AMERICAN RESIDENTIAL PROPERTIES, INC. COMPANY PRESENTATION APRIL 2014

EPS\Management Presentation\American Residential Properties - 602505097 DISCLAIMER AND CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS The information in this presentation has been prepared solely for informational purposes and does not constitute an offer to sell or the solicitation of an offer to purchase any securities. Some of the statements in this presentation constitute forward-looking statements. The forward-looking statements included in this presentation reflect American Residential Properties, Inc.’s (“ARPI’s”) current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause ARPI’s actual results to differ significantly from those expressed in any forward-looking statement. Statements regarding the following subjects, among others, may be forward-looking: ARPI’s ability to effectively deploy its capital; ARPI’s business and investment strategy; ARPI’s projected operating results; economic, demographic or real estate developments in ARPI’s markets; home value appreciation, employment growth, residential building permits, median household income and household formation in ARPI’s markets; defaults on, early terminations of or non-renewal of leases by ARPI’s tenants; ARPI’s ability to identify properties to acquire and to complete acquisitions; increased time and/or expense to gain possession and restore properties; ARPI’s ability to successfully operate acquired properties; projected operating costs; rental rates or vacancy rates; ARPI’s ability to obtain financing arrangements; general volatility of the markets in which ARPI participates; ARPI’s expected investments; interest rates and the market value of ARPI’s target assets; impact of changes in governmental regulations, tax law and rates and similar matters; ARPI’s ability to qualify and maintain ARPI’s qualification as a REIT; availability of qualified personnel; estimates relating to ARPI’s ability to make distributions to ARPI’s stockholders in the future; ARPI’s understanding of ARPI’s competition; and market trends in ARPI’s industry, real estate values, the debt securities markets or the general economy. The forward-looking statements are based on the beliefs, assumptions and expectations of ARPI as to future events, taking into account all information currently available to ARPI. Forward-looking statements are not guarantees of future events or of ARPI’s performance. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to ARPI. If a change occurs, ARPI’s business, financial condition, liquidity, cash flows and results of operations may vary materially from those expressed in or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for ARPI to predict the occurrence of those matters or the manner in which they may affect ARPI. ARPI is not obligated to, and does not intend to, update or revise any forward-looking statements contained in this presentation, whether as a result of new information, future events or otherwise. 2

EPS\Management Presentation\American Residential Properties - 602505097 A SINGLE-FAMILY RENTAL PIONEER 3

EPS\Management Presentation\American Residential Properties - 602505097 WHO IS AMERICAN RESIDENTIAL PROPERTIES, INC.? An Experienced, Internally Managed Single-Family Rental Company with a National Footprint Leadership & experience with fully integrated operating platform – a company well-positioned to capitalize on investment opportunities 4 (1) BAML, Morgan Stanley, Citibank, JP Morgan, Barclay’s, Key Bank, Deutsche Bank, Raymond James, Comerica. Public Company NYSE Listed Company (Ticker: ARPI) Independent Board Independent Board of Directors with extensive public company experience Experience Founders have six years of proven single-family rental operating experience Business Strategy Acquire, renovate, lease and operate high quality single-family homes with Resident-centric philosophy Diversified Portfolio Close to $900 MM portfolio with close to 7,000 homes in 13 states Proven Access to Institutional Capital Raised in excess of $1.2 B of debt & institutional equity without PE investors Broad Banking Support Received credit & risk committee approval from nine major banking institutions who participate in our corporate credit facility(1) Internally-Managed Internally-managed with clear shareholder alignment

EPS\Management Presentation\American Residential Properties - 602505097 WHO RUNS THE COMPANY? Experienced Senior Management & Board of Directors 5 Experienced Senior Management Team Stephen Schmitz Laurie Hawkes Shant Koumriqian Lani Porter Jay Byce Real Estate Experience Chairman & CEO Director, President & COO CFO SVP, Operations SVP, Investments > 30 years > 30 years 18 years 19 years > 15 years Recent Relevant Experience • CIO of Franchise Finance Corporation of America (NYSE: FFA) • President & Partner at U.S. Realty Advisors, a $3 B Private RE Firm • Managing Director at CS First Boston & Salomon Brothers specializing in Real Estate & Mortgage Investment Banking • CFO of MPG Office Trust (NYSE: MPG) • Senior level management and audit positions at Arthur Andersen & Deloitte • COO at nCommand; developed virtual loan process for mortgages • Director of Operations at Hometown Mortgage • CFO & VP of Operations at Accruent • Managing Director at Colony American Homes, LLC, with responsibility for acquiring over 6000 homes • Vice President at Regions Bank Independent Board Members Douglas Benham David Brain Keith Guericke Todd Mansfield Public Company Experience 10 years 15 years 20 years 20 years Recent Relevant Experience • Former CEO of Arby’s Inc. • Director of Sonic Corp. (NASDAQ: SONC) • Former Director of O’Charley’s, Inc. (NASDAQ: CHUX) • President & CEO, EPR Properties (NYSE: EPR) • Former CEO & current Director & Vice Chairman, Essex Property Trust (NYSE: ESS) • President & CEO, Crescent Communities, LLC • Executive Vice President at The Walt Disney Company (NYSE: DIS)

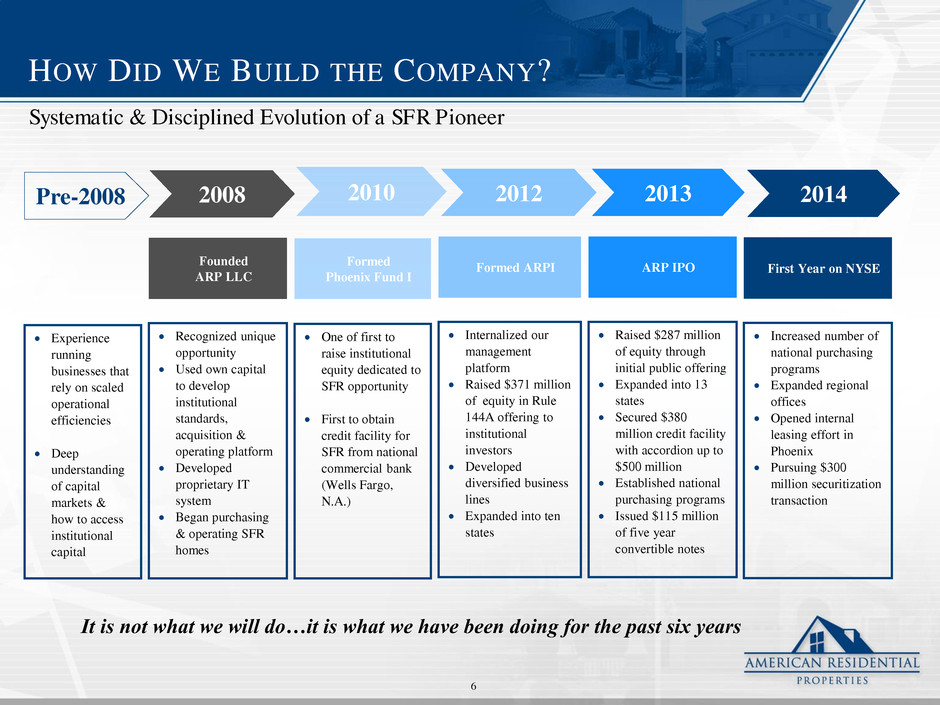

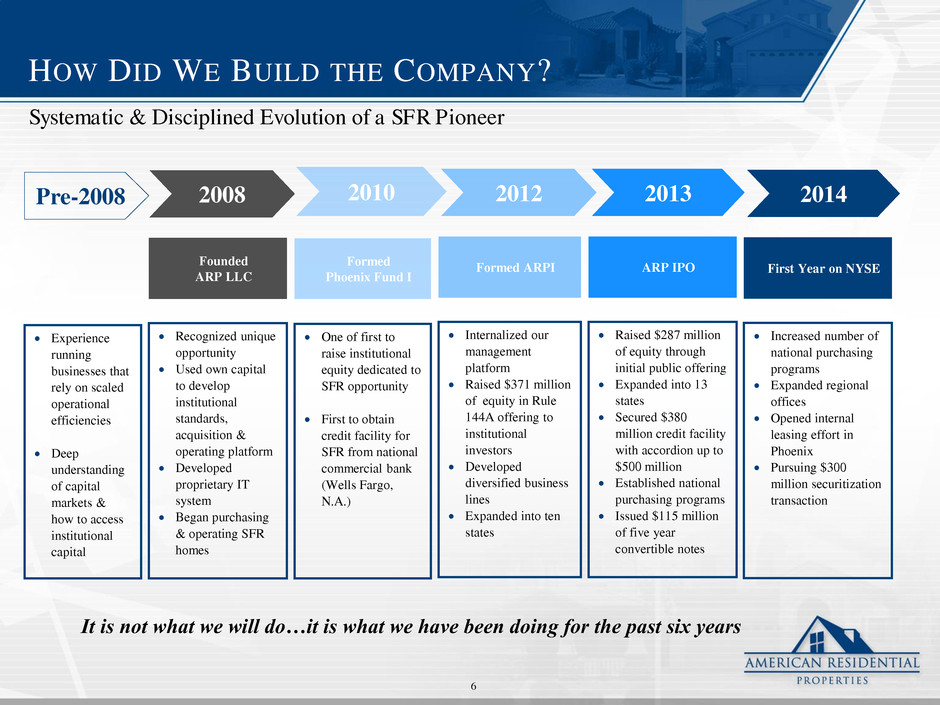

EPS\Management Presentation\American Residential Properties - 602505097 HOW DID WE BUILD THE COMPANY? One of first to raise institutional equity dedicated to SFR opportunity First to obtain credit facility for SFR from national commercial bank (Wells Fargo, N.A.) Internalized our management platform Raised $371 million of equity in Rule 144A offering to institutional investors Developed diversified business lines Expanded into ten states Raised $287 million of equity through initial public offering Expanded into 13 states Secured $380 million credit facility with accordion up to $500 million Established national purchasing programs Issued $115 million of five year convertible notes Experience running businesses that rely on scaled operational efficiencies Deep understanding of capital markets & how to access institutional capital Systematic & Disciplined Evolution of a SFR Pioneer 2010 2013 2012 Pre-2008 It is not what we will do…it is what we have been doing for the past six years Formed Phoenix Fund I Formed ARPI ARP IPO 6 Recognized unique opportunity Used own capital to develop institutional standards, acquisition & operating platform Developed proprietary IT system Began purchasing & operating SFR homes 2008 Founded ARP LLC Increased number of national purchasing programs Expanded regional offices Opened internal leasing effort in Phoenix Pursuing $300 million securitization transaction 2014 First Year on NYSE

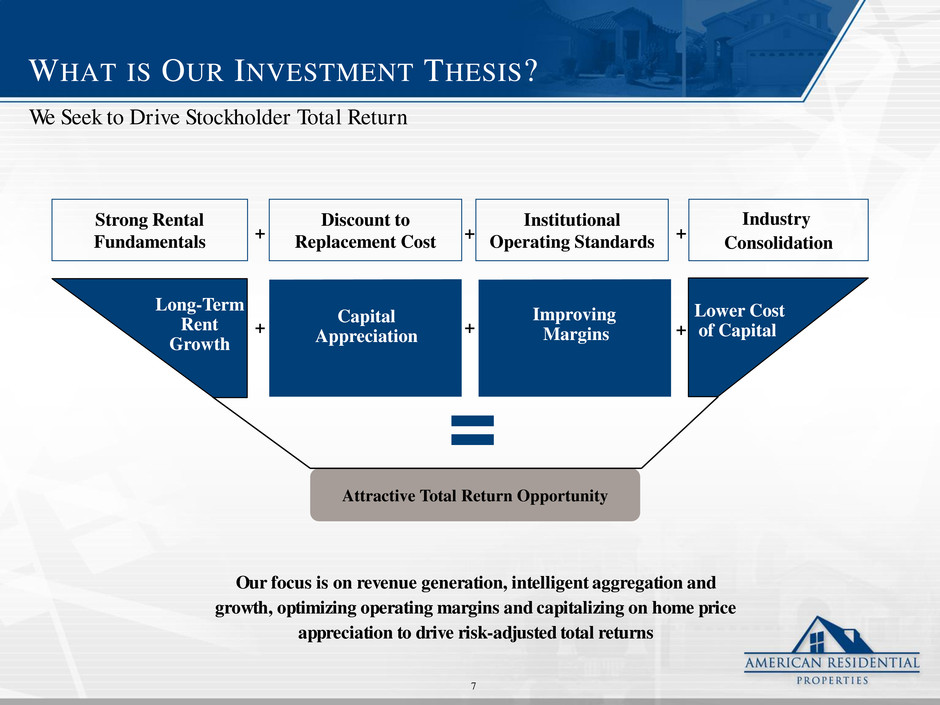

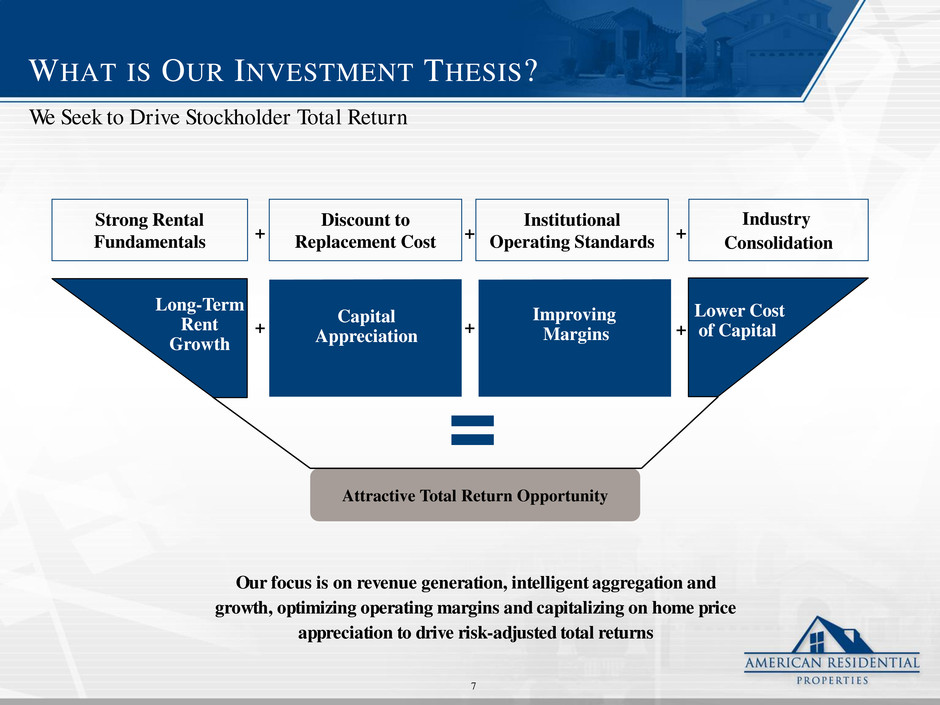

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS OUR INVESTMENT THESIS? We Seek to Drive Stockholder Total Return Our focus is on revenue generation, intelligent aggregation and growth, optimizing operating margins and capitalizing on home price appreciation to drive risk-adjusted total returns 7 Discount to Replacement Cost Institutional Operating Standards Industry Consolidation Lower Cost of Capital Improving Margins Long-Term Rent Growth Strong Rental Fundamentals Attractive Total Return Opportunity Capital Appreciation + + + + + +

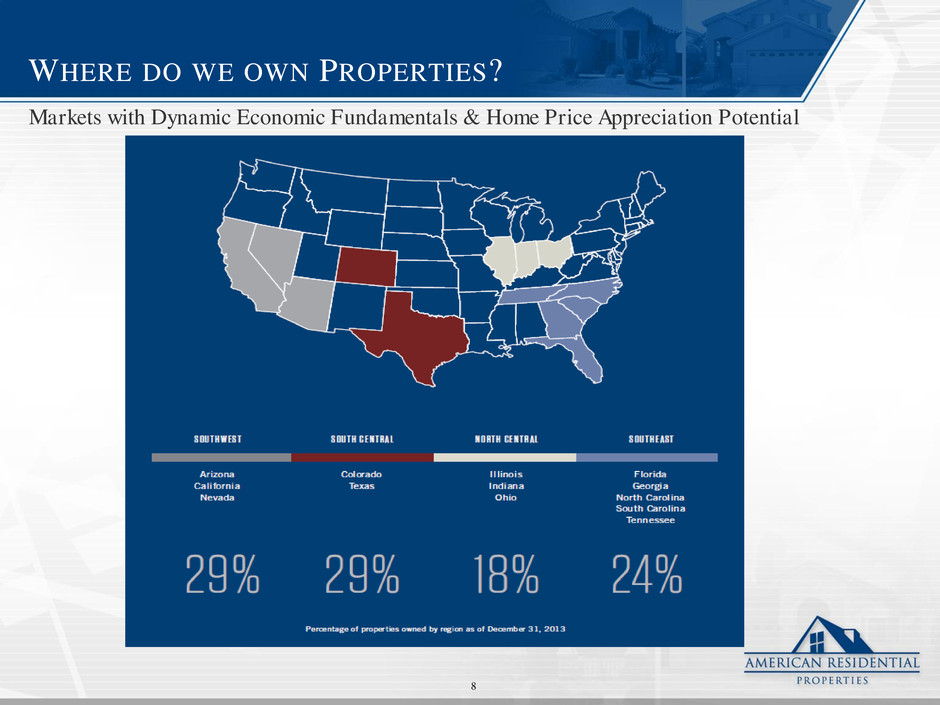

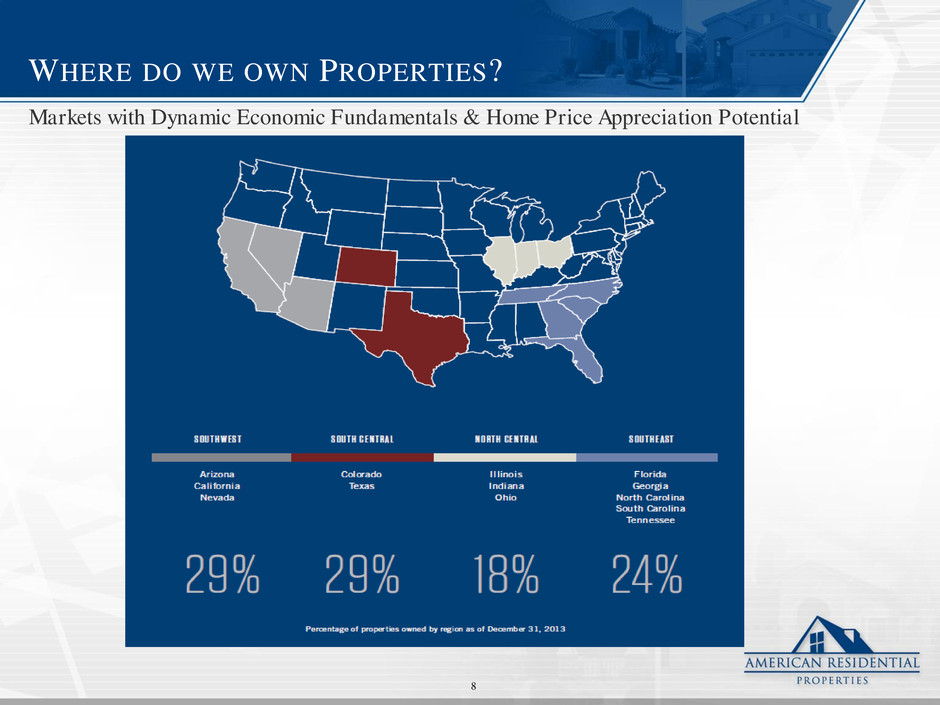

EPS\Management Presentation\American Residential Properties - 602505097 WHERE DO WE OWN PROPERTIES? Markets with Dynamic Economic Fundamentals & Home Price Appreciation Potential 8

EPS\Management Presentation\American Residential Properties - 602505097 WHAT DID WE ACCOMPLISH IN 2013? Strong Progress in Executing our Business Plan 9

EPS\Management Presentation\American Residential Properties - 602505097 THE MARKET OPPORTUNITY 10

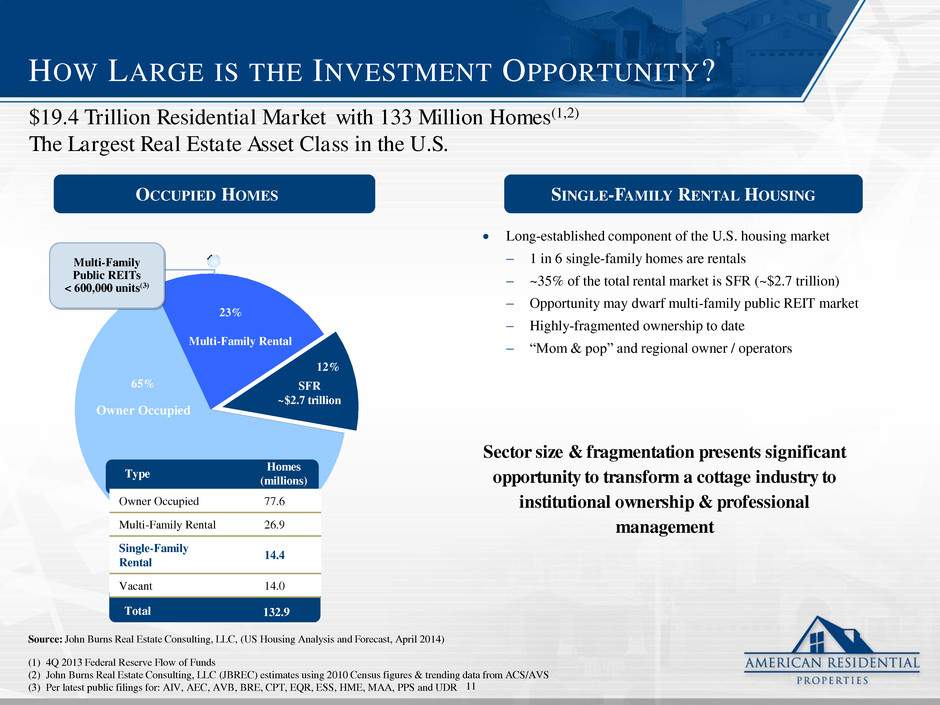

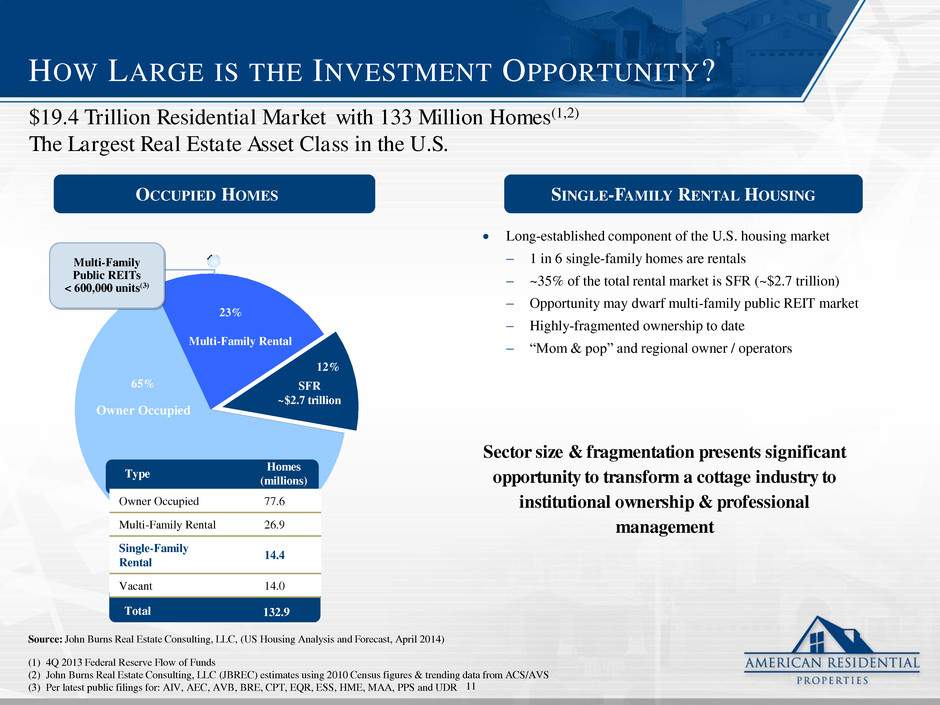

EPS\Management Presentation\American Residential Properties - 602505097 HOW LARGE IS THE INVESTMENT OPPORTUNITY? 65% 23% 12% Type Homes (millions) Total 132.9 Owner Occupied 77.6 Multi-Family Rental 26.9 Single-Family Rental 14.4 Vacant 14.0 $19.4 Trillion Residential Market with 133 Million Homes(1,2) The Largest Real Estate Asset Class in the U.S. Source: John Burns Real Estate Consulting, LLC, (US Housing Analysis and Forecast, April 2014) Long-established component of the U.S. housing market 1 in 6 single-family homes are rentals ~35% of the total rental market is SFR (~$2.7 trillion) Opportunity may dwarf multi-family public REIT market Highly-fragmented ownership to date “Mom & pop” and regional owner / operators (1) 4Q 2013 Federal Reserve Flow of Funds (2) John Burns Real Estate Consulting, LLC (JBREC) estimates using 2010 Census figures & trending data from ACS/AVS (3) Per latest public filings for: AIV, AEC, AVB, BRE, CPT, EQR, ESS, HME, MAA, PPS and UDR Owner Occupied Multi-Family Rental Sector size & fragmentation presents significant opportunity to transform a cottage industry to institutional ownership & professional management Multi-Family Public REITs < 600,000 units(3) OCCUPIED HOMES SFR ~$2.7 trillion SINGLE-FAMILY RENTAL HOUSING 11

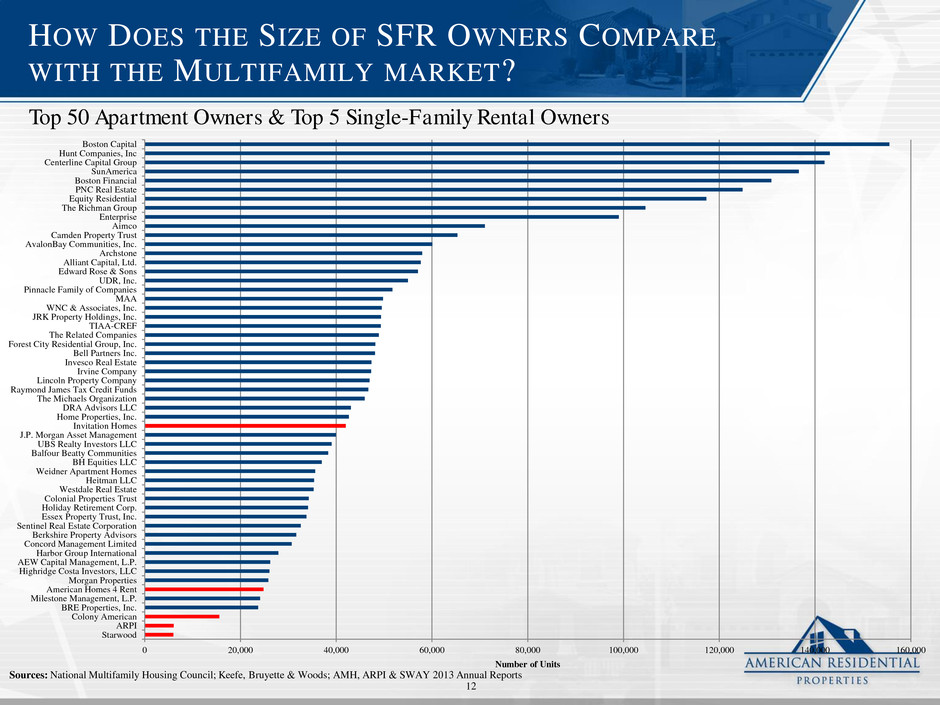

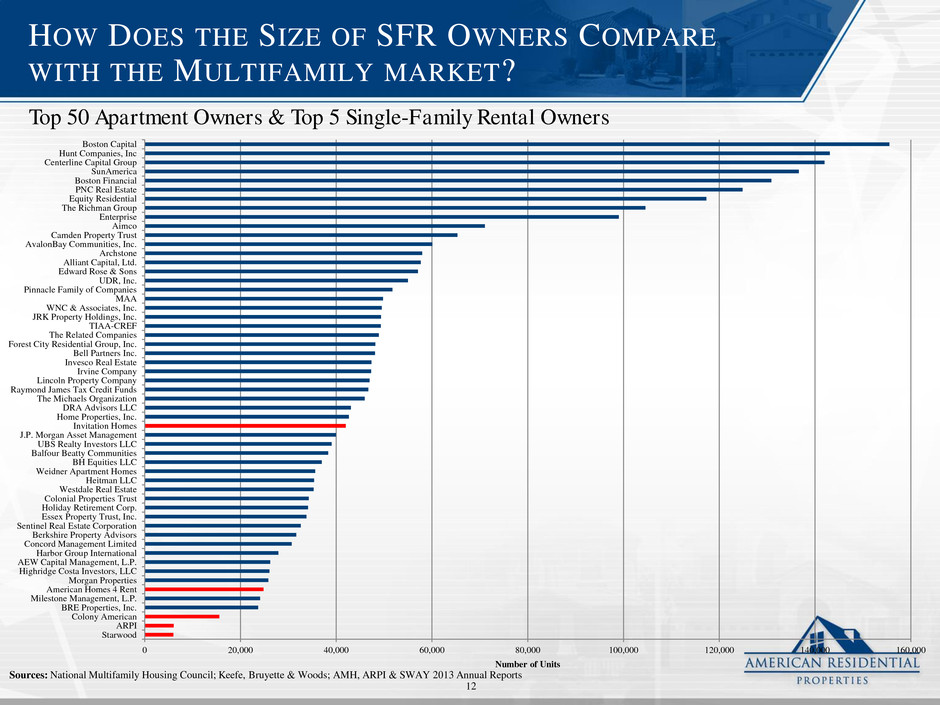

EPS\Management Presentation\American Residential Properties - 602505097 HOW DOES THE SIZE OF SFR OWNERS COMPARE WITH THE MULTIFAMILY MARKET? Top 50 Apartment Owners & Top 5 Single-Family Rental Owners Sources: National Multifamily Housing Council; Keefe, Bruyette & Woods; AMH, ARPI & SWAY 2013 Annual Reports 12 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 Starwood ARPI Colony American BRE Properties, Inc. Milestone Management, L.P. American Homes 4 Rent Morgan Properties Highridge Costa Investors, LLC AEW Capital Management, L.P. Harbor Group International Concord Management Limited Berkshire Property Advisors Sentinel Real Estate Corporation Essex Property Trust, Inc. Holiday Retirement Corp. Colonial Properties Trust Westdale Real Estate Heitman LLC Weidner Apartment Homes BH Equities LLC Balfour Beatty Communities UBS Realty Investors LLC J.P. Morgan Asset Management Invitation Homes Home Properties, Inc. DRA Advisors LLC The Michaels Organization Raymond James Tax Credit Funds Lincoln Property Company Irvine Company Invesco Real Estate Bell Partners Inc. Forest City Residential Group, Inc. The Related Companies TIAA-CREF JRK Property Holdings, Inc. WNC & Associates, Inc. MAA Pinnacle Family of Companies UDR, Inc. Edward Rose & Sons Alliant Capital, Ltd. Archstone AvalonBay Communities, Inc. Camden Property Trust Aimco Enterprise The Richman Group Equity Residential PNC Real Estate Boston Financial SunAmerica Centerline Capital Group Hunt Companies, Inc Boston Capital Number of Units

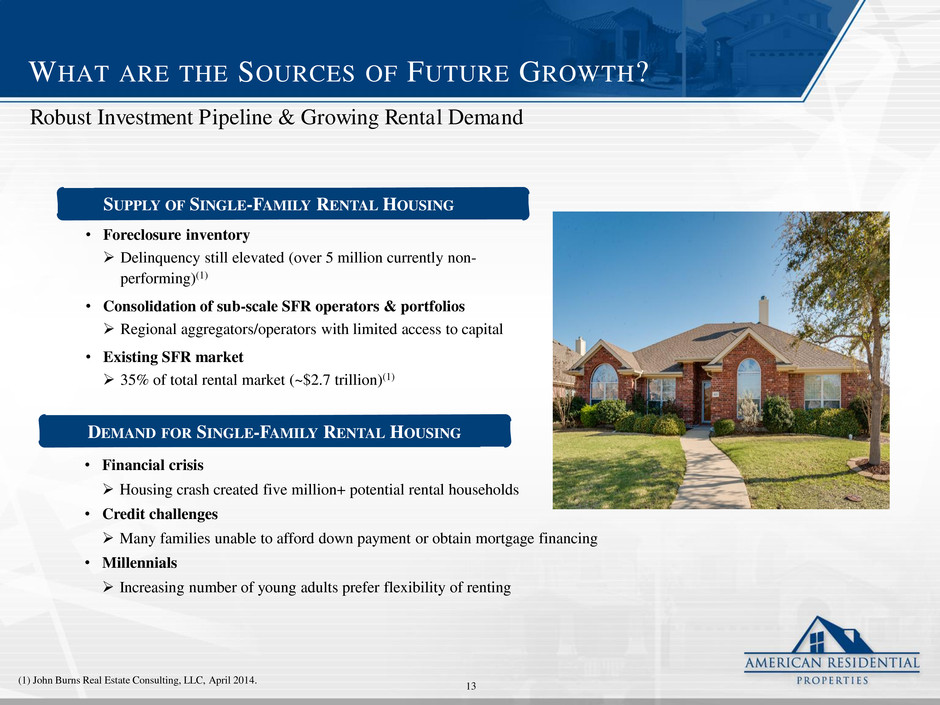

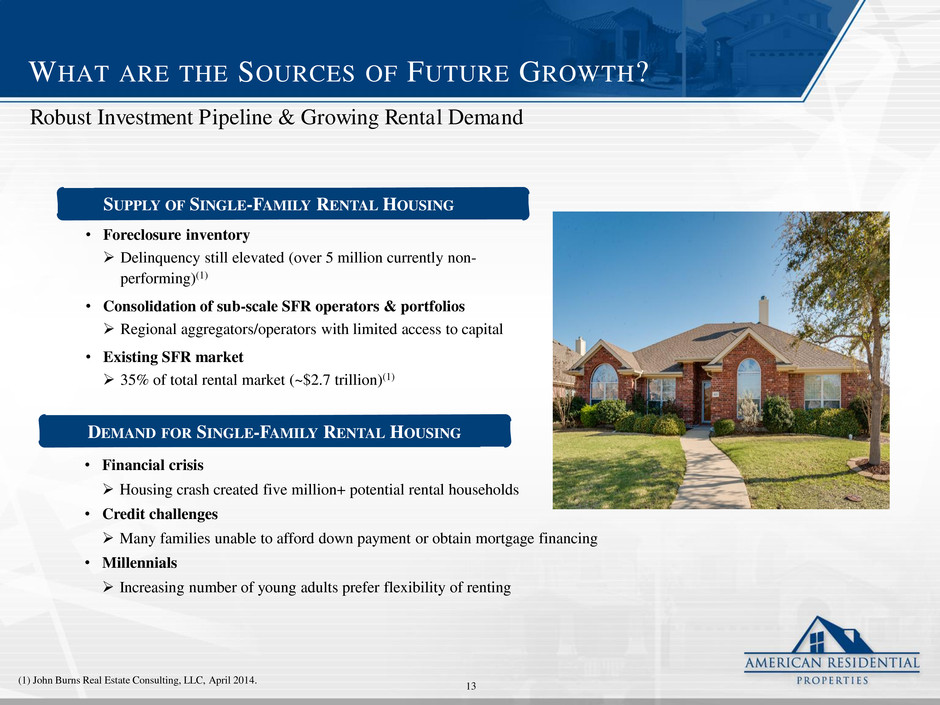

EPS\Management Presentation\American Residential Properties - 602505097 WHAT ARE THE SOURCES OF FUTURE GROWTH? Robust Investment Pipeline & Growing Rental Demand 13 • Foreclosure inventory Delinquency still elevated (over 5 million currently non- performing)(1) • Consolidation of sub-scale SFR operators & portfolios Regional aggregators/operators with limited access to capital • Existing SFR market 35% of total rental market (~$2.7 trillion)(1) • Financial crisis Housing crash created five million+ potential rental households • Credit challenges Many families unable to afford down payment or obtain mortgage financing • Millennials Increasing number of young adults prefer flexibility of renting SUPPLY OF SINGLE-FAMILY RENTAL HOUSING DEMAND FOR SINGLE-FAMILY RENTAL HOUSING (1) John Burns Real Estate Consulting, LLC, April 2014.

EPS\Management Presentation\American Residential Properties - 602505097 ACQUISITIONS & SOURCING 14

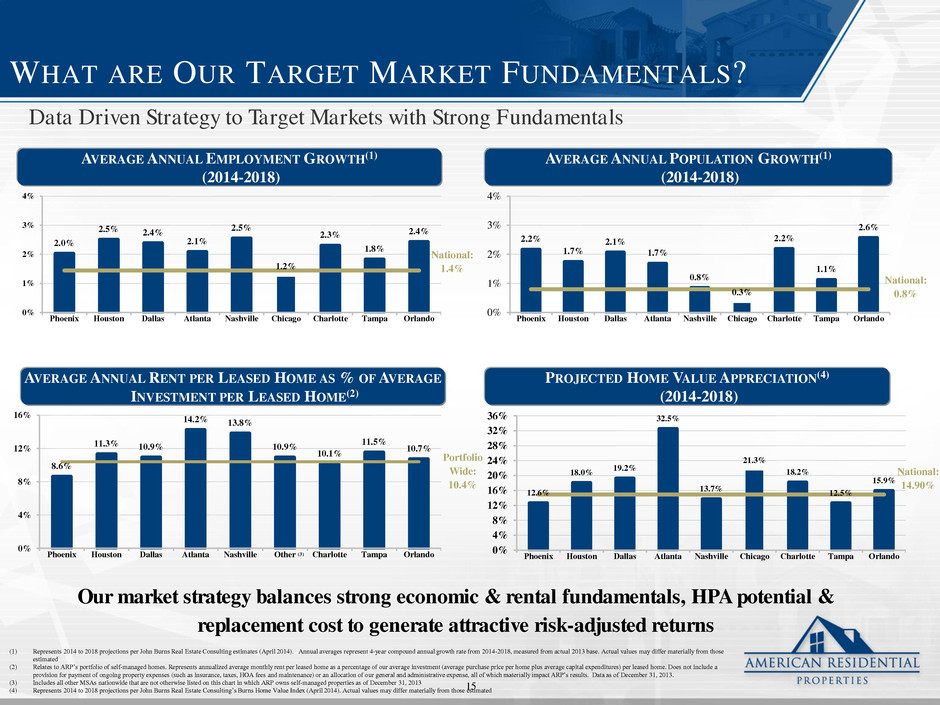

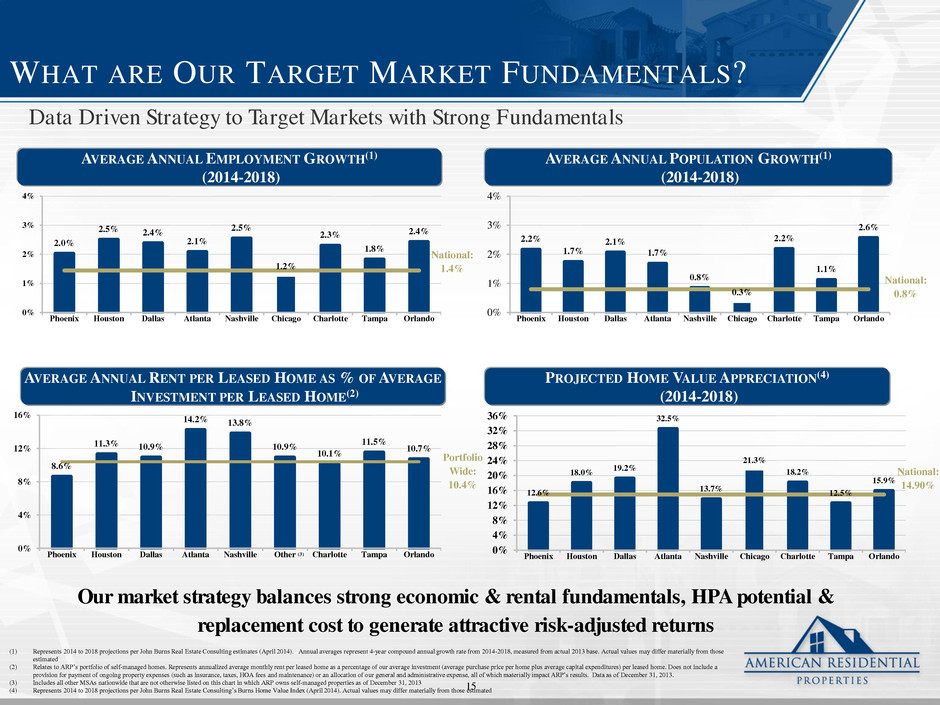

EPS\Management Presentation\American Residential Properties - 602505097 WHAT ARE OUR TARGET MARKET FUNDAMENTALS? Data Driven Strategy to Target Markets with Strong Fundamentals Our market strategy balances strong economic & rental fundamentals, HPA potential & replacement cost to generate attractive risk-adjusted returns AVERAGE ANNUAL EMPLOYMENT GROWTH(1) (2014-2018) 2.0% 2.5% 2.4% 2.1% 2.5% 1.2% 2.3% 1.8% 2.4% 0% 1% 2% 3% 4% Phoenix Houston Dallas Atlanta Nashville Chicago Charlotte Tampa Orlando National: 1.4% AVERAGE ANNUAL POPULATION GROWTH(1) (2014-2018) 2.2% 1.7% 2.1% 1.7% 0.8% 0.3% 2.2% 1.1% 2.6% 0% 1% 2% 3% 4% Phoenix Houston Dallas Atlanta Nashville Chicago Charlotte Tampa Orlando National: 0.8% AVERAGE ANNUAL RENT PER LEASED HOME AS % OF AVERAGE INVESTMENT PER LEASED HOME(2) PROJECTED HOME VALUE APPRECIATION(4) (2014-2018) 8.6% 11.3% 10.9% 14.2% 13.8% 10.9% 10.1% 11.5% 10.7% 0% 4% 8% 12% 16% Phoenix Houston Dallas Atlanta Nashville Other Charlotte Tampa Orlando Portfolio Wide: 10.4% 12.6% 18.0% 19.2% 32.5% 13.7% 21.3% 18.2% 12.5% 15.9% 0% 4% 8% 12% 16% 20% 24% 28% 32% 36% Phoenix Houston Dallas Atlanta Nashville Chicago Charlotte Tampa Orlando National: 14.90% (3) 15 (1) Represents 2014 to 2018 projections per John Burns Real Estate Consulting estimates (April 2014). Annual averages represent 4-year compound annual growth rate from 2014-2018, measured from actual 2013 base. Actual values may differ materially from those estimated (2) Relates to ARP’s portfolio of self-managed homes. Represents annualized average monthly rent per leased home as a percentage of our average investment (average purchase price per home plus average capital expenditures) per leased home. Does not include a provision for payment of ongoing property expenses (such as insurance, taxes, HOA fees and maintenance) or an allocation of our general and administrative expense, all of which materially impact ARP’s results. Data as of December 31, 2013. (3) Includes all other MSAs nationwide that are not otherwise listed on this chart in which ARP owns self-managed properties as of December 31, 2013 (4) Represents 2014 to 2018 projections per John Burns Real Estate Consulting’s Burns Home Value Index (April 2014). Actual values may differ materially from those estimated

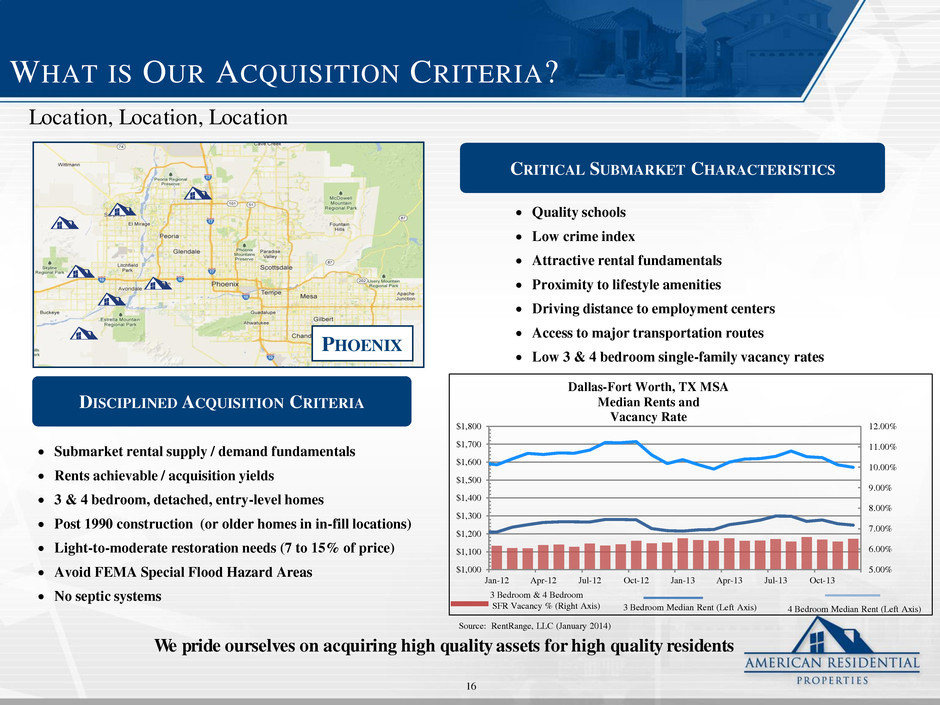

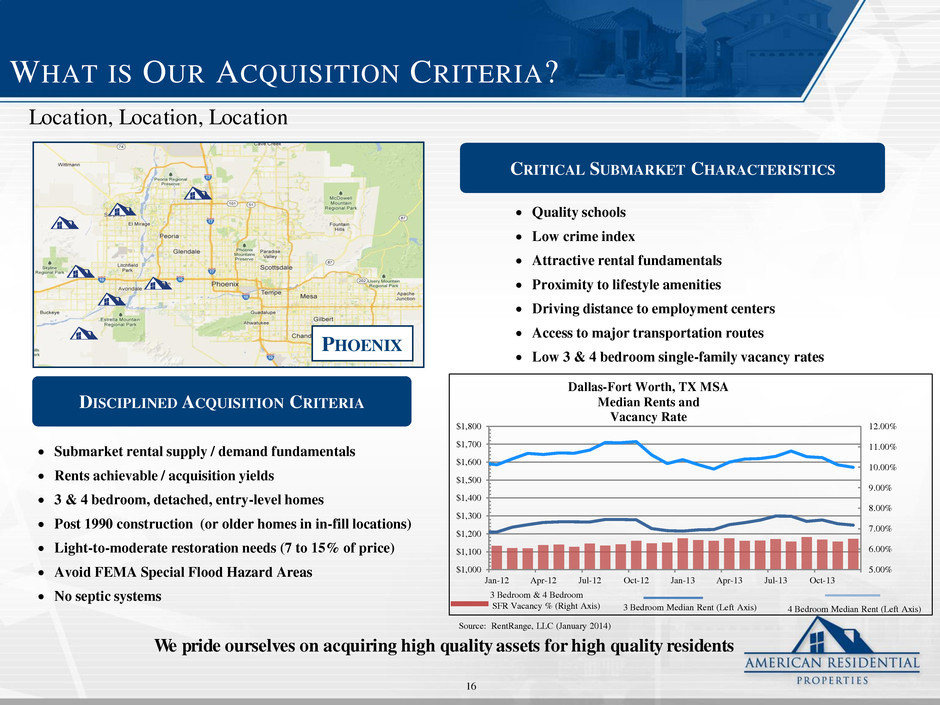

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS OUR ACQUISITION CRITERIA? Quality schools Low crime index Attractive rental fundamentals Proximity to lifestyle amenities Driving distance to employment centers Access to major transportation routes Low 3 & 4 bedroom single-family vacancy rates CRITICAL SUBMARKET CHARACTERISTICS PHOENIX Location, Location, Location Submarket rental supply / demand fundamentals Rents achievable / acquisition yields 3 & 4 bedroom, detached, entry-level homes Post 1990 construction (or older homes in in-fill locations) Light-to-moderate restoration needs (7 to 15% of price) Avoid FEMA Special Flood Hazard Areas No septic systems DISCIPLINED ACQUISITION CRITERIA We pride ourselves on acquiring high quality assets for high quality residents 16 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Dallas-Fort Worth, TX MSA Median Rents and Vacancy Rate 3 Bedroom Median Rent (Left Axis) 4 Bedroom Median Rent (Left Axis) 3 Bedroom & 4 Bedroom SFR Vacancy % (Right Axis) Source: RentRange, LLC (January 2014)

EPS\Management Presentation\American Residential Properties - 602505097 WHAT ARE OUR ACQUISITION CHANNELS? • Opportunities for embedded equity • Higher yields driven by higher barriers to entry • Greater volume potential • Higher restoration expenditures We move among channels within markets to optimize our acquisition opportunities 17 • Ability to purchase homes in bulk • Excellent method to enter new markets • Downtime often minimized as pools are often rehabbed and / or leased • Purchasing power limits competition for larger portfolios • Inherited resident quality generally less than ARPI standard PORTFOLIO ACQUISITIONS TRUSTEE AUCTIONS 3 • Robust broker network of over 250 agents across the country • Strict acquisition guidelines with yield standards and quality grading system • Approval, contracts and closings managed by ARPI • Non-payroll extension of our acquisition staff • Broker & agent scorecards used to grade effectiveness and success SINGLE-SITE “FLOW BUSINESS

EPS\Management Presentation\American Residential Properties - 602505097 AN EXPERIENCED OPERATING COMPANY 18

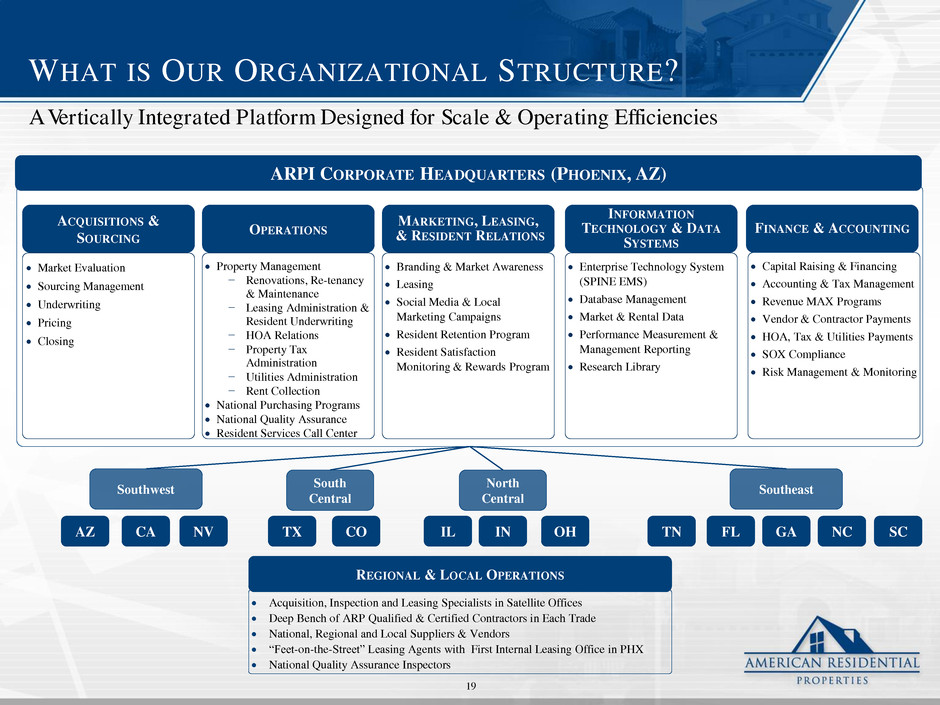

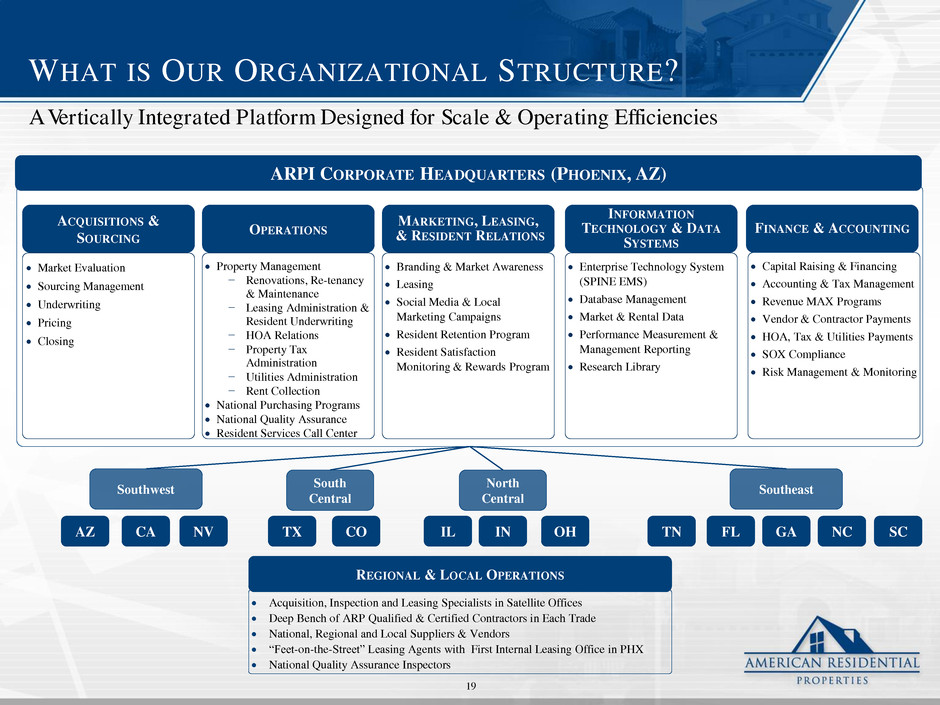

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS OUR ORGANIZATIONAL STRUCTURE? Market Evaluation Sourcing Management Underwriting Pricing Closing ACQUISITIONS & SOURCING Property Management − Renovations, Re-tenancy & Maintenance − Leasing Administration & Resident Underwriting − HOA Relations − Property Tax Administration − Utilities Administration − Rent Collection National Purchasing Programs National Quality Assurance Resident Services Call Center OPERATIONS Branding & Market Awareness Leasing Social Media & Local Marketing Campaigns Resident Retention Program Resident Satisfaction Monitoring & Rewards Program MARKETING, LEASING, & RESIDENT RELATIONS Capital Raising & Financing Accounting & Tax Management Revenue MAX Programs Vendor & Contractor Payments HOA, Tax & Utilities Payments SOX Compliance Risk Management & Monitoring FINANCE & ACCOUNTING Enterprise Technology System (SPINE EMS) Database Management Market & Rental Data Performance Measurement & Management Reporting Research Library INFORMATION TECHNOLOGY & DATA SYSTEMS CA AZ NV TX IL IN FL GA NC Acquisition, Inspection and Leasing Specialists in Satellite Offices Deep Bench of ARP Qualified & Certified Contractors in Each Trade National, Regional and Local Suppliers & Vendors “Feet-on-the-Street” Leasing Agents with First Internal Leasing Office in PHX National Quality Assurance Inspectors REGIONAL & LOCAL OPERATIONS North Central Southeast ARPI CORPORATE HEADQUARTERS (PHOENIX, AZ) South Central A Vertically Integrated Platform Designed for Scale & Operating Efficiencies SC Southwest CO TN OH 19

EPS\Management Presentation\American Residential Properties - 602505097 RESIDENT SERVICE CENTERS 20 First internalized leasing office opened March 2014

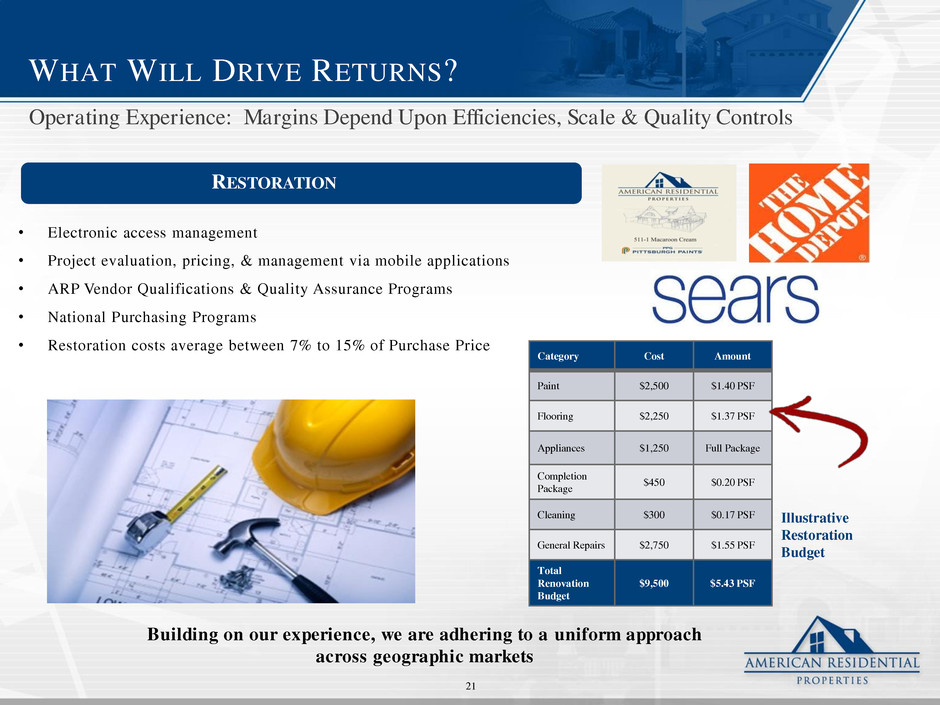

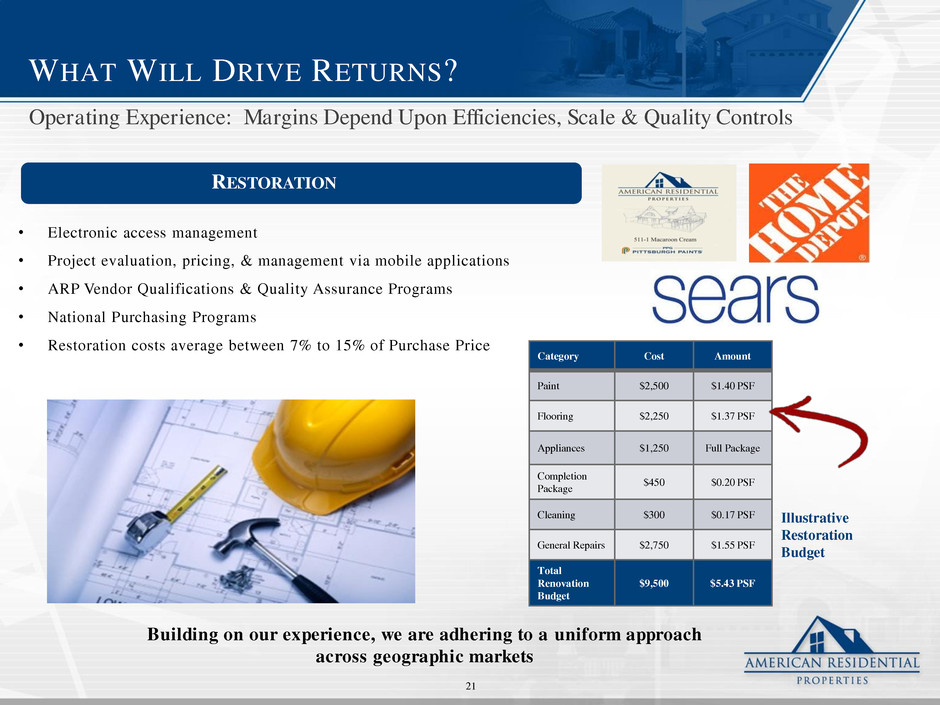

EPS\Management Presentation\American Residential Properties - 602505097 21 WHAT WILL DRIVE RETURNS? Operating Experience: Margins Depend Upon Efficiencies, Scale & Quality Controls • Electronic access management • Project evaluation, pricing, & management via mobile applications • ARP Vendor Qualifications & Quality Assurance Programs • National Purchasing Programs • Restoration costs average between 7% to 15% of Purchase Price Building on our experience, we are adhering to a uniform approach across geographic markets RESTORATION Category Cost Amount Paint $2,500 $1.40 PSF Flooring $2,250 $1.37 PSF Appliances $1,250 Full Package Completion Package $450 $0.20 PSF Cleaning $300 $0.17 PSF General Repairs $2,750 $1.55 PSF Total Renovation Budget $9,500 $5.43 PSF Illustrative Restoration Budget

EPS\Management Presentation\American Residential Properties - 602505097 RESIDENT-CENTRIC OPERATING PHILOSOPHY 22 “We believe the demand for rental housing will grow – not as a transitional, sub- standard or second class alternative to home ownership - but as a preferred option to the financial and often inflexible demands of home ownership.”

EPS\Management Presentation\American Residential Properties - 602505097 23 WHAT IS OUR MARKETING & BRANDING STRATEGY? Resident Retention is Key to Revenue and Shareholder Value

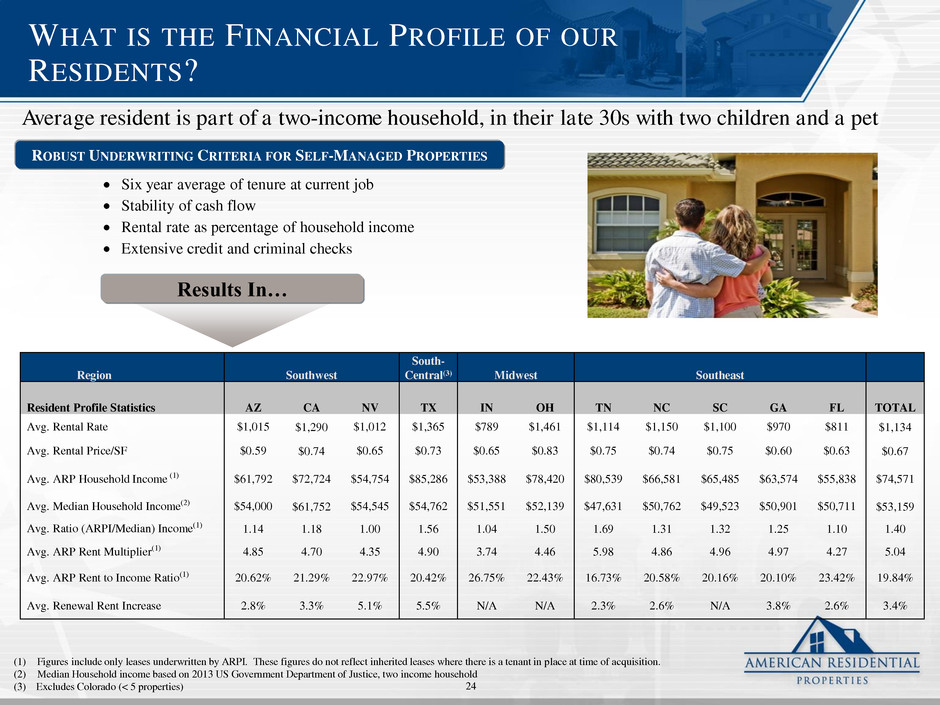

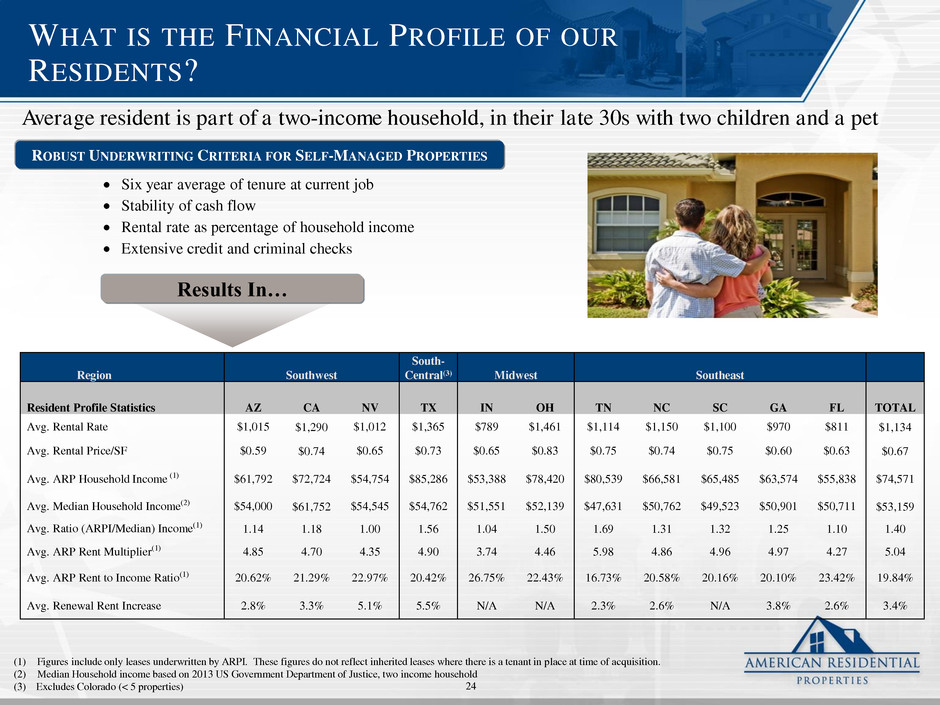

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS THE FINANCIAL PROFILE OF OUR RESIDENTS? 24 (1) Figures include only leases underwritten by ARPI. These figures do not reflect inherited leases where there is a tenant in place at time of acquisition. (2) Median Household income based on 2013 US Government Department of Justice, two income household (3) Excludes Colorado (< 5 properties) ROBUST UNDERWRITING CRITERIA FOR SELF-MANAGED PROPERTIES Results In… Six year average of tenure at current job Stability of cash flow Rental rate as percentage of household income Extensive credit and criminal checks Region Southwest South- Central(3) Midwest Southeast Resident Profile Statistics AZ CA NV TX IN OH TN NC SC GA FL TOTAL Avg. Rental Rate $1,015 $1,290 $1,012 $1,365 $789 $1,461 $1,114 $1,150 $1,100 $970 $811 $1,134 Avg. Rental Price/SF $0.59 $0.74 $0.65 $0.73 $0.65 $0.83 $0.75 $0.74 $0.75 $0.60 $0.63 $0.67 Avg. ARP Household Income (1) $61,792 $72,724 $54,754 $85,286 $53,388 $78,420 $80,539 $66,581 $65,485 $63,574 $55,838 $74,571 Avg. Median Household Income(2) $54,000 $61,752 $54,545 $54,762 $51,551 $52,139 $47,631 $50,762 $49,523 $50,901 $50,711 $53,159 Avg. Ratio (ARPI/Median) Income(1) 1.14 1.18 1.00 1.56 1.04 1.50 1.69 1.31 1.32 1.25 1.10 1.40 Avg. ARP Rent Multiplier(1) 4.85 4.70 4.35 4.90 3.74 4.46 5.98 4.86 4.96 4.97 4.27 5.04 Avg. ARP Rent to Income Ratio(1) 20.62% 21.29% 22.97% 20.42% 26.75% 22.43% 16.73% 20.58% 20.16% 20.10% 23.42% 19.84% Avg. Renewal Rent Increase 2.8% 3.3% 5.1% 5.5% N/A N/A 2.3% 2.6% N/A 3.8% 2.6% 3.4% Average resident is part of a two-income household, in their late 30s with two children and a pet

EPS\Management Presentation\American Residential Properties - 602505097 FINANCIAL OVERVIEW 25

EPS\Management Presentation\American Residential Properties - 602505097 HOW HAVE WE DEPLOYED CAPITAL? (1) For self-managed homes, represents purchase price (including broker commissions and closing costs) plus capital expenditures (does not include additional expected or future capital expenditures). For preferred operator program homes, represents purchase price (including broker commissions and closing costs) paid by us for the portfolio and does not include past, expected or budgeted general and administrative expenses associated with ongoing monitoring activities of our investment Capital Deployment 26 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 6,000 $0 $100,000,000 $200,000,000 $300,000,000 $400,000,000 $500,000,000 $600,000,000 $700,000,000 $800,000,000 Homes Acquired Aggregate Investment (1) Outstanding Loans (LHS) AZ (LHS) CA (LHS) FL (LHS) GA (LHS) IL (LHS) IN (LHS) NC (LHS) NV (LHS) SC (LHS) TX (LHS) TN (LHS) OH (LHS) CO (LHS) Total Number of Homes (RHS) $150M Revolving Credit Facility $225M 144A Equity Offering $148M 144A Equity Offering $288M Initial Public Equity Offering Revolver Increased to $340M Revolver Increased to $380M $115 M Exchangeable Notes Offering

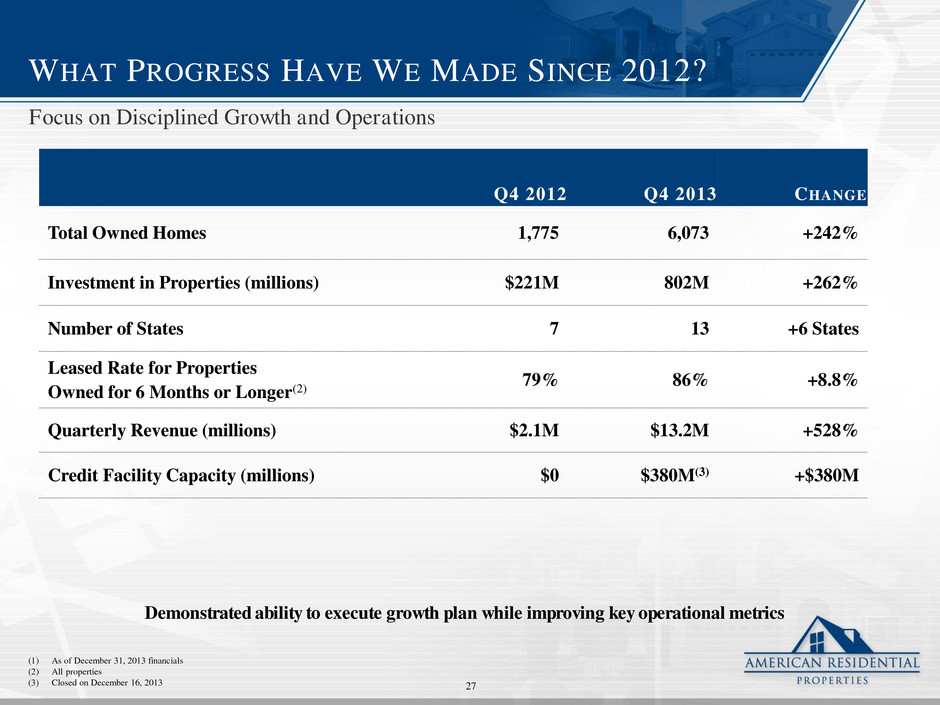

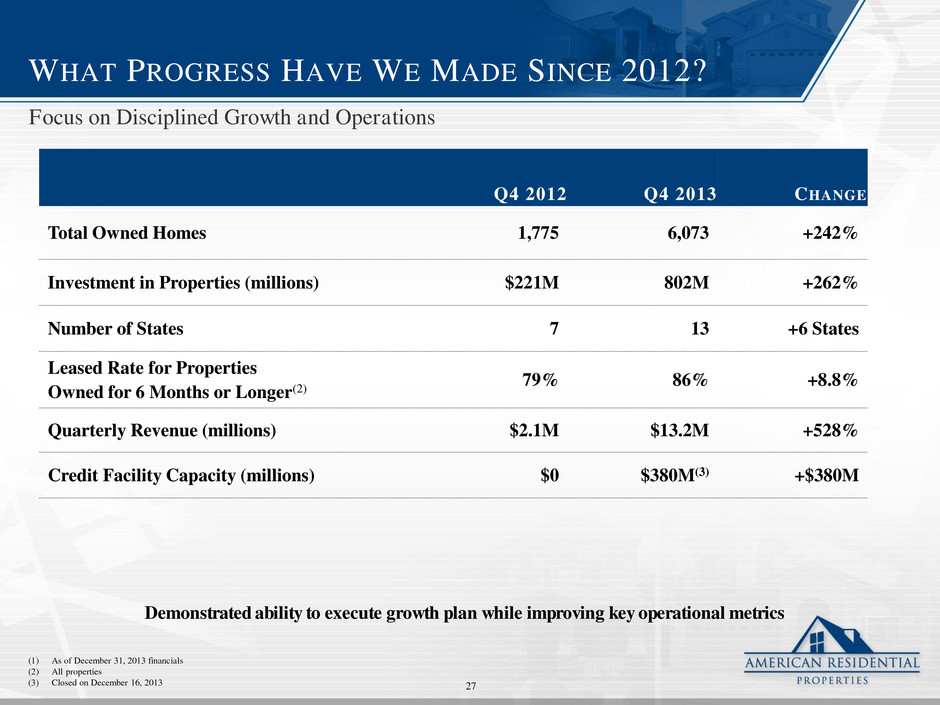

EPS\Management Presentation\American Residential Properties - 602505097 WHAT PROGRESS HAVE WE MADE SINCE 2012? Q4 2012 Q4 2013 CHANGE Total Owned Homes 1,775 6,073 +242% Investment in Properties (millions) $221M 802M +262% Number of States 7 13 +6 States Leased Rate for Properties Owned for 6 Months or Longer(2) 79% 86% +8.8% Quarterly Revenue (millions) $2.1M $13.2M +528% Credit Facility Capacity (millions) $0 $380M(3) +$380M Focus on Disciplined Growth and Operations 27 (1) As of December 31, 2013 financials (2) All properties (3) Closed on December 16, 2013 Demonstrated ability to execute growth plan while improving key operational metrics

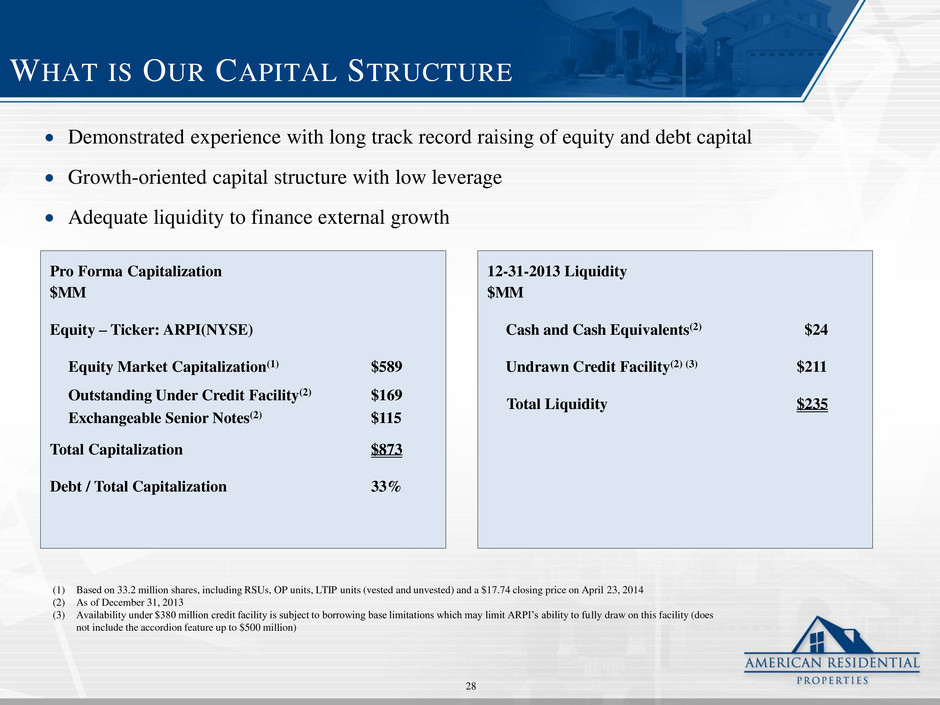

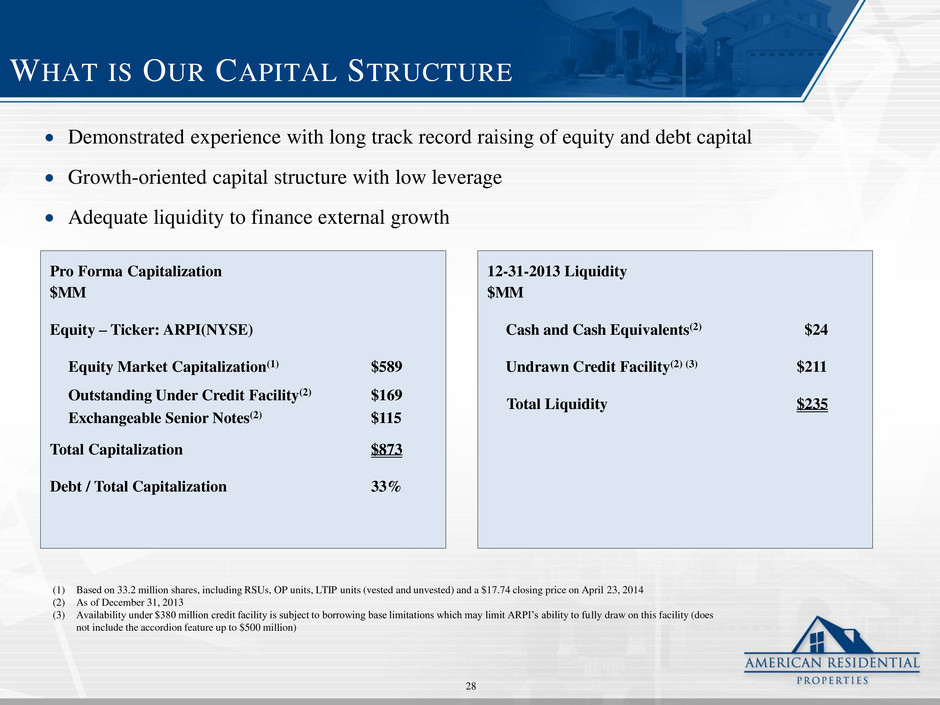

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS OUR CAPITAL STRUCTURE Demonstrated experience with long track record raising of equity and debt capital Growth-oriented capital structure with low leverage Adequate liquidity to finance external growth Pro Forma Capitalization $MM Equity – Ticker: ARPI(NYSE) Equity Market Capitalization(1) $589 Outstanding Under Credit Facility(2) $169 Exchangeable Senior Notes(2) $115 Total Capitalization $873 Debt / Total Capitalization 33% 12-31-2013 Liquidity $MM Cash and Cash Equivalents(2) $24 Undrawn Credit Facility(2) (3) $211 Total Liquidity $235 (1) Based on 33.2 million shares, including RSUs, OP units, LTIP units (vested and unvested) and a $17.74 closing price on April 23, 2014 (2) As of December 31, 2013 (3) Availability under $380 million credit facility is subject to borrowing base limitations which may limit ARPI’s ability to fully draw on this facility (does not include the accordion feature up to $500 million) 28

EPS\Management Presentation\American Residential Properties - 602505097 AMERICAN RESIDENTIAL PROPERTIES, INC. 29 Renovating the Future of the Rental Experience

EPS\Management Presentation\American Residential Properties - 602505097 APPENDIX 30

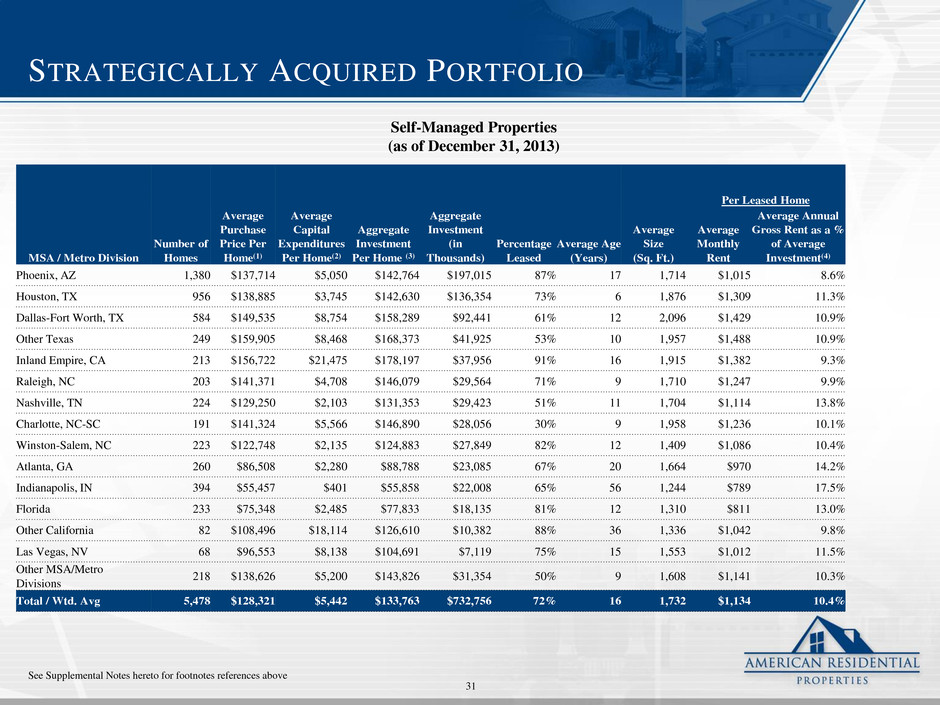

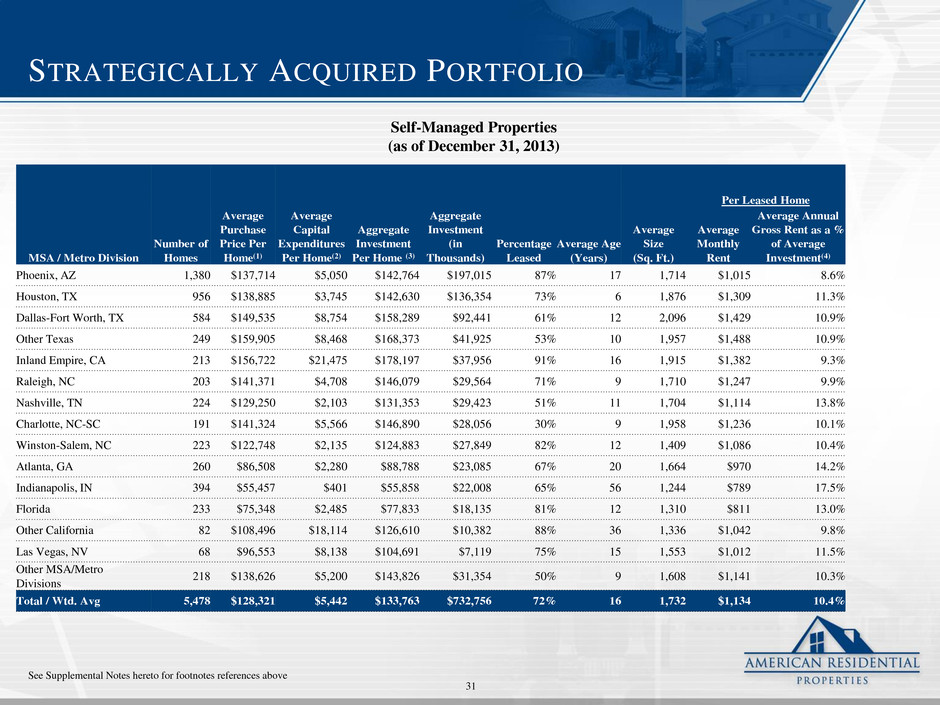

EPS\Management Presentation\American Residential Properties - 602505097 STRATEGICALLY ACQUIRED PORTFOLIO Self-Managed Properties (as of December 31, 2013) Per Leased Home MSA / Metro Division Number of Homes Average Purchase Price Per Home(1) Average Capital Expenditures Per Home(2) Aggregate Investment Per Home (3) Aggregate Investment (in Thousands) Percentage Leased Average Age (Years) Average Size (Sq. Ft.) Average Monthly Rent Average Annual Gross Rent as a % of Average Investment(4) Phoenix, AZ 1,380 $137,714 $5,050 $142,764 $197,015 87% 17 1,714 $1,015 8.6% Houston, TX 956 $138,885 $3,745 $142,630 $136,354 73% 6 1,876 $1,309 11.3% Dallas-Fort Worth, TX 584 $149,535 $8,754 $158,289 $92,441 61% 12 2,096 $1,429 10.9% Other Texas 249 $159,905 $8,468 $168,373 $41,925 53% 10 1,957 $1,488 10.9% Inland Empire, CA 213 $156,722 $21,475 $178,197 $37,956 91% 16 1,915 $1,382 9.3% Raleigh, NC 203 $141,371 $4,708 $146,079 $29,564 71% 9 1,710 $1,247 9.9% Nashville, TN 224 $129,250 $2,103 $131,353 $29,423 51% 11 1,704 $1,114 13.8% Charlotte, NC-SC 191 $141,324 $5,566 $146,890 $28,056 30% 9 1,958 $1,236 10.1% Winston-Salem, NC 223 $122,748 $2,135 $124,883 $27,849 82% 12 1,409 $1,086 10.4% Atlanta, GA 260 $86,508 $2,280 $88,788 $23,085 67% 20 1,664 $970 14.2% Indianapolis, IN 394 $55,457 $401 $55,858 $22,008 65% 56 1,244 $789 17.5% Florida 233 $75,348 $2,485 $77,833 $18,135 81% 12 1,310 $811 13.0% Other California 82 $108,496 $18,114 $126,610 $10,382 88% 36 1,336 $1,042 9.8% Las Vegas, NV 68 $96,553 $8,138 $104,691 $7,119 75% 15 1,553 $1,012 11.5% Other MSA/Metro Divisions 218 $138,626 $5,200 $143,826 $31,354 50% 9 1,608 $1,141 10.3% Total / Wtd. Avg 5,478 $128,321 $5,442 $133,763 $732,756 72% 16 1,732 $1,134 10.4% See Supplemental Notes hereto for footnotes references above 31

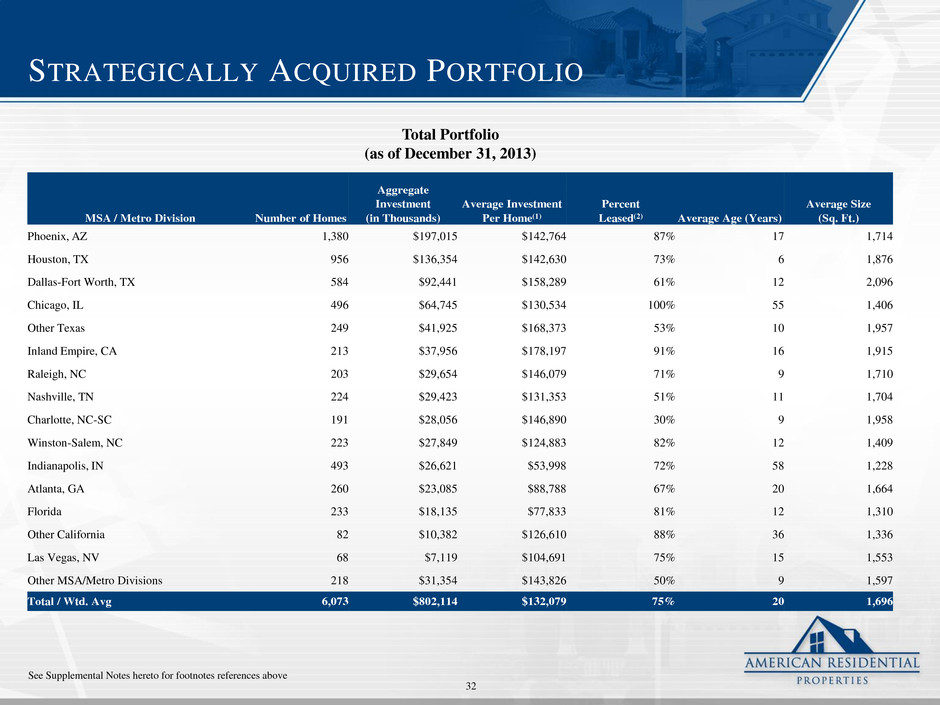

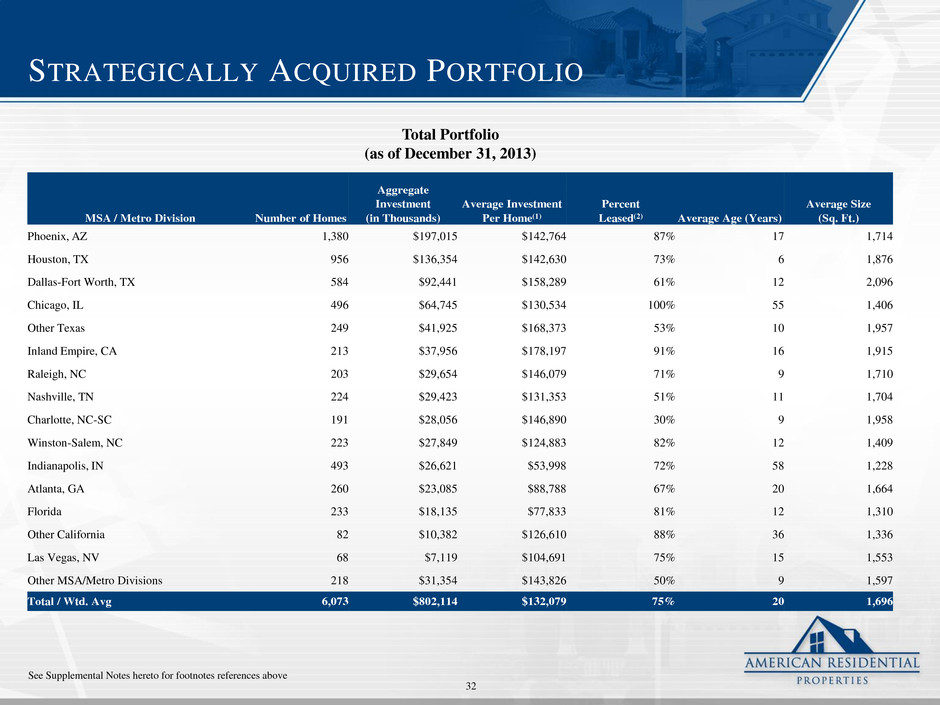

EPS\Management Presentation\American Residential Properties - 602505097 STRATEGICALLY ACQUIRED PORTFOLIO MSA / Metro Division Number of Homes Aggregate Investment (in Thousands) Average Investment Per Home(1) Percent Leased(2) Average Age (Years) Average Size (Sq. Ft.) Phoenix, AZ 1,380 $197,015 $142,764 87% 17 1,714 Houston, TX 956 $136,354 $142,630 73% 6 1,876 Dallas-Fort Worth, TX 584 $92,441 $158,289 61% 12 2,096 Chicago, IL 496 $64,745 $130,534 100% 55 1,406 Other Texas 249 $41,925 $168,373 53% 10 1,957 Inland Empire, CA 213 $37,956 $178,197 91% 16 1,915 Raleigh, NC 203 $29,654 $146,079 71% 9 1,710 Nashville, TN 224 $29,423 $131,353 51% 11 1,704 Charlotte, NC-SC 191 $28,056 $146,890 30% 9 1,958 Winston-Salem, NC 223 $27,849 $124,883 82% 12 1,409 Indianapolis, IN 493 $26,621 $53,998 72% 58 1,228 Atlanta, GA 260 $23,085 $88,788 67% 20 1,664 Florida 233 $18,135 $77,833 81% 12 1,310 Other California 82 $10,382 $126,610 88% 36 1,336 Las Vegas, NV 68 $7,119 $104,691 75% 15 1,553 Other MSA/Metro Divisions 218 $31,354 $143,826 50% 9 1,597 Total / Wtd. Avg 6,073 $802,114 $132,079 75% 20 1,696 Total Portfolio (as of December 31, 2013) See Supplemental Notes hereto for footnotes references above 32

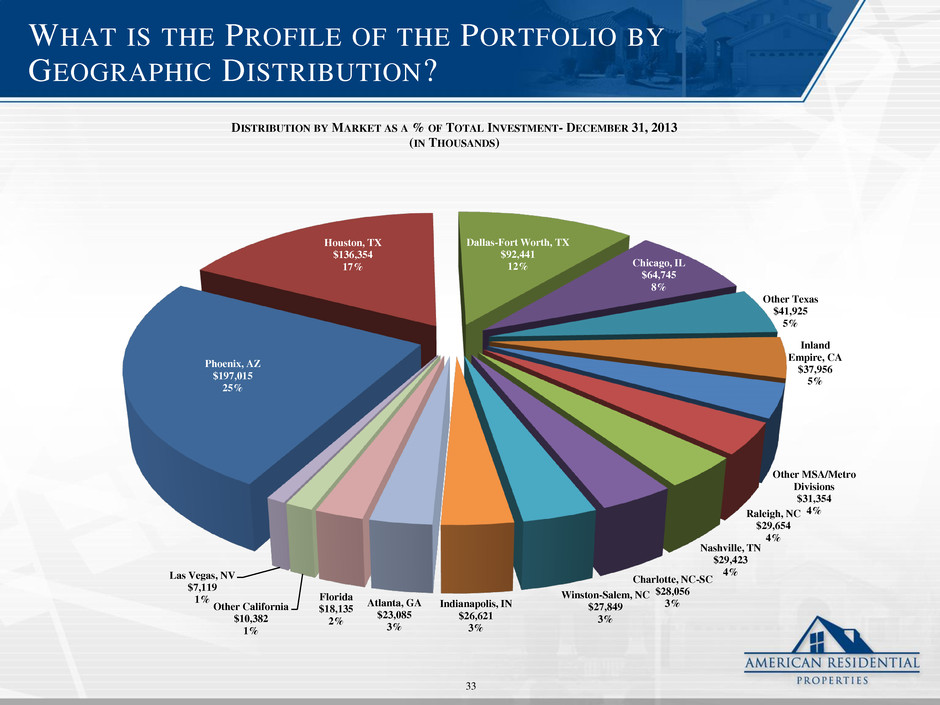

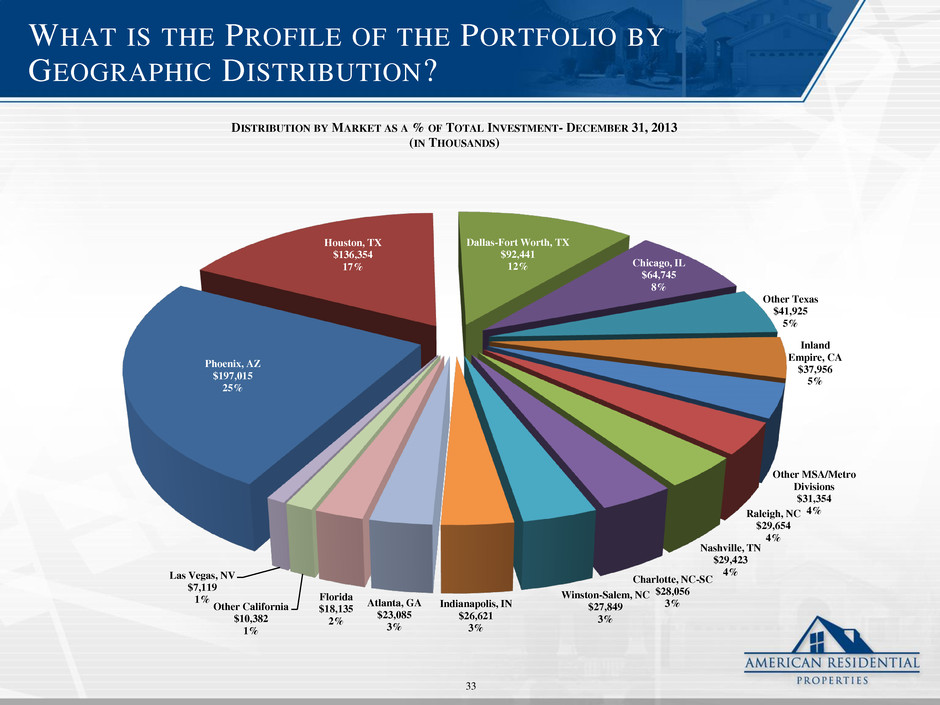

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS THE PROFILE OF THE PORTFOLIO BY GEOGRAPHIC DISTRIBUTION? 33 Phoenix, AZ $197,015 25% Houston, TX $136,354 17% Dallas-Fort Worth, TX $92,441 12% Chicago, IL $64,745 8% Other Texas $41,925 5% Inland Empire, CA $37,956 5% Other MSA/Metro Divisions $31,354 4% Raleigh, NC $29,654 4% Nashville, TN $29,423 4% Charlotte, NC-SC $28,056 3% Winston-Salem, NC $27,849 3% Indianapolis, IN $26,621 3% Atlanta, GA $23,085 3% Florida $18,135 2% Other California $10,382 1% Las Vegas, NV $7,119 1% DISTRIBUTION BY MARKET AS A % OF TOTAL INVESTMENT- DECEMBER 31, 2013 (IN THOUSANDS)

EPS\Management Presentation\American Residential Properties - 602505097 HOW MUCH HAVE HOME PRICES APPRECIATED? Uneven Recovery has Created Opportunities to Buy at a Discount in Select Markets 34 ARPI Portfolio(1) HPA Trends(2)(3) Market Homes Total Investment (Millions) % of Total Investment Since Q2 2012 Last 12 Months Phoenix, AZ 1,380 $197.0 24.6% 31.4% 17.3% Houston, TX 956 $136.4 17.0% 15.5% 11.4% Dallas-Fort Worth, TX 584 $92.4 11.5% 11.1% 8.8% Chicago, IL 496 $64.7 8.1% 9.4% 11.7% Other Texas 249 $41.9 5.2% 6.0% 4.2% Inland Empire, CA 213 $38.0 4.7% 34.9% 27.0% Raleigh, NC 203 $29.7 3.7% 5.1% 6.6% Nashville, TN 224 $29.4 3.7% 11.5% 10.1% Charlotte, NC-SC 191 $28.1 3.5% 10.3% 13.9% Winston-Salem, NC 223 $27.8 3.5% 2.9% -0.9% Indianapolis, IN 493 $26.6 3.3% 4.1% 8.1% Atlanta, GA 260 $23.1 2.9% 17.7% 14.6% Florida 233 $18.1 2.3% 16.2% 9.8% Other California 82 $10.4 1.3% 29.1% 22.5% Las Vegas, NV 68 $7.1 0.9% 41.5% 24.7% Other MSA/Metro Divisions 218 $31.4 3.8% 2.9% 3.5% Total / Weighted Averages 6,073 $802.1 100.0% 17.1%(4) 12.2%(4) Source for HPA: FHFA Purchase-Only & All Transactions Index as of December 31, 2013 See Supplemental Notes hereto for footnotes references above

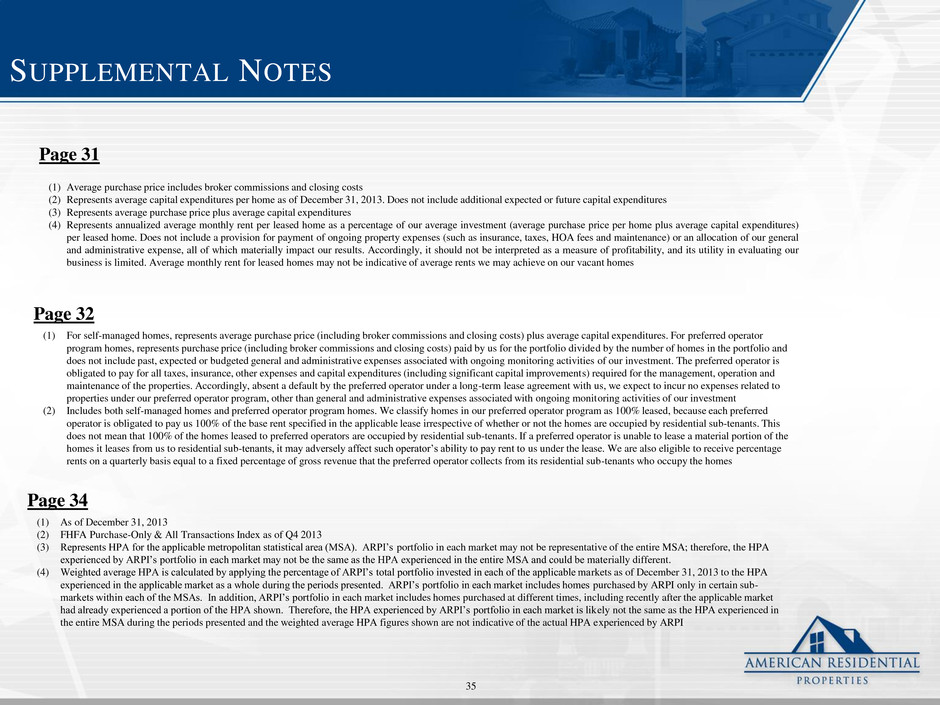

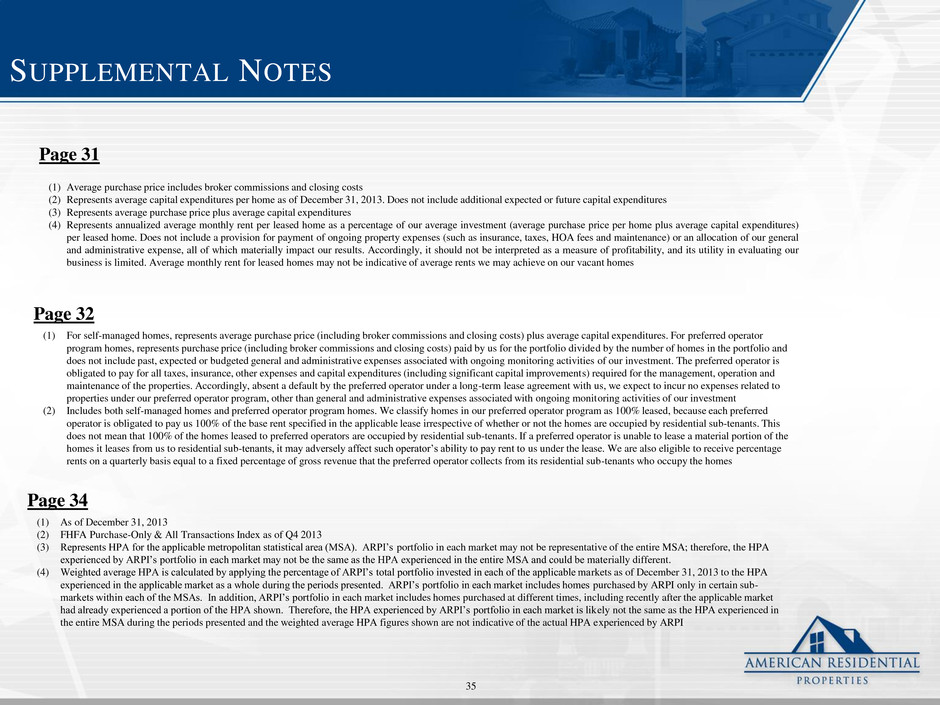

EPS\Management Presentation\American Residential Properties - 602505097 SUPPLEMENTAL NOTES (1) Average purchase price includes broker commissions and closing costs (2) Represents average capital expenditures per home as of December 31, 2013. Does not include additional expected or future capital expenditures (3) Represents average purchase price plus average capital expenditures (4) Represents annualized average monthly rent per leased home as a percentage of our average investment (average purchase price per home plus average capital expenditures) per leased home. Does not include a provision for payment of ongoing property expenses (such as insurance, taxes, HOA fees and maintenance) or an allocation of our general and administrative expense, all of which materially impact our results. Accordingly, it should not be interpreted as a measure of profitability, and its utility in evaluating our business is limited. Average monthly rent for leased homes may not be indicative of average rents we may achieve on our vacant homes Page 31 Page 32 (1) For self-managed homes, represents average purchase price (including broker commissions and closing costs) plus average capital expenditures. For preferred operator program homes, represents purchase price (including broker commissions and closing costs) paid by us for the portfolio divided by the number of homes in the portfolio and does not include past, expected or budgeted general and administrative expenses associated with ongoing monitoring activities of our investment. The preferred operator is obligated to pay for all taxes, insurance, other expenses and capital expenditures (including significant capital improvements) required for the management, operation and maintenance of the properties. Accordingly, absent a default by the preferred operator under a long-term lease agreement with us, we expect to incur no expenses related to properties under our preferred operator program, other than general and administrative expenses associated with ongoing monitoring activities of our investment (2) Includes both self-managed homes and preferred operator program homes. We classify homes in our preferred operator program as 100% leased, because each preferred operator is obligated to pay us 100% of the base rent specified in the applicable lease irrespective of whether or not the homes are occupied by residential sub-tenants. This does not mean that 100% of the homes leased to preferred operators are occupied by residential sub-tenants. If a preferred operator is unable to lease a material portion of the homes it leases from us to residential sub-tenants, it may adversely affect such operator’s ability to pay rent to us under the lease. We are also eligible to receive percentage rents on a quarterly basis equal to a fixed percentage of gross revenue that the preferred operator collects from its residential sub-tenants who occupy the homes 35 Page 34 (1) As of December 31, 2013 (2) FHFA Purchase-Only & All Transactions Index as of Q4 2013 (3) Represents HPA for the applicable metropolitan statistical area (MSA). ARPI’s portfolio in each market may not be representative of the entire MSA; therefore, the HPA experienced by ARPI’s portfolio in each market may not be the same as the HPA experienced in the entire MSA and could be materially different. (4) Weighted average HPA is calculated by applying the percentage of ARPI’s total portfolio invested in each of the applicable markets as of December 31, 2013 to the HPA experienced in the applicable market as a whole during the periods presented. ARPI’s portfolio in each market includes homes purchased by ARPI only in certain sub- markets within each of the MSAs. In addition, ARPI’s portfolio in each market includes homes purchased at different times, including recently after the applicable market had already experienced a portion of the HPA shown. Therefore, the HPA experienced by ARPI’s portfolio in each market is likely not the same as the HPA experienced in the entire MSA during the periods presented and the weighted average HPA figures shown are not indicative of the actual HPA experienced by ARPI