UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File number 811-22698

KraneShares Trust

(Exact name of registrant as specified in charter)

280 Park Avenue

32nd Floor

New York, New York 10017

(Address of principal executive offices) (Zip code)

Jonathan Krane

KraneShares Trust

280 Park Avenue

32nd Floor

New York, New York 10017

(Name and address of agent for service)

Copy to:

Stacy L. Fuller

K&L Gates LLP

1601 K Street NW

Washington, DC 20006-1600

Registrant’s telephone number, including area code: (855) 857-2638

Date of fiscal year end: March 31, 2021

Date of reporting period: March 31, 2021

| Item 1. | Reports to Stockholders. |

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended [17 CFR § 270.30e-1], are attached hereto.

| | Annual Report KFA Large Cap Quality Dividend Index ETF KFA Small Cap Quality Dividend Index ETF KFA Dynamic Fixed Income ETF KFA Value Line® Dynamic Core Equity Index ETF KFA Mount Lucas Index Strategy ETF March 31, 2021 | | |

Table of Contents

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT within sixty days after the end of the period. The Funds’ Form N-PORT are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that KraneShares Trust uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month year ended June 30, are available (i) without charge, upon request, by calling 855-857-2638; and (ii) on the Commission’s website at http://www.sec.gov.

Fund shares may only be purchased or redeemed from a Fund in large Creation Unit aggregations. Investors who cannot transact in Creation Units of a Fund’s shares must buy or sell Fund shares in the secondary market at their market price, which may be at a premium or discount to a Fund’s net asset value, with the assistance of a broker. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying Fund shares and receive less than net asset value when selling Fund shares.

Shareholder Letter (Unaudited)

Dear Shareholders:

We are pleased to provide you with the Annual Report for KFA Funds exchange-traded funds (“ETFs”) for the 12-month period ended March 31, 2021. Despite recent market volatility, we are encouraged by the long-term prospects for our differentiated, high-conviction investment strategies. Thank you for investing with us.

For the period, the ETFs delivered the following returns*:

Fund | | Return* | | Underlying

Index Return** |

KFA Large Cap Quality Dividend Index ETF (KLCD) | | 48.30 | % | | 49.26 | % |

KFA Small Cap Quality Dividend Index ETF(KSCD) | | 39.27 | % | | 40.21 | % |

KFA Dynamic Fixed Income ETF (KDFI) | | 5.79 | % | | 11.65 | % |

KFA Value Line® Dynamic Core Equity Index ETF (KVLE) | | 15.46 | %^ | | 15.22 | %^ |

KFA Mount Lucas Index Strategy ETF (KMLM) | | 10.20 | %^ | | 10.45 | %^ |

As the US economy reopens following the coronavirus pandemic, we believe that investing in diversifying stock and bond strategies is an important way to help manage portfolio risk while benefiting from improving market conditions.

Jonathan Krane, CEO

March 31, 2020

* Returns based on change in net asset value since inception (less than one-year period) as of March 31, 2021

^ Return period since Fund inception (less than one-year period)

** The underlying indexes and their definitions are as follows:

The Underlying Index for the KFA Large Cap Quality Dividend Index ETF is the Russell 1000 Dividend Select Equal Weight Index. The Russell 1000 Dividend Select Equal Weight Index is designed to measure the performance of US companies that have successfully increased their dividend payments over a period of ten years. On a quarterly basis the highest-ranking companies based on momentum are selected and equally weighted to form the final index, capturing the large cap domestic market. The index is designed to provide a benchmark for investors looking to capture a concentrated portfolio of constituents demonstrating increased dividends and positive momentum.

The Underlying Index for the KFA Small Cap Quality Dividend Index ETF is the Russell 2000 Dividend Select Equal Weight Index. The Russell 2000 Dividend Select Equal Weight Index is designed to measure the performance of US companies that have successfully increased their dividend payments over a period of ten years. On a quarterly basis the highest-ranking companies based on momentum are selected and equally weighted to form the final index, capturing the small cap domestic market. The index is designed to provide a benchmark for investors looking to capture a concentrated portfolio of constituents demonstrating increased dividends and positive momentum.

The Underlying Index for the KFA Dynamic Fixed Income ETF is the FTSE US High-Yield Treasury Rotation Index. The FTSE US High-Yield Treasury Rotation Index is designed to provide a benchmark for investors looking to capture risk-managed exposure to High-Yield credit and US Treasuries. The FTSE US High-Yield Treasury Rotation Index rotates between the following three sub-indexes: FTSE US Treasury 1-5 Years Index, FTSE US Treasury 7-10 Years Index, and the FTSE US High-Yield Market BB/B Rated Capped Custom Index. During quarterly reviews, the cumulative quarterly return of these three indexes is compared and the index with the highest return across that period receives the full allocation for the coming quarter.

1

Shareholder Letter (Unaudited) (concluded)

The Underlying Index for the KFA Value Line® Dynamic Core Equity Index ETF is the 3D/L Value Line® Dynamic Core Equity Index. The 3D/L Value Line® Dynamic Core Equity Index introduces a market adaptive approach to investing in US large cap companies. The strategy seeks to capture quality US companies based on a three-factor process that selects stocks with high dividend yields and are the highest rated among Value Line®’s Safety™ and Timeliness™ Ranking Systems. Careful quantitative modelling, that incorporates a unique set of risk management tools, adjusts the beta of the overall portfolio based on the market environment. The index is rebalanced monthly.

The Underlying Index for the KFA Mount Lucas Index Strategy ETF is the KFA MLM Index. The KFA MLM Index is a diversified trend following portfolio of commodity, currency, and global fixed income futures contracts traded on US and foreign exchanges. The performance data for the index is a representation of the MLM Index from 1/1/1988 to 12/31/2004, the MLM Index EV (“EV”), with enhanced Execution and Volatility characteristics, from 1/1/2005 to 11/30/2020, and, using the same methodology as the “EV,” the KFA MLM Index from 12/1/2020 on.

2

Management Discussion of Fund Performance (Unaudited)

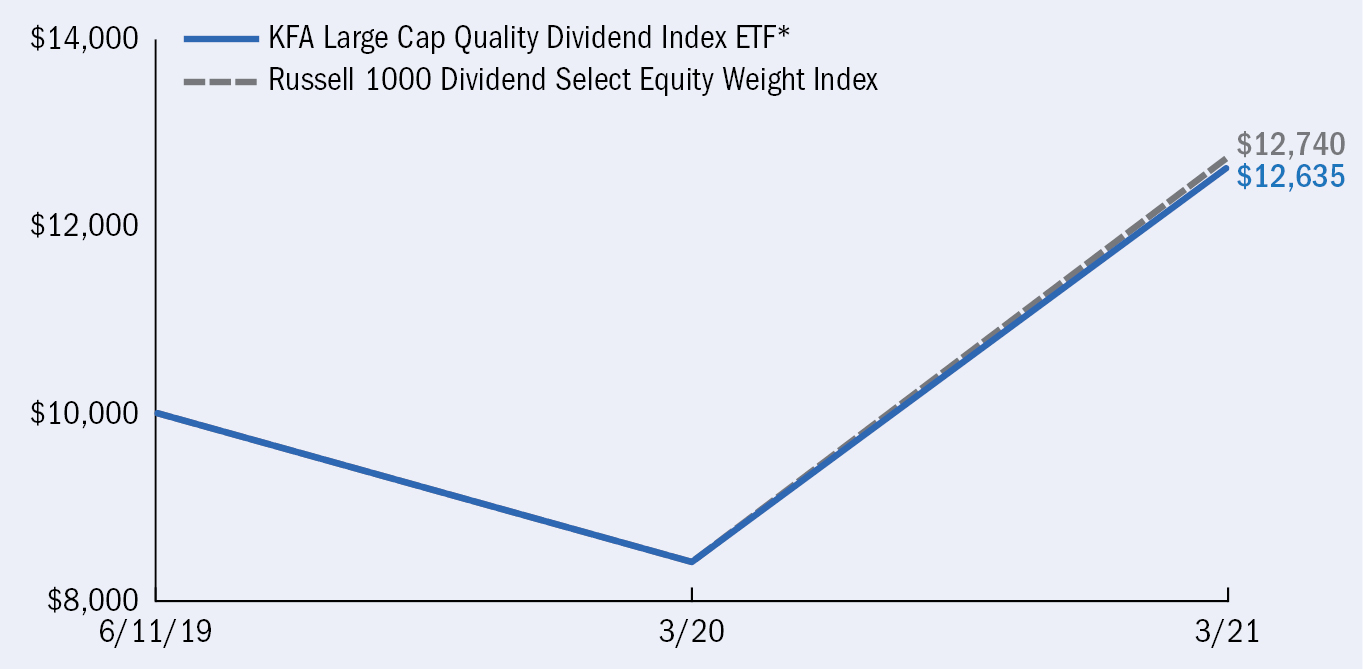

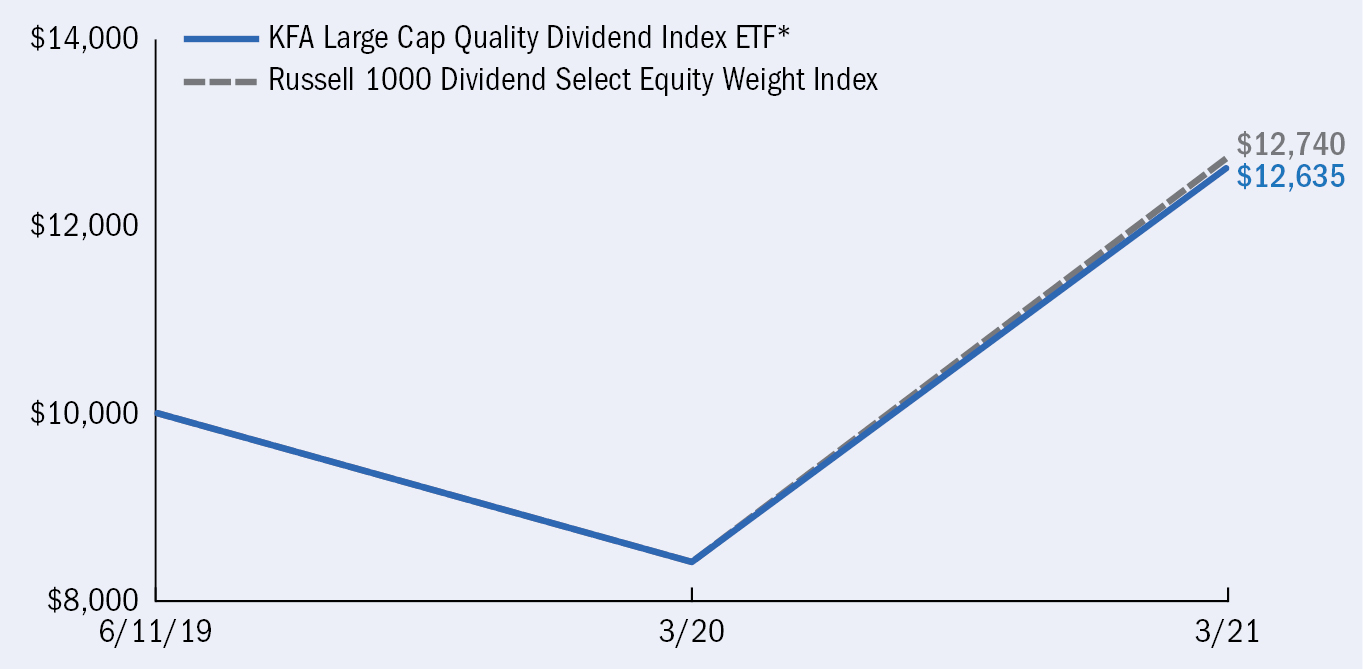

KFA Large Cap Quality Dividend Index ETF

The KFA Large Cap Quality Dividend Index ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correlate generally to the price and yield performance of the Russell 1000 Dividend Select Equal Weight Index (the ‘‘Underlying Index’’).

The Underlying Index is designed to measure the performance of US companies that have successfully increased their dividend payments over a period of ten years. On a quarterly basis the highest-ranking companies based on momentum are selected and equally weighted to form the final index, capturing the large cap domestic market.

Global equity markets continued their upward trend in the second half of 2020, powered by growth and technology stocks as pandemic-induced trends favorable to the internet sector persisted worldwide. In 2021, vaccine availability turbocharged a global economic recovery, leading to a cyclical/value rotation that placed considerable pressure on growth stocks. This downside pressure was compounded by the March wind-down of leveraged bets. Meanwhile, the yield on the 10-Year US Treasury bond increased by nearly 0.75% in the first three months of 2021 from 0.92% to 1.64% despite no action from the US Federal Reserve (the Fed), and accompanied by a rise in inflation in the United States.

Dividend paying large cap stocks gained for the period. The large cap stocks included in the Russell 1000 Index enjoyed a strong rebound from their March 2020 lows and the dividend paying stocks within the index were not left behind in that rebound. The Fund also benefitted from the continued rotation to value stocks seen at the end of 2020 and beginning of 2021. Companies in the industrial and financial sectors contributed the most to the Fund’s performance for the period on the resumption of normal economic activity and speculation of rising interest rates, respectively.

We see two potential catalysts for the US dividend-paying equity market in the year to come:

• A continuation of the rotation into value/cyclical stocks seen in the first quarter of 2021.

• An improving economy powered by vaccine distribution and the subsequent relaxation of pandemic restrictions on economic activity.

For the one-year period ending on March 31, 2021 (the “reporting period”), the NAV of the Fund increased by 48.30%, while the Underlying Index increased by 49.26%.

At the end of the reporting period, the Fund held 23.44% of the portfolio in the Industrials sector, 19.27% in the Financials sector, and 9.55% in the Consumer Staples sector, which represent the Fund’s top three sector weightings.

3

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Large Cap Quality Dividend Index ETF (concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2021*

| | One Year

Return | | Annualized

Inception to Date |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ |

KFA Large Cap Quality Dividend Index ETF | | 48.30 | % | | 48.72 | %‡ | | 13.85 | %‡ | | 14.12 | %‡ |

Russell 1000 Dividend Select Equal Weight Index | | N/A | | | 49.26 | %‡ | | N/A | | | 14.35 | %‡ |

Russell 1000 Index | | N/A | | | 60.59 | %‡ | | N/A | | | 22.64 | %‡ |

| * | The Fund commenced operations on June 11, 2019. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call (855-857-2638) or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.42%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on pages 1 thru 2.

4

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Small Cap Quality Dividend Index ETF

The KFA Small Cap Quality Dividend Index ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correlate generally to the price and yield performance of the Russell 2000 Dividend Select Equal Weight Index (the ‘‘Underlying Index’’).

The Underlying Index is designed to measure the performance of US companies that have successfully increased their dividend payments over a period of ten years. On a quarterly basis the highest-ranking companies based on momentum are selected and equally weighted to form the final index, capturing the small cap domestic market.

Global equity markets continued their upward trend in the second half of 2020, powered by growth and technology stocks as pandemic-induced trends favorable to the internet sector persisted worldwide. In 2021, vaccine availability turbocharged a global economic recovery, leading to a cyclical/value rotation that placed considerable pressure on growth stocks. This downside pressure was compounded by the March wind-down of leveraged bets. Meanwhile, the yield on the 10-Year US Treasury bond increased by nearly 0.75% in the first three months of 2021 from 0.92% to 1.64% despite no action from the US Federal Reserve (the Fed), and accompanied by a rise in inflation in the United States.

Dividend paying small cap stocks gained for the period though did not see significant momentum until late 2020 when the Russell 2000 began to rebound strongly from its pandemic lows. The unprecedented fiscal stimulus pursued by the US benefitted smaller companies the most, many of which saw the brunt of the impact from the COVID-19 pandemic. The Fund also benefitted from the continued rotation to value stocks seen at the end of 2020 and beginning of 2021. Regional banks and automotive retail companies contributed the most to the Fund’s performance for the period on early 2021 speculation of rising interest rates and surging demand for automobiles.

We see two potential catalysts for the US dividend-paying equity market in the year to come:

• A continuation of the rotation into value/cyclical stocks seen in the first quarter of 2021.

• An improving economy powered by vaccine distribution and the subsequent relaxation of pandemic restrictions on economic activity.

For the one-year period ending on March 31, 2021 (the “reporting period”), the NAV of the Fund increased by 39.27%, while the Underlying Index increased by 40.21%.

At the end of the reporting period, the Fund held 25.54% of the portfolio in the Financials sector, 22.07% in the Utilities sector, and 17.18% in the Industrials sector, which represent the Fund’s top three sector weightings.

5

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Small Cap Quality Dividend Index ETF (concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2021*

| | One Year

Return | | Annualized

Inception to Date |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ |

KFA Small Cap Quality Dividend Index ETF | | 39.27 | % | | 41.47 | %‡ | | 9.03 | %‡ | | 9.45 | %‡ |

Russell 2000 Dividend Select Equal Weight Index | | N/A | | | 40.21 | %‡ | | N/A | | | 9.71 | %‡ |

Russell 2000 Index | | N/A | | | 94.85 | %‡ | | N/A | | | 25.08 | %‡ |

| * | The Fund commenced operations on June 11, 2019. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call (855-857-2638) or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.52%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on pages 1 thru 2.

6

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Dynamic Fixed Income ETF

The KFA Dynamic Fixed Income ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, track the price and yield performance of a the FTSE US High-Yield Treasury Rotation Index (the “Underlying Index”).

The Underlying Index is designed to provide a benchmark for investors looking to capture risk-managed exposure to High-Yield credit and US Treasuries.

Global bond markets saw strong issuance in the second half of 2020 as corporations sought to take advantage of an extremely low-rate environment. In the US, high yield issuance rose 30% to $570 billion as downgraded issuers attempted to shore up their finances in the fallout from the coronavirus pandemic. However, investment grade issuance was even stronger in 2020, rising +54% to $2.01 trillion. By the end of the year, high yield spreads returned to their pre-pandemic level in the US and continued to fall in 2021 amid an improving economic situation, ending the period lower than they had been at the beginning of the pandemic.

US high yield bonds have made a remarkable comeback from their pandemic lows as issuance soared during the second half of 2020. The Fund rotated into treasuries in the second quarter of 2020 following the extreme downdraft in high yield bonds in the first quarter of 2020 before rotating back into high yield for the remainder of the period. For the three quarters during which the Fund was invested in high yield, it outperformed the average return among the three asset classes included in the rotation model (short duration treasuries, medium duration treasuries, and high yield bonds).

We see three potential catalysts for the US high yield bond market in the year to come:

• Moody’s forecasts an increase of 7% in high yield issuance in the US in 2021, compared to a 16% decrease for investment grade.1

• Moody’s forecasts the high yield default rate in the US to drop below 5% in June compared to nearly 6% in March and remain below 5% for the remainder of 2021, improving the risk profile of high yield securities.1

• The rise in inflation expected for 2021 may reduce nominal debt and thereby improve the repayment capacity for many high yield issuers.

For the one-year period ending on March 31, 2021 (the “reporting period”), the NAV of the Fund increased by 5.79%, while the Underlying Index increased by 11.65%.

At the end of the reporting period, the Fund held 75.21% of the portfolio in the Industrials sector, 10.87% in the Financials sector, and 3.06% in the Utilities sector, which represent the Fund’s top three sector weightings.

Citations:

1 Moody’s Investor Service.

7

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Dynamic Fixed Income ETF (concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2021*

| | One Year

Return | | Annualized

Inception to Date |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ |

KFA Dynamic Fixed Income ETF | | 5.79 | % | | 6.89 | %‡ | | -7.53 | %‡ | | -7.40 | %‡ |

FTSE US High-Yield Treasury Rotation Index | | N/A | | | 11.65 | %‡ | | N/A | | | -1.80 | %‡ |

| * | The Fund commenced operations on December 6, 2019. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call (855-857-2638) or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.46%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on pages 1 thru 2.

8

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Value Line® Dynamic Core Equity Index ETF

The KFA Value Line® Dynamic Core Equity Index ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, track the price and yield performance of the 3D/L Value Line® Dynamic Core Equity Index (the “Underlying Index”).

The Underlying Index is designed to capture quality US companies based on a three-factor process that selects stocks with high dividend yields that are the highest rated among Value Line®’s Safety™ and Timeliness™ Ranking Systems.

Global equity markets continued their upward trend in the second half of 2020, powered by growth and technology stocks as pandemic-induced trends favorable to the internet sector persisted worldwide. In 2021, vaccine availability turbocharged a global economic recovery, leading to a cyclical/value rotation that placed considerable pressure on growth stocks. This downside pressure was compounded by the March wind-down of leveraged bets. Meanwhile, the yield on the 10-Year US Treasury bond increased by nearly 0.75% in the first three months of 2021 from 0.92% to 1.64% despite no action from the US Federal Reserve (the Fed), and accompanied by a rise in inflation in the United States.

From inception on November 23, 2020, the investment strategy performed well against comparable beta benchmarks due mainly to the continued rotation towards value stocks and away from some growth names. Global reopening and increased vaccinations also gave a strong tailwind for equities in general. The strategy particularly benefited from strength in Financial, Utilities and Industrials. The Fund’s focused selection of consumer staples stocks also benefited the Fund avoiding the sectors decline in broad benchmarks during the period.

We see two potential catalysts for the US dividend-paying equity market in the year to come:

• A continuation of the rotation into value/cyclical stocks seen in the first quarter of 2021.

• An improving economy powered by vaccine distribution and the subsequent relaxation of pandemic restrictions on economic activity.

From inception (November 23, 2020) through the Fund’s fiscal year ending on March 31, 2021 (the “reporting period”), the NAV of the Fund increased by 15.46% while the Underlying Index increased by 15.22%.

At the end of the reporting period, the Fund held 22.51% of the portfolio in the Industrials sector, 20.56% in the Utilities sector, and 20.44% in the Financials sector, which represent the Fund’s top three sector weightings.

9

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Value Line® Dynamic Core Equity Index ETF (concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2021*

| | Cumulative

Inception to Date |

| | | Net Asset

Value | | Market

Price^ |

KFA Value Line® Dynamic Core Equity Index ETF | | 15.46 | % | | 12.92 | %‡ |

3D/L Value Line® Dynamic Core Equity Index | | N/A | | | 15.22 | %‡ |

| * | The Fund commenced operations on November 23, 2020. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call (855-857-2638) or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.56%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on pages 1 thru 2.

10

Management Discussion of Fund Performance (Unaudited) (continued)

KFA Mount Lucas Index Strategy ETF

The KFA Mount Lucas Index Strategy ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, exceeds that of the KFA MLM Index (the “Index”) over a complete market cycle.

The Index consists of a portfolio of twenty-two liquid futures contracts traded on U.S. and foreign exchanges. The Index includes futures contracts on 11 commodities, 6 currencies, and 5 global bond markets. These three baskets are weighted by their relative historical volatility, and within each basket, the constituent markets are equal dollar weighted.

Global commodity markets mostly have rebounded from their pandemic lows. Increased activity in commodity markets driven by supply chain issues, geopolitical tensions, and the reopening of economies globally benefitted trend-following commodities futures trading strategies. Oil and metals have led the commodity rebound as copper prices have risen 13% year-to-date and West Texas Intermediate (WTI)1 crude has surged nearly 22% over the same period.

We see two potential catalysts for the commodities futures market in the year to come:

• Continued supply chain bottlenecks, reopening of economies and continued shifts towards renewable energy policies could affect prices in the coming year.

• Inflationary pressures and supporting data could see more investors allocate to commodities as a hedge as the asset class traditionally rises on inflation expectations and could be a driver of returns this year.

From inception (December 1, 2020) through the Fund’s fiscal year ending on March 31, 2021 (the “reporting period”), the NAV of the Fund increased by 10.20%, while the Underlying Index increased by 10.45%.

At the end of the reporting period, the Fund’s largest exposure in each of its three respective asset classes (fixed income, currencies, commodities) were the 10-Year Japanese Government Bond (short) at 26.77% of NAV, the British Pound (long) at 16.51% of NAV, and heating oil at 7.21% of NAV.

1 WTI - West Texas Intermediate, which is the type of oil the futures contract is based on.

11

Management Discussion of Fund Performance (Unaudited) (concluded)

KFA Mount Lucas Index Strategy ETF (concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2021*

| | Cumulative

Inception to Date |

| | | Net Asset

Value | | Market

Price^ |

KFA Mount Lucas Index Strategy ETF | | 10.20 | % | | 10.40 | %‡ |

KFA MLM Index | | N/A | | | 10.45 | %‡ |

| * | The Fund commenced operations on December 1, 2020. |

| ^ | Beginning December 23, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to that date, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call (855-857-2638) or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.90%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on pages 1 thru 2.

12

Schedule of Investments March 31, 2021

KFA Large Cap Quality Dividend Index ETF

| | Shares | | Value |

COMMON STOCK — 99.8%‡ | | | | | |

UNITED STATES — 99.8% | | | | | |

Communication Services — 2.6% | | | | | |

Comcast, Cl A | | 7,443 | | $ | 402,741 |

John Wiley & Sons, Cl A | | 7,764 | | | 420,809 |

Verizon Communications | | 7,342 | | | 426,937 |

| | | | | | 1,250,487 |

Consumer Discretionary — 8.1% | | | | | |

Gentex | | 11,692 | | | 417,054 |

NIKE, Cl B | | 3,054 | | | 405,846 |

Polaris | | 3,133 | | | 418,256 |

Pool | | 1,203 | | | 415,324 |

Starbucks | | 3,895 | | | 425,607 |

Target | | 2,274 | | | 450,411 |

Thor Industries | | 3,241 | | | 436,692 |

Tractor Supply | | 2,568 | | | 454,741 |

Williams-Sonoma | | 3,166 | | | 567,347 |

| | | | | | 3,991,278 |

Consumer Staples — 9.5% | | | | | |

Altria Group | | 9,046 | | | 462,793 |

Archer-Daniels-Midland | | 7,220 | | | 411,540 |

Brown-Forman, Cl B | | 5,901 | | | 406,992 |

Casey’s General Stores | | 1,978 | | | 427,624 |

Colgate-Palmolive | | 5,461 | | | 430,490 |

Ingredion | | 4,540 | | | 408,237 |

Kroger | | 11,625 | | | 418,384 |

Nu Skin Enterprises, Cl A | | 7,923 | | | 419,047 |

Philip Morris International | | 4,816 | | | 427,372 |

Sysco | | 4,924 | | | 387,716 |

Walgreens Boots Alliance | | 8,662 | | | 475,544 |

| | | | | | 4,675,739 |

The accompanying notes are an integral part of the financial statements.

13

Schedule of Investments March 31, 2021

KFA Large Cap Quality Dividend Index ETF (continued)

| | Shares | | Value |

COMMON STOCK (continued) | | | | | |

Energy — 0.8% | | | | | |

Exxon Mobil | | 6,733 | | $ | 375,903 |

Financials — 19.2% | | | | | |

American Financial Group | | 3,673 | | | 419,089 |

Ameriprise Financial | | 1,824 | | | 423,989 |

Arthur J Gallagher | | 3,256 | | | 406,251 |

BlackRock, Cl A | | 572 | | | 431,265 |

BOK Financial | | 4,402 | | | 393,187 |

Chubb | | 2,362 | | | 373,125 |

Comerica | | 5,933 | | | 425,634 |

Cullen/Frost Bankers | | 3,705 | | | 402,956 |

Discover Financial Services | | 4,195 | | | 398,483 |

Erie Indemnity, Cl A | | 1,756 | | | 387,918 |

Evercore, Cl A | | 3,342 | | | 440,275 |

JPMorgan Chase | | 2,706 | | | 411,935 |

KeyCorp | | 20,079 | | | 401,178 |

Lincoln National | | 7,007 | | | 436,326 |

MarketAxess Holdings | | 796 | | | 396,344 |

Mercury General | | 6,582 | | | 400,251 |

People’s United Financial | | 22,528 | | | 403,251 |

PNC Financial Services Group | | 2,376 | | | 416,774 |

Raymond James Financial | | 3,503 | | | 429,328 |

T Rowe Price Group | | 2,355 | | | 404,118 |

Travelers | | 2,681 | | | 403,222 |

US Bancorp | | 7,936 | | | 438,940 |

Webster Financial | | 6,968 | | | 384,007 |

| | | | | | 9,427,846 |

Health Care — 7.1% | | | | | |

AmerisourceBergen, Cl A | | 3,881 | | | 458,230 |

Johnson & Johnson | | 2,626 | | | 431,583 |

McKesson | | 2,312 | | | 450,932 |

Medtronic | | 3,486 | | | 411,801 |

STERIS | | 2,314 | | | 440,771 |

Stryker | | 1,698 | | | 413,599 |

UnitedHealth Group | | 1,158 | | | 430,857 |

West Pharmaceutical Services | | 1,509 | | | 425,206 |

| | | | | | 3,462,979 |

Industrials — 23.4% | | | | | |

A O Smith | | 6,539 | | | 442,102 |

Caterpillar | | 1,899 | | | 440,321 |

CSX | | 4,551 | | | 438,807 |

Cummins | | 1,550 | | | 401,620 |

Donaldson | | 6,990 | | | 406,538 |

Eaton | | 3,024 | | | 418,159 |

Emerson Electric | | 4,531 | | | 408,787 |

FedEx | | 1,507 | | | 428,048 |

Graco | | 6,148 | | | 440,320 |

Honeywell International | | 1,993 | | | 432,621 |

Hubbell, Cl B | | 2,288 | | | 427,604 |

The accompanying notes are an integral part of the financial statements.

14

Schedule of Investments March 31, 2021

KFA Large Cap Quality Dividend Index ETF (continued)

| | Shares | | Value |

COMMON STOCK (continued) | | | | | |

Industrials (continued) | | | | | |

JB Hunt Transport Services | | 2,621 | | $ | 440,512 |

Lincoln Electric Holdings | | 3,458 | | | 425,127 |

MSA Safety | | 2,610 | | | 391,552 |

MSC Industrial Direct, Cl A | | 4,774 | | | 430,567 |

Norfolk Southern | | 1,611 | | | 432,586 |

PACCAR | | 4,354 | | | 404,574 |

Parker-Hannifin | | 1,380 | | | 435,293 |

Regal Beloit | | 2,928 | | | 417,767 |

Republic Services, Cl A | | 4,330 | | | 430,186 |

Robert Half International | | 5,384 | | | 420,329 |

Ryder System | | 5,673 | | | 429,162 |

Snap-on | | 1,876 | | | 432,868 |

Toro | | 4,198 | | | 432,982 |

Trinity Industries | | 14,009 | | | 399,116 |

United Parcel Service, Cl B | | 2,472 | | | 420,215 |

Waste Management | | 3,444 | | | 444,345 |

| | | | | | 11,472,108 |

Information Technology — 7.0% | | | | | |

Analog Devices | | 2,705 | | | 419,491 |

Broadcom | | 913 | | | 423,322 |

Broadridge Financial Solutions | | 2,829 | | | 433,120 |

KLA | | 1,356 | | | 448,022 |

Littelfuse | | 1,589 | | | 420,195 |

Microchip Technology | | 2,736 | | | 424,682 |

Texas Instruments | | 2,403 | | | 454,143 |

Xilinx | | 3,398 | | | 421,012 |

| | | | | | 3,443,987 |

Materials — 8.1% | | | | | |

Albemarle | | 2,856 | | | 417,290 |

AptarGroup | | 3,092 | | | 438,044 |

Avery Dennison | | 2,320 | | | 426,068 |

Celanese, Cl A | | 2,783 | | | 416,921 |

Eastman Chemical | | 3,569 | | | 393,018 |

Nucor | | 6,457 | | | 518,303 |

Scotts Miracle-Gro | | 1,986 | | | 486,511 |

Steel Dynamics | | 8,971 | | | 455,368 |

Westlake Chemical | | 4,616 | | | 409,855 |

| | | | | | 3,961,378 |

Real Estate — 6.1% | | | | | |

Camden Property Trust† | | 4,079 | | | 448,323 |

CubeSmart† | | 11,510 | | | 435,423 |

Federal Realty Investment Trust† | | 3,894 | | | 395,046 |

Iron Mountain† | | 11,389 | | | 421,507 |

Mid-America Apartment Communities† | | 3,118 | | | 450,115 |

Omega Healthcare Investors† | | 10,929 | | | 400,329 |

UDR† | | 9,829 | | | 431,100 |

| | | | | | 2,981,843 |

The accompanying notes are an integral part of the financial statements.

15

Schedule of Investments March 31, 2021

KFA Large Cap Quality Dividend Index ETF (concluded)

| | Shares | | Value |

COMMON STOCK (continued) | | | | | |

Utilities — 7.9% | | | | | |

DTE Energy | | 3,301 | | $ | 439,495 |

Duke Energy | | 4,583 | | | 442,397 |

Edison International | | 6,949 | | | 407,212 |

Evergy | | 7,308 | | | 435,045 |

National Fuel Gas | | 8,322 | | | 416,017 |

NextEra Energy | | 5,708 | | | 431,582 |

Public Service Enterprise Group | | 7,182 | | | 432,428 |

Southern | | 7,045 | | | 437,917 |

UGI | | 9,869 | | | 404,728 |

| | | | | | 3,846,821 |

TOTAL UNITED STATES | | | | | 48,890,369 |

TOTAL COMMON STOCK

(Cost $43,404,576) | | | | | 48,890,369 |

| | | | | | |

TOTAL INVESTMENTS — 99.8%

(Cost $43,404,576) | | | | | 48,890,369 |

OTHER ASSETS LESS LIABILITIES — 0.2% | | | | | 106,753 |

NET ASSETS — 100% | | | | $ | 48,997,122 |

‡ Industries are utilized for compliance purposes, whereas sectors are utilized for reporting.

† Real Estate Investment Trust

Cl — Class

As of March 31, 2021, all of the Fund’s investments were considered Level 1 of the fair value hierarchy, in accordance with the authoritative guidance under U.S. GAAP.

For the year ended March 31, 2021, there have been no transfers in or out of Level 3.

The accompanying notes are an integral part of the financial statements.

16

Schedule of Investments March 31, 2021

KFA Small Cap Quality Dividend ETF

| | Shares | | Value |

COMMON STOCK — 99.7%‡ | | | | | |

UNITED STATES — 99.7% | | | | | |

Consumer Discretionary — 4.4% | | | | | |

Churchill Downs | | 3,584 | | $ | 815,073 |

Lithia Motors, Cl A | | 2,230 | | | 869,901 |

| | | | | | 1,684,974 |

Consumer Staples — 10.7% | | | | | |

Andersons | | 30,497 | | | 835,008 |

Calavo Growers | | 10,100 | | | 784,164 |

Lancaster Colony | | 4,554 | | | 798,590 |

Universal | | 15,598 | | | 920,126 |

WD-40 | | 2,619 | | | 801,885 |

| | | | | | 4,139,773 |

Financials — 25.5% | | | | | |

Atlantic Union Bankshares | | 21,660 | | | 830,878 |

BancFirst | | 12,063 | | | 852,733 |

Bar Harbor Bankshares | | 27,229 | | | 801,077 |

Bryn Mawr Bank | | 19,975 | | | 909,062 |

Columbia Banking System | | 17,591 | | | 757,996 |

International Bancshares | | 17,169 | | | 796,985 |

Northwest Bancshares | | 56,429 | | | 815,399 |

PROG Holdings | | 18,006 | | | 779,480 |

Stock Yards Bancorp | | 15,349 | | | 783,720 |

United Bankshares | | 20,832 | | | 803,699 |

Washington Trust Bancorp | | 16,228 | | | 837,852 |

WesBanco | | 23,871 | | | 860,788 |

| | | | | | 9,829,669 |

Health Care — 4.8% | | | | | |

Ensign Group | | 10,189 | | | 956,136 |

National HealthCare | | 11,259 | | | 877,188 |

| | | | | | 1,833,324 |

The accompanying notes are an integral part of the financial statements.

17

Schedule of Investments March 31, 2021

KFA Small Cap Quality Dividend ETF (concluded)

| | Shares | | Value |

COMMON STOCK (continued) | | | | | |

Industrials — 17.1% | | | | | |

Applied Industrial Technologies | | 8,961 | | $ | 816,974 |

Franklin Electric | | 10,941 | | | 863,683 |

GATX | | 8,675 | | | 804,520 |

Healthcare Services Group | | 28,910 | | | 810,347 |

Hillenbrand | | 16,945 | | | 808,446 |

Lindsay | | 5,310 | | | 884,752 |

Matthews International, Cl A | | 21,099 | | | 834,465 |

Standex International | | 8,268 | | | 790,173 |

| | | | | | 6,613,360 |

Information Technology — 2.0% | | | | | |

Badger Meter | | 8,435 | | | 785,045 |

| | | | | | |

Materials — 8.8% | | | | | |

Balchem | | 6,767 | | | 848,650 |

HB Fuller | | 14,474 | | | 910,559 |

Quaker Chemical | | 3,125 | | | 761,781 |

Sensient Technologies | | 11,015 | | | 859,170 |

| | | | | | 3,380,160 |

Real Estate — 4.3% | | | | | |

National Health Investors† | | 11,822 | | | 854,494 |

Universal Health Realty Income Trust† | | 12,130 | | | 822,172 |

| | | | | | 1,676,666 |

Utilities — 22.1% | | | | | |

ALLETE | | 12,971 | | | 871,521 |

Artesian Resources, Cl A | | 21,395 | | | 842,535 |

Avista | | 18,916 | | | 903,239 |

California Water Service Group | | 15,727 | | | 886,059 |

Chesapeake Utilities | | 7,275 | | | 844,482 |

Middlesex Water | | 11,629 | | | 918,924 |

New Jersey Resources | | 20,738 | | | 826,824 |

SJW Group | | 13,286 | | | 836,885 |

South Jersey Industries | | 31,315 | | | 707,093 |

Spire | | 11,727 | | | 866,508 |

| | | | | | 8,504,070 |

TOTAL UNITED STATES | | | | | 38,447,041 |

TOTAL COMMON STOCK

(Cost $33,201,488) | | | | | 38,447,041 |

TOTAL INVESTMENTS — 99.7%

(Cost $33,201,488) | | | | | 38,447,041 |

OTHER ASSETS LESS LIABILITIES — 0.3% | | | | | 111,858 |

NET ASSETS — 100% | | | | $ | 38,558,899 |

‡ Industries are utilized for compliance purposes, whereas sectors are utilized for reporting.

† Real Estate Investment Trust

Cl — Class

As of March 31, 2021, all of the Fund’s investments were considered Level 1 of the fair value hierarchy, in accordance with the authoritative guidance under U.S. GAAP.

For the year ended March 31, 2021, there have been no transfers in or out of Level 3.

The accompanying notes are an integral part of the financial statements.

18

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF

| | Face Amount | | Value |

CORPORATE OBLIGATIONS — 87.9% | | | | | | |

Communication Services — 12.2% | | | | | | |

AMC Networks | | | | | | |

5.000%, 04/01/2024 | | $ | 25,000 | | $ | 25,312 |

CCO Holdings | | | | | | |

5.125%, 05/01/2027(A) | | | 186,000 | | | 196,661 |

5.000%, 02/01/2028(A) | | | 124,000 | | | 131,149 |

4.750%, 03/01/2030(A) | | | 125,000 | | | 129,531 |

4.500%, 08/15/2030(A) | | | 129,000 | | | 131,477 |

4.500%, 05/01/2032(A) | | | 200,000 | | | 202,500 |

4.250%, 02/01/2031(A) | | | 200,000 | | | 200,444 |

Clear Channel Worldwide Holdings | | | | | | |

5.125%, 08/15/2027(A) | | | 200,000 | | | 201,310 |

CommScope | | | | | | |

8.250%, 03/01/2027(A) | | | 105,000 | | | 112,350 |

6.000%, 03/01/2026(A) | | | 200,000 | | | 211,194 |

CommScope Technologies | | | | | | |

6.000%, 06/15/2025(A) | | | 77,000 | | | 78,544 |

CSC Holdings | | | | | | |

7.500%, 04/01/2028(A) | | | 105,000 | | | 115,794 |

6.500%, 02/01/2029(A) | | | 105,000 | | | 116,025 |

5.875%, 09/15/2022 | | | 93,000 | | | 98,199 |

5.750%, 01/15/2030(A) | | | 305,000 | | | 321,240 |

4.625%, 12/01/2030(A) | | | 124,000 | | | 121,968 |

3.375%, 02/15/2031(A) | | | 100,000 | | | 94,250 |

Diamond Sports Group | | | | | | |

5.375%, 08/15/2026(A) | | | 143,000 | | | 102,926 |

DISH DBS | | | | | | |

7.750%, 07/01/2026 | | | 265,000 | | | 291,897 |

5.875%, 11/15/2024 | | | 186,000 | | | 194,658 |

5.875%, 07/15/2022 | | | 100,000 | | | 104,450 |

The accompanying notes are an integral part of the financial statements.

19

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Communication Services (continued) | | | | | | |

Embarq | | | | | | |

7.995%, 06/01/2036 | | $ | 150,000 | | $ | 172,692 |

Frontier Communications | | | | | | |

5.000%, 05/01/2028(A) | | | 100,000 | | | 101,750 |

Gray Television | | | | | | |

7.000%, 05/15/2027(A) | | | 105,000 | | | 114,188 |

4.750%, 10/15/2030(A) | | | 100,000 | | | 99,125 |

iHeartCommunications | | | | | | |

4.750%, 01/15/2028(A) | | | 100,000 | | | 100,750 |

Level 3 Financing | | | | | | |

4.625%, 09/15/2027(A) | | | 124,000 | | | 127,617 |

4.250%, 07/01/2028(A) | | | 93,000 | | | 94,052 |

3.625%, 01/15/2029(A) | | | 100,000 | | | 96,875 |

Lumen Technologies | | | | | | |

7.600%, 09/15/2039 | | | 246,000 | | | 281,670 |

7.500%, 04/01/2024 | | | 105,000 | | | 117,689 |

5.800%, 03/15/2022 | | | 90,000 | | | 93,150 |

5.625%, 04/01/2025 | | | 46,000 | | | 49,622 |

Match Group Holdings II | | | | | | |

4.625%, 06/01/2028(A) | | | 124,000 | | | 126,698 |

Netflix | | | | | | |

6.375%, 05/15/2029 | | | 200,000 | | | 248,000 |

5.875%, 11/15/2028 | | | 125,000 | | | 151,196 |

4.875%, 06/15/2030(A) | | | 100,000 | | | 115,154 |

4.875%, 04/15/2028 | | | 62,000 | | | 70,488 |

4.375%, 11/15/2026 | | | 93,000 | | | 103,904 |

Nexstar Broadcasting | | | | | | |

5.625%, 07/15/2027(A) | | | 124,000 | | | 130,353 |

Scripps Escrow II | | | | | | |

3.875%, 01/15/2029(A) | | | 40,000 | | | 39,300 |

Sinclair Television Group | | | | | | |

4.125%, 12/01/2030(A) | | | 100,000 | | | 96,250 |

Sirius XM Radio | | | | | | |

5.500%, 07/01/2029(A) | | | 150,000 | | | 162,188 |

5.000%, 08/01/2027(A) | | | 62,000 | | | 65,041 |

4.625%, 07/15/2024(A) | | | 100,000 | | | 103,010 |

4.125%, 07/01/2030(A) | | | 93,000 | | | 93,107 |

Sprint | | | | | | |

7.875%, 09/15/2023 | | | 95,000 | | | 108,538 |

7.625%, 02/15/2025 | | | 150,000 | | | 178,281 |

7.625%, 03/01/2026 | | | 196,000 | | | 240,087 |

7.125%, 06/15/2024 | | | 228,000 | | | 262,485 |

Sprint Capital | | | | | | |

8.750%, 03/15/2032 | | | 150,000 | | | 221,813 |

6.875%, 11/15/2028 | | | 250,000 | | | 315,243 |

The accompanying notes are an integral part of the financial statements.

20

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Communication Services (continued) | | | | | | |

TEGNA | | | | | | |

5.000%, 09/15/2029 | | $ | 124,000 | | $ | 128,682 |

T-Mobile USA | | | | | | |

6.000%, 04/15/2024 | | | 205,000 | | | 206,538 |

United States Cellular | | | | | | |

6.700%, 12/15/2033 | | | 125,000 | | | 151,399 |

Univision Communications | | | | | | |

6.625%, 06/01/2027(A) | | | 93,000 | | | 99,317 |

5.125%, 02/15/2025(A) | | | 180,000 | | | 181,800 |

Windstream Escrow | | | | | | |

7.750%, 08/15/2028(A) | | | 85,000 | | | 86,381 |

Zayo Group Holdings | | | | | | |

4.000%, 03/01/2027(A) | | | 100,000 | | | 98,400 |

| | | | | | | 8,414,712 |

Consumer Discretionary — 15.7% | | | | | | |

1011778 BC ULC/New Red Finance Inc | | | | | | |

4.375%, 01/15/2028(A) | | | 124,000 | | | 124,585 |

4.000%, 10/15/2030(A) | | | 175,000 | | | 168,875 |

3.875%, 01/15/2028(A) | | | 185,000 | | | 186,987 |

Adient Global Holdings | | | | | | |

4.875%, 08/15/2026(A) | | | 100,000 | | | 102,625 |

American Axle & Manufacturing | | | | | | |

6.250%, 04/01/2025 | | | 150,000 | | | 154,500 |

American Builders & Contractors Supply | | | | | | |

4.000%, 01/15/2028(A) | | | 100,000 | | | 100,000 |

Aramark Services | | | | | | |

6.375%, 05/01/2025(A) | | | 186,000 | | | 197,160 |

Bed Bath & Beyond | | | | | | |

5.165%, 08/01/2044 | | | 50,000 | | | 45,551 |

Boyd Gaming | | | | | | |

8.625%, 06/01/2025(A) | | | 105,000 | | | 116,760 |

6.000%, 08/15/2026 | | | 180,000 | | | 187,412 |

Boyne USA | | | | | | |

7.250%, 05/01/2025(A) | | | 75,000 | | | 77,962 |

Brookfield Residential Properties | | | | | | |

6.250%, 09/15/2027(A) | | | 100,000 | | | 104,375 |

Caesars Entertainment | | | | | | |

6.250%, 07/01/2025(A) | | | 274,000 | | | 291,481 |

Carnival | | | | | | |

11.500%, 04/01/2023(A) | | | 200,000 | | | 229,250 |

10.500%, 02/01/2026(A) | | | 150,000 | | | 176,809 |

7.625%, 03/01/2026(A) | | | 300,000 | | | 322,290 |

Churchill Downs | | | | | | |

5.500%, 04/01/2027(A) | | | 100,000 | | | 104,520 |

Ford Motor | | | | | | |

9.625%, 04/22/2030 | | | 75,000 | | | 104,665 |

9.000%, 04/22/2025 | | | 105,000 | | | 127,167 |

The accompanying notes are an integral part of the financial statements.

21

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Consumer Discretionary (continued) | | | | | | |

8.500%, 04/21/2023 | | $ | 105,000 | | $ | 117,075 |

4.750%, 01/15/2043 | | | 124,000 | | | 124,918 |

Ford Motor Credit | | | | | | |

5.113%, 05/03/2029 | | | 150,000 | | | 160,725 |

4.687%, 06/09/2025 | | | 200,000 | | | 212,265 |

1.048%, VAR ICE LIBOR USD 3 Month+0.810%, 04/05/2021 | | | 305,000 | | | 305,000 |

Gap | | | | | | |

8.875%, 05/15/2027(A) | | | 100,000 | | | 116,750 |

General Motors Financial | | | | | | |

5.750%, VAR ICE LIBOR USD 3 Month+3.598%‡ | | | 300,000 | | | 314,640 |

Goodyear Tire & Rubber | | | | | | |

5.000%, 05/31/2026 | | | 112,000 | | | 115,148 |

Hanesbrands | | | | | | |

5.375%, 05/15/2025(A) | | | 124,000 | | | 131,207 |

Hilton Domestic Operating | | | | | | |

4.000%, 05/01/2031(A) | | | 250,000 | | | 250,000 |

Hilton Worldwide Finance | | | | | | |

4.875%, 04/01/2027 | | | 155,000 | | | 161,781 |

Installed Building Products | | | | | | |

5.750%, 02/01/2028(A) | | | 180,000 | | | 188,100 |

KFC Holding | | | | | | |

5.250%, 06/01/2026(A) | | | 100,000 | | | 103,058 |

L Brands | | | | | | |

7.500%, 06/15/2029 | | | 62,000 | | | 70,441 |

6.875%, 11/01/2035 | | | 100,000 | | | 119,179 |

6.750%, 07/01/2036 | | | 150,000 | | | 177,000 |

6.694%, 01/15/2027 | | | 150,000 | | | 169,875 |

6.625%, 10/01/2030(A) | | | 200,000 | | | 226,625 |

Lennar | | | | | | |

4.750%, 11/29/2027 | | | 105,000 | | | 120,553 |

LGI Homes | | | | | | |

6.875%, 07/15/2026(A) | | | 100,000 | | | 104,375 |

Live Nation Entertainment | | | | | | |

4.750%, 10/15/2027(A) | | | 124,000 | | | 124,930 |

Macy’s | | | | | | |

8.375%, 06/15/2025(A) | | | 300,000 | | | 332,163 |

Mattel | | | | | | |

6.750%, 12/31/2025(A) | | | 12,000 | | | 12,617 |

5.875%, 12/15/2027(A) | | | 100,000 | | | 109,782 |

MDC Holdings | | | | | | |

6.000%, 01/15/2043 | | | 150,000 | | | 189,319 |

Methanex | | | | | | |

5.125%, 10/15/2027 | | | 75,000 | | | 76,688 |

MGM Resorts International | | | | | | |

6.000%, 03/15/2023 | | | 100,000 | | | 107,125 |

5.750%, 06/15/2025 | | | 132,000 | | | 143,880 |

5.500%, 04/15/2027 | | | 186,000 | | | 199,857 |

The accompanying notes are an integral part of the financial statements.

22

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Consumer Discretionary (continued) | | | | | | |

NCL | | | | | | |

10.250%, 02/01/2026(A) | | $ | 100,000 | | $ | 117,330 |

5.875%, 03/15/2026(A) | | | 75,000 | | | 76,004 |

Newell Brands | | | | | | |

4.700%, 04/01/2026 | | | 93,000 | | | 102,845 |

Penske Automotive Group | | | | | | |

3.500%, 09/01/2025 | | | 100,000 | | | 102,355 |

Reynolds Group Issuer | | | | | | |

4.000%, 10/15/2027(A) | | | 150,000 | | | 147,000 |

Royal Caribbean Cruises | | | | | | |

11.500%, 06/01/2025(A) | | | 114,000 | | | 132,953 |

10.875%, 06/01/2023(A) | | | 100,000 | | | 115,030 |

Scientific Games International | | | | | | |

8.250%, 03/15/2026(A) | | | 100,000 | | | 107,250 |

Service International | | | | | | |

5.125%, 06/01/2029 | | | 100,000 | | | 107,320 |

3.375%, 08/15/2030 | | | 100,000 | | | 97,605 |

Six Flags Entertainment | | | | | | |

4.875%, 07/31/2024(A) | | | 75,000 | | | 75,722 |

Staples | | | | | | |

7.500%, 04/15/2026(A) | | | 167,000 | | | 176,185 |

Taylor Morrison Communities | | | | | | |

5.125%, 08/01/2030(A) | | | 195,000 | | | 207,188 |

Tenneco | | | | | | |

5.000%, 07/15/2026 | | | 350,000 | | | 329,875 |

Tesla | | | | | | |

5.300%, 08/15/2025(A) | | | 274,000 | | | 284,302 |

Travel + Leisure | | | | | | |

6.625%, 07/31/2026(A) | | | 311,000 | | | 353,094 |

6.600%, 10/01/2025 | | | 178,000 | | | 199,360 |

4.250%, 03/01/2022 | | | 124,000 | | | 125,318 |

Williams Scotsman International | | | | | | |

4.625%, 08/15/2028(A) | | | 100,000 | | | 101,750 |

Wynn Las Vegas | | | | | | |

5.500%, 03/01/2025(A) | | | 100,000 | | | 105,650 |

Yum! Brands | | | | | | |

7.750%, 04/01/2025(A) | | | 105,000 | | | 114,975 |

4.750%, 01/15/2030(A) | | | 100,000 | | | 105,730 |

| | | | | | | 10,792,891 |

Consumer Staples — 2.7% | | | | | | |

Albertsons | | | | | | |

5.875%, 02/15/2028(A) | | | 124,000 | | | 131,849 |

4.875%, 02/15/2030(A) | | | 150,000 | | | 154,200 |

4.625%, 01/15/2027(A) | | | 93,000 | | | 96,389 |

B&G Foods | | | | | | |

5.250%, 04/01/2025 | | | 75,000 | | | 77,063 |

The accompanying notes are an integral part of the financial statements.

23

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Consumer Staples (continued) | | | | | | |

JBS USA LUX | | | | | | |

6.500%, 04/15/2029(A) | | $ | 250,000 | | $ | 282,375 |

5.500%, 01/15/2030(A) | | | 85,000 | | | 94,073 |

Lamb Weston Holdings | | | | | | |

4.875%, 11/01/2026(A) | | | 93,000 | | | 96,255 |

Performance Food Group | | | | | | |

5.500%, 10/15/2027(A) | | | 100,000 | | | 104,576 |

Post Holdings | | | | | | |

5.750%, 03/01/2027(A) | | | 100,000 | | | 105,176 |

4.625%, 04/15/2030(A) | | | 100,000 | | | 100,190 |

Primo Water Holdings | | | | | | |

5.500%, 04/01/2025(A) | | | 100,000 | | | 102,780 |

Spectrum Brands | | | | | | |

5.750%, 07/15/2025 | | | 8,000 | | | 8,250 |

United Rentals North America | | | | | | |

4.000%, 07/15/2030 | | | 200,000 | | | 203,550 |

US Foods | | | | | | |

6.250%, 04/15/2025(A) | | | 100,000 | | | 107,200 |

Vector Group | | | | | | |

5.750%, 02/01/2029(A) | | | 200,000 | | | 206,250 |

| | | | | | | 1,870,176 |

Energy — 11.8% | | | | | | |

Antero Resources | | | | | | |

5.625%, 06/01/2023 | | | 150,000 | | | 150,507 |

Apache | | | | | | |

5.100%, 09/01/2040 | | | 200,000 | | | 195,500 |

4.750%, 04/15/2043 | | | 50,000 | | | 46,375 |

4.375%, 10/15/2028 | | | 406,000 | | | 404,782 |

Buckeye Partners | | | | | | |

3.950%, 12/01/2026 | | | 75,000 | | | 74,134 |

Cheniere Energy | | | | | | |

4.625%, 10/15/2028(A) | | | 100,000 | | | 104,017 |

Cheniere Energy Partners | | | | | | |

5.625%, 10/01/2026 | | | 100,000 | | | 104,570 |

4.500%, 10/01/2029 | | | 100,000 | | | 104,000 |

Comstock Resources | | | | | | |

9.750%, 08/15/2026 | | | 75,000 | | | 81,562 |

Continental Resources | | | | | | |

5.750%, 01/15/2031(A) | | | 100,000 | | | 112,986 |

4.375%, 01/15/2028 | | | 100,000 | | | 105,605 |

Energy Transfer | | | | | | |

6.625%, VAR ICE LIBOR USD 3 Month+4.155%‡ | | | 211,000 | | | 186,735 |

EQM Midstream Partners | | | | | | |

6.500%, 07/01/2027(A) | | | 100,000 | | | 108,725 |

6.500%, 07/15/2048 | | | 100,000 | | | 99,750 |

The accompanying notes are an integral part of the financial statements.

24

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Energy (continued) | | | | | | |

4.750%, 01/15/2031(A) | | $ | 200,000 | | $ | 194,000 |

4.125%, 12/01/2026 | | | 88,000 | | | 87,340 |

4.000%, 08/01/2024 | | | 6,000 | | | 6,103 |

Equities | | | | | | |

8.500%, 02/01/2030 | | | 100,000 | | | 127,530 |

7.625%, 02/01/2025 | | | 100,000 | | | 115,088 |

3.900%, 10/01/2027 | | | 100,000 | | | 102,093 |

Genesis Energy | | | | | | |

7.750%, 02/01/2028 | | | 175,000 | | | 175,053 |

GFL Environmental | | | | | | |

3.750%, 08/01/2025(A) | | | 150,000 | | | 152,250 |

Kerr-McGee | | | | | | |

7.125%, 10/15/2027 | | | 25,000 | | | 26,317 |

MEG Energy | | | | | | |

7.125%, 02/01/2027(A) | | | 400,000 | | | 419,000 |

5.875%, 02/01/2029(A) | | | 400,000 | | | 401,000 |

Murphy Oil | | | | | | |

7.050%, 05/01/2029 | | | 300,000 | | | 303,219 |

6.875%, 08/15/2024 | | | 250,000 | | | 255,625 |

NuStar Logistics | | | | | | |

6.375%, 10/01/2030 | | | 75,000 | | | 81,000 |

6.000%, 06/01/2026 | | | 16,000 | | | 17,249 |

Occidental Petroleum | | | | | | |

8.875%, 07/15/2030 | | | 100,000 | | | 126,100 |

7.150%, 05/15/2028 | | | 640,000 | | | 697,600 |

6.450%, 09/15/2036 | | | 350,000 | | | 386,444 |

6.375%, 09/01/2028 | | | 124,000 | | | 136,103 |

5.316%, 10/10/2036(B) | | | 246,000 | | | 124,107 |

2.700%, 08/15/2022 | | | 62,000 | | | 62,023 |

PBF Holding | | | | | | |

9.250%, 05/15/2025(A) | | | 85,000 | | | 86,672 |

PDC Energy | | | | | | |

5.750%, 05/15/2026 | | | 50,000 | | | 51,863 |

Petroleos Mexicanos | | | | | | |

6.500%, 03/13/2027 | | | 200,000 | | | 209,000 |

Seven Generations Energy | | | | | | |

5.375%, 09/30/2025(A) | | | 56,000 | | | 58,055 |

Southwestern Energy | | | | | | |

7.750%, 10/01/2027 | | | 70,000 | | | 74,813 |

Sunoco | | | | | | |

5.500%, 02/15/2026 | | | 100,000 | | | 102,729 |

Targa Resources Partners | | | | | | |

6.500%, 07/15/2027 | | | 100,000 | | | 108,668 |

5.875%, 04/15/2026 | | | 100,000 | | | 104,688 |

4.875%, 02/01/2031(A) | | | 348,000 | | | 352,611 |

TerraForm Power Operating | | | | | | |

5.000%, 01/31/2028(A) | | | 250,000 | | | 269,763 |

4.750%, 01/15/2030(A) | | | 75,000 | | | 77,873 |

The accompanying notes are an integral part of the financial statements.

25

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Energy (continued) | | | | | | |

Topaz Solar Farms | | | | | | |

5.750%, 09/30/2039(A) | | $ | 98,517 | | $ | 112,400 |

Western Midstream Operating | | | | | | |

6.500%, 02/01/2050 | | | 75,000 | | | 81,094 |

5.300%, 02/01/2030 | | | 224,000 | | | 242,760 |

4.500%, 03/01/2028 | | | 50,000 | | | 51,418 |

4.000%, 07/01/2022 | | | 150,000 | | | 153,754 |

WPX Energy | | | | | | |

4.500%, 01/15/2030 | | | 98,000 | | | 105,525 |

| | | | | | | 8,118,178 |

Financials — 9.5% | | | | | | |

Ally Financial | | | | | | |

5.750%, 11/20/2025 | | | 62,000 | | | 70,475 |

American Express | | | | | | |

3.622%, VAR ICE LIBOR USD 3 Month+3.428%‡ | | | 50,000 | | | 49,937 |

AmTrust Financial Services | | | | | | |

6.125%, 08/15/2023 | | | 500,000 | | | 500,271 |

Brookfield Property REIT | | | | | | |

5.750%, 05/15/2026(A) | | | 100,000 | | | 102,875 |

CIT Group | | | | | | |

5.000%, 08/01/2023 | | | 124,000 | | | 134,540 |

4.750%, 02/16/2024 | | | 100,000 | | | 108,750 |

Citigroup | | | | | | |

5.950%, VAR ICE LIBOR USD 3 Month+4.068%‡ | | | 296,000 | | | 310,543 |

5.900%, VAR ICE LIBOR USD 3 Month+4.230%‡ | | | 31,000 | | | 32,768 |

4.672%, VAR ICE LIBOR USD 3 Month+4.478%‡ | | | 190,000 | | | 190,425 |

Citizens Financial Group | | | | | | |

4.154%, VAR ICE LIBOR USD 3 Month+3.960%‡ | | | 10,000 | | | 9,953 |

Compass Group Diversified Holdings | | | | | | |

8.000%, 05/01/2026(A) | | | 75,000 | | | 78,457 |

Depository Trust & Clearing | | | | | | |

3.351%, VAR ICE LIBOR USD 3 Month+3.167%‡(A) | | | 95,000 | | | 93,100 |

Freedom Mortgage | | | | | | |

8.250%, 04/15/2025(A) | | | 75,000 | | | 78,094 |

Genworth Holdings | | | | | | |

7.625%, 09/24/2021 | | | 1,414,000 | | | 1,451,117 |

Goldman Sachs Capital III | | | | | | |

6.130%, VAR ICE LIBOR USD 3 Month+0.770%‡ | | | 105,000 | | | 100,537 |

Greystar Real Estate Partners | | | | | | |

5.750%, 12/01/2025(A) | | | 186,000 | | | 191,115 |

Jefferies Group MTN | | | | | | |

4.500%, 11/29/2028 | | | 30,000 | | | 29,970 |

JPMorgan Chase | | | | | | |

5.150%, VAR ICE LIBOR USD 3 Month+3.250%‡ | | | 20,000 | | | 20,688 |

4.005%, VAR ICE LIBOR USD 3 Month+3.800%‡ | | | 75,000 | | | 75,143 |

The accompanying notes are an integral part of the financial statements.

26

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Financials (continued) | | | | | | |

JPMorgan Chase Financial MTN | | | | | | |

6.500%, 07/30/2021(C) | | $ | 266,000 | | $ | 266,000 |

MGIC Investment | | | | | | |

5.250%, 08/15/2028 | | | 401,000 | | | 417,541 |

Morgan Stanley | | | | | | |

4.051%, VAR ICE LIBOR USD 3 Month+3.810%‡ | | | 20,000 | | | 20,000 |

3.851%, VAR ICE LIBOR USD 3 Month+3.610%‡ | | | 40,000 | | | 40,060 |

MSCI | | | | | | |

4.000%, 11/15/2029(A) | | | 100,000 | | | 102,846 |

3.875%, 02/15/2031(A) | | | 100,000 | | | 102,180 |

Navient MTN | | | | | | |

6.750%, 06/25/2025 | | | 180,000 | | | 195,525 |

6.500%, 06/15/2022 | | | 300,000 | | | 314,823 |

6.125%, 03/25/2024 | | | 100,000 | | | 105,607 |

5.500%, 01/25/2023 | | | 224,000 | | | 232,400 |

OneMain Finance | | | | | | |

8.875%, 06/01/2025 | | | 105,000 | | | 116,319 |

6.875%, 03/15/2025 | | | 90,000 | | | 102,368 |

6.625%, 01/15/2028 | | | 160,000 | | | 181,330 |

5.375%, 11/15/2029 | | | 155,000 | | | 164,881 |

4.000%, 09/15/2030 | | | 100,000 | | | 97,250 |

PNC Financial Services Group | | | | | | |

6.750%, VAR ICE LIBOR USD 3 Month+3.678%‡ | | | 20,000 | | | 20,286 |

Quicken Loans | | | | | | |

5.250%, 01/15/2028(A) | | | 186,000 | | | 195,765 |

Radian Group | | | | | | |

4.875%, 03/15/2027 | | | 124,000 | | | 130,045 |

Truist Financial | | | | | | |

4.950%, VAR US Treas Yield Curve Rate T Note Const Mat 5 Yr+4.605%‡ | | | 75,000 | | | 81,281 |

| | | | | | | 6,515,265 |

Health Care — 5.3% | | | | | | |

Avantor Funding | | | | | | |

4.625%, 07/15/2028(A) | | | 150,000 | | | 156,654 |

Bausch Health | | | | | | |

6.125%, 04/15/2025(A) | | | 248,000 | | | 254,250 |

5.250%, 01/30/2030(A) | | | 257,000 | | | 258,031 |

5.250%, 02/15/2031(A) | | | 150,000 | | | 149,283 |

Bausch Health Americas | | | | | | |

8.500%, 01/31/2027(A) | | | 105,000 | | | 116,484 |

Catalent Pharma Solutions | | | | | | |

5.000%, 07/15/2027(A) | | | 135,000 | | | 141,412 |

CHS | | | | | | |

8.000%, 03/15/2026(A) | | | 150,000 | | | 162,195 |

5.625%, 03/15/2027(A) | | | 120,000 | | | 126,216 |

The accompanying notes are an integral part of the financial statements.

27

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Health Care (continued) | | | | | | |

DaVita | | | | | | |

4.625%, 06/01/2030(A) | | $ | 118,000 | | $ | 120,024 |

3.750%, 02/15/2031(A) | | | 140,000 | | | 134,148 |

HCA | | | | | | |

5.875%, 02/01/2029 | | | 65,000 | | | 75,725 |

5.875%, 02/15/2026 | | | 295,000 | | | 338,144 |

5.625%, 09/01/2028 | | | 86,000 | | | 98,900 |

5.375%, 02/01/2025 | | | 150,000 | | | 167,327 |

3.500%, 09/01/2030 | | | 124,000 | | | 125,432 |

IQVIA | | | | | | |

5.000%, 05/15/2027(A) | | | 100,000 | | | 105,579 |

Jaguar Holding II | | | | | | |

5.000%, 06/15/2028(A) | | | 124,000 | | | 129,146 |

Legacy LifePoint Health | | | | | | |

6.750%, 04/15/2025(A) | | | 100,000 | | | 106,250 |

MEDNAX | | | | | | |

6.250%, 01/15/2027(A) | | | 150,000 | | | 160,395 |

Molina Healthcare | | | | | | |

4.375%, 06/15/2028(A) | | | 100,000 | | | 102,896 |

Par Pharmaceutical | | | | | | |

7.500%, 04/01/2027(A) | | | 145,000 | | | 154,164 |

Tenet Healthcare | | | | | | |

5.125%, 11/01/2027(A) | | | 150,000 | | | 156,855 |

4.875%, 01/01/2026(A) | | | 186,000 | | | 193,321 |

4.625%, 07/15/2024 | | | 100,000 | | | 101,675 |

| | | | | | | 3,634,506 |

Industrials — 14.0% | | | | | | |

ADT Security | | | | | | |

4.125%, 06/15/2023 | | | 224,000 | | | 232,680 |

AECOM | | | | | | |

5.875%, 10/15/2024 | | | 105,000 | | | 117,973 |

5.125%, 03/15/2027 | | | 105,000 | | | 114,240 |

Allied Universal Holdco | | | | | | |

6.625%, 07/15/2026(A) | | | 124,000 | | | 131,500 |

Allison Transmission | | | | | | |

3.750%, 01/30/2031(A) | | | 70,000 | | | 67,812 |

Altera Infrastructure | | | | | | |

8.500%, 07/15/2023(A) | | | 215,000 | | | 194,038 |

American Airlines | | | | | | |

11.750%, 07/15/2025(A) | | | 150,000 | | | 185,437 |

Beacon Roofing Supply | | | | | | |

4.875%, 11/01/2025(A) | | | 137,000 | | | 140,082 |

Boeing | | | | | | |

8.625%, 11/15/2031 | | | 165,000 | | | 234,364 |

Brink’s | | | | | | |

4.625%, 10/15/2027(A) | | | 100,000 | | | 102,467 |

Colfax | | | | | | |

6.000%, 02/15/2024(A) | | | 124,000 | | | 127,844 |

The accompanying notes are an integral part of the financial statements.

28

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Industrials (continued) | | | | | | |

Cornerstone Building Brands | | | | | | |

6.125%, 01/15/2029(A) | | $ | 100,000 | | $ | 106,500 |

Delta Air Lines 2015-1 Class B Pass-Through Trust | | | | | | |

4.250%, 07/30/2023 | | | 43,014 | | | 43,959 |

Fortress Transportation and Infrastructure Investors | | | | | | |

6.750%, 03/15/2022(A) | | | 75,000 | | | 75,094 |

Herc Holdings | | | | | | |

5.500%, 07/15/2027(A) | | | 100,000 | | | 106,420 |

Howmet Aerospace | | | | | | |

6.875%, 05/01/2025 | | | 85,000 | | | 98,494 |

5.125%, 10/01/2024 | | | 100,000 | | | 109,990 |

Icahn Enterprises | | | | | | |

6.250%, 05/15/2026 | | | 124,000 | | | 129,890 |

5.250%, 05/15/2027 | | | 100,000 | | | 103,250 |

4.750%, 09/15/2024 | | | 93,000 | | | 96,574 |

MasTec | | | | | | |

4.500%, 08/15/2028(A) | | | 75,000 | | | 77,812 |

Mauser Packaging Solutions Holding | | | | | | |

5.500%, 04/15/2024(A) | | | 124,000 | | | 125,932 |

MPH Acquisition Holdings | | | | | | |

5.750%, 11/01/2028(A) | | | 200,000 | | | 196,120 |

Navistar International | | | | | | |

9.500%, 05/01/2025(A) | | | 101,000 | | | 110,974 |

Nielsen Finance | | | | | | |

5.875%, 10/01/2030(A) | | | 300,000 | | | 324,000 |

5.625%, 10/01/2028(A) | | | 100,000 | | | 105,125 |

5.000%, 04/15/2022(A) | | | 46,000 | | | 46,009 |

Pitney Bowes | | | | | | |

7.250%, 03/15/2029(A) | | | 200,000 | | | 197,782 |

PowerTeam Services | | | | | | |

9.033%, 12/04/2025(A) | | | 100,000 | | | 111,030 |

Prime Security Services Borrower | | | | | | |

6.250%, 01/15/2028(A) | | | 124,000 | | | 129,083 |

5.750%, 04/15/2026(A) | | | 100,000 | | | 107,923 |

Sabre GLBL | | | | | | |

7.375%, 09/01/2025(A) | | | 100,000 | | | 108,975 |

Sensata Technologies | | | | | | |

4.375%, 02/15/2030(A) | | | 150,000 | | | 157,337 |

Sensata Technologies BV | | | | | | |

4.000%, 04/15/2029(A) | | | 300,000 | | | 305,409 |

Signature Aviation US Holdings | | | | | | |

5.375%, 05/01/2026(A) | | | 100,000 | | | 102,000 |

4.000%, 03/01/2028(A) | | | 100,000 | | | 101,692 |

Spirit AeroSystems | | | | | | |

7.500%, 04/15/2025(A) | | | 75,000 | | | 80,625 |

The accompanying notes are an integral part of the financial statements.

29

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Industrials (continued) | | | | | | |

SSL Robotics | | | | | | |

9.750%, 12/31/2023(A) | | $ | 88,000 | | $ | 98,956 |

Summit Materials | | | | | | |

5.250%, 01/15/2029(A) | | | 50,000 | | | 52,300 |

Teekay | | | | | | |

9.250%, 11/15/2022(A) | | | 2,575,000 | | | 2,587,875 |

TransDigm | | | | | | |

8.000%, 12/15/2025(A) | | | 105,000 | | | 114,345 |

6.500%, 05/15/2025 | | | 100,000 | | | 101,875 |

6.375%, 06/15/2026 | | | 155,000 | | | 160,231 |

6.250%, 03/15/2026(A) | | | 180,000 | | | 190,782 |

5.500%, 11/15/2027 | | | 200,000 | | | 206,750 |

Triumph Group | | | | | | |

8.875%, 06/01/2024(A) | | | 100,000 | | | 112,520 |

United Rentals North America | | | | | | |

5.250%, 01/15/2030 | | | 105,000 | | | 114,023 |

4.875%, 01/15/2028 | | | 124,000 | | | 130,618 |

3.875%, 11/15/2027 | | | 153,000 | | | 158,546 |

3.875%, 02/15/2031 | | | 401,000 | | | 403,831 |

WESCO Distribution | | | | | | |

7.250%, 06/15/2028(A) | | | 85,000 | | | 95,115 |

7.125%, 06/15/2025(A) | | | 100,000 | | | 109,350 |

XPO Logistics | | | | | | |

6.250%, 05/01/2025(A) | | | 62,000 | | | 66,421 |

| | | | | | | 9,609,974 |

Information Technology — 5.5% | | | | | | |

Avaya | | | | | | |

6.125%, 09/15/2028(A) | | | 150,000 | | | 159,570 |

Booz Allen Hamilton | | | | | | |

3.875%, 09/01/2028(A) | | | 75,000 | | | 75,394 |

BY Crown Parent | | | | | | |

4.250%, 01/31/2026(A) | | | 100,000 | | | 103,375 |

CDW | | | | | | |

3.250%, 02/15/2029 | | | 75,000 | | | 74,062 |

Change Healthcare Holdings | | | | | | |

5.750%, 03/01/2025(A) | | | 93,000 | | | 94,800 |

EMC | | | | | | |

3.375%, 06/01/2023 | | | 124,000 | | | 127,768 |

Gartner | | | | | | |

4.500%, 07/01/2028(A) | | | 115,000 | | | 118,594 |

Go Daddy Operating | | | | | | |

5.250%, 12/01/2027(A) | | | 93,000 | | | 97,185 |

Microchip Technology | | | | | | |

4.250%, 09/01/2025(A) | | | 100,000 | | | 104,461 |

NCR | | | | | | |

6.125%, 09/01/2029(A) | | | 300,000 | | | 317,625 |

5.000%, 10/01/2028(A) | | | 124,000 | | | 125,240 |

The accompanying notes are an integral part of the financial statements.

30

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Information Technology (continued) | | | | | | |

NortonLifeLock | | | | | | |

5.000%, 04/15/2025(A) | | $ | 100,000 | | $ | 101,330 |

Open Text Holdings | | | | | | |

4.125%, 02/15/2030(A) | | | 224,000 | | | 227,067 |

Rackspace Technology Global | | | | | | |

5.375%, 12/01/2028(A) | | | 452,000 | | | 459,605 |

Seagate HDD Cayman | | | | | | |

3.125%, 07/15/2029(A) | | | 75,000 | | | 72,437 |

SS&C Technologies | | | | | | |

5.500%, 09/30/2027(A) | | | 300,000 | | | 319,200 |

Switch | | | | | | |

3.750%, 09/15/2028(A) | | | 75,000 | | | 73,854 |

Veritas US | | | | | | |

7.500%, 09/01/2025(A) | | | 100,000 | | | 104,000 |

Western Digital | | | | | | |

4.750%, 02/15/2026 | | | 241,000 | | | 265,690 |

Xerox | | | | | | |

4.375%, 03/15/2023 | | | 114,000 | | | 119,273 |

Xerox Holdings | | | | | | |

5.000%, 08/15/2025(A) | | | 620,000 | | | 644,025 |

| | | | | | | 3,784,555 |

Materials — 4.4% | | | | | | |

Ball | | | | | | |

4.875%, 03/15/2026 | | | 100,000 | | | 111,831 |

2.875%, 08/15/2030 | | | 200,000 | | | 192,650 |

Blue Cube Spinco | | | | | | |

10.000%, 10/15/2025 | | | 125,000 | | | 131,875 |

CF Industries | | | | | | |

5.375%, 03/15/2044 | | | 75,000 | | | 88,969 |

5.150%, 03/15/2034 | | | 150,000 | | | 171,446 |

Chemours | | | | | | |

7.000%, 05/15/2025 | | | 104,000 | | | 106,964 |

5.750%, 11/15/2028(A) | | | 250,000 | | | 263,229 |

Element Solutions | | | | | | |

3.875%, 09/01/2028(A) | | | 50,000 | | | 49,380 |

Freeport-McMoRan | | | | | | |

5.450%, 03/15/2043 | | | 100,000 | | | 120,064 |

5.250%, 09/01/2029 | | | 200,000 | | | 218,704 |

4.375%, 08/01/2028 | | | 100,000 | | | 106,075 |

4.125%, 03/01/2028 | | | 124,000 | | | 130,349 |

Hudbay Minerals | | | | | | |

6.125%, 04/01/2029(A) | | | 100,000 | | | 106,750 |

NOVA Chemicals | | | | | | |

5.250%, 06/01/2027(A) | | | 125,000 | | | 131,171 |

Novelis | | | | | | |

5.875%, 09/30/2026(A) | | | 100,000 | | | 104,680 |

4.750%, 01/30/2030(A) | | | 100,000 | | | 103,011 |

The accompanying notes are an integral part of the financial statements.

31

Schedule of Investments March 31, 2021

KFA Dynamic Fixed Income ETF (continued)

| | Face Amount | | Value |

CORPORATE OBLIGATIONS (continued) | | | | | | |

Materials (continued) | | | | | | |

Owens-Brockway Glass Container | | | | | | |

6.625%, 05/13/2027(A) | | $ | 100,000 | | $ | 108,712 |

TPC Group | | | | | | |

10.500%, 08/01/2024(A) | | | 50,000 | | | 45,176 |

Tronox | | | | | | |

6.500%, 05/01/2025(A) | | | 93,000 | | | 99,743 |