American Midstream Partners to Acquire Southcross Energy November 1, 2017 Exhibit 99.2

Cautionary Statement This presentation and accompanying statements may contain forward-looking statements. All statements that are not statements of historical facts, including statements regarding American Midstream Partners, LP’s (“American Midstream,” “AMID,” “we,” or “us”) future financial position, results, business strategy, guidance, distribution growth, and plans and objectives of management for future operations, are forward-looking statements. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “would,” “potential,” and similar terms and phrases to identify forward-looking statements in this presentation. Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions could be inaccurate, and, therefore, we cannot assure you that the forward-looking statements included herein will prove to be accurate. These forward-looking statements reflect our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors, many of which are outside our control. Additional risks include the following: the ability to obtain requisite regulatory and unitholder approval and the satisfaction of the other conditions to the consummation of the proposed transactions, the ability of American Midstream to successfully integrate Southcross Holdings’ and Southcross Energy, L.P.’s operations and employees and realize anticipated synergies and cost savings, actions by third parties, the potential impact of the announcement or consummation of the proposed transactions on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, and the ability to achieve revenue and other financial growth, and volatility in the price of oil, natural gas, and natural gas liquids and the credit market. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the Securities and Exchange Commission (“SEC”). Please see American Midstream’s and Southcross Energy’s “Risk Factors” and other disclosures included in their Annual Reports on Form 10-K for the year ended December 31, 2016, and Quarterly Reports on Form 10-Q for the quarter ended March 31, 2017 and the quarter ended June 30, 2017. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. The forward-looking statements herein speak as of the date of this presentation. American Midstream and Southcross Energy undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this presentation.

Compelling Strategic Rationale Creates fully integrated midstream platform linking natural gas and NGL supplies to high-growth markets along the U.S. Gulf Coast, forming a $3 billion enterprise value partnership Expands AMID’s onshore gathering, processing and transmission services in the highly economic Eagle Ford play and in the Southeast U.S. gas transmission markets Accelerates the transformation of AMID, furthering asset density and full value chain participation Extends AMID’s commercial and operational capabilities to a high-quality asset platform with substantial upside as a well-capitalized company Combined company expected to generate single-digit accretion in 2018 and 2019, approaching double digits in 2020+ American Midstream Partners to acquire Southcross Holdings and Southcross Energy Partners, LP, creating a premier fully integrated growth platform

Strategic System Integration Drives Value Strategically Located Assets are a Bridge to Demand Markets Extends AMID’s customer reach to numerous producers (25+) in the core of the Eagle Ford and to key end users in high-growth downstream markets Connects Eagle Ford producers with critical natural gas and NGL demand Gulf Coast / Corpus Christi liquefaction demand Gulf Coast / Corpus Christi expansion of petrochemical, refining and industrial demand Mexico’s growing demand and associated export pipelines Crude and NGL export facilities Demand-driven interstate pipelines in Alabama and Mississippi provide stable cash flow and connectivity with AMID’s existing assets, creating a strategic system with commercial upside Southeast demand pull from natural gas-fired power generation plants and LDCs seeking to access Northeast gas supply Fully Integrated System Captures full midstream value chain: Natural gas gathering, treating, processing and fractionation NGL and residue natural gas marketing Creates asset density along the Gulf Coast with substantial value-creating opportunities that neither company could achieve on a stand-alone basis ü ü

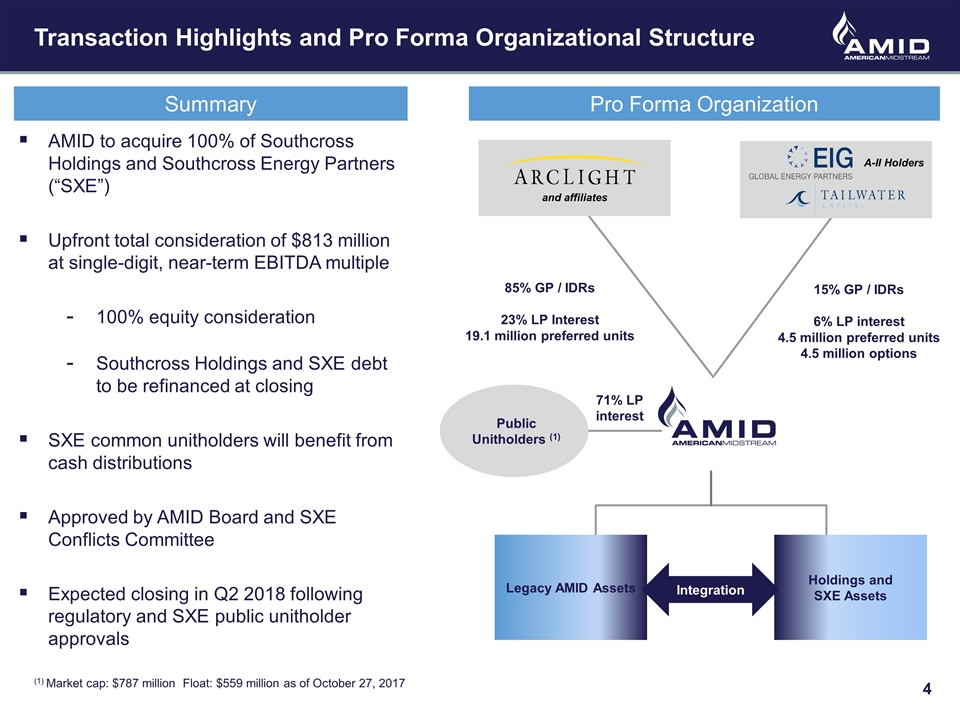

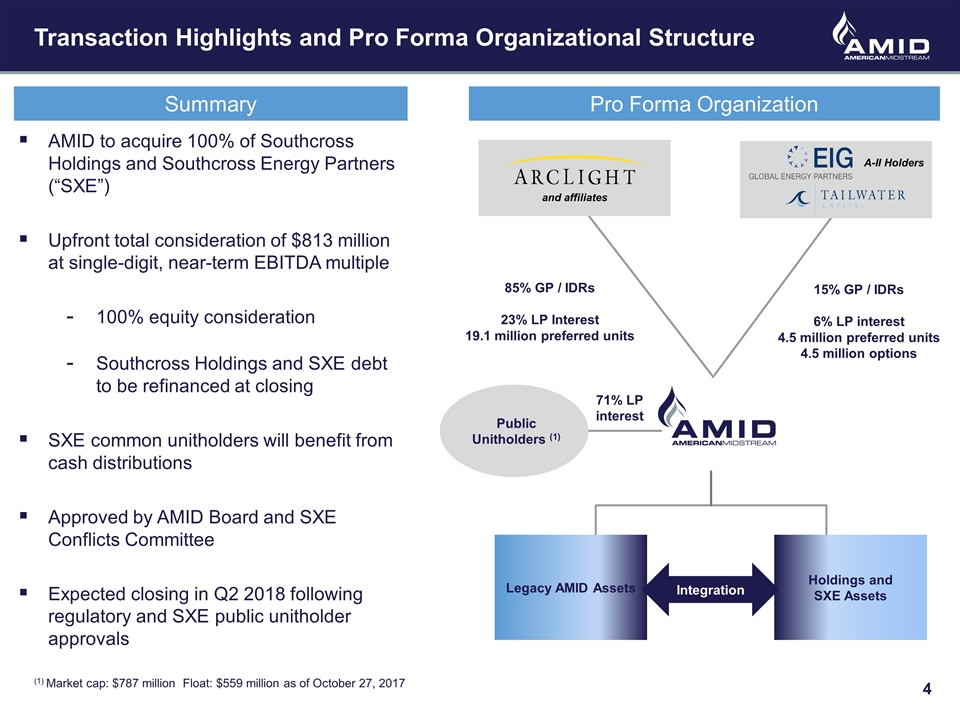

Transaction Highlights and Pro Forma Organizational Structure 71% LP interest and affiliates 15% GP / IDRs 6% LP interest 4.5 million preferred units 4.5 million options 85% GP / IDRs 23% LP Interest 19.1 million preferred units A-II Holders Holdings and SXE Assets Legacy AMID Assets AMID to acquire 100% of Southcross Holdings and Southcross Energy Partners (“SXE”) Upfront total consideration of $813 million at single-digit, near-term EBITDA multiple 100% equity consideration Southcross Holdings and SXE debt to be refinanced at closing SXE common unitholders will benefit from cash distributions Approved by AMID Board and SXE Conflicts Committee Expected closing in Q2 2018 following regulatory and SXE public unitholder approvals Summary Integration Pro Forma Organization Public Unitholders (1) (1) Market cap: $787 million Float: $559 million as of October 27, 2017

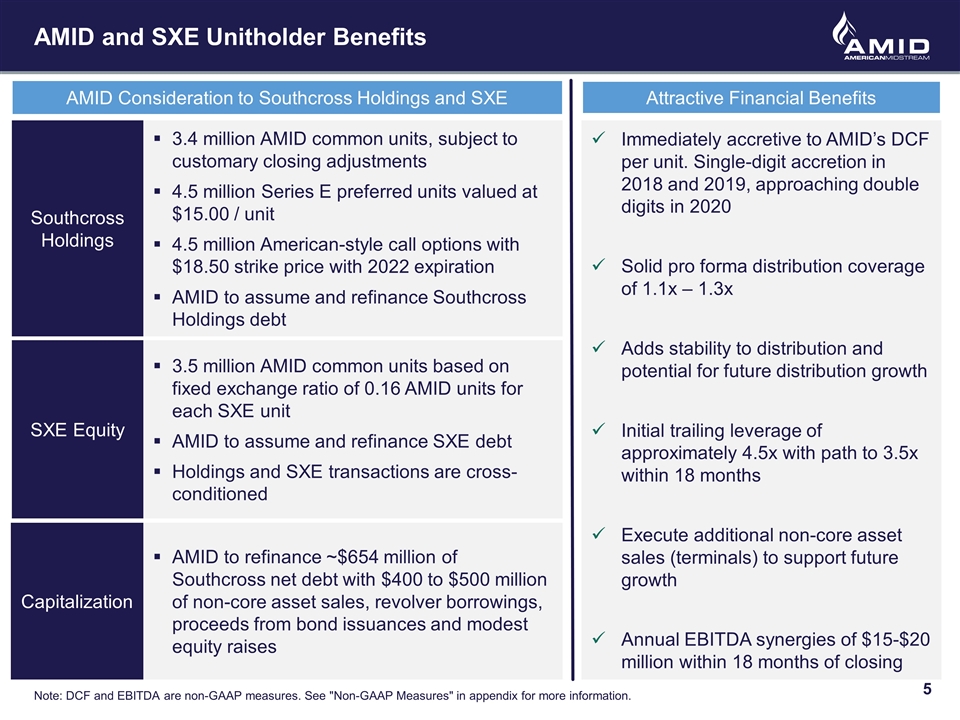

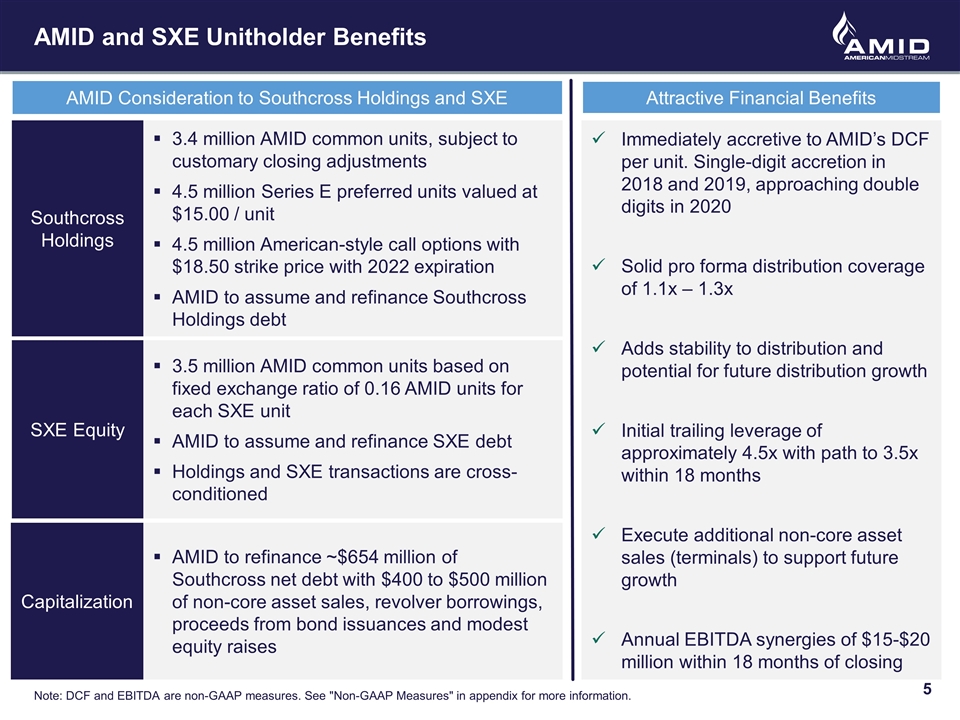

Immediately accretive to AMID’s DCF per unit. Single-digit accretion in 2018 and 2019, approaching double digits in 2020 Solid pro forma distribution coverage of 1.1x – 1.3x Adds stability to distribution and potential for future distribution growth Initial trailing leverage of approximately 4.5x with path to 3.5x within 18 months Execute additional non-core asset sales (terminals) to support future growth Annual EBITDA synergies of $15-$20 million within 18 months of closing AMID and SXE Unitholder Benefits AMID Consideration to Southcross Holdings and SXE Attractive Financial Benefits Southcross Holdings 3.4 million AMID common units, subject to customary closing adjustments 4.5 million Series E preferred units valued at $15.00 / unit 4.5 million American-style call options with $18.50 strike price with 2022 expiration AMID to assume and refinance Southcross Holdings debt SXE Equity 3.5 million AMID common units based on fixed exchange ratio of 0.16 AMID units for each SXE unit AMID to assume and refinance SXE debt Holdings and SXE transactions are cross-conditioned Capitalization AMID to refinance ~$654 million of Southcross net debt with $400 to $500 million of non-core asset sales, revolver borrowings, proceeds from bond issuances and modest equity raises Note: DCF and EBITDA are non-GAAP measures. See "Non-GAAP Measures" in appendix for more information.

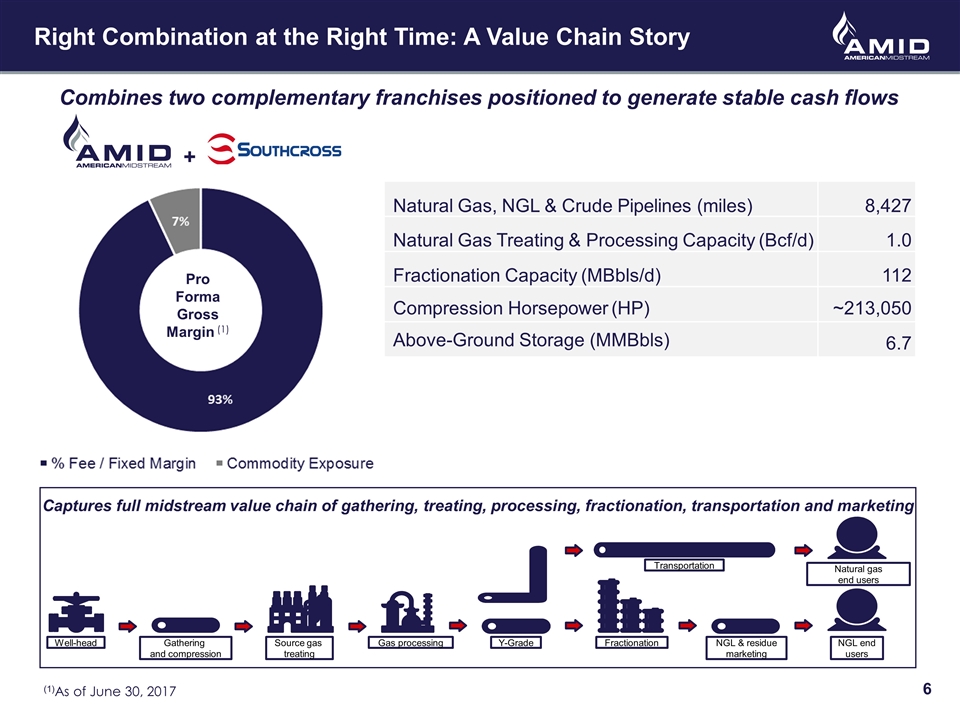

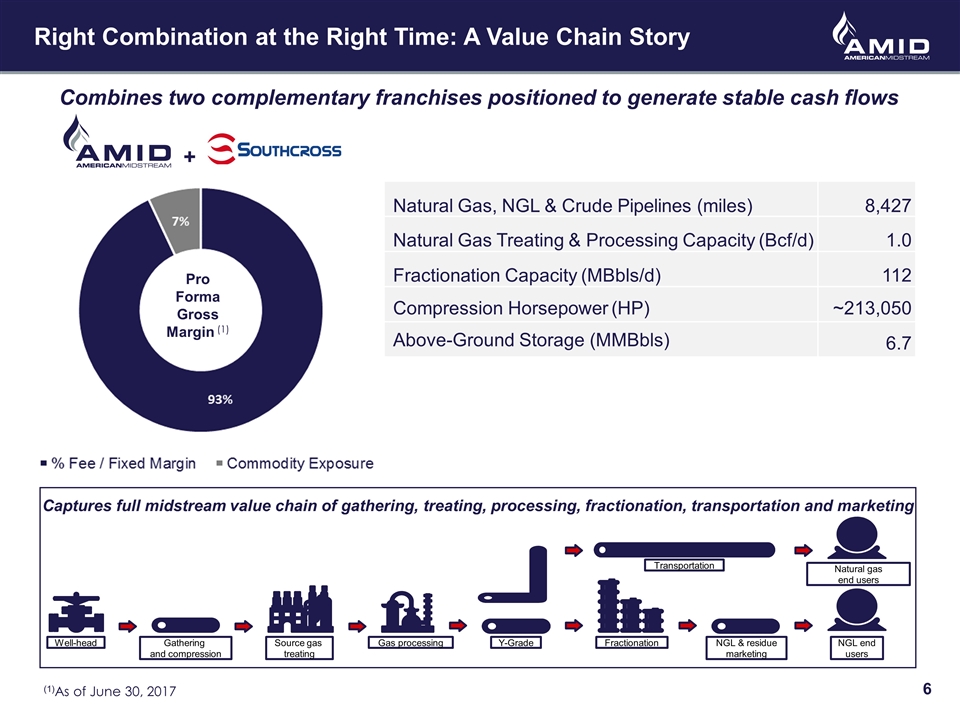

Right Combination at the Right Time: A Value Chain Story Combines two complementary franchises positioned to generate stable cash flows Transportation Natural gas end users NGL end users NGL & residue marketing Fractionation Y-Grade Gathering and compression Well-head Source gas treating Gas processing Captures full midstream value chain of gathering, treating, processing, fractionation, transportation and marketing + Pro Forma Gross Margin (1) Natural Gas, NGL & Crude Pipelines (miles) 8,427 Natural Gas Treating & Processing Capacity (Bcf/d) 1.0 Fractionation Capacity (MBbls/d) 112 Compression Horsepower (HP) ~213,050 Above-Ground Storage (MMBbls) 6.7 (1)As of June 30, 2017

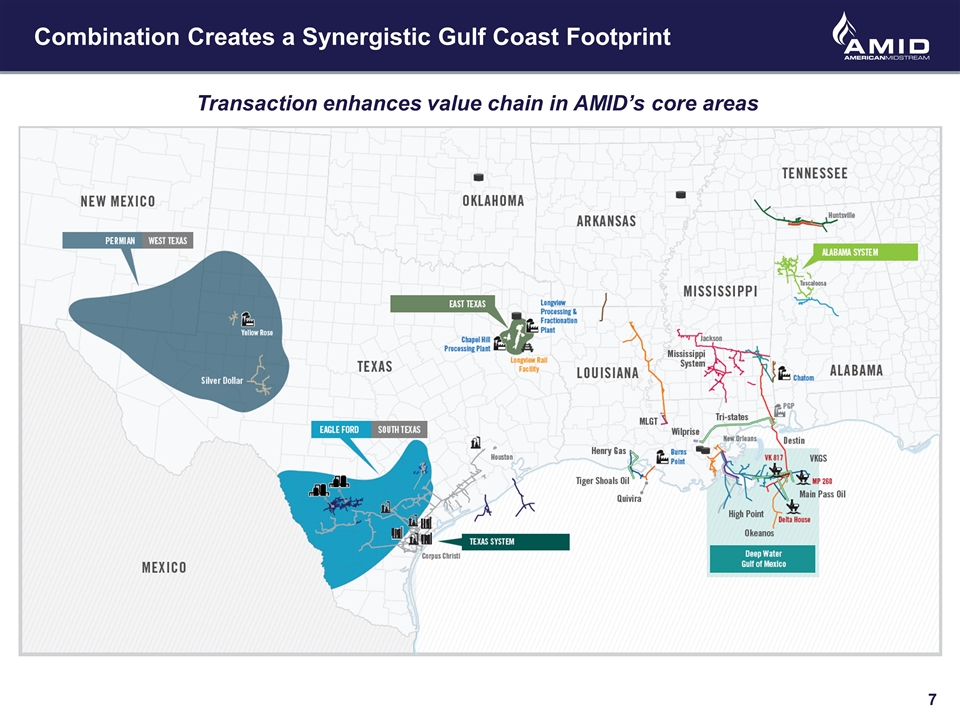

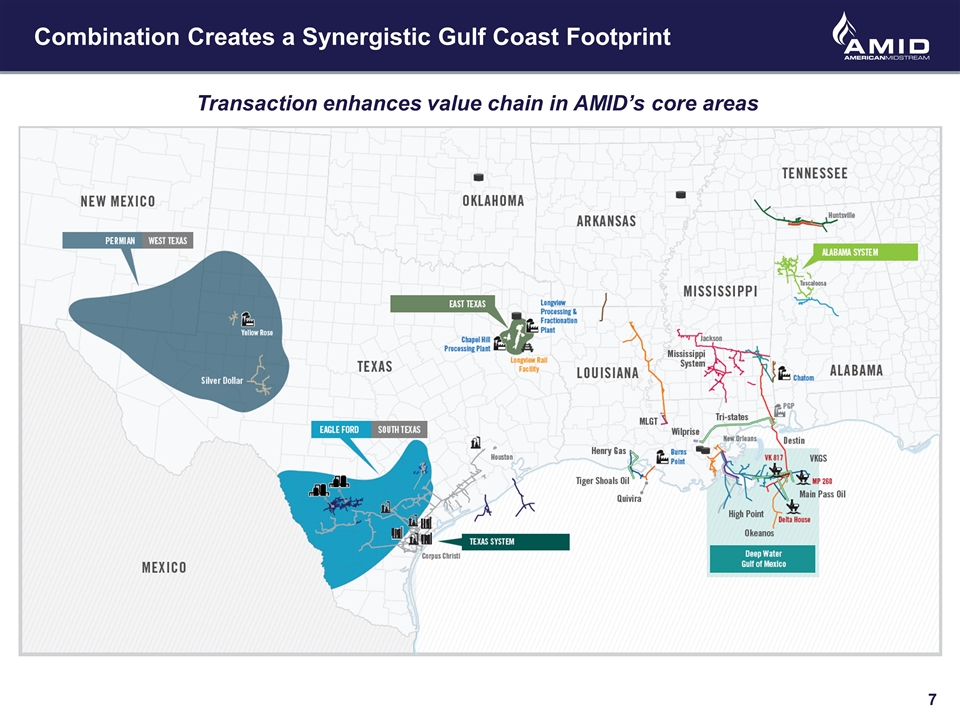

Combination Creates a Synergistic Gulf Coast Footprint Transaction enhances value chain in AMID’s core areas

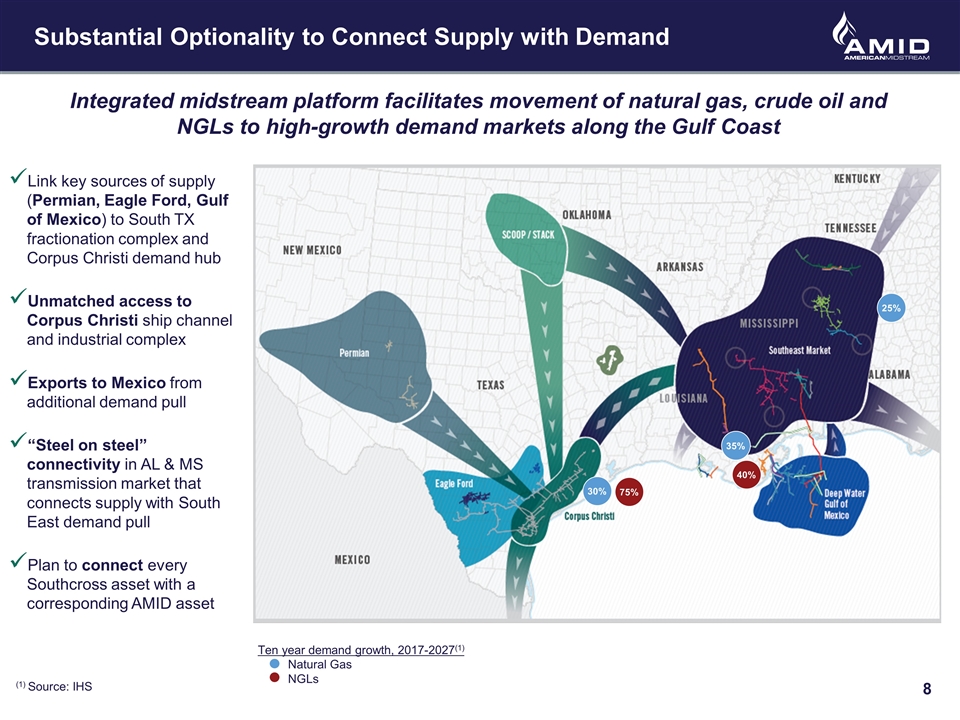

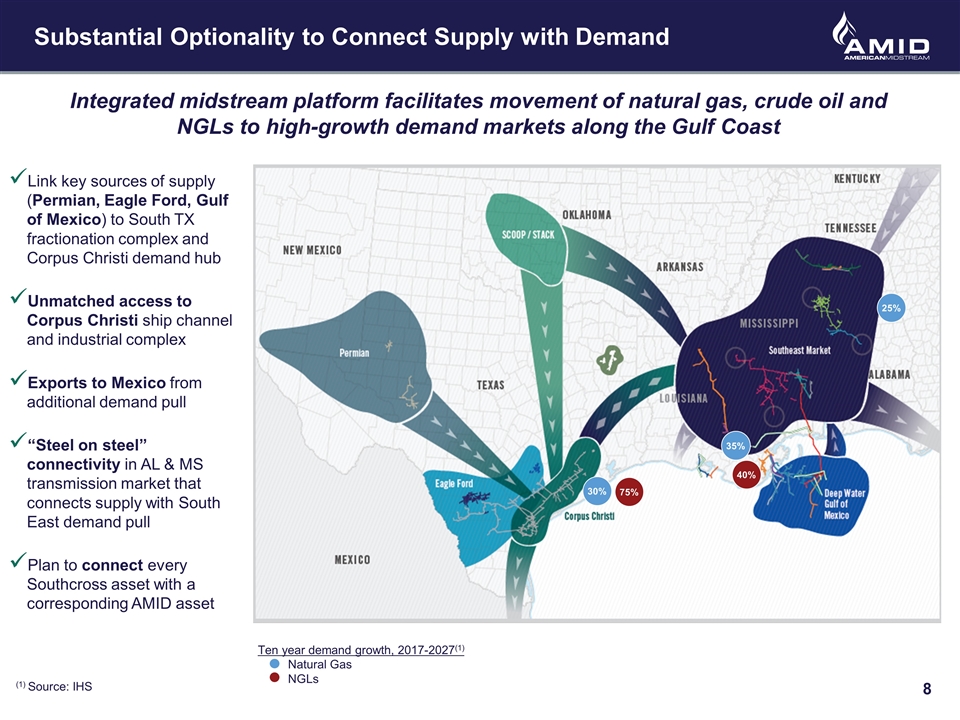

Integrated midstream platform facilitates movement of natural gas, crude oil and NGLs to high-growth demand markets along the Gulf Coast Substantial Optionality to Connect Supply with Demand Link key sources of supply (Permian, Eagle Ford, Gulf of Mexico) to South TX fractionation complex and Corpus Christi demand hub Unmatched access to Corpus Christi ship channel and industrial complex Exports to Mexico from additional demand pull “Steel on steel” connectivity in AL & MS transmission market that connects supply with South East demand pull Plan to connect every Southcross asset with a corresponding AMID asset Ten year demand growth, 2017-2027(1) Natural Gas NGLs (1) Source: IHS 30% 35% 25% 75% 40%

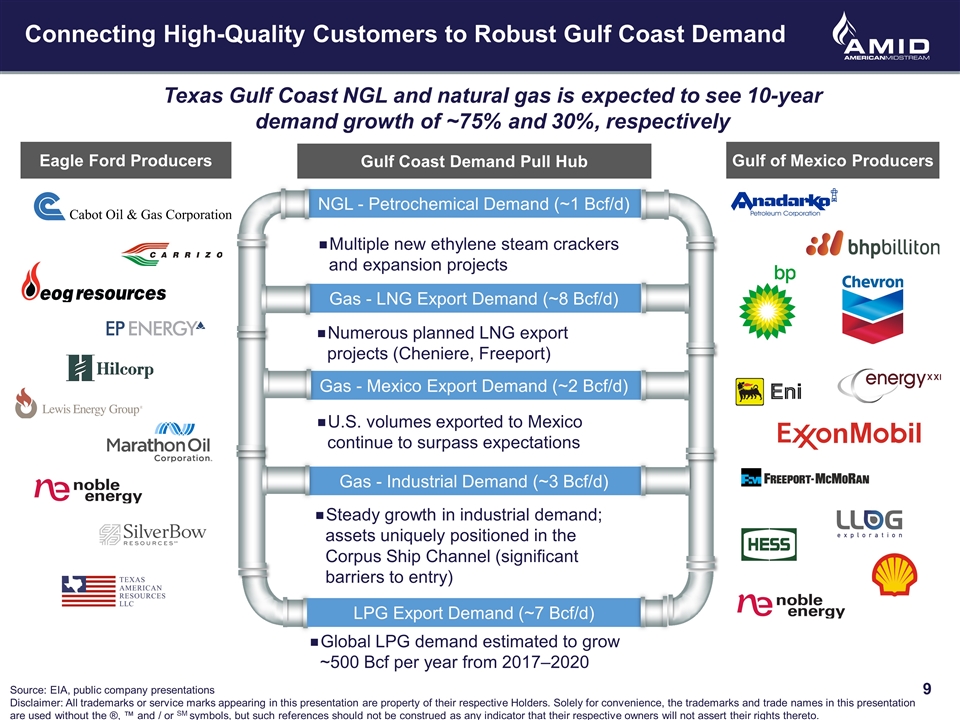

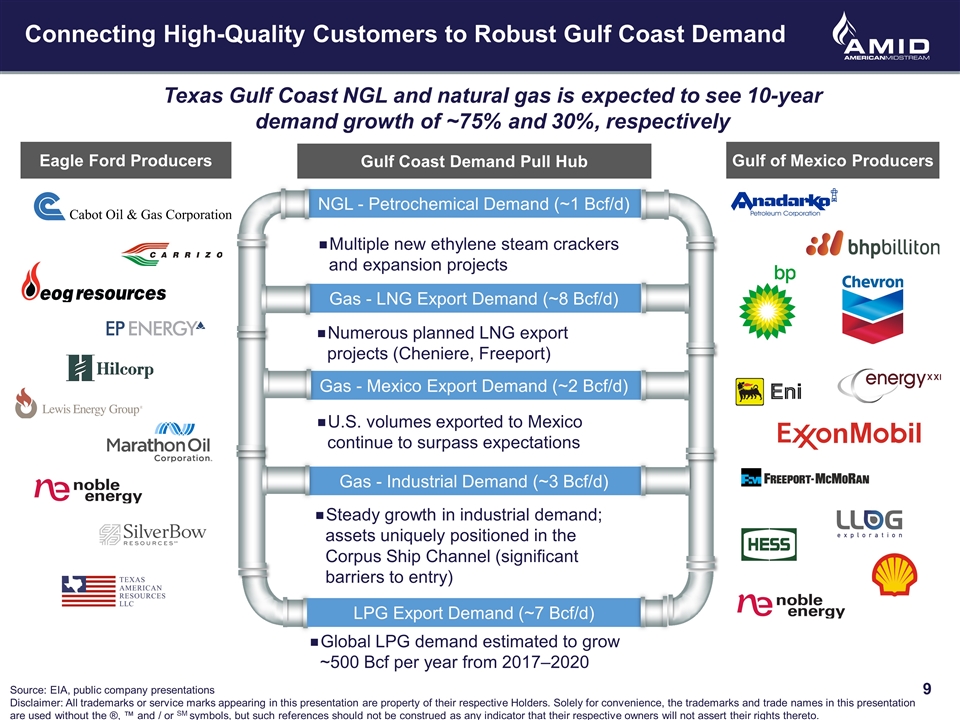

Source: EIA, public company presentations Disclaimer: All trademarks or service marks appearing in this presentation are property of their respective Holders. Solely for convenience, the trademarks and trade names in this presentation are used without the ®, ™ and / or SM symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto. Connecting High-Quality Customers to Robust Gulf Coast Demand Global LPG demand estimated to grow ~500 Bcf per year from 2017–2020 Gas - Industrial Demand (~3 Bcf/d) Steady growth in industrial demand; assets uniquely positioned in the Corpus Ship Channel (significant barriers to entry) Gas - LNG Export Demand (~8 Bcf/d) Gulf Coast Demand Pull Hub NGL - Petrochemical Demand (~1 Bcf/d) Multiple new ethylene steam crackers and expansion projects Numerous planned LNG export projects (Cheniere, Freeport) Gas - Mexico Export Demand (~2 Bcf/d) U.S. volumes exported to Mexico continue to surpass expectations Eagle Ford Producers Gulf of Mexico Producers LPG Export Demand (~7 Bcf/d) Texas Gulf Coast NGL and natural gas is expected to see 10-year demand growth of ~75% and 30%, respectively

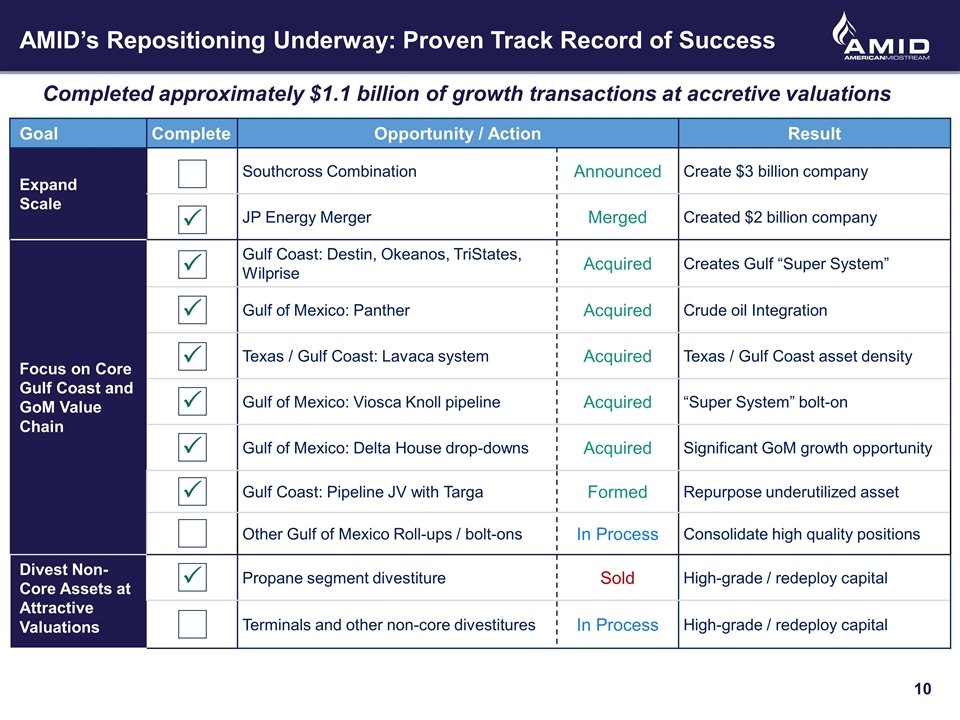

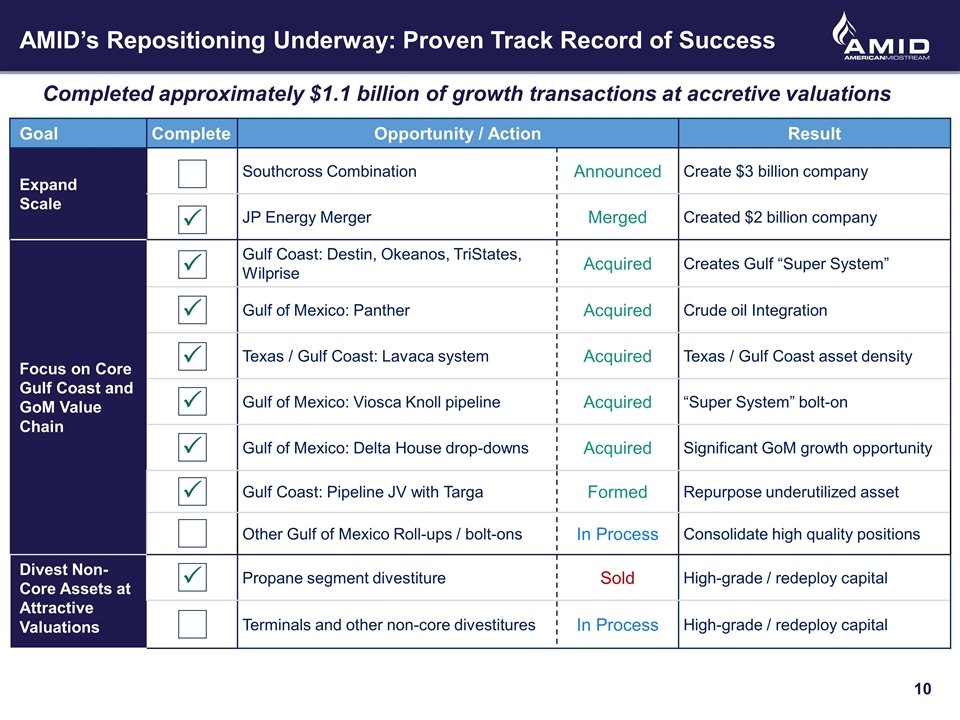

Goal Complete Opportunity / Action Result Expand Scale Southcross Combination Announced Create $3 billion company JP Energy Merger Merged Created $2 billion company Focus on Core Gulf Coast and GoM Value Chain Gulf Coast: Destin, Okeanos, TriStates, Wilprise Acquired Creates Gulf “Super System” Gulf of Mexico: Panther Acquired Crude oil Integration Texas / Gulf Coast: Lavaca system Acquired Texas / Gulf Coast asset density Gulf of Mexico: Viosca Knoll pipeline Acquired “Super System” bolt-on Gulf of Mexico: Delta House drop-downs Acquired Significant GoM growth opportunity Gulf Coast: Pipeline JV with Targa Formed Repurpose underutilized asset Other Gulf of Mexico Roll-ups / bolt-ons In Process Consolidate high quality positions Divest Non-Core Assets at Attractive Valuations Propane segment divestiture Sold High-grade / redeploy capital Terminals and other non-core divestitures In Process High-grade / redeploy capital AMID’s Repositioning Underway: Proven Track Record of Success P P P P P P P P Completed approximately $1.1 billion of growth transactions at accretive valuations

Builds Platform for Significant Growth Opportunities Active Pipeline of Growth Opportunities to Expand Core Service Offering Establishes sustainable growth trajectory and expansion in core areas ArcLight and affiliates Completed approximately $1.1 billion of drop-downs and affiliate transactions over past three years Backlog of over $0.6 billion in accretive dropdown opportunities Build on strong Gulf of Mexico and Southeast asset base Significant joint venture opportunities to build combined platform EIG & Tailwater Active midstream investors with complementary asset portfolios Dropdowns or Joint Ventures with Affiliates 1 Organic Growth Projects 2 Third Party Acquisitions 3 Ability to develop multibillion dollar greenfield opportunities Develop new interconnectivity and supply to petrochem and export projects in Corpus Christi Pipelines to supply hydrocarbons from core areas to high-growth demand markets in U.S. Gulf Coast History of acquiring at attractive multiples Bolt-ons that add immediate asset density and create synergies in core areas Creates pathway to growth capital projects

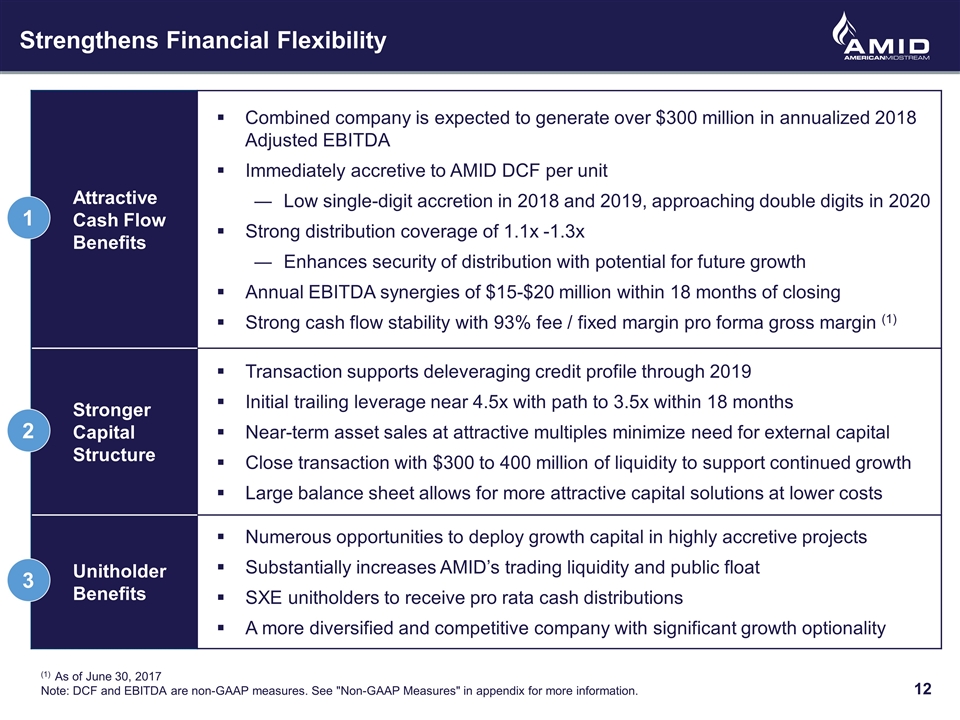

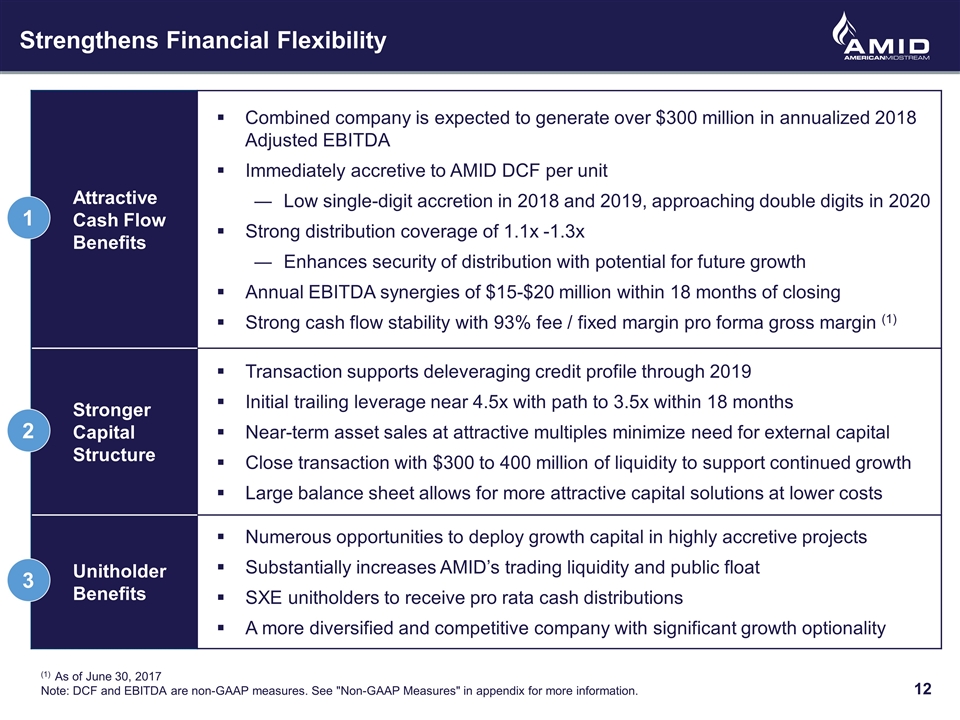

Attractive Cash Flow Benefits Combined company is expected to generate over $300 million in annualized 2018 Adjusted EBITDA Immediately accretive to AMID DCF per unit Low single-digit accretion in 2018 and 2019, approaching double digits in 2020 Strong distribution coverage of 1.1x -1.3x Enhances security of distribution with potential for future growth Annual EBITDA synergies of $15-$20 million within 18 months of closing Strong cash flow stability with 93% fee / fixed margin pro forma gross margin (1) Stronger Capital Structure Transaction supports deleveraging credit profile through 2019 Initial trailing leverage near 4.5x with path to 3.5x within 18 months Near-term asset sales at attractive multiples minimize need for external capital Close transaction with $300 to 400 million of liquidity to support continued growth Large balance sheet allows for more attractive capital solutions at lower costs Unitholder Benefits Numerous opportunities to deploy growth capital in highly accretive projects Substantially increases AMID’s trading liquidity and public float SXE unitholders to receive pro rata cash distributions A more diversified and competitive company with significant growth optionality Strengthens Financial Flexibility 1 2 3 (1) As of June 30, 2017 Note: DCF and EBITDA are non-GAAP measures. See "Non-GAAP Measures" in appendix for more information.

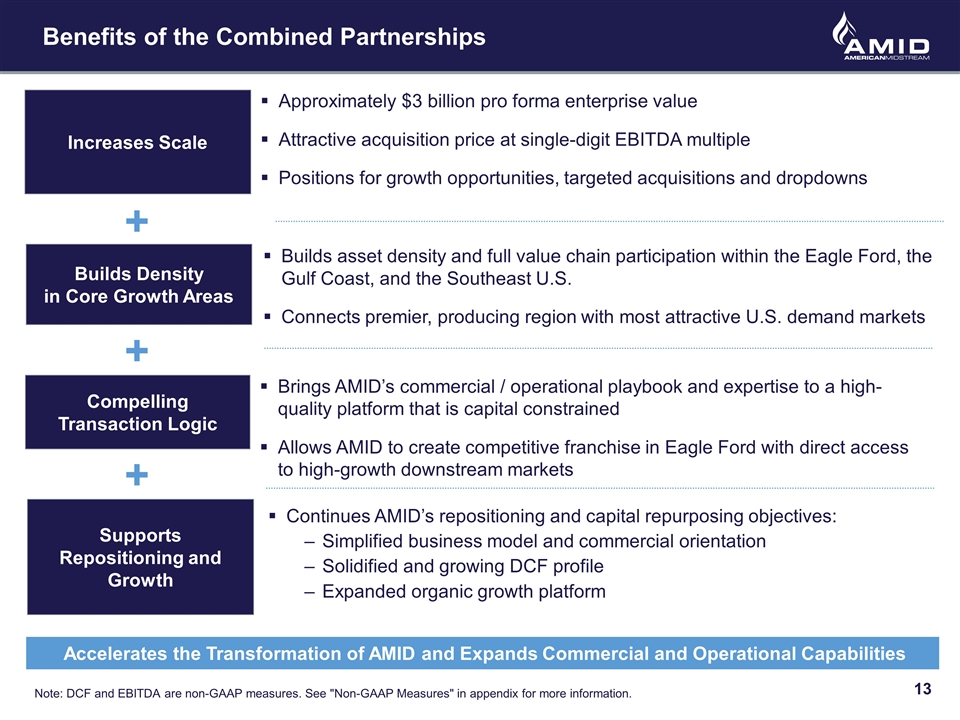

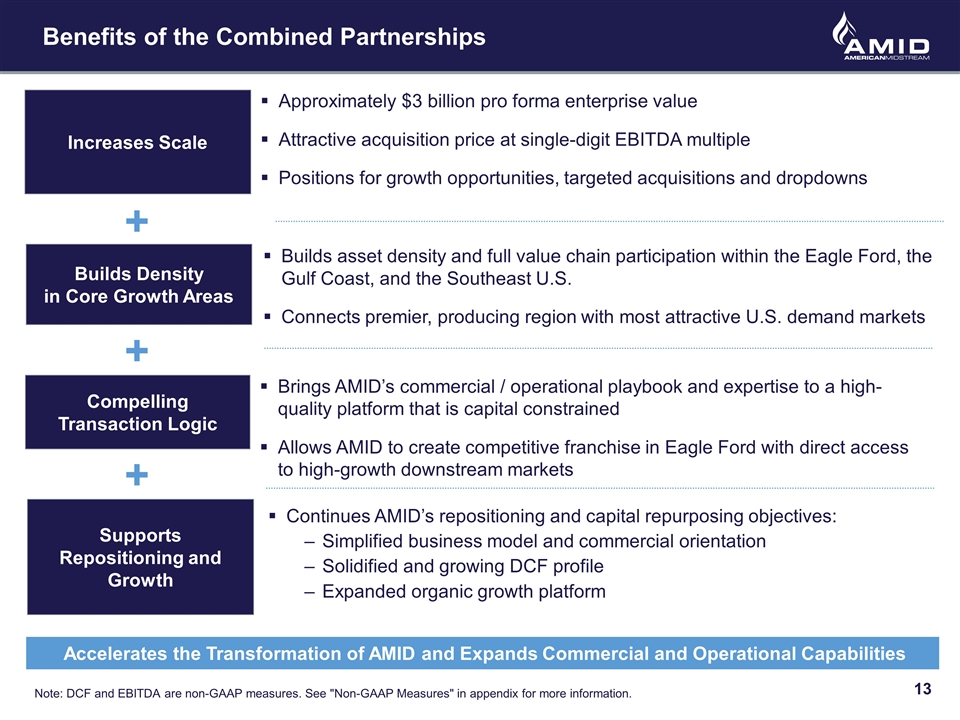

Benefits of the Combined Partnerships Increases Scale Builds Density in Core Growth Areas Approximately $3 billion pro forma enterprise value Attractive acquisition price at single-digit EBITDA multiple Positions for growth opportunities, targeted acquisitions and dropdowns Builds asset density and full value chain participation within the Eagle Ford, the Gulf Coast, and the Southeast U.S. Connects premier, producing region with most attractive U.S. demand markets Supports Repositioning and Growth Continues AMID’s repositioning and capital repurposing objectives: Simplified business model and commercial orientation Solidified and growing DCF profile Expanded organic growth platform Compelling Transaction Logic Brings AMID’s commercial / operational playbook and expertise to a high-quality platform that is capital constrained Allows AMID to create competitive franchise in Eagle Ford with direct access to high-growth downstream markets Note: DCF and EBITDA are non-GAAP measures. See "Non-GAAP Measures" in appendix for more information. Accelerates the Transformation of AMID and Expands Commercial and Operational Capabilities + + +

Rule 425 Legend Additional Information and Where to Find It This presentation relates to a proposed business combination between American Midstream and Southcross Energy. In connection with the proposed transaction, American Midstream and/or Southcross Energy expect to file a proxy statement/prospectus and other documents with the SEC. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to unitholders of Southcross Energy. Investors and security holders will be able to obtain these materials (if and when they are available) free of charge at the SEC's website, www.sec.gov. In addition, copies of any documents filed with the SEC may be obtained free of charge from Southcross Energy's investor relations website for investors at http://investors.southcrossenergy.com, and from American Midstreams's investor relations website at http://www.americanmidstream.com/investorrelations. Investors and security holders may also read and copy any reports, statements and other information filed by American Midstream and Southcross with the SEC at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC's website for further information on its public reference room. American Midstream Partners, LP 2103 City West Blvd. Bldg. 4, Suite 800 Houston, TX 77042 Attention: Investor Relations Phone: 346-241-3467 Southcross Energy Partners, LP 1717 Main Street, Suite 5200 Dallas, TX 75201 Attention: Investor Relations Phone: 214-979-3720

Participants in the Solicitation and No Offer or Solicitation Participants in the Solicitation American Midstream and Southcross Energy and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding Southcross Energy’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 9, 2017. Information regarding American Midstream’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 28, 2017. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

NON-GAAP MEASURES This presentation includes supplemental non-GAAP financial measures “Adjusted EBITDA” and “Distributable Cash Flow.” or “DCF”. You should not consider Adjusted EBITDA or DCF in isolation or as a substitute for, or more meaningful than analysis of, our results as reported under GAAP. Adjusted EBITDA and DCF may be defined differently by other companies in our industry. Our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Adjusted EBITDA is a supplemental non-GAAP financial measure used by our management and external users of our financial statements, such as investors, commercial banks, research analysts and others, to assess: the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; the ability of our assets to generate cash flow to make cash distributions to our unitholders and our general partner; our operating performance and return on capital as compared to those of other companies in the midstream energy sector, without regard to financing or capital structure; and the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities. We define Adjusted EBITDA as net income (loss) attributable to AMID, plus interest expense, income tax expense, depreciation, amortization and accretion expense attributable to AMID, debt issuance costs paid during the period, distributions from investments in unconsolidated affiliates, transaction expenses, certain non-cash charges such as non-cash equity compensation expense, unrealized (gains) losses on derivatives and selected charges that are unusual, less construction and operating management agreement income, other post-employment benefits plan net periodic benefit, earnings in unconsolidated affiliates, gains (losses) on the sale of assets, net, and selected gains that are unusual. The GAAP measure most directly comparable to our performance measure Adjusted EBITDA is net income (loss) attributable to AMID. In this release, we present expected EBITDA synergies and pro forma annual Adjusted EBITDA for 2018. We are unable to project net income (loss) attributable to AMID to provide the related reconciliations expected EBITDA synergies to the most comparable financial measure calculated in accordance with GAAP, because the impact of changes in distributions from unconsolidated affiliates, operating assets and liabilities, the volume and timing of payments received and utilized from our and SXE’s customers are out of our control and cannot be reasonably predicted. Therefore, the reconciliation of EBITDA and Adjusted EBITDA to projected net income (loss) attributable to AMID is not available without unreasonable effort. DCF is a significant performance metric used by us and by external users of AMID’s financial statements, such as investors, commercial banks and research analysts, to compare basic cash flows generated by us to the cash distributions we expect to pay AMID’s unitholders. Using this metric, management and external users of AMID’s financial statements can quickly compute the coverage ratio of estimated cash flows to planned cash distributions. DCF is also an important financial measure for AMID unitholders since it serves as an indicator of AMID’s success in providing a cash return on investment. Specifically, this financial measure may indicate to investors whether we are generating cash flow at a level that can sustain or support an increase in AMID’s quarterly distribution rates. DCF is also a quantitative standard used throughout the investment community with respect to publicly traded partnerships and limited liability companies because the value of a unit of such an entity is generally determined by the unit’s yield (which in turn is based on the amount of cash distributions the entity pays to a unitholder). DCF will not reflect changes in working capital balances. We define DCF as Adjusted EBITDA, less interest expense, normalized maintenance capital expenditures, and distributions related to the Series A, Series C and Series E convertible preferred units. The GAAP financial measure most comparable to DCF is Net income (loss) attributable to AMID.