| | |

| | Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration File No.: 333-177891-01 Date May 25, 2012 |

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,103,937,066

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

$864,905,000

(Approximate Aggregate Principal Balance of Offered Certificates)

WFRBS Commercial Mortgage Trust 2012-C7

as Issuing Entity

RBS Commercial Funding Inc.

as Depositor

The Royal Bank of Scotland

Wells Fargo Bank, National Association

Basis Real Estate Capital II, LLC

Liberty Island Group I LLC

C-III Commercial Mortgage LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2012-C7

May 25, 2012

| | | | | | |

| RBS | | | | WELLS FARGO SECURITIES |

| | |

| Co-Lead Manager and | | | | Co-Lead Manager and |

| | |

| Co-Bookrunner | | | | Co-Bookrunner |

Deutsche Bank Securities

Co-Manager

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-177891) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-866-884-2071 (8 a.m. – 5 p.m. EST) or by emailing rbscmbs@rbs.com.

Nothing in this document constitutes an offer of securities for sale in any other jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of RBS Securities Inc. (“RBSSI”), Wells Fargo Securities, LLC (“WFS”), Deutsche Bank Securities Inc. or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

RBS is a trade name for the investment banking business of RBSSI. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by RBSSI and their securities affiliates. Lending, derivatives and other commercial banking activities are performed by The Royal Bank of Scotland plc and their banking affiliates. RBSSI is a member of SIPC, FINRA and the NYSE.

Wells Fargo Securities is the trade name for certain capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, member FINRA and SIPC, and Wells Fargo Bank, National Association.

IRS CIRCULAR 230 NOTICE

THIS TERM SHEET IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. THIS TERM SHEET IS WRITTEN AND PROVIDED BY THE DEPOSITOR IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEPOSITOR AND THE CO-LEAD BOOKRUNNING MANAGERS OF THE TRANSACTION OR MATTERS ADDRESSED HEREIN. INVESTORS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the Offered Certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the Offered Certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Certificate Structure |

| | | | | | | | | | | | | | | | | | | | |

| Class | | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | | Approximate

Initial Certificate

Balance or

Notional

Amount(2) | | Approx.

Initial

Credit

Support(3) | | Pass-

Through

Rate

Description | | Weighted

Average Life

(Years)(4) | | Expected Principal

Window(4) | | Certificate

Principal to

Value Ratio(5) | | | Certificate

Principal U/W NOI Debt

Yield(6) | |

| | | Offered Certificates | | | | | | | | | | | | | | | | | | |

A-1 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $189,518,000 | | 30.000% | | (7) | | 5.39 | | 7/2012 – 12/2021 | | | 42.6 | % | | | 17.1 | % |

A-2 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $493,237,000 | | 30.000% | | (7) | | 9.84 | | 12/2021 – 6/2022 | | | 42.6 | % | | | 17.1 | % |

A-S | | AAA(sf)/AAA(sf)/Aaa(sf) | | $82,796,000 | | 22.500% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 47.1 | % | | | 15.4 | % |

B | | AA(sf)/AA(sf)/Aa2(sf) | | $57,956,000 | | 17.250% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 50.3 | % | | | 14.4 | % |

C | | A(sf)/A(sf)/A2(sf) | | $41,398,000 | | 13.500% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 52.6 | % | | | 13.8 | % |

| | | | | | | | |

| | | Non-Offered Certificates | | | | | | | | | | | | | | | | | | |

X-A | | AAA(sf)/AAA(sf)/Aaa(sf) | | $855,551,000(8) | | N/A | | Variable(9) | | N/A | | N/A | | | N/A | | | | N/A | |

X-B | | NR/NR/Ba3(sf) | | $248,386,065(10) | | N/A | | Variable(11) | | N/A | | N/A | | | N/A | | | | N/A | |

A-FL | | AAA(sf)/AAA(sf)/Aaa(sf)(12) | | $90,000,000(13) | | 30.000% | | LIBOR plus(14) | | 9.46 | | 12/2021 – 12/2021 | | | 42.6 | % | | | 17.1 | % |

D | | BBB+(sf)/BBB+(sf)/Baa1(sf) | | $27,598,000 | | 11.000% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 54.1 | % | | | 13.4 | % |

E | | BBB-(sf)/BBB-(sf)/Baa3(sf) | | $48,298,000 | | 6.625% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 56.8 | % | | | 12.8 | % |

F | | BB(sf)/BB(sf)/Ba2(sf) | | $19,319,000 | | 4.875% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 57.8 | % | | | 12.6 | % |

G | | B(sf)/B(sf)/B2(sf) | | $19,319,000 | | 3.125% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 58.9 | % | | | 12.3 | % |

H | | NR/NR/NR | | $34,498,065 | | 0.000% | | (7) | | 9.96 | | 6/2022 – 6/2022 | | | 60.8 | % | | | 11.9 | % |

Notes:

| (1) | The expected ratings presented are those of Fitch, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”) which the depositor hired to rate the rated offered certificates. One or more other nationally recognized statistical ratings organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical ratings organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. See “Risk Factors—Risks Related to the Offered Certificates—Other Rating Agencies May Have Assigned Different Ratings to the Certificates and Ratings of the Certificates Reflect only the views of the Applicable Rating Agencies as of the Date of such Ratings were Issued; Ratings May Affect ERISA Eligibility; Ratings May be Downgraded” in the free writing prospectus, dated May 29, 2012 (the “Free Writing Prospectus”). |

| (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2 and A-FL Certificates represents the approximate credit enhancement for the Class A-1, A-2 and A-FL Certificates in the aggregate. No class of certificates will provide any credit support to the Class A-FL certificates in respect of any default or termination under the related interest rate swap contract. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described on Annex D to the Free Writing Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2 and A-FL Certificates) is calculated by dividing the aggregate principal balance of such class of certificates and all classes of certificates senior to such class by the aggregate appraised value of $1,815,800,124 (calculated as described in the Free Writing Prospectus) of the mortgaged properties securing the mortgage loans. The Certificate Principal to Value Ratios for each of the Class A-1, A-2 and A-FL Certificates are calculated by dividing the aggregate principal balance of the Class A-1, A-2 and A-FL Certificates by such aggregate appraised value. However, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2 and A-FL Certificates) is calculated by dividing the underwritten net operating income for the mortgage pool of $131,911,805 (calculated as described in the Free Writing Prospectus) by the aggregate certificate balance of such class of certificates and all classes of certificates senior to such class of certificates. The Underwritten NOI Debt Yield for each of the Class A-1, A-2 and A-FL Certificates is calculated by dividing such mortgage pool underwritten net operating income by the aggregate principal balance of the Class A-1, A-2 and A-FL Certificates. However, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| (7) | The pass-through rates for the Class A-1, A-2, A-S, B, C, D, E, F, G and H Certificates and the Class A-FX Regular Interest in each case will be one of the following: (i) a fixed rateper annum, (ii) the WAC Rate (as defined in the Free Writing Prospectus) for the related distribution date, (iii) a variable rateper annumequal to the lesser of (a) a fixed rate and (b) the WAC Rate for the related distribution date or (iv) a variable rateper annumequal to the WAC Rate for the related distribution date minus a specified percentage. |

| (8) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2 and A-S Certificates and the Class A-FX Regular Interest outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (9) | The pass-through rate for the Class X-A Certificates for any distribution date will equal the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2 and A-S Certificates and the Class A-FX Regular Interest for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

| (10) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate principal balance of the Class B, C, D, E, F, G and H Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-B Certificates for any distribution date will equal the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class B, C, D, E, F, G and H Certificates for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

| (12) | The ratings assigned to the Class A-FL Certificates reflect only the receipt of up to the fixed rate of interest at a rate equal to the applicable pass-through rate for the Class A-FX Regular Interest. The ratings of Fitch, KBRA and Moody’s do not address any shortfalls or delays in payment that investors in the Class A-FL Certificates may experience as a result of the conversion of the pass-through rate on Class A-FL Certificates from a floating interest rate to a fixed rate. See “Ratings” in the Private Placement Memorandum. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Certificate Structure |

| (13) | The Class A-FL Certificates will evidence an indirect interest in a grantor trust that includes the Class A-FX Regular Interest and an interest rate swap contract. Under some circumstances, holders of the Class A-FL Certificates may exchange all or a portion of their certificates for a like principal amount of “Class A-FX” Certificates having the same pass-through rate as the Class A-FX Regular Interest. The aggregate principal balance of the Class A-FL Certificates may be adjusted from time to time as a result of such an exchange. The aggregate principal balance of the Class A-FX Certificates and Class A-FL Certificates will at all times equal the aggregate principal balance of the Class A-FX Regular Interest. |

| (14) | The pass-through rate applicable to the Class A-FL Certificates on each distribution date will be aper annum rate equal to LIBOR plus a specified percentage; provided, however, that under certain circumstances (generally involving a default or termination under the related interest rate swap contract), the pass-through rate applicable to the Class A-FL Certificates may convert to a fixed rate equal to the applicable pass-through rates on the Class A-FX Regular Interest. The initial LIBOR rate will be determined two LIBOR business days prior to the Closing Date, and subsequent LIBOR rates for the Class A-FL Certificates will be determined two LIBOR business days before the start of the related interest accrual period. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

| | | | | | | | | | |

Mortgage Loan Seller | | Number of

Mortgage

Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance | | | % of Cut-off

Date Pool

Balance |

The Royal Bank of Scotland(1) | | 16 | | 21 | | | $493,284,870 | | | 44.7% |

Wells Fargo Bank, National Association | | 19 | | 20 | | | 393,417,731 | | | 35.6% |

Basis Real Estate Capital II, LLC | | 6 | | 15 | | | 91,000,000 | | | 8.2% |

Liberty Island Group I LLC | | 5 | | 5 | | | 65,300,417 | | | 5.9% |

C-III Commercial Mortgage LLC | | 15 | | 19 | | | 60,934,048 | | | 5.5% |

| | | | | | | | | | |

Total | | 61 | | 80 | | | $1,103,937,066 | | | 100.0% |

| | | | | | | | | | |

| (1) | The mortgage loan seller referred to herein as The Royal Bank of Scotland is comprised of two affiliated companies: The Royal Bank of Scotland plc and RBS Financial Products Inc. With respect to the mortgage loans being sold for the deposit into the trust by The Royal Bank of Scotland: (a) eleven (11) mortgage loans, having an aggregate cut-off date principal balance of $367,093,394 and representing 33.3% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, are being sold for deposit into the trust only by The Royal Bank of Scotland plc and (b) five (5) mortgage loans, having an aggregate cut-off date principal balance of $126,191,476 and representing 11.4% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date are being sold for the deposit into the trust only by RBS Financial Products Inc. |

Loan Pool:

| | | | | | |

Cut-off Date Balance: | | | | | $1,103,937,066 | |

Number of Mortgage Loans: | | | | | 61 | |

Average Cut-off Date Balance per Mortgage Loan: | | | | | $18,097,329 | |

Number of Mortgaged Properties: | | | | | 80 | |

Average Cut-off Date Balance per Mortgaged Property(1): | | | | | $13,799,213 | |

Weighted Average Mortgage Interest Rate: | | | | | 4.957% | |

Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | | | | | 62.6% | |

Weighted Average Original Term to Maturity (months): | | | | | 120 | |

Weighted Average Remaining Term to Maturity (months): | | | | | 118 | |

Weighted Average Original Amortization Term (months)(2): | | | | | 344 | |

Weighted Average Remaining Amortization Term (months)(2): | | | | | 341 | |

Weighted Average Seasoning (months): | | | | | 3 | |

(1) Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in related loan documents. With respect to Northridge Fashion Center and Town Center at Cobb, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan unless otherwise stated. (2) Excludes any mortgage loan that does not amortize. | | | | | | |

Credit Statistics:

| | | | | | |

Weighted Average U/W Net Cash Flow DSCR(1): | | | | | 1.82x | |

Weighted Average U/W Net Operating Income Debt Yield Ratio(1): | | | | | 12.0% | |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | | | | | 62.5% | |

Weighted Average Balloon Loan-to-Value Ratio(1): | | | | | 52.1% | |

% of Mortgage Loans with Additional Subordinate Debt: | | | | | 0.0% | |

% of Mortgage Loans with Single Tenants(2): | | | | | 4.7% | |

(1) With respect to Northridge Fashion Center and Town Center at Cobb, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan unless otherwise stated. (2) Excludes mortgage loans that are secured by multiple single-tenant properties. | | | | | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Transaction Highlights |

Loan Structural Features:

Amortization:Based on the Cut-off Date Balance, 88.6% of the mortgage pool (59 mortgage loans) has scheduled amortization, as follows:

67.7% (54 mortgage loans) requires amortization during the entire loan term

20.9% (5 mortgage loans) provides for an interest-only period followed by an amortization period

Interest-Only: Based on the Cut-off Date Balance, 11.4% of the mortgage pool (2 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for the two mortgage loans is 49.0% and 3.67x, respectively.

Hard Lockboxes: Based on the Cut-off Date Balance, 65.3% of the mortgage pool (25 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| | | | |

Real Estate Taxes: | | 80.0% of the pool | | |

Insurance Premiums: | | 42.1% of the pool | |

Capital Replacements: | | 80.0% of the pool | |

TI/LC: | | 67.6% of the pool* | |

* The percentage of Cut-off Date Balance for loans with TI/LC reserves is based on the aggregate principal balance allocable to office, retail and industrial properties. | |

Call Protection/Defeasance: Based on the Cut-off Date Balance, the mortgage pool has the following call protection and defeasance features:

94.4% of the mortgage pool (57 mortgage loans) features a lockout period, then defeasance only until an open period

5.6% of the mortgage pool (4 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period

Please refer to Annex A to the Free Writing Prospectus for further description of individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Issue Characteristics |

| III. | Issue Characteristics |

| | |

| Securities Offered: | | $864,905,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of five classes (Classes A-1, A-2, A-S, B and C), which are offered pursuant to a registration statement filed with the SEC. |

| |

| Mortgage Loan Sellers: | | The Royal Bank of Scotland (“RBS”); Wells Fargo Bank, National Association (“WFB”); Basis Real Estate Capital II, LLC (“Basis”); Liberty Island Group I LLC (“LIG I”) and C-III Commercial Mortgage LLC (“CIIICM”). |

| |

| Co-lead Bookrunning Managers: | | RBS Securities Inc. and Wells Fargo Securities, LLC |

| |

| Co-Manager: | | Deutsche Bank Securities Inc. |

| |

| Rating Agencies: | | Fitch, Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. |

| |

| Master Servicer: | | Wells Fargo Bank, National Association |

| |

| Special Servicer: | | Torchlight Loan Services, LLC |

| |

| Certificate Administrator: | | Wells Fargo Bank, National Association |

| |

| Trustee: | | Deutsche Bank Trust Company Americas |

| |

| Trust Advisor: | | TriMont Real Estate Advisors, Inc. |

| |

| Cut-off Date: | | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in June 2012 (or, in the case of any mortgage loan that has its first due date in July 2012, the date that would have been its due date in June 2012 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| |

| Expected Closing Date: | | On or about June 28, 2012. |

| |

| Determination Dates: | | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in July 2012. |

| |

| Distribution Dates: | | The fourth business day following the Determination Date in each month, commencing in July 2012. |

| |

| Rated Final Distribution Date: | | The Distribution Date in June 2045. |

| |

| Interest Accrual Period: | | With respect to any Distribution Date, the calendar month preceding the month in which such Distribution Date occurs. |

| |

| Day Count: | | The Offered Certificates will accrue interest on a 30/360 basis. |

| |

| Minimum Denominations: | | $25,000 for each Class of Offered Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| |

| Clean-up Call: | | 1% |

| |

| Delivery: | | DTC, Euroclear and Clearstream Banking |

| |

| ERISA/SMMEA Status: | | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| |

| Risk Factors: | | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

| |

| Bond Analytics Information: | | The Certificate Administrator will generally be required to make distribution date settlements, CREFC reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg L.P., Trepp LLC, Intex Solutions, Inc., Markit Group Limited and BlackRock Financial Management Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| | |

| WFRBS Commercial Mortgage Trust 2012-C7 | | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Mortgage

Loan Seller | | Mortgage Loan Name | | City | | State | | Number of

Mortgage Loans /

Mortgaged

Properties | | Mortgage Loan

Cut-off Date

Balance ($) | | | % of Cut-off

Date Balance

(%) | | | Property

Type | | Number of

SF, Rooms

or Units | | | Cut-off Date

Balance Per

SF, Room or

Unit ($) | | Cut-off Date

LTV

Ratio

(%) | | | Balloon

LTV Ratio

(%) | | | U/W NCF

DSCR (x) | | | U/W NOI

Debt Yield

(%) | |

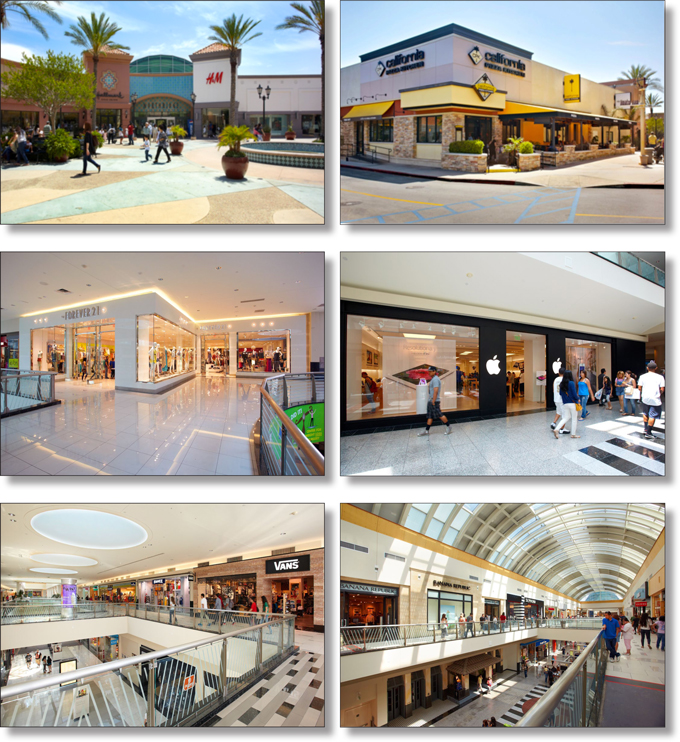

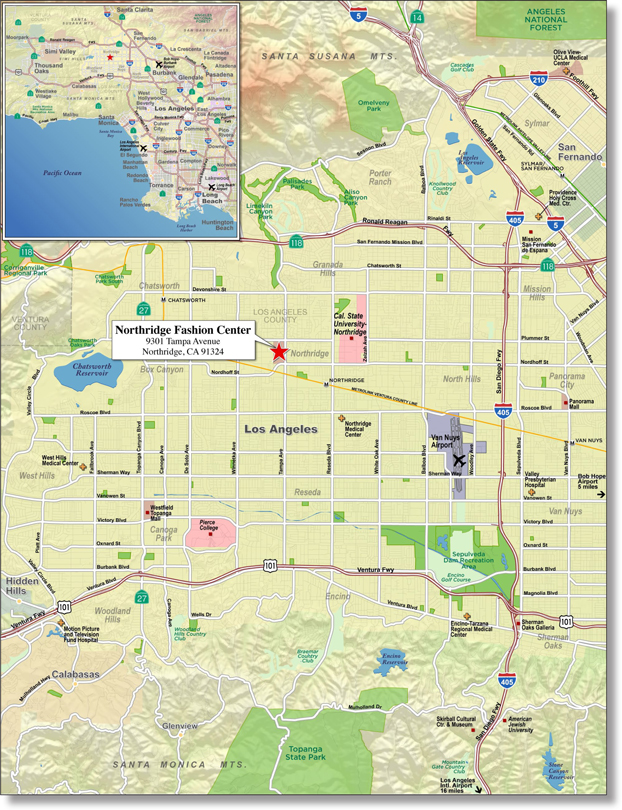

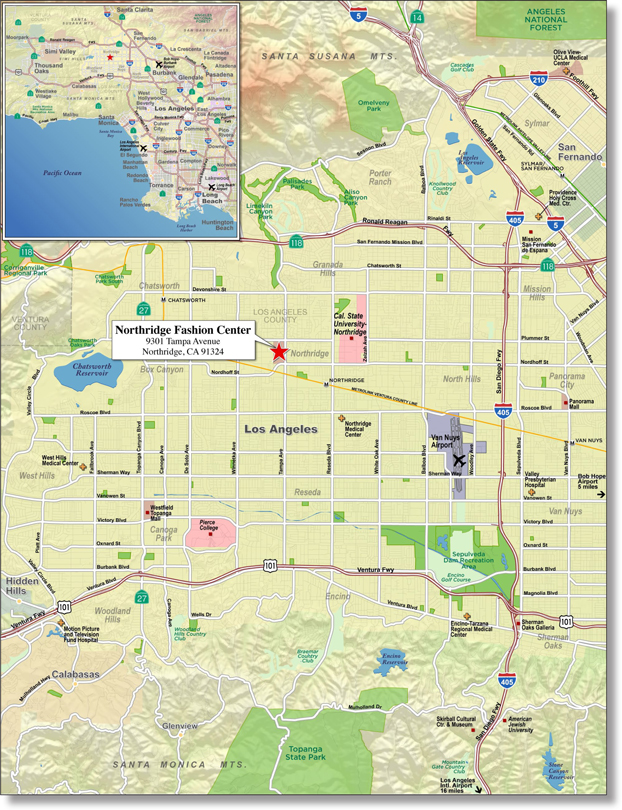

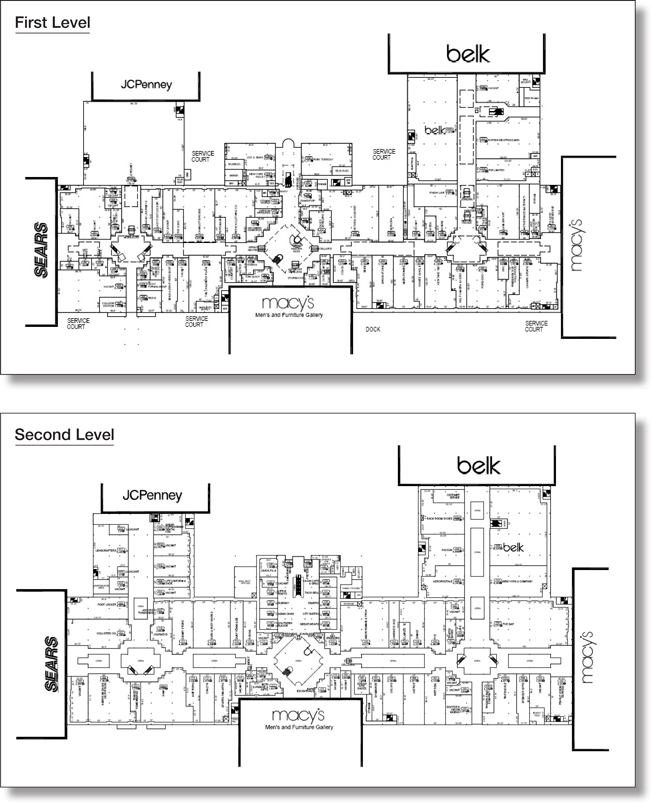

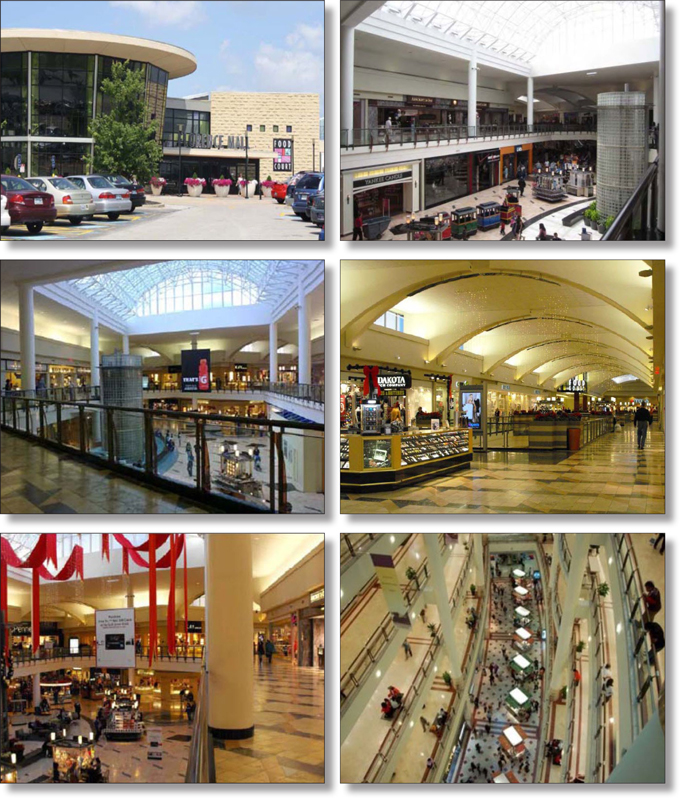

WFB | | Northridge Fashion Center | | Northridge | | CA | | 1 / 1 | | | $157,444,111 | | | | 14.3 | % | | Retail | | | 643,564 | | | $384 | | | 66.9 | % | | | 55.1 | % | | | 1.40 | x | | | 9.7 | % |

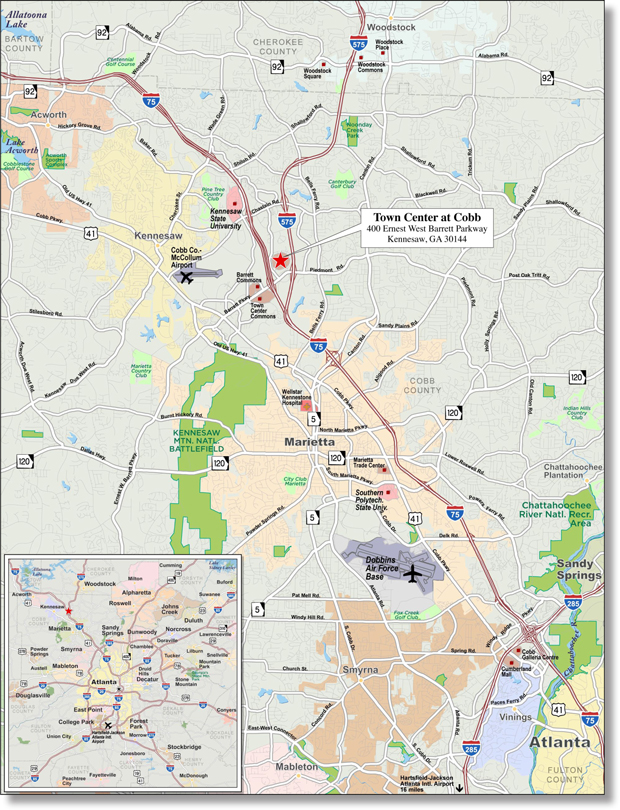

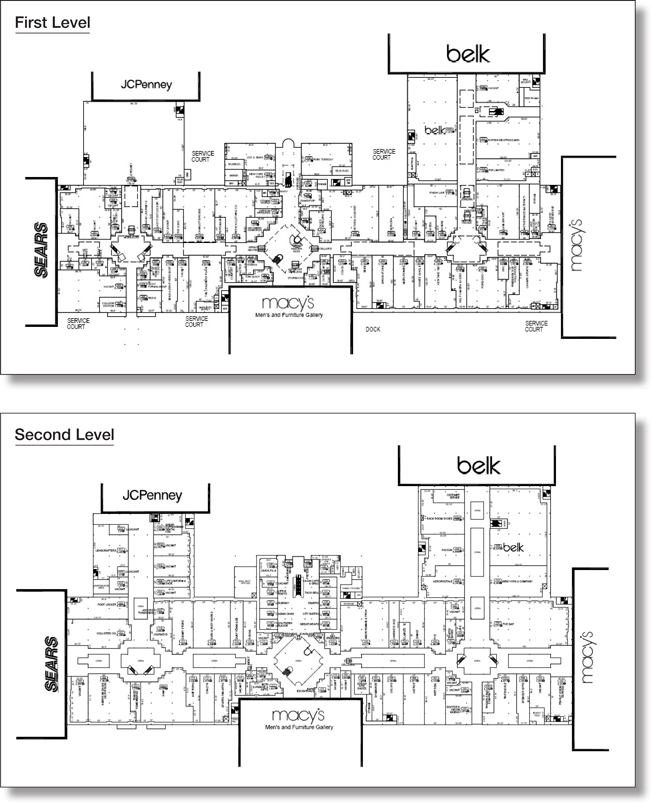

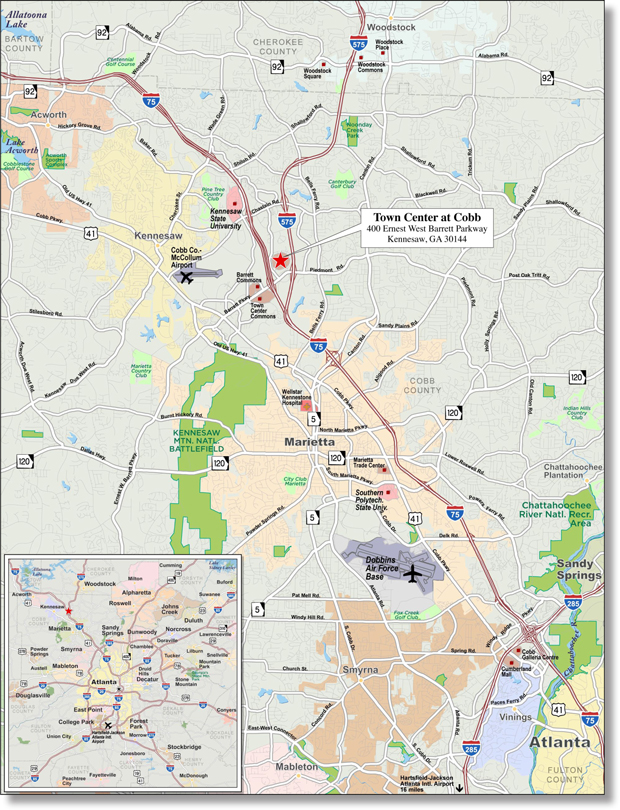

RBS | | Town Center at Cobb | | Kennesaw | | GA | | 1 / 1 | | | 130,000,000 | | | | 11.8 | | | Retail | | | 559,940 | | | 357 | | | 62.1 | | | | 53.4 | | | | 1.54 | | | | 10.0 | |

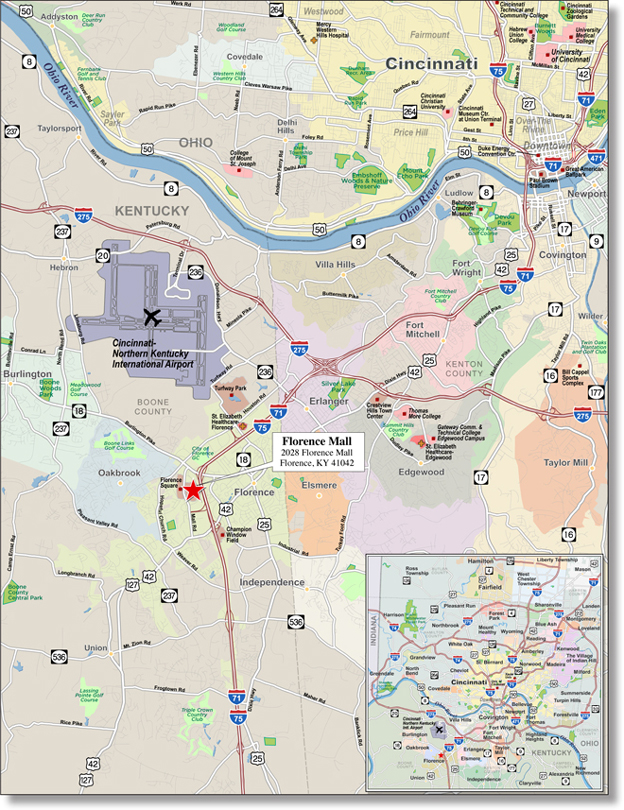

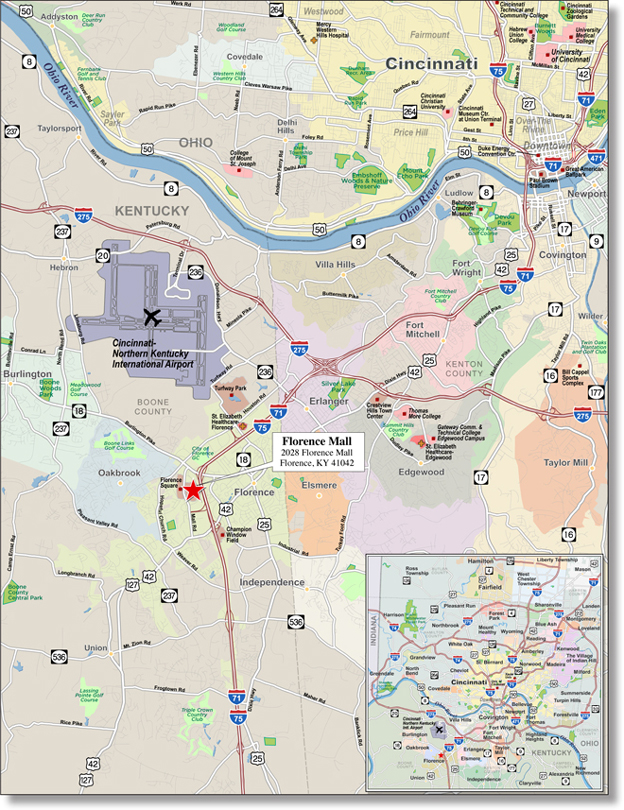

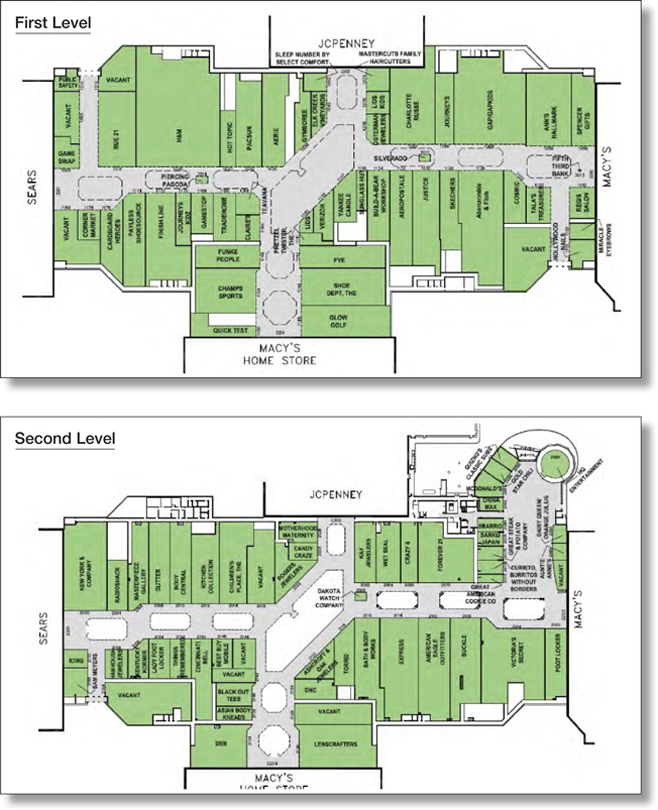

RBS | | Florence Mall | | Florence | | KY | | 1 / 1 | | | 90,000,000 | | | | 8.2 | | | Retail | | | 384,111 | | | 234 | | | 56.7 | | | | 56.7 | | | | 2.97 | | | | 13.2 | |

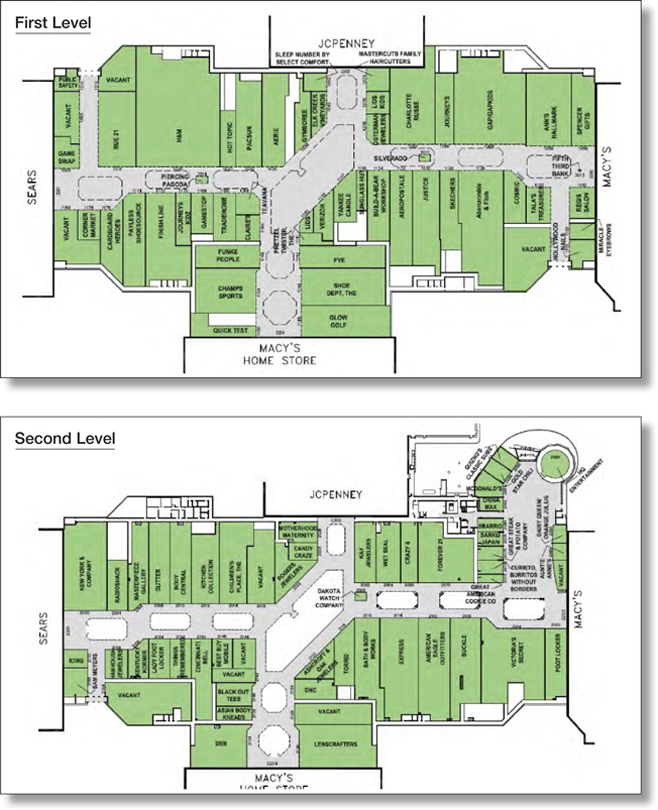

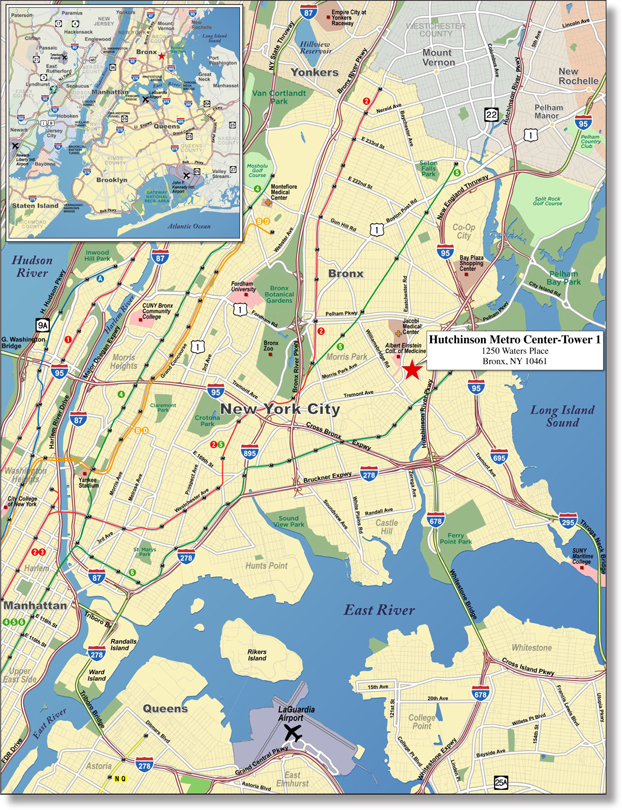

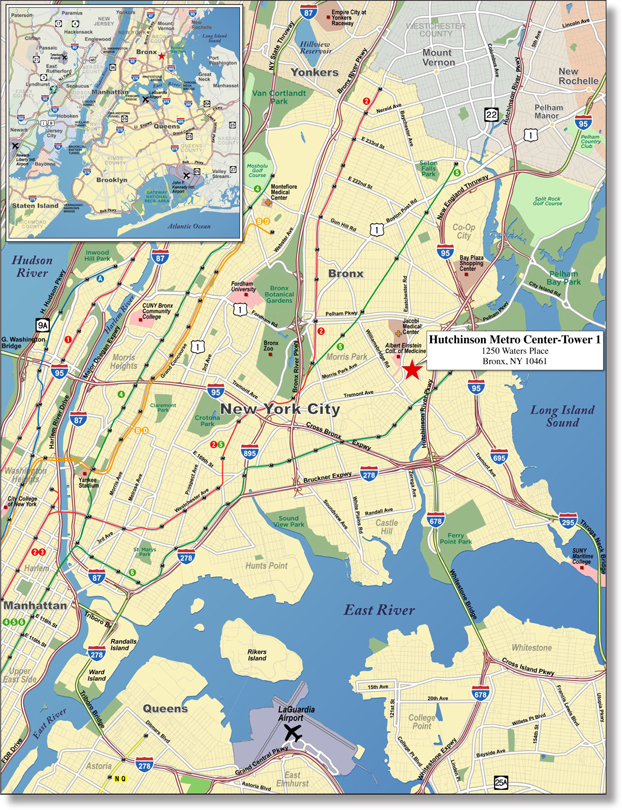

WFB | | Hutchinson Metro Center – Tower I | | Bronx | | NY | | 1 / 1 | | | 67,928,586 | | | | 6.2 | | | Office | | | 284,979 | | | 238 | | | 69.5 | | | | 57.3 | | | | 1.43 | | | | 9.9 | |

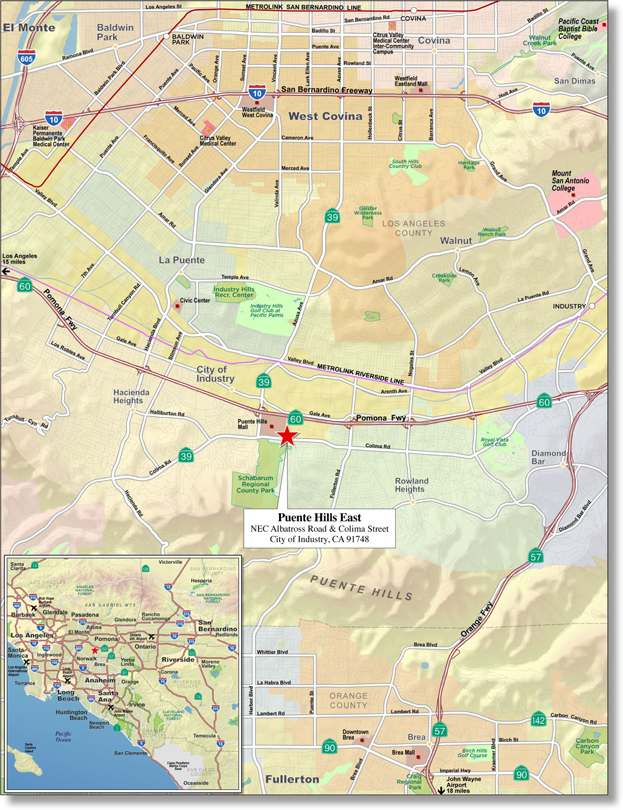

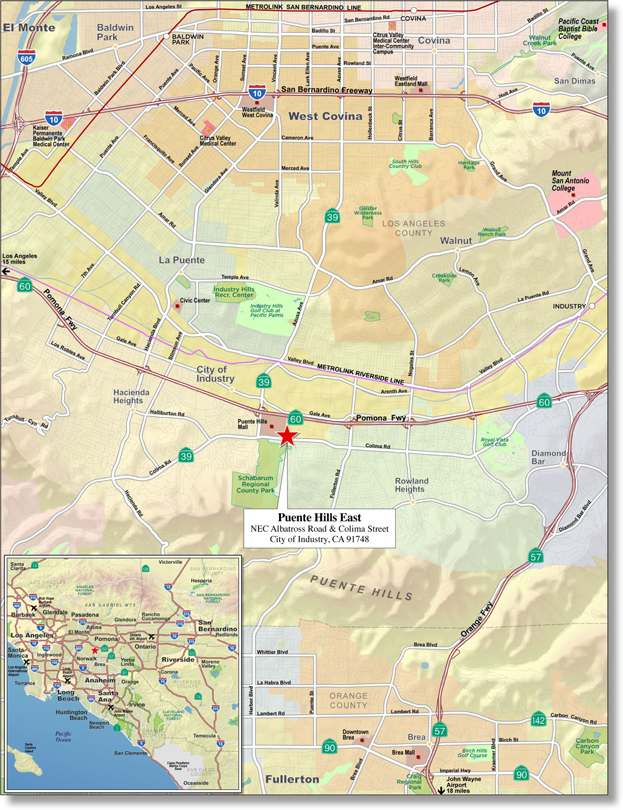

RBS | | Puente Hills East | | City of Industry | | CA | | 1 / 1 | | | 65,000,000 | | | | 5.9 | | | Retail | | | 401,170 | | | 162 | | | 57.3 | | | | 52.4 | | | | 1.66 | | | | 10.7 | |

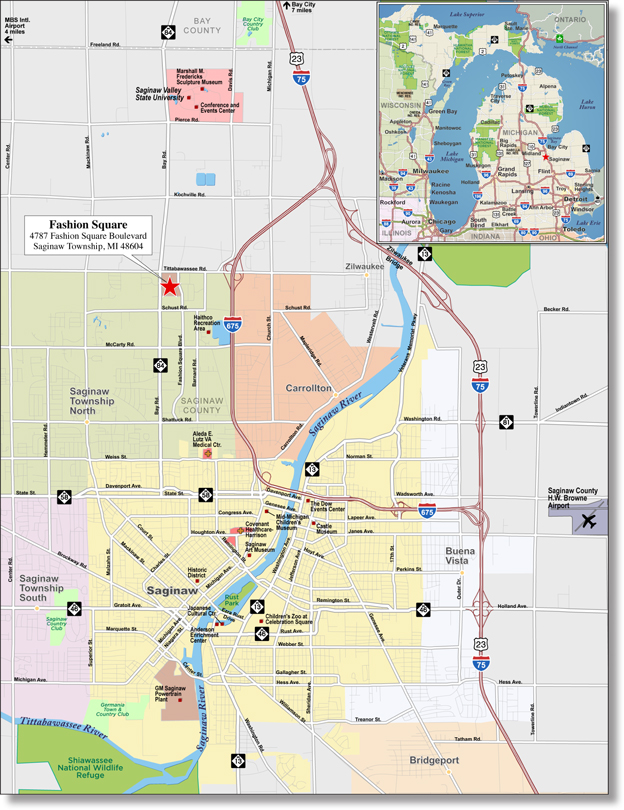

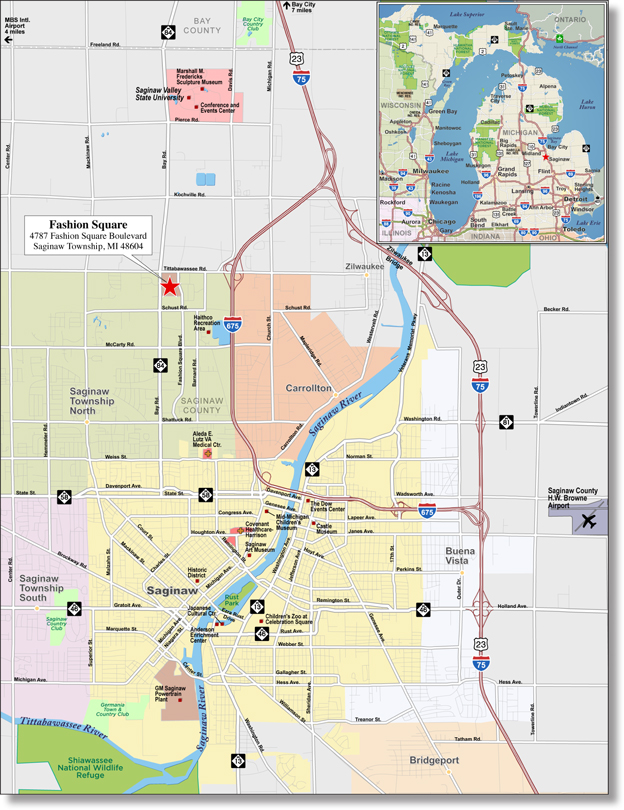

WFB | | Fashion Square | | Saginaw Township | | MI | | 1 / 1 | | | 42,000,000 | | | | 3.8 | | | Retail | | | 446,288 | | | 94 | | | 62.2 | | | | 45.9 | | | | 2.19 | | | | 16.3 | |

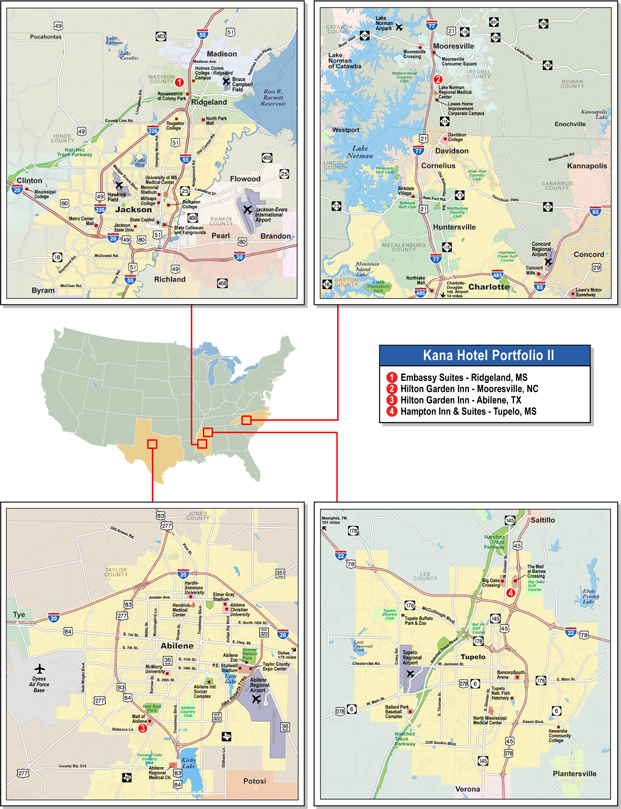

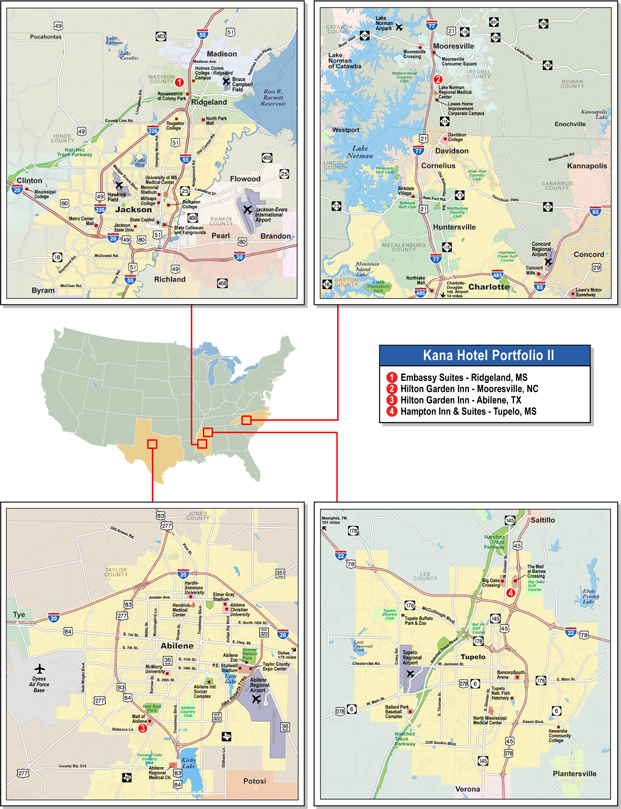

RBS | | Kana Hotel Portfolio II | | Various | | Various | | 1 / 4 | | | 38,443,862 | | | | 3.5 | | | Hospitality | | | 478 | | | 80,426 | | | 59.4 | | | | 45.0 | | | | 1.70 | | | | 13.9 | |

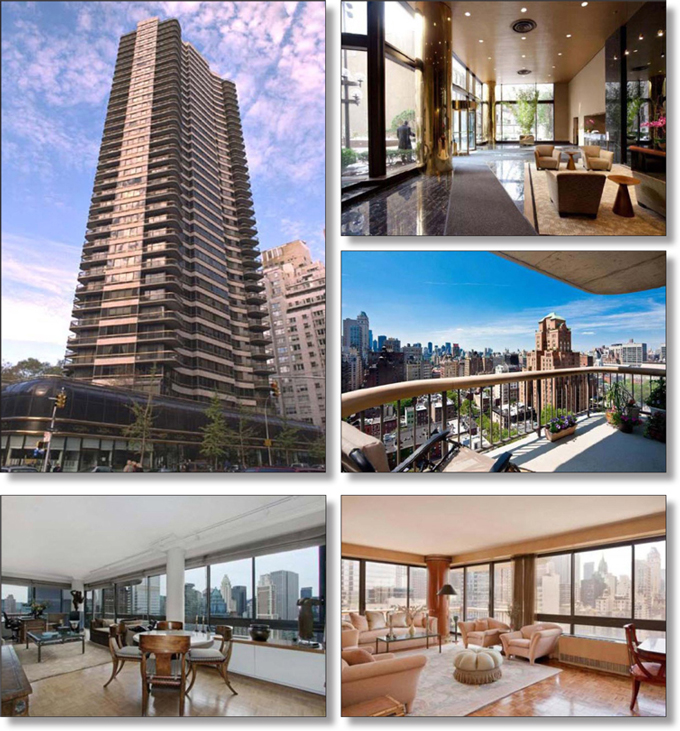

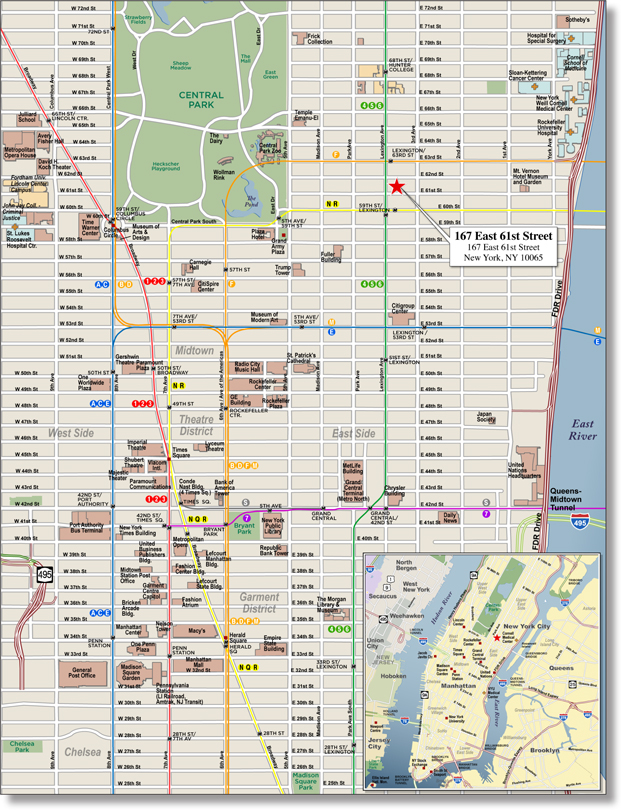

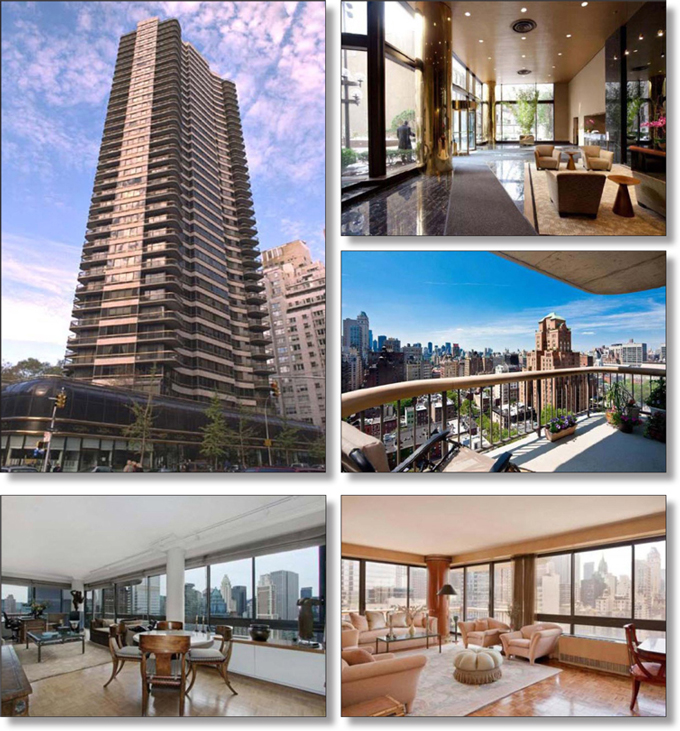

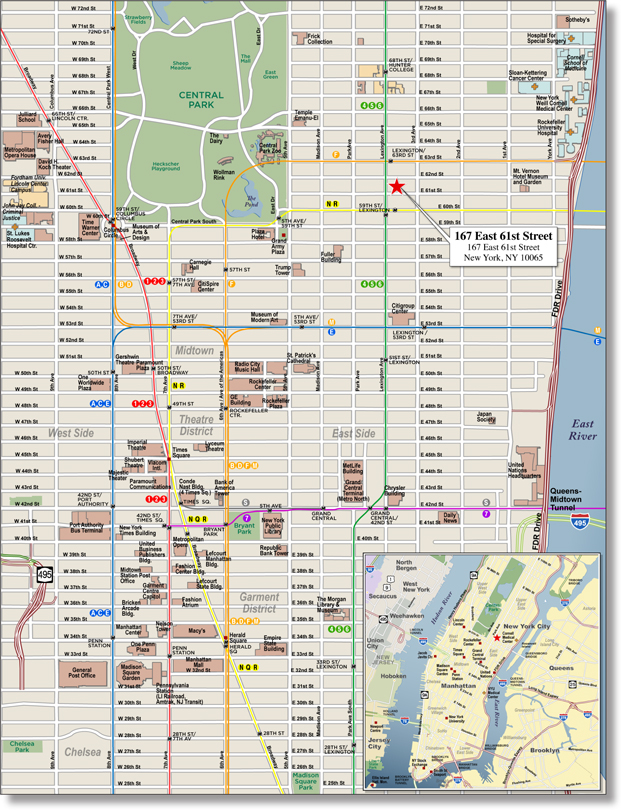

RBS | | 167 East 61st Street | | New York | | NY | | 1 / 1 | | | 35,500,000 | | | | 3.2 | | | Multifamily | | | 150 | | | 236,667 | | | 29.6 | | | | 29.6 | | | | 5.45 | | | | 24.1 | |

WFB | | Isola Bella | | Oklahoma City | | OK | | 1 / 1 | | | 33,966,123 | | | | 3.1 | | | Multifamily | | | 851 | | | 39,913 | | | 68.3 | | | | 56.7 | | | | 1.44 | | | | 10.4 | |

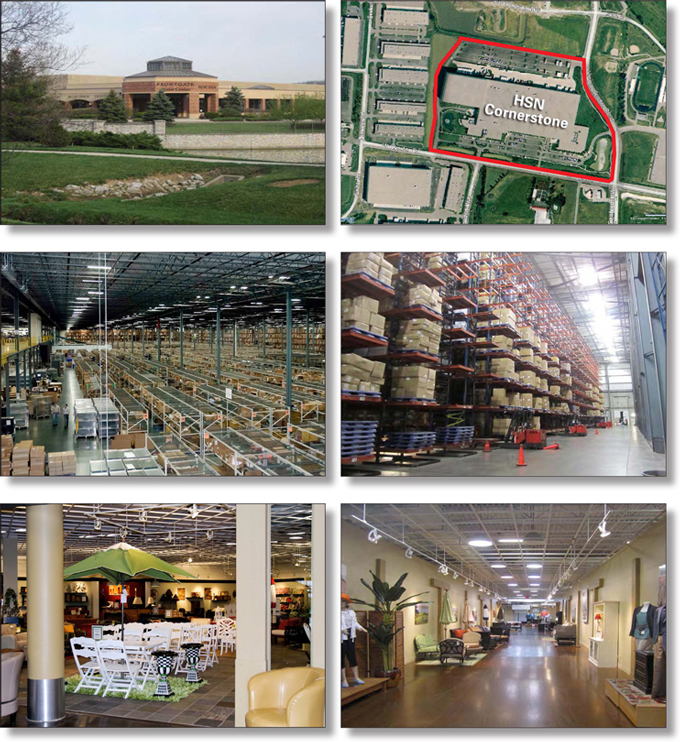

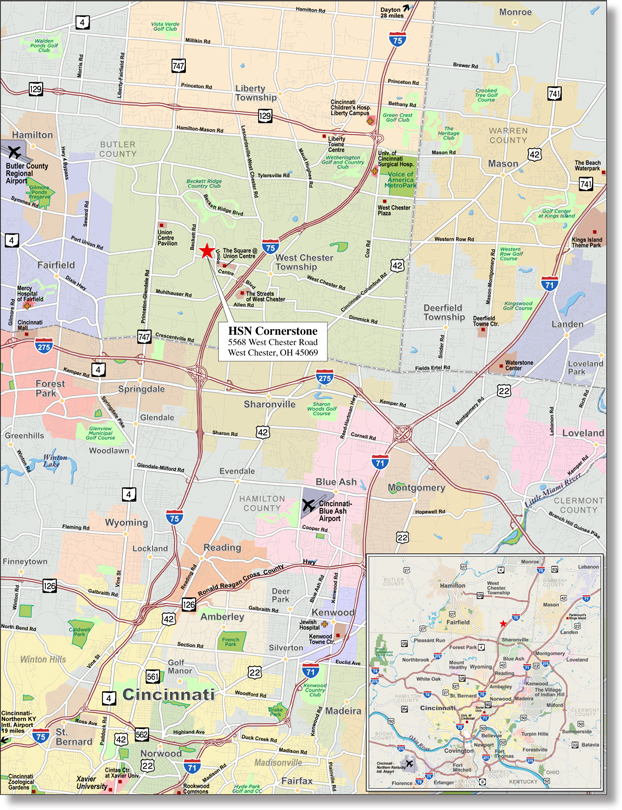

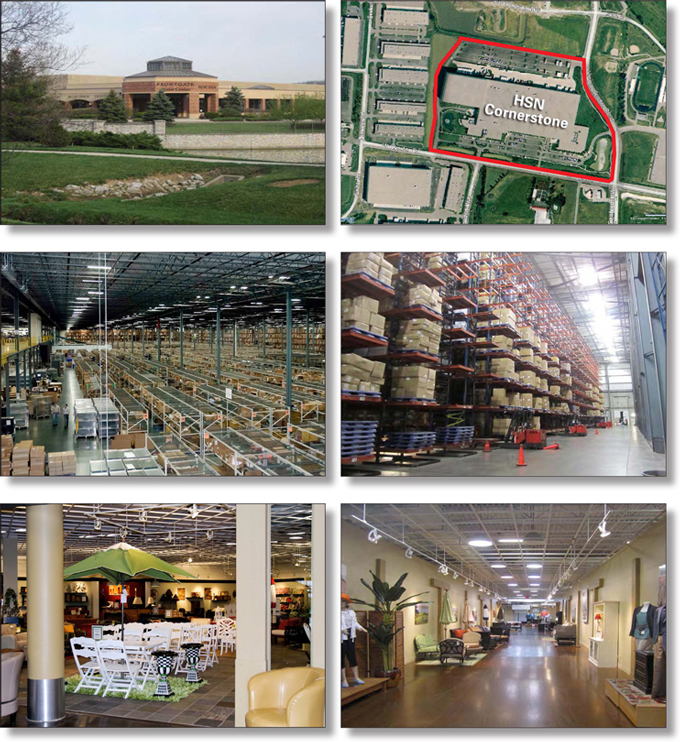

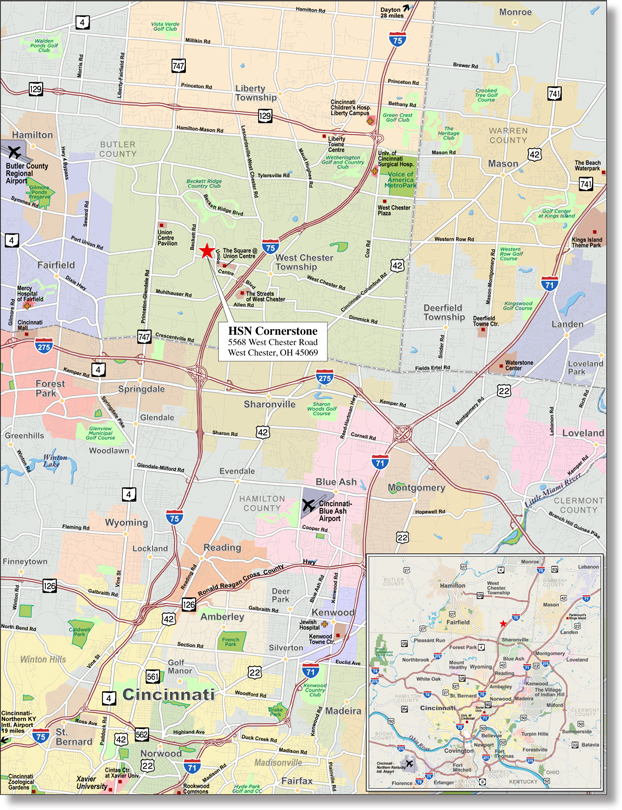

LIG I | | HSN Cornerstone | | West Chester | | OH | | 1 / 1 | | | 30,600,000 | | | | 2.8 | | | Industrial | | | 970,168 | | | 32 | | | 58.8 | | | | 48.0 | | | | 1.71 | | | | 12.4 | |

Top Three Total / Weighted Average | | 3 / 3 | | | $377,444,111 | | | | 34.2 | % | | | | | | | | | | | 62.8 | % | | | 54.9 | % | | | 1.82 | x | | | 10.6 | % |

Top Five Total / Weighted Average | | 5 / 5 | | | $510,372,697 | | | | 46.2 | % | | | | | | | | | | | 63.0 | % | | | 54.9 | % | | | 1.75 | x | | | 10.5 | % |

Top Ten Total / Weighted Average | | 10 / 13 | | | $690,882,683 | | | | 62.6 | % | | | | | | | | | | | 61.1 | % | | | 52.3 | % | | | 1.95 | x | | | 11.9 | % |

| (1) | With respect to Northridge Fashion Center and Town Center at Cobb, Cut-off Date Balance per sf, rooms or units, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

| B. | Summary of Pari Passu Split Loan Structures |

| | | | | | | | | | | | | | |

| | | | | | | |

| Property Name | | Mortgage Loan Seller | | Related Notes in

Loan Group

(Original Balance) | | | Holder of Note | | Whether Note is Lead

Servicing for the

Entire Loan Group | | Current Master Servicer for Securitized Note | | Current Special Servicer for Securitized Note |

Northridge Fashion Center | | WFB | | | $157,444,111 | | | WFRBS 2012-C7 | | Yes | | Wells Fargo Bank, National Association | | Torchlight Loan Services, LLC |

| | WFB | | | $89,546,338 | | | (1) | | No | | N/A | | N/A |

Town Center at Cobb | | RBS | | | $130,000,000 | | | WFRBS 2012-C7 | | Yes | | Wells Fargo Bank, National Association | | Torchlight Loan Services, LLC |

| | RBS | | | $70,000,000 | | | (1) | | No | | N/A | | N/A |

| (1) | WFB is the holder of the Northridge Fashion Center relatedpari passu companion loan. RBS is the holder of the Town Center at Cobb relatedpari passu companion loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Characteristics of the Mortgage Pool |

| C. | Previous Securitization History(1) |

| | | | | | | | | | | | | | | | | | |

Loan

No. | | Mortgage

Loan Seller | | Mortgage Loan Name or Mortgaged

Property | | City | | State | | Property Type | | Mortgage Loan or Mortgaged

Property Cut-off

Date Balance ($) | | | % of Cut-off

Date Balance (%) | | Previous Securitization |

1 | | WFB | | Northridge Fashion Center | | Northridge | | CA | | Retail | | | $157,444,111 | | | 14.3% | | GSMS 2001-GL3A |

2 | | RBS | | Town Center at Cobb | | Kennesaw | | GA | | Retail | | | 130,000,000 | | | 11.8 | | MLMT 2007-C1 |

3 | | RBS | | Florence Mall | | Florence | | KY | | Retail | | | 90,000,000 | | | 8.2 | | CD 2005-CD1 |

6 | | WFB | | Fashion Square | | Saginaw Township | | MI | | Retail | | | 42,000,000 | | | 3.8 | | CSFB 2002-CP5 |

8 | | RBS | | 167 East 61st Street | | New York | | NY | | Multifamily | | | 35,500,000 | | | 3.2 | | MLMT 2003-KEY1 |

10 | | LIG I | | HSN Cornerstone | | West Chester | | OH | | Industrial | | | 30,600,000 | | | 2.8 | | JPMCC 2005-LDP1 |

11 | | Basis | | 270 Peachtree Street | | Atlanta | | GA | | Office | | | 27,250,000 | | | 2.5 | | LBUBS 2000-C3 |

13.02 | | Basis | | Greene Plaza | | Waynesburg | | PA | | Retail | | | 7,930,000 | | | 0.7 | | GMACC 2003-C2 |

14 | | RBS | | Parkway Irvine | | Irvine | | CA | | Office | | | 18,500,000 | | | 1.7 | | BSCMS 2002-TOP8 |

15.01 | | Basis | | Bear Creek Meadows Phase I | | Petoskey | | MI | | Multifamily | | | 6,250,000 | | | 0.6 | | MLCFC 2007-6 |

24 | | RBS | | Crossroads Towne Center | | Gilbert | | AZ | | Retail | | | 11,400,000 | | | 1.0 | | Various(2) |

27 | | CIIICM | | Meridian Village | | Bellingham | | WA | | Retail | | | 9,854,052 | | | 0.9 | | BSCMS 2007-PWR16 |

29 | | LIG I | | North Park Shopping Center | | Midland | | TX | | Retail | | | 9,200,000 | | | 0.8 | | JPMCC 2003-LN1 |

31 | | WFB | | STORExpress | | Pittsburgh | | PA | | Self Storage | | | 8,300,000 | | | 0.8 | | LBCMT 2007-3 |

33 | | RBS | | Figueroa & Patrice | | Gardena | | CA | | Industrial | | | 7,982,357 | | | 0.7 | | SMB7 2001-C2 |

34 | | CIIICM | | Phoenix MHP Portfolio | | Apache Junction | | AZ | | Manufactured Housing Community | | | 7,650,000 | | | 0.7 | | JPMCC 2006-LDP8 |

37 | | WFB | | Mini U Storage - Columbia | | Columbia | | MD | | Self Storage | | | 6,992,735 | | | 0.6 | | WBCMT 2002-C1 |

42 | | CIIICM | | Winn-Dixie | | Meridian | | MS | | Retail | | | 4,100,000 | | | 0.4 | | JPMCC 2001-CIBC2 |

43 | | LIG I | | Courtyard at Midland Park | | Midland | | TX | | Retail | | | 4,035,492 | | | 0.4 | | MSC 2003-IQ5 |

44 | | CIIICM | | Riverfront Place | | Pittsburgh | | PA | | Office | | | 3,750,000 | | | 0.3 | | LBUBS 2008-C1 |

51 | | CIIICM | | Merrifield Plaza | | Mishawaka | | IN | | Retail | | | 2,516,513 | | | 0.2 | | JPMCC 2002-CIBC5 |

60 | | CIIICM | | Shady Oaks & Village MHC | | Stephenville | | TX | | Manufactured Housing Community | | | 1,550,000 | | | 0.1 | | JPMCC 2002-C1 |

Total | | | | | | | | | $465,361,150 | | | 42.2% | | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. The information has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | The debt on portions of the mortgaged property was securitized in two separate transactions: LBUBS 2005-C3 and CGCMT 2007-C6. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Characteristics of the Mortgage Pool |

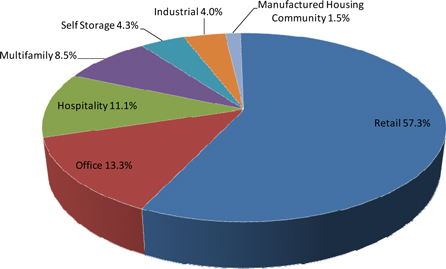

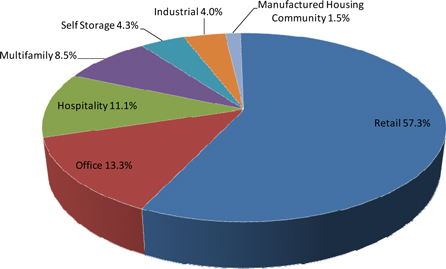

| D. | Property Type Distribution |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Type | | Number of

Mortgaged

Properties | | Aggregate Cut- off Date

Balance ($)(1) | | | % of Cut- off Date

Balance (%) | | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | | Weighted

Average

Balloon

LTV Ratio

(%) | | | Weighted

Average

U/W NCF

DSCR (x) | | | Weighted

Average

U/W NOI

Debt

Yield (%) | | | Weighted

Average

U/W NCF

Debt

Yield (%) | | | Weighted

Average

Mortgage

Rate (%) | |

Retail | | 28 | | $ | 632,749,487 | | | | 57.3 | % | | | 63.3 | % | | | 53.6 | % | | | 1.76 | x | | | 11.2 | % | | | 10.6 | % | | | 4.822 | % |

Regional Mall | | 4 | | | 419,444,111 | | | | 38.0 | | | | 62.8 | | | | 54.0 | | | | 1.86 | | | | 11.2 | | | | 10.7 | | | | 4.774 | |

Anchored | | 14 | | | 177,560,491 | | | | 16.1 | | | | 63.7 | | | | 53.3 | | | | 1.57 | | | | 11.1 | | | | 10.2 | | | | 4.861 | |

Unanchored | | 3 | | | 19,184,393 | | | | 1.7 | | | | 69.0 | | | | 52.9 | | | | 1.40 | | | | 10.9 | | | | 10.2 | | | | 5.451 | |

Shadow Anchored | | 6 | | | 11,660,492 | | | | 1.1 | | | | 65.7 | | | | 45.5 | | | | 1.64 | | | | 13.4 | | | | 11.9 | | | | 4.927 | |

Single Tenant | | 1 | | | 4,900,000 | | | | 0.4 | | | | 66.2 | | | | 54.2 | | | | 1.53 | | | | 10.1 | | | | 9.7 | | | | 4.850 | |

Office | | 8 | | | 146,713,790 | | | | 13.3 | | | | 67.2 | | | | 55.7 | | | | 1.49 | | | | 10.7 | | | | 9.7 | | | | 5.040 | |

CBD | | 3 | | | 108,150,592 | | | | 9.8 | | | | 68.9 | | | | 56.7 | | | | 1.47 | | | | 10.4 | | | | 9.5 | | | | 5.036 | |

Suburban | | 4 | | | 31,496,627 | | | | 2.9 | | | | 61.9 | | | | 52.3 | | | | 1.57 | | | | 11.2 | | | | 10.0 | | | | 4.907 | |

Medical | | 1 | | | 7,066,572 | | | | 0.6 | | | | 65.4 | | | | 56.0 | | | | 1.45 | | | | 12.1 | | | | 10.2 | | | | 5.680 | |

Hospitality | | 12 | | | 122,566,110 | | | | 11.1 | | | | 60.1 | | | | 45.8 | | | | 1.75 | | | | 14.6 | | | | 13.0 | | | | 5.457 | |

Limited Service | | 9 | | | 73,677,697 | | | | 6.7 | | | | 62.1 | | | | 46.0 | | | | 1.77 | | | | 15.0 | | | | 13.3 | | | | 5.455 | |

Full Service | | 3 | | | 48,888,413 | | | | 4.4 | | | | 57.1 | | | | 45.5 | | | | 1.73 | | | | 13.9 | | | | 12.4 | | | | 5.461 | |

Multifamily | | 6 | | | 93,526,123 | | | | 8.5 | | | | 53.2 | | | | 45.3 | | | | 2.98 | | | | 15.7 | | | | 15.1 | | | | 4.854 | |

Cooperative | | 1 | | | 35,500,000 | | | | 3.2 | | | | 29.6 | | | | 29.6 | | | | 5.45 | | | | 24.1 | | | | 23.8 | | | | 4.308 | |

Multifamily | | 1 | | | 33,966,123 | | | | 3.1 | | | | 68.3 | | | | 56.7 | | | | 1.44 | | | | 10.4 | | | | 9.5 | | | | 5.270 | |

Garden | | 4 | | | 24,060,000 | | | | 2.2 | | | | 66.6 | | | | 52.3 | | | | 1.52 | | | | 11.0 | | | | 10.3 | | | | 5.071 | |

Self Storage | | 14 | | | 47,959,768 | | | | 4.3 | | | | 63.3 | | | | 52.6 | | | | 1.71 | | | | 11.7 | | | | 11.4 | | | | 5.233 | |

Self Storage | | 14 | | | 47,959,768 | | | | 4.3 | | | | 63.3 | | | | 52.6 | | | | 1.71 | | | | 11.7 | | | | 11.4 | | | | 5.233 | |

Industrial | | 3 | | | 44,252,357 | | | | 4.0 | | | | 61.0 | | | | 50.2 | | | | 1.63 | | | | 11.9 | | | | 10.4 | | | | 4.916 | |

Distribution/Office/Retail | | 1 | | | 30,600,000 | | | | 2.8 | | | | 58.8 | | | | 48.0 | | | | 1.71 | | | | 12.4 | | | | 10.7 | | | | 4.750 | |

Flex | | 2 | | | 13,652,357 | | | | 1.2 | | | | 65.8 | | | | 55.3 | | | | 1.44 | | | | 10.9 | | | | 9.6 | | | | 5.288 | |

| Manufactured Housing Community | | 9 | | | 16,169,430 | | | | 1.5 | | | | 62.5 | | | | 51.1 | | | | 1.61 | | | | 11.7 | | | | 11.4 | | | | 5.590 | |

Manufactured Housing Community | | 9 | | | 16,169,430 | | | | 1.5 | | | | 62.5 | | | | 51.1 | | | | 1.61 | | | | 11.7 | | | | 11.4 | | | | 5.590 | |

Total/Weighted Average | | 80 | | $ | 1,103,937,066 | | | | 100.0 | % | | | 62.5 | % | | | 52.1 | % | | | 1.82 | x | | | 12.0 | % | | | 11.1 | % | | | 4.957 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents). With respect to Northridge Fashion Center and Town Center at Cobb, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Characteristics of the Mortgage Pool |

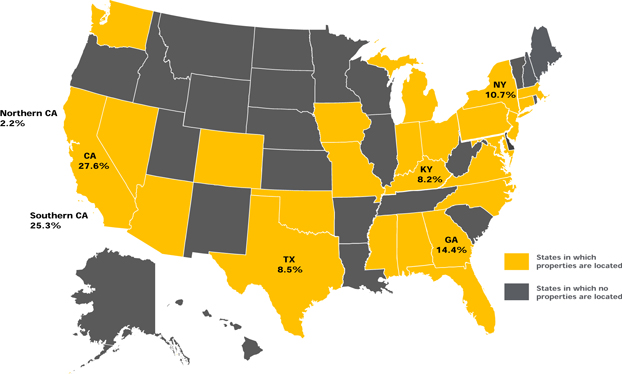

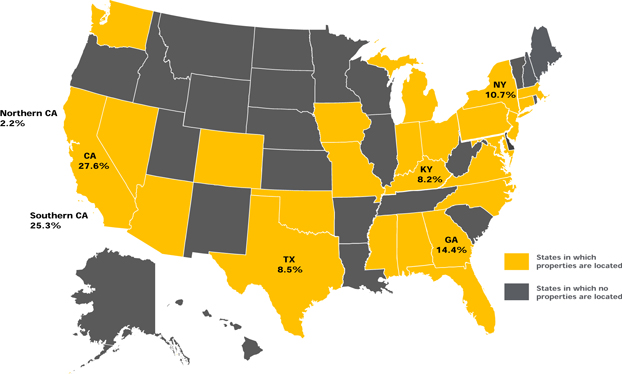

| E. | Geographic Distribution* |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location(1) | | Number of

Mortgaged

Properties | | Aggregate Cut- off Date Balance ($)(2) | | | % of Cut- off Date

Balance | | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | | Weighted

Average

Balloon or

ARD LTV

Ratio (%) | | | Weighted

Average

U/W NCF

DSCR (x) | | | Weighted

Average U/W NOI

Debt Yield

(%) | | | Weighted

Average

U/W NCF

Debt Yield (%) | | | Weighted

Average

Mortgage

Rate (%) | |

California | | 9 | | | $304,363,895 | | | | 27.6 | % | | | 63.1 | % | | | 53.4 | % | | | 1.50 | x | | | 10.5 | % | | | 9.9 | % | | | 5.006 | % |

Southern | | 6 | | | 279,793,040 | | | | 25.3 | | | | 63.2 | | | | 53.5 | | | | 1.49 | | | | 10.3 | | | | 9.6 | | | | 4.954 | |

Northern | | 3 | | | 24,570,855 | | | | 2.2 | | | | 62.0 | | | | 51.7 | | | | 1.72 | | | | 13.4 | | | | 12.5 | | | | 5.598 | |

Georgia | | 3 | | | 159,150,000 | | | | 14.4 | | | | 63.2 | | | | 53.9 | | | | 1.53 | | | | 10.1 | | | | 9.7 | | | | 4.795 | |

New York | | 4 | | | 118,028,586 | | | | 10.7 | | | | 56.6 | | | | 47.7 | | | | 2.65 | | | | 14.3 | | | | 13.8 | | | | 4.836 | |

Texas | | 21 | | | 93,704,922 | | | | 8.5 | | | | 67.8 | | | | 51.5 | | | | 1.59 | | | | 12.9 | | | | 11.8 | | | | 5.396 | |

Kentucky | | 1 | | | 90,000,000 | | | | 8.2 | | | | 56.7 | | | | 56.7 | | | | 2.97 | | | | 13.2 | | | | 12.5 | | | | 4.150 | |

Other States(3) | | 42 | | | 338,689,662 | | | | 30.7 | | | | 63.7 | | | | 50.6 | | | | 1.70 | | | | 12.7 | | | | 11.6 | | | | 5.124 | |

Total/ Weighted Average | | 80 | | | $1,103,937,066 | | | | 100.0 | % | | | 62.5 | % | | | 52.1 | % | | | 1.82 | x | | | 12.0 | % | | | 11.1 | % | | | 4.957 | % |

* The Mortgaged Properties are located in 25 states.

| (1) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents). With respect to Northridge Fashion Center and Town Center at Cobb, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

| (3) | Includes 20 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Characteristics of the Mortgage Pool |

| F. | Characteristics of the Mortgage Pool(1) |

| | | | | | | | |

| CUT-OFF DATE BALANCE | | | |

Range of Cut-off Date

Balances ($) | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance | | | % of Cut-off

Date Balance |

1,496,253 – 2,000,000 | | 8 | | | $14,169,430 | | | 1.3% |

2,000,001 – 3,000,000 | | 5 | | | 12,446,513 | | | 1.1 |

3,000,001 – 4,000,000 | | 5 | | | 17,001,793 | | | 1.5 |

4,000,001 – 5,000,000 | | 4 | | | 17,530,788 | | | 1.6 |

5,000,001 – 6,000,000 | | 1 | | | 5,670,000 | | | 0.5 |

6,000,001 – 7,000,000 | | 2 | | | 13,042,735 | | | 1.2 |

7,000,001 – 8,000,000 | | 5 | | | 38,182,602 | | | 3.5 |

8,000,001 – 9,000,000 | | 2 | | | 17,300,000 | | | 1.6 |

9,000,001 – 10,000,000 | | 3 | | | 28,791,115 | | | 2.6 |

10,000,001 – 15,000,000 | | 10 | | | 123,819,406 | | | 11.2 |

15,000,001 – 20,000,000 | | 4 | | | 74,050,000 | | | 6.7 |

20,000,001 – 30,000,000 | | 2 | | | 51,050,000 | | | 4.6 |

30,000,001 – 50,000,000 | | 5 | | | 180,509,986 | | | 16.4 |

50,000,001 – 70,000,000 | | 2 | | | 132,928,586 | | | 12.0 |

70,000,001 – 90,000,000 | | 1 | | | 90,000,000 | | | 8.2 |

110,000,001 – 130,000,000 | | 1 | | | 130,000,000 | | | 11.8 |

150,000,001 – 157,444,111 | | 1 | | | 157,444,111 | | �� | 14.3 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Average: | | $18,097,329 | | | | | | |

UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO

| | | | | | | | |

Range of U/W NOI

DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance | | | % of

Cut-off

Date

Balance |

1.35 – 1.40 | | 1 | | | $4,100,000 | | | 0.4% |

1.41 – 1.50 | | 7 | | | 200,276,494 | | | 18.1 |

1.51 – 1.60 | | 10 | | | 288,556,446 | | | 26.1 |

1.61 – 1.70 | | 16 | | | 137,742,923 | | | 12.5 |

1.71 – 1.80 | | 5 | | | 81,566,572 | | | 7.4 |

1.81 – 1.90 | | 3 | | | 57,150,000 | | | 5.2 |

1.91 – 2.00 | | 8 | | | 115,944,481 | | | 10.5 |

2.01 – 2.10 | | 1 | | | 1,998,177 | | | 0.2 |

2.11 – 2.20 | | 3 | | | 31,321,954 | | | 2.8 |

2.21 – 2.30 | | 1 | | | 4,035,492 | | | 0.4 |

2.31 – 2.40 | | 2 | | | 45,555,167 | | | 4.1 |

2.41 – 2.50 | | 1 | | | 6,992,735 | | | 0.6 |

2.61 – 3.00 | | 1 | | | 3,196,627 | | | 0.3 |

3.01 – 5.45 | | 2 | | | 125,500,000 | | | 11.4 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 1.94x | | | | | | |

UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO

| | | | | | | | |

Range of U/W NCF

DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance | | | % of

Cut-off

Date

Balance |

1.26 – 1.30 | | 2 | | | $18,072,989 | | | 1.6% |

1.31 – 1.40 | | 3 | | | 180,728,505 | | | 16.4 |

1.41 – 1.50 | | 18 | | | 258,659,204 | | | 23.4 |

1.51 – 1.60 | | 12 | | | 182,316,737 | | | 16.5 |

1.61 – 1.70 | | 9 | | | 181,030,868 | | | 16.4 |

1.71 – 1.80 | | 4 | | | 58,537,063 | | | 5.3 |

1.81 – 1.90 | | 3 | | | 15,542,399 | | | 1.4 |

1.91 – 2.00 | | 3 | | | 16,440,864 | | | 1.5 |

2.01 – 2.10 | | 2 | | | 14,919,076 | | | 1.4 |

2.11 – 2.20 | | 1 | | | 42,000,000 | | | 3.8 |

2.41 – 2.50 | | 2 | | | 10,189,362 | | | 0.9 |

2.61 – 3.00 | | 1 | | | 90,000,000 | | | 8.2 |

3.01 – 5.45 | | 1 | | | 35,500,000 | | | 3.2 |

Total/Weighted Average: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 1.82x | | | | | | |

LOAN PURPOSE(2)

| | | | | | | | |

| Loan Purpose | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance | | | % of

Cut-off

Date

Balance |

Refinance | | 56 | | | $1,026,191,077 | | | 93.0% |

Acquisition | | 4 | | | 59,345,988 | | | 5.4 |

Various | | 1 | | | 18,400,000 | | | 1.7 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

| (2) | With respect to the Bear Creek Portfolio, Bear Creek Meadows Phase I was an acquisition as the borrower re-acquired the property by exercising its right of redemption after such Mortgaged Property had been foreclosed upon, while Bear Creek Meadows Phase II and Bear Creek Crossings were each a refinance. Please refer to Annex A for further details. |

MORTGAGE RATE

| | | | | | | | |

Range of Mortgage Rates (%) | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance | | | % of

Cut-off

Date

Balance |

4.150 – 4.500 | | 3 | | | $190,500,000 | | | 17.3% |

4.501 – 5.000 | | 15 | | | 351,487,428 | | | 31.8 |

5.001 – 5.500 | | 27 | | | 469,867,493 | | | 42.6 |

5.501 – 6.000 | | 14 | | | 77,664,992 | | | 7.0 |

6.001 – 6.500 | | 2 | | | 14,417,153 | | | 1.3 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 4.957% | | | | | | |

UNDERWRITTEN NOI DEBT YIELD

| | | | | | | | |

Range of U/W NOI

Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

9.7 – 9.9 | | 4 | | | $245,672,697 | | | 22.3% |

10.0 – 10.9 | | 19 | | | 375,806,652 | | | 34.0 |

11.0 – 11.9 | | 11 | | | 73,480,000 | | | 6.7 |

12.0 – 12.9 | | 8 | | | 92,200,386 | | | 8.4 |

13.0 – 13.9 | | 8 | | | 180,979,354 | | | 16.4 |

14.0 – 14.9 | | 3 | | | 19,227,176 | | | 1.7 |

16.0 – 16.9 | | 3 | | | 50,488,989 | | | 4.6 |

17.0 – 17.9 | | 1 | | | 10,909,118 | | | 1.0 |

18.0 – 18.9 | | 2 | | | 6,751,793 | | | 0.6 |

19.0 – 19.9 | | 1 | | | 12,920,900 | | | 1.2 |

20.0 – 24.1 | | 1 | | | 35,500,000 | | | 3.2 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 12.0% | | | | | | |

UNDERWRITTEN NCF DEBT YIELD

| | | | | | | | | | |

Range of U/W NCF

Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance | |

8.9 | | 2 | | | $32,472,989 | | | | 2.9 | % |

9.0 – 9.9 | | 15 | | | 503,389,624 | | | | 45.6 | |

10.0 – 10.9 | | 20 | | | 230,820,314 | | | | 20.9 | |

11.0 – 11.9 | | 5 | | | 33,981,513 | | | | 3.1 | |

12.0 – 12.9 | | 9 | | | 174,966,586 | �� | | | 15.8 | |

13.0 – 13.9 | | 2 | | | 13,292,230 | | | | 1.2 | |

14.0 – 14.9 | | 1 | | | 1,998,177 | | | | 0.2 | |

15.0 – 15.9 | | 3 | | | 54,405,372 | | | | 4.9 | |

16.0 – 16.9 | | 2 | | | 10,189,362 | | | | 0.9 | |

17.0 – 17.9 | | 1 | | | 12,920,900 | | | | 1.2 | |

20.0 – 23.8 | | 1 | | | 35,500,000 | | | | 3.2 | |

Total: | | 61 | | | $1,103,937,066 | | | | 100.0 | % |

Weighted Average: | | 11.1% | | | | | | | | |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in related loan documents. With respect to Northridge Fashion Center and Town Center at Cobb, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Characteristics of the Mortgage Pool |

ORIGINAL TERM TO MATURITY

| | | | | | | | |

Range of Original Terms

to Maturity (months) | | Number of

Mortgage Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

60 | | 1 | | | $9,854,052 | | | 0.9% |

61 – 84 | | 1 | | | 7,991,737 | | | 0.7 |

85 – 120 | | 58 | | | 928,647,165 | | | 84.1 |

121 – 128 | | 1 | | | 157,444,111 | | | 14.3 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 120 | | | | | | |

REMAINING TERM TO MATURITY

| | | | | | | | |

Range of Remaining Terms to Maturity

(months) | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance | | | % of

Cut-off

Date

Balance |

59 – 60 | | 1 | | | $9,854,052 | | | 0.9% |

61 – 84 | | 1 | | | 7,991,737 | | | 0.7 |

85 – 120 | | 59 | | | 1,086,091,277 | | | 98.4 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 118 | | | | | | |

ORIGINAL AMORTIZATION TERM(1)

| | | | | | | | |

Range of Original

Amortization Terms

(months) | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance | | | % of

Cut-off

Date

Balance |

Non-Amortizing | | 2 | | | $125,500,000 | | | 11.4% |

180 – 240 | | 3 | | | 35,020,900 | | | 3.2 |

241 – 300 | | 16 | | | 182,467,370 | | | 16.5 |

301 – 360 | | 40 | | | 760,948,796 | | | 68.9 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average:* | | 344 | | | | | | |

| * | Excludes the non-amortizing loans. |

| (1) | The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

REMAINING AMORTIZATION TERM(2)

| | | | | | | | |

Range of Remaining

Amortization Terms

(months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

Non-Amortizing | | 2 | | | $125,500,000 | | | 11.4% |

180 – 240 | | 3 | | | 35,020,900 | | | 3.2 |

241 – 300 | | 16 | | | 182,467,370 | | | 16.5 |

301 – 360 | | 40 | | | 760,948,796 | | | 68.9 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average:* | | 341 | | | | | | |

| * | Excludes the non-amortizing loans. |

| (2) | The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

LOCKBOXES

| | | | | | | | |

| Type of Lockbox | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

Hard/Springing Cash Management | | 23 | | | $709,190,519 | | | 64.2% |

Soft/Springing Cash Management | | 13 | | | 255,938,182 | | | 23.2 |

None | | 17 | | | 101,451,626 | | | 9.2 |

Springing (Without Established Account) | | 5 | | | 21,640,167 | | | 2.0 |

Hard/Upfront Cash Management | | 2 | | | 11,966,572 | | | 1.1 |

Springing (With Established Account) | | 1 | | | 3,750,000 | | | 0.3 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

PREPAYMENT PROVISION SUMMARY

| | | | | | | | |

| Prepayment Provision | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

| | | | | | | | | |

Lockout/Defeasance/Open | | 57 | | | $1,042,608,889 | | | 94.4% |

Lockout/YM%/Open | | 4 | | | 61,328,177 | | | 5.6 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

| | | | | | | | | |

CUT-OFF DATE LOAN-TO-VALUE RATIO

| | | | | | | | |

Range of Cut-off Date

LTV Ratios (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

29.6 – 30.0 | | 1 | | | $35,500,000 | | | 3.2% |

30.1 – 35.0 | | 1 | | | 6,992,735 | | | 0.6 |

40.1 – 45.0 | | 1 | | | 3,555,167 | | | 0.3 |

45.1 – 50.0 | | 1 | | | 1,496,253 | | | 0.1 |

50.1 – 55.0 | | 2 | | | 31,291,936 | | | 2.8 |

55.1 – 60.0 | | 6 | | | 238,149,607 | | | 21.6 |

60.1 – 65.0 | | 19 | | | 309,985,488 | | | 28.1 |

65.1 – 70.0 | | 21 | | | 414,573,838 | | | 37.6 |

70.1 – 75.0 | | 8 | | | 48,419,052 | | | 4.4 |

75.1 – 76.6 | | 1 | | | 13,972,989 | | | 1.3 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 62.5% | | | | | | |

BALLOON LOAN-TO-VALUE RATIO

| | | | | | | | |

Range of Balloon LTV

Ratios (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

28.3 – 30.0 | | 3 | | | 46,592,735 | | | 4.2% |

30.1 – 35.0 | | 1 | | | 3,555,167 | | | 0.3 |

35.1 – 40.0 | | 1 | | | 1,496,253 | | | 0.1 |

40.1 - 45.0 | | 4 | | | 76,856,698 | | | 7.0 |

45.1 – 50.0 | | 10 | | | 146,517,808 | | | 13.3 |

50.1 – 55.0 | | 19 | | | 321,756,694 | | | 29.1 |

55.1 – 60.0 | | 17 | | | 467,619,669 | | | 42.4 |

60.1 – 65.0 | | 5 | | | 29,687,989 | | | 2.7 |

65.1 – 66.6 | | 1 | | | 9,854,052 | | | 0.9 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 52.1% | | | | | | |

AMORTIZATION TYPE

| | | | | | | | |

| Type of Amortization | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

Amortizing Balloon | | 53 | | | $733,294,076 | | | 66.4% |

Interest-only, Amortizing Balloon | | 5 | | | 231,170,000 | | | 20.9 |

Interest-only, Balloon | | 2 | | | 125,500,000 | | | 11.4 |

Amortizing ARD | | 1 | | | 13,972,989 | | | 1.3 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS*

| | | | | | | | |

| IO Term (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

12 | | 1 | | | $5,670,000 | | | 0.5% |

13 – 24 | | 2 | | | 148,500,000 | | | 13.5 |

25 – 36 | | 1 | | | 12,000,000 | | | 1.1 |

49 – 60 | | 1 | | | 65,000,000 | | | 5.9 |

Total: | | 5 | | | $231,170,000 | | | 20.9% |

Weighted Average: | | 34 | | | | | | |

| * | Excludes non-amortizing loans and amortizing loans that do not provide for a partial interest-only period. |

SEASONING

| | | | | | | | |

| Seasoning (months) | | Number of Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of

Cut-off

Date

Balance |

0 | | 34 | | | $482,515,000 | | | 43.7% |

1 – 3 | | 24 | | | 446,002,264 | | | 40.4 |

4 – 6 | | 1 | | | 10,909,118 | | | 1.0 |

13 – 18 | | 2 | | | 164,510,683 | | | 14.9 |

Total: | | 61 | | | $1,103,937,066 | | | 100.0% |

Weighted Average: | | 3 | | | | | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Certain Terms and Conditions |

| V. | Certain Terms and Conditions |

| | |

Interest Entitlements: | | The interest entitlement of each Class of Offered Certificates on each Distribution Date generally will be the interest accrued during the related Interest Accrual Period on the related Certificate Principal Balance or Notional Amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that Class for such Distribution Date as described below. If prepayment interest shortfalls arise from voluntary prepayments (without special servicer consent) on non-specially serviced mortgage loans during any collection period, the Master Servicer is required to make a compensating interest payment to offset those shortfalls, generally up to an amount equal to the portion of its master servicing fees that accrue at three basis pointsper annum. The remaining amount of prepayment interest shortfalls will be allocated to reduce the interest entitlement on all Classes of Certificates (other than the Class X-A and Class X-B Certificates), pro rata, based on their respective amounts of accrued interest for the related Distribution Date. If a Class receives less than the entirety of its interest entitlement on any Distribution Date, then the shortfall will be added to its interest entitlement for the next succeeding Distribution Date. Interest entitlements on the Class E, D, C and B Certificates, in that order, may be reduced by certain Trust Advisor expenses. |

| |

Principal Distribution Amount: | | The Principal Distribution Amount for each Distribution Date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any nonrecoverable advances and interest thereon that are reimbursed to the Master Servicer, the Special Servicer or the Trustee during the related collection period. Nonrecoverable advances and interest thereon are reimbursable from principal collections and advances before reimbursement from other amounts. The Principal Distribution Amount may also be reduced, with a corresponding loss to the Class E, D, C, B and A-S Certificates, then to the Class A-1 and A-2 Certificates and Class A-FX Regular Interest (with any losses on the Class A-1 and A-2 Certificates and Class A-FX Regular Interest allocatedpro rata according to their respective Certificate Principal Balances immediately prior to that Distribution Date), in that order, in connection with certain Trust Advisor expenses to the extent that interest entitlements on the Class B, C, D and E Certificates are insufficient to absorb the effect of the expense on any particular Distribution Date. |

| |

Distributions: | | On each Distribution Date, funds available for distribution from the mortgage loans, net of specified trust fees, expenses and reimbursements will generally be distributed in the following amounts and order of priority (in each case to the extent of remaining available funds): |

| |

| | 1. Class A-1, A-2, X-A and X-B Certificates and Class A-FX Regular Interest: To interest on the Class A-1, A-2, X-A and X-B Certificates and the Class A-FX Regular Interest,pro rata, according to their respective interest entitlements. |

| |

| | 2. Class A-1 and A-2 Certificates and Class A-FX Regular Interest: To principal on the Class A-1 and A-2 Certificates and Class A-FX Regular Interest in the following amounts and order of priority: (i) first, to principal on the Class A-1 Certificates until their Certificate Principal Balance is reduced to zero, up to the Principal Distribution Amount for such Distribution Date; (ii) second, to principal on the Class A-FX Regular Interest (and, therefore, to the holders of the Class A-FX and Class A-FL Certificates) until its Principal Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date; (iii) third, to principal on the Class A-2 Certificates until their Certificate Principal Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date. However, if the Certificate Principal Balance of each and every Class of Principal Balance Certificates other than the Class A-1 and A-2 Certificates and Class A-FX Regular Interest has been reduced to zero as a result of the allocation of Mortgage Loan losses and expenses and any of the Class A-1 and A-2 Certificates and Class A-FX Regular Interest remain outstanding, then the Principal Distribution Amount will be distributed on the Class A-1 and A-2 Certificates and Class A-FX Regular Interest,pro rata, based on their respective outstanding Certificate Principal Balances, until their Certificate Principal Balances have been reduced to zero. |

| |

| | 3. Class A-1 and A-2 Certificates and Class A-FX Regular Interest: To reimburse the holders of the Class A-1 and A-2 Certificates and Class A-FX Regular Interest (and, therefore, to the holders of the Class A-FX and A-FL Certificates),pro rata, for any previously unreimbursed losses (other than certain Trust Advisor expenses) on the mortgage loans that were previously allocated in reduction of the Certificate Principal Balances of such Classes. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Certain Terms and Conditions |

| | |

| | 4. Class A-S Certificates: To make distributions on the Class A-S Certificates as follows: (a) first, to interest on Class A-S Certificates in the amount of the interest entitlement for that Class; (b) next, to the extent of the portion of the Principal Distribution Amount remaining after distributions in respect of principal to each Class with a higher distribution priority (in this case, the Class A-1 and A-2 Certificates and Class A-FX Regular Interest), to principal on Class A-S Certificates until their Certificate Principal Balance is reduced to zero; and (c) next, to reimburse the holders of the Class A-S Certificates for any previously unreimbursed losses (other than certain Trust Advisor expenses) on the mortgage loans that were previously allocated to that Class in reduction of its Certificate Principal Balance. |

| |

| | 5. Class B Certificates: To make distributions on the Class B Certificates as follows: (a) first, to interest on Class B Certificates in the amount of the interest entitlement for that Class; (b) next, to the extent of the portion of the Principal Distribution Amount remaining after distributions in respect of principal to each Class with a higher distribution priority (in this case, the Class A-1, A-2 and A-S Certificates and Class A-FX Regular Interest), to principal on Class B Certificates until their Certificate Principal Balance is reduced to zero; and (c) next, to reimburse the holders of the Class B Certificates for any previously unreimbursed losses (other than certain Trust Advisor expenses) on the mortgage loans that were previously allocated to that Class in reduction of its Certificate Principal Balance. |

| |

| | 6. Class C Certificates: To make distributions on the Class C Certificates as follows: (a) first, to interest on Class C Certificates in the amount of the interest entitlement for that Class; (b) next, to the extent of the portion of the Principal Distribution Amount remaining after distributions in respect of principal to each Class with a higher distribution priority (in this case, the Class A-1, A-2, A-S and B Certificates and Class A-FX Regular Interest), to principal on Class C Certificates until their Certificate Principal Balance is reduced to zero; and (c) next, to reimburse the holders of the Class C Certificates for any previously unreimbursed losses (other than certain Trust Advisor expenses) on the mortgage loans that were previously allocated to that Class in reduction of its Certificate Principal Balance. |

| |

| | 7. After the Class A-1, A-2, A-S, B and C Certificates and Class A-FX Regular Interest are paid all amounts to which they are entitled, the remaining funds available for distribution will be used to pay interest, principal and loss reimbursement amounts (other than certain Trust Advisor expenses) on the Class D, E, F, G and H Certificates sequentially in that order in a manner analogous to the Class C Certificates. |

| |

| | 8. Amounts distributed in respect of the Class A-FX Regular Interest will generally be allocated between the Class A-FX and A-FL Certificates in accordance with their class percentage interests. |

| |

Allocation of Yield Maintenance and Prepayment Premiums: | | If any yield maintenance charges and prepayment premiums are collected during any particular collection period with respect to any mortgage loan, then on the distribution date corresponding to that collection period, the certificate administrator will pay a portion of the yield maintenance charges and prepayment premiums (net of liquidation fees payable therefrom) in the following manner: (1)pro rata, between the (x) the group (the “YM Group A”) of the Class A-1, A-2, A-S and X-A Certificates and the Class A-FX Regular Interest, and (y) the group (the “YM Group B” and, collectively with the YM Group A, the “YM Groups”) of the Class B, C, D, E and X-B Certificates, based upon the aggregate amount of principal distributed to the classes of principal balance certificates in each YM Group for that distribution date, and (2) among the classes of certificates in each YM Group, in the following manner, up to an amount equal to the product of (a) the yield maintenance or prepayment premium allocated to such YM Group, (b) the related Base Interest Fraction (as defined in the Free Writing Prospectus), and (c) a fraction, which in no event may be greater than 1.0, the numerator of which is equal to the amount of principal distributed to the holder(s) of such class for that distribution date, and the denominator of which is the aggregate amount of principal distributed to all the certificates in that YM Group for that distribution date. Any yield maintenance charges or prepayment premium allocated to such YM Group remaining after such distributions will be distributed to the Class X-A and/or Class X-B Certificates, as applicable, in such YM Group. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| | |

WFRBS Commercial Mortgage Trust 2012-C7 | | Certain Terms and Conditions |

| | |

| | No prepayment premiums or yield maintenance charges will be distributed to the holders of the Class F, G, H, V or R Certificates. The holders of the Class X-B Certificates will be entitled to all prepayment premiums and yield maintenance charges collected after the Class A-1, A-2, A-S, B, C, D and E Certificates and Class A-FX Regular Interest (and, therefore, the Class A-FX and Class A-FL Certificates) are retired. For a description of when prepayment premiums and yield maintenance charges are generally required on the mortgage loans, see Annex A-1 to the Free Writing Prospectus. See also “Risk Factors – Risks Relating to Enforceability of Yield Maintenance Charges, Prepayment Premiums or Defeasance Provisions” in the prospectus attached to the Free Writing Prospectus. Prepayment premiums and yield maintenance charges will be distributed on each Distribution Date only to the extent they are actually received on the mortgage loans as of the related Determination Date. |

| |