Q4 2019 Earnings Presentation February 2020 Hi-Crush, Inc. (NYSE: HCR)

Forward Looking Statements and Non-GAAP Measures Forward-Looking Statements and Cautionary Statements Some of the information in this presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements give our current expectations, and contain projections of results of operations or of financial condition, or forecasts of future events. Words such as "may," "should," "assume," "forecast," "position," "predict," "strategy," "expect," "intend," "hope," "plan," "estimate," "anticipate," "could," "believe," "project," "budget," "potential," "likely," or "continue," and similar expressions are used to identify forward- looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward- looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in Hi-Crush Inc.’s reports filed with the SEC, including those described under Item 1A of Hi-Crush Inc.’s Form 10-K for the year ended December 31, 2019. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors in our reports filed with the SEC or the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward looking statements include: the volume of frac sand we are able to sell; the price at which we are able to sell frac sand; the outcome of any pending litigation, claims or assessments, including unasserted claims; changes in the price and availability of natural gas or electricity; changes in prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. Hi-Crush Inc.’s forward-looking statements speak only as of the date made and Hi-Crush Inc. undertakes no obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. Use of Non-GAAP Information This presentation may include non-GAAP financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Hi-Crush Inc.’s most recent earnings release at www.hicrushinc.com. Investor Presentation | February 2020 2

Operational Update & Strategy

Fully-Integrated Solutions Offering Benefits of our efficient, reliable, high- quality, technology-enabled solutions: Increased drilling & completion efficiency Lower cost for us and our customers Ability to remain responsive to customer needs Differentiated sustainability & safety benefits Investor Presentation | February 2020 4

Differentiation in a Fragmented Industry We are the only full-service solutions provider in highly-fragmented industry Fully-integrated Generates sustainable, platform reduces costs long-term value for all for us and customers stakeholders Partners closely Delivers higher with E&P margin via increased customers operational efficiency Uses technology to drive Enhances operational productivity & deepen leverage across customer integration basins Investor Presentation | February 2020 5

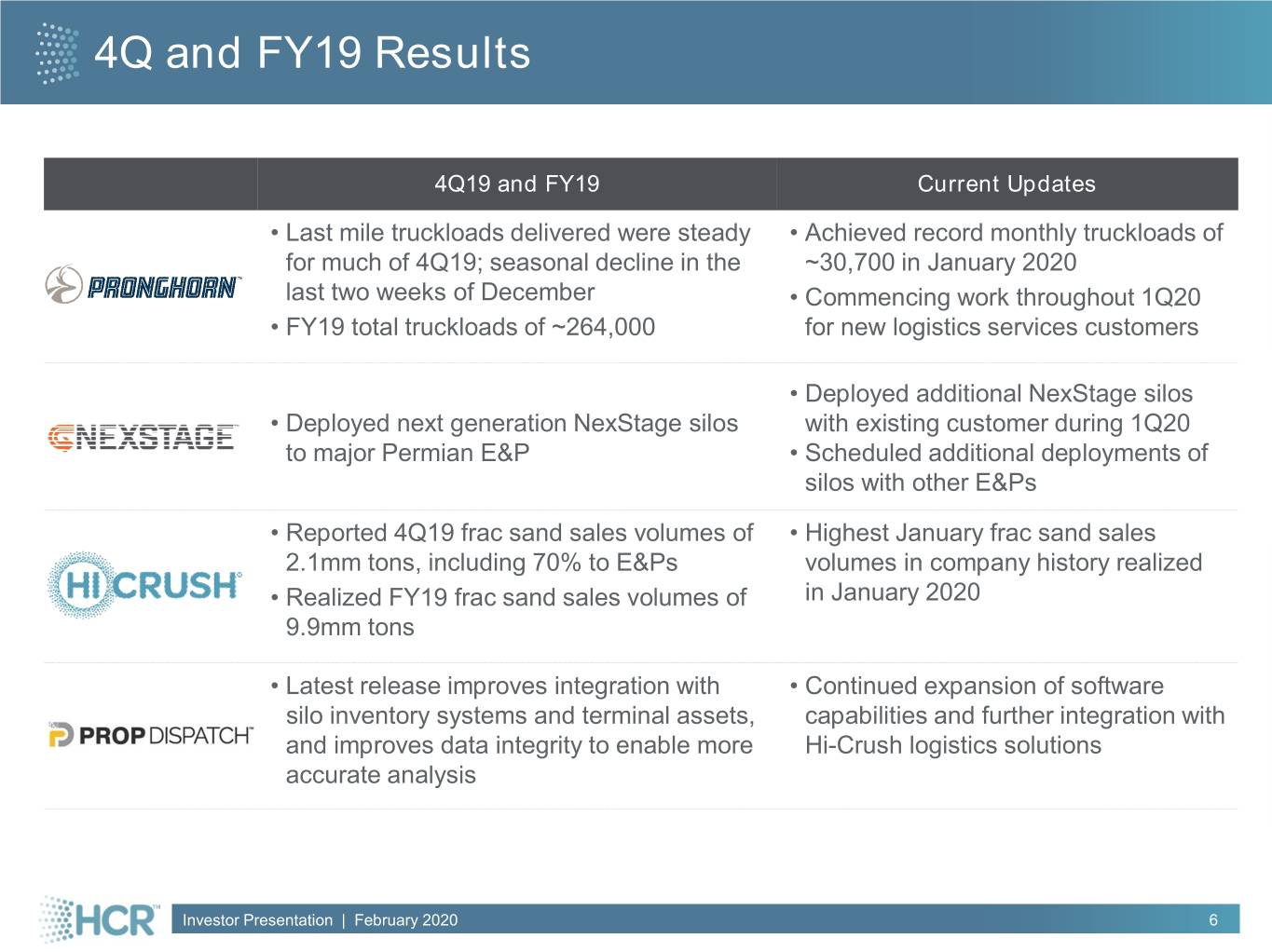

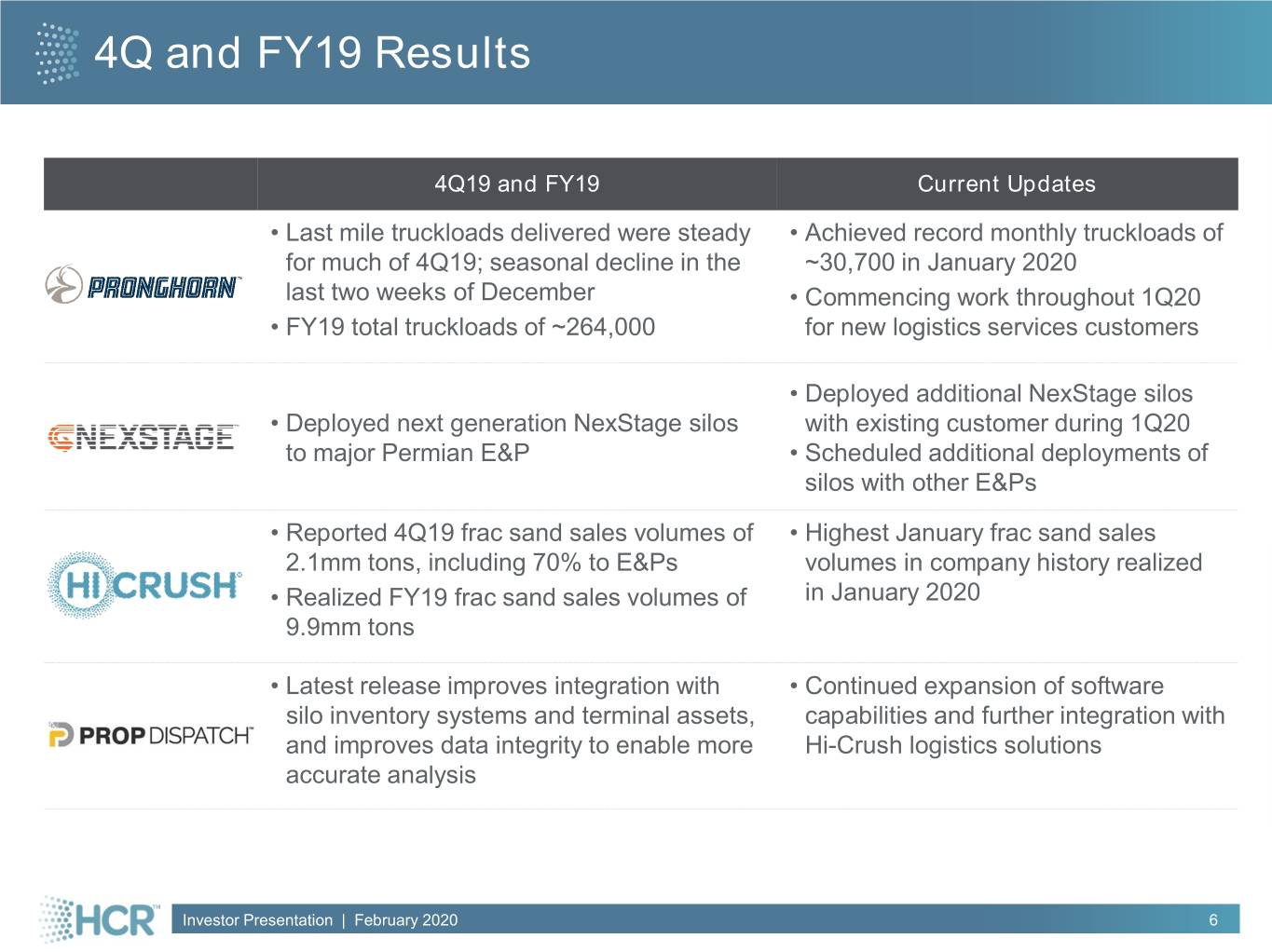

4Q and FY19 Results 4Q19 and FY19 Current Updates • Last mile truckloads delivered were steady • Achieved record monthly truckloads of for much of 4Q19; seasonal decline in the ~30,700 in January 2020 last two weeks of December • Commencing work throughout 1Q20 • FY19 total truckloads of ~264,000 for new logistics services customers • Deployed additional NexStage silos • Deployed next generation NexStage silos with existing customer during 1Q20 to major Permian E&P • Scheduled additional deployments of silos with other E&Ps • Reported 4Q19 frac sand sales volumes of • Highest January frac sand sales 2.1mm tons, including 70% to E&Ps volumes in company history realized • Realized FY19 frac sand sales volumes of in January 2020 9.9mm tons • Latest release improves integration with • Continued expansion of software silo inventory systems and terminal assets, capabilities and further integration with and improves data integrity to enable more Hi-Crush logistics solutions accurate analysis Investor Presentation | February 2020 6

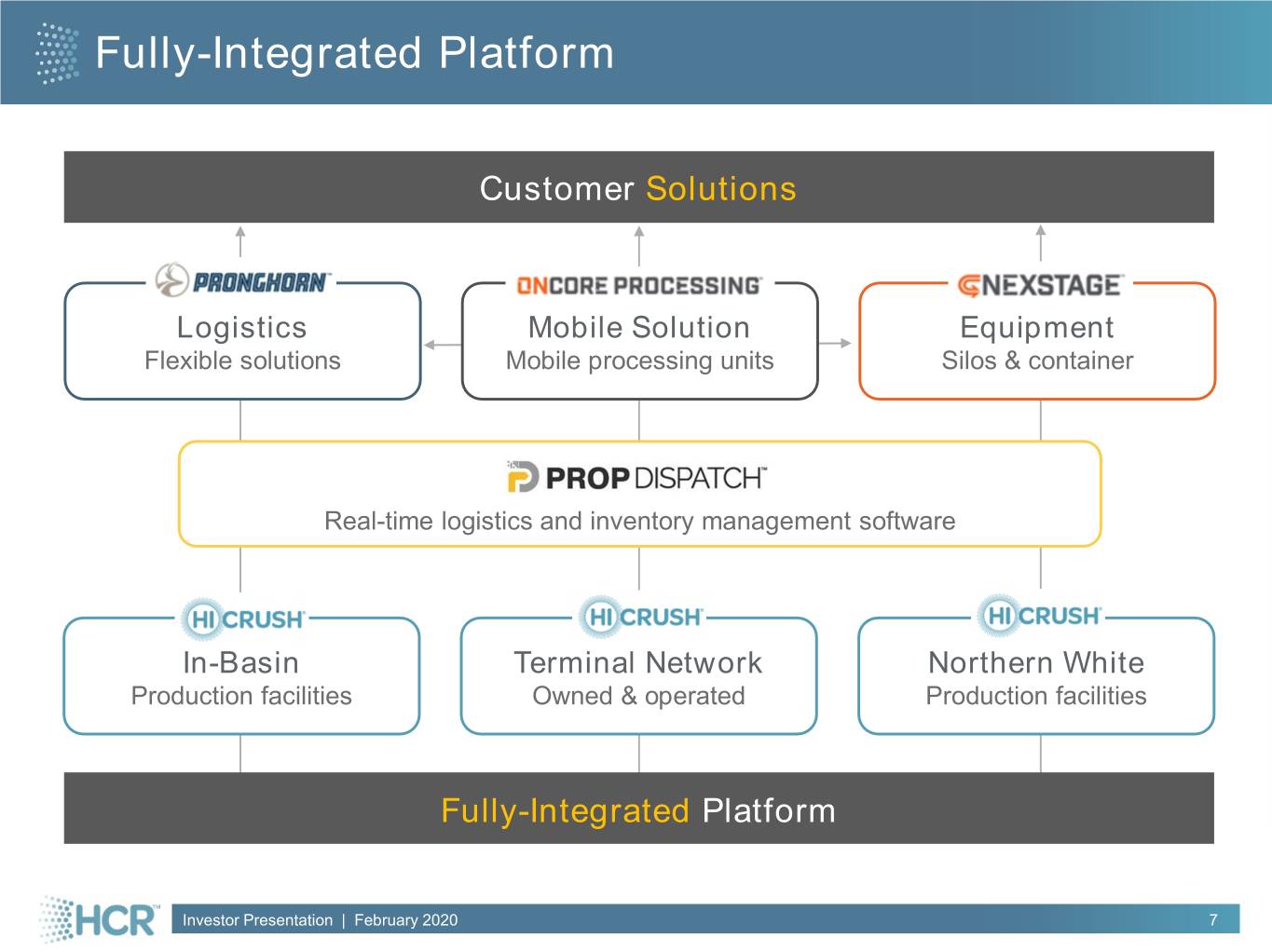

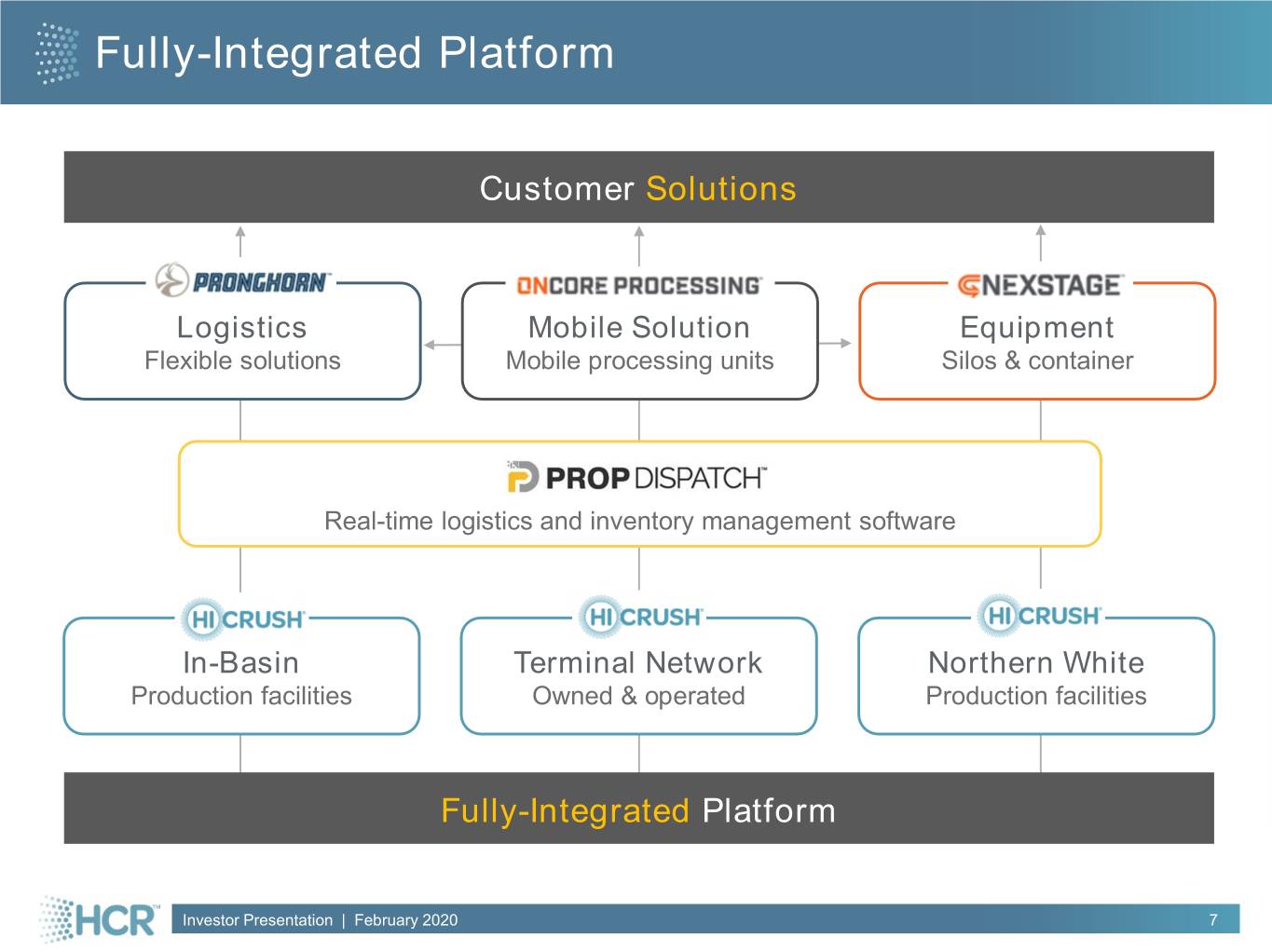

Fully-Integrated Platform Customer Solutions Logistics Mobile Solution Equipment Flexible solutions Mobile processing units Silos & container Real-time logistics and inventory management software In-Basin Terminal Network Northern White Production facilities Owned & operated Production facilities Fully-Integrated Platform Investor Presentation | February 2020 7

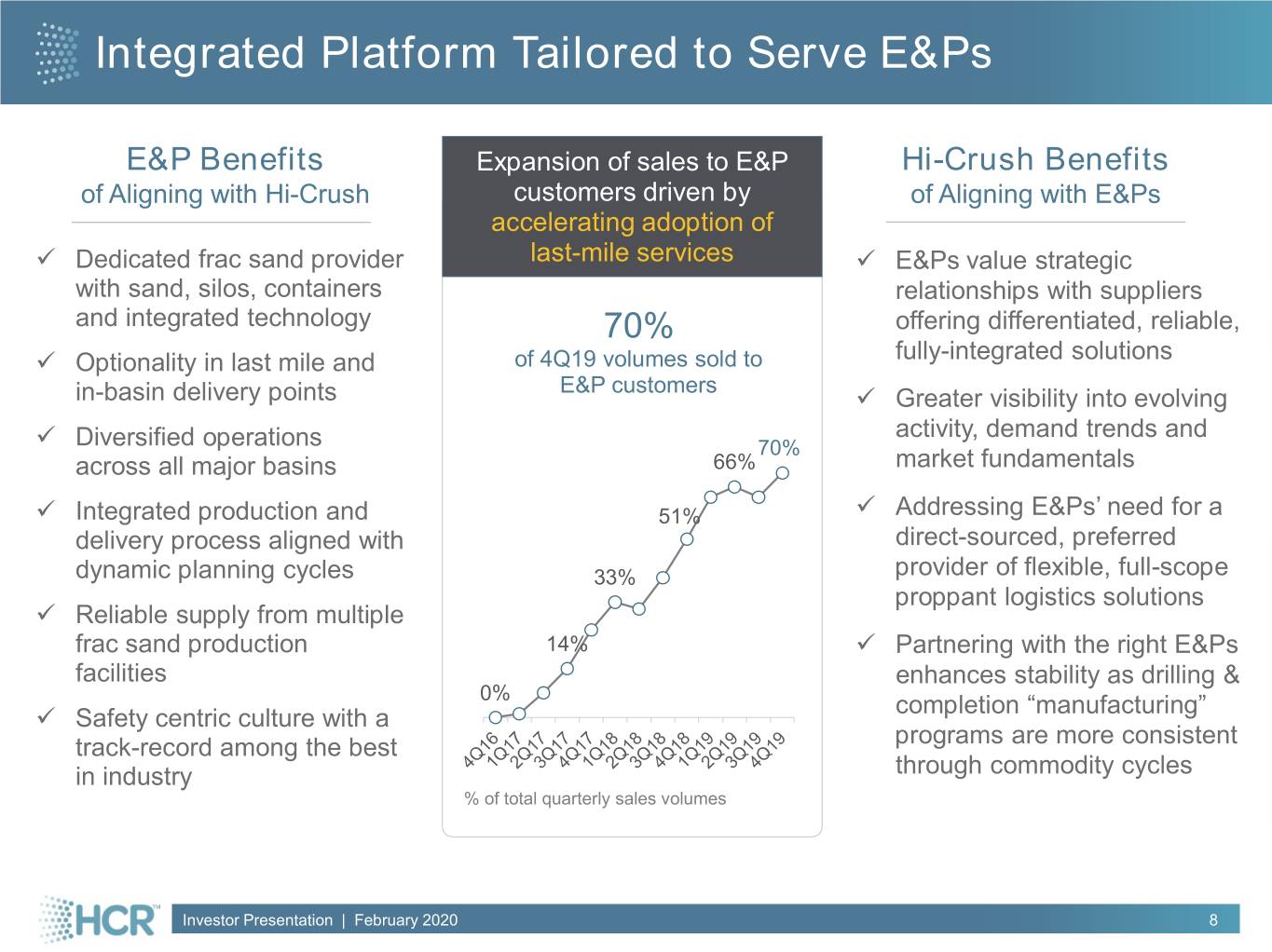

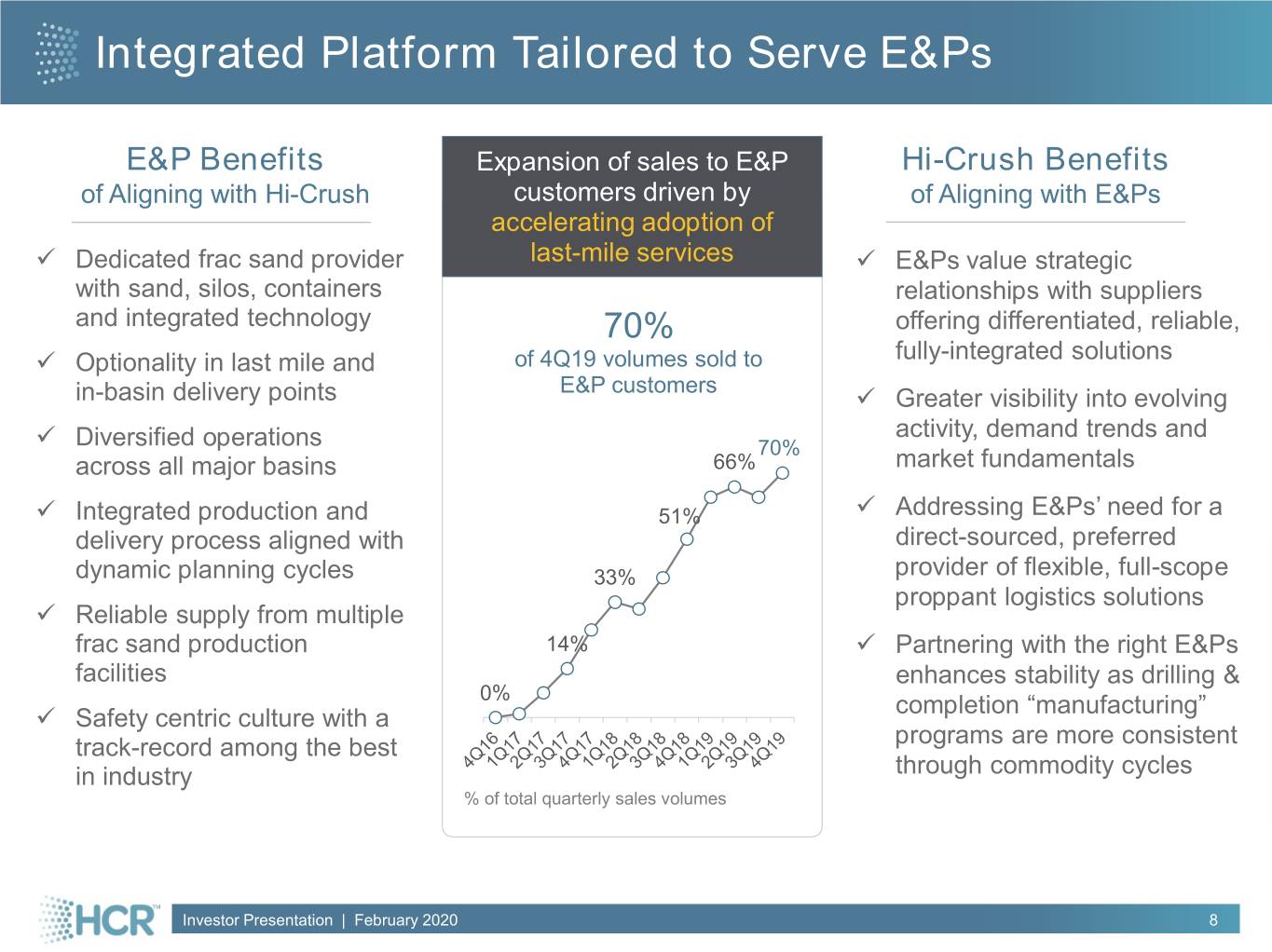

Integrated Platform Tailored to Serve E&Ps E&P Benefits Expansion of sales to E&P Hi-Crush Benefits of Aligning with Hi-Crush customers driven by of Aligning with E&Ps accelerating adoption of Dedicated frac sand provider last-mile services E&Ps value strategic with sand, silos, containers relationships with suppliers and integrated technology 70% offering differentiated, reliable, Optionality in last mile and of 4Q19 volumes sold to fully-integrated solutions E&P customers in-basin delivery points Greater visibility into evolving activity, demand trends and Diversified operations 70% across all major basins 66% market fundamentals Integrated production and 51% Addressing E&Ps’ need for a delivery process aligned with direct-sourced, preferred dynamic planning cycles 33% provider of flexible, full-scope proppant logistics solutions Reliable supply from multiple frac sand production 14% Partnering with the right E&Ps facilities enhances stability as drilling & 0% completion “manufacturing” Safety centric culture with a track-record among the best programs are more consistent in industry through commodity cycles % of total quarterly sales volumes Investor Presentation | February 2020 8

Our Operational Reach All Basins Bakken Highlights Wisconsin Marcellus / Utica • Pronghorn last mile solutions operating in all major basins Powder River • NexStage deploying innovative equipment supporting efficient last mile delivery and wellsite management DJ / Niobrara MidCon • Hi-Crush sand production facilities and terminal network meet customers demand for Permian efficient sand supply • PropDispatch utilized for major market share of trucking logistics Eagle Ford Investor Presentation | February 2020 9

PropDispatch: Real-Time Logistics Management Key Benefits Increased efficiency: Reduce landed sand Real-time monitoring of truckloads cost with real-time data on turn times, driver between transload & well pad performance, congestion and demurrage Enhanced stage reporting: Delivers Manages and displays well pad enhanced inventory management capabilities inventory to plan for future stages and ordering Weight surety: Assists drivers to ensure Delivers real-time comprehensive maximum weight per load customer dashboards ELD connectivity: Integrates with electronic logging device platforms to capture driver Efficiently dispatches drivers based availability and assist in dispatch process on location and proximity to supply Investor Presentation | February 2020 10

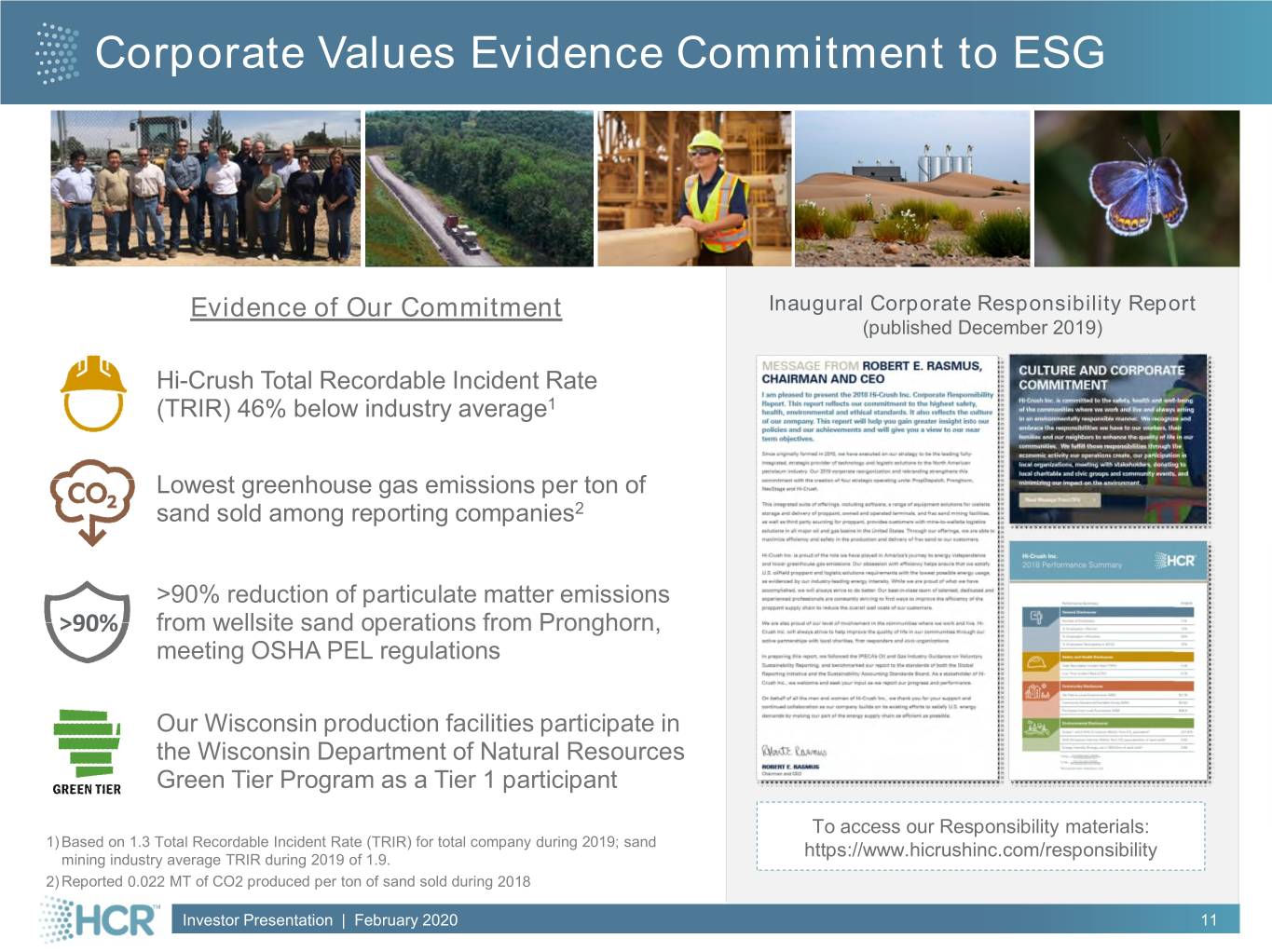

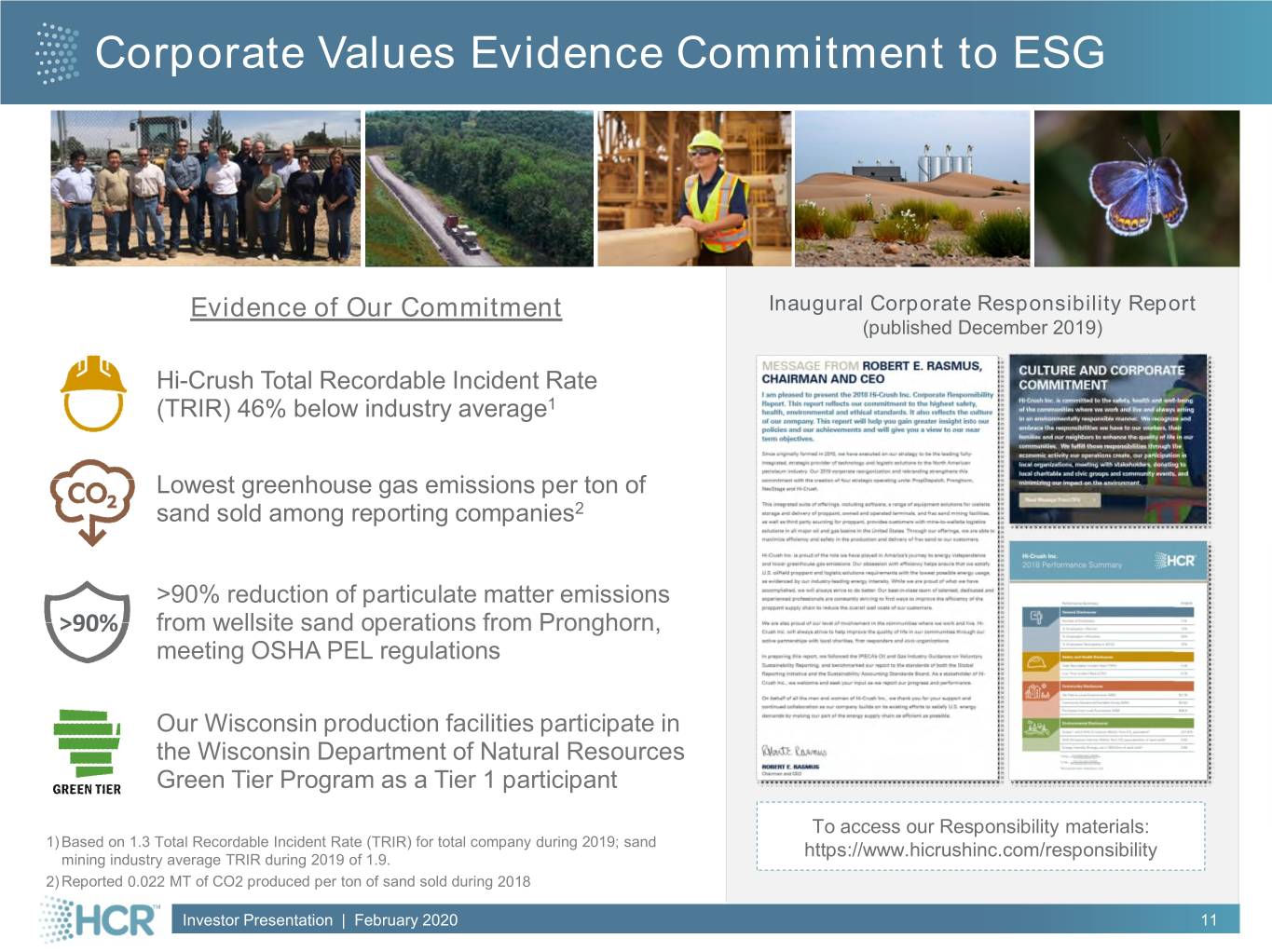

Corporate Values Evidence Commitment to ESG Evidence of Our Commitment Inaugural Corporate Responsibility Report (published December 2019) Hi-Crush Total Recordable Incident Rate (TRIR) 46% below industry average1 Lowest greenhouse gas emissions per ton of sand sold among reporting companies2 >90% reduction of particulate matter emissions >90% from wellsite sand operations from Pronghorn, meeting OSHA PEL regulations Our Wisconsin production facilities participate in the Wisconsin Department of Natural Resources Green Tier Program as a Tier 1 participant To access our Responsibility materials: 1) Based on 1.3 Total Recordable Incident Rate (TRIR) for total company during 2019; sand https://www.hicrushinc.com/responsibility mining industry average TRIR during 2019 of 1.9. 2) Reported 0.022 MT of CO2 produced per ton of sand sold during 2018 Investor Presentation | February 2020 11

Last Mile Innovation

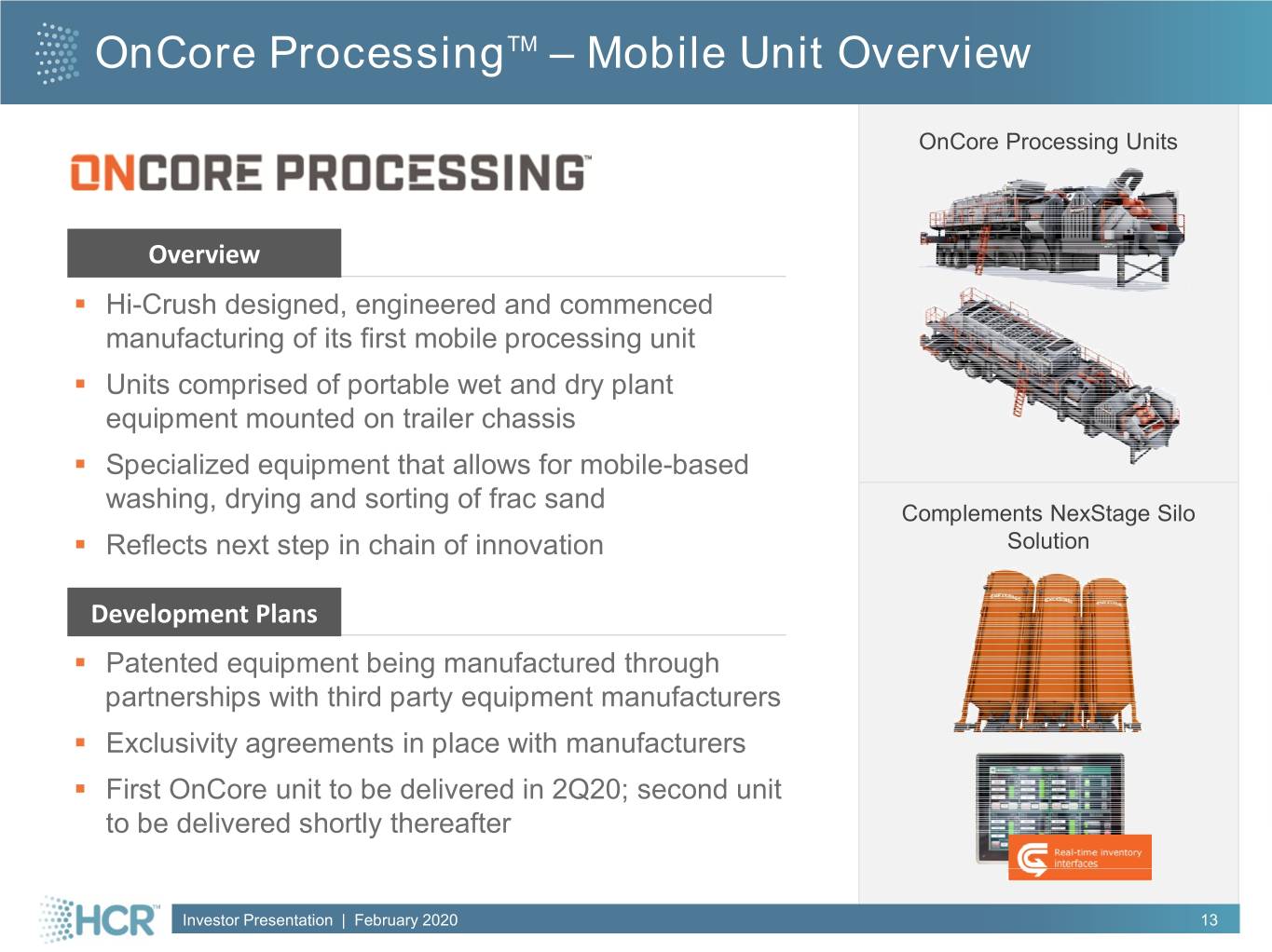

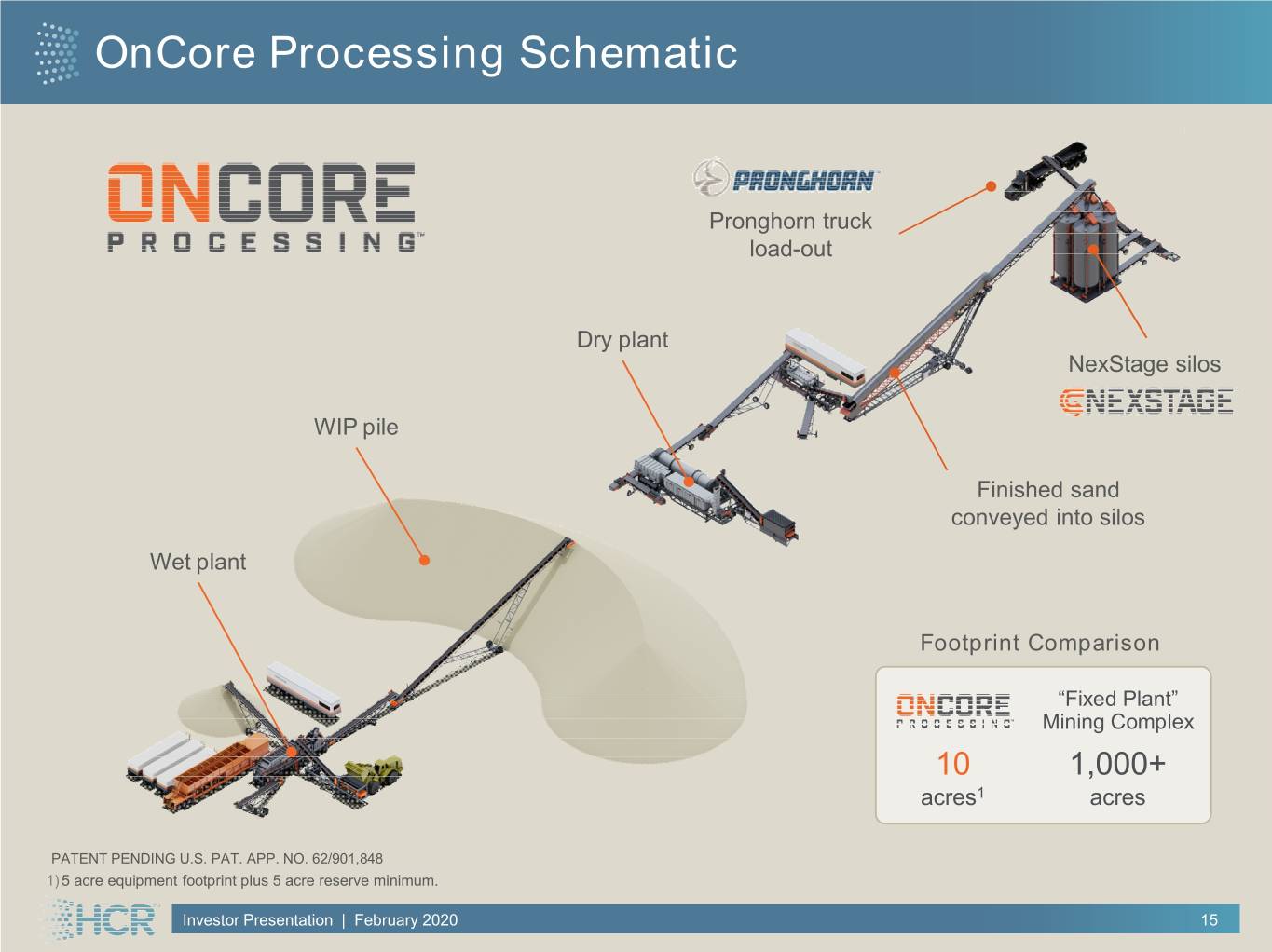

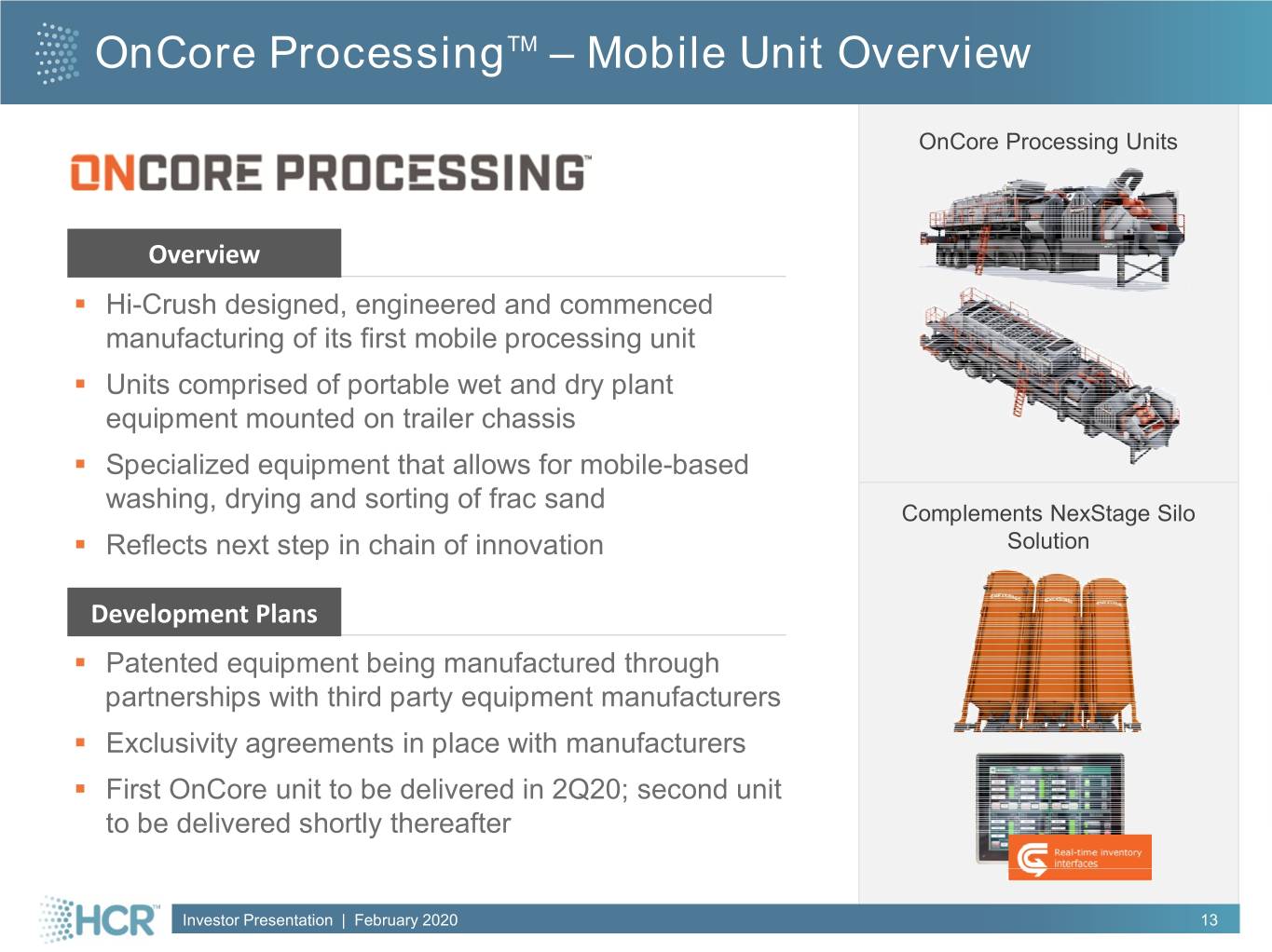

OnCore ProcessingTM – Mobile Unit Overview OnCore Processing Units Overview . Hi-Crush designed, engineered and commenced manufacturing of its first mobile processing unit . Units comprised of portable wet and dry plant equipment mounted on trailer chassis . Specialized equipment that allows for mobile-based washing, drying and sorting of frac sand Complements NexStage Silo . Reflects next step in chain of innovation Solution Development Plans . Patented equipment being manufactured through partnerships with third party equipment manufacturers . Exclusivity agreements in place with manufacturers . First OnCore unit to be delivered in 2Q20; second unit to be delivered shortly thereafter Investor Presentation | February 2020 13

OnCore Processing – Benefits & Impacts Further supports our strategy to provide significant value to customers by lowering costs and simplifying their supply chain Benefits of OnCore Solution ESG Benefits Easy mobilization and onsite setup Closer proximity to wellsite reduces trucking costs Reduction of Smaller footprint than traditional fixed plants Ability to utilize full-range of power sources 1.2 million miles Expandable silo storage capacity in truck miles on 1 Reduced manpower requirements to operate public roads Lower required investment than alternative solutions Reduction of >2,000 metric tons in greenhouse gas emissions1 1) Per OnCore Processing facility, per year Investor Presentation | February 2020 14

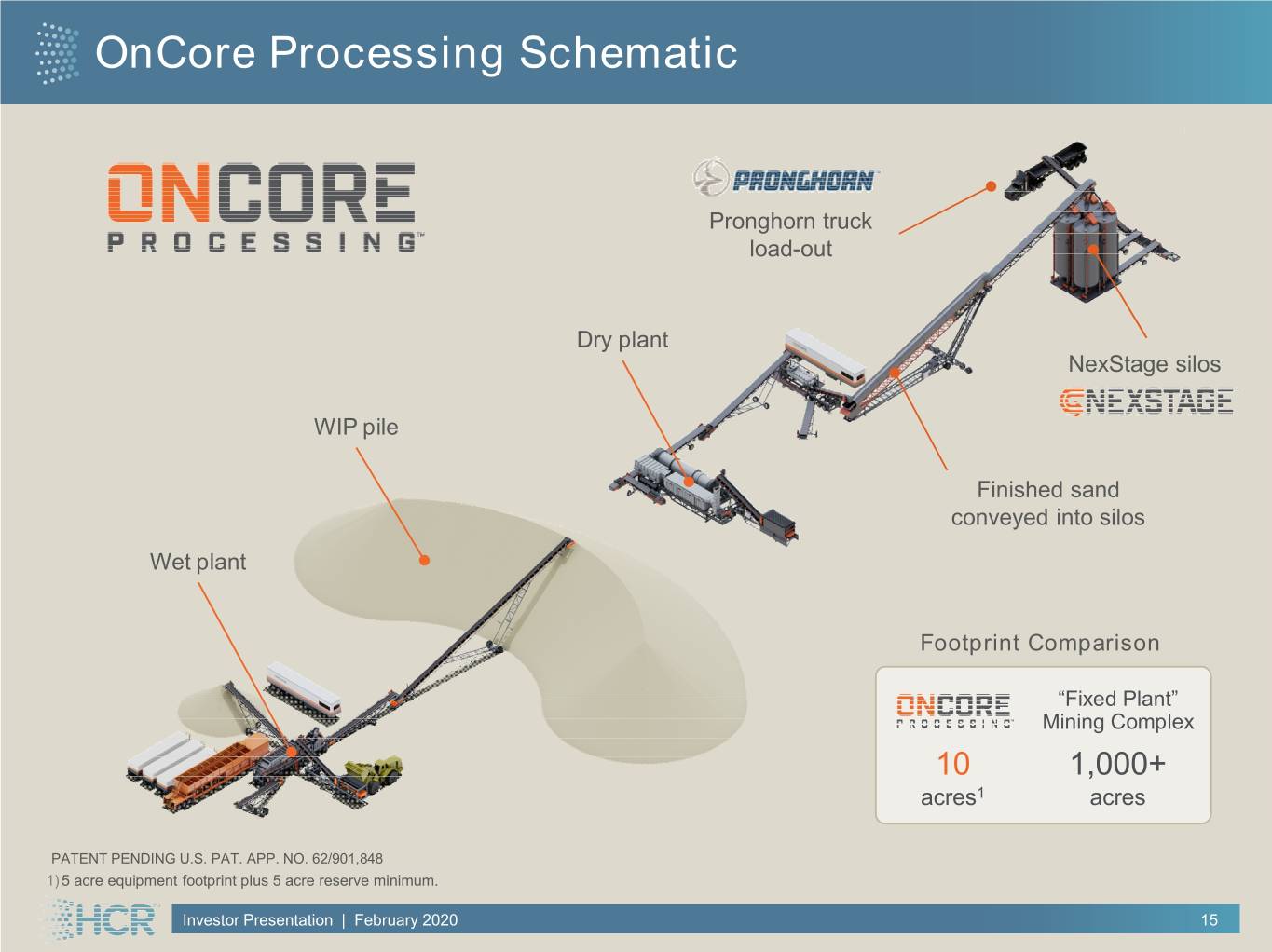

OnCore Processing Schematic Pronghorn truck load-out Dry plant NexStage silos WIP pile Finished sand conveyed into silos Wet plant Footprint Comparison “Fixed Plant” Mining Complex 10 1,000+ acres1 acres PATENT PENDING U.S. PAT. APP. NO. 62/901,848 1) 5 acre equipment footprint plus 5 acre reserve minimum. Investor Presentation | February 2020 15

Financial Update

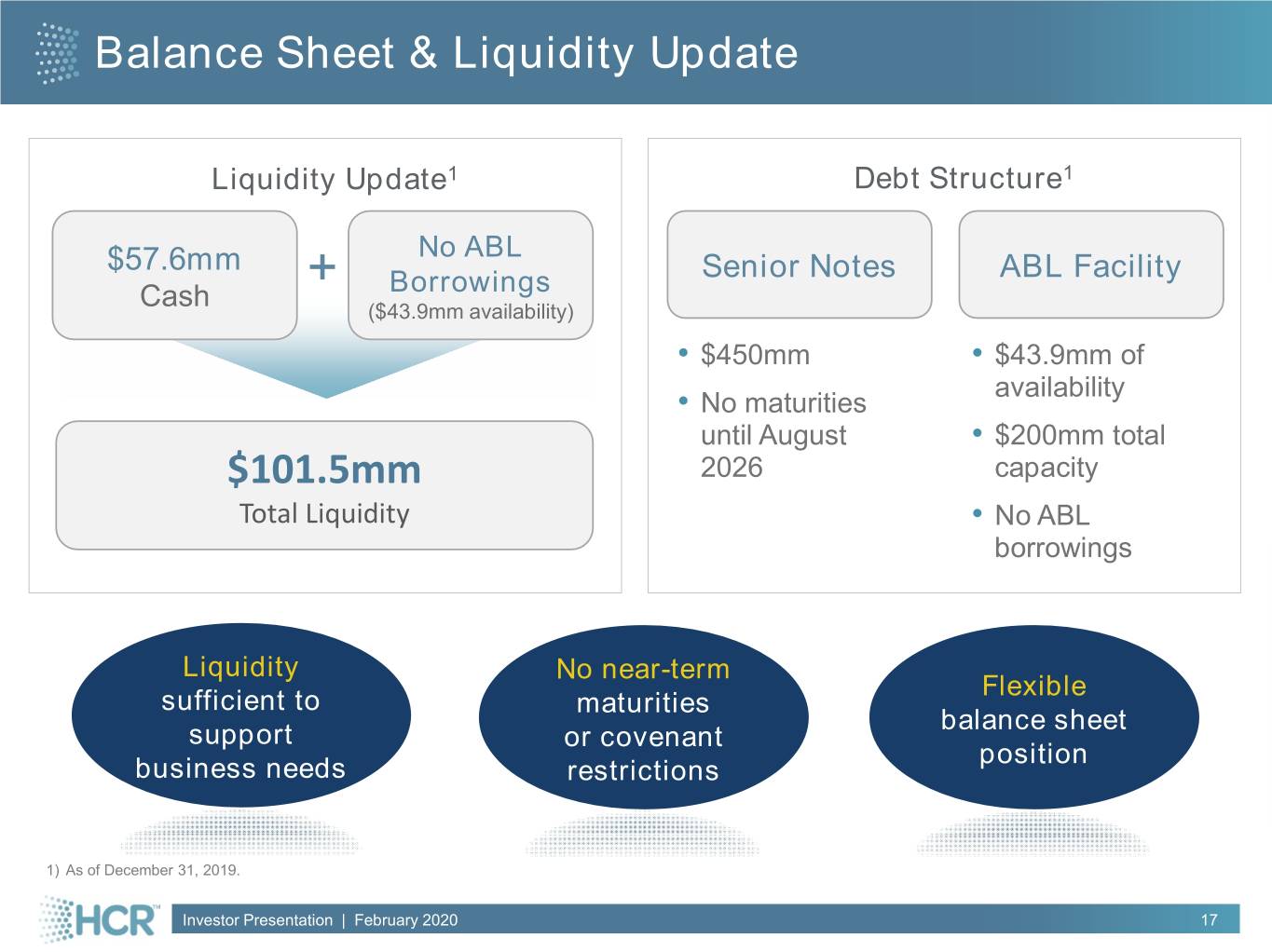

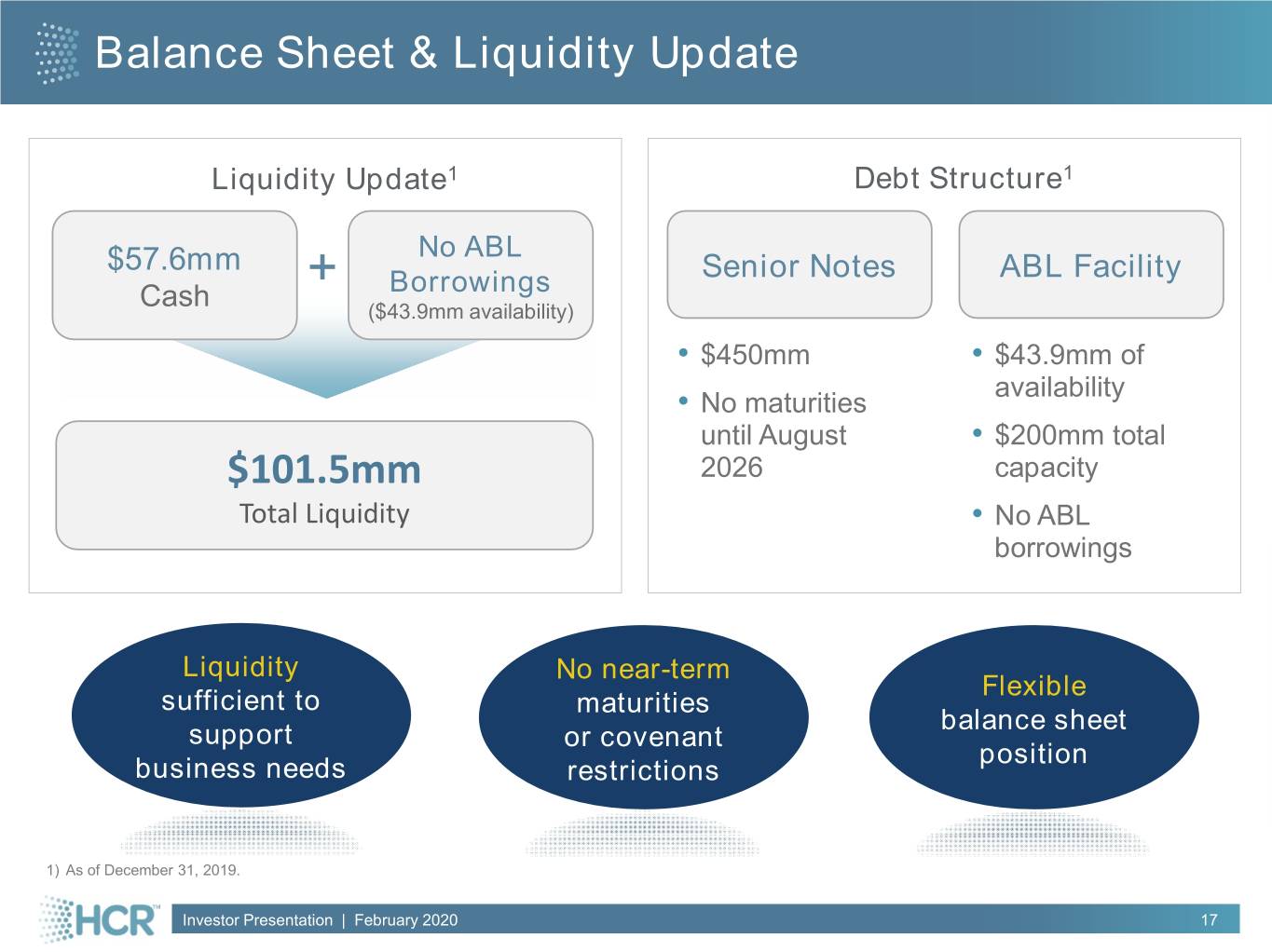

Balance Sheet & Liquidity Update Liquidity Update1 Debt Structure1 No ABL $57.6mm + Senior Notes ABL Facility Cash Borrowings ($43.9mm availability) • $450mm • $43.9mm of availability • No maturities until August • $200mm total $101.5mm 2026 capacity Total Liquidity • No ABL borrowings Liquidity No near-term Flexible sufficient to maturities balance sheet support or covenant position business needs restrictions 1) As of December 31, 2019. Investor Presentation | February 2020 17

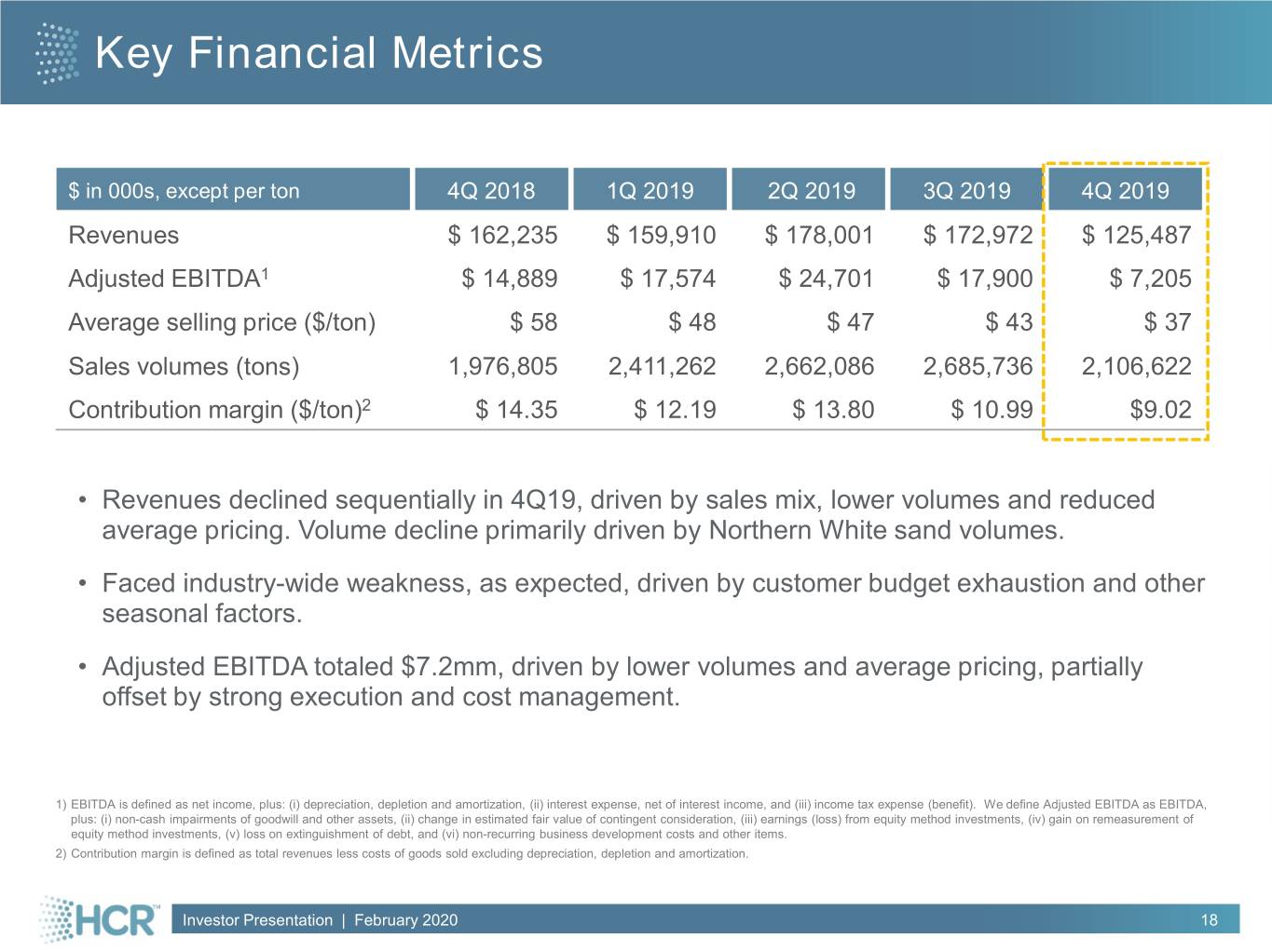

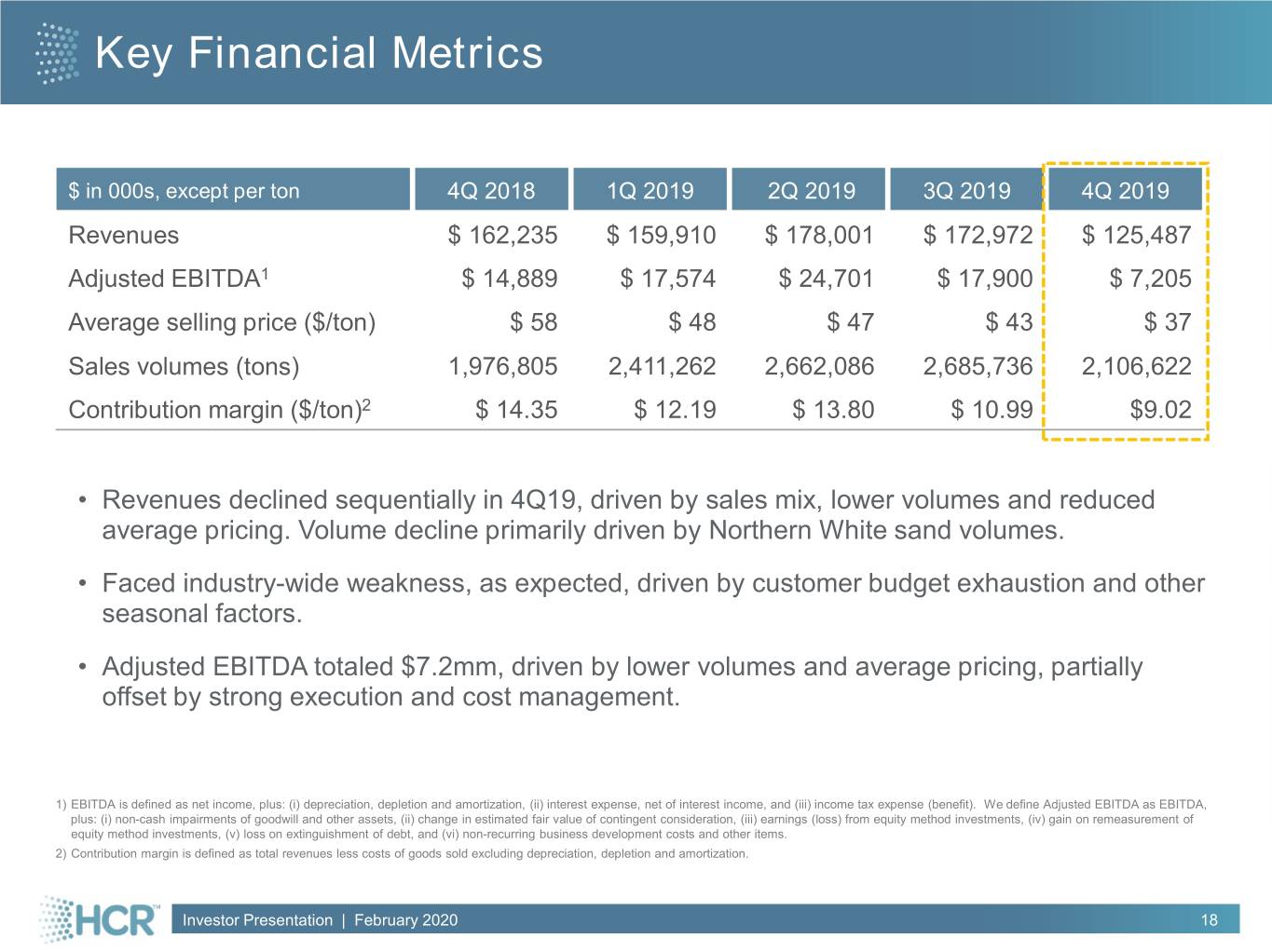

Key Financial Metrics $ in 000s, except per ton 4Q 2018 1Q 2019 2Q 2019 3Q 2019 4Q 2019 Revenues $ 162,235 $ 159,910 $ 178,001 $ 172,972 $ 125,487 Adjusted EBITDA1 $ 14,889 $ 17,574 $ 24,701 $ 17,900 $ 7,205 Average selling price ($/ton) $ 58 $ 48 $ 47 $ 43 $ 37 Sales volumes (tons) 1,976,805 2,411,262 2,662,086 2,685,736 2,106,622 Contribution margin ($/ton)2 $ 14.35 $ 12.19 $ 13.80 $ 10.99 $9.02 • Revenues declined sequentially in 4Q19, driven by sales mix, lower volumes and reduced average pricing. Volume decline primarily driven by Northern White sand volumes. • Faced industry-wide weakness, as expected, driven by customer budget exhaustion and other seasonal factors. • Adjusted EBITDA totaled $7.2mm, driven by lower volumes and average pricing, partially offset by strong execution and cost management. 1) EBITDA is defined as net income, plus: (i) depreciation, depletion and amortization, (ii) interest expense, net of interest income, and (iii) income tax expense (benefit). We define Adjusted EBITDA as EBITDA, plus: (i) non-cash impairments of goodwill and other assets, (ii) change in estimated fair value of contingent consideration, (iii) earnings (loss) from equity method investments, (iv) gain on remeasurement of equity method investments, (v) loss on extinguishment of debt, and (vi) non-recurring business development costs and other items. 2) Contribution margin is defined as total revenues less costs of goods sold excluding depreciation, depletion and amortization. Investor Presentation | February 2020 18

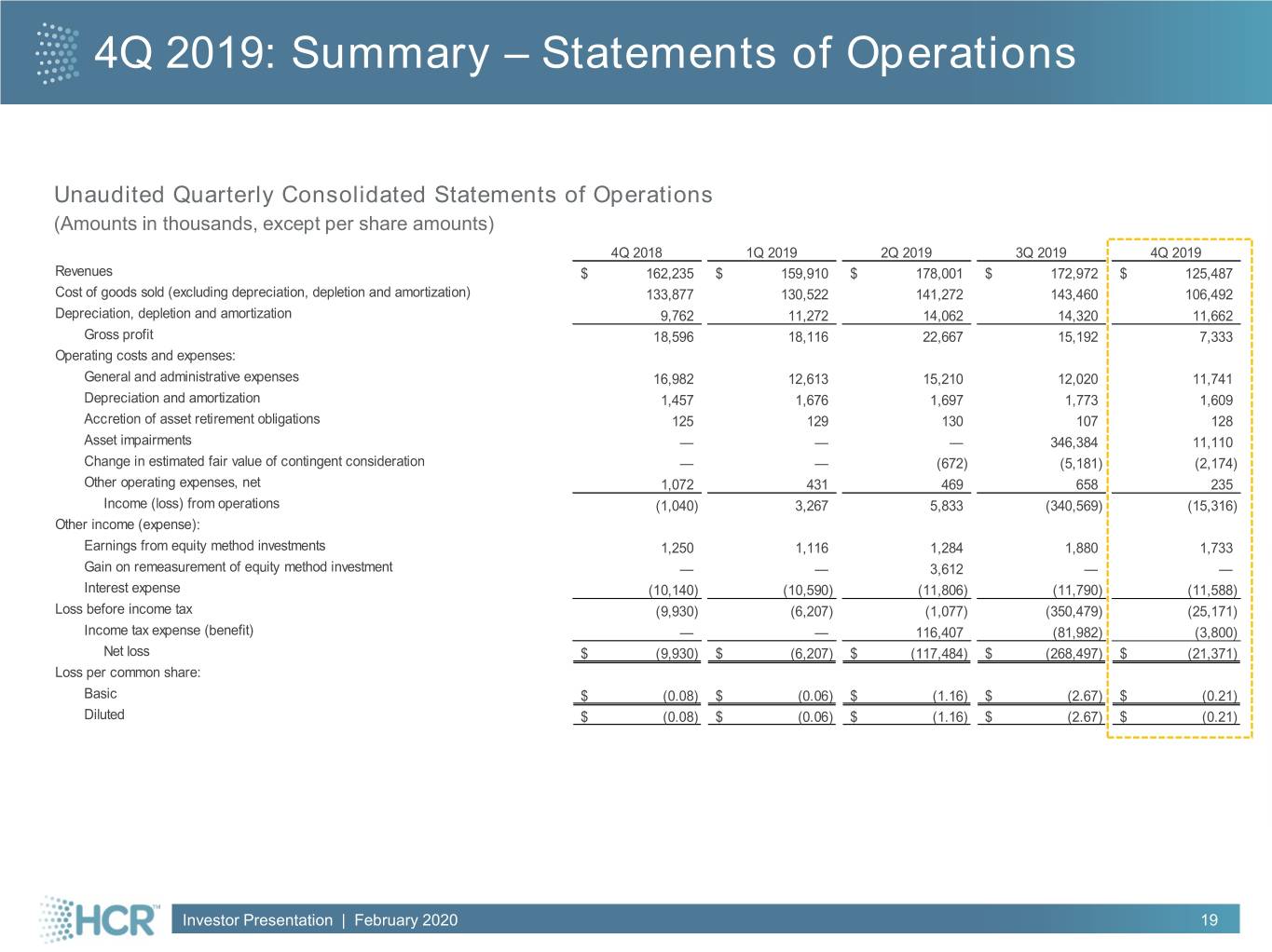

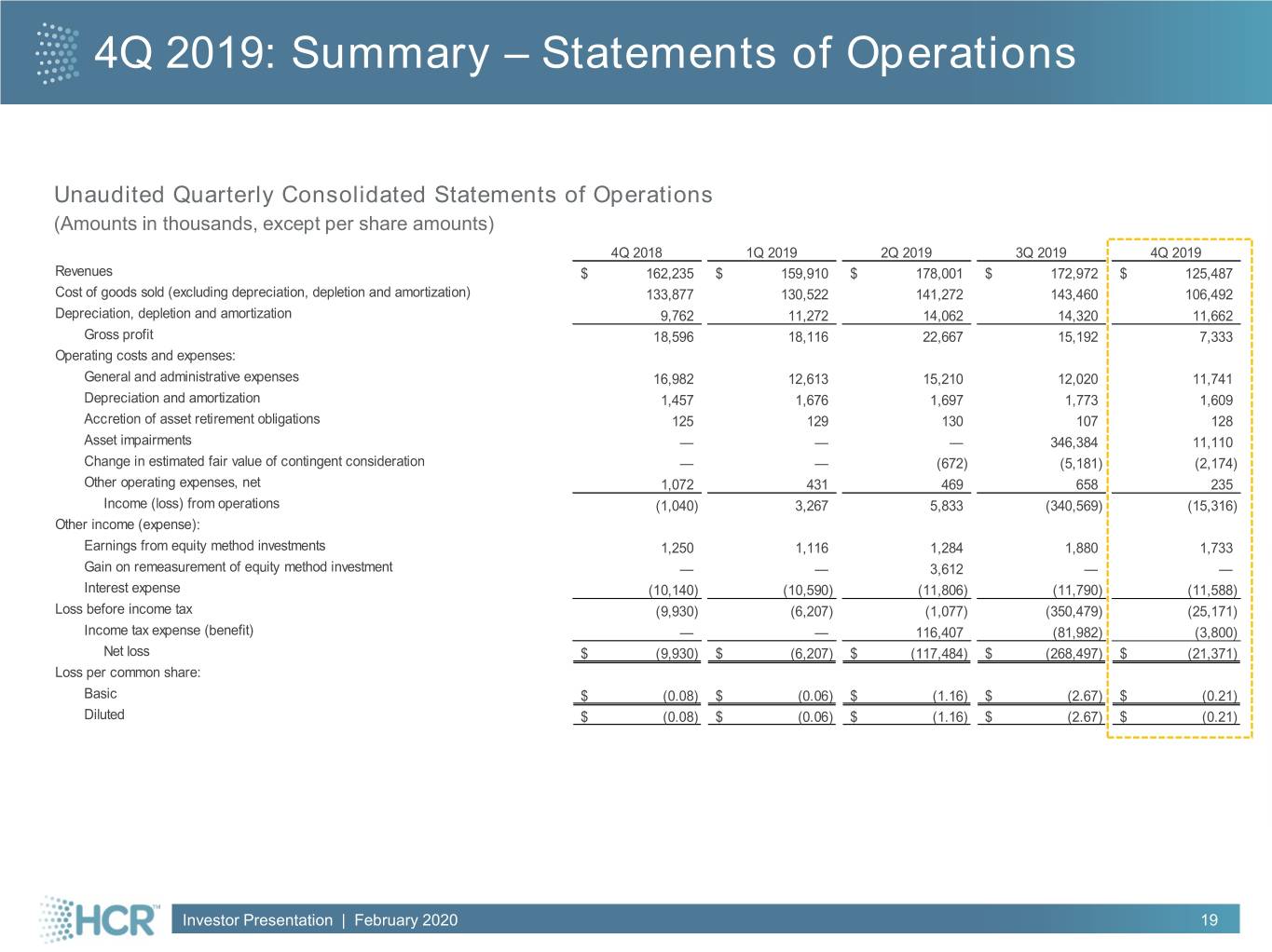

4Q 2019: Summary – Statements of Operations Unaudited Quarterly Consolidated Statements of Operations (Amounts in thousands, except per share amounts) 4Q 2018 1Q 2019 2Q 2019 3Q 2019 4Q 2019 Revenues $ 162,235 $ 159,910 $ 178,001 $ 172,972 $ 125,487 Cost of goods sold (excluding depreciation, depletion and amortization) 133,877 130,522 141,272 143,460 106,492 Depreciation, depletion and amortization 9,762 11,272 14,062 14,320 11,662 Gross profit 18,596 18,116 22,667 15,192 7,333 Operating costs and expenses: General and administrative expenses 16,982 12,613 15,210 12,020 11,741 Depreciation and amortization 1,457 1,676 1,697 1,773 1,609 Accretion of asset retirement obligations 125 129 130 107 128 Asset impairments — — — 346,384 11,110 Change in estimated fair value of contingent consideration — — (672) (5,181) (2,174) Other operating expenses, net 1,072 431 469 658 235 Income (loss) from operations (1,040) 3,267 5,833 (340,569) (15,316) Other income (expense): Earnings from equity method investments 1,250 1,116 1,284 1,880 1,733 Gain on remeasurement of equity method investment — — 3,612 — — Interest expense (10,140) (10,590) (11,806) (11,790) (11,588) Loss before income tax (9,930) (6,207) (1,077) (350,479) (25,171) Income tax expense (benefit) — — 116,407 (81,982) (3,800) Net loss $ (9,930) $ (6,207) $ (117,484) $ (268,497) $ (21,371) Loss per common share: Basic $ (0.08) $ (0.06) $ (1.16) $ (2.67) $ (0.21) Diluted $ (0.08) $ (0.06) $ (1.16) $ (2.67) $ (0.21) Investor Presentation | February 2020 19

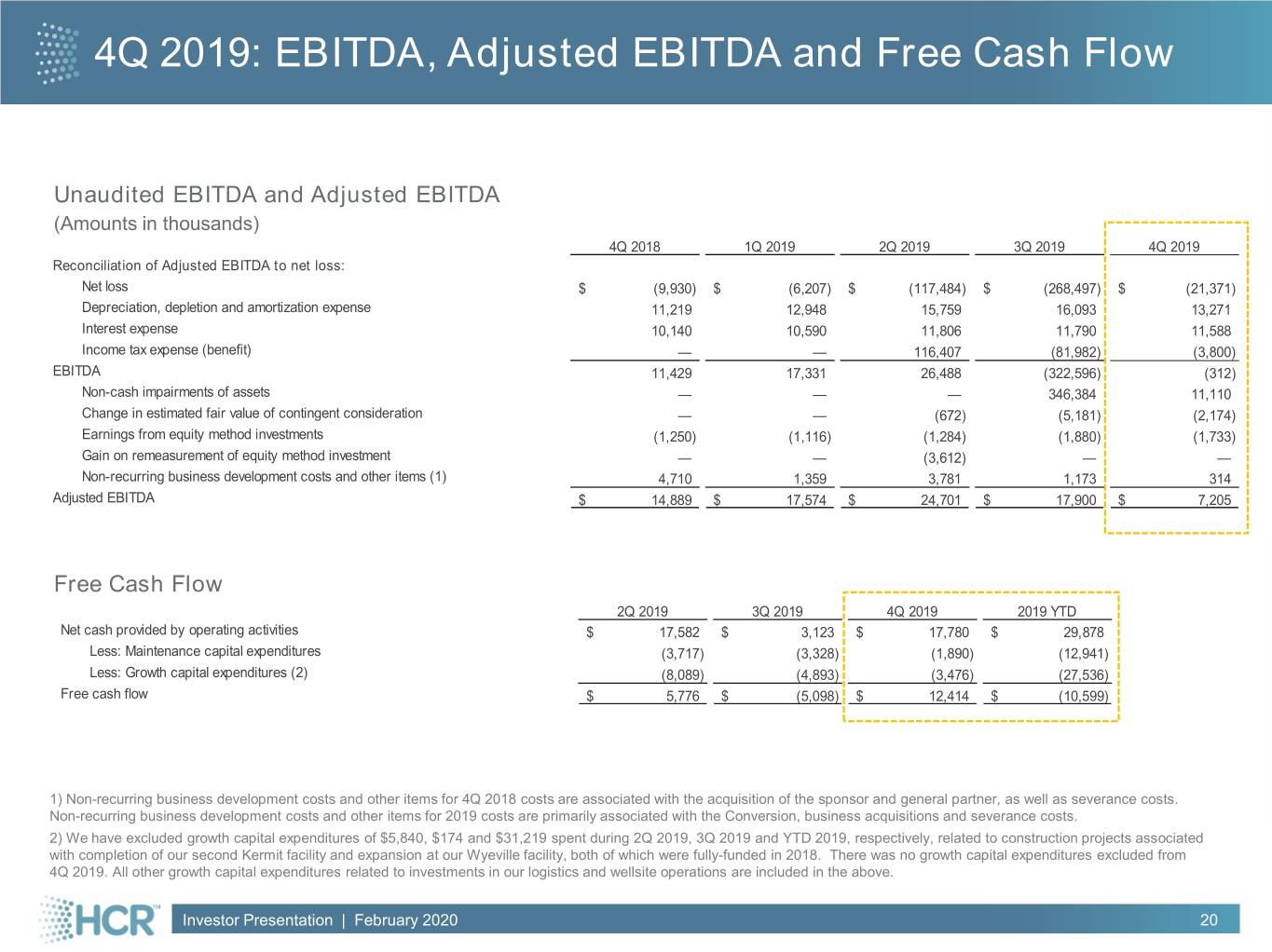

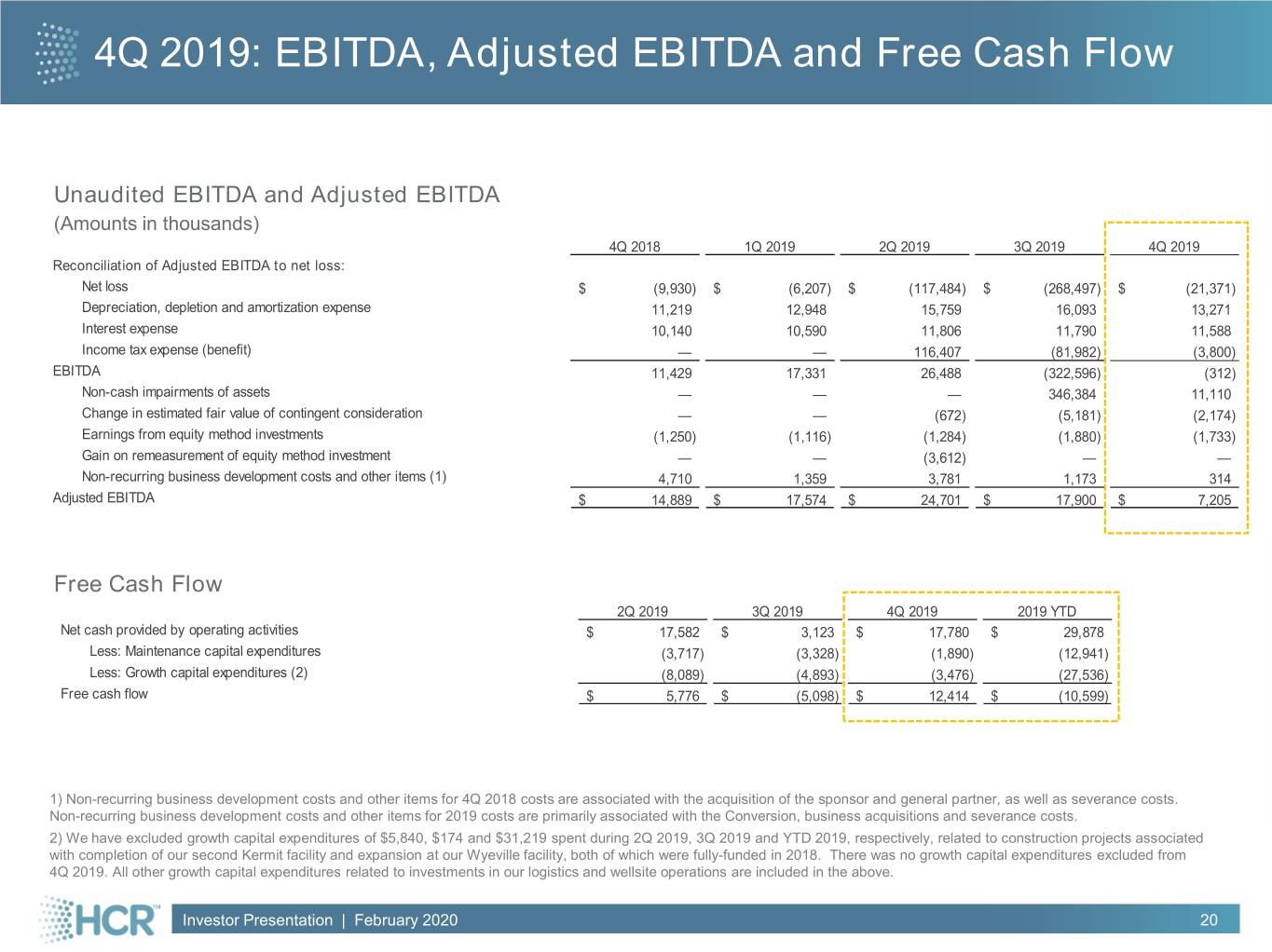

4Q 2019: EBITDA, Adjusted EBITDA and Free Cash Flow Unaudited EBITDA and Adjusted EBITDA (Amounts in thousands) 4Q 2018 1Q 2019 2Q 2019 3Q 2019 4Q 2019 Reconciliation of Adjusted EBITDA to net loss: Net loss $ (9,930) $ (6,207) $ (117,484) $ (268,497) $ (21,371) Depreciation, depletion and amortization expense 11,219 12,948 15,759 16,093 13,271 Interest expense 10,140 10,590 11,806 11,790 11,588 Income tax expense (benefit) — — 116,407 (81,982) (3,800) EBITDA 11,429 17,331 26,488 (322,596) (312) Non-cash impairments of assets — — — 346,384 11,110 Change in estimated fair value of contingent consideration — — (672) (5,181) (2,174) Earnings from equity method investments (1,250) (1,116) (1,284) (1,880) (1,733) Gain on remeasurement of equity method investment — — (3,612) — — Non-recurring business development costs and other items (1) 4,710 1,359 3,781 1,173 314 Adjusted EBITDA $ 14,889 $ 17,574 $ 24,701 $ 17,900 $ 7,205 Free Cash Flow 2Q 2019 3Q 2019 4Q 2019 2019 YTD Net cash provided by operating activities $ 17,582 $ 3,123 $ 17,780 $ 29,878 Less: Maintenance capital expenditures (3,717) (3,328) (1,890) (12,941) Less: Growth capital expenditures (2) (8,089) (4,893) (3,476) (27,536) Free cash flow $ 5,776 $ (5,098) $ 12,414 $ (10,599) 1) Non-recurring business development costs and other items for 4Q 2018 costs are associated with the acquisition of the sponsor and general partner, as well as severance costs. Non-recurring business development costs and other items for 2019 costs are primarily associated with the Conversion, business acquisitions and severance costs. 2) We have excluded growth capital expenditures of $5,840, $174 and $31,219 spent during 2Q 2019, 3Q 2019 and YTD 2019, respectively, related to construction projects associated with completion of our second Kermit facility and expansion at our Wyeville facility, both of which were fully-funded in 2018. There was no growth capital expenditures excluded from 4Q 2019. All other growth capital expenditures related to investments in our logistics and wellsite operations are included in the above. Investor Presentation | February 2020 20

Investor Contacts Caldwell Bailey Manager, Investor Relations Marc Silverberg Managing Director (ICR, Inc.) Phone: (713) 980-6270 E-mail: ir@hicrushinc.com Investor Presentation | February 2020 21