Exhibit 99.2

November 2021 Lument Finance Trust Q3 2021 Earnings Supplemental

Disclaimer 2 This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the current views of Lument Finance Trust, Inc. (NYSE: LFT) (“LFT,” the “ Company,” “we,” “our,” or “us”) with respect to, among other things, the Company’s operations and financial performance. You can identify these forward - looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “pr ojects,” “intends,” “plans,” “estimates,” or “anticipates,” or the negative version of these words or other comparable words or other statements that do not relate strictly to historical or factual matters. Such forward - looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to d iff er materially from those indicated in these statements. The Company believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10 - K for the year ended December 31, 2020 (the “2020 Form 10 - K”). Additionally, many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the COVID - 19 outbreak. It is not possible to predict or identify all such ri sks. Additional information concerning these and other risk factors are contained in our 2020 Form 10 - K which is available on the SEC’s website at www.sec.gov . These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the filings. The forward - looking statements contained in this presentation speak only as of August 9, 2021. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events or circumstances. This presentation includes non - GAAP financial measures, including Distributable Earnings. While we believe the non - GAAP information included in this presentation provides supplemental information to assist investors in analyzing our operating results and to assist investors in comparing our operating results with other peer issuers, these measures are not in accordance with GAAP, and they should not be considered a substitute for, or superior to, our financial information calculated in accordance with GAAP. Please refer to this presentation’s Appendix for a reconciliation of the non - GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP.

Company Overview 3 Key Investment Highlights Strong Sponsorship/Ownership • Access to extensive loan origination platform through affiliation with Lument, a premier national mortgage originator and asset manager • Experienced management team with average of 23 years of industry experience across multiple economic cycles • Affiliation with ORIX Corporation USA, the US subsidiary of ORIX Corporation, a publicly traded Tokyo - based international financial services firm • The Company is an externally - managed real estate investment trust focused on investing in, financing and managing a portfolio of commercial real estate debt investments • The Company is externally managed by Lument Investment Management, an affiliate of ORIX Corporation USA Attractive Investment Profile • Emphasis on middle market multifamily investments which are well positioned for the current environment • Strong credit and asset management capabilities with zero delinquencies or defaults during the COVID era • Attractive financing source via non - recourse, non mark - to - market CRE CLO

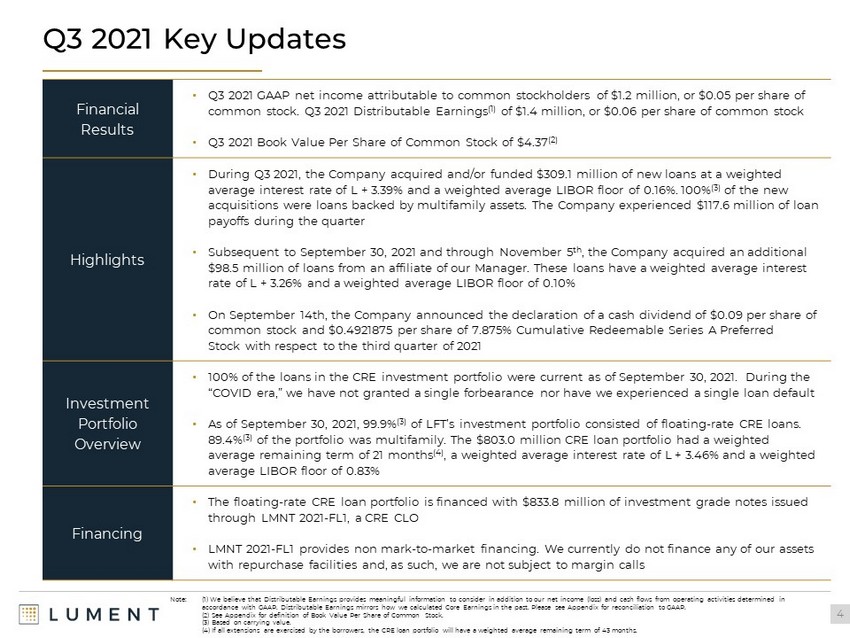

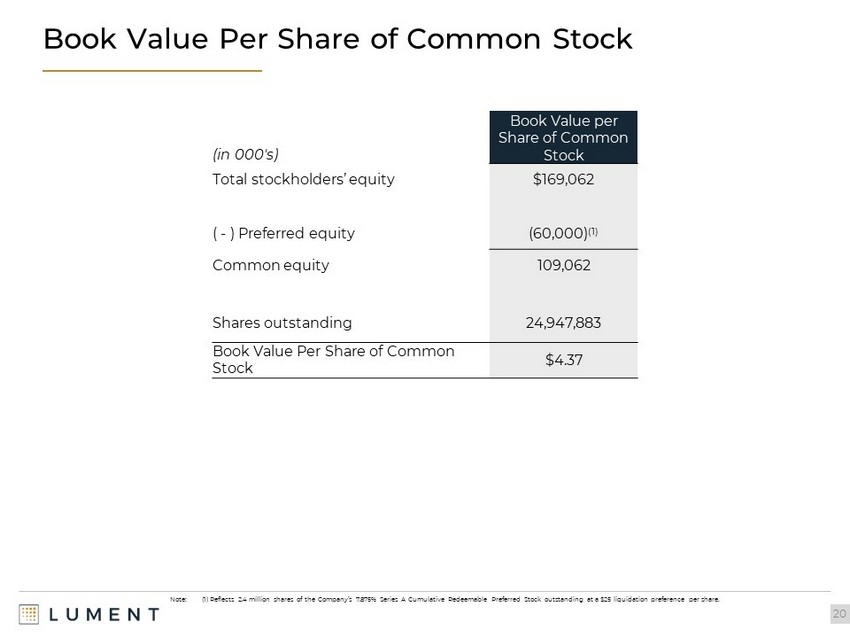

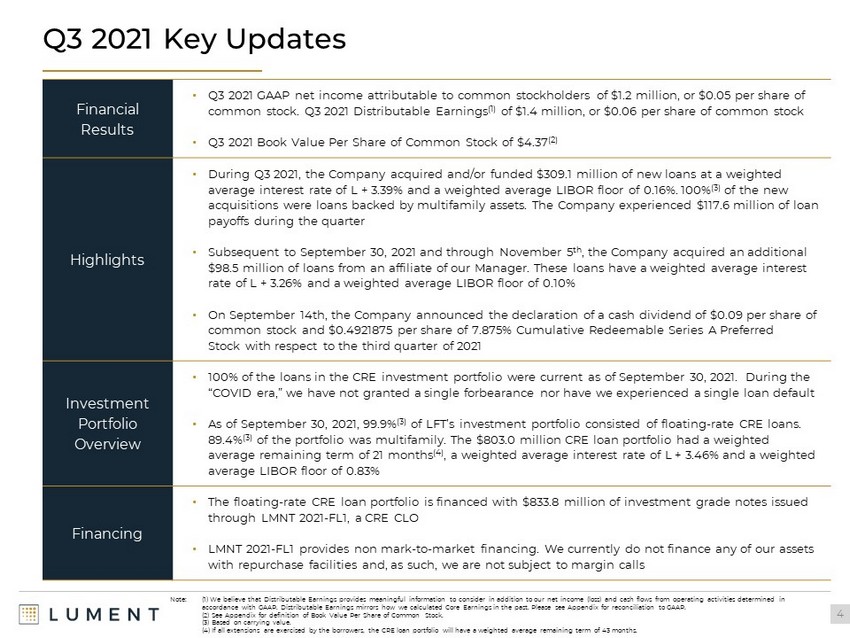

Q3 2021 Key Updates 4 Note: (1) We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (loss) a nd cash flows from operating activities determined in accordance with GAAP. Distributable Earnings mirrors how we calculated Core Earnings in the past . Please see Appendix for reconciliation to GAAP. (2) See Appendix for definition of Book Value Per Share of Common Stock. (3) Based on carrying value. (4) If all extensions are exercised by the borrowers, the CRE loan portfolio will have a weighted average remaining term of 43 months. Financial Results • Q3 2021 GAAP net income attributable to common stockholders of $1.2 million, or $0.05 per share of common stock. Q3 2021 Distributable Earnings (1) of $1.4 million, or $0.06 per share of common stock • Q3 2021 Book Value Per Share of Common Stock of $4.37 (2) Highlights • During Q3 2021, the Company acquired and/or funded $309.1 million of new loans at a weighted average interest rate of L + 3.39% and a weighted average LIBOR floor of 0.16%. 100% (3) of the new acquisitions were loans backed by multifamily assets. The Company experienced $117.6 million of loan payoffs during the quarter • Subsequent to September 30, 2021 and through November 5 th , the Company acquired an additional $98.5 million of loans from an affiliate of our Manager. These loans have a weighted average interest rate of L + 3.26% and a weighted average LIBOR floor of 0.10% • On September 14th, the Company announced the declaration of a cash dividend of $0.09 per share of common stock and $0.4921875 per share of 7.875% Cumulative Redeemable Series A Preferred Stock with respect to the third quarter of 2021 Investment Portfolio Overview • 100% of the loans in the CRE investment portfolio were current as of September 30, 2021. During the “COVID era,” we have not granted a single forbearance nor have we experienced a single loan default • As of September 30, 2021, 99.9% (3) of LFT’s investment portfolio consisted of floating - rate CRE loans. 89.4% (3) of the portfolio was multifamily. The $803.0 million CRE loan portfolio had a weighted average remaining term of 21 months (4) , a weighted average interest rate of L + 3.46% and a weighted average LIBOR floor of 0.83% Financing • The floating - rate CRE loan portfolio is financed with $833.8 million of investment grade notes issued through LMNT 2021 - FL1, a CRE CLO • LMNT 2021 - FL1 provides non mark - to - market financing. We currently do not finance any of our assets with repurchase facilities and, as such, we are not subject to margin calls

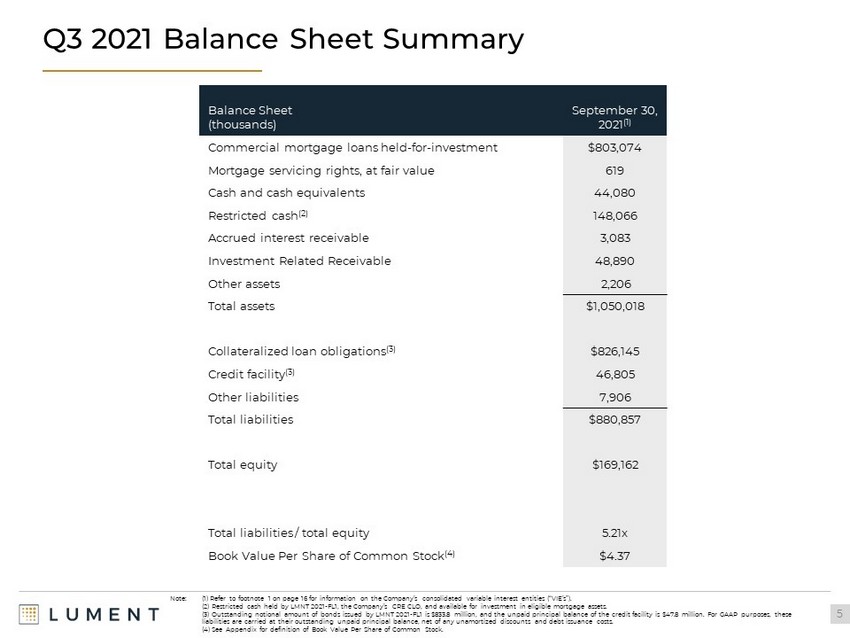

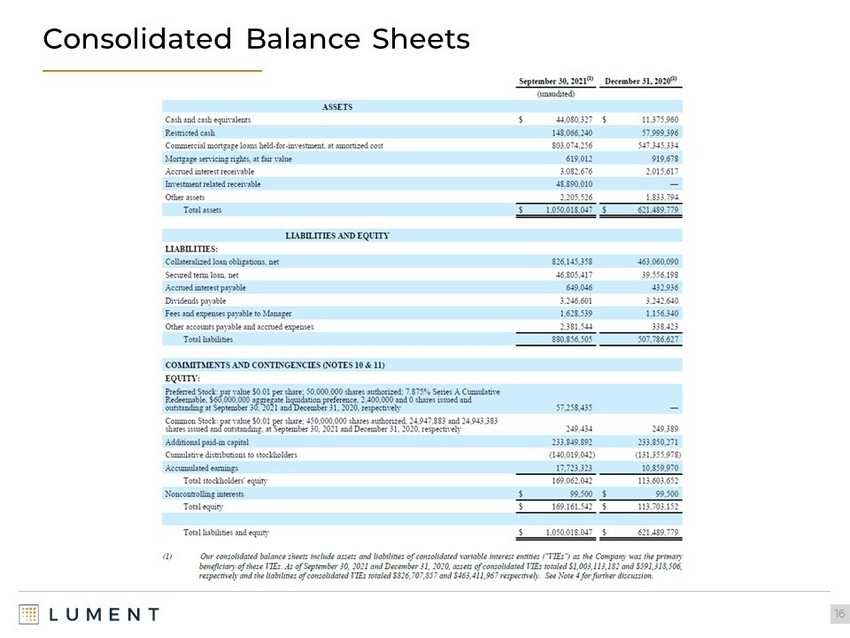

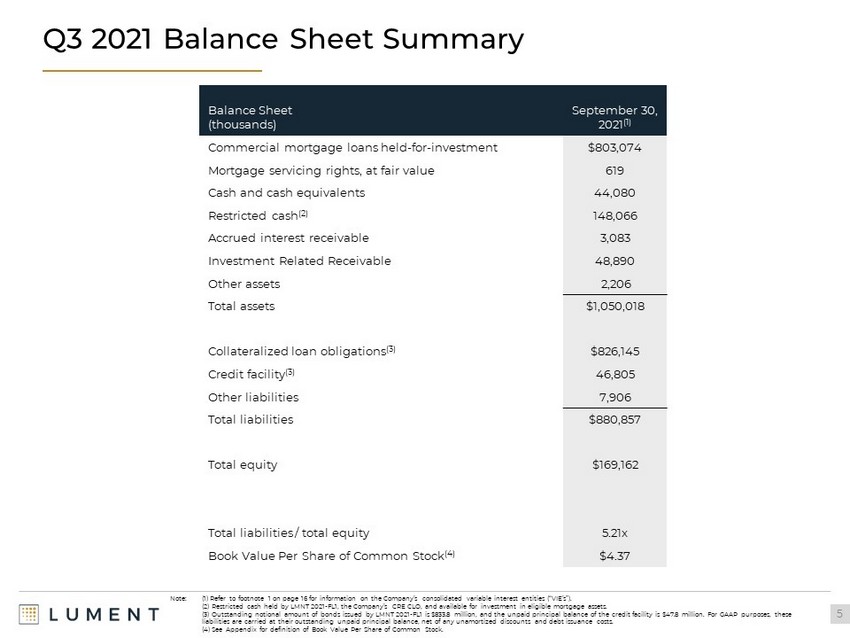

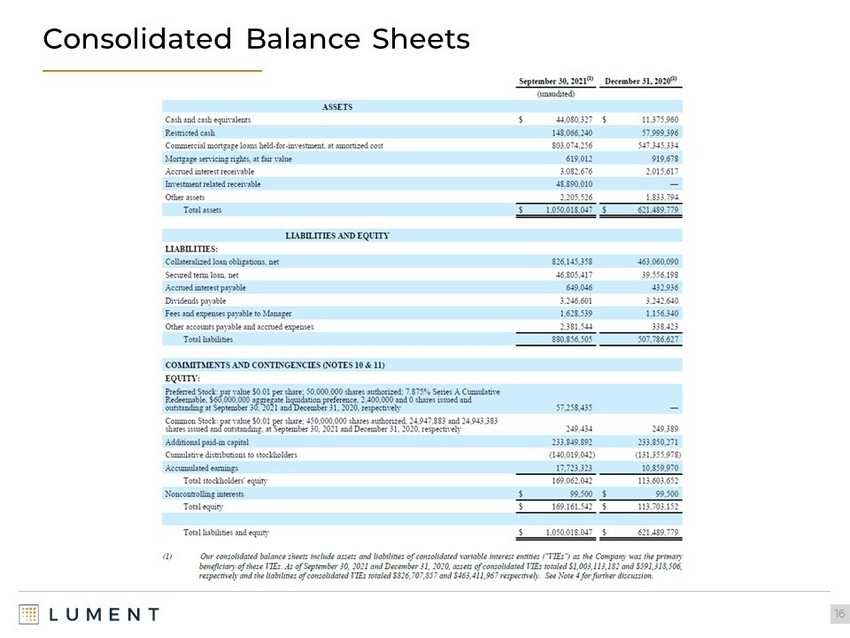

Q3 2021 Balance Sheet Summary 5 Balance Sheet (thousands) September 30, 2021 (1) Commercial mortgage loans held - for - investment $803,074 Mortgage servicing rights, at fair value 619 Cash and cash equivalents 44,080 Restricted cash (2) 148,066 Accrued interest receivable 3,083 Investment Related Receivable 48,890 Other assets 2,206 Total assets $1,050,018 Collateralized loan obligations (3) $826,145 Credit facility (3) 46,805 Other liabilities 7,906 Total liabilities $880,857 Total equity $169,162 Total liabilities / total equity 5.21x Book V alue Per Share of Common Stock (4) $ 4.37 Note: (1) Refer to footnote 1 on page 16 for information on the Company’s consolidated variable interest entities (“VIE’s”). (2) Restricted cash held by LMNT 2021 - FL1, the Company’s CRE CLO, and available for investment in eligible mortgage assets. (3) Outstanding notional amount of bonds issued by LMNT 2021 - FL1 is $833.8 million, and the unpaid principal balance of the credit facility is $47.8 million. For GAAP purposes, these liabilities are carried at their outstanding unpaid principal balance, net of any unamortized discounts and debt issuance costs. (4) See Appendix for definition of Book Value Per Share of Common Stock.

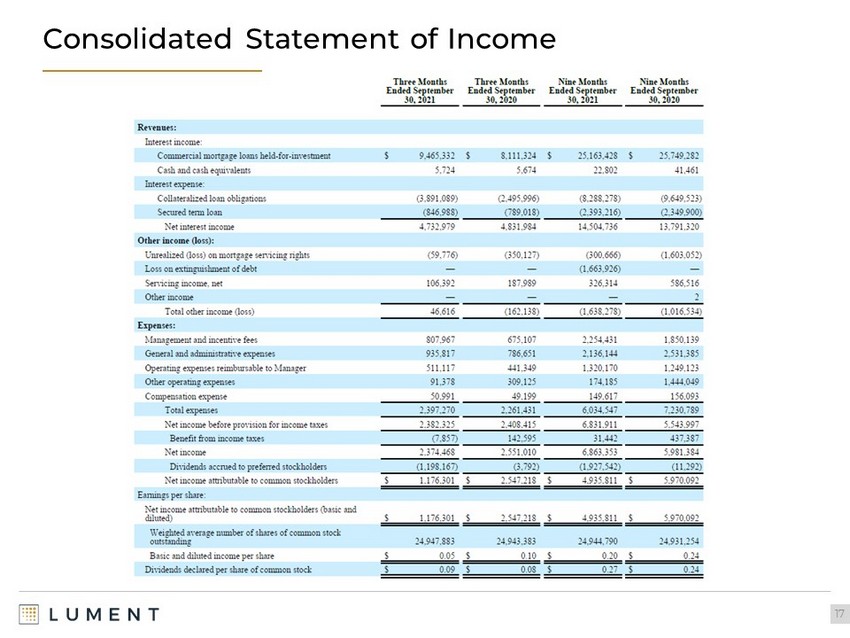

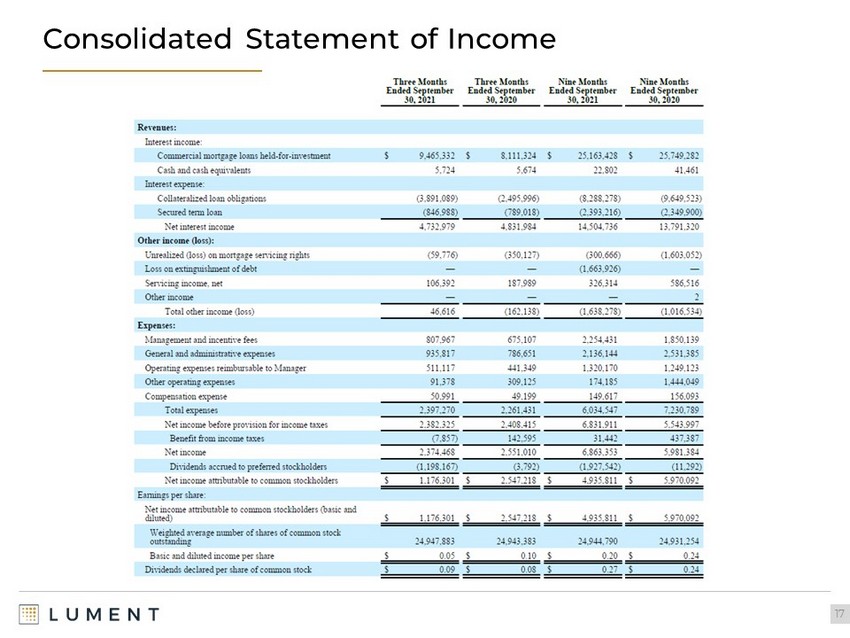

Q3 2021 Income Statement Summary 6 Summary Income Statement (thousands) Three Months Ended September 30, 2021 Net interest income $4,733 Total other income (loss) 47 Operating expenses (2,397) Benefit (provision) from income taxes (8) Preferred dividends (1,198) Net income attributable to common stockholders $1,176 Weighted average shares outstanding during the period, basic and diluted 24,947,883 Net income attributable to common stockholders per share $ 0.05 GAAP Net Income to Distributable Earnings Reconciliation (thousands) Three Months Ended September 30, 2021 Net Income attributable to common stockholders $1,176 Adjustments: Unrealized losses on mortgage servicing rights 60 Purchase premium payoffs 151 Recognized compensation expense related to restricted stock 5 Adjustment for income taxes 8 Distributable Earnings (1 ) $1,400 Weighted average shares outstanding during the period, basic and diluted 24,947,883 Distributable E arnings per share of common stock $ 0.06 Dividend per share of common stock $ 0.09 Note: (1) See Appendix for definition of Distributable Earnings and reconciliation to GAAP.

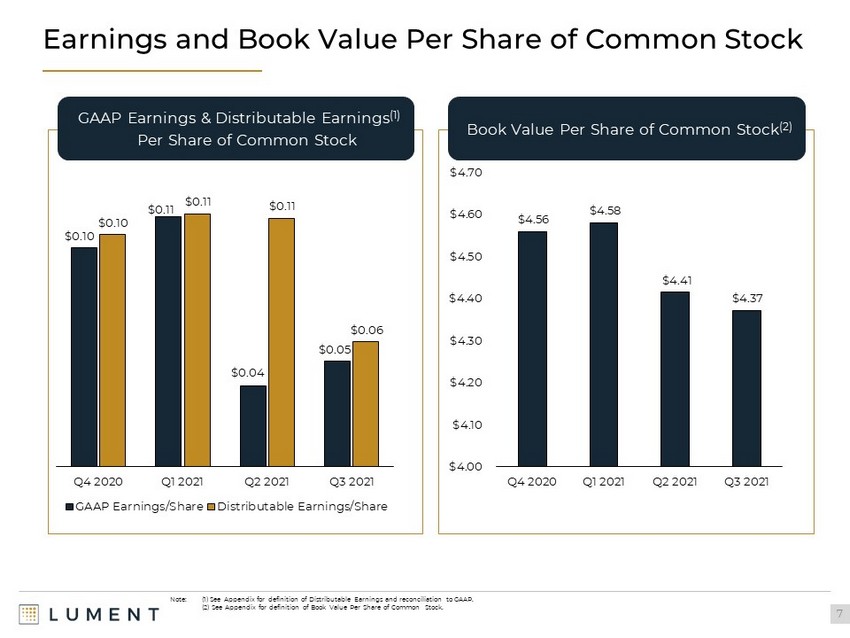

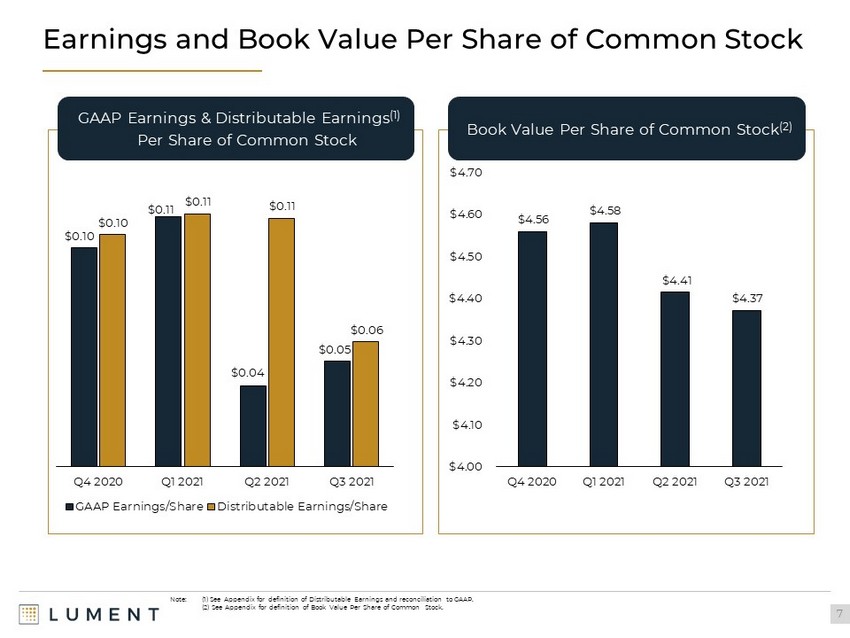

Earnings and Book Value Per Share of Common Stock 7 $0.10 $0.11 $0.04 $0.05 $0.10 $0.11 $0.11 $0.06 Q4 2020 Q1 2021 Q2 2021 Q3 2021 GAAP Earnings/Share Distributable Earnings/Share $4.56 $4.58 $4.41 $4.37 $4.00 $4.10 $4.20 $4.30 $4.40 $4.50 $4.60 $4.70 Q4 2020 Q1 2021 Q2 2021 Q3 2021 GAAP Earnings & Distributable Earnings (1) Per Share of Common Stock Book Value Per Share of Common Stock (2) Note: (1) See Appendix for definition of Distributable Earnings and reconciliation to GAAP. (2) See Appendix for definition of Book Value Per Share of Common Stock.

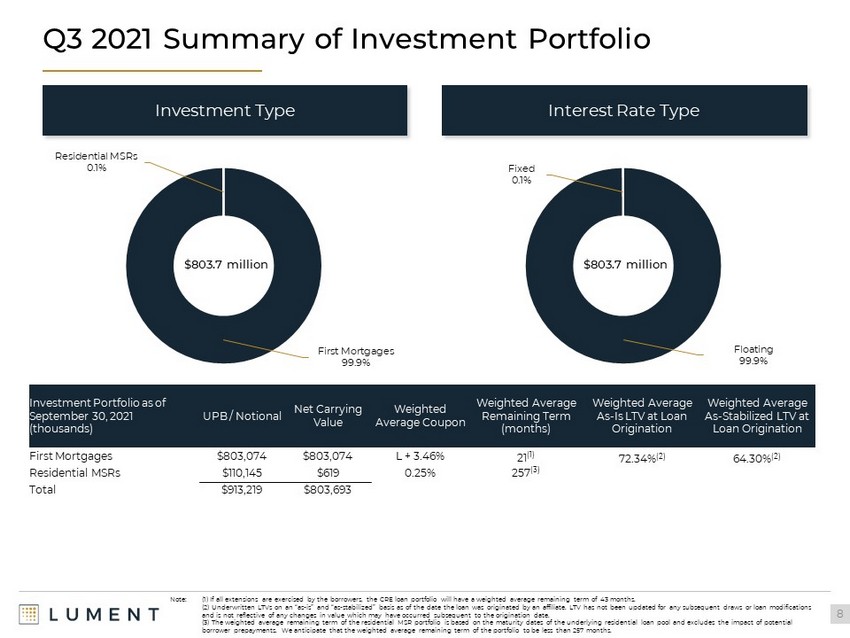

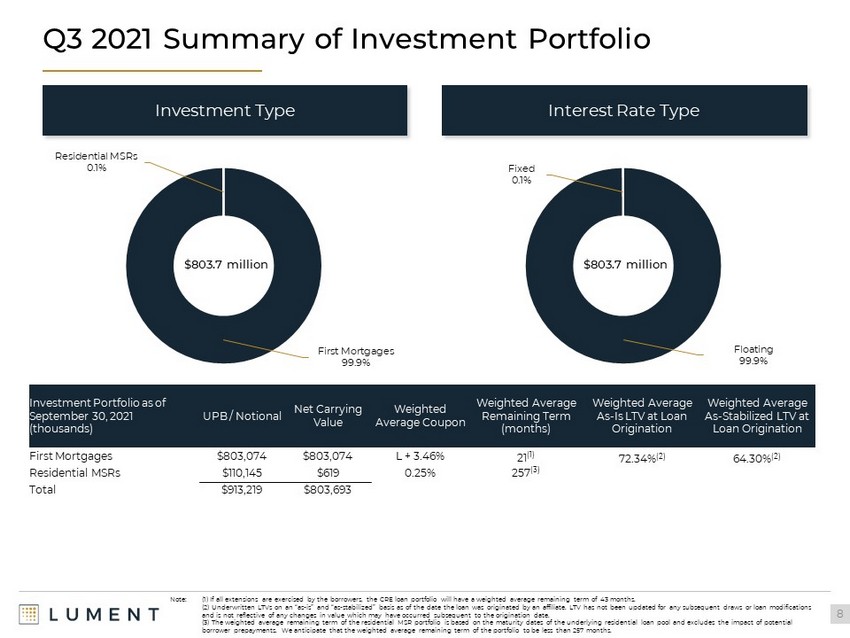

Q3 2021 Summary of Investment Portfolio 8 Floating 99.9% Fixed 0.1% First Mortgages 99.9% Residential MSRs 0.1% Investment Portfolio as of September 30, 2021 (thousands) UPB / Notional Net Carrying Value Weighted Average Coupon Weighted Average Remaining Term (months) Weighted Average As - Is LTV at Loan Origination Weighted Average As - Stabilized LTV at Loan Origination First Mortgages $803,074 $803,074 L + 3.46% 21 (1 ) 72.34% (2) 64.30% (2) Residential MSRs $110,145 $619 0.25% 257 (3) Total $913,219 $803,693 Note: (1) If all extensions are exercised by the borrowers, the CRE loan portfolio will have a weighted average remaining term of 43 months. ( 2) Underwritten LTVs on an “as - is” and “as - stabilized” basis as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date . ( 3 ) The weighted average remaining term of the residential MSR portfolio is based on the maturity dates of the underlying residen tia l loan pool and excludes the impact of potential borrower prepayments. We anticipate that the weighted average remaining term of the portfolio to be less than 257 months. Investment Type Interest Rate Type $803.7 million $803.7 million

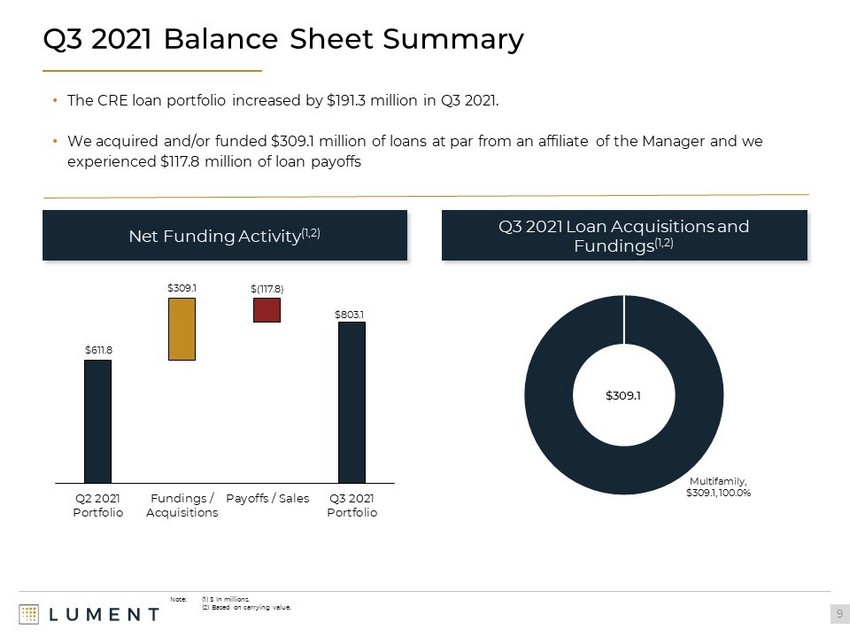

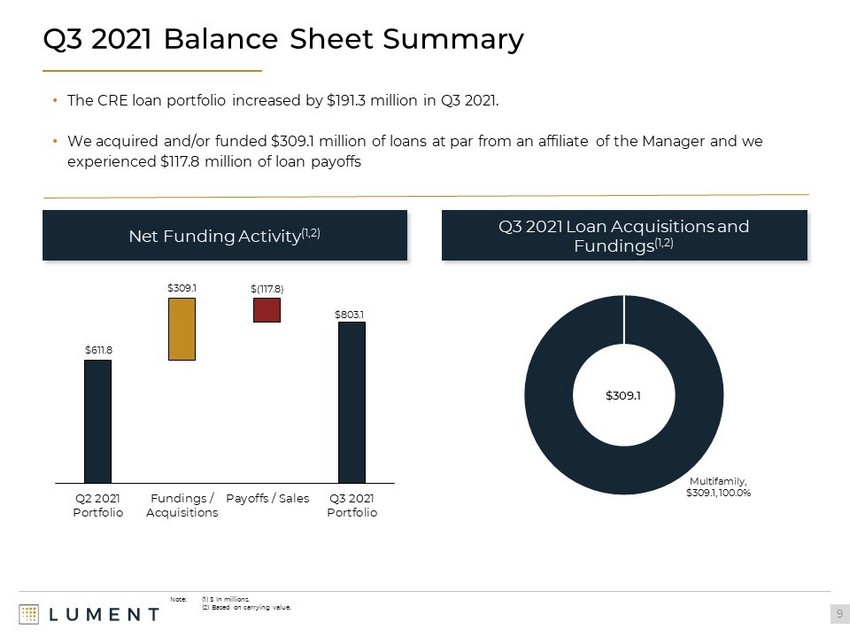

Q3 2021 Balance Sheet Summary 9 Multifamily , $309.1 , 100.0% Net Funding Activity (1,2) Q3 2021 Loan Acquisitions and Fundings (1,2) $309.1 Note: (1) $ In millions. (2) Based on carrying value. $611.8 $309.1 $(117.8) $803.1 Q2 2021 Portfolio Fundings / Acquisitions Payoffs / Sales Q3 2021 Portfolio • The CRE loan portfolio increased by $191.3 million in Q3 2021. • We acquired and/or funded $309.1 million of loans at par from an affiliate of the Manager and we experienced $117.8 million of loan payoffs

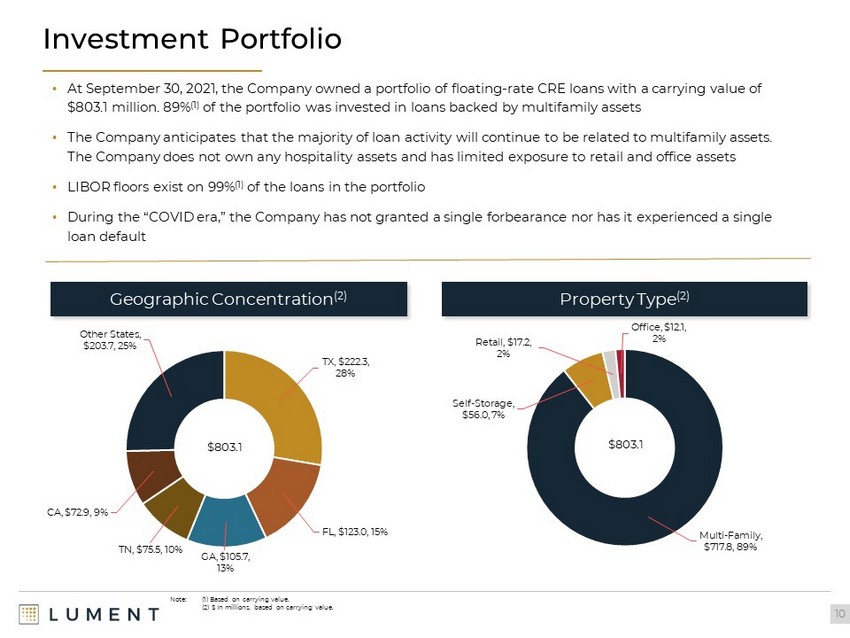

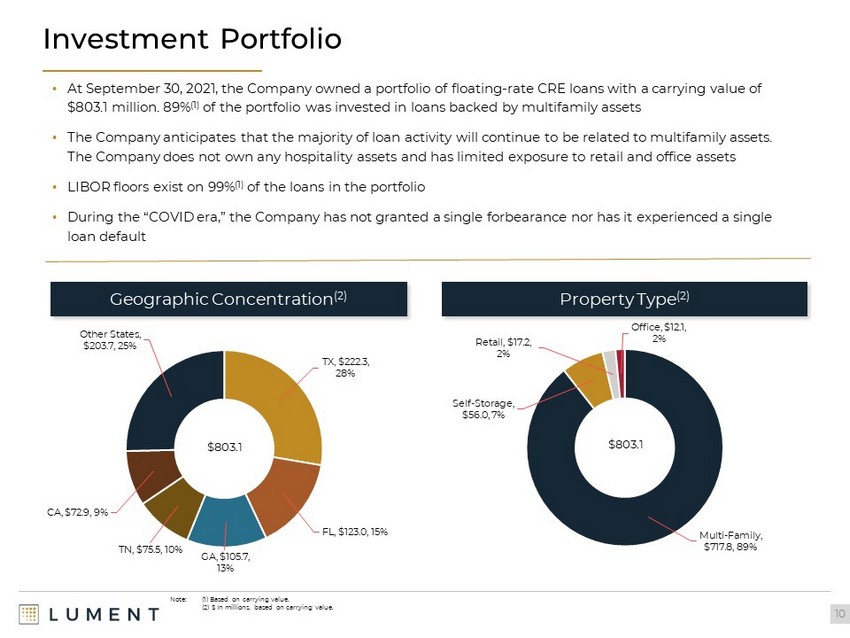

Investment Portfolio 10 Geographic Concentration (2) Multi - Family , $717.8 , 89% Self - Storage , $56.0 , 7% Retail , $17.2 , 2% Office , $12.1 , 2% Property Type (2) $803.1 Note: ( 1) Based on carrying value. (2) $ In millions, based on carrying value. • At September 30, 2021, the Company owned a portfolio of floating - rate CRE loans with a carrying value of $803.1 million. 89% (1) of the portfolio was invested in loans backed by multifamily assets • The Company anticipates that the majority of loan activity will continue to be related to multifamily assets. The Company does not own any hospitality assets and has limited exposure to retail and office assets • LIBOR floors exist on 99% (1) of the loans in the p ortfolio • During the “COVID era,” the Company has not granted a single forbearance nor has it experienced a single loan default TX , $222.3 , 28% FL , $123.0 , 15% GA , $105.7 , 13% TN , $75.5 , 10% CA , $72.9 , 9% Other States , $203.7 , 25% $803.1

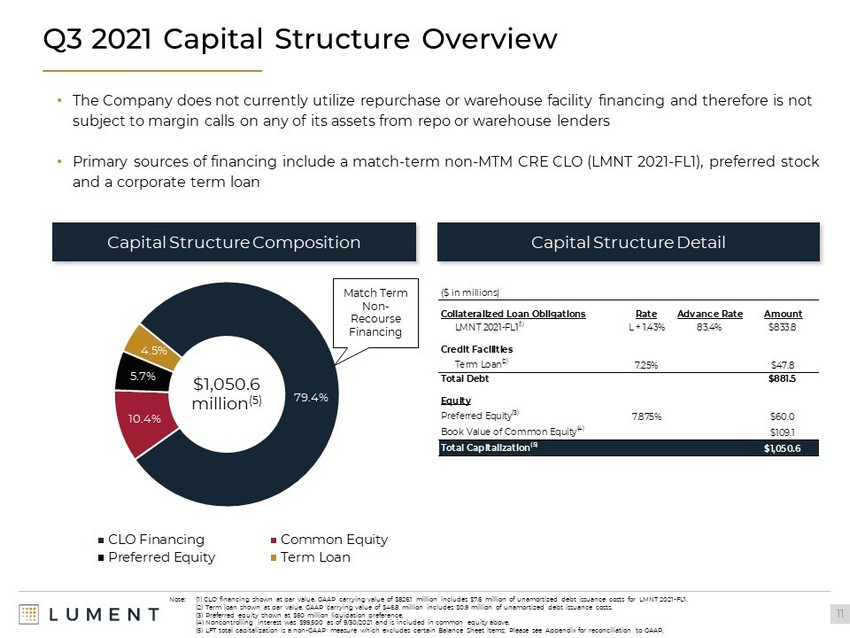

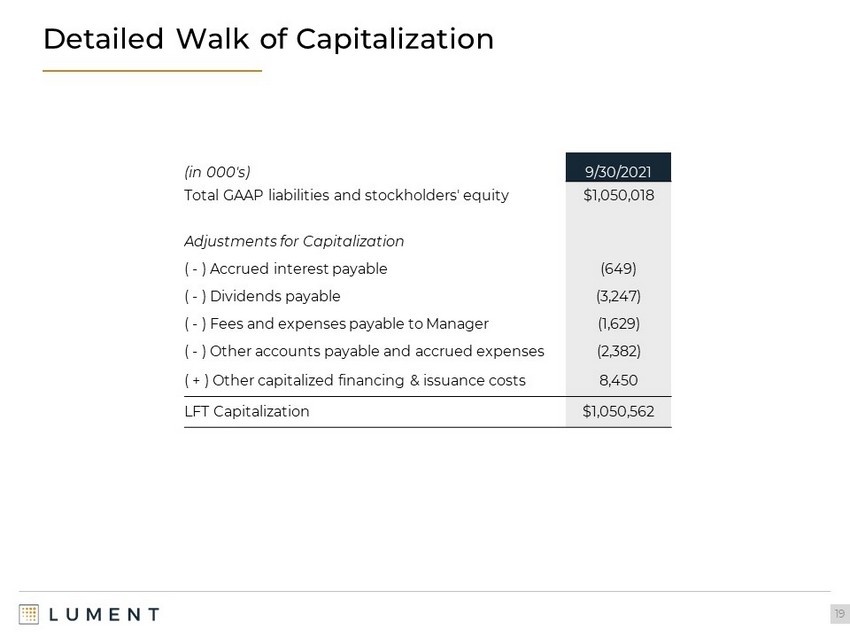

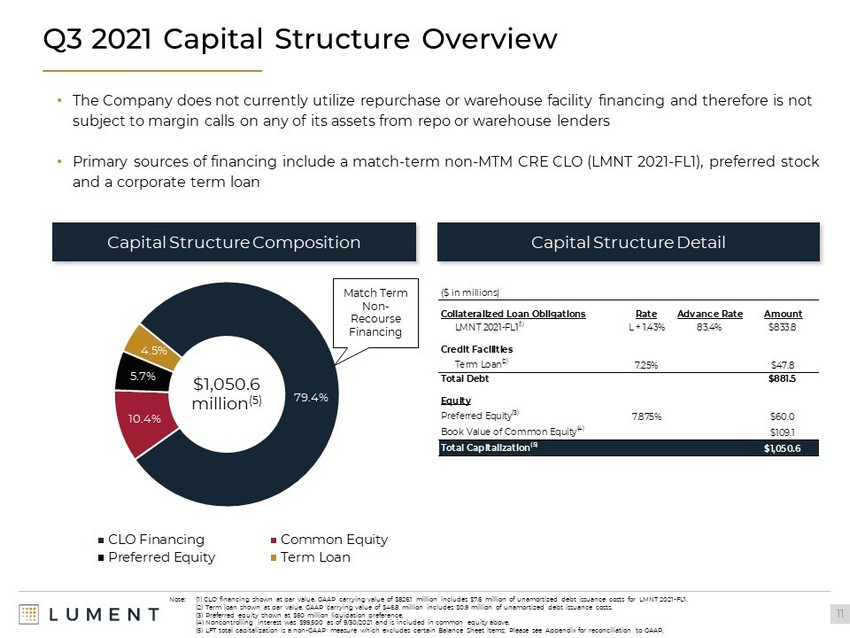

Q3 2021 Capital Structure Overview 11 79.4% 10.4% 5.7% 4.5% CLO Financing Common Equity Preferred Equity Term Loan $1,050.6 million (5) Capital Structure Composition Capital Structure Detail Note: (1) CLO financing shown at par value. GAAP carrying value of $826.1 million includes $7.6 million of unamortized debt issuance costs for LMNT 2021 - FL1. (2) Term loan shown at par value. GAAP carrying value of $46.8 million includes $ 0.9 million of unamortized debt issuance costs. (3) Preferred equity shown at $60 million liquidation preference. (4) Noncontrolling interest was $99,500 as of 9/30/2021 and is included in common equity above. (5) LFT total capitalization is a non - GAAP measure which excludes certain Balance Sheet items; Please see Appendix for reconciliatio n to GAAP. Match Term Non - Recourse Financing • The Company does not currently utilize repurchase or warehouse facility financing and therefore is not subject to margin calls on any of its assets from repo or warehouse lenders • Primary sources of financing include a match - term non - MTM CRE CLO (LMNT 2021 - FL1), preferred stock and a corporate term loan ($ in millions) Collateralized Loan Obligations Rate Advance Rate Amount LMNT 2021-FL1 (1) L + 1.43% 83.4% $833.8 Credit Facilities Term Loan (2) 7.25% $47.8 Total Debt $881.5 Equity Preferred Equity (3) 7.875% $60.0 Book Value of Common Equity (4) $109.1 Total Capitalization (5) $1,050.6

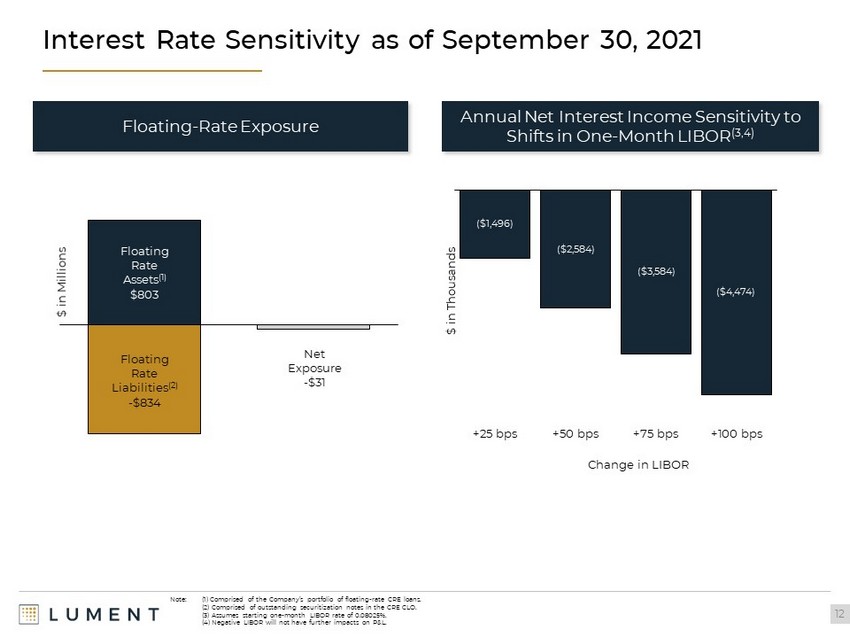

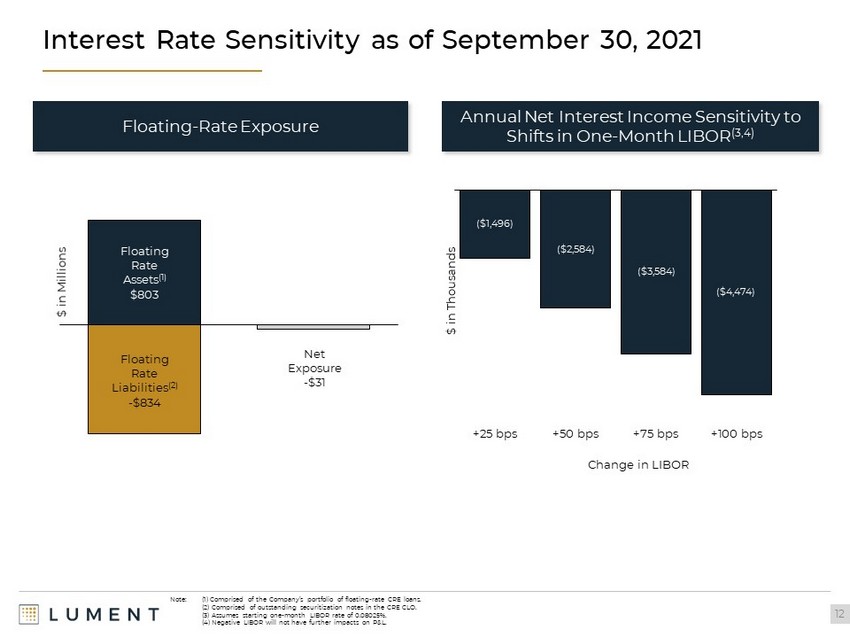

($1,496) ($2,584) ($3,584) ($4,474) +25 bps +50 bps +75 bps +100 bps $ in Thousands Change in LIBOR Interest Rate Sensitivity as of September 30, 2021 12 Floating Rate Assets (1) $803 Floating Rate Liabilities (2) - $834 Net Exposure - $31 Floating - Rate Exposure Annual Net Interest Income Sensitivity to Shifts in One - Month LIBOR (3,4) $ in Millions Note: (1) Comprised of the Company’s portfolio of floating - rate CRE loans. (2) Comprised of outstanding securitization notes in the CRE CLO. (3) Assumes starting one - month LIBOR rate of 0.08025%. ( 4) Negative LIBOR will not have further impacts on P&L.

Appendix

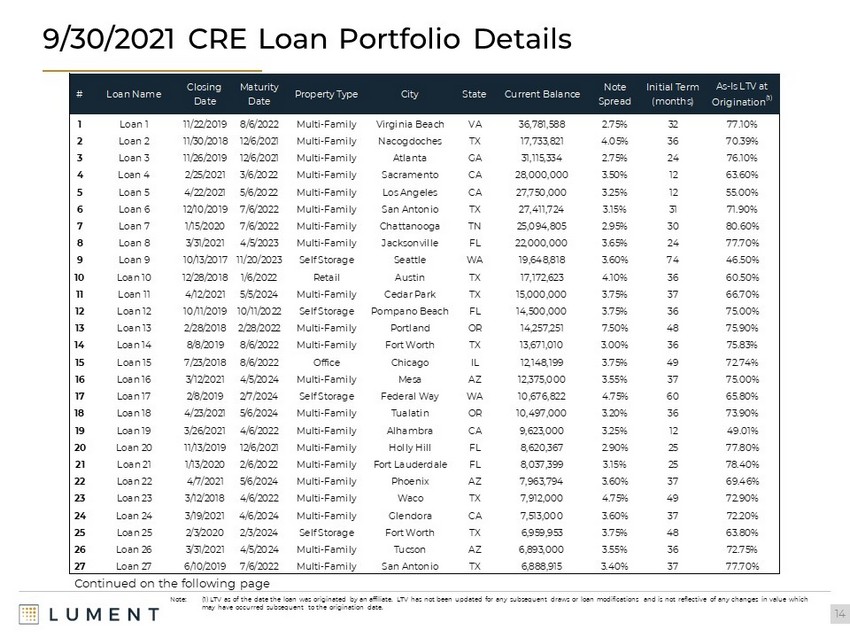

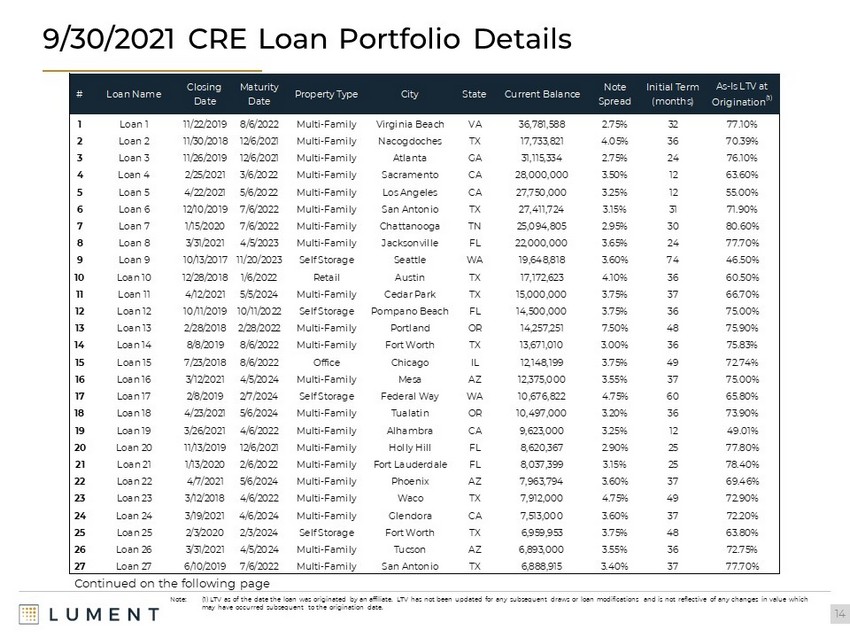

9/30/2021 CRE Loan Portfolio Details 14 Continued on the following page Note: (1 ) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modif ica tions and is not reflective of any changes in value which may have occurred subsequent to the origination date . # Loan Name Closing Date Maturity Date Property Type City State Current Balance Note Spread Initial Term (months) As-Is LTV at Origination (1) 1 Loan 1 11/22/2019 8/6/2022 Multi-Family Virginia Beach VA 36,781,588 2.75% 32 77.10% 2 Loan 2 11/30/2018 12/6/2021 Multi-Family Nacogdoches TX 17,733,821 4.05% 36 70.39% 3 Loan 3 11/26/2019 12/6/2021 Multi-Family Atlanta GA 31,115,334 2.75% 24 76.10% 4 Loan 4 2/25/2021 3/6/2022 Multi-Family Sacramento CA 28,000,000 3.50% 12 63.60% 5 Loan 5 4/22/2021 5/6/2022 Multi-Family Los Angeles CA 27,750,000 3.25% 12 55.00% 6 Loan 6 12/10/2019 7/6/2022 Multi-Family San Antonio TX 27,411,724 3.15% 31 71.90% 7 Loan 7 1/15/2020 7/6/2022 Multi-Family Chattanooga TN 25,094,805 2.95% 30 80.60% 8 Loan 8 3/31/2021 4/5/2023 Multi-Family Jacksonville FL 22,000,000 3.65% 24 77.70% 9 Loan 9 10/13/2017 11/20/2023 Self Storage Seattle WA 19,648,818 3.60% 74 46.50% 10 Loan 10 12/28/2018 1/6/2022 Retail Austin TX 17,172,623 4.10% 36 60.50% 11 Loan 11 4/12/2021 5/5/2024 Multi-Family Cedar Park TX 15,000,000 3.75% 37 66.70% 12 Loan 12 10/11/2019 10/11/2022 Self Storage Pompano Beach FL 14,500,000 3.75% 36 75.00% 13 Loan 13 2/28/2018 2/28/2022 Multi-Family Portland OR 14,257,251 7.50% 48 75.90% 14 Loan 14 8/8/2019 8/6/2022 Multi-Family Fort Worth TX 13,671,010 3.00% 36 75.83% 15 Loan 15 7/23/2018 8/6/2022 Office Chicago IL 12,148,199 3.75% 49 72.74% 16 Loan 16 3/12/2021 4/5/2024 Multi-Family Mesa AZ 12,375,000 3.55% 37 75.00% 17 Loan 17 2/8/2019 2/7/2024 Self Storage Federal Way WA 10,676,822 4.75% 60 65.80% 18 Loan 18 4/23/2021 5/6/2024 Multi-Family Tualatin OR 10,497,000 3.20% 36 73.90% 19 Loan 19 3/26/2021 4/6/2022 Multi-Family Alhambra CA 9,623,000 3.25% 12 49.01% 20 Loan 20 11/13/2019 12/6/2021 Multi-Family Holly Hill FL 8,620,367 2.90% 25 77.80% 21 Loan 21 1/13/2020 2/6/2022 Multi-Family Fort Lauderdale FL 8,037,399 3.15% 25 78.40% 22 Loan 22 4/7/2021 5/6/2024 Multi-Family Phoenix AZ 7,963,794 3.60% 37 69.46% 23 Loan 23 3/12/2018 4/6/2022 Multi-Family Waco TX 7,912,000 4.75% 49 72.90% 24 Loan 24 3/19/2021 4/6/2024 Multi-Family Glendora CA 7,513,000 3.60% 37 72.20% 25 Loan 25 2/3/2020 2/3/2024 Self Storage Fort Worth TX 6,959,953 3.75% 48 63.80% 26 Loan 26 3/31/2021 4/5/2024 Multi-Family Tucson AZ 6,893,000 3.55% 36 72.75% 27 Loan 27 6/10/2019 7/6/2022 Multi-Family San Antonio TX 6,888,915 3.40% 37 77.70%

9/30/2021 CRE Loan Portfolio Details 15 Note: (1 ) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modif ica tions and is not reflective of any changes in value which may have occurred subsequent to the origination date . # Loan Name Closing Date Maturity Date Property Type City State Current Balance Note Spread Initial Term (months) As-Is LTV at Origination (1) 28 Loan 28 12/9/2019 1/6/2022 Multi-Family Fort Worth TX 6,344,748 3.15% 25 77.70% 29 Loan 29 8/28/2019 8/6/2022 Multi-Family Austin TX 6,054,427 3.25% 35 69.90% 30 Loan 30 12/13/2019 1/6/2022 Multi-Family Jacksonville FL 5,632,870 2.90% 25 74.90% 31 Loan 31 6/10/2019 7/6/2022 Multi-Family San Antonio TX 5,295,605 2.90% 37 62.92% 32 Loan 32 4/30/2021 5/5/2024 Multi-Family Daytona Beach FL 5,285,500 3.65% 36 77.40% 33 Loan 33 12/29/2020 1/6/2022 Multi-Family Fayetteville NC 4,920,000 3.95% 12 70.30% 34 Loan 34 11/30/2018 11/30/2021 Multi-Family Anderson SC 4,446,000 3.25% 36 53.70% 35 Loan 35 5/31/2019 6/6/2022 Multi-Family Austin TX 4,275,035 3.50% 36 74.09% 36 Loan 36 11/12/2019 12/6/2021 Self Storage Chesapeake VA 4,225,000 3.15% 25 64.50% 37 Loan 37 6/8/2021 7/5/2024 Multi-Family Miami FL 30,576,666 3.20% 37 74.26% 38 Loan 38 6/8/2021 7/5/2024 Multi-Family Chattanooga TN 33,360,000 3.65% 37 79.76% 39 Loan 39 6/7/2021 7/5/2024 Multi-Family San Antonio TX 26,400,000 3.40% 37 80.00% 40 Loan 40 5/28/2021 6/6/2023 Multi-Family Houston TX 13,332,734 3.35% 24 73.76% 41 Loan 41 5/21/2021 6/6/2024 Multi-Family Youngtown AZ 5,994,000 3.65% 37 71.40% 42 Loan 42 7/8/2021 8/5/2023 Multi-Family Knoxville TN 17,000,000 3.95% 25 69.67% 43 Loan 43 5/20/2021 6/6/2024 Multi-Family Marietta GA 27,803,800 3.10% 37 77.02% 44 Loan 44 7/1/2021 7/5/2024 Multi-Family Harker Heights TX 6,290,000 3.60% 36 72.30% 45 Loan 45 6/30/2021 7/5/2024 Multi-Family Jacksonville FL 20,188,700 3.50% 36 77.10% 46 Loan 46 6/28/2021 7/6/2024 Multi-Family Barrington NJ 34,690,000 3.05% 36 78.13% 47 Loan 47 6/30/2021 7/5/2024 Multi-Family Porter TX 28,650,000 3.25% 36 71.63% 48 Loan 48 7/14/2021 8/6/2024 Multi-Family Birmingham AL 5,248,000 3.70% 37 71.69% 49 Loan 49 5/12/2021 6/5/2024 Multi-Family Lakeland FL 8,220,000 3.35% 37 76.80% 50 Loan 50 5/12/2021 6/5/2024 Multi-Family Fort Worth TX 13,026,000 3.35% 37 74.86% 51 Loan 51 8/26/2021 9/5/2024 Multi-Family Union City GA 21,957,240 3.35% 36 70.40% 52 Loan 52 8/26/2021 8/5/2024 Multi-Family Clarkston GA 24,832,000 3.50% 35 79.00% 53 Loan 53 8/16/2021 9/6/2024 Multi-Family Columbus OH 12,750,000 3.65% 37 75.00% Total / Average 803,043,750 3.46% 34 72.34%

Consolidated Balance Sheets 16

Consolidated Statement of Income 17

Reconciliation of GAAP to Distributable Earnings 18 For the Three Months Ended GAAP to Distributable Earnings Reconciliation September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 Reconciliation of GAAP to non - GAAP Information Net income attributable to common stockholders $1,176,301 $954,575 $2,804,935 $2,464,678 Adjustments for non - Distributable earnings Unrealized loss on mortgage servicing rights 59,776 220,435 20,455 177,476 Purchase premium payoffs 150,990 - - - Loss on extinguishment of debt - 1,663,926 - - Subtotal 210,766 1,884,361 20,455 177,476 Other Adjustments Recognized compensation expense related to restricted common stock 4,741 3,241 2,885 2,949 Adjustment for income taxes 7,857 (54,012) 14,713 (38,861) Subtotal 12,598 (50,771) 17,598 (35,912) Distributable Earnings $1,399,665 $2,788,165 $2,842,988 $2,606,242 Weighted average shares outstanding, b asic and diluted 24,947,883 24,944,075 24,943,383 24,943,383 Distributable Earnings per share of common stock , b asic and diluted $0.06 $0.11 $0.11 $0.10

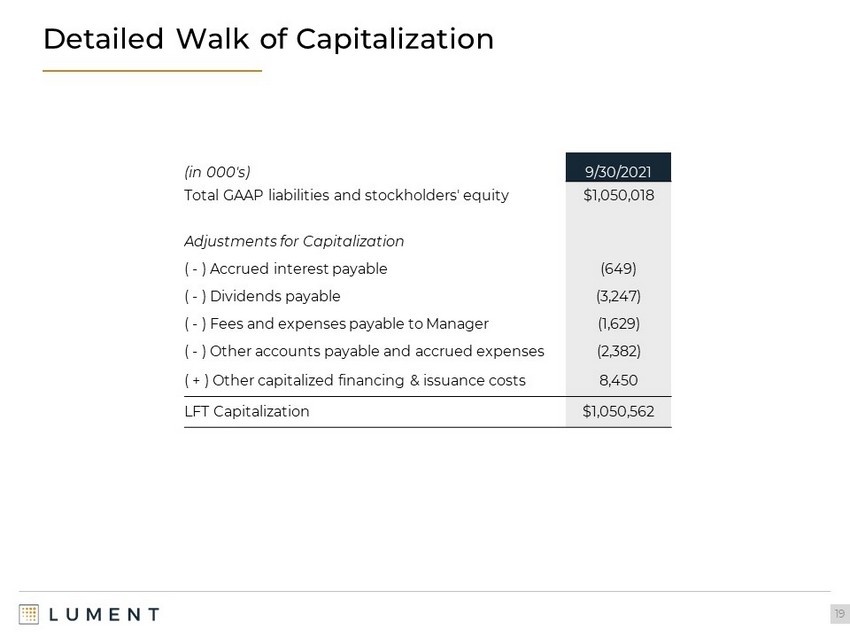

Detailed Walk of Capitalization 19 (in 000's) 9/30/2021 Total GAAP liabilities and stockholders' equity $1,050,018 Adjustments for Capitalization ( - ) Accrued interest payable (649) ( - ) Dividends payable (3,247) ( - ) Fees and expenses payable to Manager (1,629) ( - ) Other accounts payable and accrued expenses (2,382) ( + ) Other capitalized financing & issuance costs 8,450 LFT Capitalization $1,050,562

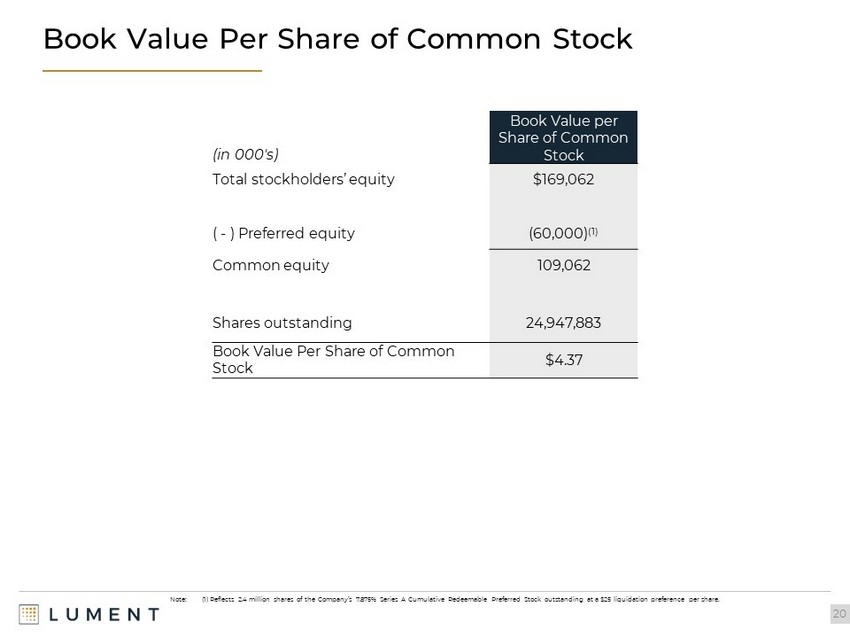

Book Value Per Share of Common Stock 20 (in 000's) Book Value per Share of Common Stock Total stockholders’ equity $169,062 ( - ) Preferred equity (60,000) (1) Common equity 109,062 Shares outstanding 24,947,883 Book Value Per Share of Common Stock $4.37 Note: (1) Reflects 2.4 million shares of the Company’s 7.875 % Series A Cumulative Redeemable Preferred Stock outstanding at a $25 liquidation preference per share.

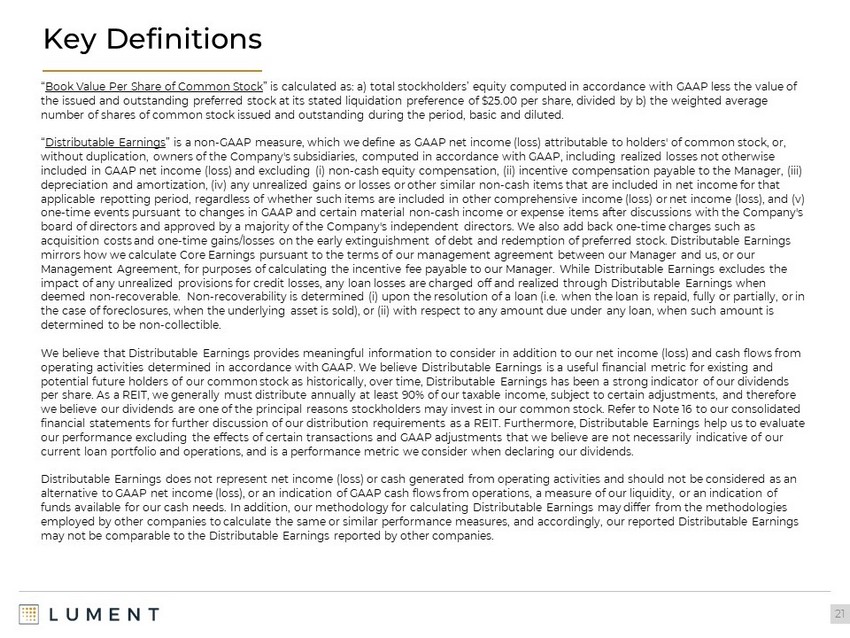

Key Definitions 21 “ Book Value Per Share of Common Stock ” is calculated as: a) total stockholders’ equity computed in accordance with GAAP less the value of the issued and outstanding preferred stock at its stated liquidation preference of $25.00 per share, divided by b) the weight ed average number of shares of common stock issued and outstanding during the period, basic and diluted. “ Distributable Earnings ” is a non - GAAP measure, which we define as GAAP net income (loss) attributable to holders' of common stock, or, without duplication, owners of the Company's subsidiaries, computed in accordance with GAAP, including realized losses not ot her wise included in GAAP net income (loss) and excluding ( i ) non - cash equity compensation, (ii) incentive compensation payable to the Manager, (iii) depreciation and amortization, (iv) any unrealized gains or losses or other similar non - cash items that are included in net inco me for that applicable repotting period, regardless of whether such items are included in other comprehensive income (loss) or net income (l oss), and (v) one - time events pursuant to changes in GAAP and certain material non - cash income or expense items after discussions with the Com pany's board of directors and approved by a majority of the Company's independent directors. We also add back one - time charges such as acquisition costs and one - time gains/losses on the early extinguishment of debt and redemption of preferred stock. Distributable Earnings mirrors how we calculate Core Earnings pursuant to the terms of our management agreement between our Manager and us, or our Management Agreement, for purposes of calculating the incentive fee payable to our Manager. While Distributable Earnings excludes the impact of any unrealized provisions for credit losses, any loan losses are charged off and realized through Distributable Ear nin gs when deemed non - recoverable. Non - recoverability is determined ( i ) upon the resolution of a loan (i.e. when the loan is repaid, fully or partially, or in the case of foreclosures, when the underlying asset is sold), or (ii) with respect to any amount due under any loan, when suc h a mount is determined to be non - collectible . We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (loss) and c ash flows from operating activities determined in accordance with GAAP. We believe Distributable Earnings is a useful financial metric for existing and potential future holders of our common stock as historically, over time, Distributable Earnings has been a strong indicator of our dividends per share. As a REIT, we generally must distribute annually at least 90% of our taxable income, subject to certain adjustments, and therefore we believe our dividends are one of the principal reasons stockholders may invest in our common stock. Refer to Note 16 to our consolidated financial statements for further discussion of our distribution requirements as a REIT. Furthermore , Distributable Earnings help us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations, and is a performance metric we consider when declaring our dividends . Distributable Earnings does not represent net income (loss) or cash generated from operating activities and should not be con sid ered as an alternative to GAAP net income (loss), or an indication of GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs . In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar performance measures, and accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies.

November 2021