UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-35695

LinnCo, LLC

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 45-5166623 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

600 Travis, Suite 5100 Houston, Texas | | 77002 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code

(281) 840-4000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Shares Representing Limited Liability Company Interests | | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check-mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

As of the last business day of the registrant’s most recently completed second fiscal quarter, no public trading market existed for the registrant’s common shares. As of January 31, 2013, the aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was approximately $1.4 billion based on $39.90 per share, the last reported sales price of the shares on the NASDAQ Global Select Market on such date.

As of January 31, 2013, there were 34,787,500 common shares outstanding.

Documents Incorporated By Reference:

Annual Report on Form 10-K of Linn Energy, LLC for the year ended December 31, 2012.

Certain information called for in Items 10, 11, 12, 13 and 14 of Part III are incorporated by reference from the registrant’s definitive proxy statement for the annual meeting of shareholders expected to be held in June 2013.

TABLE OF CONTENTS

Item 1. Business

This Annual Report on Form 10-K contains forward-looking statements based on expectations, estimates and projections as of the date of this filing. These statements by their nature are subject to risks, uncertainties and assumptions and are influenced by various factors. As a consequence, actual results may differ materially from those expressed in the forward-looking statements.

References

In this report, unless the context requires otherwise, references to “we,” “us,” “our,” the “Company,” or “LinnCo” are intended to refer to LinnCo, LLC. A reference to a “Note” herein refers to the accompanying Notes to Financial Statements contained in Item 8. “Financial Statements and Supplementary Data.” References to “shares” in this report refer to the Company’s common shares representing limited liability company interests.

Overview

LinnCo is a Delaware limited liability company formed on April 30, 2012, under the Delaware Limited Liability Company Act. As of December 31, 2012, LinnCo’s sole purpose was to own units representing limited liability company interests (“units”) in Linn Energy, LLC (“LINN Energy”) and it expected to have no significant assets or operations other than those related to its interest in LINN Energy. In connection with the pending acquisition of Berry Petroleum Company (see Note 8), LinnCo intends to amend its limited liability company agreement to permit the acquisition and subsequent contribution of assets to LINN Energy. LINN Energy is an independent oil and natural gas company that trades on the NASDAQ Global Select Market under the symbol “LINE.”

LinnCo’s success is dependent upon the operation and management of LINN Energy and its resulting performance. Therefore, LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2012, has been included in this filing as Exhibit 99.1 and incorporated herein by reference. At December 31, 2012, the Company owned approximately 15% of LINN Energy’s outstanding units. At December 31, 2012, LINN Energy owned 100% of the Company’s sole voting share and all of the Company’s common shares were held by the public.

The Company has elected to be treated as a corporation for United States (“U.S.”) federal income tax purposes. Because it is treated as a corporation for U.S. federal income tax purposes, an owner of LinnCo shares will not report on its U.S. federal income tax return any of the Company’s items of income, gain, loss and deduction relating to an investment in it.

Within five (5) business days after receiving a cash distribution related to its interest in LINN Energy units, LinnCo is required to pay the cash received, net of reserves for its income tax liability (“tax reserve”), as dividends to its shareholders. The amount of the tax reserve is calculated on a quarterly basis and is determined based on the tax liability estimate for the entire year. The current quarter tax reserve can be increased or reduced, at the Company management’s discretion, to account for the over/(under) tax reserve recorded in prior quarters. Because the tax reserve is an estimate, upon filing the annual tax returns, if the actual amount of tax due is greater or less than the total amount of tax reserved, the subsequent tax reserve, at Company management’s discretion, could be adjusted accordingly. Any such adjustments are subject to approval by the Company’s Board of Directors (“Board”).

LINN Energy has agreed to provide to LinnCo, or to pay on LinnCo’s behalf, any legal, accounting, tax advisory, financial advisory and engineering fees, printing costs or other administrative and out-of-pocket expenses incurred by LinnCo, along with any other expenses incurred in connection with any public offering of shares in LinnCo or incurred as a result of being a publicly traded entity, including costs associated with annual, quarterly and other reports to holders of LinnCo shares, tax return and Form 1099 preparation and distribution, NASDAQ listing fees, printing costs, independent auditor fees and expenses, legal counsel fees and expenses, limited liability company governance and compliance expenses and registrar and transfer agent fees. In addition, LINN Energy has agreed to indemnify LinnCo and its officers and directors for damages suffered or costs incurred (other than income taxes payable by LinnCo) in connection with carrying out LinnCo’s activities.

LinnCo Initial Public Offering (“IPO”)

On October 17, 2012, the Company closed the IPO of 34,787,500 shares to the public at a price of $36.50 per share ($34.858 per share, net of underwriting discount and structuring fee) for net proceeds of approximately $1.2 billion (after underwriting

Item 1. Business - Continued

discount and structuring fee of approximately $57 million). The net proceeds from the IPO were used to acquire 34,787,500 LINN Energy units which are equal to the number of LinnCo shares sold in the offering.

Employees

LinnCo has no employees. The Company has entered into an agreement with LINN Energy to provide the Company with the necessary services and support personnel. For more information, see Note 1 and LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2012, included in this filing as Exhibit 99.1 and incorporated herein by reference.

Principal Executive Offices

The Company is a Delaware limited liability company with headquarters in Houston, Texas. The principal executive offices are located at 600 Travis, Suite 5100, Houston, Texas 77002. The main telephone number is (281) 840-4000.

Company Website

The Company’s internet website is www.linnco.com. The Company makes available free of charge on or through its website Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Securities and Exchange Commission (“SEC”). Information on the Company’s website should not be considered a part of, or incorporated by reference into, this Annual Report on Form 10-K.

The SEC maintains an internet website that contains these reports at www.sec.gov. Any materials that the Company files with the SEC may be read or copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information concerning the operation of the Public Reference Room may be obtained by calling the SEC at (800) 732-0330.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond the Company’s control. Because substantially all of LinnCo��s assets will consist of its interest in LINN Energy’s units, these risks and uncertainties primarily relate to LINN Energy’s business which include the following:

| |

| • | ability to maintain or grow distributions; |

| |

| • | oil, natural gas and NGL reserves; |

| |

| • | realized oil, natural gas and NGL prices; |

| |

| • | lease operating expenses, general and administrative expenses and development costs; |

| |

| • | future operating results; |

| |

| • | plans, objectives, expectations and intentions; and |

All of these types of statements, other than statements of historical fact included in this Annual Report on Form 10-K, are forward-looking statements. These forward-looking statements may be found in Item 1. “Business;” Item 1A. “Risk Factors;” Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other items within this Annual Report on Form 10-K. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology.

The forward-looking statements contained in this Annual Report on Form 10-K are largely based on LINN Energy and Company expectations, which reflect estimates and assumptions made by LINN Energy and Company management. These estimates and assumptions reflect management’s best judgment based on currently known market conditions and other

Item 1. Business - Continued

factors. Although the Company believes such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond its control. In addition, management’s assumptions may prove to be inaccurate. The Company cautions that the forward-looking statements contained in this Annual Report on Form 10-K are not guarantees of future performance, and it cannot assure any reader that such statements will be realized or the forward-looking statements or events will occur. Actual results may differ materially from those anticipated or implied in forward-looking statements in this Annual Report on Form 10-K. The forward-looking statements speak only as of the date made and, other than as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. For additional discussion of such risks, uncertainties and assumptions, see LinnCo’s Prospectus filed with the SEC under Rule 424(b)(4) on October 12, 2012.

Item 1A. Risk Factors

Our business has many risks. Factors that could materially adversely affect our business, financial position, operating results or liquidity and the trading price of our shares are described below. This information should be considered carefully, together with other information in this report and other reports and materials the Company and LINN Energy file with the SEC. Because our only significant assets are the units issued by LINN Energy, our success is dependent solely upon the operation and management of LINN Energy and its resulting performance. The risk factors that affect LINN Energy also affect LinnCo; see “Risk Factors” within LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2012, included in this filing as Exhibit 99.1 and incorporated herein by reference.

Our cash flow consists exclusively of distributions from LINN Energy.

Our only significant assets are LINN Energy units representing limited liability company interests in LINN Energy that we own. Our cash flow will be therefore completely dependent upon the ability of LINN Energy to make distributions to its unitholders. The amount of cash that LINN Energy can distribute to its unitholders, including us, each quarter principally depends upon the amount of cash it generates from its operations, which will fluctuate from quarter to quarter based on, among other things:

| |

| • | produced volumes of oil, natural gas and NGL; |

| |

| • | prices at which oil, natural gas and NGL production is sold; |

| |

| • | level of its operating costs; |

| |

| • | payment of interest, which depends on the amount of its indebtedness and the interest payable thereon; and |

| |

| • | level of its capital expenditures. |

In addition, the actual amount of cash that LINN Energy will have available for distribution will depend on other factors, some of which are beyond its control, including:

| |

| • | availability of borrowings on acceptable terms under its credit facility to pay distributions; |

| |

| • | the costs of acquisitions, if any; |

| |

| • | fluctuations in its working capital needs; |

| |

| • | timing and collectibility of receivables; |

| |

| • | restrictions on distributions contained in its credit facility and the indentures governing its senior notes; |

| |

| • | prevailing economic conditions; |

| |

| • | access to credit or capital markets; and |

| |

| • | the amount of cash reserves established by its board of directors for the proper conduct of its business. |

Because of these factors, LINN Energy may not have sufficient available cash each quarter to pay a distribution at the current level or at all. Furthermore, the amount of cash that LINN Energy has available for distribution depends primarily upon its cash flow, including cash flow from financial reserves and working capital borrowings, and is not solely a function of profitability, which will be affected by noncash items. As a result, LINN Energy may be able to make cash distributions during periods when it records net losses and may not be able to make cash distributions during periods when it records net income. Please see “Risk Factors” within LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2012, included in this filing as Exhibit 99.1 and incorporated herein by reference, for a discussion of risks affecting LINN Energy’s ability to generate distributable cash flow.

Item 1A. Risk Factors - Continued

We will incur corporate income tax liabilities on income allocated to us by LINN Energy with respect to LINN Energy units we own, which may be substantial.

We are classified as a corporation for U.S. federal income tax purposes and, in most states in which LINN Energy does business, for state income tax purposes. Under current law, we will be subject to U.S. federal income tax at rates of up to 35% (and a 20% alternative minimum tax in certain cases), and to state income tax at rates that vary from state to state, on the net income allocated to us by LINN Energy with respect to the LINN Energy units we own. The amount of cash available for distribution to you will be reduced by the amount of any such income taxes payable by us for which we establish reserves.

The amount of income taxes payable by us depends on a number of factors including LINN Energy’s earnings from its operations, the amount of those earnings allocated to us and the amount of the distributions paid to us by LINN Energy. Our income tax liabilities could be substantial if any of the following occurs:

| |

| • | LINN Energy significantly decreases its drilling activity; |

| |

| • | an issuance of significant additional units by LINN Energy without a corresponding increase in the aggregate tax deductions generated by LINN Energy; |

| |

| • | proposed legislation is enacted that eliminates the current deduction of intangible drilling costs and other tax incentives to the oil and natural gas industry; or |

| |

| • | there is a significant increase in oil and natural gas prices. |

If the assumptions we used to estimate income taxes are incorrect, our income tax liabilities could be substantially higher than we project.

Events inconsistent with our assumptions could cause our income tax liabilities to be substantially higher than estimated and could therefore cause our quarterly dividends to be substantially lower than the quarterly distributions on LINN Energy units. For example, distributions that we receive with respect to our LINN Energy units that exceed the net income allocated to us by LINN Energy with respect to those units decrease our tax basis in those units. When our tax basis in our LINN Energy units is reduced to zero and any loss or other carryovers are fully utilized, the distributions we receive from LINN Energy in excess of net income allocated to us by LINN Energy will effectively be fully taxable to us, without any deductions.

Changes to current U.S. federal tax laws may affect our ability to take certain tax deductions.

Substantive changes to the existing U.S. federal income tax laws have been proposed that, if adopted, would affect, among other things, our ability to take certain deductions related to LINN Energy’s operations, including deductions for intangible drilling costs and percentage depletion and deductions for costs associated with U.S. production activities. We are unable to predict whether any changes, or other proposals to such laws, ultimately will be enacted. Any such changes could negatively impact the value of an investment in our shares.

Our shareholders are only able to indirectly vote on matters on which LINN Energy unitholders are entitled to vote, and our shareholders are not entitled to vote to elect our directors.

Our shareholders will only be able to indirectly vote on matters on which LINN Energy unitholders are entitled to vote, and our shareholders are not entitled to vote to elect our directors. Therefore, you will only be able to indirectly influence the management and board of directors of LINN Energy, and you will not be able to directly influence or change our management or board of directors. If our shareholders are dissatisfied with the performance of our directors, they have no ability to remove the directors and have no right on an annual or ongoing basis to elect our board of directors. Rather, our board of directors is appointed by the holder of our voting share, which is LINN Energy. Our limited liability company agreement also contains provisions limiting the ability of holders of our shares to call meetings or to obtain information about our operations, as well as other provisions limiting the ability of holders of our shares to influence the manner or direction of management.

LINN Energy may issue additional units without your approval or other classes of units, and we may issue additional shares, which would dilute our direct and your indirect ownership interest in LINN Energy and your ownership interest in us.

LINN Energy’s limited liability company agreement does not limit the number of additional limited liability company interests, including interests that rank senior to the LINN Energy units, that it may issue at any time without the approval of

Item 1A. Risk Factors - Continued

its unitholders. The issuance by LINN Energy of additional units or other equity securities of equal or senior rank will have the following effects:

| |

| • | our proportionate ownership interest in LINN Energy will decrease; |

| |

| • | the amount of cash available for distribution on each LINN Energy unit may decrease, resulting in a decrease in |

the amount of cash available to pay dividends to you;

| |

| • | the relative voting strength of each previously outstanding unit, including the LINN Energy units we hold and |

vote in accordance with the vote of our shareholders, will be diminished; and

| |

| • | the market price of the LINN Energy units may decline, resulting in a decline in the market price of our shares. |

In addition, our limited liability company agreement does not limit the number of additional shares that we may issue at any time without your approval. The issuance by us of additional shares will have the following effects:

| |

| • | your proportionate ownership interest in us will decrease; |

| |

| • | the relative voting strength of each previously outstanding share you own will be diminished; and |

| |

| • | the market price of our shares may decline. |

Your shares are subject to limited call rights that could result in your having to involuntarily sell your shares at a time or price that may be undesirable. Shareholders who are not “Eligible Holders” will not be entitled to receive distributions on or allocations of income or loss on their shares and their shares will be subject to redemption.

If LINN Energy or any of its affiliates owns 80% or more of our outstanding shares, LINN Energy has the right, which it may assign to any of its affiliates, to purchase all of our remaining outstanding shares, at a purchase price not less than the greater of the then-current market price of our shares and the highest price paid for our shares by LINN Energy or one of its affiliates during the prior 90 days. If LINN Energy exercises any of its rights to purchase our shares, you may be required to sell your shares at a time or price that may be undesirable, and you could receive less than you paid for your shares. Any sale of our shares, to LINN Energy or otherwise, for cash will be a taxable transaction to the owner of the shares sold. Accordingly, a gain or loss will be recognized on the sale equal to the difference between the cash received and the owner’s tax basis in the shares sold.

In addition, if at any time a person owns more than 90% of the outstanding LINN Energy units, such person may elect to purchase all, but not less than all, of the remaining outstanding LINN Energy units at a price equal to the higher of the current market price (as defined in LINN Energy’s limited liability company agreement) and the highest price paid by such person or any of its affiliates for any LINN Energy units purchased during the 90-day period preceding the date notice was mailed to the LINN Energy unitholders informing them of such election. In this case, we will be required to tender all of our outstanding LINN Energy units and distribute the cash we receive, net of income taxes payable by us, to our shareholders. Following such distribution, we will dissolve and wind up our affairs. Thus, upon the election of a holder of 90% of the outstanding LINN Energy units, you may receive a distribution that is effectively less than the price at which you would prefer to sell your shares.

In order to comply with U.S. laws with respect to the ownership of interests in oil and natural gas leases on federal lands, we have adopted certain requirements regarding those investors who may own our shares. As used herein, an Eligible Holder means a person or entity qualified to hold an interest in oil and natural gas leases on federal lands. As of the date hereof, Eligible Holder means: (1) a citizen of the U.S.; (2) a corporation organized under the laws of the U.S. or of any state thereof; or (3) an association of U.S. citizens, such as a partnership or limited liability company, organized under the laws of the U.S. or of any state thereof, but only if such association does not have any direct or indirect foreign ownership, other than foreign ownership of stock in a parent corporation organized under the laws of the U.S. or of any state thereof. For the avoidance of doubt, onshore mineral leases or any direct or indirect interest therein may be acquired and held by aliens only through stock ownership, holding or control in a corporation organized under the laws of the U.S. or of any state thereof and only for so long as the alien is not from a country that the U.S. federal government regards as denying similar privileges to citizens or corporations of the U.S. Shareholders who are not persons or entities who meet the requirements to be an Eligible Holder will not be entitled to receive distributions in kind on their shares in a liquidation and they run the risk of having their shares redeemed by us at the then-current market price.

Item 1A. Risk Factors - Continued

The terms of our shares may be changed in ways you may not like, because our board of directors has the power to change the terms of our shares in ways our board determines are not materially adverse to you.

As an owner of our shares, you may not like the changes made to the terms of our shares, if any, and you may disagree with our board of directors’ decision that the changes are not materially adverse to you as a shareholder. Your recourse if you disagree is limited because our limited liability company agreement gives broad latitude and discretion to our board of directors and limits the fiduciary duties that our officers and directors otherwise would owe to you.

Our limited liability company agreement limits the fiduciary duties owed by our officers and directors to our shareholders, and LINN Energy’s limited liability company agreement limits the fiduciary duties owed by LINN Energy’s officers and directors to its unitholders, including us.

Our limited liability company agreement has modified, waived and limited the fiduciary duties of our directors and officers that would otherwise apply at law or in equity and replaced such duties with a contractual duty requiring our directors and officers to act in good faith. For purposes of our limited liability company agreement, a person shall be deemed to have acted in good faith if the person subjectively believes that the action or omission of action is in, or not opposed to, the best interests of LinnCo. In addition, any action or omission shall be deemed to be in, or not opposed to, the best interests of LinnCo and our shareholders if the person making the determination subjectively believes that such action or omission of action is in, or not opposed to, the best interest of LINN Energy and all its unitholders, taken together, and such person may take into account the totality of the relationship between LINN Energy and us. In addition, when acting in any capacity other than as one of our directors or officers, including when acting in their individual capacities or as officers or directors of LINN Energy or any affiliate of LINN Energy, our directors and officers will not be required to act in good faith and will have no obligation to take into account our interests or the interests of our shareholders.

The above modifications of fiduciary duties are expressly permitted by Delaware law. Thus, we and our shareholders will only have recourse and be able to seek remedies against our board of directors if they breach their obligations pursuant to our limited liability company agreement. Furthermore, even if there has been a breach of the obligations set forth in our limited liability company agreement, that agreement provides that our directors and officers will not be liable to us or our shareholders, except for acts or omissions not in good faith.

These provisions restrict the remedies available to our shareholders for actions that without those limitations might constitute breaches of duty, including fiduciary duties. In addition, LINN Energy’s limited liability company agreement also limits the fiduciary duties owed by LINN Energy’s officers and directors to its unitholders, including us.

Our limited liability company agreement prohibits a shareholder who acquires 15% or more of our shares or voting power with respect to 15% or more of the outstanding LINN Energy units without the approval of our or LINN Energy’s board of directors from engaging in a business combination with us or with LINN Energy for three years. This provision could discourage a change of control of us or of LINN Energy that our shareholders may favor, which could negatively affect the price of our shares.

Our limited liability company agreement effectively adopts Section 203 of the Delaware General Corporation Laws, or the DGCL. Section 203 of the DGCL as it applies to us prevents an interested shareholder, defined as a person who owns 15% or more of our outstanding shares or voting power with respect to 15% or more of the outstanding LINN Energy units, from engaging in business combinations with us or with LINN Energy for three years following the time such person becomes an interested shareholder. Section 203 broadly defines “business combination” to encompass a wide variety of transactions with or caused by an interested shareholder, including mergers, asset sales and other transactions in which the interested shareholder receives a benefit on other than a pro rata basis with other shareholders. This provision of our limited liability company agreement could have an anti-takeover effect with respect to transactions not approved in advance by our board of directors, including discouraging takeover attempts that might result in a premium over the market price for our shares or LINN Energy’s units.

Our shares may trade at a substantial discount to the trading price of LINN Energy units.

We cannot predict whether our shares will trade at a discount or premium to the trading price of LINN Energy units. If we incur substantial corporate income tax liabilities on income allocated to us by LINN Energy with respect to LINN Energy units we own, the quarterly dividends of cash you receive per share will be substantially less than the quarterly per unit distribution of cash that we receive from LINN Energy. In addition, in the event of a merger, tender offer, going private

Item 1A. Risk Factors - Continued

transaction or sale of all or substantially all of our assets (“Terminal Transaction”) the net proceeds you receive from us per share may, as a result of our corporate income tax liabilities on the transaction and other factors, be substantially lower than the net proceeds per unit received by a direct LINN Energy unitholder. As a result of these considerations, our shares may trade at a substantial discount to the trading price of LINN Energy units.

We are a “controlled company” within the meaning of the NASDAQ rules and rely on exemptions from various corporate governance requirements.

Our shares are listed on the NASDAQ Global Select Market. A company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company is a “controlled company” within the meaning of the NASDAQ rules. A “controlled company” may elect not to comply with various corporate governance requirements of NASDAQ, including the requirement that a majority of its board of directors consist of independent directors, the requirement that its nominating and governance committee consist of all independent directors and the requirement that its compensation committee consist of all independent directors.

We are a “controlled company” because LINN Energy holds our sole voting share and has the sole power to elect our board of directors. Because we rely on certain of the “controlled company” exemptions and do not have a compensation committee or a nominating and corporate governance committee, you do not have the same corporate governance advantages afforded to stockholders of companies that are subject to all of the corporate governance requirements of NASDAQ.

Tax Risks to Shareholders

Upon a Terminal Transaction, we may be entitled to a smaller distribution per LINN Energy unit we own than other LINN Energy unitholders, and we may incur substantial corporate income tax liabilities in the transaction or upon the distribution of the proceeds from the transaction to you, in which case the net proceeds you receive from us per share may be substantially lower than the net proceeds per unit received by a direct LINN Energy unitholder.

Upon a liquidation of LINN Energy, LINN Energy unitholders will receive distributions in accordance with the positive balances in their respective capital accounts in their units. As a result of the underwriting discount and offering expenses incurred in connection with the IPO, we acquired LINN Energy units at a price lower than the market price of LINN Energy units at the time of the IPO. Therefore, our capital account in the LINN Energy units that we own is lower than the capital accounts of other LINN Energy unitholders. Therefore, we would be entitled upon a dissolution of LINN Energy to a smaller distribution per LINN Energy unit we own than other LINN Energy unitholders, unless adjustments are made to our capital accounts in the LINN Energy units that we own.

Each time LINN Energy issues or redeems units, it is required to adjust the capital accounts in all outstanding LINN Energy units upward to the extent of the “unrealized gains” in LINN Energy’s assets or downward to the extent of the “unrealized losses” in LINN Energy’s assets immediately prior to such issuance or redemption. In general, the difference between the fair market value of each such asset and its adjusted tax basis equals the unrealized gain (if the fair market value exceeds the adjusted tax basis) or the unrealized loss (if the adjusted tax basis exceeds the fair market value). Unrealized gains and unrealized losses generally are allocated among the LINN Energy unitholders in the same manner as other items of LINN Energy income, gain, deduction or loss.

The board of directors of LINN Energy, however, is authorized to make disproportionate allocations of income and deductions, including allocations of unrealized gains and unrealized losses, to the extent necessary to cause the capital accounts of all LINN Energy units to be the same. We anticipate that there will be sufficient unrealized gains or unrealized losses in connection with future issuances or redemptions of LINN Energy units in order for LINN Energy to allocate to us sufficient unrealized gains, or to allocate sufficient unrealized losses to other holders of LINN Energy units, to cause the capital accounts in the LINN Energy units that we own to be the same as the capital accounts of all other LINN Energy units and result in our being entitled upon the dissolution of LINN Energy to the same distribution per LINN Energy unit we own as other LINN Energy unitholders. However, there can be no assurance that such adjustments will occur or that any adjustments that do occur will be sufficient to eliminate the difference between our capital account in the LINN Energy units that we own and the capital accounts of other LINN Energy unitholders in their LINN Energy units.

We are classified as a corporation for U.S. federal income tax purposes and, in most states in which LINN Energy does business, for state income tax purposes. Upon a Terminal Transaction, we will be required to liquidate and distribute the net after-tax proceeds of the transaction to you. We may incur substantial corporate income tax liabilities upon such a transaction

Item 1A. Risk Factors - Continued

or upon our distribution to you of the proceeds of the transaction. The tax liability we incur will depend in part upon the amount by which the value of the LINN Energy units we own exceeds our tax basis in the units. We expect our tax basis in our LINN Energy units to decrease over time as we receive distributions that exceed the net income allocated to us by LINN Energy with respect to those units. As a result, we may incur substantial income tax liabilities upon such a transaction even if LINN Energy units decrease in value after we purchase them. The amount of cash or other property available for distribution to you upon our liquidation will be reduced by the amount of any such income taxes paid by us.

As a result of these factors, upon a Terminal Transaction, the net proceeds you receive from us per share may be substantially lower than the net proceeds per unit received by a direct LINN Energy unitholder.

Your tax gain on the disposition of our shares could be more than expected, or your tax loss on the disposition of our shares could be less than expected.

If you sell your shares, or you receive a liquidating distribution from us, you will recognize a gain or loss for U.S. federal income tax purposes equal to the difference between the amount realized and your tax basis in those shares. Because distributions in excess of your allocable share of our earnings and profits decrease your tax basis in your shares, the amount, if any, of such prior excess distributions with respect to the shares you sell or dispose of will, in effect, become taxable gain to you if you sell such shares at a price greater than your tax basis in those shares, even if the price you receive is less than your original cost.

If you are a U.S. holder of our shares, the IRS Forms 1099-DIV that you receive from your broker may over-report your dividend income with respect to our shares for U.S. federal income tax purposes, and failure to over-report your dividend income in a manner consistent with the IRS Forms 1099-DIV that you receive from your broker may cause the IRS to assert audit adjustments to your U.S. federal income tax return. If you are a non-U.S. holder of our shares, your broker or other withholding agent may overwithhold taxes from dividends paid to you, in which case you would have to file a U.S. tax return if you wanted to claim a refund of the overwithheld tax.

Dividends we pay with respect to our shares will constitute “dividends” for U.S. federal income tax purposes only to the extent of our current and accumulated earnings and profits. Dividends we pay in excess of our earnings and profits will not be treated as “dividends” for U.S. federal income tax purposes; instead, they will be treated first as a tax-free return of capital to the extent of your tax basis in your shares and then as capital gain realized on the sale or exchange of such shares. We may be unable to timely determine the portion of our distributions that is a “dividend” for U.S. federal income tax purposes.

If you are a U.S. holder of our shares, we may be unable to persuade brokers to prepare the IRS Forms 1099-DIV that they send to you in a manner that is consistent with our determination of the amount that constitutes a “dividend” to you for U.S. federal income tax purposes or you may receive a corrected IRS Form 1099-DIV (and you may therefore need to file an amended federal, state or local income tax return). We will attempt to timely notify you of available information to assist you with your income tax reporting (such as posting the correct information on our web site). However, the information that we provide to you may be inconsistent with the amounts reported to you by your broker on IRS Form 1099-DIV, and the IRS may disagree with any such information and may make audit adjustments to your tax return.

If you are a non-U.S. holder of our shares, “dividends” for U.S. federal income tax purposes will be subject to withholding of U.S. federal income tax at a 30% rate (or such lower rate as may be specified by an applicable income tax treaty) unless the dividends are effectively connected with your conduct of U.S. trade or business. Because we may be unable to timely determine the portion of our distributions that is a “dividend” for U.S. federal income tax purposes or we may be unable to persuade your broker or withholding agent to withhold taxes from distributions in a manner consistent with our determination of the amount that constitutes a “dividend” for such purposes, your broker or other withholding agent may overwithhold taxes from distributions paid to you. In such a case, you would have to file a U.S. tax return to claim a refund of the overwithheld tax.

If LINN Energy were subject to a material amount of entity-level income taxes or similar taxes, whether as a result of being treated as a corporation for U.S. federal income tax purposes or otherwise, the value of LINN Energy units would be substantially reduced and, as a result, the value of our shares would be substantially reduced.

The anticipated benefit of an investment in LINN Energy units depends largely on the assumption that LINN Energy will not be subject to a material amount of entity-level income taxes or similar taxes, and the anticipated benefit of an investment in our shares depends largely upon the value of LINN Energy units.

Item 1A. Risk Factors - Continued

LINN Energy may be subject to material entity-level U.S. federal income tax and state income taxes if it is treated as a corporation, rather than as a partnership, for U.S. federal income tax purposes. Because LINN Energy’s units are publicly traded, Section 7704 of the Internal Revenue Code requires that LINN Energy derive at least 90% of its gross income each year from the marketing of oil and natural gas, or from certain other specified activities, in order to be treated as a partnership for U.S. federal income tax purposes. We believe that LINN Energy has satisfied this requirement and will continue to do so in the future, so we believe LINN Energy is and will be treated as a partnership for U.S. federal income tax purposes. However, we have not obtained a ruling from the U.S. Internal Revenue Service regarding LINN Energy’s treatment as a partnership for U.S. federal income tax purposes. Moreover, current law or the business of LINN Energy may change so as to cause LINN Energy to be treated as a corporation for U.S. federal income tax purposes or otherwise subject LINN Energy to material entity-level U.S. federal income taxes, state income taxes or similar taxes. For example, one recent legislative proposal would eliminate the qualifying income exception upon which LINN Energy relies for its treatment as a partnership for U.S. federal income tax purposes. Any modification to current law or interpretations thereof may or may not be applied retroactively and could make it more difficult or impossible to meet the requirements for partnership status, affect or cause LINN Energy to change its business activities, change the character or treatment of portions of LINN Energy’s income and adversely affect our investment in LINN Energy units.

If LINN Energy were treated as a corporation for U.S. federal income tax purposes, it would be subject to U.S. federal income tax at rates of up to 35% (and a 20% alternative minimum tax in certain cases), and to state income tax at rates that vary from state to state, on its taxable income. Distributions from LINN Energy would generally be taxed again as corporate distributions, and no income, gain, loss, deduction or credit would flow through to LINN Energy unitholders. Any income taxes or similar taxes imposed on LINN Energy as an entity, whether as a result of LINN Energy’s treatment as a corporation for U.S. federal income tax purposes or otherwise, would reduce LINN Energy’s cash available for distribution to its unitholders. Any material reduction in the anticipated cash flow and after-tax return to LINN Energy unitholders would reduce the value of the LINN Energy units we own and the value of our shares. In addition, if LINN Energy were treated as a corporation for U.S. federal income tax purposes, that would constitute a Terminal Transaction.

Also, because of widespread state budget deficits and other reasons, several states are evaluating ways to subject partnerships and limited liability companies to entity level taxation through the imposition of state income, franchise or other forms of taxation. For example, LINN Energy is required to pay Texas franchise tax on its total revenue apportioned to Texas at a maximum effective rate of 0.7%. Imposition of a tax on LINN Energy by any other state would reduce the amount of cash available for distribution to us.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

LinnCo has no properties. Its assets consist of a small amount of working capital and the LINN Energy units that it owns. See Item 1. “Business” for additional information.

Item 3. Legal Proceedings

The Company is not a party to any litigation; however, legal proceedings that affect LINN Energy may also affect the Company. See “Legal Proceedings” within LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2012, included in this filing as Exhibit 99.1 and incorporated herein by reference.

Executive Officers of the Company

|

| | | | |

| Name | | Age | | Position with the Company |

| | | | | |

| Mark E. Ellis | | 57 | | Chairman, President and Chief Executive Officer |

| Kolja Rockov | | 42 | | Executive Vice President and Chief Financial Officer |

| Arden L. Walker, Jr. | | 53 | | Executive Vice President and Chief Operating Officer |

| Charlene A. Ripley | | 49 | | Senior Vice President and General Counsel |

| David B. Rottino | | 47 | | Senior Vice President of Finance and Chief Accounting Officer |

Mark E. Ellis is the Chairman, President and Chief Executive Officer and has served in such capacity since LinnCo’s formation in April 2012. Mr. Ellis is also the Chairman, President and Chief Executive Officer of LINN Energy and has served in such capacity since December 2011. He previously served as President, Chief Executive Officer and Director of LINN Energy from January 2010 to December 2011 and from December 2007 to January 2010, Mr. Ellis served as President and Chief Operating Officer of LINN Energy. Mr. Ellis is a member of the Society of Petroleum Engineers and the National Petroleum Council. Mr. Ellis serves on the boards of America’s Natural Gas Alliance, American Exploration & Production Council, Industry Board of Petroleum Engineering at Texas A&M University, the Visiting Committee of Petroleum Engineering at the Colorado School of Mines, Houston Museum of Natural Science and The Center for the Performing Arts at The Woodlands. In addition, he is Chairman of the Board for The Center for Hearing and Speech, and holds a position as trustee on the Texas A&M University 12th Man Foundation Board of Trustees.

Kolja Rockov is the Executive Vice President and Chief Financial Officer and has served in such capacity since LinnCo's formation in April 2012. He is also the Executive Vice President and Chief Financial Officer of LINN Energy and has served in such capacity since joining LINN in March 2005. Mr. Rockov is the founding chairman of a philanthropic organization benefitting Texas Children's Cancer Center in Houston, which has raised more than $1 million since 2009.

Arden L. Walker, Jr. is the Executive Vice President and Chief Operating Officer and has served in such capacity since LinnCo's formation in April 2012. Mr. Walker is also the Executive Vice President and Chief Operating Officer of LINN Energy and has served in such capacity since January 2011. From January 2010 to January 2011, he served as Senior Vice President and Chief Operating Officer of LINN Energy. Mr. Walker joined LINN Energy in February 2007 as Senior Vice President, Operations and Chief Engineer. Mr. Walker is a member of the Society of Petroleum Engineers and Independent Petroleum Association of America. He also serves on the boards of the Sam Houston Area Council of the Boy Scouts of America and Theatre Under The Stars.

Charlene A. Ripley is the Senior Vice President and General Counsel and has served in such capacity since LinnCo's formation in April 2012. Ms. Ripley is also the Senior Vice President and General Counsel of LINN Energy and has served in such capacity since April 2007. She also serves on several nonprofit boards, including the Impact Youth Development Center, Girls Inc., the American Heart Association of Houston and Mercury – The Orchestra Redefined.

David B. Rottino is the Senior Vice President of Finance and Chief Accounting Officer and has served in such capacity since LinnCo's formation in April 2012. Mr. Rottino is also the Senior Vice President of Finance, Business Development and Chief Accounting Officer of LINN Energy and has served in such capacity since July 2010. From June 2008 to July 2010, Mr. Rottino served as the Senior Vice President and Chief Accounting Officer of LINN Energy. Prior to joining LINN Energy, Mr. Rottino served as Vice President and E&P Controller for El Paso Corporation from June 2006 to May 2008. Mr. Rottino is a Certified Public Accountant. In addition, he currently serves on the Board of Camp for All.

Item 4. Mine Safety Disclosures

Not applicable

| |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s shares are listed on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “LNCO” and began trading on October 12, 2012, after pricing of its initial public offering (“IPO”). At the close of business on January 31, 2013, there were approximately six shareholders of record.

The following sets forth the range of high and low last reported sales prices per share, as reported by NASDAQ, for the period indicated. In addition, dividends declared during the period are presented.

|

| | | | | | | | | | | | | |

| | | Share Price Range | | Cash Dividends Declared Per Share |

| Period | | High | | Low | |

| 2012: | | | | | | | |

| October 12 – December 31 | | $ | 39.48 |

| | $ | 35.27 |

| | $ | 0.71 |

| (1) |

| |

(1) | This amount is net of the tax reserve of $0.015 per common share. |

Dividends

Within five (5) business days after receiving a cash distribution related to its interest in LINN Energy units, LinnCo is required to pay the cash received, net of reserves for its income tax liability (“tax reserve”), as dividends to its shareholders. The amount of the tax reserve is calculated on a quarterly basis and is determined based on the tax liability estimate for the entire year. The current quarter tax reserve can be increased or reduced, at the Company management’s discretion, to account for the over/(under) tax reserve recorded in prior quarters. Because the tax reserve is an estimate, upon filing the annual tax returns, if the actual amount of tax due is greater or less than the total amount of tax reserved, the subsequent tax reserve, at Company management’s discretion, could be adjusted accordingly. Any such adjustments are subject to approval by the Company’s Board of Directors (“Board”).

Shareholder Return Performance Presentation

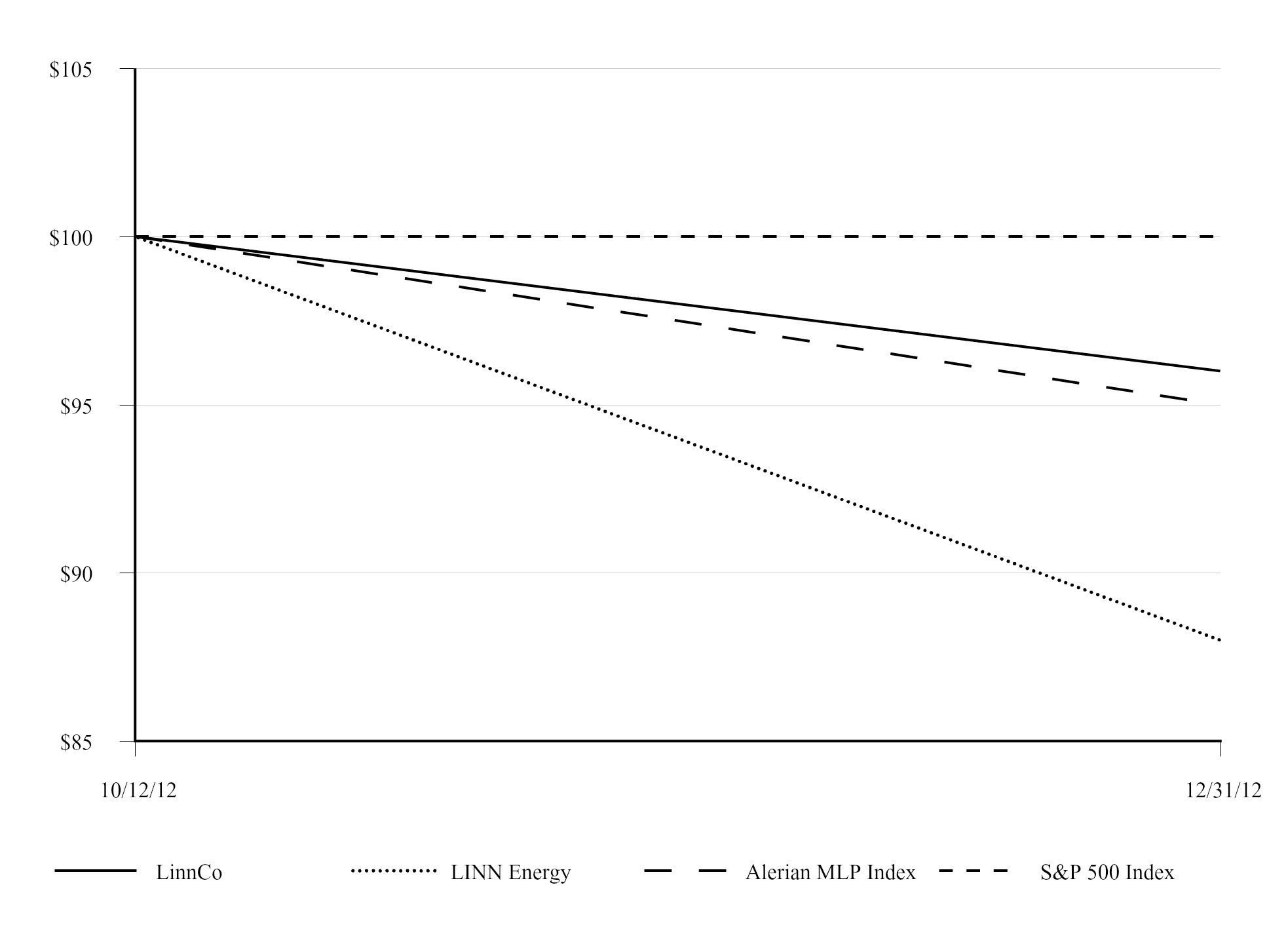

The performance graph below compares the total shareholder return on the Company’s shares, with the total return of the Standard & Poor’s 500 Index (the “S&P 500 Index”) and the Alerian MLP Index, a weighted composite of 50 prominent energy master limited partnerships. Total return includes the change in the market price, adjusted for reinvested dividends or distributions, for the period shown on the performance graph and assumes that $100 was invested in the Company on October 12, 2012, and LINN Energy, the S&P 500 Index and the Alerian MLP Index on the same date. The results shown in the graph below are not necessarily indicative of future performance.

| |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Continued |

|

| | | | | | | |

| | October 12, 2012 | | December 31, 2012 |

| | | | |

| LinnCo | $ | 100 |

| | $ | 96 |

|

| LINN Energy | $ | 100 |

| | $ | 88 |

|

| Alerian MLP Index | $ | 100 |

| | $ | 95 |

|

| S&P 500 Index | $ | 100 |

| | $ | 100 |

|

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this Annual Report on Form 10-K or future filings with the Securities and Exchange Commission (“SEC”), in whole or in part, the preceding performance information shall not be deemed to be “soliciting material” or to be “filed” with the SEC or incorporated by reference into any filing except to the extent this performance presentation is specifically incorporated by reference therein.

Use of Proceeds

On October 11, 2012, the Company’s registration statement on Form S-1 (File No. 333-182305) was declared effective by the SEC for its IPO pursuant to which LinnCo sold 34,787,500 common shares representing limited liability company interests with limited voting rights at a price to the public of $36.50 per share. Barclays, Citigroup, RBC Capital Markets, Wells Fargo Securities, BofA Merrill Lynch, Credit Suisse, Raymond James and UBS Investment Bank acted as the joint book-running managers in the transaction.

The offering commenced as of October 2, 2012, and did not terminate before all of the securities registered in the registration statement were sold. On October 17, 2012, the Company closed the sale of such shares, resulting in net proceeds of approximately $1.2 billion after deducting the underwriting discount and structuring fee of approximately $57 million. Total expenses of the offering were approximately $60 million, which includes the underwriting discount, structuring fee and other offering expenses. Except as described herein with respect to LINN Energy, no direct or indirect payments were made by the Company to directors, officers or persons owning ten percent or more of its outstanding shares or to their associates, or to the Company’s affiliates. LinnCo used the net proceeds from the sale of shares to purchase 34,787,500 units from LINN Energy. LINN Energy used such net proceeds to pay certain expenses of the offering and repay a portion of the outstanding

| |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Continued |

indebtedness under its Credit Facility. There was no material change in the planned use of proceeds from the Company’s IPO as described in its final Prospectus filed with the SEC on October 12, 2012.

There are no securities authorized for issuance under equity compensation plans, no sales of unregistered equity securities during the periods covered by this report, and the Company did not repurchase any shares during 2012.

| |

| Item 6. | Selected Financial Data |

The selected financial data set forth below should be read in conjunction with Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8. “Financial Statements and Supplementary Data.”

|

| | | |

| | April 30, 2012 (Inception) To December 31, 2012 |

| | (in thousands, except per share amounts) |

| Statement of operations data: | |

| Equity income from investment in Linn Energy, LLC | $ | 34,411 |

|

| General and administrative expenses | (1,230 | ) |

| Income tax expense | (12,528 | ) |

| Net income | 20,653 |

|

| Net income per share, basic and diluted | 1.92 |

|

| Dividends declared per share | 0.71 |

|

| Weighted average shares outstanding | 10,747 |

|

| | |

| Cash flow data: | |

| Net cash provided by (used in): | |

| Operating activities | $ | 25,221 |

|

| Investing activities | (1,212,627 | ) |

| Financing activities | 1,187,929 |

|

| | |

| Balance sheet data: | |

| Total assets at December 31, 2012 | $ | 1,222,340 |

|

Selected financial data of LINN Energy is found in Part II, Item 6. “Selected Financial Data” of LINN Energy’s Annual Report on Form 10-K, which is included in this filing as Exhibit 99.1 and incorporated herein by reference as the Company’s results of operations, financial position and cash flows are dependent on the results of operations, financial position and the cash flows of LINN Energy.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the financial statements and notes to the financial statements, which are included in this Annual Report on Form 10-K in Item 8. “Financial Statements and Supplementary Data.” The following discussion contains forward-looking statements that reflect the Company’s future plans, estimates, beliefs and expected performance. The forward-looking statements are dependent upon events, risks and uncertainties that may be outside the Company’s control. The Company’s actual results could differ materially from those discussed in these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those factors discussed below and elsewhere in this Annual Report on Form 10-K, particularly in Item 1A. “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking events discussed may not occur.

A reference to a “Note” herein refers to the accompanying Notes to Financial Statements contained in Item 8. “Financial Statements and Supplementary Data.”

General

LinnCo, LLC (“LinnCo” or the “Company”) is a Delaware limited liability company formed on April 30, 2012, under the Delaware Limited Liability Company Act, that has elected to be treated as a corporation for U.S. federal income tax purposes. Linn Energy, LLC (“LINN Energy”), an independent oil and natural gas company that trades on the NASDAQ Global Select Market under the symbol “LINE,” owns LinnCo’s sole voting share.

LinnCo’s success is dependent upon the operation and management of LINN Energy and its resulting performance. Therefore, LINN Energy’s Annual Report on Form 10-K for the year ended December 31, 2012, has been included in this filing as Exhibit 99.1 and incorporated herein by reference.

Business

At no time after LinnCo’s formation and prior to the initial public offering (“IPO”) did LinnCo have any operations or own any interest in LINN Energy. After the IPO and as of December 31, 2012, LinnCo’s sole purpose was to own units representing limited liability company interests (“units”) in LINN Energy and it expected to have no significant assets or operations other than those related to its interest in LINN Energy. In connection with the pending acquisition of Berry Petroleum Company (see Note 8), LinnCo intends to amend its limited liability company agreement to permit the acquisition and subsequent contribution of assets to LINN Energy.

Acquisition - Subsequent Event

On February 21, 2013, LinnCo and Berry Petroleum Company (“Berry”) announced they had signed a definitive merger agreement under which LinnCo would acquire all of the outstanding common shares of Berry. The transaction has a preliminary value of approximately $4.3 billion, including the assumption of debt, and is expected to close by June 30, 2013, subject to approvals by Berry and LinnCo shareholders, LINN Energy’s unitholders and regulatory agencies.

Under the terms of the agreement, Berry’s shareholders will receive 1.25 of LinnCo common shares for each Berry common share they own. This transaction, which is expected to be a tax-free exchange to Berry’s shareholders, represents value of $46.2375 per common share, based on the closing price of LinnCo common shares on February 20, 2013. Upon completion of the merger, LinnCo will contribute Berry assets to LINN Energy in exchange for LINN Energy units.

Results of Operations

Equity Income from Investment in Linn Energy, LLC

The Company’s results of operations primarily consists of its share of earnings of LINN Energy attributed to the units the Company owns. At December 31, 2012, the Company owned approximately 15% of LINN Energy’s outstanding units. The percentage ownership of LINN Energy could change over time due to the Company’s ownership of additional units or other issuances or repurchases of units by LINN Energy. The Company uses the equity method of accounting for its investment in LINN Energy and record earnings (losses) as described below.

| |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations - Continued |

Following is summarized statement of operations information for LINN Energy. Additional information on LINN Energy’s results of operations and financial position are contained in its Annual Report on Form 10-K for the year ended December 31, 2012, included in this filing as Exhibit 99.1 and incorporated herein by reference.

Linn Energy, LLC

|

| | | |

| | October 17, 2012 To December 31, 2012 |

| | (in thousands) |

| | |

| Revenues and other | $ | 604,701 |

|

| Expenses | (578,170 | ) |

| Other income and (expenses) | (85,464 | ) |

| Income tax benefit | 1,697 |

|

| Net loss | $ | (57,236 | ) |

General and Administrative Expenses

The Company’s general and administrative expenses are associated with managing the business and affairs of LinnCo. For the period from April 30, 2012 (inception) to December 31, 2012, LinnCo incurred total general and administrative expenses of approximately $1 million, all of which were paid by LINN Energy on LinnCo’s behalf. These expenses included approximately $772,000 related to services provided by LINN Energy necessary for the conduct of LinnCo’s business, such as accounting, legal, tax, information technology and other expenses. The remaining expenses were primarily related to professional services rendered by third parties. Because all general and administrative expenses reported by LinnCo on its statement of operations were actually paid by LINN Energy on LinnCo’s behalf, no cash was disbursed by LinnCo.

Income Tax Expense

Income tax expense of approximately $13 million for the period from April 30, 2012 (inception) to December 31, 2012, is based on the Company’s net income for the period, primarily associated with its equity income from its investment in LINN Energy.

Liquidity and Capital Resources

The Company’s authorized capital structure consists of two classes of interests: (1) shares with limited voting rights, which were issued in the IPO and (2) voting shares, 100% of which are held by LINN Energy. At December 31, 2012, LinnCo’s issued capitalization consisted of $1.2 billion in common shares representing limited liability company interests (“shares”) and $1,000 contributed by LINN Energy in connection with LinnCo’s formation and in exchange for its voting share. Additional classes of equity interests may be created upon approval by the Board and the holders of a majority of the outstanding shares and voting shares, voting as separate classes.

LINN Energy has agreed to provide to LinnCo, or to pay on LinnCo’s behalf, any legal, accounting, tax advisory, financial advisory and engineering fees, printing costs or other administrative and out-of-pocket expenses incurred by LinnCo, along with any other expenses incurred in connection with any public offering of shares in LinnCo or incurred as a result of being a publicly traded entity, including costs associated with annual, quarterly and other reports to holders of LinnCo shares, tax return and Form 1099 preparation and distribution, NASDAQ listing fees, printing costs, independent auditor fees and expenses, legal counsel fees and expenses, limited liability company governance and compliance expenses and registrar and transfer agent fees.

The Company expects neither to generate nor to require significant cash in its ongoing business. Any cash received from the sale of additional shares will be immediately used to purchase additional LINN Energy units. Accordingly, the Company does not anticipate any other sources or needs for additional liquidity.

| |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations - Continued |

LinnCo Initial Public Offering

On October 17, 2012, LinnCo closed its IPO as discussed in Note 3, and used all of the net proceeds, after deducting the underwriting discount and structuring fee, to purchase 34,787,500 units from LINN Energy which equal the number of LinnCo shares issued and sold. LinnCo’s limited liability company agreement requires it to maintain a one-to-one ratio between the number of LinnCo shares outstanding and the number of LINN Energy units it owns. When LINN Energy makes distributions on its units, LinnCo will pay a dividend on its shares equal to the amount of cash received from LINN Energy with respect to the LINN Energy units owned by LinnCo, net of reserves for income taxes payable by LinnCo.

Dividends

Within five (5) business days after receiving a cash distribution related to its interest in LINN Energy units, LinnCo is required to pay the cash received, net of reserves for its income tax liability (“tax reserve”), as dividends to its shareholders. The following provides a summary of dividends paid by the Company during the year ended December 31, 2012:

|

| | | | | | | | | | | |

| Date Paid | | Period Covered by Dividend | | Dividends Per Share | | Total Dividends |

| | | | | | | | (in millions) |

| | | | | | | | |

| November 2012 | | July 1 - September 30, 2012 | | $ | 0.71 |

| (1) | | $ | 25 |

|

| |

(1) | This amount is net of the tax reserve of $0.015 per common share. |

On January 24, 2013, LINN Energy’s Board declared a cash distribution of $0.725 per unit with respect to the fourth quarter of 2012. The distribution attributable to LinnCo’s interest in LINN Energy, totaling approximately $25 million, was paid to LinnCo on February 14, 2013.

On January 24, 2013, the Company’s Board declared a cash dividend of $0.71 per common share with respect to the fourth quarter of 2012, which is net of a tax reserve of $0.015 per common share from the LINN Energy distribution of $0.725 per unit. The dividend, totaling approximately $25 million after deducting the estimated income tax reserve of approximately $522,000, was paid on February 15, 2013, to shareholders of record as of the close of business on February 7, 2013.

Critical Accounting Policies and Estimates

The discussion and analysis of the Company’s financial condition and results of operations is based upon the financial statements, which have been prepared in accordance with GAAP. The preparation of these financial statements requires management of the Company to make estimates and assumptions about future events. These estimates and the underlying assumptions affect the amount of assets and liabilities reported, disclosures about contingent assets and liabilities, and reported amounts of expenses. These estimates and assumptions are based on management’s best estimates and judgment. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment, which management believes to be reasonable under the circumstances. Such estimates and assumptions are adjusted when facts and circumstances dictate. As future events and their effects cannot be determined with precision, actual results could differ from these estimates. Any changes in estimates resulting from continuous changes in the economic environment will be reflected in the financial statements in future periods.

Accounting for Investment in Linn Energy, LLC

The Company uses the equity method of accounting related to its ownership interest in LINN Energy’s net income (losses). The Company records its share of LINN Energy’s net income (losses) in the period in which it is earned. At December 31, 2012, the Company owned approximately 15% of LINN Energy’s outstanding units. The Company’s ownership percentage could change as LINN Energy issues or repurchases units. Changes in the Company’s ownership percentage affect its net income (losses).

The initial carrying amount of the Company’s investment in LINN Energy exceeded the Company’s ownership interest in LINN Energy’s underlying net assets by approximately $516 million. The difference was attributable to proved and unproved oil and natural gas properties, senior notes and equity method goodwill. These amounts are included in “investment in Linn Energy, LLC” on the balance sheet and are amortized over the lives of the related assets and liabilities.

| |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations - Continued |

Such amortization is included in the equity income from the Company’s investment in LINN Energy. Equity method goodwill is not amortized; however, the investment is reviewed for impairment. Impairment testing is performed when events or circumstances warrant such testing and considers whether there is an inability to recover the carrying value of an investment that is other than temporary. As of December 31, 2012, no such impairment had occurred with respect to the Company’s investment in LINN Energy.

Income Taxes

The Company is a limited liability company that has elected to be treated as a corporation for U.S. federal income tax purposes. Deferred income tax assets and liabilities are recognized for temporary differences between the basis of the Company’s assets and liabilities for financial and tax reporting purposes. At December 31, 2012, the majority of the Company’s temporary difference and associated deferred tax expense resulted from its investment in LINN Energy.

| |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

The nature of the Company’s business and operations is such that no activities or transactions are conducted or entered into by the Company that would require it to have a discussion under this item.

For a discussion of these matters as they pertain to LINN Energy, please read Part II, Item 7A. “Quantitative and Qualitative Disclosures About Market Risk” of LINN Energy’s Annual Report on Form 10-K, which is included in this filing as Exhibit 99.1 and incorporated herein by reference as activities of LINN Energy have an impact on the Company’s results of operations and financial position.

| |

| Item 8. | Financial Statements and Supplementary Data |

INDEX TO FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders

LinnCo, LLC:

We have audited the accompanying balance sheet of LinnCo, LLC as of December 31, 2012, and the related statements of operations, shareholders’ equity, and cash flows for the period from April 30, 2012 (inception) to December 31, 2012. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of LinnCo, LLC as of December 31, 2012, and the results of its operations and its cash flows for the period from April 30, 2012 (inception) to December 31, 2012, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Houston, Texas

February 28, 2013

LinnCo, LLC

BALANCE SHEET

|

| | | |

| | December 31, 2012 |

| | (in thousands, except share amounts) |

| ASSETS | |

| Cash | $ | 523 |

|

| Investment in Linn Energy, LLC | 1,221,817 |

|

| Total assets | $ | 1,222,340 |

|

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| Noncurrent deferred income tax | $ | 13,559 |

|

| | |

| Shareholders’ equity: | |

| Voting shares; unlimited shares authorized; 1 share issued and outstanding | 1 |

|

| Common shares; unlimited shares authorized; 34,787,500 shares issued and outstanding | 1,209,835 |

|

| Additional paid-in capital | 2,991 |

|

| Accumulated deficit | (4,046 | ) |

| | 1,208,781 |

|

| Total liabilities and shareholders’ equity | $ | 1,222,340 |

|

The accompanying notes are an integral part of these financial statements.

LinnCo, LLC

STATEMENT OF OPERATIONS

|

| | | |

| | April 30, 2012 (Inception) To December 31, 2012 |

| | (in thousands, except per share amounts) |

| | |

| Equity income from investment in Linn Energy, LLC | $ | 34,411 |

|

| General and administrative expenses | (1,230 | ) |

| Income before income taxes | 33,181 |

|

| Income tax expense | (12,528 | ) |

| Net income | $ | 20,653 |

|

| | |

| Net income per share, basic and diluted | $ | 1.92 |

|

| | |

| Weighted average shares outstanding | 10,747 |

|

| | |

| Dividends declared per share | $ | 0.71 |

|

The accompanying notes are an integral part of these financial statements.

LinnCo, LLC

STATEMENT OF SHAREHOLDERS’ EQUITY

|

| | | | | | | | | | | | | | | | | | |

| | April 30, 2012 (Inception) To December 31, 2012 |

| | Shares | | Share Amount | | Additional Paid-In Capital | | Accumulated Deficit | | Total Shareholders’ Equity |

| | (in thousands, except shares) |

| | | | | | | | | | |

Sale of voting share to Linn Energy, LLC | 1 |

| | $ | 1 |

| | $ | — |

| | $ | — |

| | $ | 1 |

|

| Sale of common shares, net of underwriting discounts and expenses of $59,909 | 34,787,500 |

| | 1,209,835 |

| | — |

| | — |

| | 1,209,835 |

|

| Deferred tax in equity investment | | | — |

| | (1,031 | ) | | — |

| | (1,031 | ) |

| Capital contributions from Linn Energy, LLC | | | — |

| | 4,022 |

| | — |

| | 4,022 |

|

| Dividends to shareholders | | | — |

| | — |

| | (24,699 | ) | | (24,699 | ) |

| Net income | | | — |

| | — |

| | 20,653 |

| | 20,653 |

|

| | 34,787,501 |

| | $ | 1,209,836 |

| | $ | 2,991 |

| | $ | (4,046 | ) | | $ | 1,208,781 |

|

The accompanying notes are an integral part of these financial statements.

LinnCo, LLC

STATEMENT OF CASH FLOWS

|

| | | |

| | April 30, 2012 (Inception) To December 31, 2012 |

| | (in thousands) |

| Cash flow from operating activities: | |

| Net income | $ | 20,653 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| Equity income from investment in Linn Energy, LLC | (34,411 | ) |

| Noncash general and administrative expenses paid by Linn Energy, LLC | 1,230 |

|

| Deferred income tax | 12,528 |

|

| Cash distributions received | 25,221 |

|

| Net cash provided by operating activities | 25,221 |

|

| | |

| Cash flow from investing activities: | |

| Investment in Linn Energy, LLC | (1,212,627 | ) |

| Net cash used in investing activities | (1,212,627 | ) |

| | |

| Cash flow from financing activities: | |

| Proceeds from sale of voting share | 1 |

|

| Proceeds from sale of common shares | 1,269,744 |

|

| Dividends paid to shareholders | (24,699 | ) |

| Offering expenses and fees | (57,117 | ) |

| Net cash provided by financing activities | 1,187,929 |

|

| | |

| Net increase in cash and cash equivalents | 523 |