RECOGNITION AND MEASUREMENT RECOGNITION AND MEASUREMENT

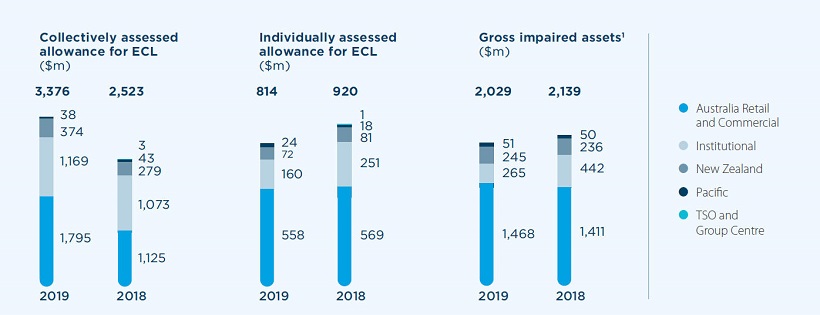

Policy applicable from 1 October 2018 EXPECTED CREDIT LOSS IMPAIRMENT MODEL The measurement of expected credit losses reflects an unbiased, probability weighted prediction, which evaluates a range of scenarios and takes into account the time value of money, past events, current conditions and forecasts of future economic conditions. Expected credit losses are either measured over 12 months or the expected lifetime of the financial asset, depending on credit deterioration since origination, according to the following three-stage approach: · Stage 1: At the origination of a financial asset, and where there has not been a significant increase in credit risk (SICR) since origination, an allowance equivalent to 12 months ECL is recognised reflecting the expected credit losses resulting from default events that are possible within the next 12 months from the reporting date. For instruments with a remaining maturity of less than 12 months, expected credit losses are estimated based on default events that are possible over the remaining time to maturity. · Stage 2: Where there has been a significant increase in credit risk since origination, an allowance equivalent to lifetime ECL is recognised reflecting expected credit losses resulting from all possible default events over the expected life of a financial instrument. If credit risk were to improve in a subsequent period such that the increase in credit risk since origination is no longer considered significant, the exposure returns to a Stage 1 classification and a 12 month ECL applies. · Stage 3: Where there is objective evidence of impairment, an allowance equivalent to lifetime ECL is recognised. Expected credit losses are estimated on a collective basis for exposures in Stage 1 and Stage 2, and on either a collective or individual basis when transferred to Stage 3. MEASUREMENT OF EXPECTED CREDIT LOSS ECL is calculated as the product of the following credit risk factors at a facility level, discounted to incorporate the time value of money: · Probability of default (PD) - the estimate of the likelihood that a borrower will default over a given period; · Exposure at default (EAD) - the expected balance sheet exposure at default taking into account repayments of principal and interest, expected additional drawdowns and accrued interest; and · Loss given default (LGD) - the expected loss in the event of the borrower defaulting, expressed as a percentage of the facility’s EAD, taking into account direct and indirect recovery costs. These credit risk factors are adjusted for current and forward looking information through the use of macro-economic variables. EXPECTED LIFE When estimating ECL for exposures in Stage 2 and 3, the Group considers the expected lifetime over which it is exposed to credit risk. Fornon-retail portfolios, the Group uses the maximum contractual period as the expected lifetime fornon-revolving credit facilities. Fornon-retail revolving credit facilities, such as corporate lines of credit, the expected life reflects the Group’s contractual right to withdraw a facility as part of a contractually agreed annual review, after taking into account the applicable notice period. For retail portfolios, the expected lifetime is determined using behavioural term, taking into account expected prepayment behaviour and substantial modifications. DEFINITION OF DEFAULT, CREDIT IMPAIRED AND WRITE-OFFS The definition of default used in measuring expected credit losses is aligned to the definition used for internal credit risk management purposes across all portfolios. This definition is also in line with the regulatory definition of default. Default occurs when there are indicators that a debtor is unlikely to fully satisfy contractual credit obligations to the Group, or the exposure is 90 days past due. Financial assets, including those that are well secured, are considered credit impaired for financial reporting purposes when they default. When there is no realistic probability of recovery, loans are written off against the related impairment allowance on completion of the Group’s internal processes and when all reasonably expected recoveries have been collected. In subsequent periods, any recoveries of amounts previouslywritten-off are credited to credit impairment charge in the income statement. |

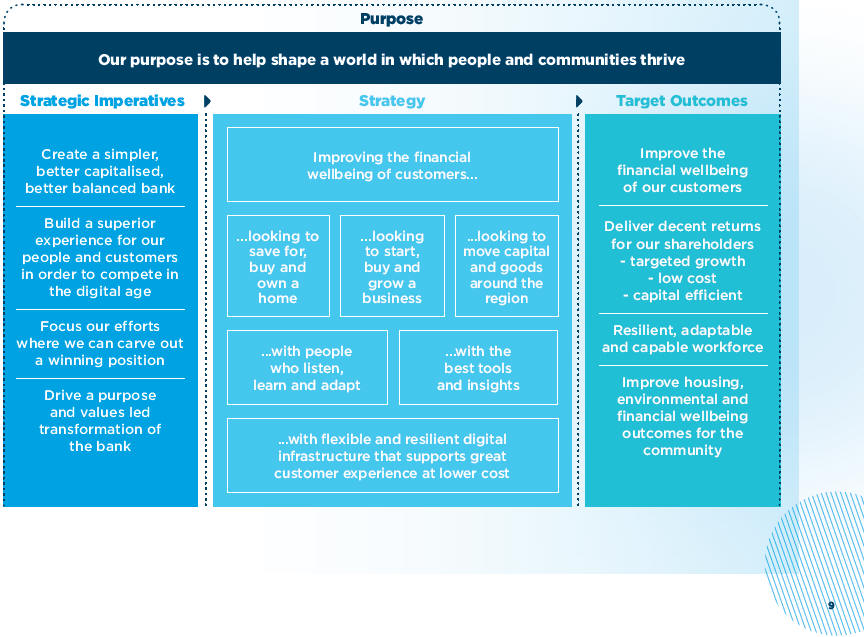

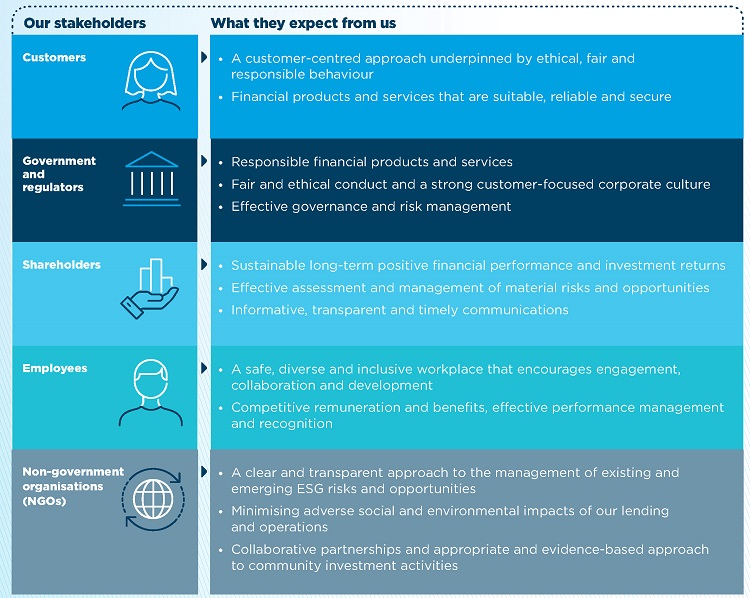

A focus on fair and responsible banking

A focus on fair and responsible banking

KEY JUDGEMENTS AND ESTIMATES

KEY JUDGEMENTS AND ESTIMATES RECOGNITION AND MEASUREMENT

RECOGNITION AND MEASUREMENT

CLASSIFICATION AND MEASUREMENT

CLASSIFICATION AND MEASUREMENT

RECOGNITION AND MEASUREMENT

RECOGNITION AND MEASUREMENT KEY JUDGEMENTS AND ESTIMATES

KEY JUDGEMENTS AND ESTIMATES

RECOGNITION AND MEASUREMENT

RECOGNITION AND MEASUREMENT KEY JUDGEMENTS AND ESTIMATES

KEY JUDGEMENTS AND ESTIMATES KEY JUDGEMENTS AND ESTIMATES

KEY JUDGEMENTS AND ESTIMATES