Our preferred shares will be offered at $25.00 per share. We expect to use substantially all of the net proceeds from this Offering, including the dividend reinvestment program (after paying or reimbursing organization and offering expenses) to invest in and manage a diverse portfolio of Investments.

We expect that any expenses or fees payable to our Adviser for its services in connection with managing our daily affairs, including but not limited to, the selection and acquisition or origination of our investments, will be paid from cash flow from operations.

If such fees and expenses are not paid from cash flow (or waived) they will reduce the cash available for investment and distribution and will directly impact our NAV. See “Management Compensation” for more details regarding the fees that will be paid to our Adviser and its affiliates.

We may not be able to promptly invest the net proceeds of this Offering in Investments. In the interim, we may invest in short-term, highly liquid or other authorized investments, subject to the requirements for qualification as a REIT. Such short-term investments will not earn as high of a return as we expect to earn on our real estate-related investments.

SERIES A AND B PREFERRED STOCK DIVIDEND REINVESTMENT PROGRAM

The Dividend Reinvestment Program (“DRIP”) provides holders of record of our preferred shares an opportunity to automatically reinvest all of their cash distributions received on the preferred shares in additional preferred shares at a discounted price. The following discussion summarizes the principal terms of the DRIP. Appendix B to this Offering Circular contains the full text of our DRIP.

The Plan will be administered by the Administrator, or any successor bank or trust company that we may from time to time designate. Certain of the administrative support to the Administrator may be performed by its designated affiliates.

Our Series A and Series B Preferred Stock purchased directly from us under the Plan will be priced at a 10% discount, or $22.50 per share (because no sales commissions are paid, so the net proceeds to us are the same). Any shares sold pursuant to the DRIP are considered part of the shares offered under this Offering Circular. At the conclusion of this Offering, we hope to continue the DRIP through another exempt offering of preferred shares, but continued participation in the DRIP may be subject to available exemptions in your state; therefore, we reserve the right to restrict participation in the DRIP to residents of only some states. The DRIP highlights include:

| • | Any holder of preferred shares may elect to participate in the DRIP. |

| • | Preferred shares are issued at a 10% discount or at $22.50 per share with a Stated Value of $25 per Share. |

| • | Shares purchased will be maintained in your name in book-entry form at no charge to you. |

| • | Detailed recordkeeping and reporting will be provided at no charge to you. |

| • | You may opt-out of the DRIP at any time. |

| • | Series A preferred shareholders in the DRIP will be issued Series A Preferred Shares. |

| • | Series B preferred shareholders in the DRIP will be issued Series B Preferred Shares, each purchased at the discounted price above, but with a new Stated Value of $25 per Share. |

GENERAL INFORMATION ABOUT US

Organization

MacKenzie Realty Capital, Inc., a Maryland corporation, (the “Parent Company,” together with its subsidiaries as discussed below, the “Company,” “we,” “us,” or “our”) was formed on January 27, 2012 by filing its Articles of Incorporation with the State Department of Assessments and Taxation of Maryland. We are an externally managed non-diversified real estate investment trust (“REIT”), as defined under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), that had elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “Investment Company Act”) until December 31, 2020, when we withdrew our election to be regulated as a BDC.

We remain registered under Section 12(g) of the Securities Exchange Act of 1934 (the “Exchange Act”), and we will continue to file periodic reports on Form 10-K, Form 10-Q, and Form 8-K, as well as file proxy statements and other reports required under the Exchange Act. As a result of the withdrawal of our election to be regulated as a BDC, we are no longer treated as an investment company for purposes of applying accounting principles generally accepted in the United States of America (“GAAP”).

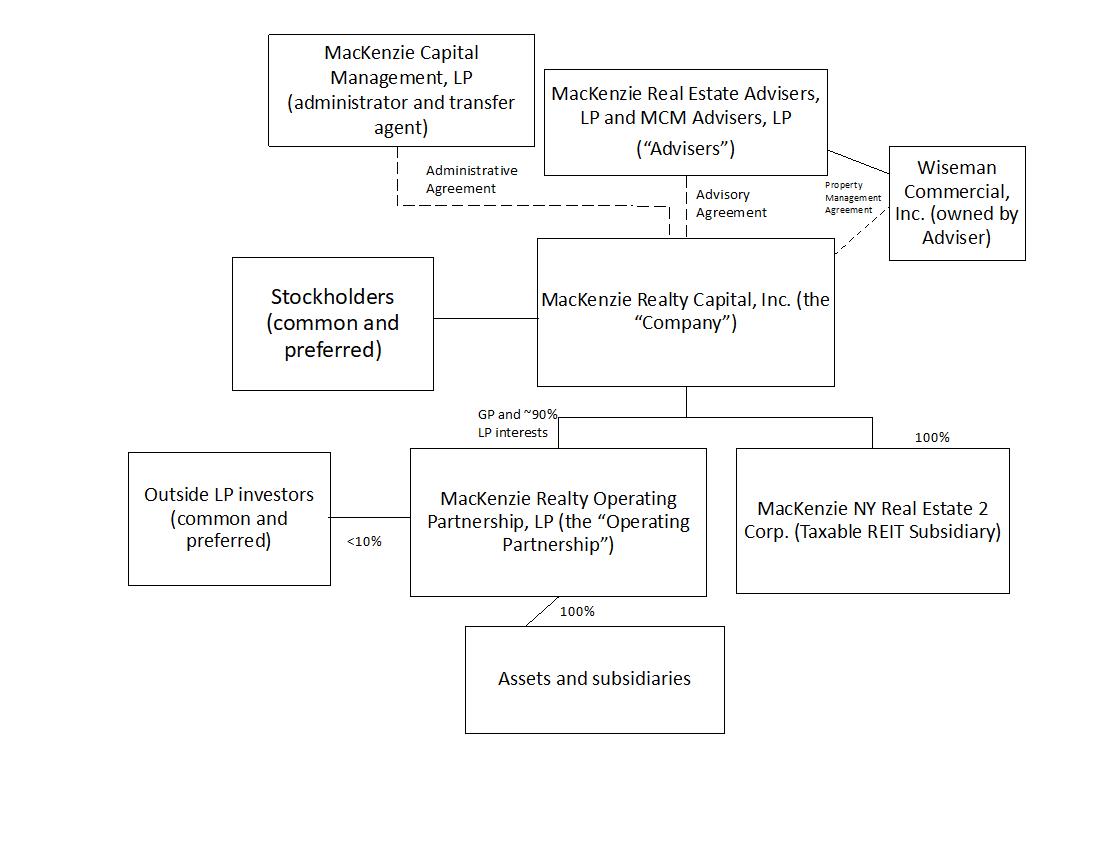

We are advised by MacKenzie Real Estate Advisers, LP (the “Real Estate Adviser”) as to our real estate investments and by MCM Advisers, LP (the “Investment Adviser”) as to our securities portfolio (together the “Real Estate Adviser” and the “Investment Adviser” are referred to as the “Advisers”). MacKenzie Capital Management, LP (“MacKenzie” or the “Administrator”) provides us with non-investment management services and administrative services necessary for us to operate.

We filed our initial registration statement in June 2012 with the Securities and Exchange Commission (“SEC”) to register the initial public offering (“IPO”) of 5,000,000 shares of our common stock. The IPO commenced in January 2014 and concluded in October 2016. We filed a second registration statement with the SEC to register a subsequent public offering of 15,000,000 shares of our common stock. The second offering commenced in December 2016 and concluded on October 28, 2019. We filed a third registration statement with the SEC to register a public offering of 15,000,000 shares of our common stock that was declared effective by the SEC on October 31, 2019. The third offering commenced shortly thereafter and ended on October 31, 2020.

On April 13, 2021, we filed a preliminary offering circular (the “Offering Circular”) pursuant to Regulation A with the SEC to sell up to $50,000,000 of shares of our Series A preferred stock at an initial offering price of $25.00 per share. The sale of shares pursuant to this offering began in November 2021 after the definitive version of the Offering Circular was qualified by the SEC on November 2, 2021, which was re-qualified again on November 8, 2022.

The Parent Company’s wholly owned subsidiary, MRC TRS, Inc., (“TRS”) was incorporated under the general corporation laws of the State of California on February 22, 2016, and operates as a taxable REIT subsidiary. TRS started its operation on January 1, 2017, and the financial statements of TRS have been consolidated with the Parent Company’s consolidated financial statements beginning with the quarter ended March 31, 2017. On December 20, 2017, a wholly owned subsidiary of TRS, MacKenzie NY Real Estate 2 Corp. (“MacKenzie NY 2”), was formed for the purpose of making certain limited investments in New York companies. We terminated TRS effective December 31, 2022, after the sale of its sole investment and transferred the ownership of MacKenzie NY 2 to the Parent Company. The financial statements of MacKenzie NY 2 have been consolidated with the Parent Company.

On May 20, 2020, we formed an operating partnership, MacKenzie Realty Operating Partnership, LP, a Delaware limited partnership (the “Operating Partnership”) for the purpose of acquiring and consolidating our wholly owned and majority-owned subsidiaries within an entity that is able to offer tax-advantaged solutions to certain sellers.

On June 14, 2023, we sold Addison Corporate Center to a third party and terminated Addison Property Owner, LLC (“Addison Property Owner”), which was wholly owned by the Operating Partnership.

In March 2021, we, together with our joint venture partners, formed two operating companies: Madison-PVT Partners LLC (“Madison”) and PVT-Madison Partners LLC (“PVT”), to acquire and operate two residential apartment buildings located in Oakland, California. We own 98.45% and 98.75% of equity units of Madison and PVT, respectively. The joint venture partners own the remaining 1.55% and 1.25% equity units of Madison and PVT, respectively, and also hold a carried interest in both companies.

On October 4, 2021, we acquired a 90% economic interest in Hollywood Hillview Owner, LLC (“Hollywood Hillview”), a Delaware limited liability company through the Operating Partnership. The remaining 10% economic interest in Hollywood Hillview is owned by an unaffiliated third party, True USA, LLC. Hollywood Hillview owns 100% of the membership interests in PT Hillview GP, LLC (the “PT Hillview”).

On January 25, 2022, through the Operating Partnership, we acquired a 98% limited liability company interest in MacKenzie BAA IG Shoreline LLC (“MacKenzie Shoreline”), formed to acquire, renovate, and own the 84-unit multifamily building located at 1841 Laguna Street, Concord, CA. The joint venture partners own the remaining 2% of the limited liability company interest as well as a carried interest.

On April 1, 2022, we, and our newly formed, wholly owned subsidiary, FSP Merger Sub, Inc. (“Merger Sub”) entered into a reverse triangular merger agreement with FSP Satellite Place Corp. (“FSP Satellite”), pursuant to which the Merger Sub would be merged with and into FSP Satellite with FSP Satellite as the surviving entity, but renamed MacKenzie Satellite Place, Inc. (“MacKenzie Satellite”). On June 1, 2022, the merger closed, and MacKenzie Satellite became our wholly owned subsidiary, which owns the Satellite Place building, a six-story Class “A” suburban office building containing approximately 134,785 rentable square feet of space located on approximately 10 acres of land in Duluth, GA. The former shareholders of FSP Satellite received cash with the exception of two shareholders who elected to receive common and preferred stock of the Company in the amount of $27,503 and $13,752, respectively. Subsequent to the completion of the merger, we have consolidated the financial statements of MacKenzie Satellite effective June 30, 2022.

On May 6, 2022, the Operating Partnership purchased 100% of the membership interests in eight limited liability companies and one parcel of entitled land from The Wiseman Company, LLC (“Wiseman”) for $17,325,000 and $3,050,000, respectively. The limited liability companies own the general partnership interests in eight limited partnerships, each of which own a Class A or B office property in Napa, Fairfield, or Woodland, California (the “Wiseman Properties”). The membership interest purchase price is subject to adjustments and holdbacks as provided in the membership interest purchase agreement. As part of the purchase agreement, $4,650,000 of the purchase price was paid through the issuance of 206,666.67 Preferred Units of the Operating Partnership and $750,000 of the land purchase price was paid through the issuance of 77,881.62 Class A units of the Operating Partnership. The Preferred Units of the Operating Partnership are meant to mirror our Series A Preferred Shares, and the terms of such Units are described in the Partnership Unit Designation of the Series A Preferred Limited Partnership Units (Exhibit 4.2). We consolidated the financial statements of the eight limited liability companies (but not the Wiseman Properties themselves) effective June 30, 2022.

Wiseman is a full-service real estate syndicator, developer, broker, and property manager. It was founded in 1979 and serves as the general partner for nine currently active partnerships owning the Wiseman Properties. Concurrently with acquiring the general partnership interests in the Wiseman Properties, the Operating Partnership also negotiated the right to acquire the limited partnership interest in each Wiseman Property at pre-determined prices over the following two years. Management believes this transaction is strategically important as it focuses the portfolio on our desired geographic area (Western United States) and creates a captive pipeline of properties which we can acquire when convenient over the next two years. Subsequently, on July 23, 2022, the Operating Partnership completed the acquisition of the limited partnership interest in First & Main, LP (“First & Main”) for total purchase price of $3,376,322, of which $2,711,377 was paid through issuance of 120,505.66 Preferred Units of the Operating Partnership. We consolidated the financial statements of First & Main during the quarter ended September 30, 2022. On October 1, 2022, in addition to the general partnership interest in 1300 Main, LP (“1300 Main”), the Operating Partnership completed the acquisition of 100% of the limited partnership interest in 1300 Main for total purchase price of $6,480,582. We consolidated the financial statements of 1300 Main during the quarter ended December 31, 2022. On January 3, 2023, the Operating Partnership completed the acquisition of 100% of the limited partnership interest in Woodland Corporate Center Two, LP (“Woodland Corporate Center Two”) for total purchase price of $5,636,966, of which $3,242,557 was paid through the issuance of 144,113.63 Preferred Units of the Operating Partnership. On February 1, 2023, the Operating Partnership completed the acquisition of 100% of the limited partnership interest in Main Street West, LP (“Main Street West”) for total purchase price of $8,277,016. We consolidated the financial statements of Woodland Corporate Center Two and Main Street West during the quarter ended March 31, 2023.

On February 6, 2023, we formed a new entity, MRC Aurora, LLC (the “MRC Aurora”) for the purpose of owning, developing, renovating, leasing, managing, renting, and potentially selling certain real property and building and improvements located at 5000 Wiseman Way, Fairfield, California (the “Aurora Project”). The Parent Company is the manager and the Operating Partnership is the sole common member of MRC Aurora. The Operating Partnership contributed the entitled land located at 5000 Wiseman Way, Fairfield, California in exchange for the common membership interest. MRC Aurora plans to raise $10 million in preferred capital and also obtain a construction loan to fund the development of the Aurora Project. As of June 30, 2023, MRC Aurora has not commenced selling the preferred units, making the Operating Partnership the sole equity holder of MRC Aurora. Therefore, we have consolidated the financial statements of MRC Aurora.

We are externally managed by MacKenzie under the administration agreement dated and effective as of January 1, 2021 (the “Administration Agreement”). MacKenzie manages all of our affairs except for providing investment advice. The Investment Adviser advises us in our assessment, acquisition, and divestiture of securities under the advisory agreement amended and restated effective January 1, 2021 (the “Amended and Restated Investment Advisory Agreement”). The Real Estate Adviser advises us in our assessment, acquisition, and divestiture of real estate assets under the Advisory Management Agreement effective January 1, 2021 (the “Advisory Management Agreement”). We pursue a strategy focused on investing primarily in real estate assets, and to a lesser extent (intended to be less than 20% of our portfolio) in illiquid or non-traded debt and equity securities issued by U.S. companies generally owning commercial real estate. These companies are likely to be non-traded REITs, small-capitalization publicly traded REITs, public and private real estate limited partnerships, and limited liability companies.

As of June 30, 2023, we have raised approximately $119.10 million from our three common stock public offerings and $16.37 million from our Series A preferred stock offering pursuant to the Offering Circular. As of June 30, 2023, we have issued common and preferred shares with gross proceeds of $14.19 million and $0.08 million, respectively, under our dividend reinvestment plan (“DRIP”). Of the total shares issued by us as of June 30, 2023, approximately $13.36 million worth of common and preferred stock shares have been repurchased under our share repurchase program.

On February 27, 2023, we have announced the updated net asset value (“NAV”) of our common shares as of December 31, 2022. As a result, our Board of Directors has lowered the price of the common shares issued under DRIP to $7.38 per share, the new NAV.

Investment Strategy

Our investment objective is to generate current income and capital appreciation through debt and equity real estate-related investments. Our Independent Directors (as defined in Part II, Item 10 of this Annual Report on Form 10-K) review our investment policies periodically, at least annually, to confirm that our policies are in the best interests of our stockholders. Each such determination and the basis thereof are contained in the minutes of our Board of Directors meetings.

We seek to accomplish our objective by rigorously analyzing the value of and risks associated with potential acquisitions, and, for up to 20% of our total assets, by acquiring real estate securities at significant discounts to their net asset value.

We intend to expand our investment strategy to include acquisition of distressed real properties. Like our other investments, we would expect to hold distressed properties and infuse funds as necessary to extract unrealized value.

Our Corporate Information

Our offices are currently located at 89 Davis Road, Suite 100, Orinda, CA 94563 and our telephone number is (925) 631-9100 or (800) 854-8357. We relocated to our current address from 1640 School Street, Moraga, CA 94556 in June 2018.

Investments

We engage in various investment strategies to achieve our overall investment objectives. The strategy we select depends upon, among other things, market opportunities, the skills and experience of the Adviser's investment team and our overall portfolio composition. We generally seek to acquire assets that produce ongoing distributable income for investors, yet with a primary focus on purchasing such assets at a discount from what the Adviser estimates to be the actual or potential value of the real estate.

Our investment strategies since our inception have included making loans to or investments in previously syndicated projects that had encountered difficulties with occupancy, financing, tenant improvements or other cash needs. Since entering the current recession, certain of our portfolio companies have encountered additional cash shortfalls, and, in one case so far, we have provided additional capital to the extent that we now own the majority of the project (such as Addison Corporate Center). We may encounter future opportunities to provide needed cash, and, in such cases, we would seek to consolidate the portfolio company into our financial statements, which is a key reason for dropping our BDC status.

We intend to continue our historical activities related to tender offers for shares of non-traded REITs in order to boost our short-term cash flow and to support our dividends, subject to the constraint that such securities will not exceed 20% of our portfolio. We believe this niche strategy will allow us to pay dividends that are supported by cash flow rather than paying back investors’ capital, although there can be no assurance that some portion of any distribution is not a return of capital. This strategy can boost cash-flow in two ways: (1) most such non-traded REITs pay regular cash distributions (even though COVID-19 prompted some to temporarily stop or cut back the distributions); and (2) when such non-traded REIT shares are liquidated or sold and we realize a profit from having purchased the shares at a discount to the underlying net asset value.

Types of Investments

We target the following real estate-related investments which may include equity interests in LLCs, tenancies-in-common, mortgages, loans, bonds, other real estate-related investment entities, or direct ownership of real property. Since dropping our BDC status, we intend to purchase primarily majority interests in properties so that we can consolidate them into our financial statements. We may purchase minority interests but we intend that such investments will constitute less than 20% of our portfolio. We do not invest in general partnerships, joint ventures, or other entities that do not afford limited liability to their security holders. However, limited liability entities in which we invest may hold interests in general partnerships, joint ventures, or other non-limited liability entities.

Investment Selection

Our Adviser's investment team is responsible for all aspects of our investment process. The current members of the investment team are C.E. Patterson, Glen Fuller, Chip Patterson, Robert Dixon, Angche Sherpa, and Christine Simpson. The investment strategy involves a team approach, whereby potential transactions are screened by various members of the investment team.

Our process for acquiring targeted real estate typically involves three steps: (i) identifying assets of the type we may be interested in acquiring; (ii) evaluating the assets to estimate their value or potential value to us, and (iii) either acquiring such assets directly or through our network of real estate partners. Different circumstances may require different procedures, or different combinations of procedures, and we adjust our acquisition strategy to fit the circumstances. Nonetheless, the typical stages of our investment selection process are as follows:

Deal Generation/Origination

We source investments through long-standing relationships with real estate operators, developers, industry contacts, brokers, commercial and investment bankers, entrepreneurs, services providers such as lawyers and accountants, as well as current and former clients, portfolio companies and investors. Our Adviser's investment team supplements these lead generators by also utilizing broader marketing efforts, such as advertisements in real estate periodicals, newspapers and other publications, attendance at prospective borrower industry conventions and the like.

Screening

In screening potential investments, the Adviser's investment team utilizes a value-oriented investment philosophy and commits resources to managing downside exposure.

Due Diligence

In conducting due diligence, the Adviser uses publicly available information as well as information from its relationships with former and current management teams, investors, consultants, competitors, and investment bankers. Our Adviser's due diligence typically includes:

| • | review of operating history, appraisals, market reports, vacancies, deferred maintenance; |

| • | review of historical and prospective financial information and regulatory disclosures; |

| • | research relating to the property’s management, industry, markets, products and services, and competitors; |

| • | verification of collateral; and |

| • | appraisals or opinions of value by third party advisers. |

Upon the completion of due diligence and a decision to proceed with an investment, the investment professionals leading the investment present the investment opportunity to the Adviser's investment team, which then determines whether to pursue the potential investment. Additional due diligence with respect to any investment may be conducted on our behalf by attorneys and independent accountants prior to the closing of the investment, as well as other outside third-party advisers, as appropriate. Any fees and expenses incurred by the Adviser to oversee due diligence investigations undertaken by third parties are subject to reimbursement by us, if not otherwise reimbursed by the prospective borrower, which reimbursements are in addition to any management or incentive fees payable by us under the advisory agreement (the “Investment Advisory Agreement”).

Monitoring

Our Adviser monitors our investments on an ongoing basis. Our Adviser has several methods of evaluating and monitoring the performance and value of the assets in which we invest, which include the following:

| • | Assessment of success in adhering to business plans and compliance with covenants; |

| • | Periodic and regular contact with property management to discuss financial position, requirements, and accomplishments; |

| • | Comparisons to other properties in the geographic area or sector, if any; |

| • | Attendance at and participation in our board meetings; and |

| • | Review of monthly and quarterly consolidated financial statements and financial projections for properties. |

Staffing

We do not currently have any employees. Our day-to-day investment operations are managed by the Adviser. Our Adviser may hire additional investment professionals, based upon its needs. We also entered into an administration agreement with MacKenzie (the “Administration Agreement”), under which we reimburse MacKenzie for our allocable portion of overhead and other expenses incurred by it in performing its obligations, including rent, the fees and expenses associated with performing compliance functions, and the compensation of our chief financial officer, our chief compliance officer (or "CCO"), and any administrative support staff. We have also retained MacKenzie as our transfer agent, for which we have been reimbursing them for certain software development costs.

Board Approval of the Investment Advisory Agreement

Our investment advisory and administrative services agreements were approved by our Board of Directors in January 2021. Such approvals were made on the basis of an evaluation satisfactory to our Board of Directors including a consideration of, among other factors, (i) the nature, quality, and extent of the advisory and other services to be provided under the agreements, (ii) the investment performance of the personnel who manage REITs with objectives similar to ours, to the extent available, (iii) comparative data with respect to advisory fees or similar expenses paid by other REITs with similar investment objectives, to the extent available and (iv) information about the services to be performed and the personnel performing such services under each of the agreements.

We were incorporated by our Promoter, MacKenzie Capital Management, LP. Its affiliates, MacKenzie Real Estate Advisers, LP and MCM Advisers, LP also serve as our Advisers, pursuant to the Advisory Agreements, see Exhibit 6.7 and 6.8.

The management of our investment portfolio is the responsibility of our Advisers and their investment committees (each member, a “Portfolio Manager”), which will initially be composed of C.E. Patterson, Glen Fuller, Chip Patterson, Robert Dixon, Angche Sherpa, and Christine Simpson. For more information regarding the business experience of the investment committee, see “Management — Board of Directors and Executive Officers.” The Advisers’ investment committee must approve each new investment that we make. The Portfolio Managers are not employed by us and do not hold any of our common stock. Further, none of the Portfolio Managers are primarily responsible for managing any other fund or account, nor do they receive any direct compensation from us or any other account or fund. Chip Patterson is a full-time employee of our Administrator and receives a fixed salary for the services he provides.

COMPANY POLICY REGARDING CERTAIN ACTIVITIES

Issuing Securities Senior to preferred shares

Our current policy is to not issue securities superior to our preferred shares. This Policy cannot be changed by the officers and directors without a vote of the shareholders.

Borrowing Money

We intend to purchase real estate assets. We may choose:

| • | to borrow money to help with the purchase of property; |

| • | to borrow money to help with the rehabilitation of already purchased property; |

| • | to borrow money against (leverage) already owned properties to help with the purchase and rehabilitation of other properties; and |

| • | to borrow money to facilitate our daily operation. |

Making Loans to Others

Our current policy does not allow us to make loans to individuals. This policy may be changed by the Board of Directors without a vote by the shareholders.

We have no history of making loans to other individuals.

Investing for Purpose of Controlling Other Entities

We may invest to take over control of others, obtain control of others, or merge with other entities. This policy may be changed by the officers or the Board of Directors without a vote by the shareholders.

We have some history of investing in the securities of other issuers for the purpose of exercising control, as we did with Addison Corporate Center.

Underwriting the Securities of Other Issuers

Our current policy does not allow us to underwrite the securities of other issuers. This policy may be changed by the officers or the Board of Directors without a vote by the shareholders.

We have no history of underwriting the securities of other issuers.

Acting as an Investment Company

Our current policy does not allow us to primarily engage in the purchase and sale (or turnover) of our investments. We intend to elect to be treated as a REIT. As such, we will be required to invest most all of our capital in real estate.

However, we envision that there may be instances where we will need to invest in assets other than real estate, such as:

| • | if a large number of investors invest through this Offering close in time to each other, it will take time for us to identify appropriate real estate investments; |

| • | We may continue to invest up to 20% of our total assets in real estate securities; or |

| • | if we have capital not in use, we may invest the capital for a short or long period of time in something other than real estate. |

If some or all of these happen, we will invest the capital not invested in real estate in other assets or securities, but securities will not comprise more than 20% of our portfolio.

This policy may be changed by the officers or the Board of Directors without a vote by the shareholders.

We previously engaged in the purchase and sale of investment securities as a BDC.

Using Company Stock to Acquire Investments

We may use our stock or OP units to acquire property.

We have a history of using our OP Units to acquire property, such as we did with the Addison Corporate Center and the Wiseman transaction.

Redemption of Preferred Shares

Please see below in “Description of Securities—Preferred Stock—Optional Early Redemption” for all of the details on our policy on redemption of preferred shares.

We may decide to reacquire our preferred shares when appropriate.

Annual Reports to Stockholders

Our current policy is to issue reports to shareholders four times a year:

| • | An annual report substantially on the SEC’s Form 10-K, which will include our financials audited by our auditor; |

| • | A quarterly report after quarters 1, 2, and 3, in the form of the SEC’s Form 10-Q, which will include financials for the subject quarter, but the financials will not be audited by our auditor. |

Our current policy is to make a report available to each stockholder by filing such report with the SEC via its Electronic Data Gathering, Analysis and Retrieval, or EDGAR, system.

INVESTMENT STRATEGIES AND POLICIES

Investment Objectives

Our investment objectives include:

Purchase Real Estate Assets at attractive prices

By purchasing real estate at attractive prices, we intend to maximize the number of properties, i.e., investments, that can be acquired using the Proceeds of this Offering.

Develop Rental Income Stream

We intend to acquire real estate assets and up to 20% real property-backed securities for our REIT. As we acquire Investments, these Investments will serve as the base of rental income. Rental income is our intended means of generating operating profits, supplemented by our limited investments in real estate securities, which we hope to distribute to our Shareholders.

Preserve Capital and Grow Capital

By acquiring Investments at attractive prices, we believe that the overall value of our assets will be significantly improved as operations improve and/or renovations are made. Such acquisitions also mean that we may be able to preserve capital during downward trends in the real estate market.

Market Opportunity

Based on our Adviser’s prior experience, we believe that recent market events make this an opportune time to invest in properties for the purpose of long-term investment.

Primary Investments in Real Estate

We intend to acquire real estate throughout the United States.

Our Adviser, through its affiliates, has established a strong deal sourcing and transaction execution presence in these regions of the United States.

We will not make any investments outside of the United States.

Types of Real Estate to be Acquired

We intend to use substantially all of the proceeds of this Offering to acquire, manage, renovate or reposition, operate, selectively leverage, lease and, following appropriate holding periods, opportunistically sell multifamily and commercial real estate properties.

Proposed Plan of Operations

Acquiring Property

We intend to acquire a portfolio of multifamily and commercial real estate properties utilizing an equity acquisition strategy.

We may acquire properties that are distressed in order to maximize the amount of real estate that can be acquired using the proceeds of this Offering.

We believe we can acquire distressed properties in at least two ways:

Our investment strategies since our inception have included making loans to or investments in previously syndicated projects that had encountered difficulties with occupancy, financing, tenant improvements or other cash needs. Certain of our portfolio companies have encountered additional cash shortfalls, and, in some cases, we have provided additional capital to the extent that we owned the majority of the project (such as, previously, in the case of Addison Corporate Center and the Britannia investment). We may encounter future opportunities to provide needed cash, and, in such cases, we would seek to consolidate the portfolio company into our financial statements.

In addition to properties acquired in multiple stages, as described above, we may acquire distressed properties by direct purchases. When we purchase properties directly, we will generally rely on a local sponsor, manager, or general partner with relevant market knowledge and proven track record of turning around distressed properties.

In many cases, properties will require significant renovation. Proceeds from this Offering will also be used to fund such renovation efforts.

Financing Investment Acquisitions

We anticipate that, with respect to Investments either acquired with debt financing or refinanced, the debt financing amount generally would be up to approximately 70% of the acquisition price of a particular Investment.

Particular Investments may be more highly leveraged. Further, the Adviser expects that any debt financing for an Investment will be secured by that Investment or the interests in an entity that owns that Investment.

The aggregate indebtedness of our investment portfolio is expected to be approximately 50-60% of the all-in cost of all portfolio investments (direct and indirect).

We will have the ability to exercise discretion as to the types of financing structures we utilize. For example, we may obtain new mortgage loans to finance property acquisitions, acquire properties subject to debt or otherwise incur secured or unsecured indebtedness at the property level at any time. The use of leverage will enable us to acquire more properties than if leverage is not used. However, leverage will also increase the risks associated with an investment in our preferred shares. See “Risk Factors.”

Leveraging Investments

Leverage, as used in this Offering Circular, means the borrowing of money based on the equity available in certain Investments. The use of leverage will enable us to acquire more properties than if leverage is not used. However, leverage will also increase the risks associated with an Investment in our preferred shares. See “Risk Factors.”

The Adviser may also elect to enter into one or more credit facilities with financial institutions. Any such credit facility may be unsecured or secured, including by a pledge of or security interest granted in our assets.

The Board has authorized the Adviser to leverage any investment to a maximum of 80% of the appraised value, said appraised value established at the time of submitting a loan application.

Manner of Liquidating Investments

Investments may be disposed of by sale on an all-cash basis or upon other terms as determined by the Adviser in its sole discretion. We may accept purchase money obligations and other forms of consideration (including other real properties) in exchange for one or more investments. In connection with acquisitions or dispositions of investments, we may enter into certain guarantee or indemnification obligations relating to environmental claims, breaches of representations and warranties, claims against certain financial defaults and other matters, and may be required to maintain reserves against such obligations. In addition, we may dispose of less than 100% of our ownership interest in any investment in the sole discretion of the Adviser.

We will consider all viable exit strategies for our investments, including single asset and/or portfolio sales to institutions, investment companies, real estate investment trusts, individuals, and 1031 exchange buyers.

Growth Policy

Our policy is to acquire properties primarily for the accumulation of capital gains.

Diversity in Investments

Our aim is that no more than 10% of all capital will be invested in any specific property. We will seek to procure as many investments that we can in order to meet this policy consideration, but our Board may decide to exceed this guideline from time to time.

No Guarantee as to Success

We cannot assure you that we will attain these objectives or that the value of our assets will not decrease. Furthermore, within our investment objectives and policies, our Adviser will have substantial discretion with respect to the selection of specific investments and the purchase and sale of our assets. Our Board of Directors will review our investment guidelines at least annually to determine whether our investment guidelines, property selection criteria, leverage policy and other investment policies continue to fulfill our investment objectives and continue to be in the best interests of our shareholders.

Our investment policies will provide the Adviser with substantial discretion with respect to the selection, purchase and sale of specific Investments, subject to the limitations in the Advisory Agreement. We may revise the investment policies, which are described below, without the approval of our stockholders. We will review the investment policies at least annually to determine whether the policies are in the best interests of our stockholders.

Prospective Investors are reminded that an investment in us is speculative and that we may or may not succeed and that any investment a Potential Investor makes may be lost.

Investment in Real Estate Mortgages

We may invest in real estate mortgages and bridge financing.

Investment in Other Securities

We intend to conduct operations so that we will not be required to register as an investment company under the Investment Company Act.

We expect that our investments in real estate will represent the substantial majority of our total asset mix, which would not subject us to the Investment Company Act. In order to maintain an exemption from regulation under the Investment Company Act, we intend to engage primarily in the business of buying real estate, and these investments are expected to be made within a year after the Offering ends.

If we are unable to invest a significant portion of the proceeds of the Offering in properties within one year of the termination of such Offering, we may avoid being required to register as an investment company by temporarily investing any unused proceeds in government securities with low returns, which would reduce the cash available for distribution to stockholders and possibly lower your returns.

In the event we cannot invest all of the proceeds of this Offering in real estate as we are required to do, we would invest money in low-yield, U.S. Government Securities, or maintain the liquidity of such proceeds until they may be invested in real estate.

To qualify for an exemption under the Investment Company Act, we are required to hold at least 60% of our assets in real property. The Investment Company Act defines an investment company as any issuer that is or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities. Section 3(a)(1)(C) of the Investment Company Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis, which we refer to as the 40% test. Excluded from the term “investment securities,” among other things, are U.S. Government securities. We intend, however, to limit our securities portfolio to 20% of our total assets.

It is possible that the staff of the SEC could disagree with any of our determinations. If the staff of the SEC were to disagree with our analysis under the Investment Company Act, we would need to adjust our investment strategy. Any such adjustment in our strategy could have a material adverse effect on us.

Although we will monitor our holdings and income in an effort to comply with the exclusions contained in the Investment Company Act, there can be no assurance that we will be able to remain in compliance or to maintain our exclusion from registration. Any of the foregoing could require us to adjust our strategy, which could limit our ability to make certain investments or require us to sell assets in a manner, at a price or at a time that we otherwise would not have chosen. Compliance with exclusion from the Investment Company Act may also require that we not sell certain property or assets to maintain such exclusion from registration. This could negatively affect the value of our preferred shares, the sustainability of our business model and our ability to make distributions.

Registration under the Investment Company Act would require us to comply with a variety of substantive requirements that impose, among other things:

| • | limitations on capital structure; |

| • | restrictions on specified investments; |

| • | restrictions on leverage or senior securities; |

| • | restrictions on unsecured borrowings; |

| • | prohibitions on transactions with affiliates; and |

| • | compliance with reporting, record keeping, voting, proxy disclosure and other rules and regulations that would significantly increase our operating expenses. |

If we were required to register as an investment company but failed to do so, we could be prohibited from engaging in our business, and criminal and civil actions could be brought against us. Registration with the SEC as an investment company would be costly, would subject us to a host of complex regulations and would divert attention from the conduct of our business, which could materially and adversely affect us. In addition, if we purchase or sell any real estate assets to avoid becoming an investment company under the Investment Company Act, our net asset value, the amount of funds available for investment and our ability to pay distributions to our shareholders could be materially adversely affected.

TAX TREATMENT OF THE COMPANY AND ITS SECURITY HOLDERS

WE URGE YOU TO CONSULT YOUR TAX ADVISOR REGARDING THE SPECIFIC TAX CONSEQUENCES TO YOU OF THE PURCHASE, OWNERSHIP AND SALE OF OUR PREFERRED STOCK AND OF OUR ELECTION TO BE TAXED AS A REIT. SPECIFICALLY, YOU ARE URGED TO CONSULT YOUR OWN TAX ADVISOR REGARDING THE FEDERAL, STATE, LOCAL, FOREIGN, AND OTHER TAX CONSEQUENCES OF SUCH PURCHASE, OWNERSHIP, SALE AND ELECTION, AND REGARDING POTENTIAL CHANGES IN APPLICABLE TAX LAWS.

The following is a summary of the current material U.S. federal income tax considerations relating to our company, our election to be taxed as a REIT and the purchase, ownership or disposition of our securities offered pursuant to this Offering Circular. Supplemental U.S. federal income tax considerations relevant to the ownership of certain securities offered by this Offering Circular may be provided in the prospectus supplement that relates to those securities. For purposes of this discussion, references to “we,” “our” and “us” mean only MacKenzie Realty Capital, Inc., and not its subsidiaries, except as otherwise indicated. This summary is for general information only and is not intended as individual tax advice. The information in this summary is based on:

| • | current, temporary and proposed Treasury regulations promulgated under the Code; |

| • | the legislative history of the Code; |

| • | current administrative interpretations and practices of the IRS; and |

in each case, as of the date of this Offering Circular. In addition, the administrative interpretations and practices of the IRS include its practices and policies as expressed in private letter rulings that are not binding on the IRS except with respect to the particular taxpayers who requested and received those rulings. The sections of the Code and the corresponding Treasury Regulations that relate to qualification and taxation as a REIT are highly technical and complex. The following discussion sets forth certain material aspects of the sections of the Code that govern the federal income tax treatment of a REIT and holders of its securities. This summary is qualified in its entirety by the applicable Code provisions, Treasury Regulations promulgated under the Code, and administrative and judicial interpretations thereof. Future legislation, Treasury Regulations, administrative interpretations and practices and/or court decisions may adversely affect the tax considerations contained in this discussion. Any such change could apply retroactively to transactions preceding the date of the change. We have not requested and do not intend to request a ruling from the IRS that we qualify as a REIT, and the statements in this Offering Circular are not binding on the IRS or any court. Thus, we can provide no assurance that the tax considerations contained in this discussion will not be challenged by the IRS or will be sustained by a court if challenged by the IRS. This summary does not discuss any state, local or non-U.S. tax consequences associated with the purchase, ownership, or disposition of our securities or our election to be taxed as a REIT. You are urged to consult your tax advisors regarding the tax consequences to you of:

| • | the acquisition, ownership and sale or other disposition of our securities, including the United States federal, state, local, foreign and other tax consequences; |

| • | our election to be taxed as a REIT for United States federal income tax purposes; and |

| • | potential changes in the applicable tax laws. |

Tax matters are very complicated and the tax consequences to a U.S. person or a Non-U.S. person of an investment in our securities will depend on the facts of his, her, or its particular situation. We encourage investors to consult their own tax advisers regarding the specific consequences of such an investment, including tax reporting requirements, the applicability of federal, state, local and foreign tax laws and the effect of any possible changes in the tax laws.

Federal Income Taxation of MRC

We have elected to be taxed as a REIT under Sections 856 through 860 of the Code and applicable Treasury Regulations, which set forth the requirements for qualifying as a REIT, commencing with our taxable year beginning January 1, 2014. We believe that we have been organized and operated in a manner so as to qualify for taxation as a REIT under the Code and we intend to continue to operate in such a manner. No assurance, however, can be given that we in fact have qualified or will remain qualified as a REIT. See “—Failure to Qualify”.

Our qualification and taxation as a REIT depend upon our ability to meet the various qualification tests imposed under the Code, which are discussed below, including through actual annual operating results, asset composition, distribution levels and diversity of stock ownership, the results of which have not been and will not be reviewed by Husch Blackwell LLP. Accordingly, no assurance can be given that our actual results of operations for any particular taxable year will satisfy those requirements. Further, the anticipated federal income tax treatment described in this discussion may be changed, perhaps retroactively, by legislative, administrative or judicial action at any time. The information in this section, is based on the Code, current, temporary and proposed Treasury Regulations, the Code legislative history, current IRS administrative interpretations and practices, and court decisions. The reference to IRS interpretations and practices includes IRS practices and policies as endorsed in private letter rulings, which are not binding on the IRS except with respect to the taxpayer that receives the ruling. In each case, these sources are relied upon as they exist on the date of this Offering Circular. No assurance can be given that future legislation, regulations, administrative interpretations and court decisions will not significantly change current law, or adversely affect existing interpretations of existing law, on which the opinion and the information in this section are based. Any change of this kind could apply retroactively to transactions preceding the date of the change. Even if there is no change in applicable law, no assurance can be provided that the statements made in the following discussion, will not be challenged by the IRS or will be sustained by a court if so challenged.

The remainder of this section discusses U.S. federal income tax consequences to us and to our stockholders as a result of our election to be taxed as a REIT. For as long as we qualify for taxation as a REIT, we generally will not be subject to Federal corporate income taxes on net income that we currently distribute to stockholders. This treatment substantially eliminates the “double taxation” (at the corporate and security holder levels) that generally results from investment in a “C” corporation. A “C” corporation is a corporation that generally is required to pay tax at the corporate level. Double taxation means taxation once at the corporate level when income is earned and once again at the stockholder level when the income is distributed. Notwithstanding a REIT election, however, we will be subject to Federal income tax in the following circumstances:

| • | First, we will be taxed at regular corporate rates on any undistributed REIT taxable income, including undistributed net capital gains, provided, however, that properly designated undistributed capital gains will effectively avoid taxation at the stockholder level. |

| • | Second, if we have (i) net income from the sale or other disposition of “foreclosure property” (which is, in general, property acquired by foreclosure or otherwise on default of a loan secured by the property) that is held primarily for sale to customers in the ordinary course of business or (ii) other nonqualifying income from foreclosure property, we will be subject to tax at the highest corporate rate on such income. |

| • | Third, if we have net income from prohibited transactions (which are, in general, certain sales or other dispositions of property (other than foreclosure property) held primarily for sale to customers in the ordinary course of business), such income will be subject to a 100% tax on prohibited transactions. |

| • | Fourth, if we should fail to satisfy the 75.0% gross income test or the 95.0% gross income test (as discussed below), and have nonetheless maintained our qualification as a REIT because certain other requirements have been met, we will be subject to a tax in an amount equal to the greater of either (i) the amount by which 75.0% of our gross income exceeds the amount qualifying under the 75.0% test for the taxable year or (ii) the amount by which 95.0% of our gross income exceeds the amount of our income qualifying under the 95.0% test for the taxable year, multiplied in either case by a fraction intended to reflect our profitability. |

| • | Fifth, if we should fail to satisfy any of the asset tests (as discussed below) for a particular quarter and do not qualify for certain de minimis exceptions but have nonetheless maintained our qualification as a REIT because certain other requirements are met, we will be subject to a tax equal to the greater of (i) $50,000 or (ii) the amount determined by multiplying the highest corporate tax rate by the net income generated by the nonqualifying assets that caused us to fail such test. |

| • | Sixth, if we fail to satisfy REIT requirements (other than the income or asset tests) and the violation is due to reasonable cause and not due to willful neglect, we will maintain our REIT status but we must pay a penalty of $50,000 for each such failure. |

| • | Seventh, if we should fail to distribute during each calendar year at least the sum of (i) 85.0% of our REIT ordinary income for such year; (ii) 95.0% of our REIT capital gain net income for such year (for this purpose such term includes capital gains which we elect to retain but which we report as distributed to our stockholders; see “Annual Distribution Requirements” below); and (iii) any undistributed taxable income from prior years, we would be subject to a 4% excise tax on the excess of such required distribution over the amounts actually distributed. |

| • | Eighth, we would be subject to a 100.0% penalty tax with respect to amounts received (or on certain expenses deducted by a taxable REIT subsidiary) if arrangements among us, our tenants and a taxable REIT subsidiary were not comparable to similar arrangements among unrelated parties. |

| • | Ninth, if we sell property subject to the built-in gains tax, we will be subject to a corporate level tax on such built-in gains if such assets are sold during the five-year period following the acquisition of such property. Built-in gain assets are assets whose fair market value exceeds the REIT’s adjusted tax basis at the time the asset was acquired from a C corporation and our initial tax basis in the asset is less than the fair market value of that asset. The results described in this paragraph with respect to the recognition of gain assume that the C corporation will refrain from making an election to receive different treatment under applicable Treasury Regulations on its tax return for the year in which we acquire the asset from the C corporation. Treasury Regulations exclude from the application of this built-in gains tax any gain from the sale of property we acquire in an exchange under Section 1031 (a like-kind exchange) or 1033 (an involuntary conversion) of the Code. |

| • | Tenth, our subsidiaries that are C corporations, including our “taxable REIT subsidiaries,” generally will be required to pay federal corporate income tax on their earnings. |

| • | Eleventh, we may elect to retain and pay income tax on our net capital gain. In that case, a stockholder would include its proportionate share of our undistributed net capital gain (to the extent we make a timely designation of such gain to the stockholder) in its income, would be deemed to have paid the tax that we paid on such gain, and would be allowed a credit for its proportionate share of the tax deemed to have been paid, and an adjustment would be made to increase the basis of the stockholder in our capital stock. |

Requirements for Qualification as a REIT

The Code defines a REIT as a corporation, trust or association:

| (i) | that is managed by one or more trustees or directors; |

| (ii) | that issues transferable shares or transferable certificates of beneficial interest to evidence its beneficial ownership; |

| (iii) | that would be taxable as a domestic corporation but for Code Sections 856 through 860; |

| (iv) | that is not a financial institution or an insurance company within the meaning of the Code; |

| (v) | that is beneficially owned by 100 or more persons; |

| (vi) | not more than 50.0% in value of the outstanding capital stock of which is owned, directly or indirectly, by five or fewer individuals (as defined in the Code to include certain entities) during the last half of each taxable year after applying certain attribution rules; |

| (vii) | that makes an election to be treated as a REIT for the current taxable year or has made an election for a previous taxable year which has not been terminated or revoked; and |

| (viii) | which meets certain other tests, described below, regarding the nature of its income and assets. |

The Code provides that conditions (i) through (iv), inclusive, must be met during the entire taxable year and that condition (v) must be met during at least 335 days of a taxable year of 12 months, or during a proportionate part of a taxable year of less than 12 months. Condition (vi) must be met during the last half of each taxable year. For purposes of determining stock ownership under condition (vi), a supplemental unemployment compensation benefits plan, a private foundation or a portion of a trust permanently set aside or used exclusively for charitable purposes generally is considered an individual. However, a trust that is a qualified trust under Code Section 401(a) generally is not considered an individual, and beneficiaries of a qualified trust are treated as holding shares of a REIT in proportion to their actuarial interests in the trust for purposes of condition (vi). MRC should satisfy conditions (v) and (vi) based upon existing ownership. If we fail to satisfy these stock ownership requirements, we will fail to qualify as a REIT. We believe that we have been organized, have operated and have issued sufficient shares of stock with sufficient diversity of ownership to allow us to satisfy conditions (i) through (viii), inclusive, during the relevant time periods. In addition, our Charter provides for restrictions regarding ownership and transfer of our shares which are intended to assist us in continuing to satisfy the share ownership requirements described in conditions (v) and (vi) above. These restrictions, however, do not ensure that we have previously satisfied, and may not ensure that we will, in all cases, be able to continue to satisfy, the share ownership requirements described in conditions (v) and (vi) above. If we fail to satisfy these share ownership requirements, except as provided in the next sentence, our status as a REIT will terminate. If, however, we comply with the rules contained in applicable Treasury Regulations that require us to ascertain the actual ownership of our shares and we do not know, or would not have known through the exercise of reasonable diligence, that we failed to meet the requirement described in condition (vi) above, we will be treated as having met this requirement. See “—Failure to Qualify”. In addition, we may not maintain our status as a REIT unless our taxable year is the calendar year and we comply with the recordkeeping requirements of the Code and the Treasury Regulations promulgated thereunder. We have and will continue to have a calendar taxable year.

Ownership of Interests in Partnerships, Limited Liability Companies and Qualified REIT Subsidiaries

In the case of a REIT that is a partner in a partnership or a member in a limited liability company treated as a partnership for federal income tax purposes, Treasury Regulations provide that the REIT will be deemed to own its proportionate share of the assets of the partnership or limited liability company, as the case may be, based on its interest in partnership capital, subject to special rules relating to the 10% asset test described below. Also, the REIT will be deemed to be entitled to its proportionate share of the income of that entity. The assets and gross income of the partnership or limited liability company retain the same character in the hands of the REIT, including satisfying the gross income tests and the asset tests. Thus, our pro rata share of the assets and items of income of any partnership or limited liability company treated as a partnership or disregarded entity for federal income tax purposes, including such partnership’s or limited liability company’s share of these items of any partnership or limited liability company treated as a partnership or disregarded entity for federal income tax purposes in which it owns an interest, would be treated as our assets and items of income for purposes of applying the requirements described in this discussion, including the gross income and asset tests described below. A brief summary of the rules governing the federal income taxation of partnerships and limited liability companies is set forth below in “—Tax Aspects of Our Operating Through Partnerships and Limited Liability Companies.”

We have sufficient control of our subsidiary partnerships and limited liability companies and intend to operate them in a manner consistent with the requirements for our qualification as a REIT. If we become a limited partner or non-managing member in any partnership or limited liability company and such entity takes or expects to take actions that could jeopardize our status as a REIT or require us to pay tax, we may be forced to dispose of our interest in such entity. In addition, it is possible that a partnership or limited liability company could take an action which could cause us to fail a gross income or asset test, and that we would not become aware of such action in time to dispose of our interest in the partnership or limited liability company or take other corrective action on a timely basis. In that case, we could fail to qualify as a REIT unless we were entitled to relief, as described below.

We may from time to time own and operate certain properties through subsidiaries that we intend to be treated as “qualified REIT subsidiaries” under the Code. If a REIT owns a corporate subsidiary that is a “qualified REIT subsidiary,” the separate existence of that subsidiary generally will be disregarded for federal income tax purposes. Generally, a qualified REIT subsidiary is a corporation, other than a taxable REIT subsidiary, all of the capital stock of which is owned by the REIT. All assets, liabilities and items of income, deduction and credit of the qualified REIT subsidiary will be treated as assets, liabilities and items of income, deduction and credit of the REIT itself for all purposes under the Code, including all REIT qualification tests. A qualified REIT subsidiary of ours will not be subject to federal corporate income taxation, although it may be subject to state and local taxation in some states.

The Bipartisan Budget Act of 2015 changed the rules applicable to U.S. federal income tax audits of partnerships (including partnerships in which we are a partner) and the collection of any tax resulting from such audits or other tax proceedings. Under the new rules, which are generally effective for taxable years beginning after December 31, 2017, among other changes and subject to certain exceptions, any audit adjustment to items of income, gain, loss, deduction, or credit of a partnership (and any partner’s distributive share thereof) is determined, and taxes, interest, or penalties attributable thereto are assessed and collected, at the partnership level. Although it is uncertain how these new rules will be implemented, it is possible that they could result in partnerships in which we directly or indirectly invest being required to pay additional taxes, interest, and penalties as a result of an audit adjustment, and we, as a direct or indirect partner of these partnerships, could be required to bear the economic burden of those taxes, interest, and penalties even though we, as a REIT, may not otherwise have been required to pay additional corporate-level taxes as a result of the related audit adjustment. The changes created by the Bipartisan Budget Act of 2015 depend in many respects on the promulgation of future regulations or other guidance by the U.S. Department of the Treasury, the particular provisions of each partnership or limited liability company agreement and elections made by the partnership representative on behalf of the partnership.

Ownerships of Interests in Taxable REIT Subsidiaries

A “taxable REIT subsidiary” is an entity taxable as a corporation in which we own stock and that elects with us to be treated as a taxable REIT subsidiary under Section 856(l) of the Code. In addition, if one of our taxable REIT subsidiaries owns, directly or indirectly, securities representing more than 35.0% of the vote or value of a subsidiary corporation, that subsidiary will also be treated as a taxable REIT subsidiary of ours. A taxable REIT subsidiary is subject to federal income tax, and state and local income tax where applicable, as a regular “C” corporation.

Generally, a taxable REIT subsidiary can perform impermissible tenant services without causing us to receive impermissible tenant services income under the REIT income tests. Subject to the tests described below, a taxable REIT subsidiary may own assets that are not considered real estate assets. Therefore, we may utilize taxable REIT subsidiaries to hold certain non-REIT qualifying investments. However, several provisions regarding the arrangements between a REIT and its taxable REIT subsidiaries ensure that a taxable REIT subsidiary will be subject to an appropriate level of federal income taxation. For example, a taxable REIT subsidiary is limited in its ability to deduct interest payments made to us. In addition, we will be obligated to pay a 100.0% penalty tax with respect to some payments that we receive or on certain expenses deducted by the taxable REIT subsidiary if the economic arrangements among us, our tenants and the taxable REIT subsidiary are not comparable to similar arrangements among unrelated parties.

In order for us to maintain qualification as a REIT, certain separate percentage tests relating to the source of our gross income must be satisfied annually. First, at least 75.0% of our gross income (excluding gross income from prohibited transactions) for each taxable year generally must be derived directly or indirectly from investments relating to real property or mortgages on real property (including “rents from real property,” gain, and, in certain circumstances, interest) or from certain types of temporary investments. Second, at least 95.0% of our gross income (excluding gross income from prohibited transactions, certain hedging transactions, and certain foreign currency gains) for each taxable year must be derived from such real property investments described above, dividends, interest and gain from the sale or disposition of stock or securities or from any combination of the foregoing.

Rents received by us will qualify as “rents from real property” in satisfying the above gross income tests only if several conditions are met. First, the amount of rent generally must not be based in whole or in part on the income or profits of any person. However, amounts received or accrued generally will not be excluded from “rents from real property” solely by reason of being based on a fixed percentage or percentages of receipts or sales.

Second, rents received from a tenant will not qualify as “rents from real property” if we, or a direct or indirect owner of 10.0% or more of our stock, actually or constructively owns 10.0% or more of such tenant (a “Related Party Tenant”). We may, however, lease our properties to a taxable REIT subsidiary and rents received from that subsidiary generally will not be disqualified from being “rents from real property” by reason of our ownership interest in the subsidiary if at least 90.0% of the property in question is leased to unrelated tenants and the rent paid by the taxable REIT subsidiary is substantially comparable to the rent paid by the unrelated tenants for comparable space, as determined pursuant to the rules in Code section 856(d)(8).

Third, if rent attributable to personal property that is leased in connection with a lease of real property is greater than 15.0% of the total rent received under the lease, then the portion of rent attributable to such personal property will not qualify as “rents from real property.” This 15.0% test is based on relative fair market value of the real and personal property. If the rent attributable to personal property does not exceed 15.0% of the total rent received under the lease, then the portion of the rent attributable to such personal property will qualify as “rents from real property” and the personal property will be treated as a real estate asset for purposes of the 75.0% assets test (as discussed below). In addition, in the case of any obligation secured by a mortgage on both real and personal property, if the fair market value of such personal property does not exceed 15.0% of the total fair market value of all such property, interest on such obligation is qualifying interest for purposes of the 75.0% gross income test and the obligation will be treated as a real estate asset for purposes of the 75.0% assets test.

Generally for rents to qualify as “rents from real property” for the purposes of the gross income tests, we are only allowed to provide services that are both “usually or customarily rendered” in connection with the rental of real property and not otherwise considered “rendered to the occupant.” Income received from any other service will be treated as “impermissible tenant service income” unless the service is provided through an independent contractor that bears the expenses of providing the services and from whom we derive no revenue or through a taxable REIT subsidiary, subject to specified limitations. The amount of impermissible tenant service income we receive is deemed to be the greater of the amount actually received by us or 150.0% of our direct cost of providing the service. If the impermissible tenant service income exceeds 1.0% of our total income from a property, then all of the income from that property will fail to qualify as rents from real property. If the total amount of impermissible tenant service income from a property does not exceed 1.0% of our total income from that property, the income will not cause the rent paid by tenants of that property to fail to qualify as rents from real property, but the impermissible tenant service income itself will not qualify as rents from real property.

To the extent our taxable REIT subsidiaries pay dividends, we generally will derive our allocable share of such dividend. Such dividend income will qualify under the 95.0%, but not the 75.0%, gross income test. We will monitor the amount of the dividend and other income from our taxable REIT subsidiaries and will take actions intended to keep this income, and any other nonqualifying income, within the limitations of the gross income tests. Although we expect these actions will be sufficient to prevent a violation of the gross income tests, we cannot guarantee that such actions will in all cases prevent such a violation.

If we fail to satisfy one or both of the 75.0% or 95.0% gross income tests for any taxable year, we may nevertheless qualify as a REIT for such year if we are entitled to relief under certain provisions of the Code. The relief provisions generally will be available if our failure to meet such tests was due to reasonable cause and not due to willful neglect, and, following the REIT’s identification of the failure to meet either of the gross income tests, a description of each item of the REIT’s gross income shall be included in a schedule for the relevant taxable year that is filed in accordance with the applicable regulations. It is not possible, however, to state whether in all circumstances we would be entitled to the benefit of these relief provisions. As discussed above, even if these relief provisions were to apply, a tax would be imposed with respect to the excess net income.

From time to time, we or our subsidiaries may enter into hedging transactions with respect to one or more of our or our subsidiaries’ assets or liabilities. Our or our subsidiaries’ hedging activities may include entering into interest rate swaps, caps, and floors, options to purchase such items, and futures and forward contracts. Income and gain from “hedging transactions” will be excluded from gross income for purposes of both the 75.0% and 95.0% gross income tests. A “hedging transaction” means (1) any transaction entered into in the normal course of our or our subsidiaries’ trade or business primarily to manage the risk of interest rate, price changes, or currency fluctuations with respect to borrowings made or to be made, or ordinary obligations incurred or to be incurred, to acquire or carry real estate assets, (2) any transaction entered into primarily to manage the risk of currency fluctuations with respect to any item of income or gain that would be qualifying income under the 75.0% or 95.0% gross income test (or any property which generates such income or gain) or (3) any hedging transaction entered into in connection with the extinguishment of specified indebtedness or disposal of property with respect to a position entered into under (1) or (2) above, if the position would be ordinary property. We are required to clearly identify any such hedging transaction before the close of the day on which it was acquired, originated, or entered into and to satisfy other identification requirements. We intend to structure any hedging transactions in a manner that does not jeopardize our qualification as a REIT; however, no assurance can be given that our hedging activities will give rise to income that qualifies for purposes of either or both of the gross income tests.

Prohibited Transaction Income

Any gain that we realize on the sale of property held as inventory or otherwise held primarily for sale to customers in the ordinary course of business, including our share of any such gain realized either directly or through any subsidiary partnerships and limited liability companies, will be treated as income from a prohibited transaction that is subject to a 100.0% penalty tax, unless certain safe harbor exceptions apply. This prohibited transaction income may also adversely affect our ability to satisfy the gross income tests for qualification as a REIT. Under existing law, whether property is held as inventory or primarily for sale to customers in the ordinary course of a trade or business is a question of fact that depends on all the facts and circumstances surrounding the particular transaction. We do not intend, and do not intend to permit any of our subsidiary partnerships or limited liability companies, to enter into any sales that are prohibited transactions. However, the IRS may successfully contend that some or all of the sales made by our subsidiary partnerships or limited liability companies are prohibited transactions. We would be required to pay the 100.0% penalty tax on our allocable share of the gains resulting from any such sales.

Any redetermined rents, redetermined deductions or excess interest we generate will be subject to a 100.0% penalty tax. In general, redetermined rents are rents from real property that are overstated as a result of any services furnished to any of our tenants by a taxable REIT subsidiary of ours, and redetermined deductions and excess interest represent any amounts that are deducted by a taxable REIT subsidiary of ours for amounts paid to us that are in excess of the amounts that would have been deducted based on arm’s length negotiations. Rents we receive will not constitute redetermined rents if they qualify for certain safe harbor provisions contained in the Code.

Currently, our taxable REIT subsidiaries do not provide any services to our tenants or conduct other material activities. However, a taxable REIT subsidiary of ours may in the future provide services to certain of our tenants and pay rent to us. We intend to set any fees paid to our taxable REIT subsidiaries for such services, and any rent payable to us by our taxable REIT subsidiaries, at arm’s length rates, although the amounts paid may not satisfy the safe-harbor provisions described above. These determinations are inherently factual, and the IRS has broad discretion to assert that amounts paid between related parties should be reallocated to clearly reflect their respective incomes. If the IRS successfully made such an assertion, we would be required to pay a 100.0% penalty tax on the excess of an arm’s length fee for tenant services over the amount actually paid, or on the excess rents paid to us.

At the close of each quarter of our taxable year, we must satisfy six tests relating to the nature of our assets.

| 1. | At least 75.0% of the value of our total assets must be represented by “real estate assets,” cash, cash items and government securities. Our real estate assets include, for this purpose, our allocable share of real estate assets held by the partnerships in which we own an interest, and the non‑corporate subsidiaries of these partnerships, as well as stock or debt instruments held for less than one year purchased with the proceeds of an offering of shares or long term debt. Real estate assets are defined to include debt instruments issued by publicly offered REITs that are not secured by a real estate asset (a “nonqualified publicly offered REIT debt instrument”). Although treated as a real estate asset, the gain on the sale of a nonqualified publicly offered REIT debt instrument does not qualify for purposes of the 75.0% gross income test and not more than 25% of the value of our total assets may be represented by nonqualified publicly offered REIT debt instruments. |

| 2. | Not more than 25.0% of the value of our total assets may be represented by securities, other than those in the 75.0% asset class. |