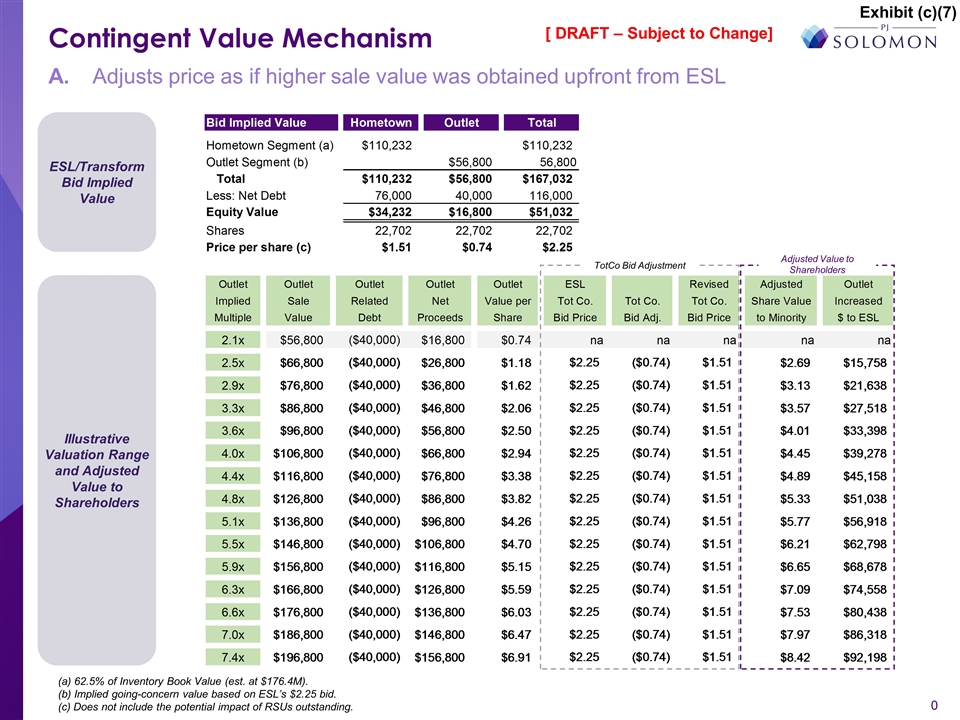

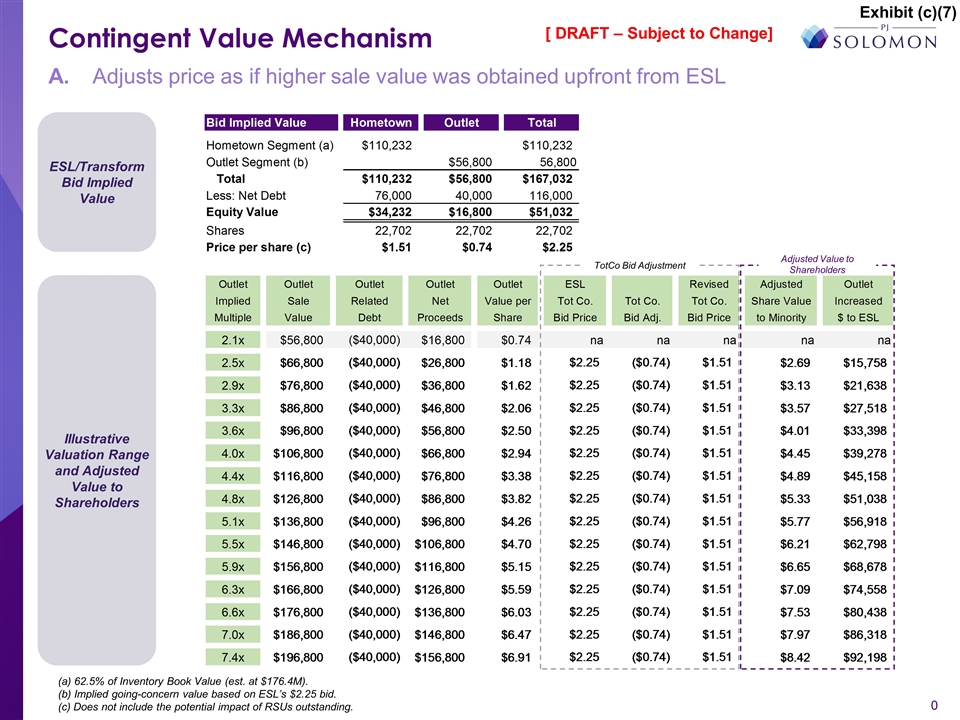

A. Adjusts price as if higher sale value was obtained upfront from ESL (a) 62.5% of Inventory Book Value (est. at $176.4M). (b) Implied going-concern value based on ESL’s $2.25 bid. (c) Does not include the potential impact of RSUs outstanding. Contingent Value Mechanism [ DRAFT – Subject to Change] ESL/Transform Bid Implied Value Illustrative Valuation Range and Adjusted Value to Shareholders TotCo Bid Adjustment Adjusted Value to Shareholders Exhibit (c)(7)

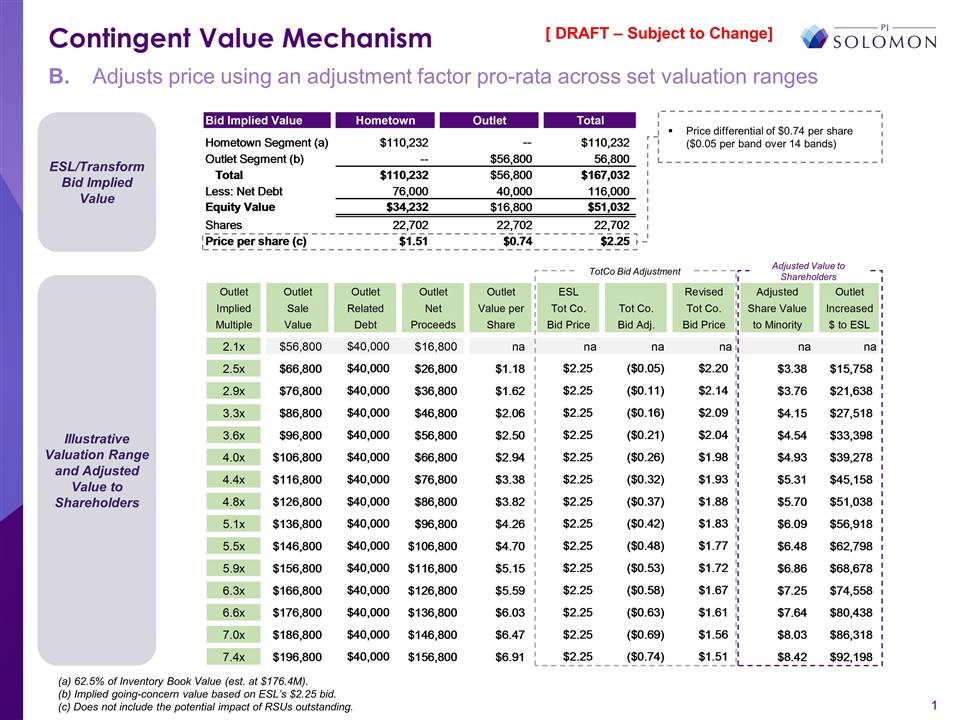

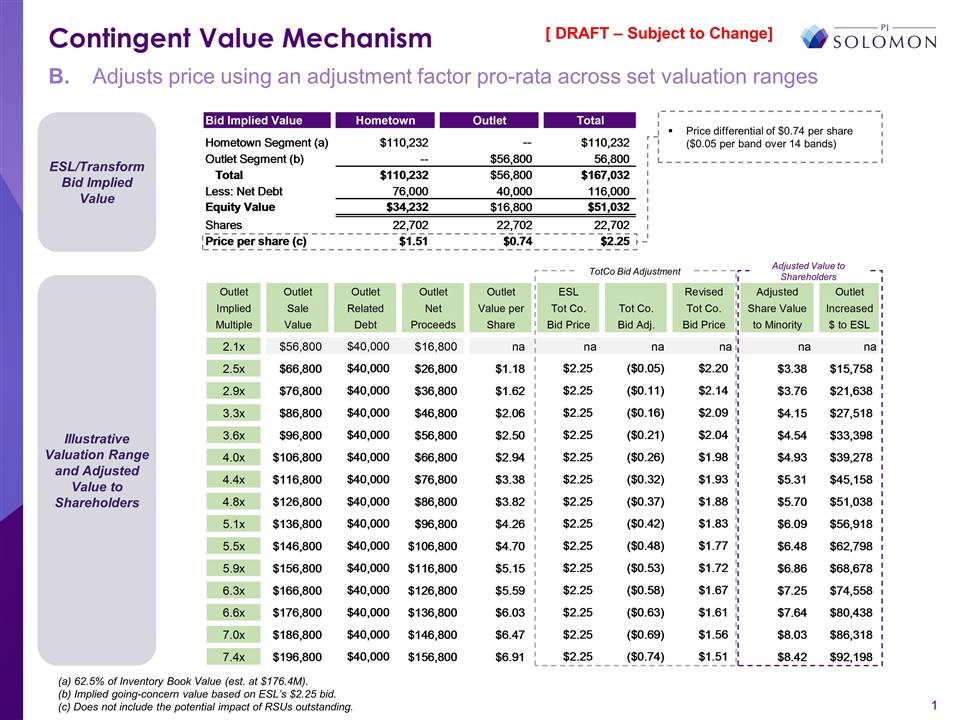

B. Adjusts price using an adjustment factor pro-rata across set valuation ranges (a) 62.5% of Inventory Book Value (est. at $176.4M). (b) Implied going-concern value based on ESL’s $2.25 bid. (c) Does not include the potential impact of RSUs outstanding. Contingent Value Mechanism [ DRAFT – Subject to Change] TotCo Bid Adjustment Adjusted Value to Shareholders ESL/Transform Bid Implied Value Illustrative Valuation Range and Adjusted Value to Shareholders Price differential of $0.74 per share ($0.05 per band over 14 bands)