February 2018 Investor Presentation

Investor Presentation February 2018 Cautionary Statements 1 This presentation contains forward-looking statements and information. Forward-looking statements include, without limitation, financial projections and estimates and the underlying assumptions, any statement that may project, indicate or imply future results, events, performance or achievements, and may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result,” and similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would” and “could.” In addition, any statement concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible actions taken by us or our subsidiaries, are also forward-looking statements. These forward-looking statements involve external risks and uncertainties, including, but not limited to, those described in our and American Midstream Partners, LP’s (“AMID”) “Risk Factors” and other disclosures included in the Registration Statement of AMID on Form S-4 (file no. 333-222501), our respective Annual Reports on Form 10-K for the year ended December 31, 2016, Quarterly Reports on Form 10-Q for the quarter ended March 31, 2017, the quarter ended June 30, 2017, and the quarter ended September 30, 2017, and in our and AMID’s other current and periodic reports filed from time to time with the U.S. Securities and Exchange Commission (“SEC”). Forward-looking statements are based on current expectations and projections about future events and are inherently subject to a variety of risks and uncertainties, many of which are beyond the control of our management team. All forward-looking statements in this report and subsequent written and oral forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties include, among others: • the volatility of natural gas, crude oil and NGL prices and the price and demand of products derived from these commodities which has the potential for further deterioration and may result in a continued reduction in exploration, development and production of crude oil and natural gas; • competitive conditions in our industry and the extent and success of producers increasing production or replacing declining production and our success in obtaining new sources of supply; • industry conditions and supply of pipelines, processing and fractionation capacity relative to available natural gas from producers; • our dependence upon a relatively limited number of customers for a significant portion of our revenues; • actions taken or inactions or nonperformance by third parties, including suppliers, contractors, operators, processors, transporters and customers; • the financial condition and creditworthiness of our customers; • our ability to recover NGLs effectively at a rate equal to or greater than our contracted rates with customers; • our ability to produce and market NGLs at the anticipated differential to NGL index pricing; • our access to markets enabling us to match pricing indices for purchases and sales of natural gas and NGLs; • our ability to complete projects within budget and on schedule, including but not limited to, timely receipt of necessary government approvals and permits, our ability to control the costs of construction and other factors that may impact projects; • our ability to manage, over time, changing exposure to commodity price risk; • the effectiveness of our hedging activities or our decisions not to undertake hedging activities; • our access to financing and ability to remain in compliance with our financial covenants, and the potential for lack of access to debt and equity capital markets as a result of the depressed energy price environment; • our ability to generate sufficient operating cash flow to resume funding our quarterly distributions; • the effects of downtime associated with our assets or the assets of third parties interconnected with our systems; • operating hazards, fires, natural disasters, weather-related delays, casualty losses and other matters beyond our control; • the failure of our processing, fractionation and treating plants to perform as expected, including outages for unscheduled maintenance or repair; • the effects of laws and governmental regulations and policies; • the effects of existing and future litigation; • satisfaction of the conditions to the completion of the proposed merger with AMID (the “proposed Merger”), including receipt of the approval of our unitholders and the closing of the transactions contemplated by the Contribution Agreement among Southcross Holdings, LP, AMID and its general partner; • the timing and likelihood of completion of the proposed Merger, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals for the proposed Merger that could reduce anticipated benefits or cause the parties to abandon the proposed transaction; • the possibility that the expected synergies, benefits and value creation from the proposed Merger will not be realized or will not be realized within the expected time period; • the ability of AMID to successfully integrate Southcross Energy Partners, L.P.’s (“SXE”) operations and employees and realize anticipated synergies and cost savings; • the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies; • the risk that unexpected costs will be incurred in connection with the proposed Merger; • the impact on our financial condition and operations resulting from the financial condition and operations of our controlling unitholder, Southcross Holdings LP and its ability to pay amounts to us; • changes in general economic conditions; and • other financial, operational and legal risks and uncertainties detailed from time to time in our filings with the SEC. Developments in any of these areas could cause actual results to differ materially from those anticipated or projected, affect our ability to maintain distribution levels and/or access necessary financial markets or cause a significant reduction in the market price of our common units. The foregoing list of risks and uncertainties may not contain all of the risks and uncertainties that could affect us. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this presentation may not, in fact, occur. Accordingly, undue reliance should not be placed on these statements. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. Projections. This presentation contains financial projections, which are forward-looking statements, with respect to SXE’s 2018 Adjusted EBITDA. The financial projections do not give effect to the proposed merger or the other transactions contemplated by the merger agreement and were not prepared with a view toward public disclosure, nor were the financial projections prepared with a view toward compliance with GAAP, published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of prospective financial and operating information. In addition, the financial projections require significant estimates and assumptions that make the information included therein inherently less comparable to the similarly titled GAAP measures in SXE’s historical GAAP financial statements. This information is not fact and should not be relied upon as being necessarily indicative of future results; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong. Important factors that may affect actual result and cause the projection to no be achieved including those discussed above. The projections also reflect assumptions as to certain business decisions that are subject to change. As a result, actual results may differ materially from those contained in the estimates.

Investor Presentation February 2018 Benefits of AMID Combination Merger with AMID provides significant benefits to SXE unitholders ‒ Unitholders will have ownership in a combined entity with a strong balance sheet, capable of pursuing significantly larger growth opportunities, and participating in increased quality of diversification of the assets and operations of the combined entity SXE units will receive units that are more likely to offer cash distributions to its unitholders ‒ Public unitholders of SXE will receive 0.160 of an AMID common unit for each SXE common unit ‒ Most recent AMID distribution is $0.4125 per common unit per quarter or $1.65 per common unit on an annualized basis ‒ AMID’s fourth quarter 2017 distribution represents the twenty-sixth consecutive quarterly distribution since AMID’s initial public offering SXE unitholders to benefit from the combined companies’ increased scale in a high-growth basin ‒ Addition of Southcross assets allows AMID to expand onshore gathering, processing and transmission services, linking supplies from the Eagle Ford shale to high-demand growth markets along the Corpus Christi ship channel AMID’s conservative financial profile offers greater financial flexibility and opportunities for growth ‒ Strong equity support through ArcLight Capital Partners, LLC allows AMID to finance near-term growth opportunities ‒ AMID’s disciplined approach to expanding its business has resulted in the completion of over $1.8 billion of growth transactions at ~7x multiple since 2013 2 SXE unitholders have the opportunity to benefit from recovering energy markets with a stronger, more diversified company

Investor Presentation February 2018 Background and Context 3 Q3 2016 SXE Default Issues ‒ For the quarter ended September 30, 2016, SXE was not in compliance with the financial covenant in its revolving credit agreement requiring it to maintain a consolidated total leverage ratio of 5.0x to 1.0x Q4 2016 SXE Waiver and Fifth Amendment – December 29, 2016 ‒ Suspended the consolidated total leverage ratio until March 31, 2019 ‒ To obtain the waiver, a number of limitations were enacted, including: o Prohibition on any asset sales o Limits on capex spending o Sweeps of all excess cash o Periodic commitment step-downs ‒ Allowed SXE time for continued evaluation of strategic alternatives and recovery in commodity prices and Eagle Ford activity 2017 ‒ Management continued to evaluate potential financial and strategic opportunities to enhance unitholder value at both Southcross Holdings, LP (“Holdings”) and SXE and to restructure SXE’s balance sheet ‒ Holdings GP Board and SXE GP Board recognized that SXE’s access to additional credit was limited and the Sponsors were not willing to provide additional financial support to SXE

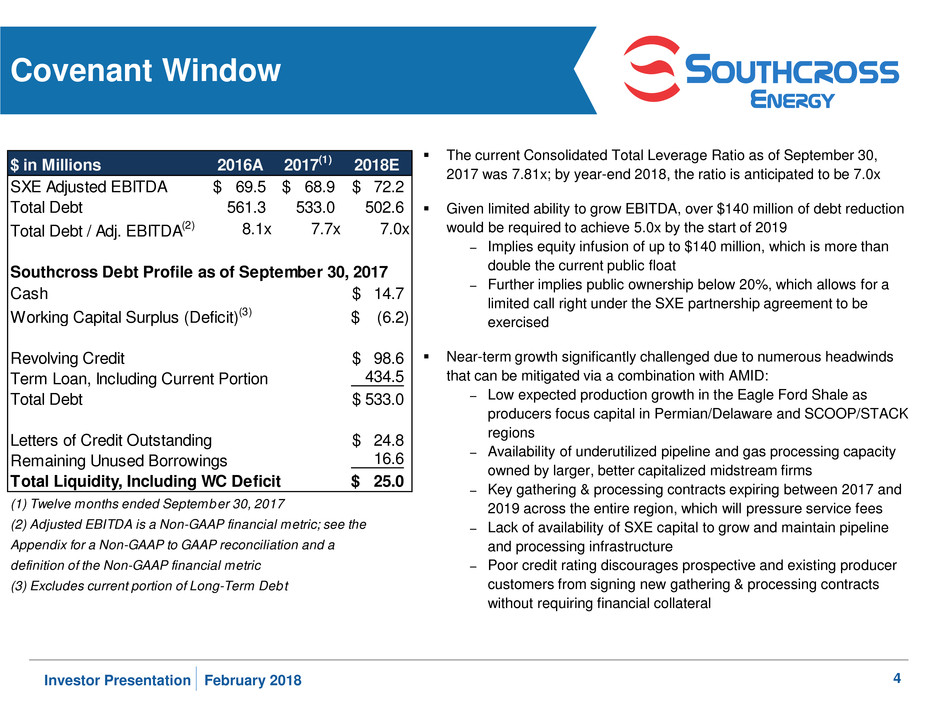

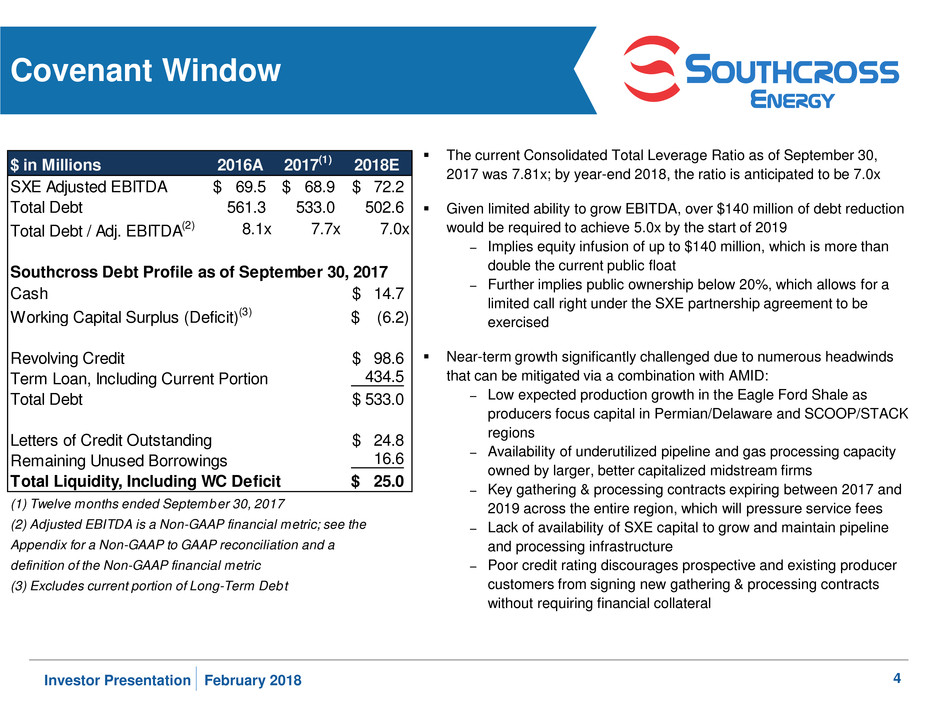

Investor Presentation February 2018 Covenant Window The current Consolidated Total Leverage Ratio as of September 30, 2017 was 7.81x; by year-end 2018, the ratio is anticipated to be 7.0x Given limited ability to grow EBITDA, over $140 million of debt reduction would be required to achieve 5.0x by the start of 2019 ‒ Implies equity infusion of up to $140 million, which is more than double the current public float ‒ Further implies public ownership below 20%, which allows for a limited call right under the SXE partnership agreement to be exercised Near-term growth significantly challenged due to numerous headwinds that can be mitigated via a combination with AMID: ‒ Low expected production growth in the Eagle Ford Shale as producers focus capital in Permian/Delaware and SCOOP/STACK regions ‒ Availability of underutilized pipeline and gas processing capacity owned by larger, better capitalized midstream firms ‒ Key gathering & processing contracts expiring between 2017 and 2019 across the entire region, which will pressure service fees ‒ Lack of availability of SXE capital to grow and maintain pipeline and processing infrastructure ‒ Poor credit rating discourages prospective and existing producer customers from signing new gathering & processing contracts without requiring financial collateral 4 $ in Millions 2016A 2017(1) 2018E SXE Adjusted EBITDA 69.5$ 68.9$ 72.2$ Total Debt 561.3 533.0 502.6 Total Debt / Adj. EBITDA(2) 8.1x 7.7x 7.0x Southcross Debt Profile as of September 30, 2017 Cash 14.7$ Working Capital Surplus (Deficit)(3) (6.2)$ Revolving Credit 98.6$ Term Loan, Including Current Portion 434.5 Total Debt 533.0$ Letters of Credit Outstanding 24.8$ Remaining Unused Borrowings 16.6 Total Liquidity, Including WC Deficit 25.0$ (1) Twelve months ended September 30, 2017 (2) Adjusted EBITDA is a Non-GAAP financial metric; see the Appendix for a Non-GAAP to GAAP reconciliation and a definition of the Non-GAAP financial metric (3) Excludes current portion of Long-Term Debt

Investor Presentation February 2018 Going Concern Assessment Management’s assessment of SXE’s ability to continue as a Going Concern ‒ It is improbable that SXE could comply with its financial covenants as a stand-alone entity ‒ This would lead to an event of default under SXE’s revolving credit agreement and term loan that would trigger a cross default under Holdings’ credit facilities ‒ Management believes an audit opinion without a going concern qualification could not be obtained after April 1, 2018, with such an event of default ‒ As a result, management believes the window to either obtain $140 million of equity or seek financial protection could close as early as the second quarter of 2018 Result for SXE ‒ These events of default, if not cured, would also allow the lenders under each of these borrowing arrangements to accelerate the maturity of the debt, making it due and payable immediately ‒ Asset values are insufficient to cover the debt level, yielding zero remaining equity value 5

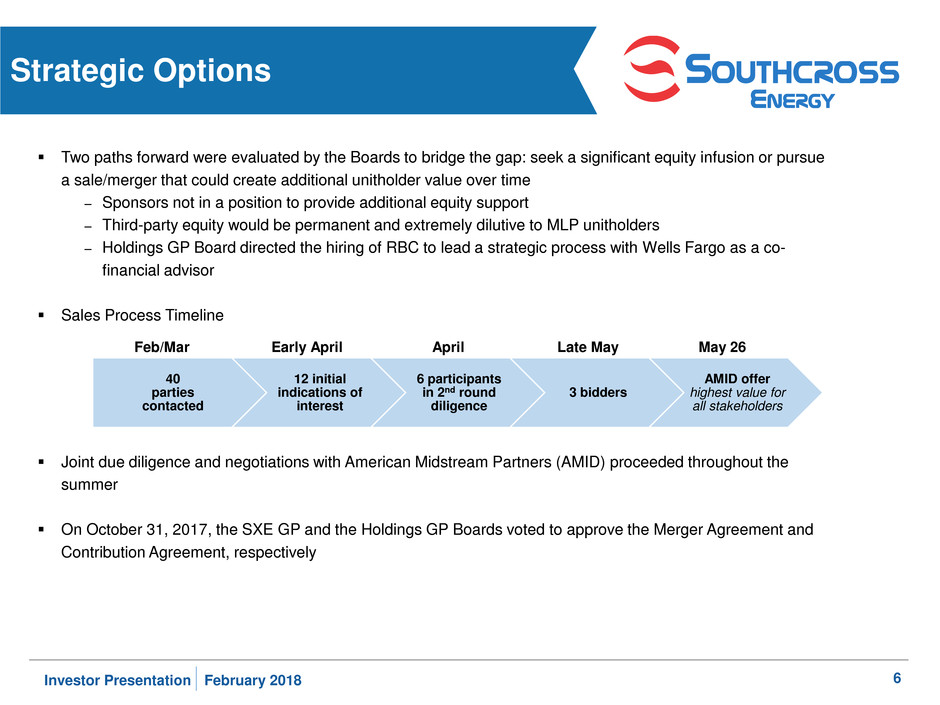

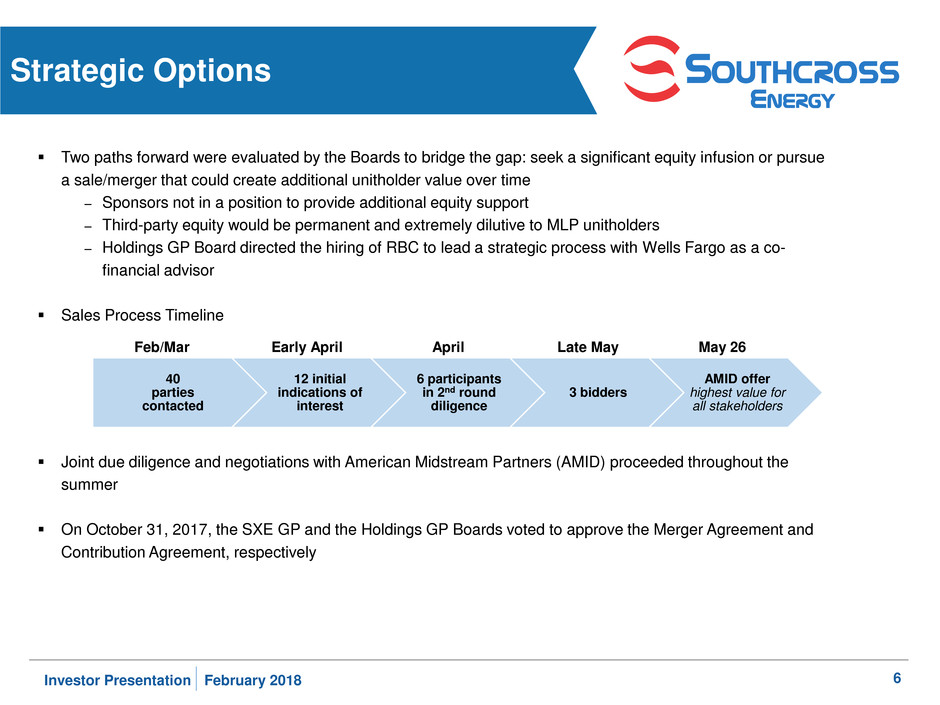

Investor Presentation February 2018 Strategic Options Two paths forward were evaluated by the Boards to bridge the gap: seek a significant equity infusion or pursue a sale/merger that could create additional unitholder value over time ‒ Sponsors not in a position to provide additional equity support ‒ Third-party equity would be permanent and extremely dilutive to MLP unitholders ‒ Holdings GP Board directed the hiring of RBC to lead a strategic process with Wells Fargo as a co- financial advisor Sales Process Timeline Joint due diligence and negotiations with American Midstream Partners (AMID) proceeded throughout the summer On October 31, 2017, the SXE GP and the Holdings GP Boards voted to approve the Merger Agreement and Contribution Agreement, respectively 6 40 parties contacted 12 initial indications of interest 6 participants in 2nd round diligence 3 bidders AMID offer highest value for all stakeholders Feb/Mar Early April April Late May May 26

Investor Presentation February 2018 Offer Highlights 7 SXE Offer Highlights Offer to publicly-owned common unitholders represents ~11% premium to January 26, 2018 closing SXE unit price; implied SXE value is currently ~$2.42/unit Common, Subordinated, and Class B Convertible units owned by Holdings will be cancelled as part of the transaction – and will receive no equivalent AMID units Pro forma ownership will represent ~5% of all outstanding AMID common units Valuation Comparison Final AMID offer for SXE units assumed a 0% premium to 20-trading-day VWAP; after negotiations with the SXE GP Conflicts Committee, Holdings agreed to an adjusted allocation of consideration to provide a 5% premium to SXE unitholders Holdings also agreed to indemnify AMID for current and future legal obligations relating to SXE ‒ Holdings consideration cannot be distributed until certain litigation is resolved Holdings’ consideration is further subject to lock up provisions of 12-24 months Cash distributions made to Holdings by AMID or AMID GP are subject to recapture by AMID Holdings will receive restricted securities and no cash at the closing of the transaction

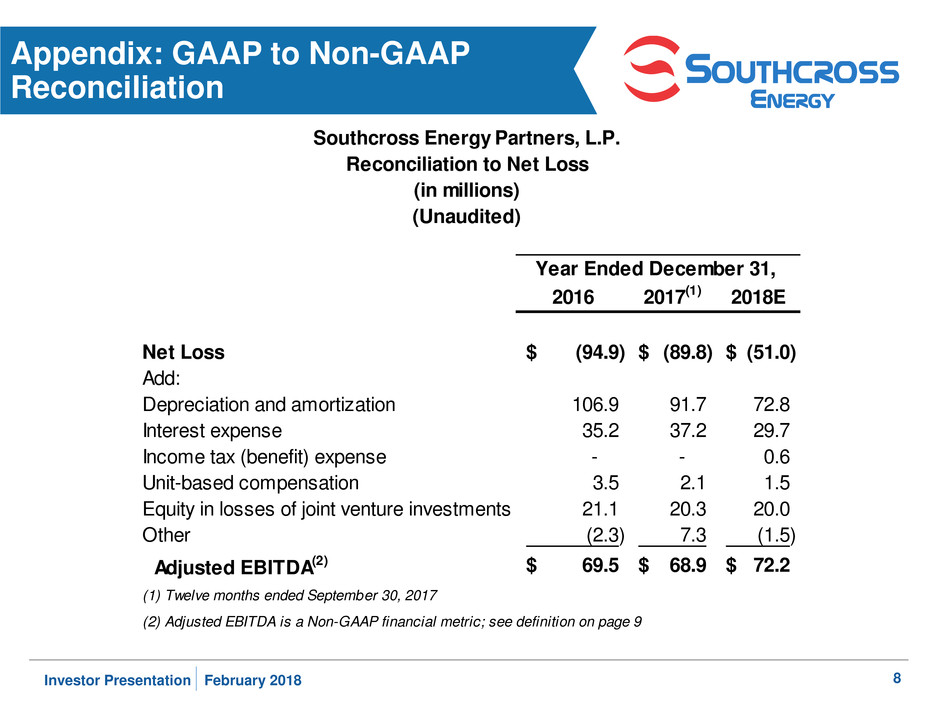

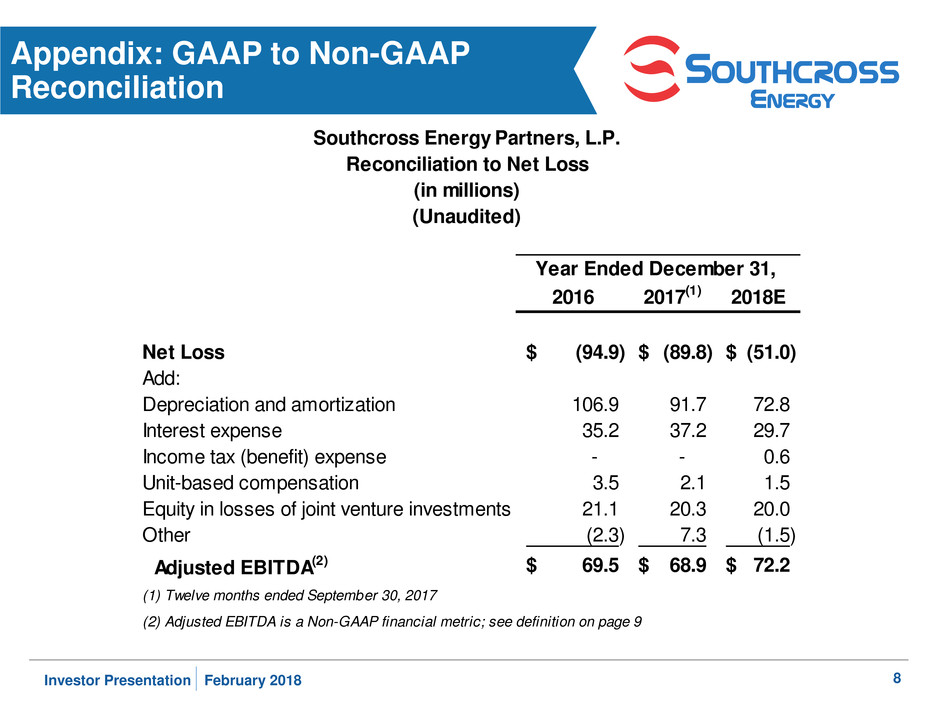

Investor Presentation February 2018 Appendix: GAAP to Non-GAAP Reconciliation 8 2016 2017(1) 2018E Net Loss (94.9)$ (89.8)$ (51.0)$ Add: Depreciation and amortization 106.9 91.7 72.8 Interest expense 35.2 37.2 29.7 Income tax (benefit) expense - - 0.6 Unit-based compensation 3.5 2.1 1.5 Equity in losses of joint venture investments 21.1 20.3 20.0 Other (2.3) 7.3 (1.5) Adjusted EBITDA(2) 69.5$ 68.9$ 72.2$ (1) Twelve months ended September 30, 2017 (2) Adjusted EBITDA is a Non-GAAP financial metric; see definition on page 9 Southcross Energy Partners, L.P. Reconciliation to Net Loss (in millions) (Unaudited) Year Ended December 31,

Investor Presentation February 2018 Appendix 9 Additional Information and Where to Find It This communication relates to a proposed business combination between SXE and AMID. In connection with the proposed transaction, SXE and/or AMID expects to file a proxy statement/prospectus and other documents with the SEC. In connection with the merger, AMID filed a registration statement on Form S-4 (file no.333-22501), including a proxy statement/prospectus of SXE and AMID, with the SEC. The registration statement has not yet become effective. After the registration statement is declared effective by the SEC, SXE and/or AMID will file with the SEC a definitive proxy statement/prospectus, and other documents with respect to the proposed transaction and a definitive proxy statement/prospectus will be mailed to unitholders of SXE. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement/prospectus (if and when available) will be mailed to unitholders of SXE. Investors and security holders will be able to obtain these materials (if and when they are available) free of charge at the SEC’s website, www.sec.gov. In addition, copies of any documents filed with the SEC may be obtained free of charge from SXE’s investor relations website for investors at http://investors.southcrossenergy.com, and from AMID’s investor relations website at http://www.americanmidstream.com/investorrelations. Investors and security holders may also read and copy any reports, statements and other information filed by AMID and SXE with the SEC at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the Solicitation AMID and SXE and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding SXE’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 9, 2017. Information regarding AMID’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 28, 2017. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Use of Non-GAAP Financial Measures We report our financial results in accordance with accounting principles generally accepted in the United States, or GAAP. We also present the non-GAAP financial measure of Adjusted EBITDA. We define Adjusted EBITDA as net income/loss, plus interest expense, income tax expense, depreciation and amortization expense, equity in losses of joint venture investments, certain non-cash charges (such as non-cash unit- based compensation, impairments, loss on extinguishment of debt and unrealized losses on derivative contracts), major litigation costs net of recoveries, transaction-related costs, revenue deferral adjustment, loss on sale of assets, severance expense and selected charges that are unusual or non-recurring; less interest income, income tax benefit, unrealized gains on derivative contracts, equity in earnings of joint venture investments, gain on sale of assets and selected gains that are unusual or non-recurring. Adjusted EBITDA should not be considered an alternative to net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. Adjusted EBITDA is a key metric used in measuring our compliance with our financial covenants under our debt agreements and is used as a supplemental measure by our management and by external users of our financial statements, such as investors, commercial banks, research analysts and others, to assess the ability of our assets to generate cash sufficient to support our indebtedness and make future cash distributions; operating performance and return on capital as compared to those of other companies in the midstream energy sector, without regard to financing or capital structure; and the attractiveness of capital projects and acquisitions and the overall rates of return on investment opportunities. Adjusted EBITDA is not a financial measure presented in accordance with GAAP. We believe that the presentation of this non-GAAP financial measure provides useful information to investors in assessing our financial condition, results of operations and cash flows from operations. Reconciliations of Adjusted EBITDA to their most directly comparable GAAP measure are included in this presentation. Net income is the GAAP measure most directly comparable to Adjusted EBITDA. Our non-GAAP financial measure should not be considered as an alternative to the most directly comparable GAAP financial measure. The non-GAAP financial measure has important limitations as an analytical tool because it excludes some but not all items that affect the most directly comparable GAAP financial measure. You should not consider Adjusted EBITDA in isolation or as a substitute for analysis of our results as reported under GAAP. Because Adjusted EBITDA may be defined differently by other companies in our industry, our definitions of this non-GAAP financial measure may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.