UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | |

| ¨ | | Preliminary Proxy Statement |

| | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | | Definitive Proxy Statement |

| | |

| ¨ | | Definitive Additional Materials |

| | |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

American Residential Properties, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| | | | | |

| x | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

| | | (1 | ) | | Title of each class of securities to which transaction applies:

|

| | | (2 | ) | | Aggregate number of securities to which transaction applies:

|

| | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | (5 | ) | | Total fee paid:

|

| ¨ | | Fee paid previously with preliminary materials: |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

| | | (1 | ) | | Amount previously paid:

|

| | | (2 | ) | | Form, Schedule or Registration Statement No.:

|

| | | (3 | ) | | Filing Party:

|

| | | (4 | ) | | Date Filed:

|

April 17, 2015

Dear Fellow Stockholder:

On behalf of the Board of Directors of American Residential Properties, Inc., I cordially invite you to attend our annual meeting of stockholders on Thursday, May 28, 2015, at The Westin Kierland Resort & Spa, 6902 East Greenway Parkway, Scottsdale, Arizona at 8:00 a.m. (PDT).

The attached Notice of Annual Meeting and Proxy Statement describe the matters to be acted upon at the meeting. We encourage you to read these materials carefully. Whether or not you plan to attend the meeting in person, your vote is very important, and we encourage you to vote promptly. We are pleased to offer multiple options for voting your shares. You may vote by telephone, via the Internet, by mail or in person as described beginning on page 2 of the proxy statement.

We look forward to seeing you at the annual meeting.

|

|

| Sincerely, |

|

| Stephen G. Schmitz |

| Chief Executive Officer and Chairman of the Board of Directors |

AMERICAN RESIDENTIAL PROPERTIES, INC.

7047 East Greenway Parkway, Suite 350

Scottsdale, Arizona 85254

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the 2015 Annual Meeting of Stockholders (the "Annual Meeting") of American Residential Properties, Inc. will be held on Thursday, May 28, 2015, at The Westin Kierland Resort & Spa, 6902 East Greenway Parkway, Scottsdale, Arizona 85254 at 8:00 a.m. (PDT), for the following purposes:

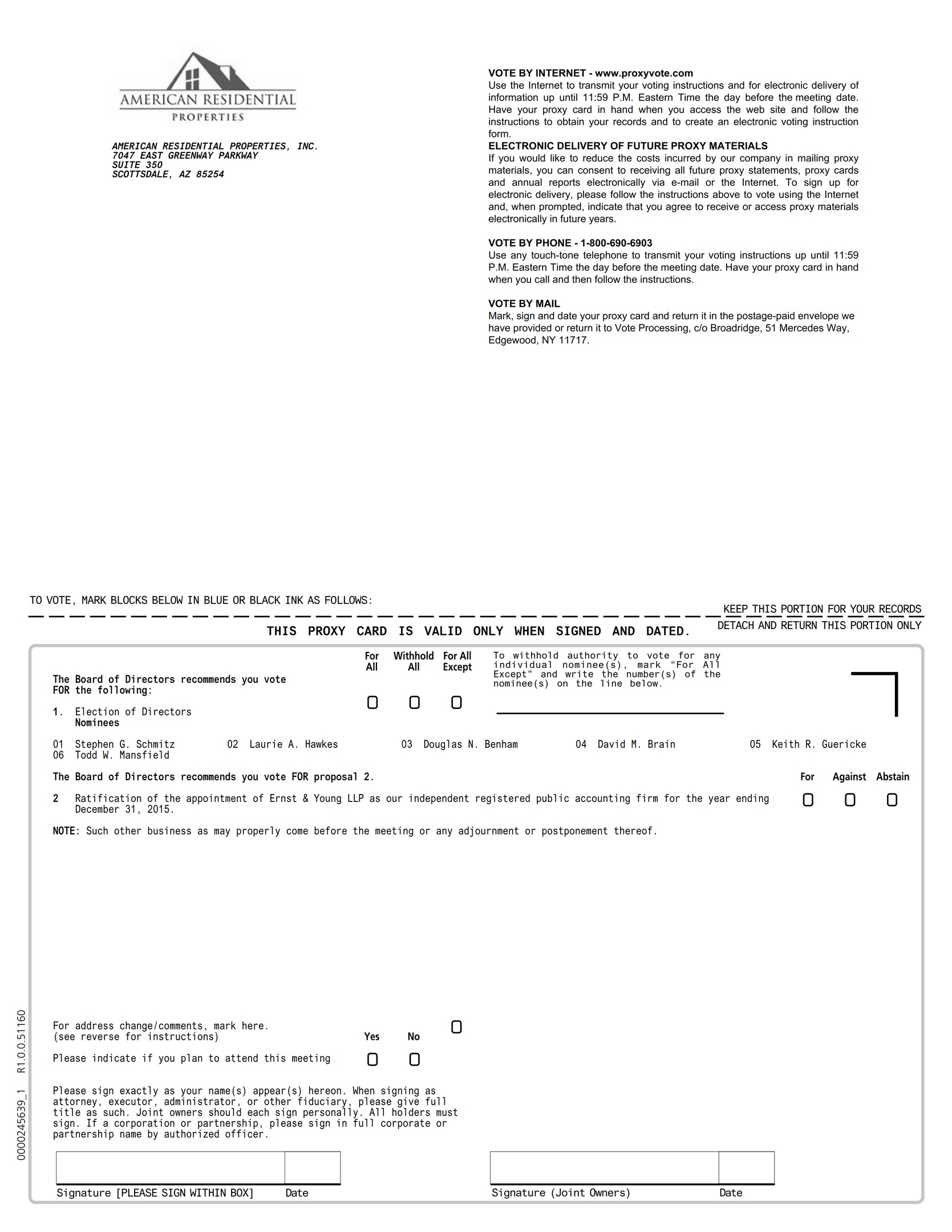

1. to elect to our Board of Directors (our "Board of Directors" or our "Board") the six nominees named in the attached proxy statement to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified;

2. to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015; and

3. to transact such other business as may properly be brought before the Annual Meeting and at any adjournment or postponement thereof.

The Board has fixed the close of business on April 1, 2015, as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

You may authorize your proxy by telephone or on the Internet, and may vote by written proxy or written ballot at the meeting. We encourage you to sign, date and return the enclosed proxy card promptly in the accompanying envelope, which requires no postage if mailed in the United States, or instruct us by telephone or on the Internet as to the authorization of your proxy. Instructions for voting are contained on the enclosed proxy card. If for any reason you should decide to revoke your proxy, you may do so at any time prior to its exercise at the Annual Meeting.

Whether or not you plan to attend the Annual Meeting in person, your vote is very important, and we encourage you to vote as promptly as possible. If you vote by proxy, but later decide to attend the Annual Meeting in person, or for any other reason desire to revoke your proxy, you may still do so by following the procedures set forth in the Proxy Statement.

|

| |

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | Patricia B. Dietz |

| | General Counsel, Chief Compliance Officer and Secretary |

Scottsdale, Arizona

April 17, 2015

Important Notice Regarding the Availability of Proxy Materials

For Stockholders Meeting to Be Held on May 28, 2015:

The Proxy Statement and Annual Report are available in the

Investor Relations section on our website at

http://www.amresprop.com

AMERICAN RESIDENTIAL PROPERTIES, INC.

7047 East Greenway Parkway, Suite 350

Scottsdale, Arizona 85254

This proxy statement, including the information incorporated by reference herein (collectively, this "Proxy Statement"), provides information about the 2015 Annual Meeting of American Residential Properties, Inc. to be held at The Westin Kierland Resort & Spa, 6902 East Greenway Parkway, Scottsdale, Arizona 85254, on Thursday, May 28, 2015, at 8:00 a.m. (PDT), and at any adjournment or postponement of the meeting.

The Notice of Internet Availability of Proxy Materials (the "Notice of Internet Availability") and this Proxy Statement and form of proxy are being distributed and made available on or about April 17, 2015.

TABLE OF CONTENTS

|

| |

| | |

| |

| | |

PROPOSAL NO. 1: | |

| | |

PROPOSAL NO. 2: | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

American Residential Properties, Inc. Contact Information and General Information

The Board of Directors ("our Board of Directors" or "our Board") of American Residential Properties, Inc., a Maryland corporation, has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the Company's solicitation of proxies for its Annual Meeting of Stockholders to be held on Thursday, May 28, 2015, at 8:00 a.m., PDT, at The Westin Kierland Resort & Spa, 6902 East Greenway Parkway, Scottsdale, Arizona 85254. These materials were first made available to stockholders on April 17, 2015. Unless the context requires otherwise, references in this Proxy Statement to "we," "our," "us," "our company" and the "Company" refer to American Residential Properties, Inc. and its consolidated subsidiaries.

The mailing address of our principal executive office is 7047 East Greenway Parkway, Suite 350, Scottsdale, Arizona 85254, and our main telephone number is (480) 474-4800. We maintain an Internet website at www.amresprop.com. Information at or connected to our website is not and should not be considered part of this Proxy Statement.

Pursuant to rules adopted by the United States Securities and Exchange Commission ("SEC"), we have elected to provide access to our proxy materials on the Internet. Accordingly, we are sending a Notice of Internet Availability to our stockholders. All stockholders will have the ability to access the proxy materials at www.proxyvote.com or request to receive a printed set of the proxy materials by mail or an electronic set of materials by email. Instructions on how to access the proxy materials on the Internet or to request a printed copy may be found in the Notice of Internet Availability. Stockholders also may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

No person is authorized to give any information or to make any representation not contained in this Proxy Statement and, if given or made, you should not rely on that information or representation as having been authorized by us. The delivery of this Proxy Statement does not imply that the information herein has remained unchanged since the date of this Proxy Statement.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Where and when is the Annual Meeting?

The Annual Meeting will be held at The Westin Kierland Resort & Spa, 6902 East Greenway Parkway, Scottsdale, Arizona 85254 on Thursday, May 28, 2015, at 8:00 a.m. (PDT).

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will vote upon matters described in the Notice of Annual Meeting and this Proxy Statement, including the election of directors and the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015. In addition, once the business of the Annual Meeting is concluded, members of management will respond to questions raised by stockholders, as time permits.

Who can attend the Annual Meeting?

All of our common stockholders of record as of the close of business on April 1, 2015, the record date for the Annual Meeting, or their duly appointed proxies, may attend the Annual Meeting. If you wish to attend the Annual Meeting, please register in advance with Investor Relations by email at IR@amresprop.com or by phone at (480) 474-4800. You should be prepared to present photo identification for admittance. Appointing a proxy in response to this solicitation will not affect a record stockholder's right to attend the Annual Meeting and to vote in person. Please note that if you hold your common stock in "street name" (that is, through a broker, bank or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of April 1, 2015, to gain admittance to the Annual Meeting.

Who may vote?

You may vote if you were the record owner of shares of our common stock at the close of business on April 1, 2015, the record date for the Annual Meeting. Each share of our common stock owned as of the record date has one vote.

What am I voting on?

Our Board is soliciting your vote for:

| |

| (1) | the election of six directors (each to serve until the next annual meeting of our stockholders and until his or her successor is duly elected and qualified); |

| |

| (2) | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015; and |

| |

| (3) | any other business that properly comes before the Annual Meeting and any adjournment or postponement thereof. |

What are the Board's recommendations?

Our Board recommends you vote:

| |

| (1) | "FOR" the election of each nominee named in this Proxy Statement (see Proposal No. 1); and |

| |

| (2) | "FOR" ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2015 (see Proposal No. 2). |

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials via the Internet. Accordingly, we are sending the Notice of Internet Availability to our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice of Internet Availability. In addition, stockholders may request to receive the proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our annual meetings.

What is the difference between a stockholder of record and a beneficial owner of our common stock held in street name?

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC ("AST"), you are considered the stockholder of record with respect to those shares, and we sent the Notice of Internet Availability directly to you. If you requested printed copies of the proxy materials by mail, you will receive a proxy card.

Beneficial Owner of Stock Held in Street Name. If your shares are held in an account at a broker, bank or other nominee, then you are the beneficial owner of those shares in "street name," and the Notice of Internet Availability was forwarded to you by your broker, bank or other nominee who is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to instruct your broker, bank or other nominee on how to vote the shares held in your account. Those instructions are contained in a "vote instruction form." If you request printed copies of the proxy materials by mail, you will receive a vote instruction form.

How do I vote?

There are four ways to vote:

| |

| • | In Person. If you are a stockholder of record, you may vote in person at the Annual Meeting. We will give you a ballot when you arrive. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the broker, bank or other nominee that holds your shares. Please contact your broker, bank or other nominee for instructions regarding obtaining a legal proxy. |

| |

| • | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice of Internet Availability. |

| |

| • | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the proxy card. |

| |

| • | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided. |

How are proxies voted?

All shares represented by valid proxies received prior to the Annual Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder's instructions.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date prior to the Annual Meeting via the Internet or by telephone (in which case only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), by signing and returning a new proxy card or vote instruction form with a later date, or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation to the Company's Secretary prior to the Annual Meeting.

Will my shares be voted if I do not provide my proxy?

It depends on whether you hold your shares in your own name or in the name of a bank or brokerage firm. If you hold your shares directly in your own name, they will not be voted unless you provide a proxy or vote in person at the Annual Meeting.

Brokerage firms generally have the authority to vote customers' non-voted shares on certain "routine" matters. If your shares are held in the name of the brokerage firm, the brokerage firm can vote your shares for the ratification of Ernst & Young LLP as our registered independent public accounting firm for the year ending December 31, 2015 (Proposal No. 2) if you do not timely provide your voting instructions, because this matter is considered "routine" under the applicable rules. The other item (Proposal No. 1) is not considered "routine" and therefore may not be voted by your broker without instructions.

What constitutes a quorum for the Annual Meeting?

As of the record date for the Annual Meeting, we expect there to be 32,195,280 shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting. In order to conduct the Annual Meeting, a majority of the shares entitled to vote must be present in person or by proxy. This is referred to as a "quorum." If you submit a properly executed

proxy card or vote by telephone or on the Internet, you will be considered part of the quorum. Abstentions and broker "non-votes" will be counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" occurs when a bank, broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under the applicable rules, does not have discretionary authority to vote on a matter. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained. No business may be conducted at the Annual Meeting if a quorum is not present.

What vote is required to approve an item of business at the Annual Meeting?

Election of Directors (Proposal No. 1). Directors are elected by a plurality of the votes cast at the Annual Meeting. "Plurality" means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote for this proposal, although they will be considered present for the purpose of determining the presence of a quorum.

Ratification of Appointment of Ernst & Young LLP (Proposal No. 2). The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve this proposal. For purposes of this vote, abstentions will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although they and broker non-votes will be considered present for the purpose of determining the presence of a quorum.

Where can I find the voting results of the Annual Meeting?

The Company intends to announce preliminary voting results at the Annual Meeting and disclose final results in a current report on Form 8-K filed with the SEC within four business days after the Annual Meeting. If final results are not yet known within that four business day period, the Company will disclose preliminary voting results in a Form 8-K and file an amendment to the Form 8-K to disclose the final results within four business days after such final results are known.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Our Board consists of six directors. The six persons named below, each of whom currently serves on our Board, have been recommended by our Nominating and Corporate Governance Committee and nominated by our Board to serve on our Board until our 2016 Annual Meeting of Stockholders and until their respective successors are elected and qualified.

Our Board has no reason to believe that any of the persons named below as a nominee for our Board will be unable, or will decline, to serve if elected. In addition, our Board has determined that all of the persons named below, other than Mr. Schmitz and Ms. Hawkes, are independent under applicable SEC and New York Stock Exchange (the "NYSE") rules.

The following table sets forth the name, age as of the Annual Meeting and position with our company of each nominee for election to our Board at the Annual Meeting:

|

| | | | |

| Name | | Age | | Position with Our Company |

| Stephen G. Schmitz | | 60 | | Chief Executive Officer and Chairman of our Board of Directors |

| Laurie A. Hawkes | | 59 | | President, Chief Operating Officer and Director |

| Douglas N. Benham | | 58 | | Independent Director |

| David M. Brain | | 59 | | Independent Director |

| Keith R. Guericke | | 66 | | Independent Director |

| Todd W. Mansfield | | 57 | | Independent Director |

The biographical descriptions below set forth certain information with respect to each nominee, including the experience, qualifications, attributes or skills of each Nominee that led us to conclude that such person should serve as a director.

Stephen G. Schmitz—Chief Executive Officer and Chairman of our Board of Directors. Mr. Schmitz has held the positions of Chief Executive Officer and Chairman since our formation in May 2012. In October 2008, with our President and Chief Operating Officer, Ms. Hawkes, Mr. Schmitz co-founded American Residential Properties, LLC, a private investment firm formed to capitalize on the extraordinary price deterioration in the single-family housing sector following the collapse in the housing and mortgage industries. The two founded ARP Phoenix Fund I ("Phoenix Fund"), a fully committed private

investment fund that owned 437 single-family homes as rental properties as of December 31, 2014, and American Residential Management, Inc. ("ARM"), the entity from which we acquired our real estate acquisition and management platform, in 2009. In 2007, Mr. Schmitz was the Managing Partner of Grayhawk Capital Partners, a private real estate investment firm. In 2006, he served as Chief Executive Officer of AutoStar Realty, L.P., an automobile dealership financing firm. From 2001 to 2005, Mr. Schmitz was an Executive Vice President at GE Capital Franchise Finance Corporation, which acquired Mr. Schmitz's prior employer, Franchise Finance Corporation of America ("FFCA"), in 2001. Mr. Schmitz served as FFCA's Chief Investment Officer for 15 years from 1986 to 2001, during which time it was a publicly traded real estate investment trust ("REIT") for federal income tax purposes and one of the nation's largest provider of mortgage and sale-leaseback financing to the chain restaurant, convenience store and retail auto parts industries. From 1982 to 1986, Mr. Schmitz was a commercial lender at Mellon Bank. A specialist in sale-leaseback acquisitions and mortgage financing on a programmatic scale, Mr. Schmitz has spent the majority of his finance career creating and managing teams of professionals that generate high volumes of small asset size real estate transactions, resulting in the production of transactions exceeding $2 billion in new investments on an annual basis. He attended the University of Wisconsin and received a BS from Franklin University and an MBA from Pennsylvania State University.

Mr. Schmitz, as a co-founder of our company, is qualified to serve as a director due to his familiarity with our history and operations, his experience as an early participant in the emerging institutionalization of the single-family rental sector, his extensive real estate experience and his familiarity with business models emphasizing large volumes of acquisition activity.

Laurie A. Hawkes—President, Chief Operating Officer and member of our Board of Directors. Ms. Hawkes has held the position of President since our formation in May 2012 and the position of Chief Operating Officer since March 2013. As described above, Ms. Hawkes co-founded American Residential Properties, LLC, Phoenix Fund and ARM with Mr. Schmitz, our Chief Executive Officer. From 1995 to 2007, Ms. Hawkes worked at U.S. Realty Advisors, a $3 billion real estate private equity firm, becoming a Partner in 1997 and serving as President of the firm from 2003 to 2007. In the fifteen years prior to joining U.S. Realty Advisors, Ms. Hawkes was a Wall Street investment banker specializing in real estate and mortgage finance. From 1993 to 1995, Ms. Hawkes was a Managing Director in the Real Estate Investment Banking Division at CS First Boston Corp., and, from 1979 to 1993, was a Director in the Real Estate Investment and Mortgage Banking Departments at Salomon Brothers Inc. During her investment banking career, she structured and negotiated more than $16 billion in real estate acquisitions and securitized mortgage debt transactions for all property types utilizing many types of financing, including private equity, capital markets, financial institutions and institutional investors. She received a BA from Bowdoin College and an MBA from Cornell University.

Ms. Hawkes, as a co-founder of our company, is qualified to serve as a director due to her familiarity with our history and operations, her experience as an early participant in the emerging institutionalization of the single-family rental sector, her extensive experience as an investment banker focusing on the real estate and mortgage industries, and her experience as an executive at a private equity firm focusing on real estate investment acquisition and financing.

Douglas N. Benham—Member of our Board of Directors. Mr. Benham has served on our Board of Directors since completion of our initial private offering in May 2012. He is the President and Chief Executive Officer of DNB Advisors, LLC, a restaurant industry consulting firm, and served as President and Chief Executive Officer of Arby's Restaurant Group ("Arby's"), a quick-service restaurant company, from January 2004 to April 2006. Prior to Arby's, from August 2003 until January 2004, Mr. Benham was President and Chief Executive Officer of DNB Advisors, LLC. For a period of fourteen years, from January 1989 until August 2003, Mr. Benham was Chief Financial Officer and, from 1997 until 2003, served on the Board of Directors of RTM Restaurant Group, Inc., an Arby's franchisee. Currently, Mr. Benham also serves as a director of Global Income Trust, Inc., a non-traded public REIT, Bob Evans Farms, Inc. (NASDAQ: BOBE) and he formerly served as a director of Sonic Corp. (NASDAQ: SONC). He received a BA in accounting from the University of West Florida.

Mr. Benham is qualified to serve as a director because of his experience as a senior executive officer at, and consultant to, various business enterprises, his experience as a board member of other publicly traded companies and his expertise in accounting and finance.

David M. Brain—Member of our Board of Directors. Mr. Brain has served on our Board of Directors since completion of our initial private offering in May 2012. From October 1999 to March 2015, he served as the President and Chief Executive Officer of Entertainment Properties Trust ("Entertainment Properties"), a NYSE-listed REIT (NYSE: EPR), before which he served as the Chief Financial Officer from 1997 to 1999, and as the Chief Operating Officer from 1998 to 1999. In 1997, Mr. Brain, while acting as a Senior Vice President in the investment banking and corporate finance department of George K. Baum & Company, an investment banking firm based in Kansas City, Missouri, acted as a consultant to AMC Entertainment, Inc. in the formation of Entertainment Properties. Before joining George K. Baum & Company in 1996, Mr. Brain was

Managing Director of the Corporate Finance Group of KPMG LLP, a practice unit he organized and managed for over 12 years. He received a BA in Economics and an MBA from Tulane University, where he was awarded an academic fellowship.

Mr. Brain is qualified to serve as a director because of his extensive leadership experience at a publicly traded REIT, his experience in investment banking and his extensive contacts with senior real estate executives throughout the United States.

Keith R. Guericke—Member of our Board of Directors. Mr. Guericke has served on our Board of Directors since completion of our initial private offering in May 2012. Mr. Guericke has served on the Board of Directors of Century Communities, Inc., a single-family home developer (NYSE:CCS), since May 2013 and on the Board of Directors of Essex Property Trust, Inc. ("Essex"), a multi-family REIT (NYSE: ESS), since June 1994. In 2001, Mr. Guericke was elected to the position of Vice Chairman of the Board of Essex, a position he still holds. Mr. Guericke served as the President and Chief Executive Officer of Essex from 1994 through 2010. Since his retirement, he continues to provide services to Essex on a part-time basis. Mr. Guericke joined Essex's predecessor, Essex Property Corporation, in 1977 to focus on investment strategies and portfolio expansion. Mr. Guericke prepared Essex for its initial public offering in 1994, and since then has overseen the significant growth of Essex's multi-family portfolio in supply-constrained markets along the West Coast. Mr. Guericke is a member of NAREIT, the National Multi-Housing Council and several local apartment industry groups. Prior to joining Essex, Mr. Guericke began his career with Kenneth Leventhal & Company, a CPA firm noted for its real estate expertise. Mr. Guericke received a BS in Accounting from Southern Oregon College in 1971.

Mr. Guericke is qualified to serve as a director because of his extensive leadership experience at a publicly traded REIT, his expansive knowledge of the real estate industry and his strong relationships with many executives at real estate companies throughout the United States.

Todd W. Mansfield—Member of our Board of Directors. Mr. Mansfield has served on our Board of Directors since March 2013. Since December 2011, he has been President and Chief Executive Officer of Crescent Communities, LLC ("Crescent") after serving as a member of its board of managers and as lead director in 2011. Crescent is a real estate investment company that primarily develops single-family, multi-family and resort residential communities throughout the southeastern United States and also owns and manages business and industrial parks. From 1999 to 2010, Mr. Mansfield served as Chairman and Chief Executive Officer of Crosland LLC, a diversified real estate investment and development company. Before joining Crosland, Mr. Mansfield was Managing Director at Security Capital Group (formerly NYSE: SCG) and spent 11 years at The Walt Disney Company (NYSE: DIS), where, as Executive Vice President, he had operating responsibility for its development and corporate real estate activities worldwide. He is a director and former chairman of Charlotte City Center Partners and serves on the Board of Directors of the Foundation for the Carolinas. He has served as a board member and past chairman of the North Carolina Chapter of The Nature Conservancy and the Urban Land Institute. Mr. Mansfield has also served on the boards of Carolinas HealthCare System, CarrAmerica Realty Corporation (formerly NYSE: CRE) and Kforce Inc. (NASDAQ: KFRC). He received a BA from Claremont McKenna College and an MBA from Harvard University.

Mr. Mansfield is qualified to serve as a director because of experience as a senior executive officer of various real estate enterprises, three decades of experience with residential investment and operations and his experience as a board member of other publicly traded companies.

Our Board recommends that you vote "FOR" the election of each nominee for director named above.

PROPOSAL NO. 2:

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm to audit our consolidated financial statements for the year ending December 31, 2015.

At the Annual Meeting, we are asking our stockholders to ratify the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the year ending December 31, 2015. In the event of a negative vote on such ratification, the audit committee will reconsider its selection. Even if this appointment is ratified, the audit committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the audit committee determines that such a change would be in the best interest of the Company and its stockholders. Representatives of Ernst & Young LLP are expected to be present at the annual meeting and will be available to make a statement and respond to appropriate questions about their services.

Our Board recommends that you vote FOR Proposal No. 2.

Fee Disclosure

The following is a summary of the fees billed to the Company by Ernst & Young LLP, the Company's independent registered public accounting firm, for professional services rendered for the years ended December 31, 2014 and 2013.

|

| | | | | | | | |

| | | Year Ended December 31, 2014 | | Year Ended December 31, 2013 |

| Ernst & Young: | | | | |

| Audit Fees | | $ | 638,046 |

| | $ | 1,302,535 |

|

| Audit Related Fees | | 110,000 |

| | — |

|

| Tax Fees | | 199,921 |

| | 80,698 |

|

| All Other Fees | | — |

| | — |

|

| Total | | $ | 947,967 |

| | $ | 1,383,233 |

|

Audit Fees

"Audit Fees" consist of fees and expenses billed for professional services rendered for the audit of the financial statements, review of the interim consolidated financial statements, review of registration statements and the preparation of comfort letters and services that are normally provided by accountants in connection with statutory and regulatory filings or engagements.

Audit-Related Fees

"Audit-Related Fees" consist of fees and expenses for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements that are not "Audit Fees."

Tax Fees

"Tax Fees" consist of fees and related expenses billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance and tax planning and structuring.

All Other Fees

"All Other Fees" consist of fees and expenses for products and services that are not "Audit Fees," "Audit-Related Fees" or "Tax Fees."

Pre-Approval Policy

All audit, tax and other services provided to us are reviewed and pre-approved by the Audit Committee. The Audit Committee concluded that the provision of such services by Ernst & Young LLP was compatible with the maintenance of that firm's independence in the conduct of its auditing functions. All of the fees paid to Ernst & Young LLP that are described above were approved by our Board.

The Audit Committee has considered whether, and has determined that, the provision by Ernst & Young LLP of the services described under "Audit-Related Fees," "Tax Fees" and "Other Fees" is compatible with maintaining Ernst & Young LLP's independence from management and the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth the beneficial ownership of shares of our common stock and shares of our common stock issuable upon redemption of common units of limited partnership interest ("OP units") in American Residential Properties OP, L.P. ("our Operating Partnership") (without giving effect to the 12-month restriction on redemption applicable to OP units) and long-term incentive plan units ("LTIP units") as of March 31, 2015, by (1) each of our named executive officers, (2) each of our directors, (3) all of our executive officers and directors as a group and (4) each person known by us to be the beneficial owner of five percent or more of shares of our common stock.

The SEC has defined "beneficial ownership" of a security to mean the possession, directly or indirectly, of voting power and/or investment power over such security. In computing the number of shares, LTIP units and OP units beneficially owned by a person and the percentage ownership of that person, shares of our common stock subject to options or other rights held by that person that are exercisable are deemed outstanding, while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. Each person named in the table has sole voting and investment power with respect to all of the shares of our common stock, LTIP units and OP units shown as beneficially owned by such person, except as otherwise set forth in the notes to the table. Unless otherwise indicated, the address of each named person is c/o American Residential Properties, Inc., 7047 East Greenway Parkway, Suite 350, Scottsdale, Arizona 85254.

|

| | | | | | | | | | | |

| Name of Beneficial Owner | | Number of Shares, LTIP Units and OP Units Beneficially Owned | | | | Percentage of All Shares (1) | | Percentage of All Shares, LTIP Units and OP Units Beneficially Owned (2) |

| 5% Stockholders | | | | | | | | |

| Vanguard Group Inc. | | 3,291,361 |

| | (3) | | 10.2 | % | | 10.0 | % |

| Long Pond Capital LP | | 3,187,734 |

| | (4) | | 9.9 | % | | 9.7 | % |

| V3 Capital Management, L.P. | | 2,429,402 |

| | (5) | | 7.5 | % | | 7.4 | % |

| Vanguard Specialized Funds | | 2,275,481 |

| | (6) | | 7.1 | % | | 6.9 | % |

| JPMorgan Chase & Co. | | 2,232,739 |

| | (7) | | 6.9 | % | | 6.8 | % |

| Bank of New York Mellon Corporation | | 2,212,889 |

| | (8) | | 6.9 | % | | 6.7 | % |

| Deutsche Bank AG | | 1,940,232 |

| | (9) | | 6.0 | % | | 5.9 | % |

| Kendall Family Investments, LLC | | 1,782,483 |

| | (10) | | 5.5 | % | | 5.4 | % |

| Directors and Named Executive Officers | | | | | | | | |

| Stephen G. Schmitz | | 547,120 |

| | (11) | | 1.7 | % | | 1.7 | % |

| Laurie A. Hawkes | | 555,120 |

| | (11) | | 1.7 | % | | 1.7 | % |

| Shant Koumriqian | | 59,680 |

| | (12) | | * |

| | * |

|

| Lani B Porter | | 10,031 |

| | (13) | | * |

| | * |

|

| Christopher J. Byce | | 2,998 |

| | (14) | | * |

| | * |

|

| Douglas N. Benham | | 17,844 |

| | (15) | | * |

| | * |

|

| David M. Brain | | 19,344 |

| | (16) | | * |

| | * |

|

| Keith R. Guericke | | 9,344 |

| | (17) | | * |

| | * |

|

| Todd W. Mansfield | | 8,124 |

| | (18) | | * |

| | * |

|

| All directors and executive officers as a group (10 persons) | | 904,605 |

| | | | 2.8 | % | | 2.7 | % |

|

| |

| * | Represents less than one percent. |

| |

| (1) | Assumes 32,195,280 shares of our common stock are outstanding as of March 31, 2015. In addition, amounts shown for individuals assume that all OP units and LTIP units held by the person are exchanged for shares of our common stock on a one-for-one basis. The total number of shares of our common stock outstanding used in calculating this percentage assumes that none of the OP units or LTIP units held by other persons are exchanged for shares of our common stock. |

| |

| (2) | Assumes a total of 32,896,345 shares of our common stock, OP units and LTIP units are outstanding as of March 31, 2015. OP units may be redeemed for cash or, at our election, shares of our common stock on a one-for-one basis. Under the terms of the LTIP units, our operating partnership will revalue its assets upon the occurrence of certain specified |

events, and any increase in our operating partnership's valuation from the time of grant until such event will be allocated first to the holders of LTIP units to equalize the capital accounts of such holders with the capital accounts of OP unitholders. Upon equalization of the capital accounts of the holders of LTIP units with the other holders of OP units, the LTIP units will achieve full parity with OP units for all purposes, including with respect to liquidating distributions. If, but not before, such parity is reached, vested LTIP units may be converted into an equal number of OP units at any time, and thereafter enjoy all the rights of OP units, including redemption/exchange rights. However, there are circumstances under which such parity may not be reached.

| |

| (3) | Information obtained solely by reference to Schedule 13G/A filed with the SEC on February 11, 2015 by Vanguard Group Inc. ("Vanguard"). Of the reported shares, Vanguard reported that it has sole voting power for 39,981 shares, sole dispositive power for 3,254,380 shares and shared dispositive power for 36,981 shares. The address for Vanguard is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| |

| (4) | Information obtained solely by reference to Schedule 13G filed with the SEC on February 13, 2015 by Long Pond Capital, LP ("Long Pond LP"). Of the reported shares, Long Pond LP reported that it has shared voting power for 3,187,734 shares and shared dispositive power for 3,187,734 shares. Long Pond Capital GP, LLC ("Long Pond LLC") is the general partner of Long Pond LP. John Khoury is the Principal Member of Long Pond LP. The address for Long Pond LP is 527 Madison Avenue, 15th Floor, New York, New York 10022. |

| |

| (5) | Information obtained solely by reference to Schedule 13G/A filed with the SEC on February 13, 2015 by V3 Capital Management, L.P. ("V3"). Of the reported shares, V3 has shared voting power for 2,429,402 shares and shared dispositive power for 2,429,402 shares, which are held as follows: |

(a) V3 Realty Partners (a), L.P. which has shared voting power for 717,807 shares and shared dispositive power for 717,807 and whose general partner is V3 Capital Advisors (a), LLC.

(b) V3 Capital Advisors, LLC which has shared voting power for 1,711,595 shares and shared dispositive power for 1,711,595 shares who is the general partner of (i) V3 Trading Vehicle, L.P., who has shared voting power for 438,050 shares and shared dispositive power for 438,050 shares; and (ii) V3 Realty Partners, L.P., who has shared voting power for 1,273,545 shares and shared dispositive power for 1,273,545 shares. V3 is also the investment manager of the three limited partnerships listed above, and Mr. Charles Fitzgerald is the general partner of V3 and the managing member of the two limited liability companies listed above. The address for V3 is 477 Madison Avenue, New York, New York 10012.

| |

| (6) | Information obtained solely by reference to Schedule 13G/A filed with the SEC on February 6, 2015 by Vanguard Specialized Funds ("Vanguard Specialized"). Of the reported shares, Vanguard Specialized reported that it has sole voting power for 2,275,481 shares and sole dispositive power for none of the shares. The address of Vanguard Specialized is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| |

| (7) | Information obtained solely by reference to Schedule 13G/A filed with the SEC on January 13, 2015 by JPMorgan Chase & Co. ("JPMorgan"). Of the reported shares, JPMorgan reported that it has sole voting power for 2,224,339 shares and sole dispositive power for 2,232,739 shares. The address of JPMorgan is 270 Park Avenue, New York, New York 10017. |

| |

| (8) | Information obtained solely by reference to Schedule 13G/A filed with the SEC on February 10, 2015 by the Bank of New York Mellon Corporation ("Mellon"). Of the reported shares, Mellon reported that it has sole voting power for 2,106,749 shares and sole dispositive power for 2,212,889 shares. The address of Mellon is One Wall Street, 31st Floor, New York, New York 10286. |

| |

| (9) | Information obtained solely by reference to Schedule 13G filed with the SEC on February 17, 2015 by Deutsche Bank AG ("Deutsche Bank"). Of the reported shares, Deutsche Bank reported that it has sole voting power for 1,746,333 shares and sole dispositive power for 1,940,232 shares. The foregoing amounts do not include 50,975 shares, which are also disclosed on Schedule 13G and represent shares for which they do not have voting or dispositive power. The address for Deutsche Bank is Taunusanlage 12, 60325 Frankfurt am Main, Federal Republic of Germany. |

| |

| (10) | Information obtained solely by reference to Schedule 13G/A filed with the SEC on February 17, 2015 by Kendall Family Investments, LLC ("Kendall"). Of the reported shares, Kendall reported that it has sole voting power for 1,782,483 shares and sole dispositive power for 1,782,483 shares. Voting and investment control over the shares held by Kendall is exercised by Louis M. Bacon. The address for Kendall and Mr. Bacon is 1251 Avenue of the Americas, New York, New York 10020. |

| |

| (a) | 500 shares of our common stock issued and sold in connection with our initial capitalization to each of Mr. Schmitz and Ms. Hawkes; |

| |

| (b) | 150,000 shares of our common stock owned by Phoenix Fund. ARP Phoenix Fund I GP, LLC is the general partner of Phoenix Fund and exercises voting and dispositive power over these shares. Each of Mr. Schmitz and Ms. Hawkes owns a 50% membership interest in ARP Phoenix Fund I GP, LLC. Accordingly, Mr. Schmitz and Ms. Hawkes share voting and dispositive power over these shares. Except to the extent of their pecuniary interest in Phoenix Fund, each of Mr. Schmitz and Ms. Hawkes disclaims beneficial ownership of these shares; |

| |

| (c) | 175,000 OP units owned by ARM, which is jointly owned by Mr. Schmitz and Ms. Hawkes. Accordingly, Mr. Schmitz and Ms. Hawkes share dispositive power over these OP units. Except to the extent of their pecuniary interest in ARM, each of Mr. Schmitz and Ms. Hawkes disclaims beneficial ownership of these OP units; and |

| |

| (d) | 192,124 and 200,124 LTIP units issued to each of Mr. Schmitz and Ms. Hawkes, respectively, that have vested and 29,495 shares that will vest before May 30, 2015. |

(12) Includes 19,563 shares of our common stock owned, 20,634 shares beneficially owned as restricted shares of our common stock of which 10,317 shares will vest before May 30, 2015, 7,143 LTIP units that will vest by May 30, 2015 and 12,340 LTIP units that have vested.

(13) Includes 500 shares of our common stock owned and 9,531 LTIP units that have vested.

(14) Includes 2,998 LTIP units that have vested.

(15) Includes 9,720 shares of our common stock owned, 5,333 LTIP units that have vested and 2,791 LTIP units that will vest before May 30, 2015.

(16) Includes 11,220 shares of our common stock owned, 5,333 LTIP units that have vested and 2,791 LTIP units that will vest before May 30, 2015.

(17) Includes 1,220 shares of our common stock owned, 5,333 LTIP units that have vested and 2,791 LTIP units that will vest before May 30, 2015.

(18) Includes 5,333 LTIP units that have vested and 2,791 LTIP units that will vest before May 30, 2015.

CORPORATE GOVERNANCE AND BOARD MATTERS

Sound Corporate Governance Practices

We are committed to sound corporate governance practices, including having a strong, majority-independent Board and maintaining clear stock ownership guidelines. The number of members of our Board of Directors will be determined from time-to-time by resolution of our Board of Directors. Our Board of Directors currently consists of six persons who are nominated each year by the Nominating and Corporate Governance Committee of our Board.

Board of Directors Structure

|

| |

| 1) | All of our directors must be elected annually. We do not have a classified Board. |

|

| |

| 2) | Our directors are subject to our director resignation policy as part of our policy on voting procedures with respect to the election of directors in uncontested elections. |

|

| |

| 3) | A majority of our directors are independent. |

|

| |

| 4) | All members of the three standing committees of our Board are independent. |

|

| |

| 5) | Our independent directors meet regularly without the presence of any of our officers or employees. |

|

| |

| 6) | We have appointed Keith R. Guericke, one of our independent directors, as Lead Director. The Lead Director's primary responsibilities are to preside at executive sessions of our Board and to preside at meetings of our Board when the Chairman is absent. |

Stock Ownership Guidelines and Other Policies

|

| |

| 1) | Although we have not adopted stock ownership guidelines that apply to our executive officers or directors, we strongly encourage our executive officers and directors to maintain an investment in our stock, and we include equity-based compensation in our compensation programs for our executive officers and our directors. |

|

| |

| 2) | We have a policy that prohibits our directors and executive officers from entering into hedging or monetization transactions involving our securities. |

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines, which provide the framework for the governance of our company and represent our Board's current views with respect to selected corporate governance issues considered to be of significance to our stockholders. The Corporate Governance Guidelines is available on the Corporate Governance page of the Investor Relations section on our website at www.amresprop.com.

Any inquiries to individual directors can be sent to our General Counsel for distribution at 7047 East Greenway Parkway, Suite 350, Scottsdale, AZ 85254.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a code of business conduct and ethics that applies to our officers, directors and employees. Among other matters, our code of business conduct and ethics is designed to deter wrongdoing and to promote the following:

| |

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest; |

| |

| • | full, fair, accurate, timely and understandable disclosure in our reports filed with the SEC and other public communications; |

| |

| • | compliance with applicable governmental laws, rules and regulations; |

| |

| • | prompt internal reporting of violations of the code of business conduct to appropriate persons identified in the code of business conduct; and |

| |

| • | accountability for adherence to the code of business conduct. |

Any waiver of the code of business conduct and ethics for our executive officers, directors or employees may be made only by the Nominating and Corporate Governance Committee and will be promptly disclosed as required by law or stock exchange regulations. The Code of Business Conduct and Ethics is available on the Corporate Governance page of the Investor Relations section on our website at www.amresprop.com.

Independence of Directors

Our Corporate Governance Guidelines require that a majority of our directors be "independent," with independence determined in accordance with the applicable standards of the NYSE. Our Board may determine a director to be independent if our Board has affirmatively determined that the director has no material relationship with us or our subsidiaries, either directly or as a stockholder, director, officer or employee of an organization that has a relationship with us or our subsidiaries. Our Board of Directors has determined that the directors listed above as "independent" meet the independence standards of the NYSE. Our independent directors meet regularly in executive sessions without members of management present.

Committees of Our Board of Directors

Our Board of Directors has established three committees: the Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee. Each of these committees currently consists of four members, each of whom satisfies the NYSE's independence standards. Matters put to a vote at one of our three independent committees of our Board of Directors must be approved by a majority of the directors on the committee who are present at the meeting at which there is a quorum or in an action by unanimous written consent of the directors serving on the committee.

Audit Committee

The Audit Committee, which is composed of Messrs. Benham, Brain, Guericke and Mansfield and for which Mr. Benham currently serves as the Chairman, assists our Board of Directors in overseeing our accounting and financial reporting processes and the audits of our financial statements. Our Board of Directors has affirmatively determined that each of the Audit Committee members meets the definition of "independent director" for purposes of the NYSE rules and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board of Directors has also determined that Mr. Benham, the chair of the Audit Committee, qualifies as an "audit committee financial expert" under SEC rules and regulations and that each of the other members of the Audit Committee is financially literate within the meaning of Rule 10A-3 of the Exchange Act. Additionally, the Audit Committee is responsible for monitoring our procedures for compliance with the rules for taxation

as a REIT under Sections 856-860 of the Internal Revenue Code of 1986, as amended (the "Code"). The Audit Committee Charter is available on the Corporate Governance page of the Investor Relations section of our website at www.amresprop.com.

Compensation Committee

The Compensation Committee, which is composed of Messrs. Benham, Brain, Guericke and Mansfield and for which Mr. Brain currently serves as the Chairman, supports our Board of Directors in fulfilling its oversight responsibilities relating to senior management and director compensation, including the administration of our 2012 Equity Incentive Plan. The Compensation Committee Charter is available on the Corporate Governance page of the Investor Relations section of our website at www.amresprop.com.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, which is composed of Messrs. Benham, Brain, Guericke and Mansfield and for which Mr. Guericke currently serves as the Chairman, assists our Board of Directors in identifying and recommending candidates to fill vacancies on our Board of Directors and for election by the stockholders, recommending committee assignments for directors, overseeing our Board of Directors' annual evaluation of the performance of our Board of Directors, its committees and individual directors, reviewing compensation received by directors for service on our Board of Directors and its committees and developing and recommending to our Board of Directors appropriate corporate governance policies, practices and procedures for our company. The Nominating and Corporate Governance Committee Charter is available on the Corporate Governance page of the Investor Relations section of our website at www.amresprop.com.

Risk Management Oversight

Our Board is actively involved in the oversight of risks that could affect our company. This oversight is conducted primarily through the Audit Committee but also through the other committees of our Board, as appropriate. Our Board and its committees, including the Audit Committee, satisfy this responsibility through reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our company.

Meetings and Attendance

In 2014, our Board convened five meetings in person and one meeting telephonically; the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee met six times, twice and once, respectively. Each of our directors attended at least 75% of the meetings of our Board and the committees of our Board on which they served during 2014. All of our directors attended the 2014 annual meeting and are expected to attend the Annual Meeting this year.

Executive Sessions of Our Independent Directors

As required by the NYSE rules, the non-employee directors, all of whom are independent under the applicable standards of the NYSE, regularly meet in executive session, without management present. Generally, these executive sessions follow regularly scheduled meetings of our Board. The independent, non-employee directors met in executive session at least two times in 2014. Mr. Guericke, our Lead Director, presided over these executive sessions.

Director Nominations

The Nominating and Corporate Governance Committee works with our Board to determine the appropriate characteristics, skills and experience for our Board as a whole and its individual members. In evaluating the suitability of individuals for Board membership, the Nominating and Corporate Governance Committee takes into account many factors, including whether the individual meets the requirements for independence; the individual's general understanding of the various disciplines relevant to the success of a publicly traded company; the individual's understanding of the Company's businesses and markets; the individual's professional expertise and educational background; and other factors that promote diversity of views and experience. The Nominating and Corporate Governance Committee evaluates each individual in the context of our Board as a whole, with the objective of recommending a group of directors that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment, using its diversity of experience. In determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee also considers the director's past attendance at meetings and participation in and contributions to the activities of our Board.

DIRECTOR COMPENSATION

Directors who are our employees (Mr. Schmitz and Ms. Hawkes) do not receive compensation for their service as directors. Our Board of Directors has established a compensation program for our independent directors. Pursuant to this compensation program, we pay the following fees to each of our independent directors:

| |

| • | an annual cash retainer of $50,000; |

| |

| • | an initial grant of 2,500 LTIP units upon becoming a director; |

| |

| • | at the time of each annual meeting of our stockholders, beginning with the 2014 annual meeting, each independent director who will continue to serve on our Board of Directors will receive an annual grant of LTIP units having a value of $50,000 if and as determined by our Board of Directors; |

| |

| • | an additional annual cash retainer of $10,000 to the chair of the Audit Committee; |

| |

| • | an additional annual cash retainer of $7,500 to the chair of the Compensation Committee; and |

| |

| • | an additional annual cash retainer of $7,500 to the chair of the Nominating and Corporate Governance Committee. |

We also reimburse our independent directors for reasonable out-of-pocket expenses incurred in connection with the performance of their duties as directors, including without limitation travel expenses in connection with their attendance in-person at meetings of our Board of Directors and its committees.

For 2015, our non-employee director compensation program will be the same as our non-employee director compensation program for 2014.

The table below summarizes the compensation paid by us to our non-employee directors for 2014.

|

| | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash (1) | | Stock Awards (2) | | Total |

| Douglas N. Benham | | $ | 60,000 |

| | $ | 43,082 |

| | $ | 103,082 |

|

| David M. Brain | | $ | 57,500 |

| | $ | 43,082 |

| | $ | 100,582 |

|

| Keith R. Guericke | | $ | 57,500 |

| | $ | 43,082 |

| | $ | 100,582 |

|

| Todd W. Mansfield | | $ | 50,000 |

| | $ | 43,082 |

| | $ | 93,082 |

|

| |

| (1) | Amounts in this column represent each director's annual cash retainer and additional cash retainer as committee chair, if applicable, paid during 2014. |

| |

| (2) | Stock awards were issued in the form of LTIP units. LTIP units are a special class of partnership interests in our Operating Partnership with certain restrictions, which are convertible into OP units, subject to satisfying vesting and other conditions. LTIP unit holders are entitled to receive the same distributions as holders of our OP units (only if we pay such distributions) on the unvested portion of their LTIP units. All LTIP unit awards were granted pursuant to our 2012 Equity Incentive Plan and will vest one year from the date of grant. The amounts in this column reflect the aggregate grant date fair value of stock awards granted in 2014 calculated in accordance with the requirements of Accounting Standards Codification Subtopic 718, Stock Compensation ("ASC 718"). In May 2014, Messrs. Benham, Brain, Guericke and Mansfield were awarded their annual $50,000 grant of LTIP units. We valued the LTIP units in accordance with ASC 718 at a per-unit value of $15.44, equivalent to the per-share closing price of our common stock on the date of grant less a discount for lack of marketability estimated by a third-party consultant. These amounts reflect accounting expenses for these awards and do not correspond to the actual value, if any, that will be recognized by the non-employee director. |

EXECUTIVE OFFICERS

Our executive officers and their ages as of the Annual Meeting are as follows:

|

| | | | |

| Name | | Age | | Position with Our Company |

| Stephen G. Schmitz | | 60 | | Chief Executive Officer and Chairman of our Board of Directors |

| Laurie A. Hawkes | | 59 | | President, Chief Operating Officer and Director |

| Shant Koumriqian | | 42 | | Chief Financial Officer and Treasurer |

| Lani B Porter | | 55 | | Senior Vice President, Operations |

| Christopher J. Byce | | 40 | | Senior Vice President, Investments |

| Patricia B. Dietz | | 40 | | General Counsel, Chief Compliance Officer and Secretary |

Biographical information with respect to Mr. Schmitz and Ms. Hawkes is set forth above under "Proposal No. 1: Election of Directors."

Shant Koumriqian—Chief Financial Officer and Treasurer. Mr. Koumriqian has served as our Chief Financial Officer and Treasurer since October 2012. Mr. Koumriqian served as Executive Vice President, Chief Financial Officer of MPG Office Trust, Inc. (NYSE: MPG) from December 2008 to March 2012, as Senior Vice President, Finance and Chief Accounting Officer from January 2008 to November 2008 and as Vice President, Finance from July 2004 to January 2008. Prior to joining MPG Office Trust, Mr. Koumriqian spent a total of nine years in real estate practice groups, first at Arthur Andersen LLP and then at Deloitte & Touche LLP, where he was a senior manager, serving public and private real estate companies. Mr. Koumriqian received a BA in Business Administration, cum laude, from California State University, Los Angeles.

Lani B Porter—Senior Vice President, Operations. Ms. Porter has been our Senior Vice President, Operations since October 2012 after joining us in July 2012 as Vice President, Operations. She has been an executive in the real estate industry since 1995, when, as a founding executive serving as Senior Vice President of Operations, she helped create the first online marketplace for mortgage lending at Getsmart.com. In 2000, after Providian Bank's acquisition of Getsmart.com, she joined nCommand as Co-Founder, Chief Operating Officer and Chief Financial Officer, where she developed an end-to-end virtual loan process for residential lending. After the acquisition of nCommand by Ellie Mae in 2002, she served as Chief Financial Officer and Vice President of Operations at Accruent, a company whose products are used in managing over 1 billion square feet of commercial space for many Fortune 500 companies and large retailers. In addition, beginning in 2005, Ms. Porter served as Director of Operations for Hometown, where she developed the systems technology and processes to underwrite, fund, manage, securitize and sell more than $2 billion in assets. Ms. Porter has served on the Mortgage Bankers Association-sanctioned Governance Board of MISMO (Mortgage Industry Standards Maintenance Organization), attended Arizona State University, and completed the Oracle RDBMS Master's program for Database Administrators.

Christopher J. Byce—Senior Vice President, Investments. Mr. Byce has served as our Senior Vice President, Investments since January 2014. Mr. Byce has 16 years of experience in the real estate industry and joined us from Colony American Homes, LLC, where he served as Managing Director from March 2012 to December 2013, responsible for leading asset acquisitions for five regions in Colony Capital's single-family rental REIT. In addition to managing underwriting, acquisitions and disposition activities for Colony, he was responsible for pioneering a Build-to-Rent strategy, resulting in a substantial acquisition pipeline of new properties. Mr. Byce also served as a Portfolio Manager for Colony AMC Opco, LLC from January 2009 to December 2013, where he was responsible for managing more than $1 billion in distressed commercial debt and REO assets. Prior to joining Colony, Mr. Byce founded and managed Redcoat Inc., a commercial and residential property development company from November 2001 to January 2009, and also served as a Vice President in the Atlanta Real Estate Division of Regions Bank from January 1998 to November 2001. Mr. Byce received a BBA in International Business Finance from the University of Georgia.

Patricia B. Dietz—General Counsel, Chief Compliance Officer and Secretary. Ms. Dietz has served as our General Counsel, Chief Compliance Officer and Secretary since July 2014. Ms. Dietz has 16 years of broad legal experience, with significant involvement in real estate, debt and equity financing, corporate governance, and commercial and regulatory matters. Ms. Dietz joined us from GE Capital Franchise Finance Corporation where she served in senior legal and compliance roles from June 2008 through June 2014. While there, she served as lead in-house counsel for over $500 million in hotel lending transactions and asset management of $2 billion sale-leaseback restaurant portfolio. In addition, she supervised corporate governance and licensing matters for dozens of entities. Prior to joining GE Capital Franchise Finance Corporation, Ms. Dietz served as Vice President, Legal Services at Fidelity National Information Services Inc. (NYSE: FIS) and Director, Legal Services, of one of its acquired companies, eFunds Corporation (formerly NYSE: EFD), from June 2005 to May 2008. She

also practiced at the law firms of Quarles & Brady LLP and Squire Sanders LLP (now part of Squire Patton Boggs). Ms. Dietz received a JD, with distinction, and a BA from the University of Iowa.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This section discusses the principles underlying our policies and decisions with respect to the compensation of our named executive officers and the principal factors relevant to an analysis of these policies and decisions. Our "named executive officers" and their positions are:

| |

| • | Stephen G. Schmitz, our Chief Executive Officer and Chairman of our Board of Directors; |

| |

| • | Laurie A. Hawkes, our President, Chief Operating Officer and Director; |

| |

| • | Shant Koumriqian, our Chief Financial Officer and Treasurer; |

| |

| • | Lani B Porter, our Senior Vice President, Operations; and |

| |

| • | Christopher J. Byce, our Senior Vice President, Investments. |

The following discussion and analysis of compensation arrangements of our named executive officers should be read together with the compensation tables and related disclosures set forth below. This discussion may contain forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. Actual compensation programs that we adopt may differ materially from the currently planned programs summarized in this discussion.

Executive Summary: 2014 Performance Highlights

We have continued to experience robust growth, extraordinary operational evolution and strong performance, including the following key accomplishments:

| |

| • | Portfolio Growth and Capital Deployment. We increased our portfolio by 46% in 2014, deploying over $500 million of capital to acquire and restore more than 2,800 homes. Our portfolio expanded to 8,893 homes for a total investment of $1.3 billion in thirteen states. |

| |

| • | Resident Retention. While our portfolio increased by almost 50%, we also achieved a resident retention rate of 72%, and an average increase in rent renewals of 4.2% in the fourth quarter 2014. At year-end our stabilized occupancy was 92%, with overall portfolio occupancy of 81%. |

| |

| • | Financial Growth. We more than doubled our revenue to $87 million and increased our Core FFO attributable to common stockholders to over $12 million - a 143% increase from last year. |

| |

| • | Core Market Penetration. We continued to execute our strategy of achieving scale in our core markets as a means of realizing greater operating efficiencies. We reached our goal of owning 1,000 homes or more in Phoenix, Dallas, Houston, and Atlanta. |

| |

| • | Debt Capital Markets Debut. We successfully expanded our financing capability in 2014. We increased our credit facility to $500 million with an accordion feature allowing borrowing capacity of up to $750 million. In August, we entered the public debt markets, executing a $342 million securitization transaction at a cost of Libor plus 211 basis points and used the proceeds to pay down our credit facility. This securitization transaction provides an additional source of intermediate-term capital at a low cost, which we believe will ultimately generate higher returns for our stockholders. |

Changes to Compensation Program (Effective 2015)

Our goal is to ensure we keep the best interests of our stockholders in mind when it comes to our compensation programs. This means we adhere to certain best practices while avoiding certain other less favorable pay practices. In working with the Compensation Committee’s new compensation consultant, FPL Associates ("FPL"), a professional compensation consulting firm, the Compensation Committee took the following actions with regard to compensation awarded in 2015:

| |

| • | Increased Performance Component of Long-Term Incentive Program. For 2015, the performance component of the long-term incentive program will be increased from one-half to two-thirds of the target total compensation. Additionally, the Compensation Committee has modified the measurement of performance from an absolute total shareholder return measurement to a relative total shareholder return measurement, compared to the total returns of both the MSCI U.S. REIT Index and an asset-focused, single-family rental peer group. |

| |

| • | Modified Equity Acceleration Treatment. Equity awards (both time-based and performance-based) made in 2015 provide for a “double trigger” to accelerate vesting rather a single trigger. Moreover, in the event that performance-based awards are actually accelerated by a double trigger, the awards will vest based on actual performance achieved, as opposed to at their maximum level. |

| |

| • | No Increases in Cash Compensation. The Compensation Committee did not increase any salary levels for our named executive officers and maintained the same target cash bonus opportunities for each named executive officer. |

Roles of Our Board of Directors and Chief Executive Officer in Compensation Decisions

The Compensation Committee of our Board of Directors is responsible for overseeing our executive compensation program, and for determining and approving, subject to the oversight of our Board of Directors, the ongoing compensation arrangements for our named executive officers. Our Compensation Committee, Board of Directors and Chief Executive Officer meet periodically to review adjustments, if any, to the compensation, including base salary, annual bonus and long-term equity awards, for our named executive officers. Equity awards are subject to approval by our Board of Directors.

Our Chief Executive Officer is responsible for evaluating the individual performance and contributions of each named executive officer, other than himself and Ms. Hawkes, our President and Chief Operating Officer, and reporting to our Compensation Committee and Board of Directors his recommendations regarding such other named executive officers' compensation, subject to approval by our Compensation Committee of all compensation decisions relating to our named executive officers. Our Chief Executive Officer has not participated in any formal discussion with our Compensation Committee and Board of Directors regarding decisions on his own compensation or the compensation of Ms. Hawkes, and he has recused himself from meetings at which his compensation and Ms. Hawkes' compensation have been discussed.

We do not generally rely on formulaic guidelines or react to short-term changes in business performance for determining the mix or levels of cash and equity-based compensation, but rather maintain a flexible compensation program that allows us to adapt components and levels of compensation to motivate, reward and retain individual named executive officers within the context of our desire to attain financial and operational goals. Subjective factors considered in compensation determinations include a named executive officer's responsibilities, leadership abilities, skills, contributions as a member of the executive management team, contributions to our overall performance and whether the total compensation potential and structure is sufficient to ensure the retention of a named executive officer when considering the compensation potential that may be available elsewhere.

Engagement of Compensation Consultants

In 2014, our Compensation Committee retained FTI Consulting Inc. ("FTI"), a professional compensation consulting firm, to provide advice regarding the executive compensation program for our senior executive management team. In 2015, our Compensation Committee retained FPL to provide advice regarding the executive compensation program for our senior executive management team. Under the engagement agreements between the Compensation Committee and each of FTI and FPL, FTI and FPL have provided, and may in the future provide, analysis and recommendations regarding base salaries, annual bonuses and long-term incentive compensation for our executive management team. Neither FTI nor FPL has performed, and neither currently provides, any other services to management or our company. The Compensation Committee has determined that each of FTI and FPL meets the criteria for an independent consultant in accordance with SEC guidelines for such services.

Executive Compensation Philosophy and Objectives

The market for experienced management is highly competitive in our industry. Our goal is to attract and retain the most highly qualified executives to manage each of our business functions. In doing so, we draw upon a pool of talent that is highly sought after by similarly sized REITs and other real estate companies. Our executive compensation philosophy recognizes that, given that the market for experienced management is highly competitive in our industry, key and core to our success is our ability to attract and retain the most highly qualified executives to manage each of our business functions.

We regard as fundamental that executive officer compensation be structured to provide competitive base salaries and benefits to attract and retain superior employees and to provide incentive compensation to motivate executive officers to attain, and to reward executive officers for attaining, financial, operational, individual and other goals that are consistent with increasing stockholder value. We also believe that our executive compensation program should include a long-term incentive component that aligns executives' interests with our stockholders' interests. The objective of our long-term incentive awards, including equity-based compensation, will be to encourage executives to focus on our long-term growth and incentivize executives to manage our company from the perspective of stockholders with a meaningful stake in our success.

We view the components of our executive compensation program as related but distinct, and we expect to regularly reassess the total compensation of our named executive officers to ensure that our overall compensation objectives are met. We have considered, but not relied upon exclusively, the following factors in determining the appropriate level for each compensation component: our understanding of the competitive market based on the collective experience of members of our Compensation Committee and our Board of Directors and their review of compensation surveys; our recruiting and retention goals; our view of internal equity and consistency; the length of service of our executive officers; our overall performance; the recommendations of the compensation consultants retained by the Compensation Committee; and other considerations our Compensation Committee and our Board of Directors and/or Chief Executive Officer determines are relevant.