Please remember this information is confidential. Third Quarter 2021 October 26, 2021

2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking. Examples of forward-looking statements include, but are not limited to, statements regarding guidance, industry prospects, future business, future results of operations or financial condition, future dividends, our ability to consummate acquisitions and integrate the businesses we have acquired or may acquire into our existing operations, new or planned features, products or services, management strategies, our competitive position and the COVID-19 pandemic. You can identify forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “aim,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “predict,” “project,” “seek,” “potential,” “opportunities” and other similar expressions and the negatives of such expressions. However, not all forward- looking statements contain these words. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Such risks and uncertainties include, among others, those discussed under the caption “Risk Factors” in our most recently filed Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission (the “SEC”) on February 11, 2021 (our “2020 Form 10-K”), and in our consolidated financial statements, related notes, and the other information appearing elsewhere in the 2020 Form 10-K, our Quarterly Report on Form 10-Q filed with the SEC on October 26, 2021, and our other filings with the SEC. Given these risks and uncertainties, you should not place undue reliance on any forward-looking statements. The forward-looking statements contained in this presentation are made only as of the date of our most recent public filings, and we do not intend, and, except as required by law, we undertake no obligation to update any such forward-looking statement after the date it is made to reflect actual results or future events or circumstances. The information contained in this presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or the solicitation of any vote or approval. Any such offer or solicitation would be made only by means of a registration statement (including a prospectus) filed with the SEC, after such registration statement becomes effective. Forward-Looking Statements

3 To supplement our consolidated financial statements presented in accordance with the accounting principles generally accepted in the United States, or GAAP, Shutterstock's management considers certain financial measures that are not prepared in accordance with GAAP, collectively referred to as non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth on a constant currency basis (expressed as a percentage), billings and free cash flow. We define adjusted EBITDA as net income adjusted for depreciation and amortization, non-cash equity-based compensation, foreign currency transaction gains and losses, interest income and expense and income taxes; adjusted EBITDA margin as the ratio of adjusted EBITDA to revenue; adjusted net income as net income adjusted for the impact of non-cash equity-based compensation, the amortization of acquisition-related intangible assets and the estimated tax impact of such adjustments; adjusted net income per diluted common share as adjusted net income divided by weighted average diluted shares; revenue growth on a constant currency basis (expressed as a percentage) as the increase in current period revenues over prior period revenues, utilizing fixed exchange rates for translating foreign currency revenues for all periods in the comparison; billings as revenue adjusted for the change in deferred revenue, excluding deferred revenue acquired through business combinations; and free cash flow as cash provided by operating activities, adjusted for capital expenditures, content acquisition, and, and with respect to the three months ended March 31, 2020, a payment associated with long-term incentives related to our 2017 acquisition of Flashstock Technology, Inc. ("Flashstock"). These figures have not been calculated in accordance with GAAP, should be considered only in addition to results prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, GAAP results. We caution investors that non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies. Shutterstock's management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth on a constant currency basis (expressed as a percentage), billings and free cash flow are useful to investors because these measures enable our investors to analyze our operating results on the same basis as that used by management. Additionally, management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted net income per diluted share provide useful information to investors about the performance of the Company’s overall business because such measures eliminate the effects of unusual or other infrequent charges that are not directly attributable to Shutterstock's underlying operating performance; and revenue growth on a constant currency basis (expressed as a percentage) provides useful information to investors by eliminating the effect of foreign currency fluctuations that are not directly attributable to Shutterstock’s operating performance. Management also believes that providing these non-GAAP financial measures enhances the comparability for investors in assessing Shutterstock's financial reporting. Shutterstock's management believes that free cash flow is useful for investors because it provides them with an important perspective on the cash available for strategic measures, after making necessary capital investments in property and equipment to support the Company’s ongoing business operations and after excluding the impact of nonrecurring payments associated with long-term incentives related to our 2017 acquisition of Flashstock, and provides them with the same measures that management uses as the basis for making resource allocation decisions. Shutterstock's management also uses the non-GAAP financial measures adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth on a constant currency basis (expressed as a percentage), billings and free cash flow, in conjunction with GAAP financial measures, as an integral part of managing the business and to, among other things: (i) monitor and evaluate the performance of Shutterstock’s business operations, financial performance and overall liquidity; (ii) facilitate management’s internal comparisons of the historical operating performance of its business operations; (iii) facilitate management’s external comparisons of the results of its overall business to the historical operating performance of other companies that may have different capital structures and debt levels; (iv) review and assess the operating performance of Shutterstock’s management team and, together with other operational objectives, as a measure in evaluating employee compensation and bonuses; (v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. Reconciliations of the differences between adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, billings and free cash flow, and the most comparable financial measures calculated and presented in accordance with GAAP, is presented immediately following the "Liquidity and Capital Allocation" slide. We do not provide a reconciliation of adjusted EBITDA guidance to net income guidance or a reconciliation of adjusted net income per diluted share guidance to net income per diluted share guidance, because we are unable to calculate with reasonable certainty the impact of potential future transactions, including, but not limited to, capital structure transactions, restructuring, acquisitions, divestitures or other events and asset impairments, without unreasonable effort. These amounts depend on various factors and could have a material impact on net income and net income per diluted share, but may be excluded from adjusted EBITDA and adjusted net income per diluted share. In addition, we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. Non-GAAP Financial Measures

4 Compared to Third Quarter 2020: • Revenue increased 18% to $194.4 million. ▪ On a constant currency basis, revenue increased 17%. • Net income decreased 29% to $16.0 million. • Adjusted EBITDA decreased 6% to $44.4 million. • Net income per diluted share decreased by 31% to $0.43. • Adjusted net income per diluted share decreased by 13% to $0.70. • Cash provided by operating activities of $54.6 million in Q3 2021 compared to $63.9 million in Q3 2020. • Free cash flow was $44.3 million in Q3 2021 compared to $57.0 million in Q3 2020. Third Quarter 2021 Financial Highlights

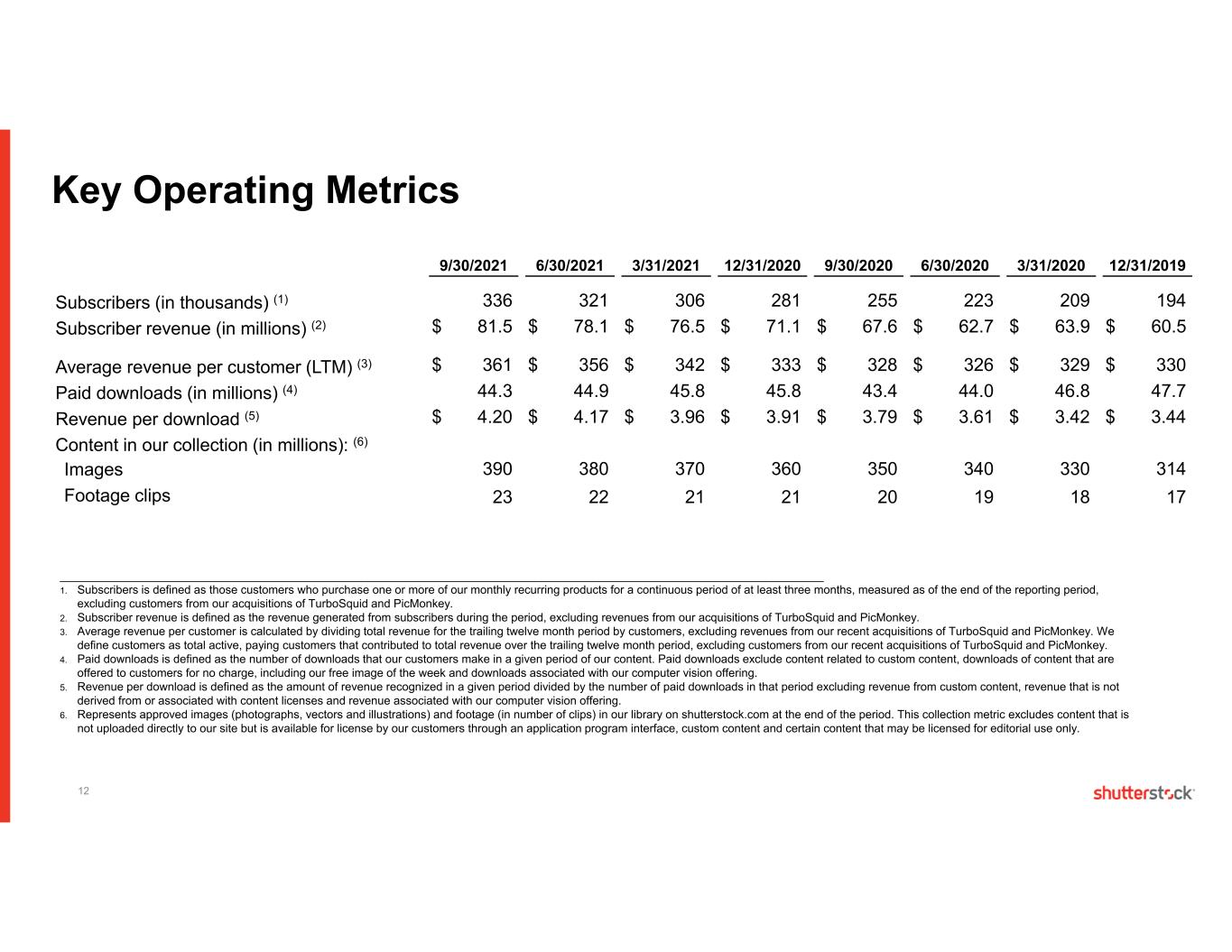

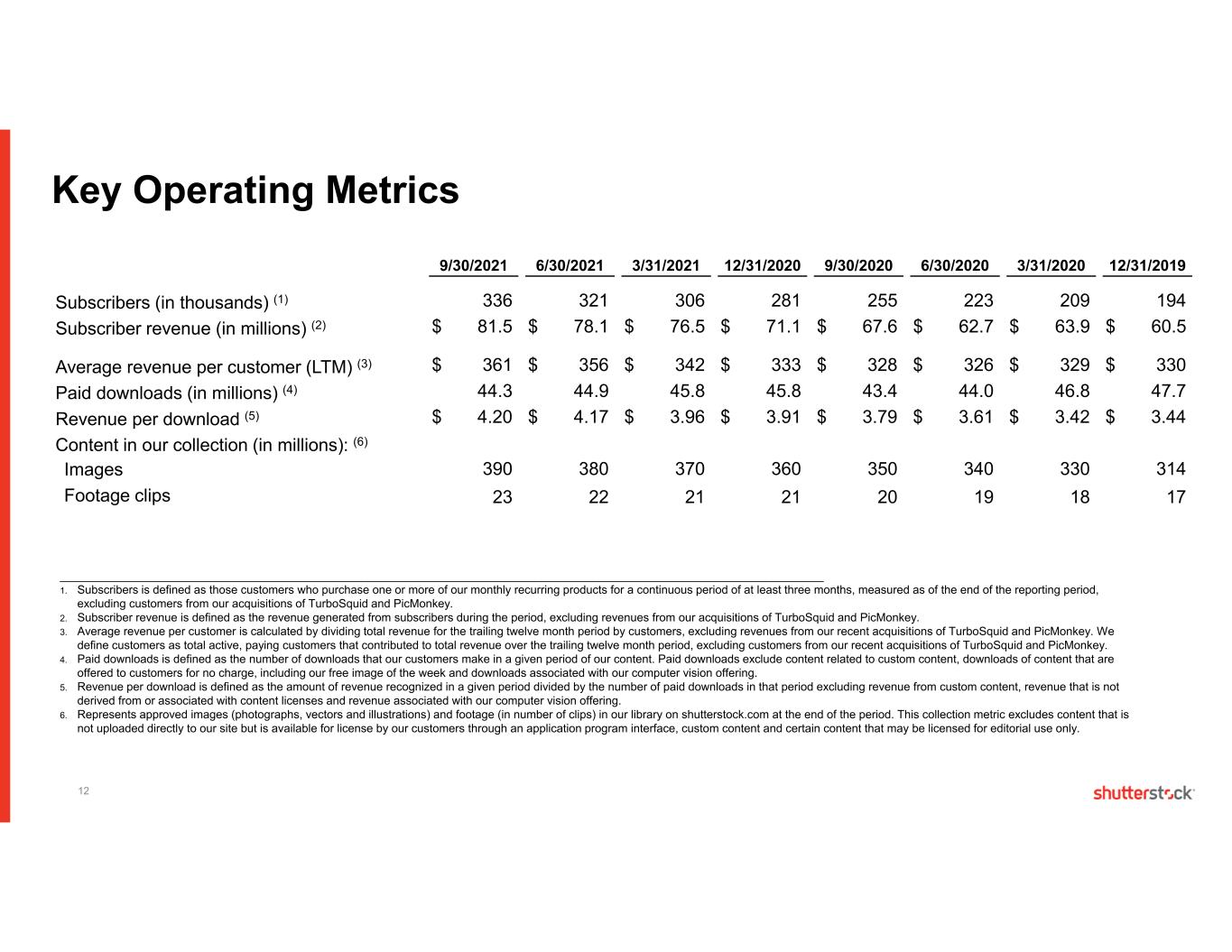

5 Compared to Third Quarter 2020: • Subscribers increased 32%, to 336,000. • Subscriber revenue increased 21%, to $81.5 million. • Average revenue per customer (LTM) increased 10% to $361. • Paid downloads increased 2% to 44.3 million. • Image library of approximately 390 million images. • Footage library of approximately 23 million footage clips. • More than 1.9 million contributors made their images, footage clips and music tracks available on Shutterstock’s platform, compared to over 1.5 million in the prior year. • More than 2.0 million customers contributed to revenue over the past 12 months, up from over 1.9 million last year. Third Quarter 2021 Operating Highlights

6 Liquidity Cash Flows: • Cash and cash equivalents decreased $110.5 million during the three months ended September 30, 2021 to $300.6 million. • For the three months ended September 30, 2021: ◦ Operating cash inflows were $54.6 million. ◦ Investing cash outflows were $151.4 million, primarily consisting of $109.6 million cash used in the acquisition of PicMonkey, $31.4 million related to the acquisitions of Pattern89, Inc., Datasine Limited and assets from Shotzr, Inc., and $10.3 million related to capital expenditures and content acquisition. ◦ Financing cash outflows were $12.7 million, which primarily consisted of $7.7 million from our quarterly dividend, $4.2 million for the repurchase of common stock under our share repurchase program and $1.0 million paid in settlement of tax withholding obligations related to employee stock-based compensation awards. ◦ Free cash flows were $44.3 million.

7 Capital Allocation Quarterly Cash Dividend: • On October 18, 2021, the Board of Directors declared a dividend of $0.21 per share of outstanding common stock, payable on December 16, 2021 to stockholders of record at the close of business on December 2, 2021. Share Repurchase Program: • During the three months ended September 30, 2021, the Company repurchased approximately 41,900 shares of its common stock at an average per share cost of $115.95.

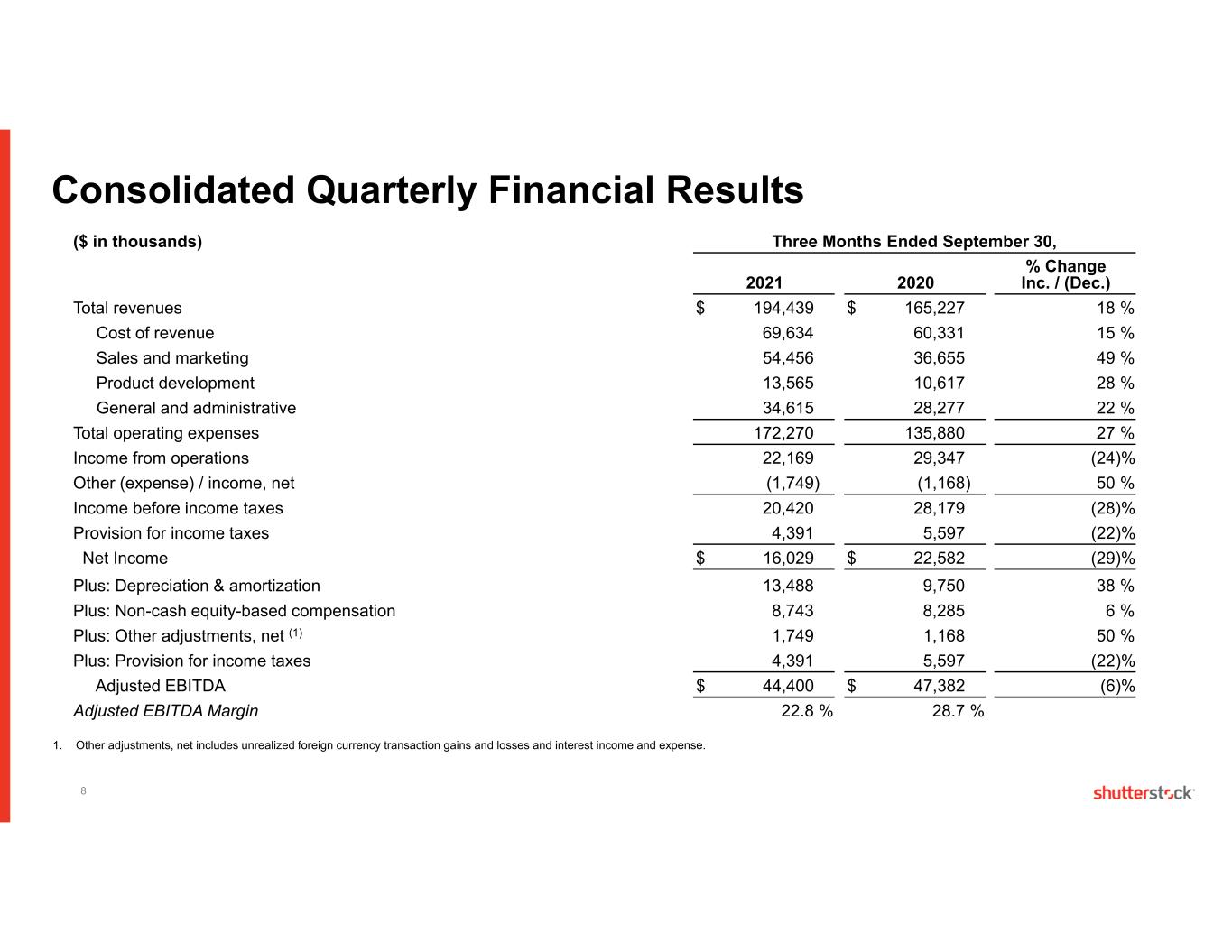

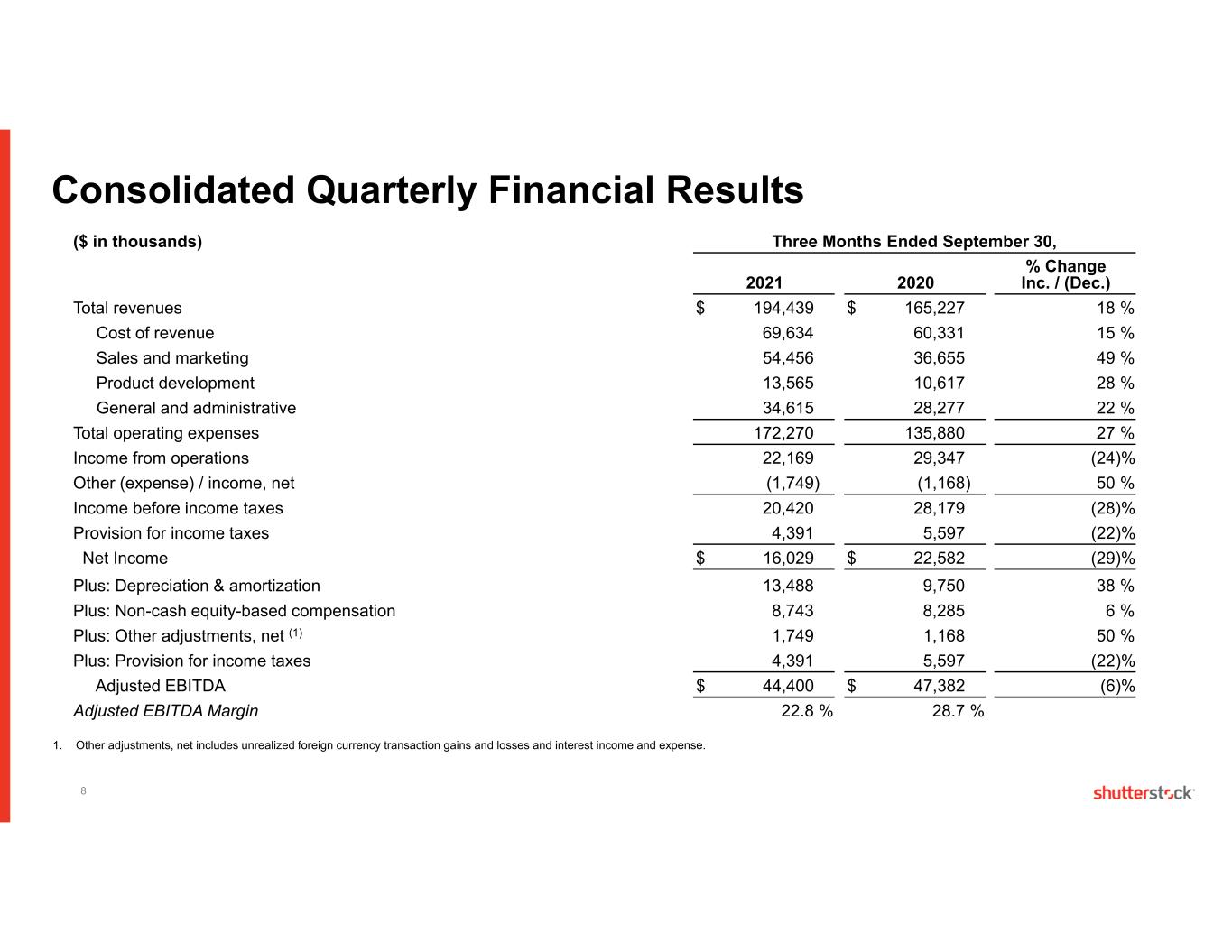

8 Consolidated Quarterly Financial Results 1. Other adjustments, net includes unrealized foreign currency transaction gains and losses and interest income and expense. ($ in thousands) Three Months Ended September 30, 2021 2020 % Change Inc. / (Dec.) Total revenues $ 194,439 $ 165,227 18 % Cost of revenue 69,634 60,331 15 % Sales and marketing 54,456 36,655 49 % Product development 13,565 10,617 28 % General and administrative 34,615 28,277 22 % Total operating expenses 172,270 135,880 27 % Income from operations 22,169 29,347 (24)% Other (expense) / income, net (1,749) (1,168) 50 % Income before income taxes 20,420 28,179 (28)% Provision for income taxes 4,391 5,597 (22)% Net Income $ 16,029 $ 22,582 (29)% Plus: Depreciation & amortization 13,488 9,750 38 % Plus: Non-cash equity-based compensation 8,743 8,285 6 % Plus: Other adjustments, net (1) 1,749 1,168 50 % Plus: Provision for income taxes 4,391 5,597 (22)% Adjusted EBITDA $ 44,400 $ 47,382 (6)% Adjusted EBITDA Margin 22.8 % 28.7 %

9 Adjusted Net Income (in thousands, except per share data) Three Months Ended September 30, 2021 2020 Net Income $ 16,029 $ 22,582 Add / (Less): Non-Cash Equity-Based Compensation 8,743 8,285 Acquisition-Related Intangible Amortization 4,754 531 Tax Effect of Adjustments1 (3,172) (2,072) Adjusted Net Income $ 26,354 $ 29,326 Diluted Shares Outstanding 37,417 36,494 Net Income Per Diluted Share $ 0.43 $ 0.62 Adjusted Net Income Per Diluted Share $ 0.70 $ 0.80 1 - Statutory tax rates are used to calculate the tax effect of the adjustments.

10 Free Cash Flow ($ in thousands) Three Months Ended September 30, 2021 2020 Net Cash From Operations $ 54,642 $ 63,882 Less: Capital Expenditures (5,830) (6,311) Less: Content Acquisitions (4,494) (530) Free Cash Flow $ 44,318 $ 57,041

11 Revenue by Sales Channel and Billings ($ in thousands) For the three months ended 9/30/2021 6/30/2021 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 E-commerce Revenue $ 121,707 $ 120,715 $ 118,400 $ 111,805 $ 102,816 $ 98,164 $ 99,736 $ 100,902 Enterprise Revenue 72,732 69,197 64,881 69,139 62,411 61,066 61,549 65,469 Total Revenue $ 194,439 $ 189,912 $ 183,281 $ 180,944 $ 165,227 $ 159,230 $ 161,285 $ 166,371 Change in Total Deferred Revenue(1) 710 8,305 3,787 5,186 6,428 (654) (3,039) 4,411 Total Billings $ 195,149 $ 198,217 $ 187,068 $ 186,130 $ 171,655 $ 158,576 $ 158,246 $ 170,782 __________________________________________________________________________________________ 1. Change in total deferred revenue excludes deferred revenue acquired through business combinations.

12 _______________________________________________________________________________________________________________________ 1. Subscribers is defined as those customers who purchase one or more of our monthly recurring products for a continuous period of at least three months, measured as of the end of the reporting period, excluding customers from our acquisitions of TurboSquid and PicMonkey. 2. Subscriber revenue is defined as the revenue generated from subscribers during the period, excluding revenues from our acquisitions of TurboSquid and PicMonkey. 3. Average revenue per customer is calculated by dividing total revenue for the trailing twelve month period by customers, excluding revenues from our recent acquisitions of TurboSquid and PicMonkey. We define customers as total active, paying customers that contributed to total revenue over the trailing twelve month period, excluding customers from our recent acquisitions of TurboSquid and PicMonkey. 4. Paid downloads is defined as the number of downloads that our customers make in a given period of our content. Paid downloads exclude content related to custom content, downloads of content that are offered to customers for no charge, including our free image of the week and downloads associated with our computer vision offering. 5. Revenue per download is defined as the amount of revenue recognized in a given period divided by the number of paid downloads in that period excluding revenue from custom content, revenue that is not derived from or associated with content licenses and revenue associated with our computer vision offering. 6. Represents approved images (photographs, vectors and illustrations) and footage (in number of clips) in our library on shutterstock.com at the end of the period. This collection metric excludes content that is not uploaded directly to our site but is available for license by our customers through an application program interface, custom content and certain content that may be licensed for editorial use only. Key Operating Metrics 9/30/2021 6/30/2021 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Subscribers (in thousands) (1) 336 321 306 281 255 223 209 194 Subscriber revenue (in millions) (2) $ 81.5 $ 78.1 $ 76.5 $ 71.1 $ 67.6 $ 62.7 $ 63.9 $ 60.5 Average revenue per customer (LTM) (3) $ 361 $ 356 $ 342 $ 333 $ 328 $ 326 $ 329 $ 330 Paid downloads (in millions) (4) 44.3 44.9 45.8 45.8 43.4 44.0 46.8 47.7 Revenue per download (5) $ 4.20 $ 4.17 $ 3.96 $ 3.91 $ 3.79 $ 3.61 $ 3.42 $ 3.44 Content in our collection (in millions): (6) Images 390 380 370 360 350 340 330 314 Footage clips 23 22 21 21 20 19 18 17

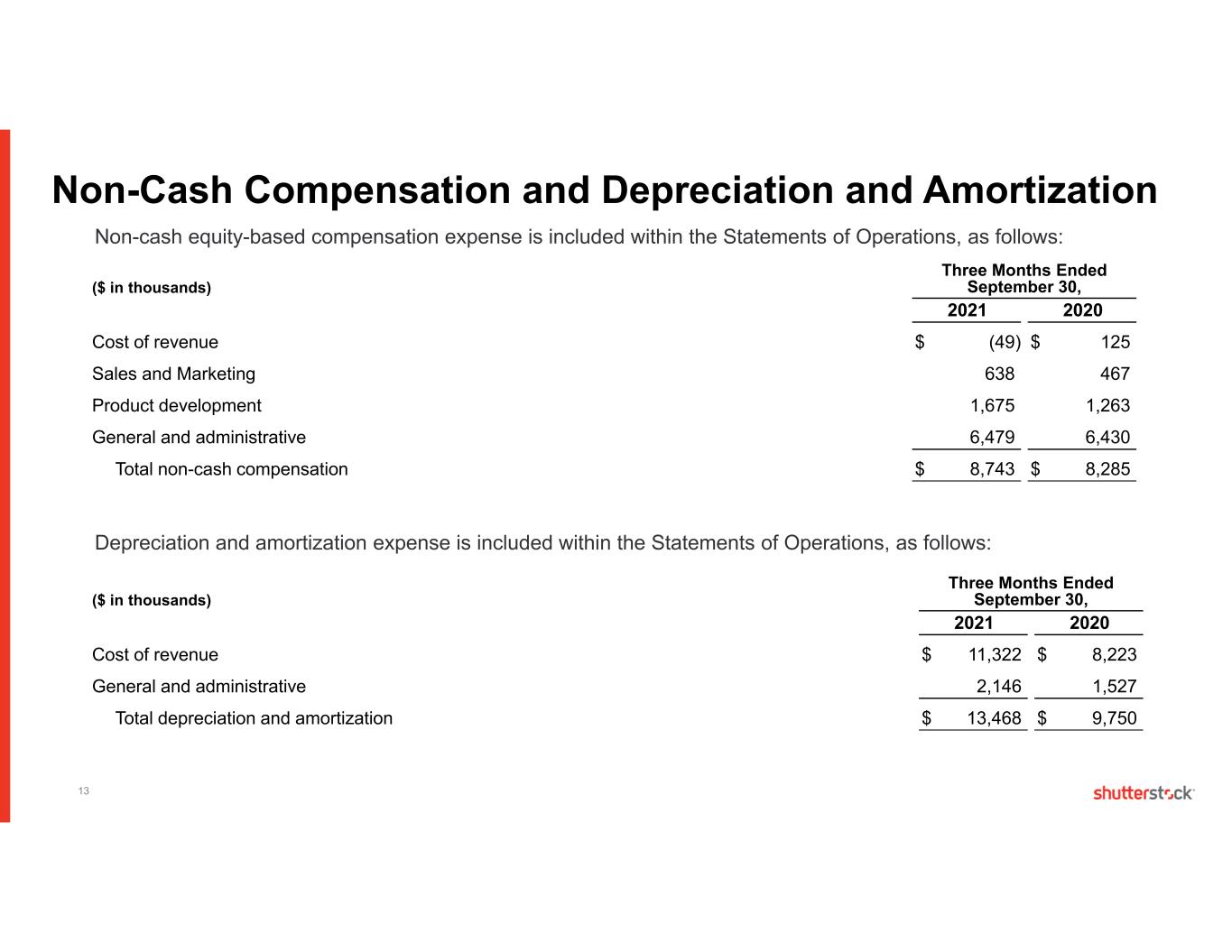

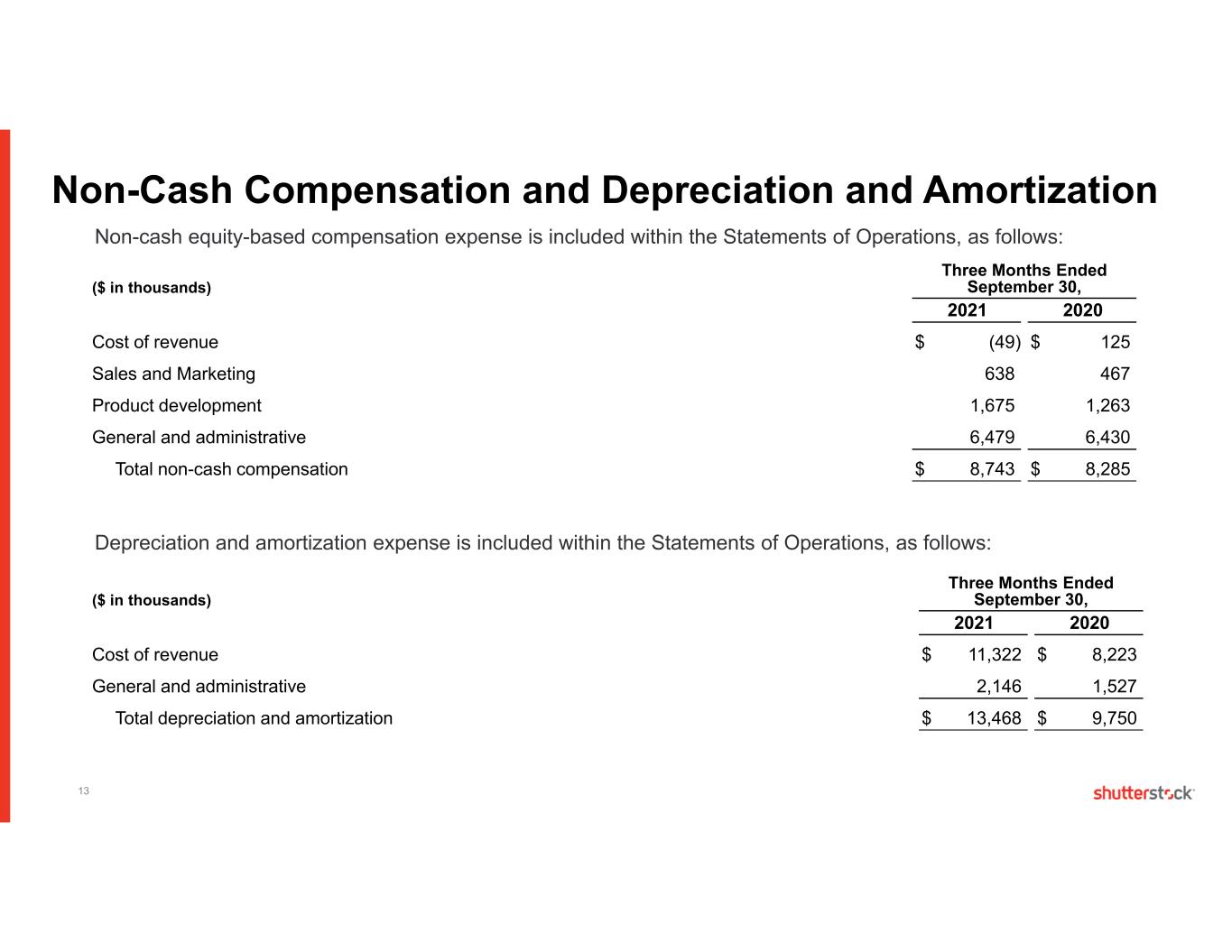

13 Non-Cash Compensation and Depreciation and Amortization Depreciation and amortization expense is included within the Statements of Operations, as follows: ($ in thousands) Three Months Ended September 30, 2021 2020 Cost of revenue $ 11,322 $ 8,223 General and administrative 2,146 1,527 Total depreciation and amortization $ 13,468 $ 9,750 Non-cash equity-based compensation expense is included within the Statements of Operations, as follows: ($ in thousands) Three Months Ended September 30, 2021 2020 Cost of revenue $ (49) $ 125 Sales and Marketing 638 467 Product development 1,675 1,263 General and administrative 6,479 6,430 Total non-cash compensation $ 8,743 $ 8,285

14 2021 Guidance Previously Announced 2021 Guidance Revenue $765 - $770 million $740 - $750 million YOY Growth vs. 2020 14.75% to 15.5% 11% to 12.5% Adjusted EBITDA $185 - $191 million $175 - $180 million Adjusted Net Income per diluted share $3.18 to $3.29 $2.80 to $2.95 The Company's revised expectations for the full year 2021 are as follows: 2021 Guidance

Please remember this information is confidential. © 2021 Shutterstock, Inc. All rights reserved.