UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22698

KraneShares Trust

(Exact name of registrant as specified in charter)

280 Park Avenue, 32nd Floor

New York, New York 10017

(Address of principal executive offices) (Zip code)

Jonathan Krane

KraneShares Trust

280 Park Avenue, 32nd Floor

New York, New York 10017

(Name and address of agent for service)

Copy to:

Stacy L. Fuller

K&L Gates LLP

1601 K Street NW

Washington, DC 20006-1600

Registrant’s telephone number, including area code: (212) 933-0393

Date of fiscal year end: March 31, 2025

Date of reporting period: September 30, 2024

Form N-CSRS is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSRS, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSRS unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) [17 CFR § 270.30e-1], is attached hereto. |

KraneShares CSI China Internet ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares CSI China Internet ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kweb/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares CSI China Internet ETF | $41 | 0.70% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $7,208,815,734 | 33 | $17,873,683 | 25% |

What did the Fund invest in?

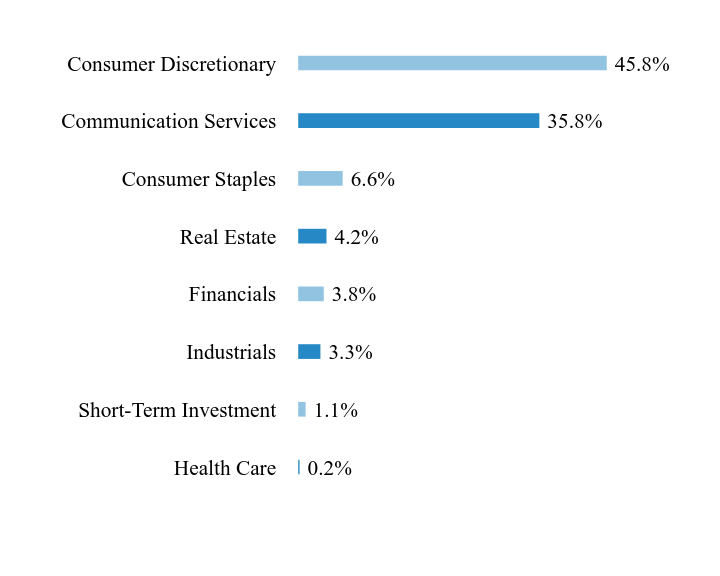

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Health Care | 0.2% |

| Short-Term Investment | 1.1% |

| Industrials | 3.3% |

| Financials | 3.8% |

| Real Estate | 4.2% |

| Consumer Staples | 6.6% |

| Communication Services | 35.8% |

| Consumer Discretionary | 45.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Alibaba Group Holding | | | 11.0% |

| Tencent Holdings | | | 9.9% |

| Meituan, Cl B | | | 9.1% |

| JD.com, Cl A | | | 7.2% |

| PDD Holdings ADR | | | 6.3% |

| KE Holdings ADR | | | 4.2% |

| Trip.com Group | | | 4.1% |

| Baidu, Cl A | | | 3.7% |

| Bilibili, Cl Z | | | 3.6% |

| Kuaishou Technology, Cl B | | | 3.6% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kweb/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Bosera MSCI China A 50 Connect Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Bosera MSCI China A 50 Connect Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kba/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Bosera MSCI China A 50 Connect Index ETF | $31 | 0.56% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $186,361,118 | 86 | $488,363 | 19% |

What did the Fund invest in?

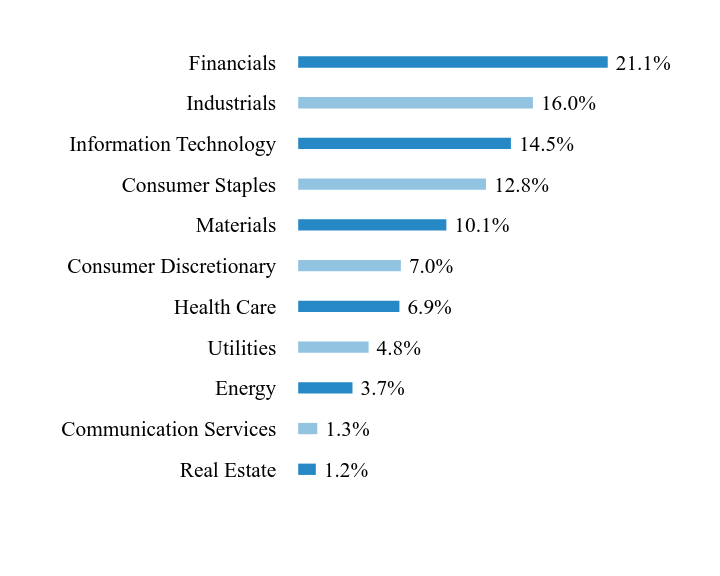

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Real Estate | 1.2% |

| Communication Services | 1.3% |

| Energy | 3.7% |

| Utilities | 4.8% |

| Health Care | 6.9% |

| Consumer Discretionary | 7.0% |

| Materials | 10.1% |

| Consumer Staples | 12.8% |

| Information Technology | 14.5% |

| Industrials | 16.0% |

| Financials | 21.1% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Kweichow Moutai, Cl A | | | 6.9% |

| Contemporary Amperex Technology, Cl A | | | 6.5% |

| Zijin Mining Group, Cl A | | | 5.6% |

| Foxconn Industrial Internet, Cl A | | | 4.6% |

| Wanhua Chemical Group, Cl A | | | 4.3% |

| Luxshare Precision Industry, Cl A | | | 4.3% |

| BYD, Cl A | | | 3.7% |

| China Yangtze Power, Cl A | | | 3.7% |

| China Merchants Bank, Cl A | | | 3.4% |

| Hygon Information Technology, Cl A | | | 3.3% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kba/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares MSCI All China Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares MSCI All China Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kall/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares MSCI All China Index ETF | $28 | 0.49% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $8,061,664 | 203 | $15,919 | 1% |

What did the Fund invest in?

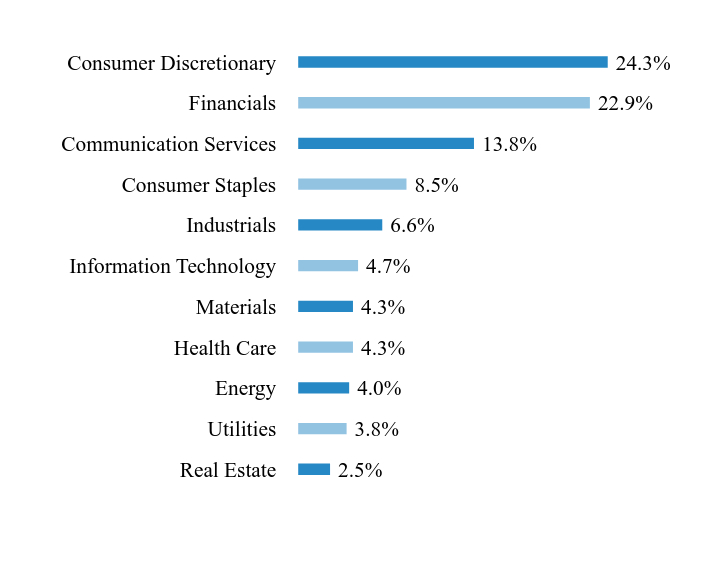

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Real Estate | 2.5% |

| Utilities | 3.8% |

| Energy | 4.0% |

| Health Care | 4.3% |

| Materials | 4.3% |

| Information Technology | 4.7% |

| Industrials | 6.6% |

| Consumer Staples | 8.5% |

| Communication Services | 13.8% |

| Financials | 22.9% |

| Consumer Discretionary | 24.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Tencent Holdings | | | 9.0% |

| Alibaba Group Holding | | | 5.8% |

| Meituan, Cl B | | | 3.1% |

| Kweichow Moutai, Cl A | | | 2.5% |

| PDD Holdings ADR | | | 2.2% |

| China Construction Bank, Cl H | | | 2.0% |

| JD.com, Cl A | | | 1.6% |

| Contemporary Amperex Technology, Cl A | | | 1.4% |

| BYD, Cl H | | | 1.4% |

| Xiaomi, Cl B | | | 1.4% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kall/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares MSCI One Belt One Road Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares MSCI One Belt One Road Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/obor/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares MSCI One Belt One Road Index ETF | $42 | 0.79% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $3,548,410 | 133 | $14,467 | 12% |

What did the Fund invest in?

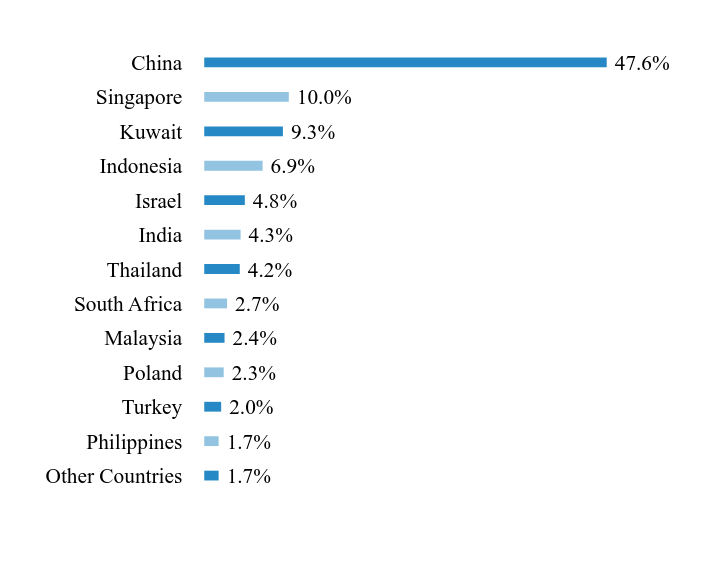

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Countries | 1.7% |

| Philippines | 1.7% |

| Turkey | 2.0% |

| Poland | 2.3% |

| Malaysia | 2.4% |

| South Africa | 2.7% |

| Thailand | 4.2% |

| India | 4.3% |

| Israel | 4.8% |

| Indonesia | 6.9% |

| Kuwait | 9.3% |

| Singapore | 10.0% |

| China | 47.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Kuwait Finance House | | | 9.3% |

| Oversea-Chinese Banking | | | 7.4% |

| China Yangtze Power, Cl A | | | 5.2% |

| PTT | | | 4.2% |

| China Petroleum & Chemical, Cl H | | | 2.5% |

| KGHM Polska Miedz | | | 2.3% |

| Elbit Systems | | | 2.1% |

| Beijing-Shanghai High Speed Railway, Cl A | | | 2.1% |

| Impala Platinum Holdings | | | 2.1% |

| Turk Hava Yollari AO | | | 1.8% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/obor/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Emerging Markets Consumer Technology Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Emerging Markets Consumer Technology Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kemq/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Emerging Markets Consumer Technology Index ETF | $35 | 0.60% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $17,376,254 | 53 | $46,123 | 22% |

What did the Fund invest in?

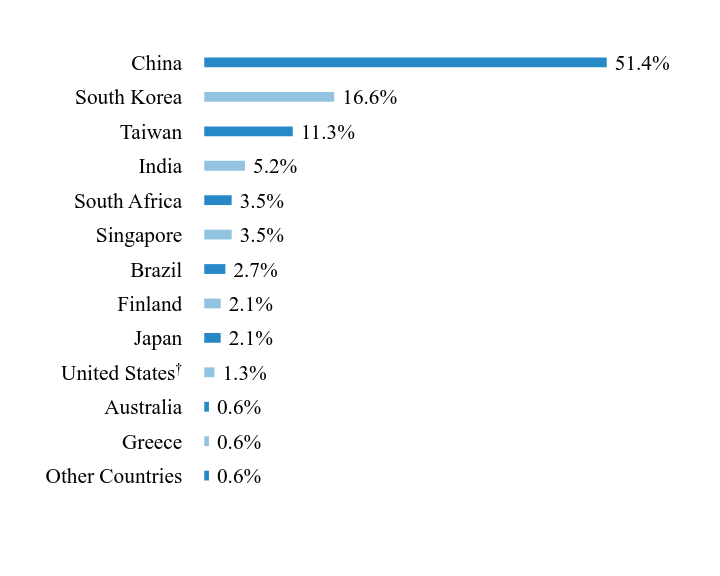

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Countries | 0.6% |

| Greece | 0.6% |

| Australia | 0.6% |

United StatesFootnote Reference† | 1.3% |

| Japan | 2.1% |

| Finland | 2.1% |

| Brazil | 2.7% |

| Singapore | 3.5% |

| South Africa | 3.5% |

| India | 5.2% |

| Taiwan | 11.3% |

| South Korea | 16.6% |

| China | 51.4% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Footnote† | This security, or a portion thereof, was purchased with cash collateral held from securities on loan. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| JD.com, Cl A | | | 4.7% |

| Meituan, Cl B | | | 4.1% |

| PDD Holdings ADR | | | 4.1% |

| Alibaba Health Information Technology | | | 3.9% |

| Alibaba Group Holding | | | 3.9% |

| NetEase | | | 3.6% |

| Naspers, Cl N | | | 3.5% |

| Sea ADR | | | 3.5% |

| Tencent Holdings | | | 3.4% |

| Bilibili, Cl Z | | | 3.4% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kemq/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares MSCI China Clean Technology Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares MSCI China Clean Technology Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kgrn/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares MSCI China Clean Technology Index ETF | $44 | 0.79% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $59,990,088 | 44 | $209,879 | 20% |

What did the Fund invest in?

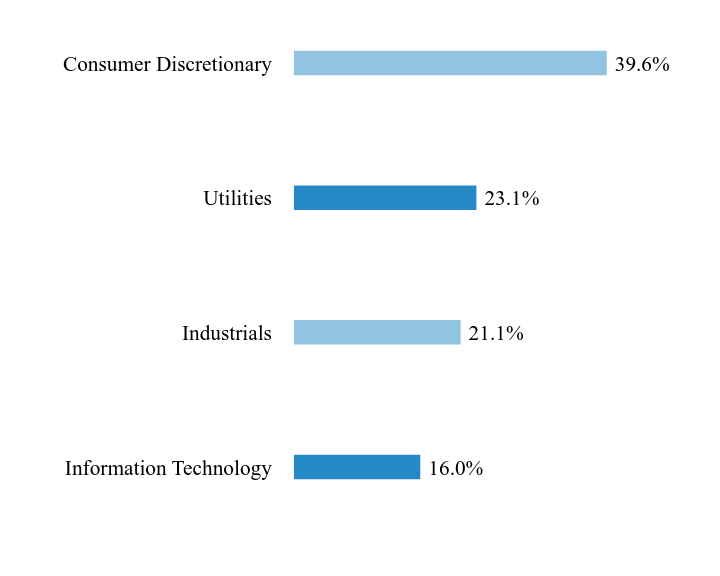

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Information Technology | 16.0% |

| Industrials | 21.1% |

| Utilities | 23.1% |

| Consumer Discretionary | 39.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Li Auto, Cl A | | | 9.0% |

| BYD, Cl H | | | 7.8% |

| Contemporary Amperex Technology, Cl A | | | 7.5% |

| XPeng, Cl A | | | 6.6% |

| NIO, Cl A | | | 6.5% |

| China Yangtze Power, Cl A | | | 5.0% |

| Kingdee International Software Group | | | 4.9% |

| Xinyi Solar Holdings | | | 3.7% |

| China Longyuan Power Group, Cl H | | | 3.6% |

| Beijing-Shanghai High Speed Railway, Cl A | | | 3.6% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kgrn/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Electric Vehicles and Future Mobility Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Electric Vehicles and Future Mobility Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kars/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Electric Vehicles and Future Mobility Index ETF | $37 | 0.73% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $87,796,405 | 54 | $297,808 | 18% |

What did the Fund invest in?

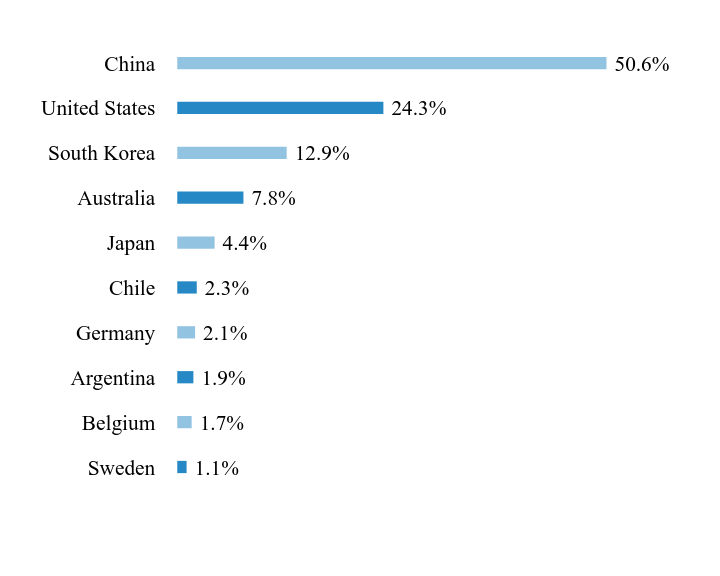

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Sweden | 1.1% |

| Belgium | 1.7% |

| Argentina | 1.9% |

| Germany | 2.1% |

| Chile | 2.3% |

| Japan | 4.4% |

| Australia | 7.8% |

| South Korea | 12.9% |

| United States | 24.3% |

| China | 50.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Contemporary Amperex Technology, Cl A | | | 4.8% |

| BYD, Cl A | | | 4.2% |

| Li Auto, Cl A | | | 4.1% |

| XPeng, Cl A | | | 3.9% |

| Samsung SDI | | | 3.8% |

| Tesla | | | 3.6% |

| Panasonic Holdings | | | 3.6% |

| Albemarle | | | 3.5% |

| NIO ADR | | | 3.5% |

| Geely Automobile Holdings | | | 3.2% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kars/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares MSCI All China Health Care Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares MSCI All China Health Care Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kure/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares MSCI All China Health Care Index ETF | $35 | 0.65% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $47,495,307 | 61 | $134,972 | 11% |

What did the Fund invest in?

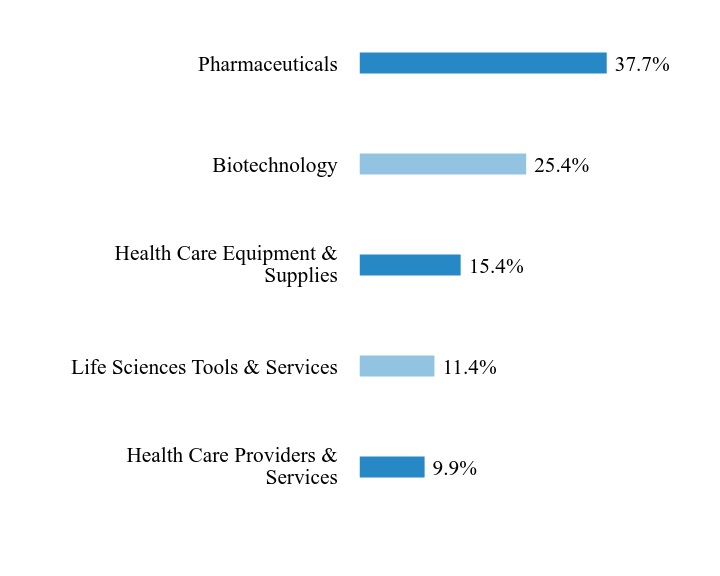

Industry WeightingsFootnote Reference*

| Value | Value |

|---|

| Health Care Providers & Services | 9.9% |

| Life Sciences Tools & Services | 11.4% |

| Health Care Equipment & Supplies | 15.4% |

| Biotechnology | 25.4% |

| Pharmaceuticals | 37.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Shenzhen Mindray Bio-Medical Electronics, Cl A | | | 8.3% |

| Jiangsu Hengrui Pharmaceuticals, Cl A | | | 7.8% |

| BeiGene | | | 7.0% |

| Wuxi Biologics Cayman | | | 4.3% |

| Innovent Biologics | | | 4.1% |

| CSPC Pharmaceutical Group | | | 3.5% |

| Aier Eye Hospital Group, Cl A | | | 3.4% |

| Zhangzhou Pientzehuang Pharmaceutical, Cl A | | | 3.4% |

| WuXi AppTec, Cl A | | | 3.1% |

| Akeso | | | 2.9% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kure/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Asia Pacific High Income USD Bond ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Asia Pacific High Income USD Bond ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/khyb/. You can also request this information by contacting us at 1-855-857-2638. This semi-annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Asia Pacific High Income USD Bond ETF | $36 | 0.69% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $18,790,000 | 74 | $54,268 | 74% |

What did the Fund invest in?

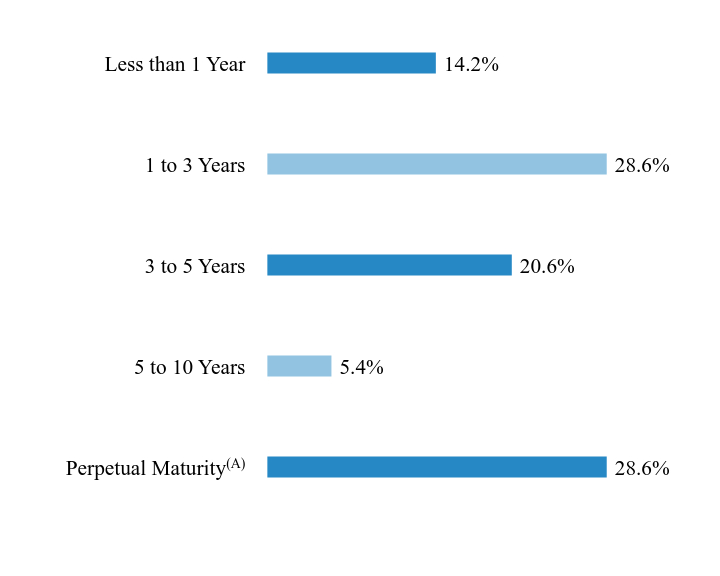

Maturity WeightingsFootnote Reference*

| Value | Value |

|---|

Perpetual MaturityFootnote Reference(A) | 28.6% |

| 5 to 10 Years | 5.4% |

| 3 to 5 Years | 20.6% |

| 1 to 3 Years | 28.6% |

| Less than 1 Year | 14.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Footnote(A) | Perpetual security with no stated maturity date. |

| Holding Name | Coupon Rate | Maturity Date | Percentage of Total Net Assets |

|---|

| India Cleantech Energy | 4.700% | 08/10/26 | 3.0% |

| NWD Finance BVI, H15T5Y + 7.889% | 5.250% | —Footnote Reference(A) | 2.7% |

| Yanlord Land HK | 5.125% | 05/20/26 | 2.2% |

| Mong Duong Finance Holdings BV | 5.125% | 05/07/29 | 2.2% |

| Petron, H15T5Y + 7.574% | 5.950% | —Footnote Reference(A) | 2.1% |

| Magnum Holdings | 5.375% | 10/31/26 | 2.1% |

| Krung Thai Bank, H15T5Y + 3.530% | 4.400% | —Footnote Reference(A) | 2.1% |

| Greentown China Holdings | 5.650% | 07/13/25 | 2.1% |

| Fortune Star BVI | 5.950% | 10/19/25 | 2.1% |

| Greentown China Holdings | 4.700% | 04/29/25 | 2.1% |

| Footnote | Description |

Footnote(A) | Perpetual security with no stated maturity date. |

This is a summary of material changes made to the Fund since April 1, 2024:

· Effective August 1, 2024, the name of the Fund changed from the “KraneShares Asia Pacific High Income Bond ETF” to the “KraneShares Asia Pacific High Income USD Bond ETF”.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/khyb/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares MSCI Emerging Markets ex China Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares MSCI Emerging Markets ex China Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kemx/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares MSCI Emerging Markets ex China Index ETF | $13 | 0.24% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $78,873,331 | 294 | $88,785 | 2% |

What did the Fund invest in?

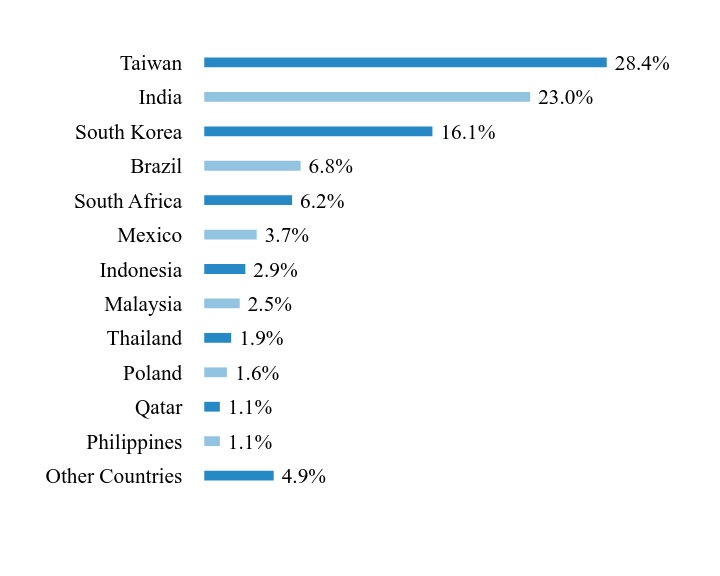

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Countries | 4.9% |

| Philippines | 1.1% |

| Qatar | 1.1% |

| Poland | 1.6% |

| Thailand | 1.9% |

| Malaysia | 2.5% |

| Indonesia | 2.9% |

| Mexico | 3.7% |

| South Africa | 6.2% |

| Brazil | 6.8% |

| South Korea | 16.1% |

| India | 23.0% |

| Taiwan | 28.4% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Taiwan Semiconductor Manufacturing | | | 11.6% |

| Samsung Electronics | | | 3.9% |

| Infosys ADR | | | 2.2% |

| Hon Hai Precision Industry | | | 1.7% |

| SK Hynix | | | 1.5% |

| ICICI Bank | | | 1.5% |

| Naspers, Cl N | | | 1.4% |

| Bharti Airtel | | | 1.4% |

| HDFC Bank | | | 1.4% |

| Tata Consultancy Services | | | 1.2% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kemx/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Value Line® Dynamic Dividend Equity Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Value Line® Dynamic Dividend Equity Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kvle/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares Value Line® Dynamic Dividend Equity Index ETF | $30 | 0.56% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $33,171,693 | 88 | $86,685 | 44% |

What did the Fund invest in?

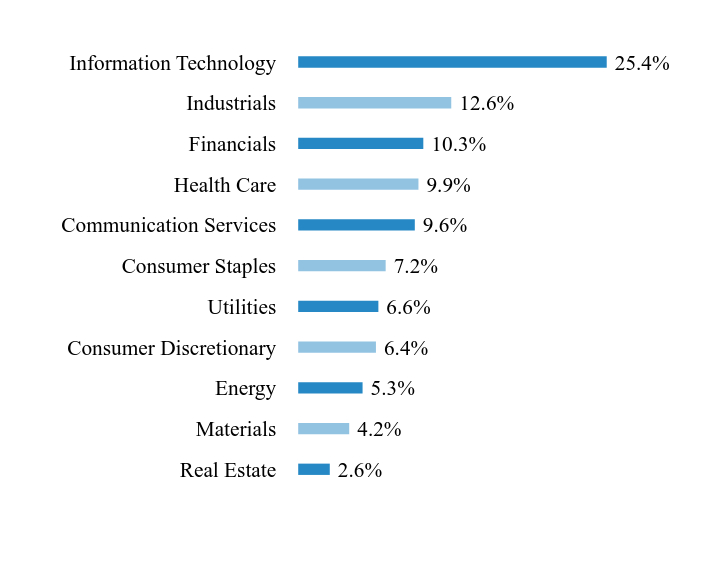

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Real Estate | 2.6% |

| Materials | 4.2% |

| Energy | 5.3% |

| Consumer Discretionary | 6.4% |

| Utilities | 6.6% |

| Consumer Staples | 7.2% |

| Communication Services | 9.6% |

| Health Care | 9.9% |

| Financials | 10.3% |

| Industrials | 12.6% |

| Information Technology | 25.4% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| NVIDIA | | | 7.9% |

| Microsoft | | | 5.8% |

| Apple | | | 5.2% |

| Alphabet, Cl C | | | 3.5% |

| Amazon.com | | | 2.9% |

| Meta Platforms, Cl A | | | 2.7% |

| Home Depot | | | 2.3% |

| Cisco Systems | | | 2.0% |

| Texas Instruments | | | 1.8% |

| Goldman Sachs Group | | | 1.8% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kvle/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Mount Lucas Managed Futures Index Strategy ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Mount Lucas Managed Futures Index Strategy ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kfafunds.com/kmlm/. You can also request this information by contacting us at 1-855-857-2638. This semi-annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Mount Lucas Managed Futures Index Strategy ETF | $45 | 0.90% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $372,045,544 | 27 | $1,406,963 | 0% |

What did the Fund invest in?

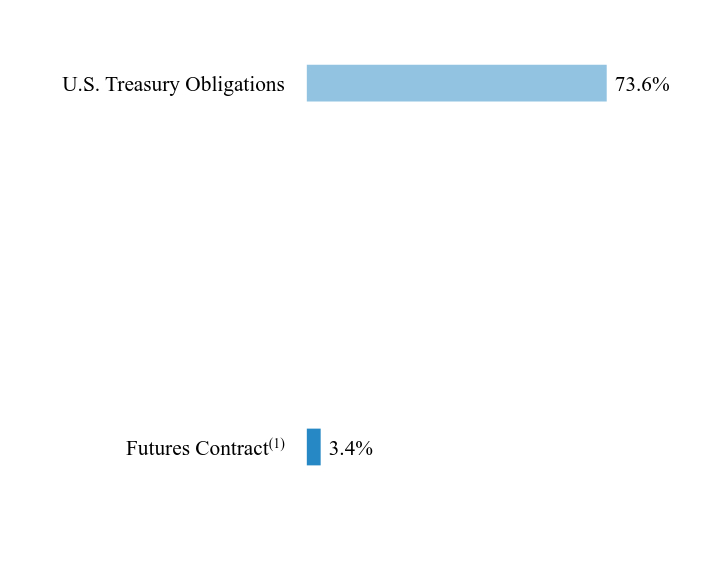

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

Futures ContractFootnote Reference(1) | 3.4% |

| U.S. Treasury Obligations | 73.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Footnote(1) | At market value. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| U.S. Treasury Bill, 5.18%, 10/3/2024 | | | 14.8% |

| U.S. Treasury Bill, 5.17%, 10/15/2024 | | | 14.7% |

| U.S. Treasury Bill, 5.08%, 10/29/2024 | | | 14.7% |

| U.S. Treasury Bill, 4.97%, 11/5/2024 | | | 14.7% |

| U.S. Treasury Bill, 4.58%, 11/29/2024 | | | 14.7% |

AUD Currency - Futures ContractFootnote Reference(1) | | | 0.6% |

NY Harbor ULSD - Futures ContractFootnote Reference(1) | | | 0.5% |

Soybean - Futures ContractFootnote Reference(1) | | | 0.5% |

Corn - Futures ContractFootnote Reference(1) | | | 0.4% |

| Footnote | Description |

Footnote(1) | At market value. |

This is a summary of material changes made to the Fund since April 1, 2024:

· Effective August 1, 2024, the name of the Fund changed from the “KFA Mount Lucas Managed Futures Index Strategy ETF” to the “KraneShares Mount Lucas Managed Futures Index Strategy ETF”.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kfafunds.com/kmlm/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares SSE STAR Market 50 Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares SSE STAR Market 50 Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kstr/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares SSE STAR Market 50 Index ETF | $48 | 0.89% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $26,618,585 | 51 | $98,334 | 12% |

What did the Fund invest in?

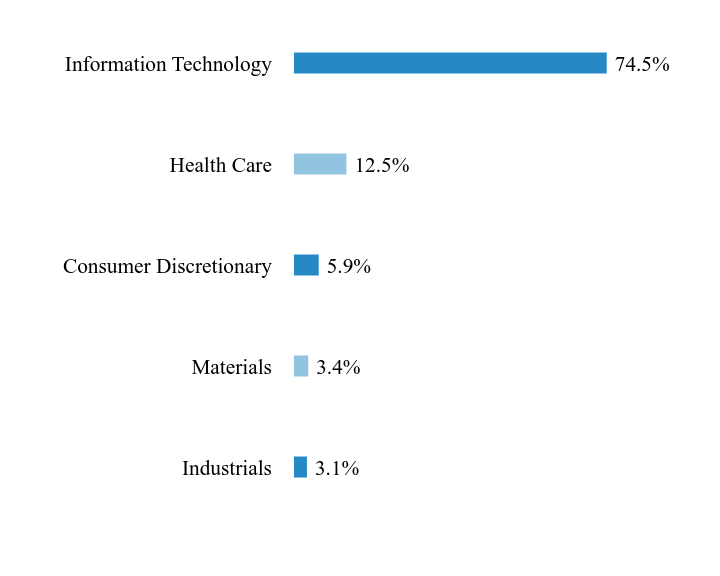

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Industrials | 3.1% |

| Materials | 3.4% |

| Consumer Discretionary | 5.9% |

| Health Care | 12.5% |

| Information Technology | 74.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Hygon Information Technology, Cl A | | | 8.8% |

| Beijing Kingsoft Office Software, Cl A | | | 5.7% |

| Montage Technology, Cl A | | | 5.6% |

| Cambricon Technologies, Cl A | | | 5.5% |

| Shenzhen Transsion Holdings, Cl A | | | 4.5% |

| Advanced Micro-Fabrication Equipment China, Cl A | | | 4.2% |

| Shanghai United Imaging Healthcare, Cl A | | | 3.9% |

| Beijing Roborock Technology, Cl A | | | 3.3% |

| Jinko Solar, Cl A | | | 3.2% |

| SUPCON Technology, Cl A | | | 2.9% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kstr/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Hang Seng TECH Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Hang Seng TECH Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/ktec/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Hang Seng TECH Index ETF | $41 | 0.69% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $12,626,822 | 29 | $24,008 | 30% |

What did the Fund invest in?

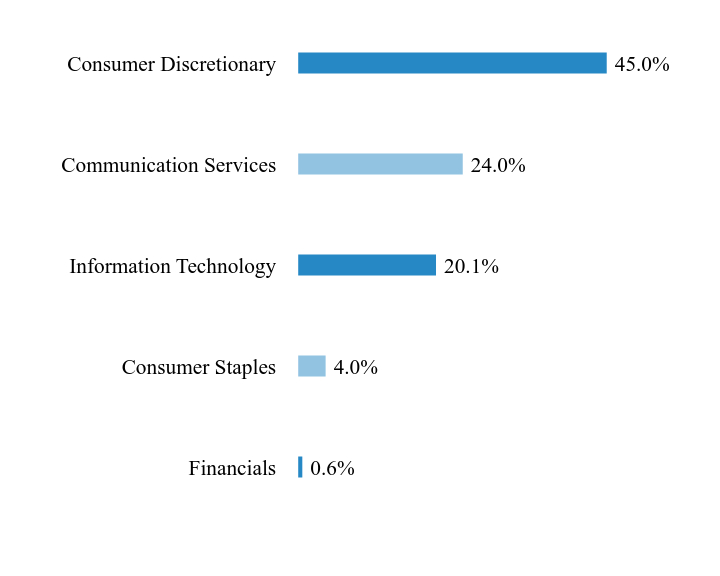

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Financials | 0.6% |

| Consumer Staples | 4.0% |

| Information Technology | 20.1% |

| Communication Services | 24.0% |

| Consumer Discretionary | 45.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| JD.com, Cl A | | | 9.9% |

| Meituan, Cl B | | | 9.0% |

| Alibaba Group Holding | | | 8.5% |

| Tencent Holdings | | | 7.4% |

| Xiaomi, Cl B | | | 7.3% |

| Kuaishou Technology, Cl B | | | 4.4% |

| Li Auto, Cl A | | | 4.2% |

| Lenovo Group | | | 4.1% |

| XPeng, Cl A | | | 4.1% |

| Trip.com Group | | | 4.0% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/ktec/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Dynamic Emerging Markets Strategy ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Dynamic Emerging Markets Strategy ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kem/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Dynamic Emerging Markets Strategy ETF | $6 | 0.11% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $5,081,514 | 2 | $2,164 | 1% |

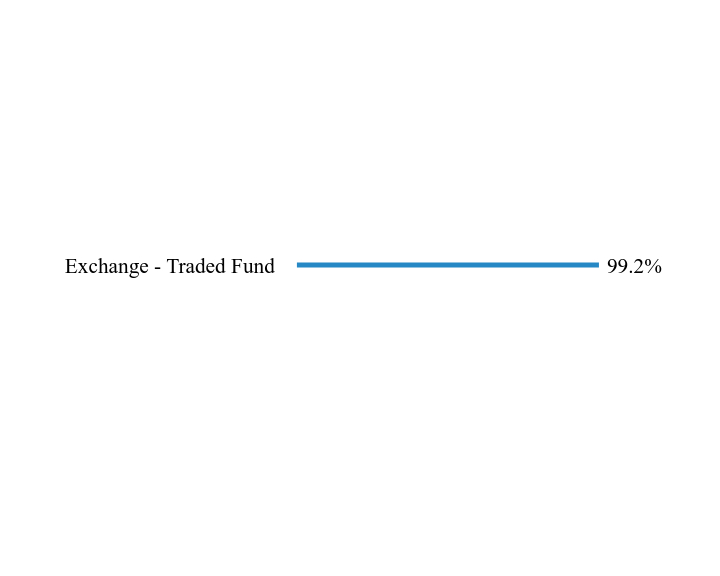

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Exchange - Traded Fund | 99.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

KraneShares MSCI All China Index ETFFootnote Reference** | | | 58.9% |

KraneShares MSCI Emerging Markets ex China Index ETFFootnote Reference** | | | 40.3% |

| Footnote | Description |

Footnote** | Affiliated |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kem/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Global Luxury Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Global Luxury Index ETF (the "Fund") for the period from April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/klxy/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Global Luxury Index ETF | $34 | 0.69% |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $2,532,190 | 28 | $8,354 | 30% |

What did the Fund invest in?

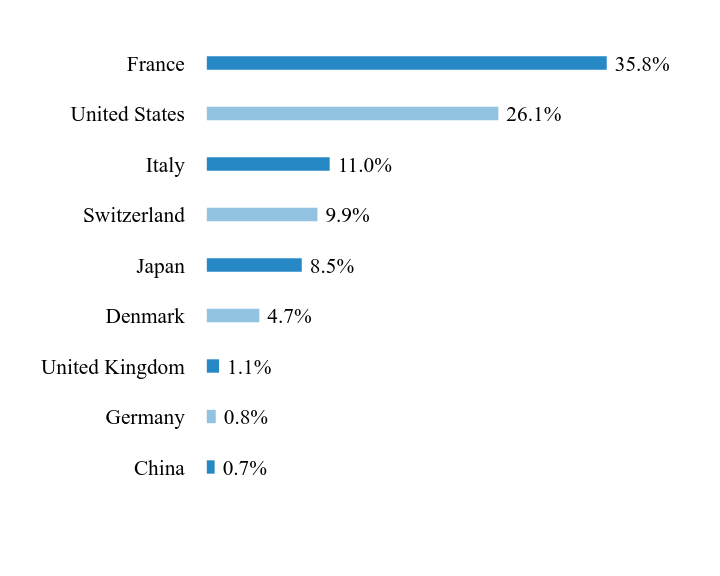

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| China | 0.7% |

| Germany | 0.8% |

| United Kingdom | 1.1% |

| Denmark | 4.7% |

| Japan | 8.5% |

| Switzerland | 9.9% |

| Italy | 11.0% |

| United States | 26.1% |

| France | 35.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| LVMH Moet Hennessy Louis Vuitton | | | 9.2% |

| L'Oreal | | | 8.4% |

| Hermes International | | | 8.1% |

| Cie Financiere Richemont, Cl A | | | 7.8% |

| EssilorLuxottica | | | 6.5% |

| Kao | | | 5.1% |

| Deckers Outdoor | | | 4.7% |

| Pandora | | | 4.7% |

| Ferrari | | | 4.4% |

| Moncler | | | 4.1% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/klxy/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Artificial Intelligence and Technology ETF

Principal Listing Exchange: The NASDAQ Stock Market, LLC

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Artificial Intelligence and Technology ETF (the "Fund") for the period from July 17, 2024 (commencement of operations) to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/agix/. You can also request this information by contacting us at 1-855-857-2683.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Artificial Intelligence and Technology ETF | $21 | 0.99% |

| Footnote | Description |

Footnote* | Costs shown not annualized. If the Fund had been open for the semi-annual period, costs shown would have been higher for the period ended. |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $5,081,872 | 39 | $8,597 | 8% |

What did the Fund invest in?

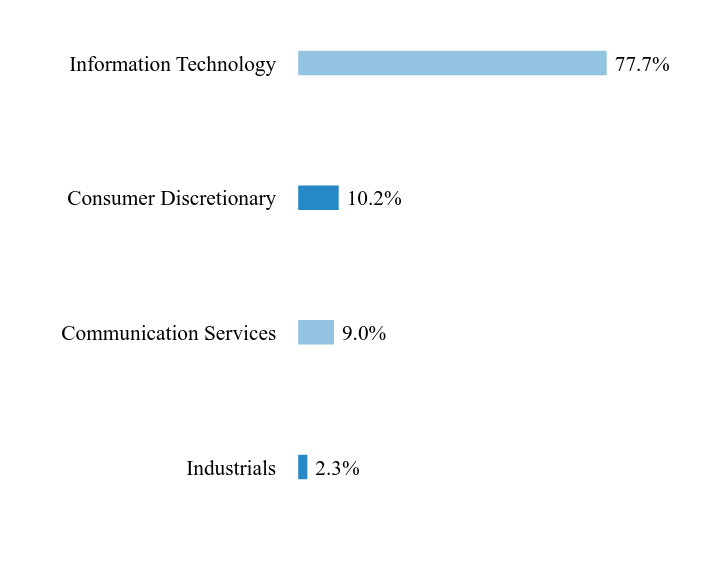

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Industrials | 2.3% |

| Communication Services | 9.0% |

| Consumer Discretionary | 10.2% |

| Information Technology | 77.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Microsoft | | | 7.6% |

| NVIDIA | | | 7.3% |

| Apple | | | 5.8% |

| Amazon.com | | | 5.1% |

| Meta Platforms, Cl A | | | 4.3% |

| Broadcom | | | 3.6% |

| Taiwan Semiconductor Manufacturing ADR | | | 3.4% |

| Alphabet, Cl A | | | 3.3% |

| Tesla | | | 3.1% |

| Oracle | | | 2.5% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/agix/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares Sustainable Ultra Short Duration Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares Sustainable Ultra Short Duration Index ETF (the "Fund") for the period from July 25, 2024 (commencement of operations) to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kcsh/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares Sustainable Ultra Short Duration Index ETF | $4 | 0.20% |

| Footnote | Description |

Footnote* | Costs shown not annualized. If the Fund had been open for the semi-annual period, costs shown would have been higher for the period ended. |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $299,965,645 | 257 | $57,044 | 0% |

What did the Fund invest in?

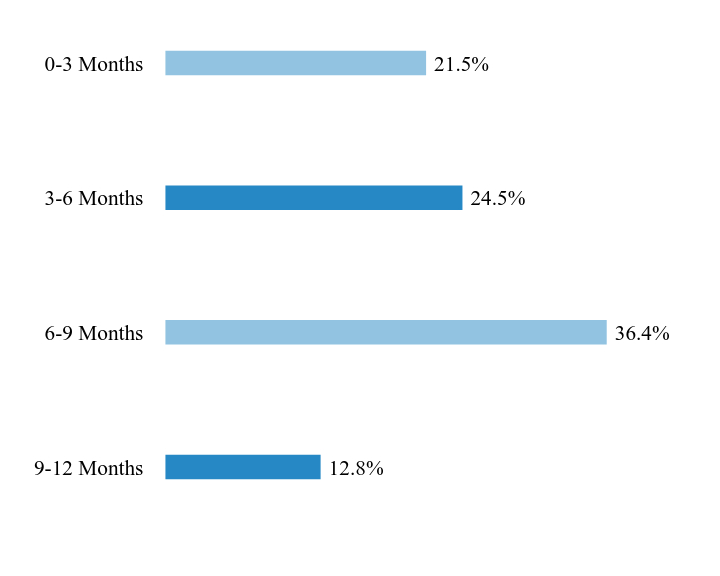

Maturity WeightingsFootnote Reference*

| Value | Value |

|---|

| 9-12 Months | 12.8% |

| 6-9 Months | 36.4% |

| 3-6 Months | 24.5% |

| 0-3 Months | 21.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Bank of Nova Scotia | | | 1.0% |

| Morgan Stanley | | | 0.9% |

| GLP Capital | | | 0.8% |

| Bank of Montreal | | | 0.8% |

| Thermo Fisher Scientific | | | 0.8% |

| Regions Financial | | | 0.8% |

| JPMorgan Chase | | | 0.8% |

| AutoZone | | | 0.8% |

| Apple | | | 0.7% |

| Bank of America | | | 0.7% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kcsh/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

KraneShares China Alpha Index ETF

Principal Listing Exchange: NYSE Arca

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about KraneShares China Alpha Index ETF (the "Fund") for the period from August 27, 2024 (commencement of operations) to September 30, 2024. You can find additional information about the Fund at https://kraneshares.com/kcai/. You can also request this information by contacting us at 1-855-857-2638.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investmentFootnote Reference* | Costs paid as a percentage of a $10,000 investment |

|---|

| KraneShares China Alpha Index ETF | $8 | 0.78% |

| Footnote | Description |

Footnote* | Costs shown not annualized. If the Fund had been open for the semi-annual period, costs shown would have been higher for the period ended. |

Key Fund Statistics as of September 30, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $8,815,812 | 38 | $4,525 | 119% |

What did the Fund invest in?

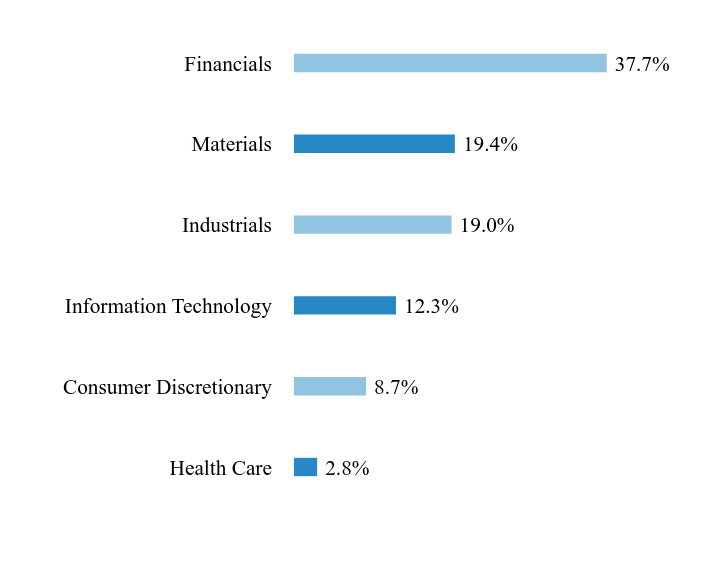

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Health Care | 2.8% |

| Consumer Discretionary | 8.7% |

| Information Technology | 12.3% |

| Industrials | 19.0% |

| Materials | 19.4% |

| Financials | 37.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Zhongji Innolight, Cl A | | | 3.9% |

| Aluminum Corp of China, Cl A | | | 3.5% |

| Foxconn Industrial Internet, Cl A | | | 3.5% |

| COSCO SHIPPING Holdings, Cl A | | | 3.3% |

| Weichai Power, Cl A | | | 3.3% |

| Chongqing Changan Automobile, Cl A | | | 3.2% |

| Zijin Mining Group, Cl A | | | 3.2% |

| Zhongjin Gold, Cl A | | | 3.1% |

| Fuyao Glass Industry Group, Cl A | | | 3.1% |

| NAURA Technology Group, Cl A | | | 3.1% |

There were no material changes during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, visit https://kraneshares.com/kcai/.

You may have consented to receive one copy of a shareholder report at your address if you and one or more individuals in your home have multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses. If you wish to change your householding status or receive individual copies of your shareholder report, please contact us at (855) 857 2638 or your financial intermediary.

(b) Not applicable to the Registrant.

Item 2. Code of Ethics.

Not applicable for semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual report.

Item 5. Audit Committee of Listed Registrants.

(a) Not applicable to the Registrant.

(b) Not applicable to the Registrant.

Item 6. Investments.

(a) The Schedules of Investments and Consolidated Schedules of Investments are included as part of the Registrant’s financial statements, which is included under Item 7.

(b) Not applicable to the Registrant.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial statements and financial highlights are filed herein.

| |  |

| | Semi-Annual Financials and Other Information

KraneShares CSI China Internet ETF KraneShares Bosera MSCI China A 50 Connect Index ETF KraneShares MSCI All China Index ETF KraneShares MSCI One Belt One Road Index ETF KraneShares Emerging Markets Consumer Technology Index ETF KraneShares MSCI China Clean Technology Index ETF KraneShares Electric Vehicles and Future Mobility Index ETF KraneShares MSCI All China Health Care Index ETF KraneShares Asia Pacific High Income USD Bond ETF (formerly, KraneShares Asia Pacific High Income Bond ETF) KraneShares MSCI Emerging Markets ex China Index ETF KraneShares Value Line® Dynamic Dividend Equity Index ETF KraneShares Mount Lucas Managed Futures Index Strategy ETF (formerly, KFA Mount Lucas Managed Futures Index Strategy ETF) KraneShares SSE STAR Market 50 Index ETF KraneShares Hang Seng TECH Index ETF KraneShares Dynamic Emerging Markets Strategy ETF KraneShares Global Luxury Index ETF KraneShares Artificial Intelligence and Technology ETF KraneShares Sustainable Ultrashort Duration Index ETF KraneShares China Alpha Index ETF September 30, 2024 | | |

Table of Contents

Fund shares may only be purchased or redeemed from a Fund in Creation Unit aggregations. Investors who cannot transact in Creation Units of a Fund’s shares must buy or sell Fund shares in the secondary market at their market price, which may be at a premium or discount to a Fund’s net asset value, with the assistance of a broker. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying Fund shares and receive less than net asset value when selling Fund shares.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares CSI China Internet ETF

| | | Shares | | | Value | |

| COMMON STOCK — 99.7%‡ | | | | | | | | |

| CHINA — 99.7% | | | | | | | | |

| Communication Services — 35.8% | | | | | | | | |

| Autohome ADR | | | 2,708,620 | | | $ | 88,355,185 | |

| Baidu, Cl A* | | | 19,703,884 | | | | 267,876,427 | |

| Bilibili, Cl Z* | | | 10,440,864 | | | | 260,500,733 | |

| China Literature* | | | 18,864,400 | | | | 78,687,681 | |

| iQIYI ADR* | | | 12,106,846 | | | | 34,625,580 | |

| JOYY ADR | | | 1,358,256 | | | | 49,223,197 | |

| Kanzhun ADR | | | 11,102,117 | | | | 192,732,751 | |

| Kingsoft | | | 35,493,600 | | | | 135,028,758 | |

| Kuaishou Technology, Cl B* | | | 36,579,500 | | | | 258,305,192 | |

| NetEase | | | 12,929,605 | | | | 250,518,900 | |

| Tencent Holdings | | | 12,473,875 | | | | 713,985,816 | |

| Tencent Music Entertainment Group ADR | | | 16,577,202 | | | | 199,755,284 | |

| Weibo ADR | | | 3,658,567 | | | | 36,878,355 | |

| Zx*(A) | | | 7,918,800 | | | | 11,458,939 | |

| | | | | | | | 2,577,932,798 | |

| Consumer Discretionary — 45.8% | | | | | | | | |

| Alibaba Group Holding | | | 55,977,064 | | | | 792,723,146 | |

| JD.com, Cl A | | | 23,998,240 | | | | 516,267,260 | |

| Meituan, Cl B* | | | 29,490,048 | | | | 653,014,248 | |

| PDD Holdings ADR* | | | 3,353,671 | | | | 452,108,387 | |

| TAL Education Group ADR* | | | 18,605,596 | | | | 220,290,257 | |

| Tongcheng Travel Holdings | | | 51,155,000 | | | | 131,452,050 | |

| Trip.com Group* | | | 4,712,950 | | | | 297,915,475 | |

| Vipshop Holdings ADR | | | 15,094,420 | | | | 237,435,227 | |

| | | | | | | | 3,301,206,050 | |

| Consumer Staples — 6.6% | | | | | | | | |

| Alibaba Health Information Technology*(A) | | | 241,702,000 | | | | 166,476,434 | |

| East Buy Holding*(A) | | | 18,569,000 | | | | 47,238,293 | |

| JD Health International* | | | 48,002,950 | | | | 216,299,098 | |

| Ping An Healthcare and Technology*(A) | | | 25,063,900 | | | | 46,788,098 | |

| | | | | | | | 476,801,923 | |

| Financials — 3.8% | | | | | | | | |

| Lufax Holding ADR | | | 8,430,975 | | | | 29,424,102 | |

| Qifu Technology ADR | | | 5,963,664 | | | | 177,776,824 | |

| ZhongAn Online P&C Insurance, Cl H*(A) | | | 32,008,700 | | | | 65,356,676 | |

| | | | | | | | 272,557,602 | |

| Health Care — 0.2% | | | | | | | | |

| YSB*(A) | | | 14,130,400 | | | | 14,298,673 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares CSI China Internet ETF (concluded)

| | | Shares | | | Value | |

| COMMON STOCK (continued) | | | | | | | | |

| Industrials — 3.3% | | | | | | | | |

| Full Truck Alliance ADR | | | 26,404,657 | | | $ | 237,905,960 | |

| | | | | | | | | |

| Real Estate — 4.2% | | | | | | | | |

| KE Holdings ADR | | | 15,304,104 | | | | 304,704,711 | |

| TOTAL CHINA | | | | | | | 7,185,407,717 | |

| | | | | | | | | |

TOTAL COMMON STOCK

(Cost $6,649,169,069) | | |

| | | |

7,185,407,717 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT — 1.1% | | | | | | | | |

| Invesco Government & Agency Portfolio, Cl Institutional, 4.840%(B)(C) | | | 77,951,273 | | | | 77,951,273 | |

TOTAL SHORT-TERM INVESTMENT

(Cost $77,951,273) | | |

| | | |

77,951,273 | |

| | | | | | | | | |

TOTAL INVESTMENTS — 100.8%

(Cost $6,727,120,342) | | |

| | | |

7,263,358,990 | |

| OTHER ASSETS LESS LIABILITIES – (0.8)% | | | | | | | (54,543,256 | ) |

| NET ASSETS - 100% | | | | | | $ | 7,208,815,734 | |

| ‡ | Industries are utilized for compliance purposes, whereas sectors are utilized for reporting. |

| * | Non-income producing security. |

| (A) | Certain securities or partial positions of certain securities are on loan at September 30, 2024. |

| (B) | The rate shown is the 7-day effective yield as of September 30, 2024. |

| (C) | This security was purchased with cash collateral held from securities on loan. The total value of such security as of September 30, 2024 was $77,951,273. |

As of September 30, 2024, all of the Fund’s investments were considered Level 1 of the fair value hierarchy, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares Bosera MSCI China A 50 Connect Index ETF

| | | Shares | | | Value | |

| COMMON STOCK — 99.4%‡ | | | | | | | | |

| CHINA — 99.4% | | | | | | | | |

| Communication Services — 1.3% | | | | | | | | |

| China United Network Communications, Cl A | | | 1,889,500 | | | $ | 1,444,396 | |

| Focus Media Information Technology, Cl A | | | 858,102 | | | | 866,851 | |

| | | | | | | | 2,311,247 | |

| Consumer Discretionary — 7.0% | | | | | | | | |

| BYD, Cl A | | | 160,700 | | | | 7,056,321 | |

| Haier Smart Home, Cl A | | | 559,700 | | | | 2,571,118 | |

| Midea Group, Cl A | | | 309,600 | | | | 3,364,674 | |

| | | | | | | | 12,992,113 | |

| Consumer Staples — 12.8% | | | | | | | | |

| Foshan Haitian Flavouring & Food, Cl A | | | 194,642 | | | | 1,339,673 | |

| Inner Mongolia Yili Industrial Group, Cl A | | | 267,312 | | | | 1,110,322 | |

| Kweichow Moutai, Cl A | | | 52,789 | | | | 13,184,710 | |

| Luzhou Laojiao, Cl A | | | 61,846 | | | | 1,322,876 | |

| Muyuan Foods, Cl A* | | | 229,545 | | | | 1,518,897 | |

| Shanxi Xinghuacun Fen Wine Factory, Cl A | | | 51,216 | | | | 1,601,834 | |

| Wuliangye Yibin, Cl A | | | 162,979 | | | | 3,784,404 | |

| | | | | | | | 23,862,716 | |

| Energy — 3.7% | | | | | | | | |

| China Petroleum & Chemical, Cl A | | | 1,610,440 | | | | 1,601,546 | |

| China Shenhua Energy, Cl A | | | 327,347 | | | | 2,039,297 | |

| PetroChina, Cl A | | | 1,071,300 | | | | 1,380,713 | |

| Shaanxi Coal Industry, Cl A | | | 481,116 | | | | 1,895,963 | |

| | | | | | | | 6,917,519 | |

| Financials — 21.1% | | | | | | | | |

| Agricultural Bank of China, Cl A | | | 4,994,107 | | | | 3,425,191 | |

| Bank of China, Cl A | | | 2,060,700 | | | | 1,472,213 | |

| Bank of Communications, Cl A | | | 2,302,599 | | | | 2,434,646 | |

| Bank of Ningbo, Cl A | | | 387,418 | | | | 1,422,652 | |

| China Merchants Bank, Cl A | | | 1,210,167 | | | | 6,503,309 | |

| China Pacific Insurance Group, Cl A | | | 401,514 | | | | 2,243,175 | |

| CITIC Securities, Cl A | | | 718,421 | | | | 2,792,117 | |

| East Money Information, Cl A | | | 926,031 | | | | 2,686,008 | |

| Industrial & Commercial Bank of China, Cl A | | | 3,690,526 | | | | 3,258,836 | |

| Industrial Bank, Cl A | | | 1,218,722 | | | | 3,355,614 | |

| Ping An Bank, Cl A | | | 1,138,467 | | | | 1,986,194 | |

| Ping An Insurance Group of China, Cl A | | | 631,398 | | | | 5,150,495 | |

| Shanghai Pudong Development Bank, Cl A | | | 1,721,946 | | | | 2,492,383 | |

| | | | | | | | 39,222,833 | |

| Health Care — 6.9% | | | | | | | | |

| Jiangsu Hengrui Pharmaceuticals, Cl A | | | 679,875 | | | | 5,080,617 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares Bosera MSCI China A 50 Connect Index ETF (continued)

| | | Shares | | | Value | |

| COMMON STOCK (continued) | | | | | | | | |

| Health Care (continued) | | | | | | | | |

| Shenzhen Mindray Bio-Medical Electronics, Cl A | | | 129,253 | | | $ | 5,411,205 | |

| Zhangzhou Pientzehuang Pharmaceutical, Cl A | | | 64,350 | | | | 2,376,720 | |

| | | | | | | | 12,868,542 | |

| Industrials — 16.0% | | | | | | | | |

| Beijing-Shanghai High Speed Railway, Cl A | | | 3,815,100 | | | | 3,292,521 | |

| China CSSC Holdings, Cl A | | | 347,500 | | | | 2,073,982 | |

| China State Construction Engineering, Cl A | | | 3,233,458 | | | | 2,855,233 | |

| Contemporary Amperex Technology, Cl A | | | 341,755 | | | | 12,300,196 | |

| COSCO SHIPPING Holdings, Cl A | | | 991,430 | | | | 2,225,481 | |

| CRRC, Cl A | | | 1,890,000 | | | | 2,206,326 | |

| NARI Technology, Cl A | | | 624,115 | | | | 2,467,514 | |

| SF Holding, Cl A | | | 374,159 | | | | 2,404,702 | |

| | | | | | | | 29,825,955 | |

| Information Technology — 14.5% | | | | | | | | |

| BOE Technology Group, Cl A | | | 6,652,745 | | | | 4,249,072 | |

| Foxconn Industrial Internet, Cl A | | | 2,384,300 | | | | 8,581,729 | |

| Hygon Information Technology, Cl A | | | 418,410 | | | | 6,174,532 | |

| Luxshare Precision Industry, Cl A | | | 1,296,650 | | | | 8,051,897 | |

| | | | | | | | 27,057,230 | |

| Materials — 10.1% | | | | | | | | |

| Wanhua Chemical Group, Cl A | | | 628,799 | | | | 8,204,715 | |

| Zijin Mining Group, Cl A | | | 4,123,692 | | | | 10,688,314 | |

| | | | | | | | 18,893,029 | |

| Real Estate — 1.2% | | | | | | | | |

| China Merchants Shekou Industrial Zone Holdings, Cl A | | | 602,500 | | | | 1,054,578 | |

| Poly Developments and Holdings Group, Cl A | | | 795,977 | | | | 1,254,475 | |

| | | | | | | | 2,309,053 | |

| Utilities — 4.8% | | | | | | | | |

| China National Nuclear Power, Cl A | | | 1,243,400 | | | | 1,980,941 | |

| China Yangtze Power, Cl A | | | 1,611,070 | | | | 6,917,427 | |

| | | | | | | | 8,898,368 | |

| TOTAL CHINA | | | | | | | 185,158,605 | |

| | | | | | | | | |

TOTAL COMMON STOCK

(Cost $156,577,733) |

|

|

|

|

|

|

185,158,605 |

|

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares Bosera MSCI China A 50 Connect Index ETF (concluded)

| | | Number of Rights | | | Value | |

| RIGHTS — 0.0% | | | | | | | | |

| CHINA — 0.0% | | | | | | | | |

| Health Care — 0.0% | | | | | | | | |

| Kangmei Pharma‡‡*(A) | | | 61,390 | | | $ | — | |

| TOTAL CHINA | | | | | | | — | |

| | | | | | | | | |

TOTAL RIGHTS

(Cost $–) | | | | | | | — | |

| | | | | | | | | |

TOTAL INVESTMENTS — 99.4%

(Cost $156,577,733) | | | | | | | 185,158,605 | |

| OTHER ASSETS LESS LIABILITIES – 0.6% | | | | | | | 1,202,513 | |

| NET ASSETS - 100% | | | | | | $ | 186,361,118 | |

| ‡ | Industries are utilized for compliance purposes, whereas sectors are utilized for reporting. |

| * | Non-income producing security. |

| (A) | Level 3 security in accordance with fair value hierarchy. |

| ‡‡ | Expiration date not available. |

The following summarizes the market value of the Fund’s investments used as of September 30, 2024, based on the inputs used to value them:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3^ | | | Total | |

| Common Stock | | | | | | | | | | | | | | | | |

| China | | $ | 185,158,605 | | | $ | — | | | $ | — | | | $ | 185,158,605 | |

| Total Common Stock | | | 185,158,605 | | | | — | | | | — | | | | 185,158,605 | |

| Rights | | | — | | | | — | | | | — | ‡‡ | | | — | |

| Total Investments in Securities | | $ | 185,158,605 | | | $ | — | | | $ | — | | | $ | 185,158,605 | |

| ^ | A reconciliation of Level 3 investments, including certain disclosures related to significant inputs used in valuing Level 3 investments is only presented when the Fund has over 1% of Level 3 investments at the end of the period in relation to net assets. |

| ‡‡ | Security or securities with a market value of $0. |

Amounts designated as “—” are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares MSCI All China Index ETF

| | | Shares | | | Value | |

| COMMON STOCK — 99.7%‡ | | | | | | | | |

| CHINA — 99.4% | | | | | | | | |

| Communication Services — 13.8% | | | | | | | | |

| Autohome ADR | | | 456 | | | $ | 14,875 | |

| Baidu, Cl A* | | | 5,750 | | | | 78,172 | |

| Bilibili, Cl Z* | | | 1,100 | | | | 27,445 | |

| Focus Media Information Technology, Cl A | | | 25,000 | | | | 25,255 | |

| iQIYI ADR* | | | 2,365 | | | | 6,764 | |

| Kanzhun ADR | | | 1,050 | | | | 18,228 | |

| Kingsoft | | | 12,600 | | | | 47,934 | |

| Kuaishou Technology, Cl B* | | | 6,300 | | | | 44,487 | |

| NetEase | | | 4,400 | | | | 85,253 | |

| Tencent Holdings | | | 12,658 | | | | 724,525 | |

| Tencent Music Entertainment Group ADR | | | 3,190 | | | | 38,439 | |

| | | | | | | | 1,111,377 | |

| Consumer Discretionary — 24.3% | | | | | | | | |

| Alibaba Group Holding | | | 33,224 | | | | 470,504 | |

| ANTA Sports Products | | | 4,000 | | | | 48,638 | |

| BYD, Cl A | | | 2,000 | | | | 87,820 | |

| BYD, Cl H | | | 3,000 | | | | 109,610 | |

| China Tourism Group Duty Free, Cl A | | | 2,000 | | | | 22,061 | |

| Chongqing Changan Automobile, Cl A | | | 24,338 | | | | 51,746 | |

| Fuyao Glass Industry Group, Cl A | | | 7,100 | | | | 59,043 | |

| Geely Automobile Holdings | | | 20,000 | | | | 31,361 | |

| Great Wall Motor, Cl H | | | 14,500 | | | | 27,068 | |

| Guangzhou Automobile Group, Cl H | | | 22,000 | | | | 8,639 | |

| H World Group ADR | | | 681 | | | | 25,333 | |

| Haier Smart Home, Cl A | | | 17,200 | | | | 73,358 | |

| Huayu Automotive Systems, Cl A | | | 4,000 | | | | 10,248 | |

| JD.com, Cl A | | | 5,822 | | | | 125,243 | |

| Li Auto, Cl A* | | | 3,100 | | | | 43,143 | |

| Li Ning | | | 6,500 | | | | 16,485 | |

| Meituan, Cl B* | | | 11,166 | | | | 247,250 | |

| New Oriental Education & Technology Group | | | 5,000 | | | | 39,910 | |

| NIO, Cl A* | | | 4,720 | | | | 34,242 | |

| PDD Holdings ADR* | | | 1,330 | | | | 179,297 | |

| SAIC Motor, Cl A | | | 10,157 | | | | 21,232 | |

| Shenzhou International Group Holdings | | | 3,300 | | | | 29,973 | |

| TAL Education Group ADR* | | | 2,520 | | | | 29,837 | |

| TravelSky Technology, Cl H | | | 6,000 | | | | 8,929 | |

| Trip.com Group* | | | 1,400 | | | | 88,497 | |

| Vipshop Holdings ADR | | | 1,609 | | | | 25,310 | |

| Yum China Holdings | | | 1,055 | | | | 47,496 | |

| | | | | | | | 1,962,273 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares MSCI All China Index ETF (continued)

| | | Shares | | | Value | |

| COMMON STOCK (continued) | | | | | | | | |

| Consumer Staples — 8.5% | | | | | | | | |

| Alibaba Health Information Technology* | | | 22,000 | | | $ | 15,153 | |

| Anhui Gujing Distillery, Cl A | | | 1,200 | | | | 34,810 | |

| China Mengniu Dairy | | | 12,000 | | | | 28,890 | |

| China Resources Beer Holdings | | | 6,000 | | | | 26,263 | |

| Foshan Haitian Flavouring & Food, Cl A | | | 5,133 | | | | 35,329 | |

| Guangdong Haid Group, Cl A | | | 4,300 | | | | 29,504 | |

| Henan Shuanghui Investment & Development, Cl A | | | 4,600 | | | | 17,805 | |

| Inner Mongolia Yili Industrial Group, Cl A | | | 6,700 | | | | 27,829 | |

| Jiangsu Yanghe Distillery, Cl A | | | 1,400 | | | | 19,842 | |

| Kweichow Moutai, Cl A | | | 800 | | | | 199,810 | |

| Luzhou Laojiao, Cl A | | | 2,000 | | | | 42,780 | |

| Muyuan Foods, Cl A* | | | 7,502 | | | | 49,641 | |

| New Hope Liuhe, Cl A* | | | 11,800 | | | | 17,552 | |

| Shanxi Xinghuacun Fen Wine Factory, Cl A | | | 1,460 | | | | 45,663 | |

| Tingyi Cayman Islands Holding | | | 12,000 | | | | 17,334 | |

| Want Want China Holdings | | | 20,000 | | | | 13,750 | |

| Wuliangye Yibin, Cl A | | | 2,800 | | | | 65,016 | |

| | | | | | | | 686,971 | |

| Energy — 4.0% | | | | | | | | |

| China Oilfield Services, Cl H | | | 14,000 | | | | 12,887 | |

| China Petroleum & Chemical, Cl A | | | 40,800 | | | | 40,574 | |

| China Petroleum & Chemical, Cl H | | | 84,500 | | | | 52,653 | |

| China Shenhua Energy, Cl H | | | 10,000 | | | | 45,124 | |

| PetroChina, Cl A | | | 19,600 | | | | 25,261 | |

| PetroChina, Cl H | | | 59,984 | | | | 48,960 | |

| Shaanxi Coal Industry, Cl A | | | 10,400 | | | | 40,984 | |

| Shanxi Lu’an Environmental Energy Development, Cl A | | | 6,700 | | | | 16,897 | |

| Yankuang Energy Group, Cl H | | | 27,300 | | | | 38,591 | |

| | | | | | | | 321,931 | |

| Financials — 22.9% | | | | | | | | |

| Agricultural Bank of China, Cl A | | | 76,600 | | | | 52,536 | |

| Agricultural Bank of China, Cl H | | | 91,397 | | | | 43,066 | |

| Bank of Beijing, Cl A | | | 24,600 | | | | 20,527 | |

| Bank of China, Cl A | | | 30,400 | | | | 21,718 | |

| Bank of China, Cl H | | | 210,396 | | | | 99,408 | |

| Bank of Communications, Cl A | | | 38,200 | | | | 40,391 | |

| Bank of Communications, Cl H | | | 37,000 | | | | 28,390 | |

| Bank of Hangzhou, Cl A | | | 12,400 | | | | 24,982 | |

| Bank of Jiangsu, Cl A | | | 19,400 | | | | 23,284 | |

| Bank of Nanjing, Cl A | | | 12,300 | | | | 19,244 | |

| Bank of Ningbo, Cl A | | | 6,300 | | | | 23,134 | |

| Bank of Shanghai, Cl A | | | 16,304 | | | | 18,380 | |

| China CITIC Bank, Cl H | | | 28,000 | | | | 17,880 | |

| China Construction Bank, Cl A | | | 10,500 | | | | 11,897 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares MSCI All China Index ETF (continued)

| | | Shares | | | Value | |

| COMMON STOCK (continued) | | | | | | | | |

| Financials (continued) | | | | | | | | |

| China Construction Bank, Cl H | | | 209,000 | | | $ | 158,213 | |

| China Everbright Bank, Cl A | | | 48,100 | | | | 24,742 | |

| China Galaxy Securities, Cl H | | | 33,500 | | | | 31,311 | |

| China Life Insurance, Cl H | | | 20,483 | | | | 41,190 | |

| China Merchants Bank, Cl A | | | 15,600 | | | | 83,833 | |

| China Merchants Bank, Cl H | | | 11,500 | | | | 57,074 | |

| China Merchants Securities, Cl A | | | 8,300 | | | | 23,055 | |

| China Minsheng Banking, Cl A | | | 44,600 | | | | 25,618 | |

| China Minsheng Banking, Cl H | | | 38,500 | | | | 15,712 | |

| China Pacific Insurance Group, Cl A | | | 6,300 | | | | 35,197 | |

| China Pacific Insurance Group, Cl H | | | 9,400 | | | | 33,885 | |

| CITIC Securities, Cl A | | | 13,845 | | | | 53,808 | |

| CITIC Securities, Cl H | | | 7,000 | | | | 18,519 | |

| East Money Information, Cl A | | | 13,700 | | | | 39,738 | |

| Everbright Securities, Cl A | | | 9,000 | | | | 24,755 | |

| GF Securities, Cl A | | | 8,800 | | | | 20,998 | |

| Guosen Securities, Cl A | | | 9,500 | | | | 16,058 | |

| Guotai Junan Securities, Cl A(A) | | | 7,300 | | | | 15,333 | |

| Haitong Securities, Cl A(A) | | | 11,000 | | | | 15,163 | |

| Huatai Securities, Cl A | | | 10,400 | | | | 26,154 | |

| Huatai Securities, Cl H | | | 8,000 | | | | 12,895 | |

| Huaxia Bank, Cl A | | | 16,200 | | | | 17,198 | |

| Industrial & Commercial Bank of China, Cl A | | | 58,600 | | | | 51,745 | |

| Industrial & Commercial Bank of China, Cl H | | | 144,441 | | | | 86,283 | |

| Industrial Bank, Cl A | | | 17,500 | | | | 48,184 | |

| Industrial Securities, Cl A | | | 24,169 | | | | 23,552 | |

| New China Life Insurance, Cl A | | | 3,500 | | | | 23,214 | |

| New China Life Insurance, Cl H | | | 4,800 | | | | 14,986 | |

| Orient Securities, Cl A | | | 12,300 | | | | 19,526 | |

| People’s Insurance Group of China, Cl H | | | 47,452 | | | | 22,665 | |

| PICC Property & Casualty, Cl H | | | 25,510 | | | | 37,834 | |

| Ping An Bank, Cl A | | | 17,391 | | | | 30,341 | |

| Ping An Insurance Group of China, Cl A | | | 8,900 | | | | 72,600 | |

| Ping An Insurance Group of China, Cl H | | | 16,500 | | | | 106,531 | |

| Qifu Technology ADR | | | 500 | | | | 14,905 | |

| Shanghai Pudong Development Bank, Cl A | | | 25,000 | | | | 36,186 | |

| Shenwan Hongyuan Group, Cl A | | | 28,700 | | | | 23,457 | |

| | | | | | | | 1,847,295 | |

| Health Care — 4.0% | | | | | | | | |

| Beijing Tong Ren Tang, Cl A | | | 1,844 | | | | 11,082 | |

| Changchun High-Tech Industry Group, Cl A | | | 1,200 | | | | 18,842 | |

| CSPC Pharmaceutical Group | | | 39,520 | | | | 30,782 | |

| Genscript Biotech* | | | 12,000 | | | | 21,536 | |

| Guangzhou Baiyunshan Pharmaceutical Holdings, Cl A | | | 2,800 | | | | 12,266 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (Unaudited) September 30, 2024

KraneShares MSCI All China Index ETF (continued)

| | | Shares | | | Value | |

| COMMON STOCK (continued) | | | | | | | | |

| Health Care (continued) | | | | | | | | |

| Huadong Medicine, Cl A | | | 2,580 | | | $ | 12,899 | |

| Innovent Biologics* | | | 2,500 | | | | 15,159 | |

| Jiangsu Hengrui Pharmaceuticals, Cl A | | | 4,916 | | | | 36,737 | |

| Shanghai Fosun Pharmaceutical Group, Cl A | | | 3,400 | | | | 13,442 | |

| Shanghai Pharmaceuticals Holding, Cl A | | | 6,600 | | | | 19,945 | |

| Shenzhen Mindray Bio-Medical Electronics, Cl A | | | 1,000 | | | | 41,865 | |

| Sinopharm Group, Cl H | | | 5,600 | | | | 14,996 | |

| Wuxi Biologics Cayman* | | | 16,000 | | | | 36,048 | |