July 25, 2012

Via EDGAR and Hand Delivery

John Reynolds

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-3561

Re: Hi-Crush Partners LP

Ladies and Gentlemen:

Pursuant to discussions with the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”), Hi-Crush Partners LP (the “Partnership”) hereby submits its currently expected offering terms of the initial public offering (the “Offering”), including the bona fide price range pursuant to Item 503(b)(3) of Regulation S-K. The Partnership expects that these pricing terms will be included in a future amendment to the Registration Statement on Form S-1, File No. 333-182574 (the “Registration Statement”). The provided terms are a bona fide estimate of the range of the minimum and maximum offering price and the maximum number of securities to be offered as of July 25, 2012. Should the bona fide estimates of these terms change, the figures presented in future amendments to the Registration Statement may increase or decrease.

The Partnership proposes to price the Offering with a bona fide price range of $19 to $21 per common unit, with a midpoint of $20 per common unit. In the Offering, Hi-Crush Proppants LLC proposes to sell up to 14,375,000 common units representing limited partner interests in the Partnership. As discussed with members of the Staff, this range is initially being provided for your consideration by correspondence given the Partnership’s and the underwriters’ concern regarding providing such information significantly in advance of the launch of the offering given recent market volatility as well as our desire to provide all information necessary for the Staff to complete its review on a timely basis.

Additionally, the Partnership is enclosing its proposed marked copy of those pages of the Registration Statement that will be affected by the offering terms set forth herein. These marked changes will be incorporated into a future amendment to the Registration Statement. The Partnership also attaches herein for the Staff’s review and comment Vinson & Elkins L.L.P.’s Exhibit 5.1 Opinion to the Partnership, to be filed as an exhibit to a future amendment to the Registration Statement.

Securities and Exchange Commission

July 25 2012

Page 2

The Partnership seeks confirmation from the Staff that it may launch its Offering with the price range specified herein and include such price range in a future filing of the Registration Statement.

Should the Staff have any questions or comments, please contact the undersigned at (713) 963-0099 or David P. Oelman of Vinson & Elkins L.L.P. at (713) 758-3708.

| | |

Very truly yours, |

HI-CRUSH PARTNERS LP |

| |

By: | | /s/ Robert Rasmus |

Name: | | Robert Rasmus |

Title: | | Co-Chief Executive Officer |

Enclosures

| cc: | Jay Williamson (Securities and Exchange Commission) |

| | James Lopez (Securities and Exchange Commission) |

| | David P. Oelman (Vinson & Elkins L.L.P.) |

| | E. Ramey Layne (Vinson & Elkins L.L.P.) |

| | Charles L. Strauss (Fulbright & Jaworski L.L.P.) |

| | P. Kevin Trautner (Fulbright & Jaworski L.L.P.) |

| | James M. Whipkey (Hi-Crush Partners LP) |

| | Mark C. Skolos (Hi-Crush Partners LP) |

As filed with the Securities and Exchange Commission on , 2012

Registration No. 333-182574

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Hi-Crush Partners LP

(Exact Name of Registrant as Specified in Its Charter)

| | | | |

| Delaware | | 1400 | | 90-0840530 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Three Riverway, Suite 1550

Houston, Texas 77056

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Robert E. Rasmus/James M. Whipkey

Three Riverway, Suite 1550

Houston, Texas 77056

(713) 963-0099

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| | |

David Palmer Oelman E. Ramey Layne Vinson & Elkins L.L.P. 1001 Fannin Street, Suite 2500 Houston, Texas 77002 Tel: (713) 758-2222 Fax: (713) 758-2346 | | Charles L. Strauss P. Kevin Trautner Fulbright & Jaworski L.L.P. Fulbright Tower 1301 McKinney, Suite 5100 Houston, Texas 77010 Tel: (713) 651-5151 Fax: (713) 651-5246 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

CALCULATION OF REGISTRATION FEE

| | | | |

|

Title of Each Class of Securities To Be Registered | | Proposed Maximum Aggregate

Offering Price(1)(2) | | Amount of Registration Fee |

Common units representing limited partner interests | | $301,875,000 | | $34,595 |

|

|

| (1) | Includes common units issuable upon exercise of the underwriters’ option to purchase additional common units. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

| (3) | The total registration fee includes $22,920 that was previously paid for the registration of $200,000,000 of proposed maximum aggregate offering price in the filing of the Registration Statement (Registration No. 333-182574) on July 9, 2012 and $11,675 for the registration of an additional $101,875,000 of proposed maximum aggregate offering price registered hereby. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated , 2012

Hi-Crush Partners LP

12,500,000 Common Units

Representing Limited Partner Interests

This is the initial public offering of our common units representing limited partner interests. Hi-Crush Proppants LLC, or the selling unitholder, is offering 12,500,000 common units. We will not receive any proceeds from the sale of common units by Hi-Crush Proppants LLC. Prior to this offering, there has been no public market for our common units. We currently expect the initial public offering price to be between $19.00 and $21.00 per common unit. Our common units have been approved for listing on the New York Stock Exchange under the symbol “HCLP,” subject to official notice of issuance.

Investing in our common units involves risks. Please read “Risk Factors” beginning on page 24.

These risks include the following:

| • | | We may not have sufficient cash from operations following the payment of costs and expenses to enable us to pay the minimum quarterly distribution to our unitholders. |

| • | | On a pro forma basis we would not have had sufficient cash available for distribution to pay the full minimum quarterly distribution on all units for the twelve months ended June 30, 2012. |

| • | | Inaccuracies in estimates of volumes and qualities of our sand reserves could result in lower than expected sales and higher than expected production costs. |

| • | | Substantially all of our sales are generated under contracts with four customers, and the loss of or reduced purchasing by any of them could adversely affect our results of operations. |

| • | | Hi-Crush Proppants LLC controls our general partner, which has sole responsibility for managing our operations. Our general partner and Hi-Crush Proppants LLC have conflicts of interest with us and limited duties, and they may favor their own interests to the detriment of us and our unitholders. |

| • | | Our partnership agreement does not require us to pay distributions. |

| • | | Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors. |

| • | | Unitholders will experience immediate and substantial dilution of $17.70 per common unit. |

| • | | If the IRS were to treat us as a corporation for federal income tax purposes, then our cash available for distribution could be substantially reduced. |

| • | | You will be required to pay taxes on your share of our income even if you do not receive any cash distributions from us. |

In addition, we qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933 and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. Furthermore, for so long as we remain an emerging growth company, we will qualify for certain limited exceptions from investor protection laws such as the Sarbanes Oxley Act of 2002 and the Investor Protection and Securities Reform Act of 2010. Please read “Risk Factors” and “Summary—Emerging Growth Company Status.”

| | | | | | | | |

| | | Per Common Unit | | | Total | |

Public Offering Price | | $ | | | | $ | | |

Underwriting Discount(1) | | $ | | | | $ | | |

Proceeds to Hi-Crush Proppants LLC | | $ | | | | $ | | |

| (1) | Excludes a structuring fee of 0.375% of the gross proceeds of this offering payable to Barclays Capital Inc. Please read “Underwriting.” |

The underwriters may purchase up to an additional 1,875,000 common units from Hi-Crush Proppants LLC at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units to purchasers on or about , 2012 through the book-entry facilities of The Depository Trust Company.

| | |

| Credit Suisse | | UBS Investment Bank |

| |

| Raymond James | | RBC Capital Markets |

Prospectus dated , 2012

SUMMARY

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the historical and pro forma financial statements and the notes to those financial statements, before investing in our common units. The information presented in this prospectus assumes an initial public offering price of $20.00 per common unit (the mid-point of the price range set forth on the cover page of this prospectus) and, unless otherwise indicated, that the underwriters’ option to purchase additional common units is not exercised. You should read “Risk Factors” for information about important risks that you should consider before buying our common units.

References in this prospectus to “Hi-Crush Partners LP,” “we,” “our,” “us” or like terms when used in a historical context refer to the business of Hi-Crush Proppants LLC, which is our accounting predecessor and is contributing certain of its subsidiaries to Hi-Crush Partners LP in connection with this offering. When used in the present tense or prospectively, those terms refer to Hi-Crush Partners LP and its subsidiaries. References in this prospectus to “Hi-Crush Proppants LLC,” “our predecessor,” “our sponsor” and “the selling unitholder” refer to Hi-Crush Proppants LLC. We include a glossary of some of the terms used in this prospectus as Appendix B.

Hi-Crush Partners LP

Overview

We are a pure play, low-cost, domestic producer of premium monocrystalline sand, a specialized mineral that is used as a “proppant” to enhance the recovery rates of hydrocarbons from oil and natural gas wells. Our reserves consist of “Northern White” sand, a resource existing predominately in Wisconsin and limited portions of the upper Midwest region of the United States, which is highly valued as a preferred proppant because it exceeds all American Petroleum Institute (“API”) specifications. We own, operate and develop sand reserves and related excavation and processing facilities and will seek to acquire or develop additional facilities. Our 561-acre facility with integrated rail infrastructure, located near Wyeville, Wisconsin, enables us to process and cost-effectively deliver approximately 1,600,000 tons of frac sand per year. Substantially all of our frac sand production is sold to leading investment grade-rated pressure pumping service providers under long-term, take-or-pay contracts that require our customers to pay a specified price for a specified volume of frac sand each month.

Over the past decade, exploration and production companies have increasingly focused on exploiting the vast hydrocarbon reserves contained in North America’s unconventional oil and natural gas reservoirs through advanced techniques, such as horizontal drilling and hydraulic fracturing. In recent years, this focus has resulted in exploration and production companies drilling more and longer horizontal wells, completing more hydraulic fracturing stages per well and utilizing more proppant per stage in an attempt to efficiently maximize the volume of hydrocarbon recoveries per wellbore. As a result, North American demand for proppant has increased rapidly, growing at an average annual rate of 28.0% from 2006 to 2011, with total annual sales of $3.7 billion in 2011, according to The Freedonia Group, a leading international business research company. We believe that the market for raw frac sand will continue to grow based on the expected long-term development of North America’s unconventional oil and natural gas reservoirs.

We intend to utilize the significant oil and natural gas industry experience of our management team to take advantage of what we believe are favorable, long-term market dynamics as we execute our growth strategy, which includes both the acquisition of additional frac sand reserves and the development of new excavation and processing facilities. We expect to have the opportunity to acquire significant additional acreage and reserves currently owned or under an agreement to be acquired by our sponsor, Hi-Crush Proppants LLC, including approximately 1,700 acres of additional land and associated reserves in western Wisconsin to which we have a

1

| | • | | Intrinsic logistics and infrastructure advantage. The strategic location and logistics capabilities of our Wyeville facility enable us to serve all major U.S. oil and natural gas producing basins. Our on-site transportation assets include three 5,000-foot rail spurs off a Union Pacific Railroad mainline that are capable of accommodating unit trains, allowing our customers to receive priority scheduling, expedited delivery and a more cost-effective shipping alternative. Our logistics capabilities enable efficient loading of sand and minimize rail car turnaround times at the facility, and we expect to acquire or develop similar logistics capabilities at any facilities we own in the future. We believe we are one of the few frac sand producers with a facility initially designed to deliver frac sand meeting API specifications to all of the major U.S. oil and natural gas producing basins by on-site rail facilities, including on-site storage capacity accommodating unit trains. |

| | • | | Competitive operating cost structure. Our operations have been strategically designed to provide low per-unit production costs with a significant variable component for the excavation and processing of our sand. Our sand reserves do not require blasting or crushing to be processed and, due to the shallow overburden at our Wyeville facility, we are able to use surface mining equipment in our operations, which provides for a lower cost structure than underground mining operations. Our mining operations are subcontracted to Gerke Excavating, Inc. at a fixed cost of $2.09 per ton excavated, subject to a diesel fuel surcharge, under a three-year contract. Unlike some competitors, our processing and rail loading facilities are located on-site, which eliminates the requirement for on-road transportation, lowers product movement costs and minimizes the reduction in sand quality due to handling. |

| | • | | Experienced and incentivized management team. Our management team has extensive experience investing and operating in the oil and natural gas industry and will be focused on optimizing our current business and expanding our operations through disciplined development and accretive acquisitions. We believe our management team’s substantial experience and relationships with participants in the oilfield services and exploration and production industries provide us with an extensive operational and commercial understanding of the markets in which our customers operate. The expertise of our management and operations teams covers a wide range of disciplines, with an emphasis on development, construction and operation of frac sand processing facilities, frac sand supply chain management and consulting and bulk solids material handling. Members of our management team are strongly incentivized to profitably grow our business and cash flows through their 39% interest in our sponsor, which will own 1,898,148 of our common units and all of our subordinated units and incentive distribution rights following this offering. |

Risk Factors

An investment in our common units involves risks. You should carefully consider the following risk factors, those other risks described in “Risk Factors” and the other information in this prospectus, before deciding whether to invest in our common units. The following risks and others are discussed in more detail in “Risk Factors.”

Risks Inherent in Our Business

| | • | | We may not have sufficient cash from operations following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our unitholders. |

| | • | | On a pro forma basis we would not have had sufficient cash available for distribution to pay the full minimum quarterly distribution on all units for the twelve months ended June 30, 2012. |

| | • | | The amount of cash we have available for distribution to holders of our units depends primarily on our cash flow and not solely on profitability, which may prevent us from making cash distributions during periods when we record net income. |

7

Risks Inherent in an Investment in Us

| | • | | Our sponsor owns and controls our general partner, which has sole responsibility for conducting our business and managing our operations. Our general partner and its affiliates, including our sponsor, have conflicts of interest with us and limited duties, and they may favor their own interests to the detriment of us and our unitholders. |

| | • | | The board of directors of our general partner may modify or revoke our cash distribution policy at any time at its discretion. Our partnership agreement does not require us to pay any distributions at all. |

| | • | | Our sponsor and other affiliates of our general partner will have the ability to compete with us, and we expect that our sponsor will compete with us once operations at its processing facility in Augusta, Wisconsin commence in the third quarter of 2012. |

| | • | | Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors, which could reduce the price at which our common units will trade. |

| | • | | Unitholders will experience immediate and substantial dilution of $17.70 per common unit. |

| | • | | There is no existing market for our common units, and a trading market that will provide you with adequate liquidity may not develop. The price of our common units may fluctuate significantly, and unitholders could lose all or part of their investment. |

| | • | | Our sponsor, which is our accounting predecessor for financial reporting purposes, has a material weakness in its internal control over financial reporting. If we fail to establish and maintain effective internal control over financial reporting, our ability to accurately report our financial results could be adversely affected. |

Tax Risks to Common Unitholders

| | • | | Our tax treatment depends on our status as a partnership for federal income tax purposes, as well as our not being subject to a material amount of entity-level taxation by individual states. If the IRS were to treat us as a corporation for federal income tax purposes or we were to become subject to material additional amounts of entity-level taxation for state tax purposes, then our cash available for distribution to you could be substantially reduced. |

| | • | | The tax treatment of publicly-traded partnerships or an investment in our units could be subject to potential legislative, judicial or administrative changes and differing interpretations, possibly on a retroactive basis. |

| | • | | You will be required to pay taxes on your share of our income even if you do not receive any cash distributions from us. |

Our Management

We are managed and operated by the board of directors and executive officers of our general partner, Hi-Crush GP LLC, a wholly owned subsidiary of our sponsor. As a result of owning our general partner, our sponsor will have the right to appoint all members of the board of directors of our general partner, including at least three independent directors meeting the independence standards established by the NYSE. At least one of our independent directors will be appointed prior to the date our common units are listed for trading on the NYSE. Our unitholders will not be entitled to elect our general partner or its directors or otherwise directly participate in our management or operations. For more information about the executive officers and directors of our general partner, please read “Management.”

9

Our sponsor has agreed to acquire approximately 700 acres in Tomah, Wisconsin, which is six miles south of the Wyeville facility in Monroe County. The Tomah site has access to the same Union Pacific Railroad mainline as the Wyeville facility, which runs adjacent to the property, and could accommodate similar rail logistics as the Wyeville facility. Extensive core samples have been taken at Tomah and independently tested with results indicating a high quality sand reserve similar to the Wyeville site. According to a John T. Boyd reserve report, the Tomah site had proven recoverable sand reserves of 33 million tons as of December 31, 2011, which represents a 51-year reserve life assuming construction of a 650,000 ton per year processing facility.

In addition, our sponsor is evaluating a number of additional development locations and adds potential projects to its development backlog regularly.

Our sponsor’s retained sand facilities represent a significant potential growth opportunity for us. Our sponsor continually evaluates acquisitions and may elect to acquire, construct or dispose of assets in the future, including sales of assets to us. As the owner of our general partner, 1,898,148 of our common units, all 14,398,148 of our subordinated units and all of our incentive distribution rights following this offering, our sponsor is well aligned and highly motivated to promote and support the successful execution of our business strategies, including utilizing our partnership as a growth vehicle for its sand mining operations. Although we expect to have the opportunity to make additional acquisitions directly from our sponsor in the future, including the sand excavation and processing facilities described above that are subject to our right of first offer, our sponsor is under no obligation to accept any offer we make, and may, following good faith negotiations with us, sell the assets subject to our right of first offer to third parties that may compete with us. Our sponsor may also elect to develop, retain and operate properties in competition with us or develop new assets that are not subject to our right of first offer.

In addition, while we believe our relationship with our sponsor is a significant positive attribute, it may also be a source of conflict. For example, our sponsor is not restricted in its ability to compete with us, and beginning with the commencement of operations at our sponsor’s Augusta facility scheduled for the third quarter of 2012, our sponsor will operate frac sand excavation and processing facilities that will compete directly with us for new and existing customers. We expect that our sponsor will develop additional frac sand excavation and processing facilities in the future, which may also compete with us. While we expect that our management team, which also manages our sponsor’s retained assets, and our sponsor will allocate new and replacement customer contracts between us and our sponsor in a manner that balances the interests of both parties, they are under no obligation to do so. Please read “Conflicts of Interest and Fiduciary Duties.”

Summary of Conflicts of Interest and Fiduciary Duties

Our general partner has a legal duty to manage us in a manner it believes is in our best interest. However, the officers and directors of our general partner also have fiduciary duties to manage our general partner in a manner beneficial to our sponsor, the owner of our general partner. As a result, conflicts of interest may arise in the future between us or our unitholders, on the one hand, and our sponsor and our general partner, on the other hand.

Our partnership agreement limits the liability of and replaces the duties owed by our general partner to our unitholders. Our partnership agreement also restricts the remedies available to our unitholders for actions that might otherwise constitute a breach of our general partner’s duties. By purchasing a common unit, the purchaser agrees to be bound by the terms of our partnership agreement, and each unitholder is treated as having consented to various actions and potential conflicts of interest contemplated in the partnership agreement that might otherwise be considered a breach of fiduciary or other duties under Delaware law.

We expect that the board of directors of our general partner will delegate to a conflicts committee of the board of directors the authority to approve material transactions with related parties.

11

Formation Transactions and Partnership Structure

We are a Delaware limited partnership formed in May 2012 by our sponsor, Hi-Crush Proppants LLC, to own and operate certain of the businesses that have historically been conducted by Hi-Crush Proppants LLC.

In connection with the closing of this offering, the following will occur:

| | • | | Hi-Crush Proppants LLC will contribute Hi-Crush Chambers LLC, Hi-Crush Railroad LLC, Hi-Crush Wyeville LLC and Hi-Crush Operating LLC to us; |

| | • | | our sponsor will contribute to us an amount of cash, which we currently expect will be approximately $6.2 million. This is the amount we expect to remain as of the closing of this offering related to prepayments for volumes of sand to be delivered during the six months ended December 31, 2012. Hi-Crush Proppants LLC will retain all other cash and cash equivalents; |

| | • | | we will issue to Hi-Crush Proppants LLC 14,398,148 common units, 14,398,148 subordinated units and all of our incentive distribution rights; |

| | • | | Hi-Crush Proppants LLC will sell 12,500,000 common units to the public in this offering and will receive gross proceeds of $250.0 million from the sale of such units at an assumed initial public offering price of $20.00 per unit; |

| | • | | Hi-Crush Proppants LLC will use a portion of the proceeds received by it from this offering to pay underwriting discounts and the structuring fee totaling approximately $16.3 million; |

| | • | | to the extent the underwriters exercise their option to purchase 1,875,000 additional common units, Hi-Crush Proppants LLC will sell such units to the public, pay the related underwriting discounts and structuring fee and retain the net proceeds; |

| | • | | we will enter into a new $100.0 million revolving credit facility; and |

| | • | | we will enter into an omnibus agreement with Hi-Crush Proppants LLC, our general partner and certain of its affiliates pursuant to which: |

| | • | | we will agree to reimburse Hi-Crush Proppants LLC and its affiliates for the payment of certain capital expenditures, operating expenses and for providing various general and administrative services; |

| | • | | Hi-Crush Proppants LLC will indemnify us for certain environmental, toxic tort, title and right-of-way defects and other matters; |

| | • | | Hi-Crush Proppants LLC will assume our customer contract with FTS International beginning on May 1, 2013; and |

| | • | | Hi-Crush Proppants LLC will grant us a right of first offer with respect to its Augusta and Tomah acreage and related assets, which are being retained by Hi-Crush Proppants LLC in connection with this offering. |

13

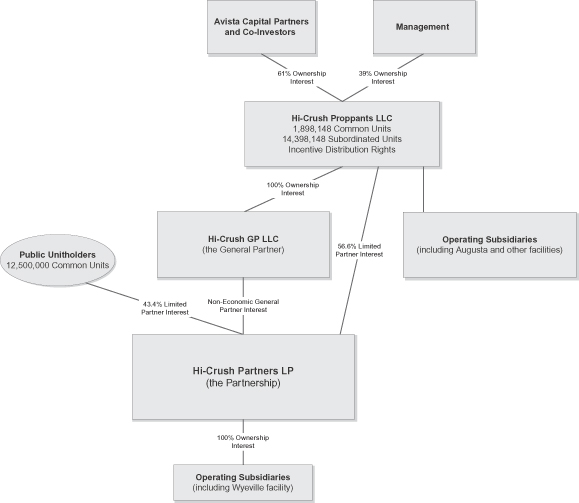

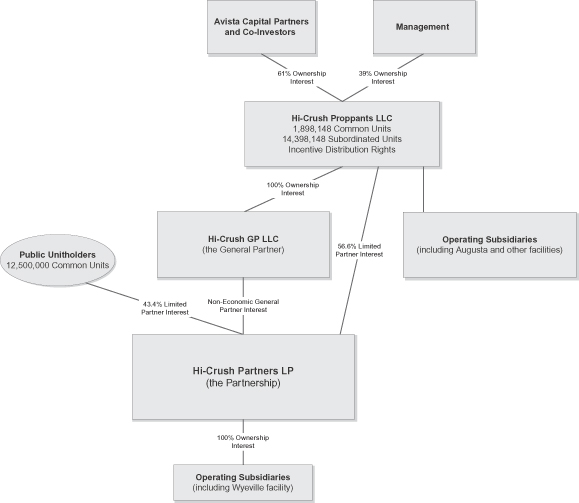

Organizational Structure

The following is a simplified diagram of our ownership structure after giving effect to this offering and the related transactions.

| | | | |

Public Common Units | | | 43.4 | %(1) |

Interests of Hi-Crush Proppants LLC: | | | | |

Common Units | | | 6.6 | %(1) |

Subordinated Units | | | 50.0 | % |

Incentive Distribution Rights | | | — | (2) |

Non-Economic General Partner Interest | | | 0.0 | %(3) |

| | | | |

| | | 100.0 | % |

| | | | |

| (1) | Assumes no exercise of the underwriters’ option to purchase additional common units. If and to the extent the underwriters exercise their option to purchase additional common units from the selling unitholder, the units purchased pursuant to such exercise will be sold to the public. |

| (2) | Incentive distribution rights represent a variable interest in distributions and thus are not expressed as a fixed percentage. Please read “How We Make Distributions To Our Partners—Incentive Distribution Rights.” Distributions with respect to the incentive distribution rights will be classified as distributions with respect to equity interests. Incentive distribution rights will be issued to Hi-Crush Proppants LLC. |

| (3) | Our general partner owns a non-economic general partner interest in us. Please read “How We Make Distributions To Our Partners—General Partner Interest.” |

14

The Offering

Common units offered to the public by the selling unitholder | 12,500,000 common units. |

Option to purchase additional common units from the selling unitholder | If the underwriters exercise their option to purchase additional common units in full, the selling unitholder will sell an additional 1,875,000 common units to the public. |

Units outstanding after this offering | 14,398,148 common units and 14,398,148 subordinated units for a total of 28,796,296 limited partner units. If and to the extent the underwriters exercise their option to purchase additional common units, the selling unitholder, Hi-Crush Proppants LLC, will sell the number of common units purchased by the underwriters pursuant to such exercise and the remainder, if any, will be retained by Hi-Crush Proppants LLC. Accordingly, the exercise of the underwriters’ option will not affect the total number of common units outstanding. In addition, our general partner will own a non-economic general partner interest in us. |

Use of proceeds | We will not receive any proceeds from the sale of common units by the selling unitholder in this offering. |

Cash distributions | We expect to make a minimum quarterly distribution of $0.45 per common unit and subordinated unit ($1.80 per common unit and subordinated unit on an annualized basis) to the extent we have sufficient cash after establishment of cash reserves and payment of fees and expenses, including payments to our general partner and its affiliates. Our ability to pay the minimum quarterly distribution is subject to various restrictions and other factors described in more detail under the caption “Cash Distribution Policy and Restrictions on Distributions.” |

| | For the first quarter that we are publicly-traded, we will pay a prorated distribution covering the period from the completion of this offering through September 30, 2012, based on the actual length of that period. |

| | Our partnership agreement generally provides that we will distribute cash each quarter in the following manner: |

| | • | | first, to the holders of common units, until each common unit has received the minimum quarterly distribution of $0.45 plus any arrearages from prior quarters; |

| | • | | second, to the holders of subordinated units, until each subordinated unit has received the minimum quarterly distribution of $0.45; and |

| | • | | third, to the holders of common units and subordinated units pro rata until each has received a distribution of $0.5175. |

15

| | If cash distributions to our unitholders exceed $0.5175 per common unit and subordinated unit in any quarter, our unitholders and our sponsor (as the holder of our incentive distribution rights) will receive distributions according to the following percentage allocations: |

| | | | | | | | |

Total Quarterly Distribution

Target Amount | | Marginal Percentage Interest

in Distributions | |

| | Unitholders | | | Sponsor

(as Holder of

Our Incentive

Distribution Rights) | |

above $0.5175 up to $0.5625 | | | 85.0 | % | | | 15.0 | % |

above $0.5625 up to $0.6750 | | | 75.0 | % | | | 25.0 | % |

above $0.6750 | | | 50.0 | % | | | 50.0 | % |

| | We refer to the additional increasing distributions to our sponsor as “incentive distributions.” Please read “How We Make Distributions To Our Partners—Incentive Distribution Rights.” |

| | Our pro forma cash available for distribution for the six months ended June 30, 2012 was approximately $21.0 million (sufficient to pay $0.90 per common unit and $0.56 per subordinated unit). This amount would have been insufficient to pay the full minimum quarterly distribution on all of our common and subordinated units for the six months ended June 30, 2012 by approximately $4.9 million. As a result, for the six months ended June 30, 2012 we would have generated cash available for distribution sufficient to pay 100% of the minimum quarterly distribution on all of our common units, but only approximately 62.3% of the minimum quarterly distribution on our subordinated units during that period. |

| | We believe, based on our financial forecast and related assumptions included in “Cash Distribution Policy and Restrictions on Distributions,” that we will have sufficient cash available for distribution to pay the minimum quarterly distribution of $0.45 on all of our common units and subordinated units for each quarter in the twelve months ending September 30, 2013. However, we do not have a legal or contractual obligation to pay quarterly distributions at our minimum quarterly distribution rate or at any other rate and there is no guarantee that we will pay distributions to our unitholders in any quarter. Please read “Cash Distribution Policy and Restrictions on Distributions.” |

Subordinated units | Our sponsor will initially own all of our subordinated units. The principal difference between our common units and subordinated units is that in any quarter during the subordination period, holders of the subordinated units are not entitled to receive any distribution until the common units have received the minimum quarterly distribution plus any arrearages in the payment of the minimum quarterly distribution from prior quarters. Subordinated units will not accrue arrearages. |

16

Conversion of subordinated units | The subordination period will end on the first business day after we have earned and paid at least (1) $1.80 (the minimum quarterly distribution on an annualized basis) on each outstanding common unit and subordinated unit for each of three consecutive, non-overlapping four quarter periods ending on or after June 30, 2015 or (2) $2.70 (150.0% of the annualized minimum quarterly distribution) on each outstanding common unit and subordinated unit and the related distribution on the incentive distribution rights for a four-quarter period ending on or after June 30, 2013, in each case provided there are no arrearages on our common units at that time. For the period after closing of this offering through September 30, 2012, we will adjust the quarterly distribution based on the actual length of the period, and use such adjusted distribution in determining whether the test described in this paragraph has been satisfied for the quarter ending September 30, 2012. |

| | The subordination period also will end upon the removal of our general partner other than for cause if no subordinated units or common units held by the holder(s) of subordinated units or their affiliates are voted in favor of that removal. |

| | When the subordination period ends, all subordinated units will convert into common units on a one-for-one basis, and all common units thereafter will no longer be entitled to arrearages. |

Our sponsor’s right to reset the target distribution levels | Our sponsor, as the initial holder of our incentive distribution rights, has the right, at any time when there are no subordinated units outstanding and it has received incentive distributions at the highest level to which it is entitled (50.0%) for the prior four consecutive whole fiscal quarters, to reset the initial target distribution levels at higher levels based on our cash distributions at the time of the exercise of the reset election. If our sponsor transfers all or a portion of our incentive distribution rights in the future, then the holder or holders of a majority of our incentive distribution rights will be entitled to exercise this right. The following assumes that our sponsor holds all of the incentive distribution rights at the time that a reset election is made. Following a reset election, the minimum quarterly distribution will be adjusted to equal the reset minimum quarterly distribution, and the target distribution levels will be reset to correspondingly higher levels based on the same percentage increases above the reset minimum quarterly distribution as the current target distribution levels. |

| | If our sponsor elects to reset the target distribution levels, it will be entitled to receive a number of common units. The number of common units to be issued to our sponsor will equal the number of common units that would have entitled the holder to an aggregate quarterly cash distribution in the quarter prior to the reset election equal to the distribution to our sponsor on the incentive distribution rights in the quarter prior to the reset election. Please read “How We Make Distributions To Our Partners—Our Sponsor’s Right to Reset Incentive Distribution Levels.” |

17

Issuance of additional units | Our partnership agreement authorizes us to issue an unlimited number of additional units without the approval of our unitholders. Please read “Units Eligible for Future Sale” and “The Partnership Agreement—Issuance of Additional Interests.” |

Limited voting rights | Our general partner will manage and operate us. Unlike the holders of common stock in a corporation, our unitholders will have only limited voting rights on matters affecting our business. Our unitholders will have no right to elect our general partner or its directors on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 66 2/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon consummation of this offering, our sponsor will own an aggregate of56.6% of our outstanding units (or50.1% of our outstanding units, if the underwriters exercise their option to purchase additional common units in full). This will give our sponsor the ability to prevent the removal of our general partner. Please read “The Partnership Agreement—Voting Rights.” |

Limited call right | If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner has the right, but not the obligation, to purchase all of the remaining common units at a price equal to the greater of (1) the average of the daily closing price of the common units over the 20 trading days preceding the date three days before notice of exercise of the call right is first mailed and (2) the highest per-unit price paid by our general partner or any of its affiliates for common units during the 90-day period preceding the date such notice is first mailed. Please read “The Partnership Agreement—Limited Call Right.” |

Estimated ratio of taxable income to distributions | We estimate that if you own the common units you purchase in this offering through the record date for distributions for the period ending December 31, 2014, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be less than60% of the cash distributed to you with respect to that period. For example, if you receive an annual distribution of $1.80 per unit, we estimate that your average allocable federal taxable income per year will be no more than approximately $1.08 per unit. Thereafter, the ratio of allocable taxable income to cash distributions to you could substantially increase. Please read “Material U.S. Federal Income Tax Consequences—Tax Consequences of Unit Ownership” beginning on page 172 for the basis of this estimate. |

Material federal income tax consequences | For a discussion of the material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read “Material U.S. Federal Income Tax Consequences.” |

Exchange listing | Our common units have been approved for listing on the New York Stock Exchange under the symbol “HCLP,” subject to official notice of issuance. |

18

Summary Historical and Pro Forma Financial and Operating Data

The partnership was formed in May 2012 and does not have historical financial statements. Therefore, in this prospectus we present the historical financial statements of our sponsor, Hi-Crush Proppants LLC, which is our accounting predecessor for financial reporting purposes. In connection with the closing of this offering, our sponsor will contribute all of the outstanding equity interests in certain of its operating subsidiaries, which account for substantially all of our sponsor’s historical business, to us. The following table presents summary historical financial and operating data of our sponsor and summary pro forma financial and operating data of Hi-Crush Partners LP as of the dates and for the periods indicated.

Our sponsor was formed in October 2010 to develop excavation, processing and logistics facilities for raw frac sand used in hydraulic fracturing operations in oil and natural gas wells. Since its formation, our sponsor acquired our assets in a number of separate acquisitions. As a result of our sponsor’s recent formation, we have limited operating history upon which you can base an evaluation of our current business and our future earnings prospects. This prospectus includes audited financial statements only as of December 31, 2011 and for the period from inception (October 28, 2010) to December 31, 2010 and unaudited financial information as of and for the six-month periods ended June 30, 2012 and 2011. In this prospectus, we refer to the period from inception to December 31, 2010 as the two-month period ended December 31, 2010. We have not completed or provided in this prospectus any stand-alone pre-acquisition financial statements for the assets we acquired in the transactions described above. As a result, and given our recent date of formation, we have not provided in this prospectus three years of audited financial statements that normally would be included in a prospectus forming part of an SEC registration statement or two years of audited financial statements as would normally be included in a prospectus forming part of an SEC registration statement filed by an emerging growth company.

The summary historical financial data presented as of December 31, 2010 and 2011, for the two-month period ended December 31, 2010 and for the year ended December 31, 2011 is derived from the audited historical financial statements of Hi-Crush Proppants LLC that are included elsewhere in this prospectus. The summary historical financial data presented as of and for the six months ended June 30, 2011 and 2012 are derived from the unaudited historical financial statements of Hi-Crush Proppants LLC included elsewhere in this prospectus.

The summary pro forma financial data presented as of and for the year ended December 31, 2011 and as of and for the six months ended June 30, 2012 is derived from our unaudited pro forma financial statements included elsewhere in this prospectus. Our unaudited pro forma financial statements give pro forma effect to the following:

| | • | | the contribution of Hi-Crush Chambers LLC, Hi-Crush Railroad LLC, Hi-Crush Wyeville LLC and Hi-Crush Operating LLC to us by our sponsor; |

| | • | | a reduction in general and administrative expenses as a result of allocations between our Wyeville facility and our sponsor’s other assets and activities that will not be contributed to us in connection with this offering; |

| | • | | the removal of other operating expenses of our sponsor related to assets and operations that will be retained by our sponsor following the completion of this offering; |

| | • | | the elimination of all cash and cash equivalents reflected on our balance sheet as of June 30, 2012, which will be retained by our sponsor; and |

| | • | | the issuance of 14,398,148 common units and 14,398,148 subordinated units to our sponsor. |

19

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor Historical | | | Hi-Crush Partners LP

Pro Forma | |

| | | Inception

to

December 31,

2010 | | | Year Ended

December 31,

2011 | | | Six Months Ended

June 30, | | | Year Ended

December 31,

2011 | | | Six Months

Ended

June 30,

2012 | |

| | | | | 2011 | | | 2012 | | | |

| | | (in thousands, except per unit and operating information) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | — | | | $ | 20,353 | | | $ | — | | | $ | 34,175 | | | $ | 20,353 | | | $ | 34,175 | |

| | | | | | |

Production costs (1) | | | — | | | | 5,998 | | | | — | | | | 9,603 | | | | 5,998 | | | | 9,603 | |

Depreciation and depletion | | | — | | | | 449 | | | | — | | | | 668 | | | | 449 | | | | 668 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cost of goods sold | | | — | | | | 6,447 | | | | — | | | | 10,271 | | | | 6,447 | | | | 10,271 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | — | | | | 13,906 | | | | — | | | | 23,904 | | | | 13,906 | | | | 23,904 | |

General and administrative | | | 26 | | | | 2,324 | | | | 647 | | | | 3,137 | | | | 1,689 | | | | 1,577 | |

Other operating expenses | | | — | | | | 381 | | | | — | | | | 419 | | | | — | | | | — | |

Accretion of asset retirement obligation | | | — | | | | 28 | | | | — | | | | 12 | | | | 28 | | | | 12 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations | | | (26 | ) | | | 11,173 | | | | (647 | ) | | | 20,336 | | | | 12,189 | | | | 22,315 | |

| | | | | | |

Other expense: | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | — | | | | (1,893 | ) | | | — | | | | (2,385 | ) | | | — | | | | — | |

Other | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total other income (expense) | | | — | | | | (1,893 | ) | | | — | | | | (2,385 | ) | | | — | | | | — | |

Income (loss) before tax expense | | | (26 | ) | | | 9,280 | | | | (647 | ) | | | 17,951 | | | | 12,189 | | | | 22,315 | |

Income tax expense | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (26 | ) | | $ | 9,280 | | | $ | (647 | ) | | $ | 17,951 | | | $ | 12,189 | | | $ | 22,315 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Pro forma net income per limited partner unit: | | | | | | | | | | | | | | | | | | | | | | | | |

Common unit | | | | | | | | | | | | | | | | | | $ | 0.85 | | | $ | 0.90 | |

Subordinated unit | | | | | | | | | | | | | | | | | | $ | — | | | $ | 0.65 | |

| | | | | | |

Statement of Cash Flow Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | (14 | ) | | $ | 18,788 | | | $ | 15,781 | | | $ | 5,063 | | | | | | | | | |

Investing activities | | | (322 | ) | | | (50,199 | ) | | | (28,775 | ) | | | (50,296 | ) | | | | | | | | |

Financing activities | | | 336 | | | | 42,465 | | | | 14,463 | | | | 45,929 | | | | | | | | | |

| | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA (1) | | $ | (26 | ) | | $ | 11,622 | | | $ | (647 | ) | | $ | 21,004 | | | $ | 12,638 | | | $ | 22,983 | |

Capital expenditures (2) | | | 72 | | | | 50,169 | | | | 28,745 | | | | 50,326 | | | | | | | | | |

| | | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Total tons sold | | | — | | | | 332,593 | | | | — | | | | 539,257 | | | | 332,593 | | | | 539,257 | |

Average realized price (per ton) | | $ | — | | | $ | 61.19 | | | $ | — | | | $ | 63.37 | | | $ | 61.19 | | | $ | 63.37 | |

Production costs (per ton) (1) | | | — | | | $ | 18.03 | | | | — | | | $ | 17.81 | | | $ | 18.03 | | | $ | 17.81 | |

| | | | | | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | — | | | $ | 11,054 | | | $ | 1,469 | | | $ | 11,750 | | | | | | | $ | — | |

Total assets | | | 614 | | | | 72,229 | | | | 36,497 | | | | 142,914 | | | | | | | | 72,328 | |

Long-term debt (including current portion) | | | — | | | | 46,112 | | | | 15,185 | | | | 96,421 | | | | | | | | — | |

Total liabilities | | | 304 | | | | 61,942 | | | | 36,571 | | | | 114,902 | | | | | | | | 5,981 | |

Members’/Partners’ capital | | | 310 | | | | 10,287 | | | | (74 | ) | | | 28,012 | | | | | | | | 66,347 | |

| (1) | For more information, please read “—Non-GAAP Financial Measures” below. |

| (2) | Expansion capital expenditures are capital expenditures made to increase the long-term operating capacity of our asset base whether through construction or acquisitions. Please read “How We Make Distributions to Our Partners—Capital Expenditures.” |

21

RISK FACTORS

Limited partner interests are inherently different from the capital stock of a corporation, although many of the business risks to which we are subject are similar to those that would be faced by a corporation engaged in a similar business. You should carefully consider the following risk factors together with all of the other information included in this prospectus in evaluating an investment in our common units.

If any of the following risks were to occur, our business, financial condition, results of operations and cash available for distribution could be materially adversely affected. In that case, we might not be able to make distributions on our common units, the trading price of our common units could decline, and you could lose all or part of your investment.

Risks Inherent in Our Business

We may not have sufficient cash from operations following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our unitholders.

We may not have sufficient cash each quarter to pay the full amount of our minimum quarterly distribution of $0.45 per unit, or $1.80 per unit per year, which will require us to have cash available for distribution of approximately $13.0 million per quarter, or $51.8 million per year, based on the number of common and subordinated units that will be outstanding after the completion of this offering. The amount of cash we can distribute on our common and subordinated units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on the following factors, some of which are beyond our control:

| | • | | the amount of frac sand we are able to excavate and process, which could be adversely affected by, among other things, operating difficulties and unusual or unfavorable geologic conditions; |

| | • | | the volume of frac sand we are able to sell; |

| | • | | the price at which we are able to sell frac sand; |

| | • | | changes in the price and availability of natural gas or electricity; |

| | • | | changes in prevailing economic conditions; |

| | • | | unanticipated ground, grade or water conditions; |

| | • | | inclement or hazardous weather conditions, including flooding, and the physical impacts of climate change; |

| | • | | changes in laws and regulations (or the interpretation thereof) related to the mining and hydraulic fracturing industries, silica dust exposure or the environment; |

| | • | | inability to acquire or maintain necessary permits or mining or water rights; |

| | • | | facility shutdowns in response to environmental regulatory actions; |

| | • | | inability to obtain necessary production equipment or replacement parts; |

| | • | | reduction in the amount of water available for processing; |

| | • | | technical difficulties or failures; |

| | • | | labor disputes and disputes with our excavation contractor; |

| | • | | late delivery of supplies; |

24

| | • | | difficulty collecting receivables; |

| | • | | inability of our customers to take delivery; |

| | • | | changes in the price and availability of transportation; |

| | • | | fires, explosions or other accidents; and |

| | • | | cave-ins, pit wall failures or rock falls. |

In addition, the actual amount of cash we will have available for distribution will depend on other factors, some of which are beyond our control, including:

| | • | | the level of capital expenditures we make; |

| | • | | the cost of acquisitions; |

| | • | | our debt service requirements and other liabilities; |

| | • | | fluctuations in our working capital needs; |

| | • | | our ability to borrow funds and access capital markets; |

| | • | | restrictions contained in debt agreements to which we are a party; and |

| | • | | the amount of cash reserves established by our general partner. |

For a description of additional restrictions and factors that may affect our ability to pay cash distributions, please read “Cash Distribution Policy and Restrictions on Distributions.”

On a pro forma basis we would not have had sufficient cash available for distribution to pay the full minimum quarterly distribution on all units for the twelve months ended June 30, 2012.

The amount of cash we need to pay the minimum quarterly distribution for four quarters on all of our units to be outstanding immediately after this offering is approximately $51.8 million. The amount of pro forma cash available for distribution generated during the twelve months ended June 30, 2012 would have been insufficient to allow us to pay the full minimum quarterly distribution on all of our common units during that period. For a calculation of our ability to make distributions to unitholders based on our pro forma results for the twelve months ended June 30, 2012, please read “Cash Distribution Policy and Restrictions on Distributions.”

The amount of cash we have available for distribution to holders of our units depends primarily on our cash flow and not solely on profitability, which may prevent us from making cash distributions during periods when we record net income.

The amount of cash we have available for distribution depends primarily upon our cash flow, including cash flow from reserves and working capital or other borrowings, and not solely on profitability, which will be affected by non-cash items. As a result, we may pay cash distributions during periods when we record net losses for financial accounting purposes and may not pay cash distributions during periods when we record net income.

None of the proceeds from the sale of common units in this offering will be available to us to fund our operations or to pay distributions to public unitholders.

We will not receive any proceeds from the sale of common units by the selling unitholder in this offering, including proceeds from the sale of additional common units by the selling unitholder pursuant to the underwriters’ option to purchase additional common units. Consequently, none of the proceeds from this offering will be available to us to fund our operations or to pay distributions to the public unitholders. Please read “Use of Proceeds.”

25

| | • | | our general partner determines the amount and timing of any capital expenditure and whether a capital expenditure is classified as a maintenance capital expenditure, which reduces operating surplus, or an expansion capital expenditure, which does not reduce operating surplus. Please read “How We Make Distributions to Our Partners—Capital Expenditures” for a discussion on when a capital expenditure constitutes a maintenance capital expenditure or an expansion capital expenditure. This determination can affect the amount of cash that is distributed to our unitholders which, in turn, may affect the ability of the subordinated units to convert. Please read “How We Make Distributions to Our Partners—Subordination Period”; |

| | • | | our general partner may cause us to borrow funds in order to permit the payment of cash distributions, even if the purpose or effect of the borrowing is to make a distribution on the subordinated units, to make incentive distributions or to accelerate the expiration of the subordination period; |

| | • | | our partnership agreement permits us to distribute up to $ million as operating surplus, even if it is generated from asset sales, non-working capital borrowings or other sources that would otherwise constitute capital surplus. This cash may be used to fund distributions on our subordinated units or the incentive distribution rights; |

| | • | | our general partner determines which costs incurred by it and its affiliates are reimbursable by us; |

| | • | | our partnership agreement does not restrict our general partner from causing us to pay it or its affiliates for any services rendered to us or entering into additional contractual arrangements with its affiliates on our behalf; |

| | • | | our general partner intends to limit its liability regarding our contractual and other obligations; |

| | • | | our general partner may exercise its right to call and purchase common units if it and its affiliates own more than 80% of the common units; |

| | • | | our general partner controls the enforcement of obligations that it and its affiliates owe to us; |

| | • | | our general partner decides whether to retain separate counsel, accountants or others to perform services for us; and |

| | • | | our sponsor may elect to cause us to issue common units to it in connection with a resetting of the target distribution levels related to our sponsor’s incentive distribution rights without the approval of the conflicts committee of the board of directors of our general partner or the unitholders. This election may result in lower distributions to the common unitholders in certain situations. |

In addition, we may compete directly with entities in which our sponsor has an interest for acquisition opportunities and potentially will compete with these entities for new and existing customers. In particular, we expect that our sponsor will compete with us for new and existing frac sand customers once operations at its processing facility in Augusta, Wisconsin commence in the third quarter of 2012. Please read “—Our sponsor and other affiliates of our general partner may compete with us.” and “Conflicts of Interest and Fiduciary Duties.”

The board of directors of our general partner may modify or revoke our cash distribution policy at any time at its discretion. Our partnership agreement does not require us to pay any distributions at all.

The board of directors of our general partner will adopt a cash distribution policy pursuant to which we intend to distribute quarterly at least $0.45 per unit on all of our units to the extent we have sufficient cash after the establishment of cash reserves and the payment of our expenses, including payments to our general partner and its affiliates. However, the board may change such policy at any time at its discretion and could elect not to pay distributions for one or more quarters. Please read “Cash Distribution Policy and Restrictions on Distributions.”

40

Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors, which could reduce the price at which our common units will trade.

Unlike the holders of common stock in a corporation, unitholders have only limited voting rights on matters affecting our business and, therefore, limited ability to influence management’s decisions regarding our business. Unitholders will have no right on an annual or ongoing basis to elect our general partner or its board of directors. The board of directors of our general partner, including the independent directors, is chosen entirely by our sponsor, as a result of it owning our general partner, and not by our unitholders. Please read “Management—Management of Hi-Crush Partners LP” and “Certain Relationships and Related Transactions.” Unlike publicly-traded corporations, we will not conduct annual meetings of our unitholders to elect directors or conduct other matters routinely conducted at annual meetings of stockholders of corporations. As a result of these limitations, the price at which the common units will trade could be diminished because of the absence or reduction of a takeover premium in the trading price.

Even if holders of our common units are dissatisfied, they cannot initially remove our general partner without its consent.

If our unitholders are dissatisfied with the performance of our general partner, they will have limited ability to remove our general partner. Unitholders initially will be unable to remove our general partner without its consent because our general partner and its affiliates will own sufficient units upon the completion of this offering to be able to prevent its removal. The vote of the holders of at least 66 2/3% of all outstanding common and subordinated units voting together as a single class is required to remove our general partner. Following the closing of this offering, our sponsor will own an aggregate of 56.6% of our common and subordinated units (or 50.1% of our common and subordinated units, if the underwriters exercise their option to purchase additional common units in full). Also, if our general partner is removed without cause during the subordination period and no units held by the holders of the subordinated units or their affiliates are voted in favor of that removal, all remaining subordinated units will automatically be converted into common units and any existing arrearages on the common units will be extinguished. Cause is narrowly defined in our partnership agreement to mean that a court of competent jurisdiction has entered a final, non-appealable judgment finding our general partner liable for actual fraud or willful or wanton misconduct in its capacity as our general partner. Cause does not include most cases of charges of poor management of the business.

Unitholders will experience immediate and substantial dilution of $17.70 per common unit.

The assumed initial public offering price of $20.00 per common unit (the mid-point of the price range set forth on the cover page of this prospectus) exceeds our pro forma net tangible book value of $2.30 per common unit. Based on the assumed initial public offering price of $20.00 per common unit, unitholders will incur immediate and substantial dilution of $17.70 per common unit. This dilution results primarily because the assets contributed to us by affiliates of our general partner are recorded at their historical cost in accordance with GAAP, and not their fair value. Please read “Dilution.”

Our general partner interest or the control of our general partner may be transferred to a third party without unitholder consent.

Our general partner may transfer its general partner interest to a third party in a merger or in a sale of all or substantially all of its assets without the consent of our unitholders. Furthermore, our partnership agreement does not restrict the ability of the members of our general partner to transfer their respective membership interests in our general partner to a third party. The new members of our general partner would then be in a position to replace the board of directors and executive officers of our general partner with their own designees and thereby exert significant control over the decisions taken by the board of directors and executive officers of our general partner. This effectively permits a “change of control” without the vote or consent of the unitholders.

44

The incentive distribution rights held by our sponsor may be transferred to a third party without unitholder consent.

Our sponsor may transfer the incentive distribution rights to a third party at any time without the consent of our unitholders. If our sponsor transfers the incentive distribution rights to a third party but retains its ownership interest in our general partner, our general partner may not have the same incentive to grow our partnership and increase quarterly distributions to unitholders over time as it would if our sponsor had retained ownership of the incentive distribution rights. For example, a transfer of incentive distribution rights by our sponsor could reduce the likelihood of our sponsor accepting offers made by us relating to assets owned by it, as it would have less of an economic incentive to grow our business, which in turn would impact our ability to grow our asset base.

Our general partner has a call right that may require unitholders to sell their common units at an undesirable time or price.

If at any time our general partner and its affiliates own more than 80% of the common units, our general partner will have the right, but not the obligation, which it may assign to any of its affiliates or to us, to acquire all, but not less than all, of the common units held by unaffiliated persons at a price equal to the greater of (1) the average of the daily closing price of the common units over the 20 trading days preceding the date three days before notice of exercise of the call right is first mailed and (2) the highest per-unit price paid by our general partner or any of its affiliates for common units during the 90-day period preceding the date such notice is first mailed. As a result, unitholders may be required to sell their common units at an undesirable time or price and may not receive any return or a negative return on their investment. Unitholders may also incur a tax liability upon a sale of their units. Our general partner is not obligated to obtain a fairness opinion regarding the value of the common units to be repurchased by it upon exercise of the limited call right. There is no restriction in our partnership agreement that prevents our general partner from issuing additional common units and exercising its call right. If our general partner exercised its limited call right, the effect would be to take us private and, if the units were subsequently deregistered, we would no longer be subject to the reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act. Upon consummation of this offering, and assuming no exercise of the underwriters’ option to purchase additional common units, our sponsor will own an aggregate of 56.6% of our common and subordinated units. At the end of the subordination period, assuming no additional issuances of units (other than upon the conversion of the subordinated units), our sponsor will own 56.6% of our common units. For additional information about the limited call right, please read “The Partnership Agreement—Limited Call Right.”

We may issue additional units without unitholder approval, which would dilute existing unitholder ownership interests.

Our partnership agreement does not limit the number of additional limited partner interests we may issue at any time without the approval of our unitholders. The issuance of additional common units or other equity interests of equal or senior rank will have the following effects:

| | • | | our existing unitholders’ proportionate ownership interest in us will decrease; |

| | • | | the amount of cash available for distribution on each unit may decrease; |

| | • | | because a lower percentage of total outstanding units will be subordinated units, the risk that a shortfall in the payment of the minimum quarterly distribution will be borne by our common unitholders will increase; |

| | • | | the ratio of taxable income to distributions may increase; |

| | • | | the relative voting strength of each previously outstanding unit may be diminished; and |

| | • | | the market price of the common units may decline. |

45

There are no limitations in our partnership agreement on our ability to issue units ranking senior to the common units.

In accordance with Delaware law and the provisions of our partnership agreement, we may issue additional partnership interests that are senior to the common units in right of distribution, liquidation and voting. The issuance by us of units of senior rank may (i) reduce or eliminate the amount of cash available for distribution to our common unitholders; (ii) diminish the relative voting strength of the total common units outstanding as a class; or (iii) subordinate the claims of the common unitholders to our assets in the event of our liquidation.

The market price of our common units could be adversely affected by sales of substantial amounts of our common units in the public or private markets, including sales by our sponsor or other large holders.

After this offering, we will have 14,398,148 common units and 14,398,148 subordinated units outstanding, which includes the 12,500,000 common units the selling unitholder is selling in this offering (or 14,375,000 common units if the underwriters exercise their option to purchase additional common units in full) that may be resold in the public market immediately. All of the subordinated units will convert into common units on a one-for-one basis at the end of the subordination period. All of 1,898,148 common units (or 23,148 common units if the underwriters exercise their option to purchase additional common units in full) that are issued to our sponsor and not sold by our sponsor as the selling unitholder in this offering will be subject to resale restrictions under a 180-day lock-up agreement with the underwriters. Each of the lock-up agreements with the underwriters may be waived in the discretion of certain of the underwriters. Sales by our sponsor or other large holders of a substantial number of our common units in the public markets following this offering, or the perception that such sales might occur, could have a material adverse effect on the price of our common units or could impair our ability to obtain capital through an offering of equity securities. In addition, we have agreed to provide registration rights to our sponsor. Under our agreement, our general partner and its affiliates have registration rights relating to the offer and sale of any units that they hold, subject to certain limitations. Please read “Units Eligible for Future Sale.”

Our partnership agreement restricts the voting rights of unitholders owning 20% or more of our common units.

Our partnership agreement restricts unitholders’ voting rights by providing that any units held by a person or group that owns 20% or more of any class of units then outstanding, other than our general partner and its affiliates, their transferees and persons who acquired such units with the prior approval of the board of directors of our general partner, cannot vote on any matter.

Cost reimbursements due to our general partner and its affiliates for services provided to us or on our behalf will reduce cash available for distribution to our unitholders. The amount and timing of such reimbursements will be determined by our general partner.

Prior to making any distribution on the common units, we will reimburse our general partner and its affiliates for all expenses they incur and payments they make on our behalf. Our partnership agreement does not set a limit on the amount of expenses for which our general partner and its affiliates may be reimbursed. These expenses include salary, bonus, incentive compensation and other amounts paid to persons who perform services for us or on our behalf and expenses allocated to our general partner by its affiliates. Our partnership agreement provides that our general partner will determine in good faith the expenses that are allocable to us. The reimbursement of expenses and payment of fees, if any, to our general partner and its affiliates will reduce the amount of cash available for distribution to our unitholders. Please read “Cash Distribution Policy and Restrictions on Distributions.”

46

There is no existing market for our common units, and a trading market that will provide you with adequate liquidity may not develop. The price of our common units may fluctuate significantly, and unitholders could lose all or part of their investment.

Prior to this offering, there has been no public market for the common units. After this offering, there will be only 12,500,000 publicly-traded common units held by our public unitholders (or 14,375,000 common units if the underwriters exercise their option to purchase additional common units in full). We do not know the extent to which investor interest will lead to the development of a trading market or how liquid that market might be. Unitholders may not be able to resell their common units at or above the initial public offering price. Additionally, the lack of liquidity may result in wide bid-ask spreads, contribute to significant fluctuations in the market price of the common units and limit the number of investors who are able to buy the common units.

The initial public offering price for our common units will be determined by negotiations between the selling unitholder and the representatives of the underwriters and may not be indicative of the market price of the common units that will prevail in the trading market. The market price of our common units may decline below the initial public offering price. The market price of our common units may also be influenced by many factors, some of which are beyond our control, including:

| | • | | our quarterly distributions; |

| | • | | our quarterly or annual earnings or those of other companies in our industry; |

| | • | | announcements by us or our competitors of significant contracts or acquisitions; |

| | • | | changes in accounting standards, policies, guidance, interpretations or principles; |