PROSPECTUS SUPPLEMENT

(To Prospectus dated February 12, 2020)

Carlyle Finance L.L.C.

$400,000,000 4.625% Subordinated Notes due 2061

Carlyle Finance L.L.C. (the “Issuer”) is offering $400,000,000 aggregate principal amount of its 4.625% subordinated notes due 2061 (the “notes”). Interest on the notes is payable on February 15, May 15, August 15 and November 15 of each year, beginning on August 15, 2021. Interest on the notes will accrue from May 11, 2021. The notes will mature on May 15, 2061. The Issuer may defer interest payments during one or more deferral periods for up to five consecutive years as described in this prospectus supplement.

On or after May 15, 2026, the Issuer may redeem the notes, in whole at any time or in part from time to time, at their principal amount plus accrued and unpaid interest to, but excluding, the date of redemption; provided that if the notes are not redeemed in whole, at least $25 million aggregate principal amount of the notes must remain outstanding after giving effect to such redemption.

The Issuer may redeem the notes, in whole, but not in part, within 120 days of the occurrence of a Tax Redemption Event (as defined in “Description of the Notes—Tax Redemption”) at a redemption price equal to their principal amount plus accrued and unpaid interest to, but excluding, the date of redemption.

The Issuer may redeem the notes, in whole, but not in part, at any time prior to May 15, 2026, within 90 days of the occurrence of a “rating agency event” (as defined in “Description of the Notes—Optional Redemption of the Notes”), at a redemption price equal to 102% of their principal amount plus any accrued and unpaid interest to, but excluding, the date of redemption.

We intend to use the net proceeds from this offering for general corporate purposes.

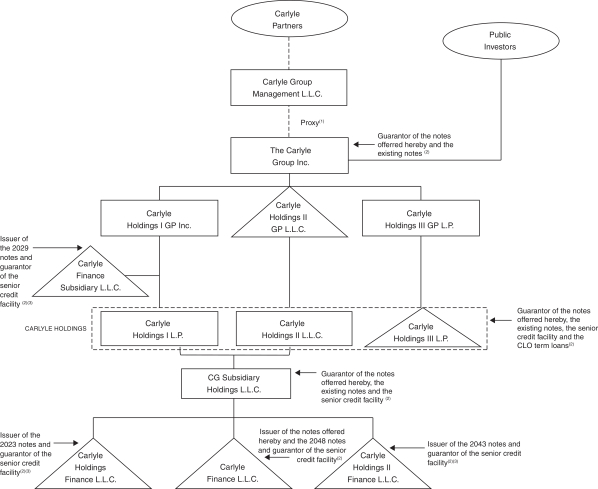

The notes will be fully and unconditionally guaranteed, jointly and severally, on a subordinated basis, by The Carlyle Group Inc., Carlyle Holdings I L.P., Carlyle Holdings II L.L.C., Carlyle Holdings III L.P. and CG Subsidiary Holdings L.L.C. and any other entity that is required to become a guarantor of the notes as provided under “Description of the Notes—Guarantees” (collectively, the “Guarantors”). Initially, none of the subsidiaries of The Carlyle Group Inc., other than the Issuer, Carlyle Holdings (as defined herein) and CG Subsidiary Holdings L.L.C., will guarantee or have any obligation in respect of the notes. The Issuer is an indirect finance subsidiary of The Carlyle Group Inc. and has no operations or assets other than in such capacity.

The notes and the guarantees will be the Issuer’s and the Guarantors’ direct and unsecured obligations and will (a) be subordinate and junior in right of payment and upon our liquidation junior to all of their respective existing and future unsecured and unsubordinated indebtedness, including in the case of the Guarantors, their guarantees of the existing notes (as defined herein); (b) rank equal in right of payment with all existing and future Indebtedness Ranking on a Parity with the notes (as defined in “Description of the Notes—Subordination of Notes and Guarantees”) of the Issuer or the relevant Guarantor; (c) be effectively subordinated to all existing and future secured Indebtedness of the Issuer or the relevant Guarantor, to the extent of the value of the assets securing such Indebtedness; and (d) be structurally subordinated in right of payment to all existing and future Indebtedness, liabilities and other obligations of each subsidiary of the Issuer or the relevant Guarantor that is not itself the Issuer or a Guarantor.

The notes will be issued in book-entry form in denominations of $25 and multiples of $25 in excess thereof.

We intend to apply to list the notes on The Nasdaq Global Select Market (the “Nasdaq”) under the symbol “CGABL.” If approved for listing, we expect trading of the notes on the Nasdaq to commence within 30 days after they are first issued.

Investing in the notes involves significant risks. See “Risk Factors” beginning on page S-8 herein and in the documents we have incorporated by reference for more information.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per

Note | | | Total | |

Price to public(1) | | $ | 25.0000 | | | $ | 400,000,000 | |

Underwriting discount(2) | | $ | 0.7355 | | | $ | 11,768,000 | |

Proceeds, before expenses, to us | | $ | 24.2645 | | | $ | 388,232,000 | |

| (1) | Plus accrued interest, if any, from May 11, 2021 to the date of delivery. |

| (2) | Reflects $327,600,000 aggregate principal amount of notes sold to retail investors, for which the underwriters received an underwriting discount of $0.7875 per note, and $72,400,000 aggregate principal amount of notes sold to institutional investors, for which the underwriters received an underwriting discount of $0.50 per note. Underwriting discount per note is calculated using a weighted average underwriting discount for retail and institutional investors. See “Underwriting” for more information. |

We have granted the underwriters an option to purchase up to an additional $60,000,000 aggregate principal amount of notes within 30 days from the date of this prospectus supplement solely to cover overallotments at the price to public less the applicable underwriting discount.

The underwriters expect to deliver the notes to purchasers through the book-entry delivery system of The Depository Trust Company (“DTC”) for the accounts of its participants, which may include Clearstream Banking S.A., or Euroclear Bank SA/NV, on or about May 11, 2021, against payment in immediately available funds.

Joint Book-Running Managers

| | | | | | |

| Morgan Stanley | | BofA Securities | | Citigroup | | J.P. Morgan |

Joint Lead Managers

| | | | |

Credit Suisse | | Goldman Sachs & Co. LLC | | Mizuho Securities |