As filed with the U.S. Securities and Exchange Commission on January 7, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22732

HORIZONS ETF TRUST I

(Exact name of registrant as specified in charter)

c/o Horizons ETFs Management (US) LLC

625 Madison Avenue, 3rd Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Jonathan Molchan

President/Chief Executive Officer

c/o Horizons ETFs Management (US) LLC

625 Madison Avenue, 3rd Floor

New York, New York 10022

(Name and address of agent for service)

212-205-8300

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Item 1. Reports to Stockholders.

Annual Report

October 31, 2018

Horizons ETF Trust I

Horizons ETF Trust I (the “Trust”), was organized as a Delaware statutory trust on May 17, 2012 and is currently comprised of three investment portfolios. These financial statements relate to the Horizons NASDAQ 100® Covered Call ETF (“QYLD”), Horizons S&P 500® Covered Call ETF (“HSPX”) and Horizons DAX Germany ETF (“DAX”) (each a “Fund” and collectively, the “Funds”). The Horizons NASDAQ 100® Covered Call ETF and Horizons DAX Germany ETF both trade on the NASDAQ Stock Exchange and the Horizons S&P 500® Covered Call ETF trades on the New York Stock Exchange.

NASDAQ 100® is a registered trademark of The NASDAQ Stock Market, Inc. and has been licensed for use by Horizons ETFs Management (US) LLC and QYLD. The Fund is not sponsored, endorsed, issued, sold or promoted by NASDAQ, nor does this company make any representation regarding the advisability of investing in the Fund.

S&P 500® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and has been licensed for use by Horizons S&P 500® Covered Call ETF. S&P®, S&P 500®, and S&P 500 Stock Covered Call are trademarks of S&P and have been licensed for use by Horizons ETFs Management (US) LLC.

DAX® is a registered trademark of Deutsche Böerse AG and has been licensed for use by Horizons ETFs Management (US) LLC and DAX. The Fund is not sponsored, endorsed, issued, sold or promoted by Deutsche Böerse AG, nor does this company make any representation regarding the advisability of investing in the Fund.

The financial statements contained herein are submitted for the general information of the shareholders of each Fund. This report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Not FDIC Insured • No Bank Guarantee • May Lose Value

Foreside Fund Services, LLC, distributor.

An investment in each Fund is subject to investment risk, including the possible loss of principal amount invested. The risks associated with the Funds are detailed in the prospectus which include: stock market risk, index risk, tracking error risk, replication management risk, market price risk and trading halts risk.

Shares are bought and sold at market price (not net asset value or “NAV”), are not individually redeemable, and owners of the shares may acquire those shares from the Funds and tender those shares for redemption to the Funds in creation unit aggregations only.

TABLE OF CONTENTS

October 31, 2018 | | | | Page(s)

|

| | | | | 3 |

| | | | | 4 |

| | | | | 10 |

| | | | | 11 |

| | | | | 19 |

| | | | | 20 |

| | | | | 21 |

| | | | | 23 |

| | | | | 26 |

| | | | | 35 |

| | | | | 36 |

| | | | | 37 |

| | | | | 39 |

| | | | | 41 |

2

Letter to Shareholders

October 31, 2018 (Unaudited)

Dear Shareholder,

For the twelve month period that ended on October 31, 2018, investors witnessed a slight rise in U.S. equity benchmarks and the U.S. Dollar while U.S. yields and volatility moved significantly higher. U.S. markets have been the global leader for the past twelve months shrugging off a consistent slew of headlines and uncertainties that have led to a handful of volatility events, which eventually brought the U.S. equity benchmarks to nearly flat for 2018.

The prior years’ trend remained intact as the NASDAQ continued to lead broader equity markets. Technology companies continued to exhibit outperformance relative to other sectors despite headlines that have reshaped the way in which social media and technology companies are perceived by both governments and citizens. After reaching new all-time highs in October, the markets saw a sharp rise in volatility coinciding with higher interest rates. This move lower came in lockstep with ongoing worries of a trade war between the U.S. and China and various tariffs on other U.S. trading partners.

International markets did not participate with U.S. markets as regional economic data and global growth forecasts became more uncertain given tariffs, sanctions, and the potential material impacts of a trade war between the U.S. and China. Europe’s storylines continued to be focused on the potential outcome and effects of Brexit, the regional migrant crisis, and more recently issues in Italy. The stronger dollar negatively impacted Europe and Asia over the past year with most equity markets seeing double digit declines or worse in 2018. Two similarities between the U.S. and broader international markets have been elevated yields, coupled with heightened volatility.

The past twelve months can be categorized as a period of continued domestic growth where yield-focused investors found difficulty sourcing income without forfeiting a total return. At Horizons ETFs U.S. we strive to produce investment strategies that combat the current low yield environment through cost effective products aimed at generating income for investors.

I want to personally thank you for interest in Horizons ETFs U.S. and our investment products.

For more information on our company, and the features and risks of our investment solutions visit us at https://horizonsetfsus.com or call us at 855-496-3837. Investments are subject to Risk. For the Funds’ prospectus please visit https://horizonsetfsus.com. The Funds are distributed by Foreside Fund Services, LLC, which is not affiliated with Horizons ETFs Management (US) LLC, or any of its affiliates.

Sincerely,

Jonathan Molchan

Principal Executive Officer

Horizons ETF Trust I

3

Management Discussion of Fund Performance

October 31, 2018 (Unaudited)HORIZONS NASDAQ 100® COVERED CALL ETF The Fund seeks to provide investment results that will closely correspond, before fees and expenses, generally to the price and yield performance of the CBOE NASDAQ 100® BuyWrite V2 Index (the “Index”). The Index measures the total return of a portfolio consisting of equity securities of the 100 (103) companies included in the NASDAQ 100® Index and call options systematically written on those securities through a “buy-write” or covered call strategy.

A “buy-write” strategy is an investment strategy in which the Fund buys a specific basket of stocks (such as the NASDAQ 100® Index) and sells covered call options that correspond to that basket of stocks. The Fund implements its strategy by investing in all securities contained in the NASDAQ 100® Index and seeks to track the Index’s weightings per each constituent. The Fund also sells NASDAQ 100® Index call options on a monthly basis. These options are determined by the Chicago Board Options Exchange (“CBOE”) but are typically the closest to at-the-money and the position is updated for the next month (rolled) on the third Friday of every month, which is option expiration.

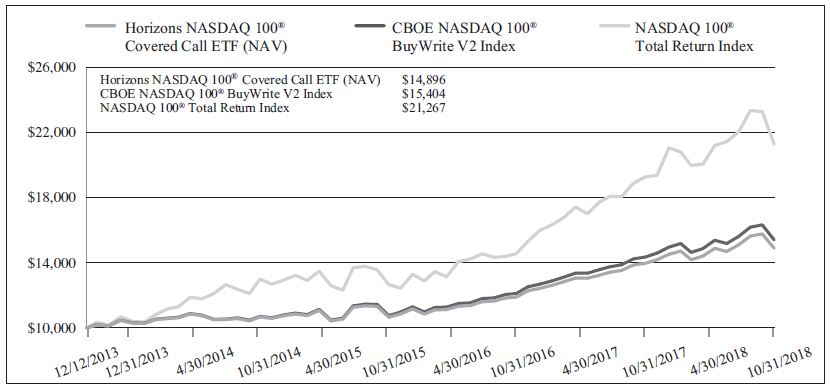

For the 12-month period ended October 31, 2018, the Fund (NAV) returned 7.44% versus 8.19% for the Index. The Fund’s inception was December 12, 2013.

The principal contributors to Fund performance for the period, in aggregate, were the Fund’s exposure to the underlying equities contained in the NASDAQ 100® Index along with the monthly income component derived from index options of the strategy. Another driver that impacted performance was the constituents of the NASDAQ 100® Index which had positive performance during the year and predominately composed of technology and healthcare names that are considered growth stocks.

Hypothetical Growth of a $10,000 Investment

(Since Inception, 12/12/2013 through 10/31/2018)

Gross Expense Ratio: 0.60%

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

4

Management Discussion of Fund Performance (continued)

October 31, 2018 (Unaudited)Fund Performance History

Average Annual Total Returns (%) (for periods ended October 31, 2018)

| | Inception1

| | 3 Year

| | 1 Year

|

Market Price2 | | 8.55% | | 9.70% | | 7.50% |

Net Asset Value | | 8.49% | | 9.73% | | 7.44% |

CBOE NASDAQ 100® BuyWriteV2 Index3 | | 9.24% | | 10.68% | | 8.19% |

NASDAQ 100® Total Return Index | | 16.69% | | 15.78% | | 12.67% |

1 | | Fund Inception Date: 12/12/2013. |

2 | | The price used to calculate Market Price returns is determined by using the closing price and does not represent returns an investor would receive if shares were traded at other times. |

3 | | The Fund switched its index from the CBOE NASDAQ 100® BuyWrite Index (BXN) to the CBOE NASDAQ 100® BuyWrite V2 Index (BXNT). The BXNT index replicates the methodology used to calculate the BXN index, with one exception: In BXNT, the written NASDAQ 100® index covered call options are held until one day prior to the expiration date and in BXN, the written NASDAQ 100® index covered call options are held until expiration. The BXNT index inception is 9/29/2015. Performance shown from 12/12/2013 to 9/28/2015 is that of the BXN index and performance after 9/28/2015 is that of the BXNT index. |

Performance data quoted represents past performance, which does not guarantee future results. The prior graph and table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost; and the current performance may be lower or higher than the performance data quoted. Please call 1-855-496-3837 or visit https://horizonsetfsus.com/qyld-horizons-nasdaq-100-covered-call-etf/ for the most recent month-end performance.

QYLD collects dividends from NASDAQ 100® Index companies and monthly options premium from selling NASDAQ 100® Index options, and portions have been passed to shareholders as monthly distributions. The Fund realizes capital gains from writing options and capital gains or losses whenever it sells securities. Any net realized long-term capital gains are distributed to shareholders as “capital gain distributions.” These do not imply rates for any future distributions. The Fund is not required to make monthly distributions.

Shares are bought and sold at market price (not NAV), are not individually redeemable, and owners of the shares may acquire those shares from the Fund and tender those shares for redemption to the Fund in creation unit aggregations only, consisting of 50,000 shares. Brokerage commissions will reduce returns. The Fund engages in writing covered call Index options on the NASDAQ 100® Index. By selling covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying Index above the exercise price, but continues to bear the risk of a decline in the index. A liquid market may not exist for options held by the Fund. While the Fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. The Fund is considered non-diversified and may be subject to greater risks than a diversified fund. Horizons ETFs Management (US) LLC is the Investment Adviser of the Fund. The Fund is distributed by Foreside Fund Services, LLC, which is not affiliated with Horizons ETFs Management (US) LLC or any of its affiliates. Please visit https://horizonsetfsus.com or call 1-855-496-3837 if you have any questions. Important Disclosures: Authorized for distribution only when preceded or accompanied by a prospectus.

5

Management Discussion of Fund Performance (continued)

October 31, 2018 (Unaudited)HORIZONS S&P 500® COVERED CALL ETF

The Fund seeks to provide investment results that will closely correspond, before fees and expenses, generally to the price and yield performance of the CBOE S&P 500® 2% OTM BuyWrite Index (the “Index”). The Index measures the total return of a portfolio consisting of equity securities of the 500 (505) companies included in the S&P 500® Index and call options systematically written on those securities through a “buy-write” or covered call strategy.

A “buy-write” strategy is an investment strategy in which the Fund buys a specific basket of stocks (such as the S&P 500® Index) and sells covered call options that correspond to that basket of stocks. The Fund implements its strategy by investing in all securities contained in the S&P 500® Index and seeks to track the Index’s weightings per each constituent. The Fund also sells S&P 500® Index call options on a monthly basis. These options are determined by the CBOE but are typically the closest to 2% out-of-the-money and the position is updated for the next month (rolled) on the third Friday of every month, which is option expiration.

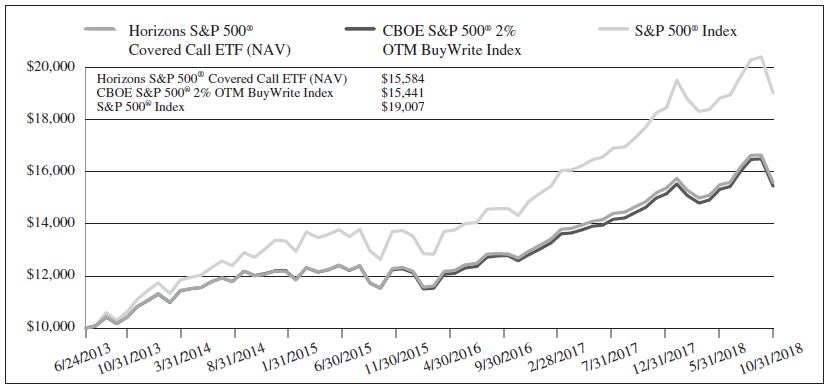

For the 12-month period ended October 31, 2018, the Fund (NAV) returned 4.97% versus 5.53% for the Index. The Fund’s inception was June 24, 2013.

The principal contributors to Fund performance for the period, in aggregate, were the Fund’s exposure to the underlying equities contained in the S&P 500® Index along with the monthly income component derived from index options of the strategy. Another driver that impacted performance were the constituents of the S&P 500® Index which had positive performance during the year.

Hypothetical Growth of a $10,000 Investment

(Since Inception, 6/24/2013 through 10/31/2018)

Gross Expense Ratio: 0.65%

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

6

Management Discussion of Fund Performance (continued)

October 31, 2018 (Unaudited)Fund Performance History

Average Annual Total Returns (%) (for periods ended October 31, 2018)

| | Inception1

| | 5 Year

| | 1 Year

|

Market Price2 | | 9.09% | | 7.98% | | 7.24% |

Net Asset Value | | 8.63% | | 7.53% | | 4.97% |

CBOE S&P 500® 2% OTM BuyWrite Index3 | | 8.44% | | 7.36% | | 5.53% |

S&P 500® Index | | 12.73% | | 11.34% | | 7.35% |

1 | | Fund Inception Date: 6/24/2013. |

2 | | The price used to calculate Market Price returns is determined by using the closing price and does not represent returns an investor would receive if shares were traded at other times. |

3 | | The Fund switched its index from the S&P 500® Stock Covered Call Index (SPXCC) to the CBOE S&P 500® 2% OTM BuyWrite Index (BXY). The BXY index inception is 3/17/2006. Performance shown from 6/24/2013 to 12/13/2017 is that of the SPXCC index and performance after 12/13/2017 is that of the BXY index. |

Performance data quoted represents past performance, which does not guarantee future results. The prior graph and table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost; and the current performance may be lower or higher than the performance data quoted. Please call 1-855-496-3837 or visit https://horizonsetfsus.com/hspx-horizons-sp-500-covered-call-etf/ for the most recent month-end performance.

HSPX collects dividends from the S&P 500® Index companies and monthly options premium from selling single stock options or selling S&P 500® Index Options, and portions have been passed to shareholders as monthly distributions. The Fund realizes capital gains from writing options and capital gains or losses whenever it sells securities. Any net realized long-term capital gains are distributed to shareholders as “capital gain distributions.” These do not imply rates for any future distributions. The Fund is not required to make monthly distributions.

Individual shares of the Fund may be purchased or sold in the secondary market throughout the regular trading day on the New York Stock Exchange through a brokerage account. However, shares are not individually redeemable directly from the Fund. The Fund engages in writing covered call Index options on the S&P 500® Index. By selling covered call options, the Fund limits its opportunity to profit from an increase in the price of the Index above the exercise price, but continues to bear the risk of a decline in the Index. A liquid market may not exist for options held by the Fund. While the Fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the current market price. The Fund issues and redeems shares on a continuous basis, at NAV, only in blocks of at least 50,000 shares (“Creation Units”), principally in-kind for securities included in the relevant Index. Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus which must precede or accompany this material. Please read the prospectus carefully before you invest. Distributor: Foreside Fund Services, LLC. Please visit https://horizonsetfsus.com or call 1-855-496-3837 if you have any questions. Important Disclosures: Authorized for distribution only when preceded or accompanied by a prospectus.

7

Management Discussion of Fund Performance (continued)

October 31, 2018 (Unaudited)HORIZONS DAX GERMANY ETF

The Fund seeks to provide investment results that will closely correspond, before fees and expenses, to the price and yield performance of the DAX® Index (the “Index”). The Index tracks the segment of the largest and most important companies, known as blue chips, on the German equities market. It contains the shares of the 30 largest and most liquid companies admitted to the FWB Frankfurt Stock Exchange in the Prime Standard segment. The Index represents about 80% of the aggregated prime standard’s market cap. It is completely rules based and transparent. On the basis of a clear and publicly available set of rules — the guide to the equity indices of Deutsche Böerse — the composition of the Index is determined in a manner comprehensive to all market participants.

The Fund implements its strategy by investing in the 30 stocks contained in the Index and seeks to track the Index’s weighting per each constituent.

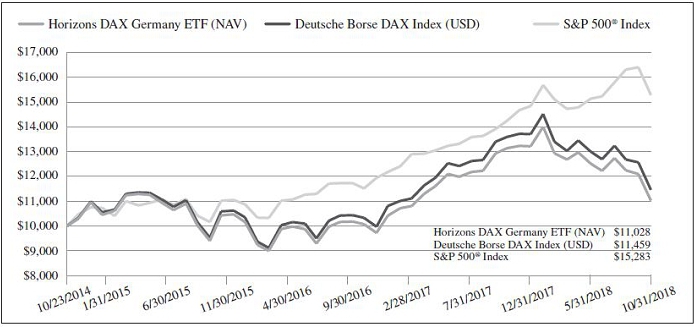

For the 12-month period ended October 31, 2018, the Fund (NAV) returned -16.05% versus -15.72% for the Index. The Fund’s inception was October 23, 2014.

The contributors to Fund performance for the period, in aggregate, were the Fund’s exposure to the underlying equities contained in the DAX® Index which traded lower over the twelve month period and also benefitted from lack of strength in the euro.

Hypothetical Growth of a $10,000 Investment

(Since Inception, 10/23/2014 through 10/31/2018)

Gross Expense Ratio: 0.45%, Net Expense Ratio: 0.20% (Effective August 1, 2017; Note 3)

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance.

8

Management Discussion of Fund Performance (continued)

October 31, 2018 (Unaudited)Fund Performance History

Average Annual Total Returns (%) (for periods ended October 31, 2018)

| | Inception1

| | 3 Year

| | 1 Year

|

Market Price2 | | 2.36% | | 1.97% | | (17.08)% |

Net Asset Value | | 2.46% | | 1.88% | | (16.05)% |

Deutsche Borse DAX Index (USD) | | 3.44% | | 2.67% | | (15.72)% |

S&P 500® Index | | 11.11% | | 11.52% | | 7.35% |

1 | | Fund Inception Date: 10/23/2014. |

2 | | The price used to calculate Market Price returns is determined by using the closing price and does not represent returns an investor would receive if shares were traded at other times. |

Performance data quoted represents past performance, which does not guarantee future results. The prior graph and table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost; and the current performance may be lower or higher than the performance data quoted. Please call 1-855-496-3837 or visit https://horizonsetfsus.com/horizons-dax-germany-etf-dax/ for the most recent month-end performance.

You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing. Contact Horizons ETF Management (US) LLC at 1-855-496-3837 or visit https://horizonsetfsus.com to obtain a prospectus which contains this and other information about the Fund. The prospectus should be read carefully before investing.

Shares are bought and sold at market price (not NAV), are not individually redeemable, and owners of the Shares may acquire those shares from the Fund and tender those shares for redemption to the Fund in Creation Unit aggregations only, consisting of 50,000 shares. Brokerage commissions will reduce returns. Index returns are for illustrative purposes only. Investors cannot directly invest in an index and unmanaged index returns do not reflect any management fees, transaction costs or expenses. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with investments in the Fund. Past performance does not guarantee future results. Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s shares and the possibility of significant losses. An investment in the Fund involves a substantial degree of risk. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries. Diversification may not protect against market risk or loss of principal. Brokerage commissions will reduce returns. The Fund is considered non-diversified and may be subject to greater risks than a diversified fund. The Fund is distributed by Foreside Fund Services, LLC, which is not affiliated with Horizons ETFs Management (US) LLC or any of its affiliates. Important Disclosures: Authorized for distribution only when preceded or accompanied by a prospectus.

9

Shareholder Expense Example

October 31, 2018 (Unaudited)

As a shareholder of the Funds, you incur a unitary management fee. Each Fund bears other expenses which are not covered under the unitary management fee that may vary and will affect the total level of expenses paid by the Fund, such as taxes and governmental fees, brokerage fees, commissions and other transaction expenses, costs of borrowing money, including interest expenses, certain custody expenses, acquired fund fees and expenses and extraordinary expenses (such as litigation and indemnification expenses), if any. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (from May 1, 2018 to October 31, 2018)

Actual Expenses

The first line under the Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under the Fund in the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account

Value

5/1/2018

| | Ending

Account

Value

10/31/2018

| | Annualized

Expense Ratios

During the Period

5/1/2018 to

10/31/2018

| | Expenses

Paid

During

Period**

5/1/2018 to

10/31/2018

|

Horizons NASDAQ 100® Covered Call ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,033.40 | | 0.60% | | $3.08 |

| Hypothetical* | | $1,000.00 | | $1,022.18 | | 0.60% | | $3.06 |

Horizons S&P 500® Covered Call ETF | | | | | | | | |

| Actual | | $1,000.00 | | $1,032.20 | | 0.65% | | $3.33 |

| Hypothetical* | | $1,000.00 | | $1,021.93 | | 0.65% | | $3.31 |

Horizons DAX Germany ETF*** | | | | | | | | |

| Actual | | $1,000.00 | | $850.20 | | 0.20% | | $0.93 |

| Hypothetical* | | $1,000.00 | | $1,024.20 | | 0.20% | | $1.02 |

* | | 5% return before expenses |

** | | Expenses are calculated using the most recent expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period) for QYLD, HSPX and DAX. |

*** | | The Adviser waived a portion of its fee (Note 3). |

10

Portfolio of Investments — Horizons NASDAQ 100® Covered Call ETF

October 31, 2018

| Security Description | | Shares

| | Fair

Value

|

Common Stocks — 100.7% † | | | | | | | | |

Communication Services — 22.8% | | | | | | | | |

Activision Blizzard, Inc. | | | 37,754 | | | $ | 2,606,914 | |

Alphabet, Inc. Class A * | | | 14,863 | | | | 16,209,291 | |

Alphabet, Inc. Class C * | | | 17,385 | | | | 18,719,646 | |

Baidu, Inc. (a)* | | | 13,926 | | | | 2,646,776 | |

Charter Communications, Inc. Class A * | | | 11,776 | | | | 3,772,677 | |

Comcast Corp. Class A | | | 231,411 | | | | 8,826,016 | |

Electronic Arts, Inc. * | | | 15,221 | | | | 1,384,807 | |

Facebook, Inc. Class A * | | | 118,955 | | | | 18,056,179 | |

Liberty Global PLC Class A * | | | 11,215 | | | | 287,440 | |

Liberty Global PLC Class C * | | | 28,792 | | | | 720,952 | |

NetEase, Inc. (a) | | | 3,807 | | | | 791,285 | |

Netflix, Inc. * | | | 21,193 | | | | 6,395,624 | |

Sirius XM Holdings, Inc. | | | 224,192 | | | | 1,349,636 | |

Take-Two Interactive Software, Inc. * | | | 5,760 | | | | 742,291 | |

T-Mobile US, Inc. * | | | 42,660 | | | | 2,924,343 | |

Twenty-First Century Fox, Inc. Class A | | | 52,499 | | | | 2,389,754 | |

Twenty-First Century Fox, Inc. Class B | | | 40,114 | | | | 1,812,350 | |

Vodafone Group PLC (a) | | | 23,570 | | | | 446,180 | |

| | | | | | | 90,082,161 | |

Consumer Discretionary — 15.9% | | | | | | | | |

Amazon.com, Inc. * | | | 23,869 | | | | 38,142,901 | |

Booking Holdings, Inc. * | | | 2,361 | | | | 4,425,883 | |

Ctrip.com International Ltd. (a)* | | | 22,547 | | | | 750,364 | |

Dollar Tree, Inc. * | | | 11,735 | | | | 989,261 | |

eBay, Inc. * | | | 50,442 | | | | 1,464,331 | |

Expedia, Inc. | | | 6,771 | | | | 849,287 | |

Hasbro, Inc. | | | 5,879 | | | | 539,163 | |

JD.Com, Inc. (a)* | | | 45,938 | | | | 1,080,462 | |

Marriott International, Inc. Class A | | | 17,751 | | | | 2,074,914 | |

MercadoLibre, Inc. | | | 2,186 | | | | 709,357 | |

O’Reilly Automotive, Inc. * | | | 4,082 | | | | 1,309,302 | |

Qurate Retail Group, Inc. * | | | 21,432 | | | | 470,218 | |

Ross Stores, Inc. | | | 19,009 | | | | 1,881,891 | |

Starbucks Corp. | | | 68,812 | | | | 4,009,675 | |

Tesla Motors, Inc. * | | | 8,310 | | | | 2,803,129 | |

Ulta Beauty, Inc. * | | | 3,028 | | | | 831,247 | |

Wynn Resorts Ltd. | | | 5,279 | | | | 531,067 | |

| | | | | | | 62,862,452 | |

Consumer Staples — 6.3% | | | | | | | | |

Costco Wholesale Corp. | | | 22,024 | | | | 5,035,347 | |

Kraft Heinz Co. | | | 61,439 | | | | 3,377,302 | |

Mondelez International, Inc. | | | 74,190 | | | | 3,114,496 | |

Monster Beverage Corp. * | | | 28,019 | | | | 1,480,804 | |

PepsiCo, Inc. | | | 70,568 | | | | 7,930,432 | |

Walgreens Boots Alliance, Inc. | | | 49,337 | | | | 3,935,613 | |

| | | | | | | 24,873,994 | |

Health Care — 9.3% | | | | | | | | |

Alexion Pharmaceuticals, Inc. * | | | 10,929 | | | | 1,224,813 | |

Align Technology, Inc. * | | | 3,876 | | | | 857,371 | |

Amgen, Inc. | | | 32,207 | | | | 6,209,188 | |

Biogen, Inc. * | | | 10,564 | | | | 3,214,308 | |

BioMarin Pharmaceutical, Inc. * | | | 8,641 | | | | 796,441 | |

Celgene Corp. * | | | 36,220 | | | | 2,593,352 | |

Cerner Corp. * | | | 16,461 | | | | 942,886 | |

DENTSPLY SIRONA, Inc. | | | 11,555 | | | | 400,150 | |

Express Scripts Holding Co. * | | | 27,318 | | | | 2,649,026 | |

Gilead Sciences, Inc. | | | 65,371 | | | | 4,456,995 | |

Henry Schein, Inc. * | | | 7,577 | | | | 628,891 | |

Hologic, Inc. * | | | 13,904 | | | | 542,117 | |

| | | | | | | | | |

| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Health Care (Continued) | | | | | | | | |

IDEXX Laboratories, Inc. * | | | 4,227 | | | $ | 896,631 | |

Illumina, Inc. * | | | 7,239 | | | | 2,252,415 | |

Incyte Corp. * | | | 10,254 | | | | 664,664 | |

Intuitive Surgical, Inc. * | | | 5,609 | | | | 2,923,299 | |

Mylan NV * | | | 25,550 | | | | 798,437 | |

Regeneron Pharmaceuticals, Inc. * | | | 5,185 | | | | 1,758,959 | |

Shire PLC (a) | | | 3,445 | | | | 626,301 | |

Vertex Pharmaceuticals, Inc. * | | | 12,571 | | | | 2,130,282 | |

| | | | | | | 36,566,526 | |

Industrials — 2.0% | | | | | | | | |

American Airlines Group, Inc. | | | 23,520 | | | | 825,082 | |

Cintas Corp. | | | 5,110 | | | | 929,356 | |

CSX Corp. | | | 43,397 | | | | 2,988,317 | |

Fastenal Co. | | | 14,317 | | | | 736,037 | |

JB Hunt Transport Services, Inc. | | | 5,402 | | | | 597,515 | |

PACCAR, Inc. | | | 17,490 | | | | 1,000,603 | |

Verisk Analytics, Inc. * | | | 8,304 | | | | 995,151 | |

| | | | | | | 8,072,061 | |

Information Technology — 44.4% | | | | | | | | |

Adobe Systems, Inc. * | | | 24,485 | | | | 6,017,434 | |

Analog Devices, Inc. | | | 18,514 | | | | 1,549,807 | |

Apple, Inc. | | | 240,004 | | | | 52,527,275 | |

Applied Materials, Inc. | | | 49,576 | | | | 1,630,059 | |

ASML Holding NV | | | 3,533 | | | | 608,948 | |

Autodesk, Inc. * | | | 10,885 | | | | 1,406,886 | |

Automatic Data Processing, Inc. | | | 22,025 | | | | 3,173,362 | |

Broadcom, Inc. | | | 21,484 | | | | 4,801,459 | |

CA, Inc. | | | 20,838 | | | | 924,374 | |

Cadence Design Systems, Inc. * | | | 14,275 | | | | 636,237 | |

Check Point Software Technologies Ltd. * | | | 8,034 | | | | 891,774 | |

Cisco Systems, Inc. | | | 233,272 | | | | 10,672,194 | |

Citrix Systems, Inc. | | | 6,684 | | | | 684,909 | |

Cognizant Technology Solutions Class A | | | 29,281 | | | | 2,021,267 | |

Fiserv, Inc. * | | | 20,493 | | | | 1,625,095 | |

Intel Corp. | | | 229,589 | | | | 10,763,132 | |

Intuit, Inc. | | | 12,739 | | | | 2,687,929 | |

KLA-Tencor Corp. | | | 7,646 | | | | 699,915 | |

Lam Research Corp. | | | 8,022 | | | | 1,136,958 | |

Maxim Integrated Products, Inc. | | | 13,936 | | | | 697,079 | |

Microchip Technology, Inc. | | | 11,556 | | | | 760,154 | |

Micron Technology, Inc. * | | | 55,797 | | | | 2,104,663 | |

Microsoft Corp. | | | 379,933 | | | | 40,580,644 | |

NVIDIA Corp. | | | 30,326 | | | | 6,393,630 | |

Paychex, Inc. | | | 18,031 | | | | 1,180,850 | |

Paypal Holdings, Inc. * | | | 57,377 | | | | 4,830,570 | |

QUALCOMM, Inc. | | | 73,116 | | | | 4,598,265 | |

Seagate Technology PLC | | | 14,123 | | | | 568,168 | |

Skyworks Solutions, Inc. | | | 8,983 | | | | 779,365 | |

Symantec Corp. | | | 30,519 | | | | 553,920 | |

Synopsys, Inc. * | | | 7,525 | | | | 673,713 | |

Texas Instruments, Inc. | | | 48,392 | | | | 4,492,229 | |

Western Digital Corp. | | | 14,668 | | | | 631,751 | |

Workday, Inc. * | | | 7,134 | | | | 948,965 | |

Xilinx, Inc. | | | 12,654 | | | | 1,080,272 | |

| | | | | | | 175,333,252 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $364,414,954) | | | | | | | 397,790,446 | |

The accompanying notes are an integral part of these financial statements.

11

Portfolio of Investments — Horizons NASDAQ 100® Covered Call ETF (concluded)

October 31, 2018| Security Description | | Shares

| | Fair

Value

|

INVESTMENTS, AT VALUE — 100.7% | | | | | | | | |

(Cost $364,414,954) | | | | | | $ | 397,790,446 | |

Liabilities in Excess of Other Assets: | | | | | | | | |

Written Call Options — (0.8)% | | | | | | | (3,311,800 | ) |

Other Assets 0.1% | | | | | | | 722,935 | |

Total Liabilities in Excess of

Other Assets — (0.7%) | | | | | | | (2,588,865 | ) |

Total Net Assets — 100.0% | | | | | | $ | 395,201,581 | |

† | | All or a portion of these securities has been segregated as collateral for written options contracts. The aggregate market value of collateral at October 31, 2018 was $397,790,446. |

* | | Non-income producing security. |

(a) | | American Depositary Receipt |

Glossary:

Ltd. — Private Limited Company

PLC — Public Limited Company

Number of

Contractsˆ

| | | | Notional

Value

| | Fair Value

|

| Written Call Options — (0.8)% | | | | | | | | |

| | (571 | ) | | NASDAQ 100® Index,

Strike @ $7,210, Exp 11/16/18 | | $ | (397,821,182 | ) | | $ | (3,311,800 | ) |

| | | | | Total Written Call Options | | | | | | | | |

| | | | | (Premiums Received $8,400,436) | | | | | | $ | (3,311,800 | ) |

ˆ | | Each contract equals 100 shares. |

| Sector Allocation (unaudited) | | | | |

(as of October 31, 2018) | | | | |

Information Technology | | | 44.4 | % |

Communication Services | | | 22.8 | |

Consumer Discretionary | | | 15.9 | |

Health Care | | | 9.3 | |

Consumer Staples | | | 6.3 | |

Industrials | | | 2.0 | |

Total Investments | | | 100.7 | |

Liabilities in Excess of Other Assets | | | (0.7 | ) |

Net Assets | | | 100.0 | % |

Sector allocation excludes derivatives and percentages indicated are based upon net assets.

The accompanying notes are an integral part of these financial statements.

12

Portfolio of Investments — Horizons S&P 500® Covered Call ETF

October 31, 2018| Security Description | | Shares

| | Fair

Value

|

Common Stocks — 99.5%† | | | | | | | | |

Communication Services — 10.0% | | | | | | | | |

Activision Blizzard, Inc. | | | 2,522 | | | $ | 174,144 | |

Alphabet, Inc. Class A* | | | 1,017 | | | | 1,109,120 | |

Alphabet, Inc. Class C* | | | 1,041 | | | | 1,120,918 | |

AT&T, Inc. | | | 24,146 | | | | 740,799 | |

CBS Corp. Class B | | | 1,210 | | | | 69,393 | |

CenturyLink, Inc. | | | 3,230 | | | | 66,667 | |

Charter Communications, Inc. Class A* | | | 669 | | | | 214,328 | |

Comcast Corp. Class A | | | 15,661 | | | | 597,311 | |

Discovery Communications, Inc. Class A* | | | 511 | | | | 16,551 | |

Discovery Communications, Inc. Class C* | | | 1,018 | | | | 29,838 | |

DISH Network Corp.* | | | 758 | | | | 23,301 | |

Electronic Arts, Inc.* | | | 1,024 | | | | 93,163 | |

Facebook, Inc. Class A* | | | 7,886 | | | | 1,197,016 | |

Interpublic Group of Cos., Inc. | | | 1,306 | | | | 30,247 | |

Netflix, Inc.* | | | 1,434 | | | | 432,752 | |

News Corp. Class A | | | 1,270 | | | | 16,751 | |

News Corp. Class B | | | 414 | | | | 5,523 | |

Omnicom Group, Inc. | | | 767 | | | | 57,003 | |

Take-Two Interactive Software, Inc.* | | | 395 | | | | 50,904 | |

TripAdvisor, Inc.* | | | 359 | | | | 18,718 | |

Twenty-First Century Fox, Inc. Class A | | | 3,503 | | | | 159,457 | |

Twenty-First Century Fox, Inc. Class B | | | 1,484 | | | | 67,047 | |

Twitter, Inc.* | | | 2,238 | | | | 77,770 | |

Verizon Communications, Inc. | | | 13,807 | | | | 788,242 | |

Viacom, Inc. Class B | | | 1,172 | | | | 37,481 | |

Walt Disney Co. | | | 5,084 | | | | 583,796 | |

| | | | | | | 7,778,240 | |

Consumer Discretionary — 9.7% | | | | | | | | |

Advance Auto Parts, Inc. | | | 256 | | | | 40,899 | |

Amazon.com, Inc.* | | | 1,357 | | | | 2,168,500 | |

Aptiv PLC | | | 888 | | | | 68,198 | |

AutoZone, Inc.* | | | 101 | | | | 74,080 | |

Best Buy Co., Inc. | | | 884 | | | | 62,021 | |

Booking Holdings, Inc.* | | | 163 | | | | 305,556 | |

BorgWarner, Inc. | | | 669 | | | | 26,365 | |

CarMax, Inc.* | | | 610 | | | | 41,425 | |

Carnival Corp. | | | 1,358 | | | | 76,102 | |

Chipotle Mexican Grill, Inc.* | | | 95 | | | | 43,731 | |

Darden Restaurants, Inc. | | | 417 | | | | 44,431 | |

Dollar General Corp. | | | 865 | | | | 96,344 | |

Dollar Tree, Inc.* | | | 799 | | | | 67,356 | |

DR Horton, Inc. | | | 1,134 | | | | 40,779 | |

eBay, Inc.* | | | 3,313 | | | | 96,176 | |

Expedia, Inc. | | | 416 | | | | 52,179 | |

Foot Locker, Inc. | | | 413 | | | | 19,469 | |

Ford Motor Co. | | | 13,014 | | | | 124,284 | |

Gap Inc. | | | 731 | | | | 19,956 | |

Garmin Ltd. | | | 380 | | | | 25,141 | |

General Motors Co. | | | 4,361 | | | | 159,569 | |

Genuine Parts Co. | | | 487 | | | | 47,687 | |

Goodyear Tire & Rubber Co. | | | 834 | | | | 17,564 | |

H&R Block, Inc. | | | 696 | | | | 18,472 | |

Hanesbrands, Inc. | | | 1,211 | | | | 20,781 | |

Harley-Davidson, Inc. | | | 568 | | | | 21,709 | |

Hasbro, Inc. | | | 356 | | | | 32,649 | |

Hilton Worldwide Holdings, Inc. | | | 678 | | | | 48,253 | |

Home Depot, Inc. | | | 3,919 | | | | 689,274 | |

Kohl’s Corp. | | | 571 | | | | 43,242 | |

L Brands, Inc. | | | 830 | | | | 26,909 | |

Leggett & Platt, Inc. | | | 441 | | | | 16,013 | |

| | | | | | | | | |

| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Consumer Discretionary (Continued) | | | | | | | | |

Lennar Corp. | | | 676 | | | $ | 29,054 | |

LKQ Corp.* | | | 1,025 | | | | 27,952 | |

Lowe’s Cos., Inc. | | | 2,809 | | | | 267,473 | |

Macy’s, Inc. | | | 1,013 | | | | 34,736 | |

Marriott International, Inc. Class A | | | 1,041 | | | | 121,682 | |

Mattel, Inc.* | | | 1,140 | | | | 15,481 | |

McDonald’s Corp. | | | 2,561 | | | | 453,041 | |

MGM Resorts International | | | 1,733 | | | | 46,236 | |

Michael Kors Holdings Ltd.* | | | 505 | | | | 27,982 | |

Mohawk Industries, Inc.* | | | 221 | | | | 27,565 | |

Newell Brands, Inc. | | | 1,641 | | | | 26,059 | |

NIKE, Inc. Class B | | | 4,382 | | | | 328,825 | |

Nordstrom, Inc. | | | 386 | | | | 25,387 | |

Norwegian Cruise Line Holdings Ltd.* | | | 469 | | | | 20,669 | |

O’Reilly Automotive, Inc.* | | | 293 | | | | 93,980 | |

PulteGroup, Inc. | | | 922 | | | | 22,654 | |

PVH Corp. | | | 257 | | | | 31,043 | |

Ralph Lauren Corp. | | | 194 | | | | 25,144 | |

Ross Stores, Inc. | | | 1,296 | | | | 128,304 | |

Royal Caribbean Cruises Ltd. | | | 572 | | | | 59,906 | |

Starbucks Corp. | | | 4,803 | | | | 279,871 | |

Tapestry, Inc. | | | 950 | | | | 40,194 | |

Target Corp. | | | 1,827 | | | | 152,792 | |

Tiffany & Co. | | | 349 | | | | 38,844 | |

TJX Cos., Inc. | | | 2,117 | | | | 232,616 | |

Tractor Supply Co. | | | 421 | | | | 38,686 | |

Ulta Beauty, Inc.* | | | 194 | | | | 53,257 | |

Under Armour, Inc. Class A* | | | 615 | | | | 13,598 | |

Under Armour, Inc. Class C* | | | 630 | | | | 12,493 | |

VF Corp. | | | 1,085 | | | | 89,925 | |

Whirlpool Corp. | | | 253 | | | | 27,769 | |

Wynn Resorts Ltd. | | | 265 | | | | 26,659 | |

Yum! Brands, Inc. | | | 1,145 | | | | 103,519 | |

| | | | | | | 7,558,510 | |

Consumer Staples — 7.3% | | | | | | | | |

Altria Group, Inc. | | | 6,380 | | | | 414,955 | |

Archer Daniels Midland Co. | | | 1,870 | | | | 88,358 | |

Brown-Forman Corp. Class B | | | 823 | | | | 38,138 | |

Campbell Soup Co. | | | 644 | | | | 24,092 | |

Church & Dwight Co., Inc. | | | 830 | | | | 49,277 | |

Clorox Co. | | | 441 | | | | 65,466 | |

Coca-Cola Co. | | | 12,772 | | | | 611,523 | |

Colgate-Palmolive Co. | | | 2,933 | | | | 174,660 | |

ConAgra Brands, Inc. | | | 1,393 | | | | 49,591 | |

Constellation Brands, Inc. Class A | | | 572 | | | | 113,960 | |

Costco Wholesale Corp. | | | 1,458 | | | | 333,343 | |

Coty, Inc. | | | 1,579 | | | | 16,658 | |

Estee Lauder Cos., Inc. Class A | | | 742 | | | | 101,981 | |

General Mills, Inc. | | | 1,929 | | | | 84,490 | |

Hershey Co. | | | 479 | | | | 51,325 | |

Hormel Foods Corp. | | | 894 | | | | 39,014 | |

JM Smucker Co. | | | 379 | | | | 41,053 | |

Kellogg Co. | | | 827 | | | | 54,152 | |

Kimberly-Clark Corp. | | | 1,174 | | | | 122,448 | |

Kraft Heinz Co. | | | 1,987 | | | | 109,225 | |

Kroger Co. | | | 2,997 | | | | 89,191 | |

McCormick & Co., Inc. | | | 393 | | | | 56,592 | |

Molson Coors Brewing Co. Class B | | | 614 | | | | 39,296 | |

Mondelez International, Inc. | | | 5,016 | | | | 210,572 | |

The accompanying notes are an integral part of these financial statements.

13

Portfolio of Investments — Horizons S&P 500® Covered Call ETF (continued)

October 31, 2018| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Consumer Staples (Continued) | | | | | | | | |

Monster Beverage Corp.* | | | 1,390 | | | $ | 73,462 | |

PepsiCo, Inc. | | | 4,763 | | | | 535,266 | |

Philip Morris International, Inc. | | | 5,361 | | | | 472,143 | |

Procter & Gamble Co. | | | 8,484 | | | | 752,361 | |

Sysco Corp. | | | 1,615 | | | | 115,198 | |

Tyson Foods, Inc. Class A | | | 960 | | | | 57,523 | |

Walgreens Boots Alliance, Inc. | | | 2,899 | | | | 231,253 | |

Wal-Mart Stores, Inc. | | | 4,868 | | | | 488,163 | |

| | | | | | | 5,704,729 | |

Energy — 5.5% | | | | | | | | |

Anadarko Petroleum Corp. | | | 1,865 | | | | 99,218 | |

Apache Corp. | | | 1,267 | | | | 47,931 | |

Baker Hughes a GE Co. | | | 1,424 | | | | 38,007 | |

Cabot Oil & Gas Corp. | | | 1,549 | | | | 37,532 | |

Chevron Corp. | | | 6,461 | | | | 721,371 | |

Cimarex Energy Co. | | | 317 | | | | 25,192 | |

Concho Resources, Inc.* | | | 505 | | | | 70,240 | |

ConocoPhillips | | | 4,046 | | | | 282,815 | |

Devon Energy Corp. | | | 1,748 | | | | 56,635 | |

EOG Resources, Inc. | | | 1,922 | | | | 202,463 | |

EQT Corp. | | | 797 | | | | 27,074 | |

Exxon Mobil Corp. | | | 14,157 | | | | 1,128,030 | |

Halliburton Co. | | | 2,898 | | | | 100,503 | |

Helmerich & Payne, Inc. | | | 360 | | | | 22,424 | |

Hess Corp. | | | 896 | | | | 51,430 | |

HollyFrontier Corp. | | | 663 | | | | 44,713 | |

Kinder Morgan, Inc. | | | 6,399 | | | | 108,911 | |

Marathon Oil Corp. | | | 2,838 | | | | 53,894 | |

Marathon Petroleum Corp. | | | 1,683 | | | | 118,567 | |

National Oilwell Varco, Inc. | | | 1,265 | | | | 46,552 | |

Newfield Exploration Co.* | | | 663 | | | | 13,393 | |

Noble Energy, Inc. | | | 1,618 | | | | 40,207 | |

Occidental Petroleum Corp. | | | 2,555 | | | | 171,364 | |

ONEOK, Inc. | | | 1,265 | | | | 82,984 | |

Phillips 66 | | �� | 1,428 | | | | 146,827 | |

Pioneer Natural Resources Co. | | | 574 | | | | 84,533 | |

Schlumberger Ltd. | | | 4,634 | | | | 237,771 | |

TechnipFMC PLC | | | 1,460 | | | | 38,398 | |

Valero Energy Corp. | | | 1,481 | | | | 134,904 | |

Williams Cos., Inc. | | | 2,750 | | | | 66,908 | |

| | | | | | | 4,300,791 | |

Financials — 13.8% | | | | | | | | |

Affiliated Managers Group, Inc. | | | 195 | | | | 22,164 | |

Aflac, Inc. | | | 2,648 | | | | 114,049 | |

Allstate Corp. | | | 1,203 | | | | 115,151 | |

American Express Co. | | | 2,439 | | | | 250,558 | |

American International Group, Inc. | | | 3,004 | | | | 124,035 | |

Ameriprise Financial, Inc. | | | 509 | | | | 64,765 | |

Aon PLC | | | 856 | | | | 133,690 | |

Arthur J. Gallagher & Co. | | | 600 | | | | 44,406 | |

Assurant, Inc. | | | 178 | | | | 17,303 | |

Bank of America Corp. | | | 32,647 | | | | 897,792 | |

Bank of New York Mellon Corp. | | | 3,439 | | | | 162,768 | |

BB&T Corp. | | | 2,688 | | | | 132,142 | |

Berkshire Hathaway, Inc. Class B* | | | 6,490 | | | | 1,332,267 | |

BlackRock, Inc. Class A | | | 413 | | | | 169,916 | |

Brighthouse Financial, Inc.* | | | 319 | | | | 12,642 | |

Capital One Financial Corp. | | | 1,609 | | | | 143,684 | |

CBOE Holdings, Inc. | | | 384 | | | | 43,334 | |

| | | | | | | | | |

| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Financials (Continued) | | | | | | | | |

Charles Schwab Corp. | | | 4,006 | | | $ | 185,237 | |

Chubb Ltd. | | | 1,548 | | | | 193,361 | |

Cincinnati Financial Corp. | | | 506 | | | | 39,792 | |

Citigroup, Inc. | | | 8,821 | | | | 577,423 | |

Citizens Financial Group, Inc. | | | 1,676 | | | | 62,599 | |

CME Group, Inc. | | | 1,140 | | | | 208,894 | |

Comerica, Inc. | | | 583 | | | | 47,549 | |

Discover Financial Services, Inc. Class A | | | 1,238 | | | | 86,251 | |

E*TRADE Financial Corp. | | | 916 | | | | 45,269 | |

Everest Re Group Ltd. | | | 135 | | | | 29,411 | |

Fifth Third Bancorp | | | 2,461 | | | | 66,422 | |

Franklin Resources, Inc. | | | 1,105 | | | | 33,703 | |

Goldman Sachs Group, Inc. | | | 1,198 | | | | 269,993 | |

Hartford Financial Services Group, Inc. | | | 1,210 | | | | 54,958 | |

Huntington Bancshares Inc. | | | 3,626 | | | | 51,961 | |

Intercontinental Exchange, Inc. | | | 1,959 | | | | 150,921 | |

Invesco Ltd. | | | 1,355 | | | | 29,417 | |

Jefferies Financial Group, Inc. | | | 1,051 | | | | 22,565 | |

JPMorgan Chase & Co. | | | 11,718 | | | | 1,277,496 | |

KeyCorp | | | 3,628 | | | | 65,884 | |

Lincoln National Corp. | | | 737 | | | | 44,360 | |

Loews Corp. | | | 919 | | | | 42,789 | |

M&T Bank Corp. | | | 505 | | | | 83,532 | |

Marsh & McLennan Cos., Inc. | | | 1,705 | | | | 144,499 | |

MetLife, Inc. | | | 3,535 | | | | 145,607 | |

Moody’s Corp. | | | 552 | | | | 80,305 | |

Morgan Stanley | | | 4,704 | | | | 214,785 | |

MSCI, Inc. | | | 294 | | | | 44,212 | |

Nasdaq, Inc. | | | 387 | | | | 33,557 | |

Northern Trust Corp. | | | 710 | | | | 66,790 | |

People’s United Financial, Inc. | | | 1,144 | | | | 17,915 | |

PNC Financial Services Group, Inc. | | | 1,592 | | | | 204,556 | |

Principal Financial Group, Inc. | | | 893 | | | | 42,034 | |

Progressive Corp. | | | 1,934 | | | | 134,800 | |

Prudential Financial, Inc. | | | 1,421 | | | | 133,261 | |

Raymond James Financial, Inc. | | | 426 | | | | 32,670 | |

Regions Financial Corp. | | | 3,977 | | | | 67,490 | |

S&P Global, Inc. | | | 856 | | | | 156,066 | |

State Street Corp. | | | 1,242 | | | | 85,388 | |

SunTrust Banks, Inc. | | | 1,610 | | | | 100,883 | |

SVB Financial Group* | | | 169 | | | | 40,092 | |

Synchrony Financial | | | 2,489 | | | | 71,882 | |

T. Rowe Price Group, Inc. | | | 799 | | | | 77,495 | |

Torchmark Corp. | | | 359 | | | | 30,393 | |

Travelers Cos., Inc. | | | 919 | | | | 114,994 | |

Unum Group | | | 760 | | | | 27,558 | |

US Bancorp | | | 5,296 | | | | 276,822 | |

Wells Fargo & Co. | | | 14,875 | | | | 791,796 | |

Willis Towers Watson PLC | | | 446 | | | | 63,849 | |

Zions Bancorporation | | | 695 | | | | 32,700 | |

| | | | | | | 10,682,852 | |

Health Care — 14.9% | | | | | | | | |

Abbott Laboratories | | | 5,779 | | | | 398,404 | |

AbbVie, Inc. | | | 5,459 | | | | 424,983 | |

ABIOMED, Inc.* | | | 135 | | | | 46,062 | |

Aetna, Inc. | | | 1,104 | | | | 219,034 | |

Agilent Technologies, Inc. | | | 1,078 | | | | 69,844 | |

Alexion Pharmaceuticals, Inc.* | | | 740 | | | | 82,932 | |

Align Technology, Inc.* | | | 238 | | | | 52,646 | |

The accompanying notes are an integral part of these financial statements.

14

Portfolio of Investments — Horizons S&P 500® Covered Call ETF (continued)

October 31, 2018| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Health Care (continued) | | | | | | | | |

Allergan PLC | | | 1,111 | | | $ | 175,549 | |

AmerisourceBergen Corp. | | | 539 | | | | 47,432 | |

Amgen, Inc. | | | 2,217 | | | | 427,415 | |

Anthem, Inc. | | | 884 | | | | 243,604 | |

Baxter International, Inc. | | | 1,676 | | | | 104,767 | |

Becton Dickinson and Co. | | | 889 | | | | 204,914 | |

Biogen, Inc.* | | | 703 | | | | 213,902 | |

Boston Scientific Corp.* | | | 4,568 | | | | 165,087 | |

Bristol-Myers Squibb Co. | | | 5,457 | | | | 275,797 | |

Cardinal Health, Inc. | | | 1,051 | | | | 53,181 | |

Celgene Corp.* | | | 2,615 | | | | 187,234 | |

Centene Corp.* | | | 573 | | | | 74,673 | |

Cerner Corp.* | | | 1,048 | | | | 60,029 | |

Cigna Corp. | | | 834 | | | | 178,318 | |

Cooper Cos., Inc. | | | 163 | | | | 42,104 | |

CVS Health Corp. | | | 3,382 | | | | 244,823 | |

Danaher Corp. | | | 2,032 | | | | 201,981 | |

DaVita, Inc.* | | | 508 | | | | 34,209 | |

DENTSPLY SIRONA, Inc. | | | 763 | | | | 26,423 | |

Edwards Lifesciences Corp.* | | | 702 | | | | 103,615 | |

Eli Lilly & Co. | | | 3,222 | | | | 349,394 | |

Express Scripts Holding Co.* | | | 1,939 | | | | 188,025 | |

Gilead Sciences, Inc. | | | 4,347 | | | | 296,378 | |

HCA Healthcare, Inc. | | | 959 | | | | 128,055 | |

Henry Schein, Inc.* | | | 538 | | | | 44,654 | |

Hologic, Inc.* | | | 931 | | | | 36,300 | |

Humana, Inc. | | | 481 | | | | 154,117 | |

IDEXX Laboratories, Inc.* | | | 291 | | | | 61,727 | |

Illumina, Inc.* | | | 485 | | | | 150,908 | |

Incyte Corp.* | | | 571 | | | | 37,012 | |

Intuitive Surgical, Inc.* | | | 381 | | | | 198,570 | |

IQVIA Holdings, Inc.* | | | 374 | | | | 45,976 | |

Johnson & Johnson | | | 8,918 | | | | 1,248,431 | |

Laboratory Corp. of America Holdings* | | | 349 | | | | 56,032 | |

McKesson Corp. | | | 699 | | | | 87,207 | |

Medtronic PLC | | | 4,507 | | | | 404,819 | |

Merck & Co., Inc. | | | 8,925 | | | | 656,969 | |

Mettler-Toledo International, Inc.* | | | 96 | | | | 52,495 | |

Mylan NV* | | | 1,781 | | | | 55,656 | |

Nektar Therapeutics* | | | 536 | | | | 20,732 | |

PerkinElmer, Inc. | | | 378 | | | | 32,689 | |

Perrigo Co. PLC | | | 442 | | | | 31,073 | |

Pfizer, Inc. | | | 19,755 | | | | 850,650 | |

Quest Diagnostics, Inc. | | | 452 | | | | 42,538 | |

Regeneron Pharmaceuticals, Inc.* | | | 255 | | | | 86,506 | |

ResMed, Inc. | | | 474 | | | | 50,206 | |

Stryker Corp. | | | 1,071 | | | | 173,738 | |

Thermo Fisher Scientific, Inc. | | | 1,331 | | | | 310,988 | |

UnitedHealth Group, Inc. | | | 3,216 | | | | 840,502 | |

Universal Health Services, Inc. Class B | | | 294 | | | | 35,739 | |

Varian Medical Systems, Inc.* | | | 316 | | | | 37,721 | |

Vertex Pharmaceuticals, Inc.* | | | 835 | | | | 141,499 | |

Waters Corp.* | | | 264 | | | | 50,078 | |

WellCare Health Plans, Inc.* | | | 168 | | | | 46,366 | |

Zimmer Biomet Holdings, Inc. | | | 673 | | | | 76,446 | |

Zoetis, Inc. | | | 1,642 | | | | 148,026 | |

| | | | | | | 11,587,184 | |

Industrials — 9.4% | | | | | | | | |

3M Co. | | | 1,987 | | | | 378,047 | |

Alaska Air Group, Inc. | | | 412 | | | | 25,305 | |

| | | | | | | | | |

| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Industrials (continued) | | | | | | | | |

Allegion PLC | | | 316 | | | $ | 27,091 | |

American Airlines Group, Inc. | | | 1,452 | | | | 50,936 | |

AMETEK, Inc. | | | 767 | | | | 51,450 | |

AO Smith Corp. | | | 486 | | | | 22,128 | |

Arconic, Inc. | | | 1,403 | | | | 28,523 | |

Boeing Co. | | | 1,925 | | | | 683,105 | |

C.H. Robinson Worldwide, Inc. | | | 476 | | | | 42,378 | |

Caterpillar, Inc. | | | 1,965 | | | | 238,394 | |

Cintas Corp. | | | 284 | | | | 51,651 | |

Copart, Inc.* | | | 677 | | | | 33,112 | |

CSX Corp. | | | 3,036 | | | | 209,059 | |

Cummins, Inc. | | | 521 | | | | 71,215 | |

Deere & Co. | | | 1,075 | | | | 145,598 | |

Delta Air Lines, Inc. | | | 2,216 | | | | 121,282 | |

Dover Corp. | | | 516 | | | | 42,745 | |

Eaton Corp PLC | | | 1,482 | | | | 106,215 | |

Emerson Electric Co. | | | 2,127 | | | | 144,381 | |

Equifax, Inc. | | | 411 | | | | 41,692 | |

Expeditors International of Washington, Inc. | | | 601 | | | | 40,375 | |

Fastenal Co. | | | 956 | | | | 49,148 | |

FedEx Corp. | | | 822 | | | | 181,119 | |

Flowserve Corp. | | | 444 | | | | 20,380 | |

Fluor Corp. | | | 475 | | | | 20,834 | |

Fortive Corp. | | | 1,014 | | | | 75,290 | |

Fortune Brands Home & Security, Inc. | | | 511 | | | | 22,908 | |

General Dynamics Corp. | | | 924 | | | | 159,464 | |

General Electric Co. | | | 30,590 | | | | 308,959 | |

Harris Corp. | | | 410 | | | | 60,971 | |

Honeywell International, Inc. | | | 2,534 | | | | 366,974 | |

Huntington Ingalls Industries, Inc. | | | 161 | | | | 35,175 | |

IHS Markit Ltd.* | | | 1,207 | | | | 63,404 | |

Illinois Tool Works, Inc. | | | 1,041 | | | | 132,800 | |

Ingersoll-Rand PLC | | | 854 | | | | 81,933 | |

Jacobs Engineering Group, Inc. | | | 411 | | | | 30,862 | |

JB Hunt Transport Services, Inc. | | | 284 | | | | 31,413 | |

Johnson Controls International PLC | | | 3,100 | | | | 99,107 | |

Kansas City Southern | | | 351 | | | | 35,788 | |

L3 Technologies, Inc. | | | 259 | | | | 49,073 | |

Lockheed Martin Corp. | | | 831 | | | | 244,189 | |

Masco Corp. | | | 1,071 | | | | 32,130 | |

Nielsen Holdings PLC | | | 1,115 | | | | 28,968 | |

Norfolk Southern Corp. | | | 956 | | | | 160,445 | |

Northrop Grumman Corp. | | | 578 | | | | 151,407 | |

PACCAR, Inc. | | | 1,170 | | | | 66,936 | |

Parker-Hannifin Corp. | | | 444 | | | | 67,324 | |

Pentair PLC | | | 549 | | | | 22,042 | |

Quanta Services, Inc.* | | | 504 | | | | 15,725 | |

Raytheon Co. | | | 962 | | | | 168,388 | |

Republic Services, Inc. Class A | | | 762 | | | | 55,382 | |

Robert Half International, Inc. | | | 419 | | | | 25,362 | |

Rockwell Automation, Inc. | | | 426 | | | | 70,175 | |

Rockwell Collins, Inc. | | | 540 | | | | 69,131 | |

Rollins, Inc. | | | 280 | | | | 16,576 | |

Roper Technologies, Inc. | | | 349 | | | | 98,732 | |

Snap-on, Inc. | | | 191 | | | | 29,403 | |

Southwest Airlines Co. | | | 1,832 | | | | 89,951 | |

Stanley Black & Decker, Inc. | | | 509 | | | | 59,309 | |

Stericycle, Inc.* | | | 284 | | | | 14,191 | |

Textron, Inc. | | | 882 | | | | 47,302 | |

TransDigm Group, Inc.* | | | 161 | | | | 53,170 | |

Union Pacific Corp. | | | 2,660 | | | | 388,945 | |

The accompanying notes are an integral part of these financial statements.

15

Portfolio of Investments — Horizons S&P 500® Covered Call ETF (continued)

October 31, 2018| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Industrials (continued) | | | | | | | | |

United Continental Holdings, Inc.* | | | 860 | | | $ | 73,539 | |

United Parcel Service, Inc. Class B | | | 2,302 | | | | 245,255 | |

United Rentals, Inc.* | | | 290 | | | | 34,820 | |

United Technologies Corp. | | | 2,522 | | | | 313,258 | |

Verisk Analytics, Inc.* | | | 515 | | | | 61,718 | |

Waste Management, Inc. | | | 1,368 | | | | 122,395 | |

WW Grainger, Inc. | | | 174 | | | | 49,411 | |

Xylem, Inc. | | | 606 | | | | 39,741 | |

| | | | | | | 7,295,604 | |

Information Technology — 20.6% | | | | | | | | |

Accenture PLC | | | 2,056 | | | | 324,067 | |

Adobe Systems, Inc.* | | | 1,642 | | | | 403,538 | |

Advanced Micro Devices, Inc.* | | | 2,679 | | | | 48,784 | |

Akamai Technologies, Inc.* | | | 571 | | | | 41,255 | |

Alliance Data Systems Corp. | | | 161 | | | | 33,195 | |

Amphenol Corp. Class A | | | 1,016 | | | | 90,932 | |

Analog Devices, Inc. | | | 1,233 | | | | 103,214 | |

ANSYS, Inc.* | | | 291 | | | | 43,519 | |

Apple, Inc. | | | 15,560 | | | | 3,405,462 | |

Applied Materials, Inc. | | | 3,560 | | | | 117,053 | |

Arista Networks, Inc.* | | | 147 | | | | 33,861 | |

Autodesk, Inc.* | | | 729 | | | | 94,223 | |

Automatic Data Processing, Inc. | | | 1,484 | | | | 213,815 | |

Broadcom, Inc. | | | 1,355 | | | | 302,829 | |

Broadridge Financial Solutions, Inc. | | | 413 | | | | 48,296 | |

CA, Inc. | | | 1,049 | | | | 46,534 | |

Cadence Design Systems, Inc.* | | | 930 | | | | 41,450 | |

Cisco Systems, Inc. | | | 16,108 | | | | 736,941 | |

Citrix Systems, Inc. | | | 478 | | | | 48,981 | |

Cognizant Technology Solutions Class A | | | 1,964 | | | | 135,575 | |

Corning, Inc. | | | 3,004 | | | | 95,978 | |

DXC Technology Co. | | | 948 | | | | 69,043 | |

F5 Networks, Inc.* | | | 222 | | | | 38,912 | |

Fidelity National Information Services, Inc. | | | 1,141 | | | | 118,778 | |

Fiserv, Inc.* | | | 1,400 | | | | 111,020 | |

FleetCor Technologies, Inc.* | | | 325 | | | | 65,010 | |

FLIR Systems, Inc. | | | 454 | | | | 21,025 | |

Fortinet, Inc.* | | | 500 | | | | 41,090 | |

Gartner, Inc.* | | | 300 | | | | 44,256 | |

Global Payments, Inc. | | | 507 | | | | 57,915 | |

Hewlett Packard Enterprise Co. | | | 5,463 | | | | 83,311 | |

HP, Inc. | | | 5,555 | | | | 134,098 | |

Intel Corp. | | | 15,250 | | | | 714,920 | |

International Business Machines Corp. | | | 2,838 | | | | 327,590 | |

Intuit, Inc. | | | 820 | | | | 173,020 | |

IPG Photonics Corp.* | | | 126 | | | | 16,827 | |

Juniper Networks, Inc. | | | 1,265 | | | | 37,026 | |

KLA-Tencor Corp. | | | 520 | | | | 47,601 | |

Lam Research Corp. | | | 540 | | | | 76,534 | |

Mastercard, Inc. Class A | | | 3,104 | | | | 613,568 | |

Microchip Technology, Inc. | | | 771 | | | | 50,716 | |

Micron Technology, Inc.* | | | 3,717 | | | | 140,205 | |

Microsoft Corp. | | | 26,158 | | | | 2,793,936 | |

Motorola Solutions, Inc. | | | 541 | | | | 66,305 | |

NetApp, Inc. | | | 915 | | | | 71,818 | |

NVIDIA Corp. | | | 1,995 | | | | 420,606 | |

Oracle Corp. | | | 10,093 | | | | 492,942 | |

Paychex, Inc. | | | 1,075 | | | | 70,402 | |

Paypal Holdings, Inc.* | | | 3,761 | | | | 316,638 | |

| | | | | | | | | |

| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Information Technology (continued) | | | | | | | | |

Qorvo, Inc.* | | | 422 | | | $ | 31,021 | |

QUALCOMM, Inc. | | | 4,916 | | | | 309,167 | |

Red Hat, Inc.* | | | 601 | | | | 103,156 | |

salesforce.com, Inc.* | | | 2,271 | | | | 311,672 | |

Seagate Technology PLC | | | 955 | | | | 38,420 | |

Skyworks Solutions, Inc. | | | 611 | | | | 53,010 | |

Symantec Corp. | | | 2,055 | | | | 37,298 | |

Synopsys, Inc.* | | | 509 | | | | 45,571 | |

TE Connectivity Ltd. | | | 1,174 | | | | 88,543 | |

Texas Instruments, Inc. | | | 3,292 | | | | 305,596 | |

Total System Services, Inc. | | | 568 | | | | 51,773 | |

VeriSign, Inc.* | | | 286 | | | | 40,766 | |

Visa, Inc. | | | 5,936 | | | | 818,278 | |

Western Digital Corp. | | | 981 | | | | 42,252 | |

Western Union Co. | | | 1,544 | | | | 27,854 | |

Xerox Corp. | | | 708 | | | | 19,732 | |

Xilinx, Inc. | | | 827 | | | | 70,601 | |

| | | | | | | 16,019,324 | |

Materials — 2.6% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 726 | | | | 112,058 | |

Albemarle Corp. | | | 378 | | | | 37,505 | |

Avery Dennison Corp. | | | 294 | | | | 26,672 | |

Ball Corp. | | | 1,171 | | | | 52,461 | |

CF Industries Holdings, Inc. | | | 772 | | | | 37,079 | |

DowDuPont, Inc. | | | 7,949 | | | | 428,610 | |

Eastman Chemical Co. | | | 482 | | | | 37,765 | |

Ecolab, Inc. | | | 865 | | | | 132,475 | |

FMC Corp. | | | 445 | | | | 34,746 | |

Freeport-McMoRan, Inc. | | | 4,477 | | | | 52,157 | |

International Flavors & Fragrances, Inc. | | | 262 | | | | 37,901 | |

International Paper Co. | | | 1,371 | | | | 62,188 | |

Linde PLC | | | 1,901 | | | | 314,558 | |

LyondellBasell Industries NV Class A | | | 1,079 | | | | 96,322 | |

Martin Marietta Materials, Inc. | | | 206 | | | | 35,284 | |

Mosaic Co. | | | 1,169 | | | | 36,169 | |

Newmont Mining Corp. | | | 1,774 | | | | 54,852 | |

Nucor Corp. | | | 1,073 | | | | 63,436 | |

Packaging Corp of America | | | 322 | | | | 29,563 | |

PPG Industries, Inc. | | | 854 | | | | 89,747 | |

Sealed Air Corp. | | | 600 | | | | 19,416 | |

Sherwin-Williams Co. | | | 284 | | | | 111,745 | |

Vulcan Materials Co. | | | 441 | | | | 44,603 | |

WestRock Co. | | | 855 | | | | 36,739 | |

| | | | | | | 1,984,051 | |

Real Estate — 2.7% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 320 | | | | 39,113 | |

American Tower Corp. | | | 1,426 | | | | 222,185 | |

Apartment Investment & Management Co. | | | 520 | | | | 22,381 | |

AvalonBay Communities, Inc. | | | 457 | | | | 80,149 | |

Boston Properties, Inc. | | | 512 | | | | 61,829 | |

CBRE Group, Inc.* | | | 1,025 | | | | 41,297 | |

Crown Castle International Corp. | | | 1,362 | | | | 148,104 | |

Digital Realty Trust, Inc. | | | 679 | | | | 70,113 | |

Duke Realty Corp. | | | 1,181 | | | | 32,560 | |

Equinix, Inc. | | | 259 | | | | 98,094 | |

Equity Residential | | | 1,232 | | | | 80,031 | |

Essex Property Trust, Inc. | | | 228 | | | | 57,178 | |

Extra Space Storage, Inc. | | | 418 | | | | 37,645 | |

The accompanying notes are an integral part of these financial statements.

16

Portfolio of Investments — Horizons S&P 500® Covered Call ETF (concluded)

October 31, 2018| Security Description | | Shares

| | Fair

Value

|

Common Stocks (continued) | | | | | | | | |

Real Estate (continued) | | | | | | | | |

Federal Realty Investment Trust | | | 238 | | | $ | 29,524 | |

HCP, Inc. | | | 1,558 | | | | 42,923 | |

Host Hotels & Resorts, Inc. | | | 2,462 | | | | 47,049 | |

Iron Mountain, Inc. | | | 889 | | | | 27,212 | |

Kimco Realty Corp. | | | 1,418 | | | | 22,816 | |

Macerich Co. | | | 361 | | | | 18,635 | |

Mid-America Apartment Communities, Inc. | | | 379 | | | | 37,032 | |

Prologis, Inc. | | | 1,770 | | | | 114,112 | |

Public Storage | | | 508 | | | | 104,379 | |

Realty Income Corp. | | | 921 | | | | 55,509 | |

Regency Centers Corp. | | | 504 | | | | 31,933 | |

Resideo Technologies, Inc.* | | | 422 | | | | 8,890 | |

SBA Communications Corp.* | | | 411 | | | | 66,652 | |

Simon Property Group, Inc. | | | 1,044 | | | | 191,595 | |

SL Green Realty Corp. | | | 327 | | | | 29,842 | |

UDR, Inc. | | | 890 | | | | 34,879 | |

Ventas, Inc. | | | 1,182 | | | | 68,603 | |

Vornado Realty Trust | | | 573 | | | | 39,010 | |

Welltower, Inc. | | | 1,229 | | | | 81,200 | |

Weyerhaeuser Co. | | | 2,503 | | | | 66,655 | |

| | | | | | | 2,109,129 | |

Utilities — 3.0% | | | | | | | | |

AES Corp. | | | 2,206 | | | | 32,163 | |

Alliant Energy Corp. | | | 768 | | | | 33,009 | |

Ameren Corp. | | | 805 | | | | 51,987 | |

American Electric Power Co., Inc. | | | 1,644 | | | | 120,604 | |

American Water Works Co., Inc. | | | 603 | | | | 53,384 | |

CenterPoint Energy, Inc. | | | 1,432 | | | | 38,678 | |

CMS Energy Corp. | | | 948 | | | | 46,945 | |

Consolidated Edison, Inc. | | | 985 | | | | 74,860 | |

Dominion Energy, Inc. | | | 2,146 | | | | 153,267 | |

DTE Energy Co. | | | 605 | | | | 68,002 | |

Duke Energy Corp. | | | 2,337 | | | | 193,106 | |

Edison International | | | 1,082 | | | | 75,080 | |

Entergy Corp. | | | 606 | | | | 50,874 | |

Evergy, Inc. | | | 863 | | | | 48,319 | |

Eversource Energy | | | 1,052 | | | | 66,549 | |

Exelon Corp. | | | 3,194 | | | | 139,929 | |

FirstEnergy Corp. | | | 1,488 | | | | 55,473 | |

NextEra Energy, Inc. | | | 1,556 | | | | 268,410 | |

NiSource, Inc. | | | 1,082 | | | | 27,440 | |

NRG Energy, Inc. | | | 1,011 | | | | 36,588 | |

PG&E Corp.* | | | 1,706 | | | | 79,858 | |

Pinnacle West Capital Corp. | | | 381 | | | | 31,337 | |

PPL Corp. | | | 2,273 | | | | 69,099 | |

Public Service Enterprise Group, Inc. | | | 1,682 | | | | 89,869 | |

SCANA Corp. | | | 475 | | | | 19,024 | |

Sempra Energy | | | 832 | | | | 91,620 | |

Southern Co. | | | 3,323 | | | | 149,635 | |

WEC Energy Group, Inc. | | | 1,048 | | | | 71,683 | |

Xcel Energy, Inc. | | | 1,687 | | | | 82,680 | |

| | | | | | | 2,319,472 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $69,229,898) | | | | | | | 77,339,886 | |

| | | | | | | | | |

INVESTMENTS, AT VALUE — 99.5% | | | | | | | | |

(Cost $69,229,898) | | | | | | $ | 77,339,886 | |

Other Assets in Excess of Liabilities: | | | | | | | | |

Written Call Options — (0.1)% | | | | | | | (76,950 | ) |

Other Assets — 0.6% | | | | | | | 437,598 | |

Total Other Assets in Excess of

Liabilities — 0.5% | | | | | | | 360,648 | |

Total Net Assets — 100.0% | | | | | | $ | 77,700,534 | |

† | | All or a portion of these securities has been segregated as collateral for written options contracts. The aggregate market value of collateral at October 31, 2018 was $77,339,886. |

*Non-income producing security.

Glossary:

Ltd. — Private Limited Company

PLC — Public Limited Company

Number of

Contractsˆ

| | | | Notional

Value

| | Fair

Value

|

Written Call Options — (0.1)% | | | | | | | | |

| | (285 | ) | | S&P 500® Index,

Strike @ $2,850, Exp 11/16/18 | | $ | (77,284,590 | ) | | $ | (76,950 | ) |

| | | | | Total Written Call Options | | | | | | | | |

| | | | | (Premiums Received

$432,235) | | | | | | $ | (76,950 | ) |

ˆ | | Each contract equals 100 shares. |

Sector Allocation (unaudited)

| | | | | | |

(as of October 31, 2018) |

Information Technology | | | | | 20.6 | % |

Health Care | | | | | 14.9 | |

Financials | | | | | 13.8 | |

Communication Services | | | | | 10.0 | |

Consumer Discretionary | | | | | 9.7 | |

Industrials | | | | | 9.4 | |

Consumer Staples | | | | | 7.3 | |

Energy | | | | | 5.5 | |

Utilities | | | | | 3.0 | |

Real Estate | | | | | 2.7 | |

Materials | | | | | 2.6 | |

Total Investments | | | | | 99.5 | |

Other Assets in Excess of Liabilities | | | | | 0.5 | |

Net Assets | | | | | 100.0 | % |

Sector allocation excludes derivatives and percentages indicated are based upon net assets.

The accompanying notes are an integral part of these financial statements.

17

Portfolio of Investments — Horizons DAX Germany ETF

October 31, 2018| Security Description | | Shares

| | Fair

Value

|

Common Stocks — 93.7% | | | | | | | | |

Communication Services — 4.8% | | | | | | | | |

Deutsche Telekom AG | | | 48,750 | | | $ | 800,652 | |

| | | | | | | | | |

Consumer Discretionary — 13.7% | | | | | | | | |

adidas AG | | | 2,937 | | | | 692,178 | |

Bayerische Motoren Werke AG | | | 5,308 | | | | 458,467 | |

Continental AG | | | 1,744 | | | | 288,404 | |

Daimler AG | | | 14,736 | | | | 874,239 | |

| | | | | | | 2,313,288 | |

Consumer Staples — 1.0% | | | | | | | | |

Beiersdorf AG | | | 1,586 | | | | 164,248 | |

| | | | | | | | | |

Financials — 15.9% | | | | | | | | |

Allianz SE | | | 6,998 | | | | 1,462,446 | |

Deutsche Bank AG | | | 31,490 | | | | 308,667 | |

Deutsche Boerse AG | | | 3,000 | | | | 380,197 | |

Muenchener Rueckversicherungs-Gesellschaft AG | | | 2,437 | | | | 524,500 | |

| | | | | | | 2,675,810 | |

Health Care — 5.4% | | | | | | | | |

Fresenius Medical Care AG & Co. KGaA | | | 3,418 | | | | 268,461 | |

Fresenius SE & Co. KGaA | | | 6,580 | | | | 419,595 | |

Merck KGaA | | | 2,088 | | | | 223,854 | |

| | | | | | | 911,910 | |

Industrials — 12.7% | | | | | | | | |

Deutsche Lufthansa AG | | | 7,171 | | | | 144,303 | |

Deutsche Post AG | | | 15,386 | | | | 487,257 | |

Siemens AG | | | 13,115 | | | | 1,511,560 | |

| | | | | | | 2,143,120 | |

Information Technology — 14.0% | | | | | | | | |

Infineon Technologies AG | | | 18,029 | | | | 361,777 | |

SAP SE | | | 15,452 | | | | 1,657,304 | |

Wirecard AG | | | 1,860 | | | | 348,577 | |

| | | | | | | 2,367,658 | |

Materials — 21.0% | | | | | | | | |

BASF SE | | | 14,981 | | | | 1,154,761 | |

Bayer AG | | | 15,113 | | | | 1,160,655 | |

Covestro AG | | | 2,777 | | | | 179,727 | |

HeidelbergCement AG | | | 2,409 | | | | 163,772 | |

Linde AG | | | 2,474 | | | | 541,390 | |

Linde PLC | | | 534 | | | | 171,450 | |

ThyssenKrupp AG | | | 7,852 | | | | 165,257 | |

| | | | | | | 3,537,012 | |

Real Estate — 2.1% | | | | | | | | |

Vonovia SE | | | 7,816 | | | | 357,958 | |

| | | | | | | | | |

Utilities — 3.1% | | | | | | | | |

E.ON SE | | | 35,627 | | | $ | 345,383 | |

RWE AG | | | 8,759 | | | | 170,898 | |

| | | | | | | 516,281 | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $18,111,899) | | | | | | | 15,787,937 | |

| | | | | | | | | |

Preferred Stocks — 5.0% | | | | | | | | |

Consumer Discretionary — 3.1% | | | | | | | | |

Volkswagen AG (2.66%) | | | 3,132 | | | | 527,909 | |

| | | | | | | | | |

Consumer Staples — 1.9% | | | | | | | | |

Henkel AG & Co. KGaA (1.85%) | | | 2,828 | | | | 309,469 | |

| | | | | | | | | |

TOTAL PREFERRED STOCKS | | | | | | | | |

(Cost $1,066,389) | | | | | | | 837,378 | |

| | | | | | | | | |

INVESTMENTS, AT VALUE — 98.7% | | | | | | | | |

(Cost $19,178,288) | | | | | | | 16,625,315 | |

Other Assets in Excess of Liabilities — 1.3% | | | | | | | 225,566 | |

Total Net Assets — 100.0% | | | | | | $ | 16,850,881 | |

Glossary:

AG — Aktiengesellschaft is both the German and Swiss term for a stock corporation.

KGaA — Kommanditgesellschaft auf Aktien is a German corporate designation standing for partnership limited by shares.

PLC — Public Limited Company

SE — SE Regulation. A European Company which can operate on a Europe-wide basis and be governed by Community law directly applicable in all Member States.

| Sector Allocation (unaudited) | | | |

(as of October 31, 2018) |

Materials | | | | | 21.0 | % |

Consumer Discretionary | | | | | 16.8 | |

Financials | | | | | 15.9 | |

Information Technology | | | | | 14.0 | |

Industrials | | | | | 12.7 | |

Health Care | | | | | 5.4 | |

Communication Services | | | | | 4.8 | |

Utilities | | | | | 3.1 | |

Consumer Staples | | | | | 2.9 | |

Real Estate | | | | | 2.1 | |

Total Investments | | | | | 98.7 | |

Other Assets in Excess of Liabilities | | | | | 1.3 | |

Net Assets | | | | | 100.0 | % |

Percentages indicated are based upon net assets.

The accompanying notes are an integral part of these financial statements.

18

Statements of Assets and Liabilities

October 31, 2018

| | Horizons

NASDAQ 100®

Covered Call ETF

| | Horizons

S&P 500®

Covered Call ETF

| | Horizons DAX

Germany ETF

|

Assets: | | | | | | | | | | | | |

Investments, at cost | | $ | 364,414,954 | | | $ | 69,229,898 | | | $ | 19,178,288 | |

Investments, at value (Note 2) | | $ | 397,790,446 | | | $ | 77,339,886 | | | $ | 16,625,315 | |

Cash | | | 762,114 | | | | 377,990 | | | | 80,301 | |

Receivables: | | | | | | | | | | | | |

Investments Receivable | | | 1,044,766 | | | | 191,472 | | | | 672,325 | |

Dividends and interest | | | 55,299 | | | | 68,951 | | | | 132 | |

Due From Administrator (Note 10) | | | — | | | | — | | | | 64,838 | |

Reclaims | | | — | | | | 620 | | | | 98,841 | |

Total Assets | | | 399,652,625 | | | | 77,978,919 | | | | 17,541,752 | |

| | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | |

Payables: | | | | | | | | | | | | |

Options written, at value (premiums received $8,400,436, $432,235 and $—) | | | 3,311,800 | | | | 76,950 | | | | — | |

Investments Payable | | | 940,332 | | | | 157,313 | | | | 687,900 | |

Accrued Advisory fees | | | 198,912 | | | | 44,122 | | | | 2,971 | |

Total Liabilities | | | 4,451,044 | | | | 278,385 | | | | 690,871 | |

Net Assets | | $ | 395,201,581 | | | $ | 77,700,534 | | | $ | 16,850,881 | |

| | | | | | | | | | | | | |

Net Assets Consist of: | | | | | | | | | | | | |

Paid-in capital | | $ | 399,605,331 | | | $ | 77,719,166 | | | $ | 19,721,141 | |

Total distributable earnings (loss) (Note 5) | | | (4,403,750 | ) | | | (18,632 | ) | | | (2,870,260 | ) |

Net Assets | | $ | 395,201,581 | | | $ | 77,700,534 | | | $ | 16,850,881 | |

| | | | | | | | | | | | | |

Shares outstanding (unlimited number of shares of beneficial interest authorized, without par value) | | | 16,850,000 | | | | 1,600,000 | | | | 650,000 | |

Net asset value, per share | | $ | 23.45 | | | $ | 48.56 | | | $ | 25.92 | |

The accompanying notes are an integral part of these financial statements.

19

Statements of Operations

For the Year Ended October 31, 2018

| | Horizons

NASDAQ 100®

Covered Call ETF

| | Horizons

S&P 500®

Covered Call ETF

| | Horizons DAX

Germany ETF

|

Investment Income: | | | | | | | | | | | | |

Dividend income1 | | $ | 2,405,193 | | | $ | 1,108,585 | | | $ | 546,453 | |

| | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | |

Advisory fees | | | 1,467,560 | | | | 385,304 | | | | 88,874 | |

Excise tax (Note 5) | | | 205,113 | | | | — | | | | — | |

Total Expenses | | | 1,672,673 | | | | 385,304 | | | | 88,874 | |

Advisory fees waived | | | — | | | | — | | | | (49,375 | ) |

Net Expenses | | | 1,672,673 | | | | 385,304 | | | | 39,499 | |

Net Investment Income | | | 732,520 | | | | 723,281 | | | | 506,954 | |

| | | | | | | | | | | | | |