Exhibit 99.2

Investment Corp. Second Quarter 2017 Earnings and Performance Highlights Presentation August 7, 2017

Safe Harbor Statement Confidential 2 This presentation includes "forward - looking statements" within the meaning of the U . S . securities laws that are subject to risks and uncertainties . These forward - looking statements include information about possible or assumed future results of the Company's business, financial condition, liquidity, results of operations, plans and objectives . You can identify forward - looking statements by use of words such as "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions or other comparable terms, or by discussions of strategy, plans or intentions . Statements regarding the following subjects, among others, may be forward - looking : the return on equity ; the yield on investments ; the ability to borrow to finance assets ; and risks associated with investing in real estate assets, including changes in business conditions, interest rates, the general economy and political conditions and related matters . Forward - looking statements are based on the Company's beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company . Actual results may differ from expectations, estimates and projections and, consequently, you should not rely on these forward looking statements as predictions of future events . Forward - looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control . Additional information concerning these and other risk factors are contained in the Company's most recent filings with the Securities and Exchange Commission, which are available on the Securities and Exchange Commission's website at www . sec . gov . All subsequent written and oral forward - looking statements that the Company makes, or that are attributable to the Company, are expressly qualified in their entirety by this cautionary notice . Any forward - looking statement speaks only as of the date on which it is made . Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .

Performance Highlights: Second Quarter 3 • On June 21 , 2017 we completed an underwritten public offering of 4 , 600 , 000 shares of common stock, including 600 , 000 shares upon the exercise in full of the underwriters’ over - allotment option, for estimated net proceeds of $ 19 . 8 million • We believe this was an important step in scaling our business, improving the trading liquidity of our stock and continuing to reduce our expense ratio over time • We chose to do a 1 - day follow on offering to provide both existing and new investors the opportunity to participate • The majority of our new investors were institutions • Core earnings ( 1 ) of $ 2 . 2 million, or $ 0 . 12 per common share • We reported an economic loss on common equity of 9 . 45 % , comprised of a $ 0 . 73 decrease in book value per share and a $ 0 . 15 dividend per common share ( 2 ) • The decrease in book value was due in approximately equal measure to unrealized losses related to our Agency RMBS portfolio as spreads widened during the quarter, and the dilutive effect of our common stock issuance in June • Hybrid Agency ARMs Z - spread widened in the quarter by approximately 20 • As a result of the widening in Agency ARM spreads during the quarter, we were able to invest the proceeds of our common stock issuance at more attractive levels than would have been available earlier in the quarter • Our new investments and scale has added incremental earnings Confidential Footnotes: 1) Core Earnings is a non - GAAP measure that we define as GAAP net income, excluding impairment losses, realized and unrealized gains or losses on the aggregate portfolio and certain non - recurring upfront costs related to securitization transactions or other one - time charges. As defined, Core Earnings includes interest income or expense and premium income or loss on derivative instruments 2) Economic return is a non - GAAP measure that we define as the sum of the change in net book value per common share and dividends d eclared on our common stock during the period over the beginning net book value per common share

Market Observations: Second Quarter 2017 4 • The treasury yield curve flattened in the second quarter as the Trump reflation expectation receded and quantitative easing in the EU and Japan kept a lid on long rates in the U . S . • The USD 2 / 10 ’s spread narrowed 30 bps to a low of 78 bps • On June 27 Mario Draghi, President of the ECB, contemplated that the ECB may also consider tapering its balance sheet following similar comments made by the Fed • The Fed is likely to begin “tightening” by reducing its balance sheet of Treasury’s and Agency mortgage backed securities later this year • To date, the Fed owns approximately a third of Agency RMBS and about 13 % of Treasuries outstanding • The Fed in its own research views a withdrawal of its purchases as adding approximately 100 bps of term premium to the term structure of U . S . rates • The Street believes that spreads on Agency RMBS may be impacted by 20 - 25 bps to attract new buyers over time • We believe the Fed is likely closer to the end of raising short rates in the traditional manner as it also contemplates reducing its balance sheet • A steeper yield curve in the U . S . is positive for mortgage REIT returns • A Fed balance sheet reduction is positive for a levered Agency hybrid strategy and provides a strong tail wind to returns potentially for years to come Confidential

Investment Strategy 5 Confidential • As we communicated previously, we intend to focus on a business strategy that is simpler to understand and more cost efficient • We have moved to an “expense light” investment strategy and have reduced the C ompany’s run - rate expenses by approximately a third • Management is proactively limiting non - investment professional compensation to no more than $ 2 million for a period of twelve months in recognition of our new focused strategy • Our focus is now primarily upon Agency hybrid floating - rate securities and Freddie Mac K - series Multifamily credit exposure • Exiting our prime jumbo securitization platform has allowed us to meaningfully reduce our fixed expenses • Investing in intermediate floating rate Agency hybrid securities allows us to minimize extension risk • Agency intermediate term hybrid securities should benefit from rolling down the yield curve • The Fed’s intention to reduce its balance sheet we believe is a net positive for our Agency reinvestment and is expected to add a strong tail wind to MBS spread investments for years to come • We have reduced our repo - funded Freddie Mac K - series investments as spreads have tightened • We have employed an active hedging strategy in an attempt to minimize large price changes resulting from movements in rates and changes in the shape of the yield curve • We have booked $ 521 million in gross loan volume as a limited rep and warranty risk backstop guarantee provider on prime jumbo loans sold through MAXEX’s LNEX Exchange

ARM and Credit Portfolios 6 • Our 2 Q 17 Agency ARM Portfolio has a three month CPR of 8 . 6 % • Our weighted average coupon is 2 . 57 % • Our weighted average purchase price is $ 102 . 10 • Lower coupon and dollar price hybrids benefit from “roll down the curve” • To date, we have not experienced any delinquencies in the underlying loan portfolios of our Freddie Mac K - series investments Confidential Months to Reset Avg. MTR % of ARM Portfolio Current Face Value Weighted Avg. Coupon Weighted Avg. Amortized Purchase Price Amortized Cost Weighted Avg. Market Price Market Value 0 -36 31 0.6% $ 6,854,392 2.32% 102.91 $ 7,053,703.59 102.23 $ 7,006,929.49 37-60 39 5.8% $ 69,721,117 2.23% 102.72 $ 71,614,063.96 101.74 $ 70,934,354.60 61-72 69 35.9% $ 431,055,432 2.56% 102.43 $ 441,542,874.32 101.63 $ 438,087,249.78 73-120 79 57.7% $ 693,077,283 2.64% 101.86 $ 705,945,909.61 101.69 $ 704,803,355.21 Total ARMs 72 100.0% $ 1,200,708,224 2.57% 102.10 $ 1,226,156,551.48 101.64 $ 1,220,831,889.09 Agency ARM Portfolio: 6/30/2017

Core Earnings Analysis: Second Quarter 2017 7 Confidential GAAP to Core Earnings Reconciliation Three Months Ended June 30, 2017 Reconciliation of GAAP to non-GAAP Information Net Income (loss) attributable to common shareholders $ (3,167,297) Adjustments for non-core earnings Realized (Gain) Loss on sale of investments, net $ 151,549 Unrealized (Gain) Loss on fair value option securities - Realized (Gain) Loss on derivative contracts, net $ (1,453,074) Unrealized (Gain) Loss on derivative contracts, net $ 5,813,275 Realized (Gain) Loss on mortgage loans held-for-sale $ 249 Unrealized (Gain) Loss on mortgage loans held-for-sale $ 7,358 Unrealized (Gain) Loss on mortgage servicing rights $ 228,329 Unrealized (Gain) Loss on multi-family loans held in securitization trusts $ (803,206) Unrealized (Gain) Loss on residential loans held in securitization trusts $ 250,079 Other income $ (12,735) Subtotal $ 4,181,824 Other Adjustments Recognized compensation expense related to restricted common stock 6,698 Adjustment for consolidated securities/securitization costs 1,183,192 Adjustment for one-time charges - Core Earnings 2,204,417 Weighted average shares outstanding - Basic and Diluted 18,297,500 Core Earnings per weighted average shares outstanding - Basic and Diluted $ 0.12 Footnotes: • Core earnings does not include roll

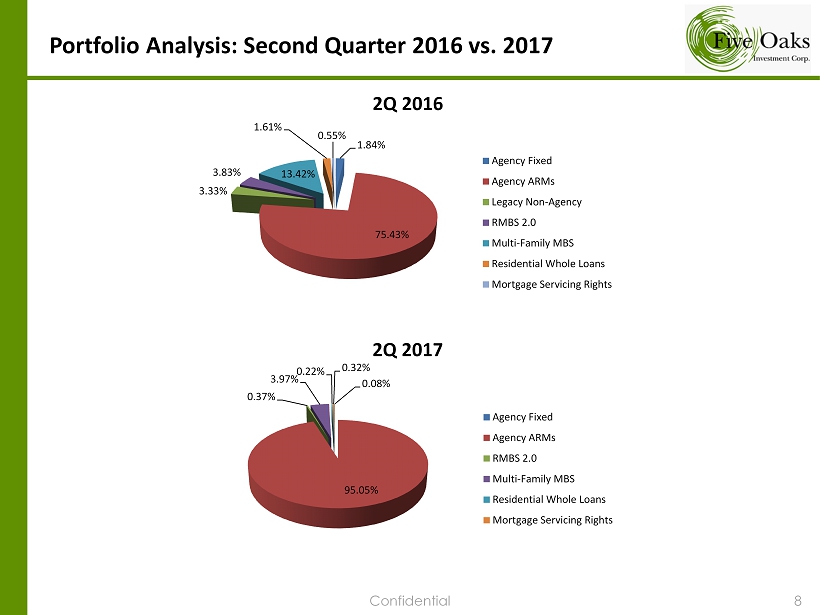

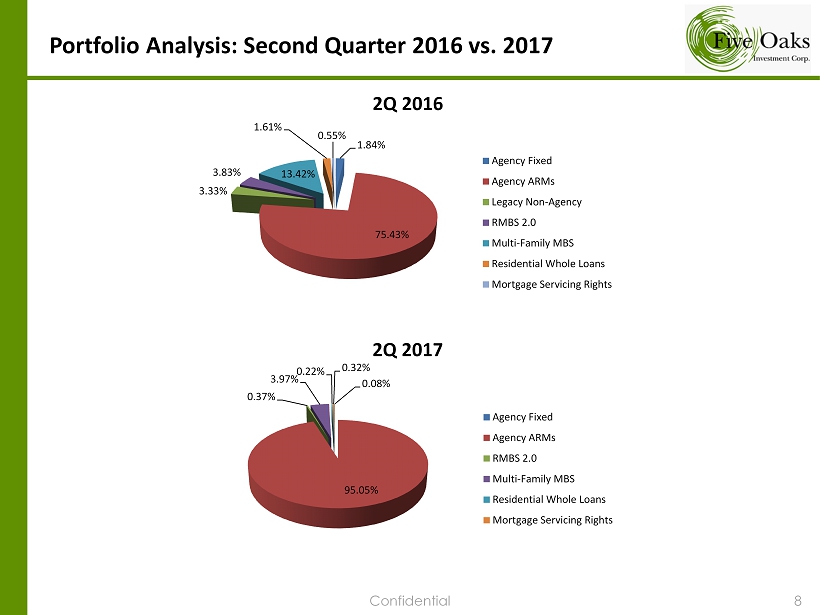

Portfolio Analysis: Second Quarter 2016 vs. 2017 8 Confidential 1.84% 75.43% 3.33% 3.83% 13.42% 1.61% 0.55% 2Q 2016 Agency Fixed Agency ARMs Legacy Non-Agency RMBS 2.0 Multi-Family MBS Residential Whole Loans Mortgage Servicing Rights 0.08% 95.05% 0.37% 3.97% 0.22% 0.32% 2Q 2017 Agency Fixed Agency ARMs RMBS 2.0 Multi-Family MBS Residential Whole Loans Mortgage Servicing Rights

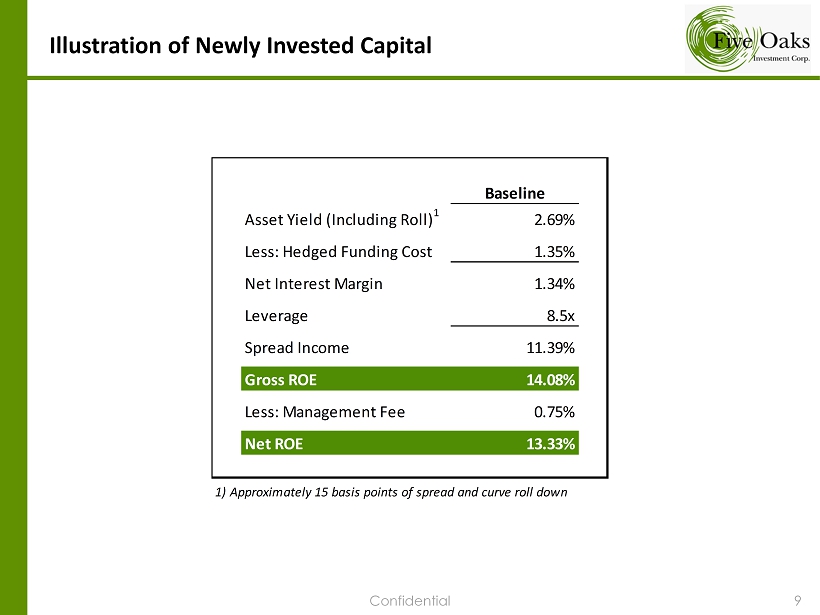

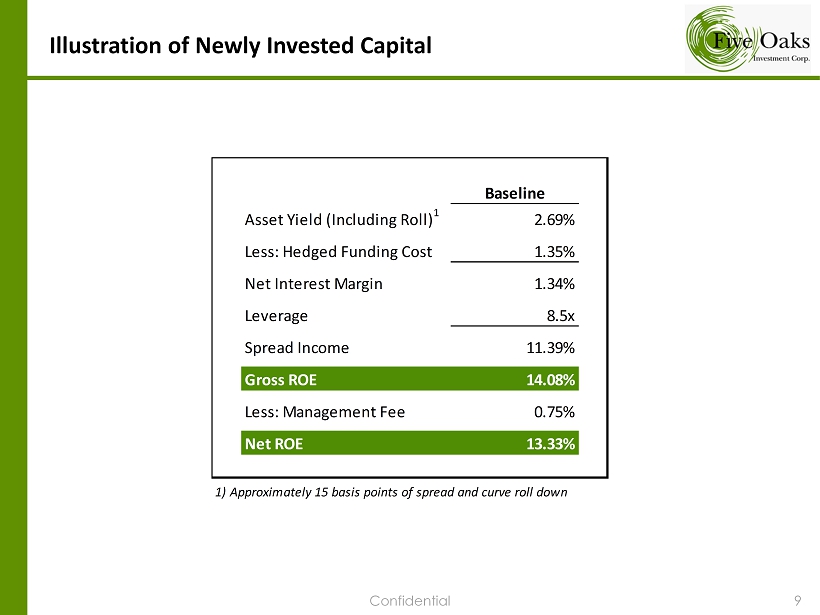

Illustration of Newly Invested Capital 9 Confidential Baseline Asset Yield (Including Roll) 1 2.69% Less: Hedged Funding Cost 1.35% Net Interest Margin 1.34% Leverage 8.5x Spread Income 11.39% Gross ROE 14.08% Less: Management Fee 0.75% Net ROE 13.33% 1) Approximately 15 basis points of spread and curve roll down

End of Presentation 10 Investment Corp.

Investment Corp. Second Quarter 2017 Earnings and Performance Highlights Presentation August 7, 2017