UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

| x | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-54726

Sears Canada Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Canada

(Jurisdiction of incorporation or organization)

290 Yonge Street, Suite 700, Toronto, Ontario, Canada, M5B 2C3

(Address of principal executive office)

Klaudio Leshnjani

Senior Vice-President and General Counsel

290 Yonge Street

Suite 700

Toronto, Ontario, Canada M5B 2C3

Tel: 416 941-4421

Fax: 416 941-2321

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Copies to:

| | | | |

Andrew J. Beck

Torys LLP

1114 Ave of the Americas, 23rd Floor New York, New York 10036

(212) 880-6010 | | | | Patricia A. Koval Torys LLP Suite 3000, TD Centre

79 Wellington Street West

Toronto, Ontario, Canada

M5K 1N2 (416) 865-7356 |

Dane A. Drobny Senior Vice President, General Counsel and Corporate Secretary Sears Holdings Corporation 3333 Beverly Road Hoffman Estates, Illinois 60179 (847) 286-2500 | | Kevin D. Cramer Osler, Hoskin & Harcourt LLP 620 8th Avenue, 36th Floor New York, New York 10018 (212) 867-5800 | | William H. Hinman, Jr. Simpson Thacher & Bartlett LLP 2550 Hanover Street Palo Alto, California 94304 (650) 251–5000 |

Securities registered or to be registered pursuant to Section 12(b) of the Act. None

| | |

Title of each class | | Name of each exchange on which registered |

| N/A | | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Not applicable

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ¨

TABLE OF CONTENTS

ii

iii

INTRODUCTION AND USE OF CERTAIN TERMS

We have prepared this Registration Statement on Form 20-F, or this Form 20-F, using a number of conventions, which you should consider when reading the information contained herein. Unless otherwise indicated or the context otherwise requires, in this Form 20-F the disclosure assumes that the spin-off has been completed and references to:

| | • | | “we”, “us” and “our”, “Sears Canada” or “the Company” are to Sears Canada Inc. and its subsidiaries, together with its investments in joint venture interests; |

| | • | | an “affiliate” of any person are to any other person that, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such person; |

| | • | | “common shares” are to the common shares, no par value, of Sears Canada Inc.; |

| | • | | “ESL” are to ESL Investments, Inc. and its investment affiliates, including Edward S. Lampert; |

| | • | | “Fiscal 2009”, “Fiscal 2010”, “Fiscal 2011” and “Fiscal 2012” are to the 52-week periods ended January 30, 2010, January 29, 2011, January 28, 2012 and the 53-week period ending February 2, 2013, respectively; |

| | • | | “fiscal year” are to the 52 or 53-week period ending on the Saturday closest to January 31; |

| | • | | “Q1 2011” and “Q1 2012” are to the 13-week periods ended April 30, 2011 and April 28, 2012, respectively; |

| | • | | “Sears Holdings” are, collectively, to Sears Holdings Corporation, our controlling shareholder and a Delaware corporation, and its subsidiaries, excluding Sears Canada; |

| | • | | “Sears Roebuck” are to Sears, Roebuck and Co., a New York corporation and wholly-owned subsidiary of Sears Holdings Corporation; |

| | • | | “spin-off” are to the special dividend of a portion of our common shares held by Sears Holdings to its stockholders, as described under Item 4.A. “Information on the Company – History and Development of the Company – The Spin-Off”; |

| | • | | “Spin-Off Date” are to 11:59 p.m., New York City time on , 2012, when the spin-off will become effective; and |

| | • | | “TSX” are to the Toronto Stock Exchange. |

Historical Performance and Market Data

This Form 20-F contains information relating to our business as well as historical performance and market data. When considering this data, you should bear in mind that historical results and market data may not be indicative of the future results that you should expect from us. Certain statistical and market data have been obtained from third party sources. We have not independently verified this data and cannot guarantee its accuracy or completeness.

Financial Information

All financial information is presented in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, other than certain non-IFRS financial measures and measures of operating performance which are defined under “Use of Non-IFRS Measures, Measures of Operating Performance and Reconciliation of Net Earnings (Loss) to Adjusted EBITDA,” below. All figures are unaudited unless otherwise indicated.

We maintain our financial statements in Canadian dollars, and, in this Form 20-F, all references to “CAD” or “$” are to Canadian dollars unless expressly otherwise stated.

1

Exchange Rate Table

The following table sets forth the average exchange rate for one Canadian dollar expressed in terms of U.S. dollars for each of the last five fiscal years. The average rate is calculated using the average of the exchange rates on the last day of each month during the period.

| | | | |

| | | Average | |

2012 (through July 6) | | | 0.9927 | |

2011 | | | 1.0151 | |

2010 | | | 0.9671 | |

2009 | | | 0.8833 | |

2008 | | | 0.9397 | |

2007 | | | 0.9418 | |

The following table sets forth the high and low exchange rates for each month during the previous six months.

| | | | | | | | |

| | | Low | | | High | |

July 2012 (through July 6) | | | 0.9805 | | | | 0.9878 | |

June 2012 | | | 0.9599 | | | | 0.9825 | |

May 2012 | | | 0.9663 | | | | 1.0164 | |

April 2012 | | | 0.9961 | | | | 1.0197 | |

March 2012 | | | 0.9985 | | | | 1.0153 | |

February 2012 | | | 0.9984 | | | | 1.0136 | |

January 2012 | | | 0.9735 | | | | 1.0014 | |

The exchange rates are based upon the noon buying rate as quoted by the Bank of Canada. At July 6, 2012, the exchange rate for one Canadian dollar expressed in terms of one U.S. dollar, as quoted by The Bank of Canada at 4 p.m. Eastern Time, equaled $0.9817.

USE OF NON-IFRS MEASURES, MEASURES OF OPERATING PERFORMANCE AND RECONCILIATION OF NET EARNINGS (LOSS) TO ADJUSTED EBITDA

Our financial statements are prepared in accordance with IFRS. Management uses IFRS, non-IFRS and operating performance measures as key performance indicators to better assess our underlying performance and provides this additional information in this Form 20-F so that readers may do the same. See Item 5.A. “Operating and Financial Review and Prospects – Operating Results – Use of Non-IFRS Measures, Measures of Operating Performance and Reconciliation of Net Earnings (Loss) to Adjusted EBITDA” for additional information.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Forward-looking statements in this Form 20-F include statements regarding the anticipated benefits of the spin-off, our future results of operations, our future growth prospects, and our business strategy, plans, expectations, goals and objectives. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or statements that certain “endeavored” actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or

2

factors, not all of which are known to us or within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. The following factors, among others, could cause our actual results to vary from our forward-looking statements:

| | • | | our ability to successfully implement our strategic initiatives, productivity improvement and cost reduction initiatives and whether such initiatives will yield the expected benefits; |

| | • | | the results achieved pursuant to our long-term credit card marketing and servicing alliance with JPMorgan Chase Bank, N.A. (Toronto Branch), or JPMorgan Chase; |

| | • | | general economic conditions; |

| | • | | competitive conditions in the businesses in which we participate; |

| | • | | changes in consumer spending; |

| | • | | seasonal weather patterns; |

| | • | | weaker business performance in the fourth quarter; |

| | • | | customer preference toward product offerings; |

| | • | | ability to retain senior management and key personnel; |

| | • | | ability to successfully manage our inventory levels; |

| | • | | disruptions to our computer systems; |

| | • | | economic, social and political instability in jurisdictions where suppliers are located; increased shipping costs, potential transportation delays and interruptions; |

| | • | | damage to the reputations of the brands we sell; |

| | • | | changes in our relationship with our suppliers; |

| | • | | the outcome of product liability claims; |

| | • | | any significant security compromise or breach of our customer, associate or Company information; |

| | • | | the credit worthiness and financial stability of tenants, partners and co-venturers, with respect to our real estate joint venture interests; |

| | • | | possible changes in our ownership by Sears Holdings and other significant shareholders following the spin-off; |

| | • | | interest rate fluctuations and other changes in funding costs and investment income; |

| | • | | fluctuations in foreign currency exchange rates; |

| | • | | the possibility of negative investment returns in our pension plan or an unexpected increase to the defined benefit obligation; |

| | • | | the impairment of goodwill and other assets; |

| | • | | new accounting pronouncements, or changes to existing pronouncements, that impact the methods we use to report our financial condition and results from operations; |

| | • | | uncertainties associated with critical accounting assumptions and estimates; |

| | • | | the outcome of pending legal proceedings; |

| | • | | changes in laws, rules and regulations that apply to us; |

| | • | | compliance costs associated with environmental laws and regulations; |

3

| | • | | the possible future termination of certain intellectual property rights associated with the “Sears” name and brand names if Sears Holdings reduces its interest in the Company to less than 25%; and |

| | • | | other factors described in this Form 20-F, including those set forth under Item 3.D. “Key Information – Risk Factors”, Item 5 “Operating and Financial Review and Prospects” and Item 4.B. “Information on the Company – Business Overview”. |

Except as required by applicable law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. We qualify any and all of our forward-looking statements by these cautionary factors. Please keep this cautionary note in mind as you read this Form 20-F.

4

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

1.A. DIRECTORS AND SENIOR MANAGEMENT

For information regarding our directors and senior management, see Item 6.A. “Directors, Senior Management and Employees – Directors and Senior Management”.

1.B. ADVISERS

Our Canadian legal counsel is Torys LLP, Suite 3000, TD Centre, 79 Wellington Street West, Toronto, Ontario, Canada, M5K 1N2. Our U.S. legal counsel is Torys LLP, 23rd Floor – 1114 Ave of the Americas, New York, New York, 10036-7703.

1.C. AUDITORS

We have retained Deloitte & Touche LLP to act as our independent registered chartered accountants. The address for Deloitte & Touche LLP is Brookfield Place, 181 Bay Street, Suite 1400, Toronto, Ontario, M5J 2V1.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3.A. SELECTED FINANCIAL DATA

The following table presents selected financial data which is derived from, and should be read in conjunction with, the recast Q1 2012 Interim Condensed Consolidated Financial Statements and the recast 2011 Annual Consolidated Financial Statements, each of which are included in this Form 20-F.

| | | | | | | | | | | | | | | | |

($ in millions, except per share amounts) | | Q1 2012 | | | Fiscal 2011

(recast**) | | | Q1 2011

(recast**) | | | Fiscal 2010

(recast**) | |

Total revenue | | $ | 915.1 | | | $ | 4,619.3 | | | $ | 992.5 | | | $ | 4,938.5 | |

Same store sales (%) | | | (6.3 | %) | | | (7.5 | %) | | | (9.2 | %) | | | (4.4 | %) |

Adjusted EBITDA* | | | (30.1 | ) | | | 124.0 | | | | (22.3 | ) | | | 306.5 | |

Operating (loss) earnings | | | (53.8 | ) | | | (50.9 | ) | | | (50.9 | ) | | | 196.3 | |

Net earnings (loss) | | | 93.1 | | | | (50.3 | ) | | | (47.0 | ) | | | 125.0 | |

| | | | | | | | | | | | | | | | |

| | | As at

April 28, 2012 | | | As at

January 28, 2012 | | | As at

April 30, 2011 | | | As at

January 29, 2011 | |

Cash and cash equivalents and short-term investments | | $ | 361.6 | | | $ | 397.4 | | | $ | 198.4 | | | $ | 432.3 | |

Working capital | | | 486.7 | | | | 471.0 | | | | 360.3 | | | | 536.9 | |

Inventories | | | 883.7 | | | | 823.9 | | | | 981.7 | | | | 953.2 | |

Total assets | | | 2,744.6 | | | | 2,730.7 | | | | 2,727.5 | | | | 2,907.5 | |

Total long-term obligations, including principal payments on long-term obligations due within one year | | | 28.2 | | | | 122.7 | | | | 33.4 | | | | 129.1 | |

Shareholders’ equity | | | 1,182.3 | | | | 1,092.0 | | | | 1,201.3 | | | | 1,260.4 | |

| | | | |

Per share of capital stock | | | | | | | | | | | | | | | | |

Operating (loss) earnings | | $ | (0.57 | ) | | $ | (0.49 | ) | | $ | (0.48 | ) | | $ | 1.83 | |

Basic net earnings (loss) | | $ | 0.91 | | | $ | (0.48 | ) | | $ | (0.45 | ) | | $ | 1.16 | |

Diluted net earnings (loss) | | $ | 0.91 | | | $ | (0.48 | ) | | $ | (0.45 | ) | | $ | 1.16 | |

Shareholders’ equity | | | 11.53 | | | | 10.63 | | | | 11.40 | | | | 11.96 | |

5

| * | Adjusted EBITDA is a non-IFRS measure. See Item 5. “Operating and Financial Review and Prospects – Operating Results – Use of Non-IFRS Measures, Measures of Operating Performance and Reconciliation of Net Earnings (Loss) to Adjusted EBITDA”. |

| ** | Recast to reflect changes resulting from the retrospective application of the change in accounting policy related to the early adoption of the amendments to accounting standard “IAS 19 (Revised), Employee Benefits”. |

3.B. CAPITALIZATION AND INDEBTEDNESS

The following table presents our capitalization as of April 28, 2012 on an actual unaudited historical basis.

| | | | |

| | | As of April 28, 2012

(recast**) | |

| | | ($ in millions) | |

Debt Outstanding:* | | | | |

Finance lease obligations – Current | | $ | 4.9 | |

Secured revolving credit facility | | | — | |

Finance lease obligations – Non-current | | | 23.3 | |

| | | | |

| | $ | 28.2 | |

| |

Shareholders’ Equity: | | | | |

Capital Stock | | | 15.0 | |

Retained earnings | | | 1,308.8 | |

Accumulated other comprehensive loss | | | (141.5 | ) |

| | | | |

Total Capitalization (debt plus shareholders’ equity) | | $ | 1,210.5 | |

| | | | |

| * | Finance lease obligations are unsecured and not guaranteed by any third parties. |

| ** | Recast to reflect changes resulting from the retrospective application of the change in accounting policy related to the early adoption of the amendments to accounting standard “IAS 19 (Revised), Employee Benefits”. |

This table should be read in conjunction with Item 5.A. “Operating and Financial Review and Prospects – Operating Results” and Item 5.B. “Operating and Financial Review and Prospects – Liquidity and Capital Resources”, collectively referred to herein as the Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A, as well as the consolidated financial statements and accompanying notes.

3.C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

3.D. RISK FACTORS

You should carefully consider the risks described below, together with all of the other information included in this Form 20-F, in evaluating the Company and our common shares. The following risk factors could adversely affect our business, results of operations, financial condition and the price of our common shares.

Risks Relating to Our Business

If we are unable to compete effectively in the highly competitive retail industry, our business and results of operations could be materially adversely affected.

The Canadian retail market remains highly competitive as key players and new entrants compete for market share. International retailers continue to expand into Canada while existing competitors enhance their product offerings and become direct competitors. Our competitors include traditional full-line department stores, discount

6

department stores, wholesale clubs, ‘‘big-box’’ retailers, internet retailers and specialty stores offering alternative retail formats. Failure to develop and implement appropriate competitive strategies and the performance of our competitors could have a material adverse effect on our business, results of operations and financial condition.

To stay competitive and relevant to our customers, significant initiatives in support of our strategic plan are underway for Fiscal 2012. These initiatives include improvements in business processes, advancements in information technology and other organizational changes. The achievement of strategic goals may be adversely affected by a wide range of factors, many of which are beyond our control. The inability to execute and integrate strategic plans could have a negative impact on our current operations, market reputation, customer satisfaction and financial position. Our potential to implement and achieve our long-term strategic objectives is dependent on the achievement of these strategic plans and initiatives. There can be no assurance that such plans and initiatives will yield the expected results, either of which could cause us to fall short in achieving financial objectives and long-range goals.

Additional risk may arise when foreign retailers carrying on business in Canada in competition with us engage in marketing activities which are not in full compliance with Canadian legal requirements regarding advertising and labeling rules and product quality standards. Such retailers may gain an unfair advantage and their activities may negatively affect our business and results of operations.

The majority of the performance payments earned pursuant to the credit card marketing and servicing alliance with JPMorgan Chase are related to customers’ purchases using the Sears Card and Sears MasterCard. The credit card industry is highly competitive as credit card issuers continue to expand their product offerings to distinguish their cards. As competition increases, there is a risk that a reduction in the percentage of purchases charged to the Sears Card and Sears MasterCard may negatively impact our results of operations and financial condition.

Due to the seasonality of our business, our results of operations would be adversely affected if our business performed poorly in the fourth quarter or as a result of unseasonable weather patterns.

Our operations are seasonal in nature with respect to results of operations and in products and services offered. Merchandise and service revenues, as well as performance payments received from JPMorgan Chase, vary by quarter based upon consumer spending behavior. Historically, our revenues and earnings have been higher in the fourth quarter due to the holiday season and we have reported a disproportionate level of earnings in that quarter. As a result, our fourth quarter results of operations significantly impacts our annual results of operations. Our fourth quarter results of operations may fluctuate significantly, based on many factors, including holiday spending patterns and weather conditions. In addition, we offer many seasonal goods and services. We set budgeted inventory levels and promotional activity to be in accordance with our strategic initiatives and expected consumer demand. Businesses such as the Company that generate revenue from the sale of seasonal merchandise and services are subject to the risk of changes in consumer spending behavior as a result of unseasonable weather patterns.

If we fail to offer merchandise and services that our customers want, our sales may be limited, which would reduce our revenues and profits and adversely impact our results of operations.

To be successful, we must identify, obtain supplies and offer to customers attractive, relevant and high-quality merchandise and services on a continuous basis. Customers’ preferences may change over time. If we misjudge either the demand for products and services we sell or our customers’ purchasing habits and tastes, we may be faced with excess inventories of some products and missed opportunities for products and services we chose not to offer. This could have a negative effect on our revenues and profits and adversely impact our results of operations.

7

Our failure to retain our senior management team and to continue to attract qualified new personnel could adversely affect our business and results of operations.

Our success is dependent on our ability to attract, motivate and retain senior leaders and other key personnel. The loss of one or more of the members of our senior management may disrupt our business and adversely affect our results of operations. We do not maintain key-man life insurance on any of our executives. Furthermore, we may not be successful in attracting, assimilating and retaining new personnel to grow our business profitably. The inability to attract and retain key personnel could have an adverse effect on our business.

If we do not successfully manage our inventory levels, our results of operations will be adversely affected.

We must maintain sufficient in-stock inventory levels to operate the business successfully while minimizing out-of-stock levels. A significant portion of inventory is sourced from vendors requiring advance notice periods in order to supply the quantities that we require. These lead times may adversely impact our ability to respond to changing consumer preferences, resulting in inventory levels that are insufficient to meet demand or in merchandise that may have to be sold at lower prices. Inappropriate inventory levels or a failure to accurately anticipate the future demand for a particular product or the time it will take to obtain new inventory may negatively impact our results of operations.

We rely extensively on computer systems to process transactions, summarize results and manage our business. Disruptions in these systems could harm our ability to run our business.

Given the number of individual transactions that we process each year, it is critical that we maintain uninterrupted operation of our computer and communications hardware and software systems. These systems are subject to obsolescence, damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, catastrophic events such as fires, natural disasters and adverse weather occurrences and usage errors by our employees. If the systems are damaged or cease to function properly, we may have to make a significant investment to fix or replace them, may suffer interruptions in operations in the interim and our reputation with our customers may be harmed. Our ability to maintain sufficient inventory levels in our stores is critical to our success and largely depends upon the efficient and uninterrupted operation of our computer and communications hardware and software systems. Any material interruption in our computer operations may have a material adverse effect on our business and results of operations.

We rely on foreign sources for significant amounts of our merchandise, and our business may therefore be negatively affected by the risks associated with international trade.

We are dependent upon a significant amount of products that originate from non-Canadian markets. In particular, we source a significant amount of products from China. We are subject to the risks that are associated with the sourcing and delivery of this merchandise, including: potential economic, social and political instability in jurisdictions where suppliers are located; increased shipping costs, potential transportation delays and interruptions; adverse foreign currency fluctuations, changes in international laws, rules and regulations pertaining to the importation of products, quotas; and the imposition and collection of taxes and duties. Any increase in cost to us of merchandise purchased from foreign vendors or restriction on the merchandise made available to us by such vendors could have an adverse effect on our business and results of operations.

Damage to the reputations of the brands we sell could reduce our revenues and profits and adversely impact our results of operations.

As a diverse and multi-channel retailer, we promote many brands as part of our normal course of business. These brands include the Sears brand, Sears private label brands for product lines such as Jessica, and non-proprietary brands exclusive to Sears. Damage to the reputation of these brands or the reputation of the suppliers of these brands could negatively impact consumer opinions of Sears or our related products and reduce our revenues and profits and adversely impact our results of operations. In those circumstances, it may be difficult and costly for us to regain customer confidence.

8

If our relationships with our significant suppliers were to be impaired, it could have a negative impact on our competitive position and our results of operations and financial condition.

Although our business is not substantially dependent on any one supplier, our relationship with certain suppliers is of significance to our merchandising strategy, including attracting customers to our locations, cross-segment sales and image. The loss of a significant supplier relationship could result in lower revenues and decreased customer interest in our stores, which, in turn, would adversely affect our results of operations and financial condition. In addition, we may not be able to develop relationships with new suppliers, and products from alternative sources, if any, may be of a lesser quality and more expensive than those we currently purchase.

The lack of willingness of our vendors to provide acceptable payment terms could negatively impact our liquidity and/or reduce the availability of products or services we seek to procure.

We depend on our vendors to provide us with financing for our purchases of inventory and services. Our vendors could seek to limit the availability of vendor credit to us or other terms under which they sell to us, or both, which could negatively impact our liquidity. In addition, the inability of our vendors to access liquidity, or the insolvency of our vendors, could lead to their failure to deliver inventory or other services to us. Certain of our vendors may finance their operations and/or reduce the risk associated with collecting accounts receivable from us by selling or “factoring” the receivables or by purchasing credit insurance or other forms of protection from loss associated with our credit risks. The ability of our vendors to do so is subject to our perceived credit quality. Our vendors could be limited in their ability to factor receivables or obtain credit protection in the future because of our perceived financial position and credit worthiness, which could reduce the availability of products or services we seek to procure.

We may be subject to product liability claims if people or properties are harmed by the products we sell or the services we offer.

We sell products produced by third party manufacturers. Some of these products may expose us to product liability claims relating to personal injury, death or property damage caused by such products and may require us to take actions, such as product recalls. In addition, we also provide various services which could give rise to such claims. Although we maintain liability insurance to mitigate these potential claims, we cannot be certain that its coverage will be adequate for liabilities actually incurred or that insurance will continue to be available on economically reasonable terms or at all. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for significant periods, regardless of the ultimate outcome. Claims of this nature, as well product recalls, could also have a negative impact on customer confidence in the products and services we offer and on our reputation, and adversely affect our business and our results of operations.

If we do not maintain the security of our customer, associate or Company information, we could damage our reputation, incur substantial additional costs and become subject to litigation.

Any significant security compromise or breach of customer, associate or Company data, either held or maintained by the Company or our third party providers, could significantly damage our reputation and brands and result in additional costs, lost sales, fines and/or lawsuits. The regulatory environment in Canada related to information security and privacy is very rigorous. There is no guarantee that the procedures that we have implemented to protect against unauthorized access to secured data are adequate to safeguard against all data security breaches. A data security breach could negatively impact our business and our results of operations.

The performance of our real estate joint ventures may be affected by events outside of our control.

The primary objective of our real estate joint venture operations is to maximize the returns on our investments in shopping center real estate. We review the performance of these joint ventures on a regular basis. Shopping center investments are non-core assets that we sell when we believe it is financially advantageous to do

9

so. Similarly, we may also develop excess land within these real estate holdings and shopping center joint venture investments when it is advantageous to do so. The return on such transactions is contingent on the state of the economic environment and other factors. In addition, the credit worthiness and financial stability of tenants and partners could negatively impact our results of operations.

We are subject to a number of long-term real estate leases which could restrict our ability to respond to changes in demographics or the retail environment and adversely affect our results of operations.

As of April 28, 2012, we operated a total of 122 Full-line Department stores, 371 specialty stores (including 48 Sears Home stores, 11 Outlet stores, four Appliances and Mattresses stores, 278 Hometown Dealer stores operated under independent local ownership and 30 Corbeil stores), 16 Floor Covering Centres, 1,597 catalogue merchandise pick-up locations and 105 Sears Travel offices. Company owned stores consist of 14 Full-line Department stores and two Sears Home stores, with the majority of the remainder held under long-term leases. While we are able to change our merchandise mix and relocate stores in order to maintain competitiveness, we are restricted from vacating a current site without breaching our contractual obligations and incurring lease-related expenses for the remaining portion of the lease-term. The long-term nature of the leases may limit our ability to respond in a timely manner to changes in the demographic or retail environment at any location, which could adversely affect our results of operations. In addition, when leases for the stores in our ongoing operations expire, we may be unable to negotiate renewals, either on commercially acceptable terms, or at all, which could cause us to close stores. Accordingly, we are subject to the risks associated with leasing real estate, which could have an adverse effect on our results of operations.

We may be subject to legal proceedings if we violate the operating covenants in our real estate leases that could adversely affect our business and results of operations.

As of April 28, 2012, we had operating covenants with landlords for approximately 100 of our Sears brand corporate stores. An operating covenant generally requires us, during normal operating hours, to operate a store continuously as per the identified format in the lease agreement. As of April 28, 2012, the remaining term of the various Sears operating covenants ranged from less than one year to 25 years, with an average remaining term of approximately seven years. Failure to observe our operating covenants may result in legal proceedings against us and adversely affect our business and results of operations.

We are subject to laws and regulations that impact our business and a failure to comply with such laws and regulations could lead to lawsuits or regulatory actions against us that could adversely affect our business and results of operations.

Laws and regulations are in place to protect the interests and well-being of our customers and communities, business partners, suppliers, employees, shareholders and creditors. Changes to statutes, laws, regulations or regulatory policies, including changes in the interpretation, implementation or enforcement of statutes, laws, regulations and regulatory policies, could adversely affect our business and results of operations. In addition, we may incur significant costs in the course of complying with any changes to applicable statutes, laws, regulations and regulatory policies. Our failure to comply with applicable statutes, laws, regulations or regulatory policies could result in a judicial or regulatory judgment or sanctions and financial penalties that could adversely impact our reputation, business and results of operations. Although we believe that we have taken reasonable measures designed to ensure compliance with governing statutes, laws, regulations and regulatory policies in the jurisdictions in which we conduct business, there is no assurance that we will always be in compliance or deemed to be in compliance.

We are required to comply with federal and provincial environmental laws and regulations, the cost of which may adversely affect our results of operations and financial condition.

We are exposed to environmental risk as an owner, lessor and lessee of property. Under federal and provincial laws, the owner, lessor or lessee could be liable for the costs of removal and remediation of certain

10

hazardous substances on its properties or disposed of at other locations. The failure to remove or remediate such substances, if any, could lead to claims against us.

We are currently remediating various locations across Canada where we operated auto centers, gas bars and a logistics facility. The extent of the remediation and the costs thereof have not yet been determined. We continue to monitor the costs of remediation and appropriately provide for these costs in our reserves. If we commit to renovating a leased or owned building that contains or may contain asbestos, or if asbestos is inadvertently disturbed, we will be legally obligated to comply with asbestos removal standards. The extent of this liability has not yet been determined because the costs to remove asbestos depend upon factors including, among others, the location and extent of any renovations undertaken. Inadvertent disturbance of asbestos cannot be foreseen. The costs incurred by us could be significant and may negatively impact our results of operations and financial condition.

We are exposed to a variety of legal proceedings, including class action lawsuits, and tax audits which, if adversely decided, could materially adversely affect us.

We currently are involved in various legal proceedings incidental to the normal course of business. Although we are of the view that the final disposition of any such litigation is not expected to have a material adverse effect on our liquidity, consolidated financial position or results of operations, the outcome of such litigation cannot be predicted with certainty.

In the ordinary course of business, we are subject to ongoing audits by tax authorities. While we believe that our tax filing positions are appropriate and supportable, periodically, certain matters are reviewed and from time to time are challenged by the tax authorities. As we routinely evaluate and provide for potentially unfavorable outcomes with respect to any tax audits, we believe that the final disposition of tax audits will not have a material adverse effect on our liquidity, consolidated financial position or results of operations. If the result of a tax audit materially differs from the existing provisions, our effective tax rate and our net earnings could be affected positively or negatively in the period in which the tax audits are completed.

Three class actions in the provinces of Québec, Saskatchewan and Ontario were commenced against us in 2005 arising out of our pricing of tires. The plaintiffs allege that we inflated the regular retail price of certain brands of tires sold by us in order to later claim that the same brands were on sale for up to 45% off the regular retail price so as to induce potential customers into believing that substantial savings were being offered. The plaintiffs seek general damages, special damages, and punitive damages, as well as costs and pre- and post-judgment interest. No dollar amounts are currently specified. The plaintiffs intend to proceed with the Québec action and seek certification as a class action on a national basis. We believe these claims are without merit, and intend to defend against them vigorously. In view of the uncertainty regarding the amount of damages, if any, that could be established, and in light of the plaintiffs not having stated an amount of damages they may seek in this matter, we do not believe a material outflow of resources embodying economic benefit is likely to result.

Events outside our control such as social or political unrest, natural disasters, extreme or unseasonable weather, acts of war or terrorism, systems breakdowns or power outages could have a material adverse effect on our business and results of operations.

Our business is sensitive to customers’ spending patterns, which may be affected by domestic and international social or political unrest, natural disasters, extreme or unseasonable weather, acts of war or terrorism, or other significant events outside of our control, any of which could lead to a decrease in spending by consumers. In addition, such events as well as systems breakdowns and power outages could cause store closures, disrupt our supply chain or other operations, delay shipments of our merchandise to consumers, reduce our revenue and result in expenses to repair or replace our facilities. Disruptions during a peak season such as the month of December, which may account for up to 40% of a year’s earnings, could have a particularly adverse effect on our business and results of operations.

11

Our business could suffer if we are unsuccessful in making, integrating, and maintaining acquisitions and investments.

From time to time we pursue strategic acquisitions of, joint ventures with, or investments in, other companies or businesses, although we have no present commitments with respect to any material acquisitions or investments. Any such acquisition, joint venture or investment that we make may require us to spend our cash, or incur debt, contingent liabilities, or amortization expenses related to intangible assets, any of which could reduce our profitability and harm our business. Acquisitions, joint ventures and investments also increase the complexity of our business and place strain on our management, personnel, operations, supply chain, financial resources, and internal financial controls and reporting functions. We may not be able to manage acquisitions, joint ventures or investments effectively, which could damage our reputation, limit our growth and adversely affect our business and results of operations.

Financial Risks

Our business has been and will continue to be affected by Canadian and worldwide economic conditions; a persistence or worsening of current economic conditions could lead to reduced revenues and gross margins, and negatively impact our liquidity.

We plan our operations giving regard to economic and financial variables that are beyond our control. Changes to these variables may adversely impact our performance. Should the current economic conditions persist or worsen, heightened competition, a further decline in consumer confidence, lower disposable income, higher unemployment and personal debt levels may result, which could lead to reduced demand for our products and services. Any of these events could cause us to increase inventory markdowns and promotional expenses, thereby reducing our gross margins and results of operations. Our results of operations have been negatively impacted as a result of the current economic conditions and the volatility in the Canadian and global economies and it is difficult to accurately assess the potential impact on our business. If the Canadian or global economies continue to worsen, however, we could experience a decline in same store sales, erosion of gross profit and profitability.

Increasing fuel and energy costs may have a significant negative impact on our operations. We require significant quantities of fuel for the vehicles used to distribute and deliver inventory and we are exposed to the risk associated with variations in the market price for petroleum products. We could experience a disruption in energy supplies, including our supply of gasoline, as a result of factors that are beyond our control, which could have an adverse effect on our business. Certain of our vendors also are experiencing increases in the cost of various raw materials, such as cotton, oil-related materials, steel and rubber, which could result in increases in the prices that we pay for merchandise, particularly apparel, appliances and tires and adversely affect our results of operations.

Liquidity Risk

We could face liquidity risk due to various factors, including but not limited to, the unpredictability of the current economic climate, failure to secure appropriate funding vehicles and cash flow issues relating to the operation and management of the business. Failure to fulfill financial obligations due and owing from us as a result of this liquidity risk could have undesirable consequences on us.

Fluctuations in U.S. and Canadian dollar exchange rates may affect our results of operations.

Our foreign exchange risk is currently limited to currency fluctuations between the Canadian and U.S. dollar. We are vulnerable to increases in the value of the U.S. dollar relative to the Canadian dollar because the majority of our revenues are denominated in Canadian dollars and a substantial amount of the merchandise we purchase is priced in U.S. dollars. The costs of these goods in Canadian dollars rise when the U.S. dollar increases in value relative to the Canadian dollar and, as a result, we may be forced to increase our prices or reduce our gross margins. We may use foreign currency forward and option contracts to hedge the exchange rate

12

risk on a portion of our expected requirement for U.S. dollars. There can be no assurance that our hedging efforts will achieve their intended results or that our estimate of our requirement for U.S. dollars will be accurate, with the result that currency fluctuations may have an adverse impact on our results of operations.

In addition, the appreciation of the Canadian dollar over the past few years relative to the U.S. dollar presents an additional challenge to us as our customers are motivated to cross-border shop, which may have an adverse impact on our results of operations. See “Exchange Rate Table” elsewhere in this Form 20-F.

We are exposed to counterparty credit risk which could adversely affect our results of operations.

Credit risk refers to the possibility that we can suffer financial losses due to the failure of counterparties to meet their payment obligations to us. Exposure to credit risk exists for derivative instruments, cash and cash equivalents, short-term investments, accounts receivable and investments included in other long-term assets. Cash and cash equivalents, short-term investments, accounts receivable, derivative financial assets, and other long-term assets of $489.9 million as at April 28, 2012 (January 28, 2012: $514.9 million, January 29, 2011: $577.6 million, January 31, 2010: $1,536.5 million) expose us to credit risk should the borrower default on maturity of the investment. Although we seek to manage this exposure through policies that require borrowers to have a minimum credit rating of A, and limiting investments with individual borrowers at maximum levels based on credit rating, there can be no assurance that we will be able to successfully manage our credit risk.

We invest our surplus cash in investment grade, short-term money market instruments, the return on which depends upon interest rates and the credit worthiness of the issuer. We attempt to mitigate credit risk resulting from the possibility that an issuer may default on repayment by requiring that issuers have a minimum credit rating and limiting exposures to individual borrowers.

We are exposed to interest rate risk which could adversely affect our results of operations.

Interest rate risk reflects the sensitivity of our financial condition to movements in interest rates. Financial assets and liabilities which do not bear interest or bear interest at fixed rates are classified as non-interest rate sensitive. Cash and cash equivalents and borrowings under our $800.0 million senior secured revolving credit facility, or the Credit Facility, are subject to interest rate risk. The total outstanding balance subject to interest rate risk as at April 28, 2012 was a net asset of $362.9 million (January 28, 2012: net asset of $297.7 million, January 29, 2011: net asset of $322.9 million). An increase or decrease in interest rate of 0.25% would cause an immaterial after-tax impact on net (loss) earnings.

Expenses associated with our retirement benefit plans may fluctuate significantly depending on changes in actuarial assumptions, future market performance of plan assets, and other events outside of our control and adversely affect our results of operations.

We currently maintain a defined benefit registered pension plan, a non-registered supplemental savings arrangement and a defined benefit non-pension post-retirement plan, which provides life insurance, medical and dental benefits to eligible retired associates through a health and welfare trust. The defined benefit plan continues to accrue benefits related to future compensation increases although no further service credit is earned. In addition, we no longer provide medical, dental and life insurance benefits at retirement for associates who had not achieved the eligibility criteria for these non-pension post-retirement benefits as at December 31, 2008.

There is no assurance that our retirement benefit plans will be able to earn the assumed rate of return. New regulations and market driven changes may result in changes in the discount rates and other variables which would result in the Company being required to make contributions in the future that differ significantly from the estimates. Management is required to use assumptions to account for the plans in conformity with IFRS. However, actual future experience will differ from these assumptions giving rise to actuarial gains or losses. In any year, actual experience differing from the assumptions may be material. Plan assets consist primarily of cash,

13

alternative investments, marketable equity and fixed income securities. The value of the marketable equity and fixed income investments will fluctuate due to changes in market prices. Plan obligations and annual pension expense are determined by independent actuaries and through the use of a number of assumptions.

Although we believe that the assumptions used in the actuarial valuation process are reasonable, there remains a degree of risk and uncertainty which may cause results to differ materially from expectations. Significant assumptions in measuring the benefit obligations and pension plan costs include the discount rate and the rate of compensation increase. See Note 20.4 “Pension assumptions” of the Notes to the 2011 Annual Consolidated Financial Statements for more information on the weighted-average actuarial assumptions for the plans.

We face risks associated with impairment of goodwill and other assets.

Our goodwill, intangible assets and long-lived assets, primarily consisting of stores and joint ventures, are subject to periodic testing for impairment. A significant amount of judgment is involved in the periodic testing. Failure to achieve sufficient levels of cash flow within each of our cash generating units or specific operating units could result in impairment charges for goodwill and intangible assets or fixed asset impairment for long-lived assets, which could have a material adverse effect on our reported results of operations.

Risks Relating to our Relationship with Sears Holdings

We may lose rights to some intellectual property if Sears Holdings’ equity ownership in us falls below specified thresholds.

We rely on our right to use the “Sears” name, including as part of our corporate and commercial name, which we consider a significant and valuable aspect of our business. Our right to use the “Sears” name and certain other brand names was granted pursuant to a license agreement with Sears Holdings. Our license to use the “Sears” name and certain brand names may be terminated if Sears Holdings’ indirect ownership interest in us is reduced to less than 25%. In addition, our license to use the “Sears” name may also terminate upon the occurrence of certain bankruptcy events. Losing our right to use these intellectual properties could significantly diminish our competitiveness and could materially harm our business. If the license agreement is terminated, we would attempt to renegotiate the license agreement although the terms of any renegotiated license agreement would likely be less favorable to us.

Some of our directors and executive officers may have conflicts of interest because of their ownership of Sears Holdings common stock and positions with Sears Holdings.

Some of our directors and executive officers own Sears Holdings common stock. In addition, one of our directors, William R. Harker, is an executive officer of Sears Holdings. Ownership of Sears Holdings common stock by our directors and officers after the spin-off and the presence of executive officers or directors of Sears Holdings on our board of directors could create, or appear to create, conflicts of interest with respect to matters involving both us and Sears Holdings.

Risks Relating to Our Common Shares and the Spin-off

As long as Sears Holdings or ESL controls us, your ability to influence matters requiring shareholder approval will be limited.

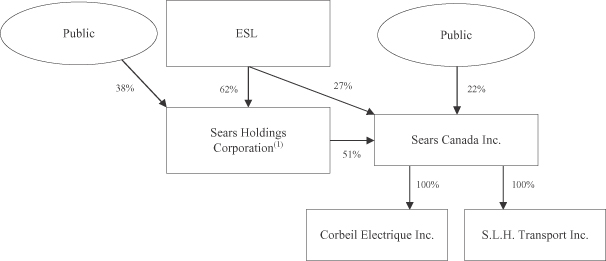

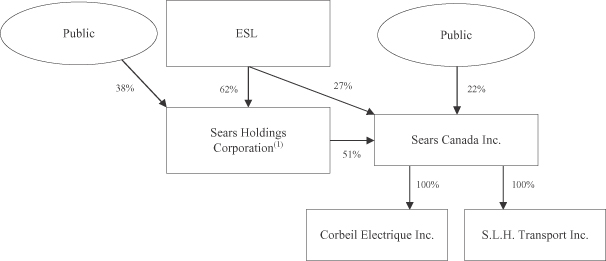

Immediately following the spin-off, Sears Holdings will control approximately 51% of our voting power and ESL is expected to directly control approximately 27% of our voting power based on ESL’s ownership of Sears Holdings common stock as disclosed in ESL’s Schedule 13D/A filed July 5, 2012. As of the date of this Form 20-F, ESL controlled Sears Holdings and, therefore, ESL will directly or indirectly control approximately 78% of our voting power immediately following the spin-off. So long as ESL directly or indirectly controls a

14

majority of our outstanding common shares, ESL will have the ability to control the election of our board of directors and the outcome of certain shareholder votes.

Accordingly, Sears Holdings and ESL will continue to have the ability to exercise control over certain actions to be taken or approved by our directors and shareholders, including with respect to certain mergers or business combinations or dispositions of all or substantially all of our assets.

Sears Holdings and ESL’s voting control may discourage transactions involving a change of control of us, including transactions in which you, as a holder of our common shares, might otherwise receive a premium for your shares over the then-current market price. Subject to certain limits, Sears Holdings is also not prohibited from selling a controlling interest in us to a third party and may do so without your approval and, subject to applicable laws, without providing for a purchase of your common shares. Accordingly, your common shares may be worth less than they would be if Sears Holdings and ESL did not maintain voting control over us.

Sears Holdings and ESL’s interests may be different than your interests and Sears Holdings and ESL may have investments in other companies that may compete with us, and may have interests from time to time that diverge from the interests of our other shareholders, particularly with regard to new investment opportunities.

In addition, conflicts of interest may arise between Sears Holdings and/or ESL and us, including corporate opportunities, potential acquisitions or transactions, as well as other matters. We may be adversely affected by any conflicts of interest between Sears Holdings and/or ESL and us.

Furthermore, neither Sears Holdings nor ESL owes us or our shareholders any fiduciary duties under Canadian law. See Item 7.B. “Related Party Transactions – Conflicts of Interest and Fiduciary Duties”.

Becoming a reporting company in the United States will increase our expenses and administrative burden, in particular to bring us into compliance with certain provisions of the Sarbanes-Oxley Act of 2002 to which we are not currently subject.

As a U.S. reporting company, we will incur additional legal, accounting and other expenses that we did not incur prior to being a U.S. reporting company. These increased costs and expenses may arise from various factors, including costs associated with complying with U.S. federal securities laws (including compliance with the Sarbanes-Oxley Act of 2002) and tax administration.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure, including those related to foreign private issuers and the Sarbanes-Oxley Act of 2002, and related regulations implemented by the United States Securities and Exchange Commission, or the SEC, are creating uncertainty for foreign private issuers and other U.S. public companies, increasing legal and financial compliance costs, and making some activities more time consuming. We are currently evaluating and monitoring developments with respect to new and proposed rules and cannot predict or estimate the amount of the additional costs we may incur or the timing of such costs. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and our business may be harmed. The costs of compliance or our failure to comply with these laws, rules and regulations could adversely affect our reputation, business, results of operations, financial condition and the price of our common shares.

15

The price of our common shares may decline if Sears Holdings or ESL alter their strategy with respect to their ownership of our shares.

Sears Holdings and ESL have advised us that they have not reached any decision regarding whether or for how long they will retain their share ownership in us and what form, if any, the disposition or distribution of their shares in us will take. Sears Holdings and ESL will, in their respective sole discretions, determine the timing and terms of any transactions with respect to their shares in us, taking into account business and market conditions and other factors that they deem relevant. Neither Sears Holdings nor ESL is subject to any contractual obligation to maintain its ownership position in us, nor is ESL subject to any contractual obligation to us to maintain its ownership in Sears Holdings. Consequently, we cannot assure you that either Sears Holdings or ESL will maintain their current direct or indirect ownership of our common shares. Any announcement by Sears Holdings or ESL that they have reached a determination regarding what to do with their direct or indirect ownership of our common shares, or the perception by the investment community that Sears Holdings or ESL has reached such a determination, could have an adverse impact on the price of our common shares.

If our share price fluctuates after the spin-off, you could lose all or a significant part of your investment.

Although there is a current public market for our common shares, the number of holders of our common shares is likely to substantially increase following the spin-off and the spin-off will potentially enhance liquidity. We cannot predict the prices at which our common shares may trade after the spin-off. The market price of our common shares may fluctuate widely, depending on many factors, some of which may be beyond our control, including:

| | • | | our business profile and market capitalization may not fit the investment objectives of some Sears Holdings stockholders and, as a result, these Sears Holdings stockholders may sell our shares after the spin-off; |

| | • | | actual or anticipated fluctuations in our results of operations due to factors related to our business; |

| | • | | success or failure of our business strategy; |

| | • | | actual or anticipated changes in the Canadian economy or the retailing environment, our quarterly or annual earnings, or those of other companies in our industry; |

| | • | | announcements by us or our competitors of significant acquisitions or dispositions; |

| | • | | changes in earnings estimates by securities analysts or our ability to meet those estimates; |

| | • | | the operating and stock price performance of other comparable companies, including Sears Holdings; |

| | • | | overall market fluctuations; |

| | • | | changes in laws and regulations affecting our business; |

| | • | | actual or anticipated sales or distributions of our common shares by Sears Holdings, ESL, our officers, directors or certain other significant shareholders; |

| | • | | terrorist acts or wars; and |

| | • | | general economic conditions and other external factors. |

In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies like us. These broad market and industry factors may materially reduce the market price of our common shares, regardless of our operating performance.

Substantial sales of our common shares may occur in connection with the spin-off, which could cause the price of our common shares to decline.

Although we have no actual knowledge of any plan or intention on the part of any significant shareholder to sell our shares following the spin-off, it is likely that some shareholders, possibly including our significant

16

shareholders, will sell their common shares for a number of reasons, including if, for reasons such as our business profile or market capitalization, we do not fit their investment objectives. In particular, Sears Holdings is a member of the S&P 500 Index, while we will not be and, accordingly, certain Sears Holdings stockholders may elect or be required to sell our shares following the spin-off due to such shareholders’ own investment guidelines or other reasons.

The common shares held by Sears Holdings, ESL and our other affiliates may be sold in the U.S. public market only if registered or if the holders thereof qualify for an exemption from registration under the Securities Act of 1933, as amended, or the Securities Act, or to the extent sold to investors in Canada in compliance with applicable Canadian securities laws. Individuals who may be considered our affiliates after the spin-off include individuals who control, are controlled by or are under common control with us, as those terms generally are interpreted for U.S. federal securities law purposes. These individuals include our directors, executive officers and certain significant shareholders. Individuals who are our affiliates will be permitted to sell their common shares only pursuant to an effective registration statement under the Securities Act, or an exemption from the registration requirements of the Securities Act, such as the exemptions afforded by Section 4(1) of the Securities Act, or Rule 144, or Regulation S thereunder.

In addition, non-affiliates will have be able to offer their Sears Canada common shares for sale over the TSX immediately after the spin-off. The sale of a substantial number of our common shares could adversely affect the market price of our common shares and could impair our future ability to raise capital through an offering of our equity securities.

Your percentage ownership in us may be diluted in the future.

Your percentage ownership in us may be diluted in the future if additional equity awards are granted to our directors, officers and employees in the future. We may establish equity incentive plans that provide for the grant of common share-based equity awards to our directors, officers and other employees. In addition, we may issue equity in order to raise capital or in connection with future acquisitions, strategic investments or partnerships, which would dilute your percentage ownership.

The combined post-spin-off value of our common shares and Sears Holdings common stock may not equal or exceed the aggregate pre-spin-off value of Sears Holdings common stock and our common shares.

After the spin-off, Sears Holdings common stock will continue to be listed and traded on the NASDAQ Global Select Market. Our common shares will continue to be traded under the symbol “SCC” on the TSX. We have no current plans to apply for listing on any additional stock exchanges. We cannot assure you that the combined trading prices of Sears Holdings common stock and our common shares after the spin-off will be equal to or greater than the aggregate trading prices of Sears Holdings common stock and our outstanding common shares prior to the spin-off. Until the market has fully evaluated the impact of the spin-off on Sears Holdings and on our business, the price at which Sears Holdings common stock and our common shares trade may fluctuate.

Because we are a Canadian corporation, half of our directors and most of our officers, and the experts named in this Form 20-F, are resident in Canada. It may be difficult for investors in the United States to enforce civil liabilities against such persons, based solely upon the federal securities laws of the United States.

We are a Canadian corporation with our principal place of business in Canada. Half of our directors and most of our officers and the auditors named herein are residents of Canada and all or a substantial portion of our assets and those of such persons are located outside the United States. Consequently, it may be difficult for U.S. investors to effect service of process within the United States upon us, our directors or officers, or such auditors who are not residents of the United States, or to realize in the United States upon judgments of courts of the United States predicated upon civil liabilities under the U.S. securities laws. Investors should not assume that Canadian courts: (1) would enforce judgments of U.S. courts obtained in actions against us or such persons predicated upon the civil liability provisions of the U.S. federal securities laws or the securities or “blue sky” laws of any state within the

17

United States or (2) would enforce, in original actions, liabilities against us or such persons predicated upon the U.S. federal securities laws or any such state securities or blue sky laws. We believe that a judgment of a U.S. court predicated solely upon civil liability under such laws would likely be enforceable in Canada if the U.S. court in which the judgment was obtained had a basis for jurisdiction in the matter that was recognized by a Canadian court for such purposes. We cannot be certain that Canadian courts will allow shareholders to originate actions in Canada predicated solely upon U.S. federal or state securities laws.

As a foreign private issuer, we are not subject to certain U.S. securities law disclosure requirements that apply to a domestic U.S. issuer, which may limit the information publicly available to our shareholders.

As a foreign private issuer, we are not required to comply with all the periodic disclosure requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and therefore, there may be less publicly available information about us than if we were a U.S. domestic issuer. For example, we are not subject to the proxy rules in the United States and disclosure with respect to our annual meetings will be governed by Canadian requirements. Our governing corporate law statute, the Canada Business Corporations Act, generally requires that we must call an annual meeting of shareholders not later than 15 months after holding our last preceding annual meeting but no later than six months after the end of our preceding financial year. Our most recent annual meeting was held on April 17, 2012. Therefore, our first annual meeting of shareholders after completion of the spin-off will not be required to occur until July 2013. Although our directors and principal shareholders are required to report trades in our securities and are subject to early warning obligations under Canadian securities laws, they are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act.

We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us.

In order to maintain our current status as a foreign private issuer under U.S. federal securities laws, a majority of our common shares must be either directly or indirectly owned by non-residents of the United States unless we also satisfy each of the three additional requirements in accordance with the definition of “foreign private issuer” under the Exchange Act. In addition to the majority of our common shares being owned by residents of the United States, if any of (i) the majority of our executive officers or directors are United States citizens or residents, (ii) more than fifty percent of our assets are located in the United States or (iii) our business is administered principally in the United States, then we would lose our foreign private issuer status. We currently satisfy the test and qualify as a foreign private issuer, but we cannot be certain that we will meet these requirements in the future. The regulatory and compliance costs to us under U.S. federal securities laws as a U.S. domestic issuer may be significantly more than the costs we incur as a Canadian foreign private issuer. If we cease to be a foreign private issuer, we would not be eligible to use the multijurisdictional disclosure system or other foreign issuer forms and would be required to file periodic and current reports and registration statements on U.S. domestic issuer forms with the SEC, which are more detailed and extensive than the forms available to a foreign private issuer. We may also be required to prepare our financial statements in accordance with U.S. generally accepted accounting principles, or GAAP. These additional reporting obligations could be costly and have a negative impact on our financial condition.

If you receive our common shares in the spin-off, you may need to fund your United States federal income tax liability with cash from other sources or by selling our common shares.

If you receive our common shares pursuant to the spin-off, you generally will be considered to have received a taxable distribution in an amount equal to the fair market value of our common shares received by you plus the amount of cash received in lieu of fractional common shares on the date of the distribution. As a result, you may need to fund any United States federal income tax and/or Canadian federal income tax resulting from the receipt of our common shares with cash from your own funds or by selling all or a portion of such common shares received by you. You should discuss with your tax advisor the United States federal income tax

18

consequences and Canadian federal income tax consequences of receiving our common shares pursuant to the spin-off. For a detailed discussion, see Item 10.E. “Taxation – Material United States Federal Income Tax Consequences” and “Taxation – Material Canadian Federal Income Tax Consequences”.

Because we are a foreign corporation for United States federal income tax purposes, the ownership and disposition of our shares may result in different tax consequences to you than would the ownership and disposition of the shares of a United States corporation such as Sears Holdings.

We are a foreign corporation for United States federal income tax purposes, which may result in different tax consequences to you than would the ownership and disposition of the shares of a United States corporation such as Sears Holdings. Such differences include the imposition of any Canadian withholding taxes, your ability to claim foreign tax credits in respect of Canadian taxes and, as a result of the spin-off, your ability potentially to exclude distributions of “previously taxed income” (and any related Canadian dollar exchange gain or loss that you may be required to recognize in respect of such excluded distributions). You should discuss the United States federal income tax consequences to you of the ownership and disposition of our common shares with your own tax advisor. For additional discussion, see Item 10.E. “Taxation – Material United States Federal Income Tax Consequences – Ownership of Our Common Shares”.

ITEM 4. INFORMATION ON THE COMPANY

4.A. HISTORY AND DEVELOPMENT OF THE COMPANY

We were incorporated under the laws of Canada by letters patent dated September 17, 1952 and were continued under the Canada Business Corporations Act, or CBCA, by articles of continuance effective May 15, 1980. By articles of amendment effective May 31, 1984, we changed our name from Simpsons-Sears Limited to Sears Canada Inc. By articles of amalgamation dated January 1, 1994, December 29, 1996 and December 30, 1999, we were amalgamated with various wholly-owned subsidiaries. The address of our registered office and principal place of business is 290 Yonge Street, Suite 700, Toronto, Ontario, Canada, M5B 2C3.

Development of the Business Over the Last Three Years

In Fiscal 2009, we focused on our gift registry business, which was expanded to a total of 107 stores, and launched Oasis in two Full-line Department stores. Oasis is a beauty department concept offering a ‘one-stop’, ‘head-to-toe’ shopping destination featuring a wide assortment of beauty brands and personal care tools.

In addition, during Fiscal 2009, we expanded the products and services offered throughout our various channels, including: (i) launched “Sears Certified Real Estate Services”, designed to help make real estate transactions professional, easy and rewarding for customers who are buying or selling a home in the Greater Toronto Area; (ii) secured commercial agreements with a provincial electric utility company to supply energy efficient appliances for its major appliance replacement program as well as with reputable home builders to supply major appliances to new home buyers; (iii) expanded our diverse product and services offerings to include a new residential painting service in select markets; and (iv) launched the Sears Water Appliance Program (SWAP), a national program that encourages homeowners to upgrade their inefficient or non-functional water softeners to an ENERGY STAR®-compliant unit, providing Canadians with more energy efficient solutions and another way to reduce emissions of greenhouse gases into the environment.

In Fiscal 2009, we completed the relocation of head office operations to the vacant space above the Toronto Eaton Centre Full-line Department store to reduce costs and improve efficiencies. We also reduced inventory levels by $116.0 million through promotional events and improved inventory management practices through initiatives such as integrating return-to-vendor provisions into agreements as well as selling products on consignment. Furthermore, we improved our replenishment and direct importing practices to increase margins, enhance our competitive pricing capabilities and ensure customers have a broad and relevant selection of quality products to choose from in order to grow sales.

19

During Fiscal 2009, Sears Canada opened 15 new Hometown Dealer stores and one new Outlet store. The Company also closed nine Floor Covering Centres, one Appliances and Mattresses store and one Lands’ End store.