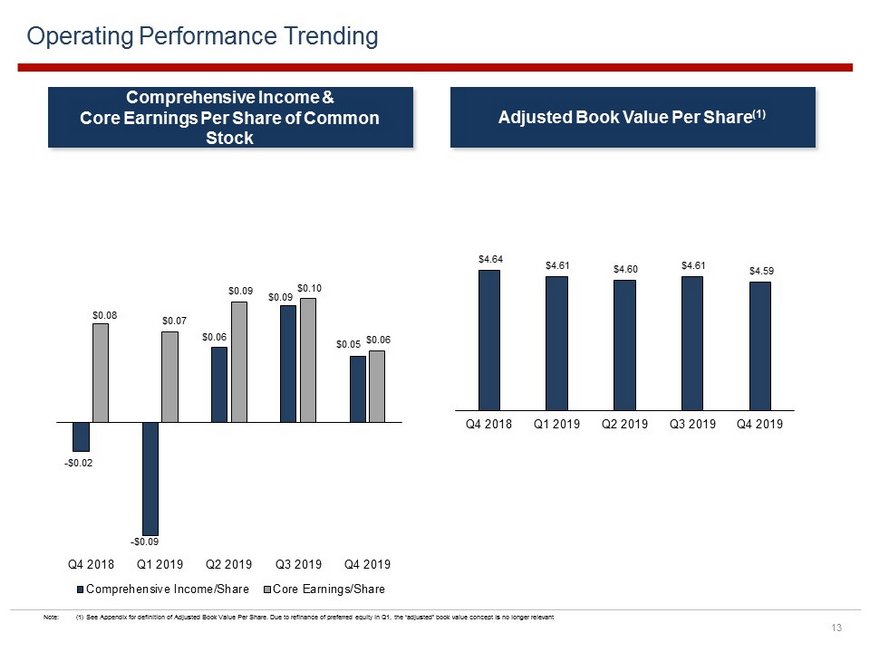

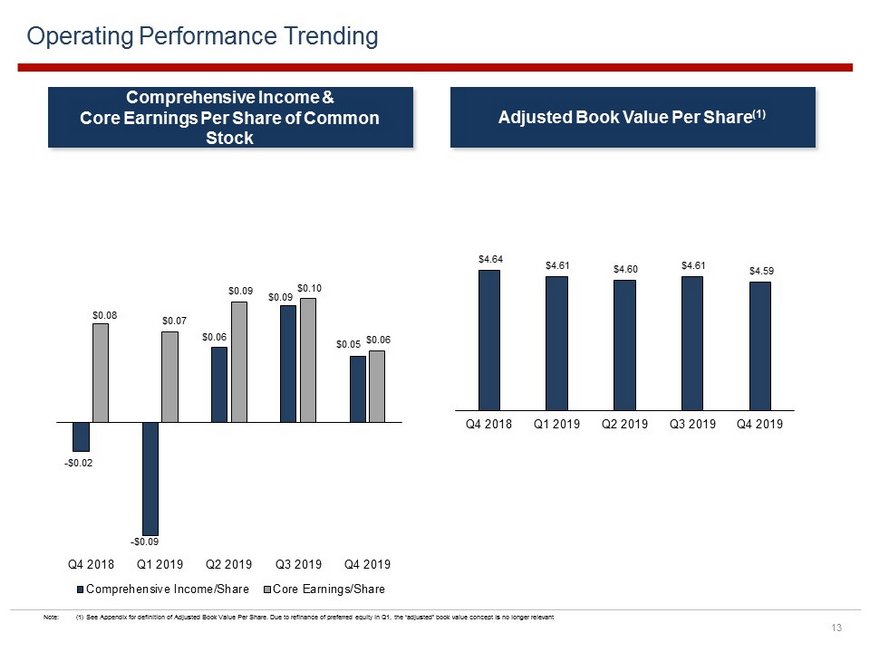

Operating Performance Trending 13 Comprehensive Income & Core Earnings Per Share of Common Stock Adjusted Book Value Per Share (1) - $0.02 - $0.09 $0.06 $0.09 $0.05 $0.08 $0.07 $0.09 $0.10 $0.06 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Comprehensive Income/Share Core Earnings/Share $4.64 $4.61 $4.60 $4.61 $4.59 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Note: (1) See Appendix for definition of Adjusted Book Value Per Share. Due to refinance of preferred equity in Q1, the “adjusted” book value concept is no longer relevant

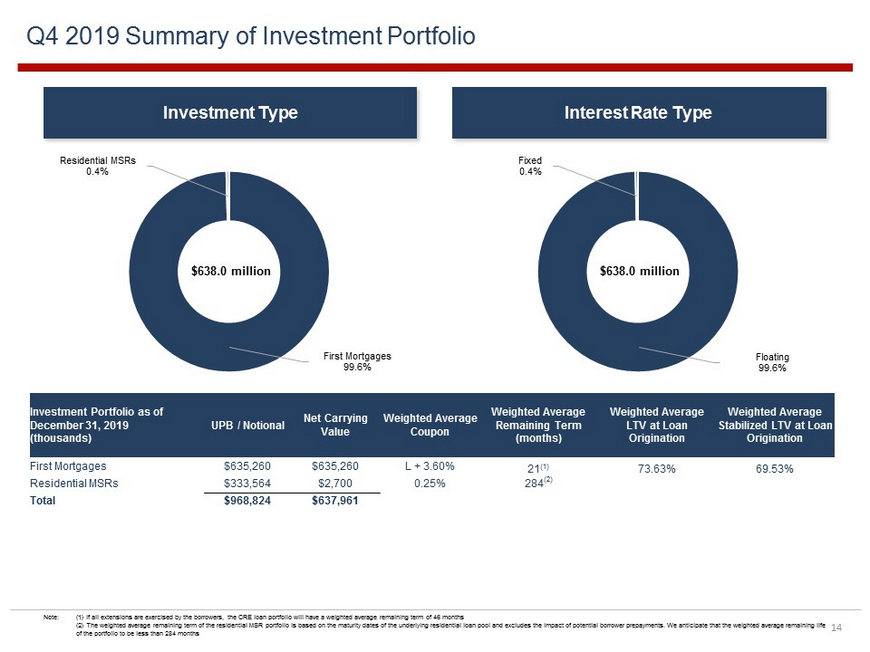

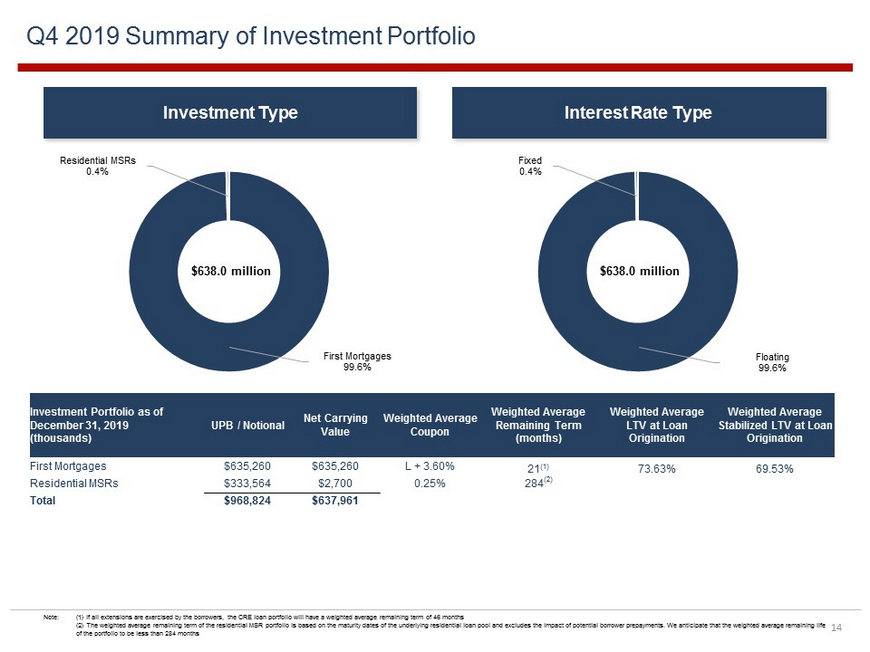

Q4 2019 Summary of Investment Portfolio 14 Floating 99.6% Fixed 0.4% First Mortgages 99.6% Residential MSRs 0.4% Investment Portfolio as of December 31, 2019 (thousands) UPB / Notional Net Carrying Value Weighted Average Coupon Weighted Average Remaining Term (months) Weighted Average LTV at Loan Origination Weighted Average Stabilized LTV at Loan Origination First Mortgages $635,260 $635,260 L + 3.60% 21 (1) 73.63% 69.53% Residential MSRs $333,564 $2,700 0.25% 284 (2) Total $968,824 $637,961 Note: (1) If all extensions are exercised by the borrowers, the CRE loan portfolio will have a weighted average remaining term of 46 months (2) The weighted average remaining term of the residential MSR portfolio is based on the maturity dates of the underlying res ide ntial loan pool and excludes the impact of potential borrower prepayments. We anticipate that the weighted average remaining lif e of the portfolio to be less than 284 months Investment Type Interest Rate Type $638.0 million $638.0 million

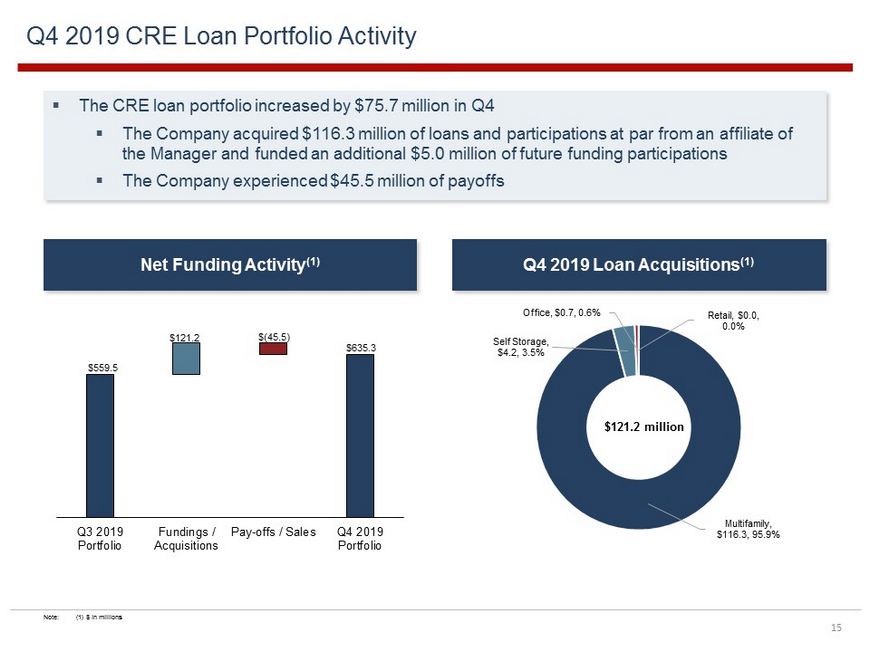

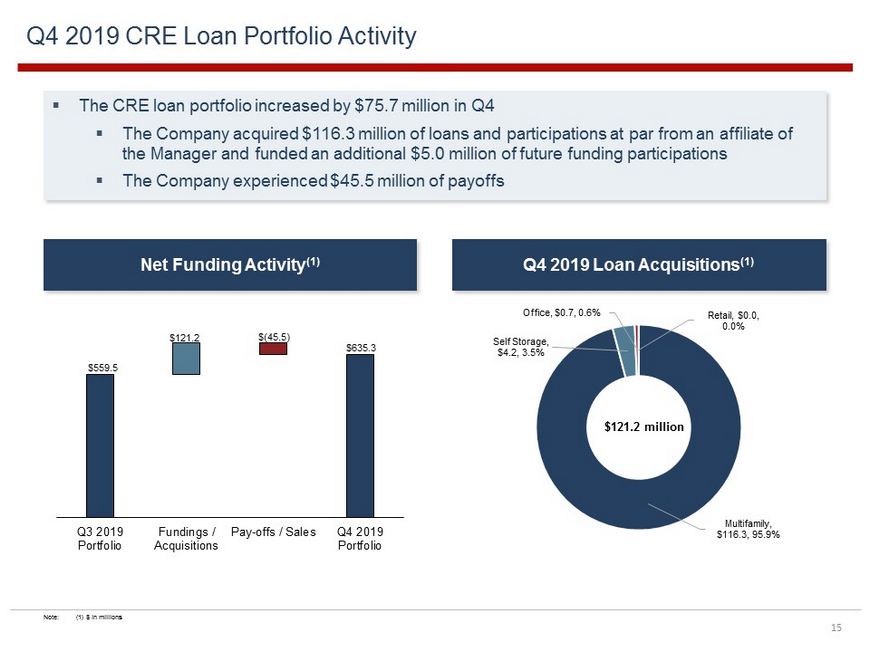

Multifamily , $116.3 , 95.9% Self Storage , $4.2 , 3.5% Office , $0.7 , 0.6% Retail , $0.0 , 0.0% Q4 2019 CRE Loan Portfolio Activity 15 $559.5 $121.2 $(45.5) $635.3 Q3 2019 Portfolio Fundings / Acquisitions Pay-offs / Sales Q4 2019 Portfolio Net Funding Activity (1) Q4 2019 Loan Acquisitions (1) ▪ The CRE loan portfolio increased by $75.7 million in Q4 ▪ The Company acquired $116.3 million of loans and participations at par from an affiliate of the Manager and funded an additional $5.0 million of future funding participations ▪ The Company experienced $45.5 million of payoffs $121.2 million Note: (1) $ In millions

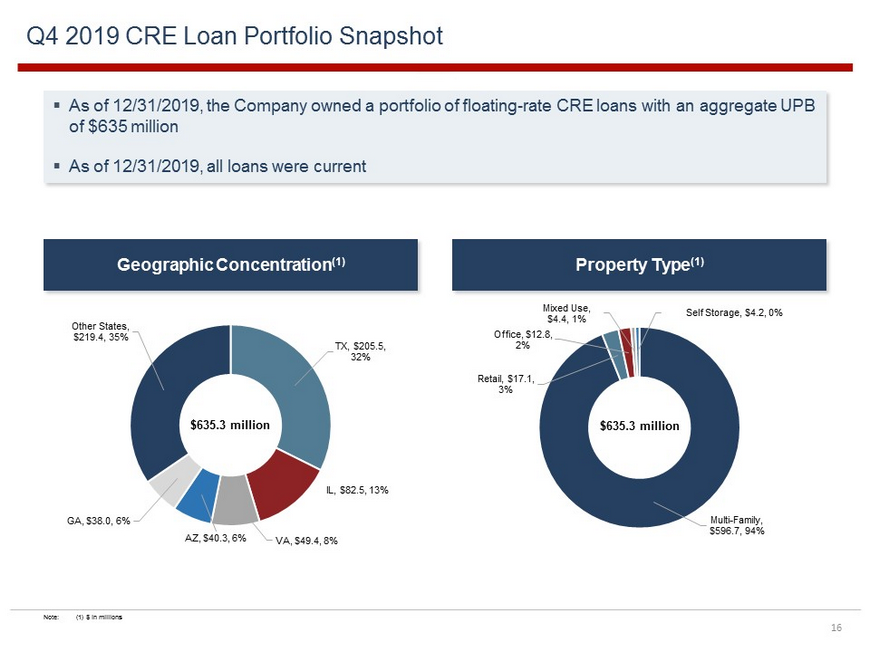

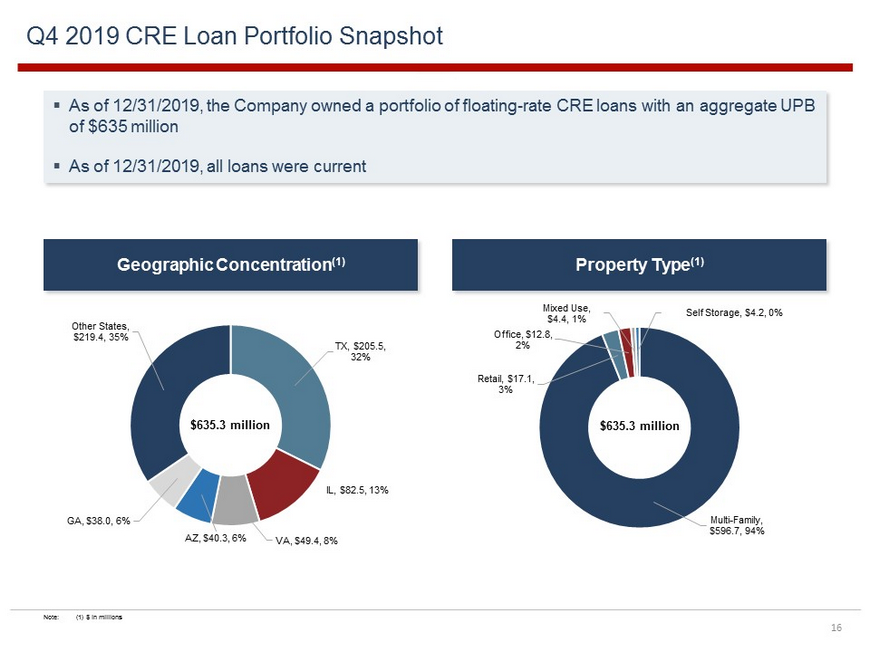

Q4 2019 CRE Loan Portfolio Snapshot 16 TX , $205.5 , 32% IL , $82.5 , 13% VA , $49.4 , 8% AZ , $40.3 , 6% GA , $38.0 , 6% Other States , $219.4 , 35% Geographic Concentration (1) Multi - Family , $596.7 , 94% Retail , $17.1 , 3% Office , $12.8 , 2% Mixed Use , $4.4 , 1% Self Storage , $4.2 , 0% Property Type (1) ▪ As of 12/31/2019, the Company owned a portfolio of floating - rate CRE loans with an aggregate UPB of $635 million ▪ As of 12/31/2019, all loans were current $635.3 million $635.3 million Note: (1) $ In millions

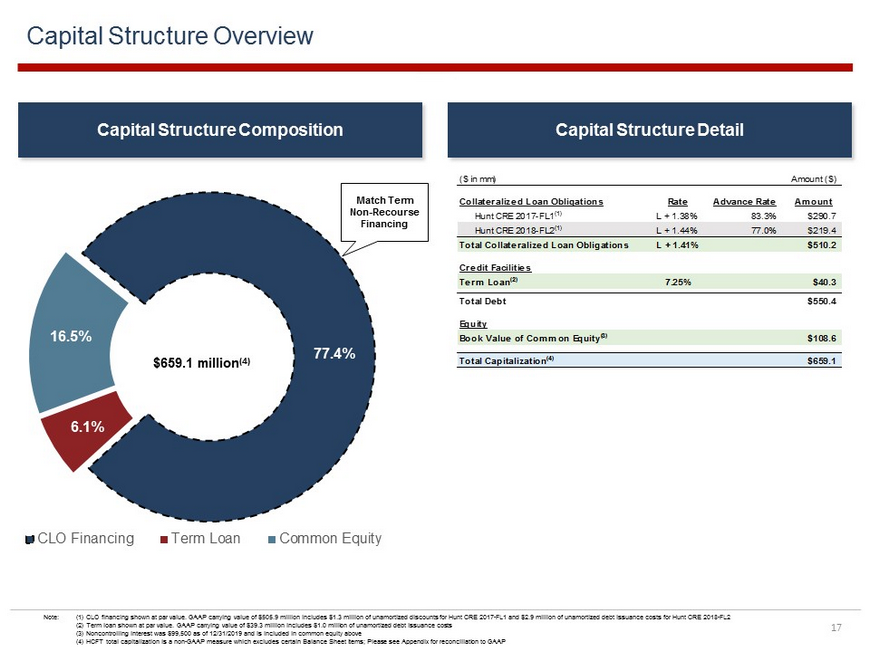

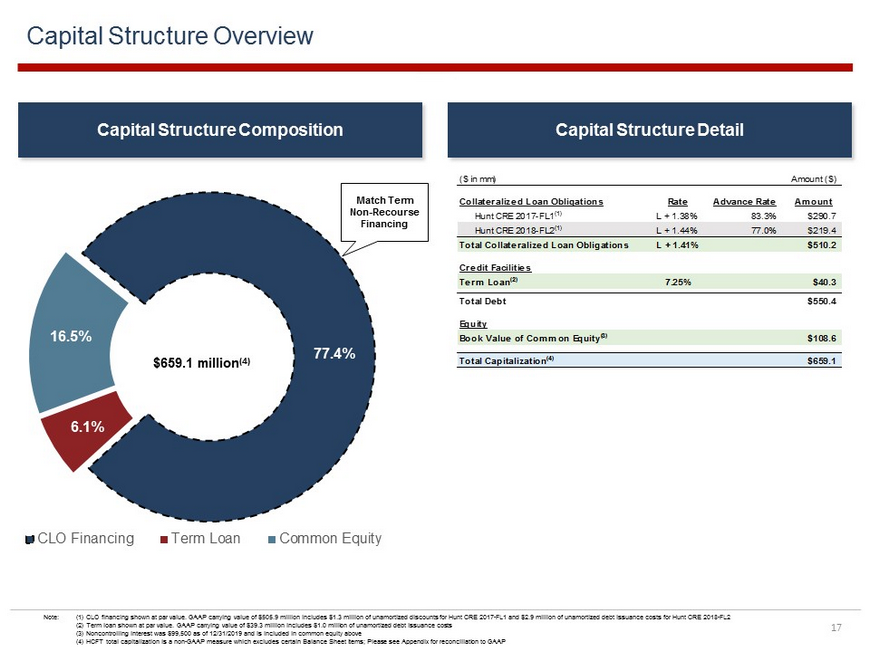

77.4% 6.1% 16.5% CLO Financing Term Loan Common Equity $659.1 million (4) Capital Structure Overview 17 Capital Structure Composition Capital Structure Detail Note: (1) CLO financing shown at par value. GAAP carrying value of $505.9 million includes $1.3 million of unamortized discounts for Hu nt CRE 2017 - FL1 and $2.9 million of unamortized debt issuance costs for Hunt CRE 2018 - FL2 (2) Term loan shown at par value. GAAP carrying value of $39.3 million includes $1.0 million of unamortized debt issuance cos ts (3) Noncontrolling interest was $99,500 as of 12/31/2019 and is included in common equity above (4) HCFT total capitalization is a non - GAAP measure which excludes certain Balance Sheet items; Please see Appendix for reconcil iation to GAAP Match Term Non - Recourse Financing ($ in mm) Amount ($) Collateralized Loan Obligations Rate Advance Rate Amount Hunt CRE 2017-FL1(1) L + 1.38% 83.3% $290.7 Hunt CRE 2018-FL2(1) L + 1.44% 77.0% $219.4 Total Collateralized Loan Obligations L + 1.41% $510.2 Credit Facilities Term Loan(2) 7.25% $40.3 Total Debt $550.4 Equity Book Value of Common Equity(3) $108.6 Total Capitalization(4) $659.1

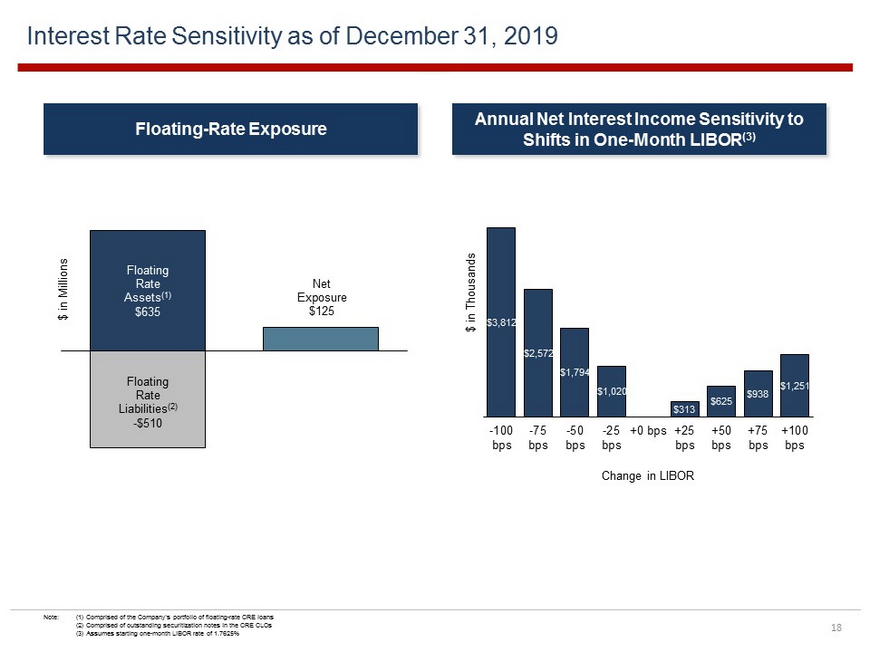

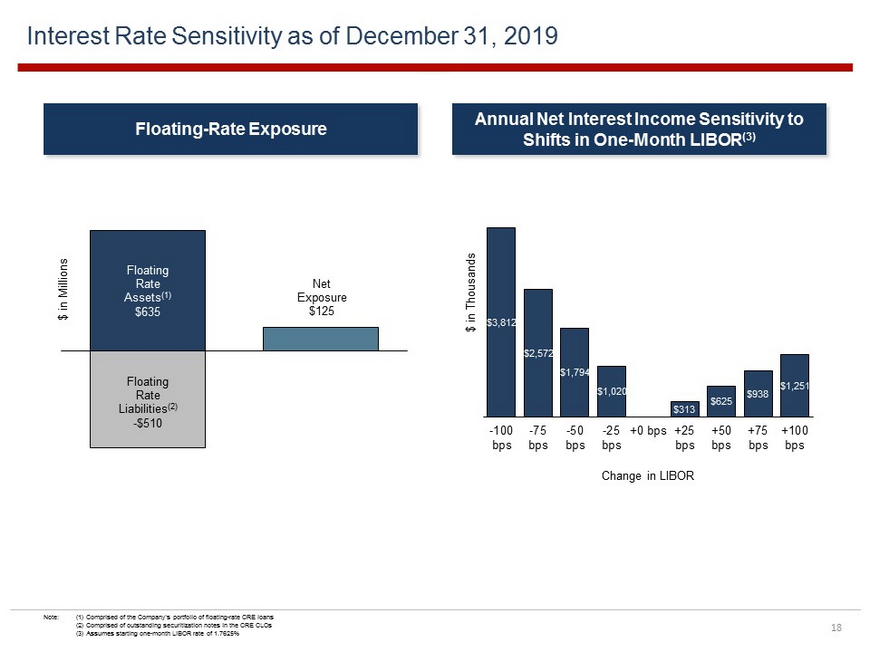

Interest Rate Sensitivity as of December 31, 2019 18 Floating Rate Assets (1) $635 Floating Rate Liabilities (2) - $510 Net Exposure $125 $3,812 $2,572 $1,794 $1,020 $313 $625 $938 $1,251 -100 bps -75 bps -50 bps -25 bps +0 bps +25 bps +50 bps +75 bps +100 bps $ in Thousands Change in LIBOR Floating - Rate Exposure Annual Net Interest Income Sensitivity to Shifts in One - Month LIBOR (3) $ in Millions Note: (1) Comprised of the Company’s portfolio of floating - rate CRE loans (2) Comprised of outstanding securitization notes in the CRE CLOs (3) Assumes starting one - month LIBOR rate of 1.7625%

19 Appendix

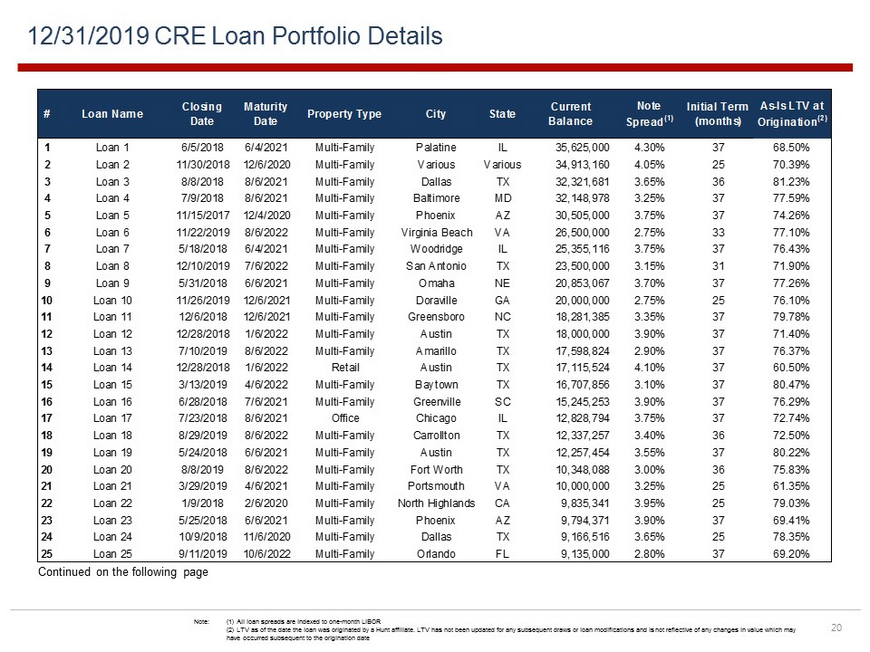

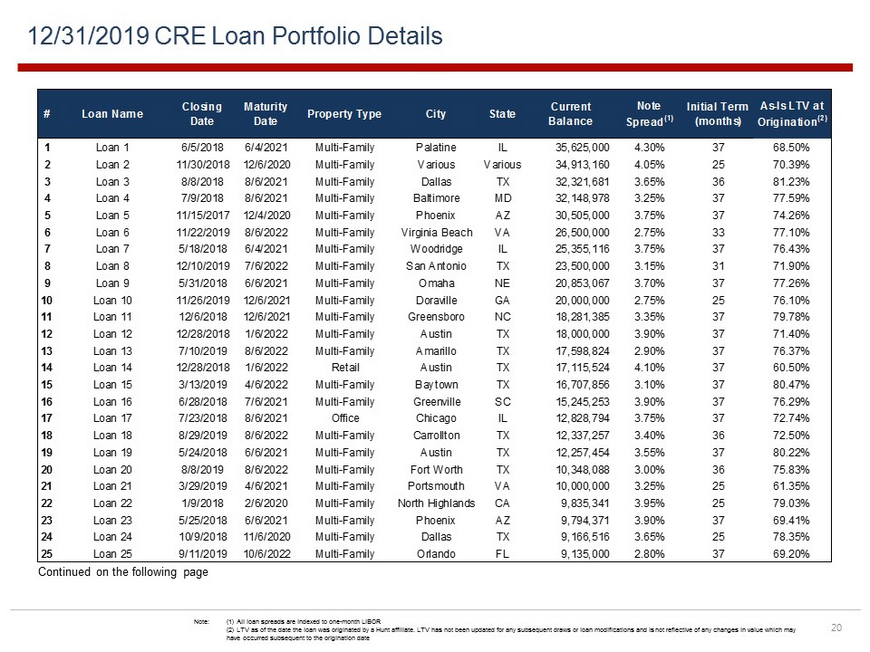

12/31/2019 CRE Loan Portfolio Details 20 Continued on the following page Note: (1) All loan spreads are indexed to one - month LIBOR (2) LTV as of the date the loan was originated by a Hunt affiliate. LTV has not been updated for any subsequent draws or loan mo difications and is not reflective of any changes in value which may have occurred subsequent to the origination date # Loan Name Closing Date Maturity Date Property Type City State Current Balance Note Spread (1) Initial Term (months) As-Is LTV at Origination (2) 1 Loan 1 6/5/2018 6/4/2021 Multi-Family Palatine IL 35,625,000 4.30% 37 68.50% 2 Loan 2 11/30/2018 12/6/2020 Multi-Family Various Various 34,913,160 4.05% 25 70.39% 3 Loan 3 8/8/2018 8/6/2021 Multi-Family Dallas TX 32,321,681 3.65% 36 81.23% 4 Loan 4 7/9/2018 8/6/2021 Multi-Family Baltimore MD 32,148,978 3.25% 37 77.59% 5 Loan 5 11/15/2017 12/4/2020 Multi-Family Phoenix AZ 30,505,000 3.75% 37 74.26% 6 Loan 6 11/22/2019 8/6/2022 Multi-Family Virginia Beach VA 26,500,000 2.75% 33 77.10% 7 Loan 7 5/18/2018 6/4/2021 Multi-Family Woodridge IL 25,355,116 3.75% 37 76.43% 8 Loan 8 12/10/2019 7/6/2022 Multi-Family San Antonio TX 23,500,000 3.15% 31 71.90% 9 Loan 9 5/31/2018 6/6/2021 Multi-Family Omaha NE 20,853,067 3.70% 37 77.26% 10 Loan 10 11/26/2019 12/6/2021 Multi-Family Doraville GA 20,000,000 2.75% 25 76.10% 11 Loan 11 12/6/2018 12/6/2021 Multi-Family Greensboro NC 18,281,385 3.35% 37 79.78% 12 Loan 12 12/28/2018 1/6/2022 Multi-Family Austin TX 18,000,000 3.90% 37 71.40% 13 Loan 13 7/10/2019 8/6/2022 Multi-Family Amarillo TX 17,598,824 2.90% 37 76.37% 14 Loan 14 12/28/2018 1/6/2022 Retail Austin TX 17,115,524 4.10% 37 60.50% 15 Loan 15 3/13/2019 4/6/2022 Multi-Family Baytown TX 16,707,856 3.10% 37 80.47% 16 Loan 16 6/28/2018 7/6/2021 Multi-Family Greenville SC 15,245,253 3.90% 37 76.29% 17 Loan 17 7/23/2018 8/6/2021 Office Chicago IL 12,828,794 3.75% 37 72.74% 18 Loan 18 8/29/2019 8/6/2022 Multi-Family Carrollton TX 12,337,257 3.40% 36 72.50% 19 Loan 19 5/24/2018 6/6/2021 Multi-Family Austin TX 12,257,454 3.55% 37 80.22% 20 Loan 20 8/8/2019 8/6/2022 Multi-Family Fort Worth TX 10,348,088 3.00% 36 75.83% 21 Loan 21 3/29/2019 4/6/2021 Multi-Family Portsmouth VA 10,000,000 3.25% 25 61.35% 22 Loan 22 1/9/2018 2/6/2020 Multi-Family North Highlands CA 9,835,341 3.95% 25 79.03% 23 Loan 23 5/25/2018 6/6/2021 Multi-Family Phoenix AZ 9,794,371 3.90% 37 69.41% 24 Loan 24 10/9/2018 11/6/2020 Multi-Family Dallas TX 9,166,516 3.65% 25 78.35% 25 Loan 25 9/11/2019 10/6/2022 Multi-Family Orlando FL 9,135,000 2.80% 37 69.20%

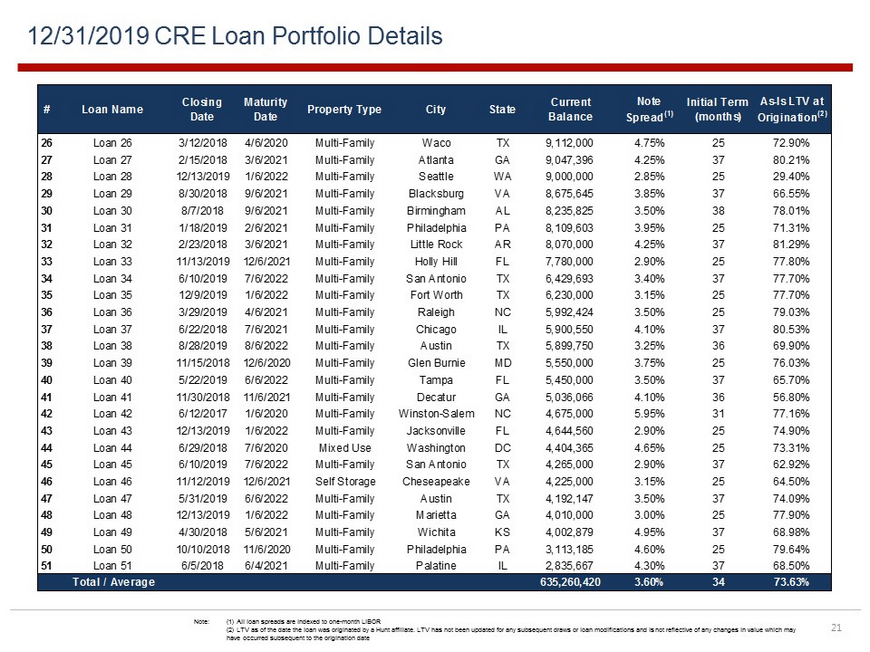

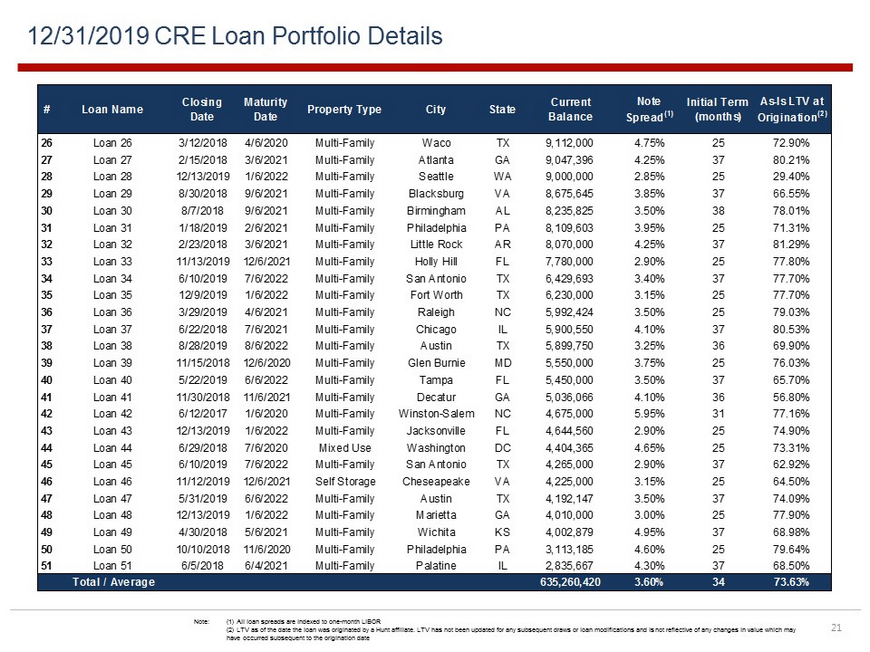

12/31/2019 CRE Loan Portfolio Details 21 Note: (1) All loan spreads are indexed to one - month LIBOR (2) LTV as of the date the loan was originated by a Hunt affiliate. LTV has not been updated for any subsequent draws or loan mo difications and is not reflective of any changes in value which may have occurred subsequent to the origination date # Loan Name Closing Date Maturity Date Property Type City State Current Balance Note Spread (1) Initial Term (months) As-Is LTV at Origination (2) 26 Loan 26 3/12/2018 4/6/2020 Multi-Family Waco TX 9,112,000 4.75% 25 72.90% 27 Loan 27 2/15/2018 3/6/2021 Multi-Family Atlanta GA 9,047,396 4.25% 37 80.21% 28 Loan 28 12/13/2019 1/6/2022 Multi-Family Seattle WA 9,000,000 2.85% 25 29.40% 29 Loan 29 8/30/2018 9/6/2021 Multi-Family Blacksburg VA 8,675,645 3.85% 37 66.55% 30 Loan 30 8/7/2018 9/6/2021 Multi-Family Birmingham AL 8,235,825 3.50% 38 78.01% 31 Loan 31 1/18/2019 2/6/2021 Multi-Family Philadelphia PA 8,109,603 3.95% 25 71.31% 32 Loan 32 2/23/2018 3/6/2021 Multi-Family Little Rock AR 8,070,000 4.25% 37 81.29% 33 Loan 33 11/13/2019 12/6/2021 Multi-Family Holly Hill FL 7,780,000 2.90% 25 77.80% 34 Loan 34 6/10/2019 7/6/2022 Multi-Family San Antonio TX 6,429,693 3.40% 37 77.70% 35 Loan 35 12/9/2019 1/6/2022 Multi-Family Fort Worth TX 6,230,000 3.15% 25 77.70% 36 Loan 36 3/29/2019 4/6/2021 Multi-Family Raleigh NC 5,992,424 3.50% 25 79.03% 37 Loan 37 6/22/2018 7/6/2021 Multi-Family Chicago IL 5,900,550 4.10% 37 80.53% 38 Loan 38 8/28/2019 8/6/2022 Multi-Family Austin TX 5,899,750 3.25% 36 69.90% 39 Loan 39 11/15/2018 12/6/2020 Multi-Family Glen Burnie MD 5,550,000 3.75% 25 76.03% 40 Loan 40 5/22/2019 6/6/2022 Multi-Family Tampa FL 5,450,000 3.50% 37 65.70% 41 Loan 41 11/30/2018 11/6/2021 Multi-Family Decatur GA 5,036,066 4.10% 36 56.80% 42 Loan 42 6/12/2017 1/6/2020 Multi-Family Winston-Salem NC 4,675,000 5.95% 31 77.16% 43 Loan 43 12/13/2019 1/6/2022 Multi-Family Jacksonville FL 4,644,560 2.90% 25 74.90% 44 Loan 44 6/29/2018 7/6/2020 Mixed Use Washington DC 4,404,365 4.65% 25 73.31% 45 Loan 45 6/10/2019 7/6/2022 Multi-Family San Antonio TX 4,265,000 2.90% 37 62.92% 46 Loan 46 11/12/2019 12/6/2021 Self Storage Cheseapeake VA 4,225,000 3.15% 25 64.50% 47 Loan 47 5/31/2019 6/6/2022 Multi-Family Austin TX 4,192,147 3.50% 37 74.09% 48 Loan 48 12/13/2019 1/6/2022 Multi-Family Marietta GA 4,010,000 3.00% 25 77.90% 49 Loan 49 4/30/2018 5/6/2021 Multi-Family Wichita KS 4,002,879 4.95% 37 68.98% 50 Loan 50 10/10/2018 11/6/2020 Multi-Family Philadelphia PA 3,113,185 4.60% 25 79.64% 51 Loan 51 6/5/2018 6/4/2021 Multi-Family Palatine IL 2,835,667 4.30% 37 68.50% Total / Average 635,260,420 3.60% 34 73.63%

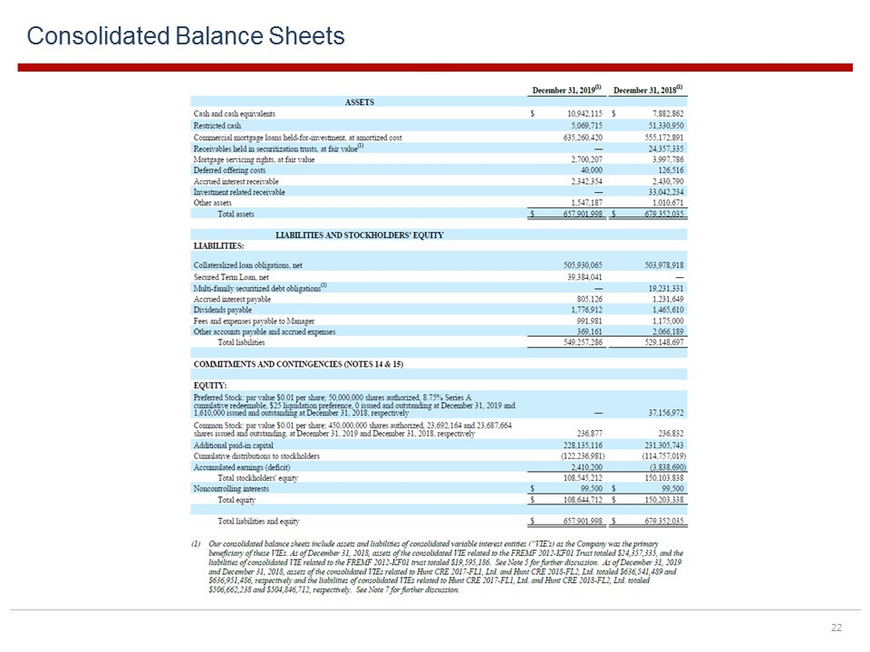

Consolidated Balance Sheets 22

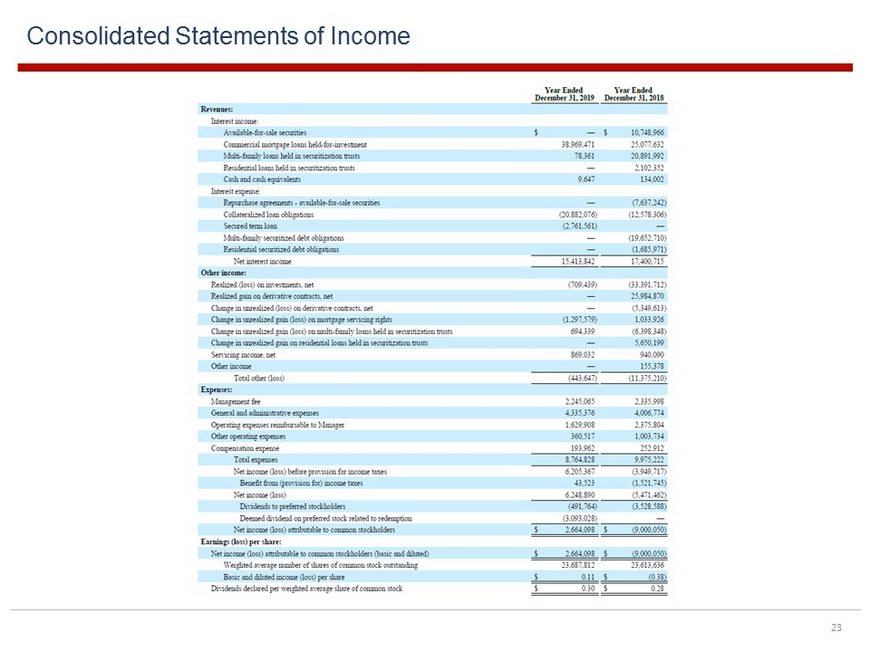

Consolidated Statements of Income 23

Reconciliation of GAAP to Core Earnings 24 GAAP to Core Earnings Reconciliation Three months Ended Year-Ended December 31, 2019 September 30, 2019 Reconciliation of GAAP to non-GAAP Information Net Income (loss) attributable to common shareholders 1,218,497$ 2,664,098$ Adjustments for non-core earnings Realized (Gain) Loss on sale of investments, net - 709,439 Unrealized (Gain) Loss on mortgage servicing rights 13,602 1,297,579 Unrealized (Gain) Loss on multi-family loans held in securitization trusts - (694,339) Subtotal 13,602 1,312,679 Other Adjustments Recognized compensation expense related to restricted common stock 1,040 8,962 Adjustment for consolidated securities - 3,269 Adjustment for one-time charges - 512,115 Adjustment for (provision for) income taxes 83,473 (43,523) Adjustment for deemed dividend related to preferred stock redemption 3,093,028 Subtotal 84,513 3,573,851 Core Earnings 1,316,612$ 7,550,628$ Weighted average shares outstanding - Basic and Diluted 23,688,251 23,687,812 Core Earnings per weighted share outstanding - Basic and Diluted 0.06$ 0.32$

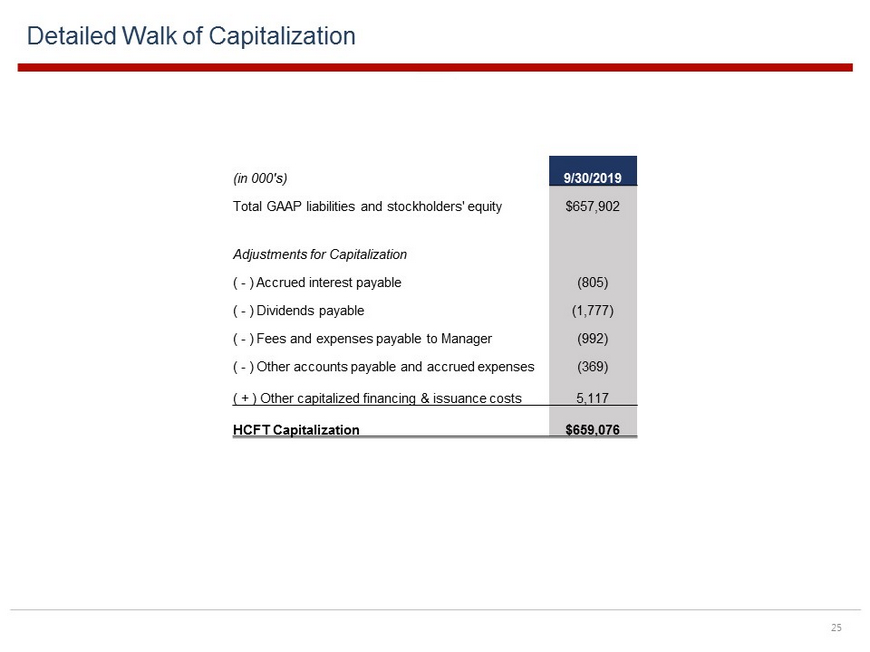

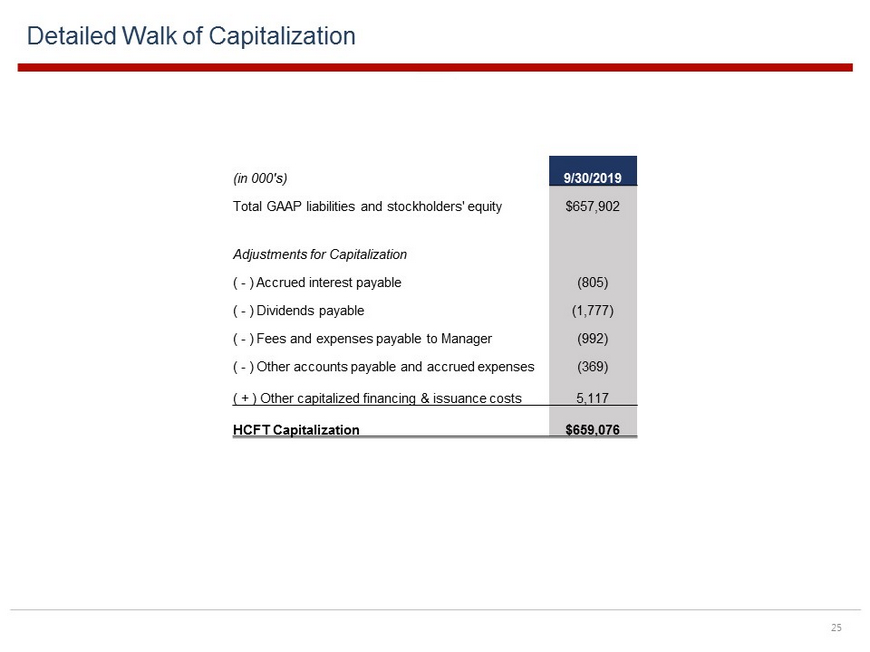

Detailed Walk of Capitalization 25 (in 000's) 9/30/2019 Total GAAP liabilities and stockholders' equity $657,902 Adjustments for Capitalization ( - ) Accrued interest payable (805) ( - ) Dividends payable (1,777) ( - ) Fees and expenses payable to Manager (992) ( - ) Other accounts payable and accrued expenses (369) ( + ) Other capitalized financing & issuance costs 5,117 HCFT Capitalization $659,076

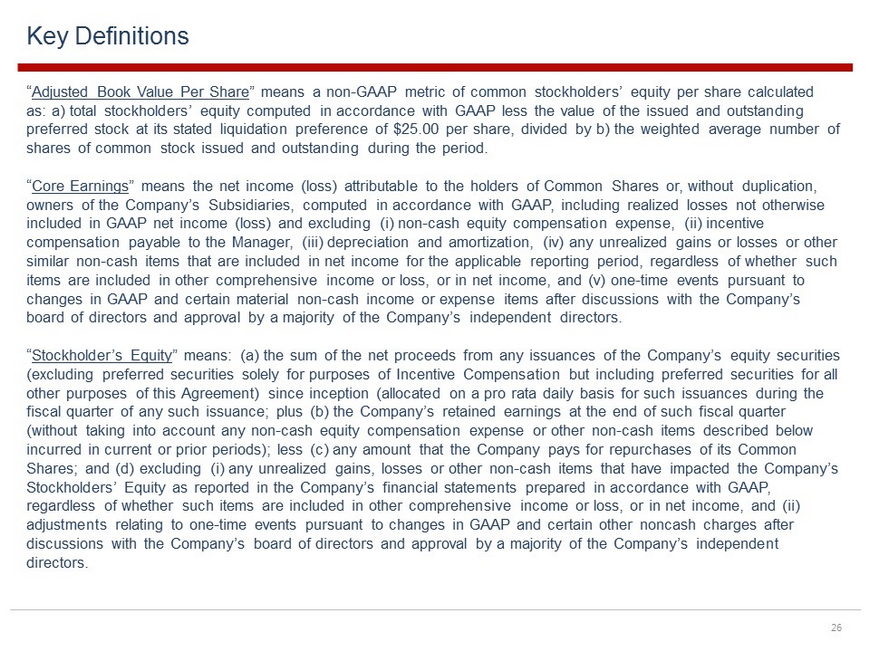

Key Definitions “ Adjusted Book Value Per Share ” means a non - GAAP metric of common stockholders’ equity per share calculated as: a) total stockholders’ equity computed in accordance with GAAP less the value of the issued and outstanding preferred stock at its stated liquidation preference of $25.00 per share, divided by b) the weighted average number of shares of common stock issued and outstanding during the period. “ Core Earnings ” means the net income (loss) attributable to the holders of Common Shares or, without duplication, owners of the Company’s Subsidiaries, computed in accordance with GAAP, including realized losses not otherwise included in GAAP net income (loss) and excluding (i) non - cash equity compensation expense, (ii) incentive compensation payable to the Manager, (iii) depreciation and amortization, (iv) any unrealized gains or losses or other similar non - cash items that are included in net income for the applicable reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net income, and (v) one - time events pursuant to changes in GAAP and certain material non - cash income or expense items after discussions with the Company’s board of directors and approval by a majority of the Company’s independent directors. “ Stockholder’s Equity ” means: (a) the sum of the net proceeds from any issuances of the Company’s equity securities (excluding preferred securities solely for purposes of Incentive Compensation but including preferred securities for all other purposes of this Agreement) since inception (allocated on a pro rata daily basis for such issuances during the fiscal quarter of any such issuance; plus (b) the Company’s retained earnings at the end of such fiscal quarter (without taking into account any non - cash equity compensation expense or other non - cash items described below incurred in current or prior periods); less (c) any amount that the Company pays for repurchases of its Common Shares; and (d) excluding (i) any unrealized gains, losses or other non - cash items that have impacted the Company’s Stockholders’ Equity as reported in the Company’s financial statements prepared in accordance with GAAP, regardless of whether such items are included in other comprehensive income or loss, or in net income, and (ii) adjustments relating to one - time events pursuant to changes in GAAP and certain other noncash charges after discussions with the Company’s board of directors and approval by a majority of the Company’s independent directors. 26

27