As filed with the Securities and Exchange Commission on July 2, 2012

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT

Under Schedule B of

THE SECURITIES ACT OF 1933

Japan Bank for International Cooperation

(Issuer)

Japan

(Guarantor)

(Names of Registrants)

4-1 Otemachi 1-chome

Chiyoda-ku

Tokyo 100-8144, Japan

(Address of Principal Executive Office of Japan Bank for International Cooperation)

Names and addresses of Duly Authorized Representatives:

| | |

For the Issuer: Noriko Nasu Chief Representative Representative Office in New York Japan Bank for International Cooperation 712 Fifth Avenue, 26th Floor New York, New York 10019 | | For the Guarantor: Koyu Izumi Ministry of Finance, Government of Japan New York Representative Office 140 Broadway, 18th Floor New York, New York 10005 |

Copies to:

Garth W. Bray

Sullivan & Cromwell LLP

Otemachi First Square

5-1, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-0004

Japan

Approximate date of commencement of proposed sale to the public:

From time to time after this Registration Statement becomes effective as described herein.

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | | | | |

| Title of Each Class of Securities to be Registered | | Amount being

Registered(1) | | | Proposed

Maximum Offering

Price Per unit(2) | | | Proposed

maximum aggregate

offering price(2) | | | Amount of

Registration Fee | |

Debt Securities | | $ | 4,218,250,000 | | | | 100 | % | | $ | 4,218,250,000 | | | $ | 483,411.45 | |

Guarantee of Japan | | | — | | | | — | | | | — | | | | — | |

| (1) | In the case of Debt Securities issued at an original issue discount, such greater principal amount as will result in an aggregate public offering price of such registered amount and, in the case of Debt Securities denominated in a currency other than U.S. dollars, such principal amount in such currency as will result in an aggregate public offering price of such registered amount when converted into U.S. dollars at the exchange rate in effect on the date such Debt Securities are initially offered to the public. |

| (2) | Estimated solely for the purpose of determining the registration fee. |

The Debt Securities covered by this Registration Statement are to be offered on a delayed or continuous basis pursuant to Releases Nos. 33-6240 and 33-6424 under the Securities Act of 1933, as amended.

Pursuant to Rule 429 under the Securities Act of 1933, the prospectus contained in this Registration Statement and supplements to such prospectus will be used in connection with $3,781,750,000 of Debt Securities registered under Japan Finance Corporation’s Registration Statement No. 333-157296, which together with the Debt Securities listed above total $8,000,000,000. On April 28, 2011, the Japan Bank for International Cooperation Act was passed into law, pursuant to which, on April 1, 2012, the Japan Bank for International Cooperation Operations and the Financial Operations for Facilitating Realignment of United States Forces in Japan were transferred out of Japan Finance Corporation to establish the “Japan Bank for International Cooperation” or “JBIC”, as described herein.

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Pursuant to the Japan Bank for International Cooperation Act (the “JBIC Act”), which was passed into law on April 28, 2011, on April 1, 2012, Japan Finance Corporation (the “Predecessor”) spun off two of its operations: (i) the Japan Bank for International Cooperation Operations (the “JBIC Operations”) and (ii) the Financial Operations for Facilitating Realignment of United States Forces in Japan (the “Financial Operations for Facilitating Realignment of United States Forces in Japan”). Effective the same date, the JBIC Operations and the Financial Operations for Facilitating Realignment of United States Forces in Japan were transferred out of the Predecessor to establish Japan Bank for International Cooperation (“JBIC”), a joint-stock corporation wholly owned by the Japanese government. This registration statement contains a prospectus, consisting of a cover page, page ii and pages 1 through 17 relating to debt securities of JBIC and guarantees of Japan.

A maximum aggregate principal amount of US$8,000,000,000 or its equivalent in other currencies or currency units of debt securities may be offered and sold in the United States pursuant to the prospectus on or after the date of effectiveness of this registration statement. Of such aggregate principal offering amount, US$4,218,250,000 is registered hereby, and US$3,781,750,000 was previously registered under the Predecessor’s Registration Statement No. 333-157296. The first US$3,781,750,000 offered and sold pursuant to the prospectus contained herein shall be deemed to be the securities registered under Registration Statement No. 333-157296.

JBIC offers its securities as separate issues from time to time on the terms and in the manner to be specified in supplements to the prospectus contained in this registration statement. Upon any public offering or sale in the United States of such other debt securities covered by the prospectus, one or more prospectus supplements describing such debt securities and the particular terms of such offer or sale will be filed in accordance with the rules of the Commission.

The information in this prospectus is not complete and may be changed. Japan Bank for International Cooperation may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted

Subject to Completion, Dated July 2, 2012

P R O S P E C T U S

Japan Bank for International Cooperation

(Issuer)

Japan

(Guarantor)

$8,000,000,000

Debt Securities

Japan Bank for International Cooperation (“JBIC”) may offer any combination of debt securities from time to time in one or more offerings. JBIC will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any prospectus supplement carefully before you invest. This prospectus may not be used to make offers or sales of securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2012.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that JBIC and Japan filed with the Securities and Exchange Commission (the “Commission”) under a “shelf” registration process. Under this shelf process, JBIC may, from time to time, sell debt securities (“Debt Securities”) described in this prospectus in one or more offerings up to a total dollar amount of $8,000,000,000. This prospectus provides you with a general description of the Debt Securities JBIC may offer. Each time JBIC sells securities under this shelf process, JBIC will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. Before you invest, you should read both this prospectus and the relevant prospectus supplement together with additional information under the heading “Where You Can Find More Information”.

Issuance of any guarantee by Japan of any Debt Securities will be subject to limits imposed by annual budgetary authorizations set by the Japanese Diet. In addition, each particular issue of Debt Securities will require authorization by Japan of any guarantee of such Debt Securities on a case-by-case basis.

None of JBIC, Japan or the underwriters of the Debt Securities to which any particular prospectus supplement relates has authorized any dealer, salesman or other person to give any information or to make any representation not contained in this prospectus or such a prospectus supplement. If any such dealer, salesman or other person has given or made such information or representation, you must not rely upon such information or representation as having been authorized by JBIC, Japan or such underwriters. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any of the Debt Securities in any jurisdiction to any person to whom it is unlawful to make such offer in such jurisdiction.

ii

WHERE YOU CAN FIND MORE INFORMATION

JBIC and Japan file, and JBIC’s predecessor, Japan Finance Corporation (the “Predecessor”), and Japan have filed annual reports, amendments to annual reports and other information with the Commission. These reports and amendments include certain financial, statistical and other information about JBIC, the Predecessor and Japan, and may be accompanied by exhibits. You may read and copy any document JBIC and Japan file, and the Predecessor and Japan have filed, with the Commission at the Commission’s public reference rooms in Washington, D.C., New York, New York and Chicago, Illinois. You may also obtain copies of the same documents from the public reference room in Washington, D.C. by paying a fee. Please call the Commission at 1-800-SEC-0330 for further information on the public reference rooms. In addition, the Commission maintains an Internet site (www.sec.gov) that contains reports and other information regarding issuers that file electronically with the Commission.

The Commission allows JBIC and Japan to “incorporate by reference” the information JBIC and Japan file, and the Predecessor and Japan have filed, with the Commission, which means that JBIC and Japan can disclose important information to you by referring you to those documents. Information that is incorporated by reference is an important part of this prospectus. JBIC and Japan incorporate by reference the documents listed below and any future filings made with the Commission to the extent such filings indicate that they are intended to be incorporated by reference:

| | • | | the Predecessor’s Annual Report on Form 18-K (File No. 333-11680) for the year ended March 31, 2011, filed on September 7, 2011 with respect to the unaudited financial statements and other information relating to the JBIC Operations and the Financial Operations for Facilitating Realignment of United States Forces in Japan; and |

| | • | | Japan’s Annual Report on Form 18-K (File No. 033-23423-01) for the year ended March 31, 2011, filed on September 12, 2011. |

Each time JBIC or Japan files a document with the Commission that is incorporated by reference, the information in that document automatically updates the information contained in previously filed documents.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. JBIC and Japan have not authorized anyone else to provide you with different or additional information. JBIC and Japan are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the dates set forth on the respective cover pages of these documents.

You may request a copy of the annual reports, amendments to annual reports and other information mentioned above by writing or calling JBIC. Written requests for such documents should be directed to JBIC, 4-1 Otemachi 1-chome, Chiyoda-ku, Tokyo 100-8144, Japan, Attention: Capital Markets and Funding Division, Treasury Department, Corporate Group, JBIC. JBIC’s telephone number is 81-3-5218-3304. The Internet site of JBIC is http://www.jbic.go.jp/en. The information on the website is not incorporated by reference into this prospectus.

In this document all amounts are expressed in Japanese Yen (“¥” or “yen”), except as otherwise specified. The spot buying rate quoted on the Tokyo Foreign Exchange Market on June 26, 2012 as reported by the Bank of Japan at 5:00 p.m., Tokyo time, was 79.52 = $1.00, and the noon buying rate on June 22, 2012 for cable transfers in New York City payable in yen, as reported by the Federal Reserve Bank of New York, was 80.52 = $1.00.

References herein to Japanese fiscal years (“JFYs”) are to 12-month periods commencing in each case on April 1 of the year indicated and ending on March 31 of the following year.

1

JAPAN BANK FOR INTERNATIONAL COOPERATION

The following information updates information in the Predecessor’s 18-K relating to JBIC. The following section has been updated to reflect current information and has not been revised in its entirety. In the following section, information pertaining to previous years is provided solely for your convenience.

JBIC is a joint stock corporation organized under the laws of Japan and established on April 1, 2012. The Japan Bank for International Cooperation Act (the “JBIC Act”) was passed into law on April 28, 2011 to spin off the Japan Bank for International Cooperation Operations (“JBIC Operations”), together with the Financial Operations for Facilitating Realignment of United States Forces in Japan, from the domestic financial operations of the Predecessor. Pursuant to the JBIC Act, on April 1, 2012, all of the assets and liabilities relating to the JBIC Operations and the Financial Operations for Facilitating Realignment of United States Forces in Japan were assumed by JBIC.

After the establishment of JBIC on April 1, 2012, with respect to bonds issued by the former Japan Bank for International Cooperation prior to the establishment of the Predecessor on October 1, 2008 and subsequently succeeded to by the Predecessor, JBIC and the Japan International Cooperation Agency, jointly and severally, assumed the obligations under such bonds. With respect to bonds issued by the Predecessor prior to the establishment of JBIC on April 1, 2012, the post-spin off Predecessor and JBIC, jointly and severally, assumed the obligations under such bonds. The guarantee of the bonds by the Japanese government remains in effect under the same conditions and such bonds continue to rank senior in terms of payment to unsecured general obligations not represented by debt securities.

Purpose and Authority

Under the JBIC Act, the purposes and operations of JBIC remain substantially unchanged from the former purposes and operations of JBIC Operations and the Financial Operations for Facilitating Realignment of United States Forces in Japan, but includes certain new loan and guarantee operations that are extensions of the JBIC Operations, as described below under the caption “Operations”.

Government Control and Supervision

Under the JBIC Act, JBIC’s shares are wholly owned by the Japanese government, and JBIC is under the Japanese government’s control. JBIC’s operations, including appointment of directors, business plans and issuance of new debt securities, are supervised by the Minister of Finance. JBIC’s budgets are subject to approval of the Japanese Diet, and the annual financial statements of JBIC are required to be submitted to the Diet.

Operations

JBIC Operations

Pursuant to the JBIC Act, JBIC conducts the JBIC Operations to fulfill the following four missions in order to contribute to the sound development of Japan and the international economy and society: (a) promoting the overseas development and securement of resources which are important for Japan, (b) maintaining and improving the international competitiveness of Japanese industries, (c) promoting the overseas businesses having the purpose of preserving the global environment, such as preventing global warming, and (d) preventing disruptions to international financial order or taking appropriate measures with respect to damages caused by such disruption.

In order to execute the above missions, JBIC conducts the following seven operations and by way of financing instruments such as loans, guarantees, acquisition and securitization of public/corporate bonds, assignment and securitization of loan assets and equity participations.

| | • | | Export Finance. Export finance provides funds to support exports of equipment by Japanese companies and overseas transfer of their technologies. |

2

| | • | | Import Finance. Import finance provides funds to support imports of oil, LNG, iron ore and other strategically important materials to Japan. Apart from resources, the guarantee facility supports imports of goods and services for which there are crucial domestic needs, such as aircraft. |

| | • | | Overseas Investment Finance. Overseas investment finance provides funds to support overseas investment projects undertaken by Japanese companies for manufacturing, resource development, and other business ventures. |

| | • | | Untied Finance. Untied finance provides funds to support improvements in the overseas business environment to facilitate Japanese trade, investments and other overseas business activities. Untied finance also supports projects undertaken by foreign governments and government agencies. |

| | • | | Bridge Finance. Bridge finance provides short-term financing for developing country governments facing balance-of payments difficulties to enable them to ride out temporary strains in foreign currency management. |

| | • | | Equity Participation. Equity participation is equity investment in overseas joint ventures involving Japanese companies, or funds in which Japanese companies participate. |

| | • | | Studies and Research Activities. JBIC conducts studies and research to support its operations. |

Financial Operations for Facilitating Realignment of United States Forces in Japan

The Act on Special Measures Concerning Smooth Implementation of Realignment of United States Forces in Japan was passed in May 2007 as a special legislation related to the former Japan Bank for International Cooperation Act, authorizing the former Japan Bank for International Cooperation (which was subsequently succeeded to by the Predecessor on October 1, 2008) to provide financial services for facilitating the realignment of United States Forces in Japan as exceptional measures. Following the passing of the budget bill for the fiscal year ended March 31, 2011 on March 24, 2010, the Finance Department for Facilitating Realignment of United States Forces in Japan was established, including a separate account for the financial services to be conducted by such Department, segregating it from other accounts of the Predecessor. Such financial services include equity investments, loans and other operations necessary for projects (such as the public-private partnerships of family housing and infrastructure projects associated with the relocation of U.S. marine force personnel and their dependents to Guam) to facilitate the realignment of United States Forces in Japan.

Organizational Structure

Management

JBIC’s board of directors has the ultimate responsibility for the administration of its affairs. JBIC’s articles of incorporation provide for a board of directors of not more than five directors and three corporate auditors. All directors and corporate auditors are elected by the Japanese government as JBIC’s sole shareholder at the shareholder’s general meetings, but the election of each director and corporate auditor is subject to approval of the Minister of Finance in accordance with the JBIC Act. The normal term of office for directors is two years, and the normal term of office for corporate auditors is four years, but directors and corporate auditors may serve any number of consecutive terms. The board of directors may elect from among its members, a Governor, a CEO, an Executive Managing Director, several COOs, Senior Managing Directors and several Senior Managing Directors. The Governor acts as the chairperson at the shareholder’s general meeting. The board of directors may also elect one or more representative directors from among its members, but such election is subject to the approval of the Minister of Finance. Each of the Governor, CEO and Executive Managing Director shall represent JBIC in the conduct of its affairs, and in addition, several Directors may be appointed to have the authority to represent JBIC in the conduct of its affairs.

The corporate auditors form the board of corporate auditors. The board of corporate auditors has a statutory duty to prepare and submit an audit report to the board of directors each year based on the audit reports issued by

3

the individual corporate auditors in that year. A corporate auditor may note his or her opinion in the audit report issued by the board of corporate auditors if his or her opinion expressed in the individual audit report is different from the opinion expressed in the audit report issued by the board of corporate auditors. The board of corporate auditors is empowered to establish audit principles, the method of examination by the corporate auditors of JBIC’s affairs and financial position and any other matters relating to the performance of the corporate auditors’ duties.

JBIC is required to appoint, and has appointed, Account Auditors, who have the statutory duties of examining the financial statements, prepared on a basis consistent with accounting principles generally accepted in Japan, to be submitted to the shareholders by a representative director, and preparing their audit report thereon. JBIC has selected its Account Auditors to audit the financial statements for the fiscal year ending March 31, 2013, which is JBIC’s initial fiscal period.

JBIC’s initial directors and corporate auditors, elected on April 1, 2012, are as follows:

| | |

Name | | Title |

Hiroshi Okuda | | Governor |

| |

Hiroshi Watanabe | | CEO, Executive Managing Director |

| |

Fumio Hoshi | | COO, Senior Managing Director |

| |

Kohei Nakanishi | | Managing Director |

| |

Akira Kondoh | | Managing Director |

| |

Hiroshi Imoto | | Corporate Auditor |

| |

Shinji Nishio | | Corporate Auditor |

| |

Tatsuo Igarashi | | Corporate Auditor |

| | |

Hiroshi Okuda |

1955 | | Joined Toyota Motor Corporation (TMC) |

1995 | | President, TMC |

1999 | | Chairman, TMC |

2006 | | Senior Advisor, TMC |

2012 | | Governor, JBIC |

|

Hiroshi Watanabe |

1972 | | Joined the Ministry of Finance (MOF) |

2004 | | Vice Minister of Finance for International Affairs, MOF |

2007 | | Special Advisor to the Minister of Finance |

2008 | | President and CEO, JBIC as international wing of the Predecessor |

2012 | | CEO, Executive Managing Director, JBIC |

|

Fumio Hoshi |

1973 | | Joined The Export Import Bank of Japan (currently JBIC) |

2002 | | Executive Director, former JBIC (before establishment of Predecessor) |

2011 | | Deputy President, JBIC as international wing of the Predecessor |

2012 | | COO, Senior Managing Director, JBIC |

|

Kohei Nakanishi |

1977 | | Joined The Export Import Bank of Japan (currently JBIC) |

2011 | | Executive Director, JBIC as international wing of the Predecessor |

2012 | | Managing Director, JBIC |

4

| | |

Akira Kondoh |

1967 | | Joined the Sumitomo Bank Ltd. (currently the Sumitomo-Mitsui Banking Co.) |

1997 | | Managing Director, the Sumitomo Bank Ltd. |

1999 | | Deputy President, Daiwa Securities SB Capital Markets Co. Ltd. |

2000 | | Corporate Senior Executive VP and Deputy CFO, Sony Corporation |

2004 | | Vice Chairman Finance and Investment, AIG East Asia Holdings Management Inc. |

2009 | | President and CEO, Fuji Fire and Marine Insurance Company, Ltd.. |

2011 | | Vice Chairman, Chartis Far East Holdings KK. |

2012 | | Managing Director, JBIC |

|

Hiroshi Imoto |

1981 | | Joined The Export Import Bank of Japan (currently JBIC) |

2011 | | Executive Officer for West Japan, JBIC as international wing of the Predecessor |

2012 | | Corporate Auditor, JBIC |

|

Shinji Nishio |

1964 | | Joined Nippon Oil Company, Ltd. |

2005 | | Representative Director, President, Nippon Oil Corporation |

2010 | | Representative Director, Chairman of the Board, JX Holdings, Inc. |

2012 | | Corporate Auditor, JBIC |

|

Tatsuo Igarashi |

1975 | | Joined Tomatsu Awoki & Co. (currently Deloitte Touche Tohmatsu LLC) |

2011 | | Opened The Office of Igarashi Certified Public Accountant |

2012 | | Corporate Auditor, JBIC |

5

Summary Financial Information

The table below sets forth the summary unaudited financial information of JBIC with respect to the JBIC Operations as of and for the fiscal years ended March 31, 2010 and 2011, prepared in accordance with accounting principles generally accepted in Japan (“Japanese GAAP”).

JBIC OPERATIONS BALANCE SHEET (unaudited)

| | | | | | | | | | | | |

| | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2011 | |

| | | (In millions of yen) | | | (In millions of yen) | | | (In millions of

U.S. dollars) | |

Assets: | | | | | | | | | | | | |

Cash and due from banks | | ¥ | 455,113 | | | ¥ | 978,074 | | | $ | 11,763 | |

Cash | | | 0 | | | | 0 | | | | 0 | |

Due from bank | | | 455,112 | | | | 978,074 | | | | 11,763 | |

Securities | | | 44,280 | | | | 76,453 | | | | 919 | |

Other securities | | | 44,280 | | | | 76,453 | | | | 919 | |

Loans and bills discounted | | | 8,771,342 | | | | 8,376,794 | | | | 100,743 | |

Loans on deeds | | | 8,771,342 | | | | 8,376,794 | | | | 100,743 | |

Other assets | | | 724,223 | | | | 1,001,457 | | | | 12,044 | |

Prepaid expenses | | | 225 | | | | 234 | | | | 4 | |

Accrued income | | | 30,685 | | | | 29,379 | | | | 353 | |

Derivatives other than for trading-assets | | | 693,022 | | | | 966,988 | | | | 11,629 | |

Other | | | 290 | | | | 4,855 | | | | 58 | |

Property, plant and equipment | | | 37,903 | | | | 37,664 | | | | 453 | |

Buildings | | | 3,554 | | | | 3,488 | | | | 42 | |

Land | | | 33,881 | | | | 33,881 | | | | 407 | |

Lease assets | | | 79 | | | | 58 | | | | 1 | |

Construction in progress | | | 90 | | | | 2 | | | | 0 | |

Other | | | 296 | | | | 233 | | | | 3 | |

Intangible assets | | | 2,320 | | | | 2,349 | | | | 29 | |

Software | | | 2,025 | | | | 2,116 | | | | 25 | |

Lease assets | | | 259 | | | | 218 | | | | 4 | |

Other | | | 34 | | | | 14 | | | | 0 | |

Customers’ liabilities for acceptances and guarantees | | | 1,977,071 | | | | 2,443,266 | | | | 29,384 | |

Allowance for loan losses | | | (145,354 | ) | | | (134,417 | ) | | | (1,617 | ) |

| | | | | | | | | | | | |

Total assets | | ¥ | 11,866,899 | | | ¥ | 12,781,643 | | | $ | 153,718 | |

| | | | | | | | | | | | |

6

| | | | | | | | | | | | |

| | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2011 | |

| | | (In millions of yen) | | | (In millions of yen) | | | (In millions of

U.S. dollars) | |

Liabilities: | | | | | | | | | | | | |

Borrowed money | | ¥ | 5,267,246 | | | ¥ | 5,502,495 | | | $ | 66,176 | |

Borrowings | | | 5,267,246 | | | | 5,502,495 | | | | 66,176 | |

Bonds payable | | | 2,598,954 | | | | 2,703,551 | | | | 32,514 | |

Other liabilities | | | 56,394 | | | | 71,181 | | | | 856 | |

Accrued expenses | | | 32,809 | | | | 29,911 | | | | 360 | |

Unearned revenue | | | 21,534 | | | | 38,881 | | | | 468 | |

Derivatives other than for trading-liabilities | | | 1,598 | | | | 1,899 | | | | 23 | |

Lease obligations | | | 356 | | | | 290 | | | | 3 | |

Other | | | 94 | | | | 198 | | | | 2 | |

Provision for bonuses | | | 511 | | | | 465 | | | | 6 | |

Provision for directors’ bonuses | | | 6 | | | | 6 | | | | 0 | |

Provision for retirement benefits | | | 11,872 | | | | 12,135 | | | | 146 | |

Provision for directors’ retirement benefits | | | 17 | | | | 28 | | | | 0 | |

Acceptances and guarantees | | | 1,977,071 | | | | 2,443,266 | | | | 29,384 | |

| | | | | | | | | | | | |

Total liabilities | | ¥ | 9,912,072 | | | ¥ | 10,733,129 | | | $ | 129,082 | |

| | | | | | | | | | | | |

| | | |

Net Assets: | | | | | | | | | | | | |

Capital Stock | | ¥ | 1,055,500 | | | ¥ | 1,091,000 | | | $ | 13,121 | |

Retained earnings | | | 759,218 | | | | 801,398 | | | | 9,638 | |

Legal retained earnings | | | 726,011 | | | | 742,615 | | | | 8,931 | |

Other retained earnings | | | 33,207 | | | | 58,783 | | | | 707 | |

Retained earnings brought forward | | | 33,207 | | | | 58,783 | | | | 707 | |

| | | | | | | | | | | | |

Total shareholders’ equity | | | 1,814,718 | | | | 1,892,398 | | | | 22,759 | |

| | | | | | | | | | | | |

Valuation and difference on available for sale securities | | | (687 | ) | | | (1,665 | ) | | | (21 | ) |

Deferred gains or losses on hedges | | | 140,795 | | | | 157,781 | | | | 1,898 | |

| | | | | | | | | | | | |

Valuation and translation adjustments | | | 140,107 | | | | 156,115 | | | | 1,877 | |

| | | | | | | | | | | | |

Total net assets | | ¥ | 1,954,826 | | | ¥ | 2,048,513 | | | $ | 24,636 | |

| | | | | | | | | | | | |

Total liabilities and net assets | | ¥ | 11,866,899 | | | ¥ | 12,781,643 | | | $ | 153,718 | |

| | | | | | | | | | | | |

7

STATEMENTS OF OPERATIONS (unaudited)

| | | | | | | | | | | | |

| | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2011 | |

| | | (In millions of yen) | | | (In millions of yen) | | | (In millions of

U.S. dollars) | |

Ordinary income: | | ¥ | 191,178 | | | ¥ | 197,217 | | | $ | 2,372 | |

Interest income | | | 179,396 | | | | 178,661 | | | | 2,148 | |

Interest on loans and discounts | | | 143,212 | | | | 122,329 | | | | 1,471 | |

Interest and dividends on securities | | | — | | | | 48 | | | | 1 | |

Interest on deposit with banks | | | 547 | | | | 1,199 | | | | 14 | |

Interest on interest swaps | | | 35,617 | | | | 55,061 | | | | 662 | |

Other interest income | | | 19 | | | | 22 | | | | 0 | |

Fees and Commissions | | | 11,144 | | | | 13,183 | | | | 159 | |

Other fees and commissions | | | 11,144 | | | | 13,183 | | | | 159 | |

Other ordinary income | | | 33 | | | | 74 | | | | 1 | |

Other | | | 33 | | | | 74 | | | | 1 | |

Other income | | | 604 | | | | 5,298 | | | | 64 | |

Other | | | 604 | | | | 5,298 | | | | 64 | |

Ordinary expenses: | | | 163,355 | | | | 147,576 | | | | 1,775 | |

Interest expenses | | | 122,322 | | | | 118,777 | | | | 1,428 | |

Interest on borrowings and rediscounts | | | 58,349 | | | | 55,696 | | | | 670 | |

Interest on bonds | | | 63,973 | | | | 63,081 | | | | 758 | |

Fees and commissions payments | | | 1,107 | | | | 1,332 | | | | 16 | |

Other fees and commissions | | | 1,107 | | | | 1,332 | | | | 16 | |

Other ordinary expenses | | | 4,679 | | | | 3,370 | | | | 41 | |

Loss on foreign exchange transactions | | | 3,416 | | | | 2,501 | | | | 30 | |

Amortization of bond issuance cost | | | 854 | | | | 651 | | | | 8 | |

Expenses on derivatives other than for trading or hedging | | | 68 | | | | 8 | | | | 0 | |

Other | | | 340 | | | | 209 | | | | 3 | |

General and administrative expenses | | | 16,392 | | | | 15,861 | | | | 191 | |

Other expenses | | | 18,854 | | | | 8,233 | | | | 99 | |

Provision of allowance for loan losses | | | 18,853 | | | | 8,232 | | | | 99 | |

Other | | | 0 | | | | 0 | | | | 0 | |

Ordinary profit | | | 27,823 | | | | 49,641 | | | | 597 | |

Extraordinary income | | | 5,388 | | | | 9,142 | | | | 110 | |

Gain on disposal of noncurrent assets | | | 0 | | | | 0 | | | | 0 | |

Recoveries of written-off claims | | | 5,387 | | | | 8,715 | | | | 105 | |

Other | | | — | | | | 425 | | | | 5 | |

Extraordinary losses | | | 3 | | | | 0 | | | | 0 | |

Loss on disposal of noncurrent assets | | | 3 | | | | 0 | | | | 0 | |

Net income | | ¥ | 33,207 | | | ¥ | 58,783 | | | $ | 707 | |

The ordinary income of the JBIC Operations for the fiscal year ended March 31, 2010 was ¥191.1 billion. This was attributable primarily to interest income which amounted to ¥179.3 billion, reflecting temporary measures undertaken in response to the global financial crisis, such as JBIC’s commitments to Emergency Projects to Support Overseas Operations.

The ordinary expenses of the JBIC Operations for the fiscal year ended March 31, 2010 were ¥163.3 billion. This was attributable primarily to interest expenses, amounting to ¥122.3 billion, which primarily reflected interest expenses for borrowings.

8

For the fiscal year ended March 31, 2010, JFC recorded ordinary profit of ¥27.8 billion and net income of ¥33.2 billion for the JBIC Operations.

The ordinary income of the JBIC Operations for the fiscal year ended March 31, 2011 was ¥197.2 billion. This was attributable primarily to interest income which amounted to ¥178.6 billion, reflecting temporary measures undertaken in response to the overseas development and acquisition support of material resources and JBIC’s commitments to Emergency Projects to Support Overseas Operations.

The ordinary expenses of the JBIC Operations for the fiscal year ended March 31, 2011 were ¥147.5 billion. This was attributable primarily to interest expenses, amounting to ¥118.7 billion, which mostly reflected interest expenses for borrowings.

For the fiscal year ended March 31, 2011, JFC recorded ordinary profit of ¥49.6 billion and net income of ¥58.7 billion for the JBIC Operations.

9

Outstanding Loans

The following table sets forth, as of the dates indicated, the total amounts of loans outstanding provided by JBIC, by type of credit and geographical distribution:

| | | | | | | | | | | | | | | | |

| | | JBIC Operations | | | JBIC Operations | |

| | | As of March 31, | | | As of March 31, | |

| | | 2010 | | | 2011 | |

| | | (In millions of yen) | | | (In millions of yen) | |

EXPORT LOANS | | | | | | | | | | | | | | | | |

Asia | | ¥ | 441,044 | | | | 5.0 | % | | ¥ | 379,675 | | | | 4.5 | % |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | 71,853 | | | | 0.8 | % | | | 66,604 | | | | 0.8 | % |

The Middle East | | | 159,034 | | | | 1.8 | % | | | 136,152 | | | | 1.6 | % |

Africa | | | 44,635 | | | | 0.5 | % | | | 34,112 | | | | 0.4 | % |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | 88,857 | | | | 1.0 | % | | | 78,925 | | | | 1.0 | % |

International Organizations, etc. | | | 2,809 | | | | 0.0 | % | | | 3,040 | | | | 0.0 | % |

| | | | | | | | | | | | | | | | |

Total | | ¥ | 808,231 | | | | 9.2 | % | | | 698,507 | | | | 8.3 | % |

| | | | | | | | | | | | | | | | |

IMPORT LOANS | | | | | | | | | | | | | | | | |

Asia | | | 23,396 | | | | 0.3 | % | | | 25,289 | | | | 0.3 | % |

The Pacific | | | 77,579 | | | | 0.9 | % | | | 64,807 | | | | 0.8 | % |

Europe | | | 20,128 | | | | 0.2 | % | | | 15,996 | | | | 0.2 | % |

The Middle East | | | 441,786 | | | | 5.0 | % | | | 366,226 | | | | 4.3 | % |

Africa | | | 4,777 | | | | 0.1 | % | | | 2,844 | | | | 0.0 | % |

North America | | | 210,999 | | | | 2.4 | % | | | 142,147 | | | | 1.7 | % |

Latin America | | | 14,617 | | | | 0.2 | % | | | 13,261 | | | | 0.2 | % |

International Organizations, etc. | | | 5 | | | | 0.0 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | | 793,287 | | | | 9.0 | % | | | 630,570 | | | | 7.5 | % |

| | | | | | | | | | | | | | | | |

OVERSEAS INVESTMENT LOANS | | | | | | | | | | | | | | | | |

Asia | | | 1,157,372 | | | | 13.1 | % | | | 1,059,775 | | | | 12.5 | % |

The Pacific | | | 287,050 | | | | 3.3 | % | | | 302,665 | | | | 3.6 | % |

Europe | | | 1,100,822 | | | | 12.5 | % | | | 931,618 | | | | 11.0 | % |

The Middle East | | | 1,086,085 | | | | 12.3 | % | | | 1,047,916 | | | | 12.4 | % |

Africa | | | 142,532 | | | | 1.6 | % | | | 138,053 | | | | 1.6 | % |

North America | | | 512,778 | | | | 5.8 | % | | | 430,471 | | | | 5.1 | % |

Latin America | | | 827,617 | | | | 9.4 | % | | | 934,209 | | | | 11.0 | % |

International Organizations, etc. | | | 672,124 | | | | 7.6 | % | | | 982,497 | | | | 11.6 | % |

| | | | | | | | | | | | | | | | |

Total | | | 5,786,381 | | | | 65.6 | % | | | 5,827,203 | | | | 68.8 | % |

| | | | | | | | | | | | | | | | |

UNITED LOANS | | | | | | | | | | | | | | | | |

Asia | | | 569,795 | | | | 6.5 | | | | 518,711 | | | | 6.1 | % |

The Pacific | | | 141 | | | | 0.0 | % | | | 94 | | | | 0.0 | % |

Europe | | | 56,496 | | | | 0.6 | % | | | 45,261 | | | | 0.5 | % |

The Middle East | | | 46,921 | | | | 0.5 | % | | | 49,530 | | | | 0.6 | % |

Africa | | | 39,430 | | | | 0.4 | % | | | 47,094 | | | | 0.6 | % |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | 385,569 | | | | 4.4 | % | | | 345,229 | | | | 4.1 | % |

International Organizations, etc. | | | 235,557 | | | | 2.7 | % | | | 177,873 | | | | 2.1 | % |

| | | | | | | | | | | | | | | | |

Total | | | 1,333,909 | | | | 15.1 | % | | | 1,183,793 | | | | 14.0 | % |

| | | | | | | | | | | | | | | | |

10

| | | | | | | | | | | | | | | | |

| | | JBIC Operations | | | JBIC Operations | |

| | | As of March 31, | | | As of March 31, | |

| | | 2010 | | | 2011 | |

| | | (In millions of yen) | | | (In millions of yen) | |

GOVERNMENTAL LOANS | | | | | | | | | | | | | | | | |

Asia | | | 16,011 | | | | 0.2 | % | | | 15,938 | | | | 0.2 | % |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | 1,099 | | | | 0.0 | % | | | 2,036 | | | | 0.0 | % |

The Middle East | | | 19,037 | | | | 0.2 | % | | | 19,071 | | | | 0.2 | % |

Africa | | | 3,226 | | | | 0.0 | % | | | 6,517 | | | | 0.1 | % |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | 12,622 | | | | 0.1 | % | | | 10,777 | | | | 0.1 | % |

International Organizations, etc. | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | | 51,996 | | | | 0.6 | % | | | 54,339 | | | | 0.6 | % |

| | | | | | | | | | | | | | | | |

EQUITY PARTICIPATION | | | | | | | | | | | | | | | | |

Asia | | | 11,039 | | | | 0.1 | % | | | 10,957 | | | | 0.1 | % |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | — | | | | — | | | | — | | | | — | |

The Middle East | | | — | | | | — | | | | — | | | | — | |

Africa | | | — | | | | — | | | | — | | | | — | |

North America | | | 4,811 | | | | 0.1 | % | | | 4,811 | | | | 0.1 | % |

Latin America | | | — | | | | — | | | | — | | | | — | |

International Organizations, etc. | | | 28,442 | | | | 0.3 | % | | | 56,898 | | | | 0.7 | % |

| | | | | | | | | | | | | | | | |

Total | | | 44,293 | | | | 0.5 | % | | | 72,666 | | | | 0.9 | % |

| | | | | | | | | | | | | | | | |

Total loans outstanding | | ¥ | 8,818,096 | | | | 100.0 | % | | ¥ | 8,467,079 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

11

New Loan Commitments

The following table sets forth the new loan commitments made by JBIC by type of credit and geographical distribution in accordance with JBIC’s system of classification for the periods indicated.

| | | | | | | | | | | | | | | | |

| | | JBIC Operations | | | JBIC Operations | |

| | | As of March 31, | | | As of March 31, | |

| | | 2010 | | | 2011 | |

| | | (In millions of yen) | | | (In millions of yen) | |

EXPORT LOANS | | | | | | | | | | | | | | | | |

Asia | | ¥ | 69,884 | | | | 2.6 | % | | ¥ | 34,510 | | | | 3.1 | % |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | 5,552 | | | | 0.2 | % | | | 14,637 | | | | 1.3 | % |

The Middle East | | | 1,566 | | | | 0.1 | % | | | 20,768 | | | | 1.8 | % |

Africa | | | — | | | | — | | | | 66,389 | | | | 5.9 | % |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | 20,877 | | | | 0.8 | % | | | 11,652 | | | | 1.0 | % |

International Organizations, etc. | | | — | | | | — | | | | 3,283 | | | | 0.3 | % |

| | | | | | | | | | | | | | | | |

Total | | | 97,879 | | | | 3.7 | % | | | 151,239 | | | | 13.4 | % |

| | | | | | | | | | | | | | | | |

IMPORT LOANS | | | | | | | | | | | | | | | | |

Asia | | | 8,208 | | | | 0.3 | % | | | — | | | | — | |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | — | | | | — | | | | — | | | | — | |

The Middle East | | | — | | | | — | | | | 169,512 | | | | 15.0 | % |

Africa | | | — | | | | — | | | | — | | | | — | |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | — | | | | — | | | | — | | | | — | |

International Organizations, etc. | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | | 8,208 | | | | 0.3 | % | | | 169,512 | | | | 15.0 | % |

| | | | | | | | | | | | | | | | |

OVERSEAS INVESTMENT LOANS | | | | | | | | | | | | | | | | |

Asia | | | 288,246 | | | | 10.8 | % | | | 48,231 | | | | 4.3 | % |

The Pacific | | | 175,438 | | | | 6.6 | % | | | 8,384 | | | | 0.7 | % |

Europe | | | 474,858 | | | | 17.9 | % | | | 47,847 | | | | 4.2 | % |

The Middle East | | | 101,133 | | | | 3.8 | % | | | — | | | | — | |

Africa | | | 12,248 | | | | 0.5 | % | | | — | | | | — | |

North America | | | 288,354 | | | | 10.9 | % | | | 74,644 | | | | 6.6 | % |

Latin America | | | 191,376 | | | | 7.2 | % | | | 149,261 | | | | 13.2 | % |

International Organizations, etc. | | | 662,078 | | | | 24.9 | % | | | 381,962 | | | | 33.9 | % |

| | | | | | | | | | | | | | | | |

Total | | | 2,193,731 | | | | 82.6 | % | | | 710,329 | | | | 63.0 | % |

| | | | | | | | | | | | | | | | |

UNITED LOANS | | | | | | | | | | | | | | | | |

Asia | | | 271,094 | | | | 10.2 | % | | | 18,283 | | | | 1.6 | % |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | — | | | | — | | | | — | | | | — | |

The Middle East | | | — | | | | — | | | | 19,969 | | | | 1.8 | % |

Africa | | | 13,532 | | | | 0.5 | % | | | — | | | | — | |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | 50,532 | | | | 1.9 | % | | | 23,684 | | | | 2.1 | % |

International Organizations, etc. | | | 9,160 | | | | 0.3 | % | | | 14,909 | | | | 1.3 | % |

| | | | | | | | | | | | | | | | |

Total | | | 344,317 | | | | 13.0 | % | | | 76,846 | | | | 6.8 | % |

| | | | | | | | | | | | | | | | |

12

| | | | | | | | | | | | | | | | |

| | | JBIC Operations | | | JBIC Operations | |

| | | As of March 31, | | | As of March 31, | |

| | | 2010 | | | 2011 | |

| | | (In millions of yen) | | | (In millions of yen) | |

GOVERNMENTAL LOANS | | | | | | | | | | | | | | | | |

Asia | | | — | | | | — | | | | — | | | | — | |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | — | | | | — | | | | — | | | | — | |

The Middle East | | | — | | | | — | | | | — | | | | — | |

Africa | | | — | | | | — | | | | — | | | | — | |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | — | | | | — | | | | — | | | | — | |

International Organizations, etc. | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

EQUITY PARTICIPATION | | | | | | | | | | | | | | | | |

Asia | | | — | | | | — | | | | 3,055 | | | | 0.3 | % |

The Pacific | | | — | | | | — | | | | — | | | | — | |

Europe | | | — | | | | — | | | | — | | | | — | |

The Middle East | | | — | | | | — | | | | — | | | | — | |

Africa | | | — | | | | — | | | | — | | | | — | |

North America | | | — | | | | — | | | | — | | | | — | |

Latin America | | | — | | | | — | | | | — | | | | — | |

International Organizations, etc. | | | 13,040 | | | | 0.5 | % | | | 16,764 | | | | 1.5 | % |

| | | | | | | | | | | | | | | | |

Total | | | 13,040 | | | | 0.5 | % | | | 19,819 | | | | 1.8 | % |

| | | | | | | | | | | | | | | | |

Total loans outstanding | | ¥ | 2,657,175 | | | | 100.0 | % | | ¥ | 1,127,744 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

13

Semi-annual Balance Sheet for Period Ending September 30, 2011 (unaudited)

The table below sets forth the summary unaudited financial information of JBIC with respect to the JBIC Operations for the six months ended September 30, 2011, prepared in accordance with Japanese GAAP.

| | | | |

| | | As of

September 30,

2011 | |

| | | (in millions) | |

Assets: | | | | |

Cash and due from banks | | ¥ | 496,790 | |

Receivables under resale agreements | | | 469,809 | |

Securities | | | 75,111 | |

Loans and bills discounted | | | 7,959,361 | |

Other assets | | | 1,258,959 | |

Property, plant and equipment | | | 37,465 | |

Intangible assets | | | 1,981 | |

Customers’ liabilities for acceptances and guarantees | | | 2,400,158 | |

Allowance for loan losses | | | (129,994 | ) |

| | | | |

Total Assets | | ¥ | 12,569,643 | |

| | | | |

| |

| | | As of

September 30,

2011 | |

| | | (in millions) | |

Liabilities: | | | | |

Borrowed money | | ¥ | 5,322,050 | |

Bonds payable | | | 2,558,517 | |

Other liabilities | | | 73,795 | |

Provision for bonuses | | | 493 | |

Provision for directors’ bonuses | | | 6 | |

Provision for retirement benefits | | | 12,237 | |

Provision for directors’ retirement benefits | | | 19 | |

Acceptances and guarantees | | | 2,400,158 | |

| | | | |

Total liabilities | | | 10,367,278 | |

| | | | |

Net assets: | | | | |

Capital stock | | | 1,191,000 | |

Retained earnings | | | 797,522 | |

Valuation and translation adjustments | | | 213,843 | |

| | | | |

Total net assets | | | 2,202,365 | |

| | | | |

Total liabilities and net assets | | ¥ | 12,569,643 | |

| | | | |

14

Semi-annual Statement of Operations for Period Ending September 30, 2011 (unaudited)

| | | | |

| | | As of

September 30,

2011 | |

| | | (in millions) | |

Ordinary income: | | ¥ | 99,972 | |

Interest income | | | 87,406 | |

Fees and Commissions | | | 7,570 | |

Other ordinary income | | | 4,995 | |

Ordinary expenses: | | | 69,864 | |

Interest expenses | | | 57,524 | |

Fees and commissions payments | | | 425 | |

Other ordinary expenses | | | 3,891 | |

General and administrative expenses | | | 7,824 | |

Other expenses | | | 198 | |

Ordinary income | | | 30,108 | |

Extraordinary income | | | 1 | |

Extraordinary losses | | | 4,594 | |

Net income | | ¥ | 25,515 | |

The ordinary income of the JBIC Operations for the six months ended September 30, 2011 was ¥99,972 million. Interest income, which amounted to ¥87,406 million and reflected financing and other assistance provided to large-scale natural resource and infrastructure projects, accounted for most of this income.

The ordinary expenses of the JBIC Operations for the six months ended September 30, 2011 were ¥69,864 million. Interest expense, which amounted to ¥57,524 million and mostly reflected interest expense for our borrowings and outstanding debt securities, accounted for most of these expenses.

For the six months ended September 30, 2011, we recorded net income of ¥25,515 million for the JBIC Operations.

15

Non-Performing Loans

Our asset quality self-assessment is based on our financial statements prepared in accordance with Japanese GAAP.

The table below sets forth the results of our assessment of our loans relating to the JBIC Operations as of September 30, 2011, classified in all material respects according to the standards under the Banking Act (Act No. 59 of 1981, as amended) (the “Banking Act”):

| | | | |

| | | As of

September 30,

2011 | |

| | | (in millions) | |

Bankrupt loans(a) | | ¥ | 8,969 | |

Non-accrual loans(b) | | | 96,788 | |

Past due loans (three months or more)(c) | | | — | |

Restructured loans(d) | | | 84,333 | |

Total | | ¥ | 190,092 | |

| (a) | “Bankrupt loans” are loans which are placed on non-accrual status when collection of either the principal of or interest on the loans becomes doubtful, are made to borrowers which have begun bankruptcy, composition, reorganization, winding-up or special liquidation proceedings under the Bankruptcy Act, the Corporate Reorganization Act, the Commercial Code or other similar laws of Japan or which have had their transactions with the promissory note clearinghouse suspended, or made to borrowers which have begun similar proceedings under any foreign law. As of September 30, 2011, our loans falling into this category were as follows: operations aimed at micro business and individuals—¥34,002 million; operations aimed at agriculture, forestry, fisheries and food business—¥7,029 million; and operations aimed at small and medium enterprises—¥20,572 million. |

| (b) | “Non-accrual loans” are loans which are placed on non-accrual status when collection of either the principal of or interest on the loans becomes doubtful, but exclude “Bankrupt loans” and loans the terms of which we have modified in favor of borrowers in order to expedite the borrower’s restructuring and to support the borrowers by deferring interest payments. As of September 30, 2011, our loans falling into this category were as follows: operations aimed at micro business and individuals—¥135,770 million; operations aimed at agriculture, forestry, fisheries and food business—¥67,094 million; and operations aimed at small and medium enterprises—¥365,975 million. |

| (c) | “Past due loans (three months or more)” are loans for which principal and/or interest is past due three months or more from their scheduled payment dates, but exclude “Bankrupt loans” and “Non-accrual loans.” As of September 30, 2011, our loans falling into this category were as follows: operations aimed at micro business and individuals—¥109 million; operations aimed at agriculture, forestry, fisheries and food business—¥1,992 million; and operations aimed at small and medium enterprises—¥69 million. |

| (d) | “Restructured loans” are loans the terms of which we have modified in favor of borrowers in order to expedite the borrowers’ restructuring and to support the borrowers by, among other things, reducing the stated interest rate, deferring interest payments or writing down principal, but exclude (1) “Bankrupt loans,” (2) “Non-accrual loans,” and (3) “Past due loans (three months or more)”. As of September 30, 2011, our loans falling into this category were as follows: operations aimed at micro business and individuals—¥609,632 million; operations aimed at agriculture, forestry, fisheries and food business—¥39,841 million; and operations aimed at small and medium enterprises—¥58,125 million. |

16

The table below sets forth the results of our assessment of our loan portfolio relating to the JBIC Operations as of September 30, 2011, classified in all material respects according to the standards under the Act on Emergency Measures for the Revitalization of the Functions of the Financial System of 1998, as amended (the “Financial Revitalization Act”):

| | | | |

| | | As of

September 30,

2011 | |

| | | (in millions) | |

Bankrupt and quasi-bankrupt assets(a) | | ¥ | 8,969 | |

Doubtful assets(b) | | | 96,788 | |

Substandard loans(c) | | | — | |

Total | | ¥ | 190,092 | |

| (a) | “Bankrupt and quasi-bankrupt assets” are loans to and other credits to debtors which have begun proceedings under the Bankruptcy Act, the Corporate Reorganization Act, the Financial Revitalization Act or other similar laws of Japan and have financially failed, as well as similar loans as so designated. As of September 30, 2011, our loans falling into this category were as follows: operations aimed at micro business and individuals—¥114,308 million; operations aimed at agriculture, forestry, fisheries and food business—¥11,639 million; and operations aimed at small and medium enterprises—¥64,482 million. |

| (b) | “Doubtful assets” are loans to and other credits to debtors whose financial and operational conditions have been deteriorated and which are unlikely to make payment of principal and/or interest on a contractual basis. As of September 30, 2011, our loans falling into this category were as follows: operations aimed at micro business and individuals—¥56,292 million; operations aimed at agriculture, forestry, fisheries and food business—¥62,523 million; and operations aimed at small and medium enterprises—¥322,328 million. |

| (c) | “Substandard loans” are (1) “Past due loans (three months or more)” for which principal and/or interest is past due three months or more from their date scheduled payment dates excluding “Bankrupt and quasi-bankrupt assets” and “Doubtful assets”, and (2) restructured loans on which we granted concessions to borrowers in financial difficulty to assist them in their financial recovery and enable them to eventually pay their creditors, but exclude “Bankrupt and quasi-bankrupt assets,” “Doubtful assets” and “Past due loans (three months or more)”. As of September 30, 2011, our loans falling into this category were as follows: operations aimed at micro business and individuals—¥609,741 million; operations aimed at agriculture, forestry, fisheries and food business—¥41,834 million; and operations aimed at small and medium enterprises—¥58,194 million. |

17

JAPAN

The following information updates information in Japan’s 18-K. The following section has been updated to reflect current information and has not been revised in its entirety. In the following section, information pertaining to previous years is provided solely for your convenience.

General

Japan is a mountainous island country in the western Pacific, with a population of over 127 million. Japan has a parliamentary form of government.

Government

The legislative power in Japan is vested in the Diet, which currently consists of a House of Representatives having 480 members and a House of Councilors having 242 members. Members of both houses are elected by direct universal suffrage, except that some members of each house are elected by proportional representation. The power of the House of Representatives is superior to that of the House of Councilors in respect of approving certain matters including the national budget and electing the Prime Minister.

The executive power is vested in the Cabinet consisting of a Prime Minister, elected by the Diet from among its members, and other Ministers appointed by the Prime Minister, a majority of whom must be members of the Diet. The judicial power is vested in the Supreme Court and such lower courts as are established by law.

Japan’s 47 prefectures, and its cities, towns and villages, have a certain degree of local autonomy through popularly elected legislative bodies and chief executives. The central government exercises its influence on local governments indirectly through financial aid and prescribing standards of local administration.

Leadership

Japan’s current Prime Minister is Yoshihiko Noda, a member of the Democratic Party of Japan and member of the House of Representatives in the Diet. Mr. Noda was formally appointed Prime Minister by the Emperor on September 2, 2011, and succeeded the former Prime Minister Naoto Kan, who is also a member of the Democratic Party of Japan. Mr. Kan served as Japan’s 94th Prime Minister from June 8, 2010 through September 2, 2011. Prior to the Kan Administration, Yukio Hatoyama, a member of the Democratic Party of Japan, served as the 93rd Prime Minister from September 16, 2009 through June 8, 2010.

18

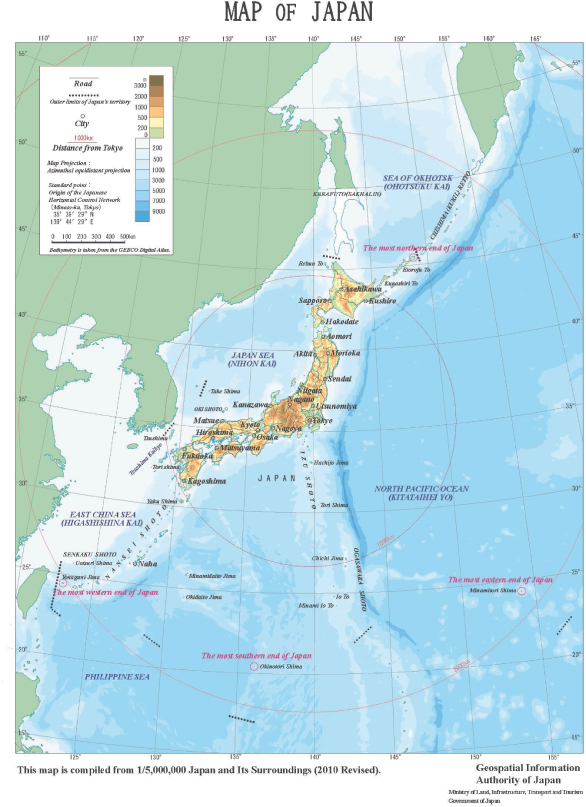

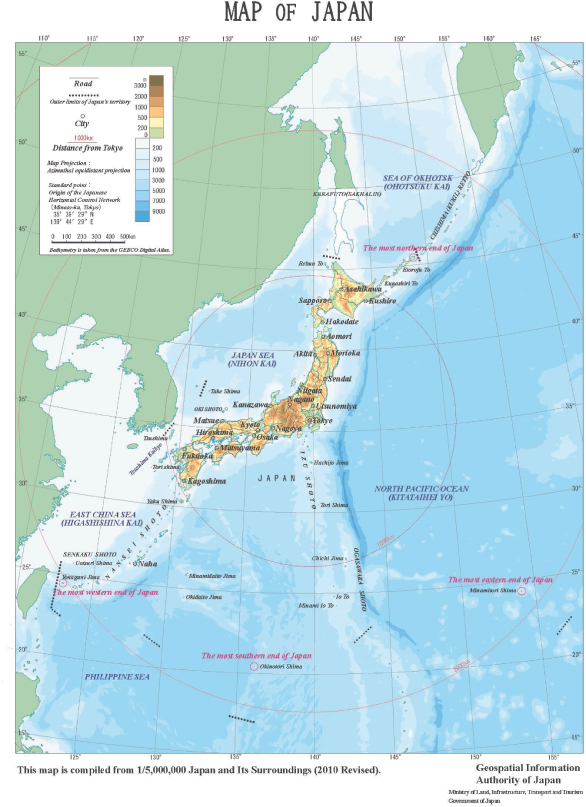

The following is a map of Japan, illustrating its location with respect to neighboring countries:

19

The Japanese Economy

Overview

Japan has a highly advanced and diversified economy, which has developed in response to changing conditions in Japan and the world. During the era of high economic growth in the 1960s and the early 1970s, the expansion was based on the development of heavy industries consuming large quantities of resources. During the 1980s, there was rapid growth in high value-added industries, such as electronics and precision instruments, which employ high level technology and consume relatively low quantities of resources. The service sector of the economy grew significantly during the 1980s and 1990s.

While the Japanese economy expanded during the period from 2002 to 2007, amidst that expansion, and prior to the global economic crisis of 2008, Japan continued to face several domestic economic difficulties. Among other things, domestic consumption contributed to the economic recovery to a lesser degree than was the case in prior economic growth periods. Also, despite the improving employment environment at the time, the average wage failed to grow appreciably. While those Japanese manufacturing companies with a global competitive edge achieved growth on the back of the favorable world economy, small-to-medium enterprises and the non-manufacturing sectors realized only limited productivity growth and profitability. This in turn caused imbalance in the level of economic recovery among the different regions in Japan. In the longer term, Japan faced a declining population, mass retirement of the baby boomer generation, environmental/energy conservation agenda, and fiscal deficit problem. Against this backdrop, the subprime loan crisis in the United States and increases in the prices of energy and raw materials precipitated weakness in the global economy, causing the Japanese economy to deteriorate. Throughout JFY 2008, the global economy continued to worsen, as the collapse of several major financial institutions in the United States and other factors contributed to a credit tightening, volatility in stock, currency and other markets, loss of consumer confidence and decrease in business and industrial activities on a global basis. The Japanese economy was also adversely affected by these factors, especially as Japan’s export sector was hit by the decline in global demand and appreciation of the yen against other major currencies. In November 2008, the Japanese government announced that Japan had entered a recession. The Japanese economy in JFY 2010 picked up, despite a difficult situation where the unemployment rate remained at a high level. The GDP growth rate at constant prices (real GDP growth) in JFY 2010 turned positive to 2.3%, up from -2.4% in the previous fiscal year. The GDP growth rate at current prices (nominal GDP growth), which more directly reflects people’s sentiment toward the economy, also showed improvement in JFY 2010 to 0.4%, up from -3.7% in JFY 2009 after a decline for two consecutive fiscal years.

On March 11, 2011, just as the Japanese economy was in a transition from the state of stagnation to recovery, the Great East Japan Earthquake (“Earthquake”) struck Japan. As a result, the Japanese economy posted negative growth for the first and second quarter in 2011. Unlike the cases of the Great Hanshin-Awaji Earthquake in 1995 or Hurricane Katrina in 2005, personal consumption declined on a nationwide basis, with consumer sentiment deteriorating sharply after the Earthquake. The Earthquake had a severe impact on production in Japan through the shutdown of damaged factories, disruptions of the supply chains and power supply constraints. In particular, the Earthquake affected Japan’s auto industry which depends on the Tohoku region for the supply of key parts including semiconductors and other electronic components. The supply constraints and the slower growth in corporate earnings in the aftermath of the Earthquake also put downward pressure on capital investment activities. The Earthquake was accompanied by a nuclear power plant accident, which not only caused power supply constraints but also had a chilling effect on certain business activities, such as in the tourism and leisure sectors. Following the Earthquake, the number of visitors to Japan from foreign countries dropped by approximately half from the monthly averages in the prior year. The Earthquake and its aftermath prompted the Government of Japan to compile a series of supplementary budgets to ameliorate the downside effects on the Japanese economy while supporting reconstruction efforts. On May 2, 2011, a first supplementary budget of approximately ¥4 trillion was approved by the Diet to finance reconstruction relating to damages from the Earthquake and tsunami. The budget was aimed at disaster relief, including providing temporary housing, restoration of infrastructure and disaster-related loans. On July 25, 2011, the Japanese government approved a second supplementary budget of approximately ¥2 trillion aimed at further disaster relief,

20

including increasing reserve funds also related to reconstruction relating to damages from the Earthquake and tsunami. On November 21, 2011, the Japanese government approved the third supplementary budget of approximately ¥12 trillion aimed at disaster relief, including provision of emergency support for victims, reconstruction of public utilities and facilities and the additional allocation of tax grants. On February 8, 2012, the Japanese government approved the fourth supplementary budget of approximately ¥2.5 trillion aimed at meeting additional financial demand in affected areas, not limited to disaster relief.

The Earthquake and the nuclear disaster in Fukushima were followed by a severe flooding that occurred at the end of July in Thailand, Japan’s sixth largest trading country in both export and import. With approximately 90% of Japan’s Thailand-bound export being intermediary materials for cars and electronics, the suspended operations of the local factories has suppressed the export of these goods and thereby adversely affect the Japanese economy.

Thus, JFY 2011 started in a very challenging environment, with the Earthquake seriously crippling the economy and posting negative growth for the first two consecutive quarters. Over time, the government and the people joined forces in an all-out effort to rebuild the social and economic infrastructure, facilitating a rapid recovery of the supply chains and helping the economy on a track to a gradual recovery. Since the summer of 2011, however, the rapid appreciation in yen, the reduced external demand due to the Thai flooding (as described above) and the global economic slowdown on the back of the European sovereign debt crisis kept such recovery to a modest level. The real GDP marked a negative growth by 0.0% during JFY 2011, with the nominal GDP posting a negative growth by 1.9%. Consumer prices have remained stable since the Earthquake, although households’ expected inflation rate has risen due to a rise in crude oil prices and the post-Earthquake supply constraints. The Cabinet Office of the Government of Japan currently expects the Japanese economy to gradually grow during JFY 2012, posting real GDP growth of 2.2% and the nominal GDP growth of 2.0%.

The Japanese economy faces certain challenges. The strong yen may also lead to the Japanese companies’ relocation overseas and local procurement of manufacturing materials, resulting in loss of employment in Japan. Further challenges for the Japanese economy include, as further described herein, an increased dependence on LNG and other energy imports as a result of the nuclear accident at the Fukushima Daiichi Nuclear Plant and suspension of operations at other nuclear power plants and, over the long term, demographic challenges, such as an aging workforce and population decrease, and the high levels of public debt and associated debt servicing payments.

Quantitative Impact of Declining Global Demand and Yen Appreciation

The recent global uncertainty may adversely affect the global economic environment as well as the currency exchange rates, which in turn may negatively affect Japan’s economy. The following tables illustrate quantitative impact on Japan’s economy in cases of declining world demand and appreciation in yen according to the Cabinet Office’s report dated August 3, 2011:

Downward pressure on the business activities if the global demand decreases by 1%

| | | | | | | | | | | | |

| | | Export | | | Capital investment | | | GDP | |

First year | | | (0.4 | ) | | | (0.1 | ) | | | (0.1 | ) |

Second year | | | (0.6 | ) | | | (0.1 | ) | | | (0.1 | ) |

(Note) Short-term Japanese econometric macro model. Difference ratio (%) from the standard case.

21

Downward pressure on the business activities by yen appreciation (increase against the dollar by 10%)

| | | | | | | | | | | | |

| | | Export | | | Capital investment | | | GDP | |

First year | | | (1.7 | ) | | | 0.0 | | | | (0.2 | ) |

Second year | | | (2.1 | ) | | | (0.2 | ) | | | (0.4 | ) |

(Note) Difference ratio (%) from the standard case.

(Companies’ anticipated foreign exchange rate: FY2011 ¥82.59/dollar (researched in June)

Gross Domestic Product and National Income

The following table sets forth information pertaining to Japan’s gross domestic product for JFY 2007 through JFY 2011.

Gross Domestic Product

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | JFY 2007 | | | JFY 2008 | | | JFY 2009 | | | JFY 2010 | | | JFY 2011 | | | Percentage of

JFY 2011

GDP | |

Total Consumption | | | | | | | | | | | | | | | | | | | | | | | | |

Private sectors | | ¥ | 294,728 | | | ¥ | 288,105 | | | ¥ | 284,233 | | | ¥ | 284,177 | | | ¥ | 284,700 | | | | 60.6 | % |

Public sectors | | | 93,256 | | | | 92,895 | | | | 94,244 | | | | 95,784 | | | | 97,183 | | | | 20.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 387,983 | | | | 381,000 | | | | 378,477 | | | | 379,961 | | | | 381,883 | | | | 81.3 | |

Total Gross Capital Formation | | | | | | | | | | | | | | | | | | | | | | | | |

Private sectors | | | | | | | | | | | | | | | | | | | | | | | | |

Producers’ Durable Equipment | | | 76,832 | | | | 71,015 | | | | 60,771 | | | | 62,031 | | | | 61,612 | | | | 13.1 | |

Residential Construction | | | 16,354 | | | | 16,528 | | | | 12,642 | | | | 12,997 | | | | 13,561 | | | | 2.9 | |

Public sectors | | | 22,083 | | | | 21,200 | | | | 22,829 | | | | 21,443 | | | | 22,413 | | | | 4.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 115,269 | | | | 108,743 | | | | 96,242 | | | | 96,470 | | | | 97,586 | | | | 20.8 | |

Additions to Business Inventories | | | | | | | | | | | | | | | | | | | | | | | | |

Private sectors | | | 1,658 | | | | 1,341 | | | | (5,123 | ) | | | (1,345 | ) | | | (3,156 | ) | | | -0.7 | |

Public sectors | | | 52 | | | | 55 | | | | (33 | ) | | | (75 | ) | | | 38 | | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1,710 | | | | 1,396 | | | | (5,156 | ) | | | (1,419 | ) | | | (3,118 | ) | | | -0.7 | |

Net Exports of Goods and Services | | | 8,062 | | | | (1,619 | ) | | | 4,316 | | | | 4,300 | | | | (6,362 | ) | | | -1.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Nominal Gross Domestic Expenditures | | ¥ | 513,023 | | | ¥ | 489,520 | | | ¥ | 473,878 | | | ¥ | 479,311 | | | ¥ | 469,990 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Real Gross Domestic Expenditures(a) | | ¥ | 525,470 | | | ¥ | 505,803 | | | ¥ | 495,439 | | | ¥ | 511,145 | | | ¥ | 511,101 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Surplus of the Nation on Current Account | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of Goods and Services and Other Receipts from Abroad | | | 26,710 | | | | 23,202 | | | | 18,434 | | | | 18,641 | | | | 20,858 | | | | | |

Less: Imports of Goods and Services and Other Payments Abroad | | | (8,981 | ) | | | (7,929 | ) | | | (5,364 | ) | | | (5,383 | ) | | | (5,798 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 17,730 | | | | 15,272 | | | | 13,070 | | | | 13,259 | | | | 15,060 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross National Income | | ¥ | 530,753 | | | ¥ | 504,792 | | | ¥ | 486,948 | | | ¥ | 492,570 | | | ¥ | 485,050 | | | | | |

Percentage Changes of GDP from Previous Year | | | | | | | | | | | | | | | | | | | | | | | | |

At Nominal Prices | | | 0.8 | % | | | -4.6 | % | | | -3.2 | % | | | 1.1 | % | | | -1.9 | % | | | | |

At Real Prices(a) | | | 1.8 | | | | -3.7 | | | | -2.0 | | | | 3.2 | | | | -0.0 | | | | | |

Deflator | | | -1.0 | | | | -0.9 | | | | -1.2 | | | | -2.0 | | | | -1.9 | | | | | |

| (a) | Real prices are based on calendar year 2000. |

Source: Economic and Social Research Institute, Cabinet Office.

22

The following table sets forth information pertaining to Japan’s gross domestic product, as seasonally adjusted, for each of the eight quarters ended March 31, 2012.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarterly Gross Domestic Product(a) | |

| | | JFY 2010 | | | JFY 2011 | |

| | | First

Quarter | | | Second

Quarter | | | Third

Quarter | | | Fourth

Quarter | | | First

Quarter | | | Second

Quarter | | | Third

Quarter | | | Fourth

Quarter | |

Nominal Gross Domestic Expenditures(b) | | ¥ | 483,232 | | | ¥ | 484,011 | | | ¥ | 481,099 | | | ¥ | 469,491 | | | ¥ | 463,557 | | | ¥ | 471,099 | | | ¥ | 469,519 | | | ¥ | 475,144 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real Gross Domestic Expenditures(b)(c) | | ¥ | 510,859 | | | ¥ | 514,820 | | | ¥ | 514,710 | | | ¥ | 504,447 | | | ¥ | 502,335 | | | ¥ | 511,882 | | | ¥ | 511,986 | | | ¥ | 517,953 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Percentage Changes of GDP from the Previous Quarter At

Nominal Prices(d) | | | 0.8 | % | | | 0.2 | % | | | -0.6 | % | | | -2.4 | % | | | -1.3 | % | | | 1.6 | % | | | -0.3 | % | | | 1.2 | |

At Real Prices(c)(d) | | | 1.2 | | | | 0.8 | | | | -0.0 | | | | -2.0 | | | | -0.4 | | | | 1.9 | | | | 0.0 | | | | 1.2 | |

Deflator(d) | | | -0.3 | | | | -0.6 | | | | -0.6 | | | | -0.4 | | | | -0.8 | | | | -0.3 | | | | -0.4 | | | | 0.0 | |

| (a) | Quarterly GDP financial data are subject to change. |

| (b) | Numbers are based on seasonally-adjusted GDP figures. |

| (c) | Real prices are based on calendar year 2005. |

| (d) | Percentage changes are based on seasonally-adjusted GDP figures. |

Source: Economic and Social Research Institute, Cabinet Office.

Per Capita Gross Domestic Product

The following table indicates per capita gross domestic product for the last five years:

| | | | | | | | |

Fiscal Year | | Per Capita GDP | |

| | Amount

(in thousands of yen) | | | Year-on-year change (%) | |

2006 | | | 3,981 | | | | 0.6 | |

2007 | | | 4,008 | | | | 0.7 | |

2008 | | | 3,822 | | | | (4.6 | ) |

2009 | | | 3,700 | | | | (3.2 | ) |

2010 | | | 3,742 | | | | 1.1 | |

National Income

The following table sets forth national income for calendar year 2006 through calendar year 2010.

| | | | | | | | | | | | | | | | | | | | |

| | | National Income | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| | | (yen amounts in billions) | |

Domestic Factor Income | | ¥ | 360,923 | | | ¥ | 364,908 | | | ¥ | 350,438 | | | ¥ | 327,146 | | | ¥ | 335,258 | |

Net Income from Abroad | | | 14,399 | | | | 17,198 | | | | 16,511 | | | | 12,629 | | | | 12,257 | |

| | | | | | | | | | | | | | | | | | | | |

National Income at Factor Cost | | ¥ | 375,323 | | | ¥ | 382,106 | | | ¥ | 366,949 | | | ¥ | 339,775 | | | ¥ | 347,515 | |

| | | | | | | | | | | | | | | | | | | | |

Percentage Changes of Income at Factor Cost from Previous Year | | | 0.4 | % | | | 1.8 | % | | | -4.0 | % | | | -7.4 | % | | | 2.3 | % |

Source: Economic and Social Research Institute, Cabinet Office.

23

Industry

The following table sets forth the proportion of gross domestic product contributed by major industrial sectors of the economy for calendar year 2006 through calendar year 2010.

GDP by Industrial Sectors (at nominal prices)

| | | | | | | | | | | | | | | | | | | | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

Industry | | | | | | | | | | | | | | | | | | | | |

Agriculture, Forestry and Fisheries | | | 1.2 | % | | | 1.1 | % | | | 1.1 | % | | | 1.2 | % | | | 1.2 | % |

Mining | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Manufacturing | | | 19.8 | | | | 20.2 | | | | 19.7 | | | | 17.7 | | | | 19.4 | |

Construction | | | 5.8 | | | | 5.7 | | | | 5.6 | | �� | | 5.7 | | | | 5.5 | |

Electric Power Generation, Gas and Water | | | 2.2 | | | | 2.0 | | | | 1.9 | | | | 2.4 | | | | 2.3 | |

Wholesale and Retail Trade | | | 14.2 | | | | 13.6 | | | | 14.0 | | | | 13.6 | | | | 13.4 | |

Finance and Insurance | | | 6.0 | | | | 6.0 | | | | 5.0 | | | | 5.0 | | | | 4.9 | |

Real Estate | | | 10.9 | | | | 10.9 | | | | 11.2 | | | | 12.1 | | | | 11.8 | |

Transportation and Communication | | | 5.0 | | | | 5.2 | | | | 5.1 | | | | 4.9 | | | | 4.9 | |

Services | | | 17.9 | | | | 18.3 | | | | 18.9 | | | | 19.4 | | | | 19.1 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 88.4 | | | | 88.4 | | | | 88.0 | | | | 87.6 | | | | 87.9 | |

Public Services | | | | | | | | | | | | | | | | | | | | |

Electric Power Generation, Gas and Water | | | 0.6 | | | | 0.6 | | | | 0.6 | | | | 0.7 | | | | 0.6 | |

Services | | | 2.4 | | | | 2.4 | | | | 2.4 | | | | 2.5 | | | | 2.4 | |

Public Administration | | | 5.9 | | | | 5.9 | | | | 6.1 | | | | 6.4 | | | | 6.1 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 9.0 | | | | 8.9 | | | | 9.2 | | | | 9.6 | | | | 9.2 | |

Non-Profit Services | | | 2.0 | | | | 1.9 | | | | 2.0 | | | | 2.1 | | | | 2.1 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 99.3 | % | | | 99.3 | % | | | 99.1 | % | | | 99.2 | % | | | 99.1 | % |

| | | | | | | | | | | | | | | | | | | | |

Source: Economic and Social Research Institute, Cabinet Office, Annual Report on National Accounts.

Energy

The following table sets forth the total amounts of primary energy supplied and the percentages supplied by different sources for JFY 2006 through JFY 2010.

| | | | | | | | | | | | | | | | | | | | | | | | |

JFY | | Sources of Primary Energy Supplied | |

| | Total Primary

Energy Supplied

(peta-joule) | | | Oil | | | Coal | | | Nuclear | | | Natural

Gas | | | Other | |

2006 | | | 23,773 | | | | 47.0 | | | | 20.5 | | | | 11.2 | | | | 15.1 | | | | 6.1 | |

2007 | | | 23,855 | | | | 47.0 | | | | 21.3 | | | | 9.7 | | | | 16.3 | | | | 5.7 | |

2008 | | | 23,218 | | | | 46.4 | | | | 21.4 | | | | 9.7 | | | | 16.7 | | | | 5.8 | |

2009 | | | 21,743 | | | | 45.2 | | | | 20.3 | | | | 11.1 | | | | 17.4 | | | | 6.0 | |

2010 | | | 23,123 | | | | 43.7 | | | | 21.6 | | | | 10.8 | | | | 17.3 | | | | 6.6 | |

Source: Agency for Natural Resources and Energy, Ministry of Economy, Trade and Industry, Report on Energy Supply and Demand.

During JFY 2011, largely due to the effects of the Earthquake, the import of LNG increased significantly as the demand increased for power generation at thermal power stations. See “Foreign Trade and Balance of Payments—Foreign Trade”.

24

The table below sets forth information regarding crude oil imports for JFY 2007 through JFY 2011.

| | | | | | | | | | | | | | | | | | | | |

| | | JFY 2007 | | | JFY 2008 | | | JFY 2009 | | | JFY 2010 | | | JFY 2011 | |

Volume of imports (thousand kilo-liters per day) | | | 666 | | | | 637 | | | | 583 | | | | 589 | | | | 574 | |

Cost of imports (c.i.f. in billions of yen) | | ¥ | 13,693 | | | ¥ | 13,640 | | | ¥ | 8,587 | | | ¥ | 9,756 | | | ¥ | 11,894 | |

Average price (c.i.f. in yen kilo-liters) | | ¥ | 56,335 | | | ¥ | 58,542 | | | ¥ | 40,374 | | | ¥ | 45,373 | | | ¥ | 56,678 | |

Source: Customs and Tariff Bureau, Ministry of Finance.

Japan has historically depended on oil for most of its energy requirements and almost all its oil is imported, mostly from the Middle East. Oil price movements thus have a major impact on the domestic economy. Recently, as the demand for oil in emerging economies such as China and India has expanded and the geopolitical tension in the Middle East worsened, crude oil prices increased significantly.