OFFERING CIRCULAR DATED MAY 18, 2017

UNATION, LLC

12802 Tampa Oaks Blvd., Suite 405

Tampa, FL 33637

Up to 25,000,000 Series C Non-Voting Membership Units including up to 8,333,330 Series C Non-Voting Membership Units sold by current securityholders. Sales by current securityholders will not begin until the company has sold at least $15,000,000 worth of its Series C Non-Voting Membership Units.

The current holders of Series A Membership Units of the company will convert their Series A Membership Units into Series C Non-Voting Membership Units at a 1 to 10 ratio prior to selling to investors in this Offering.

SEE “SECURITIES BEING OFFERED” AT PAGE 31

| | | Price to Public | | | Underwriting

discount and

commissions* | | | Proceeds to

issuer before

expenses,

discounts and

commissions* | | | Proceeds to

current

security

holders** | |

| | | | | | | | | | | | | |

| Per unit for sales of $0 to $15,000,000 | | $ | 1.20 | | | | — | | | $ | 1.20 | | | | — | |

| Per unit for sales of $15,000,000 to $30,000,000 | | $ | 1.20 | | | | — | | | $ | 0.21 | | | $ | 0.99 | |

| Total Maximum | | $ | 30,000,000 | | | | — | | | $ | 21,750,000 | | | $ | 8,250,000 | |

* The company expects that the amount of expenses of the offering that it will pay will be approximately $80,000, not including state filing fees. The company has engaged Quint Capital Corporation to act as an introducing broker-dealer in connection with this Offering. Quint Capital Corporation is not providing underwriting or investment banking services, and is not acting as a placement agent for this Offering. See the “Plan of Distribution” for details regarding the compensation payable to Quint Capital Corporation.

** See the “Plan of Distribution” for details regarding the method of determining when current securityholders may sell their interests.

This offering is being made on a best efforts basis without any minimum investment target and will be made on continuous basis as provided by Rule 241(d)(3)(i)(F) for up to two years following the date of qualification by the Commission.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERINGCIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVERTHE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURALPERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OFREGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TOwww.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 6.

Sales of these securities will commence on approximately [June 30, 2017].

The company is following the “Offering Circular” format of disclosure under Regulation A.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

TABLE OF CONTENTS

In this Offering Circular, the terms “UNATION, LLC”, “UNATION” or “the company” refers to UNATION, LLC and its subsidiaries, UNATION Technologies, LLC and UNATION Entertainment Group, LLC, on a consolidated basis.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

SUMMARY

This Offering Circular Summary highlights information contained elsewhere and does not contain all of the information that you should consider in making your investment decision. Before investing in the company’s Series C Units, you should carefully read this entire Offering Circular, including the company’s financial statements and related notes. You should also consider amount other information, the matters described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

The Company

UNATION is connecting the world through events. We are an event-driven social platform that believes life is a series of events, and by connecting around the events of our lives we form meaningful and relevant relationships.

UNATION first organized as a limited liability company on June 10, 2010. The concept for UNATION was conceived on a napkin on a move set by the company’s founder, John Bartoletta. The idea was simple — Events are what bring people together and branding around events is critical for creating honest and lasting relationships between the event creators and event attendees.

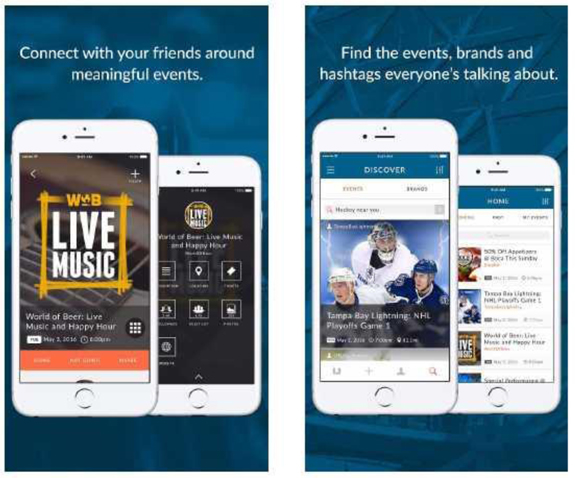

Our Product

UNATION has developed its UNATION app for use through an internet browser, or through Android or iOS on a person’s smartphone. The app allows users to create, discover, and obtain information needed to attend events.

We have recently expanded the functionality of the app to allow for registration and ticketing of events. This functionality is the first prong of our efforts to monetize the UNATION app.

Our Growth Strategy

Our current expansion model is focused on the State of Florida. To date, the UNATION app is available for events in Tampa,St. Pete, Sarasota, Orlando, Daytona, Miami, Ft. Lauderdale and Key West. We intend to further expand within the state of Florida through the use of our Brand Ambassador, College Initiative, and One Million Users in 100 Days programs.

Our strategy when entering a new market is four-fold. By partnering with local event organizers, creating Brand Ambassadors among college Greek systems, partnering with local influencers, and the use of targeted marketing through social ad campaigns, we reach our desired user base and acquire new UNATION users.

The Offering

We are offering investors the opportunity to purchase Series C limited liability company membership units at $1.20 per unit. The Series C Units do not include any voting rights or the ability to direct the operations of the Company.

Key Risk Factors of this Offering

We are in competition with other social media companies that are larger and better funded.

We have not yet realized significant revenues from operations and it is uncertain we will be able to do so.

Our business depends on being able to scale and maintain our technical infrastructure.

Investors in this Offering will receive non-voting Series C Units and will have no ability to meaningfully direct the operations of the Company.

The rights of investors are determined by the Operating Agreement of the Company rather than any body of state corporations law.

We have elected to be taxed as a partnership, meaning that any gains and losses will flow directly to the holder of membership Units of the Company in proportion to their percent ownership of the Company.

RISK FACTORS

The SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies are inherently more risky than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to Our Business and Industry

If we fail to retain existing users or add new users, our business may be significantly harmed. We depend on our users to create events and identify interest in those events. Further, event organizers will only utilize our product if there are sufficient number of potential attendees that they will be able to reach through the product. Potential attendees will only utilize our product if there are a sufficient number of events to discover and attend. Our future financial performance will be significantly determined by adding, retaining, and engaging active users.

We face competition from larger and better funded social media companies. Our current competitors have significantly greater resources and better competitive positions in certain markets than we do. These factors may allow out competitors to respond more effectively than us to new or emerging technologies and changes in the market.

We may not be successful in our efforts to grow and monetize the UNATION app. We are currently pre-revenue and have not charged users for the services contained in the UNATION app. Our future financial performance will depend on monetizing the services included in the app and growing our user base. It is unclear how charging for our services will impact the existing user base or future growth of our user base.

We operate in a highly competitive space. Competition presents an ongoing threat to the success of our business. Our competitors may develop products, features, or services that are similar to ours or that achieve greater market acceptance. Our competitors may also undertake more far-reaching and successful product development efforts or marketing campaigns.

If we are not able to maintain and enhance our brand, our ability to expand our base of users may be impaired, and our business and financial results may be harmed. Maintaining and enhancing our brand is critical to expanding our base of users. Our brand image will depend on our ability to provide users with the ability to find and share exciting, local events. If we fail to successfully maintain and enhance the UNATION brand, or if we incur excessive expenses in this effort, our business and financial results may be adversely affected.

We have not yet generated any revenue from the UNATION app and there are no assurances we will be able to generate revenue. Since the launch of the UNATION app in beta, we have not generated any revenue from the app. We have created partnerships and promoted the app with the condition that we would not charge for the service. Our goal is to monetize the app, however there are no assurances we will be successful in doing so.

We are controlled by a small team with substantially greater rights than those of investors. We have a small team of Managers and executive officers that exercise substantial control over the company. These Managers and executive officers have received Series A Units of the company, which are the only class entitled to vote on any matters presented to the members of the company.

We cannot be certain that additional financing will be available on reasonable terms when required, or at all. We will need additional financing in the future. Our ability to obtain additional financing, if and when required, will depend on investor demand, our operating performance, the condition of the capital markets, and other factors. When we seek such additional financing, the terms may not be favorable to us, or such financing may not be available at all.

Our business depends on our ability to maintain and scale our technical infrastructure. Our reputation and ability to attract, retain, and serve our users depends on the reliable performance of the UNATION app and its underlying technical infrastructure. Our systems may not be adequately designed with the necessary reliability and redundancy to avoid performance delays or outages that could be harmful to our business. If UNATION is unavailable when users attempt to access it, users may not continue using the app.

We rely on third party developers and third party providers of network infrastructure. Our developers and network infrastructure are provided by third party contractors. We rely on those third parties to fulfil their obligations under existing agreements. Should those third parties not fulfil their obligations to UNATION we may be required to find other third parties, if any are available. Our financial results could be negatively affected if we are required to change developers and network infrastructure providers.

We cannot assure you that we will effectively manage our growth. We currently operate in a limited number of markets around UNATION’s base of operations in Tampa, FL. As we expand to additional metropolitan regions, we will be required to take on additional personnel. Our management may not be able to manage such growth effectively.

Computer malware, viruses, hacking, phishing attacks, and spamming could harm our business and results of Operations. As an app hosting information that may be used to identify users and their networks, we may be the subject of computer malware, viruses, hacking, phishing attacks, and spamming. Should we be unable to effectively manage these attacks and threats to user information, we may experience harm to our reputation and our ability to retain existing users and attract new users.

Our auditor has issued a going concern opinion. UNATION is a development stage company and we have suffered losses from operations since the inception of the company. While the management of the company is taking steps to raise additional funds and we believe we will be able to start generating revenue from the company’s core product, there are no assurances that these capital raising efforts will be successful or that we will receive significant revenue from operations.

We have entered into a loan agreement with a related party to the company. We have entered into a loan agreement with Marquesas Capital Partners, LLC, a company controlled by the Managers of UNATION. The loan agreement was first entered into on January 31, 2013. The terms of the loan have been altered from time to time. Should we be unable to continue operations, Marquesas Capital Partners, LLC, as a creditor to the company, would receive proceeds from any liquidation to satisfy the loan prior to any disbursement to unit holders of the company, including investors in this Offering.

Risks Related to this Offering and Ownership of Our Series C Units

The price of our Class C Units has been set arbitrarily. The price of our Series C Units was determined internally based on the management’s perceived value of the company. This price is the same as the price that was offered to previous investors in the Series B Units of the Company. We have not obtained any third-party valuation reports or negotiated the price with any third party.

There is no current market for any of our Series C Units. There is no formal marketplace for the resale of the Series C Units of the company. Units may be traded on the over-the-counter market to the extent that any demand exists. Investors should assume that they may not be able to liquidate their investment for some time, or be able to pledge their Units as collateral.

Investors hold minority interests in the company. UNATION has already issued 20,000,000 units of its Series A Units, and 34,672,767 of its Series B Units. Investors will hold minority interests in the company and will not be able to direct its operations. The rights, preferences, and privileges of the Series C Units are provided in the Amended and Restated Operating Agreement of the company, which provides substantial control of the company to the holders of Series A Units.

The Series C Units are non-voting units. The Series C Unit holders do not have the right to vote on any manner presented to the Members of the company. We rely on the flexibility provided under Section 302 of the Delaware Limited Liability Company Act which allows for any limited liability company, through its operating agreement, to provide any class of members with no voting rights.

We have elected to be taxed as a partnership. Each member of the company, that is, those persons holding any number of Series A, Series B, or Series C Units of the company will have individual tax liability for the profits and losses of the company. Investors will be informed of this individual liability when we provide Internal Revenue Service Form K-1s to each investor on an annual basis.

The rights of investors are determined by the Operating Agreement of the company. Limited liability companies are creatures of contract governed by the specific terms of its own operating agreement. This is in contrast with corporations that are governed by state corporation codes in addition to their own certificate of incorporation. Among other terms, the Amended and Restated Operating Agreement of UNATION, LLC sets out the rights of Members, the rules regarding allocation of profits and losses, the rules regarding distributions, the powers of the Managers and executive officers of the company, and other significant terms. Investors should carefully review the Amended and Restated Operating Agreement and should only invest if they agree to be bound by those terms.

THE COMPANY’S BUSINESS

Basic Information about the Company and Overview

We founded the company in June 2010 in order to create an event-driven social platform. We believe life is a series of events and by connecting around the events of our lives, we are giving users the ability to form meaningful and relevant relationships.

Our current expansion model is focused on the State of Florida. To date, the UNATION app is available for events in Tampa, St. Pete, Sarasota, Orlando, Daytona, Miami, Ft. Lauderdale and Key West. As of March 22, 2017, we have not earned significant income from operations and still consider ourselves to be a developmental stage company.

We have one non-operating, wholly-owned subsidiary entity. That entity is UNATION Technologies, LLC, a Texas organized limited liability company. We had one additional non-operating, wholly-owned subsidiary named UNATION Entertainment Group, LLC. We intend to dissolve that entity under the procedures provided by the Delaware Limited Liability Company Act.

Principal Products and Services

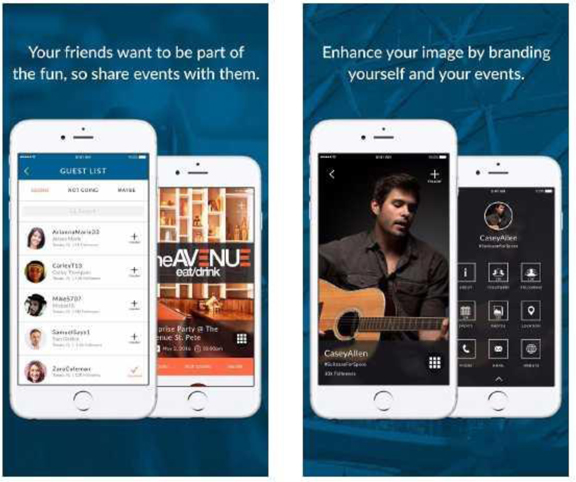

Our core product is the UNATION app, currently available through the Apple App Store and through Google Play as well as available through our web-based app. We also have a “Check in” app to better assist people in managing their ticket events. The app allows businesses and people to create, discover, and share local events, such as concerts, nightlife, restaurant specials, festivals, date nights, and other social gatherings.

We issue updates to the app on a monthly basis, or as often as needed when responding to known, global security threats that regularly impact iPhone and Android applications. Our recent updates have also expanded the features available to our users and Brand Ambassadors (for more information on our Brand Ambassador Program, see “Brand Ambassador Program” below).

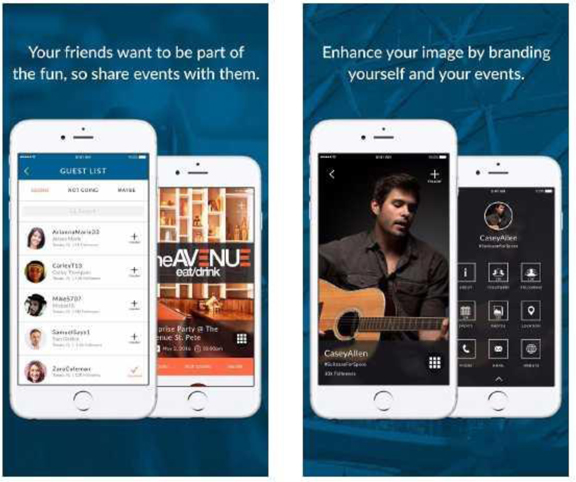

The format of the app allows event organizers to build brand recognition. To us, branding means that users have control of the appearance of their profile and everything on it, from photos to events. This branding focus provides users with the ability to put their best image forward and showcase their content in the way they see fit.

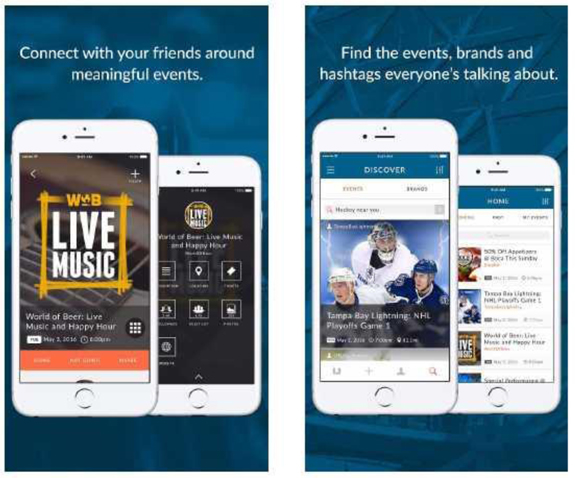

Users of the app benefit from the ease of finding local events and building relationships with people who share the same interest. Users find the UNATION to be a useful tool to find events by scrolling through what is happening in their area and by filtering those searches based on categories of events, dates, and event creators. Once finding the event, a user is provided with all the pertinent details right in the app, including date, time, description, ticket links, directors, who’s going, and photos.

For businesses and event organizers, the UNATION app delivered a relevant audience looking for this to do. To that end, UNATION is a promotional tool for anyone interested in promoting an event.

The app does more than just allowing users to view the details of events created by users. Our features allow organizers to promote and generate revenues from their events. Currently, the features of the UNATION app include:

| • | Create ticket | • | Absorb fees |

| • | Edit ticket | • | Multiple ticket levels |

| • | Buy ticket | • | Promo codes |

| • | Link your bank account | • | Add to calendar |

| • | Pass on fees | • | Registration |

| • | Reporting | • | Check in App |

| • | Ambassador Portal | • | Event marketing support |

We began generating revenue on our ticketing services in the fourth quarter of 2016 by receiving a fee on each ticket sold through the app. The app allows for event organizers and promoters to absorb the cost of the fees, or pass them on to purchasers. The majority of event creators pass on the fees to the ticket purchasers as that is industry standard and expected by the end user. Either way, whether the fee is passed on or absorbed, UNATION still collects that fee as revenue. So far, the revenues were nominal but demonstrated the potential available for generating revenue through the UNATION app. In the first quarter of 2017, UNATION introduced promoted content as our second revenue stream. This feature allows event creators to pay UNATION to promote their content on our app, over social media, email, etc. The revenue from this feature has been nominal to date but has proved another revenue source.

In the future, we plan to introduce premium application services and promoted content as sources of revenue to UNATION.

Since event organizers of any size, from farmers’ markets to Taylor Swift concerns, are able to create events on the UNATION app, we have created a curated Top List of events in a user’s geographic area to help navigate the events created on the app.

Market

We are currently focused on the Florida market for events and have established a presence in Tampa, St. Pete, Sarasota, Orlando, Daytona, Miami, Ft. Lauderdale and Key West. Rather than merely having a presence, we want to dominate particular markets to make the UNATION app ubiquitous and the go-to resource for event organizers and promoters.

Effectively, the scope of our market is only limited by the number of event organizers in the cities in which we operate. Nationwide, every year there are thousands of professional sporting events, as well as hundreds of thousands of nightlife activities, restaurant promotions, and concerts. Each of these organizers is part of the potential market for UNATION.

Our pricing model for ticketing services is based on percentage of the ticket price. As such, we are the beneficiaries of the general trend towards higher ticket prices for concerts and sporting events. For instance, the current average ticket price for a music concert is $74.25, as determined by Pollstar in its 2015 Year End Stats & Analysis. This represents an increase of $2.81, or 4% over the previous year.

Marketing/Business Development

When we open in a new city or region, we focus on building our user base by engaging with people who will help us promote the UNATION app. We do this through targeting of Brand Ambassadors and Influencers, creating partnerships with large event organizers, digital marketing campaigns, and engaging with colleges. Our current marketing focus is being done through our Brand Ambassador Program and our College Initiative. These efforts typically result in user acquisition cost of $1 per user or less, with some campaigns only costing approximately $0.15 per user.

Brand Ambassador Program

As it is people that drive attendance to events, one means we have used to market the UNATION app is through our Brand Ambassador Program. Each person that signs up under the Brand Ambassador Program is entitled to a percentage of any revenue earned by a client or account that the Ambassador has introduced to UNATION. The fee structure is tiered to encourage participation by Ambassadors. Each Ambassador receives 20% of the revenue generated by the first event for a new client or account, and 10% for subsequent events. We may adjust these percentages in the future. In this way, Ambassadors are incentivized to encourage use of the app and our current primary revenue generator — ticketing services.

To assist and track the progress of our Ambassadors, we have built an admin portal within the UNATION app that allows Ambassadors to invite new users to UNATION and track revenue earned by any new user that the Ambassador has introduced.

College Initiative

According to the Florida College System Annual Report, there were over 813,000 college students in the state of Florida in 2014. The current generation of students is entrepreneurial and enjoys supplementing their online and in app experiences with in-person events. In response, we developed our College Initiative to formalize the process in which we can engage with college students. Students have the ability to join as a Campus Brand Ambassador to promote the UNATION app on their campus, allowing them to earn a portion of the revenue generated through their work promoting the UNATION app. As students show promise, we intend to provide additional experience, culminating in a role as a UNATION employee for select students.

One Million Users in 100 Days

Starting on March 1, 2017, we have a launched our “One Million Users in 100 Days” campaign. The goal of this campaign is to leverage our current methods of increasing our user base to generate one million users in specific regions of Florida. We intend to do this by growing our base of Brand Ambassadors to over 100 active Ambassadors, generating over 250 active ticketing accounts, engaging with three to five strategic growth partners, expanding into Miami, FL, as well as expanding into two more colleges.

Competition

We believe we offer a unique product that is not being provided by other social media services. While there are other apps and services that allows for discovery and promotion of events, we are not aware of any competitor that includes the same robust features for event organizers and users to create, promote, and discover events.

UNATION distinguishes itself in event promotion and ease of creation by adding the mobile component to the equation. Currently, an event creator is unable to create events from their phone on Eventbrite, which is arguably the top user generated event site in the United States. However, an event creator can do so on UNATION. We also differentiate in price and speed to market. Many event creators spend thousands of dollars for an event page, attached to an e-commerce engine, with the ability for tickets and registration. On UNATION, it is free to set all of that up as a user. We only make money when the event creator sells tickets.

Development Team and Network Infrastructure

We utilize in-house contractors to develop the prototype and products that UNATION brings to the market. We also have an ongoing business relationship with West Agile Labs in San Francisco, CA, which is responsible for developing the technical infrastructure supporting the UNATION app. We pay West Agile Labs based on the work performed, and all resulting intellectual property is the property of UNATION.

Additionally, we leverage cloud computing from Amazon Web Services (“AWS”) for our hardware needs. Cloud computing provides a simple way to access servers, storage, databases and a broad set of application services over the Internet. AWS owns and maintains the network-connected hardware required for these application services, while we provision and use what we need via a web application.

Employees

We currently have 23 people working for UNATION on a full time, part time, or contract basis.

Intellectual Property

In the scope of their work developing the UNATION App, any contractor hired by UNATION is required to acknowledge that the work product is the property of UNATION.

We have filed for trademark protection on three marks used by the company as a means to protect our brand and image, as well as promote the UNATION app. These marks include:

| Serial Number | Mark | Date Filed |

| 85250129 | UNATION | February 23, 2011 |

| 85379969 | It’s where you live | July 25, 2011 |

| 85379701 | Affinity Bonding | July 25, 2011 |

Legal Proceedings

We are involved in four current legal proceedings. The first is a lawsuit brought by Bridgeline Digital, Inc. against the company in Superior Court in the Commonwealth of Massachusetts in regards to a contract entered into between Bridgeline Digital, Inc. and the company. The law suit was filed in October 2012. The lawsuit alleges breach of contract and seeks monetary damages and other civil remedies. The company has challenged the claims of Bridgeline and the lawsuit is currently ongoing.

The second legal proceeding involves a lawsuit brought by the company against Compuware Corp in September 2011 Circuit Court for Hillsborough County in the State of Florida in regards to a contract entered into between the company and Compuware Corp. In the lawsuit we allege that Compuware was in breach of a contract entered into with UNATION and are seeking monetary damages and other civil remedies. Compuware filed a counterclaim for services and fees UNATION is disputing. We are currently in settlement negotiations with Compuware.

In July 2016, an entity allegedly known as Apercu Global, Inc. filed suit against us for breach of contract in the United States District Court for the Middle District of Florida, following a dismissal of a complaint with prejudice based on jurisdictional grounds in July 2015 filed in New Jersey Superior Court. The July 2016 lawsuit was voluntarily dismissed in January 2017, at which point an entity by the name of Apercu Financial Services, Inc. filed a lawsuit against the company. We believe the complaint filed against us to be a sham pleading and will vigorously defend ourselves and aggressively prosecute appropriate counterclaims as necessary.

In December 2016 three individuals filed a complaint against the company in the United States District Court for the Middle District of Florida alleging violations of the Fair Labor Standards Act. One of the plaintiffs subsequently dropped his claim against the company. The company has challenged the claims and the lawsuit is currently ongoing.

DILUTION

Dilution means a reduction in value, control or earnings of the units the investor owns.

Immediate dilution

An early-stage limited liability company typically sells its units or membership interests (or grants options over its units) to its founders and early employees at a very low cash cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new investors typically pay a much larger sum for their units than the founders or earlier investors, which means that the cash value of your stake is diluted because all the units are worth the same amount, and you paid more than earlier investors for your shares.

The following table compares the price that new investors are paying for their units with the effective cash price paid, or to be paid, by existing unit holders, at a price of $1.20 per unit. The table presents units and the weighted effective price by series of unit issued since inception.

| | | | | | | | | Effective

Cash Price | |

| | | Year Issued | | | Issued Units | | | Per Unit at

Issuance | |

| Series A Units* | | | 2010 | | | | 20,000,000 | | | $ | 0.006 | |

| Series B Units (Acquired by Investors)** | | | 2010–2016 | | | | 24,495,270 | | | $ | 0.389 | |

| Series B Units (Grants as compensation)*** | | | 2011–2016 | | | | 10,177,497 | | | $ | 1.084 | |

| Total Units Outstanding | | | | | | | 54,672,767 | | | $ | 0.38 | |

| Series C Units (Investors in the offering, assuming $30 Million raised | | | | | | | 25,000,000 | | | $ | 1.20 | |

| Total After inclusion of this Offering | | | | | | | 79,672,767 | | | $ | 0.64 | |

* Reflects a 10 for 1 split effected on December 31, 2016.

* Includes units that were issued pursuant to a 3 for 1 split effected on March 31, 2016 and further 10 for 1 split on December 31, 2016. Units were originally purchased at a cash price of $10.00 or $12.00.

** Includes units issued as compensation for services to partners, in exchange for technology, and in exchange to settle disputes. Reflects a 10 for 1 split on December 31, 2016.

The following table demonstrates the dilution that new investors will experience upon investment in the Company. This table uses the Company’s tangible net book value as of December 31, 2016 of $(763,131), which is derived from the net equity of the Company in the December 31, 2016 financial statements. The offering costs assumed include a 4% commission on sales of the units in the offering. The table presents two scenarios: a raise of $15,000,000 in which no sales are made by selling securityholders, and a fully subscribed $30,000,000 raise that includes selling securityholders.

| | | $15 Million Raise | | | $30 Million

Raise | |

| Price per Units | | $ | 1.20 | | | $ | 1.20 | |

| Units Issued | | | 12,500,000 | | | | 25,000,000 | |

| Capital Raised | | $ | 15,000,000 | | | $ | 30,000,000 | |

| Less: Offering Costs | | $ | (600,000 | ) | | $ | (1,200,000 | ) |

| Less: Sales by Existing Securityholders | | $ | -0- | | | $ | (12,375,000 | ) |

| Net Offering Proceeds | | $ | 14,400,000 | | | $ | 16,425,000 | |

| Net Tangible Book Value Pre-Financing | | $ | (763,131 | ) | | $ | (763,131 | ) |

| Net Tangible Book Value Post-Financing | | $ | 13,636,869 | | | $ | 15,661,869 | |

| | | | | | | | | |

| Units Issued and Outstanding Pre-Financing at 12/31/2016 | | | 54,672,767 | | | | 54,672,767 | |

| Post-Financing Units Issued and Outstanding | | | 67,172,767 | | | | 79,672,767 | |

| | | | | | | | | |

| Net tangible book value per unit prior to offering | | $ | (0.01 | ) | | $ | (0.01 | ) |

| Increase/(Decrease) per unit attributable to new Investors | | $ | 0.22 | | | $ | 0.21 | |

| Net tangible book value per unit after offering | | $ | 0.20 | | | $ | 0.20 | |

| Dilution per unit to new investors ($) | | $ | (1.00 | ) | | $ | (1.00 | ) |

| Dilution per unit to new investors (%) | | | -83.08 | % | | | -83.62 | % |

Future dilution

Another important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional units. In other words, when the company issues more units, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of units outstanding could result from a securities offering (such as an initial public offering, another crowd funding round, a venture capital round, angel investment), employees exercising options, or by conversion of certain instruments (e.g. convertible bonds, preferred units or warrants) into units.

If the company decides to issue more units, an investor could experience value dilution, with each unit being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per unit (though this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the company).

The type of dilution that hurts early-stage investors most occurs when the company sells more units in a “down round,” meaning at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative purposes only):

| | · | In June 2014 Jane invests $20,000 for units that represent 2% of a company valued at $1 million. |

| | · | In December the company is doing very well and sells $5 million in units to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. |

| | · | In June 2015 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

This type of dilution might also happen upon conversion of convertible notes into units. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more units than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a per unit price ceiling. Either way, the holders of the convertible notes get more units for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more units for their money. Investors should pay careful attention to the amount of convertible notes that the company has issued (and may issue in the future), and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each unit to hold a certain amount of value, it’s important to realize how the value of those units can decrease by actions taken by the company. Dilution can make drastic changes to the value of each unit, ownership percentage, voting control, and earnings per share.

USE OF PROCEEDS TO ISSUER

The net proceeds of a fully subscribed offering to UNATION, after total offering expenses, broker fees, and sales by current securityholders will be approximately $21.45 million.* We plan to use these proceeds as follows:

| · | Approximately $12.5 million for marketing, sales, and event development efforts. |

| · | Approximately $620,000 for ongoing technology development. |

| · | Approximately $1.4 million for general and administrative expenses of the company. |

| · | Approximately $5.7 million to service and repay a loan issued to the company by Marquesas Capital Partners, LLC, a company controlled by the management of UNATION. The loan was originated on January 31, 2013 in the amount of $2.5 million and carries an interest rate of 12 percent per annum. The terms of the loan have been amended from time to time in response to the capital needs of the company. The principal amount of the loan was later increased to $4,344,729. As of December 31, 2015, the unpaid principal balance equaled $3,409,729 with accrued interest of $1,083,182. The loan is secured by the property and assets of the company. No principal needs to be repaid until the maturity of the loan on January 30, 2017. |

* Includes a 1% processing fee to Quint Capital Corporation.

Because this offering is being made on a “best efforts” basis, without a minimum offering amount, we may close the offering without sufficient funds for all the intended purposes set out above.

To help ensure the company receives sufficient capital to fund its operations, current securityholders will not be able to sell their Units until we have received at least $15 million in gross investment. Should we only raise $15 million from investors, the net proceeds to the company after offering expenses, broker fees will be approximately $14.77 million.* Under this scenario, the use of proceeds would be as follows:

| · | Approximately $9.2 million for marketing, sales, and event development efforts. |

| | |

| · | Approximately $330,000 for ongoing technology development. |

| | |

| · | Approximately $810,000 for general and administrative expenses of the company. |

| | |

| · | Approximately $3.56 million to service and repay a loan issued to the company by Marquesas Capital Partners, LLC. |

* Includes 1% processing fee to Quint Capital Corporation.

The above description of the anticipated use of proceeds is not binding on the company and is merely description of our current intentions.We reserve the right to change the above use of proceeds if management believes it is in the best interests of the company.

THE COMPANY’S PROPERTY

We operate from two locations in Tampa, Florida. The corporate headquarters for the company is located at 12802 Tampa Oaks Blvd, Suite 405, Tampa, FL 33637. This location also serves as the headquarters office for Highstreet Group, LLC, an investment management firm operated by UNATION executive officers John Bartoletta and Jody Clermont. Highstreet Group, LLC allows the company to use this location without cost.

The company’s second location for the company is at 324 S. Hyde Park Ave, Suite 405, Tampa, FL 33637. All of our technical and development operations are carried out from this location. Our current lease for these premises will expire on July 31, 2017.

The network infrastructure that is used to host the UNATION App is leased from Amazon Web Services. The arrangement with Amazon Web Services will allow us to increase our server utilization as demand and usage of the UNATION App increases.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes included in this Offering Circular. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements.

Results of Operations

The UNATION App (the “App”) is free to download for any user. Our business model is to generate revenue primarily from taking a percentage of ticket sales and from advertising on the App. As of December 31, 2016, we were still in developmental stages of operations, having only generated nominal revenue tied to our core operations. For year-end 2016, the company had revenues of $1,972, compared to $1,544 for year-end 2015, and $11,994 for year-end 2014. In the first quarter of 2017, our revenues continue to be nominal.

Offsetting that revenue is the cost of operations of the Company for development and support of the App along with the cost to host the App on Amazon’s servers. In 2016, we spent $460,436 on contract labor for development support of the App, compared to $492,652 in 2015 and $501,251 in 2014. Our costs to host the App in 2016 were $45,541 compared to $67,433 in 2015 and $112,407 in 2014. This drop was due to efficiency improvements in the use of server resources. For the first quarter of 2017, we have spent $136,850 (unaudited) for contract labor, $13,465 (unaudited), on App hosting, and $13,465 (unaudited) for hosting services. .

In 2016, our operating expenses totaled $1,094,448, compared to $1,090,780 for the year-end 2015 and $587,283 for 2014. The main component of our operating expenses for 2015 was a loan of $500,000 made to Starshop, Inc. for marketing services. Starshop subsequently breached the agreement, and collecting on the loaned amount is in question, resulting in our decision to expense the loan as a marketing expense. In contrast, we incurred $51,761 in marketing expenses for 2016, with the majority of that expense occurring in the first half of 2016. In 2015, we also incurred $370,391 in depreciation expenses. This amount increased to $622,336 for 2016. For the first quarter of 2017 we have spent $49,679 (unaudited) for marketing expenses.

During 2016, we also experienced a significant increase in legal and professional fees as a result of our offering under Regulation A of the Securities Act, as well as certain settlement agreements resulting from complaints against the company settled prior to 2016. In 2016, our legal and professional fees were $200,456, compared to $28,771 in 2015.

During the development stage of the Company, our management is receiving limited compensation from the Company. Only two of our officers, Georges Beardsley and Jody Clermont are directly compensated by the Company. That compensation amounted to a total of $136,000 in 2016, compared to $89,000 in 2015 and $48,000 in 2014.

The result of the foregoing is that we incurred a net loss of $1,617,310 in 2016, compared to a net loss of $1,667,675 in 2015, a decrease in our net loss of $50,365, or approximately 3%. Our net loss for 2014 was $1,209,179. If the one-time marketing expense of $500,000 incurred due to the breach of the marketing agreement by Starshop in 2015 were excluded, our net loss from 2015 to 2016 would have increased by $449,635.

Liquidity and Capital Resources

As of December 31, 2016, the Company’s cash and cash equivalents on hand was $260,349, which comprises the entirety of the Company’s current assets. At that time, the cash and cash equivalents on hand were not sufficient to cover the current liabilities of the Company, including $532,896 in current accounts payable.

Additionally, in order to continue development of the UNATION App, and support the current users of the App, the Company will be required to compensate its development team working on a contract basis. We expect that the Company will pay approximately $500,000 to its development team working on contract over the next 12 months, which is consistent with the amount paid in 2016 and 2015 of $460,436 and $492,652, respectively.

In order to meet its current liabilities, the Company will continue to raise funds from accredited investors. Over the course of 2016, the company raised $1,455,017 from accredited investors who purchased the Series B Units of the company. This amount was $2,275,443 in 2015. To date, the Company has demonstrated the ability to raise funds as needed.

On September 30, 2016, we were qualified by the SEC to raise up to $30,000,000, with proceeds to the company of $21,750,000 (which includes sales of up to $8.25 million by current securityholders), from investors in an offering of our Series C Membership Units under Regulation A under the Securities Act of 1933. To date, we have not actively sought investors for those securities and have not made any sales to investors of securities qualified under Regulation A.

Between the offerings of our Series B Units to accredited investors, and our Series C Units under Regulation A, we believe we will be able to obtain sufficient capital to continue our operations. If required, we may also turn to Marquesas Capital Partners, LLC to request additional funds to be loaned to the company at the same terms as have been loaned previously.

While these sources of liquidity are potentially available, there can be no assurances that the Company will be able to raise funds from additional outside investors or from Marquesas Capital Partners.

Plan of Operations

Over the next 12 months we plan to generate a larger user base through our “One Million Users in 100 Days” campaign and building our Brand Ambassador and College Initiative programs. We believe these efforts will result in increased revenues for the Company. As of August 2016, the UNATION App has been developed to the point that we have moved beyond the testing phases and have rolled out our ticketing services. We continue to believe that ticketing, along with our promotional program, will be the primary revenue source for the Company.

Additionally, have improved the user interface for our Brand Ambassadors, which we believe will encourage greater activity on the part of Ambassadors. In the next 12 months we intend to add premium App services that will be made available to event organizers. We will charge for some of these services through the App that we intend to roll out. Our intent is that the premium services in the App will allow for event organizers to engage with their attendees on a deeper level, making it an appealing option for organizers.

The next revenue stream we intend to tap into over the next 12 months is allowing event organizers to promote their events through the UNATION App in an automated fashion. In this way, promoted events would appear at the top of any user search for events in their area. Organizers will pay a fee inside of the App to promote their event. Prior to adding these features to the App, we have introduced the ability for organizers to hire the UNATION marketing team to promote their events, which launched in the first quarter of 2017.

Through these activities we also will take steps to saturate key market in the State of Florida.

It is our belief that the proceed this offering will satisfy our cash requirements to engage in the anticipated expansion and development of services that will generate revenues for the Company.

Trend Information and Metrics

We care about three key metrics: active users, retention, and viral coefficient. An active user is defined as a user who joins our App and does something we would like them to do, such as follow an event or create an event. We measure active users as a percentage of total users on UNATION.

Retention is defined as a user who comes back to the App more than once a month. A strong retention rate lowers our user acquisition cost. Viral coefficient is defined as when one user is responsible for getting another user to join. We measure this based on the number of other persons a user invites to the App (i.e., a user that invites 10 friends would have a viral coefficient of 10).

In our old UNATION web app model that was in place for beta testing from January 1, 2013 to July 31, 2013, we experienced the following metrics:

| | · | Active users: 15-20% |

| | | |

| | · | Retention rate: 15.5% |

| | | |

| | · | Viral coefficient: Estimated at 0.25 (we were not able to accurately measure the viral coefficient at the time) |

In our new model available through iOS, Android, and the web app, we experienced the following metrics from January 1, 2016 to June 20, 2016:

| | · | Active users: 50-55% |

| | | |

| | · | Retention rate (iOS): 65% |

| | | |

| | · | Retention rate (Android): 70% |

| | | |

| | · | Retention rate (web app): 40.5% |

| | | |

| | · | Viral coefficient: 0.25 |

Our most recent metrics cover the period from January 1, 2017 to March 31, 2017:

| | · | Active users: 60% |

| | | |

| | · | Retention rate (iOS, Android, and web app together): 45% |

| | | |

| | · | Viral coefficient: 0.25 |

We also measure user engagement based on the amount of time spent in the App. In our iPhone beta release, we saw users increase the average time spent on the App from 4:38 to 11:15.

MANAGING MEMBERS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

The following table sets out the company’s officers and managing members.

| Name | | Position | | Age | | Term of Office (if

indefinite, give date

appointed) | | Approximate hours per

week (if part-time)/full-

time |

| | | | | | | | | |

| Executive Officers: |

| John Bartoletta | | Chairman | | 53 | | June 2010 | | 20 (Mr. Bartoletta also serves as CEO of Highstreet Financial, LLC and is a Managing Member of Marquesas Capital Partners, LLC) |

| George Beardsley | | Chief Strategy Officer | | 50 | | June 2010 | | Full time |

| Dennis Thomas | | Chief Financial Officer | | 58 | | June 2010 | | 8 (Mr. Thomas is employed by and is the owner of Dendar Enterprises, LLC, which is the Managing Member of CPA Partners, LLC. Mr. Thomas is also a Managing Member of Marquesas Capital Partners, LLC) |

| Jody Clermont | | Chief Operating Officer | | 55 | | December 2011 | | 25 (Mr. Clermont also serves as COO of Highstreet Financial, LLC) |

| | | | | | | | | |

| Managing Members: |

| John Bartoletta | | Managing Member | | 53 | | June 2010 | | 20 |

| Dennis Thomas | | Managing Member | | 58 | | June 2010 | | 8 |

| | | | | | | | | |

| Significant Employees: |

| N/A | | | | | | | | |

John Bartoletta – Founder / Chairman

Mr. Bartoletta is an impassioned entrepreneur and the founder of UNATION. His passion for mathematics and complex algorithms for financial investing, combined with recent experiences in multi-media and film, led him to a belief that there was an opportunity in communications, digital-media and branding. UNATION is the result of his dedication for the past five years.

Prior to founding UNATION, Mr. Bartoletta founded The High Street Group, LLC in Tampa, FL and was its CEO for sixteen years. High Street is an independent investment firm focused on the capital markets. Mr. Bartoletta developed and implemented High Street’s proprietary quantitative-style investment methodology known as Dynamic Style Rotation and Dynamic Trend Algorithms.

Mr. Bartoletta is a member of the American Business Conference (ABC), a finalist for the 2002 Small Business of the Year by the U.S. Congress and Small Business Administration, and a guest lecturer at the graduate-level at the University of Florida. He attended the University of Michigan, where he concentrated his studies in Economics and Finance.

George Beardsley, III – Chief Strategy Officer, Co-Founder

Mr. Beardsley is responsible for creating, executing and sustaining product direction, as well as strategic marketing and operational initiatives. Mr. Beardsley provides over twenty years of online business and creative development experience. Prior to founding UNATION, Mr. Beardsley built and ran several successful businesses in sectors including business to consumer (B2C) Internet commerce, as well as traditional and online publishing.

Mr. Beardsley, also a former golf professional, has served on the Boards for a number of charities, including the Chair Scholars Foundation for over ten years. He has also served as guest lecturer at the graduate-level at the University of South Florida and University of Tampa.

Dennis K. Thomas, CPA – Chief Financial Officer

Mr. Thomas oversees all financial aspects of the company including: preparing the financing strategy, financial and capital planning, annual budgeting and accounting policies.

In addition to joining UNATION, Mr. Thomas the managing partner of CPA Partners, LLC, an accounting firm specializing in tax planning for closely held companies and their owners. He also provides management advisory services in areas including company sales, mergers and acquisitions, venture capital funding and international structures. Prior to establishing his own practice in 1994, Dennis was a partner with a large central Florida accounting firm and the CEO of a private company.

Mr. Thomas received his bachelor’s degree in Accounting and Finance from the University of South Florida and is licensed as a Certified Public Accountant.

Jody D. Clermont – Chief Operating Officer

Mr. Clermont is responsible for meeting our strategic operational goals and managing investor relations.

Prior to joining UNATION, Mr. Clermont spent twenty years with Syniverse Technologies, formerly GTE, and held multiple senior management positions within the Finance, Technology, Operations and CEO Staff areas. Most recently he served as, Vice President of Global Operational Excellence, Vice President of Business Integrity/Quality Assurance and Director of Six Sigma. Mr. Clermont is known for developing and leading high performance, data driven teams. Major projects include, managing the Los Angeles CA, Cellular Call box Installations, implementing Syniverse’s first Wireless Fraud Resource Center and leading the successful rollout of the US Wireless Number Portability System.

Mr. Clermont’s naval studies included two years of Electronics and one year of Business Management. He holds several certifications, including a PMP Certification in Project Management and a Six Sigma Black Belt Certification. Mr. Clermont is an active member of the Tampa Bay Technology Forum and a decorated Navy Veteran.

Legal Proceedings of Managing Members and Executive Officers

None of the Managing Members or executive officers have filed a petition under federal bankruptcy laws or any state insolvency law personally, or have had such a petition filed against them in the preceding five years. Additionally, none have been similarly involved in any bankruptcy or insolvency proceedings for any partnership, corporation, or business association in which the Managing Member or executive officer was a general partner, managing member, or executive officer in the preceding five years. Nor have any been convicted in a criminal proceeding in the previous five years.

COMPENSATION OF MANAGING MEMBERS AND EXECUTIVE OFFICERS

For the fiscal year ended December 31, 2016 only two of our Managing Members and executive officers received compensation from the Company. The compensation is as follows:

| Name | | Capacities in

which

compensation

was received | | Cash

compensation

($) | | | Other

compensation

($) | | Total

compensation

($) | |

| George Beardsley | | Chief Strategy Officer | | $ | 52,000 | | | N/A | | $ | 52,000 | |

| Jody Clermont | | Chief Operating Officer | | $ | 84,000 | | | N/A | | $ | 84,000 | |

For the fiscal year ended December 2016, we paid did not pay our Managing Members for their services as Managing Members.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS

The below table identifies the ownership and acquirable ownership of certain executive officers of the company holding more than 10 percent of any class of the company’s units as of March 31, 2017.

| Title of class | | Name and

address of

beneficial

owner | | Amount and

nature of

beneficial

ownership | | | Amount and

nature of

beneficial

ownership

acquirable‡ | | | Percent of

class | |

| Series A Units | | John

Bartoletta,

17007 Abastros

De Avila,

Tampa, FL

33613* | | | 15,000,000 Units | | | | — | | | | 75.00 | % |

| Series A Units | | Dennis

Thomas, 910

Jungle Avenue

N, St.

Petersburg, FL

33710† | | | 4,000,000 Units | | | | — | | | | 20.00 | % |

| Series B Units | | John

Bartoletta,

17007 Abastros

De Avila,

Tampa, FL

33613* | | | — | | | | 11,495,425 Units | | | | 22.99 | % |

| Series B Units | | Dennis

Thomas, 910

Jungle Avenue

N, St.

Petersburg, FL

33710† | | | — | | | | 3,065,447 Units | | | | 6.13 | % |

| Series C Units | | John

Bartoletta,

17007 Abastros

De Avila,

Tampa, FL

33613* | | | — | | | | 22,500,000 Units | | | | 75.00 | % |

| Series C Units | | Dennis

Thomas, 910

Jungle Avenue

N, St. Petersburg,

FL 33710† | | | — | | | | 6,000,000 Units | | | | 20.00 | % |

* Units are held by Marquesas Capital Partners, LLC for the benefit of John Bartoletta.

†Units are held by Marquesas Capital Partners, LLC and Centurion Enterprises, LLC for the benefit of Dennis Thomas.

‡ The amount and nature of beneficial ownership acquirable is based on the authorized but unissued Series B Units and Series C Units, as of March 31, 2017, that are deemed to be owned by the holders of Series A Units.

The final column (Percent of Class) includes a calculation of the amount the person owns now, plus the amount that person is entitled to acquire. That amount is then shown as a percentage of the outstanding amount of securities in that class if no other people exercised their rights to acquire those securities. The result is a calculation of the maximum amount that person could ever own based on their current and acquirable ownership, which is why the amounts in this column will not add up to 100%.

INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS

The company has received a loan from Marquesas Capital, LLC to fund its operations. Marquesas Capital is controlled by UNATION’s Managers. The loan was first issued to the company in the principal amount of $2.5 million in July 2013 at an annual interest rate of 12 percent. Since then, the loan has been modified from time to time. The most recent modification extended the maturity date to June 30, 2017. As of December 31, 2016, the current balance on the loan, including principal and accrued interest, is $5,258,477.

The day-to-day bookkeeping and financial records and tax reporting of the company is maintained by CPA Partners, LLC, an accounting firm owned by Dennis Thomas, who also serves as UNATION’s CFO. For the years ending December 31, 2016, 2015 and 2014, we paid $13,125, $13,450 and $13,175 to CPA Partners, LLC, respectively.

SECURITIES BEING OFFERED

General

We are offering Series C Non-Voting Membership Units to investors in this offering.

The following description summarizes important terms of the classes of units of UNATION. This summary does not purport to be complete and is qualified in its entirety by the provisions of the Amended and Restated Operating Agreement, which has been filed as an Exhibit to the Offering Statement of which this Offering Circular is part. For a complete description of UNATION’s classes of membership interests, you should refer to its Amended and Restated Operating Agreement and application provisions of the Delaware Limited Liability Company Act.

At the commencement of this offering, the authorized number and classes of units consists of 20,000,000 Series A Units, 40,000,000 Series B Units, 10,000,000 Series B Restricted Profits Only Units, and 40,000,000 Series C Units.

As of March 31, 2017, the outstanding units of UNATION included: 20,000,000 Series A Units, 34,672,767 Series B Units, and 0 Series C Units. These figures reflect a 10 for 1 split effected on December 31, 2016.

Series A Units

Allocation of Profits and Losses

Profits and losses of the company will be first allocated to each holder of Series A Units in proportion to the holder’s ownership interest, which is determined by dividing the number of Series A Units by the aggregate number of all authorized units of UNATION. Series A Units holders are also entitled to their pro rata share of authorized, but unissued Series B and Series C Units when determining their ownership interest. The 10 for 1 conversion terms identified below do not apply to the determination of ownership interest.

Distributions

When cash of the company is available for distribution to each holder of the company’s units, the Managers of the company, in their sole and absolute discretion, may distribute that cash to the unit holders. Distributions will first be made to each holder of Series A Units in proportion to the holder’s ownership interest, which is determined by dividing the number of Series A Units by the aggregate number of all authorized units of UNATION. Series A Units holders are also entitled to their pro rata share of authorized, but unissued Series B and Series C Units when determining their ownership interest. The 10 for 1 conversion terms identified below do not apply to the determination of ownership interest.

Voting Rights

Each holder of Series A Units is entitled to 10 votes per Unit on any matter submitted to the vote of the Members of the company.

Conversion Right

Each holder of Series A Units may convert the holder’s Series A Units to Series C Units of the company at a ratio of 1 Series A Unit to 10 Series C Units. It is anticipated that current holders of Series A Units will convert their Units to Series C Units at various times during the period in which this Offering Statement is qualified and make such Units available for purchase by investors.

Series B Units

Allocation of Profits and Losses

After profits and losses of the company are allocated to the holders of Series A Units, profits and losses will then be allocated to each holder of Series B and Series C Units in proportion to the holder’s ownership interest, which is determined by dividing the number of Series B Units by the aggregate number of all authorized units of UNATION.

Distributions

When cash of the company is available for distribution to each holder of the company’s units, the Managers of the company, in their sole and absolute discretion, may distribute that cash to the unit holders. After distributions have been made to the holders of Series A Units, distributions will then be made to each holder of Series B and Series C Units in proportion to the holder’s ownership interest, which is determined by dividing the number of Series B Units by the aggregate number of all authorized units of UNATION.

Voting Rights

The Series B Units of the company do not include any right to vote on any matters presented to the Members of the company.

Series C Units

Allocation of Profits and Losses

After profits and losses of the company are allocated to the holders of Series A Units and Series B Units, profits and losses will then be allocated to each holder of Series C and Series B Units in proportion to the holder’s ownership interest, which is determined by dividing the number of Series C Units by the aggregate number of all authorized units of UNATION.

Distributions

When cash of the company is available for distribution to each holder of the company’s units, the Managers of the company, in their sole and absolute discretion, may distribute that cash to the unit holders. After distributions have been made to the holders of Series A Units and Series B Units, distributions will then be made to each holder of Series C and Series B Units in proportion to the holder’s ownership interest, which is determined by dividing the number of Series C Units by the aggregate number of all authorized units of UNATION.

Voting Rights

The Series C Units of the company do not include any right to vote on any matters presented to the Members of the company.

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

Plan of Distribution

We are offering up to 25,000,000 Series C Units of the Company, as described in this Offering Circular on a best efforts basis. We have engaged Quint Capital Corporation as an introducing broker-dealer in connection with this Offering.

Commissions and fees

Quint Capital Corporation will not be providing underwriting or investment banking services to UNATION. It will not act as a placement agent either and will not earn commissions on sales of securities in this Offering. Quint Capital Corporation will receive a processing fee based on the amount of securities sold in this Offering. Additionally, no commissions will be paid to managing members of officers of UNATION, LLC.

| | | Per Unit | |

| Public offering price | | $ | 1.20 | |

| Broker fees* | | $ | 0.012 | |

| Proceeds, before expenses, to us | | $ | 1.188 | |

* Quint Capital Corporation will receive a processing fee of 1% on the sale of securities in this Offering.

Selling Securityholders

Below is a table of the current beneficial holders of the Series A Units of UNATION who will convert their current Units into Series C Units, at a ratio of 1 to 10, and sell to investors in this Offering. Sales by existing securityholders will not begin until after the Company has achieved $15 million in gross sales of its Series C Units in this Offering. To provide additional detail on the selling securityholders, the table includes information on the conversion of Series A to Series C units at gross sales of $20 million and $30 million in this Offering. Only those units converted from Series A to Series C will be available for sale by the selling securityholders.

Current

Security

Holder | | Current

Number

of

Series A

Units

Held | | | Total

Series A

Units

To be

Converted

($20MM) | | | Series C

Units

Held

After

Conversion

($20MM) | | | Series A

Units

Held

After

Conversion

($20 MM) | | | Total

Series A

Units

To be

Converted

($30MM) | | | Series C

Units

Held

After

Conversion

($30 MM) | | | Series A

Units

Held

After

Conversion

($30 MM) | |

| John Bartoletta | | | 15,000,000 | | | | 93,750 | | | | 937,500 | | | | 14,906,250 | | | | 515,625 | | | | 5,156,250 | | | | 12,484,375 | |

| Dennis Thomas | | | 4,000,000 | | | | 25,000 | | | | 250,000 | | | | 3,975,000 | | | | 137,500 | | | | 1,375,000 | | | | 3,862,500 | |

| George Beardsley | | | 1,000,000 | | | | 6,250 | | | | 62,500 | | | | 993,750 | | | | 34,375 | | | | 343,750 | | | | 965,625 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 20,000,000 | | | | 125,000 | | | | 1,250,000 | | | | 19,875,000 | | | | 687,500 | | | | 6,875,000 | | | | 19,312,500 | |

CONSOLIDATED FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016

The consolidated balance sheets of UNATION, LLC and Subsidiaries for the fiscal year ended December 31, 2016, and the consolidated statements of operations, changes in stockholders' equity, and cash flows of UNATION, LLC and Subsidiaries for each such period have been included in this Annual Report with the Independent Auditor's Report of Kristina Helferty, CPA, independent certified public accountants, and upon the authority of said firm as experts in accounting and auditing.

TABLE OF CONTENTS

INDEPENDENT AUDITORS’ REPORT

Board of Managers

UNATION, LLC

Tampa, FL

We have audited the accompanying financial statements of UNATION, LLC (a developmental stage Company), which comprise the Balance Sheet as of December 31, 2016, and the related Statements of Operations, Changes in Members’ Equity, and Cash Flows for the year then ended, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements 7are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditors consider internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the UNATION, LLC as of December 31, 2016, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

4500 140th Ave N, Suite 120, Clearwater, FL 33762 * (727) 310-2000 * Fax (727) 310-2001

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the financial statements, the Company has suffered losses from operations, which raises substantial doubt about its ability to continue as a going concern. Management is taking steps to raise additional funds to address its operating and financial cash requirements to continue operations. The Company’s ability to continue as a going concern is dependent upon raising additional funds through equity financing and generating revenue. There are no assurances the Company will receive the necessary funding or generate revenue necessary to fund operations. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to that matter.

The financial statements contain no adjustments for the outcome of this uncertainty.

/s/ Kristina Helferty, CPA

Kristina Helferty, CPA

March 22, 2017

4500 140th Ave N, Suite 120, Clearwater, FL 33762 * (727) 310-2000 * Fax (727) 310-2001

UNATION, LLC

BALANCE SHEET

DECEMBER 31, 2016

| ASSETS | |

| | | | | |

| Current Assets | | | | |

| Cash and Cash Equivalents | | $ | 260,349 | |

| | | | | |

| Total Current Assets | | | 260,349 | |

| | | | | |

| Property and Equipment, Net | | | 4,856,699 | |

| | | | | |

| Other Assets | | | | |

| Intangible Assets, Net | | | 11,194 | |

| | | | | |

| Total Other Assets | | | 11,194 | |

| | | | | |

| Total Assets | | $ | 5,128,242 | |

| | | | | |

| LIABILITIES AND MEMBERS' EQUITY | |

| | | | | |

| Current Liabilities | | | | |

| Accounts Payable | | $ | 532,896 | |

| Accrued Litigation Reserve | | | 100,000 | |

| | | | | |

| Total Current Liabilities | | | 632,896 | |

| | | | | |

| Long-Term Liabilities | | | | |

| Long-Term Note Payable | | | 4,069,729 | |

| Accrued Interest | | | 1,188,748 | |

| | | | | |

| Total Long-Term Liabilities | | | 5,258,477 | |

| | | | | |

| Total Liabilities | | | 5,891,373 | |

| | | | | |

| Members' Equity | | | (763,131 | ) |

| | | | | |

| Total Liabilities and Members' Equity | | $ | 5,128,242 | |

| UNATION, LLC |

| |

| STATEMENT OF OPERATIONS |

| |

| YEAR ENDED DECEMBER 31, 2016 |

| Revenues | | $ | 1,972 | |

| | | | | |

| Cost of Operations | | | | |

| Contract Labor | | | 460,436 | |

| Hosting Services | | | 45,541 | |

| Software Subscriptions | | | 18,857 | |

| | | | | |

| Total Cost of Operations | | | 524,834 | |

| | | | | |

| Gross Loss | | | (522,862 | ) |

| | | | | |

| General and Administrative Expenses | | | | |

| Depreciation Expense | | | 622,336 | |

| Legal and Professional Fees | | | 200,456 | |

| Management Fees | | | 136,000 | |

| Rent Expense | | | 58,611 | |

| Advertising and Marketing Expense | | | 51,761 | |

| Other Expenses | | | 19,917 | |

| Office Expenses | | | 4,173 | |

| Amortization Expense | | | 1,194 | |

| | | | | |

| Total General and Administrative Expenses | | | 1,094,448 | |

| | | | | |

| Net Loss | | $ | (1,617,310 | ) |

| UNATION, LLC |

| |

| STATEMENT OF CHANGES IN MEMBERS' EQUITY |

| |

| YEAR ENDED DECEMBER 31, 2016 |

| | | Total | |

| | | | |

| Balance, December 31, 2015 | | $ | (600,838 | ) |

| | | | | |

| Contributions | | | 1,455,017 | |

| | | | | |

| Net Loss | | | (1,617,310 | ) |

| | | | | |

| Balance, December 31, 2016 | | $ | (763,131 | ) |

| UNATION, LLC |

| |

| STATEMENT OF CASH FLOWS |

| |