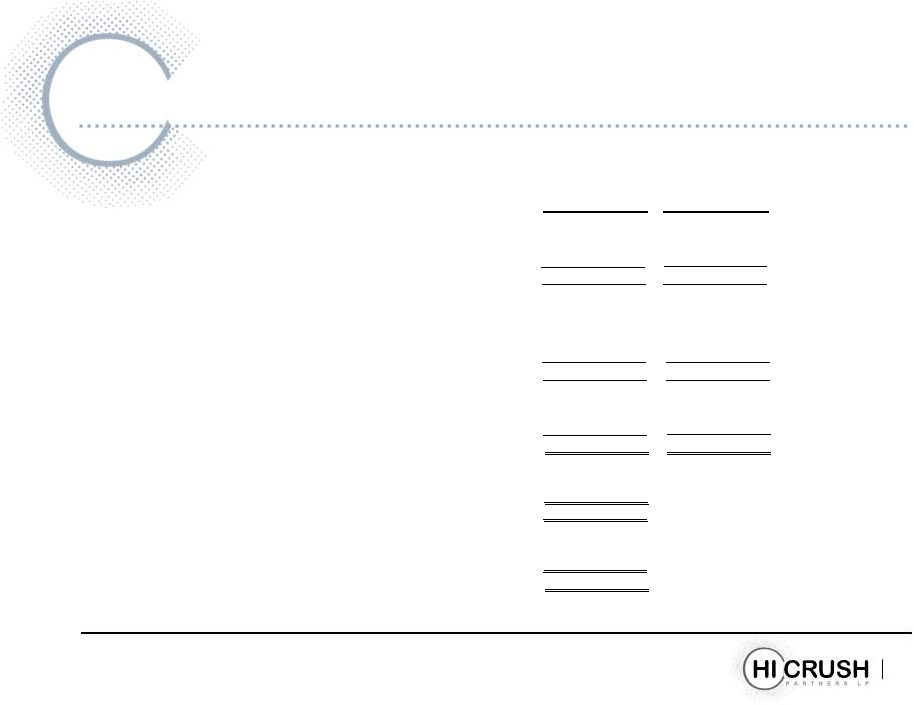

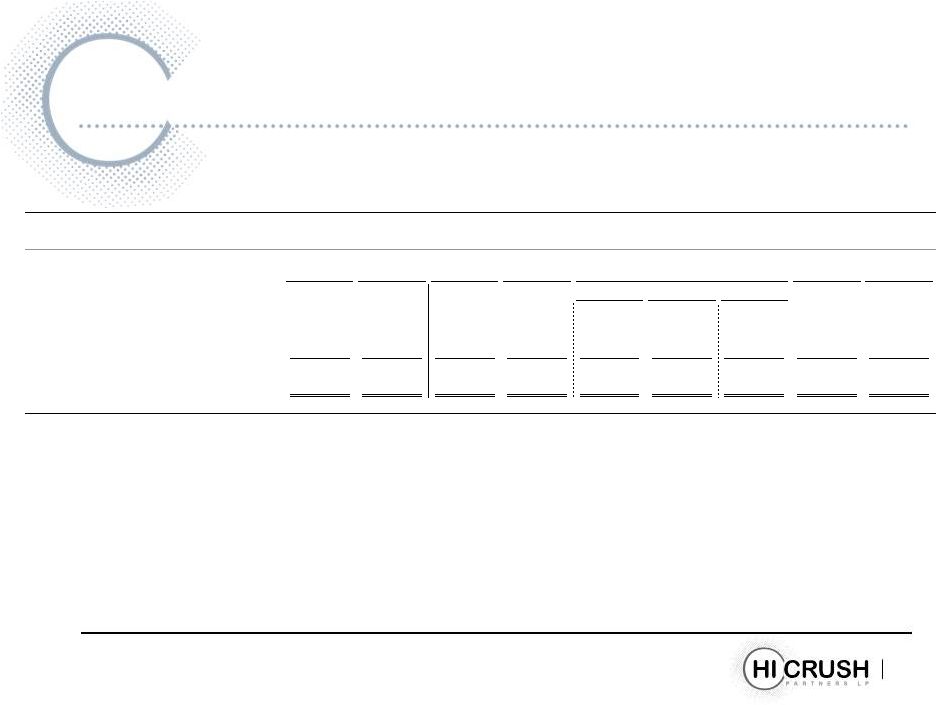

First Quarter Summary 24 Three Months Three Months Ended Ended March 31, 2013 March 31, 2012 Successor Predecessor Reconciliation of distributable cash flow to net income: Net income $ 10,783 $ 6,136 Depreciation and depletion expense 273 179 Income tax expense - - Interest expense 314 928 EBITDA $ 11,370 $ 7,243 Less: Cash interest paid (255) Less: Maintenance and replacement capital expenditures, including accrual for reserve replacement (1) (422) Add: Accretion of asset retirement obligation 29 Add: Quarterly distribution from preferred interest in Augusta (2) 3,750 Distributable cash flow $ 14,472 (1) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton sold during the period. Such expenditures include those associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital. (2) The amount pertains to the first quarter performance of Augusta, on which we are entitled to receive a preferred distribution of $3,750. We have included this amount in our distributable cash flow for the first quarter of 2013 as we received this distribution on May 10, 2013, in advance of our first quarter 2013 cash distributions to our common and subordinated unitholders, which will be paid on May 15, 2013. The amount is not reflected in our GAAP net income because our investment in Augusta is accounted for under the cost method. In accordance with that method, any distributions earned under our preferred interest are not recognized as income until the cash is actually received by the Partnership. |