Exhibit 99.1

Investor Presentation May 2018 Five Oaks Investment Corp.

1 Disclaimer & Name Change This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, an d Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the current views of Five Oaks Investment Corp. (NYSE: OAKS) (“Five Oaks” or the “Company”) with respect to, among other things, the Company’s operations and financial performance. You can identify these forward - looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “in tends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward - looking statements are subject to various risks a nd uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these s tat ements. The Company believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10 - K for t he fiscal year ended December 31, 2017, as such factors may be updated from time to time in its periodic filings with the Securities and Exchange Commission (“SEC”) whi ch are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautiona ry statements that are included in this presentation and in the filings. The Company assumes no obligation to update or supplement forward - looking statements that become untrue because of subsequent events or circumstances. Name Change On January 18, 2018, Hunt Investment Management, LLC assumed management of Five Oaks Investment Corp. ( NYSE : OAKS) ("Five Oaks" or the "Company "). Five Oaks previously announced that it will change its name to Hunt Companies Finance Trust, Inc. , effective May 25, 2018. The new name has been chosen to better reflect the Company’s new strategic direction and management by Hunt Investment Management. In addition to the new name , the Company will change its ticker symbols on the NYSE to “HCFT” and “HCFT PR A” and anticipates that trading under the new name and ticker symbols will commence on May 29, 2018. Hunt Companies, Inc. is the parent to several Hunt entities, including Hunt Investment Management, the company’s external manager. Collectively, Hunt, its affiliated entities, and underlying owned subsidiary entities shall be hereinafter referred to as “Hunt” unless specifically noted otherwise.

2 Overview Hunt Companies Finance Trust ON JANUARY 18, 2018 Hunt assumed management of Five Oaks Investment Corp . EFFECTIVE MAY 25, 2018 Five Oaks Investment Corp. will be renamed Hunt Companies Finance Trust, Inc.

Hunt Companies, Inc. is a diversified global real estate organization dedicated to creating value through the development, construction, investment, management, and financing of real estate assets 3 An Integrated and Diversified Real Estate Platform Hunt Companies, Inc. Privately owned and founded in 1947 Over 1,700 direct employees among 46 offices nationwide. Including affiliates, the companies employ over 6,000 additional employees across 80 offices Hunt and its affiliated companies own , service, or manage over $30 billion in real estate and infrastructure assets Broad platform with expertise across the real estate industry Significant information advantage with visibility into expansive real estate portfolio Largest owner of privatized military housing units in the U.S. 3rd largest U.S. apartment property management portfolio 4th largest U.S. affordable housing developer 7th largest U.S. multifamily owner Top 10 non - bank originator of agency multifamily loans Top 30 mortgage servicing portfolio

4 An Integrated and Diversified Real Estate Platform Hunt Companies, Inc. logo Commercial Real Estate Lender $14.9B Servicing Portfolio Investment Manager and Broker Dealer SEC - Registered Investment Advisor and FINRA Registered Broker - Dealer Developer of Real Estate Assets Over 100,000 multifamily units and 19.7mm square feet of commercial space Military Housing Developer Largest private owner and manager of Military Housing Property Manager #3 Multifamily Property Management portfolio in the United States General Contractor and Construction Service Provider $15.3B in Projects Completed Global Public Infrastructure Manager Over £8.2 AUM Real Estate Owner and Operator Over 70,000 units, including military, affordable and conventional housing. 1.3mm square ft. of mixed - use, office and retail space

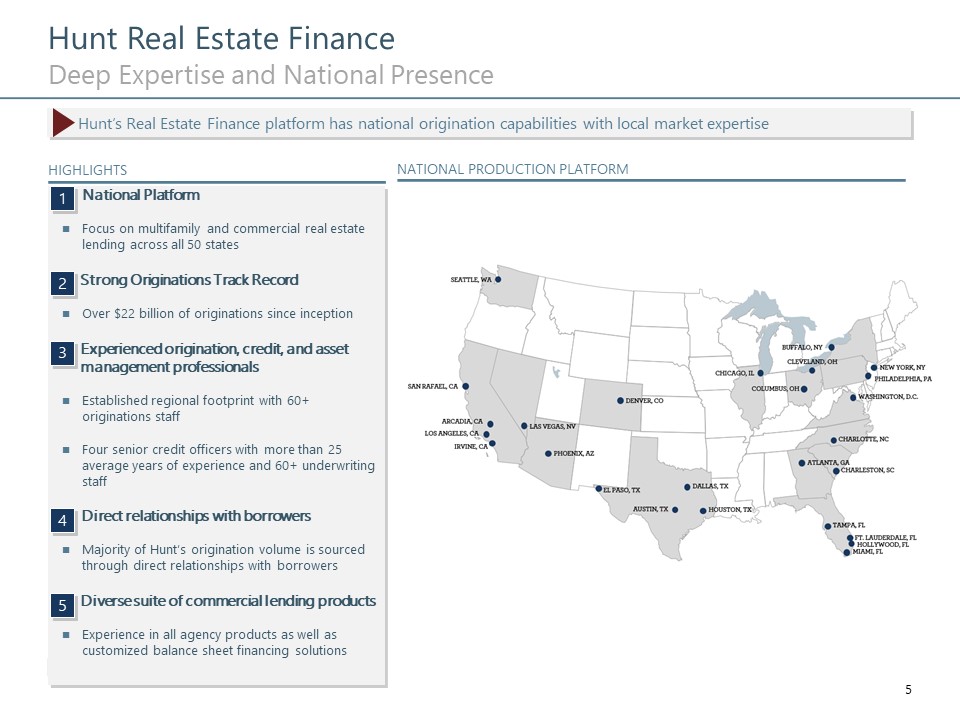

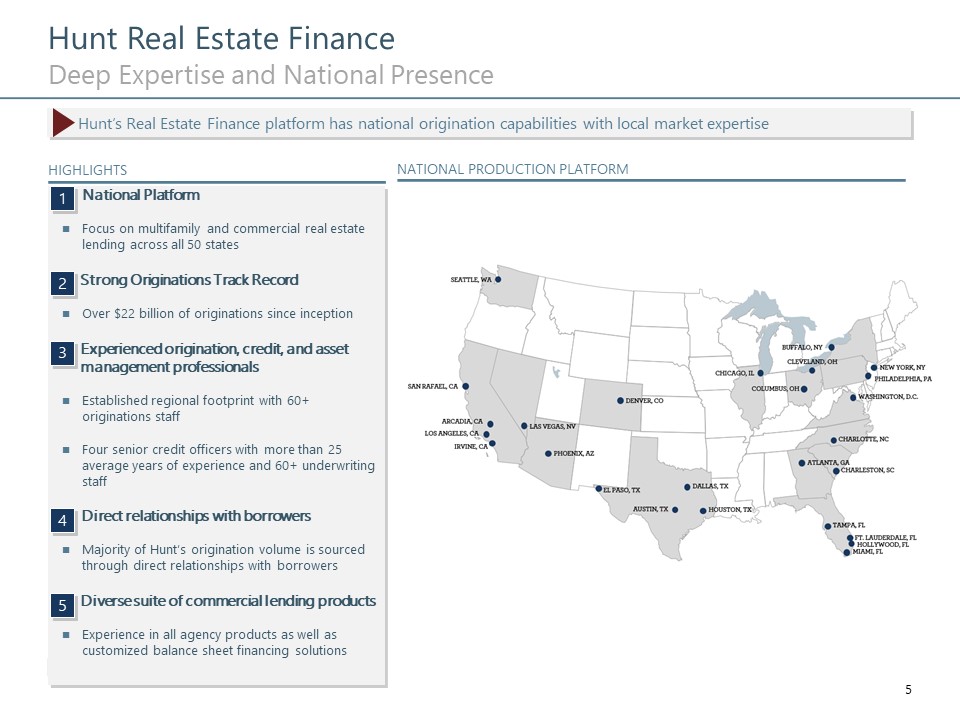

5 Deep Expertise and National Presence Hunt Real Estate Finance NATIONAL PRODUCTION PLATFORM National Platform Focus on multifamily and commercial real estate lending across all 50 states Strong Originations Track Record Over $22 billion of originations since inception Experienced origination , credit, and asset management professionals Established regional footprint with 60+ originations staff Four senior credit officers with more than 25 average years of experience and 60+ underwriting staff Direct relationships with borrowers Majority of Hunt’s origination volume is sourced through direct relationships with borrowers Diverse suite of commercial lending products Experience in all agency products as well as customized balance sheet financing solutions Hunt’s Real Estate Finance platform has national origination capabilities with local market expertise 1 2 3 4 5 HIGHLIGHTS

6 Hunt Real Estate Finance Experienced Leadership Team CEO, Hunt Companies Finance Trust President, Hunt Mortgage Group President, Hunt Companies Finance Trust CFO & COO, Hunt Mortgage Group CEO, Hunt Companies Chairman, Hunt Companies Finance Trust Chief Credit Officer, Hunt Mortgage Group President, Hunt Investment Management Head of Capital Markets, Hunt Mortgage Group CFO, Hunt Companies Finance Trust Head of Asset Management, Hunt Mortgage Group CHRIS HUNT JAMES FLYNN MICHAEL LARSEN DAVID OSTON MEGAN GOODFELLOW TOM DUDA JUSTIN SHORT JEFFREY DODSON

7 Recent Transactions 1 Hunt Real Estate Finance Portland, Oregon $14,500,000 MULTIFAMILY Stafford, Texas $4,400,000 OFFICE Dallas, Texas $9,405,000 MULTIFAMILY Akron, Ohio $13,500,000 MIXED USE Fort Worth, Texas $14,750,000 MULTIFAMILY Stamford, Connecticut $28,125,000 1: Transactions above were originated by Hunt MULTIFAMILY Austin, Texas $11,200,000 Kalamazoo, Michigan $9,800,000 RETAIL STUDENT HOUSING

ABILITY TO LEVERAGE HUNT’S DIVERSE AND EXTENSIVE NETWORK OF CAPITAL PARTNER RELATIONSHIPS 8 Leveraging the Breadth and Depth of the Hunt Platform Benefits of a Hunt Affiliation The Company expects to leverage Hunt’s vertically integrated real estate platform and expertise across construction, development, property management, and finance when originating and underwriting investments ACCESS TO A SIGNIFICANT, SCALED PLATFORM WHICH SHOULD PROVIDE OPPORTUNITIES TO CAPTURE OPERATING COST EFFICIENCIES NATIONAL FOOTPRINT WITH DEEP INDUSTRY EXPERTISE ACROSS THE REAL ESTATE LIFE CYCLE STRONG INVESTMENT SOURCING CAPABILITIES 1 5 2 EXPERIENCED MANAGEMENT TEAM WITH PROVEN TRACK RECORD 3 4

Strength of Ownership / Sponsorship 9 Company Overview Hunt Companies Finance Trust Access to Extensive Loan Origination Platform Experienced Management Team Real Estate Investment Trust focused on commercial and non - commercial real estate debt investments Externally managed by Hunt, a diverse real estate company Emphasis on floating rate investments well suited for rising interest rate environment Strong focus on middle - market multifamily sector Strategy Well Positioned for Rising Interest Rates KEY INVESTMENT HIGHLIGHTS Proven Credit and Asset Management Capabilities

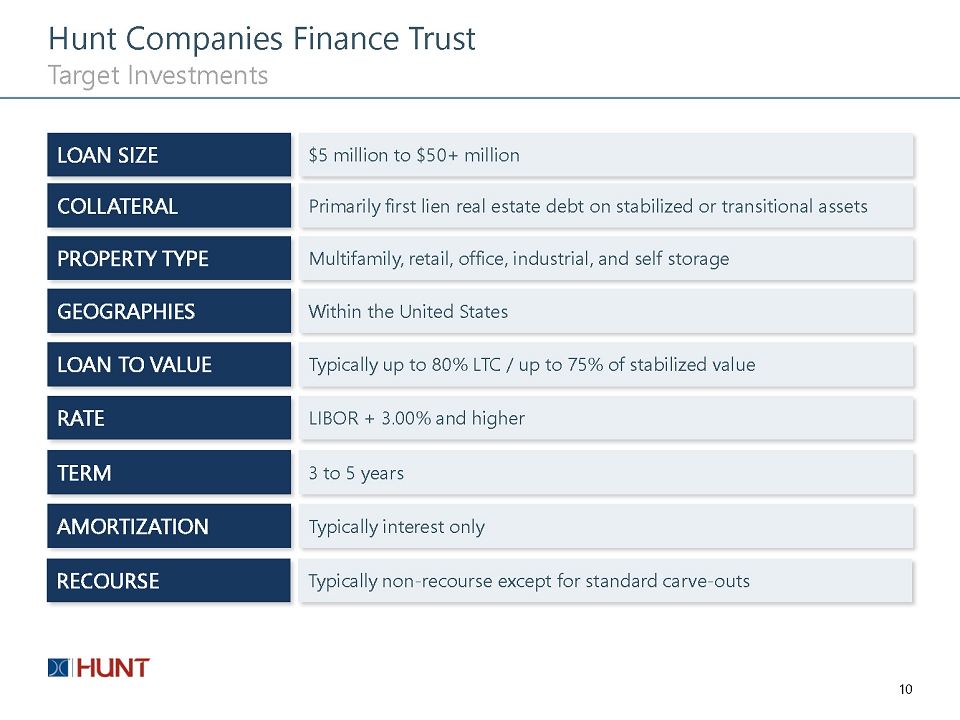

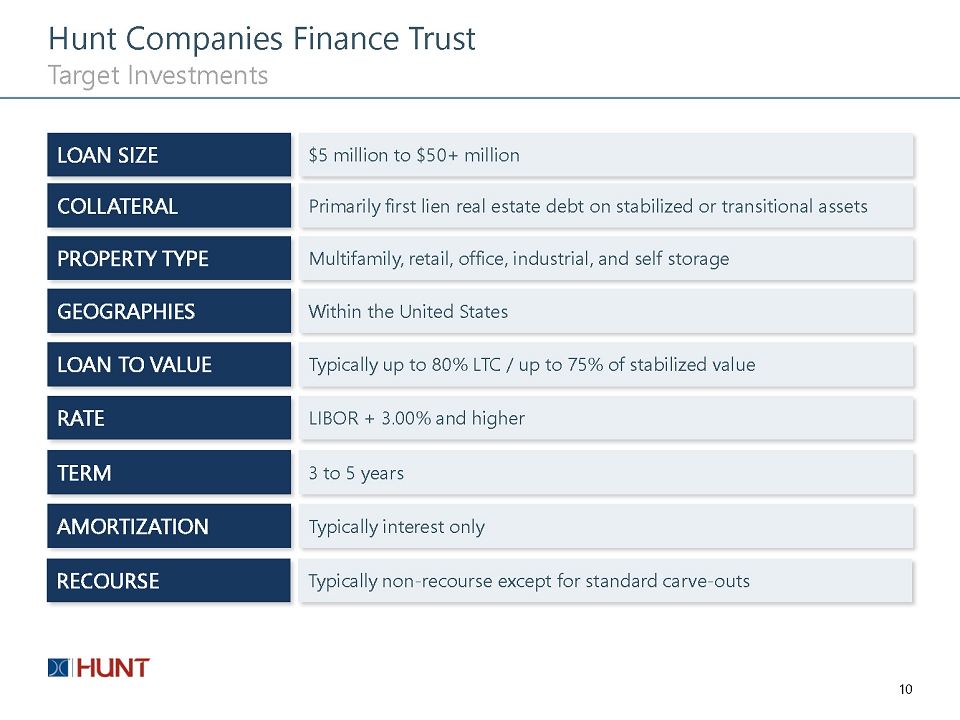

10 Target Investments Hunt Companies Finance Trust LOAN SIZE $ 5 million to $ 50+ million COLLATERAL Primarily first lien real estate debt on stabilized or transitional assets PROPERTY TYPE Multifamily, retail, office , industrial , and self storage GEOGRAPHIES Within the United States LOAN TO VALUE Typically up to 80 % LTC / up to 75% of stabilized value RATE LIBOR + 3.00% and higher TERM 3 to 5 years AMORTIZATION Typically interest only RECOURSE Typically non - recourse except for standard carve - outs

11 Transaction Summary Hunt CMT Equity Acquistion – April 2018 On April 30, 2018, the Company acquired 100% of the equity interests of Hunt CMT Equity LLC (“HCMT”) from Hunt for an aggregate purchase price of approximately $68 million ▪ Assets of HCMT include the junior retained notes and preferred shares of a commercial real estate loan securitization (" CLO ") secured by a portfolio of commercial loans, a licensed commercial mortgage lender, and eight loan participations ▪ The Transaction is part of the Company's previously announced reallocation of capital into new investment opportunities in the commercial real estate debt space ▪ The Company believes that it is a significant positive step in directing its strategy toward transitional commercial real estate loans, which are expected to be positive to stockholder returns while lowering overall leverage Highlights of HCMT loan portfolio and CLO financing : ▪ Assets consist of performing transitional floating rate commercial real estate loans collateralized by a diverse mix of property types, including multifamily, retail, office, mixed - use, industrial and student housing, with a weighted - average spread of 492 basis points over one - month LIBOR ▪ Financed by match - term securitization with non - retained investment - grade notes that bear a weighted - average cost of 138 basis points over one - month LIBOR, excluding fees and transaction costs ▪ Securitization financing includes a replenishment period that allows principal proceeds from repayments of the portfolio assets to be reinvested in qualifying replacement assets, subject to certain conditions

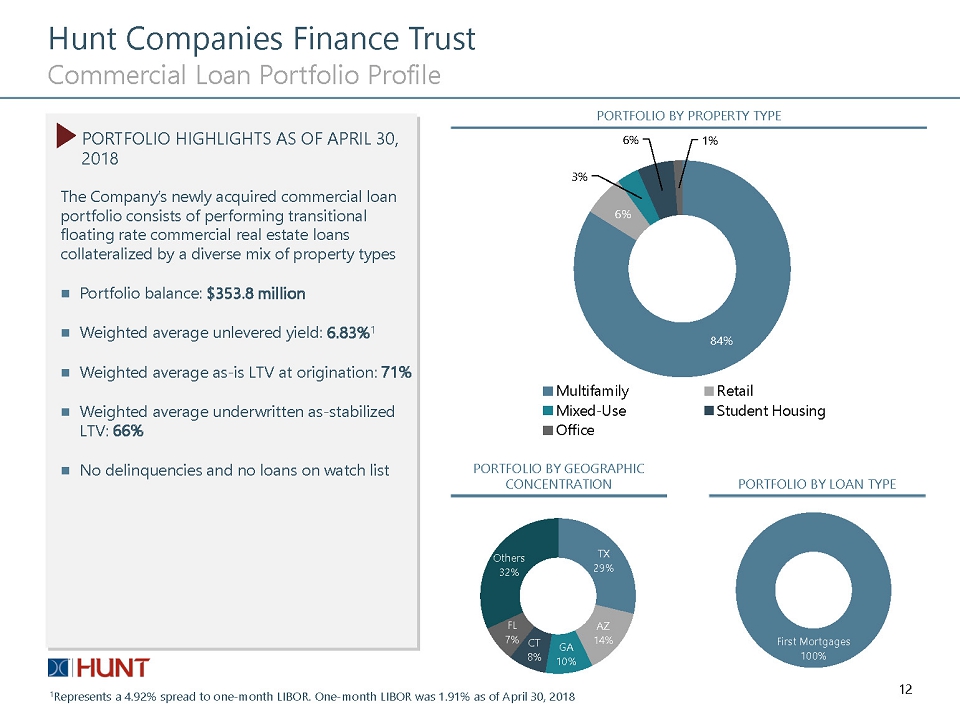

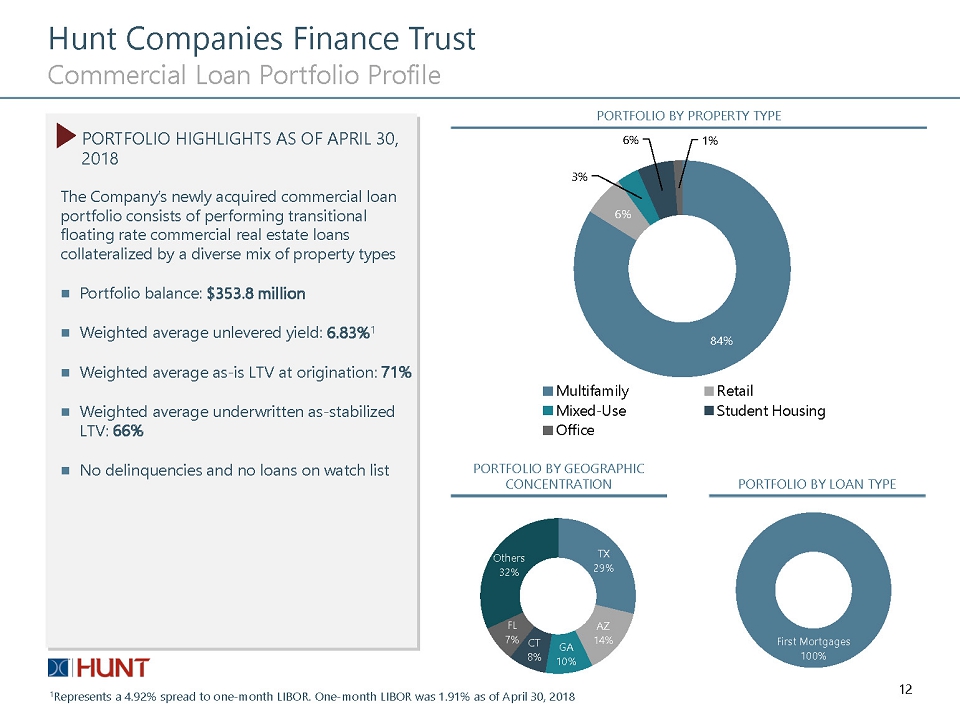

12 Commercial Loan Portfolio Profile Hunt Companies Finance Trust 84% 6% 3% 6% 1% Multifamily Retail Mixed-Use Student Housing Office The Company’s newly acquired commercial loan portfolio consists of performing transitional floating rate commercial real estate loans collateralized by a diverse mix of property types Portfolio balance : $ 353.8 million Weighted average unlevered yield: 6.83% 1 Weighted average as - is LTV at origination: 71% Weighted average underwritten as - stabilized LTV: 66% No delinquencies and no loans on watch list PORTFOLIO HIGHLIGHTS AS OF APRIL 30, 2018 PORTFOLIO BY GEOGRAPHIC CONCENTRATION PORTFOLIO BY LOAN TYPE PORTFOLIO BY PROPERTY TYPE First Mortga ges 100% TX 29% AZ 14% GA 10% CT 8% FL 7% Others 32% 1 Represents a 4.92% spread to one - month LIBOR. One - month LIBOR was 1.91% as of April 30, 2018

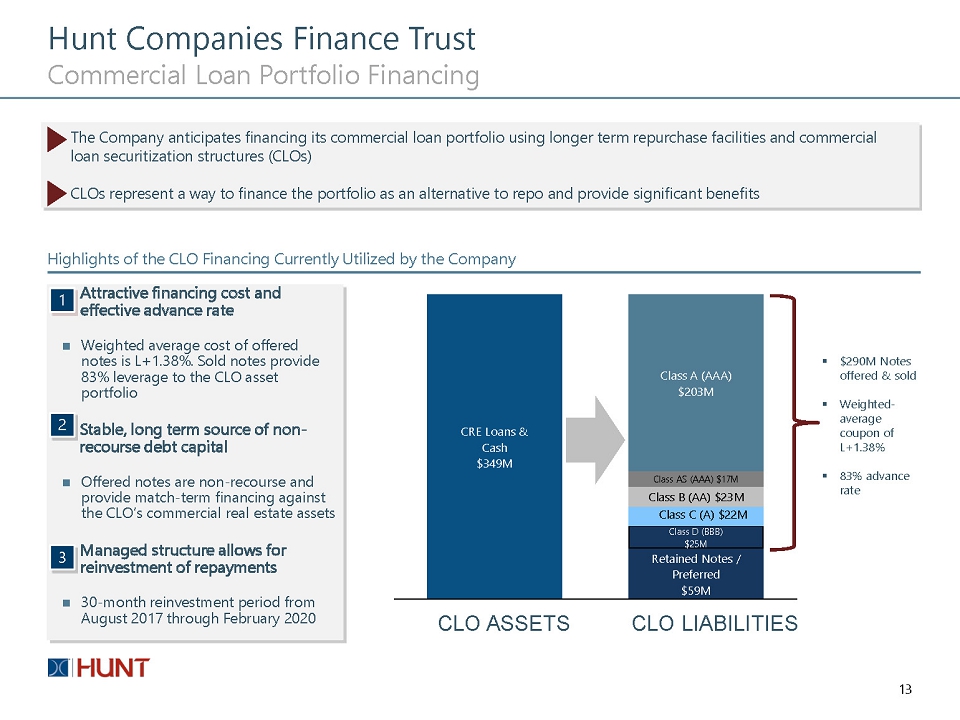

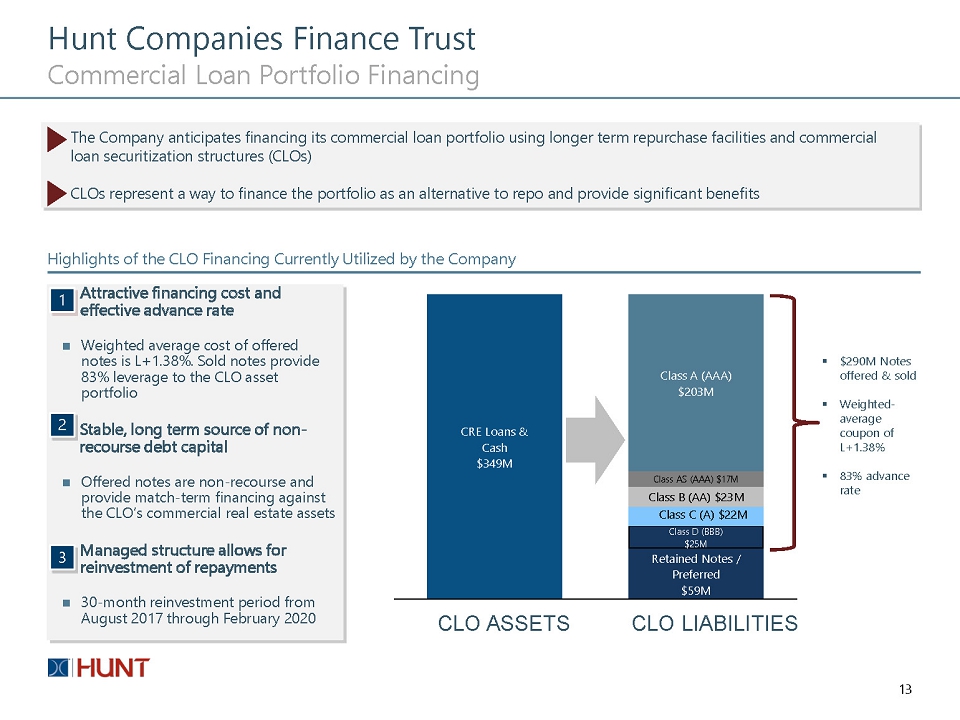

The Company anticipates financing its commercial loan portfolio using longer term repurchase facilities and commercial loan securitization structures (CLOs) CLOs represent a way to finance the portfolio as an alternative to repo and provide significant benefits 13 Commercial Loan Portfolio Financing Hunt Companies Finance Trust CRE Loans & Cash $349M Retained Notes / Preferred $59M Class D (BBB) $25M Class C (A) $22M Class B (AA) $23M Class AS (AAA) $17M Class A (AAA) $203M CLO Assets CLO Liabilities Attractive financing cost and effective advance rate Weighted average cost of offered notes is L+1.38%. Sold notes provide 83% leverage to the CLO asset portfolio Stable, long term source of non - recourse debt capital Offered notes are non - recourse and provide match - term financing against the CLO’s commercial real estate assets Managed structure allows for reinvestment of repayments 30 - month reinvestment period from August 2017 through February 2020 Highlights of the CLO Financing Currently Utilized by the Company 1 2 3 ▪ $290M Notes offered & sold ▪ Weighted - average coupon of L+1.38% ▪ 83% advance rate CLO ASSETS CLO LIABILITIES

Hunt Companies Finance Trust Capital Deployment Hunt intends to continue to liquidate the legacy Agency MBS assets of HCFT and their related hedges to generate capital to redeploy in commercial real estate debt assets Market value of the Agency MBS portfolio as of April 30, 2018 was $651 million $720 million of Agency MBS have been sold since March 31, 2018 Capital generated utilized, in part, to fund the HCMT acquisition 14

15 Summary Hunt Companies Finance Trust IN SUMMARY Real Estate Investment Trust focused on commercial and non - commercial real estate investments Externally managed by Hunt as part of its Real Estate Finance platform Focused on floating rate investments well suited for rising interest rate environment Strong focus on middle - market multifamily sector KEY INVESTMENT HIGHLIGHTS Access to attractive & sustainable market opportunities Experienced management team Strength of ownership / sponsorship Strategy well - positioned for rising interest rates Access to extensive loan origination platform