Exhibit 99.2

May 2022 Lument Finance Trust Q1 2022 Earnings Supplemental

Disclaimer 2 This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the current views of Lument Finance Trust, Inc. (NYSE: LFT) (“LFT,” the “Company,” “we,” “our,” or “us”) with respect to, among other things, the Company ’s operations and financial performance. You can identify these forward - looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “pr ojects,” “intends,” “plans,” “estimates,” or “anticipates,” or the negative version of these words or other comparable words or other statements that do not relate strictly to historical or factual matters. Such forward - looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to d iff er materially from those indicated in these statements. The Company believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10 - K for the year ended December 31, 2021 (the “2021 Form 10 - K”). Additionally, many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the COVID - 19 outbreak. It is not possible to predict or identify all such ri sks. Additional information concerning these and other risk factors are contained in our 2021 Form 10 - K which is available on the SEC’s website at www.sec.gov . These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the filings. The forward - looking statements contained in this presentation speak only as of May 9, 2022. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events or circumstances. This presentation includes non - GAAP financial measures, including Distributable Earnings. While we believe the non - GAAP information included in this presentation provides supplemental information to assist investors in analyzing our operating results and to assist investors in comparing our operating results with other peer issuers, these measures are not in accorda nce with GAAP, and they should not be considered a substitute for, or superior to, our financial information calculated in accordance with GAAP. Please refer to this presentation’s Appendix for a reconciliation of the non - GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP.

Company Overview 3 Key Investment Highlights Strong Sponsorship/Ownership • Access to extensive loan origination platform through affiliation with Lument, a premier national mortgage originator and asset manager • Experienced management team with average of 27 years of industry experience across multiple economic cycles • Affiliation with ORIX Corporation USA, the US subsidiary of ORIX Corporation, a publicly traded Tokyo - based international financial services firm • The Company is an externally - managed real estate investment trust focused on investing in, financing and managing a portfolio of commercial real estate debt investments • The Company is externally managed by Lument Investment Management, an affiliate of ORIX Corporation USA Attractive Investment Profile • Emphasis on middle market multifamily investments which are well positioned for the current environment • Strong credit and asset management capabilities with zero delinquencies or monetary defaults during the COVID era • Attractive financing source via non - recourse, non mark - to - market CRE CLO

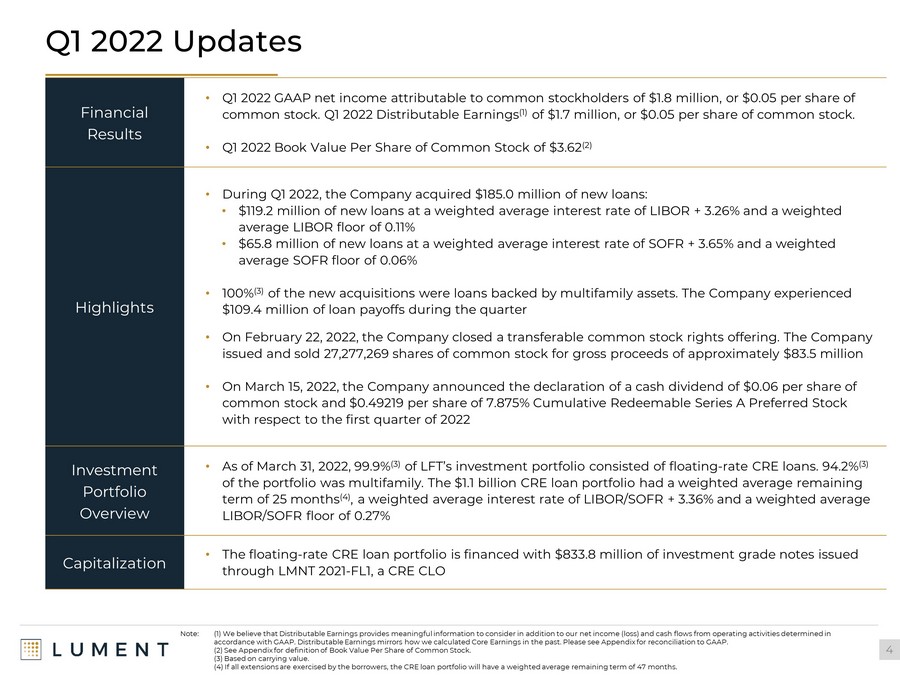

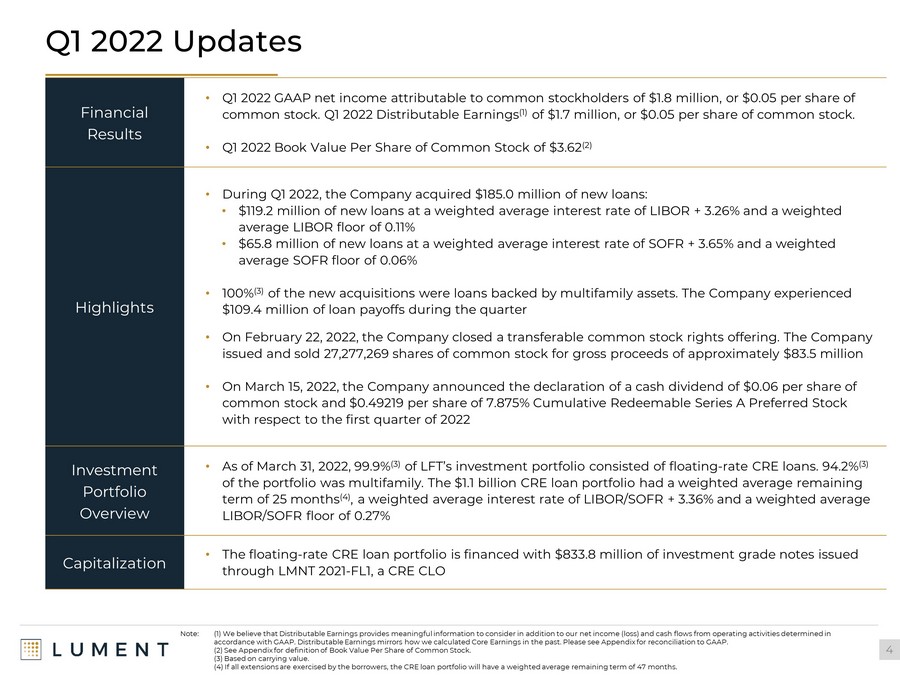

Q1 2022 Updates 4 Note: (1) We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (los s) and cash flows from operating activities determined in accordance with GAAP. Distributable Earnings mirrors how we calculated Core Earnings in the past. Please see Appendix for rec onc iliation to GAAP. (2) See Appendix for definition of Book Value Per Share of Common Stock. (3) Based on carrying value. (4) If all extensions are exercised by the borrowers, the CRE loan portfolio will have a weighted average remaining term of 4 7 months. Financial Results • Q1 2022 GAAP net income attributable to common stockholders of $1.8 million, or $0.05 per share of common stock. Q1 2022 Distributable Earnings (1) of $1.7 million, or $0.05 per share of common stock. • Q1 2022 Book Value Per Share of Common Stock of $3.62 (2) Highlights • During Q1 2022, the Company acquired $185.0 million of new loans: • $119.2 million of new loans at a weighted average interest rate of LIBOR + 3.26% and a weighted average LIBOR floor of 0.11% • $65.8 million of new loans at a weighted average interest rate of SOFR + 3.65% and a weighted average SOFR floor of 0.06% • 100% (3) of the new acquisitions were loans backed by multifamily assets. The Company experienced $109.4 million of loan payoffs during the quarter • On February 22, 2022, the Company closed a transferable common stock rights offering. The Company issued and sold 27,277,269 shares of common stock for gross proceeds of approximately $83.5 million • On March 15, 2022, the Company announced the declaration of a cash dividend of $0.06 per share of common stock and $0.49219 per share of 7.875% Cumulative Redeemable Series A Preferred Stock with respect to the first quarter of 2022 Investment Portfolio Overview • As of March 31, 2022, 99.9% (3) of LFT’s investment portfolio consisted of floating - rate CRE loans. 94.2% (3) of the portfolio was multifamily. The $1.1 billion CRE loan portfolio had a weighted average remaining term of 25 months (4) , a weighted average interest rate of LIBOR/SOFR + 3.36% and a weighted average LIBOR/SOFR floor of 0.27% Capitalization • The floating - rate CRE loan portfolio is financed with $833.8 million of investment grade notes issued through LMNT 2021 - FL1, a CRE CLO

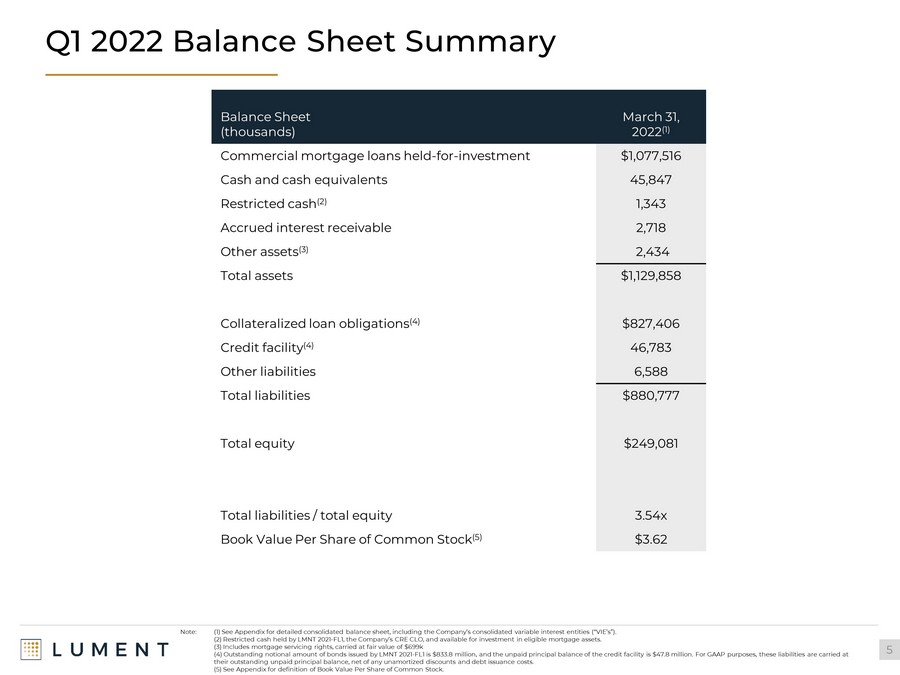

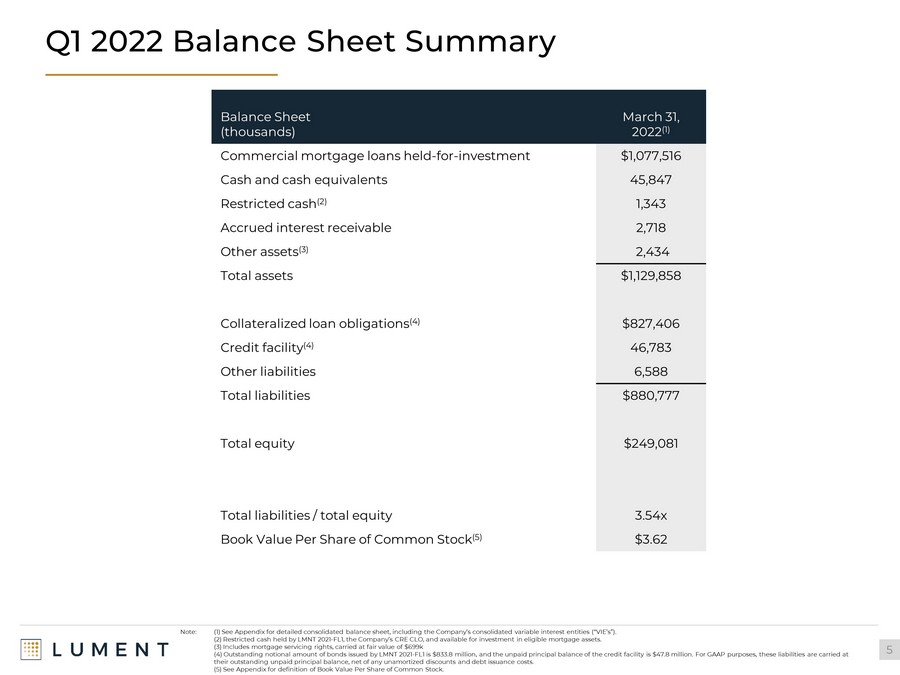

Q1 2022 Balance Sheet Summary 5 Balance Sheet (thousands) March 31, 2022 (1) Commercial mortgage loans held - for - investment $1,077,516 Cash and cash equivalents 45,847 Restricted cash (2) 1,343 Accrued interest receivable 2,718 Other assets (3) 2,434 Total assets $1,129,858 Collateralized loan obligations (4) $827,406 Credit facility (4) 46,783 Other liabilities 6,588 Total liabilities $880,777 Total equity $249,081 Total liabilities / total equity 3.54x Book Value Per Share of Common Stock (5) $3.62 Note: (1) See Appendix for detailed consolidated balance sheet, including the Company’s consolidated variable interest entities (“VIE’s”). (2) Restricted cash held by LMNT 2021 - FL1, the Company’s CRE CLO, and available for investment in eligible mortgage assets. (3) Includes mortgage servicing rights, carried at fair value of $699k (4) Outstanding notional amount of bonds issued by LMNT 2021 - FL1 is $833.8 million, and the unpaid principal balance of the cre dit facility is $47.8 million. For GAAP purposes, these liabilities are carried at their outstanding unpaid principal balance, net of any unamortized discounts and debt issuance costs. (5) See Appendix for definition of Book Value Per Share of Common Stock.

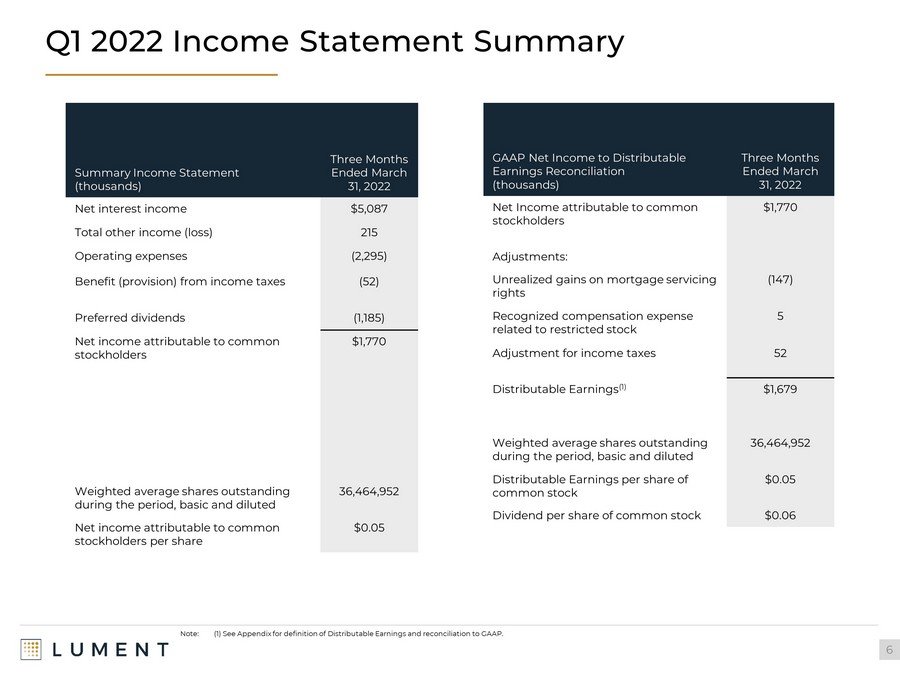

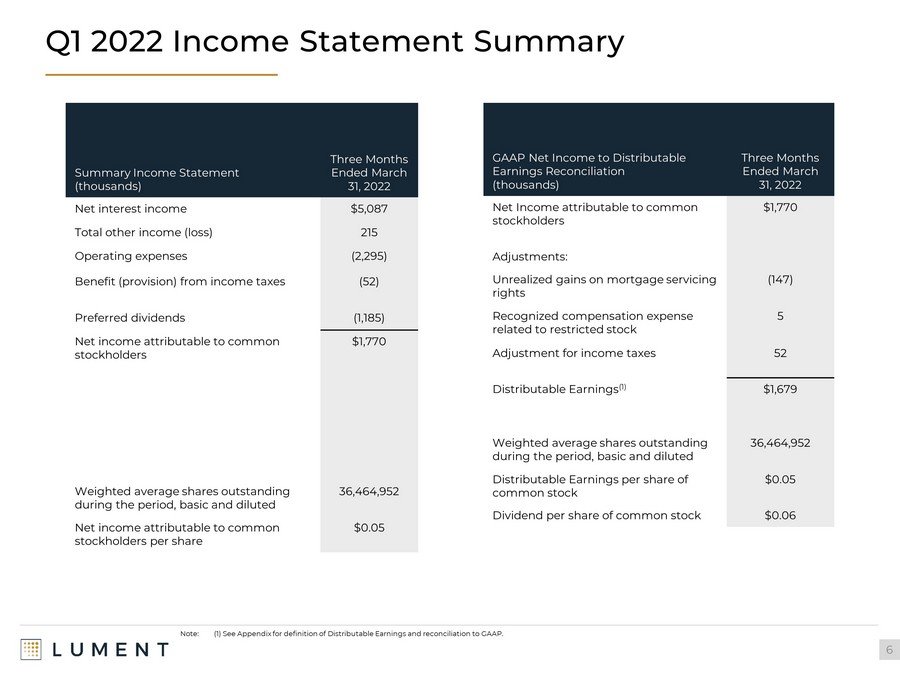

Q1 2022 Income Statement Summary 6 Summary Income Statement (thousands) Three Months Ended March 31, 2022 Net interest income $5,087 Total other income (loss) 215 Operating expenses (2,295) Benefit (provision) from income taxes (52) Preferred dividends (1,185) Net income attributable to common stockholders $1,770 Weighted average shares outstanding during the period, basic and diluted 36,464,952 Net income attributable to common stockholders per share $0.05 GAAP Net Income to Distributable Earnings Reconciliation (thousands) Three Months Ended March 31, 2022 Net Income attributable to common stockholders $1,770 Adjustments: Unrealized gains on mortgage servicing rights (147) Recognized compensation expense related to restricted stock 5 Adjustment for income taxes 52 Distributable Earnings (1) $1,679 Weighted average shares outstanding during the period, basic and diluted 36,464,952 Distributable Earnings per share of common stock $0.05 Dividend per share of common stock $0.06 Note: (1) See Appendix for definition of Distributable Earnings and reconciliation to GAAP.

Earnings and Book Value Per Share of Common Stock 7 $0.04 $0.05 $0.10 $0.05 $0.11 $0.06 $0.11 $0.05 Q2 2021 Q3 2021 Q4 2021 Q1 2022 GAAP Earnings/Share Distributable Earnings/Share $4.41 $4.37 $4.38 $3.62 Q2 2021 Q3 2021 Q4 2021 Q1 2022 GAAP Earnings & Distributable Earnings (1) Per Share of Common Stock Book Value Per Share of Common Stock (2) Note: (1) See Appendix for definition of Distributable Earnings and reconciliation to GAAP. (2) See Appendix for definition of Book Value Per Share of Common Stock.

Q1 2022 Balance Sheet Summary 8 Multifamily , $185.0 , 100.0% Net Funding Activity (1,2) Q1 2022 Loan Acquisitions and Fundings (1,2) $185.0 Note: (1) $ In millions. (2) Based on carrying value. $1,001.8 $185.0 $(109.3) $1,077.5 Q4 2021 Portfolio Fundings / Acquisitions Payoffs / Sales Q1 2022 Portfolio • The CRE loan portfolio increased by $75.3 million in Q1 2022 • We acquired $185.0 million of loans at par from an affiliate of the Manager and we experienced $109.7 million of loan payoffs

Investment Portfolio 9 Geographic Concentration (2) Multi - Family , $1,014.9 , 94% Retail , $16.7 , 2% Office , $11.7 , 1% Self Storage , $34.2 , 3% Property Type (2) $1,077.5 Note: (1) Based on carrying value. (2) $ In millions, based on carrying value. • At March 31, 2022, the Company owned a portfolio of floating - rate CRE loans with a carrying value of $1.1 billion. 94% (1) of the portfolio was invested in loans backed by multifamily assets • The Company anticipates that the majority of loan activity will continue to be related to multifamily assets. The Company does not own any hospitality assets and has limited exposure to retail, office, and self - storage assets (less than 10% of portfolio) • During the “COVID era,” the Company has not granted a single forbearance nor has it experienced a single monetary loan default TX , $242.4 , 22% FL , $186.8 , 17% GA , $135.4 , 13% NJ , $98.3 , 9% TN , $92.1 , 9% Other States , $322.5 , 30% $1,077.5

Q1 2022 Capital Structure Overview 10 73.8% 16.7% 5.3% 4.2% CLO Financing Common Equity Preferred Equity Term Loan $1,130.5 million (5) Capital Structure Composition Capital Structure Detail Note: (1) CLO financing shown at par value. GAAP carrying value of $827.4 million includes $6.3 million of unamortized debt issu ance costs for LMNT 2021 - FL1. (2) Term loan shown at par value. GAAP carrying value of $46.8 million includes $1.0 million of unamortized debt issuance cos ts . (3) Preferred equity shown at $60 million liquidation preference. (4) Noncontrolling interest was $99,500 as of 3/31/2022 and is excluded from common equity above. (5) LFT total capitalization is a non - GAAP measure which excludes certain Balance Sheet items; Please see Appendix for reconcil iation to GAAP. Match Term Non - Recourse Financing • The Company does not currently utilize repurchase or warehouse facility financing and therefore is not subject to margin calls on any of its assets from repo or warehouse lenders • Primary sources of financing include a match - term non - MTM CRE CLO (LMNT 2021 - FL1), preferred stock and a corporate term loan ($ in millions) Collateralized Loan Obligations Rate Advance Rate Amount LMNT 2021-FL1 (1) L + 1.43% 83.4% $833.8 Credit Facilities Term Loan (2) 7.25% $47.8 Total Debt $881.5 Equity Preferred Equity (3) 7.875% $60.0 Book Value of Common Equity (4) $189.0 Total Capitalization (5) $1,130.5

$887 $680 $1,641 $2,679 $3,893 $5,111 $6,330 -50 bps +50 bps +100 bps +150 bps +200 bps +250 bps +300 bps $ in Thousands Change in LIBOR / SOFR Net Interest Income Sensitivity to Shifts in One - Month LIBOR and Term SOFR 11 Floating Rate Assets (1) $1,078 Floating Rate Liabilities (2) - $834 Net Exposure $244 Floating - Rate Exposure Annual Net Interest Income Sensitivity to Shifts in One - Month LIBOR (3,4) & Term SOFR $ in Millions Note: (1) Comprised of the Company’s portfolio of floating - rate CRE loans: 93.9% indexed to one - month LIBOR and 6.1% indexed to 30 - day term SOFR. (2) Comprised of outstanding securitization notes in the CRE CLO, which is indexed to one - month LIBOR. (3) Assumes starting one - month LIBOR rate of 0.4520% and 30 - day term SOFR of 0.3024%. (4) Negative shifts beyond - 50bps to LIBOR/SOFR will not have further impacts on P&L. • 100% of loan portfolio is floating - rate • 93.9% of portfolio is indexed to one - month LIBOR and 6.1% of portfolio is indexed to 30 - day term SOFR

Appendix

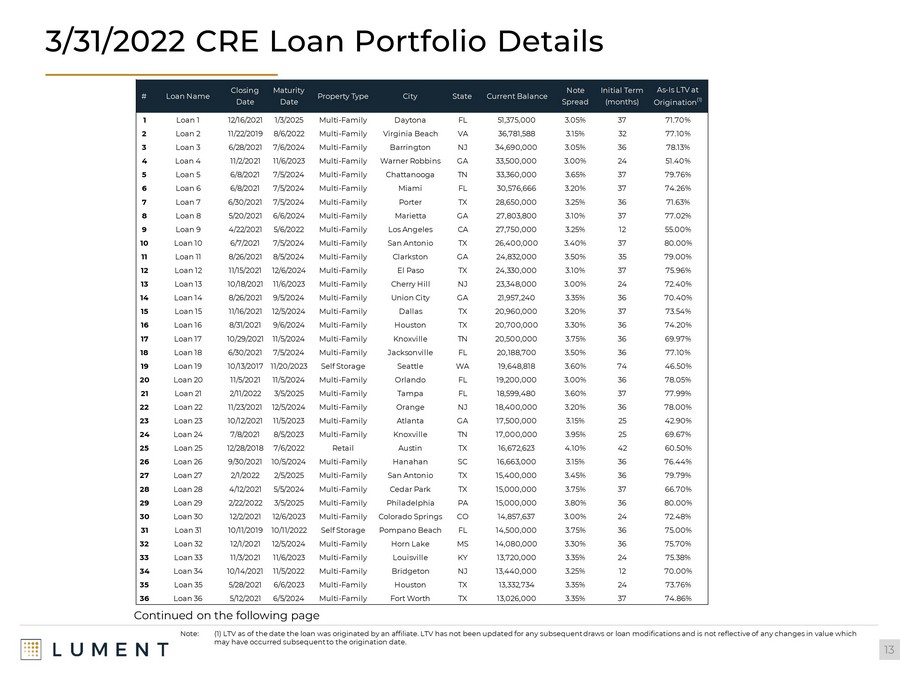

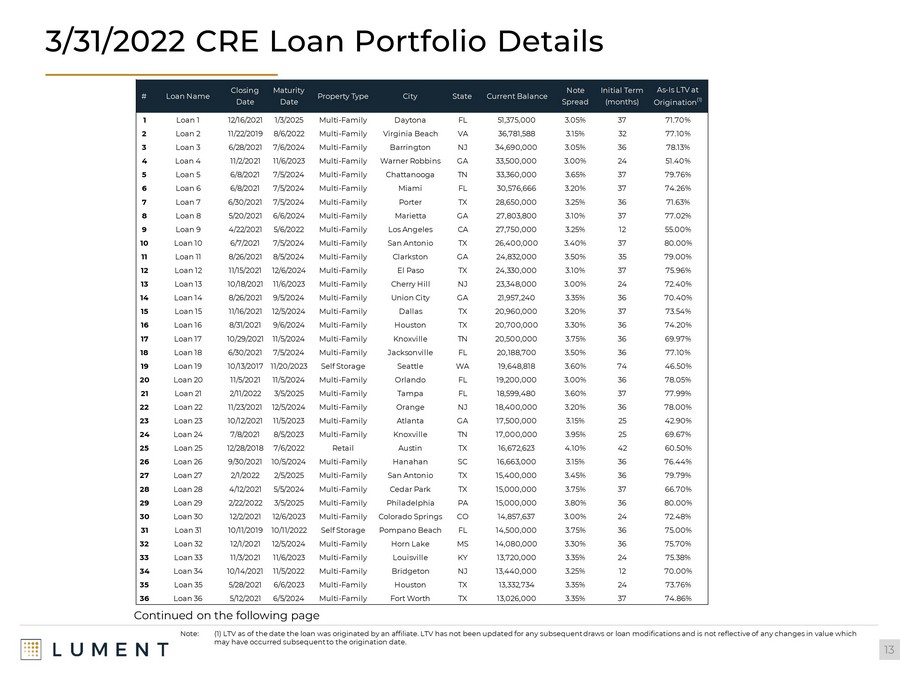

3/31/2022 CRE Loan Portfolio Details 13 Continued on the following page Note: (1) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date. # Loan Name Closing Date Maturity Date Property Type City State Current Balance Note Spread Initial Term (months) As-Is LTV at Origination (1) 1 Loan 1 12/16/2021 1/3/2025 Multi-Family Daytona FL 51,375,000 3.05% 37 71.70% 2 Loan 2 11/22/2019 8/6/2022 Multi-Family Virginia Beach VA 36,781,588 3.15% 32 77.10% 3 Loan 3 6/28/2021 7/6/2024 Multi-Family Barrington NJ 34,690,000 3.05% 36 78.13% 4 Loan 4 11/2/2021 11/6/2023 Multi-Family Warner Robbins GA 33,500,000 3.00% 24 51.40% 5 Loan 5 6/8/2021 7/5/2024 Multi-Family Chattanooga TN 33,360,000 3.65% 37 79.76% 6 Loan 6 6/8/2021 7/5/2024 Multi-Family Miami FL 30,576,666 3.20% 37 74.26% 7 Loan 7 6/30/2021 7/5/2024 Multi-Family Porter TX 28,650,000 3.25% 36 71.63% 8 Loan 8 5/20/2021 6/6/2024 Multi-Family Marietta GA 27,803,800 3.10% 37 77.02% 9 Loan 9 4/22/2021 5/6/2022 Multi-Family Los Angeles CA 27,750,000 3.25% 12 55.00% 10 Loan 10 6/7/2021 7/5/2024 Multi-Family San Antonio TX 26,400,000 3.40% 37 80.00% 11 Loan 11 8/26/2021 8/5/2024 Multi-Family Clarkston GA 24,832,000 3.50% 35 79.00% 12 Loan 12 11/15/2021 12/6/2024 Multi-Family El Paso TX 24,330,000 3.10% 37 75.96% 13 Loan 13 10/18/2021 11/6/2023 Multi-Family Cherry Hill NJ 23,348,000 3.00% 24 72.40% 14 Loan 14 8/26/2021 9/5/2024 Multi-Family Union City GA 21,957,240 3.35% 36 70.40% 15 Loan 15 11/16/2021 12/5/2024 Multi-Family Dallas TX 20,960,000 3.20% 37 73.54% 16 Loan 16 8/31/2021 9/6/2024 Multi-Family Houston TX 20,700,000 3.30% 36 74.20% 17 Loan 17 10/29/2021 11/5/2024 Multi-Family Knoxville TN 20,500,000 3.75% 36 69.97% 18 Loan 18 6/30/2021 7/5/2024 Multi-Family Jacksonville FL 20,188,700 3.50% 36 77.10% 19 Loan 19 10/13/2017 11/20/2023 Self Storage Seattle WA 19,648,818 3.60% 74 46.50% 20 Loan 20 11/5/2021 11/5/2024 Multi-Family Orlando FL 19,200,000 3.00% 36 78.05% 21 Loan 21 2/11/2022 3/5/2025 Multi-Family Tampa FL 18,599,480 3.60% 37 77.99% 22 Loan 22 11/23/2021 12/5/2024 Multi-Family Orange NJ 18,400,000 3.20% 36 78.00% 23 Loan 23 10/12/2021 11/5/2023 Multi-Family Atlanta GA 17,500,000 3.15% 25 42.90% 24 Loan 24 7/8/2021 8/5/2023 Multi-Family Knoxville TN 17,000,000 3.95% 25 69.67% 25 Loan 25 12/28/2018 7/6/2022 Retail Austin TX 16,672,623 4.10% 42 60.50% 26 Loan 26 9/30/2021 10/5/2024 Multi-Family Hanahan SC 16,663,000 3.15% 36 76.44% 27 Loan 27 2/1/2022 2/5/2025 Multi-Family San Antonio TX 15,400,000 3.45% 36 79.79% 28 Loan 28 4/12/2021 5/5/2024 Multi-Family Cedar Park TX 15,000,000 3.75% 37 66.70% 29 Loan 29 2/22/2022 3/5/2025 Multi-Family Philadelphia PA 15,000,000 3.80% 36 80.00% 30 Loan 30 12/2/2021 12/6/2023 Multi-Family Colorado Springs CO 14,857,637 3.00% 24 72.48% 31 Loan 31 10/11/2019 10/11/2022 Self Storage Pompano Beach FL 14,500,000 3.75% 36 75.00% 32 Loan 32 12/1/2021 12/5/2024 Multi-Family Horn Lake MS 14,080,000 3.30% 36 75.70% 33 Loan 33 11/3/2021 11/6/2023 Multi-Family Louisville KY 13,720,000 3.35% 24 75.38% 34 Loan 34 10/14/2021 11/5/2022 Multi-Family Bridgeton NJ 13,440,000 3.25% 12 70.00% 35 Loan 35 5/28/2021 6/6/2023 Multi-Family Houston TX 13,332,734 3.35% 24 73.76% 36 Loan 36 5/12/2021 6/5/2024 Multi-Family Fort Worth TX 13,026,000 3.35% 37 74.86%

3/31/2022 CRE Loan Portfolio Details 14 Note: (1) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date. # Loan Name Closing Date Maturity Date Property Type City State Current Balance Note Spread Initial Term (months) As-Is LTV at Origination (1) 37 Loan 37 8/16/2021 9/6/2024 Multi-Family Columbus OH 12,750,000 3.65% 37 75.00% 38 Loan 38 3/12/2021 4/5/2024 Multi-Family Mesa AZ 12,375,000 3.55% 37 75.00% 39 Loan 39 10/1/2021 10/4/2024 Multi-Family East Nashville TN 12,100,000 3.35% 36 79.08% 40 Loan 40 7/23/2018 8/6/2022 Office Chicago IL 11,748,199 3.75% 49 72.74% 41 Loan 41 10/28/2021 11/6/2024 Multi-Family Tampa FL 11,202,535 2.95% 36 75.70% 42 Loan 42 9/30/2021 10/6/2023 Multi-Family Clearfield UT 10,795,000 3.15% 24 67.98% 43 Loan 43 4/23/2021 5/6/2024 Multi-Family Tualatin OR 10,497,000 3.20% 36 73.90% 44 Loan 44 12/29/2021 1/3/2025 Multi-Family Phoenix AZ 10,239,800 3.65% 36 75.90% 45 Loan 45 12/2/2021 12/6/2024 Multi-Family Tomball TX 9,975,000 3.40% 36 68.50% 46 Loan 46 11/23/2021 12/5/2024 Multi-Family Atlanta GA 9,856,000 3.35% 36 79.50% 47 Loan 47 3/26/2021 4/6/2022 Multi-Family Alhambra CA 9,623,000 3.25% 12 49.01% 48 Loan 48 1/14/2022 2/5/2025 Multi-Family Houston TX 9,609,250 3.60% 37 78.76% 49 Loan 49 10/21/2021 11/5/2024 Multi-Family Madison TN 9,100,000 3.20% 37 68.42% 50 Loan 50 11/30/2021 12/5/2024 Multi-Family Lindenwood NJ 8,400,000 3.55% 36 76.40% 51 Loan 51 5/12/2021 6/5/2024 Multi-Family Lakeland FL 8,220,000 3.35% 37 76.80% 52 Loan 52 4/7/2021 5/6/2024 Multi-Family Phoenix AZ 7,963,794 3.60% 37 69.46% 53 Loan 53 10/29/2021 11/5/2024 Multi-Family Riverside MO 7,934,000 3.40% 36 76.60% 54 Loan 54 3/12/2018 4/6/2022 Multi-Family Waco TX 7,912,000 4.75% 49 72.90% 55 Loan 55 11/16/2021 12/6/2023 Multi-Family Cape Coral FL 7,680,000 3.25% 25 79.18% 56 Loan 56 10/27/2021 11/5/2024 Multi-Family Ambler PA 7,624,400 3.30% 36 79.92% 57 Loan 57 3/19/2021 4/6/2024 Multi-Family Glendora CA 7,513,000 3.60% 37 72.20% 58 Loan 58 9/28/2021 10/4/2024 Multi-Family Chicago IL 7,286,000 3.65% 36 75.90% 59 Loan 59 2/18/2022 3/5/2025 Multi-Family Drexel Hills PA 7,200,000 3.95% 37 78.09% 60 Loan 60 12/30/2021 1/25/2023 Multi-Family New Haven CT 7,000,000 3.50% 13 59.80% 61 Loan 61 3/31/2021 4/5/2024 Multi-Family Tucson AZ 6,893,000 3.55% 36 72.75% 62 Loan 62 7/1/2021 7/5/2024 Multi-Family Harker Heights TX 6,290,000 3.60% 36 72.30% 63 Loan 63 8/28/2019 8/6/2022 Multi-Family Austin TX 6,054,427 3.25% 35 69.90% 64 Loan 64 5/21/2021 6/6/2024 Multi-Family Youngtown AZ 5,994,000 3.65% 37 71.40% 65 Loan 65 10/26/2021 11/6/2023 Multi-Family Indianapolis IN 5,812,000 3.85% 24 77.08% 66 Loan 66 6/10/2019 7/6/2022 Multi-Family San Antonio TX 5,295,605 2.90% 37 62.92% 67 Loan 67 4/30/2021 5/5/2024 Multi-Family Daytona Beach FL 5,285,500 3.65% 36 77.40% 68 Loan 68 7/14/2021 8/6/2024 Multi-Family Birmingham AL 5,248,000 3.70% 37 71.69% 69 Loan 69 11/19/2021 12/5/2024 Multi-Family Huntsville AL 5,040,000 3.75% 37 78.75% 70 Loan 70 11/30/2018 11/30/2022 Multi-Family Anderson SC 4,446,000 3.25% 48 53.70% 71 Loan 71 12/28/2021 1/3/2025 Multi-Family Houston TX 2,800,000 3.15% 36 71.20% Total / Average 1,077,505,797 3.36% 34 72.02%

Consolidated Balance Sheets 15

Consolidated Statement of Income 16

Reconciliation of GAAP to Distributable Earnings 17 For the Three Months Ended GAAP to Distributable Earnings Reconciliation March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Reconciliation of GAAP to non - GAAP Information Net income attributable to common stockholders $1,769,841 $2,478,911 $1,176,301 $954,575 Adjustments for non - Distributable earnings Unrealized loss on mortgage servicing rights (147,382) 56,106 59,776 220,435 Purchase premium payoffs - - 150,990 - Loss on extinguishment of debt - - - 1,663,926 Subtotal (147,382) 56,106 210,766 1,884,361 Other Adjustments Recognized compensation expense related to restricted common stock 4,638 4,741 4,741 3,241 Adjustment for income taxes 51,665 109,336 7,857 (54,012) Subtotal 56,303 114,077 12,598 (50,771) Distributable Earnings $1,678,762 $2,649,094 $1,399,665 $2,788,165 Weighted average shares outstanding, b asic and diluted 36,464,952 24,947,883 24,947,883 24,944,075 Distributable Earnings per share of common stock , b asic and diluted $0.05 $0.11 $0.06 $0.11

Detailed Walk of Capitalization as of 3/31/2022 18 (in 000's) 3/31/2022 Total GAAP liabilities and stockholders' equity $1,129,758 Adjustments for Capitalization ( - ) Accrued interest payable (817) ( - ) Dividends payable (4,135) ( - ) Fees and expenses payable to Manager (1,324) ( - ) Other accounts payable and accrued expenses (312) ( + ) Other capitalized financing & issuance costs 7,311 LFT Capitalization $1,130,481

Book Value Per Share of Common Stock as of 3/31/2022 19 (in 000's) Book Value per Share of Common Stock Total stockholders’ equity $248,981 ( - ) Preferred equity (60,000) (1) Common equity 188,981 Shares outstanding 52,225,152 Book Value Per Share of Common Stock $3.62 Note: (1) Reflects 2.4 million shares of the Company’s 7.875% Series A Cumulative Redeemable Preferred Stock outstanding at a $ 25 liquidation preference per share.

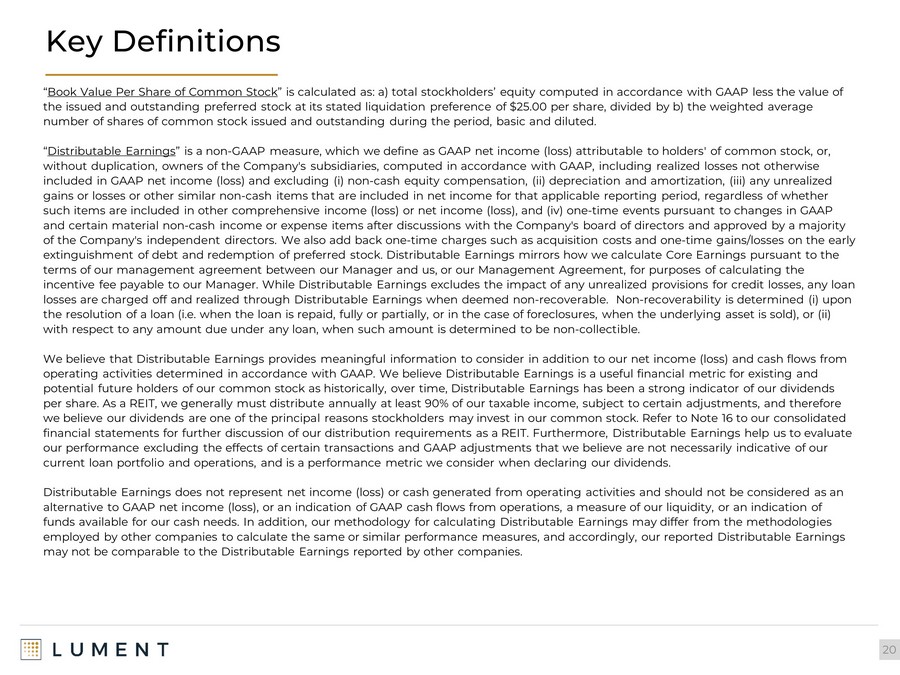

Key Definitions 20 “ Book Value Per Share of Common Stock ” is calculated as: a) total stockholders’ equity computed in accordance with GAAP less the value of the issued and outstanding preferred stock at its stated liquidation preference of $25.00 per share, divided by b) the weight ed average number of shares of common stock issued and outstanding during the period, basic and diluted. “ Distributable Earnings ” is a non - GAAP measure, which we define as GAAP net income (loss) attributable to holders' of common stock, or, without duplication, owners of the Company's subsidiaries, computed in accordance with GAAP, including realized losses not ot her wise included in GAAP net income (loss) and excluding ( i ) non - cash equity compensation, (ii) depreciation and amortization, (iii) any unrealized gains or losses or other similar non - cash items that are included in net income for that applicable reporting period, regardless of whether such items are included in other comprehensive income (loss) or net income (loss), and (iv) one - time events pursuant to changes in GAAP and certain material non - cash income or expense items after discussions with the Company's board of directors and approved by a majority of the Company's independent directors. We also add back one - time charges such as acquisition costs and one - time gains/losses on the early extinguishment of debt and redemption of preferred stock. Distributable Earnings mirrors how we calculate Core Earnings pursu ant to the terms of our management agreement between our Manager and us, or our Management Agreement, for purposes of calculating the incentive fee payable to our Manager. While Distributable Earnings excludes the impact of any unrealized provisions for credi t l osses, any loan losses are charged off and realized through Distributable Earnings when deemed non - recoverable. Non - recoverability is determine d ( i ) upon the resolution of a loan (i.e. when the loan is repaid, fully or partially, or in the case of foreclosures, when the underlyi ng asset is sold), or (ii) with respect to any amount due under any loan, when such amount is determined to be non - collectible. We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (loss) and c ash flows from operating activities determined in accordance with GAAP. We believe Distributable Earnings is a useful financial metric for e xis ting and potential future holders of our common stock as historically, over time, Distributable Earnings has been a strong indicator o f o ur dividends per share. As a REIT, we generally must distribute annually at least 90% of our taxable income, subject to certain adjustment s, and therefore we believe our dividends are one of the principal reasons stockholders may invest in our common stock. Refer to Note 16 to ou r c onsolidated financial statements for further discussion of our distribution requirements as a REIT. Furthermore, Distributable Earnings h elp us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indica tiv e of our current loan portfolio and operations, and is a performance metric we consider when declaring our dividends. Distributable Earnings does not represent net income (loss) or cash generated from operating activities and should not be con sid ered as an alternative to GAAP net income (loss), or an indication of GAAP cash flows from operations, a measure of our liquidity, or an in dication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the m eth odologies employed by other companies to calculate the same or similar performance measures, and accordingly, our reported Distributabl e E arnings may not be comparable to the Distributable Earnings reported by other companies.

May 2022