3RD QUARTER 2015 EARNINGS PRESENTATION OCTOBER 2015

Forward Looking Statements Some of the information included herein may contain forward-looking statements within the meaning of the federal securities laws. Forward- looking statements give our current expectations and may contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “could,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no expected results of operations or financial condition or other forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in Hi-Crush Partners LP’s (“Hi-Crush”) reports filed with the Securities and Exchange Commission (“SEC”), including those described under Item 1A, “Risk Factors” of Hi-Crush’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and any subsequently filed Quarterly Report on Form 10-Q. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors in our reports filed with the SEC or the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include: the volume of frac sand we are able to sell; the price at which we are able to sell frac sand; the outcome of any pending litigation; changes in the price and availability of natural gas or electricity; changes in prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. Hi-Crush’s forward-looking statements speak only as of the date made and Hi-Crush undertakes no obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. 2

Current Environment 3 Increasingly competitive and focused on cost • Strong frac sand intensity trends more than offset by reduced well completion activity • Extremely competitive environment for all oilfield service providers • Sand suppliers working with customers to lower all-in pricing at well head through better origin/destination matching, increasing use of unit trains, and more in-basin services • Oilfield service providers continuing to consolidate vendors down to key partners, capable of delivering large quantities of frac sand, efficiently and on time Positive factors supporting an eventual recovery • Sand suppliers have idled or shut down operations, reducing supply • New sand supply pushed out to late 2016 or 2017 • Sand intensity trend continues with “super fracs” growing from 10,000 to 15,000+ tons per well • Potential pent-up demand for frac sand with work through of drilled but uncompleted wells backlog

Managing the Downturn 4 Temporary measures to address contract customer market factors • Pricing discounts to contract customers, in certain circumstances in exchange for additional term and/or volume • Extended price discounts through 2015; pricing pressure expected to continue into 2016 Maintaining liquidity and capital flexibility • Distribution temporarily suspended • Capex budget of $15-25 million in 2016 is flexible Focused on internal cost reductions • Key focus on reducing logistics costs and improving origin/destination pairings • Temporary idling of Augusta facility to maximize production from lowest cost plants while optimizing origin/destination pairings to lower delivered costs • Reducing headcount for more efficient operations (~16% reduction YTD) • Receiving discounts and increased efficiency from vendors and suppliers

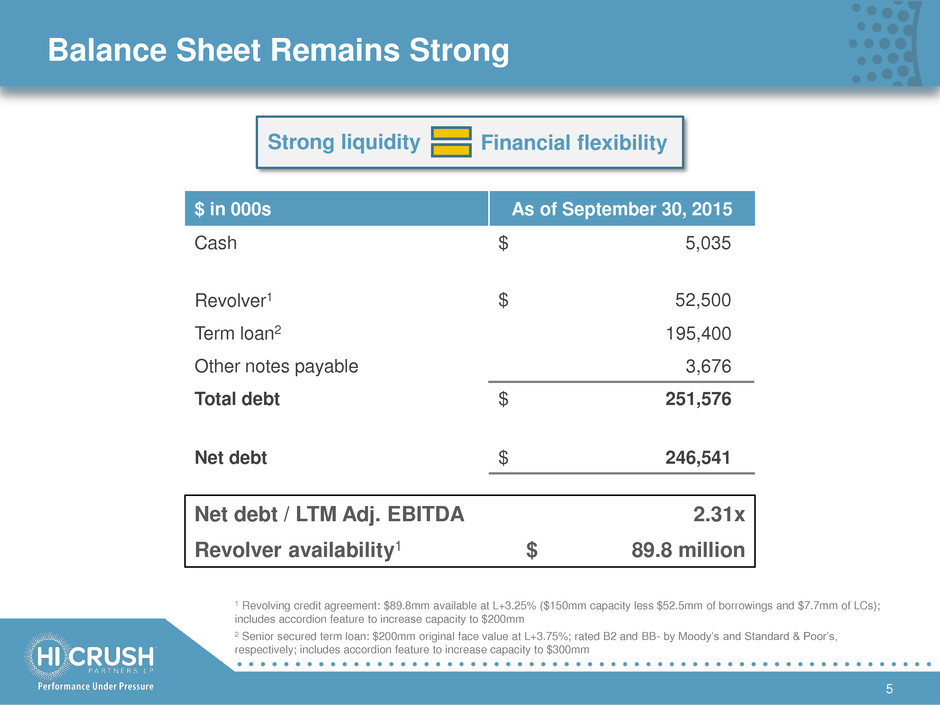

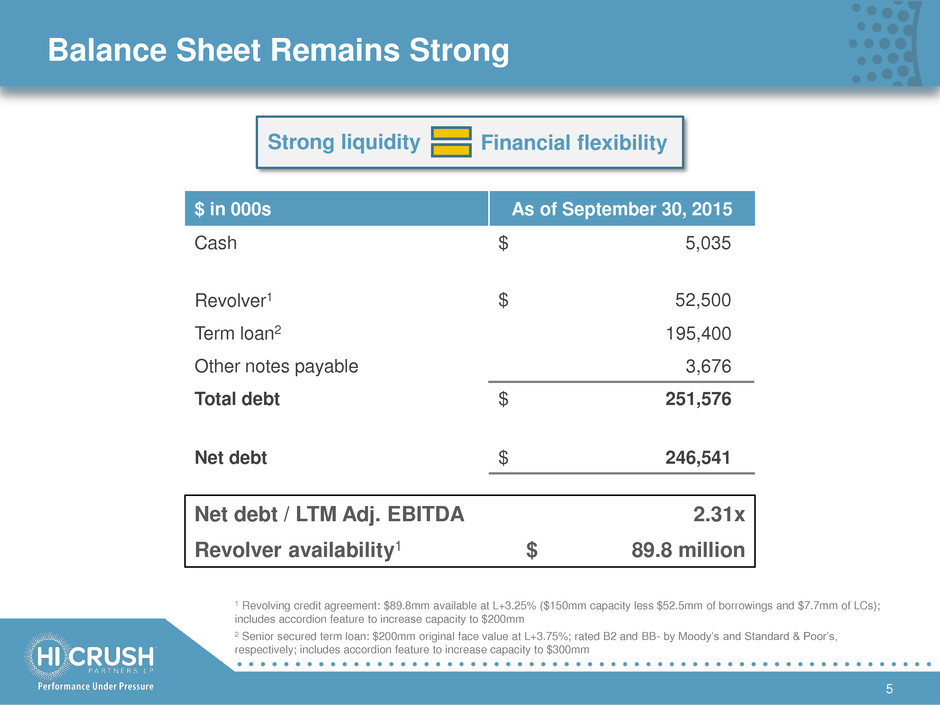

Balance Sheet Remains Strong 5 $ in 000s As of September 30, 2015 Cash $ 5,035 Revolver1 $ 52,500 Term loan2 195,400 Other notes payable 3,676 Total debt $ 251,576 Net debt $ 246,541 Net debt / LTM Adj. EBITDA 2.31x Revolver availability1 $ 89.8 million 1 Revolving credit agreement: $89.8mm available at L+3.25% ($150mm capacity less $52.5mm of borrowings and $7.7mm of LCs); includes accordion feature to increase capacity to $200mm 2 Senior secured term loan: $200mm original face value at L+3.75%; rated B2 and BB- by Moody’s and Standard & Poor’s, respectively; includes accordion feature to increase capacity to $300mm Strong liquidity Financial flexibility

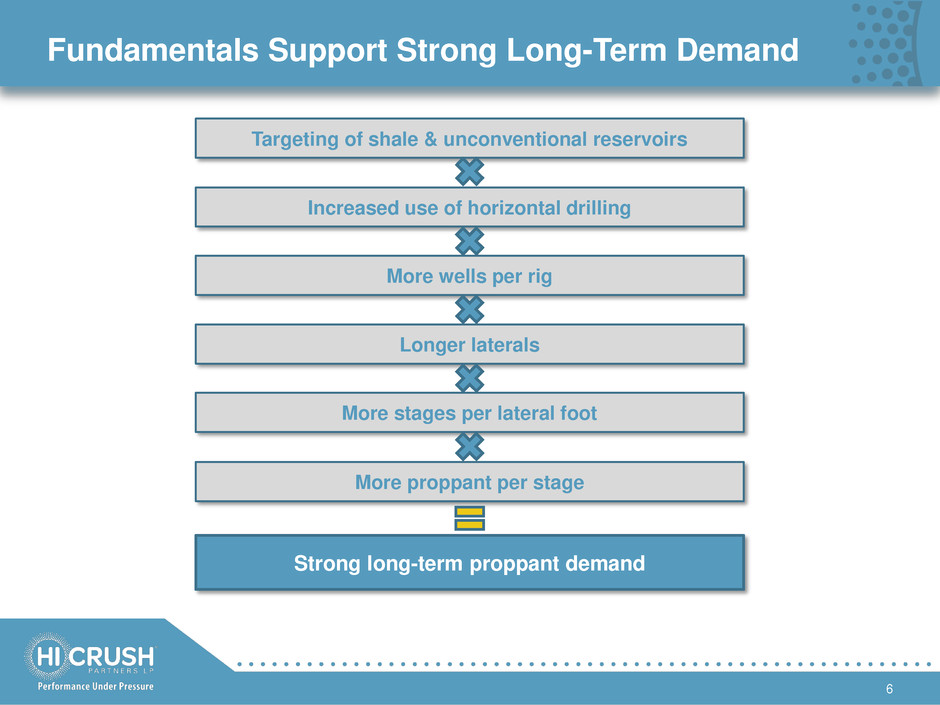

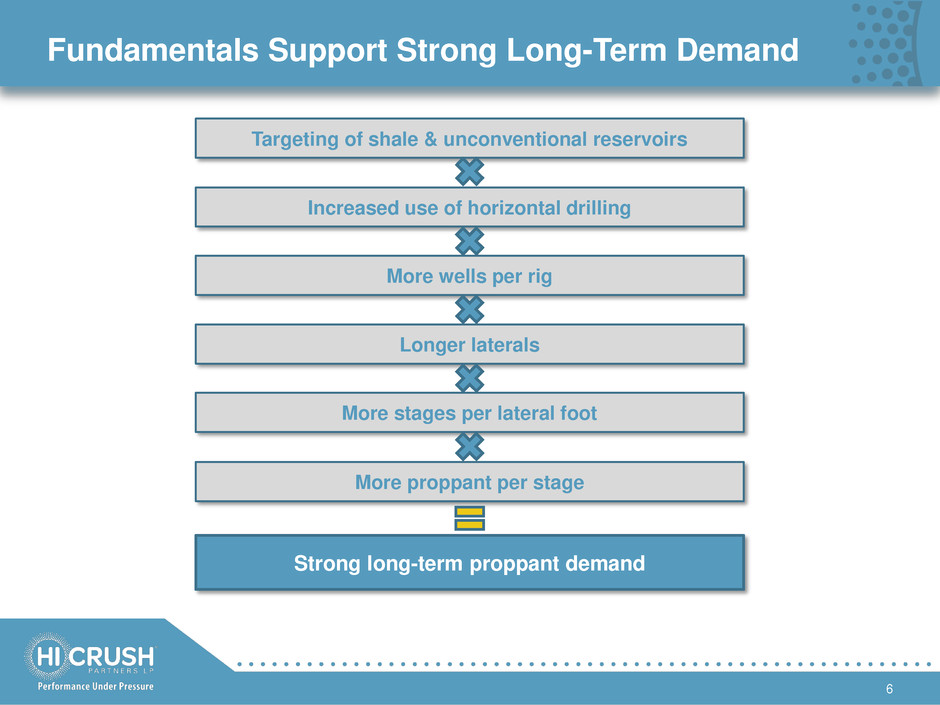

Fundamentals Support Strong Long-Term Demand 6 Targeting of shale & unconventional reservoirs Increased use of horizontal drilling More wells per rig Longer laterals More stages per lateral foot More proppant per stage Strong long-term proppant demand

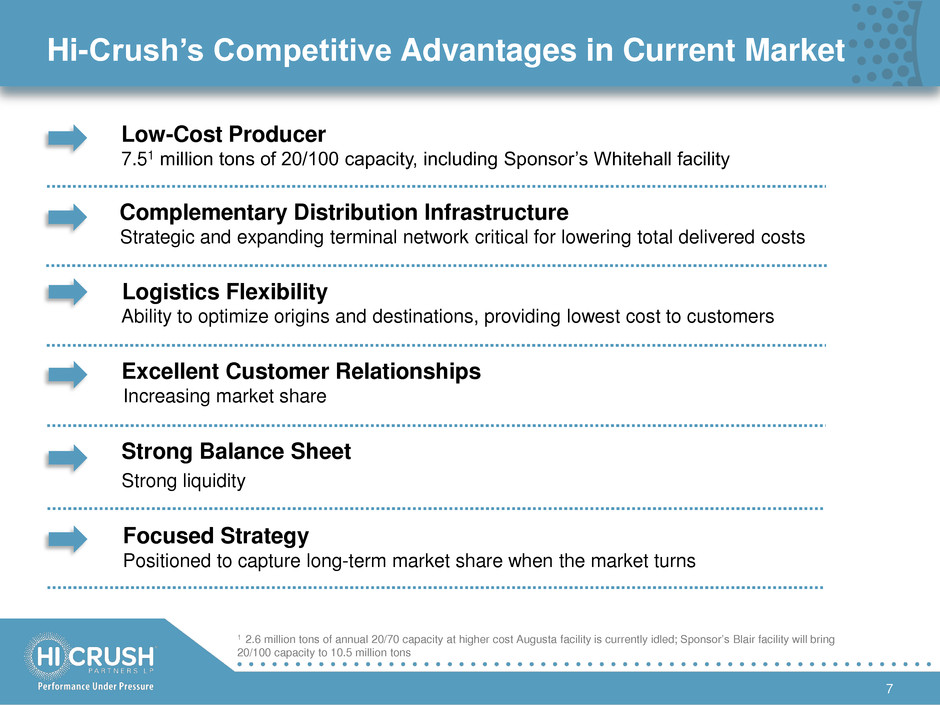

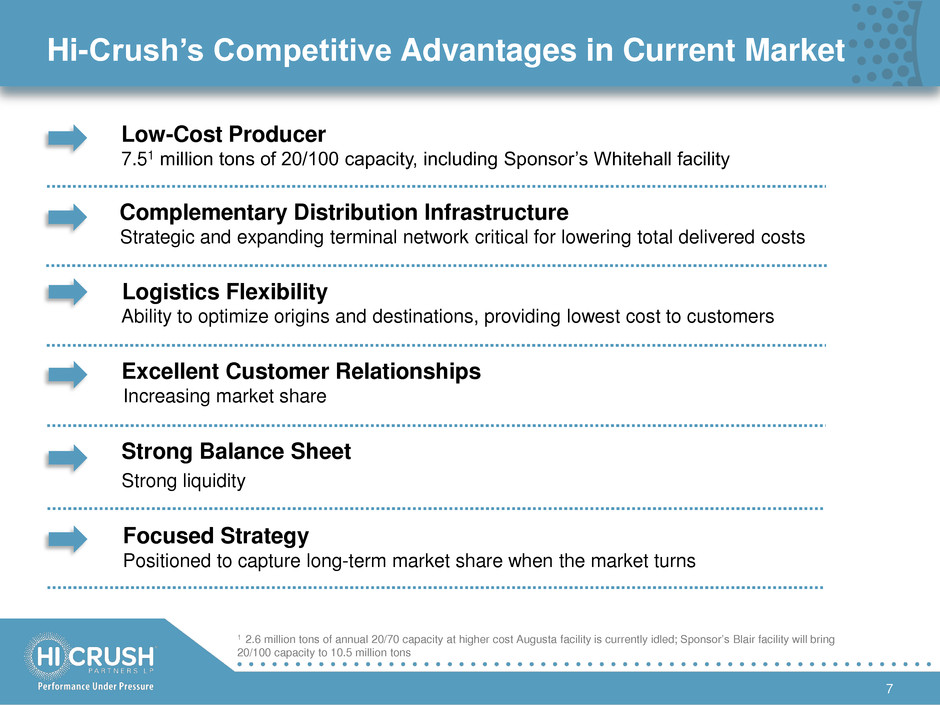

Hi-Crush’s Competitive Advantages in Current Market 7 1 2.6 million tons of annual 20/70 capacity at higher cost Augusta facility is currently idled; Sponsor’s Blair facility will bring 20/100 capacity to 10.5 million tons Low-Cost Producer 7.51 million tons of 20/100 capacity, including Sponsor’s Whitehall facility Complementary Distribution Infrastructure Strategic and expanding terminal network critical for lowering total delivered costs Logistics Flexibility Ability to optimize origins and destinations, providing lowest cost to customers Excellent Customer Relationships Increasing market share Strong Balance Sheet Strong liquidity Focused Strategy Positioned to capture long-term market share when the market turns

Hi-Crush Operations

Comparison to Prior Quarters 9 $ in 000s Q3 2015 Q2 2015 Q1 2015 Revenues $81,494 $83,958 $102,111 Adjusted EBITDA1 $13,426 $19,195 $29,581 Adjusted EPU (basic)1 $0.15 $0.31 $0.61 Adjusted EPU (diluted)1 $0.15 $0.31 $0.60 Sales volumes (tons) 1,409,032 1,190,156 1,195,343 Production costs per ton $11.32 $13.45 $16.28 Distributions per unit2 – $0.475 $0.675 1 Adjusted EBITDA and adjusted earnings per unit for Q3 2015 include add-backs for one-time expenses related to impairments and restructuring. 2 Represents distributions declared for the quarter. Sequential volume increase in Q3 2015 bodes well for market share despite further price erosion • Trend of increasing sand intensity per well continued during quarter, but more than offset by lower well completions • Working with customers and vendors to lower delivered cost at terminal locations • Preserving capital and protecting our strong balance sheet for an eventual recovery

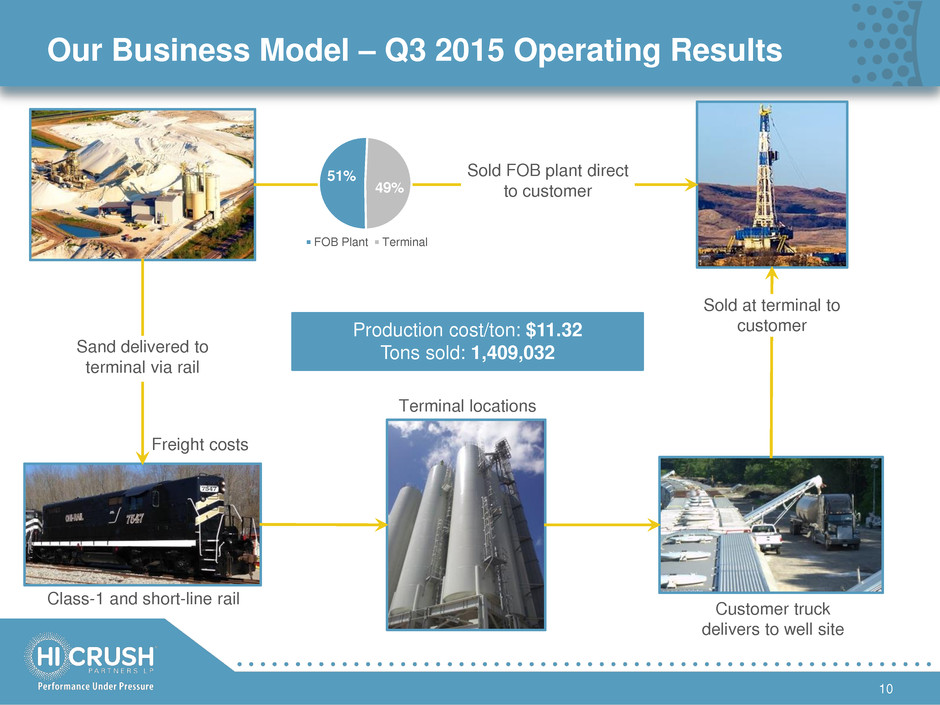

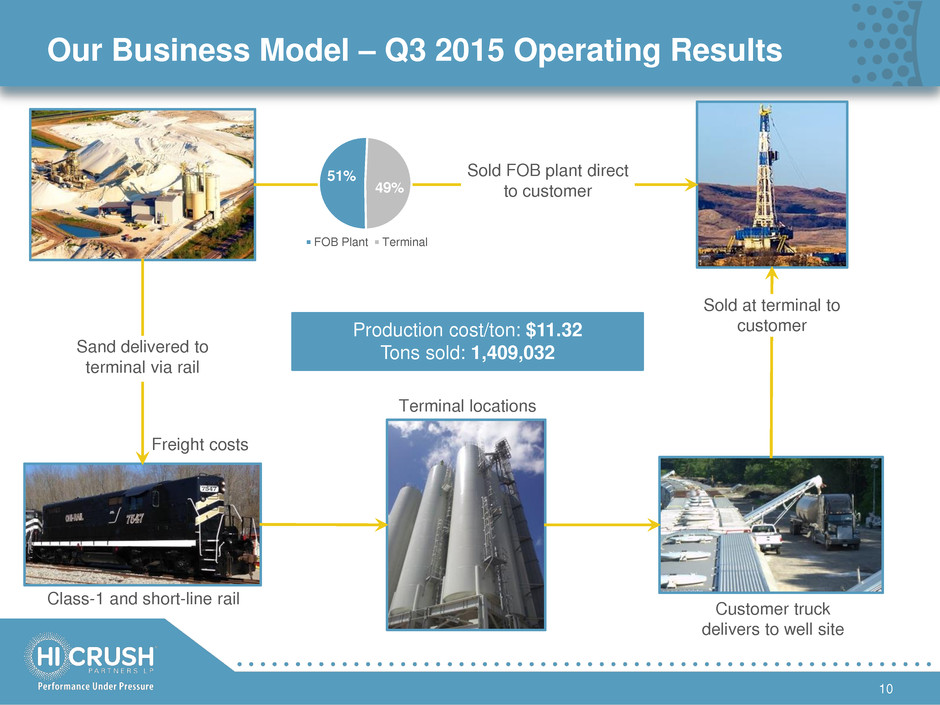

Our Business Model – Q3 2015 Operating Results 10 Sold FOB plant direct to customer Sand delivered to terminal via rail Customer truck delivers to well site Sold at terminal to customer Freight costs Class-1 and short-line rail Production cost/ton: $11.32 Tons sold: 1,409,032 Terminal locations 51% 49% FOB Plant Terminal

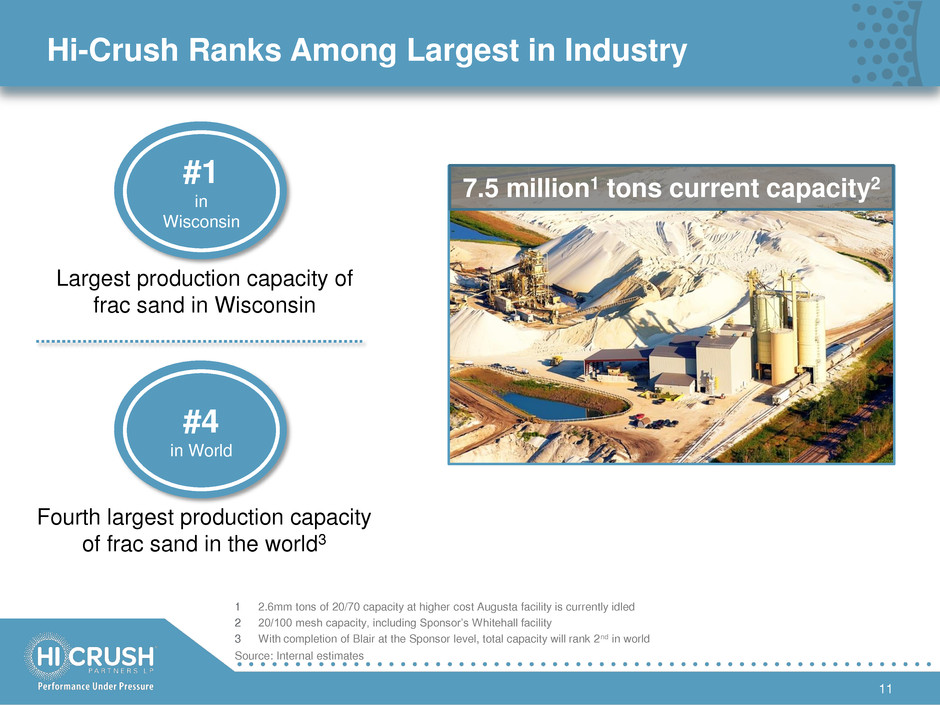

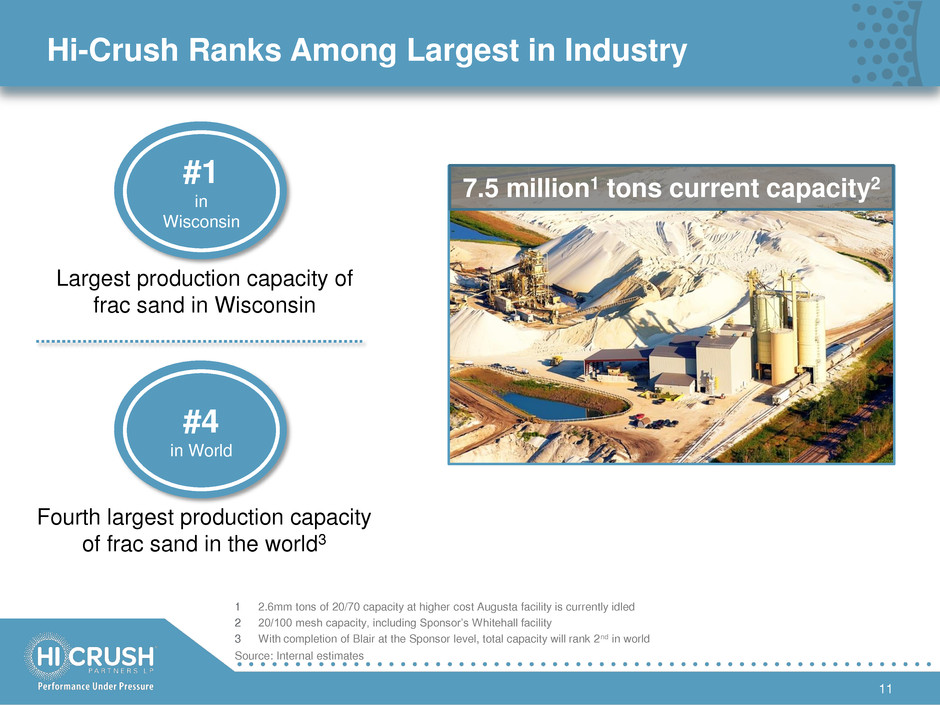

Hi-Crush Ranks Among Largest in Industry 11 #1 in Wisconsin #4 in World Largest production capacity of frac sand in Wisconsin Fourth largest production capacity of frac sand in the world3 Source: Internal estimates 7.5 million1 tons current capacity2 1 2.6mm tons of 20/70 capacity at higher cost Augusta facility is currently idled 2 20/100 mesh capacity, including Sponsor’s Whitehall facility 3 With completion of Blair at the Sponsor level, total capacity will rank 2nd in world

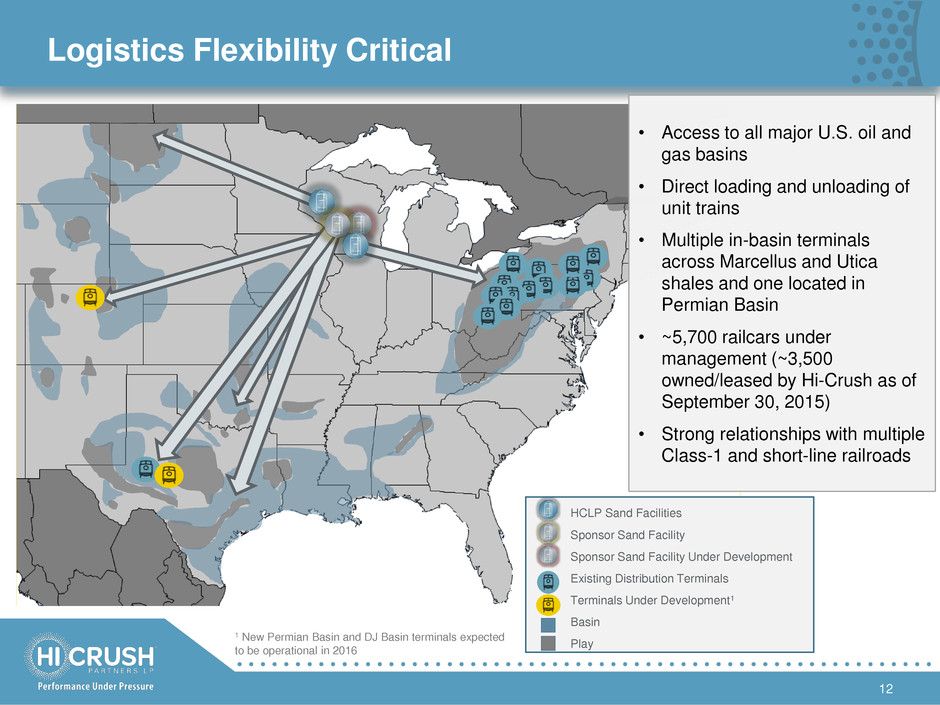

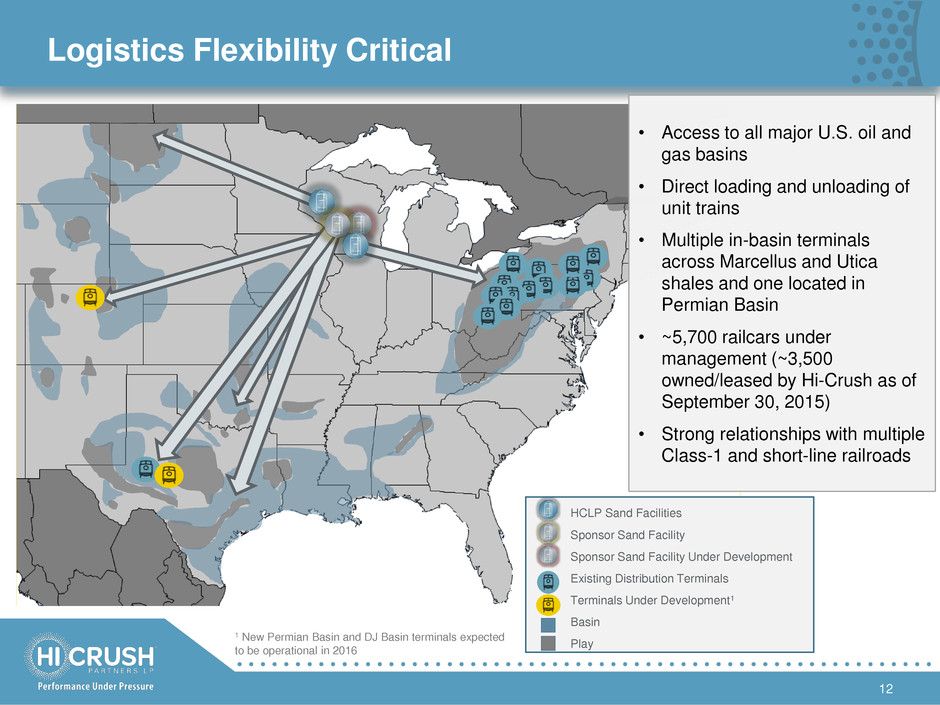

Logistics Flexibility Critical 12 Sandstone Formations Sponsor’s Whitehall Facility • Access to all major U.S. oil and gas basins • Direct loading and unloading of unit trains • Multiple in-basin terminals across Marcellus and Utica shales and one located in Permian Basin • ~5,700 railcars under management (~3,500 owned/leased by Hi-Crush as of September 30, 2015) • Strong relationships with multiple Class-1 and short-line railroads HCLP Sand Facilities Sponsor Sand Facility Existing Distribution Terminals Basin Play Terminals Under Development1 1 New Permian Basin and DJ Basin terminals expected to be operational in 2016 Sponsor Sand Facility Under Development

A Strategy for the Current Market 13 • Cutting costs internally and externally • Optimizing origin and destination pairings to lower delivered cost • Preserving capital to maintain a strong balance sheet • Ensuring that we are positioned to capture additional market share during a recovery

Financial Results

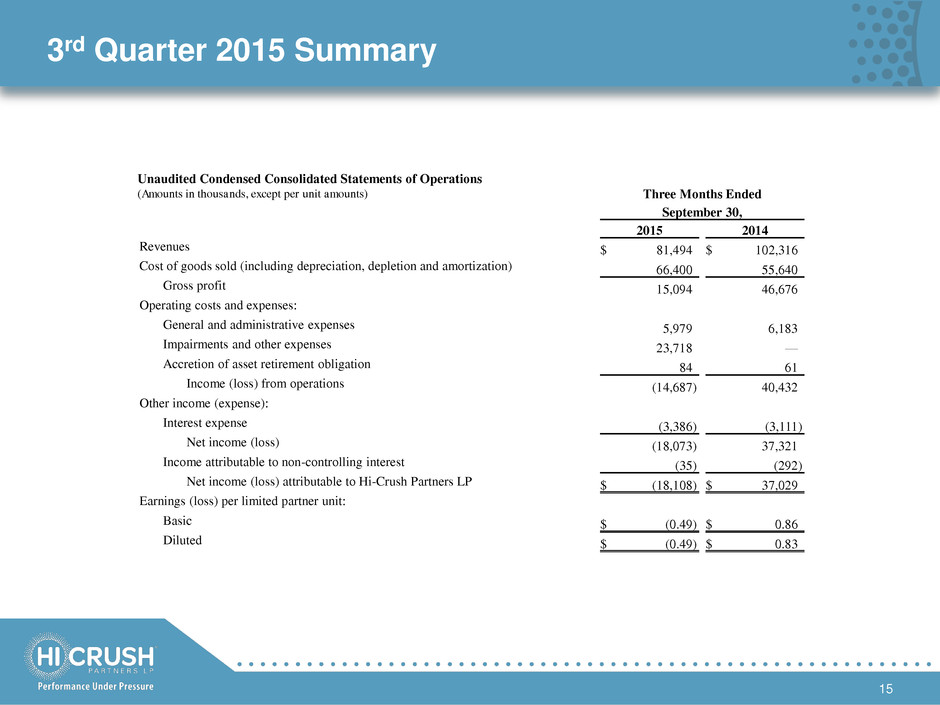

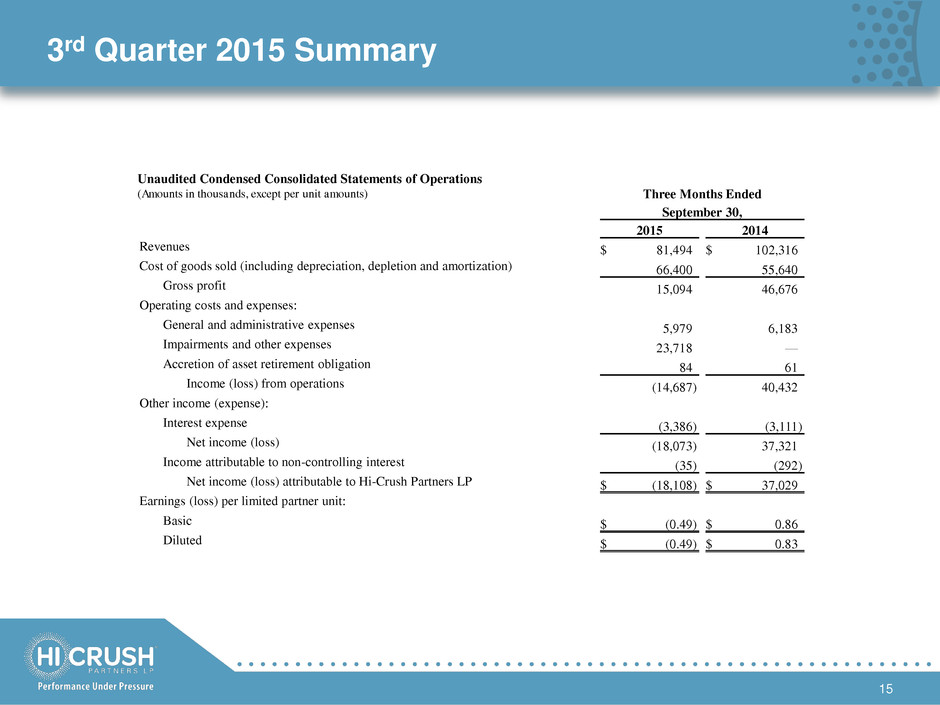

3rd Quarter 2015 Summary 15 Unaudited Condensed Consolidated Statements of Operations (Amounts in thousands, except per unit amounts) Three Months Ended September 30, 2015 2014 Revenues $ 81,494 $ 102,316 Cost of goods sold (including depreciation, depletion and amortization) 66,400 55,640 Gross profit 15,094 46,676 Operating costs and expenses: General and administrative expenses 5,979 6,183 Impairments and other expenses 23,718 — Accretion of asset retirement obligation 84 61 Income (loss) from operations (14,687 ) 40,432 Other income (expense): Interest expense (3,386 ) (3,111 ) Net income (loss) (18,073 ) 37,321 Income attributable to non-controlling interest (35 ) (292 ) Net income (loss) attributable to Hi-Crush Partners LP $ (18,108 ) $ 37,029 Earnings (loss) per limited partner unit: Basic $ (0.49 ) $ 0.86 Diluted $ (0.49 ) $ 0.83

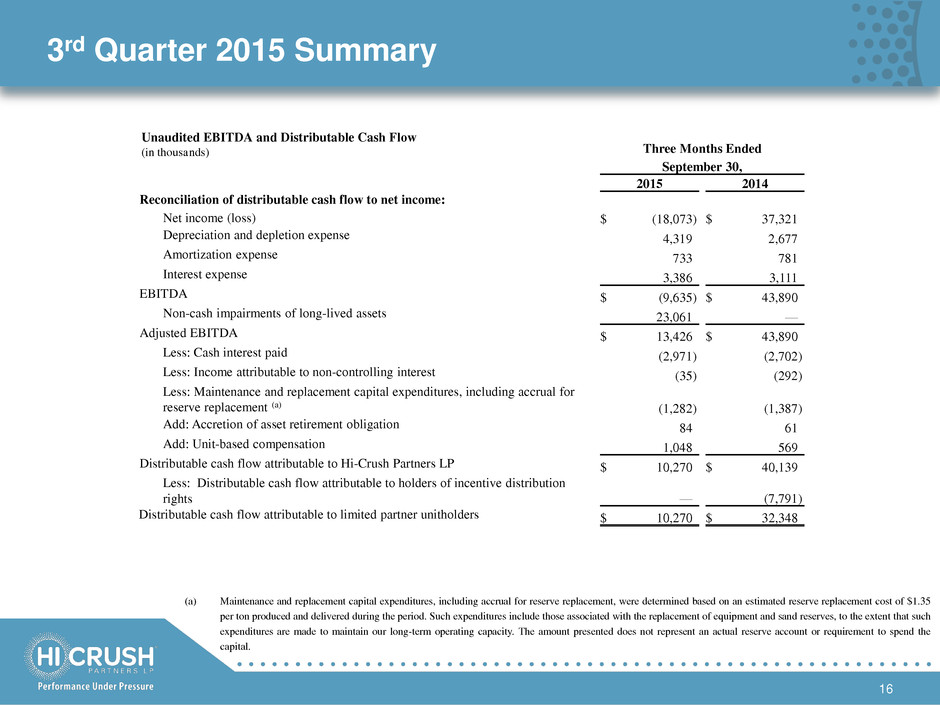

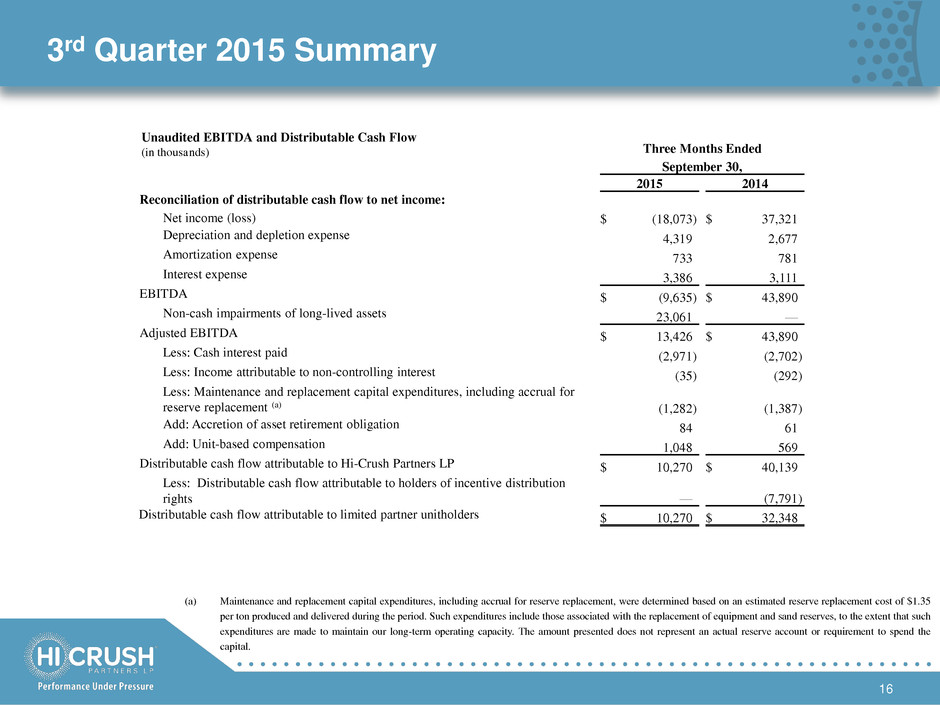

3rd Quarter 2015 Summary 16 (a) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton produced and delivered during the period. Such expenditures include those associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital. Unaudited EBITDA and Distributable Cash Flow (in thousands) Three Months Ended September 30, 2015 2014 Reconciliation of distributable cash flow to net income: Net income (loss) $ (18,073 ) $ 37,321 Depreciation and depletion expense 4,319 2,677 Amortization expense 733 781 Interest expense 3,386 3,111 EBITDA $ (9,635 ) $ 43,890 Non-cash impairments of long-lived assets 23,061 — Adjusted EBITDA $ 13,426 $ 43,890 Less: Cash interest paid (2,971 ) (2,702 ) Less: Income attributable to non-controlling interest (35 ) (292 ) Less: Maintenance and replacement capital expenditures, including accrual for reserve replacement (a) (1,282 ) (1,387 ) Add: Accretion of asset retirement obligation 84 61 Add: Unit-based compensation 1,048 569 Distributable cash flow attributable to Hi-Crush Partners LP $ 10,270 $ 40,139 Less: Distributable cash flow attributable to holders of incentive distribution rights — (7,791 ) Distributable cash flow attributable to limited partner unitholders $ 10,270 $ 32,348

YTD 2015 Summary 17 Unaudited Condensed Consolidated Statements of Operations (Amounts in thousands, except per unit amounts) (a) Financial information has been recast to include the financial position and results attributable to Hi-Crush Augusta LLC. Nine Months Ended September 30, 2015 2014 (a) Revenues $ 267,563 $ 255,618 Cost of goods sold (including depreciation, depletion and amortization) 198,737 143,665 Gross profit 68,826 111,953 Operating costs and expenses: General and administrative expenses 17,946 19,287 Impairments and other expenses 23,718 — Accretion of asset retirement obligation 251 184 Income from operations 26,911 92,482 Other income (expense): Interest expense (9,682 ) (6,836 ) Net income 17,229 85,646 Income attributable to non-controlling interest (202 ) (704 ) Net income attributable to Hi-Crush Partners LP $ 17,027 $ 84,942 Earnings per limited partner unit: Basic $ 0.43 $ 2.24 Diluted $ 0.42 $ 2.15

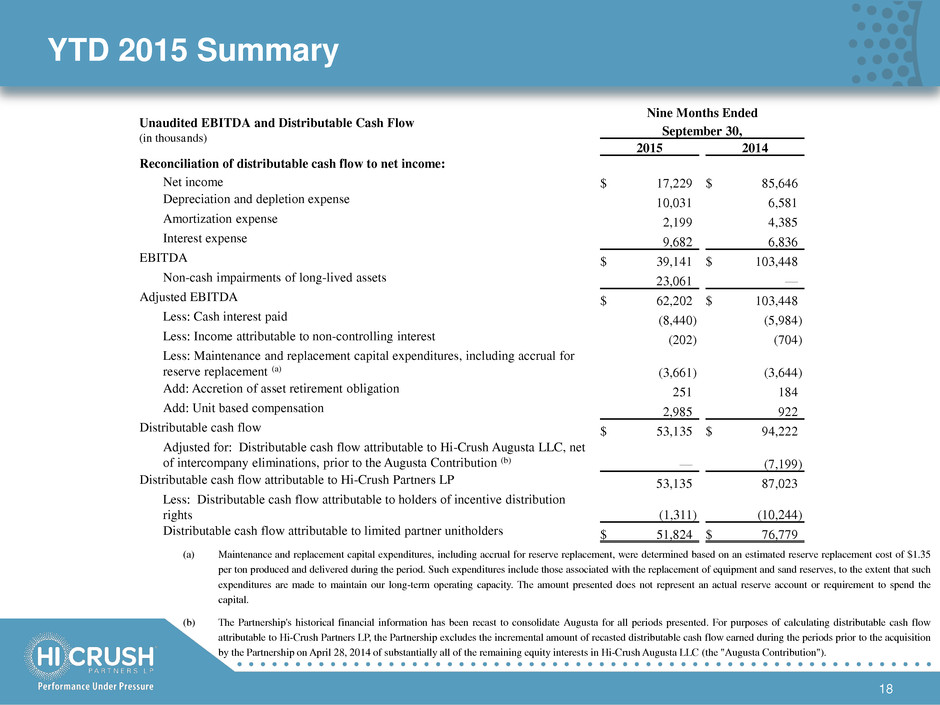

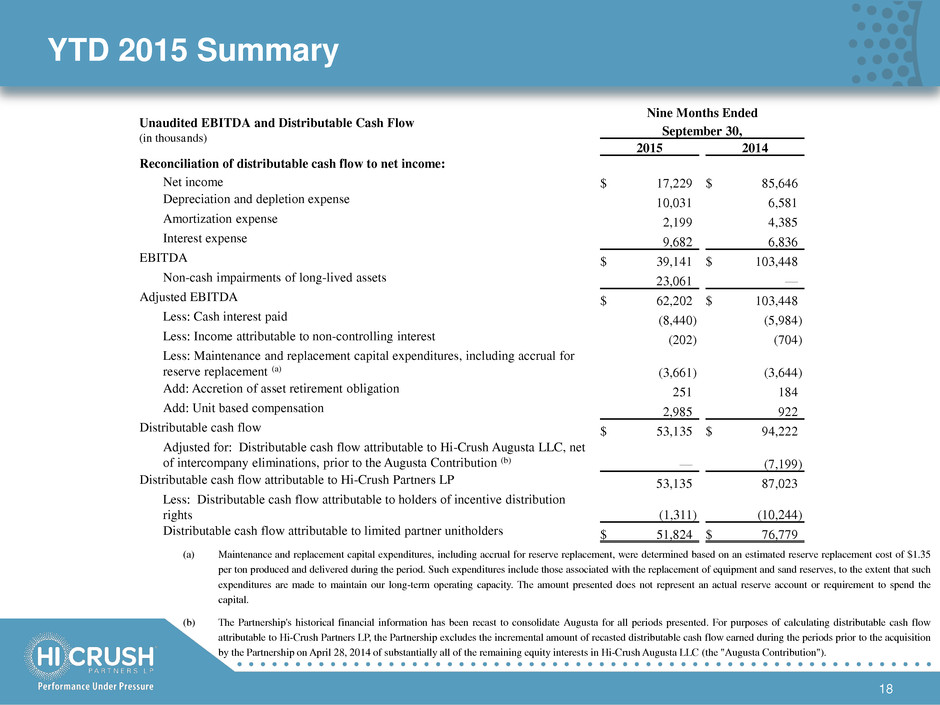

YTD 2015 Summary 18 (a) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton produced and delivered during the period. Such expenditures include those associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital. (b) The Partnership's historical financial information has been recast to consolidate Augusta for all periods presented. For purposes of calculating distributable cash flow attributable to Hi-Crush Partners LP, the Partnership excludes the incremental amount of recasted distributable cash flow earned during the periods prior to the acquisition by the Partnership on April 28, 2014 of substantially all of the remaining equity interests in Hi-Crush Augusta LLC (the "Augusta Contribution"). Unaudited EBITDA and Distributable Cash Flow (in thousands) Nine Months Ended September 30, 2015 2014 Reconciliation of distributable cash flow to net income: Net income $ 17,229 $ 85,646 Depreciation and depletion expense 10,031 6,581 Amortization expense 2,199 4,385 Interest expense 9,682 6,836 EBITDA $ 39,141 $ 103,448 Non-cash impairments of long-lived assets 23,061 — Adjusted EBITDA $ 62,202 $ 103,448 Less: Cash interest paid (8,440 ) (5,984 ) Less: Income attributable to non-controlling interest (202 ) (704 ) Less: Maintenance and replacement capital expenditures, including accrual for reserve replacement (a) (3,661 ) (3,644 ) Add: Accretion of asset retirement obligation 251 184 Add: Unit based compensation 2,985 922 Distributable cash flow $ 53,135 $ 94,222 Adjusted for: Distributable cash flow attributable to Hi-Crush Augusta LLC, net of intercompany eliminations, prior to the Augusta Contribution (b) — (7,199 ) Distributable cash flow attributable to Hi-Crush Partners LP 53,135 87,023 Less: Distributable cash flow attributable to holders of incentive distribution rights (1,311 ) (10,244 ) Distributable cash flow attributable to limited partner unitholders $ 51,824 $ 76,779

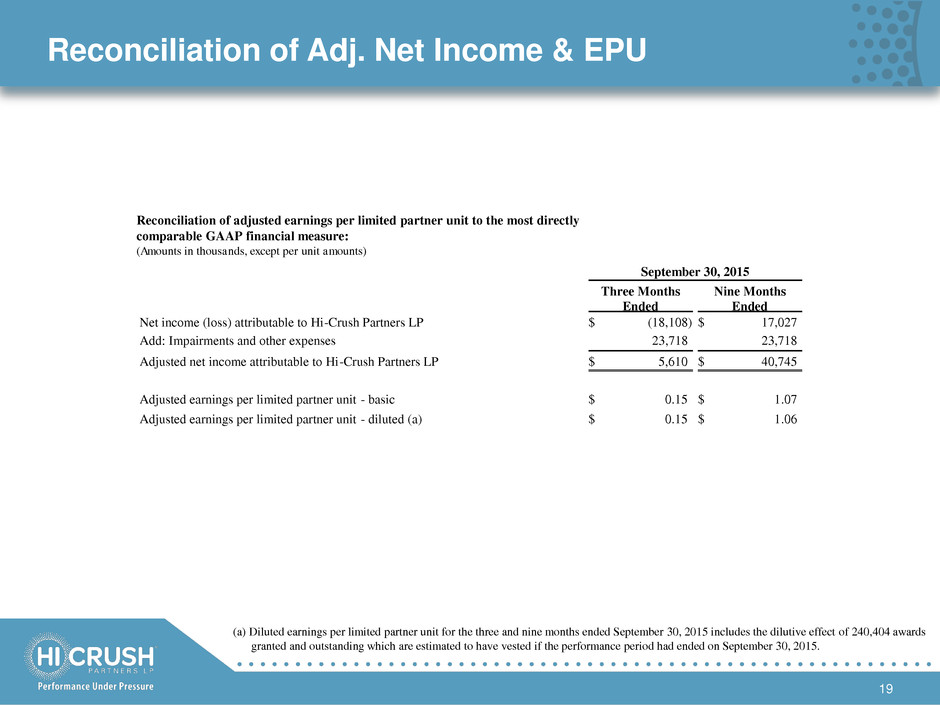

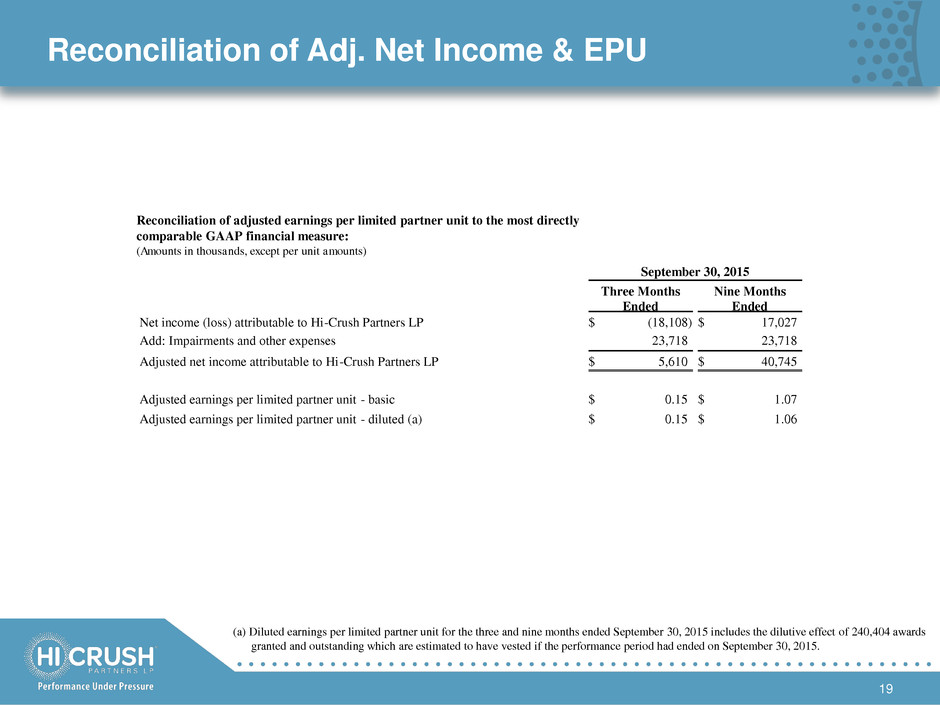

Reconciliation of Adj. Net Income & EPU 19 September 30, 2015 Three Months Ended Nine Months Ended Net income (loss) attributable to Hi-Crush Partners LP $ (18,108 ) $ 17,027 Add: Impairments and other expenses 23,718 23,718 Adjusted net income attributable to Hi-Crush Partners LP $ 5,610 $ 40,745 Adjusted earnings per limited partner unit - basic $ 0.15 $ 1.07 Adjusted earnings per limited partner unit - diluted (a) $ 0.15 $ 1.06 (a) Diluted earnings per limited partner unit for the three and nine months ended September 30, 2015 includes the dilutive effect of 240,404 awards granted and outstanding which are estimated to have vested if the performance period had ended on September 30, 2015. Reconciliation of adjusted earnings per limited partner unit to the most directly comparable GAAP financial measure: (Amounts in thousands, except per unit amounts)