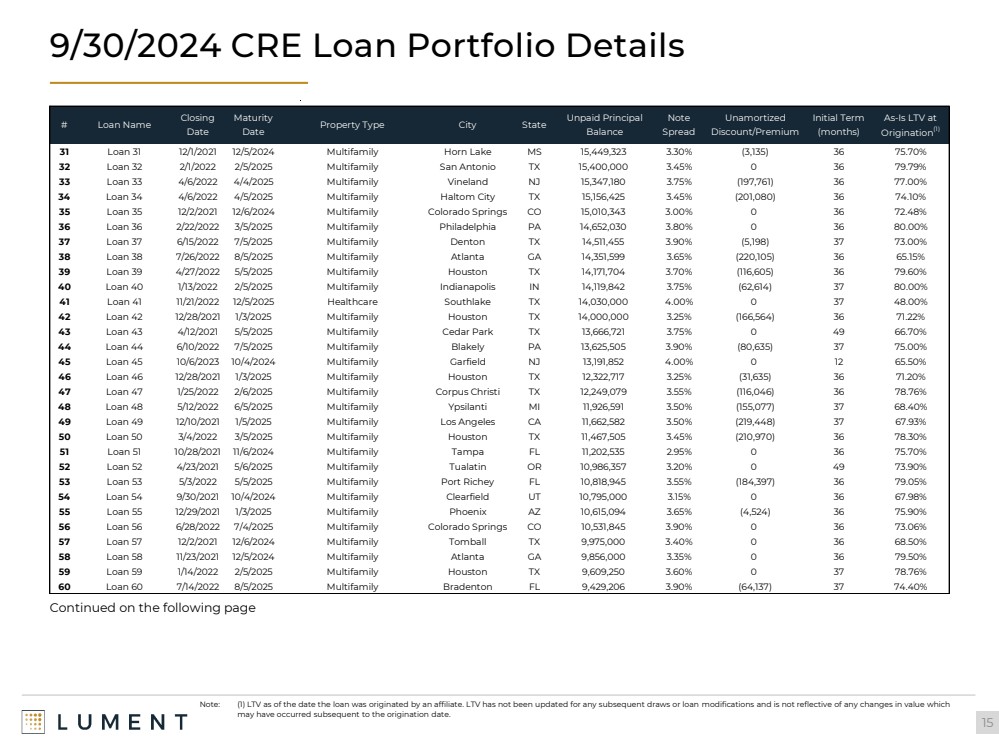

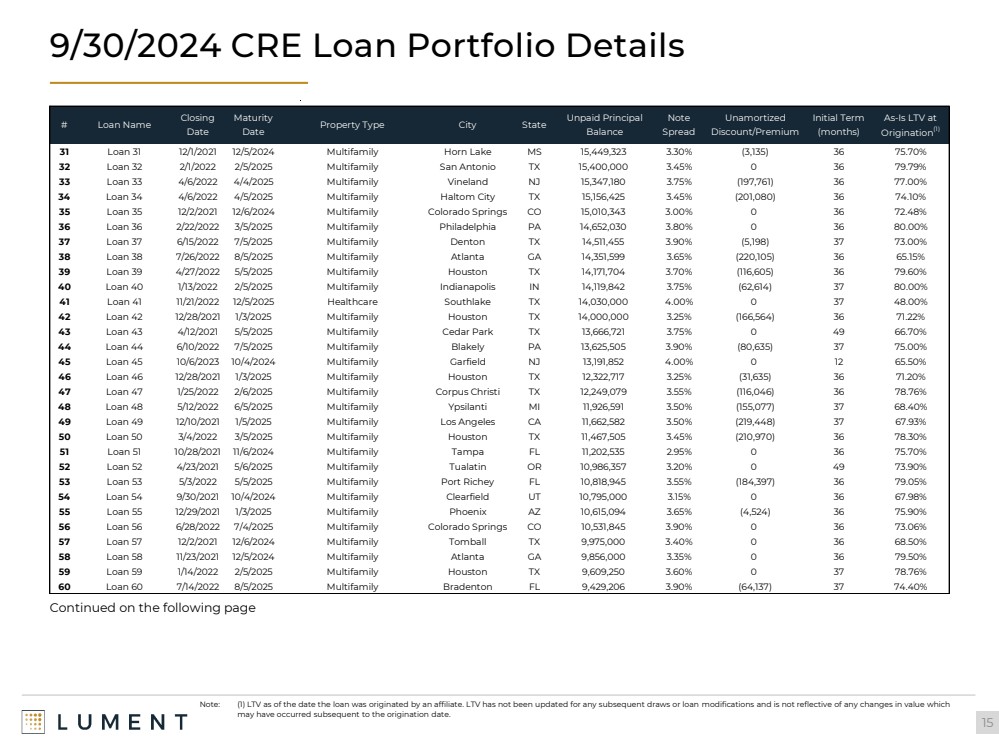

| # Loan Name Closing Date Maturity Date Property Type City State Unpaid Principal Balance Note Spread Unamortized Discount/Premium Initial Term (months) As-Is LTV at Origination(1) 31 Loan 31 12/1/2021 12/5/2024 Multifamily Horn Lake MS 15,449,323 3.30% (3,135) 36 75.70% 32 Loan 32 2/1/2022 2/5/2025 Multifamily San Antonio T X 15,400,000 3.45% 0 36 79.79% 33 Loan 33 4/6/2022 4/4/2025 Multifamily Vineland NJ 15,347,180 3.75% (197,761) 36 77.00% 34 Loan 34 4/6/2022 4/5/2025 Multifamily Haltom City T X 15,156,425 3.45% (201,080) 36 74.10% 35 Loan 35 12/2/2021 12/6/2024 Multifamily Colorado Springs CO 15,010,343 3.00% 0 36 72.48% 36 Loan 36 2/22/2022 3/5/2025 Multifamily Philadelphia PA 14,652,030 3.80% 0 36 80.00% 37 Loan 37 6/15/2022 7/5/2025 Multifamily Denton T X 14,511,455 3.90% (5,198) 37 73.00% 38 Loan 38 7/26/2022 8/5/2025 Multifamily Atlanta GA 14,351,599 3.65% (220,105) 36 65.15% 39 Loan 39 4/27/2022 5/5/2025 Multifamily Houston T X 14,171,704 3.70% (116,605) 36 79.60% 40 Loan 40 1/13/2022 2/5/2025 Multifamily Indianapolis IN 14,119,842 3.75% (62,614) 37 80.00% 41 Loan 41 11/21/2022 12/5/2025 Healthcare Southlake T X 14,030,000 4.00% 0 37 48.00% 42 Loan 42 12/28/2021 1/3/2025 Multifamily Houston T X 14,000,000 3.25% (166,564) 36 71.22% 43 Loan 43 4/12/2021 5/5/2025 Multifamily Cedar Park T X 13,666,721 3.75% 0 49 66.70% 44 Loan 44 6/10/2022 7/5/2025 Multifamily Blakely PA 13,625,505 3.90% (80,635) 37 75.00% 45 Loan 45 10/6/2023 10/4/2024 Multifamily Garfield NJ 13,191,852 4.00% 0 12 65.50% 46 Loan 46 12/28/2021 1/3/2025 Multifamily Houston T X 12,322,717 3.25% (31,635) 36 71.20% 47 Loan 47 1/25/2022 2/6/2025 Multifamily Corpus Christi T X 12,249,079 3.55% (116,046) 36 78.76% 48 Loan 48 5/12/2022 6/5/2025 Multifamily Ypsilanti MI 11,926,591 3.50% (155,077) 37 68.40% 49 Loan 49 12/10/2021 1/5/2025 Multifamily Los Angeles CA 11,662,582 3.50% (219,448) 37 67.93% 50 Loan 50 3/4/2022 3/5/2025 Multifamily Houston T X 11,467,505 3.45% (210,970) 36 78.30% 51 Loan 51 10/28/2021 11/6/2024 Multifamily Tampa FL 11,202,535 2.95% 0 36 75.70% 52 Loan 52 4/23/2021 5/6/2025 Multifamily Tualatin OR 10,986,357 3.20% 0 49 73.90% 53 Loan 53 5/3/2022 5/5/2025 Multifamily Port Richey FL 10,818,945 3.55% (184,397) 36 79.05% 54 Loan 54 9/30/2021 10/4/2024 Multifamily Clearfield UT 10,795,000 3.15% 0 36 67.98% 55 Loan 55 12/29/2021 1/3/2025 Multifamily Phoenix AZ 10,615,094 3.65% (4,524) 36 75.90% 56 Loan 56 6/28/2022 7/4/2025 Multifamily Colorado Springs CO 10,531,845 3.90% 0 36 73.06% 57 Loan 57 12/2/2021 12/6/2024 Multifamily Tomball T X 9,975,000 3.40% 0 36 68.50% 58 Loan 58 11/23/2021 12/5/2024 Multifamily Atlanta GA 9,856,000 3.35% 0 36 79.50% 59 Loan 59 1/14/2022 2/5/2025 Multifamily Houston T X 9,609,250 3.60% 0 37 78.76% 60 Loan 60 7/14/2022 8/5/2025 Multifamily Bradenton FL 9,429,206 3.90% (64,137) 37 74.40% 9/30/2024 CRE Loan Portfolio Details 15 Note: (1) LTV as of the date the loan was originated by an affiliate. LTV has not been updated for any subsequent draws or loan modifications and is not reflective of any changes in value which may have occurred subsequent to the origination date. Continued on the following page |