Exhibit 99.1

| | | | |

| | WHO WE ARE AND HOW WE OPERATE ANZ’s history of expansion and growth stretches over 175 years. We have a strong franchise in Retail, Commercial and Institutional banking in our home markets of Australia and New Zealand and we have been operating in Asia Pacific for more than 30 years. Today, ANZ operates in 32 markets globally. We are the third largest bank in Australia, the largest banking group in New Zealand and the Pacific, and among the top 20 banks in the world. | | |

| | |

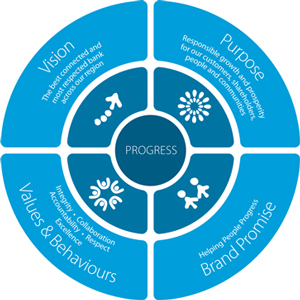

| | OUR SUPER REGIONAL STRATEGY » Strengthening our business in Australia, New Zealand and the Pacific, while establishing a significant presence in key markets in Asia. » Building connectivity to support customers who are operating increasingly within and across our region. » Providing our customers with the right financial solutions and insights to help them progress. » Growing and strengthening the bank by diversifying our earnings. |

| | | | | | | | |

| | | 2012 | | | 2011 | |

| | |

Profitability | | | | | | | | |

| | |

Profit attributable to shareholders of the Company ($m) | | | 5,661 | | | | 5,355 | |

Underlying profit1 ($m) | | | 6,011 | | | | 5,652 | |

| | |

Return on: | | | | | | | | |

Average ordinary shareholders’ equity2 | | | 14.6% | | | | 15.3% | |

Average ordinary shareholders’ equity (underlying profit basis)1,2 | | | 15.6% | | | | 16.2% | |

Average assets3 | | | 0.90% | | | | 0.94% | |

Net interest margin3 | | | 2.31% | | | | 2.42% | |

Net interest margin (excluding Global Markets)3 | | | 2.71% | | | | 2.80% | |

Underlying profit per average FTE ($)1,4 | | | 122,681 | | | | 116,546 | |

| | |

Efficiency ratios | | | | | | | | |

| | |

Operating expenses to operating income | | | 48.1% | | | | 47.4% | |

Operating expenses to average assets3 | | | 1.36% | | | | 1.40% | |

Operating expenses to operating income (underlying)1 | | | 45.6% | | | | 45.9% | |

Operating expenses to average assets (underlying)1,3 | | | 1.28% | | | | 1.35% | |

| | |

Credit impairment provisioning | | | | | | | | |

| | |

Collective provision charge/(release) ($m) | | | (379 | ) | | | 7 | |

Individual provision charge ($m) | | | 1,577 | | | | 1,230 | |

Total provision charge ($m) | | | 1,198 | | | | 1,237 | |

Individual provision charge as a % of average net advances | | | 0.38% | | | | 0.32% | |

Total provision charge as a % of average net advances | | | 0.29% | | | | 0.32% | |

| | |

Ordinary share dividends | | | | | | | | |

| | |

Interim – 100% franked (cents) | | | 66 | | | | 64 | |

Final – 100% franked (cents) | | | 79 | | | | 76 | |

Total dividend (cents) | | | 145 | | | | 140 | |

Ordinary share dividend payout ratio5 | | | 69.3% | | | | 68.6% | |

Underlying ordinary share dividend payout ratio1,5 | | | 65.3% | | | | 65.0% | |

| | |

Preference share dividend ($m) | | | | | | | | |

| | |

Dividend paid6 | | | 11 | | | | 12 | |

| 1 | Profit has been adjusted for certain non-core items to arrive at underlying profit, the result for the ongoing business activities of the Group. These adjustments have been determined on a consistent basis with those made in prior years. The adjustments made in arriving at underlying profit are included in statutory profit which is subject to audit within the context of the Group statutory audit opinion. Underlying profit is not audited, however, the external auditor has informed the Audit Committee that the adjustments, and the presentation thereof, are based on the guidelines released by the Australian Institute of Company Directors (AICD) and the Financial Services Institute of Australasia (FINSIA), and have been determined on a consistent basis with those made in prior years. Refer to page 204 to 206 for analysis of the adjustments between statutory profit and underlying profit. |

| 2 | Average ordinary shareholders’ equity excludes non-controlling interests and preference shares. |

| 3 | Comparative information has been restated to reflect the impact of the current period reporting treatment of derivative related collateral posted/received and the associated interest income/expense. Refer to note 1 of the financial statement for further details. |

| 4 | Comparative amounts have changed reflecting an amendment to FTE to align to the current year methodology. |

| 5 | The 2012 dividend payout ratio is calculated using the March 2012 interim and the proposed September 2012 final dividend. The 2011 dividend payout ratio is calculated using the March 2011 interim and September 2011 final dividend. |

| 6 | Represents dividends paid on Euro Trust Securities issued on 13 December 2004. |

FINANCIAL HIGHLIGHTS  5

5

I am pleased to report that ANZ’s statutory profit after tax for the year ended 30 September 2012 was $5.7 billion, up 6%. This good performance reflected continued progress with our super regional strategy which saw growth across our key businesses in Australia, New Zealand and Asia Pacific, together with renewed focus on cost management.

The final dividend of 79 cents per share brings the total dividend for the year to 145 cents per share fully franked, an increase of 4%.

Our capital position remains strong, placing ANZ among the world’s best capitalised banks and we remain one of only a small number of banks globally which have maintained a AA rating from all three credit ratings agencies.

Super Regional Strategy

Over the past five years we have had a consistent focus on creating the region’s best connected and most respected bank.

2012 has been another year of achievement. In Asia, we continued to invest. For example, in our subsidiary bank in China we increased capital to support growth. Greater China, including Hong Kong and Taiwan, is now ANZ’s largest market outside Australia and New Zealand. We also opened our first Malaysian branch in Labuan.

In Australia and New Zealand, our largest markets, we also continued to invest in customer service and innovation, and in leveraging connectivity with our international network. This is increasingly a source of differentiation, particularly in Commercial and Institutional banking.

At the same time, we have increased our focus on simplifying the bank and on containing cost growth. Alistair Currie was appointed to the role of Group Chief Operating Officer to deliver a more integrated approach to technology, shared services and operations. In New Zealand, we made significant progress with our simplification program, including our migration to one banking and technology platform, a decision to move to a single brand.

Customers, our People and the Community

Since the onset of the global financial crisis, the reputation of banks throughout the world has been challenged. Although Australian banks have remained strong throughout this period, we have also had to face up to community concerns about our industry and increase our efforts with customers and with the wider community.

As we made structural changes to our business in 2012 to adjust to the more difficult operating environment, our leading position on retail customer satisfaction slipped in Australia but has since regained momentum. Although we have maintained strong customer satisfaction in New Zealand, management refocused their efforts on improving satisfaction in Australia. There was early recognition of our

| 1 | Money magazine Bank of the Year and Home Lender of the Year. AFR Capital Business Bank of the Year 2012. Top 5 Corporate Bank, Greenwich Associates Survey 2012. |

progress with ANZ receiving awards1 as Bank of the Year, Mortgage Lender of the Year and Business Bank of the Year in 2012.

We were also pleased to be recognised for our long-term commitment to building the money management skills and savings of disadvantaged groups, receiving two major awards at the MoneySmart Week Awards in Australia.

Throughout 2012, we have continued to equip our people for high performance, continuing to support them to make ethically, socially and environmentally responsible decisions while promoting their wellbeing.

We have linked ANZ’s super regional strategy to our corporate responsibility framework and continued to work with stakeholders to guide our activities. This includes reviewing and improving our responsible lending practices which have been built into our training programs.

ANZ was ranked the most sustainable bank globally in the 2012 Dow Jones Sustainability Index.

Outlook

The global economy is softening as we enter our 2013 financial year with many European economies contracting and the United States continuing to recover slowly.

Although China’s economy is also in a managed slow-down we expect it will continue to grow at 7–8% in 2013. This will see Asia remain the best performing region in the world. In Australia and New Zealand consumer and business confidence remains weak and growth during 2013 is expected to be around 2.7% and 2.5% respectively.

Although the year ahead looks challenging with headwinds in a number of areas, ANZ’s unique strategy and the momentum we have in adapting to the new environment means for banks we are well placed to deliver value to our shareholders, our customers and the community.

Finally, on behalf of shareholders, I would like to acknowledge the commitment and dedication of our management team and of all our 48,000 staff who have worked so hard in 2012. My thanks also go to my fellow Directors for their commitment and support during the year.

JOHN MORSCHEL

CHAIRMAN

ANZ has delivered another good performance1 in 2012 through a consistent focus on delivering our super regional strategy by strengthening our domestic businesses in Australia, New Zealand and the Pacific while driving significant growth in Asia.

Revenue grew 5% with market share gains across key segments and geographies. We continued to invest in our strategy and future growth with costs up by 4%, but at the same time we have increased our focus on productivity which saw cost growth trend lower during the year.

Our focus on costs resulted in significant change across ANZ which impacted many of our staff and so I am pleased to report that employee engagement remained steady at 70%. Our aim remains to reach global best-in-class standards through a bank-wide commitment to customer service and to ensure ANZ is a great place to work.

Divisional Performance

In the Australia Division we produced a solid result with profit up 4% benefiting from market share gains, tighter management of margins and a strong productivity focus. Retail lending grew 7% while average deposits grew at 12%. Commercial also performed well, with average growth in customer numbers and continued leverage of our regional capabilities.

Profit grew 3% in the International and Institutional Banking Division. The division continues to grow and diversify its earnings by geography, product and customer with 43% of revenue and 54% deposits now derived from outside Australia and New Zealand. This includes significant growth in many of our priority segments based on the connectivity of our international network, although this was offset by softer demand for loans and significant margin contraction in Australia.

New Zealand delivered a good performance with profit up 12%. Business simplification showed benefits with improved financial results based on productivity improvements and market share growth in key segments. We also announced we would move to one brand in New Zealand – the ANZ brand, and in late October 2012 we reached a significant milestone when we moved to a single technology platform.

Profit from the newly-formed Global Wealth and Private Banking Division was flat, in line with market conditions, however we saw improving performance trends during the year, particularly in insurance and investment earnings, and through productivity gains.

Credit quality was stable with ANZ’s provision charge of $1.25 billion broadly in line with 2011 and the Group’s provision coverage remains strong.

Our Strategy and the Environment for Banking

While ANZ delivered a good performance in 2012, just as important has been our strategic progress.

Five years ago, we articulated an ambition to create value for our shareholders, our customers and the wider community by becoming a super regional bank – a bank of global quality with regional focus. This included an aspiration to source 20% of our revenues from outside Australia and New Zealand.

I am pleased to report, despite having endured the global financial crisis, our network in Asia Pacific, Europe and America contributed 21% of Group revenue in 2012.

To deliver this outcome, the scale of transformation has been significant involving a systematic and coordinated program of action in every area of the bank. In our separate Shareholder Review we have provided a five-year progress report showing how we have strengthened ANZ in our key domestic markets in Australia and New Zealand while building a much bigger business in the growth markets of Asia Pacific.

While we have made significant progress, the journey is not over. We have set new aspirations which will see further growth, particularly in Asia, while also adapting the bank to the post-financial-crisis world.

We believe the lower growth business environment that we have seen following the financial crisis will be with us for the foreseeable future. We have been actively responding to these fast-changing and challenging conditions in different markets by driving both growth and productivity.

Our 2012 results highlight that after five years, ANZ’s super regional strategy has growing momentum. ANZ has moved from being a largely domestic bank to an integrated and growing, regionally focused international bank that is increasingly delivering differentiated value and performance.

MICHAEL SMITH

CHIEF EXECUTIVE OFFICER

| 1 | All figures on an underlying basis unless noted otherwise. |

CHAIRMAN’S REPORT AND CHIEF EXECUTIVE OFFICER’S REPORT  7

7

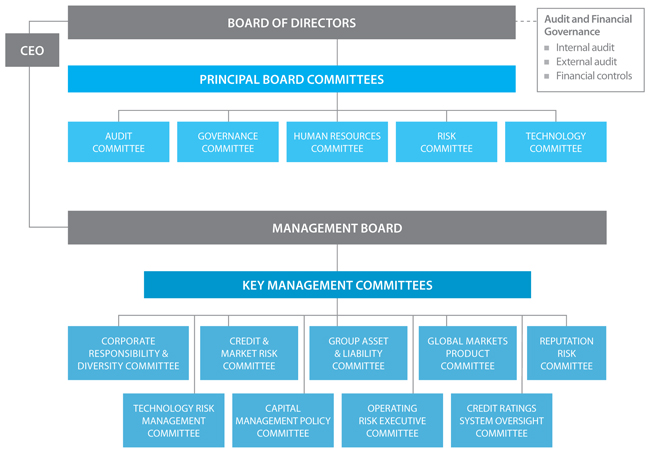

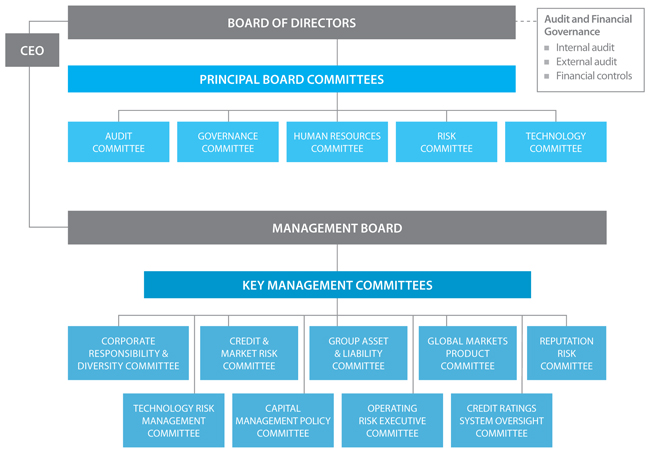

Principal Activities

The Group provides a broad range of banking and financial products and services to retail, small business, corporate and institutional clients.

The Group conducts its operations primarily in Australia, New Zealand and the Asia Pacific region. It also operates in a number of other countries including the United Kingdom and the United States.

The Group operates on a divisional structure with Australia, International and Institutional Banking, New Zealand and Global Wealth and Private Banking being the major operating divisions.

At 30 September 2012, the Group had 1,337 branches and other points of representation worldwide excluding Automatic Teller Machines (ATMs).

Results

Consolidated profit after income tax attributable to shareholders of the Company was $5,661 million, an increase of 6% over the prior year.

Operating income growth of $779 million or 5% was primarily driven by higher net interest income following a 10% increase in average interest earning assets, partially offset by an 11 basis point decline in net interest margin. Operating expenses increased $496 million or 6%, impacted by a software impairment charge of $274 million and an increase in restructuring expenses of $126 million.

Provision for credit impairment decreased by $39 million or 3% with improvements across the Australia and New Zealand divisions.

Balance sheet growth was strong with total assets increasing by $37.9 billion (6%) and total liabilities increasing by $34.6 billion (6%). Movements within the major components include:

| n | | Net loans and advances increased by $30.5 billion (8%) primarily driven by above system housing lending growth of $12.2 billion (7%) in the Australia division and growth of $10.4 billion (11%) in International and Institutional Banking, mainly in Global Loans and Transaction Banking. |

| n | | Growth in customer deposits of $31.1 billion (10%) was concentrated in the second half, and reflected growth in Australia of $13.8 billion (11%), growth in International and Institutional Banking of $13.0 billion (10%) driven by strong momentum in Asia Pacific, Europe and America (APEA) and strong customer deposit growth in New Zealand of $3.7 billion (10%) driven by Retail and Small Business Banking. |

Further details are contained on pages 55 to 61 of this Annual Report.

State of Affairs

In the Directors’ opinion there have been no significant changes in the state of affairs of the Group during the financial year.

Further review of matters affecting the Group’s state of affairs is also contained in the Review of Operating Results on pages 55 to 61 of this Annual Report.

Dividends

The Directors propose that a fully franked final dividend of 79 cents per fully paid ordinary share will be paid on 19 December 2012. The proposed payment amounts to approximately $2,149 million.

During the financial year, the following fully franked dividends were paid on fully paid ordinary shares:

| | | | | | | | | | |

| Type | | Cents

per share | | | Amount before bonus option plan adjustment $m | | | Date of payment |

Final 2011 | | | 76 | | | | 2,002 | | | 16 December 2011 |

Interim 2012 | | | 66 | | | | 1,769 | | | 2 July 2012 |

The proposed final dividend of 79 cents together with the interim dividend of 66 cents brings total dividends in relation to the year ended 30 September 2012 to 145 cents fully franked.

Further details of dividends provided for or paid during the year ended 30 September 2012 on ANZ’s ordinary and preference shares are set out in notes 7, 29 and 30 to the financial statements.

Review of Operations

A review of the Group during the financial year and the results of those operations, including an assessment of the financial position and business strategies of the Group, is contained in the Chairman’s Report, the Chief Executive Officer’s Report and the Review of Operating Results of this Annual Report.

8

Events Since the End of the Financial Year

There were no significant events from 30 September 2012 to the date of this report.

Future Developments

Details of likely developments in the operations of the Group and its prospects in future financial years are contained in this Annual Report under the Chairman’s Report and Chief Executive Officer’s Report. In the opinion of the Directors, disclosure of any further information would be likely to result in unreasonable prejudice to the Group.

Environmental Regulation

The Company recognises the expectations of its stakeholders – customers, shareholders, staff and the community – to operate in a way that mitigates the Company’s environmental impact.

The Company sets and reports against public targets regarding its environmental performance.

The Company is subject to two relevant pieces of legislation. The Company’s operations in Australia are categorised as a ‘high energy user’ under the Energy Efficiency Opportunities Act 2006 (Cth) (EEO). The Company has a mandatory obligation to identify energy efficiency opportunities and report to the Australian Federal Government progress with the implementation of the opportunities identified. As required under the legislation, the Company completed its first five-year assessment cycle through submission of its final report in December 2011. It has now commenced the second five-year cycle of the program and is required to submit an updated assessment plan by December 2012 that assesses cost-effective opportunities across 90% of its usage. The Company complies with its obligations under the EEO.

The National Greenhouse Energy Reporting Act 2007 (Cth) has been designed to create a national framework for energy and associated greenhouse gas emissions reporting. The Act makes registration and reporting mandatory for corporations whose energy production, energy use, or greenhouse gas emissions trigger the specified corporate or facility threshold. The Company is over the corporate threshold defined within this legislation and as a result was required to submit its first report on 31 October 2009. Subsequent reports have been submitted in 2010, 2011 and 2012.

The Company’s operations are not subject to any site specific or license requirements which could be considered particular or significant environmental regulation under any law of the Australian Commonwealth Government or of any state or territory thereof.

The Company may become subject to environmental regulation as a result of its lending activities in the ordinary course of business. The Company has developed policies to manage such environmental risks.

Having made due enquiry, and to the best of the Company’s knowledge, no entity of the Group has incurred any material environmental liability during the year.

Further details on the Company’s environmental performance, including progress against its targets and details of its emissions profile, are available on anz.com > About us > Corporate Responsibility.

Directors’ Qualifications, Experience

and Special Responsibilities

At the date of this report, the Board comprises eight Non-Executive Directors who have a diversity of business and community experience and one Executive Director, the Chief Executive Officer, who has extensive banking experience. The names of Directors and details of their skills, qualifications, experience and when they were appointed to the Board are contained on pages 37 to 40 of this Annual Report.

Details of the number of Board and Board Committee meetings held during the year, Directors’ attendance at those meetings and details of Directors’ special responsibilities, are shown on pages 37 to 49 of this Annual Report. No Directors retired during the 2012 financial year.

Details of directorships of other listed companies held by each current Director in the three years prior to the end of the 2012 financial year are listed on pages 37 to 40.

| | | | |

| | | | DIRECTOR’S REPORT  9 9 |

Company Secretaries’ Qualifications

and Experience

Currently there are two people appointed as Company Secretaries of the Company. Details of their roles are contained on page 44. Their qualifications and experience are as follows:

| n | | Bob Santamaria, BCom, LLB (Hons) |

Group General Counsel.

Mr Santamaria joined ANZ in 2007. He had previously been a Partner at the law firm Allens Arthur Robinson since 1987. He was Executive Partner Corporate, responsible for client liaison with some of Allens Arthur Robinson’s largest corporate clients.

Mr Santamaria brings to ANZ a strong background in leadership of a major law firm, together with significant experience in securities, mergers and acquisitions. He holds a Bachelor of Commerce and Bachelor of Laws (Honours) from the University of Melbourne. He is also an Affiliate of Chartered Secretaries Australia.

| n | | John Priestley, BEc, LLB, FCIS |

Company Secretary.

Mr Priestley, a qualified lawyer, joined ANZ in 2004. Prior to ANZ, he had a long career with Mayne Group and held positions which included responsibility for the legal, company secretarial, compliance and insurance functions. He is a Fellow of Chartered Secretaries Australia and also a member of Chartered Secretaries Australia’s National Legislation Review Committee.

Non-audit Services

The Company’s Stakeholder Engagement Model for Relationship with the External Auditor (which incorporates requirements of the Corporations Act 2001) states that the external auditor may not provide services that are perceived to impair or impact the independence of the external auditor or be in conflict with the role of the external auditor. These include consulting advice and sub-contracting of operational activities normally undertaken by management, and engagements where the external auditor may ultimately be required to express an opinion on their own work.

Specifically the Stakeholder Engagement Model:

| n | | limits the non-audit services that may be provided; |

| n | | requires that audit, audit-related and permitted non-audit services must be pre-approved by the Audit Committee, or pre-approved by the Chairman of the Audit Committee (or up to a specified amount by a limited number of authorised senior members of management) and notified to the Audit Committee; and |

| n | | requires the external auditor to not commence any engagement for the Group, until the Group has confirmed that the engagement has been pre-approved. |

Further details about the Stakeholder Engagement Model can be found in the Corporate Governance Statement on page 49.

The Audit Committee has reviewed a summary of non-audit services provided by the external auditor for 2012, and has confirmed that the provision of non-audit services for 2012 is consistent with the Stakeholder Engagement Model and compatible with the general standard of independence for external auditors imposed by the Corporations Act 2001. This has been formally advised by the Audit Committee to the Board of Directors.

The external auditor has confirmed to the Audit Committee that they have:

| n | | implemented procedures to ensure they comply with independence rules both in Australia and the United States (US); and |

| n | | complied with domestic policies and regulations, together with the regulatory requirements of the US Securities and Exchange Commission (SEC), and ANZ’s policy regarding the provision of non-audit services by the external auditor. |

The non-audit services supplied to the Group by the Group’s external auditor, KPMG, and the amount paid or payable by the Group by type of non-audit service during the year ended 30 September 2012 are as follows:

| | | | | | | | |

| | | Amount paid/payable

$’000’s | |

| Non-audit services | | 2012 | | | 2011 | |

Review of Wealth internal capital adequacy assessment process | | | 83 | | | | – | |

Benchmarking review of Wealth IT data centre transfer | | | 75 | | | | – | |

Review application of new Australian consumer cards legislation | | | 50 | | | | – | |

Regulatory benchmarking review (Taiwan) | | | 49 | | | | – | |

Review of accounts in relation to potential divestment | | | 35 | | | | – | |

Accounting advice | | | 28 | | | | 5 | |

Assist with Taiwanese brokerage license application | | | 11 | | | | – | |

Group collective provision review (on behalf of APRA) | | | – | | | | 101 | |

Wealth managed investment schemes distribution model review | | | – | | | | 81 | |

Review of Wealth scrip for scrip audit validation model and trust voting analysis models | | | – | | | | 46 | |

Wealth R&D claim review | | | – | | | | 40 | |

Review output from Group counterparty credit risk review project | | | – | | | | 20 | |

Presentations | | | – | | | | 18 | |

Solomon Islands prudential standard impact assessment | | | – | | | | 11 | |

Training courses in China | | | – | | | | 9 | |

Witness branch transfer of deposit boxes in Singapore | | | – | | | | 4 | |

Total | | | 331 | | | | 335 | |

Further details on the compensation paid to KPMG is provided in note 5 to the financial statements. Note 5 also provides details of audit-related services provided during the year of $4.313 million (2011: $4.444 million).

For the reasons set out above, the Directors are satisfied that the provision of non-audit services by the external auditor during the year ended 30 September 2012 is compatible with the general standard of independence for external auditors imposed by the Corporations Act 2001.

10

Directors and Officers who were previously Partners

of the Auditor

Mr Marriott, the Company’s Chief Financial Officer up to 31 May 2012, was a Partner of KPMG at a time when KPMG was the auditor of the Company. In particular, Mr Marriott was a Partner in the Melbourne office of the then KPMG Peat Marwick prior to joining the Company in 1993.

Chief Executive Officer/Chief Financial Officer

Declaration

The Chief Executive Officer and the Chief Financial Officer have given the declarations to the Board concerning the Group’s financial statements and other matters as required under section 295A(2) of the Corporations Act 2001 and Recommendation 7.3 of the ASX Corporate Governance Principles and Recommendations.

Directors’ and Officers’ Indemnity

The Company’s Constitution (Rule 11.1) permits the Company to indemnify each officer or employee of the Company against liabilities (so far as may be permitted under applicable law) incurred in the execution and discharge of the officer’s or employee’s duties. It is the Company’s policy that its employees should not incur any liability to any third party as a result of acting in the course of their employment, subject to appropriate conditions.

Under the policy, the Company will indemnify employees against any liability they incur in carrying out their role. The indemnity protects employees and former employees who incur a liability when acting as an employee, trustee or officer of the Company, another corporation or other body at the request of the Company or a related body corporate.

The indemnity is subject to applicable law and in addition will not apply to liability arising from:

| n | | serious misconduct, gross negligence or lack of good faith; |

| n | | illegal, dishonest or fraudulent conduct; or |

| n | | material non-compliance with the Company’s policies, processes or discretions. |

The Company has entered into Indemnity Deeds with each of its Directors, with certain secretaries and former Directors of the Company, and with certain employees and other individuals who act as directors or officers of related bodies corporate or of another company. To the extent permitted by law, the Company indemnifies the individual for all liabilities, including costs, damages and expenses incurred in their capacity as an officer of the company to which they have been appointed.

The Company has indemnified the trustees and former trustees of certain of the Company’s superannuation funds and directors, former directors, officers and former officers of trustees of various Company sponsored superannuation schemes in Australia. Under the relevant Deeds of Indemnity, the Company must indemnify each indemnified person if the assets of the relevant fund are insufficient to cover any loss, damage, liability or cost incurred by the indemnified person in connection with the fund, being loss, damage, liability or costs for which the indemnified person would have been entitled to be indemnified out of the assets of the fund in accordance with the trust deed and the Superannuation Industry (Supervision) Act 1993. This indemnity survives the termination of the fund. Some of the indemnified persons are or were Directors or executive officers of the Company.

The Company has also indemnified certain employees of the Company, being trustees and administrators of a trust, from and against any loss, damage, liability, tax, penalty, expense or claim of any kind or nature arising out of or in connection with the creation, operation or dissolution of the trust or any act or omission performed or omitted by them in good faith and in a manner that they reasonably believed to be within the scope of the authority conferred by the trust.

Except for the above, neither the Company nor any related body corporate of the Company has indemnified or made an agreement to indemnify any person who is or has been an officer or auditor of the Company against liabilities incurred as an officer or auditor of the Company.

During the financial year, the Company has paid premiums for insurance for the benefit of the directors and employees of the Company and related bodies corporate of the Company. In accordance with common commercial practice, the insurance prohibits disclosure of the nature of the liability insured against and the amount of the premium.

Rounding of Amounts

The Company is a company of the kind referred to in Australian Securities and Investments Commission class order 98/100 (as amended) pursuant to section 341(1) of the Corporations Act 2001.

As a result, amounts in this Directors’ Report and the accompanying financial statements have been rounded to the nearest million dollars except where otherwise indicated.

DIRECTORS’ REPORT  11

11

Key Management Personnel and Employee Share

and Option Plans

Details of equity holdings of Non-Executive Directors, the Chief Executive Officer and Disclosed Executives during the 2012 financial year and as at the date of this report are detailed in note 46 of the financial statements.

Details of options/rights issued over shares granted to the Chief Executive Officer and Disclosed Executives during the 2012 financial year and as at the date of this report are detailed in the Remuneration Report.

Details of options/rights issued over shares granted to employees and on issue as at the date of this report are detailed in note 45 of the 2012 financial statements.

Details of shares issued as a result of the exercise during the 2012 financial year of options/rights granted to employees are detailed in note 45 of the 2012 financial statements.

Other details about the share options/rights issued, including any rights to participate in any share issues of the Company, are set out in note 45 of the 2012 financial statements. No person entitled to exercise any option/right has or had, by virtue of an option/right, a right to participate in any share issue of any other body corporate. The names of all persons who currently hold options/rights are entered in the register kept by the Company pursuant to section 170 of the Corporations Act 2001. This register may be inspected free of charge.

Lead Auditor’s Independence Declaration

The lead auditor’s independence declaration given under section 307C of the Corporations Act 2001 is set out below and forms part of this Directors’ Report for the year ended 30 September 2012.

THE AUDITOR’S INDEPENDENCE DECLARATION

Lead Auditor’s Independence Declaration under Section 307C of the Corporations Act 2001

To: the Directors of Australia and New Zealand Banking Group Limited

I declare that, to the best of my knowledge and belief, in relation to the audit for the financial year ended 30 September 2012, there have been:

(i) no contraventions of the auditor independence requirements as set out in the Corporations Act 2001 in relation to the audit; and

(ii) no contraventions of any applicable code of professional conduct in relation to the audit.

| | |

| |  |

| |

| KPMG | | Andrew Yates |

| | Partner |

| | Melbourne |

| |

| | 5 November 2012 |

12

Contents

| | | | | | | | |

| 1 | | Basis of Preparation | | 14 |

| | |

| 2 | | Key Management Personnel | | 14 |

| | |

| 3 | | Role of the Board in Remuneration | | 15 |

| | |

| 4 | | HR Committee Activities | | 15 |

| | |

| 5 | | Remuneration Strategy and Objectives | | 16 |

| | |

| 6 | | The Composition of Remuneration at ANZ | | 16 |

| | | | 6.1 | | Fixed Remuneration | | 18 |

| | | | 6.2 | | Variable Remuneration | | 18 |

| | | | | | 6.2.1 Short Term Incentives | | 18 |

| | | | | | 6.2.2 Long Term Incentives | | 19 |

| | | | 6.3 | | Other Remuneration Elements | | 20 |

| | |

| 7 | | Linking Remuneration to Balanced Scorecard Performance | | 21 |

| | | | 7.1 | | ANZ Performance | | 21 |

| | | | 7.2 | | STI – Performance and Outcomes | | 22 |

| | |

| 8 | | 2012 Remuneration | | 23 |

| | | | 8.1 | | Non-Executive Directors (NEDs) | | 23 |

| | | | 8.2 | | Chief Executive Officer (CEO) | | 25 |

| | | | 8.3 | | Disclosed Executives | | 27 |

| | | | 8.4 | | Remuneration Tables – CEO and Disclosed Executives | | 30 |

| | | | | | Non Statutory Remuneration Table | | 30 |

| | | | | | Statutory Remuneration Table | | 32 |

| | | | 8.5 | | STI – Performance and STI Correlation | | 34 |

| | |

| 9 | | Equity | | 34 |

| | | | 9.1 | | Equity Valuations | | 34 |

| | | | 9.2 | | Legacy LTI Program | | 35 |

REMUNERATION REPORT  13

13

1. Basis of Preparation

This Directors’ Remuneration Report has been prepared in accordance with section 300A of the Corporations Act 2001 for the Company and the consolidated entity for 2011 and 2012. Information in Table 6: Non Statutory Remuneration has been prepared in accordance with the presentation basis set out in Section 8.4. The information provided in this Remuneration Report has been audited as required by section 308(3C) of the Corporations Act 2001, unless indicated otherwise, and forms part of the Directors’ Report.

The Directors’ Remuneration Report is designed to provide shareholders with an understanding of ANZ’s remuneration policies and the link between our remuneration approach and ANZ’s performance, in particular regarding Key Management Personnel (KMP) as defined under the Corporations Act 2001. Individual outcomes are provided for ANZ’s Non-Executive Directors (NEDs), the Chief Executive Officer (CEO) and Disclosed Executives (current and former).

The Disclosed Executives are defined as those direct reports to the CEO with key responsibility for the strategic direction and management of a major revenue generating Division or who control material revenue and expenses that fall within the definition of KMP of the Company and of the Group.

2. Key Management Personnel (KMP)

The KMP disclosed in this year’s report are detailed in Table 1. A number of movements occurred during 2012 which are summarised as follows:

NEDs

| n | | Effective 1 April 2012, Ms Paula Dwyer was appointed as a NED. |

DISCLOSED EXECUTIVES

| n | | In November 2011 ANZ announced the retirement of Mr Chris Page, Chief Risk Officer (CRO), effective 16 December 2011, and confirmed the promotion of Mr Nigel Williams into the role of CRO immediately following Mr Page’s departure. |

| n | | In February 2012 ANZ announced a number of senior management and organisational changes to accelerate its super regional strategy, support its growth and transformation, and strengthen succession planning within its senior leadership group. Effective 1 March 2012: |

| | – | | Mr Shayne Elliott was promoted from CEO Institutional to Chief Financial Officer (CFO) (CFO designate from 1 March until 31 May 2012), succeeding Mr Peter Marriott who concluded in the role on 31 May 2012. Mr Elliott also took on responsibility for Group Strategy and Mergers and Acquisitions (M&A). |

| | – | | Mr Alex Thursby was promoted from CEO Asia Pacific, Europe and America to CEO International and Institutional Banking which is focused on ANZ’s largest multi-national clients globally and the growth and transformation of ANZ’s international franchise. |

| | – | | Ms Joyce Phillips was promoted from Group Managing Director Strategy, M&A, Marketing and Innovation to a new role of CEO Global Wealth and Private Banking with responsibility for Wealth Management and Private Banking globally. Ms Phillips retained responsibility for Marketing, Innovation and Digital. |

TABLE 1: KEY MANAGEMENT PERSONNEL

| | | | |

Name | | Position | | Term as KMP

in 2012 |

Non-Executive Directors (NEDs) |

| | |

J Morschel | | Chairman – Appointed Chairman March 2010 (Director October 2004) | | Full Year |

| | |

G Clark | | Director – Appointed February 2004 | | Full Year |

| | |

P Dwyer | | Director – Appointed 1 April 2012 | | Part Year |

| | |

P Hay | | Director – Appointed November 2008 | | Full Year |

| | |

H Lee | | Director – Appointed February 2009 | | Full Year |

| | |

I Macfarlane | | Director – Appointed February 2007 | | Full Year |

| | |

D Meiklejohn | | Director – Appointed October 2004 | | Full Year |

| | |

A Watkins | | Director – Appointed November 2008 | | Full Year |

Chief Executive Officer (CEO) |

| | |

M Smith | | CEO | | Full Year |

|

Disclosed Executives – Current |

| | |

P Chronican | | Chief Executive Officer, Australia | | Full Year |

| | |

S Elliott | | Chief Financial Officer – appointed 1 June 2012; Chief Financial Officer Designate from 1 March until 31 May 2012 | | Full Year |

| | |

D Hisco | | Chief Executive Officer, New Zealand – appointed 13 October 2010 | | Full Year |

| | |

G Hodges | | Deputy Chief Executive Officer | | Full Year |

| | |

J Phillips | | CEO Global Wealth and Private Banking – appointed 1 March 2012 | | Part Year |

| | |

A Thursby | | Chief Executive Officer, International & Institutional Banking – appointed 1 March 2012 | | Full Year |

| | |

N Williams | | Chief Risk Officer – appointed 17 December 2011 | | Part Year |

|

Disclosed Executives – Former |

| | |

P Marriott | | Former Chief Financial Officer – concluded in role 31 May 2012, ceased employment 31 August 2012 | | Part Year |

| | |

C Page | | Former Chief Risk Officer – retired 16 December 2011 | | Part Year |

14

3. Role of the Board in Remuneration

The Board Human Resources (HR) Committee is a Committee of the Board. The Board HR Committee is responsible for:

| n | | reviewing and making recommendations to the Board in relation to remuneration governance, director and senior executive remuneration and senior executive succession; |

| n | | specifically making recommendations to the Board on remuneration and succession matters related to the CEO, and individual remuneration arrangements for other key executives covered by the Group’s Remuneration Policy; |

| n | | the design of significant incentive plans (such as the ANZ Employee Reward Scheme (ANZERS) and the Institutional Incentive Plan); and |

| n | | remuneration structures for senior executives and others specifically covered by the Remuneration Policy. |

More details about the role of the HR Committee can be found on the ANZ website1.

The link between remuneration and risk is considered a key requirement by the Board, with Committee membership structured to ensure overlap of representation across the Board HR Committee and Board Risk Committee, with two Non Executive Directors currently on both committees.

Throughout the year the HR Committee and management received information from external providers (Ernst & Young, Freehills, Mercer (Australia) Pty Ltd, Hay Group and PricewaterhouseCoopers). This information related to remuneration market data and analysis, market practice on the structure and design of incentive programs (both short and long term), legislative requirements and interpretation of governance and regulatory requirements both in Australia and globally.

The HR Committee did not receive any recommendations from remuneration consultants during the year in relation to the remuneration arrangements of KMP. ANZ employs in house remuneration professionals who provide recommendations to the Board, taking into consideration information from external providers. The Board’s decisions were made independently using the information provided and having careful regard to ANZ’s strategic objectives and Remuneration Policy and principles.

4. HR Committee Activities

During 2012, the HR Committee met on five occasions, with remuneration matters a standing agenda item on each occasion. The HR Committee has a strong focus on the relationship between business performance, risk management and remuneration, with the following key activities occurring during the year:

| n | | annual review of the effectiveness of the Remuneration Policy; |

| n | | adjustment of the Short Term Incentive (STI) mandatory deferral threshold downward from $200,000 to $100,000. Refer to page 19 for more detail on STI mandatory deferral; |

| n | | review of terms and conditions of key senior executive appointments and terminations; |

| n | | engagement with APRA on remuneration compliance and application of the APRA Remuneration Standard; |

| n | | involvement of the Risk function in remuneration regulatory and compliance related activities; and |

| n | | monitoring of domestic and international regulatory and compliance matters relating to remuneration governance. |

| 1 | Go to anz.com, about us, our company, corporate governance, HR Committee Charter |

REMUNERATION REPORT  15

15

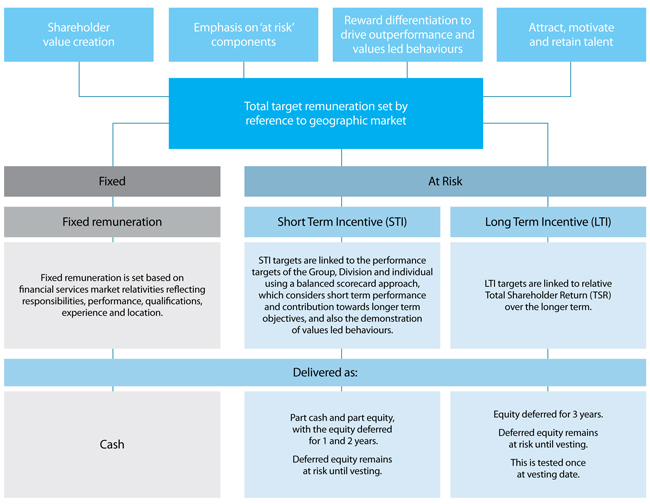

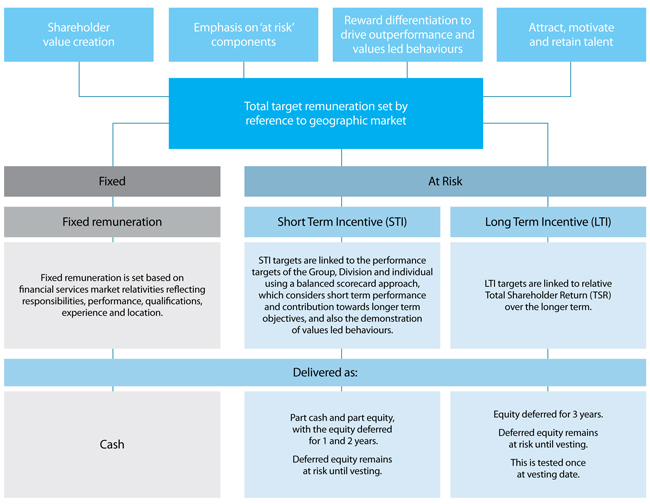

5. Remuneration Strategy and Objectives

ANZ’s remuneration strategies and initiatives shape the Group’s Remuneration Policy, which is approved by the Board. The following principles underpin ANZ’s Remuneration Policy, which is applied globally across ANZ:

| n | | creating and enhancing value for all ANZ stakeholders; |

| n | | emphasis on ‘at risk’ components of total rewards to increase alignment with shareholders and encourage behaviour that supports both the long term financial soundness and the risk management framework of ANZ, and to deliver superior long term total shareholder returns; |

| n | | differentiated rewards in line with ANZ’s culture of rewarding for outperformance and demonstration of values led behaviours; and |

| n | | provide a competitive reward proposition to attract, motivate and retain the highest quality individuals in order to deliver ANZ’s business and growth strategies. |

The key aspects of ANZ’s remuneration strategy for the CEO and Disclosed Executives are set out below:

REMUNERATION OBJECTIVES

6. The Composition of Remuneration at ANZ

The Board aims to find a balance between:

| n | | fixed and at-risk remuneration; |

| n | | short term and long term incentives; and |

| n | | amounts paid in cash and deferred equity. |

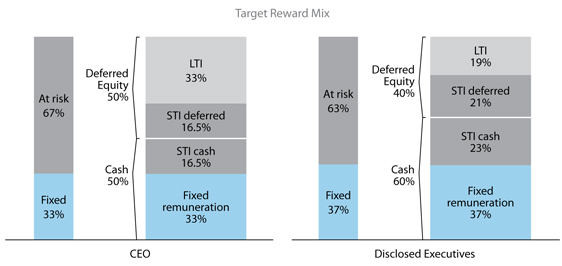

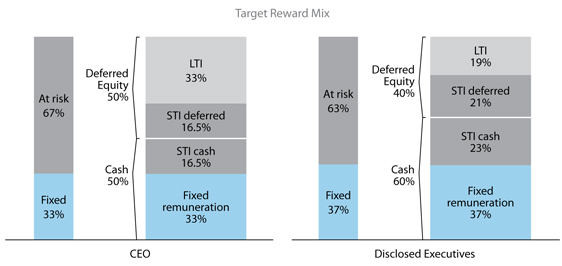

Refer Figure 1 for an overview of the target remuneration mix for the CEO and Disclosed Executives.

16

FIGURE 1: ANNUAL TOTAL REWARD MIX PERCENTAGE (% BASED ON ‘AT TARGET’ LEVELS OF PERFORMANCE)

The CEO’s target remuneration mix is equally weighted between fixed remuneration, STI and LTI, with approximately half of total target remuneration payable in cash in the current year and half allocated as equity and deferred over one, two or three years. The deferred remuneration remains at risk until vesting date.

The target remuneration mix for Disclosed Executives is weighted between fixed remuneration (37%), STI (44%) and LTI (19%), with approximately 60% of total target remuneration payable in cash in the current year and 40% allocated as equity and deferred over one,

two or three years. The deferred remuneration remains at risk until vesting date. The Board has adopted this mix as the most effective reward mechanism to drive strong performance and value for the shareholder in both the short and longer term. In line with that, the STI balanced scorecard contains a combination of short and long term objectives. See page 22.

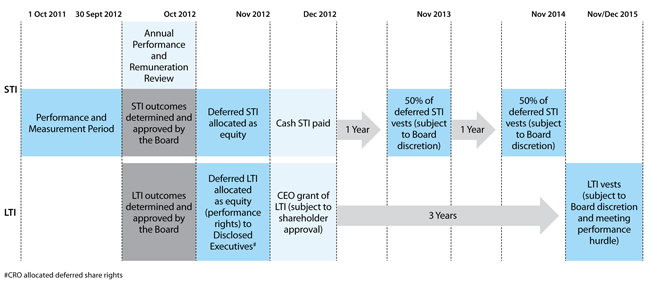

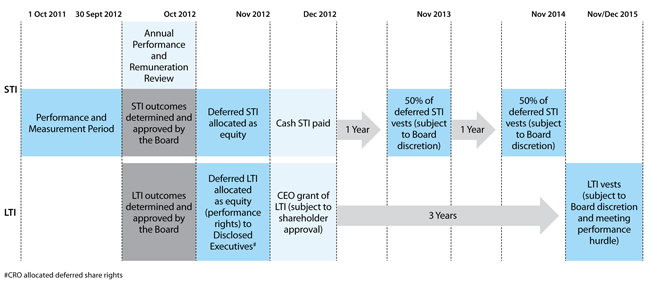

The following diagram demonstrates the time horizon associated with STI and LTI awards.

The reward structure for the CEO and Disclosed Executives is as detailed below. The only exception is the CRO whose remuneration arrangements have been structured differently to preserve the independence of this role and to minimise any conflicts of interest in carrying out the risk control function across the organisation.

The CRO’s role has a greater weighting on fixed remuneration with more limited STI leverage for individual performance and none (either positive or negative) for Group performance. LTI is delivered as unhurdled deferred share rights, with a three year time based hurdle, and is therefore not subject to meeting a TSR performance hurdle.

REMUNERATION REPORT  17

17

6.1 FIXED REMUNERATION

The fixed remuneration amount is expressed as a total dollar amount which can be taken as cash salary, superannuation contributions, and other nominated benefits.

ANZ positions fixed remuneration for the CEO and Disclosed Executives against the relevant financial services market (referencing both domestic and international financial services companies) and takes into consideration role responsibilities, performance, qualifications, experience and location. The financial services market is considered the most relevant comparator as this is the key pool for sourcing talent and where key talent may be lost.

6.2 VARIABLE REMUNERATION

Variable remuneration forms a significant part of the CEO’s and Disclosed Executives’ potential remuneration, providing at risk components that are designed to drive performance in the short, medium and long term. The term ‘variable remuneration’ within ANZ covers both the STI and LTI arrangements.

6.2.1 SHORT TERM INCENTIVES (STI)

The STI provides an annual opportunity for an incentive award. It is assessed against Group, Divisional and individual objectives based on a balanced scorecard of measures and positive demonstration of values led behaviours. Many of the measures relate to contribution towards medium to longer term performance outcomes aligned to ANZ’s strategic objectives as well as annual goals. For the CEO and Disclosed Executives, the weighting of measures in the balanced scorecard will vary to reflect the responsibilities of each role.

STI ARRANGEMENTS

| | | | |

| Purpose | | The STI arrangements support ANZ’s strategic objectives by providing rewards that are significantly differentiated on the basis of achievement against annual performance targets coupled with demonstration of values led behaviours. ANZ’s Employee Reward Scheme (ANZERS) structure and pool is reviewed by the HR Committee and approved by the Board. The size of the overall pool is based on an assessment of the balanced scorecard of measures of the Group. This pool is then distributed between the different Divisions based on their relative performance against a balanced scorecard of quantitative and qualitative measures. |

Performance targets | | In order to focus on achieving individual, Divisional and Group performance objectives a mix of quantitative and qualitative short, medium and long term measures are assessed. Examples of these are given below and further detail is provided on page 22, Section 7.2, STI – Performance and Outcomes: |

| | n | | Finance – profit, capital and liquidity, return on equity, core funding ratio and cost to income ratio; |

| | n | | Customer – customer satisfaction and market share; |

| | n | | Shareholder returns – total shareholder returns and credit rating; |

| | n | | People – employee engagement, leadership and diversity; |

| | n | | Connectivity – growth in Asia Pacific, Europe and America; and |

| | n | | Process/risk – risk management, audit and compliance measures/standards. |

| | Targets are set considering prior year performance, industry standards and ANZ’s strategic agenda. Many of the measures also focus on targets which are set for the current year in the context of progress towards longer term goals. The specific targets and features relating to all these measures have not been provided in detail due to their commercial sensitivity. The validation of performance and achievements against these objectives for: |

| | n | | the CEO involve an independent review and endorsement by the CRO and CFO, followed by review and endorsement by the HR Committee with final outcomes approved by the Board; and |

| | |

| | n | | Disclosed Executives involve a review at the end of the year by the CEO, input on each individual’s risk management from the CRO and input on the financial performance of all key Divisions from the CFO. Preliminary and final review is completed by the HR Committee and final outcomes are approved by the Board. |

| | | The Board reviews performance outcomes against target for each metric, combined with a judgmental assessment of the prioritisation and impact of each outcome relative to overall business performance for both the short and longer term. The method of assessment used to measure performance has been adopted to ensure validation from a risk management and financial performance perspective, along with independent input and recommendation from the HR Committee to the Board for approval. |

Rewarding performance | | The 2012 target STI award level for the CEO represents one third of total target remuneration and for Disclosed Executives approximately 44% of their total target remuneration. The maximum STI opportunity for top performers is up to 250% of the target whereas weaker performers receive a significantly reduced or no incentive payment at all. |

18

| | |

| Mandatory deferral | | Mandatory deferral of a portion of the STI places an increased emphasis on having a variable structure that is flexible, continues to be performance linked, has significant retention elements and aligns the interests of the CEO and Disclosed Executives to shareholders to drive continued performance over the longer term. |

| | For the financial year ending September 2012, the mandatory deferral threshold for STI payments was reduced from $200,000 to $100,000 (subject to a minimum deferral amount of $25,000) with: |

| | n the first $100,000 of STI paid in cash; |

| | n 50% of STI above $100,000 paid in cash; |

| | n 25% of STI above $100,000 deferred in ANZ equity for one year; and |

| | n 25% of STI above $100,000 deferred in ANZ equity for two years. |

| | The deferred component of bonuses paid in relation to the 2012 year is delivered as ANZ deferred shares or deferred share rights. Where deferred share rights are granted, for grants made after 1 November 2012 at the Board’s discretion, any portion of the award which vests may be satisfied by a cash equivalent payment rather than shares. |

| | As the incentive amount has already been earned, there are no further performance measures attached to the shares or share rights, however, they do remain at risk and subject to clawback until the vesting date. |

6.2.2 LONG TERM INCENTIVES (LTI)

The LTI provides an annual opportunity for an equity award deferred for three years that aligns a significant portion of overall remuneration to shareholder value over the longer term.

LTI awards remain at risk and subject to clawback until vesting and must meet or exceed a relative TSR performance hurdle (excluding the CRO who is allocated deferred share rights).

LTI ARRANGEMENTS

| | | | |

| Type of equity awarded | | LTI is delivered to the CEO and Disclosed Executives as 100% performance rights. A performance right is a right to acquire a share at nil cost, subject to meeting time and performance hurdles. Upon exercise, each performance right entitles the CEO and Disclosed Executives to one ordinary share. The future value of the grant may range from zero to an undefined amount depending on performance against the hurdle and the share price at the time of exercise. For grants made after 1 November 2012, at the Board’s discretion, any portion of the award which vests may be satisfied by a cash equivalent payment rather than shares. |

Time restrictions | | Performance rights awarded to the CEO and Disclosed Executives will be tested against the performance hurdle at the end of three years. A three year time based hurdle provides a reasonable period to align reward with shareholder return and also acts as a vehicle to retain the CEO and Disclosed Executives. If the performance rights do not achieve the required performance hurdle they are forfeited at that time. |

Performance hurdle | | The performance rights granted to the CEO and Disclosed Executives have a single long term performance measure. The performance rights are designed to reward the CEO and Disclosed Executives if the Group’s TSR is at or above the median TSR of a group of peer companies over a three year period. TSR represents the change in the value of a share plus the value of reinvested dividends paid. TSR was chosen as the most appropriate comparative measure as it focuses on the delivery of shareholder value and is a well understood and tested mechanism to measure performance. |

Vesting schedule | | The proportion of performance rights that become exercisable will depend upon the TSR achieved by ANZ relative to the companies in the comparator group at the end of the three year period. |

| | An averaging calculation is used for TSR over a 90 day period for start and end values in order to reduce the impact of share price volatility. To ensure an independent TSR measurement, ANZ engages the services of an external organisation (Mercer (Australia) Pty Ltd) to calculate ANZ’s performance against the TSR hurdle. The level of performance required for each level of vesting, and the percentage of vesting associated with each level of performance, are set out below. The performance rights lapse if the performance condition is not met. There is no re-testing. |

| | If the TSR of ANZ: | | The percentage of performance rights which will vest is: |

| | |

| | Does not reach the 50th percentile of the TSR of the Comparator Group | | 0% |

| | |

| | Reaches or exceeds the 50th percentile of the TSR of the Comparator Group but does not reach the 75th percentile | | 50%, plus 2% for every one percentile increase above the 50th percentile |

| | |

| | Reaches or exceeds the 75th percentile of the TSR of the Comparator Group | | 100% |

REMUNERATION REPORT  19

19

| | | | | | |

| Comparator group | | The ANZ comparator group currently consists of the following nine companies: |

| | n | | AMP Limited | | n National Australia Bank Limited |

| | n | | ASX Limited | | n QBE Insurance Group Limited |

| | n | | Commonwealth Bank of Australia Limited | | n Suncorp-Metway Limited |

| | n | | Insurance Australia Group Limited | | n Westpac Banking Corporation |

| | n | | Macquarie Group Limited | | |

| | | These companies represent domestic financial services companies and are considered by the Board as the most appropriate comparator for ANZ at this time, given the majority of our business is generated in Australia and New Zealand. |

| | | | | | |

Size of LTI grants | | Refer to Section 8.2, Chief Executive Officer (CEO) for details on the CEO’s LTI arrangements. The size of individual LTI grants for Disclosed Executives is determined by reference to market practice, an individual’s level of responsibility, their performance and the assessed potential of the Disclosed Executive. The target LTI for Disclosed Executives is around 19% of total target remuneration. Disclosed Executives are advised of the dollar value of their LTI grant, which is then converted into a number of performance rights based on an independent valuation. Refer to section 9.1, Equity Valuations for further details on the valuation approach and inputs. |

| | LTI allocations are made annually after the annual performance and remuneration review which occurs in October. The following example uses the November 2011 allocation value: |

| | n | | LTI award value (communicated value) | | $500,000 |

| | n | | approved allocation value per performance right (independently valued by external advisors) | | $9.03 |

| | n | | number of performance rights allocated ($500,000/$9.03) | | 55,370 |

LTI ARRANGEMENTS FOR THE CRO

| | |

Deferred share rights | | The CRO is the only Disclosed Executive to receive LTI deferred share rights. |

| | Deferred share rights are subject to a time-based vesting hurdle of three years, during which time they are held in trust. The value used to determine the number of LTI deferred share rights to be allocated is based on an independent valuation, as detailed in Section 9.1, Equity Valuations. For grants made after 1 November 2012, at the Board’s discretion, any portion of the award which vests may be satisfied by a cash equivalent payment rather than shares. |

6.3 OTHER REMUNERATION ELEMENTS

CLAWBACK

The Board has on-going and absolute discretion to adjust performance-based components of remuneration (including previously deferred equity or cash) downwards, or to zero, at any time, including after the grant of such remuneration, where the Board considers such an adjustment is necessary to protect the financial soundness of ANZ or to meet unexpected or unknown regulatory requirements, or if the Board subsequently considers that having regard to information which has come to light after the grant of deferred equity/cash, the deferred equity/ cash was not justified.

Prior to any scheduled release of deferred equity/cash, the Board considers whether any downward adjustment should be made.

HEDGING AND MARGIN LENDING PROHIBITION

As specified in the Trading in ANZ Securities Policy and in accordance with the Corporations Act 2001, equity allocated under ANZ incentive schemes must remain at risk until fully vested (in the case of deferred shares) or exercisable (in the case of options, deferred share rights or performance rights). As such, it is a condition of grant that no schemes are entered into, by an individual or their associated persons, that specifically protects the unvested value of shares, options, deferred share rights or performance rights allocated.

Doing so would constitute a breach of the grant conditions and would result in the forfeiture of the relevant shares, options, deferred share rights or performance rights.

ANZ also prohibits the CEO and Disclosed Executives providing ANZ securities in connection with a margin loan or similar financing arrangements which maybe subject to a margin call or loan to value ratio breach.

To monitor adherence to this policy, ANZ’s CEO and Disclosed Executives are required to sign an annual declaration stating that they and their associated persons have not entered into (and are not currently involved in) any schemes to protect the value of their interests in any ANZ securities. Based on the 2012 declarations, ANZ can advise that the CEO and Disclosed Executives are fully compliant with this policy.

SHAREHOLDING GUIDELINES

The CEO and Disclosed Executives are:

| n | | expected to accumulate ANZ shares over a five year period, to the value of 200% of their fixed remuneration and to maintain this shareholding while an executive of ANZ; |

| n | | shareholdings for this purpose include all vested and allocated (but unvested) equity which is not subject to performance hurdles; and |

| n | | the CEO and all Disclosed Executives have met or, if less than five years tenure, are on track to meet their minimum shareholding guidelines requirement. |

CESSATION OF EMPLOYMENT PROVISIONS

The provisions that apply for STI and LTI awards in the case of cessation of employment are detailed in Sections 8.2 CEO’s Contract Terms and 8.3 Disclosed Executives’ Contract Terms.

CONDITIONS OF GRANT

The conditions under which STI (deferred shares and deferred share rights) and LTI (performance rights and deferred share rights) are granted are approved by the Board in accordance with the rules of the ANZ Employee Share Acquisition Plan and/or the ANZ Share Option Plan.

7. Linking Remuneration to Balanced Scorecard Performance

7.1 ANZ PERFORMANCE

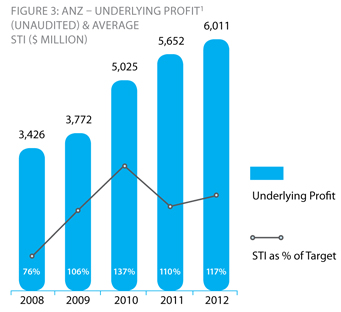

TABLE 2: ANZ’S FINANCIAL PERFORMANCE 2008 – 2012

| | | | | | | | | | | | | | | | | | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 |

Statutory profit ($m) | | | 5,661 | | | | 5,355 | | | | 4,501 | | | | 2,943 | | | 3,319 |

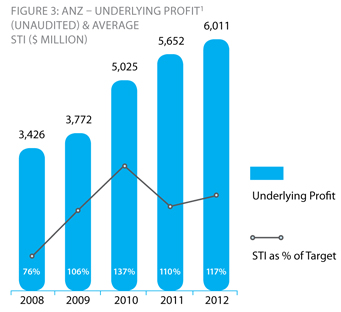

Underlying profit1 (Unaudited) | | | 6,011 | | | | 5,652 | | | | 5,025 | | | | 3,772 | | | 3,426 |

Underlying return on equity (ROE) (%) | | | 15.6% | | | | 16.2% | | | | 15.5% | | | | 13.3% | | | 15.1% |

Underlying earnings per share (EPS) | | | 225.3 | | | | 218.4 | | | | 198.7 | | | | 168.3 | | | 175.9 |

Share price at 30 September ($) | | | 24.75 | | | | 19.52 | | | | 23.68 | | | | 24.39 | | | 18.75 |

Total dividend (cents per share) | | | 145 | | | | 140 | | | | 126 | | | | 102 | | | 136 |

Total shareholder return (12 month %) | | | 35.4 | | | | (12.6) | | | | 1.9 | | | | 40.3 | | | (33.5) |

| 1 | Profit has been adjusted for non-core items to arrive at underlying profit, the result for the ongoing business activities of the Group. These adjustments have been determined on a consistent basis with those made in prior periods. The adjustments made in arriving at underlying earnings are included in statutory profit which is subject to audit within the context of the Group statutory audit opinion. Underlying profit is not audited; however, |

| | the external auditor has informed the Audit Committee that the adjustments, and the presentation thereof, are based on the guidelines released by the Australian Institute of Company Directors (AICD) and the Financial Services Institute of Australasia (FINSIA). Further details on underlying profit are provided on page 55. |

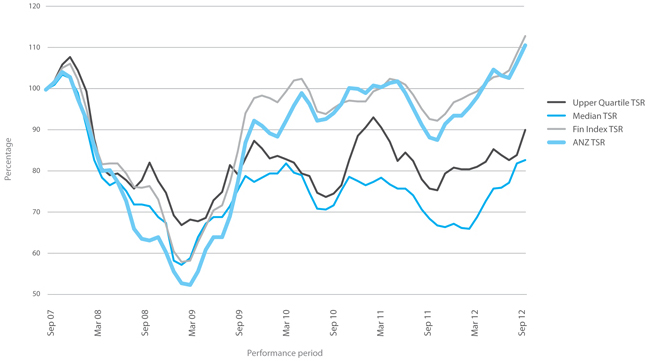

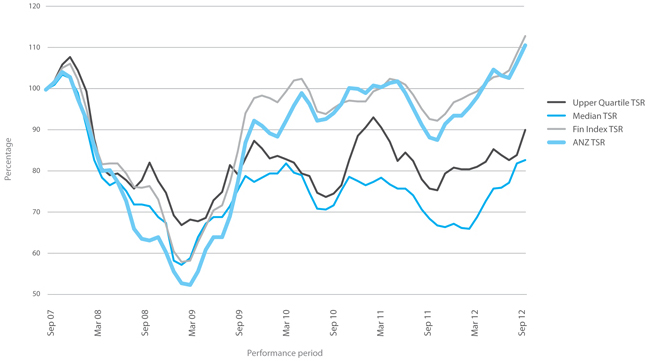

Figure 2 compares ANZ’s TSR performance against the median TSR and upper quartile TSR of the LTI comparator group and the S&P/ASX 200 Banks Accumulation Index (Fin Index) over the 2008 to 2012

measurement period. ANZ’s TSR performance has well exceeded the upper quartile TSR of the LTI comparator group during 2012.

FIGURE 2: ANZ 5-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN PERFORMANCE

REMUNERATION REPORT  21

21

7.2 STI – PERFORMANCE AND OUTCOMES

ANZ uses a balanced scorecard to measure performance in relation to the Group’s main incentive programs. The scorecard provides a framework whereby a combination of measures can be applied to ensure a broader long term strategic focus on driving shareholder value as well as a focus on annual priorities.

In 2012, the Human Resources Committee refined the balanced scorecard to align it to the Group’s key strategic priorities, resulting in six categories containing a range of measures. Each of the six categories are broadly equal in weight. These measures were agreed at the beginning of the financial year.

The Board has assessed the Bank’s overall 2012 performance as solid across the range of balanced score card measures. Overall spend approved by the Board for the main short-term incentive pools was at below target levels with a range of underlying outcomes for business units and individuals, in line with ANZ’s objectives of differentiating reward based on performance.

The following table provides examples of some of the key measures used in 2012 for assessing performance for the purpose of determining short term incentive pools. The list provides examples of some of the measures under each of the balanced scorecard categories.

| | | | |

Category | | Measure | | Outcome1 |

Finance | | | | On Target: |

| | Profit | �� | A record underlying profit after tax of $6,011m, up 6% on the prior year. The total dividend for 2012 was $1.45 per share up 4%. Economic profit2 of $2,539 million was up 1% on 2011 and was impacted by continuing regulatory requirements to hold higher capital levels and by the impact of lower interest rates on capital earnings. |

| | Capital and Liquidity | | Building long term shareholder value requires a resilient balance sheet. In the current economic environment, measures for Capital, Liquidity and Funding are regarded as particularly important. At balance date the Group’s Tier 1 Capital Ratio was 10.8% and Liquid Assets held were well in excess of regulatory requirements. The Bank is currently carrying $17 billion more in capital than pre the Global Financial Crisis (with $11 billion being balance sheet strengthening and $6 billion to support growth). |

| | Return on Equity | | Underlying ROE is measured against longer-term targets and while 2012 was slightly lower than 2011, this was as a result of the requirement to build our capital ratios in a lower interest environment. |

| | Core Funding Ratio (CFR) | | Over the year, ANZ has maintained its CFR at comfortable levels. |

| | | Cost to Income Ratio | | Overall business growth was good and in line with strategic objectives. Productivity improved with the cost to income ratio reduced 20bps year on year and 110bps half on half based on significant cost reduction programs across the bank. |

Customer | | | | Slightly below Target: |

| | Customer satisfaction (based on external survey outcomes) | | ANZ tracks customer satisfaction across its businesses as part of a group of indicators of longer term performance trends. ANZ aims to achieve top quartile customer satisfaction scores in each business based on external surveys. |

| | | | | In 2012 top quartile scores were achieved in Australia in the Corporate and Institutional segments and in the Institutional segment in New Zealand. Asia scores improved significantly and New Zealand Retail scores remained steady. However, in Australia Retail the initial reaction to changes to our mortgage pricing methodology contributed to a decline in scores although they have started to return to a competitive level and there was no impact to customer acquisition, retention or market share. |

Shareholder returns | | | | Out Performed: |

| | Total Shareholder return (TSR) | | ANZ aims to outperform peers both in terms of financial strength and earnings performance. TSR in 2012 was very strong at 35.4% placing us in the top quartile of Australian peers (comparator group). |

| | Maintain Strong Credit Rating | | The maintenance of a strong credit rating is fundamental to the ongoing stability of the Group and there have been no changes to the Group’s rating during the period. |

22

| | | | |

| Category | | Measure | | Outcome1 |

People | | | | On Target: |

| | |

| | Employee engagement | | An engaged workforce is regarded as an important driver of long term performance. Despite difficult business conditions and significant bank-wide changes over the year, employee engagement remained steady at 70% in 2012. |

| | |

| | Senior leaders as role models | | Strong score improvements were seen in key areas like ‘Inspirational Leadership’ with various programs and activities re-energising the approach and focus on values-led leadership. |

| | |

| | | Workforce Diversity | | ANZ is focused on increasing the diversity of its workforce and targeted an increase in women in management; however results at senior levels remained flat year on year. |

Connectivity | | | | On Target: |

| | |

| | | Growth in Asia Pacific, Europe and America | | ANZ aspires to be the most respected bank in the Asia Pacific region using super regional connectivity to better meet the needs of customers which are increasingly linked to regional capital, trade and wealth flows. One important measure of the success of the super regional strategy is the growth in total Network revenues (revenue arising from having a meaningful business in Asia Pacific, Europe and America regardless of whether the revenue is subsequently booked within the region or in Australia or New Zealand). Network revenues reached 21% of Group revenue in 2012. This significantly differentiates ANZ against its Australian peer group. |

Process/ Risk | | | | On Target: |

| | |

| | Number of outstanding internal audit items | | ANZ Global Internal Audit conducts an ongoing and rigorous review process to identify weaknesses in procedures and compliance with policies. In 2012 there was a low, stable number of outstanding items. |

| | |

| | | Risk Culture | | During 2012 there was a continued strengthening of the risk culture across ANZ. |

| 1 | Software impairment charges of $274 million have been taken into account in assessing performance against measures. |

| 2 | Economic profit is an unaudited risk adjusted profit measure determined by adjusting underlying profit for economic credit costs, the benefit of imputation credits and the cost of capital. |

8. 2012 Remuneration

8.1 NON EXECUTIVE DIRECTORS (NEDs)

Principles underpinning the remuneration policy for NEDs.

| | |

| Principle | | Comment |

Aggregate Board and Committee fees are within the maximum annual aggregate limit approved by shareholders | | The current aggregate fee pool for NEDs of $3.5 million was approved by shareholders at the 2008 Annual General Meeting. The annual total of NEDs’ fees, including superannuation contributions, is within this agreed limit. Retirement benefits accrued as at September 2005 are not included within this limit. |

| | Shareholder approval will be sought at the 2012 Annual General Meeting for an increase to the NED fee pool from $3.5 million to $4 million, the first increase to the pool since 2008. Refer to the 2012 Notice of Meeting for more detail. |

Fees are set by reference to key considerations | | Board and Committee fees are set by reference to a number of relevant considerations including: |

| | n general industry practice and best principles of corporate governance; n the responsibilities and risks attached to the role of NEDs; n the time commitment expected of the NEDs on Group and Company matters; and n reference to fees paid to NEDs of comparable companies. |

| | ANZ compares NED fees to a comparator group of Australian listed companies with a similar size market capitalisation, with particular focus on the major financial services institutions. This is considered an appropriate group, given similarity in size, nature of work and time commitment required by NEDs. |

The remuneration structure preserves independence whilst aligning interests of NEDs and shareholders | | So that independence and impartiality is maintained, fees are not linked to the performance of the Company and NEDs are not eligible to participate in any of the Group’s incentive arrangements. |

REMUNERATION REPORT  23

23

Components of NED Remuneration

NEDs receive a fee for being a Director of the Board, and additional fees for either chairing or being a member of a Board Committee. The Chairman of the Board does not receive additional fees for service on a Board Committee.

The Board agreed not to increase the individual NED fees for 2012. For details of remuneration paid to NEDs for the years 2011 and 2012, refer to Table 3.

| | | | | | | | |

| Elements | | Details | | | | | | |

| Board/Committee fees | | Board Chairman Fee | | $775,000 | | | | |

| per annum – 2012 | | Board NED Base Fee | | $210,000 | | | | |

| | | | |

| | | Committee Fees | | Committee Chair | | Committee Member | | |

| | Audit | | $65,000 | | $32,500 | | |

| | Governance | | $35,000 | | $15,000 | | |

| | Human Resources | | $55,000 | | $25,000 | | |

| | Risk | | $57,000 | | $30,000 | | |

| | | Technology | | $35,000 | | $15,000 | | |

Post – employment Benefits | | Superannuation contributions are made at a rate of 9% of base fee (but only up to the Government’s prescribed maximum contributions limit) which satisfies the Company’s statutory superannuation contributions. Contributions are not included in the base fee. |

| |

| | The ANZ Directors’ Retirement Scheme was closed effective 30 September 2005. Accrued entitlements relating to the ANZ Directors’ Retirement Scheme were fixed at 30 September 2005 and NEDs had the option to convert these entitlements into ANZ shares. Such entitlements, either in ANZ shares or cash, have been carried forward or will be transferred to the NED when they retire from the ANZ Board (including interest accrued at the 30 day bank bill rate for cash entitlements). |

| |

| | The accrued entitlements for current NEDs fixed under the ANZ Directors’ Retirement Scheme as at 30 September 2005 were as follows: |

| | | | |

| | n G Clark | | $83,197 | | | | |

| | | | |

| | n D Meiklejohn | | $64,781 | | | | |

| | | | |

| | | n J Morschel | | $60,459 | | | | |

Shareholdings of NEDs

The movement in shareholdings during the reporting period (held directly, indirectly and by related parties) is provided in Notes to the Financial Statements – note 46 on page 184.

The NED shareholding guidelines require Directors to accumulate shares, over a five year period from appointment, to the value of 100% (200% for the Chairman) of the base annual NED fee and to maintain this shareholding while a Director of ANZ. Directors have agreed that where their holding is below this guideline they will direct a minimum of 25% of their fees each year toward achieving this shareholding.

All NEDs have met or, if less than five years appointment, are on track to meet their minimum shareholding guidelines requirement.

NED Statutory Remuneration

Remuneration details of NEDs for 2011 and 2012 are set out in Table 3. There was no increase in NED fees throughout the year. Overall, there is an increase in total NED remuneration year on year due to the commencement of Ms Dwyer in April 2012 and the prescribed increase in Superannuation Guarantee Contributions.

24

TABLE 3: NED REMUNERATION FOR 2012 AND 2011

| | | | | | | | | | | | | | | | | | |

| | | | | | Short-Term NED Benefits | | | | Post-Employment | | | |

| | | Financial Year | | | Fees1 $ | | | Non monetary benefits $ | | | | Super contributions $ | | Total remuneration2,3 $ | |

Non-Executive Directors (NEDs) | | | | | | | | | | | | | | | | | | |

J Morschel | | | 2012 | | | | 775,000 | | | – | | | | 15,949 | | | 790,949 | |

| | | | 2011 | | | | 775,000 | | | – | | | | 15,343 | | | 790,343 | |

G Clark | | | 2012 | | | | 300,000 | | | – | | | | 15,949 | | | 315,949 | |

| | | | 2011 | | | | 300,000 | | | – | | | | 15,343 | | | 315,343 | |

P Dwyer4 | | | 2012 | | | | 136,250 | | | – | | | | 8,061 | | | 144,311 | |

P Hay | | | 2012 | | | | 302,500 | | | – | | | | 15,949 | | | 318,449 | |

| | | | 2011 | | | | 302,500 | | | – | | | | 15,343 | | | 317,843 | |

H Lee | | | 2012 | | | | 280,000 | | | – | | | | 15,949 | | | 295,949 | |

| | | | 2011 | | | | 280,000 | | | – | | | | 15,343 | | | 295,343 | |

I Macfarlane | | | 2012 | | | | 314,500 | | | – | | | | 15,949 | | | 330,449 | |