UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Brown Advisory Funds

Brown Advisory Emerging Markets Select Fund

(formerly the Brown Advisory-Somerset Emerging Markets Fund)

901 South Bond Street, Suite 400

Baltimore, Maryland 21231

March 8 , 2019

Dear Shareholder:

Please find enclosed proxy information for a Special Meeting of Shareholders of the Brown Advisory Emerging Markets Select Fund (the “Fund”), a separate investment series of the Brown Advisory Funds (the “Trust”) to be held on April 29, 2019 at 11:00 A.M. Eastern Time at the offices of the Trust located at 901 South Bond Street, Suite 400, Baltimore, Maryland 21231 (the “Meeting”). The purpose of the Meeting is to ask shareholders of the Fund to consider each of the following proposals:

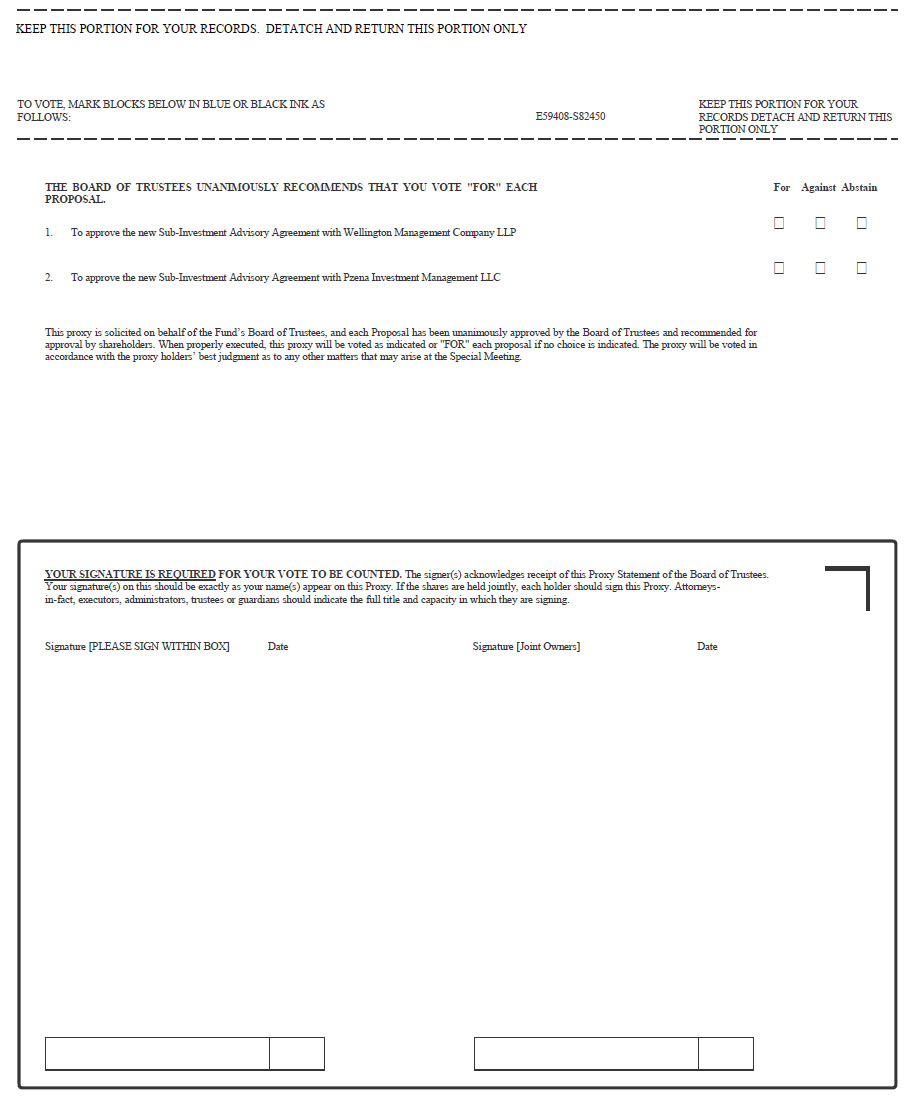

Proposal No. 1: Approval of a new Sub-Investment Advisory Agreement between Brown Advisory LLC and Wellington Management Company LLP on behalf of the Fund;

Proposal No. 2: Approval of a new Sub-Investment Advisory Agreement between Brown Advisory LLC and Pzena Investment Management LLC on behalf of the Fund; and

Approval of such other matters as may properly come before the Meeting and any adjournment or postponement thereof.

Your vote is important. Please review this proxy statement and sign and return the proxy card you have received today. You may also vote by telephone or via the Internet as explained in the enclosed proxy materials. As the Meeting date approaches and we have still not received your executed ballot, you may receive a call from a representative of the Fund reminding you to vote your shares.

Thank you for your prompt attention to the enclosed proxy materials.

| Sincerely,

Edward J . Paz Secretary Brown Advisory Funds |

Brown Advisory Funds

Brown Advisory Emerging Markets Select Fund

(formerly the Brown Advisory-Somerset Emerging Markets Fund)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of the Fund:

Notice is hereby given that a Special Meeting of Shareholders of the Brown Advisory Emerging Markets Select Fund (the “Fund”), a separate investment series of Brown Advisory Funds (the “Trust”) will be held on April 29, 2019, at 11:00 A.M. Eastern Time at the offices of the Trust located at 901 South Bond Street, Suite 400, Baltimore, Maryland 21231 (the “Meeting”), for the purpose of considering and acting on the following matters:

| 1. | To approve a new Sub-Investment Advisory Agreement between Brown Advisory LLC and Wellington Management Company LLP on behalf of the Fund; |

| 2. | To approve a new Sub-Investment Advisory Agreement between Brown Advisory LLC and Pzena Investment Management LLC on behalf of the Fund; and |

To consider and act upon any matters incidental to the foregoing and to transact such other business as may properly come before the Meeting and any adjournment or postponement thereof.

After careful consideration, the Board of Trustees of the Trust, including all of the “Independent Trustees”, unanimously approved Proposals 1 and 2 listed above and have recommended that shareholders vote “FOR” each of Proposals 1 and 2. The matters referred to above are discussed in detail in the Proxy Statement attached to this Notice. The Board of Trustees has fixed the close of business on February 28, 2019 as the record date for determining shareholders entitled to notice of and to vote at the Meeting. Each share of the Fund is entitled to one vote with respect to each proposal, with fractional votes for fractional shares.

Regardless of whether you plan to attend the Meeting, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED SO THAT YOU WILL BE REPRESENTED AT THE MEETING, OR YOU MAY ALSO VOTE BY TELEPHONE OR ON THE INTERNET AS DESCRIBED BELOW. If you have submitted a proxy card and are present at the Meeting, you may change the vote specified in the proxy at that time. However, attendance in person at the Meeting, by itself, will not revoke a previously tendered proxy.

| By Order of the Board of Trustees of Brown Advisory Funds

Edward J . Paz Secretary |

March 8 , 2019

YOUR VOTE IS IMPORTANT

In order to avoid the additional expense of a second solicitation, we urge you to complete, sign and return promptly the enclosed Proxy Card. The enclosed addressed envelope requires no postage and is intended for your convenience.

In addition to voting by mail you may also vote by either telephone or via the Internet, as follows:

| To vote by Telephone: | To vote by Internet: |

1.

| Read the Proxy Statement and have your Proxy Card at hand. | 1.

| Read the Proxy Statement and have your Proxy Card at hand. |

2.

| Call the 1-800 number that appears on your Proxy Card. | 2.

| Go to the website printed on your Proxy Card.

|

3.

| Enter the control number set forth on the Proxy Card and follow the simple instructions. | 3.

| Enter the control number set forth on the Proxy Card and follow the simple instructions. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS’ MEETING TO BE HELD ON APRIL 29, 2019

This Proxy Statement and the Proxy Card, along with the Fund’s Annual Report for the fiscal year ended June 30, 2018 and the Fund’s Semi-Annual Report for the fiscal period ended December 31, 2018 are available free of charge on the Fund’s website at https://www.brownadvisory.com/mf.

Brown Advisory Funds

Brown Advisory Emerging Markets Select Fund

(formerly the Brown Advisory-Somerset Emerging Markets Fund)

901 South Bond Street, Suite 400

Baltimore, Maryland 21231

PROXY STATEMENT

FOR A SPECIAL MEETING OF SHAREHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of the Brown Advisory Funds, a Delaware statutory trust (the “Trust”), on behalf of the Brown Advisory Emerging Markets Select Fund (formerly the Brown Advisory–Somerset Emerging Markets Fund) (the “Fund”), to be used in connection with a Special Meeting of Shareholders of the Fund to be held on April 29, 2019 (the “Meeting”). All persons who are shareholders of the Fund as of the close of business on February 28, 2019 (the “Record Date”) will be entitled to notice of and to vote at the Meeting. The Fund knows of no other business to be voted upon at the Meeting other than the proposals set forth in the accompanying Notice of Special Meeting of Shareholders and described in this Proxy Statement.

The mailing address of the principal executive offices of the Fund is 901 South Bond Street, Suite 400, Baltimore, Maryland 21231. The approximate date on which this Proxy Statement and form of proxy are first being sent to shareholders of the Fund is March 12 , 2019.

Only shareholders of record of the Fund at the close of business on the Record Date will be entitled to notice of and to vote at the Meeting. Shares represented by proxies, unless previously revoked, will be voted at the Meeting in accordance with the instructions of the shareholders. If no instructions are given, the proxies will be voted in favor of each of the proposals. To revoke a proxy, the shareholder giving such proxy must either submit to the Fund a subsequently dated proxy, deliver to the Fund a written notice of revocation or otherwise give notice of revocation in open meeting, in all cases prior to the exercise of the authority granted in the proxy.

The presence in person or by proxy of the holders of record of one-third of the outstanding shares of the Fund shall constitute a quorum at the Meeting, permitting action to be taken. In the event that sufficient votes are not received by the date of the Meeting, a person named as proxy may propose one or more adjournments of the Meeting for a reasonable period or periods to permit further solicitation of proxies. The persons named as proxies will vote in favor of such adjournment those proxies that they are entitled to vote in favor of the proposals and will vote against any such adjournment those proxies required to be voted against the proposals.

The Fund will furnish, without charge, a copy of the Fund’s most recent Annual and Semi-Annual Reports to shareholders upon request, which may be made either by writing to the Fund at the address above or by calling toll-free 1-800-540-6807 . The Annual and Semi-Annual Reports will be mailed to you by first-class mail within three business days of your request.

_____________________

INTRODUCTION TO THE PROPOSALS

Brown Advisory LLC, the investment adviser to the Fund (the “Adviser”), recently notified the Board of Trustees of the Fund of its recommendation to replace Somerset Capital Management LLP (“Somerset”), the former sub-adviser to the Fund, and terminate the Sub-Investment Advisory Agreement between Brown Advisory and Somerset (the “Prior Sub-Advisory Agreement”). In connection with this action, at a meeting of the Board held on February 20, 2019, the Board, at the recommendation of the Adviser, took action to remove Somerset and approved the appointment of Wellington Management Company LLP (“Wellington”) and Pzena Investment Management LLC (“Pzena” and collectively with Wellington, the “New Sub-Advisers”) to serve as sub-advisers to the Fund both on an interim basis and a longer-term basis (pending the shareholder approval being requested herein).

The Adviser recommended that the Board approve these changes to the Fund’s sub-advisory arrangements in light of various factors, including a review of the performance results obtained by Somerset for the Fund, the experience and capabilities of Wellington and Pzena in managing emerging markets investments, and the Adviser’s opinion that the appointment of Wellington and Pzena to manage the Fund’s investments is in the best interests of the Fund and its shareholders. Effective with Wellington’s and Pzena’s assumption of the sub-advisory responsibilities, the Fund’s name was changed to the Brown Advisory Emerging Markets Select Fund.

As described further below, for the New Sub-Advisers to provide their services on a longer-term basis, shareholders of the Fund are required to approve Proposal 1 and Proposal 2. If either Proposal 1 or Proposal 2 is not approved by the shareholders of the Fund, then the Board of Trustees of the Fund will need to consider what steps to take with respect to the ongoing management of the Fund. The Proposals are described more fully below.

_____________________

PROPOSAL 1 — TO APPROVE A NEW SUB-INVESTMENT ADVISORY

AGREEMENT BETWEEN BROWN ADVISORY LLC AND WELLINGTON MANAGEMENT COMPANY LLP ON BEHALF OF THE FUND

PROPOSAL 2 — TO APPROVE A NEW SUB-INVESTMENT ADVISORY

AGREEMENT BETWEEN BROWN ADVISORY LLC AND PZENA INVESTMENT MANAGEMENT COMPANY LLC ON BEHALF OF THE FUND

You are being asked to approve: (i) a new sub-investment advisory agreement between Wellington and the Adviser (the “Wellington Sub-Advisory Agreement”) on behalf of the Fund; and (ii) a new sub-investment advisory agreement between Pzena and the Adviser (the “Pzena Sub-Advisory Agreement” and, together with the Wellington Sub-Advisory Agreement, the “New Sub-Advisory Agreements”) on behalf of the Fund. Additional information about Wellington and Pzena is found below under the heading “Additional Information about the Fund’s Proposed Sub-Advisers”.

Why are shareholders of the Funds being asked to approve the New Sub-Advisory Agreements?

In order for continuous sub-advisory services to be provided to the Fund after the termination of the Prior Sub-Advisory Agreement, the Board, in accordance with Rule 15a-4 under the Investment Company Act of 1940, as amended (the “1940 Act”), approved interim sub-investment advisory agreements between the Adviser and Wellington and between the Adviser and Pzena (collectively, the “Interim Sub-Advisory Agreements”), on behalf of the Fund. Pursuant to the terms of the Interim Sub-Advisory Agreements, Wellington and Pzena currently serve as the Fund’s sub-advisers and are responsible for the day-to-day management of their allocated portions of the Fund’s portfolio. The Interim Sub-Advisory Agreements will remain in effect until the earlier of: (1) the expiration of a 150 day period from the date the Prior Sub-Advisory Agreement was deemed terminated and the Interim Sub-Advisory Agreements took effect (that is, February 22, 2019); or (2) until such time as shareholders of the Fund approve the New Sub-Advisory Agreements.

At the meeting held on February 20, 2019, the Board approved the New Sub-Advisory Agreements on behalf of the Fund and determined that each such Agreement would be submitted to the Fund’s shareholders for their approval in accordance with Section 15 of the 1940 Act, which requires that any investment advisory agreement be in writing and be approved initially by both: (1) the fund’s board of trustees (including a majority of those trustees who are not considered to be “interested persons” of the fund or a party to the agreement, as that term is defined in the 1940 Act) (the “Independent Trustees”) and (2) the fund’s shareholders. Accordingly, in order for Wellington and Pzena to continue to act as Sub-Advisers to the Fund after the expiration of the Interim Sub-Advisory Agreements, the New Sub-Advisory Agreements must be approved by shareholders of the Fund.

How would the proposals affect shareholders of the Fund?

The change in sub-advisers is not expected to have any material effect on shareholders of the Fund. In particular, the terms of the New Sub-Advisory Agreements are substantially similar to the terms of the Prior Sub-Advisory Agreement, with certain exceptions as further discussed below. Further, there are no changes contemplated to be made to the Fund’s investment objective or principal investment strategies. Lastly, no changes are expected with respect to the level of services that the New Sub-Advisers are expected to provide to the Fund nor to the fees payable by each Fund for those services since the Adviser is responsible for the payment of the sub-advisory fees.

Who will be responsible for the management of the Fund’s portfolio?

If the New Sub-Advisory Agreements are approved, the portfolio management personnel of the Adviser and the New Sub-Advisers who will be primarily responsible for allocation decisions with respect to the Fund’s portfolio and the day-to-day management of their allocated portions of the Fund’s portfolio, respectively, will be:

| Investment Adviser or Sub-Adviser | Portfolio Managers |

| Brown Advisory LLC | Christopher Bartlett |

| Wellington Management Company LLP | Niraj Bhagwat, CA |

| Pzena Investment Management Company LLC | Rakesh Bordia Caroline Cai, CFA Allison Fisch John Goetz |

What are the terms of the New Sub-Advisory Agreements?

The forms of the New Sub-Advisory Agreements are attached as Exhibits A and B to this Proxy Statement. The description in this section of the terms of the New Sub-Advisory Agreements is qualified in its entirety by reference to those Exhibits. There are no material differences between the terms of the Interim Sub-Advisory Agreements and the terms of the New Sub-Advisory Agreements, except that the Interim Sub-Advisory Agreements terminate upon the earlier of: (1) the expiration of a 150 day period from the date the Prior Sub-Advisory Agreement was deemed terminated and the Interim Sub-Advisory Agreements took effect (that is, February 22, 2019); or (2) until such time as shareholders of the Fund approve the New Sub-Advisory Agreements.

The terms of the New Sub-Advisory Agreements approved by the Board and proposed for shareholder approval are substantially similar in all material respects to the Prior Sub-Advisory Agreement. Wellington and Pzena will serve as sub-advisers to the Fund and will retain responsibility for the day-to-day management of their allocated portions of the Fund’s portfolio. These investment management services are substantially similar to the services that were provided under the Prior Sub-Advisory Agreement.

Under the New Sub-Advisory Agreements, Wellington and Pzena will, subject to the general supervision of the Adviser and the Trustees of the Trust, provide an investment program of continuous investment management of their allocated portions of the Fund (the “Segment”), at the request of the Adviser, in accordance with the Fund’s stated investment objectives, policies and limitations as stated in the Fund’s Prospectus and Statement of Additional Information. The investment program will include investment research and management with respect to securities and investments, including cash and cash equivalents in the Segment. In performing its investment management services to the Fund, Wellington and Pzena will each determine from time to time what securities and other investments will be purchased, retained or sold by and within the Segment. Wellington and Pzena will each place orders pursuant to its respective investment determinations for the Fund directly with the issuer, or with any broker or dealer, in accordance with applicable policies expressed in the Fund’s Prospectus and/or Statement of Additional Information and in accordance with applicable legal requirements and will maintain all necessary or appropriate records with respect to the Fund’s securities transactions.

The Prior Sub-Advisory Agreement had an initial term of two years and could be renewed annually thereafter by the approval of a majority of the Trustees, including a majority of the Independent Trustees. The New Sub-Advisory Agreements will run for an initial term of two years and may be renewed annually thereafter so long as they are approved by a majority of the Trustees, including a majority of the Independent Trustees. The New Sub-Advisory Agreements are terminable as to the Fund at any time without penalty by the Board in its sole discretion, by vote of a majority of the outstanding shares of the Fund, or by the Adviser. Each New Sub-Advisory Agreement also contains a provision that it will terminate automatically in the event of any “assignment”, as defined in the 1940 Act.

The shareholders of the Fund last approved the Prior Sub-Advisory Agreement with respect to the Fund on December 3, 2012.

What are the respective sub-advisory fee rates to be charged by Wellington and Pzena and is there any change to the total management fees paid by the Fund?

Under the Prior Sub-Advisory Agreement and the New Sub-Advisory Agreements, the Adviser is responsible for paying the investment sub-advisory fees owed to a Sub-Adviser out of the investment advisory fee the Fund pays to the Adviser. The Adviser’s fee for its management of the Fund is an annual rate of 0.90% of the Fund’s average daily net assets, and this amount payable by the Fund to the Adviser will not change. Under the Prior Sub-Advisory Agreement, the Adviser paid Somerset a sub-advisory fee equal to an annual rate of 0.45% of the Fund’s average daily net assets. Under the New Sub-Advisory Agreements, the Adviser pays Wellington a sub-advisory fee equal to an annual rate of 0.55% of the Fund’s average daily net assets and the Adviser pays Pzena a sub-advisory fee equal to an annual rate of 0.58% of the Fund’s average daily net assets.

The Adviser received advisory fees of $5,903,179 from the Fund for the fiscal year ended June 30, 2018. The aggregate compensation paid by the Adviser to Somerset during the last fiscal year ended June 30, 2018 was $2,951,446, representing 0.45% of the Fund’s average net assets during that period. The aggregate compensation that would have been paid by the Adviser to the New Sub-Advisers during the fiscal year ended June 30, 2018, taking into account the new sub-advisory arrangement, is $3,705,884, representing 0.565% of the Fund’s average net assets during that period. The Fund did not make any payments to any affiliated persons of Wellington or Pzena during the fiscal year ended June 30, 2018.

What if Fund shareholders do not approve one or both of the New Sub-Advisory Agreements?

Should the Fund’s shareholders not approve one or both of the New Sub-Advisory Agreements with respect to the Fund prior to the expiration of the 150 day term of the Interim Sub-Advisory Agreements, the Board will consider what other action is necessary, appropriate and in the best interests of the Fund and its shareholders under the circumstances, which may include approving an extension of one or both of the Interim Sub-Advisory Agreements in accordance with applicable law, including Rule 15a-4 under the 1940 Act and related SEC staff guidance, pending a further shareholder vote on the New Sub-Advisory Agreement(s). Importantly, approval of either New Sub-Advisory Agreement by shareholders of the Fund is not contingent upon approval of the other New Sub-Advisory Agreement.

What did the Board consider when approving the New Sub-Advisory Agreements?

In accordance with relevant provisions of the 1940 Act, the Board of Trustees of the Fund was required to consider the initial approval of the New Sub-Advisory Agreement between the Adviser and Wellington, and the New Sub-Advisory Agreement between the Adviser and Pzena, on behalf of the Fund, and this action was required to take place at an in-person meeting of the Board. The relevant provisions of the 1940 Act specifically provide that it is the duty of the Board to request and evaluate such information as the Board determines is necessary to allow them to properly consider the initial approval of the New Sub-Advisory Agreements, and it is the duty of the Adviser, Wellington and Pzena to furnish the Trustees with such information that is responsive to their request. Accordingly, in determining whether to approve the adoption of the New Sub-Advisory Agreements, the Board of Trustees requested, and the Adviser, Wellington and Pzena provided, information and data relevant to the Board’s consideration. This included materials prepared for the Board that provided the Board with information regarding the investment performance of the Fund and information regarding the proposed fees and expenses of the Fund, compared to other similar mutual funds.

1. The Board of Trustees’ Considerations With Respect to the Approval of the Wellington Sub-Advisory Agreement

The Wellington Sub-Advisory Agreement was approved by the Board of Trustees at the meeting of the Board held on February 20, 2019. In determining whether to approve the Wellington Sub-Advisory Agreement, the Board of Trustees requested, and both the Adviser and Wellington each provided, information and data relevant to the Board’s consideration. This included materials prepared by both the Adviser and Wellington that provided the Board with information regarding the investment performance of Wellington’s separate accounts having similar investment objectives and strategies as the Fund, and information regarding the fees payable to Wellington by the Adviser.

At this meeting, representatives of Wellington reviewed for the members of the Board Wellington’s experience and background in managing emerging markets assets and they reviewed information regarding the investment advisory process followed by Wellington and the compliance program of Wellington. In addition, the members of the Board reviewed with the representatives from Wellington various matters with respect to the proposed sub-advisory services to be provided to the Fund by Wellington and the investment strategies that would be employed by the firm in managing its Segment of the Fund.

Following their review and consideration of these matters, the Trustees determined that the Wellington Sub-Advisory Agreement would enable shareholders of the Fund to obtain high quality services at a cost that is appropriate, reasonable, and in the best interests of the Fund and its shareholders. Accordingly, the Board, including a majority of the Independent Trustees, unanimously approved the Wellington Sub-Advisory Agreement. In reaching their decision, the Trustees requested and obtained from the Adviser and Wellington such information as they deemed reasonably necessary to evaluate the Wellington Sub-Advisory Agreement. In considering the approval of the Wellington Sub-Advisory Agreement, the Trustees evaluated a number of factors that they believed, in light of their reasonable business judgment, to be relevant. They based their decision on the following considerations, among others, although they did not identify any one specific consideration or any particular information that was controlling of their decision:

The Board considered various matters involving the respective services to be provided by each of Brown Advisory and Wellington in connection with the management and operation of the Fund and they took note of the extensive oversight duties to be performed by the Adviser including investment management and compliance oversight of the operations of Wellington.

The Board reviewed and evaluated the information that Brown Advisory and Wellington had presented for the Board’s review. The Board particularly noted, among other considerations, that the Fund’s proposed investment advisory fees and overall operating expenses were competitive with comparable mutual funds, and that Wellington has successfully managed other accounts with similar investment objectives and policies. The Board took note of the fact that Wellington has experience serving as investment adviser and sub-adviser to other mutual funds. Based on its review of all of the information, the Board determined that the Wellington Sub-Advisory Agreement was consistent with the best interests of the Fund and its shareholders and would enable the Fund to receive high quality sub-advisory services at a cost that is appropriate, reasonable, and in the best interests of the Fund and its shareholders. In reaching these conclusions, the Board considered the following:

The nature, extent and quality of the sub-investment advisory services to be provided. The Trustees concluded that Wellington is capable of providing high quality sub-advisory services to the Fund, as indicated by the nature and quality of services provided to its other managed accounts having a similar investment objective and strategy as the Fund, the professional qualifications and experience of the proposed portfolio managers of the Fund, and Wellington’s investment management processes. On the basis of the Trustees’ assessment of the nature, extent and quality of the sub-advisory services to be provided by Wellington, the Trustees concluded that Wellington is capable of generating a level of long-term investment performance that is appropriate in light of the Fund’s investment objectives, policies and strategies and competitive with many other comparable investment companies.

The cost of advisory services to be provided and the expected level of profitability. The Board took note of the fact that the sub-advisory fee had been separately negotiated by Brown Advisory and Wellington and was consistent with fee arrangements for sub-advisory services in connection with other sub-advised mutual funds. Accordingly, on the basis of the Board’s review of the fees to be charged by Wellington for the sub-investment advisory services to be provided to the Fund, the Board concluded that the level of sub-investment advisory fees are appropriate in light of the management fees, overall expense ratios and investment performance of comparable investment companies, and that the sub-advisory fee had been separately negotiated at arms-length by independent third parties.

The extent to which economies of scale may be realized as the Fund grows and whether the advisory fees reflect possible economies of scale. While it was noted that the Fund’s investment advisory fees will not decrease as the Fund’s assets grow because they will not be subject to investment advisory fee breakpoints, the Trustees concluded that the Fund’s investment advisory fees are appropriate in light of the projected size of the Fund, and appropriately reflect the current economic environment for Brown Advisory and Wellington and the competitive nature of the mutual fund market. The Trustees then noted that they will have the opportunity to periodically re-examine whether the Fund has achieved economies of scale, and the appropriateness of the investment advisory fees and sub-investment advisory fees with respect to the Fund, in the future at which time the implementation of fee breakpoints on the Fund could be further considered.

Benefits to Wellington from its relationship with the Fund (and any corresponding benefits to the Fund). The Trustees concluded that other benefits that may be derived by Wellington from its relationship with the Fund, including any potential “soft dollar” benefits in connection with the Fund’s brokerage transactions and use of the Fund’s performance track record in advertising materials, are reasonable and fair, and consistent with industry practice and the best interests of the Fund and its shareholders.

Other Considerations. In approving the Wellington Sub-Advisory Agreement, the Trustees determined that Wellington has made a substantial commitment to the recruitment and retention of high quality personnel, and maintains the financial, compliance and operational resources reasonably necessary to provide sub-advisory services to the Fund in a professional manner that is consistent with the best interests of the Fund and its shareholders. The Board also considered matters with respect to the brokerage practices of Wellington, including its soft dollar arrangements and its best-execution procedures, and noted that these were reasonable and consistent with standard industry practice.

It was noted that in making their determination, the Trustees had considered and relied upon the materials provided to them with respect to the proposed contract and the presentation of the representatives of Brown Advisory and Wellington at the Board meeting. In reaching their conclusion with respect to the approval of the Wellington Sub-Advisory Agreement and the level of fees to be paid under the Agreement, the Trustees did not identify any one single factor as being controlling, rather, the Trustees took note of a combination of factors that had influenced their decision making process. They noted the level and quality of investment advisory services provided by Wellington to its other investment advisory clients and they found that these services will benefit the Fund and its shareholders. They also considered the nature of the allocation of the duties and responsibilities for the management and operation of the Fund between Brown Advisory and Wellington and they determined that the sub-advisory fee, as negotiated by Brown Advisory and Wellington, reasonably reflected the nature and extent of the services to be provided by Wellington with respect to the Fund. The Board also took into consideration the fact that Wellington currently sub-advises another Fund in the Trust and that Wellington had, until recently, also sub-advised another Fund in the Trust, and the Board took note of the fact that Wellington has managed these other Funds in a highly capable manner.

2. The Board of Trustees’ Considerations With Respect to the Approval of the Pzena Sub-Advisory Agreement

The Pzena Sub-Advisory Agreement was also approved by the Board of Trustees at the meeting of the Board held on February 20, 2019. In determining whether to approve the Pzena Sub-Advisory Agreement, the Board of Trustees requested, and both the Adviser and Pzena each provided, information and data relevant to the Board’s consideration. This included materials prepared by both the Adviser and Pzena that provided the Board with information regarding the investment performance of Pzena’s separate accounts having similar investment objectives and strategies as the Fund, and information regarding the fees payable to Pzena by the Adviser.

At this meeting, representatives of Pzena reviewed for the members of the Board Pzena’s experience and background in managing emerging markets assets and they reviewed information regarding the investment advisory process followed by Pzena and the compliance program of Pzena. In addition, the members of the Board reviewed with the representatives from Pzena various matters with respect to the proposed sub-advisory services to be provided to the Fund by Pzena and the investment strategies that would be employed by the firm in managing its Segment of the Fund.

Following their review and consideration of these matters, the Trustees determined that the Pzena Sub-Advisory Agreement would enable shareholders of the Fund to obtain high quality services at a cost that is appropriate, reasonable, and in the best interests of the Fund and its shareholders. Accordingly, the Board, including a majority of the Independent Trustees, unanimously approved the Pzena Sub-Advisory Agreement. In reaching their decision, the Trustees requested and obtained from the Adviser and Pzena such information as they deemed reasonably necessary to evaluate the Pzena Sub-Advisory Agreement. In considering the approval of the Pzena Sub-Advisory Agreement, the Trustees evaluated a number of factors that they believed, in light of their reasonable business judgment, to be relevant. They based their decision on the following considerations, among others, although they did not identify any one specific consideration or any particular information that was controlling of their decision:

The Board considered various matters involving the respective services to be provided by each of Brown Advisory and Pzena in connection with the management and operation of the Fund and they took note of the extensive oversight duties to be performed by the Adviser including investment management and compliance oversight of the operations of Pzena.

The Board reviewed and evaluated the information that Brown Advisory and Pzena had presented for the Board’s review. The Board particularly noted, among other considerations, that the Fund’s proposed investment advisory fees and overall operating expenses were competitive with comparable mutual funds, and that Pzena has successfully managed other accounts with similar investment objectives and policies. The Board took note of the fact that Pzena has experience serving as investment adviser and sub-adviser to other mutual funds. Based on its review of all of the information, the Board determined that the Pzena Sub-Advisory Agreement was consistent with the best interests of the Fund and its shareholders and would enable the Fund to receive high quality sub-advisory services at a cost that is appropriate, reasonable, and in the best interests of the Fund and its shareholders. In reaching these conclusions, the Board considered the following:

The nature, extent and quality of the sub-investment advisory services to be provided. The Trustees concluded that Pzena is capable of providing high quality sub-advisory services to the Fund, as indicated by the nature and quality of services provided to its other managed accounts having a similar investment objective and strategy as the Fund, the professional qualifications and experience of the proposed portfolio managers of the Fund, and Pzena’s investment management processes. On the basis of the Trustees’ assessment of the nature, extent and quality of the sub-advisory services to be provided by Pzena, the Trustees concluded that Pzena is capable of generating a level of long-term investment performance that is appropriate in light of the Fund’s investment objectives, policies and strategies and competitive with many other comparable investment companies.

The cost of advisory services to be provided and the expected level of profitability. The Board took note of the fact that the sub-advisory fee had been separately negotiated by Brown Advisory and Pzena and was consistent with fee arrangements for sub-advisory services in connection with other sub-advised mutual funds. Accordingly, on the basis of the Board’s review of the fees to be charged by Pzena for the sub-investment advisory services to be provided to the Fund, the Board concluded that the level of sub-investment advisory fees are appropriate in light of the management fees, overall expense ratios and investment performance of comparable investment companies, and that the sub-advisory fee had been separately negotiated at arms-length by independent third parties.

The extent to which economies of scale may be realized as the Fund grows and whether the advisory fees reflect possible economies of scale. While it was noted that the Fund’s investment advisory fees will not decrease as the Fund’s assets grow because they will not be subject to investment advisory fee breakpoints, the Trustees concluded that the Fund’s investment advisory fees are appropriate in light of the projected size of the Fund, and appropriately reflect the current economic environment for Brown Advisory and Pzena and the competitive nature of the mutual fund market. The Trustees then noted that they will have the opportunity to periodically re-examine whether the Fund has achieved economies of scale, and the appropriateness of the investment advisory fees and sub-investment advisory fees with respect to the Fund, in the future at which time the implementation of fee breakpoints on the Fund could be further considered.

Benefits to Pzena from its relationship with the Fund (and any corresponding benefits to the Fund). The Trustees concluded that other benefits that may be derived by Pzena from its relationship with the Fund, including any potential “soft dollar” benefits in connection with the Fund’s brokerage transactions and use of the Fund’s performance track record in advertising materials, are reasonable and fair, and consistent with industry practice and the best interests of the Fund and its shareholders.

Other Considerations. In approving the Pzena Sub-Advisory Agreement, the Trustees determined that Pzena has made a substantial commitment to the recruitment and retention of high quality personnel, and maintains the financial, compliance and operational resources reasonably necessary to provide sub-advisory services to the Fund in a professional manner that is consistent with the best interests of the Fund and its shareholders. The Board also considered matters with respect to the brokerage practices of Pzena, including its soft dollar arrangements and its best-execution procedures, and noted that these were reasonable and consistent with standard industry practice.

It was noted that in making their determination, the Trustees had considered and relied upon the materials provided to them with respect to the proposed contract and the presentation of the representatives of Brown Advisory and Pzena at the Board meeting. In reaching their conclusion with respect to the approval of the Pzena Sub-Advisory Agreement and the level of fees to be paid under the Agreement, the Trustees did not identify any one single factor as being controlling, rather, the Trustees took note of a combination of factors that had influenced their decision making process. They noted the level and quality of investment advisory services provided by Pzena to its other investment advisory clients and they found that these services will benefit the Fund and its shareholders. They also considered the nature of the allocation of the duties and responsibilities for the management and operation of the Fund between Brown Advisory and Pzena and they determined that the sub-advisory fee, as negotiated by Brown Advisory and Pzena, reasonably reflected the nature and extent of the services to be provided by Pzena with respect to the Fund.

Additional Information about the Fund’s Proposed Sub-Advisers

Wellington Management Company LLP, a limited liability partnership organized under the laws of the State of Delaware, is an investment adviser registered as such with the U.S. Securities and Exchange Commission having its principal place of business at 280 Congress Street, Boston, Massachusetts 02210, and currently serves as subadviser to the Brown Advisory–WMC Strategic European Equity Fund. Wellington was founded in 1928 and is one of the largest investment management firms in the world. Wellington Management Group LLP (the “Partnership”) is Wellington’s parent company, and no single partner owns or has the right to vote more than 5% of the Partnership’s capital. As of December 31, 2018, Wellington had approximately $1.1 trillion in assets under management, including both discretionary and non-discretionary accounts.

The names and principal occupations of the principal executive officers and directors of Wellington are listed below. The address of each principal executive officer and director, as it relates to the person’s position with Wellington, is 280 Congress Street, Boston, Massachusetts 02210.

| Name | | Principal Occupation |

| Brendan J. Swords | | Chairman and Chief Executive Officer |

| Edward J. Steinborn | | Chief Financial Officer |

| John E. Bruno | | Chief Legal Officer |

| John D. Norberg | | Chief Compliance Officer |

Pzena Investment Management LLC, a limited liability company organized under the laws of the State of Delaware, is an investment adviser registered as such with the U.S. Securities and Exchange Commission having its principal place of business at 320 Park Avenue, 8th Floor, New York, New York 10022. Pzena was founded in 1995 and is principally owned by its founder, Richard S. Pzena, who is currently Pzena’s Chief Executive Officer and Co-Chief Investment Officer and a Managing Principal. Pzena Investment Management, Inc., a NYSE-listed company, is the sole managing member of Pzena, which is its operating company. As of December 31, 2018, Pzena had approximately $36 billion in assets under management, including both discretionary and non-discretionary accounts.

The names and principal occupations of the principal executive officers and directors of Pzena are listed below. The address of each principal executive officer and director, as it relates to the person’s position with Pzena, is 320 Park Avenue, 8th Floor, New York, New York 10022.

| Name | | Principal Occupation |

| Richard S. Pzena | | Chairman, Chief Executive Officer and Co-Chief Investment Officer |

| John P. Goetz | | Managing Principal and Co-Chief Investment Officer |

| Gary J. Bachman | | Managing Principal and Chief Operating Officer |

| William L. Lipsey | | Managing Principal and Head of Business Development and Client Service |

| Jessica R. Doran | | Chief Financial Officer |

| Joan F. Berger | | General Counsel and Chief Compliance Officer |

Who is bearing the expenses related to the proposals?

The Adviser will be bearing all of the costs and expenses associated with each of Proposals 1 and 2, including all of the costs associated with the solicitation of proxies from Fund shareholders, which consists of the costs associated with the preparation, printing and distribution of the proxy materials, as well as any additional out-of-pocket costs incurred in connection with the proxy statement.

Vote Required for the Proposals

Approval of each proposal requires the vote of a “majority of the outstanding voting securities” entitled to vote on the proposal, as defined in the 1940 Act, which means the vote of 67% or more of the voting securities entitled to vote on the proposal that are present at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or the vote of more than 50% of the outstanding voting securities entitled to vote on the proposal, whichever is less.

THE BOARD OF TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” APPROVAL OF THE PROPOSED NEW SUB-ADVISORY AGREEMENTS AS PROVIDED UNDER PROPOSAL 1 AND PROPOSAL 2. SIGNED BUT UNMARKED PROXIES WILL BE SO VOTED.

_____________________

ADDITIONAL INFORMATION ABOUT THE FUNDS

Ownership of Fund Shares

Information regarding the percent ownership of each person who, as of February 28, 2019, owned of record and/or beneficially 5% or more of the outstanding shares of the Fund is included in Exhibit C to the Proxy Statement.

The Fund’s Distributor

Quasar Distributors, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202, a wholly-owned subsidiary of U.S. Bancorp, serves as the distributor of the shares of the Fund, pursuant to a Distribution Agreement with the Trust on behalf of the Fund. In this capacity, it receives purchase orders and redemption requests relating to Fund shares.

Fund Administration

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“USBGFS”), 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the administrator to the Fund and provides day-to-day administrative services pursuant to an Administration Agreement, including, among other responsibilities, coordinating the negotiation of contracts and fees with, and the monitoring of performance and billing of, the Fund’s independent contractors and agents; preparation for signature by an officer of the Trust of all documents required to be filed for compliance by the Trust and the Fund with applicable laws and regulations excluding those of the securities laws of various states; arranging for the computation of performance data, including NAV and yield; responding to shareholder inquiries; and arranging for the maintenance of books and records of the Fund, and providing, at its own expense, office facilities, equipment and personnel necessary to carry out its duties. In this capacity, USBGFS does not have any responsibility or authority for the management of the Fund, the determination of investment policy, or for any matter pertaining to the distribution of Fund shares.

Voting Information

Shareholders of record of the Fund on the Record Date are entitled to be present and to vote at the Meeting. Exhibit C to this Proxy Statement sets forth the number of shares of each class of shares of the Fund issued and outstanding on the Record Date.

With respect to the actions to be taken by the shareholders of the Trust on the matters described in this Proxy Statement, one-third of the outstanding shares present at the Meeting by proxy or in person of the Fund shall constitute a quorum at the Meeting. For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present but which have not been voted. Accordingly, abstentions and broker non-votes effectively will be a vote against adjournment and against each proposal, for which the required vote is a percentage of the shares present or outstanding.

Certain Fund shares are owned by separately managed account clients of the Adviser, and the Adviser may have proxy voting discretion with respect to Fund shares held in such accounts. The Adviser intends to vote those shares over which it has investment discretion in favor of each of Proposal 1 and Proposal 2. As a result of the amount of investment discretion held by the Adviser as of the Record Date, it is expected that the Adviser will be able to control the vote on each of Proposal 1 and Proposal 2.

Proxy Related Expenses

The Adviser will bear all of the costs associated with the solicitation of proxies from Fund shareholders with respect to each proposal, including the costs associated with the preparation, printing and distribution of the proxy materials, and any additional out-of-pocket costs, such as legal expenses and vendor fees, incurred in connection with the preparation of the proxy statement and the implementation of each of the proposals if approved by shareholders. Solicitations may be made by regular mail, telephone, e-mail, or other personal contact by officers or employees of the Adviser or by the proxy soliciting firm retained by the Adviser to assist with the solicitation process. Broadridge Financial Solutions, Inc. has been retained to provide proxy processing services in connection with the Meeting and the costs of the firm are being borne by the Adviser.

Shareholder Communications and Proposals

Any shareholder proposal intended to be presented at any future meeting of shareholders must be received by the Trust at its principal offices a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in the proxy statement and form or forms of proxy relating to such meeting.

| By Order of the Board of Trustees

Edward Paz Secretary Brown Advisory Funds |

March 8 , 2019

Exhibit A

Form of Sub-Investment Advisory Agreement for

the Brown Advisory Emerging Markets Select Fund with

Wellington Management Company LLP

This Investment Sub-Advisory Agreement is made as of April __, 2019, by and between Brown Advisory LLC (the “Adviser”) and Wellington Management Company LLP (the “Sub-Adviser”).

WHEREAS, pursuant to an Investment Advisory Agreement dated as of June 29, 2012 (as amended from time to time, the “Advisory Agreement”), the Adviser serves as investment adviser to Brown Advisory Funds, a Delaware statutory trust and an open-end management investment company (the “Trust”), which has filed a registration statement (the “Registration Statement”) under the Investment Company Act of 1940, as amended (the “1940 Act”) and the Securities Act of 1933; and

WHEREAS, the Trust is comprised of several separate investment series, one of which is the Brown Advisory Emerging Markets Select Fund (the “Fund”); and

WHEREAS, the Adviser and the Sub-Adviser are each registered as investment advisers with the United States Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”); and

WHEREAS, the Advisory Agreement permits the Adviser to delegate certain of its investment advisory duties under the Advisory Agreement to one or more sub-advisers; and

WHEREAS, the Adviser desires to avail itself of the services, information, advice, assistance and facilities of an investment adviser experienced in the management of a portfolio of securities to assist the Adviser in performing services for the Fund; and

WHEREAS, the Sub-Adviser represents that it has the legal power and authority to perform the services contemplated hereunder without violation of applicable law, including the Advisers Act, and desires to provide such services to the Adviser; and

WHEREAS, the Trust and the Fund are intended to be third party beneficiaries of the arrangements described herein;

NOW, THEREFORE, in consideration of the terms and conditions hereinafter set forth, it is agreed as follows:

1. Appointment of the Sub-Adviser. The Adviser hereby appoints the Sub-Adviser to provide a continuous investment program for that portion of the Fund designated by the Adviser as assigned to the Sub-Adviser (the “Segment” of the Fund), subject to such written instructions and supervision as the Adviser may from time to time furnish. The Sub-Adviser hereby accepts such appointment and agrees to render the services and to assume the obligations herein set forth for the compensation herein provided. The Sub-Adviser will provide the services under this Agreement with respect to the Segment in accordance with the Fund’s investment objective, policies and applicable restrictions as stated in the Fund’s most recent Prospectus and Statement of Additional Information and as the same may, from time to time, be supplemented or amended and in resolutions of the Trust’s Board of Trustees. The Adviser agrees to furnish to the Sub-Adviser from time to time copies of all Prospectuses and Statements of Additional Information and of all amendments of, or supplements to, such Prospectuses and Statements of Additional Information and of all resolutions of the Trust’s Board of Trustees applicable to the Sub-Adviser’s services hereunder and agrees that the Sub-Adviser shall not be responsible for complying with such documents and/or instructions unless and until such documents and/or instructions have been provided to the Sub-Adviser. The Sub-Adviser shall for all purposes herein be deemed to be an independent contractor and shall, except as expressly provided or authorized (whether herein or otherwise), have no authority to act for or represent the Adviser, the Fund or the Trust in any way.

2. Sub-Advisory Services. Subject to such written instructions and supervision as the Adviser may from time to time furnish, the Sub-Adviser will provide an investment program for the Segment, including investment research and management with respect to securities and investments, including cash and cash equivalents in the Segment, and will determine from time to time what securities and other investments will be purchased, retained or sold by and within the Segment. The Sub-Adviser will exercise full discretion to implement such determinations through the placement, on behalf of the Fund, of orders for the execution of portfolio transactions through such brokers or dealers as it may select. The Sub-Adviser’s broker selection shall be conducted in accordance with its Policies and Procedures on Order Execution, as may be amended from time to time. Sub-Adviser may utilize the personnel of its affiliates (including affiliates outside of the United States) to assist it with providing its services under this Agreement, provided that Sub-Adviser: will remain solely responsible for the provision of services under this Agreement; will supervise the personnel of its affiliates and subject them to its Code of Ethics; and represents that it will satisfy the conditions adopted by the SEC staff with respect to utilizing personnel of affiliates. In addition, the Sub-Adviser may utilize unaffiliated third-party data service providers in effecting compliance with the Fund’s investment objective, policies and applicable restrictions, and the Sub-Adviser shall not be held responsible for any losses resulting from non-compliance with the investment objective, policies and applicable restrictions where the Sub-Adviser has reasonably relied on information provided by third-party data service providers.

In fulfilling its responsibilities hereunder, the Sub-Adviser agrees that it will:

a. use reasonable care and act in a manner consistent with applicable federal and state laws and regulations in rendering the services it agrees to provide under this Agreement;

b. conform with all applicable rules and regulations of the SEC and in addition will conduct its activities under this Agreement in accordance with any applicable regulations of any government authority pertaining to the investment advisory activities of the Sub-Adviser and shall furnish such written reports or other documents substantiating such compliance as the Adviser reasonably may request from time to time;

c. not make loans to any person to purchase or carry shares of beneficial interest in the Trust or make loans to the Trust;

d. place orders pursuant to investment determinations for the Fund either directly with the issuer or with an underwriter, market maker or broker or dealer (“Brokers”). The Sub-Adviser will act in good faith and with reasonable skill and care in the selection, use and monitoring of Brokers and, in placing orders, the Sub-Adviser will use its reasonable best efforts to seek best execution of such orders, considering all relevant circumstances. Subject thereto, neither the Sub-Adviser nor any of its affiliates will be liable for the performance of the obligations, or acts or omissions of Brokers with respect to any transaction placed on behalf of the Fund. Consistent with this obligation, the Sub-Adviser may, to the extent permitted by law, effect portfolio securities transactions through brokers and dealers who provide brokerage and research services (within the meaning of Section 28(e) of the Securities Exchange Act of 1934) to or for the benefit of the Fund and/or other accounts over which the Sub-Adviser exercises investment discretion. Subject to the review of the Trust’s Board of Trustees from time to time with respect to the extent and continuation of the policy, the Sub-Adviser is authorized to cause the Fund to pay a broker or dealer who provides such brokerage and research services a commission for effecting a securities transaction for the Fund which is in excess of the amount of commission another broker or dealer would have charged for effecting that transaction if the Sub-Adviser determines in good faith that such commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the overall responsibilities of the Sub-Adviser with respect to the accounts as to which it exercises investment discretion. The Trust or the Adviser may, from time to time in writing, direct the Sub-Adviser to place orders through one or more brokers or dealers and, thereafter, the Sub-Adviser will have no responsibility for ensuring best execution with respect to such orders. In no instance will portfolio securities be purchased from or sold to the Sub-Adviser or any affiliated person of the Sub-Adviser as principal except as may be permitted by the 1940 Act or an exemption therefrom. The Sub-Adviser may, but shall be under no obligation to, aggregate the securities or other investments to be purchased or sold on behalf of the Fund with similar transactions executed by the Sub-Adviser on behalf of the Sub-Adviser’s other clients. Such aggregated orders (including associated expenses) will be allocated by the Sub-Adviser as set forth in the Sub-Adviser’s Policy and Procedures Regarding Allocation of Trades, as may be amended from time to time. If the Sub-Adviser determines in good faith that the transaction is in the best interest of each client, securities may be purchased on behalf of the Fund from, or sold on behalf of the Fund to, another client of the Sub-Adviser, subject to the Sub-Adviser’s Policy and Procedures on Order Execution. Unless otherwise instructed by the Adviser in writing, the Sub-Adviser will effect foreign exchange transactions through the Fund’s custodian for income repatriation and when country-specific regulations and/or local market practice call for such execution. These transactions will be subject to the terms and conditions of the Adviser’s agreement with its custodian. The Adviser acknowledges Brokers may request information about the Fund from the Sub-Adviser in connection with the Brokers’ anti-money laundering or client identification obligations. The Sub-Adviser is hereby authorized to furnish such information to such Broker based on information provided to the Sub-Adviser by the Adviser. In addition, the Adviser agrees that, upon request, the Adviser will promptly provide the Sub-Adviser with such information about the Fund or documentation relating to it as the Sub-Adviser may reasonably request in order to respond to a Broker’s request. In certain circumstances, the Sub-Adviser may require the Adviser to enter into trading or other agreements directly with a Broker;

e. maintain all necessary or appropriate records with respect to the Fund’s securities transactions for the Segment in accordance with all applicable laws, rules and regulations, including but not limited to Section 31 (a) of the 1940 Act, and will furnish the Trust’s Board of Trustees and the Adviser such periodic and special reports as the Board and Adviser reasonably may request. The Sub-Adviser is not the official pricing agent with respect to the Fund, but will provide reasonable assistance to the Adviser in valuing the securities held in the Segment upon request (e.g., fair value recommendations). The Sub-Adviser endeavors to value all securities at fair market value as determined by the Sub-Adviser in good faith and in accordance with its Pricing Policies and Procedures;

f. treat confidentially and as proprietary information of the Adviser and the Trust all records and other information relative to the Adviser and the Trust and prior, present, or potential shareholders, and will not use such records and information for any purpose other than the performance of its responsibilities and duties hereunder, except that subject to prompt notification to the Trust and the Adviser, the Sub-Adviser may divulge such information to its independent auditors and regulatory authorities, or when so requested by the Adviser and the Trust; provided, however, that nothing contained herein shall prohibit the Sub-Adviser from (1) advertising or soliciting the public generally with respect to other products or services, regardless of whether such advertisement or solicitation may include prior, present or potential shareholders of the Fund or (2) including the Adviser and Trust on its general list of disclosable clients;

g. in conducting its fiduciary functions, Sub-Adviser will exercise independence with respect to investment decisions, in that it will not inquire or take into consideration whether the issuers of securities proposed for purchase or sale for the Fund’s account are customers of the Adviser, other sub-advisers, the Sub-Adviser or of their respective parents, subsidiaries or affiliates. In dealing with such customers, the Sub-Adviser and its subsidiaries and affiliates will not inquire or take into consideration whether securities of those customers are held by the Trust;

h. to the extent reasonably requested by the Trust, the Sub-Adviser will use its best efforts to assist the Chief Compliance Officer of the Trust in respect of Rule 38a-1 under the 1940 Act upon request including, without limitation, providing the Chief Compliance Officer of the Trust with (i) copies of the compliance policies and procedures of the Sub-Adviser, (ii) a compliance report concerning the Sub-Adviser’s compliance program in connection with the annual review thereof by the Trust required under Rule 38a-1, and (iii) upon request, a certificate of the chief compliance officer of the Sub-Adviser to the effect that the policies and procedures of the Sub-Adviser are reasonably designed to prevent violation of the Federal Securities Laws (as such term is defined in Rule 38a-1);

i. vote all proxies for securities held in the Segment in accordance with the Sub-Adviser’s Proxy Voting Policy and maintain records concerning how it has voted such proxies on behalf of the Fund, and those records shall be made available to the Trust upon request for use in connection with the preparation and filing of the Trust’s Form N-PX, provided that Sub-Adviser will provide the Chief Compliance Officer annually with a summary of any material changes to the Sub-Adviser’s Proxy Voting Policy;

j. render, upon the reasonable request of the Adviser or the Trust’s Board of Trustees, written reports concerning the investment activities of the Sub-Adviser with respect to the Sub-Adviser’s Segment of the Fund; and

k. not consult with any other adviser to (i) the Fund, (ii) any other series of the Trust or (iii) any other investment company under common control with the Trust concerning transactions of the Fund in securities or other assets. (This shall not be deemed to prohibit the Adviser from consulting with any of its affiliated persons concerning transactions in securities or other assets.)

3. Expenses. During the term of this Agreement, the Sub-Adviser will pay all expenses incurred by it in performing its services under this Agreement. The Sub-Adviser shall not be liable for any expenses of the Adviser or the Trust, including without limitation: (a) their interest and taxes, (b) brokerage commissions and other costs in connection with the purchase or sale of securities or other investment instruments with respect to the Fund and (c) custodian fees and expenses. Subject to the foregoing, the Sub-Adviser will pay all expenses incurred by it in connection with its activities under this Agreement, including without limitation, all costs associated with attending or otherwise participating in regular or special meetings of the Trust’s Board of Trustees, or with the Adviser, as requested, and additions or modifications to the Sub-Adviser’s operations necessary to perform its services hereunder in compliance with this Agreement, any other procedures reasonably implemented by the Adviser or the Trust’s Board of Trustees and applicable law. The Sub-Adviser shall also be responsible for all costs associated with any information statements and/or other disclosure materials that are for the primary benefit of, or otherwise occur as a result of a significant event occurring with respect to, the Sub-Adviser such as a change in control (including, but not limited to, the legal fees associated with preparation, printing, filing and mailing thereof, as well as any shareholder meeting and/or solicitation costs, if applicable).

4. Records. In compliance with the requirements of Rule 31a-3 under the 1940 Act, the Sub-Adviser hereby agrees that all records, if any, which it maintains for the Fund are the property of the Fund and further agrees to surrender promptly to the Adviser or the Trust any such records upon the Adviser’s or the Trust’s request and that such records shall be available for inspection by the SEC.

5. Compensation of the Sub-Adviser.

| a. | In consideration of services rendered pursuant to this Agreement, the Adviser will pay the Sub-Adviser a fee, in arrears, equal to an annual rate in accordance with Schedule A hereto, paid quarterly.

|

| b. | Such fee for each calendar quarter shall be calculated based on the average daily net assets of the Fund under management by the Sub-Adviser as of the end of each of the three months in the quarter just ended, as provided by the Adviser.

|

| c. | If the Sub-Adviser should serve for less than the whole of any calendar quarter, its compensation shall be determined as provided above on the basis of the average daily net assets managed in the partial month in which the services occur and shall be payable on a pro rata basis for the period of the calendar quarter for which it has served as Sub-Adviser hereunder. |

6. Services Not Exclusive. Except to the extent agreed to by the Adviser and the Sub-Adviser, the services of the Sub-Adviser hereunder are not to be deemed exclusive, and the Sub-Adviser shall be free to render similar services to others and to engage in other activities, so long as the services rendered hereunder are not impaired. It is understood that the action taken by the Sub-Adviser under this Agreement may differ from the advice given or the timing or nature of action taken with respect to other clients of the Sub-Adviser, and that a transaction in a specific security may not be accomplished for all clients of the Sub-Adviser at the same time or at the same price.

7. Use of Names. Subject to the prior written confirmation of accuracy and completeness from the Sub-Adviser, which shall not be unreasonably delayed or withheld, the Adviser and the Trust are authorized to publish and distribute any information, including but not limited to registration statements, advertising or promotional material, regarding the provision of sub-investment advisory services by the Sub-Adviser pursuant to this Agreement and to use in advertising, publicity or otherwise the name of the Sub-Adviser, or any trade name, trademark, trade device, service mark, symbol or logo of the Sub-Adviser that the Sub-Adviser has provided to the Adviser for this purpose. In addition, the Adviser may distribute information regarding the provision of sub-investment advisory services by the Sub-Adviser to the Trust’s Board of Trustees without the prior written consent of the Sub-Adviser. The Sub-Adviser shall not use the name of the Trust, the Fund or the Adviser in any materials relating to the Sub-Adviser in any manner not approved prior thereto by the Adviser; provided, however, that the Sub-Adviser may use such names to merely refer in accurate terms to the appointment of the Sub-Adviser hereunder, including placing the Trust’s or the Adviser’s name on the Sub-Adviser’s list of representative clients, or which are required by the SEC or a state securities commission. Any other use of names by Sub-Adviser shall require approval in advance by the Adviser which approval shall not be unreasonably delayed or withheld.

8. Liability of the Sub-Adviser. Absent willful misfeasance, bad faith, gross negligence, or reckless disregard of obligations or duties hereunder on the part of the Sub-Adviser, or loss resulting from breach of fiduciary duty, the Sub-Adviser shall not be liable for any act or omission in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security. Notwithstanding the foregoing, neither the Adviser nor the Trust shall be deemed to have waived any rights it may have against the Sub-Adviser under federal or state securities laws.

The Sub-Adviser shall indemnify and hold harmless the Trust and the Adviser (and its affiliated companies and their respective officers, directors and employees) from any and all claims, losses, liabilities, costs, expenses or damages (including reasonable attorney’s fees and other related expenses) directly arising out of or in connection with the willful misfeasance, bad faith, gross negligence, or reckless disregard of its obligations or duties under this Agreement, including breach of its fiduciary duty.

The Adviser shall indemnify and hold harmless the Sub-Adviser for any and all claims, losses, liabilities, costs, expenses or damages (including reasonable attorney’s fees and other related expenses) directly arising out of or in connection with any claim or demand by any person that is based upon: (i) the obligations of any other sub-adviser to the Fund, (ii) any obligation of the Adviser under the Advisory Agreement that has not been delegated to the Sub-Adviser under this Agreement or (iii) any matter for which the Sub-Adviser does not have liability in accordance with the first sentence of this Section 8.

9. Class Actions and Other Legal Proceedings; Cooperation with the Fund and the Adviser. The Sub-Adviser will not compile or file claims or take any related action on behalf of the Fund in any class action, bankruptcy or other legal proceeding related to securities currently or previously held in the Segment. The Sub-Adviser agrees to cooperate with and provide reasonable assistance to the Adviser, the Fund, the Fund’s custodian, accounting agent, administrator, pricing agents, independent auditors and all other agents, representatives and service providers of the Fund and the Adviser, and to provide the foregoing persons such information with respect to the Segment as they may reasonably request from time to time in the performance of their obligations; provide prompt responses to reasonable requests made by such persons; and establish and maintain appropriate operational programs, procedures and interfaces with such persons so as to promote the efficient exchange of information and compliance with applicable laws, rules and regulations, and the guidelines, policies and procedures adopted or implemented with respect to the Fund (as provided to the Sub-Adviser from time to time) and/or the Sub-Adviser. The Sub-Adviser shall not act as custodian for the Segment. Notwithstanding any other provision in this Agreement, the Sub-Adviser shall not hold, directly or indirectly, funds or securities contained in the Segment or have any authority to obtain possession of them. Notwithstanding the foregoing, the Sub-Adviser shall have no responsibility or liability for the acts, omissions or other conduct of the Fund’s custodian, accounting agent, administrator, pricing agents, independent auditors and all other agents, representatives and service providers of the Fund and the Adviser. Without limiting the foregoing, the Sub-Adviser does not assume responsibility for the accuracy of information furnished to it by the Adviser, custodian, or by any person on whom it reasonably relies.

10. Use of Service Providers. The Sub-Adviser may employ third party agents to perform any administrative or ancillary services, including security and cash reconciliation, portfolio pricing and corporate action processing, required to enable the Sub-Adviser to perform the services under this Agreement. The Sub-Adviser will act in good faith and with reasonable skill and care in the selection, use and monitoring of agents.

11. Limitation of Trust’s Liability. The Sub-Adviser acknowledges that it has received notice of and accepts the limitations upon the Trust’s and the Fund’s liability set forth in its Trust Instrument and under Delaware law. The Sub-Adviser agrees that any of the Trust’s obligations shall be limited to the assets of the Fund and that the Sub-Adviser shall not seek satisfaction of any such obligation from the shareholders of the Trust nor from any Trustee, officer, employee or agent of the Trust.

The names “Brown Advisory Funds” and “Trustees of Brown Advisory Funds” refer respectively to the Trust created and the Trustees, as trustees but not individually or personally, acting from time to time under the Trust Instrument dated as of May 1, 2012, to which reference is hereby made and a copy of which is on file at the office of the Secretary of State of the State of Delaware and elsewhere as required by law, and to any and all amendments thereto so filed or hereafter filed. The obligations of “Brown Advisory Funds” entered into in the name or on behalf thereof, or in the name or on behalf of any series or class of shares of the Trust, by any of the Trustees, representatives or agents are made not individually, but in such capacities, and are not binding upon any of the Trustees, shareholders or representatives of the Trust personally, but bind only the assets of the Trust, and all persons dealing with any series or class of shares of the Trust must look solely to the assets of the Trust belonging to such series or class for the enforcement of any claims against the Trust.

12. Master Agreement Representations. The Adviser agrees to each of the representations, warranties and agreements set forth in Schedule B, Master Agreement Representations.

13. Duration, Renewal, Termination and Amendment. This Agreement will become effective as of the date first written above, provided that it shall have been approved by vote of a majority of the Trustees, including a majority of the disinterested Trustees cast in person at a meeting called for the purpose of voting on such approval, and, unless sooner terminated as provided herein, shall continue in effect for an initial period of two (2) years.

Thereafter, if not terminated, this Agreement shall continue in effect with respect to the Fund for successive one year periods provided such continuance is specifically approved at least annually: (a) by the vote of a majority of the disinterested Trustees cast in person at a meeting called for the purpose of voting on such approval, and (b) by the vote of a majority of the Trust’s Board of Trustees or by the vote of a majority (as such term is defined in the 1940 Act) of all votes attributable to the outstanding Shares of the Fund. This Agreement may be terminated as to the Fund at any time, without payment of any penalty, by the Trust’s Board of Trustees, by the Adviser, or by a vote of a majority of the outstanding voting securities of the Fund, upon 60 days’ prior written notice to the Sub-Adviser (or such shorter period as may be deemed by the Adviser or the Trust’s Board of Trustees in its sole discretion to be in the best interest of the shareholders of the Fund), or by the Sub-Adviser upon 60 days’ prior written notice to the Adviser and the Trust’s Board of Trustees, or upon such shorter notice as may be mutually agreed upon.

This Agreement shall terminate automatically and immediately upon termination of the Advisory Agreement. This Agreement shall terminate automatically and immediately in the event of its assignment (as such term is defined in the 1940 Act). No assignment of this Agreement shall be made by the Sub-Adviser without the consent of the Adviser and the Board of Trustees of the Trust.