- ETN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-3ASR Filing

Eaton (ETN) S-3ASRAutomatic shelf registration

Filed: 1 Aug 24, 4:11pm

Ireland (State or other Jurisdiction of Incorporation or Organization) | | | 98-1059235 (IRS Employer Identification No.) |

Ireland (State or other Jurisdiction of Incorporation or Organization) | | | 98-1006842 (IRS Employer Identification No.) |

Ohio (State or other Jurisdiction of Incorporation or Organization) | | | 34-0196300 (IRS Employer Identification No.) |

Large accelerated filer | | | ☒ | | | Non-accelerated filer | | | ☐ | | | Accelerated filer | | | ☐ | | | Smaller reporting company | | | ☐ |

| | | | | | | | | | | | | Emerging growth company | | | ☐ |

Exact Name of Additional Registrant as Specified in its Charter (or Other Organizational Document) | | | State of Other Jurisdiction of Incorporation or Organization | | | I.R.S. Employer Identification Number | | | Address, Including Zip Code and Telephone Number, Including Area Code, of Additional Registrant’s Principal Executive Offices |

Cooper B-Line, Inc. | | | Delaware | | | 76-0638615 | | | 509 West Monroe Street, Highland, IL 62249 (800) 851-7415 |

Cooper Bussmann, LLC | | | Delaware | | | 46-1039791 | | | 114 Old State Road, Ellisville, MO 63021 (636) 394-2877 |

Cooper Crouse-Hinds, LLC | | | Delaware | | | 20-1288146 | | | Wolf & 7th North Streets, Syracuse, NY 13221-4999 (866) 764-5454 |

Cooper Industries Unlimited Company | | | Ireland | | | 98-0632292 | | | Eaton House, 30 Pembroke Rd., Dublin 4, Ireland D04 Y0C2 +353 1637 2900 |

Cooper Power Systems, LLC | | | Delaware | | | 76-0253330 | | | 2300 Badger Drive, Waukesha, WI 53188 (877) 277-4636 |

Cooper Wiring Devices, Inc. | | | New York | | | 11-0701510 | | | 203 Cooper Circle, Peachtree City, GA 30269 (770) 631-2100 |

Eaton Aeroquip LLC | | | Ohio | | | 26-3155882 | | | 1000 Eaton Boulevard, Cleveland, OH 44122 (440) 523-5000 |

Eaton Aerospace LLC | | | Delaware | | | 34-1926527 | | | 1000 Eaton Boulevard, Cleveland, OH 44122 (440) 523-5000 |

Eaton Controls (Luxembourg) S.à r.l.(2) | | | Luxembourg | | | 98-1116654 | | | 12 rue Eugene Ruppert, L-2453, Luxembourg +352 481081 |

Eaton Domhanda Unlimited Company | | | Ireland | | | 98-1494324 | | | Eaton House, 30 Pembroke Rd., Dublin 4, Ireland D04 Y0C2 +353 1637 2900 |

Eaton Electric Holdings LLC | | | Delaware | | | 76-0518215 | | | 1000 Eaton Boulevard, Cleveland, OH 44122 (440) 523-5000 |

Eaton Filtration LLC | | | Delaware | | | 26-3155993 | | | 1000 Eaton Boulevard, Cleveland, OH 44122 (440) 523-5000 |

Eaton Leasing Corporation | | | Ohio | | | 34-1349740 | | | 1000 Eaton Boulevard, Cleveland, OH 44122 (440) 523-5000 |

Eaton Technologies (Luxembourg) S.à r.l.(2) | | | Luxembourg | | | 98-1116656 | | | 12 rue Eugene Ruppert, L-2453, Luxembourg +352 481081 |

Turlock B.V. | | | The Netherlands | | | 98-1116699 | | | Europalaan 210, 7559 SC, Hengelo Ov, Netherlands +31 20 52 14 777 |

Wright Line LLC | | | Delaware | | | 03-0471268 | | | 1000 Eaton Boulevard, Cleveland, OH 44122 (440) 523-5000 |

| (1) | Eaton Corporation plc directly or indirectly owns 100% of Eaton Corporation and the other co-registrants in this table. Each guarantee of the senior notes registered hereunder will be full and unconditional and joint and several. |

| (2) | Each of Eaton Controls (Luxembourg) S.à r.l. and Eaton Technologies (Luxembourg) S.à r.l. is a société à responsabilité limitée, having their registered office at 12 rue Eugène Ruppert, L-2453 Luxembourg, Grand Duchy of Luxembourg, registered with the Luxembourg Register of Commerce and Companies under the numbers B 9145 and B 172818, respectively. |

| • | debt securities (the “debt securities”), which may be either senior or subordinated, unsecured or secured, and which may be guaranteed by Eaton Corporation plc and/or certain subsidiaries of Eaton Corporation plc, which may include Eaton Corporation, Eaton Capital Unlimited Company, Turlock B.V., Eaton Controls (Luxembourg) S.à r.l., Eaton Technologies (Luxembourg) S.à r.l., Eaton Aeroquip LLC, Eaton Aerospace LLC, Eaton Filtration LLC, Eaton Leasing Corporation, Wright Line LLC, Cooper Industries Unlimited Company, Eaton Electric Holdings LLC, Eaton Domhanda Unlimited Company, Cooper B-Line, Inc., Cooper Bussmann, LLC, Cooper Crouse-Hinds, LLC, Cooper Power Systems, LLC, and Cooper Wiring Devices, Inc. (collectively, the “Subsidiary Guarantors” and, together with Eaton Corporation plc, the “Guarantors”); |

| • | guarantees of debt securities (the “guarantees”); |

| • | euro deferred shares, A preferred shares, and serial preferred shares of Eaton Corporation plc (the “preference shares”); |

| • | ordinary shares of Eaton Corporation plc (the “ordinary shares”); |

| • | depositary shares of Eaton Corporation plc (the “depositary shares”); |

| • | warrants to purchase debt securities, ordinary shares, or preference shares of Eaton Corporation plc (the “warrants”); or |

| • | units representing an interest in two or more of the debt securities (including any applicable guarantees), preference shares, ordinary shares, depositary shares and warrants listed above, which may or may not be separable from one another (the “units”). |

| • | global pandemics such as COVID-19; |

| • | unanticipated changes in the markets for the Company’s business segments; |

| • | unanticipated downturns in business relationships with customers or their purchases from us; |

| • | the availability of credit to customers and suppliers; supply chain disruptions, competitive pressures on sales and pricing; unanticipated changes in the cost of material, labor and other production costs, or unexpected costs that cannot be recouped in product pricing; the introduction of competing technologies; |

| • | unexpected technical or marketing difficulties; unexpected claims, charges, litigation or dispute resolutions; |

| • | strikes or other labor unrest at the Company or at our customers or suppliers; |

| • | the impact of acquisitions and divestitures; |

| • | unanticipated difficulties integrating acquisitions; |

| • | new laws and governmental regulations; interest rate changes; tax rate changes or exposure to additional income tax liability; |

| • | stock market and currency fluctuations; |

| • | war, geopolitical tensions, natural disasters, civil or political unrest or terrorism; |

| • | unanticipated deterioration of economic and financial conditions in the United States and around the world; and |

| • | other factors described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 which is incorporated by reference herein and any additional risks described in our other filings with the SEC. |

| • | Annual Report on Form 10-K for the year ended December 31, 2023 (including the sections incorporated by reference therein from our definitive proxy statement on Schedule 14A filed with the SEC on March 15, 2024). |

| • | Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024. |

| • | Current Reports on Form 8-K filed with the SEC on January 18, 2024, March 1, 2024, April 22, 2024, April 26, 2024 and July 29, 2024. |

| • | the title of the debt securities, whether the securities will be senior or subordinated and the issuer thereof if other than Eaton; |

| • | the total principal amount of the debt securities and any limit on the total principal amount of debt securities of each series; |

| • | the date or dates when the principal of the debt securities will be payable or the method by which such date or dates will be determined or extended; |

| • | the interest rate or rates, which may be fixed or variable, that the debt securities will bear, if any, or the method by which such rate or rates will be determined, the date or dates from which any interest will |

| • | whether the amount of payments of principal of (or premium, if any), or interest on, the debt securities will be determined with reference to an index, formula or other method (which could be based on one or more Currencies, commodities, equity indices or other indices) and how such amounts will be determined; |

| • | any optional redemption provisions; |

| • | if debt securities are not guaranteed by the Company and any modifications to such guarantee; |

| • | whether debt securities are guaranteed by any Subsidiary Guarantors and/or the Company, as applicable, and any deletions from, modifications to, or additions to such guarantees, Events of Default or covenants with respect to such guarantees; |

| • | any sinking fund or other provisions that would obligate us to repurchase or otherwise redeem the debt securities; |

| • | if other than U.S. dollars, the Currency or Currencies in which the debt securities are denominated and/or payable; |

| • | if other than denominations of $2,000 and integral multiples of $1,000 thereafter in the case of Registered Securities, the denominations in which the offered debt securities will be issued; |

| • | if not the principal amount of the debt securities, the portion of the principal amount at which the debt securities will be issued and, if not the principal amount of the debt securities, the portion of the principal amount payable upon acceleration of the maturity of the debt securities or how that portion will be determined; |

| • | the form of the debt securities, if other than a registered global note, including whether the debt securities are to be issuable in permanent or temporary global form, as Registered Securities, Bearer Securities or both, any restrictions on the offer, sale or delivery of Bearer Securities, and the terms, if any, upon which you may exchange Bearer Securities for Registered Securities and vice versa (if permitted by applicable laws and regulations); |

| • | any modifications or additions to the provisions of Article Fourteen of the Indenture described below under “—Defeasance and Covenant Defeasance” if that Article is applicable to the debt securities; |

| • | any changes or additions to the Events of Default or our covenants with respect to the debt securities; |

| • | the place or places, if any, other than or in addition to The City of New York, of payment, transfer, conversion, and/or exchange of the debt securities, and where notices or demands to or upon us in respect of the debt securities may be served; |

| • | whether the issuer or a holder may elect payment of the principal or interest in one or more Currencies other than that in which such debt securities are stated to be payable, and the period or periods within which, and the terms and conditions upon which, that election may be made, and the time and manner of determining the exchange rate between the Currency or Currencies in which they are stated to be payable and the Currency or Currencies in which they are to be so payable; |

| • | if other than the Trustee, the identity of each Security Registrar and/or Paying Agent; |

| • | the designation of the initial Exchange Rate Agent, if applicable; |

| • | the Person to whom any interest on any Registered Security of the series will be payable, if other than the registered holder as of the close of business on the Regular Record Date, the manner in which, or the Person to whom, any interest on any Bearer Security of the series will be payable, if not upon presentation and surrender of the coupons relating to the Bearer Security as they mature, and the extent to which, or the manner in which, any interest payable on a temporary global security on an Interest Payment Date will be paid if not in the manner provided in the Indenture; |

| • | whether and under what circumstances the issuer will pay additional amounts as contemplated under the Indenture (“Additional Amounts”) in respect of any tax, assessment, or governmental charge and, if so, whether the issuer will have the option to redeem the debt securities rather than pay the Additional Amounts (and the terms of any such option); |

| • | any provisions granting special rights to the holders of the debt securities upon the occurrence of specified events; |

| • | whether the debt securities will be convertible into or exchangeable for any other securities and the applicable terms and conditions; |

| • | in the case of convertible securities, any terms by which they may be convertible into ordinary shares; |

| • | if the issuer issues the debt securities in definitive form, the terms and conditions under which definitive securities will be issued; |

| • | if the issuer issues the debt securities upon the exercise of warrants, the time, manner, and place for them to be authenticated and delivered; |

| • | the manner for paying principal and interest and the manner for transferring the debt securities; and |

| • | any other terms of the debt securities that are consistent with the requirements of the Trust Indenture Act. |

Currency | | | Principal Financial Center |

U.S. dollars | | | The City of New York |

Australian dollars | | | Sydney |

Canadian dollars | | | Toronto |

New Zealand dollars | | | Auckland |

South African rand | | | Johannesburg |

Swiss francs | | | Zurich |

| • | the unsecured unsubordinated obligations of the issuer and will rank equally with all of the issuer’s existing and future unsecured unsubordinated indebtedness; |

| • | effectively subordinated to any existing or future secured obligations of the issuer, to the extent of the value of the collateral securing such obligations; |

| • | senior in right of payment to any existing and future obligations of the issuer, that are by their terms expressly subordinated or junior in right of payment to the debt securities; and |

| • | structurally subordinated to the obligations of the subsidiaries of the issuer that do not guarantee the debt securities. |

| • | will be the unsecured unsubordinated obligations of such Guarantor; |

| • | will rank equally in right of payment with any existing and future unsecured unsubordinated indebtedness of such Guarantor; |

| • | will be senior in right of payment to any existing and future obligations of such Guarantor that are by their terms expressly subordinated or junior in right of payment to the guarantees of the debt securities; and |

| • | will be effectively subordinated to any existing or future secured obligations of each Guarantor, to the extent of the value of the collateral securing such obligations. |

| (a) | the consummation of any transaction permitted under the Indenture (including a sale, transfer, disposition, or distribution of such Subsidiary Guarantor to a Person that is not the Company or one of its Subsidiaries, or a dissolution) resulting in such Subsidiary Guarantor ceasing to be a Subsidiary; |

| (b) | the merger, amalgamation or consolidation of any Subsidiary Guarantor with and into Eaton, the Company or another Subsidiary Guarantor that is the surviving Person in such merger, amalgamation or consolidation; |

| (c) | upon the issuer’s exercise of either of its defeasance options with respect to such debt securities as described under “—Defeasance and Covenant Defeasance” or the issuer’s obligations under the Indenture with respect to the debt securities being discharged in accordance with the terms of the Indenture; |

| (d) | such time (after giving effect to the guarantee release set forth in this clause (d) and any similar guarantee release provisions governing any other indebtedness) such Subsidiary Guarantor ceases to be a guarantor or issuer of indebtedness of the Company or any of its subsidiaries, other than (i) such securities and (ii) other outstanding indebtedness in an aggregate principal amount not exceeding 25% of the Company and its Subsidiaries’ then-outstanding indebtedness (it being understood that any indebtedness under which such Subsidiary Guarantor will be released as a guarantor substantially concurrently with the release of the guarantee of such securities shall be excluded for purposes of calculating the amount of such Subsidiary Guarantor’s indebtedness under clause (ii) (but not, for the avoidance of doubt, the amount of the Company and its subsidiaries then-outstanding indebtedness)); or; |

| (e) | receipt of consent of holders holding the requisite percentage of such series of debt securities pursuant to the terms of the Indenture. |

| (a) | such Guarantor becomes prohibited by any applicable law, rule or regulation binding on such Guarantor or its properties from guaranteeing the obligations under the Indenture; |

| (b) | upon the issuer’s exercise of its covenant defeasance option with respect to such debt securities as described under “—Defeasance and Covenant Defeasance—Covenant Defeasance” or the issuer’s obligations under the Indenture with respect to the debt securities being discharged in accordance with the terms of the Indenture; |

| (c) | with the consent of holders holding the requisite percentage of such series of debt securities pursuant to the terms of the Indenture; or |

| (d) | remaining a Guarantor would, in our reasonable determination, result in material adverse tax consequences to the Company or any of its Subsidiaries. |

| • | the conversion price or exchange ratio (or the calculation method); |

| • | the conversion or exchange period (or how such period will be determined); |

| • | if conversion or exchange will be mandatory, at your option or at our option; |

| • | provisions for adjustment of the conversion price or the exchange ratio; and |

| • | provisions affecting conversion or exchange in the event of the redemption of the debt securities. |

| • | how it handles securities payments and notices; |

| • | whether it imposes fees or charges; |

| • | how it would handle a request for the indirect holders’ consent, if ever required; |

| • | whether and how you can instruct it to send you debt securities registered in your own name so you can be a holder, if that is permitted in the future for a particular series of debt securities; |

| • | how it would exercise rights under the debt securities if there were a default or other event triggering the need for holders to act to protect their interests; and |

| • | if the debt securities are in book-entry form, how the depositary’s rules and procedures will affect these matters. |

| • | the CD Rate; |

| • | the Commercial Paper Rate; |

| • | SOFR; |

| • | EURIBOR; |

| • | the Federal Funds Rate; |

| • | the Prime Rate; |

| • | the Treasury Rate; |

| • | the CMT Rate; |

| • | the Eleventh District Cost of Funds Rate; or |

| • | another negotiated interest rate basis or formula. |

| • | for Notes with interest that resets daily, each Business Day; |

| • | for Notes (other than Treasury Rate Notes) with interest that resets weekly, Wednesday of each week; |

| • | for Treasury Rate Notes with interest that resets weekly, Tuesday of each week; |

| • | for Notes with interest that resets monthly, the third Wednesday of each month; |

| • | for Notes with interest that resets quarterly, the third Wednesday of March, June, September and December of each year; |

| • | for Notes with interest that resets semiannually, the third Wednesday of each of the two months of each year indicated in the applicable prospectus supplement or term sheet; and |

| • | for Notes with interest that resets annually, the third Wednesday of the month of each year indicated in the applicable prospectus supplement or term sheet. |

| • | for Notes with interest that resets daily, weekly or monthly, on the third Wednesday of each month; |

| • | for Notes with interest payable quarterly, on the third Wednesday of March, June, September, and December of each year; |

| • | for Notes with interest payable semiannually, on the third Wednesday of each of the two months specified in the applicable prospectus supplement or term sheet; |

| • | for Notes with interest payable annually, on the third Wednesday of the month specified in the applicable prospectus supplement or term sheet (each of the above, with respect to Floating Rate Notes, an “Interest Payment Date”); and |

| • | at maturity, redemption or repayment. |

| • | If the above rate is not published in H.15(519) by 3:00 p.m., New York City time, on the Calculation Date, the CD Rate will be the rate on that Interest Determination Date for negotiable U.S. dollar certificates of deposit of the Index Maturity described in the prospectus supplement or term sheet as published in H.15 Daily Update, or such other recognized electronic source used for the purpose of displaying such rate, under the caption “CDs (secondary market).” |

| • | If that rate is not published in H.15(519), H.15 Daily Update or another recognized electronic source by 3:00 p.m., New York City time, on the Calculation Date, then the calculation agent will determine the CD Rate to be the average of the secondary market offered rates as of 10:00 a.m., New York City time, on that Interest Determination Date, quoted by three leading nonbank dealers of negotiable U.S. dollar certificates of deposit in New York City (which may include an agent or underwriter or its affiliates) for negotiable U.S. dollar certificates of deposit of major United States money-center banks with a remaining maturity closest to the Index Maturity in an amount that is representative for a single transaction in the market at that time described in the prospectus supplement or term sheet. The issuer will select and identify the three dealers referred to above. |

| • | If fewer than three dealers are quoting as mentioned above, the CD Rate will remain the CD Rate then in effect on that Interest Determination Date, provided, that if the initial interest rate is in effect on such Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

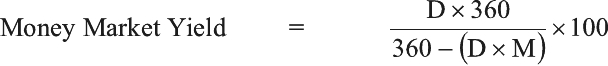

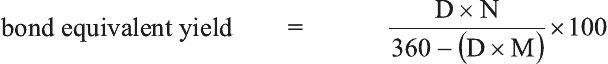

| • | If the above rate is not published in H.15(519) by 3:00 p.m., New York City time, on the Calculation Date, the Commercial Paper Rate will be the Money Market Yield of the rate on that Interest Determination Date for commercial paper having the Index Maturity described in the prospectus supplement or term sheet, as published in H.15 Daily Update, or such other recognized electronic source used for the purpose of displaying such rate, under the heading “Commercial Paper—Nonfinancial.” |

| • | If that rate is not published in H.15(519), H.15 Daily Update or another recognized electronic source by 3:00 p.m., New York City time, on the Calculation Date, then the calculation agent will determine the Commercial Paper Rate to be the Money Market Yield of the average of the offered rates of three leading dealers of U.S. dollar commercial paper in New York City (which may include an agent or underwriter or |

| • | If fewer than three dealers selected by the issuer are quoting as mentioned above, the Commercial Paper Rate will remain the Commercial Paper Rate then in effect on that Interest Determination Date, provided, that if the initial interest rate is in effect on such Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

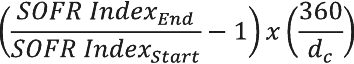

| (1) | the SOFR Index value as published by the SOFR Administrator as such index appears on the SOFR Administrator’s Website at 3:00 p.m. (New York time) on such U.S. Government Securities Business Day (the “SOFR Index Determination Time”); or |

| (2) | if a SOFR Index value specified in (1) above does not so appear at the SOFR Index Determination Time, then: (i) if a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, then Compounded SOFR Index shall be the rate determined pursuant to the “SOFR Index Unavailability” provisions below; or (ii) if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR, then Compounded SOFR Index shall be the rate determined pursuant to the “Effect of a Benchmark Transition Event” provisions below |

| • | EURIBOR will be determined on the basis of the rates, at approximately 11:00 a.m., Brussels time, on such EURIBOR Interest Determination Date, at which deposits of the following kind are offered to prime banks in the euro-zone interbank market by the principal euro-zone office of each of four major banks in that market (which may include an agent or underwriter or its affiliates) selected and identified by the issuer: euro deposits having such EURIBOR Index Maturity, beginning on such EURIBOR Interest Reset Date, and in a representative amount at the time described in the applicable prospectus supplement or term sheet. The calculation agent will request that the principal euro-zone office of each of these banks provide a quotation of its rate. If at least two quotations are provided, EURIBOR for such EURIBOR Interest Determination Date will be the arithmetic mean of the quotations. |

| • | If fewer than two quotations are provided as described above, EURIBOR for such EURIBOR Interest Determination Date will be the arithmetic mean of the rates for loans of the following kind to leading euro-zone banks quoted, at approximately 11:00 a.m., Brussels time on that Interest Determination Date, by three major banks in the euro-zone (which may include an agent or underwriter or its affiliates selected and identified by the issuer: loans of euro having such EURIBOR Index Maturity, beginning on such EURIBOR Interest Reset Date, and in an amount that is representative of a single transaction in euro in that market at the time described in the applicable prospectus supplement or term sheet. |

| • | If fewer than three banks selected by the issuer are quoting as described above, EURIBOR determined as of such EURIBOR Interest Determination Date will be EURIBOR in effect on such EURIBOR Interest Determination Date, provided that if the initial interest rate is in effect on such EURIBOR Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

| • | If Federal Funds (Effective) Rate is the specified Federal Funds Rate in the applicable prospectus supplement or term sheet, the Federal Funds Rate as of the applicable Federal Funds Rate Interest Determination Date shall be the rate with respect to such date for U.S. dollar federal funds as published in H.15(519) opposite the caption “Federal funds (effective),” as such rate is displayed on Reuters on page FEDFUNDS1 (or any other page as may replace such page on such service) (“Reuters Page FEDFUNDS1”) under the heading “EFFECT,” or, if such rate is not so published by 3:00 p.m., New York City time, on the calculation date, the rate with respect to such Federal Funds Rate Interest Determination Date for U.S. dollar federal funds as published in H.15 Daily Update, or such other recognized electronic source used for the purpose of displaying such rate, under the caption “Federal funds (effective).” |

| • | The following procedure will be followed if “Federal Funds (Effective) Rate” is the specified Federal Funds Rate in the applicable prospectus supplement or term sheet and such Federal Funds Rate cannot be determined as described above. The Federal Funds Rate with respect to such Federal Funds Rate Interest Determination Date shall be calculated by the calculation agent and will be the arithmetic mean of the rates for the last transaction in overnight U.S. dollar federal funds arranged by three leading brokers of U.S. dollar federal funds transactions in New York City (which may include an agent or underwriter or its affiliates) selected and identified by the issuer prior to 9:00 a.m., New York City time, on the Business Day following such Federal Funds Rate Interest Determination Date; provided, however, that if the brokers so selected by the issuer are not quoting as mentioned in this sentence, the Federal Funds Rate determined as of such Federal Funds Rate Interest Determination Date will be the Federal Funds Rate in effect on such Federal Funds Rate Interest Determination Date, provided, that if the initial interest rate is in effect on such Federal Funds Rate Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

| • | If Federal Funds Open Rate is the specified Federal Funds Rate in the applicable prospectus supplement or term sheet, the Federal Funds Rate as of the applicable Federal Funds Rate Interest Determination Date shall be the rate on such date under the heading “Federal Funds” for the relevant Index Maturity and opposite the caption “Open” as such rate is displayed on Reuters on page 5 (or any other page as may replace such page on such service) (“Reuters Page 5”), or, if such rate does not appear on Reuters Page 5 by 3:00 p.m., New York City time, on the calculation date, the Federal Funds Rate for the Federal Funds Rate Interest Determination Date will be the rate for that day displayed on FFPREBON Index page on Bloomberg L.P. (“Bloomberg”), which is the Federal Funds Opening Rate as reported by Prebon Yamane (or a successor) on Bloomberg. |

| • | The following procedure will be followed if “Federal Funds Open Rate” is the specified Federal Funds Rate in the applicable prospectus supplement or term sheet and such Federal Funds Rate cannot be determined as described above. The Federal Funds Rate on such Federal Funds Rate Interest Determination Date shall be calculated by the issuer and will be the arithmetic mean of the rates for the last transaction in overnight U.S. dollar federal funds arranged by three leading brokers of U.S. dollar federal funds transactions in New York City (which may include an agent or underwriter or its affiliates) selected and identified by the issuer prior to 9:00 a.m., New York City time, on such Federal Funds Rate Interest Determination Date; provided, however, that if the brokers so selected by the issuer are not quoting as mentioned in this sentence, the Federal Funds Rate determined as of such Federal Funds Rate Interest Determination Date will be the Federal Funds Rate in effect on such Federal Funds Rate Interest Determination Date, provided, that if the initial interest rate is in effect on such Federal Funds Rate Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

| • | If Federal Funds Target Rate is the specified Federal Funds Rate in the applicable prospectus supplement or term sheet, the Federal Funds Rate as of the applicable Federal Funds Rate Interest Determination Date shall be the rate on such date as displayed on the FDTR Index page on Bloomberg. If such rate does not appear on the FDTR Index page on Bloomberg by 3:00 p.m., New York City time, on the calculation date, the Federal Funds Rate for such Federal Funds Rate Interest Determination Date will be the rate for that day appearing on Reuters Page USFFTARGET= (or any other page as may replace such page on such service) (“Reuters Page USFFTARGET=“). |

| • | The following procedure will be followed if “Federal Funds Target Rate” is the specified Federal Funds Rate in the applicable prospectus supplement or term sheet and such Federal Funds Rate cannot be determined as described above. The Federal Funds Rate on such Federal Funds Rate Interest Determination Date shall be calculated by the calculation agent and will be the arithmetic mean of the rates for the last transaction in overnight U.S. dollar federal funds arranged by three leading brokers of U.S. dollar federal funds transactions in New York City (which may include the agents, underwriters or their affiliates) selected and identified by the issuer prior to 9:00 a.m., New York City time, on such Federal Funds Rate Interest Determination Date; provided, however, that if the brokers so selected by the issuer are not quoting as mentioned in this sentence, the Federal Funds Rate determined as of such Federal Funds Rate Interest Determination Date will be the Federal Funds Rate in effect on such Federal Funds Rate Interest Determination Date, provided, that if the initial interest rate is in effect on such Federal Funds Rate Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

| • | If the rate is not published in H.15(519), H.15 Daily Update or another recognized electronic source by 3:00 p.m., New York City time, on the Calculation Date, then the calculation agent will determine the Prime Rate to be the average of the rates of interest publicly announced by each bank that appears on the Reuters Screen designated as “USPRIME1 Page” as that bank’s prime rate or base lending rate in effect as of 11:00 a.m., New York City time on that Interest Determination Date. |

| • | If fewer than four rates appear on the Reuters Page USPRIME1 on the Interest Determination Date, then the Prime Rate will be the average of the prime rates or base lending rates quoted (on the basis of the actual number of days in the year divided by a 360-day year) as of the close of business on the Interest Determination Date by three major banks, which may include an agent, underwriter or its affiliates, in The City of New York selected and identified by the issuer. |

| • | If the banks selected by the issuer are not quoting as mentioned above, the Prime Rate will remain the Prime Rate then in effect on the Interest Determination Date, provided, that if the initial interest rate is in effect on such Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

| • | If “Reuters Page FRBCMT” is the specified CMT Reuters Page in the applicable prospectus supplement or term sheet, the CMT Rate on the CMT Rate Interest Determination Date shall be a percentage equal to the yield for United States Treasury securities at “constant maturity” having the Index Maturity specified in the applicable prospectus supplement or term sheet as set forth in H.15(519) under the caption “Treasury constant maturities,” as such yield is displayed on Reuters (or any successor service) on page FRBCMT (or any other page as may replace such page on such service) (“Reuters Page FRBCMT”) for such CMT Rate Interest Determination Date. |

| • | If such rate does not appear on Reuters Page FRBCMT, the CMT Rate on such CMT Rate Interest Determination Date shall be a percentage equal to the yield for United States Treasury securities at “constant maturity” having the Index Maturity specified in the applicable prospectus supplement or term sheet and for such CMT Rate Interest Determination Date as set forth in H.15(519) under the caption “Treasury constant maturities.” |

| • | If such rate does not appear in H.15(519), the CMT Rate on such CMT Rate Interest Determination Date shall be the rate for the period of the Index Maturity specified in the applicable prospectus supplement or term sheet as may then be published by either the Federal Reserve Board or the United States Department of the Treasury that the issuer determines to be comparable to the rate that would otherwise have been published in H.15(519). |

| • | If the Federal Reserve Board or the United States Department of the Treasury does not publish a yield on United States Treasury securities at “constant maturity” having the Index Maturity specified in the applicable prospectus supplement or term sheet for such CMT Rate Interest Determination Date, the CMT Rate on such CMT Rate Interest Determination Date shall be calculated by the calculation agent and shall be a yield-to-maturity based on the arithmetic mean of the secondary market bid prices at approximately 3:30 p.m., New York City time, on such CMT Rate Interest Determination Date of three leading primary United States government securities dealers in New York City (which may include the agents, underwriters or their affiliates) (each, a “reference dealer”) selected and identified by the issuer from five such reference dealers selected and identified by the issuer and eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity equal to the Index Maturity specified in the applicable prospectus supplement or term sheet, a remaining term to maturity no more than one year shorter than such Index Maturity and in a principal amount that is representative for a single transaction in such securities in such market at such time described in the applicable prospectus supplement or term sheet. If |

| • | If “Reuters Page FEDCMT” is the specified CMT Reuters Page in the applicable prospectus supplement or term sheet, the CMT Rate on the CMT Rate Interest Determination Date shall be a percentage equal to the one-week or one-month, as specified in the applicable prospectus supplement or term sheet, average yield for United States Treasury securities at “constant maturity” having the Index Maturity specified in the applicable prospectus supplement or term sheet as set forth in H.15(519) opposite the caption “Treasury Constant Maturities,” as such yield is displayed on Reuters on page FEDCMT (or any other page as may replace such page on such service) (“Reuters Page FEDCMT”) for the week or month, as applicable, ended immediately preceding the week or month, as applicable, in which such CMT Rate Interest Determination Date falls. |

| • | If such rate does not appear on Reuters Page FEDCMT, the CMT Rate on such CMT Rate Interest Determination Date shall be a percentage equal to the one-week or one-month, as specified in the applicable prospectus supplement or term sheet, average yield for United States Treasury securities at “constant maturity” having the Index Maturity specified in the applicable prospectus supplement or term sheet for the week or month, as applicable, preceding such CMT Rate Interest Determination Date as set forth in H.15(519) opposite the caption “Treasury Constant Maturities.” |

| • | If such rate does not appear in H.15(519), the CMT Rate on such CMT Rate Interest Determination Date shall be the one-week or one-month, as specified in the applicable prospectus supplement or term sheet, average yield for United States Treasury securities at “constant maturity” having the Index Maturity specified in the applicable prospectus supplement or term sheet as otherwise announced by the Federal Reserve Bank of New York for the week or month, as applicable, ended immediately preceding the week or month, as applicable, in which such CMT Rate Interest Determination Date falls. |

| • | If the Federal Reserve Bank of New York does not publish a one-week or one-month, as specified in the applicable prospectus supplement or term sheet, average yield on United States Treasury securities at “constant maturity” having the Index Maturity specified in the applicable prospectus supplement or term sheet for the applicable week or month, the CMT Rate on such CMT Rate Interest Determination Date shall be calculated by the calculation agent and shall be a yield-to-maturity based on the arithmetic mean of the secondary market bid prices at approximately 3:30 p.m., New York City time, on such CMT Rate Interest Determination Date of three reference dealers selected and identified by the issuer from five such reference dealers selected and identified by the issuer and eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest) for United States Treasury securities with an original maturity equal to the Index Maturity specified in the applicable prospectus supplement or term sheet, a remaining term to maturity of no more than one year shorter than such Index Maturity and in a principal amount that is representative for a single transaction |

| • | If the rate is not displayed on the relevant page as of 11:00 a.m., San Francisco time, on the Calculation Date, then the Eleventh District Cost of Funds Rate will be the monthly weighted average cost of funds paid by member institutions of the Eleventh Federal Home Loan Bank District, as announced by the Federal Home Loan Bank of San Francisco, as the cost of funds for the calendar month preceding the date of announcement. |

| • | If no announcement was made relating to the calendar month preceding the Interest Determination Date, the Eleventh District Cost of Funds Rate will remain the Eleventh District Cost of Funds Rate then in effect on the Interest Determination Date, provided, that if the initial interest rate is in effect on such Interest Determination Date, it will remain in effect for the new Interest Reset Period. |

| (1) | the Extendible Note with the form “Option to Elect Repayment” on the reverse of the Note duly completed; or |

| (2) | a facsimile transmission or letter from a member of a national securities exchange or FINRA or a commercial bank or trust company in the United States setting forth the name of the holder of the Extendible Note, the principal amount of the Note, the principal amount of the Note to be repaid, the certificate number or a description of the tenor and terms of the Note, a statement that the option to elect repayment is being exercised thereby and a guarantee that the Note be repaid, together with the duly completed form entitled “Option to Elect Repayment” on the reverse of the Note, will be received by the applicable trustee (or paying agent) not later than the fifth Business Day after the date of the facsimile transmission or letter; provided, however, that the facsimile transmission or letter will only be effective if the Note and form duly completed are received by the applicable trustee (or paying agent) by that fifth Business Day. The option may be exercised by the holder of an Extendible Note for less than the aggregate principal amount of the Note then outstanding if the principal amount of the Note remaining outstanding after repayment is an authorized denomination. |

| • | as Registered Securities; |

| • | as Bearer Securities (with interest coupons attached unless otherwise stated in the prospectus supplement or term sheet); |

| • | as both Registered Securities and Bearer Securities; |

| • | in denominations that are even multiples of $2,000 and $1,000 thereafter for Registered Securities and even multiples of $5,000 for Bearer Securities; or |

| • | in global form. See “—Global Securities.” |

| • | the issuer does not pay the principal of (or premium, if any) on a debt security of such series on its due date; |

| • | the issuer does not pay interest on a debt security of such series within 30 days of its due date; |

| • | the issuer does not make or satisfy any sinking fund payment in respect of debt securities of such series within 30 days of its due date; |

| • | we and/or an issuer remains in breach of a covenant in respect of debt securities of such series for 90 days after we or the relevant issuer receives a written notice of default stating we or such issuer is in breach. The notice must be sent by either the Trustee or holders of 30% of the principal amount of debt securities of such series; |

| • | the guarantees of the debt securities of any series by the Company, Eaton, or any Restricted Subsidiary that is a Significant Subsidiary (or group of Restricted Subsidiaries that together would constitute a Significant Subsidiary) ceases to be, or is asserted by us or any of the foregoing not to be, in full force and effect or enforceable in accordance with its terms, other than by reason of the termination of the Indenture or the release of any such guarantee in accordance with the Indenture; |

| • | we or any Restricted Subsidiary that is a Significant Subsidiary (or group of Restricted Subsidiaries that together would constitute a Significant Subsidiary) files for bankruptcy, or certain other events in bankruptcy, insolvency, or reorganization occur; or |

| • | there occurs any other Event of Default as to debt securities of the series described in the prospectus supplement or term sheet. |

| • | you must give the Trustee written notice that an Event of Default has occurred and remains uncured; |

| • | the holders of 30% in principal amount of all of the debt securities of the relevant series must make a written request that the Trustee take action because of the default and must offer indemnity satisfactory to the Trustee against the cost, expenses and liabilities of taking that action; |

| • | the Trustee must not have instituted a proceeding for 60 days after receipt of the above notice and offer of indemnity; and |

| • | the holders of a majority in principal amount of the debt securities must not have given the Trustee a direction inconsistent with the above notice during such 60-day period. |

| • | the payment of principal of, any premium, interest or Additional Amounts on any debt security or related coupon; or |

| • | in respect of a covenant that under Article Ten of the Indenture cannot be modified or amended without the consent of each holder. |

| • | a change of the Stated Maturity of the principal of or interest on a debt security; |

| • | a reduction of any amounts due on a debt security; |

| • | a reduction of the amount of principal payable upon acceleration of the Maturity of a Security following a default; |

| • | an adverse effect on any right of repayment at your option; |

| • | a change of the place (except as otherwise described in this prospectus) or Currency of payment on a debt security; |

| • | impairment of your right to sue for payment; |

| • | a reduction of the percentage of holders of debt securities whose consent is needed to modify or amend the Indenture; |

| • | a reduction of the percentage of holders of debt securities whose consent is needed to waive compliance with certain provisions of the Indenture or to waive certain defaults; |

| • | a modification of any other aspect of the provisions of the Indenture dealing with modification and waiver of past defaults, the quorum or voting requirements of the debt securities or provisions relating to the waiver of certain covenants, except to increase any percentage of consents required to amend the Indenture or for any waiver or to add certain provisions that cannot be modified without the approval of each holder; or |

| • | a change of any of our obligations to pay Additional Amounts. |

| • | for original issue discount securities, we will use the principal amount that would be due and payable on the voting date if the Maturity of the debt securities were accelerated to that date because of a default; |

| • | for debt securities whose principal amount is not known (for example, because it is based on an index), we will use a special rule for that debt security described in the prospectus supplement or term sheet; and |

| • | for debt securities denominated in one or more foreign Currencies or Currency units, we will use the U.S. dollar equivalent. |

| • | there will be no minimum quorum requirement for that meeting; and |

| • | the principal amount of the Outstanding debt securities of that series that vote in favor of such action will be taken into account in determining whether that action has been taken under the Indenture. |

| • | An investor cannot cause the debt securities to be registered in his or her name, and cannot obtain certificates for his or her interest in the debt securities, except in the special situations we describe below. |

| • | An investor will be an indirect holder and must look to his or her own bank or broker for payments on the debt securities and protection of his or her legal rights relating to the debt securities, as we describe under “—Issuance of Securities in Registered Form” above. |

| • | An investor may not be able to sell interests in the debt securities to some insurance companies and other institutions that are required by law to own their securities in non-book-entry form. |

| • | An investor may not be able to pledge his or her interest in a global security in circumstances where certificates representing the debt securities must be delivered to the lender or other beneficiary of the pledge in order for the pledge to be effective. |

| • | The depositary’s policies, which may change from time to time, will govern payments, transfers, exchanges and other matters relating to an investor’s interest in a global security. We and the Trustee have no responsibility for any aspect of the depositary’s actions or for its records of ownership interests in a global security. We and the Trustee also do not supervise the depositary in any way. |

| • | If the issuer redeems less than all the debt securities of a particular series being redeemed, DTC’s practice is to determine by lot the amount to be redeemed from each of its participants holding that series. |

| • | An investor is required to give notice of exercise of any option to elect repayment of its debt securities, through its participant, to the Trustee and to deliver the related debt securities by causing its participant to transfer its interest in those debt securities, on DTC’s records, to the Trustee. |

| • | DTC requires that those who purchase and sell interests in a global security deposited in its book-entry system use immediately available funds. Your broker or bank may also require you to use immediately available funds when purchasing or selling interests in a global security. |

| • | Financial institutions that participate in the depositary’s book-entry system, and through which an investor holds its interest in a global security, may also have their own policies affecting payments, notices and other matters relating to the debt securities. There may be more than one financial intermediary in the chain of ownership for an investor. We and the Trustee do not monitor and are not responsible for the actions of any of those intermediaries. |

| • | If the depositary notifies the issuer that it is unwilling, unable or no longer qualified to continue as depositary for that global security, and the issuer does not appoint another institution to act as depositary within 90 days, |

| • | if the issuer notifies the Trustee that the issuer wishes to terminate that global security (subject to the depositary’s procedures), or |

| • | if an event of default has occurred with regard to the debt securities represented by that global security and has not been cured or waived; we discuss defaults above under “—Events of Default.” |

| • | an individual who is, for United States federal income tax purposes, a citizen or resident of the United States; |

| • | a corporation, partnership or other entity created or organized in or under the laws of the United States or of any political subdivision; |

| • | an estate the income of which is subject to United States federal income taxation regardless of its source; or |

| • | a trust with respect to which a court within the United States is able to exercise primary supervision over its administration and one or more United States persons have the authority to control all of its substantial decisions, or certain electing trusts that were in existence on August 19, 1996 and were treated as domestic trusts on that date. |

| • | where the Company or Eaton merge or consolidate out of existence or the Company or Eaton sell or transfer their assets substantially as an entirety, the resulting firm must agree to be legally responsible for all obligations under the debt securities and the Indenture; |

| • | the merger, consolidation or sale or transfer of assets substantially as an entirety must not cause a default under the debt securities. For purposes of this no-default test, a default would include an Event of Default that has not been cured, as described above under “—Events of Default;” |

| • | where Eaton merges or consolidates out of existence or sells or transfers its assets substantially as an entirety, the resulting firm (if a corporation) must be a corporation organized under the laws of the United States or any state thereof or the District of Columbia; |

| • | where the Company merges or consolidates out of existence or sells or transfers its assets substantially as an entirety, the resulting firm (if a corporation) must be a corporation organized under the laws of any member state of the European Union or the United States or any state thereof or the District of Columbia; and |

| • | the Company, or Eaton, as applicable, must deliver certain certificates and documents to the Trustee where the Company or Eaton merge or consolidate out of existence. |

| • | the sale or transfer of property is made within 180 days after the later of the date of |

| • | the acquisition of such property, |

| • | the completion of construction of such property, or |

| • | the commencement of full operation thereof; |

| • | such lease has a term, including permitted extensions and renewals, of not more than three years, and it is intended that the use by the Company or the Restricted Subsidiary of the Principal Property covered by such lease will be discontinued on or before the expiration of such term; |

| • | the amount that the Company and its Restricted Subsidiaries realize from such sale or transfer, together with the value (as defined) of then outstanding Sale and Leaseback Transactions not otherwise permitted by the Indenture and the outstanding aggregate principal amount of mortgage, pledge or lien indebtedness not otherwise permitted by the Indenture, will not exceed 10% of our Consolidated Net Tangible Assets (as defined below); or |

| • | the Company or its Restricted Subsidiaries causes an amount equal to the value (as defined) of the Principal Property to be sold or transferred and leased to be applied to the retirement (other than any mandatory retirement) within 180 days of the effective date of such Sale and Leaseback Transaction of either the debt securities or other Funded Debt which is equal in rank to the debt securities, or both. |

| • | the creation of any mortgage or other lien on any Principal Property to secure indebtedness incurred prior to, at the time of, or within 180 days after the later of, the acquisition, the completion of construction or the commencement of full operation of such Principal Property; provided that such secured indebtedness is incurred for the purpose of financing all or any part of the acquisition or construction of any such Principal Property; and |

| • | mortgages or liens on any Principal Property acquired after the date of the Indenture by the Company or any Restricted Subsidiary existing at the time of such acquisition. |

| • | the current liabilities of the Company and those of its consolidated subsidiaries, including an amount equal to indebtedness required to be redeemed by reason of any sinking fund payment due in 12 months or less from the date as of which current liabilities are to be determined; |

| • | all of the other liabilities of the Company and those of its consolidated subsidiaries other than Funded Debt, deferred income taxes and liabilities for employee post-retirement health plans recognized in accordance with Statement of Financial Accounting Standards No. 106; |

| • | all of the Company’s and its consolidated subsidiaries’ depreciation and valuation reserves and all other reserves (except for reserves for contingencies which have not been allocated to any particular purpose); |

| • | the book amount of all the Company’s and its consolidated subsidiaries’ segregated intangible assets, including, but without limitation, such items as goodwill, trademarks, trade names, patents, and unamortized debt discount and expense, less unamortized debt premium; and |

| • | appropriate adjustments on account of minority interests of other persons holding stock in subsidiaries. |

| • | any subsidiary substantially all the assets of which are located, or substantially all of the business of which is carried on, outside of the United States, its territories and possessions and Canada, or any subsidiary substantially all the assets of which consist of stock or other securities of such subsidiary; |

| • | any subsidiary principally engaged in the business of financing notes and accounts receivable and any subsidiary substantially all the assets of which consist of stock or other securities of such subsidiary; or |

| • | any subsidiary acquired or organized after the date of the Indenture, provided, however, that the term “Restricted Subsidiary” will mean also any subsidiary which, subsequent to the date of the Indenture, is designated by the board of directors fo the Company as a Restricted Subsidiary, if as a result of such designation no covenant or agreement in the Indenture would be breached. |

| • | the net proceeds of the sale or transfer of such Principal Property; or |

| • | the fair value of such Principal Property at the time of entering into such Sale and Leaseback Transaction, as determined by the board of directors of the Company. |

| • | The issuer must deposit in trust for your benefit and the benefit of all other direct holders of the debt securities a combination of money and U.S. government or U.S. government agency obligations that will generate enough cash to make interest, principal and any other payments on such debt securities on their various due dates. |

| • | The issuer must deliver to the Trustee a legal opinion confirming that there has been a change in current U.S. federal tax law or an Internal Revenue Service (the “IRS”) ruling that lets the issuer make the above deposit without causing you to be taxed on the debt securities any differently than if the issuer did not make the deposit and just repaid the debt securities itself. Under current U.S. federal tax law, the deposit and the issuer’s legal release from the debt securities would be treated as though the issuer paid you your share of the cash and notes or bonds at the time the cash and notes or bonds are deposited in trust in exchange for your debt securities, and you would recognize gain or loss on the debt securities at the time of the deposit. |

| • | deposit in trust for your benefit and the benefit of all other direct holders of the debt securities a combination of money and U.S. government or U.S. government agency obligations that will generate enough cash to make interest, principal and any other payments on the debt securities on their various due dates; and |

| • | deliver to the Trustee a legal opinion of its counsel confirming that, under current U.S. federal income tax law, an issuer may make the above deposit without causing you to be taxed on the debt securities any differently than if the issuer did not make the deposit and just repaid the debt securities itself. |

| • | amending the objects or memorandum of association of the Company; |

| • | amending the articles of association of the Company; |

| • | approving a change of name of the Company; |

| • | authorizing the entering into of a guarantee or provision of security in connection with a loan, quasi-loan, or credit transaction to a director or connected person; |

| • | opting out of preemption rights on the issuance of new shares; |

| • | re-registration of the Company from a public limited company to a private company; |

| • | variation of class rights attaching to classes of shares (where the articles of association do not provide otherwise); |

| • | purchase of own shares off-market; |

| • | reduction of issued share capital; |

| • | sanctioning a compromise/scheme of arrangement; |

| • | resolving that the Company be wound up by the Irish courts; |

| • | resolving in favor of a shareholders’ voluntary winding-up; |

| • | re-designation of shares into different share classes; and |

| • | setting the re-issue price of treasury shares. |

| • | a court-approved scheme of arrangement under the Companies Acts. A scheme of arrangement with shareholders requires a court order from the Irish High Court and the approval of a majority in number representing 75% in value of the shareholders present and voting in person or by proxy at a meeting called to approve the scheme; |

| • | through a tender or takeover offer by a third party for all of the shares of the Company. Where the holders of 80% or more of the Company’s shares have accepted an offer for their shares in the Company, the remaining shareholders may also be statutorily required to transfer their shares. If the bidder does not exercise its “squeeze out” right, then the non-accepting shareholders also have a statutory right to require the bidder to acquire their shares on the same terms. If shares of the Company were to be listed on the main market of Euronext Dublin or another regulated stock exchange in the European Union, this threshold would be increased to 90%; and |

| • | it is also possible for the Company to be acquired by way of a transaction with an EU-incorporated company under the European Union (Cross-Border Conversion, Mergers and Divisions) Regulations 2023. Such a transaction must be approved by a special resolution. If the Company is being merged with another EU company under the EU Cross-Border Mergers Directive and the consideration payable to the Company’s shareholders is not all in the form of cash, the Company’s shareholders may be entitled to require their shares to be acquired at fair value. |

| (a) | the sale, exchange, lease, transfer, or other disposition by the Company of all, or substantially all, of its assets or business; |

| (b) | the consolidation of the Company, or its merger, into another company; |

| (c) | the merger into the Company of another company or companies if the merger involves the issuance or transfer by the Company to the shareholders of the other constituent company or companies of such number of shares of the Company as entitle the holders thereof to exercise at least one-sixth of the voting power of the Company in the election of directors immediately after the consummation of the merger; |

| (d) | a combination or majority share acquisition in which the Company is the acquiring company and its voting shares are issued or transferred to another company if the combination or majority share acquisition involves the issuance or transfer by the Company to the shareholders of the other company or companies of such number of shares of the Company as entitle the holders thereof to exercise at least one-sixth of the voting power of the Company in the election of directors immediately after the consummation of the combination or majority share acquisition; or |

| (e) | to approve any agreement, contract, or other arrangement providing for any of the transactions described in subparagraph (a) above. |

| • | any transfer of those shares, or in the case of unissued shares any transfer of the right to be issued with shares and any issue of shares, shall be void; |

| • | no voting rights shall be exercisable in respect of those shares; |

| • | no further shares shall be issued in right of those shares or in pursuance of any offer made to the holder of those shares; and |

| • | no payment shall be made of any sums due from the Company on those shares, whether in respect of capital or otherwise. |

| • | in the event of an offer, all holders of security of the target company should be afforded equivalent treatment and, if a person acquires control of a company, the other holders of securities must be protected; |

| • | the holders of the securities in the target company must have sufficient time and information to enable them to reach a properly informed decision on the offer; where it advises the holders of securities, the board of the target company must give its views on the effects of implementation of the offer on employment, conditions of employment and the locations of the target company's places of business; |

| • | the board of the target company must act in the interests of the company as a whole and must not deny the holders of securities the opportunity to decide on the merits of the offer; |

| • | false markets must not be created in the securities of the target company, the bidder or of any other company concerned by the offer in such a way that the rise or fall of the prices of the securities becomes artificial and the normal functioning of the markets is distorted; |

| • | a bidder must announce an offer only after ensuring that he or she can fulfill in full, any cash consideration, if such is offered, and after taking all reasonable measures to secure the implementation of any other type of consideration; |

| • | a target company must not be hindered in the conduct of its affairs for longer than is reasonable by an offer for its securities; and |

| • | a substantial acquisition of securities (whether such acquisition is to be effected by one transaction or a series of transactions) shall take place only at an acceptable speed and shall be subject to adequate and timely disclosure. |

| • | the action is approved by the Company’s shareholders at a general meeting; or |

| • | the Irish Takeover Panel has given its consent, where: |

| • | it is satisfied the action would not constitute frustrating action; |

| • | the Company’s shareholders that hold 50% of the voting rights state in writing that they approve the proposed action and would vote in favor of it at a general meeting; |

| • | the action is taken in accordance with a contract entered into prior to the announcement of the offer; or |

| • | the decision to take such action was made before the announcement of the offer and either has been at least partially implemented or is in the ordinary course of business. |

| • | Allow the Company’s board of directors to issue preference shares without shareholder approval, with such rights, preferences and privileges as the board of directors may designate (see “Preference Shares”); |

| • | Permit holders of not less than 10% of the total voting rights of the Company to requisition an extraordinary meeting for various purposes, including considering director nominations (see “Description of Ordinary Shares-Extraordinary General Meetings of Shareholders”); |

| • | Establish advance notice procedures for shareholders to submit shareholder proposals or to submit nominations of candidates for election to the Company’s board of directors; |

| • | Permit the board of directors to fill any vacancy occurring on the board of directors (see “Description of Ordinary Shares-Removal of Directors”); |

| • | Authorize the board of directors to adopt a shareholder rights plan upon such terms and conditions as the board deems expedient and in the best interests of the Company; |

| • | Impose particular approval and other requirements in relation to certain business combinations (see “Description of Ordinary Shares-Acquisitions”); |

| • | Grant statutory preemption rights to shareholders when shares are being issued for cash consideration unless the Company “opts out” of these rights in its articles of association (see “Description of Ordinary Shares-Preemption Rights, Share Warrants and Share Options”); |

| • | Impose notification requirements on shareholders who acquire or cease to be interested in a specified percentage of the Company’s shares (see “Description of Ordinary Shares-Disclosure of Interests in Shares”); and |

| • | Provide that the Company may only alter its memorandum and articles of association by the passing of a special resolution of shareholders. |

| • | the number of depositary shares and the fraction or multiple of a share of preference shares represented by each depositary share; |

| • | the terms of the series of preference shares deposited by us under the deposit agreement; |

| • | whether the depositary shares will be listed on any securities exchange; |

| • | whether the depositary shares will be sold with any other offered securities and, if so, the amount and terms of these other securities; and |

| • | any other terms of the depositary shares. |

| • | the title and aggregate number of the warrants; |

| • | the title, rank, aggregate principal amount and terms of the underlying debt securities, preference shares or ordinary shares purchasable upon exercise of the warrants; |

| • | the principal amount of underlying debt securities, preference shares or ordinary shares that may be purchased upon exercise of each warrant, and the price or the manner of determining the price at which this principal amount may be purchased upon exercise; |

| • | the currency or currencies, including composite currencies, in which the price of such warrants may be payable; |

| • | the price at which and the currencies, including composite currencies, in which the securities purchasable upon exercise of such warrants shall commence and the date on which such right will expire; |

| • | the minimum or maximum amount of such warrants which may be exercised at any one time; |

| • | the title, rank, aggregate principal amount and terms of the securities with which such warrants are issued and the number of such warrants issued with each such security; |

| • | the date on and after which such warrants and related securities will be separately transferable; |

| • | any optional redemption terms; |

| • | the identity of the warrant agent; |

| • | whether certificates evidencing the warrants will be issued in registered or bearer form and, if registered, where they may be transferred and exchanged; and |

| • | any other material terms of the warrants. |

| • | a court within the United States is able to exercise primary supervision over the administration of the trust, and |

| • | one or more United States persons have the authority to control all substantial decisions of the trust. |

| • | the product of an OID Note’s adjusted issue price at the beginning of such accrual period and its yield to maturity (determined on the basis of compounding at the close of each accrual period and adjusted for the length of such accrual period) over |

| • | the amount of qualified stated interest, if any, payable on such OID Note and allocable to such accrual period. |

| (1) | has an issue price that does not exceed the total noncontingent principal payments by more than the lesser of: |

| (a) | the product of: |

| • | the total noncontingent principal payments; |

| • | the number of complete years to maturity from the issue date (or in the case of an Amortizing Note, the weighted average maturity); and |

| • | 0.015; or |

| (b) | 15 percent of the total noncontingent principal payments; |

| (2) | only provides for stated interest compounded or paid at least annually at: |

| (a) | one or more “qualified floating rates”; |

| (b) | a single fixed rate and one or more qualified floating rates; |

| (c) | a single “objective rate”; or |

| (d) | a single fixed rate and a single objective rate that is a “qualified inverse floating rate”; and |

| (3) | does not provide for any principal payments that are contingent (other than as described in (1) above). |

| (1) | variations in the value of the rate can reasonably be expected to measure contemporaneous variations in the cost of newly borrowed funds in the currency in which the Note is denominated; or |

| (2) | it is equal to the product of such a rate and either: |

| (a) | a fixed multiple that is greater than 0.65 but not more than l.35; or |

| (b) | a fixed multiple greater than 0.65 but not more than 1.35, increased or decreased by a fixed rate. |

| • | have values within 0.25 percentage points of each other on the issue date; or |

| • | can reasonably be expected to have approximately the same values throughout the term of the Note, |

| • | the rate is equal to a fixed rate minus a qualified floating rate; and |

| • | the variations in the rate can reasonably be expected to inversely reflect contemporaneous variations in the qualified floating rate. |

| • | the fixed rate and the qualified floating rate or objective rate have values on the issue date of the Note that do not differ by more than 0.25 percentage points; or |

| • | the value of the qualified floating rate or objective rate on the issue date is intended to approximate the fixed rate, |

| • | determining a fixed rate substitute for each variable rate provided under the Variable Rate Note (generally the value of each variable rate as of the issue date or, in the case of an objective rate that is not a qualified inverse floating rate, a rate that reflects the reasonably expected yield on the Variable Rate Note); |

| • | constructing the equivalent fixed rate debt instrument (using the fixed rate substitute described above); |

| • | determining the amount of qualified stated interest and original issue discount with respect to the equivalent fixed rate debt instrument; and |

| • | making the appropriate adjustments for actual variable rates during the applicable accrual period. |

| • | gains or losses attributable to changes in exchange rates (as described in the next paragraph), |

| • | gains attributable to market discount and |

| • | gains on the disposition of a Short-Term Note, |

| • | to reset the interest rate, in the case of a Fixed Rate Note, or to reset the spread, the spread multiplier or other formulas by which the interest rate basis is adjusted, in the case of a Floating Rate Note; and/or |

| • | to extend the maturity of such Note. |

| (1) | such holder does not actually or constructively own 10% or more of the total combined voting power of all classes of Eaton’s stock entitled to vote; |

| (2) | such holder is not a controlled foreign corporation for United States tax purposes that is related to Eaton through stock ownership; |

| (3) | such holder is not a bank receiving interest described in Code Section 881(c)(3)(A); and |

| (4) | neither Eaton nor its agent has actual knowledge or reason to know that such holder is a United States person, and either: |

| (a) | the beneficial owner of the Note certifies to Eaton or its agent, under penalties of perjury, that such owner is not a United States person and provides its name and address (which certification can be made on IRS Form W-8BEN, IRS Form W-8BEN-E or a suitable substitute); or |

| (b) | a securities clearing organization, bank or other financial institution that holds customers’ securities in the ordinary course of its trade or business (a “financial institution”) certifies to the Company or |

| • | the certification described in clause (4)(a) above must be provided by the partners or beneficiaries rather than by the foreign partnership or foreign trust; and |

| • | the partnership or trust must provide certain information, including a United States taxpayer identification number (which certification can be made on IRS Form W-8IMY or a suitable substitute) and such other information as may be required if such foreign partnership (or foreign trust) is a withholding foreign partnership (or withholding foreign trust) that has entered into a qualified intermediary or similar agreement with the IRS. |

| • | such gain is effectively connected with a United States trade or business of the holder; or |

| • | in the case of an individual, such holder is present in the United States for 183 days or more in the taxable year of the retirement or disposition and certain other conditions are met. |

| • | in the case of a foreign financial institution, such institution enters into an agreement with the U.S. government to withhold on certain payments, and to collect and provide to the U.S. tax authorities information regarding U.S. account holders of such institution (which includes certain equity and debt holders of such institution, as well as certain account holders that are foreign entities with U.S. owners); |

| • | the non-financial foreign entity either certifies it does not have any “substantial U.S. owners” (as defined in the Code) or furnishes identifying information regarding each substantial U.S. owner (generally by providing an IRS Form W-8BEN-E); or |

| • | the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules and provides appropriate documentation (such as an IRS Form W-8BEN-E). |

| • | through agents; |

| • | to or through underwriters or dealers; or |

| • | directly to other purchasers. |

| • | at a fixed public offering price or prices, which may be changed; |

| • | at market prices prevailing at the time of sale; |

| • | at prices related to such prevailing market prices; or |

| • | at negotiated prices. |

| Item 14. | Other Expense of Issuance and Distribution |

Filing fee for Registration Statement | | | $ (1) |

FINRA Fees | | | (2) |

Legal Fees and Expenses | | | (2) |

Rating Agency Fees | | | (2) |

Blue Sky Fees and Expenses | | | (2) |

Printing and Engraving Fees | | | (2) |

Accounting Fees and Expenses | | | (2) |

Trustee’s and Depositary’s Fees and Expenses | | | (2) |

Miscellaneous Expenses | | | (2) |

Total | | | $ (2) |

| (1) | Deferred in accordance with Rules 456(b) and 457(r) of the Securities Act of 1933. |

| (2) | These fees and expenses are calculated based on the securities offered and the number of issuances and accordingly are not known at the time of filing this registration statement. |

| Item 15. | Indemnification of Directors and Officers |

| Item 16. | Exhibits |

| Item 17. | Undertakings |

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to the registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |