4Q 2016 EARNINGS CALL FEBRUARY 2017

Forward Looking Statements Some of the information included herein may contain forward-looking statements within the meaning of the federal securities laws. Forward- looking statements give our current expectations and may contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “could,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no expected results of operations or financial condition or other forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in Hi-Crush Partners LP’s (“Hi-Crush”) reports filed with the Securities and Exchange Commission (“SEC”), including those described under Item 1A, “Risk Factors” of Hi-Crush’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016. Actual results may vary materially. You are cautioned not to place undue reliance on any forward- looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors in our reports filed with the SEC or the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include: whether we are able to complete the Blair acquisition, the volume of frac sand we are able to sell; the price at which we are able to sell frac sand; the outcome of any litigation, claims or assessments, including unasserted claims; changes in the price and availability of natural gas or electricity; changes in prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. Hi-Crush’s forward-looking statements speak only as of the date made and Hi-Crush undertakes no obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. 2

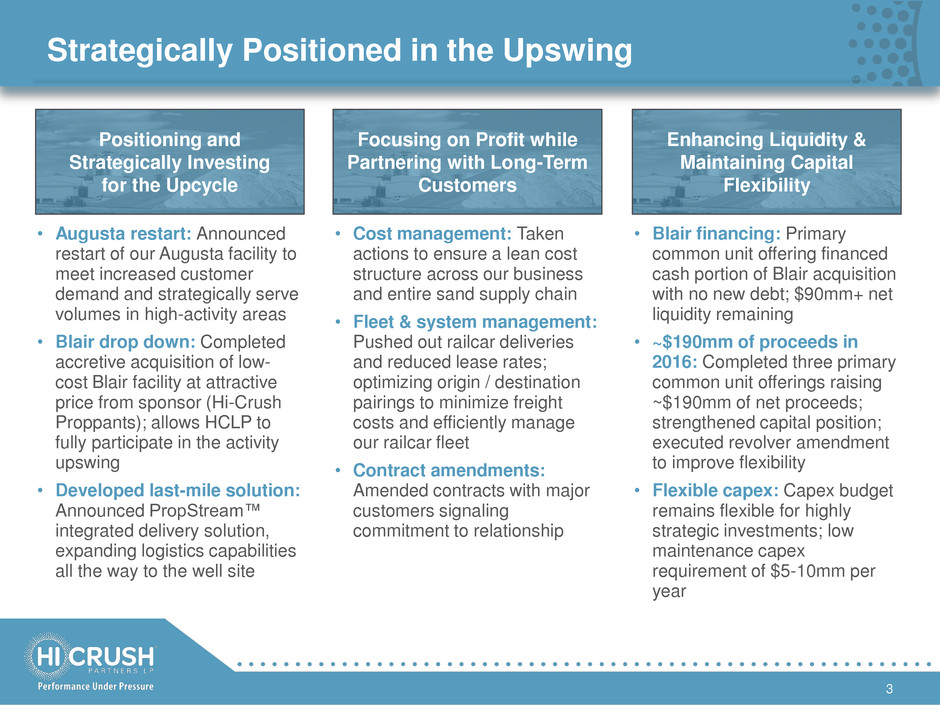

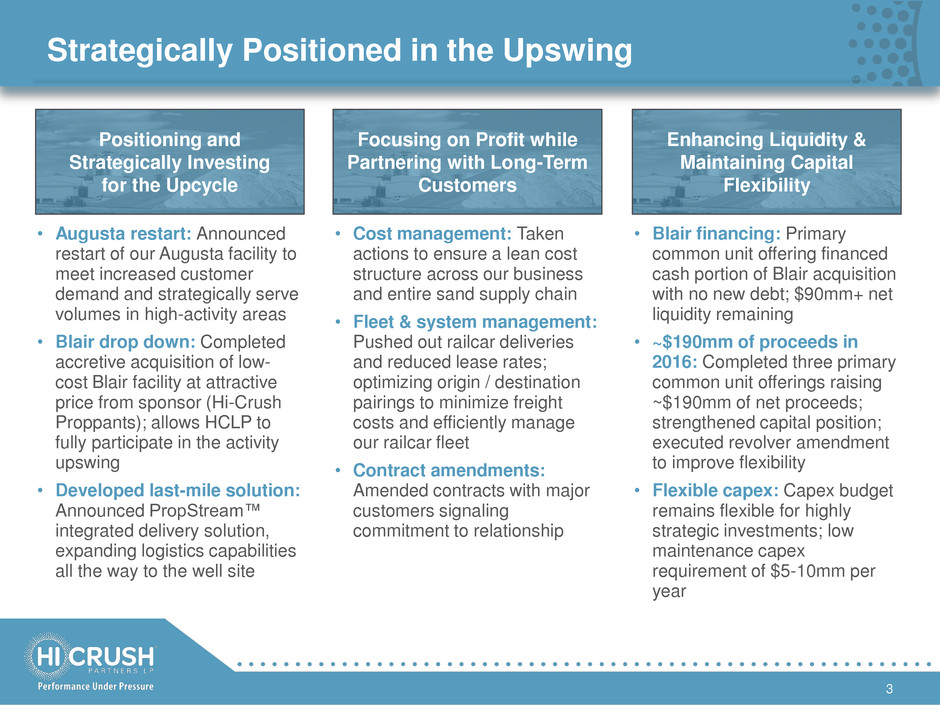

Strategically Positioned in the Upswing 3 Positioning and Strategically Investing for the Upcycle • Augusta restart: Announced restart of our Augusta facility to meet increased customer demand and strategically serve volumes in high-activity areas • Blair drop down: Completed accretive acquisition of low- cost Blair facility at attractive price from sponsor (Hi-Crush Proppants); allows HCLP to fully participate in the activity upswing • Developed last-mile solution: Announced PropStream™ integrated delivery solution, expanding logistics capabilities all the way to the well site Focusing on Profit while Partnering with Long-Term Customers • Cost management: Taken actions to ensure a lean cost structure across our business and entire sand supply chain • Fleet & system management: Pushed out railcar deliveries and reduced lease rates; optimizing origin / destination pairings to minimize freight costs and efficiently manage our railcar fleet • Contract amendments: Amended contracts with major customers signaling commitment to relationship Enhancing Liquidity & Maintaining Capital Flexibility • Blair financing: Primary common unit offering financed cash portion of Blair acquisition with no new debt; $90mm+ net liquidity remaining • ~$190mm of proceeds in 2016: Completed three primary common unit offerings raising ~$190mm of net proceeds; strengthened capital position; executed revolver amendment to improve flexibility • Flexible capex: Capex budget remains flexible for highly strategic investments; low maintenance capex requirement of $5-10mm per year

Leveraging Our Competitive Advantages 4 1) Annual capacity, including 2.86mm tons of annual capacity at Sponsor’s Whitehall facility, which is expected to resume operat ions in March/April 2017. Factor Our Position The Hi-Crush Advantage Size & Scale Four facilities, two Class- 1 rail origins, 10.4mm1 tons of annual capacity Top-tier supplier with operational flexibility and ability to meet increasingly dynamic customer needs Low Cost Market leading cost structure Industry-leading cost structure provides competitive, financial, and operational advantages from mine-site to well-site Distribution Network Strategic and expanding distribution terminal network Direct access to UP and CN railroads; combined with PropStream last-mile solution, extends low-cost competitive advantages to the well site Customer Relationships Strong, long-term relationships Gaining profitable market share through close partnerships with key customers, vendor consolidation and supply attrition Balance Sheet Ample liquidity and significant capital flexibility Provides resources needed for higher activity levels, offering optionality for potential market opportunities Focused Strategy A clear strategy to manage near-term and win long-term Positioned to profitably capture long- term market share with higher activity

Hi-Crush’s Portfolio of Processing Plant Assets 5 Wyeville Capacity: 1.85 mm TPY Rail: Union Pacific Reserve Life: 41 years Status: Active Augusta1 Capacity: 2.86 mm TPY Rail: Union Pacific Reserve Life: 14 years Status: Active Blair Capacity: 2.86 mm TPY Rail: Canadian National Reserve Life: 41 years Status: Active Whitehall Capacity: 2.86 mm TPY Rail: Canadian National Reserve Life: 28 years Status: Expected to resume operations in March/April 2017 HCLP Owned Sponsor Owned Note: 1 98% owned by HCLP, 2% owned by Sponsor. Acquired via drop down in August 2016 100% owned at IPO Acquired via drop down in 2013 / 2014

Frac Sand Volumes Recovering with Activity 6 Source: Company filings, Baker Hughes. Note: U.S. Rig Count represents quarterly average 1 ,3 5 9 2 7 4 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 HCLP FMSA EMES SLCA SND 000s tons 4Q15 1Q16 2Q16 3Q16 4Q16 589 1,359 479 1,083 0.6 0.7 0.8 0.9 1 1.1 1.2 1.3 U.S. Rig Count (Total) HCLP (000s Tons) 3Q16 4Q16 +25% Frac Sand Volumes by Quarter Frac Sand Volumes vs. Rigs • 3rd highest quarterly volumes in HCLP history • ~8% below highest volume quarter (4Q 2014) • Volumes improving and outperforming +23% • Quarterly run-rate represents only ~52% of capacity across our available 10.4mm TPY • Positioned for further upside as well completion outperformance vs rig count gains momentum

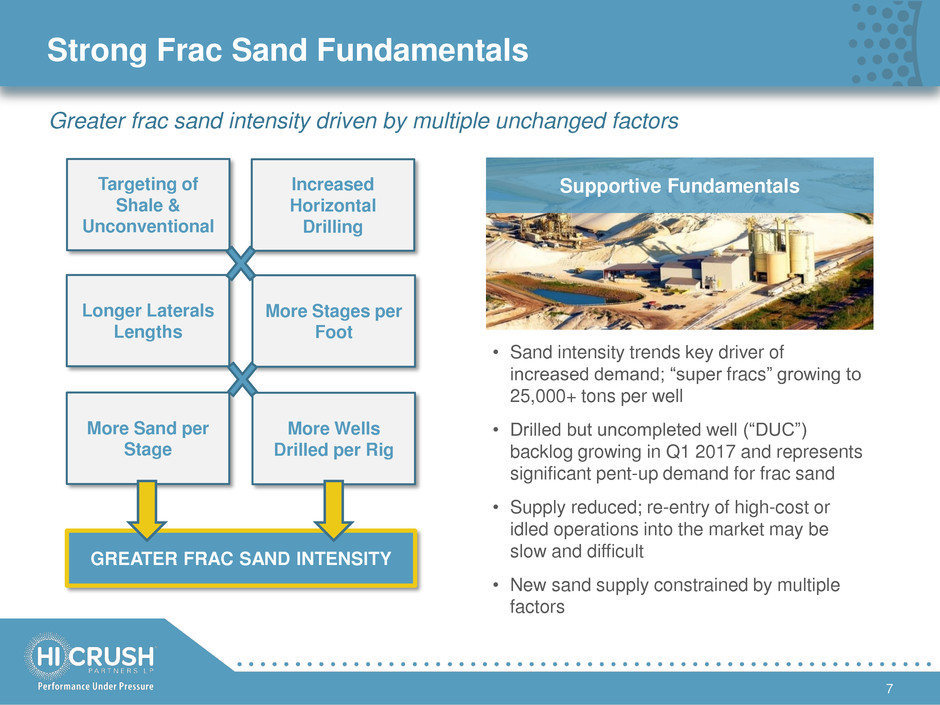

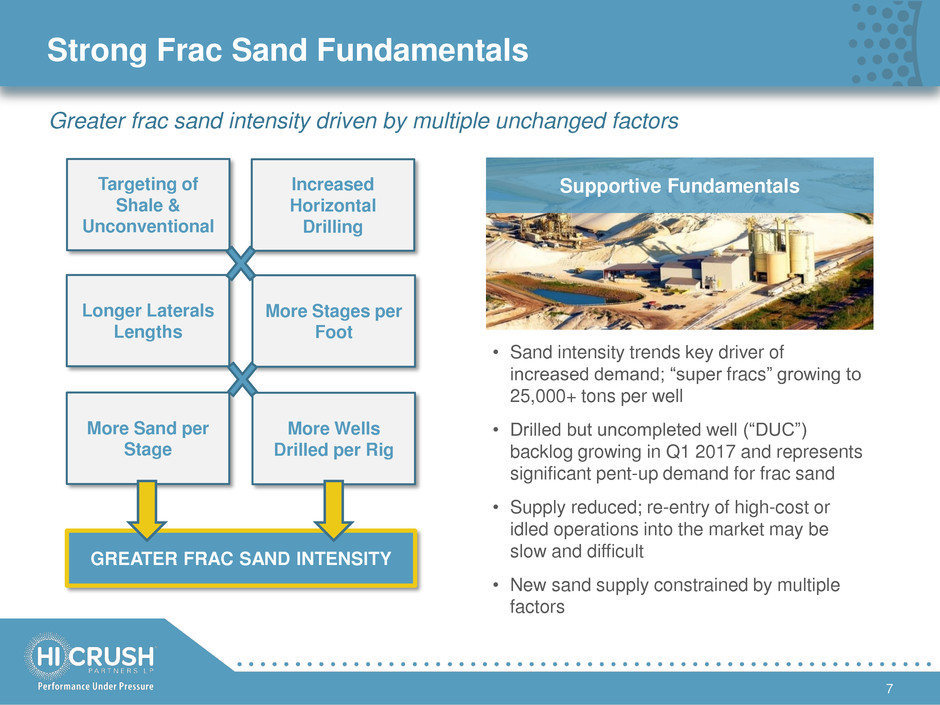

Strong Frac Sand Fundamentals 7 Supportive Fundamentals Targeting of Shale & Unconventional Increased Horizontal Drilling Longer Laterals Lengths More Stages per Foot More Sand per Stage More Wells Drilled per Rig GREATER FRAC SAND INTENSITY Greater frac sand intensity driven by multiple unchanged factors • Sand intensity trends key driver of increased demand; “super fracs” growing to 25,000+ tons per well • Drilled but uncompleted well (“DUC”) backlog growing in Q1 2017 and represents significant pent-up demand for frac sand • Supply reduced; re-entry of high-cost or idled operations into the market may be slow and difficult • New sand supply constrained by multiple factors

Leverage to Current Upcycle vs Prior Peak1 8 2,000 rigs 27 days 13 wells 13 wells 26,000 wells 2,500 tons 65,000,000 tons Rig Count # of rigs Rig Efficiency Days/well drilled Rig Productivity Wells drilled/year/rig Completions Well completions/year/rig Wells Completed Well completions/year Average Sand Usage Tons/well Potential Demand Tons/year Old Model 1) Hypothetical example for illustrative purposes only; some results rounded 900 rigs 19 days 19 wells 20 wells 18,000 wells 5,250 tons 94,500,000 tons New Model - DUC Inventory Drawdown DUCs completed/year/rig 1 well +45% Calculated Calculated -55% Calculated

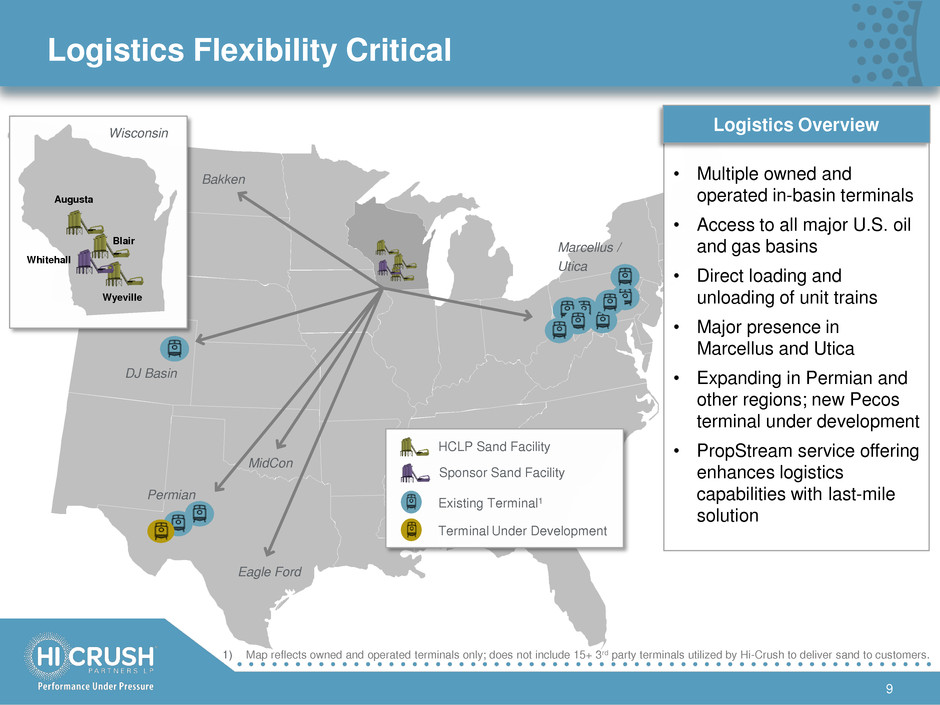

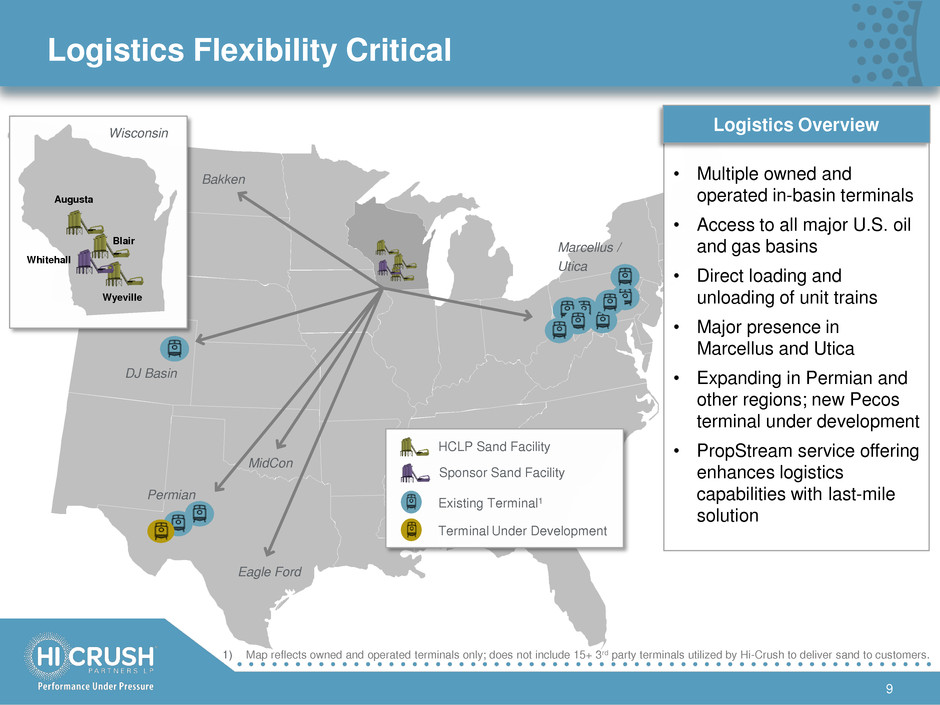

Logistics Flexibility Critical 9 1) Map reflects owned and operated terminals only; does not include 15+ 3rd party terminals utilized by Hi-Crush to deliver sand to customers. • Multiple owned and operated in-basin terminals • Access to all major U.S. oil and gas basins • Direct loading and unloading of unit trains • Major presence in Marcellus and Utica • Expanding in Permian and other regions; new Pecos terminal under development • PropStream service offering enhances logistics capabilities with last-mile solution HCLP Sand Facility Existing Terminal1 Bakken DJ Basin Permian MidCon Eagle Ford Marcellus / Utica Wisconsin Augusta Wyeville Whitehall Blair Logistics Overview Terminal Under Development Sponsor Sand Facility

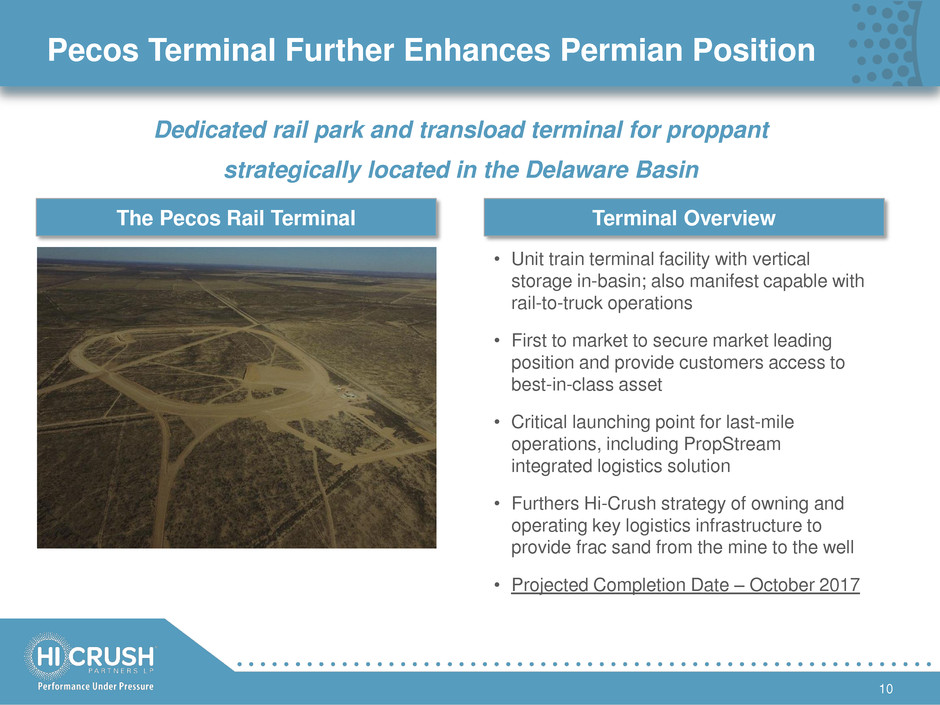

Pecos Terminal Further Enhances Permian Position 10 Terminal Overview • Unit train terminal facility with vertical storage in-basin; also manifest capable with rail-to-truck operations • First to market to secure market leading position and provide customers access to best-in-class asset • Critical launching point for last-mile operations, including PropStream integrated logistics solution • Furthers Hi-Crush strategy of owning and operating key logistics infrastructure to provide frac sand from the mine to the well • Projected Completion Date – October 2017 Dedicated rail park and transload terminal for proppant strategically located in the Delaware Basin The Pecos Rail Terminal

PropStream – Streamlining the Supply Chain 11 Differentiated Last-Mile Capabilities • Developed fully-integrated PropStream delivery solution to provide containerized mine site to well site services • Control quality of sand from origin to the blender hopper • Purpose-built PropX cubic design – greater tonnage into the container • Highly efficient PropBeast™ conveyor systems – up to 20% faster delivery into the blender • Fully enclosed system reduces particulate matter emissions by >90% versus pneumatic equipment • Eliminates need for specialized equipment, significantly reduces capital intensity and other up- front costs • Fully mobile system of conveyors, containers and trucks, with a significantly smaller wellsite footprint • Lessens well site trucking congestion, reduces or eliminates demurrage

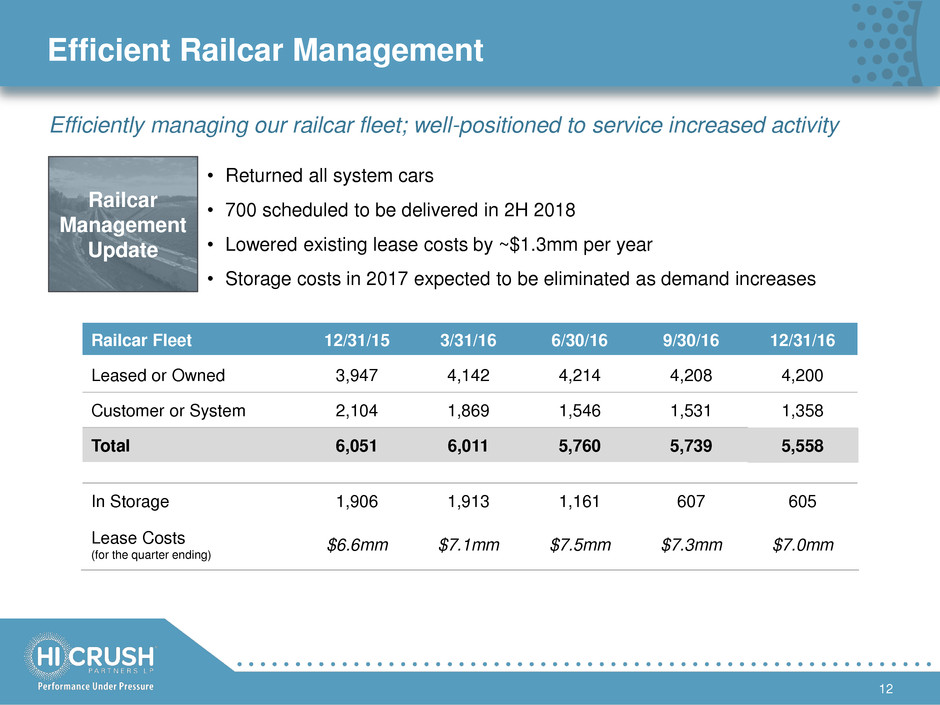

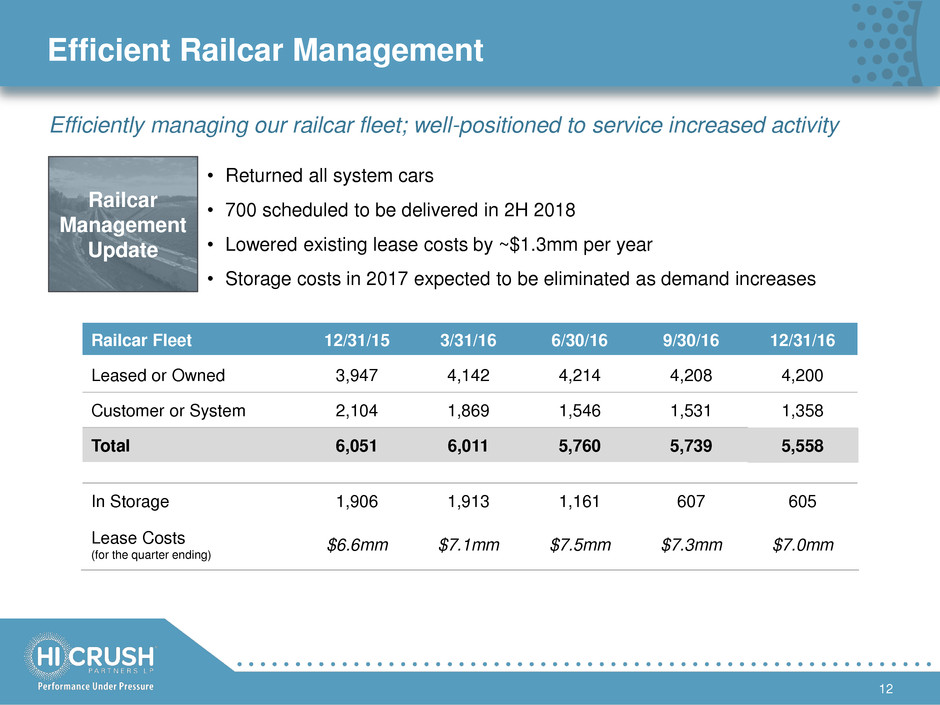

Efficient Railcar Management 12 Railcar Fleet 12/31/15 3/31/16 6/30/16 9/30/16 12/31/16 Leased or Owned 3,947 4,142 4,214 4,208 4,200 Customer or System 2,104 1,869 1,546 1,531 1,358 Total 6,051 6,011 5,760 5,739 5,558 In Storage 1,906 1,913 1,161 607 605 Lease Costs (for the quarter ending) $6.6mm $7.1mm $7.5mm $7.3mm $7.0mm • Returned all system cars • 700 scheduled to be delivered in 2H 2018 • Lowered existing lease costs by ~$1.3mm per year • Storage costs in 2017 expected to be eliminated as demand increases Railcar Management Update Efficiently managing our railcar fleet; well-positioned to service increased activity

PropX – Investing in the Future of Proppant Delivery 13 PropX Strategic Overview • Proppant Express Investment LLC (“PropX”) is a joint venture formed for development of critical last-mile proppant logistics equipment • PropX is responsible for manufacturing the cubic containers and the PropBeast conveyor system used in Hi-Crush’s PropStream integrated logistics solution • Hi-Crush is committed to invest up to $17.4mm in PropX ‒ $10.2mm has been invested through December 31, 2016

14 PropX Performance To-Date All PropX Systems >1 billion pounds delivered >80 wells completed * September 2016 to February 15, 2017 Hi-Crush PropStream Systems • 4Q 2016 utilization of 44% • Lower 4Q 2016 utilization and start-up costs impacted EBITDA by $(0.9) million • 2 Permian crews expected to be fully-utilized throughout 2017 • Northeast crew is mobilizing for deployment

Financial Results

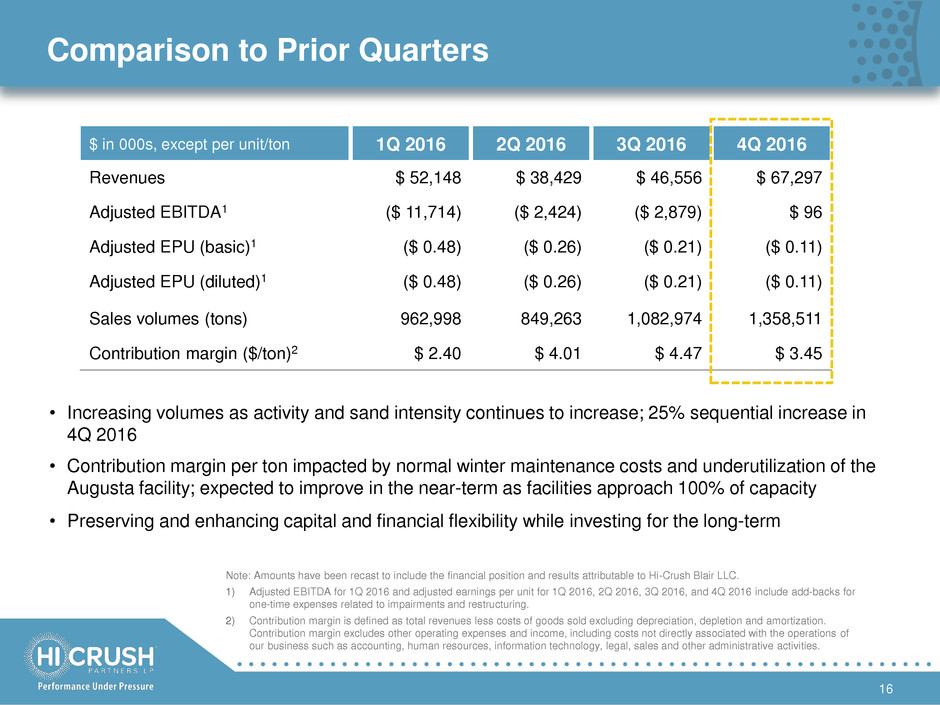

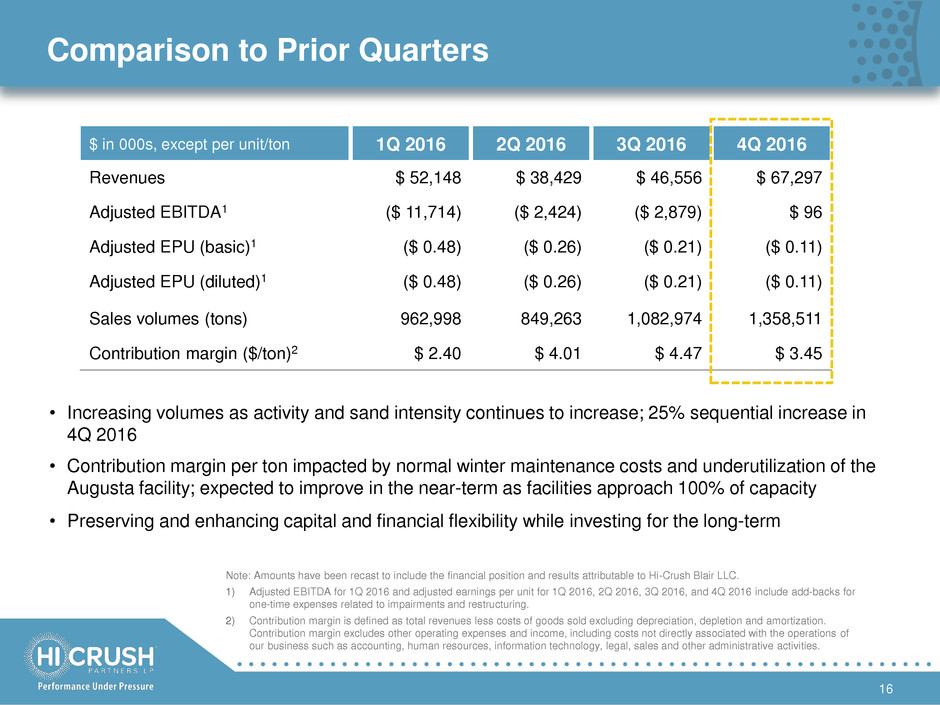

Comparison to Prior Quarters 16 $ in 000s, except per unit/ton 1Q 2016 2Q 2016 3Q 2016 4Q 2016 Revenues $ 52,148 $ 38,429 $ 46,556 $ 67,297 Adjusted EBITDA1 ($ 11,714) ($ 2,424) ($ 2,879) $ 96 Adjusted EPU (basic)1 ($ 0.48) ($ 0.26) ($ 0.21) ($ 0.11) Adjusted EPU (diluted)1 ($ 0.48) ($ 0.26) ($ 0.21) ($ 0.11) Sales volumes (tons) 962,998 849,263 1,082,974 1,358,511 Contribution margin ($/ton)2 $ 2.40 $ 4.01 $ 4.47 $ 3.45 Note: Amounts have been recast to include the financial position and results attributable to Hi-Crush Blair LLC. 1) Adjusted EBITDA for 1Q 2016 and adjusted earnings per unit for 1Q 2016, 2Q 2016, 3Q 2016, and 4Q 2016 include add-backs for one-time expenses related to impairments and restructuring. 2) Contribution margin is defined as total revenues less costs of goods sold excluding depreciation, depletion and amortization. Contribution margin excludes other operating expenses and income, including costs not directly associated with the operations of our business such as accounting, human resources, information technology, legal, sales and other administrative activities. • Increasing volumes as activity and sand intensity continues to increase; 25% sequential increase in 4Q 2016 • Contribution margin per ton impacted by normal winter maintenance costs and underutilization of the Augusta facility; expected to improve in the near-term as facilities approach 100% of capacity • Preserving and enhancing capital and financial flexibility while investing for the long-term

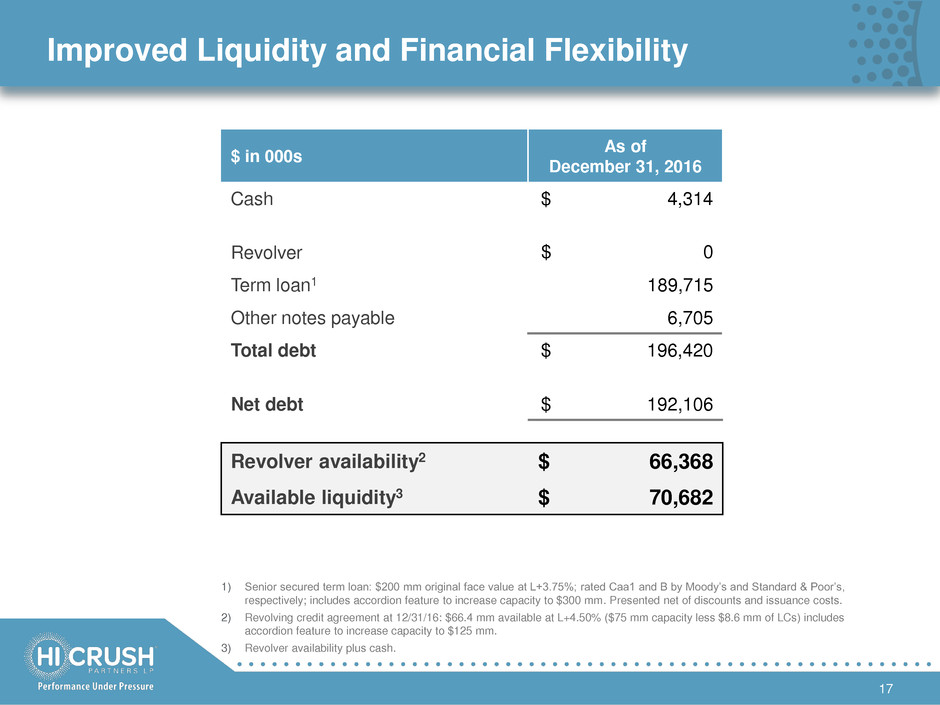

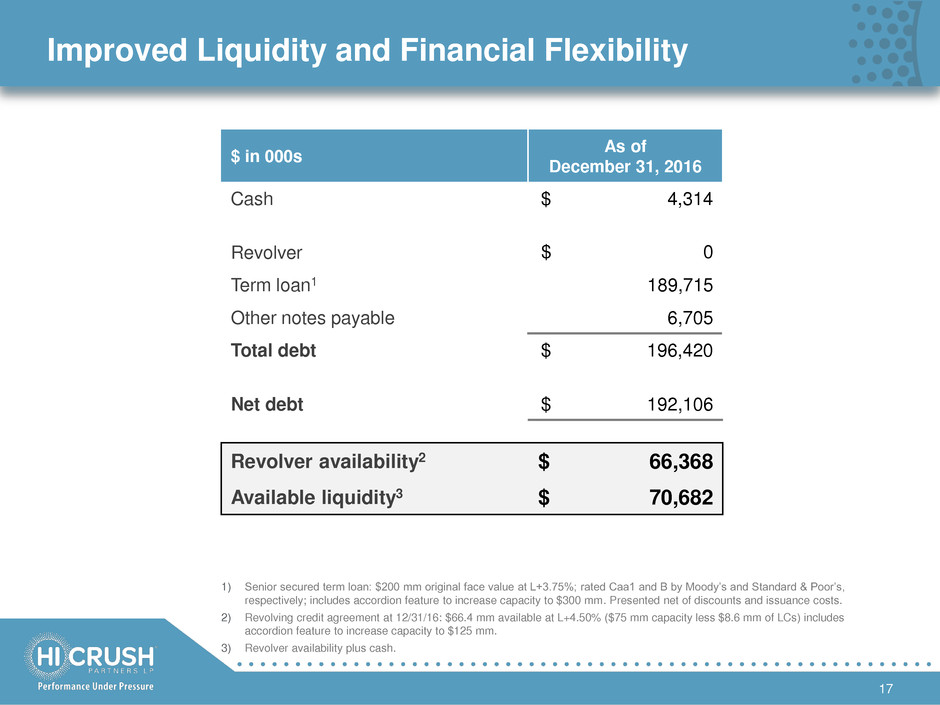

Improved Liquidity and Financial Flexibility 17 $ in 000s As of December 31, 2016 Cash $ 4,314 Revolver $ 0 Term loan1 189,715 Other notes payable 6,705 Total debt $ 196,420 Net debt $ 192,106 Revolver availability2 $ 66,368 Available liquidity3 $ 70,682 1) Senior secured term loan: $200 mm original face value at L+3.75%; rated Caa1 and B by Moody’s and Standard & Poor’s, respectively; includes accordion feature to increase capacity to $300 mm. Presented net of discounts and issuance costs. 2) Revolving credit agreement at 12/31/16: $66.4 mm available at L+4.50% ($75 mm capacity less $8.6 mm of LCs) includes accordion feature to increase capacity to $125 mm. 3) Revolver availability plus cash.

Credit Facility Provides Liquidity & Flexibility 18 1) Calculated as: (Fixed assets book value + eligible accounts receivable and inventory) / total funded debt 2) Effective Period through June 29, 2017 3) Leverage and interest coverage ratios for 2Q17-4Q17 based on annualized figures beginning April 1, 2017 • Capacity: Total revolver capacity of $75mm • 2017 Covenants: EBITDA minimums for 6 months ending 1Q17; leverage ratio max & interest coverage minimum beginning quarter ended 6/30/17; all with equity cure provision • Equity Cure: Equity cure provision available to cover any covenant shortfalls • Asset Coverage1: Minimum of 1.0x to draw funds during Effective Period2 • Permitted Distributions: Limited to 50% of DCF less scheduled amortization payments during Effective Period2 Credit Facility Terms n/a -5.0 5.0x 4.5x 4.0x 3.5x -4.0x -3.0x -2.0x -1.0x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x -10.0 -5.0 0.0 5.0 10.0 15.0 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 $mm Amendment eliminated EBITDA minimums through end of 2016 Equity cure provision available to address any potential EBITDA covenant shortfalls Trailing 6 Month EBITDA Minimum Leverage Ratio Maximum3 and thereafter

Fourth Quarter 2016 Summary 19

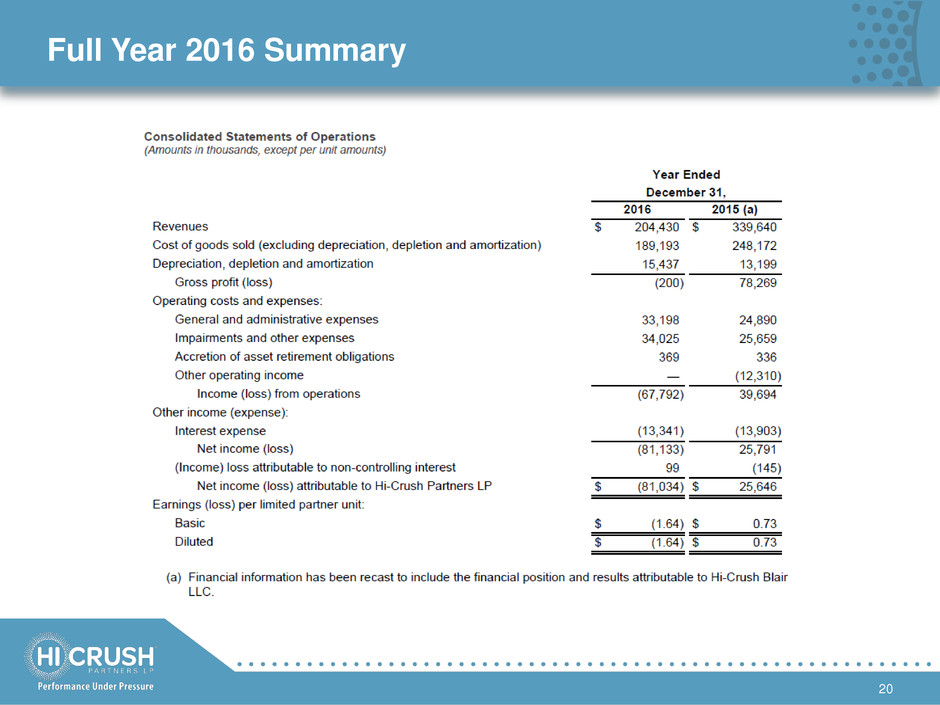

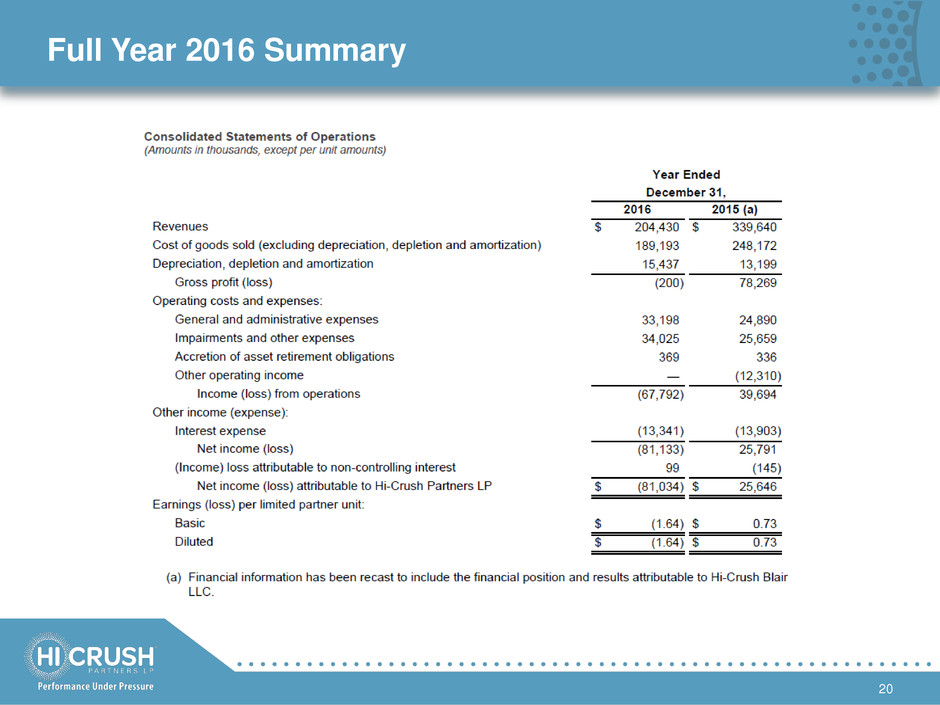

Full Year 2016 Summary 20

Fourth Quarter 2016 Summary – EBITDA & DCF 21 a) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton produced and delivered during the period. Such expenditures include those associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital. b) The Partnership's historical financial information has been recast to consolidate Blair for the three months ended December 31, 2015. For purposes of calculating distributable cash flow attributable to Hi-Crush Partners LP, the Partnership excludes the incremental amount of recast distributable cash flow earned during the periods prior to the Blair Contribution.

Full Year 2016 Summary – EBITDA & DCF 22 a) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton produced and delivered during the period. Such expenditures include those associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital. b) The Partnership's historical financial information has been recast to consolidate Blair for all periods presented. For purposes of calculating distributable cash flow attributable to Hi-Crush Partners LP, the Partnership excludes the incremental amount of recast distributable cash flow earned during the periods prior to the Blair Contribution.

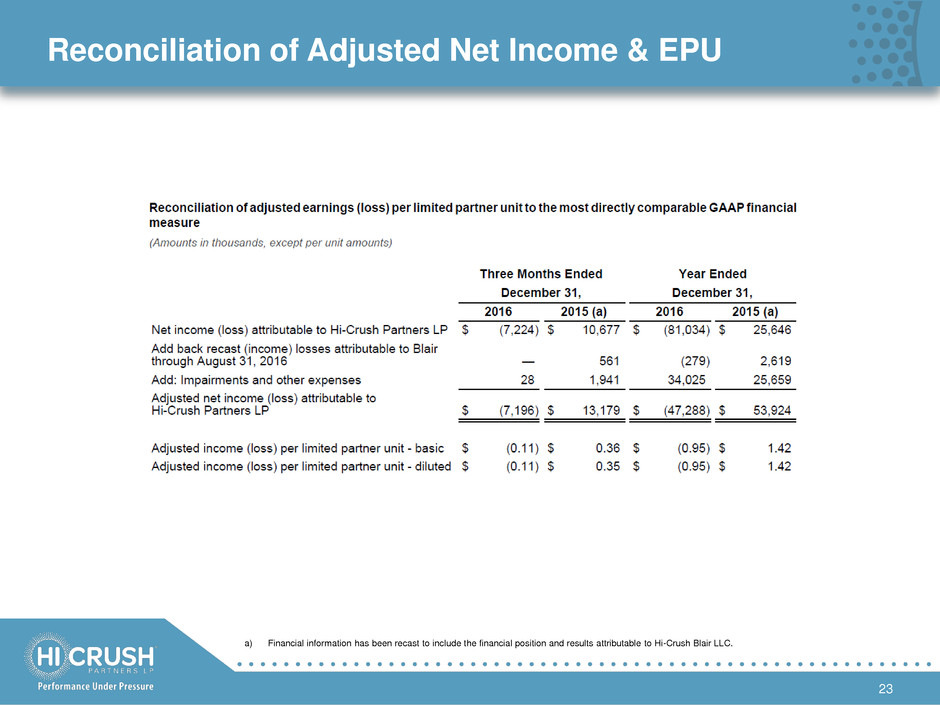

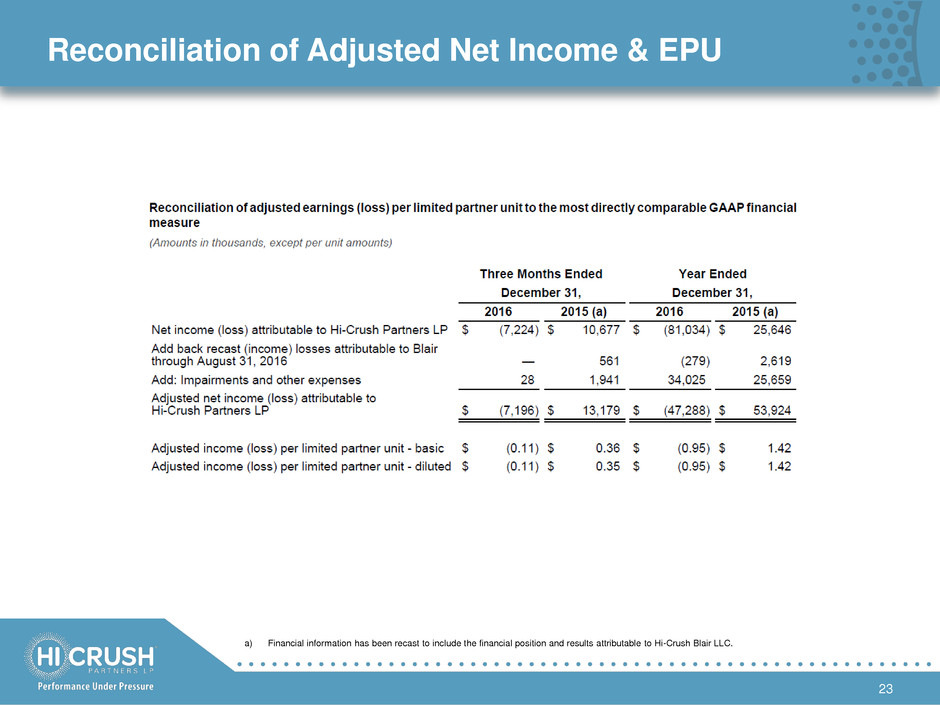

Reconciliation of Adjusted Net Income & EPU 23 a) Financial information has been recast to include the financial position and results attributable to Hi-Crush Blair LLC.

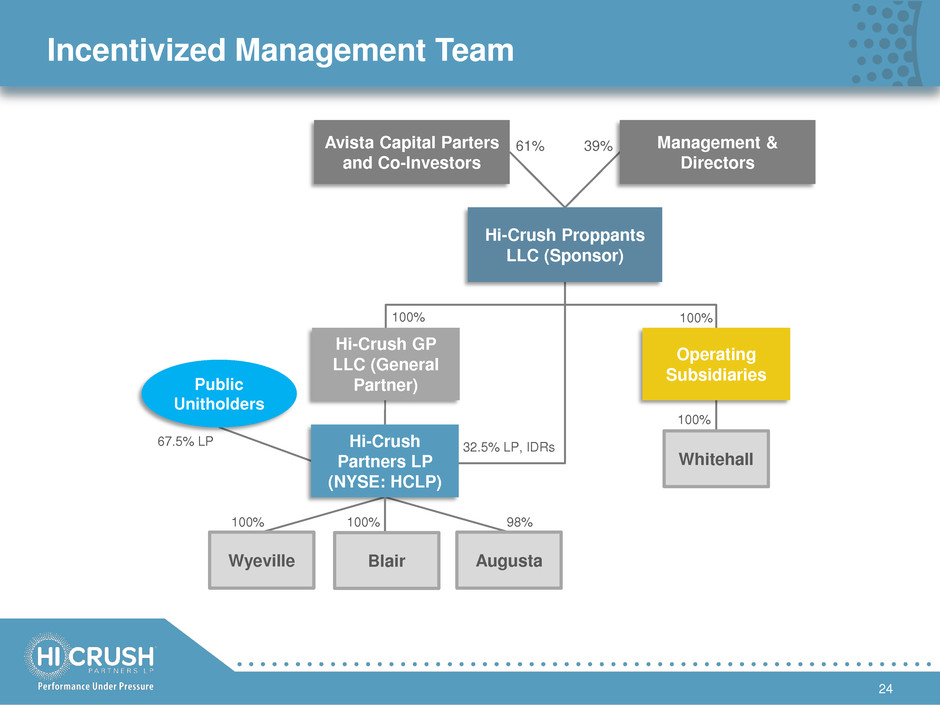

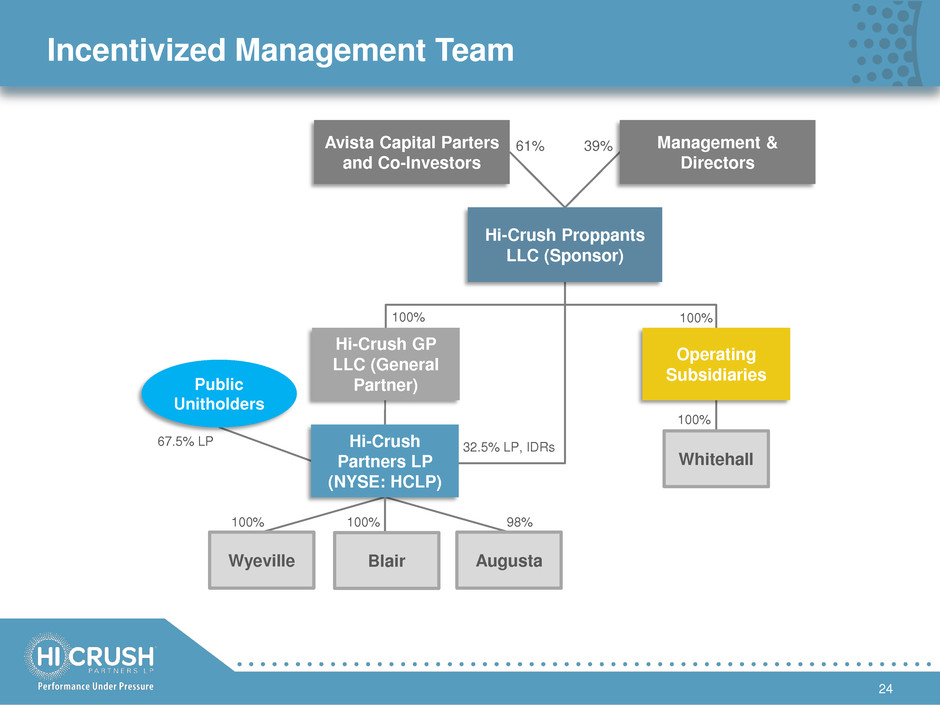

Incentivized Management Team 24 39% 61% 100% 100% 98% 100% 100% 67.5% LP 32.5% LP, IDRs Wyeville Augusta Whitehall Hi-Crush Proppants LLC (Sponsor) Avista Capital Parters and Co-Investors Management & Directors Hi-Crush Partners LP (NYSE: HCLP) Public Unitholders Operating Subsidiaries Hi-Crush GP LLC (General Partner) Blair 100%