UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------

Amendment No. 1

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission File Number: 333-182072

--------------------------

Hunt Mining Corp.

(Exact name of Registrant as specified in its charter)

| British Columbia | 1041 | |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) |

23800 East Appleway Ave.

Liberty Lake, WA 99019

(509)-290-5659

(Address of principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name on each exchange on which registered |

| Not Applicable | Not Applicable |

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares, without par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: Not Applicable

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 146,494,823 Common Shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ X ]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes [ ] No [ X ]

0

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 12 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past ninety days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ X ]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP [ ] | International Financial Reporting standards as issued by the International Accounting Standards Board [ X ] | Other [ ] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ] N/A

Index to Exhibits on Page 43

TABLE OF CONTENTS

| PART I | 3 |

Item 1. Identity of Directors, Senior Management and Advisers. | 3 |

Item 2. Offer Statistics and Expected Timetable. | 3 |

Item 3. Key Information | 4 |

Item 4. Information on the Company | 11 |

Item 4A. Unresolved Staff Comments | 30 |

Item 5. Operating and Financial Review and Prospects | 30 |

Item 6. Directors, Senior Management and Employees | 32 |

Item 7. Major Shareholders and Related Party Transactions | 39 |

Item 8. Financial Information | 41 |

Item 9. The Offer and Listing | 42 |

Item 10. Additional Information | 43 |

Item 11. Quantitative and Qualitative Disclosures About Market Risk | 55 |

Item 12. Description of Securities Other Than Equity Securities | 56 |

| PART II | 56 |

Item 13. Defaults, Dividend Arrearages and Delinquencies | 56 |

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | 56 |

Item 15. Controls and Procedures | 56 |

Item 16. [Reserved] | 56 |

1

Item 16A. Audit Committee Financial Expert | 57 |

Item 16B. Code of Ethics | 57 |

Item 16C. Principal Accountant Fees and Services | 57 |

Item 16D. Exemptions from the Listing Standards for Audit Committees | 57 |

Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 57 |

Item 16F. Changes in Registrant’s Certifying Accountant | 57 |

Item 16G. Corporate Governance | 59 |

Item 16H. Mine Safety Disclosure | 59 |

| PART III | 59 |

Item 17. Financial Statements | 59 |

Item 18. Financial Statements | 59 |

Item 19. Exhibits | 59 |

INTRODUCTION

Hunt Mining Corp (“Hunt Mining”) was incorporated on January 10, 2006 under the laws of Alberta, Canada. On November 6, 2013, the Company announced that effective November 6, 2013, it had continued from the Province of Alberta to the Province of British Columbia pursuant to a special resolution passed by shareholders of the Corporation at the annual and special meeting of shareholders held on November 5, 2013. We are, together with our subsidiaries, engaged in the exploration of mineral properties in Santa Cruz province, Argentina.

We were initially listed on the TSX Venture Exchange (“TSXV”) as a Capital Pool Company within the meaning ascribed by TSXV Policy 2.4, as “Sinomar Capital Corporation”. On December 23, 2009, we completed our Qualifying Transaction by acquiring all of the issued and outstanding shares of Cerro Cazador, S.A., an Argentine mineral exploration company, in a reverse takeover transaction. We were a shell company until we completed the acquisition. We subsequently changed our name to Hunt Mining Corp.

We are a reporting issuer under the securities legislation of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland. Our common shares are listed on the TSXV under the symbol HMX.V.

Our offices are located at: 23800 East Appleway Ave., Liberty Lake, WA 99019.

The Company qualifies as an “emerging growth company”, as defined in section 3(a) of the U.S. Securities Exchange Act of 1934 (as amended by the U.S. “Jumpstart Our Business Startups Act (the “JOBS Act”), enacted on April 5, 2012). The Company will continue to qualify as an “emerging growth company” until such time as the Company produces more than US$1 billion in gross revenue, the Company issues more than US$1 billion in non-convertible debt within a three-year period, the Company is deemed to be a “large accelerated filer”, or more than five years elapse from the time of its initial public offering in the United States. The Company expects that it will continue to qualify as an emerging growth company for the foreseeable future. As an emerging growth company, the Company is exempt from the requirements of section 404(b) of the Sarbanes-Oxley Act, meaning that the Company is exempt from the requirement to obtain an external audit of its internal controls over financial reporting.

BUSINESS OF HUNT MINING CORP.

Hunt Mining is a mineral company engaged in the acquisition and exploration of mineral properties.

There are no known proven reserves of minerals on Hunt Mining’s properties. All of the Company's properties are currently at the exploration stage. The Company does not have any commercially producing mines or sites, nor is the Company in the process of developing any commercial mines or sites. Other than minimal revenue derived from operator’s fees received from its former exploration partner, the Company has not reported any revenue from operations since incorporation. As such, Hunt Mining is defined as an “exploration-stage company”.

2

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” within the meaning of section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), which represent expectations or beliefs of the Company about future events. Any statements that are not statements of historical facts may be deemed to be forward-looking statements. These statements appear in a number of different places in this Annual Report and, in some cases, can be identified by words such as “anticipates”, “estimates”, “projects”, “expects”, “intends”, “believes”, “plans”, or their negatives or other comparable words. The forward-looking statements, including the statements contained in the sections entitled Risk Factors, involve known and unknown risks, uncertainties and other factors which may cause our Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such statements. Forward-looking statements include statements regarding the outlook for our Company’s future operations, plans and timing for the Company’s exploration programs, statements about future market conditions, supply and demand conditions, forecasts of future costs and expenditures, the outcome of legal proceedings, and other expectations, intentions and plans that are not historical facts.

The risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied by the forward-looking statements include:

• general economic and business conditions, including changes in interest rates;

• prices of natural resources, costs associated with mineral exploration and other economic conditions;

• natural phenomena;

• actions by government authorities, including changes in government regulation;

• uncertainties associated with legal proceedings;

• changes in the resources market;

• future decisions by management in response to changing conditions;

• our Company’s ability to execute prospective business plans; and

• misjudgments in the course of preparing forward-looking statements.

The Company’s forward-looking statements contained in this Annual Report are made as of the respective dates set forth in this Annual Report. Such forward-looking statements are based on the beliefs, expectations and opinions of management as of the date the statements are made. The Company does not intend to update these forward-looking statements. For the reasons set forth above, investors should not place undue reliance on forward-looking statements. You should carefully review the cautionary statements and risk factors contained in this and other documents that the Company may file from time to time with the Securities and Exchange Commission.

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

Not Applicable

Item 2. Offer Statistics and Expected Timetable.

Not Applicable

3

Item 3. Key Information

| A. | Selected Financial Data. |

The following tables set forth and summarize selected consolidated financial data for the Company, prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) for 2014, 2013 and 2012. The consolidated financial statements have been audited by Crowe MacKay LLP, Chartered Accountants, as at and for the year ended December 31, 2014 and by MNP LLP, Chartered Accountants, as at and for the years ended December 31, 2013 and 2012 and are reported in Canadian dollars.

The selected financial data should be read in conjunction with Item 5, “Operating and Financial Review and Prospects” and in conjunction with the Consolidated Financial Statements of the Company and the Notes thereto contained elsewhere in this Annual Report. The Company’s fiscal period ends on December 31 of each year.

The following are summaries of certain selected financial information for the Company’s most recently completed fiscal year and the fiscal years ended December 31, 2013, 2012, 2011 and 2010.

| Year ended | ||||||||||||||||||||

December 31, 2014 (IFRS) $ | December 31, 2013 (IFRS) $ | December 31, 2012 (IFRS) $ | December 31, 2011 (IFRS) $ | December 31, 2010 (IFRS) $ | ||||||||||||||||

| Net loss for the period | (3,302,154 | ) | (2,680,088 | ) | (4,172,082 | ) | (8,280,161 | ) | (3,362,240 | ) | ||||||||||

| Net loss for the period – basic and diluted loss per share | (0.03 | ) | (0.02 | ) | (0.04 | ) | (0.09 | ) | (0.07 | ) | ||||||||||

| Working capital | (655,728 | ) | 1,967,559 | 4,426,615 | 8,261,632 | 5,918,120 | ||||||||||||||

| Total assets | 2,526,707 | 5,002,767 | 7,701,979 | 11,494,788 | 8,138,880 | |||||||||||||||

| Total non-current liabilities | 207,069 | 125,000 | 125,000 | 125,000 | 125,000 | |||||||||||||||

| Total shareholders’ equity | 1,465,640 | 4,285,821 | 6,639,883 | 10,628,859 | 7,505,089 | |||||||||||||||

| Cash dividends | - | - | - | - | - | |||||||||||||||

The Company has chosen to expense its exploration and evaluation expenditures as incurred. No dividends have been declared in any of the years presented above.

Exchange Rate Information

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian dollars. References in this document to “$” and “CDN$” refer to Canadian dollars, unless otherwise specified; and references to “US$” refer to US dollars.

The following table sets forth the high and low rates of exchange for the Canadian dollars per U.S. dollar, for each month during the previous six months and the average of such exchange rates during the five most recent years ended December 31. The average rates presented in the table below represent the average of the exchange rates on the last day of each month during a year for the past five fiscal years. The noon rate of exchange on April 30, 2015, as set forth in the Bank of Canada website, for the conversion of Canadian dollars into United States dollars was US$1.00 = CDN$1.XX.

4

Exchange Rate U.S. Dollars into Canadian dollars | ||

| High | Low | |

| Month ended March 31, 2015 | 1.2783 | 1.2446 |

| Month ended February 28, 2015 | 1.2723 | 1.2414 |

| Month ended January 31, 2015 | 1.2660 | 1.1599 |

| Month ended December 31, 2014 | 1.1643 | 1.1354 |

| Month ended November 30, 2014 | 1.1414 | 1.1226 |

| Month ended October 31, 2014 | 1.1319 | 1.1116 |

| Average | ||

| Fiscal year ended December 31, 2014 | 1.1041 | |

| Fiscal year ended December 31, 2013 | 1.0297 | |

| Fiscal year ended December 31, 2012 | 0.9696 | |

| Fiscal year ended December 31, 2011 | 0.9592 | |

| Fiscal year ended December 31, 2010 | 0.9994 | |

| B. | Capitalization and Indebtedness |

Not Applicable

| C. | Reasons for the Offer and Use of Proceeds |

Not Applicable

| D. | Risk Factors |

The mining business is inherently risky in nature. Exploration activities are based on professional judgments and statistically‐based tests and calculations and often yield few rewarding results. Mineral properties are often non‐productive for reasons that cannot be anticipated in advance and operations may be subject to numerous risks. As a result, an investment in our common shares should be considered highly speculative and prospective investors should carefully consider all of the information disclosed in this prospectus prior to making an investment. In addition to the other information presented in this prospectus, the following risk factors should be given special consideration when evaluating an investment in our common shares.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to continue operating and our ability to obtain future financing

The audit opinion for our financial statements for the fiscal year ended December 31, 2014 includes a qualification raising substantial doubt about our ability to continue as a going concern. The Company is an exploration stage company and has incurred losses since its inception. The Company has had minimal revenues and has incurred an accumulated loss of $34,478,437 through December 31, 2014 (December 31, 2013 - $31,176,283). The Company’s ability to continue as a going concern is dependent upon the discovery of economically recoverable mineral reserves, the ability to obtain necessary financing to complete development and fund operations and future production or proceeds from their disposition. Additionally, the current capital markets and general economic conditions in the United States and Canada provide no assurance that the Company’s funding initiatives will continue to be successful. These factors raise doubt about the Company’s ability to continue as a going concern.

Our Company has had minimal revenues and there can be no assurance that our exploration activities will result in future profitable earnings.

Hunt Mining has had only minimal revenues. Our properties are in the exploration stage and there are no known commercially mineable mineral deposits on our properties. There can be no guarantee that our exploration activities will result in the discovery of economically recoverable mineral reserves and/or profitable production of precious metals.

5

Title to our mineral properties may be subject to other claims which could have an adverse effect on our property rights.

Although CCSA has exercised due diligence with respect to determining title to the properties in which it has a material interest, there is no guarantee that title to such properties will not be challenged or impugned. Our mineral property interests may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. Until competing interests, if any, in the mineral lands have been determined, we can give no assurance as to the validity of title to those lands or the size of such mineral lands.

Our Company’s continued viability is dependent upon the results of our exploration activities and the development economically recoverable mineral reserves.

Resource exploration and development is a highly speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals we acquire or discover may be affected by numerous factors that are beyond our control and that cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, the import and export of minerals and environmental protection, the combination of which may result in us not receiving an adequate return of investment capital.

All of the claims in which we have acquired or have a right to acquire an interest are in the exploration stage only and are without a known commercially-mineable ore body. Development of the subject mineral properties would follow only if favorable exploration results are obtained.

There is no assurance that Hunt Mining’s mineral exploration and development activities will result in any discoveries of commercial bodies of ore. The long-term profitability of our operations will in part be directly related to the costs and success of our exploration programs, which may be affected by a number of factors.

Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis.

Our Company’s exploration activities may be impacted by cyclical changes in weather, available workforce and other factors.

Exploration activity in our operating area is seasonal in nature. Exploration activity generally becomes more difficult during the winter months in Santa Cruz province. During the warmer months exploration activity generally increases, which increases demand for qualified exploration personnel, drilling contractors and drill rigs.

The impact of global financial markets on precious metal prices, interest rates, foreign currencies and other economic factors may have an adverse effect on our business and future operations.

Worldwide cycles of economic growth, interest rates, inflation rates and other economic factors can have a profound impact on the demand and realizable sale prices for precious metals and base metals over time. Relatively high metals prices can improve the probability that a mineral deposit could be developed into an economic producing property. In contrast, relatively low metals prices can reduce the probability that a mineral deposit could be developed into a producing property. The relative attractiveness of all mineral deposits is therefore highly dependent on metals prices and overall macroeconomic activity. Thus, mineral exploration activity is closely tied to the worldwide markets for precious metals and base metals. Current market conditions are not favorable to junior mineral exploration companies such as Hunt Mining.

6

Hunt Mining’s ability to explore for precious metals is dependent on access to external equity and debt financing and therefore our business is highly sensitive to macroeconomic changes over time. During times of economic growth and favorable equity market conditions our access to capital is better than during times of poor economic growth and weak equity market conditions. Therefore, Hunt Mining’s ability to explore for precious metals and base metals is highly sensitive to changing equity market conditions.

Historically, we have spent the majority of our exploration efforts on the La Josefina property and we recently added the contiguous La Valenciana property to our portfolio of exploration target properties. We remain economically dependent on these projects.

We consider La Josefina to be our primary exploration property because La Josefina occupies 52,800 hectares and approximately 90% of the nearly 57,000 meters drilled by us have been drilled on La Josefina. Hunt Mining’s rights to explore the La Josefina and La Valenciana properties are governed by exploration agreements between our wholly-owned subsidiary, CCSA, and Fomicruz. We remain economically dependent on these projects and therefore upon our continued relationship with Fomicruz.

We do not insure against all risk to which we may be subject part of our exploration activities.

Exploration, development and production of mineral properties is subject to certain risks, and in particular, unexpected or unusual geological operating conditions including rock bursts, cave-ins, fires, flooding and earthquakes may occur. It is not always possible to insure fully against such risks and we may decide not to take out insurance against such risks as a result of high premiums or for other reasons. Should such liabilities arise, they could have a material adverse impact on Hunt Mining’s operations and could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of our securities.

Mining is inherently dangerous and subject to operating hazards and risks beyond our control, which could have a material adverse effect on our business.

Mineral exploration and development involves risks which even a combination of experience, knowledge and careful examination may not be able to overcome. Operations in which we have a direct or indirect interest will be subject to hazards and risks normally incidental to exploration, developments and production of minerals, any of which could result in work stoppages, damage to or destruction of property, loss of life and environmental damage. We currently carry a $2,000,000 foreign liability insurance policy providing coverage in respect of our operations in Argentina, and make efforts to confirm that our contractors have adequate insurance coverage. The nature of these risks is such that liabilities might exceed insurance policy limits, the liabilities and hazards might not be insurable or we may elect not to insure ourselves against such liabilities due to high premium costs or other factors. Such liabilities may have a materially adverse effect upon our financial condition.

Our Company’s exploration activities may be subject to environmental laws and regulations that could increase the cost of doing business and restrict our operations.

Our operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas that would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner that means standards are stricter, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Our exploration activities may require, and any future development activities and any commencement of production on our properties will require, permits from various federal, provincial or territorial and local governmental authorities, and such operations are and will be governed by laws, and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters.

7

Such exploration activities and future operations are and will also be subject to substantial regulation under applicable laws by governmental agencies that may require that we obtain permits from various governmental agencies. There can be no assurance, however, that all permits that we may require for our exploration activities and future operations will be obtainable on reasonable terms or on a timely basis or that such laws and regulations will not have an adverse effect on any mining project which we might undertake.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may have civil or criminal fine or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on us and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Our Company must compete with larger, better capitalized competitors in the mining industry.

The mining industry is intensely and increasingly competitive in all its phases, and we will compete with other companies that have greater financial and technical resources. Competition in the precious metals mining industry is primarily for mineral rich properties which can be developed and produced economically and businesses compete for the technical expertise to find, develop, and produce such properties, the skilled labor to operate the properties and the capital for the purpose of financing development of such properties. Such competition could adversely affect our ability to acquire suitable producing properties or prospects for mineral exploration, recruit or retain qualified employees or acquire the capital necessary to fund our operations and develop our properties.

Our Company may experience difficulty attracting and retaining qualified personnel with the specialized skills and knowledge necessary to further our business objectives, which could have a material adverse effect on our business and financial condition.

Hunt Mining’s business requires specialized skills and knowledge in the areas of geology, exploration planning, drilling and regulatory compliance. Our ability to attract and retain qualified professionals with the background and experience specific to our projects and business plan cannot be assured. Any inability on our part to attract and retain qualified personnel could potentially hamper our ability to execute our business plan in a timely manner or at all. If we are unable to operate our business due to a shortage of qualified personnel, we may be forced to suspend our mineral exploration activities which, in turn, could have a material adverse effect on our ability to raise working capital and on our overall financial condition.

We are largely dependent on our management, and could be adversely affected by the loss of the services of our directors and officers, or by any inability on our part to attract and retain other management personnel as our business evolves.

We are largely dependent on our directors and officers. There is no assurance that we will be able to retain our existing directors and officers, or that we will be able to attract and retain additional qualified management personnel as our business evolves. The loss of any of our directors or officers, as well as any inability to attract and retain additional management personnel as and when needed, could have a material adverse effect on us and our prospects.

The fluctuation of mineral prices, which have varied widely in the past, will have a significant impact on our Company’s value and future exploration activities.

The mining industry is heavily dependent upon the market price of metals or minerals being mined. There is no assurance that, even if commercial quantities of mineral resources are discovered, a profitable market will exist at the time of sale. Factors beyond our control may affect the marketability of metals or minerals discovered, if any. Metal prices have fluctuated widely, particularly in recent years, and we will be affected by numerous factors beyond our control. The effect of these factors on our operations cannot be predicted. If mineral prices decline significantly, it could affect our decision to proceed with further exploration of our properties.

8

Our exploration and development activities will require future financing, which cannot be assured.

Our continued operation will be dependent upon our ability to generate operating revenues and to procure additional financing. There can be no assurance that any such revenues can be generated or that other financing can be obtained on acceptable terms to us, if at all. Failure to obtain additional financing on a timely basis may result in delay or indefinite postponement of further exploration and development or forfeiture of some rights in some or all of our properties. If additional financing is raised by the issuance of shares from treasury, control of the Company may change and shareholders may suffer additional dilution. If adequate funds are not available, or are not available on acceptable terms, we may not be able to further explore and develop our properties, take advantage of other opportunities, or otherwise remain in business. Events in the equity market may impact our ability to raise additional capital in the future.

Our Company’s business model is largely dependent on the ability to find and acquire interest in economically recoverable mineral reserves, there is no guarantee that our Company will be able to locate and/or acquire economically viable mineral interest in the future.

As part of our business strategy, we may seek to grow by acquiring companies, assets or establishing joint ventures that we believe will complement our current or future business. We may not effectively select acquisition candidates or negotiate or finance acquisitions or integrate the acquired businesses and their personnel or acquire assets for our business. We cannot guarantee that it can complete any acquisition it pursues on favorable terms, or that any acquisitions competed will ultimately benefit our business.

Our Company’s share price may be subject to increased price volatility that is outside management control.

In recent years, the securities markets in the United States and Canada, and the TSX Venture Exchange in particular, have experienced a high level of price and volume volatility, and the market prices of securities of many companies have experienced wide fluctuations in price that have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. There can be no assurance that continual fluctuations in price will not occur. It may be anticipated that any quoted market for the shares will be subject to market trends and conditions generally, notwithstanding any potential success in creating revenues, cash flows or earnings.

Our directors and officers may have conflicts of interest as a result of their relationships with other companies.

Certain of the directors and officers of the Company serve or have served as officers and directors for other companies engaged in mineral exploration and development, and may in the future serve as directors and/or officers of other companies involved in natural resource exploration and development, which are potential competitors of Hunt Mining. For example: Although our officers and directors are subject to certain fiduciary duties to our Company under applicable corporate law, they will not necessarily be required to give the Company consideration with respect to every opportunity of which they may become aware. Consequently, although the Company is not aware of any specific conflicts of interest involving any of its directors or officers at the present time, there is a possibility that our directors and/or officers may be in a position of conflict in the future. In the event that such a conflict of interest arises at a meeting of the Company’s directors, a director who has such a conflict is required to abstain from voting for or against the approval of such participation or such terms. In accordance with applicable laws, the directors and officers of the Company are required to act honestly, in good faith and in the best interests of the Company.

Our Company’s exploration activities are in part based on historical information for our various properties, and the accuracy of this historical data could have an impact on the results of our exploration activities.

We have relied, and our resource estimation technical report in respect of the La Josefina Project dated September 29, 2010 (filed on SEDAR on October 4, 2010) is based, in part, upon historical data compiled by previous parties involved with the La Josefina project. To the extent that any of such historical data is inaccurate or incomplete, our exploration plans may be adversely affected.

9

Our Company has never paid a dividend and any potential future dividend payments are dependent upon our Company’s ability find and develop economically recoverable mineral deposits.

We have never paid a dividend on our Common Shares. It is not anticipated that we will pay any dividends on our Common Shares in the foreseeable future.

Our Company is subject to changes in foreign exchange rates, including the Argentine Peso and Canadian dollar, which could have a material impact on our result of operations and future

We will maintain most of our working capital in Canadian and United States dollars. However, a significant portion of Hunt Mining’s operating costs are incurred in Argentinean pesos. Accordingly, we will be subject to fluctuations in the rates of currency exchange between the Canadian, United States dollar and the Argentinean peso and these fluctuations could materially affect our financial position and results of operations as costs may be higher than anticipated. The costs of goods and services could increase due to changes in the value of the Canadian dollar, the United States dollar, or the Argentinean peso. Consequently, operation and development of our properties might be more costly than we anticipate.

Our Company currently carries out all its exploration activities in Argentina, and any economic or political instability in that country could have an adverse effect on value of the business and future business operations.

All of our material properties are located in Argentina. There are risks relating to an uncertain or unpredictable political and economic environment in Argentina. During an economic crisis in 2002 and 2003, Argentina defaulted on foreign debt repayments and on the repayment on a number of official loans to multinational organizations. In addition, the Argentinean government has renegotiated or defaulted on contractual arrangements. In January, 2008, the Argentinean government reassessed its policy and practice in respect of export duties and began levying export duties on mining companies operating in the country.

There also is the risk of political violence and increased social tension in Argentina and Argentina has experienced periods of civil unrest, crime and labor unrest.

Certain political and economic events such as acts or failures to act by a government authority in Argentina, and acts of political violence in Argentina, could have a material adverse effect on our ability to operate.

Limitations on the transfer of cash, mineral interests or other assets between our Company and our operating subsidiary in Argentina, or our joint venture partners, could adversely impact the value of our securities.

We are a Canadian company that is conducting operations primarily through Cerro Cazador, S.A. (referred to elsewhere in this prospectus as “CCSA”), an Argentinean subsidiary, and substantially all of our assets consist of equity in Cerro Cazador, S.A.

In January 2008, the Government of Argentina reassessed its policy and practice in respect of export duties and began levying export duties on mining companies operating in the country. Although this particular change did not affect Cerro Cazador, S.A., there can be no assurance that the Government of Argentina will not unilaterally take other action which could have a material adverse effect on our interests in Argentina.

In October 2011, Argentina announced a decree requiring mining companies to repatriate mining revenues to Argentine currency before distributing revenue either locally or overseas. In April 2012, the Government of Argentina and their central bank announced further rules which initially reduced the number of days mining companies have to repatriate funds to 15 days and then subsequently in July 2012, relaxed the repatriation requirement to 45 days on the sale of doré and 180 days on the sale of concentrates for certain mining companies.

10

These and any future limitations that may be imposed by the Government of Argentina on the transfer of cash or other assets between our Company and Cerro Cazador, S.A. or our joint venture partners, could restrict our ability to fund our operations efficiently, and could negatively affect our ability to explore or develop our La Josefina project or other exploration properties in Argentina. Accordingly, any such limitations, or the perception that such limitations might exist now or in the future, could have an adverse impact on available credit, and on our valuation and stock price.

The Government of Argentina has recently nationalized the majority stake of Argentina’s largest oil company, and there is no assurance that similar action will not be taken with respect to other natural resources companies in the future.

In April 2012, Argentina’s President announced the nationalization of the majority stake of Yacimientos Petrolíferos Fiscales (YPF), Argentina’s largest oil company. There is no assurance that similar action may not be taken with respect to other natural resource companies in Argentina.

Current global economic conditions may impact our ability to raise capital or obtain financing to further our exploration activities or develop economically recoverable mineral reserves.

Recent market events and conditions, including disruptions in the international credit markets and other financial systems and the deterioration of global economic conditions, could impede our access to capital or increase our cost of capital. Failure to raise capital when needed or on reasonable terms may have a material adverse effect on our business, financial condition and results of operations.

It may be difficult to effect service of process on our directors who reside outside the United States.

Some of our directors reside outside of the United States, and it will therefore be difficult to effect service of process (service of legal proceedings) on such directors.

Item 4. Information on the Company

| A. | History and Development of the Company |

Hunt Mining Corp. (the “Company” or “Hunt”), is a mineral exploration company incorporated on January 10, 2006 under the laws of Alberta, Canada and, together with its subsidiaries, is engaged in the exploration of mineral properties in Santa Cruz Province, Argentina. On November 6, 2013, the Company continued from the Province of Alberta to the Province of British Columbia pursuant to a special resolution passed by shareholders of the Company at the annual and special meeting of shareholders held on November 5, 2013.

We were initially listed on the TSX Venture Exchange (“TSXV”) as a Capital Pool Company within the meaning ascribed by TSXV Policy 2.4, as “Sinomar Capital Corporation”. On December 23, 2009, we completed our Qualifying Transaction by acquiring all of the issued and outstanding shares of Cerro Cazador, S.A., an Argentine mineral exploration company, in a reverse takeover transaction. We were a shell company until we completed the acquisition. We subsequently changed our name to Hunt Mining Corp.

The Company’s registered office is located at 1810, 1111 West Georgia Street, Vancouver, British Columbia, Canada, V6E 4M3. The Company’s head office is located at 23800 E Appleway Avenue, Liberty Lake, Washington, USA.

| B. | Business Overview |

The Company’s primary activity is the exploration of mineral properties in Argentina. On the basis of information to date, the Company has not yet determined whether these properties contain economically recoverable ore reserves. The underlying value of the mineral properties is entirely dependent upon the existence of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete development and upon future profitable production or a sale of these properties.

11

| C. | Organizational Structure |

The consolidated financial statements include the accounts of the following subsidiaries after elimination of intercompany transactions and balances:

Corporation | Incorporation | Percentage ownership | Business Purpose |

| Cerro Cazador S.A. | Argentina | 100% | Holder of Assets and Exploration Company |

| 1494716 Alberta Ltd. | Alberta | 100% | Nominee Shareholder |

| Hunt Gold USA LLC | Washington, USA | 100% | Management Company |

| D. | Property and Equipment |

The majority of the Company’s assets are located in Argentina. The Company owns a 25,000-acre ranch called the La Josefina Estancia, on which the Company’s La Josefina project is located.

The Company also owns mobile housing units, trucks and additional mechanical equipment, all purchased within the last ten years and in good physical condition, to support exploration activities on the Company’s projects, all located in Argentina.

PROPERTIES

12

La Josefina Property

The La Josefina property is our primary exploration property because it occupies 52,800 hectares and approximately 90% of the nearly 65,000 meters drilled by us. It is located in North-Central Santa Cruz province in southern Argentina, within the region known as Patagonia.

Exploration Agreement between Fomicruz and CCSA

In March 2007, CCSA was awarded the exploration and development rights from Fomento Minero de Santa Cruz Sociedad del Estado (“Fomicruz”) through a required public bidding process to explore the La Josefina Project. As Fomicruz is a government owned company in Santa Cruz province in Argentina, it cannot make individual agreements with a private company without first publishing the offer and giving other private companies the opportunity to submit bids, but the first company making an offer has the right to match any new offer.

The definitive agreement between CCSA and Fomicruz was finalized in July, 2007. Pursuant to this agreement, CCSA was obligated to spend US$6 million in exploration and complete pre-feasibility and feasibility studies during a 4 year exploration period (excluding three months each year for winter holiday) commencing in October, 2007 at La Josefina in order to earn mining and production rights for a 40-year period in a joint venture partnership (“JV”) with Fomicruz. CCSA may terminate this agreement at the end of each exploration stage if results are negative.

The 4-year exploration period was originally planned to proceed in the following three stages:

| Year 1 | Year 2 | Years 3 & 4 | ||

| Target Area | To July 2008 | July 2008 to July 2009 | July 2009 to July 2011 | Totals |

| Noreste Area | US$300,000 | US$400,000 | US$500,000 | US$1,200,000 |

| Veta Norte | 500,000 | 800,000 | 800,000 | 2,100,000 |

| Central Area | 500,000 | 800,000 | 900,000 | 2,200,000 |

| Piedra Labrada | 200,000 | 100,000 | 200,000 | 500,000 |

| TOTAL US$ | US$1,500,000 | US$2,100,000 | US$2,400,000 | US$6,000,000 |

At the successful completion of positive pre-feasibility and feasibility studies, which cannot be assured, a new joint venture company will be formed to develop the project. This new company will have joint participating ownership with 91% owned by CCSA and 9% by Fomicruz; however, upon inception Fomicruz may elect to increase its participating interest in the new joint venture company to either 19%, 29% or 49% by reimbursing CCSA 10%, 20% or 40%, respectively, of CCSA’s total investment in the project. Once the choice is made by Fomicruz, there are no means to modify the agreement.

Other conditions of the agreement:

| 1. | CCSA posted a US$600,000 performance bond (equal to 10% of the total proposed exploration investment). |

| 2. | CCSA must maintain the La Josefina mining rights by paying the annual canons due the province on the project’s 398 pertenencias. |

| 3. | CCSA must complete surface agreements (lease or buy) with the surface landowners, as required by the Federal mining law, to gain legal access to the farms (estancias) that cover the project. Most of the project and all of the current target areas lie within two large farms that have been unoccupied for many years - Estancia La Josefina and Estancia Piedra Labrada. The major part of mineralization occurs on Estancia La Josefina, which CCSA purchased in 2007. CCSA rents Estancia Piedra Labrada, which it uses as an exploration field camp. |

Since CCSA fulfilled its exploration requirement mandated by the agreement with Fomicruz, the performance bond was no longer required to secure the La Josefina project. In June 2010, the Company used the bond to secure the La Valenciana project.

13

On November 15, 2012, we signed an amendment to our agreement with Fomicruz which extends the time we have to develop the La Josefina project by four years, from 2015 to 2019. The Company has agreed to make a minimum investment of US$12 million, of which it has already invested approximately US$9 million. Additionally, and subject to proof of compliance with committed investments, the Company has the option to continue exploration for a second additional term of four years, ending on June 30, 2019, requiring it to make an additional investment US$6 million, which will bring the total investments in the La Josefina Project to US$18 million.

Total costs incurred to date are approximately US$15 million.

A participating interest of Fomicruz over the minerals and metals extracted from the field and the purchase option of up to a 49% participating interest in the incorporation of the future Company to be organized for the productions and exploitation of the project, having Fomicruz to contribute the equivalent of such percentage of the investments made. The Company has the right to buy back any increase in Fomicruz’s ownership interest in the JV Corporation at a purchase price of USD$200,000 per each percentage interest owned by Fomicruz down to its initial ownership interest of 19%; the Company can purchase 10% of the Fomicruz’s initial 19% JV Corporation ownership interest by negotiating a purchase amount with Fomicruz.

In December, 2007, CCSA purchased the “La Josefina Estancia”, a 92 square kilometer parcel of land within the La Josefina Project area. CCSA plans to use the La Josefina Estancia as a base of operations for Santa Cruz exploration. The purchase price for the La Josefina Estancia was US$710,000.

Initially, the La Josefina property was excluded from our exploration agreement with Eldorado Gold. This property was made subject to the exploration agreement with Eldorado Gold on May 7, 2013, an agreement later terminated by Eldorado in July 2013.

In 2014, the Company conducted a shallow Diamond drilling campaign, including 12 holes totaling 651 meters in length completed on the Maria Belen target and 15 holes totaling 957 meters on the Sinter target. Detailed results of the La Josefina drilling program are included in the Company’s website, www.huntmining.com.

The Company has been actively pursuing a new exploration partner for the La Josefina project, as of the date of this filing these discussions are still in process.

Drilling is currently planned on both La Josefina and La Valenciana with approximately 10 to 15 holes each. Exploration will be funded through closely held insider investments and/or loans.

Current negotiations with third parties for advanced exploration of mineable targets including definition drilling, excavation methods, and metallurgy to determine recoveries. The corporation intends to invest approximately $1,100,000 on the Company's ongoing exploration and development on the La Josefina and La Valenciana Projects located in Santa Cruz, Argentina in 2015. More specifically, the Corporation would use: (i) $ 700,000 for advance development and exploration needed to develop drilling targets: geologic mapping, surface geochemical surveys, (chip/channel/trench) sample collection, assaying and +/- geophysical surveys; (ii) $330,000 to complete claims maintenance, surface leases, national and provincial taxes, permits and fees; and (iii) up to $70,000 on general and administrative expenses.

Personnel

| · | Danilo Silva; General Manager of Hunt’s Argentina Subsidiary – Has served as a Senior Geologist and Project Manager with Yamana Resources and Buenaventura mining companies in his homeland of Argentina, and as general manager for Platero Resources |

| · | Vicente Sanchez; Exploration Manager – Professional Geologist from Argentina who leads all Hunt’s Argentinean geologic crews |

14

| · | Mariano Ibaldi; Exploration Data Management – Professional Geologist who is meticulous in his documentation and analysis of data collected from all forms of sampling |

| · | Jorge Garay; Exploration Geologist – Senior Geologist and Project Manager with tremendous exploration experience in Santa Cruz |

| · | Klaus Triebel; Resource Estimation, Mine Planning & Pit Design – Most recently with Coeur as Manager – Resource Estimation, Mr. Triebel is a Senior Mine Geologist and Engineer |

| · | Martin Fromm; Consultant – Mine Management – Mining Engineer from Argentina, recently a Project Manager for Patagonia Gold S.A. at their Capa Oeste and Lomada mines |

Much of the following information is derived from, and based upon the La Josefina 2010 Technical Report, which is available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

Property Description and Location

The La Josefina Project is situated about 450 km northwest of the city of Rio Gallegos, in the Department of Deseado, Santa Cruz province, Argentina within a scarcely populated steppe-like region known as Patagonia.

The La Josefina Project consists of mineral rights composed by an area of 528 square kilometers established in 1994 as a Mineral Reserve held by Fomicruz, an oil and mining company owned by the Santa Cruz provincial government.

The boundaries of the property are summarized in the following table:

| Boundary | Latitude/Longitude | Gauss-Krüger * |

| North | 47°45’00” S | 4,711,533 N |

| South | 48°00’06” S | 4,683,433 N |

| East | 69°10’47” W | 2,486,505 E |

| West | 69°30’08” W | 2,462,505 E |

* The Argentine National Grid System (Gauss-Krüger) uses the Gauss-Krüger (also known as Transverse Mercator or TM) projection and is based on the Campo Inchauspe datum which uses the International 1924 (also known as Hayford) ellipsoid. Argentina is divided into seven zones which, similar to UTM zones, are north-south slices centered on 72°, 69°, 66°, 63°, 60°, 57° and 54° W longitude. Unlike UTM which effectively has two meridians of zero scale distortion, in Gauss-Krüger only the central meridian has zero scale distortion. Unlike UTM where the easting offset is always 500,000m, each zone in the Gauss-Krüger Campo Inchauspe system has a different offset to remove coordinate ambiguity between zones. Zone 1 has an easting offset of 1,500,000m with each successive zone adding 1,000,000m to the offset. Consequently, grid coordinates are often quoted without explicitly specifying the zone as would normally be done with UTM coordinates. A new national grid named POSGAR is currently being introduced. This datum uses the WGS84 ellipsoid and has already become common in some provinces.

The La Josefina Project comprises 16 Manifestations of Discovery totaling 52,776 hectares which are partially covered by 399 pertenencias, listed in the following table:

| Manifestation of Discovery | File # | Hectares |

| Julia | 409.048/F/98 | 6 |

| Miguel Ángel | 409.058/F/98 | 3,435 |

| Diana | 409.059/F/98 | 2,995 |

| Noemi | 409.060/F/98 | 3,013 |

| Rosella | 409.061/F/98 | 3,227 |

| Giuliana | 409.062/F/98 | 5,100 |

15

| Benjamin | 409.063/F/98 | 3,500 |

| Mariana T. | 409.064/F/98 | 3,500 |

| Ailín | 409.065/F/98 | 3,500 |

| Mirta Julia | 409.066/F/98 | 3,500 |

| Ivo Gonzalo | 409.067/F/98 | 3,500 |

| Maria José | 409.068/F/68 | 3,500 |

| Matias Augusto | 409.069/F/98 | 3,500 |

| Sofia Luján | 409.070/F/98 | 3,500 |

| Lucas Marcelo | 409.071/F/98 | 3,500 |

| Nicolás Alejandro | 409.072/F/98 | 3,500 |

| Total | 52,776 |

The La Josefina pertenencias consist of 398 disseminated pertenencias, each requiring an annual canon (tax) payment to the province of 3,200 pesos and one common pertenencia which requires an annual canon of 640 pesos. Therefore the pertenencias at La Josefina require annual canon payments totaling 1,274,240 pesos.

The La Josefina project is without known reserves as defined by SEC industry Guide No. 7.

The exploration targets consist of gold and silver mineralized quartz veins in volcanic host rocks. Current work is conducted on the La Josefina and La Valenciana claim blocks. La Josefina includes four major vein systems while La Valenciana harbors three. A total of more than 900 trenches and drillholes have been drilled with approximately 40,000 assayed samples. Higher gold values exceed 100 g/tone and higher silver values are above 1,000 g/t. Veins are formed by upward fluid migration and are therefore typically open to depth.

There is no geophysics. Geochemistry is conducted through ICP analysis (35+ elements) of all field and drill-hole samples. Even if no elevated precious metal grades are encountered this trace element analysis can still expose possible trends which often preclude gold and silver mineralization.

Royalties

Mineral properties in Argentina carry no federal royalties but the provinces are entitled to collect up to 3% mine-mouth royalty.

In Santa Cruz, the province has opted to drop this MMR to 1% if the operation is a precious metals mine that produces doré bullion within the province. The agreement between CCSA and Fomicruz stipulates that any doré bullion resulting from future La Josefina operations must be produced in the province, so it is likely the project will carry the minimal 1% MMR. However, because La Josefina is a Mining Reserve in which the mineral rights belong to Fomicruz, the project also carries an additional 5% MMR payable to the province. Therefore, the total MMR for any future gold/silver/base metal production at La Josefina under the current agreement total 6%.

Environmental Liabilities

There are no known environmental liabilities associated with the La Josefina Property.

Permits Required

No permits are required at this time to conduct the proposed exploration.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

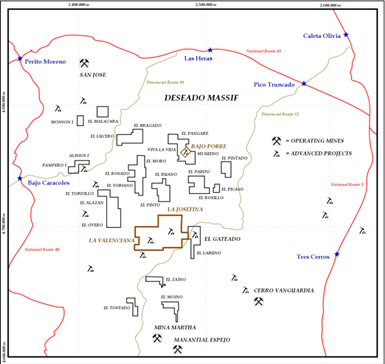

The project is located in the Deseado Massif mineral district in the north-central part of Santa Cruz province, the southernmost of several Argentine provinces comprising a vast, sparsely-populated, steppe-like region of South America known as Patagonia. The nearest town to the project is Gobernador Gregores (population 2,500), about 110 kilometers to the southwest. The nearest Atlantic coastal town is Puerto San Julián (population 6,800), 190 kilometers to the southeast. The project is reached by driving east from Gobernador Gregores for 40 km on gravel Provincial Route 25 – or west from Puerto San Julián for 170 km on the same road – and then north on gravel Provincial Route 12 for 110 km. Provincial Route 12 crosses the edge of the project and continues another 240 kilometers north to the oil town of Pico Truncado (population 16,500) in the northeastern part of the province.

16

The provincial gravel roads are generally accessible via two-wheel drive vehicles in dry weather but can become slippery or cannot be used for short periods when wet, so four wheel drive vehicles are sometimes required to access the project. Gobernador Gregores and Puerto San Julián are both served by fixed wing flights two or three times per week, to and from Comodoro Rivadavia (population 135,813), an important industrial center and port city. Comodoro Rivadavia lies 428 km north of Puerto San Julián. It can be reached via paved National Route 3, a major coastal highway. Comodoro Rivadavia serves as the region’s major supply center for the booming petroleum and mining industries and is served by several airline daily flights to Buenos Aires and other major cities in Argentina. National Route 3 runs from Buenos Aires on the north to Ushuaia at the southernmost tip of the continent and offers all-weather access to a number of sea ports.

The Patagonia region is classified as a continental steppe-like climate. It is arid, very windy and has two distinct seasons, cold and warm. As Patagonia is located in the southern hemisphere, the cold winter months are from May to September and the warmer summer months are from November to March. The average annual precipitation averages only 200 mm (8 inches), much of which occurs as winter snow. Average monthly temperatures range from 3°C to 14°C, but vary widely depending on elevation. The winds are persistent, cool, dry and gusty, averaging about 36 km/h and directed predominantly to the east-southeast off the Andean Cordillera.

The La Josefina project area consists largely of subdued hilly terrain with internal drainages and playa lakes. Elevations range from 300 meters to 800 meters above sea level. Hill slopes are not steep, usually less than 10 degrees, and the rock exposures on these hillsides are typically abundant. Almost all of the mineralization and significant geochemical and geophysical anomalies are found on the crests or the flanks of these subdued hills.

The area is covered by sparse vegetation, consisting mostly of scattered low bushes and grass. In the area the only inhabitants are farm owners and employees. The nearest farms are Los Ventisqueros, Maria Esther, Las Vallas, La Florentina, La Laguna, La Josefina and Piedra Labrada.

The local economy was formerly based largely on sheep herding and marine fishing but in the late-1980s, sheep herding began a steep decline because of the Hudson volcano eruption and a descending economy; for those reasons many of the former large sheep farms are now unoccupied and in disrepair. The prolific sheep herds have since been replaced by overpopulated herds of wild guanacos, ostriches and flamingos (in the playas). One hundred km southeast of the property is the gold-silver epithermal Cerro Vanguardia Mine owned by AngloGold Ashanti Limited and Fomicruz.

Away from the towns and villages in Patagonia there are few power grids and scant telephone service. The many mineral exploration and development camps scattered widely throughout the Deseado Massif typically rely on diesel or gasoline generators for electrical power and satellite phones or radios for communications. Some communities in the region now have wind power generating stations and experimental hydrogen plants (Pico Truncado for example) and it is possible such stations might someday be utilized in mining camps to supplement their power requirements. However, the recent effort by the Santa Cruz Provincial Government to pave the Provincial Route 12, which runs within several kilometers of the project, may also include the construction of a power line which runs along the highway.

Near surface water tables exist on the La Josefina property.

Manpower is available in the larger communities to serve most exploration or mining operations.

History

Santa Cruz province - and indeed much of Patagonia - has only a short history of mineral prospecting and mining. Until the Cerro Vanguardia mine was commissioned in late 1989, only a few mineral occurrences had been identified within the 100,000 square kilometer area of the Deseado Massif. Notably, although Coeur Mining Corporation ceased active mining operations at its Martha Mine in September, 2012, the Desado Massif continues to host three producing mines: the Cerro Vanguardia Mine (AngloGold Ashanti Limited - Fomicruz), the San Jose – Huevos Verdes Mine (Hochschild Mining plc – Minera Andes Incorporated) and the Manantial Espejo Mine (Pan American Silver Corp.). Additionally, several new mines are being readied for production, and many active exploration projects (including Coeur Mining’s Joaquin exploration project) are in progress.

17

In 1975, the first occurrence of metals known in the La Josefina area was publicly mentioned by the Patagonian delegation of the National Ministry of Mining. They reported the presence of an old lead-zinc mine in veins very near Estancia La Josefina. The mineralization received no further attention until 1994 when a research project by the Institute of Mineral Resources of the Universidad Nacional de la Plata and the geology department of the University of Patagonia San Juan Bosco examined the occurrence. That investigation corroborated not only the presence of base metals, but also precious metals.

In 1994, immediately after the La Josefina gold-silver discovery, Fomicruz claimed the area as a Provincial Mineral Reserve and explored the project in collaboration with the Instituto de Recursos Minerales (INREMI) of La Plata University. The geology and alteration of the project area was mapped at a scale of 1:20,000. Mineralized structures and zones of sinter were mapped at 1:2,500, trenches across the structures were continuously sampled and mapped at scales of 1:100 and ground geophysical surveys consisting of 6,000 m of IP-resistivity and 5,750 meters of magnetic surveys were completed over sectors of greatest interest.

In 1998, after four years of exploring and advancing interest in the project, Fomicruz offered La Josefina for public bidding by international mining companies. In accordance with provincial law, the winner would continue exploring the project to earn the right to share production with Fomicruz of any commercial discoveries. The bid was awarded to Minamérica S. A. (“Minamerica”), a private Argentine mining company. Minamerica dug a limited number of new trenches, initiated a program of systematic surface geochemical sampling, completed several new IP-Resistivity geophysical survey lines and drilled the first exploration holes on the project – 12 diamond core holes totaling 1,320 meters in length. The results of this effort were relatively encouraging but Minamerica nevertheless abandoned the project a year later in 1999.

In 2000, Fomicruz resumed exploration of the project and continued their efforts until 2006. Pits were dug to bedrock on 100- grids over some of the target areas, 3,900 meters of new trenches were dug and sampled, more than 8,000 float, soil and outcrop samples were collected for geochemical analyses, some new IP-Resistivity surveys were completed under contract to Quantec Geophysical Co., and 59 diamond core holes (total 3,680 meters) were drilled to average shallow depth below surface of 55 s. Of these holes, 37 were NQ-size core (47.6mm diameter) and 22 were HQ-size core (63.5mm).

Fomicruz reported spending more than US$2.8 million in exploring and improving infrastructure on the La Josefina Project from 1994 to 2006. In late-2006, the La Josefina Project was again opened to international bidding and in May, 2007, CCSA was awarded the right to explore the project. Throughout 2007 and 2008, CCSA was mainly focused on an intensive drill plan (37,605 meters), and in 2009 and the first quarter of 2010 reviewed all the data gathered in order to generate a geological model for the project, and continued working on regional exploration to define new additional targets for next drilling stages.

Geologic Setting

The La Josefina Project is located near the center of a large non-deformed stable platform known as the Deseado Massif, which covers an area of approximately 100,000 square kilometers in the northern third of Santa Cruz province. The Deseado Massif is a virtual twin of the Somun Cura Massif which encompasses an equally large area in the two adjoining provinces to the north. These two massifs are major metallotectonic features of the Patagonia region, and they are products of the massive continental volcanism formed by extensional rifting during the breakup of the South American and African continents in Jurassic time. The information in this paragraph is derived from “Tectonic Evolution of South America” prepared by Ramos, V.A and Aguirre-Urreta, M.B. in 2000 on behalf of the International Geological Congress.

The massifs are composed primarily of rhyolitic lavas, tuffs and ignimbrites which were erupted over a 50-million year period in middle-to late-Jurassic time (125 to 175 million years ago). The eruptives created a vast volcanic plateau which was subsequently segmented into the two massifs. These massifs are separated and bounded by sediment-filled basins: the Neuquén Basin north of the Somun Cura Massif, the San Jorge Basin between the massifs, and the Austral-Magellan Basin south of the Deseado Massif. These basins, filled largely with Cretaceous-age non-marine sedimentary rocks, are now sites of Argentina’s largest oil and gas fields.

18

General Geology of the Deseado Massif

The geology of the Deseado Massif region has been described and discussed in numerous papers and reports published only during the last fifteen years. The geology has been mapped at various scales by government agencies, most recently covered by a series of 1:250,000 quadrangles published by the Instituto de Geología y Recursos Minerales and Servico Geológico Minero Argentino.

The Deseado Massif is dominated by a few major regional sequences comprised of felsic volcanic and volcaniclastic rocks deposited in middle- to late-Jurassic time. The rocks are broken by a series of regional fractures that probably represent reactivated basement fracture zones. Faults that were active during the period of intense Jurassic extension and volcanism trend mostly NNW-SSE and form a series of grabens, half-grabens and horst blocks which are tilted slightly to the east. Since Jurassic time, the rocks have been cut by normal faults of several different orientations, mainly NW-SE and ENE-WSW, but have undergone very little compression. As a result, they remain relatively undeformed and generally flat-lying to gently dipping, except locally where close to faults, volcanic domes or similar features.

Exposures of rocks older than Jurassic are limited. The oldest pre-Jurassic “basement” rocks are small outcrops of metamorphic rocks thought to be late Precambrian to early Paleozoic in age (about 540 Ma). These rocks have been assigned to the La Modesta Formation in the western part of the area and to the Complejo Río Deseado in the eastern part. They consist of schists, phyllites, quartzites, gneisses and amphibolites and plutonic intrusions.

The Precambrian and older Paleozoic rocks are unconformably overlain by thick continental sedimentary sequences of late-Paleozoic to early-Mesozoic age, called La Golondrina Formation and El Tranquilo Group. La Golondrina Formation is Permian (299–251 Ma) and is up to 2,200m of arkosic to lithic sandstones, siltstones and conglomerates deposited in N-S to NW-SE rift basins along older reactivated basement structures. El Tranquilo Group is Triassic in age (251– 200 Ma) and is up to 650m of rhythmically bedded arkosic sandstones and shales which grade upward into conglomerates and redbeds.

The Triassic sequence is intruded and overlain by the first indications of igneous activity related to the crustal separation and extension initiated in early Jurassic: La Leona and the Roca Blanca Formations. La Leona Formation, early Jurassic in age (175–200 Ma), is composed of calc-alkaline granitic intrusive bodies sparsely scattered throughout the northeastern part of the Deseado Massif. The Roca Blanca Formation is also early Jurassic age, and consists of up to 900m of a coarsening-upward fluvial to lacustrine mudstone and sandstone sequence deposited in grabens or other rift basins, mainly in the south-central part of the Deseado Massif. The upper third of the sequence is distinctly richer in volcanic tuffs and other pyroclastic materials.

The Jurassic volcanic rocks are divided into formal units, but can be treated as a single bimodal (andesite-rhyolite) Jurassic volcanic complex. There are three units in this volcanic complex: the Cerro Leon and Bajo Pobre Formations and the Bahía Laura Group. The last two units make up the most extensive unit in the massif.

The Cerro Leon unit (lower to middle Jurassic in age) consists of hypabyssal mafic rocks composed of andesitic to basaltic dykes and shallow intrusions located in the south-central part of the massif. The Bajo Pobre Formation (middle to upper Jurassic in age) is typically 150-200m thick and is locally up to 600m thick. It is composed of andesites and volcanic agglomerates with minor basalts, which intercalate upwards with mafic tuffs, conglomerates and sediments. Olivine basalts, common in the lower part of the formation in the El Tranquilo anticline region are thought to be products of fissure eruptions from rifts related to the early stages of the Gondwana breakup and continental separation.

The Bahia Laura Group (middle to upper Jurassic in age) covers more than half the area of the massif and hosts more than 90 percent of the known gold-silver occurrences. It is a complex sequence of felsic volcanic-sedimentary rocks that has been divided into two formations according to whether there is a predominance of volcanic flows (Chon Aike Formation) vs. a predominance of volcaniclastic and sedimentary debris (La Matilde Formation). These two formations are complexly intercalated and have rapid lateral changes in facies and thickness which make it virtually impossible to define a coherent regional stratigraphy.

19

Non-marine sediments of late Jurassic to early Cretaceous age occur at various places throughout the Deseado Massif filling structural or erosional basins in the underlying Jurassic terrain. The presence of continental sediments in these basins, typically less than 150 meters thick, indicates that the massif remained as a positive geological feature throughout the Cretaceous. The most extensive cover rocks are a series of young basalt lava flows, Miocene to Quaternary in age, which blanket large parts of the region. The flows are typically only a few meters thick except where they fill paleo-valleys in the old land surface. In some cases, these thicker lava accumulations stand in relief above the surrounding landscape, providing classic examples of inverted topography caused by differential erosion. The youngest deposit consists of an extensive veneer of Quaternary gravels, especially in the eastern part of the massif.

Geology of the La Josefina Project Area

The oldest unit in the area is the La Modesta Formation, which crops out west of the La Josefina Estancia. It is formed mainly by grey to greenish micaceous-quartz schists and phyllites that occur in small outcrops. An angular unconformity separates the overlying La Modesta Formation from the mid-Jurassic basic to intermediate volcanic rocks of the Bajo Pobre Formation. The most extensive unit is represented by the Jurassic Bahia Laura Group which is divided in the Chon Aike Formation and La Matilde Formation tuffs. The Chon Aike formation is divided into nine members, representing each event a separated volcanic event. Each of the members is comprised of generally similar sequences consisting of basal surge breccia followed by pyroclastic flows (ignimbrites), ash-fall tuffs and finally by re-worked volcaniclastic detritus. Rhyolitic domes intrude the volcanic sequence, grading towards lavas in their upper parts. The lava flows and breccias are best developed in the southern part of the prospect area, where they occur with small vitrophiric bodies. Those volcanic events took place along 4 million years in the upper Jurassic and emplaced the epithermal system that generated the mineralization. Around 800 meters east of La Josefina farm old facilities there is a hill oriented north-south 200 meters long and 20 meters wide, with outcrops of a mega-breccia made out of ignimbrite boulders about 2-3 cubic meters in size. Finally, covering large extensions in the northern part of the area, Tertiary and Quaternary basaltic levels complete the geological sequence.

La Josefina basically draws matching geological features of The Deseado Massif:

| · | There is one outcrop of metamorphic basement rocks belonging to the Paleozoic-age La Modesta Formation |

| · | There are several small inliers of andesitic volcanics belonging to the Bajo Pobre Formation which underlies the Chon Aike Formation |

| · | The area is dominated by Jurassic-age rhyolitic volcanic units. They belong to Chon Aike Formation. |

| · | Sedimentary and volcaniclastic units of Roca Blanca and La Matilde Formations are not present in the area, or perhaps have not been recognized or mapped yet |

| · | About half of the area is covered by thin Quaternary basalt flows |

| · | The project is crossed by a number of conjugate NNW-SSE and NE-SW sets of strong fault lineaments which are similar to those occurring throughout the Deseado Massif region |

Deposit Types

The Deseado Massif is characterized by the presence of low-sulphidation type epithermal vein deposits that are spatially, temporally and genetically related to a complex and long-lived (more than 30 million years) Jurassic bimodal magmatic event associated with tectonic extension that spread out in a surface of 60,000 km2. The Deseado Massif hosts three active mines, including Cerro Vanguardia (AngloGold Ashanti Limited/Fomicruz), San José (Hochschild Mining plc/Minera Andes Incorporated) and Manantial Espejo (Pan American Silver Corp.). In addition, the region boasts a number of projects at the feasibility stage as well as more than 30 properties at the exploration stage.

20