Exhibit 99.1

Australia and New Zealand Banking Group Limited

ABN 11 005 357 522

Half Year

31 March 2014

Consolidated Financial Report

Dividend Announcement

and Appendix 4D

The Consolidated Financial Report and Dividend Announcement contains information required by Appendix 4D of the Australian Securities Exchange Listing Rules. It should be read in conjunction with ANZ’s 2013 Annual Report and is lodged with the Australian Securities Exchange under listing rule 4.2A.

| | |

| RESULTS FOR ANNOUNCEMENT TO THE MARKET | | APPENDIX 4D |

| | |

| Name of Company: | | Australia and New Zealand Banking Group Limited |

| | ABN 11 005 357 522 |

Report for the half year ended 31 March 2014

| | | | | | | | |

| Operating Results1 | | | | | A$ million | |

| | |

Operating income | | ñ | 7% to | | | | 9,518 | |

| | |

Net statutory profit attributable to shareholders | | ñ | 15% to | | | | 3,381 | |

| | |

Cash profit2 | | ñ | 11% to | | | | 3,515 | |

| | | | | | | | |

| Dividends3 | | Cents

per

share | | | Franked amount4 per share | |

| | |

Proposed interim dividend | | | 83 | | | | 100 | % |

| | |

Record date for determining entitlements to the proposed 2014 interim dividend | | | | | | | 13 May 2014 | |

| | |

Payment date for the proposed 2014 interim dividend | | | | | | | 1 July 2014 | |

Dividend Reinvestment Plan and Bonus Option Plan

Australia and New Zealand Banking Group Limited (ANZ) has a Dividend Reinvestment Plan (DRP) and a Bonus Option Plan (BOP) that will operate in respect of the 2014 interim dividend. For the 2014 interim dividend, ANZ intends to provide shares under the DRP and BOP through the issue of new shares. The ‘Acquisition Price’ to be used in determining the number of shares to be provided under the DRP and BOP will be calculated by reference to the arithmetic average of the daily volume weighted average sale price of all fully paid ANZ ordinary shares sold in the ordinary course of trading on the ASX during the ten trading days commencing on 16 May 2014, and then rounded to the nearest whole cent. Shares provided under the DRP and BOP will rank equally in all respects with existing fully paid ANZ ordinary shares. Election notices from shareholders wanting to commence, cease or vary their participation in the DRP or BOP for the 2014 interim dividend must be received by ANZ’s Share Registrar by 5.00pm (Australian Eastern Standard Time) on 14 May 2014. Subject to receiving effective contrary instructions from the shareholder, dividends payable to shareholders with a registered address in the United Kingdom (including the Channel Islands and the Isle of Man) or New Zealand will be converted to Pounds Sterling and New Zealand dollars respectively at an exchange rate calculated on 16 May 2014.

| 1 | Compared to prior comparable period (half year ended 31 March 2013). |

| 2 | Statutory profit has been adjusted to exclude non-core items to arrive at cash profit, and has been provided to assist readers to understand the results for the ongoing activities of the Group. The net after tax adjustment was an increase to cash profit of $134 million made up of several items. Refer pages 83 to 92 for further details. |

| 3 | There is no conduit foreign income attributed to the dividends. |

| 4 | It is proposed that the interim dividend will be fully franked for Australian tax purposes (30% tax rate) and carry New Zealand imputation credits of NZD 10 cents per ordinary share. |

| | |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | | ABN 11 005 357 522 |

CONSOLIDATED FINANCIAL REPORT, DIVIDEND ANNOUNCEMENT AND APPENDIX 4D

Half year ended 31 March 2014

| | | | |

| CONTENTS | | PAGE | |

| |

Section 1 - Media release | | | 3 | |

| |

Section 2 - Snapshot | | | 7 | |

| |

Section 3 - CEO overview | | | 13 | |

| |

Section 4 - CFO overview | | | 15 | |

| |

Section 5 - Segment review | | | 41 | |

| |

Section 6 - Geographic review | | | 75 | |

| |

Section 7 - Profit reconciliation | | | 83 | |

| |

Section 8 - Condensed consolidated financial statements | | | 93 | |

| |

Section 9 - Supplementary information | | | 131 | |

| |

Definitions | | | 145 | |

| |

ASX Appendix 4D Cross Reference Index | | | 148 | |

| |

Alphabetical Index | | | 149 | |

This Consolidated Financial Report and Dividend Announcement has been prepared for Australia and New Zealand Banking Group Limited (the “Company”) together with its subsidiaries which are variously described as “ANZ”, “Group”, “ANZ Group”, “us”, “we” or “our”.

All amounts are in Australian dollars unless otherwise stated. The information on which the Condensed Consolidated Financial Statements are based, has been reviewed by the Group’s auditors, KPMG. The Company has a formally constituted Audit Committee of the Board of Directors. The signing of these Condensed Consolidated Financial Statements was approved by resolution of a Committee of the Board of Directors on 30 April 2014.

When used in this Results Announcement the words “estimate”, “project”, “intend”, “anticipate”, “believe”, “expect”, “should” and similar expressions, as they relate to ANZ and its management, are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. ANZ does not undertake any obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Unless otherwise noted, all figures relate to the half year ended 31 March 2014. The term “prior comparable period” (PCP) refers to the half year ended 31 March 2013 and the term “previous half” (HOH) refers to the half year ended 30 September 2013.

| | |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | | ABN 11 005 357 522 |

This page has been left blank intentionally

| | |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | | ABN 11 005 357 522 |

Media Release

ANZ 2014 Half Year Result

– good result demonstrates strategy is delivering diversified growth and stronger returns –

Performance Highlights – 1H 2014 compared to 1H 2013 (PCP)1

| • | | Statutory profit $3.4 billion up 15%; Cash profit2$3.5 billion up 11%. |

| • | | Fully franked Interim Dividend of 83 cents per share an increase of 14%. |

| • | | Income up 3.6% and expenses up 1.7% (FX adjusted). |

| • | | Cost to income ratio improved a further 20 basis points to 44.3%. |

| • | | Return on equity steady at 15.5% with earnings per share up 10% to 128.7 cents. |

| • | | Customer deposits grew 13%, net loans and advances up 12%. |

| • | | Provision charge of $528 million, 12% lower. |

ANZ Chief Executive Officer Mike Smith said: “This is a good set of results. They demonstrate consistent progress with ANZ’s long-term strategy to grow in our core franchises in Australia and New Zealand, to build a significant and profitable franchise in Asia Pacific, and to establish common infrastructure and processes that improve productivity and reduce risk.

“The diversification this strategy provides is now delivering a differentiated proposition for our customers and improved returns for shareholders.

“Our international business, particularly Asia, is firing on all cylinders with revenue and profits again growing strongly, and a sustained improvement in returns. Profits from International and Institutional in Asia Pacific, Europe and Americas (APEA) are up 43% based on significant growth in customer numbers and in products that support regional trade and investment flows such as foreign exchange, cash management and trade finance.

“Since we launched our strategy six years ago, the compound annual growth rate in earnings from Asia has been 37% and ANZ is now being consistently rated a top 4 Corporate Bank in Asia by Greenwich Associates3.

“In Australia we are seeing ongoing benefits emerge from the investment in our Banking on Australia program which includes new digital solutions for our customers. We have developed greater scale based on market share growth in home lending, small business lending and retail deposits. Business confidence in Australia is recovering more slowly than expected however, and in some segments growth remains subdued with competition placing pressure on margins. Costs were carefully managed in this environment.

“In New Zealand after several years of hard work our business is in a winning position. ANZ’s move to a single brand and technology platform together with New Zealand’s economic recovery saw volume growth, improved productivity and lower provisions.

“Global Wealth continues to focus on improving the customer experience with wealth solutions increasingly integrated with our banking offering and more options for self directed customers. Our revenue performance was positive, underpinned by strong growth in funds under management, favourable claims and lapse experience along with growth in Private Wealth.

“Across the Group, operational and risk outcomes continue to be strong. Operational productivity continues to improve, we increased the volume of transactions globally by around 8% on average while reducing operations costs 4% (FX adjusted) on the prior year.

“Management actions are driving further improvements in the quality of the lending book. In International and Institutional Banking 77% of Institutional customers are now rated investment grade up from 60% in 2008, and this continues to drive a significant reductions in Group impaired assets.

| 1 | All comparisons are Half Year to 31 March 2014 compared to Half Year to 31 March 2013 and on a cash basis unless otherwise noted. |

| 2 | Statutory profit has been adjusted to exclude non-core items to arrive at Cash profit, the result for the ongoing activities of the Group. |

| 3 | Greenwich Associates 2013 Asian Large Corporate Banking Study |

3

| | |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | | ABN 11 005 357 522 |

“Our focus on the customer and productivity program coupled with momentum from our diversified growth opportunities has set us up for a good performance this year,” Mr Smith said.

PERFORMANCE BY DIVISION4

AUSTRALIA

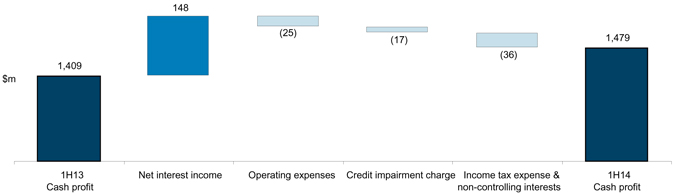

Building on a strong performance in 2013, the Australia Division grew profit 5%, reflecting 4% income growth, a 2% increase in expenses and a 4% increase in the provision charge. Lending grew 6% with customer deposits up 7%.

ANZ had the strongest home loan growth of the major banks over the past year and has grown home loans at above system for 17 consecutive quarters. Small Business Banking has performed particularly strongly with lending up 16%. To date ANZ has lent $1.2 billion to new Australian small businesses as part of our $2 billion pledge, while maintaining credit quality.

Execution of the Banking on Australia program is building business momentum. Simpler products, streamlined processes and improving distribution capability has seen growth in customer numbers. We’ve brought 110,000 net new customers on board across Retail and Commercial in the last year while simultaneously reducing average monthly customer complaints by 9%.

Back office efficiency programs, increased training and iPad enablement have increased frontline Commercial team customer contact by 20%. ANZ is now equal first in Commercial customer satisfaction, up from fourth and customer numbers are up 26,000 year on year.

We have strengthened our position in mobile and digital channels. More than half our customers are digital users including 1.1 million active ANZ goMoney users with $78 billion in goMoney transactions processed to date and we have rolled out 400 Smart ATMs across the branch network. Commercial FastPay transactions have grown at a compound monthly rate of 43% since launch in October 2012.

INTERNATIONAL AND INSTITUTIONAL BANKING (IIB)5

International and Institutional Banking profit grew 9% with income up 4% and expenses up 3%, along with further credit quality improvements driving provisions down 18%. The business continues to diversify its earnings with 52% of income now coming from outside Australia and New Zealand and cash profit from APEA up 31%.

Ongoing focus on higher return less capital intensive flow products delivered volume increases in Foreign Exchange turnover (up 37%), Cash Management deposits (up 20%) and funded Trade and Supply Chain (up 6%).

The Global Markets business which services customers Foreign Exchange, Interest Rate management and Commodities needs, delivered another strong result with income up 5% primarily driven by customer sales. Income from servicing customers in Asia increased by 34% with particularly strong sales in Foreign Exchange.

Institutional and Commercial customer numbers grew 12%. Our strong relationship focus is being recognised in key customer surveys, including the Greenwich Associates 2013 Asian Large Corporate Banking Study in which ANZ has achieved the fastest growth in ranking in the study’s history and a consistent top 5 outcome over the past 3 years, including a top 4 in the last two years.6

Targeted growth in Asia Pacific is delivering a shorter duration, lower risk balance sheet with just under half of our Institutional lending assets in Asia Pacific being Trade Finance related.

NEW ZEALAND(all comparisons are in NZD)

The New Zealand Division grew profit 21%. Market share growth, productivity and credit quality improvements were key features of the result with income up 3%, expenses down 6% and the provision charge declining by $73 million. Lending grew 5% with customer deposits up 7%.

Under a single ANZ brand the business is now beginning to leverage its scale while also improving customer experience. Brand consideration is at an all time high and leads the major banks. ANZ is now number one for new mortgages in all of the larger New Zealand cities including Christchurch and Auckland.

| 4 | All comparisons are Half Year to 31 March 2014 compared to Half Year to 31 March 2013 and on a cash basis unless otherwise noted. |

| 5 | All figures are FX adjusted |

| 6 | Greenwich Associates 2013 Asian Large Corporate Banking Study |

4

| | |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | | ABN 11 005 357 522 |

Our Commercial business has grown across all regions with overall growth faster than system year to date. Small Business Banking has been particularly strong, up 14% driven by growth in customer numbers (up 29% on the prior year).

We are investing in digital capability to grow customer numbers and increase customer satisfaction and to improve our frontline capability and productivity. Active ANZ goMoney users are up 96% with the App rated the number one Finance app in both the Apple App store and on Google Play7. In Commercial, ANZ FastPay has had over 4,000 downloads since its launch in December 2013. Over the counter transactions in branches have reduced by 11% over the year as customers take advantage of our self service technology including Smart ATMs.

GLOBAL WEALTH

The Global Wealth Division grew profit 11% with operating income up 8% and expenses up 7%. Underlying performance was strong driven by growth in funds under management (FUM) and inforce insurance premiums, as well as an improved claims and lapse experience, with retail lapse rates in Australia declining a further 120 bps across the year.

Global Wealth is focused on making it easier for customers to connect, protect and grow their wealth using simple, direct solutions such as ANZ Smart Choice Super which now has over 270,000 customers and continues to build momentum. Wealth solutions are increasingly being integrated into broader customer banking options with wealth solutions held by ANZ customers up 10% across the year.

Private Wealth grew operating income by 28%, with customer deposits up 26% and lending up 4%.

CREDIT QUALITY

The quality of the loan book continues to strengthen with the provision charge of $528 million 12% lower.

Gross impaired assets decreased 23%. Impaired assets are down 32% over the last two years, and are lower than at any point since September 2008 despite 46% growth in the lending book in that time8. While ANZ continues to expect that the provision charge for FY14 will be around 10% lower than for FY139 it maintains a strong provision balance.

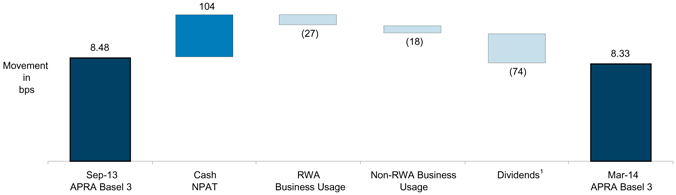

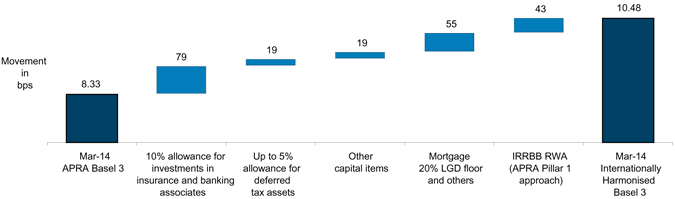

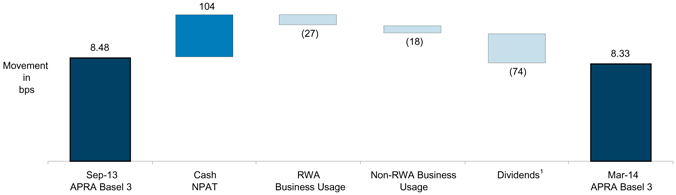

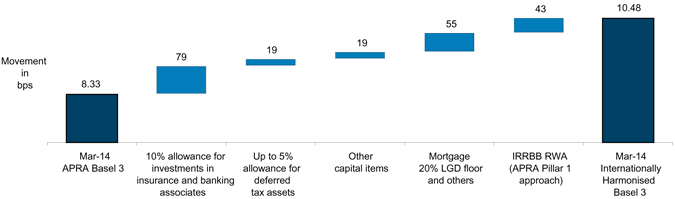

CAPITAL

ANZ remains well capitalised with an APRA Common Equity Tier One ratio at 31 March of 8.33% or 10.5% on an internationally harmonised Basel 3 basis.

DIVIDEND

The fully franked dividend of 83 cps, up 14%, equates to a payment of $2.3 billion to shareholders. The increased dividend reflects our stronger performance and a gradual rebalancing towards a more even split between the Interim and Final Dividend amounts, maintaining a payout ratio towards the upper end of the 65 to 70% of Cash Profit range.

| | |

| For media enquiries contact: | | |

| |

| Paul Edwards | | Stephen Ries |

| Group GM, Corporate Communications | | Head of Media Relations |

| Tel: +61-3-8654 9999 or +61-434-070101 | | Tel: +61-3-8654 3659 or +61-409-655551 |

| Email:Paul.Edwards@anz.com | | Email:Stephen.Ries@anz.com |

| |

| For investor and analyst enquiries contact: | | |

| |

| Jill Craig | | Ben Heath |

| Group GM, Investor Relations | | Senior Manager, Investor Relations |

| Tel: +61-3-8654 7749 or +61-412-047448 | | Tel: +61-3-8654 7793 or +61-435-655033 |

| Email:Jill.Craig@anz.com | | Email:Ben.Heath@anz.com |

| 7 | Refers to the New Zealand App Store and Google Play sites. ANZ is the top ranked free finance App. |

| 8 | Net lending assets increased 46% from $349.85 billion to $509.25 billion between 30 September 2008 and 31 March 2014. |

| 9 | The ANZ Group Full Year 2013 provision charge was $1.197 billion. |

5

| | |

| AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED | | ABN 11 005 357 522 |

This page has been left blank intentionally

6

SNAPSHOT

CONTENTS

Section 2 – Snapshot

| | | | |

Statutory Profit Results | | | 8 | |

| |

Cash Profit Results | | | 9 | |

| |

Key Balance Sheet Metrics | | | 10 | |

| |

FX Adjusted - Cash Profit Results and Net Loans and Advances | | | 11 | |

7

SNAPSHOT

Statutory Profit Results

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14 v. Mar 13 | |

| | | | | |

Net interest income | | | 6,778 | | | | 6,558 | | | | 6,200 | | | | 3 | % | | | 9 | % |

| | | | | |

Other operating income | | | 2,740 | | | | 2,965 | | | | 2,736 | | | | -8 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Operating income | | | 9,518 | | | | 9,523 | | | | 8,936 | | | | 0 | % | | | 7 | % |

| | | | | |

Operating expenses | | | (4,286 | ) | | | (4,213 | ) | | | (4,044 | ) | | | 2 | % | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Profit before credit impairment and income tax | | | 5,232 | | | | 5,310 | | | | 4,892 | | | | -1 | % | | | 7 | % |

| | | | | |

Credit impairment charge | | | (527 | ) | | | (600 | ) | | | (588 | ) | | | -12 | % | | | -10 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Profit before income tax | | | 4,705 | | | | 4,710 | | | | 4,304 | | | | 0 | % | | | 9 | % |

| | | | | |

Income tax expense | | | (1,318 | ) | | | (1,376 | ) | | | (1,362 | ) | | | -4 | % | | | -3 | % |

| | | | | |

Non-controlling interests | | | (6 | ) | | | (5 | ) | | | (5 | ) | | | 20 | % | | | 20 | % |

| | | | | | | | | | | | | | | | | | | | |

Profit attributable to shareholders of the Company | | | 3,381 | | | | 3,329 | | | | 2,937 | | | | 2 | % | | | 15 | % |

| | | | | | | | | | | | | | | | | | | | |

Earnings per ordinary share (cents)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Half Year | | | Movement | |

| | | Reference Page | | Mar 14 | | | Sep 13 | | | Mar 13 | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

| | | | | | |

Basic | | 105 | | | 124.4 | | | | 122.5 | | | | 108.5 | | | | 2 | % | | | 15 | % |

| | | | | | |

Diluted | | 105 | | | 120.2 | | | | 118.5 | | | | 105.3 | | | | 1 | % | | | 14 | % |

| | | | | | | | | | | | | | |

| | | | | Half Year | |

| Ordinary share dividends (cents) | | Reference

Page | | Mar 14 | | | Sep 13 | | | Mar 13 | |

Interim - 100% franked1 | | 104 | | | 83 | | | | n/a | | | | 73 | |

Final - 100% franked1 | | 104 | | | n/a | | | | 91 | | | | n/a | |

Ordinary share dividend payout ratio2 | | 104 | | | 67.4 | % | | | 75.1 | % | | | 68.3 | % |

| | | | |

Preference share dividend ($M) | | | | | | | | | | | | | | |

Dividend paid3 | | 104 | | | 3 | | | | 3 | | | | 3 | |

| | | | |

Profitability ratios | | | | | | | | | | | | | | |

Return on average ordinary shareholders’ equity4 | | | | | 15.0 | % | | | 15.3 | % | | | 14.4 | % |

Return on average assets | | | | | 0.92 | % | | | 0.95 | % | | | 0.90 | % |

Net interest margin | | | | | 2.15 | % | | | 2.20 | % | | | 2.24 | % |

| | | | |

Efficiency ratios | | | | | | | | | | | | | | |

Operating expenses to operating income | | | | | 45.0 | % | | | 44.2 | % | | | 45.3 | % |

Operating expenses to average assets | | | | | 1.17 | % | | | 1.21 | % | | | 1.24 | % |

| | | | |

Credit impairment charge/(release) | | | | | | | | | | | | | | |

Individual credit impairment charge ($M) | | | | | 601 | | | | 574 | | | | 584 | |

Collective credit impairment charge/(release) ($M) | | | | | (74 | ) | | | 26 | | | | 4 | |

| | | | | | | | | | | | | | |

Total credit impairment charge ($M) | | 107 | | | 527 | | | | 600 | | | | 588 | |

Individual credit impairment charge as a % of average net advances | | | | | 0.24 | % | | | 0.24 | % | | | 0.26 | % |

Total credit impairment charge as a % of average net advances | | | | | 0.21 | % | | | 0.25 | % | | | 0.27 | % |

| | | | | | | | | | | | | | |

| 1. | Fully franked for Australian tax purposes and carry New Zealand imputation credits of NZD 10 cents per ordinary share for the proposed 2014 interim dividend (2013 final dividend: NZD 10 cents; 2013 interim dividend: NZD 9 cents). |

| 2. | Dividend payout ratio is calculated using 2013 interim, 2013 final dividends and the proposed 2014 interim dividend. |

| 3. | Represents dividends paid on Euro Trust Securities (preference shares) issued on 13 December 2004. |

| 4. | Average ordinary shareholders’ equity excludes non-controlling interests and preference shares. |

8

SNAPSHOT

Cash Profit Results1

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| | | Mar 14 $M | | | Sep 13 $M | | | Mar 13 $M | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

| | | | | |

Net interest income | | | 6,764 | | | | 6,536 | | | | 6,236 | | | | 3 | % | | | 8 | % |

| | | | | |

Other operating income | | | 2,904 | | | | 2,763 | | | | 2,856 | | | | 5 | % | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Operating income | | | 9,668 | | | | 9,299 | | | | 9,092 | | | | 4 | % | | | 6 | % |

| | | | | |

Operating expenses | | | (4,286 | ) | | | (4,213 | ) | | | (4,044 | ) | | | 2 | % | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Profit before credit impairment and income tax | | | 5,382 | | | | 5,086 | | | | 5,048 | | | | 6 | % | | | 7 | % |

| | | | | |

Credit impairment charge | | | (528 | ) | | | (598 | ) | | | (599 | ) | | | -12 | % | | | -12 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Profit before income tax | | | 4,854 | | | | 4,488 | | | | 4,449 | | | | 8 | % | | | 9 | % |

| | | | | |

Income tax expense | | | (1,333 | ) | | | (1,170 | ) | | | (1,265 | ) | | | 14 | % | | | 5 | % |

| | | | | |

Non-controlling interests | | | (6 | ) | | | (5 | ) | | | (5 | ) | | | 20 | % | | | 20 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash profit1 | | | 3,515 | | | | 3,313 | | | | 3,179 | | | | 6 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Earnings per ordinary share (cents) | | | | Half Year | | | Movement | |

| | | Reference

Page | | Mar 14 | | | Sep 13 | | | Mar 13 | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

Basic | | 30 | | | 128.7 | | | | 121.4 | | | | 116.9 | | | | 6 | % | | | 10 | % |

Diluted | | 30 | | | 124.3 | | | | 117.4 | | | | 113.1 | | | | 6 | % | | | 10 | % |

| | | | | | | | | | | | | | |

| | | | | Half Year | |

| Ordinary share dividends (cents) | | Reference Page | | Mar 14 | | | Sep 13 | | | Mar 13 | |

Ordinary share dividend payout ratio2 | | 31 | | | 64.9 | % | | | 75.4 | % | | | 63.1 | % |

| | | | | | | | | | | | | | |

| | | | |

Profitability ratios | | | | | | | | | | | | | | |

Return on average ordinary shareholders’ equity3 | | | | | 15.5 | % | | | 15.1 | % | | | 15.5 | % |

Return on average assets | | | | | 0.96 | % | | | 0.95 | % | | | 0.97 | % |

Net interest margin | | 19 | | | 2.15 | % | | | 2.19 | % | | | 2.25 | % |

Profit per average FTE ($)4 | | | | | 73,266 | | | | 67,972 | | | | 62,429 | |

| | | | | | | | | | | | | | |

| | | | |

Efficiency ratios | | | | | | | | | | | | | | |

Operating expenses to operating income | | | | | 44.3 | % | | | 45.3 | % | | | 44.5 | % |

Operating expenses to average assets | | | | | 1.17 | % | | | 1.21 | % | | | 1.23 | % |

| | | | | | | | | | | | | | |

| | | | |

Credit impairment charge/(release) | | | | | | | | | | | | | | |

Individual credit impairment charge ($M) | | 25 | | | 602 | | | | 572 | | | | 595 | |

Collective credit impairment charge/(release) ($M) | | 26 | | | (74 | ) | | | 26 | | | | 4 | |

| | | | | | | | | | | | | | |

Total credit impairment charge ($M) | | 25 | | | 528 | | | | 598 | | | | 599 | |

Individual credit impairment charge as a % of average net advances | | | | | 0.24 | % | | | 0.24 | % | | | 0.27 | % |

Total credit impairment charge as a % of average net advances | | | | | 0.21 | % | | | 0.25 | % | | | 0.27 | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

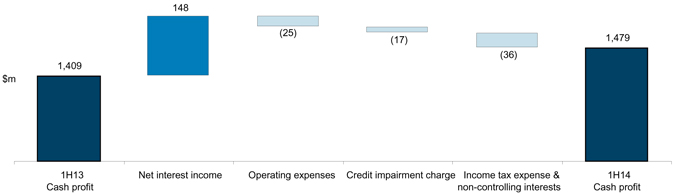

| Cash profit by division/geography | | Half Year | | | Movement | |

| | | Mar 14 $M | | | Sep 13 $M | | | Mar 13 $M | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

Australia | | | 1,479 | | | | 1,449 | | | | 1,409 | | | | 2 | % | | | 5 | % |

International and Institutional Banking | | | 1,372 | | | | 1,244 | | | | 1,208 | | | | 10 | % | | | 14 | % |

New Zealand | | | 546 | | | | 482 | | | | 396 | | | | 13 | % | | | 38 | % |

Global Wealth | | | 226 | | | | 268 | | | | 204 | | | | -16 | % | | | 11 | % |

GTSO and Group Centre | | | (108 | ) | | | (130 | ) | | | (38 | ) | | | -17 | % | | | large | |

| | | | | | | | | | | | | | | | | | | | |

Cash profit by division | | | 3,515 | | | | 3,313 | | | | 3,179 | | | | 6 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Australia | | | 2,025 | | | | 2,136 | | | | 2,164 | | | | -5 | % | | | -6 | % |

Asia Pacific, Europe & America | | | 681 | | | | 554 | | | | 459 | | | | 23 | % | | | 48 | % |

New Zealand | | | 809 | | | | 623 | | | | 556 | | | | 30 | % | | | 46 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash profit by geography | | | 3,515 | | | | 3,313 | | | | 3,179 | | | | 6 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

| 1. | Statutory profit has been adjusted to exclude non-core items to arrive at cash profit, and has been provided to assist readers to understand the result for the ongoing business activities of the Group. Refer to page 83 for the reconciliation between statutory and cash profit. |

| 2. | Dividend payout ratio is calculated using 2013 interim, 2013 final dividends and the proposed 2014 interim dividend. |

| 3. | Average ordinary shareholders’ equity excludes non-controlling interests and preference shares. |

| 4. | Comparative information has been restated to include technology contractors, consistent with how FTE are reported and managed internally. |

9

SNAPSHOT

Key Balance Sheet Metrics

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | As at | | | Movement | |

| | | Reference

Page | | Mar 14 | | | Sep 13 | | | Mar 13 | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

| | | | | | |

Capital adequacy ratio (%) | | | | | | | | | | | | | | | | | | | | | | |

Common Equity Tier 1 | | | | | | | | | | | | | | | | | | | | | | |

- APRA Basel 3 | | 35 | | | 8.3 | % | | | 8.5 | % | | | 8.2 | % | | | | | | | | |

- Internationally Harmonised Basel 31 | | 35 | | | 10.5 | % | | | 10.8 | % | | | 10.3 | % | | | | | | | | |

Credit risk weighted assets ($B) | | 135 | | | 305.3 | | | | 287.7 | | | | 275.0 | | | | 6 | % | | | 11 | % |

Total risk weighted assets ($B) | | 135 | | | 360.7 | | | | 339.3 | | | | 322.6 | | | | 6 | % | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Balance Sheet: Key Items | | | | | | | | | | | | | | | | | | | | | | |

Gross loans & advances ($B) | | | | | 512.4 | | | | 486.9 | | | | 457.6 | | | | 5 | % | | | 12 | % |

Net loans & advances ($B) | | | | | 509.3 | | | | 483.3 | | | | 454.3 | | | | 5 | % | | | 12 | % |

Total assets ($B) | | | | | 737.8 | | | | 703.0 | | | | 672.6 | | | | 5 | % | | | 10 | % |

Customer deposits ($B) | | | | | 388.0 | | | | 368.8 | | | | 344.1 | | | | 5 | % | | | 13 | % |

Total equity ($B) | | | | | 47.0 | | | | 45.6 | | | | 42.5 | | | | 3 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Impaired assets | | | | | | | | | | | | | | | | | | | | | | |

Gross impaired assets ($M) | | 27 | | | 3,620 | | | | 4,264 | | | | 4,685 | | | | -15 | % | | | -23 | % |

Net impaired assets ($M) | | 27 | | | 2,150 | | | | 2,797 | | | | 3,142 | | | | -23 | % | | | -32 | % |

Net impaired assets as a % of net advances | | | | | 0.42 | % | | | 0.58 | % | | | 0.69 | % | | | | | | | | |

Net impaired assets as a % of shareholders’ equity | | | | | 4.6 | % | | | 6.1 | % | | | 7.4 | % | | | | | | | | |

| | | | | | |

Individual provision ($M) | | 107 | | | 1,470 | | | | 1,467 | | | | 1,543 | | | | 0 | % | | | -5 | % |

Individual provision as a % of gross impaired assets | | | | | 40.6 | % | | | 34.4 | % | | | 32.9 | % | | | | | | | | |

Collective provision ($M) | | 107 | | | 2,843 | | | | 2,887 | | | | 2,769 | | | | -2 | % | | | 3 | % |

Collective provision as a % of credit risk weighted assets | | | | | 0.93 | % | | | 1.00 | % | | | 1.01 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net Assets | | | | | | | | | | | | | | | | | | | | | | |

Net tangible assets per ordinary share ($) | | | | | 13.90 | | | | 13.48 | | | | 12.55 | | | | 3 | % | | | 11 | % |

Net tangible assets attributable to ordinary shareholders ($B) | | | | | 38.1 | | | | 37.0 | | | | 34.4 | | | | 3 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Other information | | | | | | | | | | | | | | | | | | | | | | |

Full time equivalent staff (FTE)2 | | | | | 48,857 | | | | 48,865 | | | | 48,871 | | | | 0 | % | | | 0 | % |

Assets per FTE ($M) | | | | | 15.1 | | | | 14.4 | | | | 13.8 | | | | 5 | % | | | 9 | % |

Share price | | | | | | | | | | | | | | | | | | | | | | |

- high | | | | $ | 34.06 | | | $ | 32.09 | | | $ | 29.46 | | | | 6 | % | | | 16 | % |

- low | | | | $ | 28.84 | | | $ | 26.30 | | | $ | 23.42 | | | | 10 | % | | | 23 | % |

- closing | | | | $ | 33.06 | | | $ | 30.78 | | | $ | 28.53 | | | | 7 | % | | | 16 | % |

Market capitalisation of ordinary shares ($B) | | | | | 90.7 | | | | 84.5 | | | | 78.3 | | | | 7 | % | | | 16 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| 1. | ANZ’s interpretation of the regulations documented in the Basel Committee publications; “Basel 3: A global regulatory framework for more resilient banks and banking systems” (June 2011) and “International Convergence of Capital Measurement and Capital Standards” (June 2006). See page 36 for a reconciliation between APRA Basel 3 and Internationalised harmonised Basel 3 standards. |

| 2. | Comparative information has been restated to include technology contractors, consistent with how FTE are reported and managed internally. |

| | | | | | | | | | | | | | | | | | | | |

| Net loans & advances by division/geography | | As at ($B) | | | Movement | |

| | | Mar 14 | | | Sep 13 | | | Mar 13 | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

Australia | | | 278.3 | | | | 271.6 | | | | 262.0 | | | | 2 | % | | | 6 | % |

International and Institutional Banking | | | 136.3 | | | | 123.5 | | | | 114.5 | | | | 10 | % | | | 19 | % |

New Zealand | | | 88.2 | | | | 81.5 | | | | 71.7 | | | | 8 | % | | | 23 | % |

Global Wealth | | | 6.0 | | | | 6.2 | | | | 5.8 | | | | -3 | % | | | 3 | % |

GTSO and Group Centre | | | 0.5 | | | | 0.5 | | | | 0.3 | | | | 0 | % | | | 67 | % |

| | | | | | | | | | | | | | | | | | | | |

Net loans & advances by division | | | 509.3 | | | | 483.3 | | | | 454.3 | | | | 5 | % | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Australia | | | 336.5 | | | | 324.3 | | | | 314.6 | | | | 4 | % | | | 7 | % |

Asia Pacific, Europe & America | | | 76.6 | | | | 69.9 | | | | 61.2 | | | | 10 | % | | | 25 | % |

New Zealand | | | 96.2 | | | | 89.1 | | | | 78.5 | | | | 8 | % | | | 23 | % |

| | | | | | | | | | | | | | | | | | | | |

Net loans & advances by geography | | | 509.3 | | | | 483.3 | | | | 454.3 | | | | 5 | % | | | 12 | % |

| | | | | | | | | | | | | | | | | | | | |

10

SNAPSHOT

FX Adjusted1– Cash Profit Results and Net Loans and Advances

Cash profit - FX adjusted

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| | | Mar 14 $M | | | Sep 13 $M | | | Mar 13 $M | | | Mar 14 v. Sep 13 | | | Mar 14

v. Mar 13 | |

| | | | | |

Net interest income | | | 6,764 | | | | 6,640 | | | | 6,459 | | | | 2 | % | | | 5 | % |

| | | | | |

Other operating income | | | 2,904 | | | | 2,769 | | | | 2,876 | | | | 5 | % | | | 1 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Operating income | | | 9,668 | | | | 9,409 | | | | 9,335 | | | | 3 | % | | | 4 | % |

| | | | | |

Operating expenses | | | (4,286 | ) | | | (4,280 | ) | | | (4,213 | ) | | | 0 | % | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Profit before credit impairment and income tax | | | 5,382 | | | | 5,129 | | | | 5,122 | | | | 5 | % | | | 5 | % |

| | | | | |

Credit impairment charge | | | (528 | ) | | | (596 | ) | | | (615 | ) | | | -11 | % | | | -14 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Profit before income tax | | | 4,854 | | | | 4,533 | | | | 4,507 | | | | 7 | % | | | 8 | % |

| | | | | |

Income tax expense | | | (1,333 | ) | | | (1,180 | ) | | | (1,266 | ) | | | 13 | % | | | 5 | % |

| | | | | |

Non-controlling interests | | | (6 | ) | | | (5 | ) | | | (5 | ) | | | 20 | % | | | 20 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash profit (FX adjusted) | | | 3,515 | | | | 3,348 | | | | 3,236 | | | | 5 | % | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cash profit - FX adjusted by division and geography | | Half Year | | | Movement | |

| | | Mar 14 $M | | | Sep 13 $M | | | Mar 13 $M | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

Australia | | | 1,479 | | | | 1,449 | | | | 1,409 | | | | 2 | % | | | 5 | % |

International and Institutional Banking | | | 1,372 | | | | 1,256 | | | | 1,264 | | | | 9 | % | | | 9 | % |

New Zealand | | | 546 | | | | 515 | | | | 443 | | | | 6 | % | | | 23 | % |

Global Wealth | | | 226 | | | | 270 | | | | 209 | | | | -16 | % | | | 8 | % |

GTSO and Group Centre | | | (108 | ) | | | (142 | ) | | | (89 | ) | | | -24 | % | | | 21 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash profit - FX adjusted by division | | | 3,515 | | | | 3,348 | | | | 3,236 | | | | 5 | % | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Australia | | | 2,025 | | | | 2,117 | | | | 2,098 | | | | -4 | % | | | -3 | % |

Asia Pacific, Europe & America | | | 681 | | | | 561 | | | | 501 | | | | 21 | % | | | 36 | % |

New Zealand | | | 809 | | | | 670 | | | | 637 | | | | 21 | % | | | 27 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash profit - FX adjusted by geography | | | 3,515 | | | | 3,348 | | | | 3,236 | | | | 5 | % | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Net loans & advances by division/geography - FX adjusted | | As at ($B) | | | Movement | |

| | | Mar 14 | | | Sep 13 | | | Mar 13 | | | Mar 14 v. Sep 13 | | | Mar 14 v. Mar 13 | |

Australia | | | 278.3 | | | | 271.6 | | | | 262.1 | | | | 2 | % | | | 6 | % |

International and Institutional Banking | | | 136.3 | | | | 124.1 | | | | 122.2 | | | | 10 | % | | | 12 | % |

New Zealand | | | 88.2 | | | | 85.9 | | | | 83.8 | | | | 3 | % | | | 5 | % |

Global Wealth | | | 6.0 | | | | 6.3 | | | | 6.2 | | | | -5 | % | | | -3 | % |

GTSO and Group Centre | | | 0.5 | | | | 0.4 | | | | 0.3 | | | | 25 | % | | | 67 | % |

| | | | | | | | | | | | | | | | | | | | |

Net loans & advances by division - FX adjusted | | | 509.3 | | | | 488.3 | | | | 474.6 | | | | 4 | % | | | 7 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Australia | | | 336.5 | | | | 324.3 | | | | 314.6 | | | | 4 | % | | | 7 | % |

Asia Pacific, Europe & America | | | 76.6 | | | | 70.2 | | | | 68.3 | | | | 9 | % | | | 12 | % |

New Zealand | | | 96.2 | | | | 93.8 | | | | 91.7 | | | | 2 | % | | | 5 | % |

| | | | | | | | | | | | | | | | | | | | |

Net loans & advances by geography - FX adjusted | | | 509.3 | | | | 488.3 | | | | 474.6 | | | | 4 | % | | | 7 | % |

| | | | | | | | | | | | | | | | | | | | |

| 1. | Comparative period data has been adjusted to remove the impact of foreign exchange movements. |

11

SNAPSHOT

This page has been left blank intentionally

12

CEO OVERVIEW

CEO Overview1

Strategy and Performance

ANZ is executing a focused strategy to build the best connected, most respected bank across the Asia Pacific region, and in doing so provide shareholders with above-peer earnings growth.

The bank is pursuing significant organic growth opportunities in the Asia Pacific region, and with our strong domestic businesses in Australia and New Zealand, our distinctive footprint and super regional connectivity, we are uniquely positioned to meet the needs of customers, who are increasingly linked to regional capital, trade and wealth flows.

This half our differentiated strategy delivered a cash profit of $3.5 billion, up 11% from $3.2 billion over the prior corresponding period, and 6% on the half, with a Return on Equity of 15.5%, earnings per share of $1.287 cents and a fully-franked dividend per share of 83 cents. This result was driven by 6% revenue growth and 6% expense growth on a cash basis, and a 12% reduction in provisions. Total shareholder returns for the past twelve months were 19%.

Pleasingly, profits sourced from the Asia Pacific region increased to 25% of total Group profits putting the Group within range of its stated target of achieving 25-30% of profit driven by network revenue by 2017. While ANZ has ongoing growth aspirations in the region, we are now sufficiently advanced with our strategy to place a greater emphasis on improving returns, hence the goal to lift Group RoE to 16% or above by 2016 in part driven by improving returns outside Australia and New Zealand.

Strategic Progress

While economic conditions across the Asia Pacific region remain more robust by comparison to much of the rest of the world, conditions for banking remain challenging – particularly for institutional banking where relatively subdued economic conditions and margin compression have impacted growth.

Within that environment, management continued to focus on balancing the need for investment to meet the needs of our customers and drive longer-term growth, and the need to generate attractive returns for our shareholders in the near-term. This has been achieved by focusing on both productivity initiatives and capital management to improve returns and support strong EPS growth.

| • | | We are building stronger positions in our home markets of Australia and New Zealand, led by further gains in productivity and market share, and further penetration of Wealth products into our existing customer base in these markets. |

| • | | We have continued to build Asia quickly, focused on intermediating the fast growing trade and capital flows in the region with particular emphasis on regional treasury centres like Hong Kong and Singapore and products like Trade, FX and Cash Management for Institutional customers. Notable achievements include 52% of International and Institutional Banking profit now coming from outside Australia and New Zealand; and significant increases in volume for higher return less capital intensive flow products like Foreign Exchange (up 37%), Cash Management Deposits (up 20%) and funded Trade and Supply Chain (up 6%). |

| • | | Our Operations and Technology functions continue to deliver economies of scale, speed to market and a stronger control environment to the business, particularly from our regional hubs and our use of common platforms and processes, resulting in lower unit costs, better quality and lower risk. While average volumes increased by 8% over the past year, operations expenses reduced 4% (fx adjusted) on the prior comparative period. |

| • | | The Group generated around $1.9 billion of additional capital over the year, and remains well capitalised with a Common Equity Tier 1 ratio of 10.5% at 31 March 2014 on a Basel 3 harmonised basis, or 8.3% under APRA’s Basel 3 standards. Customer funding remained stable at 62% of total funding. |

| • | | Gross impaired assets reduced both HOH and PCP, and the Group’s coverage ratios remain strong with CP to CRWA at 0.93% and the total provision ratio at 1.41%. |

| • | | Finally, we focused on strengthening management depth and the alignment between business, operations, support and technology. |

Medium to Long Term Strategic Goals

ANZ is committed to delivering strong total shareholder returns and above-peer earnings growth over the business cycle, targeting a Group cost to income ratio below 43% and return on equity above 16% by 2016. The target dividend payout ratio remains at 65-70% of cash profit, which we believe to be a sustainable level in a Basel 3 environment.

To do this we will continue to:

| • | | Strengthen our position in our core markets of Australia and New Zealand by growing our Retail and Commercial operations, driving productivity benefits, leveraging our super regional strategy and using technology to drive better functionality. |

| | • | | In Australia, we are transforming the way we serve our customers by investing in physical, mobile and digital channels to support our retail customers, by increasing sales capacity to support our business banking customers, and by investing in customer analytics. |

| | • | | In New Zealand, we will work under one brand on one platform with more efficient market coverage. |

| • | | Focus our Asian expansion primarily on Institutional Banking, supporting our Australian and New Zealand customers, targeting profitable markets and segments in which we have expertise and which are connected through trade and capital flows. |

| • | | Achieve greater efficiency and control through the use of scalable common infrastructure and platforms. |

| • | | Maintain strong liquidity and actively manage capital to enhance ROE. |

| • | | Build on our Super Regional capabilities – utilising our management bench-strength and continuing to deepen our international talent pool. |

| • | | Apply strict criteria when reviewing existing investment and new inorganic opportunities. |

| 1 | The CEO Overview is reported on a cash basis |

13

This page has been left blank intentionally

14

CFO OVERVIEW

CONTENTS

Section 4 – CFO Overview

| | | | |

Cash profit | | | 16 | |

| |

Divisional performance | | | 17 | |

| |

Review of Group results | | | 19 | |

| |

Credit risk | | | 25 | |

| |

Income and expenses | | | 19 | |

| |

Income tax expense | | | 29 | |

| |

Impact of exchange rate movements/revenue hedges | | | 29 | |

| |

Earnings per share and dividends | | | 30-31 | |

| |

Economic profit | | | 31 | |

| |

Balance sheet, liquidity and capital | | | 32 | |

| |

Deferred acquisition costs and deferred income | | | 37 | |

| |

Investment spend | | | 38 | |

| |

Software capitalisation | | | 39 | |

15

CFO OVERVIEW

Non-IFRS information

The Group provides two additional measures of performance in the Results Announcement which are prepared on a basis other than in accordance with accounting standards – cash profit and economic profit. The guidance provided in Australian Securities and Investments Commission Regulatory Guide 230 has been followed when presenting this information.

Cash profit

Statutory profit has been adjusted to exclude non-core items to arrive at cash profit, and has been provided to assist readers to understand the results for the ongoing business activities of the Group. The adjustments made in arriving at cash profit are included in statutory profit which is subject to review within the context of the external auditor’s review of the Condensed Consolidated Financial Statements. Cash profit is not subject to review by the external auditor, however, the external auditor has informed the Audit Committee that the adjustments have been determined on a consistent basis across each period presented.

The CFO Overview is reported on a cash basis.

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14

v. Mar 13 | |

Statutory profit attributable to shareholders of the Company | | | 3,381 | | | | 3,329 | | | | 2,937 | | | | 2 | % | | | 15 | % |

Adjustments between statutory profit and cash profit1 | | | 134 | | | | (16 | ) | | | 242 | | | | large | | | | -45 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash profit | | | 3,515 | | | | 3,313 | | | | 3,179 | | | | 6 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | Half Year | | | | Movement | |

| | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14

v. Mar 13 | |

Adjustments between statutory profit and cash profit1 | | | | | | | | | | | | | | | | | | | | |

Treasury shares adjustment | | | 37 | | | | 31 | | | | 53 | | | | 19 | % | | | -30 | % |

Revaluation of policy liabilities | | | (3 | ) | | | 27 | | | | 19 | | | | large | | | | large | |

Economic hedging | | | 89 | | | | (205 | ) | | | 192 | | | | large | | | | -54 | % |

Revenue and net investment hedges | | | 18 | | | | 143 | | | | 16 | | | | -87 | % | | | 13 | % |

Structured credit intermediation trades | | | (7 | ) | | | (12 | ) | | | (38 | ) | | | -42 | % | | | -82 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total adjustments between statutory profit and cash profit1 | | | 134 | | | | (16 | ) | | | 242 | | | | large | | | | -45 | % |

| | | | | | | | | | | | | | | | | | | | |

|

1. Refer to pages 83 to 92 for analysis of the reconciliation of statutory profit to cash profit. | |

Cash Profit1 | |

| | | Half Year | | | Movement | |

| | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14 v. Mar 13 | |

Net interest income | | | 6,764 | | | | 6,536 | | | | 6,236 | | | | 3 | % | | | 8 | % |

Other operating income | | | 2,904 | | | | 2,763 | | | | 2,856 | | | | 5 | % | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 9,668 | | | | 9,299 | | | | 9,092 | | | | 4 | % | | | 6 | % |

Operating expenses | | | (4,286 | ) | | | (4,213 | ) | | | (4,044 | ) | | | 2 | % | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | |

Profit before credit impairment and income tax | | | 5,382 | | | | 5,086 | | | | 5,048 | | | | 6 | % | | | 7 | % |

Credit impairment charge | | | (528 | ) | | | (598 | ) | | | (599 | ) | | | -12 | % | | | -12 | % |

| | | | | | | | | | | | | | | | | | | | |

Profit before income tax | | | 4,854 | | | | 4,488 | | | | 4,449 | | | | 8 | % | | | 9 | % |

Income tax expense | | | (1,333 | ) | | | (1,170 | ) | | | (1,265 | ) | | | 14 | % | | | 5 | % |

Non-controlling interests | | | (6 | ) | | | (5 | ) | | | (5 | ) | | | 20 | % | | | 20 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash profit | | | 3,515 | | | | 3,313 | | | | 3,179 | | | | 6 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

|

1. Refer to page 29 for the impact of exchange rates and revenue hedges on cash profit. | |

16

CFO OVERVIEW

Divisional performance

There have been no major changes to Divisional segments since 30 September 2013, however certain amounts in the comparatives have been reclassified to conform with current period financial statement presentations.

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| Cash profit by division | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14

v. Mar 13 | |

Australia | | | 1,479 | | | | 1,449 | | | | 1,409 | | | | 2 | % | | | 5 | % |

International and Institutional Banking | | | 1,372 | | | | 1,244 | | | | 1,208 | | | | 10 | % | | | 14 | % |

New Zealand | | | 546 | | | | 482 | | | | 396 | | | | 13 | % | | | 38 | % |

Global Wealth | | | 226 | | | | 268 | | | | 204 | | | | -16 | % | | | 11 | % |

GTSO and Group Centre | | | (108 | ) | | | (130 | ) | | | (38 | ) | | | -17 | % | | | large | |

| | | | | | | | | | | | | | | | | | | | |

Cash profit/(loss) by division | | | 3,515 | | | | 3,313 | | | | 3,179 | | | | 6 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

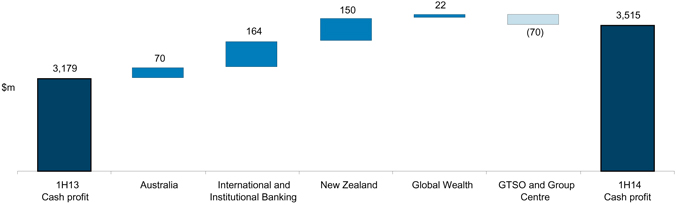

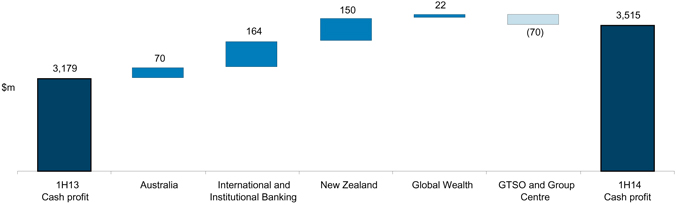

Cash profit by division – March 2014 Half Year v March 2013 Half Year

| • | | March 2014 half year v March 2013 half year |

Australia

| | • | | Profit increased 5% primarily due to a 7% increase in average net loans and advances, partially offset by a 4% increase in credit impairment charges, higher operating expenses from the investment in the ‘Banking on Australia’ program and a 5 bp contraction in net interest margin. |

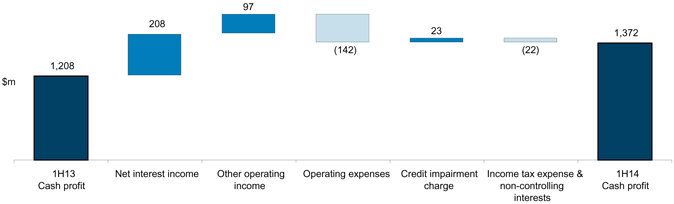

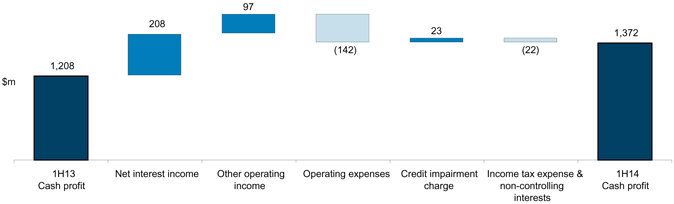

International and Institutional Banking

| | • | | Profit increased 14% due to stronger operating income in Global Markets (primarily from strong customer demand for foreign exchange and commodity products in Asia) and Transaction Banking, volume driven income growth from both Retail Asia Pacific and Asia Partnerships, and lower credit impairment charges, partially offset by 10% growth in operating expenses. Excluding the impact of favourable foreign exchange translations, profit was up 9%. |

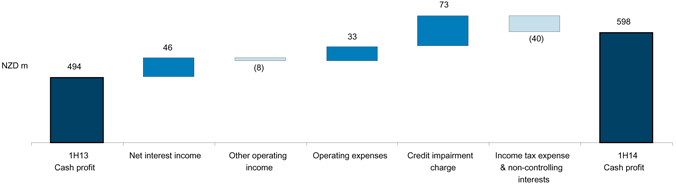

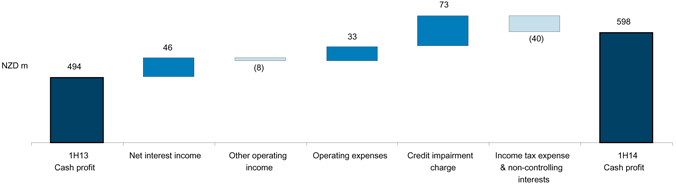

New Zealand

| | • | | Profit increased 38% primarily due to above system growth in mortgages, a reduction in credit impairment charges (reflecting strong improvements in credit quality across the lending book), a 6% decrease in operating expenses and favourable foreign exchange translation. |

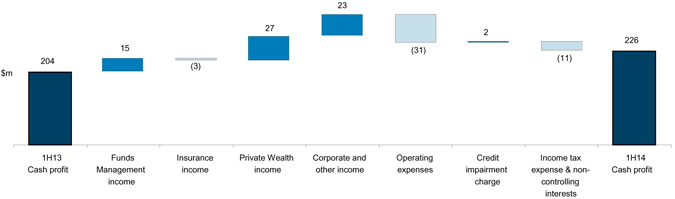

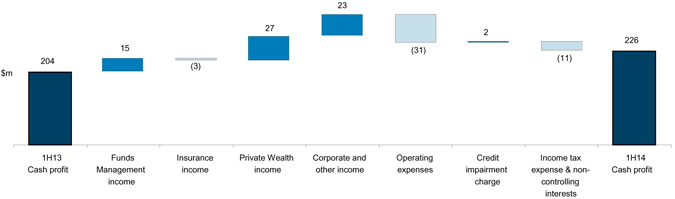

Global Wealth

| | • | | Profit increased 11% primarily due to higher funds management operating income (average funds under management (FUM) increased 14%), strong income growth in Private Wealth (strong growth in average customer deposits and loans and advances), partially offset by a decline in insurance income and higher operating expenses from strategic growth initiatives and regulatory spend. |

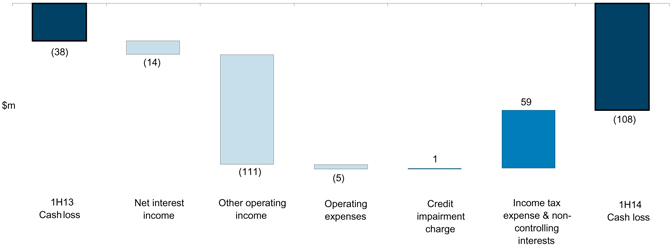

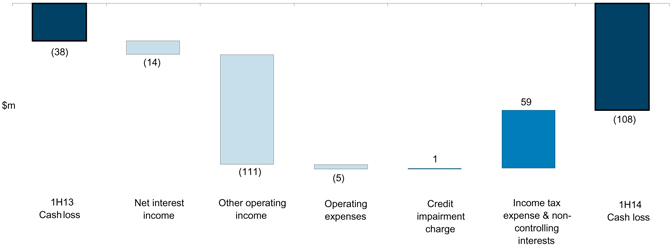

GTSO and Group Centre

| | • | | Net loss increased $70 million primarily due to realised losses from hedges of Group foreign currency revenues (offsetting translation gains elsewhere in the Group) and annual salary increases. |

| • | | March 2014 half year v September 2013 half year |

Australia

| | • | | Profit increased 2% primarily due to a 3% increase in average net loans and advances and a 7% decrease in credit impairment charges, partially offset by 1% uplift in expenses and a 3 bp contraction in net interest margin. |

International and Institutional Banking

| | • | | Profit increased 10% due to stronger operating income in Global Markets (primarily from stronger customer demand for foreign exchange and commodity products in Asia) and volume driven income growth in Retail Asia Pacific and Asia Partnerships, partially offset by 4% growth in operating expenses and higher credit impairment charges. |

17

CFO OVERVIEW

New Zealand

| | • | | Profit increased 13% primarily due to solid growth in mortgages and small business banking, a significant reduction in credit impairment charges (reflecting strong improvements in credit quality across the lending book), a 1% decrease in operating expenses and favourable foreign exchange translation. |

Global Wealth

| | • | | Profit decreased 16% mainly due to a favourable one off tax consolidation adjustment in the September 2013 half. Profit before tax increased 9% driven by strong growth in Private Wealth operating income (mainly from customer deposits) and higher funds management income (reflecting 7% average FUM growth), partially offset by lower insurance operating income and higher operating expenses from strategic growth initiatives and regulatory spend. |

GTSO and Group Centre

| | • | | Net loss decreased 17% primarily due to lower restructuring costs in the current period, partially offset by higher realised losses from hedges of Group foreign currency revenues (offsetting translation gains elsewhere in the Group). |

Refer to Section 5 – Segment Review on pages 41 to 74 for further details

18

CFO OVERVIEW

Review of Group results

Income and expenses

Net interest income

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| Group | | Mar 14

$M | | | Sep 13 $M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14

v. Mar 13 | |

Cash net interest income | | | 6,764 | | | | 6,536 | | | | 6,236 | | | | 3 | % | | | 8 | % |

Average interest earning assets | | | 632,400 | | | | 595,998 | | | | 556,264 | | | | 6 | % | | | 14 | % |

Average deposit and other borrowings | | | 498,484 | | | | 466,261 | | | | 433,780 | | | | 7 | % | | | 15 | % |

Net interest margin (%) - cash | | | 2.15 | | | | 2.19 | | | | 2.25 | | | | -4 bps | | | | -10 bps | |

| | | | | |

Group (excluding Global Markets) | | | | | | | | | | | | | | | | | | | | |

Cash net interest income | | | 6,241 | | | | 6,095 | | | | 5,860 | | | | 2 | % | | | 7 | % |

Average interest earning assets | | | 492,602 | | | | 466,006 | | | | 440,110 | | | | 6 | % | | | 12 | % |

Average deposit and other borrowings | | | 381,118 | | | | 360,113 | | | | 334,212 | | | | 6 | % | | | 14 | % |

Net interest margin (%) - cash | | | 2.54 | | | | 2.61 | | | | 2.67 | | | | -7 bps | | | | -13 bps | |

| | |

| | | Half Year | | | Movement | |

| Cash net interest margin by major division | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14 v. Mar 13 | |

Australia | | | | | | | | | | | | | | | | | | | | |

Net interest margin (%) | | | 2.48 | | | | 2.51 | | | | 2.53 | | | | -3 bps | | | | -5 bps | |

Average interest earning assets ($M) | | | 276,779 | | | | 268,795 | | | | 259,721 | | | | 3 | % | | | 7 | % |

Average deposits and other borrowings ($M) | | | 155,314 | | | | 148,675 | | | | 144,277 | | | | 4 | % | | | 8 | % |

| | | | | |

International and Institutional Banking | | | | | | | | | | | | | | | | | | | | |

Net interest margin (%) | | | 1.55 | | | | 1.58 | | | | 1.65 | | | | -3 bps | | | | -10 bps | |

Average interest earning assets ($M) | | | 258,222 | | | | 240,370 | | | | 216,536 | | | | 7 | % | | | 19 | % |

Average deposits and other borrowings ($M) | | | 216,062 | | | | 195,535 | | | | 182,389 | | | | 10 | % | | | 18 | % |

| | | | | |

New Zealand | | | | | | | | | | | | | | | | | | | | |

Net interest margin (%) | | | 2.48 | | | | 2.49 | | | | 2.50 | | | | -1 bp | | | | -2 bps | |

Average interest earning assets ($M) | | | 85,864 | | | | 77,786 | | | | 71,497 | | | | 10 | % | | | 20 | % |

Average deposits and other borrowings ($M) | | | 54,516 | | | | 48,311 | | | | 45,023 | | | | 13 | % | | | 21 | % |

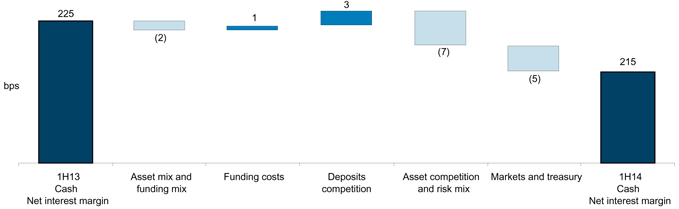

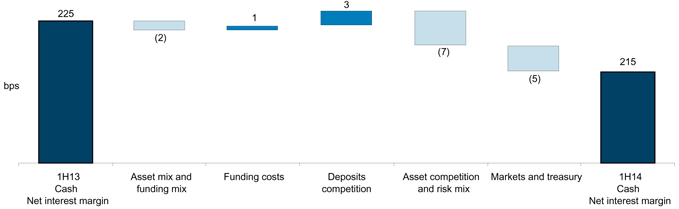

Group net interest margin – March 2014 Half Year v March 2013 Half Year

| • | | March 2014 half year v March 2013 half year |

Net interest margin (-10 bps)

| | • | | Asset mix and funding mix (-2 bps): adverse asset mix from an increased proportion of lower margin home loans and trade loans. |

| | • | | Funding costs (+1 bp): impact from slightly favourable wholesale funding costs. |

| | • | | Deposit competition (+3 bps): benefit from active margin management across deposit products as a result of lower deposit competition, particularly term deposits. |

| | • | | Asset competition and risk mix (-7 bps): continued pressure on lending margins, including competition and switching from variable to fixed in the home loan market in Australia and New Zealand, competition in Global Loans and lower spreads within Corporate and Commercial Banking. |

19

CFO OVERVIEW

| | • | | Markets and treasury (-5 bps): primarily Treasury due to adverse impact of lower earnings on capital from lower interest rates. |

Average interest earning assets (+$76.1 billion or 14%)

| | • | | Australia (+$17.1 billion or 7%): driven by growth in net loans and advances, largely home loans and commercial lending facilities. |

| | • | | International and Institutional Banking (+$41.7 billion or 19%): $7.5 billion increase in Global Loans and $7.3 billion increase in Transaction Banking loans which grew in line with strategy. Reverse repos, investment in government securities, bonds and liquidity portfolio within Global Markets increased by $23.2 billion. |

| | • | | New Zealand (+$14.4 billion or 20%): increased Commercial and Retail lending, primarily in shorter term fixed rate home loans, as well as the impact of stronger NZD. |

| | • | | GTSO and Group Centre (+$2.4 billion): Increase in cash balance to facilitate interbank overnight settlement driven by new RBA requirements. |

Average deposits and other borrowings (+$65 billion or 15%)

| | • | | Australia (+$11.0 billion or 8%): driven by growth in customer deposits across the retail and commercial portfolios, largely at call products. |

| | • | | International and Institutional Banking (+$33.7 billion or 18%): primarily due to increased customer deposits within APEA and Australia. Increase of $17.8 billion in Global Markets driven by customer deposits and external repos for funding purposes. |

| | • | | New Zealand (+$9.5 billion or 21%): increasing volumes in Retail and Commercial banking, including a focus on growing higher margin savings products, as well as the impact of a stronger NZD. |

| | • | | GTSO and Group Centre (+$8.4 billion): reflecting increased short term Negotiable Certificates of Deposit issuance and an increase in cash borrowing balance related to the new RBA requirements. |

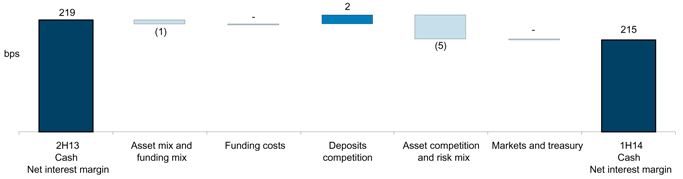

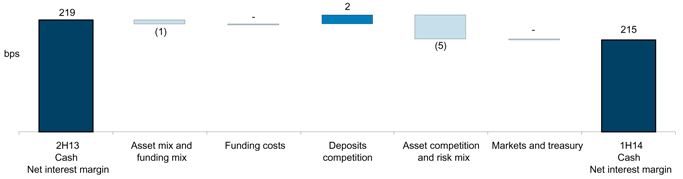

Group net interest margin – September 2013 Half Year v March 2013 Half Year

| • | | March 2014 half year v September 2013 half year |

Net interest margin (-4 bps)

| | • | | Asset mix and funding mix (-1 bp): unfavourable asset mix impact from faster growth in lower margin Home Loans business and slower growth in higher margin Cards and Payments business. |

| | • | | Deposit competition (+2 bps): benefit from active margin management across deposit products as a result of lower deposit competition, particularly term deposits. |

| | • | | Asset competition and risk mix (-5 bps): continued pressure on lending margins, including significant competition and switching from variable to fixed in the home loan market in Australia and New Zealand, competition in Global Loans within IIB and lower spreads within Corporate and Commercial Banking. |

Average interest earning assets (+$36.4 billion or 6%)

| | • | | Australia (+$8.0 billion or 3%): driven by growth in net loans and advances, largely in the variable home loan portfolio. |

| | • | | International and Institutional Banking (+$17.9 billion or 7%): Global Loans increased by $5.0 billion with strong re-financing levels in Australia and Transaction Banking loans increased by $1.6 billion, primarily in Asia. Reverse repos, investment in government securities and liquidity portfolio within Global Markets increased by $8.6 billion. |

| | • | | New Zealand (+$8.1 billion or 10%): Increased Commercial and Retail lending volumes, particularly shorter term fixed rate home loans as the economic environment improved, as well as the impact of a stronger NZD. |

| | • | | GTSO and Group Centre (+$2.5 billion): Increase in cash balance to facilitate interbank overnight settlement attributed to new RBA requirements. |

Average deposits and other borrowings (+$32 billion or 7%)

| | • | | Australia (+$6.6 billion or 4%): driven by growth in customer deposits across the retail and commercial portfolios, largely at call products. |

| | • | | International and Institutional Banking (+$20.5 billion or 10%): increase in term deposits, with growth concentrated in APEA and Australia. Increase of $11.2 billion in deposits within Global Markets driven by customers and external repos for funding purposes and commodities trading in Asia. |

| | • | | New Zealand (+$6.2 billion or 13%): increased customer deposits in both Commercial and Retail, as well as the impact of a stronger NZD. |

| | • | | GTSO and Group Centre (-$2.1 billion): decreased short term wholesale funding borrowings, partially offset by increased cash borrowings balance related to the new RBA requirements. |

20

CFO OVERVIEW

Income and expenses, cont’d

Other operating income

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14

v. Mar 13 | |

Fee income1 | | | 1,191 | | | | 1,171 | | | | 1,145 | | | | 2 | % | | | 4 | % |

Foreign exchange earnings1 | | | 43 | | | | 75 | | | | 134 | | | | -43 | % | | | -68 | % |

Net income from wealth management | | | 617 | | | | 622 | | | | 594 | | | | -1 | % | | | 4 | % |

Share of associates’ profit1 | | | 243 | | | | 269 | | | | 209 | | | | -10 | % | | | 16 | % |

Other1 | | | 90 | | | | 59 | | | | 31 | | | | 52 | % | | | large | |

Global Markets other operating income | | | 720 | | | | 567 | | | | 743 | | | | 27 | % | | | -3 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash other operating income | | | 2,904 | | | | 2,763 | | | | 2,856 | | | | 5 | % | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | |

|

1. Excluding Global Markets. | |

| | | | | |

| Global Markets income | | | | | | | | | | | | | | | |

Net interest income | | | 523 | | | | 441 | | | | 376 | | | | 19 | % | | | 39 | % |

Other operating income | | | 720 | | | | 567 | | | | 743 | | | | 27 | % | | | -3 | % |

| | | | | | | | | | | | | | | | | | | | |

Cash Global Markets income | | | 1,243 | | | | 1,008 | | | | 1,119 | | | | 23 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | Half Year | | | Movement | |

| Other operating income by division | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14 v. Mar 13 | |

Australia | | | 588 | | | | 602 | | | | 588 | | | | -2 | % | | | 0 | % |

International and Institutional Banking | | | 1,599 | | | | 1,409 | | | | 1,502 | | | | 13 | % | | | 6 | % |

New Zealand | | | 178 | | | | 186 | | | | 162 | | | | -4 | % | | | 10 | % |

Global Wealth | | | 726 | | | | 705 | | | | 680 | | | | 3 | % | | | 7 | % |

GTSO and Group Centre | | | (187 | ) | | | (139 | ) | | | (76 | ) | | | 35 | % | | | large | |

| | | | | | | | | | | | | | | | | | | | |

Cash other operating income | | | 2,904 | | | | 2,763 | | | | 2,856 | | | | 5 | % | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | |

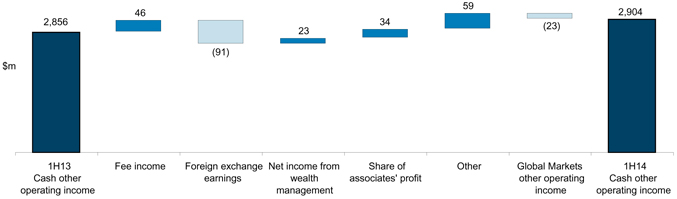

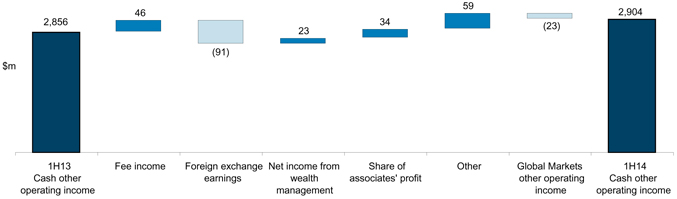

Other operating income – March 2014 Half Year v March 2013 Half Year

| • | | March 2014 half year v March 2013 half year |

Fee income (+$46 million or +4%)

| | • | | Transaction Banking increased $17 million, primarily due to an $8 million increase in fees relating to issuance of Letters of Credit in China, Korea and Singapore, $3 million increase in fees from guarantees and Letters of Credit issued in Europe and $3 million increase in fees earned in the Pacific due to volume growth. |

| | • | | Retail Asia Pacific increased $13 million, primarily due to higher income from investment and insurance products in Hong Kong and Singapore and weakening of the AUD during the March 2014 half. |

| | • | | New Zealand increased $13 million, mainly due to weakening of the AUD during the March 2014 half. |

| | • | | Cards and Payments decreased $5 million, primarily due to reduced income as a result of improved customer payment behaviour on consumer credit card products. |

Foreign Exchange (-$91 million or -68%)

| | • | | Group Centre decreased $126 million, primarily due to realised losses on foreign currency revenue hedges (offsetting translation gains elsewhere in the Group). |

| | • | | IIB (excluding Global Markets) increased $32 million, mainly driven by growth in cross border transaction volumes in Transaction Banking and higher gains in Retail Asia Pacific due to the weakening of AUD. |

21

CFO OVERVIEW

Net Income from Wealth Management (+$23 million or +4%)

| | • | | Global Wealth increased $6 million due to improved funds management results driven by higher average funds under management, partially offset by lower insurance income arising from the exit of a large group Iife insurance plan. |

| | • | | Group Centre increased $13 million due to a reduction in the elimination of Global Wealth investments in ANZ products (offset in net interest income). |

Share of associates profit (+$34 million or +16%)

| | • | | AMMB Holdings Berhad (AMMB) increased by $13 million mainly due to strong non-interest income growth driven by Retail and Insurance segments. |

| | • | | Bank of Tianjin (BoT) increased $12 million due to increased earnings driven by strong lending growth in both Enterprise and Retail clients, growth in interbank assets and weakening of the AUD. |

| | • | | Shanghai Rural Commercial Bank (SRCB) increased $5 million mainly due to weakening of the AUD. |

| | • | | P.T. Bank Pan Indonesia increased by $2 million due to increased earnings driven by lending growth more than offsetting the weakening of the IDR. |

Other income (+$59 million or large %)

| | • | | Global Wealth increased $33 million, primarily due to resolution of an insurance settlement relating to a legacy New Zealand funds management matter. |

| | • | | Global Loans increased $7 million mainly due to the profit on the restructuring of structured lease assets. |

| | • | | Asia Partnerships increased $12 million due to the BoT dilution gain (from non-participation in a rights issue) recorded in the March 2014 half. |

Global Markets Income (+$124 million or +11%)

In relatively similar trading conditions the customer franchise has been the key driver in increasing revenue by $124 million:

| | • | | Sales revenue increased $74 million, mainly due to the foreign exchange business where increased volatility has led to increased customer hedging activity. |

| | • | | Trading income increased $20 million, primarily due to strong growth across the foreign exchange business, with high levels of customer demand in China, Hong Kong and Taiwan. |

| | • | | Income from management of the Group’s balance sheet and liquidity portfolio increased $30 million due to tightening of credit spreads on mark to market valuation. |

Refer to page 56 for further information.

| • | | March 2014 half year v September 2013 half year |

Fee income (+$20 million or +2%)

| | • | | Transaction Banking increased $13 million, primarily due to a $10 million increase in fees relating to the issuance of Letters of Credit in China, Korea, and Singapore and $3 million increase in guarantee fees in Australia. |

| | • | | Retail Asia Pacific increased $9 million, primarily due to higher income from investment and insurance products in Hong Kong and Singapore. |

Foreign Exchange (-$32 million or -43%)

| | • | | Group Centre decreased $25 million driven by realised losses on foreign currency revenue hedges (offsetting translation gains elsewhere in the Group). |

| | • | | Cards and Payments decreased $12 million due to seasonally lower travel card volumes. |

Net Income from Wealth Management (-$5 million or -1%)

| | • | | Global Wealth decreased $5 million driven by a decline in insurance income arising from the exit of a large group life insurance plan, partially offset by growth in funds management income. |

Share of associates profit (-$26 million or -10%)

| | • | | AMMB decreased $12 million mainly due to seasonal factors impacting non-annuity earnings. |

| | • | | BoT increased $7 million due to increased earnings driven by growth in both Corporate lending and interbank assets. |

| | • | | SRCB decreased $12 million mainly due to an impairment of an investment held by SRCB. |

| | • | | P.T. Bank Pan Indonesia decreased $6 million mainly due to seasonal factors impacting earnings and the weakening of the IDR. |

Other income (+$31 million or +52%)

| | • | | Asia Partnerships increased by $39 million due to a write down of the investment in Saigon Securities Inc. (SSI) of $26 million in the September 2013 half and a dilution gain of $12 million (from non-participation in a rights issue) relating to BoT recorded in the March 2014 half. |

| | • | | Global Wealth increased $21 million, primarily due to resolution of an insurance settlement relating to a legacy New Zealand funds management matter. |

| | • | | Global Loans increased by $8 million mainly due to the profit on the restructuring of structured lease assets. |

| | • | | New Zealand decreased $14 million as the September 2013 results included the gain on sale of EFTPOS New Zealand Limited. |

22

CFO OVERVIEW

Global Markets Income (+$235 million or +23%)

A sustained period of strong client acquisition and favourable trading conditions has increased revenue by $235 million:

| | • | | Sales revenues increased $45 million mainly attributable to the foreign exchange business where increased volatility has led to increased customer hedging activity. |

| | • | | Trading income (primarily on customer foreign exchange hedging and precious metals) increased $68 million on improved trading conditions and higher customer flows. |

| | • | | Income from management of the Group’s balance sheet and liquidity portfolio increased $122 million in part due to tightening of credit spreads from September 2013 half. |

Refer to page 56 for further information.

23

CFO OVERVIEW

Income and expenses, cont’d

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| Expenses | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14

v. Mar 13 | |

Personnel expenses | | | 2,493 | | | | 2,417 | | | | 2,347 | | | | 3 | % | | | 6 | % |

Premises expenses | | | 391 | | | | 377 | | | | 356 | | | | 4 | % | | | 10 | % |

Computer expenses | | | 640 | | | | 625 | | | | 618 | | | | 2 | % | | | 4 | % |

Restructuring expenses | | | 35 | | | | 28 | | | | 57 | | | | 25 | % | | | -39 | % |

Other expenses | | | 727 | | | | 766 | | | | 666 | | | | -5 | % | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | |

Total cash operating expenses | | | 4,286 | | | | 4,213 | | | | 4,044 | | | | 2 | % | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | |

Total full time equivalent staff (FTE)1,2 | | | 48,857 | | | | 48,865 | | | | 48,871 | | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | |

| 1. | Refer to page 142 for a summary of full time equivalent staff movements during the period. |

| 2. | Comparative information has been restated to include technology contractors, consistent with how FTE are reported and managed internally. |

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| Expenses by division | | Mar

14 $M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14

v. Sep 13 | | | Mar 14

v. Mar 13 | |

Australia | | | 1,500 | | | | 1,492 | | | | 1,475 | | | | 1 | % | | | 2 | % |

International and Institutional Banking | | | 1,598 | | | | 1,531 | | | | 1,456 | | | | 4 | % | | | 10 | % |

New Zealand | | | 514 | | | | 486 | | | | 475 | | | | 6 | % | | | 8 | % |

Global Wealth | | | 494 | | | | 489 | | | | 463 | | | | 1 | % | | | 7 | % |

GTSO and Group Centre | | | 180 | | | | 215 | | | | 175 | | | | -16 | % | | | 3 | % |

| | | | | | | | | | | | | | | | | | | | |

Total cash operating expenses | | | 4,286 | | | | 4,213 | | | | 4,044 | | | | 2 | % | | | 6 | % |

| | | | | | | | | | | | | | | | | | | | |

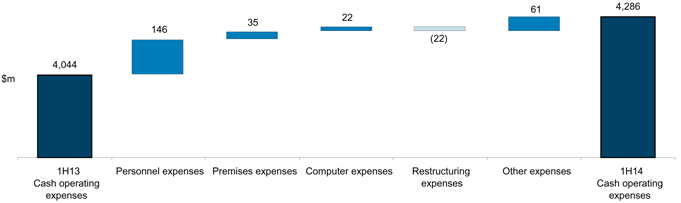

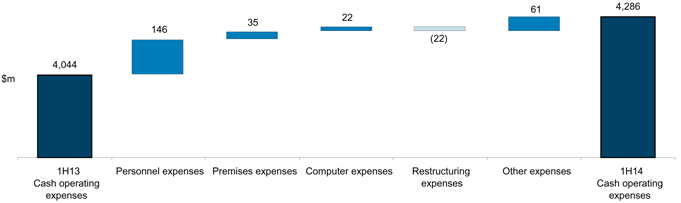

Operating expenses – March 2014 Half Year v March 2013 Half Year

| • | | March 2014 half year v March 2013 half year |

| | • | | Personnel expenses increased $146 million (6%), primarily due to annual salary increases and the adverse impact of foreign exchange movements, partially offset by lower redundancy costs in the March 2014 half. |

| | • | | Premises expenses increased $35 million (10%), driven by increased rental space, including our new Sydney premises, along with rent and utility cost increases and adverse foreign exchange translation. |

| | • | | Computer expenses increased $22 million (4%) due to increased depreciation and amortisation and higher spend on computer contractors and communication costs, partially offset by lower software purchases. |

| | • | | Restructuring expenses decreased $22 million (-39%) due to the completion of “NZ Simplification” and lower restructuring initiatives in GTSO and Group Centre. |

| | • | | Other expenses increased $61 million (9%), primarily due to adverse impact of foreign exchange movements, the impact of a one off GST credit in the March 2013 half and higher advertising costs, partially offset by lower spend on project consultants. |

| • | | March 2014 half year v September 2013 half year |

| | • | | Personnel expenses increased $76 million (3%), primarily due to annual salary increases and the adverse impact of foreign exchange movements. |

| | • | | Premises expenses increased $14 million (4%) due to increased depreciation and amortisation on new office buildings and fixtures. |

| | • | | Computer expenses increased $15 million (2%) due to increased depreciation and amortisation and higher computer contractors costs, partially offset by lower software purchases. |

| | • | | Restructuring expenses increased $7 million (25%) due mainly to increased restructuring in GTSO and Group Centre. |

| | • | | Other expenses decreased $39 million (-5%) primarily due to lower spend on project consultants and decreased travel and entertainment costs. |

24

CFO OVERVIEW

Credit risk

Overall asset quality has improved compared to the prior comparable period in 2013, with gross impaired assets reducing $1,065 million (23%) to $3,620 million at 31 March 2014. This was driven by a focus on portfolio credit quality resulting in lower levels of impaired exposures across Australia, IIB and New Zealand.

The Group continues to maintain a prudent approach to provisioning, with total provisions for impairment losses of $4,313 million as at 31 March 2014, down $41 million (1%) from 30 September 2013, up $1 million compared to the 31 March 2013.

The total credit impairment charge of $528 million reduced by $71 million (12%) compared to the prior comparable period and by $70 million (12%) compared to the September 2013 half.

| | | | | | | | | | | | | | | | | | | | |

| | | Half Year | | | Movement | |

| Credit impairment charge | | Mar 14

$M | | | Sep 13

$M | | | Mar 13

$M | | | Mar 14