Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 8 DATED OCTOBER 14, 2015

TO THE PROSPECTUS DATED APRIL 27, 2015

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 27, 2015, as supplemented by Prospectus Supplement No. 1, dated May 12, 2015, Prospectus Supplement No. 2, dated May 15, 2015, Prospectus Supplement No. 3, dated June 5, 2015, Prospectus Supplement No. 4, dated July 10, 2015, Prospectus Supplement No. 5, dated July 30, 2015, Prospectus Supplement No. 6, dated August 12, 2015, and Prospectus Supplement No. 7, dated September 9, 2015 (the “Prospectus”). Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purposes of this Supplement are as follows:

| A. | To provide information regarding our public offering; |

| B. | To provide information regarding distributions declared; and |

| C. | To update the section of the Prospectus titled “Business.” |

| A. | Status of Our Public Offering |

As of October 12, 2015, we had raised gross proceeds of approximately $120.0 million from the sale of approximately 12.5 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan.

| B. | Declaration of Distributions |

On September 22, 2015, with the authorization of our board of managers, the Company declared distributions for all classes of units for the period from September 1 through September 30, 2015. These distributions were calculated based on unitholders of record for each day in an amount equal to $0.00197808 per unit per day (less the distribution fee with respect to Class C units). On October 1, 2015, $434,227 of these distributions were paid in cash and on September 30, 2015, $268,521 were reinvested in the Company’s units for those investors participating in the Company’s unit Distribution Reinvestment Plan. Some or all of the Company’s distributions have been and may continue to be paid from sources other than cash flow from operations, such as capital contributions from the Sponsor, cash resulting from a waiver or deferral of fees, and/or proceeds from this offering.

| C. | Update to the Section Titled “Business” |

| 1. | The following information updates and supplements the “Business—Investments—Overview” section of the Prospectus to provide certain information regarding the Company’s investment portfolio as of September 30, 2015: |

Investments

Since the Company commenced operations and through September 30, 2015, the Company has funded in excess of $180.4 million in in aggregate investments, including $26.5 million in short-term investments. Of the aggregate investment amount, the Company has received $84.5 million in full aggregate transaction repayments from existing and exited trade finance and term loan facilities. Of the aggregate transaction repayment amount, approximately $27.1 million represents transactions of trade finance and term loan facilities that are closed and no longer part of the Company’s portfolio.

As of September 30, 2015, the Company had the following investments:

| | | | | | | | | | | | | | | | | | | | | | |

| Investment Portfolio |

| Description | | Sector | | Country | | Investment

Type | | | Maturity1 | | Interest

Rate2 | | Total Loan

Commitment3 | | | Total Amount

Outstanding4 | | | Primary

Impact

Objective |

| Agriculture Distributor | | Farm-Product Raw

Materials | | Argentina | |

| Trade

Finance |

| | 12/15/2015 | | 9.00% | | | $7,000,000 | | | | $6,000,000 | | | Job Creation |

| Beef Exporter | | Meat Products | | Argentina | |

| Trade

Finance |

| | 12/15/2015 | | 11.98% | | | $7,000,000 | | | | $6,000,000 | | | Job Creation |

| Cement Distributor | | Cement, Hydraulic | | Kenya | |

| Trade

Finance |

| | 9/30/2015 | | 14.75% | | | $7,000,000 | | | | $5,000,000 | | | Job Creation |

| Construction Materials Distributor | | Hardware,

Plumbing, and

Heating Equipment | | South

Africa | |

| Trade

Finance |

| | 7/1/2015 | | 12.75% | | | $750,000 | | | | $253,306 | | | Job Creation |

| Consumer Goods Distributor5 | | Groceries and

Related Products | | Namibia | |

| Trade

Finance |

| | 3/3/2016 | | 12.00% | | | $2,000,000 | | | | $2,000,000 | | | Job Creation |

| Dairy Co-Operative | | Dairy Products | | Argentina | |

| Trade

Finance |

| | 2/25/2016 | | 10.85% | | | $6,000,000 | | | | $6,000,000 | | | Job Creation |

| Diaper Manufacturer | | Converted Paper and

Paperboard Products | | Peru | | | Term Loan | | | 6/15/2017 | | 15.57%6 | | | $2,750,000 | | | | $2,750,000 | | | Job Creation |

| Electronics Assembler7 | | Communications

Equipment | | South

Africa | |

| Trade

Finance |

| | 1/29/2016 | | 13.00% | | | $9,500,000 | | | | $6,388,975 | | | Job Creation |

| Farm Supplies Distributor | | Miscellaneous Non-

Durable Goods | | Zambia | |

| Trade

Finance |

| | 10/25/2015 | | 12.22% | | | $10,000,000 | | | | $9,500,000 | | | Job Creation |

| Farm Supplies Wholesaler | | Miscellaneous Non-

Durable Goods | | South

Africa | |

| Trade

Finance |

| | 12/3/2015 | | 12.50% | | | $1,500,000 | | | | $1,250,000 | | | Agricultural

Productivity |

| Fish Processor & Exporter | | Commercial Fishing | | Ecuador | |

| Trade

Finance |

| | 6/19/2016 | | 9.00% | | | $2,000,000 | | | | $1,946,485 | | | Job Creation |

| Fruit & Nut Distributor | | Groceries and

Related Products | | South

Africa | |

| Trade

Finance |

| | 5/22/2015 | | 17.50% | | | $1,250,000 | | | | $689,088 | | | Job Creation |

| Industrial Chemicals Distributor8 | | Chemicals and

Allied Products | | South

Africa | |

| Trade

Finance |

| | 11/24/2015 | | 13.00% | | | $2,000,000 | | | | $1,475,570 | | | Job Creation |

| Integrated Steel Producer | | Steel Works, Blast

Furnaces, And

Rolling And

Finishing Mills | | Zambia | |

| Trade

Finance |

| | 2/14/2016 | | 13.00% | | | $6,000,000 | | | | $6,000,000 | | | Job Creation |

| Marine Logistics Provider | | Services Incidental

to Water

Transportation | | Nigeria | | | Term Loan | | | 8/31/2020 | | 15.82%9 | | | $16,050,000 | | | | $12,600,000 | | | Capacity-

Building |

| Meat Processor | | Meat Products | | South

Africa | |

| Trade

Finance |

| | 1/28/2016 | | 14.50% | | | $2,800,000 | | | | $1,446,432 | | | Job Creation |

| Mine Remediation Company | | Metal Mining

Services | | South

Africa | |

| Trade

Finance |

| | 2/2/2016 | | 17.50% | | | $3,250,000 | | | | $2,418,284 | | | Job Creation |

| Oilseed Distributor10 | | Fats and Oils | | Argentina | |

| Trade

Finance |

| | 2/3/2016 | | 8.89% | | | $3,100,000 | | | | $3,100,000 | | | Job Creation |

| Rice Producer | | Cash Grains | | Tanzania | |

| Trade

Finance |

| | 10/26/2015 | | 11.50% | | | $3,900,000 | | | | $3,900,000 | | | Job Creation |

| Sugar Producer | | Field Crops, Except

Cash Grains | | Brazil | | | Term Loan | | | 5/15/2017 | | 17.43%11 | | | $3,000,000 | | | | $3,000,000 | | | Capacity-

Building |

| Textile Distributor12 | | Apparel, Piece

Goods, and Notions | | South

Africa | |

| Trade

Finance |

| | 12/16/2015 | | 15.00% | | | $2,500,000 | | | | $1,174,080 | | | Job Creation |

| | | |

Investment Portfolio Total | | | $99,350,000 | | | | $82,892,220 | | | |

|

Short-Term Investments13 |

| | | | | | | | |

| Agricultural Products Exporter14 | | Farm-Product

Raw Materials | | Singapore | | | Short-Term | | | 8/22/2015 | | 11.50% | | | $10,000,000 | | | | $10,000,000 | | | N/A |

| | | |

Short-Term Investment Total | | | $10,000,000 | | | | $10,000,000 | | | |

| | | |

Investment Portfolio and Short-Term Investment Totals | | | $109,350,000 | | | | $92,892,220 | | | |

1The Company’s trade finance borrowers may be granted flexibility with respect to repayment relative to the stated maturity date to accommodate specific contracts and/or business cycle characteristics. This flexibility in each case is agreed upon between the Company and the sub-advisor and between the sub-advisor and the borrower.

2 Interest rates are as of September 30, 2015. Interest rates include contractual rates and accrued fees where applicable.

3The total loan commitment represents the maximum amount that can be borrowed under the agreement. The actual amount drawn on the loan by the borrower may change over time. Loan commitments are subject to availability of funds and do not represent a contractual obligation to provide funds to a borrower.

4The total amount outstanding represents the actual amount borrowed under the loan as of September 30, 2015. In some instances where there is a $0 balance, the borrower may have paid back the original amount borrowed under a trade finance facility and under an agreement, may borrow again.

5 On September 8, 2015, the Company funded $1,000,000 as part of an existing $2,000,000 purchase and repurchase trade finance facility at a fixed interest rate of 12.00% to a Namibian consumer goods importer and distributor. The transaction, set to mature on March 3, 2016, is secured by rice and sugar inventory. The borrower anticipates that the Company’s financing will support job creation in a region noted for its high unemployment.

6 The interest rate includes 2.50% of deferred interest.

7 Between September 8 and September 30, 2015, the Company funded four transactions totaling $4,099,713 as a part of two separate trade finance facilities with a total commitment size of $9,500,000 to a South African electronics company. With a fixed interest rate of 13.00%, all transactions are set to mature between January 7 and January 29, 2016 and are secured by receivables as well as specific inventory being imported into South Africa from Asia. The borrower anticipates that the Company’s financing will support employment generation. Since the publication of Supplement No. 7, dated September 9, 2015, the Company has changed the borrower’s unique identifier name from “Mobile Phone Assembler” to “Electronics Assembler.”

8 On September 9, 2015, the Company funded $1,000,000 as part of a new $2,000,000 purchase and repurchase trade finance facility at a fixed interest rate of 13.00% to a South African industrial chemicals distributor. The transaction, set to mature on November 24, 2015 is secured by specific inventory. The borrower anticipates that the Company’s financing will support job creation. . Since the publication of Supplement No. 7, dated September 9, 2015, the Company has changed the borrower’s unique identifier name from “Farm Supplies Importer” to “Industrial Chemicals Distributor.”

9The interest rate is a variable rate of one month Libor +10.5% plus 5.13% in deferred fixed interest.

10 Since the publication of Supplement No. 7, dated September 9, 2015, the Company has changed the borrower’s unique identifier name from “Soybean Distributor” to “Oilseed Distributor.”

11 The interest rate includes 5.00% of penalty interest because the borrower has missed four interest payments. On August 27, 2015, the Company was informed that the borrower had filed for judicial recuperation with the local court in Brazil. The filing allows the borrower time to present a comprehensive plan of restructure to the Company.

12 On September 17, 2015, the Company funded $316,322 as part of an existing $2,500,000 revolving senior secured trade finance facility at a fixed interest rate of 15.00% to a South African textile distributor. Set to mature on December 16, 2015, the transaction is secured by specific inventory being imported into South Africa from Asia. The borrower anticipates that the Company’s financing will support employment generation.

13Short-Term Investments are defined as investments that generally meet the standard underwriting guidelines for trade finance and term loan transactions and that also have the following characteristics: (1) maturity of less than one year, (2) loans to borrowers to whom, at the time of funding, the Company does not expect to re-lend. Impact data is not tracked for Short-term Investments.

14The transaction is secured by specific collateral held by the borrower’s subsidiaries in Kenya, Tanzania, and Zambia.

As of September 30, 2015 the Company had exited the following investments:

| | | | | | | | | | | | | | | | | | | | | | |

| Investment Portfolio |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | Transaction

Amount | | | Payoff

Date | | | Internal

Rate of

Return

(“IRR”)1 | | | Primary

Impact

Objective |

Agricultural Supplies Producer | | Agricultural

Chemicals | | South

Africa | | Trade

Finance | | 10/15/2014 | | | $8,196,189 | | | | 8/14/2015 | | | | 13.02 | % | | Job Creation |

| Candle Distributor | | Miscellaneous

Manufacturing

Industries | | South

Africa | | Trade

Finance | | 9/1/2014 | | | $1,400,000 | | | | 9/16/2015 | | | | 14.27 | % | | Job Creation |

| Electronics Retailer | | Radio,

Television,

Consumer

Electronics,

and Music

Stores | | Indonesia | | Term Loan | | 7/26/2013 | | | $5,000,000 | | | | 6/17/2014 | | | | 19.59 | % | | Access to

Finance |

| Fertilizer Distributor | | Agricultural

Chemicals | | Zambia | | Trade

Finance | | 7/17/2014 | | | $3,000,000 | | | | 11/4/2014 | | | | 12.65 | % | | Job Creation |

| Food Processor | | Groceries and

Related

Products | | Peru | | Term Loan | | 3/25/2014 | | | $576,000 | | | | 11/28/2014 | | | | 14.01 | % | | Job Creation |

| Frozen Seafood Exporter | | Groceries and

Related

Products | | Ecuador | | Trade

Finance | | 6/17/2013 | | | $240,484 | | | | 5/14/2014 | | | | 13.49 | % | | Job Creation |

| Insulated Wire Manufacturer | | Rolling,

Drawing, and

Extruding of

Nonferrous

Metals | | Peru | | Trade

Finance | | 5/2/2014 | | | $1,991,000 | | | | 12/2/2014 | | | | 8.43 | % | | Job Creation |

| International Tuna Exporter | | Groceries and

Related

Products | | Ecuador | | Trade

Finance | | 7/17/2013 | | | $1,000,000 | | | | 10/9/2013 | | | | 13.58 | % | | Job Creation |

| Rice & Bean Importer | | Groceries and

Related

Products | | South

Africa | | Trade

Finance | | 7/7/2014 | | | $1,000,000 | | | | 8/5/2015 | | | | 12.97 | % | | Job Creation |

| Seafood Processing Company | | Miscellaneous

Food

Preparations

and Kindred

Products | | Ecuador | | Trade

Finance | | 6/19/2013 | | | $496,841 | | | | 7/1/2013 | | | | 13.44 | % | | Job Creation |

| Timber Exporter | | Sawmills and

Planing Mills | | Chile | | Trade

Finance | | 7/3/2013 | | | $915,000 | | | | 6/12/2014 | | | | 10.25 | % | | Job Creation |

| Waste Management Equipment Distributor | | Machinery,

Equipment, and

Supplies | | South

Africa | | Trade

Finance | | 2/13/2015 | | | $310,752 | | | | 5/15/2015 | | | | 20.19 | % | | Equality &

Empowerment |

| | | | |

| Investment Portfolio Totals | | | $24,126,266 | | | | | | | | | | | |

|

| Short-Term Investments1 |

| Financial Services Provider | | Miscellaneous

Business Credit

Institutions | | Mauritius | | Short-Term | | 9/23/2014 | | | $3,000,000 | | | | 11/17/2014 | | | | 15.94 | % | | N/A |

| | | | |

| Short-Term Investment Total | | | $3,000,000 | | | | | | | | | | | |

| | |

Investment Portfolio and Short-Term Investment Totals | | | $27,126,266 | | | | |

1Given that the loan has been paid off, this investment is no longer part of the Company’s portfolio. The internal rate of return is defined as the gross average annual return earned through the life of an investment. The internal rate of return was calculated by our Advisor (unaudited) as the investment (loan advance) was made and cash was received (principal, interest and fees).

Certain Portfolio Characteristics1

| | | | |

Total Assets (est.) | | | $105,500,000 | |

Current Loan Commitments | | | $99,350,000 | |

Leverage | | | 0% | |

Weighted Average Portfolio Loan Size | | | $4,824,219 | |

Weighted Average Portfolio Duration | | | 0.63 years | |

Weighted Average Position Yield | | | 13.04% | |

USD Denominated | | | 100% | |

Senior Secured First-Lien | | | 100% | |

Countries2 | | | 10 | |

Sectors2 | | | 18 | |

Top Five Investments by Percentage

| | | | | | |

| Company Description | | Country | | % of Total Assets | |

Marine Logistics Provider | | Nigeria | | | 11.9% | |

Farm Supplies Distributor | | Zambia | | | 9.0% | |

Electronics Assembler | | South Africa | | | 6.1% | |

Agriculture Distributor | | Argentina | | | 5.7% | |

Beef Exporter | | Argentina | | | 5.7% | |

1All information provided in this section, with the exception of the Total Asset (est.) figure, pertains exclusively to the Company’s Investment Portfolio and therefore does not include the Company’s Short-Term Investments.

2 This represents all countries/sectors where the Company currently has a loan commitment. Due to the revolving debt nature of trade finance facilities and the timing of funding, it is possible that certain commitments currently have a zero outstanding balance and would therefore not be represented in the country/sector allocation charts, which represents invested capital.

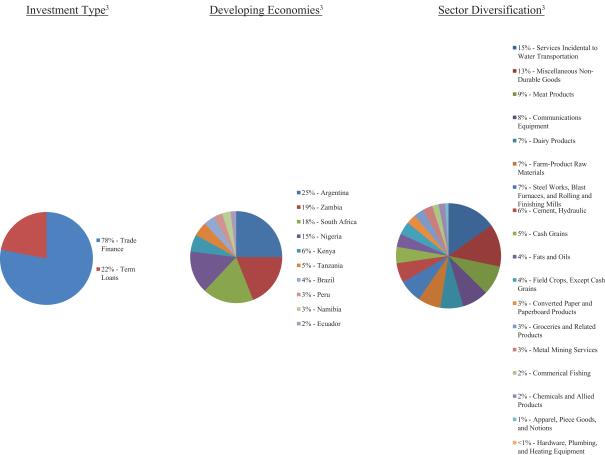

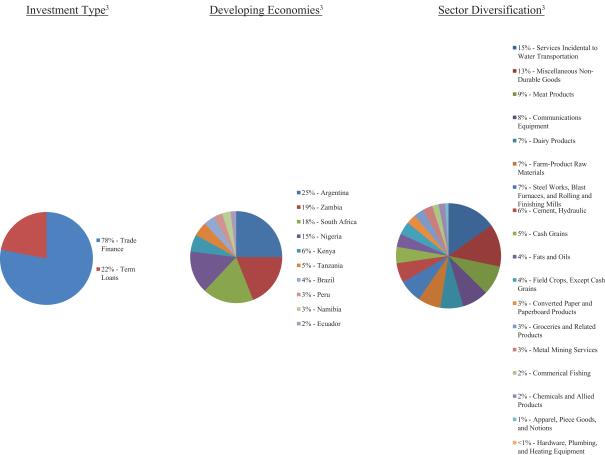

3The above charts represent investment type, developing economy, and sector diversification as a percentage of the total amount outstanding of the Company’s Investment Portfolio.

| 2. | The following disclosure supplements the “Business—Investments—Overview—Impact Overview” section of the Prospectus to provide an impact overview of the Company’s investment portfolio as of September 30, 2015: |

The Company’s borrower companies currently employ a total of 11,930 employees

| | | | |

Percentage of the Borrowers that: | | | | |

Comply with local environmental, labor, health, safety and business laws, standards and regulations | | | 100 | % |

Demonstrate their positive impact on the community through community service and/or community donations | | | 71 | % |

Commit to working towards implementing international environmental and health and safety best practices | | | 100 | % |

Implement environmentally sustainable practices including energy savings, waste reduction and/or water conservation | | | 81 | % |

Top 5 Borrower Impact Objectives | | | | |

1. Job Creation | | | 90 | % |

2. Agricultural Productivity & Food Security | | | 24 | % |

3. Capacity-Building | | | 10 | % |

4. Wage Increase | | | 10 | % |

5. Health Improvement | | | 5 | % |

Top 5 Borrower Environmental and Social Practices | | | | |

1. Waste Reduction | | | | |

2. Charitable Donations | | | | |

3. Fair Hiring and Recruiting | | | | |

4. Energy Savings | | | | |

5. Maternity/Paternity Leave | | | | |

1 All information provided in this section pertains exclusively to the Company’s Investment Portfolio and therefore does not include the Company’s Short-Term Investments.

| 3. | The following disclosures are inserted in the section titled “Business—Investments—Investment Spotlights” on page 79 of the Prospectus: |

Construction Materials Distributor

Investment Overview

| | |

Investment Type | | Senior Secured Trade Finance |

Structure | | Inventory Financing |

Facility Amount1 | | $750,000 |

Interest Rate | | 12.75% |

Approximate Repayment Period2 | | < 1 year |

Sector | | Hardware, Plumbing, and Heating Equipment |

Collateral Coverage Ratio3 | | ³1.17x |

Environmental, Social, and Governance Screens | | Compliant |

Primary Impact Objective | | Job Creation |

1 The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time.

2 Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year.

3 The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility.

Borrower Background

The Company has provided financing to a construction materials distributor in South Africa. Established in 2010, the borrower imports and distributes piping, fittings, and related hardware and tools for its retail and commercial hardware customers throughout South Africa. The borrower has competitively positioned itself as the country’s exclusive distributor of products from a globally recognized piping systems industry leader with

over 60 internationally recognized certifications and a market footprint in more than 100 countries. The borrower reinforces this high level of product quality by importing and distributing products that have been certified by the South African Bureau of Standards. The Company’s financing provides the borrower with timely and flexible short-term liquidity for the import of plastic piping and fittings inventory to support business expansion efforts, which the borrower anticipates will also lead to increased employment opportunities. Additionally, the borrower:

| | • | | Maintains its competitive edge in product quality, the borrower holds a South African Bureau of Standards certification for its multilayer piping system, including the underlying piping and fitting component parts. |

| | • | | Has piping and fitting products the support quality-of-life and energy savings applications, such as solar water heating systems, heat pumps, and air-conditioning units for commercial and residential clients. |

| | • | | Is a responsible corporate citizen and supporter of local community development as it financially supports various employee-selected charities. |

Electronics Assembler

Investment Overview

| | | | |

Investment Type | | Senior Secured Trade Finance | | |

Structure | | Purchase and Repurchase Loan Facility | | |

Facility Amount1 | | $9,500,000 | | |

Interest Rate | | 13.00% | | |

Approximate Repayment Period2 | | < 1 year | | |

Sector | | Communications Equipment | | |

Collateral Coverage Ratio3 | | ³1.25x | | |

Environmental, Social, and Governance Screens | | Compliant | | |

Primary Impact Objective | | Job Creation | | |

1The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time.

2Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year.

3The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility.

Borrower Background

With a 2014 GDP of $349.8 billion and a population of approximately 54 million, South Africa is the second largest economy in Sub-Saharan Africa and 33rd largest in the world, according to the World Bank. During the post-apartheid era (1994-present), South Africa has achieved marked growth in its natural resource, financial, and communications sectors. However, these advances have not equally benefitted all demographic segments of the country.

To reduce inequality, the South African public and private sectors have collaborated to create a model of inclusive economic growth that empowers previously disadvantaged populations through job creation and training initiatives. The Company supports this model by providing capital to established small and medium-sized enterprises in South Africa that are both commercially viable and that seek to improve the livelihoods of their employees and the communities in which they operate.

Between August and September 2015, the Company extended two separate trade finance facilities with a total commitment size of up to $9,500,000 to a company that specializes in the production and assembly of electronic components for the telecom, utility metering, and data acquisition industries. The borrower is utilizing the Company’s financing to support the expansion of its telecom division through the purchase and import of manufactured cell phone and television components for assembly at the company’s facility outside of Johannesburg. The company’s telecom division employs 200 workers, 95% of whom belong to previously disadvantaged groups, including women, who represent 90% of their labor force.

Upon purchase and import of all component parts, the borrower completes the final assembly of cellular phone products for purchase and distribution to the largest telecom operater in the region. Additionally, the borrower supplies finished television products to a leading South African government telecom agency responsible for promoting universal telecom access and services. Offered at affordable price points, the borrower’s finished cellular phone and television products aim to satisfy the growing demand of South Africa’s low-income population for access to modern communication and technology.

Fish Processor and Exporter

Investment Overview

| | | | |

Investment Type | | Senior Secured Trade Finance | | |

Structure | | Revolving Facility | | |

Facility Amount1 | | $2,000,000 | | |

Interest Rate | | 9.00% | | |

Approximate Repayment Period2 | | < 1 year | | |

Sector | | Commercial Fishing | | |

Collateral Coverage Ratio3 | | ³1.25x | | |

Environmental, Social, and Governance Screens | | Compliant | | |

Primary Impact Objective | | Job Creation | | |

1The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time.

2Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year.

3The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility.

Borrower Background

Established in 1973, the borrower is engaged in the processing and sale of sardine and dolphin-safe tuna products for domestic and international consumption, primarily in the U.S., Europe, and Japan. As a locally-owned family business with over 40 years of experience, the borrower is a recognized leader in the Ecuadorian tuna industry. The Company’s financing provides the company with the necessary funds to meet its 2015 production and sales projections while supporting further employment generation. The facility is backed by purchase agreements under pre-existing sales contracts.

Integrated Steel Producer

Investment Overview

| | |

Investment Type | | Senior Secured Trade Finance |

Structure | | Purchase and Repurchase Loan Facility |

Facility Amount1 | | $6,000,000 |

Interest Rate | | 13.00% |

Approximate Repayment Period2 | | < 1 year |

Sector | | Steel Works, Blast Furnaces, And Rolling And Finishing Mills |

Collateral Coverage Ratio3 | | ³20x |

Environmental, Social, and Governance Screens | | Compliant |

Primary Impact Objective | | Job Creation |

1The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time.

2Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year.

3The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility.

Borrower Background

Founded in 1989, the borrower is a wholly Zambian-owned company engaged in the manufacturing of iron and steel products. As the first integrated steel and iron manufacturer in Zambia, the borrower seeks to

strengthen the country’s infrastructure by reducing dependence on expensive imports. The Company’s financing provides the company with a source of short-term capital to purchase scrap metal and ferrous alloy inputs, and support job creation as well as equality and empowerment initiatives in the workplace. The facility is structured as part of a purchase and repurchase agreement and is secured by inventory and a first security interest over the borrower’s fixed assets.

Mine Remediation Company

Investment Overview

| | | | |

Investment Type | | Senior Secured Inventory Finance | | |

Structure | | Revolving Facility | | |

Facility Amount1 | | $3,250,000 | | |

Interest Rate | | 17.50% | | |

Approximate Repayment Period2 | | < 1 year | | |

Sector | | Metal Mining Services | | |

Collateral Coverage Ratio3 | | ³2.00x | | |

Environmental, Social, and Governance Screens | | Compliant | | |

Primary Impact Objective | | Job Creation | | |

1The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time.

2Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year.

3The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility.

Borrower Background

The Company has provided financing to a company in South Africa created to extract metal tailings and remediate the land site of a recently shuttered zinc mine. The zinc mine site and its accompanying refinery began operations in 1968, and were shut down in 2013 by the South African company that managed the mine’s extraction and production operations. The borrower acquired the land site in December 2013 and was granted the rights to extract and process gold, silver, lead, and iron tailings for sale to trading companies located in South Africa, and Europe. As a part of its tailings extraction activity, the borrower is required to remediate the land site and has already begun the process by establishing a mine rehabilitation fund, dismantling the shuttered mine’s refinery, disposing of mining equipment, and maintaining a sophisticated, onsite laboratory that allows for continuous monitoring of ground water contamination levels. The Company’s financing enables the borrower to recover and process the tailings and supports the borrower’s objective of creating new mine servicing and remediation jobs. Once the tailings extraction is complete and the site is deemed to be completely rehabilitated by South African regulatory authorities, the borrower intends to donate the property to the community for affordable housing developments. Additionally, the borrower:

| | • | | Engages in general surface reclamation, conversion of previously disturbed land to a usable state, and continuous groundwater monitoring and cleansing activities through its water treatment plant. |

| | • | | Has created 45 new jobs and anticipates that it will create an additional 120 new employment opportunities in 2015 in a region of South Africa characterized by an unemployment rate of approximately 25%, according to the Government of South Africa. |

| | • | | Supports a community development facility and a house which has been converted to a center for HIV-infected children. |

| 4. | The following disclosure replaces the “Cement Distributor” description in the section titled “Business—Investments—Investment Spotlights” on page 81 of the Prospectus: |

Cement Distributor

Investment Overview

| | | | |

Investment Type | | Senior Secured Inventory and Receivable Finance | | |

Structure | | Revolving Facility | | |

Facility Amount1 | | $7,000,000 | | |

Interest Rate | | 14.25% | | |

Approximate Repayment Period2 | | < 1 year | | |

Sector | | Cement Hydraulic | | |

Collateral Coverage Ratio3 | | ³1.80x | | |

Environmental, Social, and Governance Screens | | Compliant | | |

Primary Impact Objective | | Job Creation | | |

1The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time.

2Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year.

3The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility.

Borrower Background

The Company has provided financing to a cement producer and distributor in Kenya. Incorporated in 2008, the borrower runs a state-of-the-art cement grinding facility that transforms cement clinker into finished Portland and Pozzolanic cement varieties. The borrower’s clients range from homeowners to large project sponsors engaged in small, medium, and large-scale construction activities. The borrower is the only African majority-owned cement manufacturer in Kenya, and as a private company, lacks adequate access to timely and competitive financing. With the objective of becoming the leading cement producer and distributor in the greater Sub-Saharan Africa region, the borrower was seeking short-term credit to purchase additional cement clinker inputs to meet increasing demand for its finished cement products. The borrower anticipates that the Company’s financing will enable it to execute on its growth objectives, support increased employment opportunities, and further develop its reputation as a reliable and high-quality cement producer and distributor. Additionally, the borrower:

| | • | | Utilizes state-of-the-art roller press, separator, energy storing capacitor bank, and automated operation technologies, the borrower seeks to be eco-friendly as its facility is considered the most energy-efficient cement grinding plant in the region. |

| | • | | Is mindful of its impact on the environment, the borrower is in the process of implementing an ISO 14000 Environmental Management System in 2015 and monitors its particulate matter emissions on a daily basis to ensure adherence to World Health Organization guidelines. Additionally, the borrower proactively benchmarks, monitors, and tracks its CO2 emissions on a monthly basis with the intent to improve the level of plant emissions. The borrower also funds tree seedling plantings as an emission offsetting initiative. |

| | • | | Provides comprehensive benefits to its employees, including payment of school fees for employees’ children, retirement plan matching contributions, group life insurance, subsidized meal plans, annual medical examinations, and daily employee transportation. |

| | • | | Actively contributes to its surrounding communities through supporting sustainable health, environmental, educational and recreational initiatives. |

| 5. | The following disclosure replaces the “Waste Management Equipment Distributor” description in Supplement 4 to the Prospectus and is inserted in the section titled “Business—Investments—Overview of Exited Investments-Investment Spotlights of Exited Positions” on page 91 of the Prospectus: |

Waste Management Equipment Distributor

Investment Overview

| | | | |

Investment Type | | Senior Secured Trade Finance | | |

Structure | | Purchase and Repurchase Loan Facility | | |

Facility Amount1 | | $500,000 | | |

Interest Rate | | 19.50% | | |

Approximate Repayment Period2 | | < 1 year | | |

Sector | | Machinery, Equipment, and Supplies | | |

Collateral Coverage Ratio3 | | ³1.17x | | |

Environmental, Social, and Governance Screens | | Compliant | | |

Primary Impact Objective | | Equality & Empowerment | | |

1The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time.

2Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year.

3The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility.

Borrower Background

The Company has provided financing to a waste management equipment distributor in South Africa. Established in 2003, the borrower imports and distributes a wide variety of machinery and equipment for public and private sector clients throughout the country, ranging from rock crushers and shrub mulchers to wood chippers and tire shredders. The borrower aims to provide its customers with highly innovative and state-of-the-art equipment that reduces waste and minimizes environmental impact. The borrower consistently strives to satisfy demand through customized solutions in line with the latest technologies and international trends in the global marketplace. The borrower is a small locally-owned enterprise with positive growth prospects and a customer-centric approach to doing business. In support of the borrower’s growth, the Company has provided innovative and flexible financing that will afford the borrower short-term liquidity needed to purchase and import rock crusher equipment for the City of Johannesburg’s exclusive recycling and waste management service provider. The Company’s loan will also support the borrower’s efforts to promote the participation of women and minorities in the work place. Additionally, the borrower:

| | • | | Imports equipment that directly supports the City of Johannesburg’s efforts in executing its Growth and Development 2040 strategy and becoming a city that provides sustainability for citizens. |

| | • | | Focuses on gender and minority equality and empowerment and implements human resource policies that promote fair hiring and recruitment, fair career advancement, fair compensation, and prevent sexual harassment. |

| | • | | Is one of only a few black-owned and operated companies that provide environmental management and waste management solutions in South Africa. |

| | • | | Provides financial support to local social service charities that serve underprivileged and at-risk children and women throughout South Africa. |